The Daily Shot: 22-Jan-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

As a reminder, there will be a brief hiatus in the publication of The Daily Shot due to a necessary medical procedure. This pause will be from January 24th to at least January 26th (perhaps longer). We are committed to ensuring that our content remains as insightful and informative as ever, and we eagerly anticipate resuming publication shortly after this period.

Your understanding and support during this time is greatly appreciated.

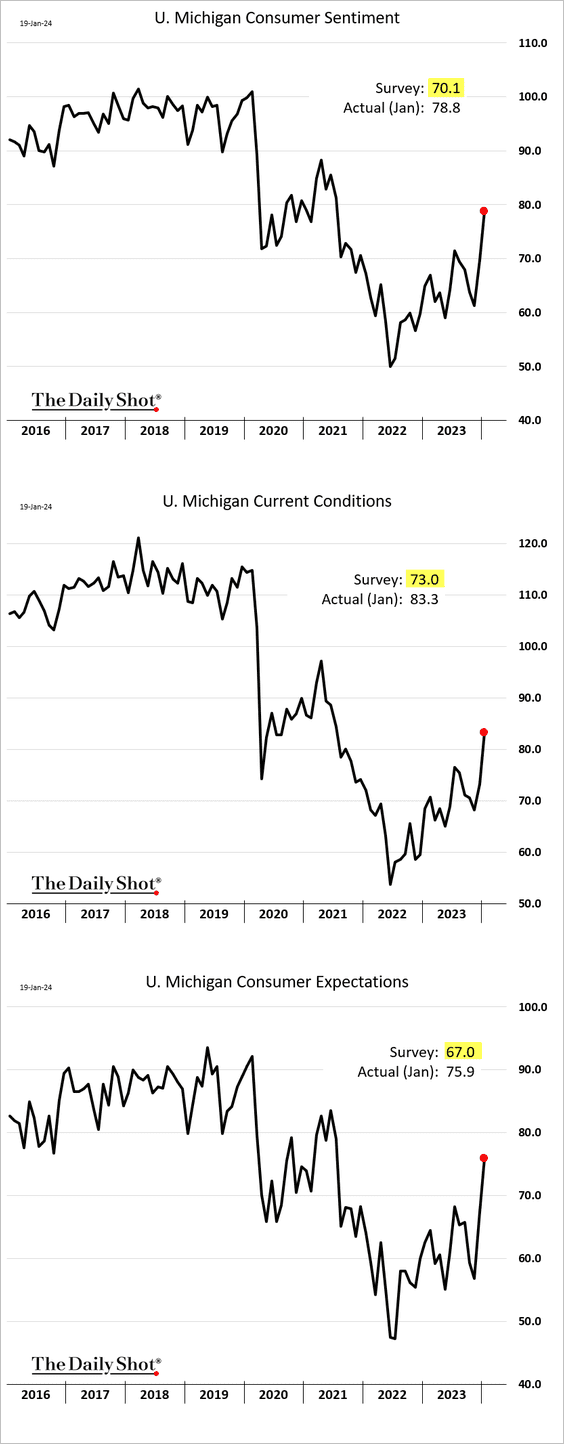

The United States

1. The U. Michigan’s consumer sentiment index jumped this month, boosted by stock market gains, firmer home prices, and a robust job market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Households are more upbeat about their financial situation, …

… and expecting faster gains in home prices.

• Buying conditions for durables improved.

• Inflation expectations declined again.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Existing home sales held at multi-year lows in December, …

… with the lowest annual sales in decades.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Inventories improved in recent months.

• The median transaction price exceeded 2023 levels.

——————–

3. New tenant rents were down substantially last quarter (year-over-year).

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

4. A declining quits rate typically leads to a slowdown in wage growth.

Source: BCA Research

Source: BCA Research

5. Small business sentiment improved further last quarter, according to the MetLife & US Chamber of Commerce Small Business Index.

Source: Bank of America Institute

Source: Bank of America Institute

6. The number of Bloomberg articles mentioning “soft landing” has gathered pace. A contrarian indicator?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

1. The December retail sales estimate showed a robust improvement.

Source: @economics Read full article

Source: @economics Read full article

——————–

2. Data from the private sector have been signaling an impending economic downturn.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

3. Canadian equities remain in a long-term downtrend versus US equities, although correlations are still positive.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

• The TSX Venture Index (micro caps) appears to have bottomed with improving breadth.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

