The Daily Shot: 19-Jan-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

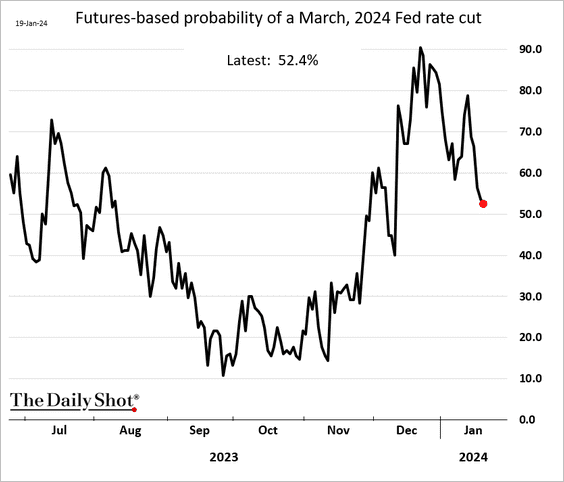

1. Market-based probability of a March Fed rate cut continues to ease.

2. The Philly Fed’s manufacturing index confirmed that the soft patch in US factory activity extended into 2024.

Source: Barron’s Read full article

Source: Barron’s Read full article

• Forward-looking indicators were soft.

– Expected shipments:

– Expected hiring:

• Price pressures eased.

• Delivery times haven’t contracted this quickly since the GFC, as demand weakens.

——————–

2. Initial jobless claims remained very low last week.

Below is the seasonally adjusted index (note that seasonal adjustments to weekly claims data are not very reliable).

• Continuing jobless claims have also shifted lower at the start of the year.

——————–

3. This chart shows the year-over-year changes in US cement production.

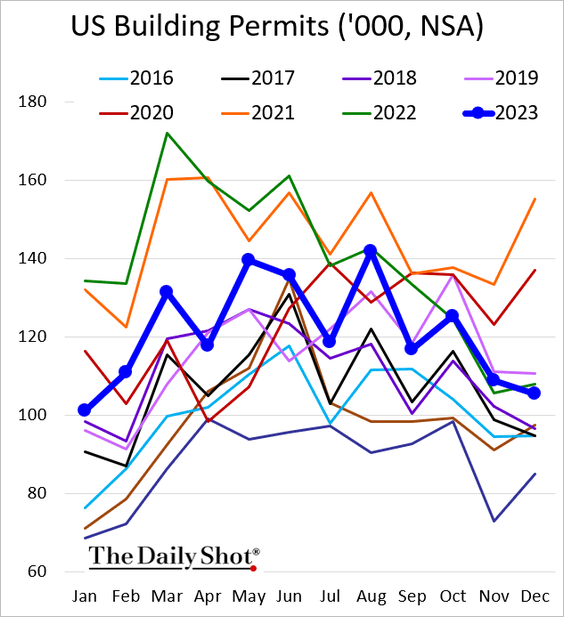

4. Housing starts held above 2022 levels in December (2 charts), …

… but single-family construction activity pulled back from robust November levels.

• Building permits were back below the prior year’s levels, …

… amid weak multifamily housing activity.

– Single-family permits were almost 27% above the depressed levels we saw in December of 2022 (2 charts).

——————–

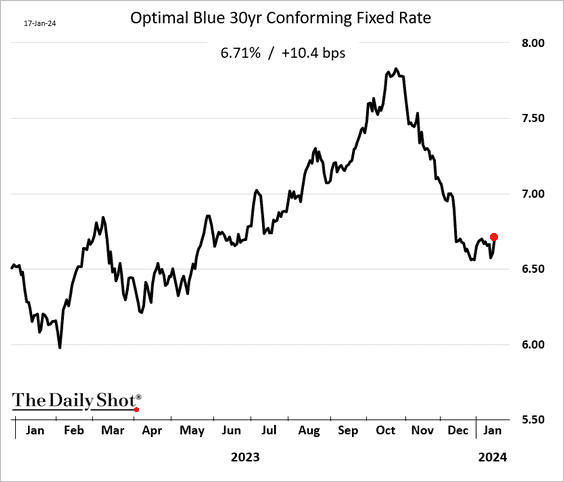

5. Mortgage rates are no longer falling.

6. Consumer sentiment improved further in recent days, according to the Penta-CS indicator.

Source: @Pentagrp, @CivicScience

Source: @Pentagrp, @CivicScience

Back to Index

The United Kingdom

1. The rise in real household incomes could support consumer spending.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

2. Business investment remains weak despite recent stability in private consumption.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

3. New home buyer inquiries are picking up.

Source: Longview Economics

Source: Longview Economics

4. Services inflation should fall further based on survey data.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Will the headline inflation reach 2% next quarter? Here is a forecast from ING.