4. Here is a look at the distribution of last year’s ETF flows.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

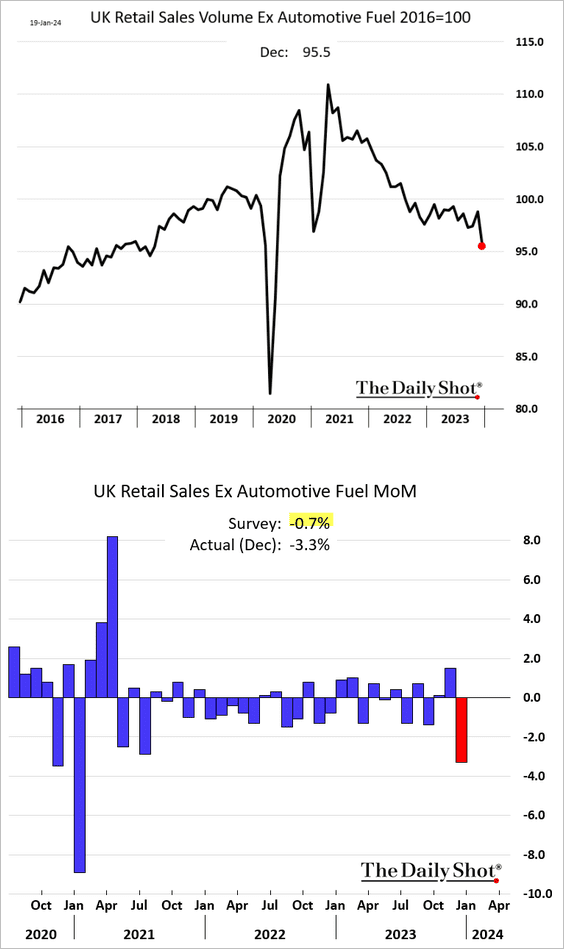

The United Kingdom

1. The December retail sales report was awful.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Credit conditions have eased significantly.

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

1. Germany’s PPI declined more than expected last month.

2. Dutch home prices are rising again.

3. Spain’s house sales held below 2021/22 levels.

4. Is the ECB’s inflation forecast too high?

Source: Barclays Research

Source: Barclays Research

Back to Index

Asia-Pacific

1. South Korea’s exports were slightly below last year’s level this month.

2. Next, we have some updates on New Zealand.

• Factory activity (deep contraction):

• House sales (picking up momentum):

• Net migration (a sharp drop):

Source: @markets Read full article

Source: @markets Read full article

Back to Index

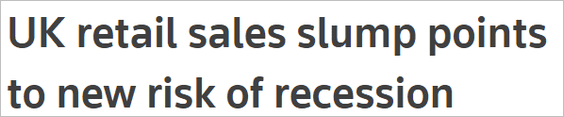

China

1. China’s currency has significantly underperformed the MSCI’s broad EM currency index.

Further reading

Further reading

2. Bond yields declined again today, …

… as the yield curve flattens.

——————–

3. The stock market remains under pressure.

• Mainland shares:

• ChiNext (smaller growth/tech companies):

• Shares listed in Hong Kong:

——————–

4. Beijing is increasingly concerned about surging local government debt.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @AyeshaTariq

Source: @AyeshaTariq

——————–

5. Here is a look at housing completions per 1000 people in China, the US, and Spain.

Source: Arcano Economics

Source: Arcano Economics

6. It may be a while before China’s economy overtakes the US.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Emerging Markets

1. Brazil’s economic activity was virtually flat in November.

2. Mexico’s retail sales report was disappointing.

3. Turkey’s homes sales have returned to more typical levels after the recent surge.

4. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

1. Will bitcoin’s $40k support hold?

2. Grayscale’s ETF has been seeing outflows due to a large position held by the FTX estate.

Source: @axios Read full article

Source: @axios Read full article

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Commodities

1. Cocoa futures hit the highest level since 1977.

2. Next, we have some speculative positioning trends in agricultural commodities.

• Coffee:

• Sugar:

• Corn:

• Soybeans:

• Spring wheat:

——————–

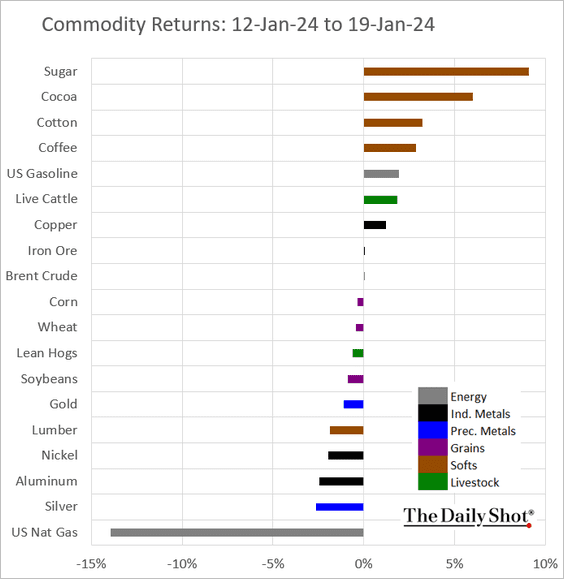

3. Finally, here is a look at last week’s performance across key commodity markets.

Back to Index

Energy

1. Crude oil edged lower as Libya resumes production at its largest oilfield.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: ABC News Read full article