Source: ING

Source: ING

Back to Index

The Eurozone

1. Danske’s euro area growth tracker is improving, mainly because of financial variables such as downside surprises in inflation and lower interest rate expectations.

![]() Source: Danske Bank

Source: Danske Bank

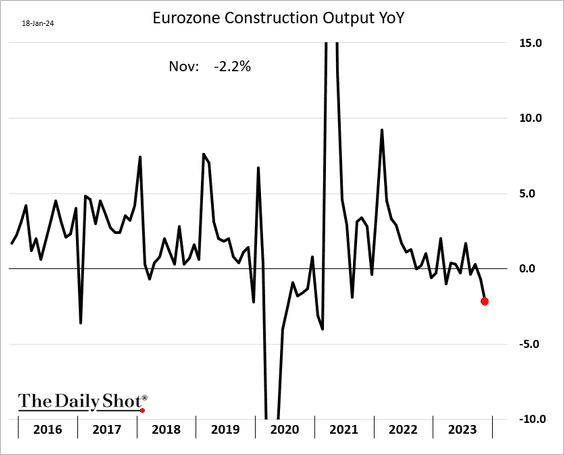

2. Construction output was down sharply on a year-over-year basis in November.

3. The euro has been correlated to the Eurozone’s current account balance.

Source: Ven Ram, Bloomberg Read full article

Source: Ven Ram, Bloomberg Read full article

Back to Index

Europe

1. In December, the EU’s new vehicle registrations dipped below 2022 levels.

Here is the same chart for the Eurozone.

——————–

2. Container freight costs from Asia to Europe keep climbing as shippers avoid the Red Sea.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Poland’s consumer confidence continues to improve.

4. Here is a look at millionaires In Europe.

Source: Landgeist Read full article

Source: Landgeist Read full article

Back to Index

Japan

1. Inflation has been moderating, but the core CPI remains sticky.

Vehicle price gains have picked up momentum.

——————–

2. Tax revenue is falling at a pace normally seen during major economic downturns.

Source: Capital Economics

Source: Capital Economics

3. Japan’s stocks have widened their outperformance over China’s equities.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

China

1. Let’s start with three charts on residential property sales.

Source: Arcano Economics

Source: Arcano Economics

Source: Arcano Economics

Source: Arcano Economics

Source: Arcano Economics

Source: Arcano Economics

——————–

2. Home prices were down in 89% of China’s cities in December.

Source: @MacroKova

Source: @MacroKova

3. According to ANZ, the PBoC has been hesitant to cut rates because “the authorities may be concerned about bank profitability.”

Source: @ANZ_Research

Source: @ANZ_Research

4. China’s stocks are trading at a massive discount to India’s market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The price gap between US and Hong Kong-traded stocks continues to widen.

——————–

5. Exports of smartphones remained below historical levels last year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Emerging Markets

1. The largest Mexico-focused ETF saw substantial outflows this week.

2. Colombia’s economic activity improved in November.

3. Argentina’s trade balance swung into surplus last month.

4. Here is the decomposition of Brazil’s 10-year bond yield, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

5. LatAm equities still trade at a discount to EM Asia despite recent outperformance.

Source: Alpine Macro

Source: Alpine Macro

——————–

6. South Africa’s mining output jumped in November.

7. Saudi stocks have decoupled from oil prices.

Source: BofA Global Research

Source: BofA Global Research

8. EM manufacturing PMIs are improving.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

1. It has been a tough week for crypto with bitcoin cash (BCH) and litecoin (LTC) underperforming top peers.

Source: FinViz

Source: FinViz

• Bitcoin is trading below $42k, with the next support level at $40k.