Source: ABC News Read full article

——————–

2. US drilling activity remains subdued.

3. This chart shows the OPEC+ market share over time.

Source: @FactSet Read full article

Source: @FactSet Read full article

4. US natural gas has been tanking as weather forecasts point to higher temperatures.

Source: NOAA

Source: NOAA

——————–

5. European natural gas futures are also falling.

6. Uranium prices continue to surge.

Back to Index

Equities

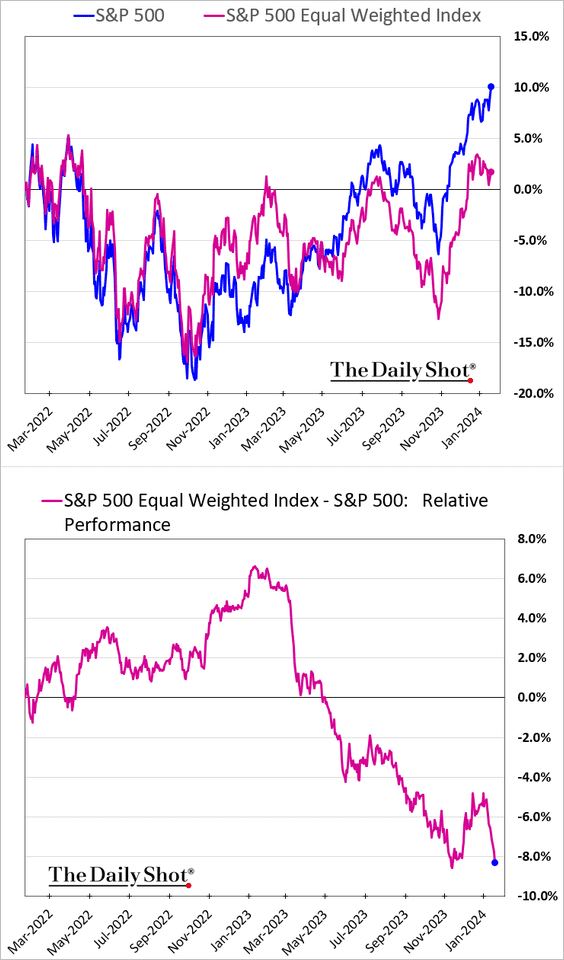

1. The S&P 500 hit a record high.

The Nasdaq 100 also reached a new record and is back in overbought territory.

——————–

2. The equal weight index has widened its underperformance.

Small caps are lagging as well.

——————–

3. Value stocks tumbled relative to growth this year.

4. US equity issuance remains below average following the pandemic boom.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. This chart shows the S&P 500 returns by year of presidential cycle.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

6. Equity futures positioning looks aggressive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

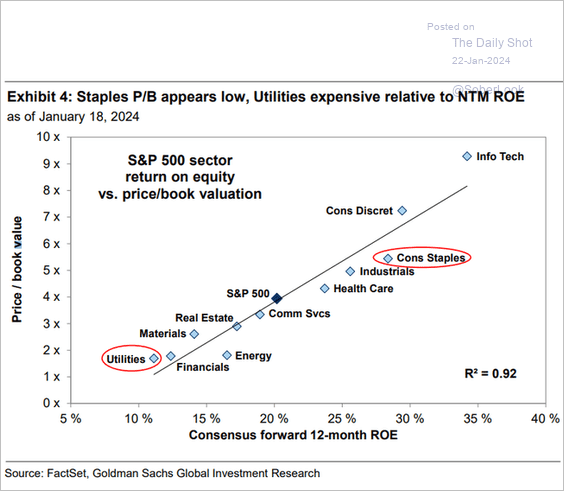

7. Here is a look at the price-to-book ratio and forward return on equity by sector.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

8. Finally, we have some performance data from last week.

• Sectros:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. Leveraged loan refinancing volume is trending lower since the 2021 peak.

Source: PitchBook

Source: PitchBook

• Loan prices continue to rebound.