——————–

2. Bitcoin’s current price action is tracking historical pre-halving cycles.

Source: VanEck Read full article

Source: VanEck Read full article

3. This chart shows bitcoin holdings by ETFs, countries, and companies.

Source: VanEck Read full article

Source: VanEck Read full article

4. Here is a charted path to a US spot-bitcoin ETF approval.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. Most consumers surveyed by Deutsche Bank expect BTC to end the year below $20K.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Money launderers love Tether.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Energy

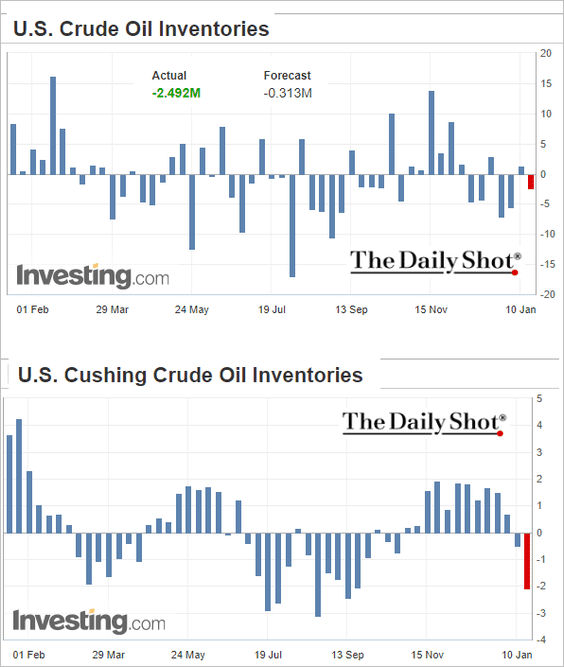

1. US crude oil stockpiles declined last week.

But refined product inventories continued to climb.

Here are the inventory levels.

——————–

2. Brent crude is above its 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. The crude oil market faces a surplus later this year.

Source: Grant Smith, Bloomberg Read full article

Source: Grant Smith, Bloomberg Read full article

4. OPEC+ has plenty of spare capacity.

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

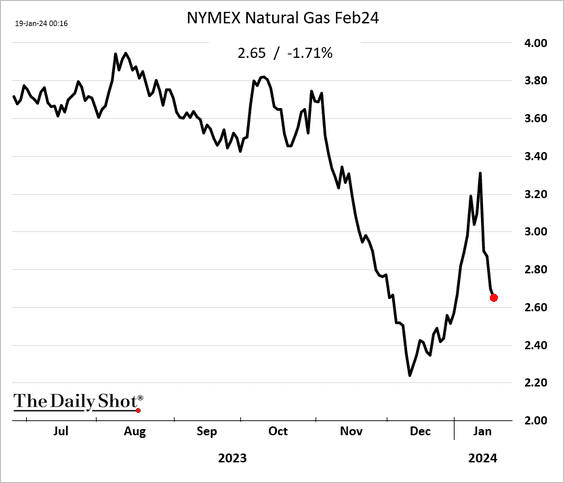

5. US natural gas futures continue to sink.

6. European natural gas prices keep trending lower.

• Here is a look at European gas storage capacity.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Equities

1. The semiconductor industry outlook is improving, driving share prices higher.

Source: @technology Read full article

Source: @technology Read full article

Here is NVIDIA.

——————–

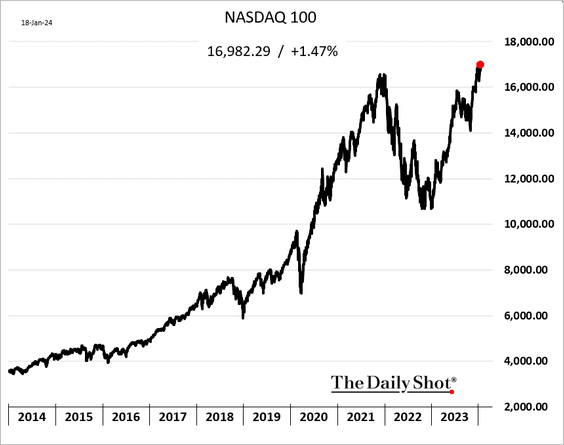

2. The Nasdaq 100 hit a record high.

• Nasdaq futures positioning has been very bullish.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

3. Here is a look at sector leadership over time.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

4. Sentiment eased in recent days.

• Retail investors:

• Investment managers:

Source: NAAIM

Source: NAAIM

——————–

5. Next, we have global and US IPO activity by quarter.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Post-IPO stocks have been struggling this year.

——————–

6. Longer-term stock-bond correlations are near the highest levels since the 1990s.

7. There is a lot of cash on the sidelines.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Money market funds will see outflows when rate cuts begin. How much of that liquidity will end up in the stock market?