——————–

2. US high-yield new-issue volume increased for a third straight week.

Source: PitchBook

Source: PitchBook

3. Oxford Economics expects a sub-2% US high-yield default rate this year, roughly in line with consensus.

Source: Oxford Economics

Source: Oxford Economics

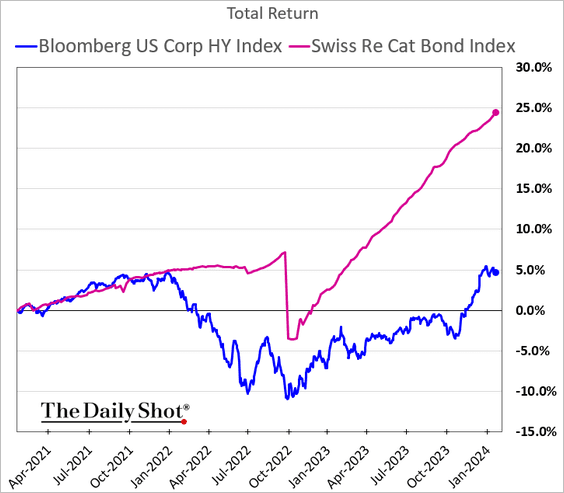

4. Cat bonds continue to outperform.

Further reading

Further reading

5. This chart shows yields and implied volatility across credit markets (expected return vs. perceived risk).

6. How correlated are credit markets to Treasuries and the S&P 500?

7. Finally, we have some performance data from last week.

Back to Index

Rates

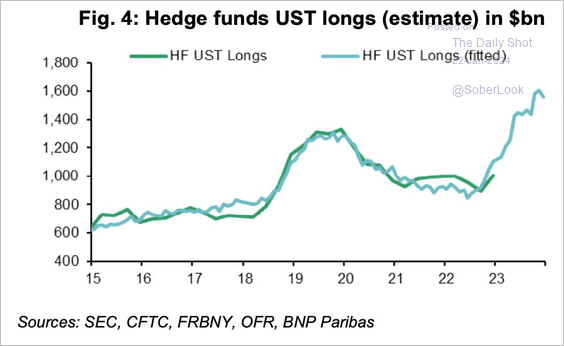

1. BNP Paribas reports that hedge fund basis trades (futures versus cash Treasuries) are likely at an all-time high.

Source: BNP Paribas; @dailychartbook

Source: BNP Paribas; @dailychartbook

This arb trade is driving speculative net shorts in the 10-year Treasury contract to record levels.

——————–

2. Hedge funds continue to bet on Fed rate cuts.

Back to Index

Global Developments

1. Here is a look at recent trends in fund flows across asset classes and categories.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. This table shows a sum of federal, state, and local tax and spending across developed markets.

Source: Research Affiliates Read full article

Source: Research Affiliates Read full article

3. Finally, here is a look at last week’s performance data.

• Currecnies:

• Bond yields:

• Equities:

——————–

Food for Thought

1. Retail investors’ asset allocation by generation:

Source: The Economist Read full article

Source: The Economist Read full article

2. Steel production:

Source: semafor

Source: semafor

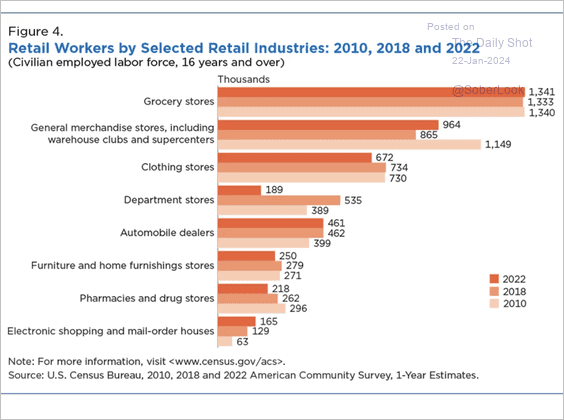

3. US retail workers by industry:

Source: Census Bureau Read full article

Source: Census Bureau Read full article

4. Growing share of jobless MBA graduates:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Russia’s frozen assets:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

6. Semaglutide (Wegovy) weight-loss drug trial:

Source: The Economist Read full article

Source: The Economist Read full article

7. Warm oceans:

Source: Climate Reanalyzer

Source: Climate Reanalyzer

8. US retirement benefits and taxes:

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

9. Each state’s least favorite state:

Source: @mattsurely

Source: @mattsurely

——————–

As a reminder, there will be a brief hiatus in the publication of The Daily Shot due to a necessary medical procedure. This pause will be from January 24th to at least January 26th (perhaps longer). We are committed to ensuring that our content remains as insightful and informative as ever, and we eagerly anticipate resuming publication shortly after this period.

Your understanding and support during this time is greatly appreciated.

Back to Index