Source: Morgan Stanley Research; @AyeshaTariq

Source: Morgan Stanley Research; @AyeshaTariq

——————–

8. Pharmaceuticals’ market capitalization has been bolstered by weight-loss medications. Eli Lilly has ascended into the top ten companies of the S&P 500 in terms of market cap.

Source: @bespokeinvest

Source: @bespokeinvest

Back to Index

Credit

1. Leveraged loans have been rallying, …

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

… and are now the top choice of BofA’s private clients.

Source: BofA Global Research

Source: BofA Global Research

——————–

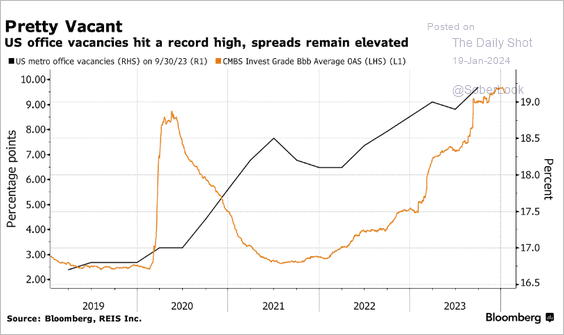

2. Climbing office vacancy rates are a headwind for the CMBS market.

Source: James Crombie, Bloomberg Read full article

Source: James Crombie, Bloomberg Read full article

Office delinquencies are expected to surge over the next couple of years.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. Increased funding costs have presented a challenge for mid-sized banks.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Rates

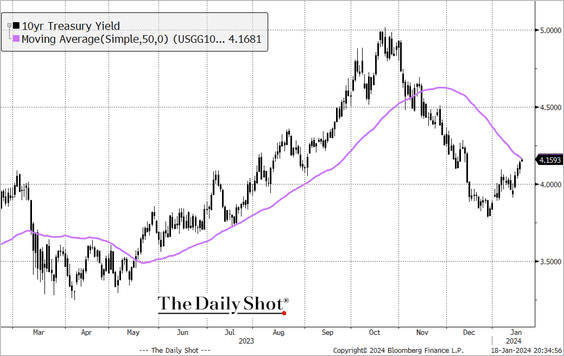

1. The 10-year Treasury yield is at its 50-day moving average.

2. TLT is nearing support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Investor demand for the 20-year note has strengthened.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. BofA’s private clients have been selling T-bills as they extend duration.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

1. Red Sea freight container volumes are down 65% from typical levels.

Source: Reuters Read full article

Source: Reuters Read full article

2. Developed market equity returns are still high since the October low despite a weak start to the year. However, Chinese equities and commodities continue to struggle.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Investors are focused on the interest rate differential between the US and the rest of the world as the primary factor influencing the US dollar.

Source: BofA Global Research

Source: BofA Global Research

Oxford Economics expects the dollar to weaken gradually.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

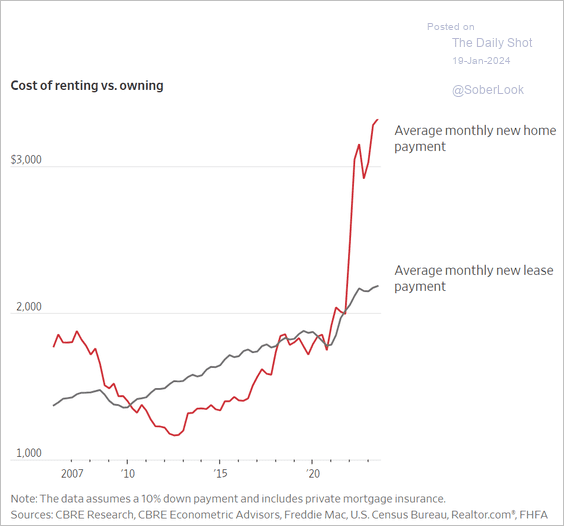

1. Renting vs. owning:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. US clean energy and transportation investment:

Source: Rhodium Group Read full article

Source: Rhodium Group Read full article

3. Earnings calls mentioning D.E.I.:

Source: The New York Times Read full article

Source: The New York Times Read full article

4. The world (ex-US) proportional to the number of mentions in Biden’s and Trump’s Twitter posts:

Source: BofA Global Research

Source: BofA Global Research

5. Trump’s Iowa performance by county demographics:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

6. Top podcast genres:

Source: Horowitz Research

Source: Horowitz Research

7. Working dogs:

Source: USAFacts

Source: USAFacts

——————–

Have a great weekend!

Back to Index