The Daily Shot: 30-Jan-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

We will continue to publish an abbreviated version of The Daily Shot over the next few days.

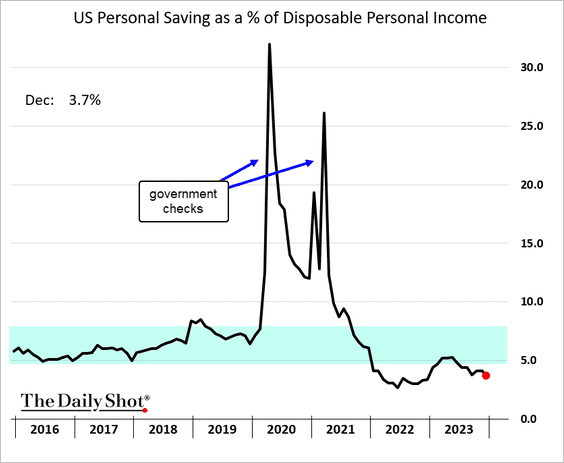

The United States

1. Consumers continue to save less than they did prior to the pandemic (relative to their disposable incomes). The rate has been trending lower since last spring.

2. Core durable goods orders held up well in December.

Here is a look at nominal and real capital goods orders.

——————–

3. Jobless claims are running slightly above last year’s levels.

4. US new home sales were trending higher going into 2024 (2 charts).

Source: Oxford Economics

Source: Oxford Economics

This is partially explained by homebuilders reducing home sizes to offset the affordability challenges posed by higher mortgage rates.

Source: Oxford Economics

Source: Oxford Economics

——————–

5. Pending home sales were in line with 2022 levels in December.

6. Further upside in oil prices could lead to higher inflation expectations.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

7. Cheap natural gas in the US (see Energy) offers a competitive edge, potentially accelerating the ‘reshoring’ of industries by reducing operational costs.

Source: Morningstar

Source: Morningstar

Back to Index

Canada

The CFIB index of small/medium-size business activity signaled some improvement this month, boosted by retail.

Back to Index

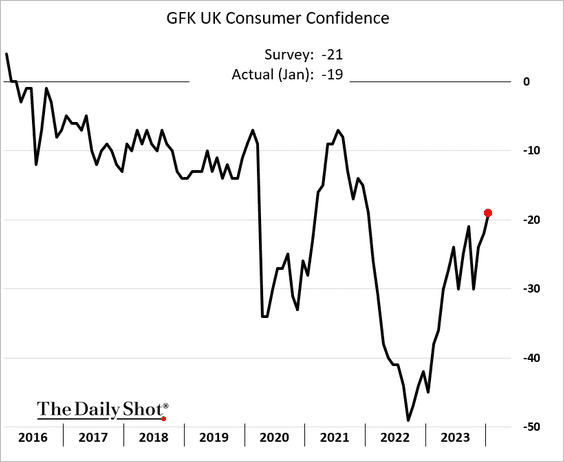

The United Kingdom

1. The flash PMI report showed stronger business activity this month.

2. But industrial orders remain soft, according to the CBI.

3. Consumer confidence is rebounding.

Back to Index

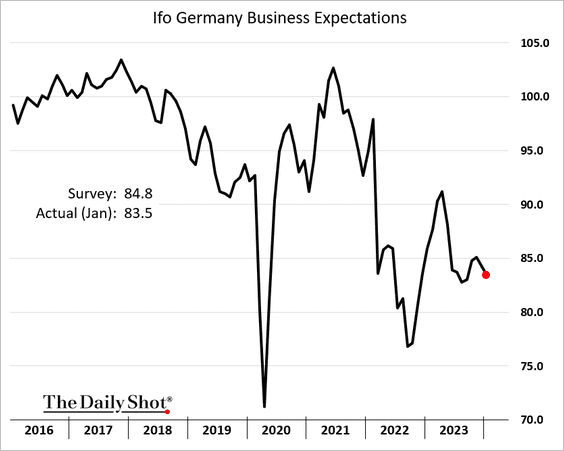

The Eurozone

1. Germany’s Ifo index declined this month, coming in below forecasts.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

2. Germany’s power prices have normalized relative to the extremes hit in the wake of the destruction of Nord Stream-2.

But normalization came at the expense of industrial production, …

Source: Morningstar

Source: Morningstar

… resulting in a significant drawdown for some of Germany’s largest industrial companies.

Source: Morningstar

Source: Morningstar

——————–

3. Pantheon Macroeconomics expects a meaningful contraction in the euro-area GDP.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Here is the French composite PMI.

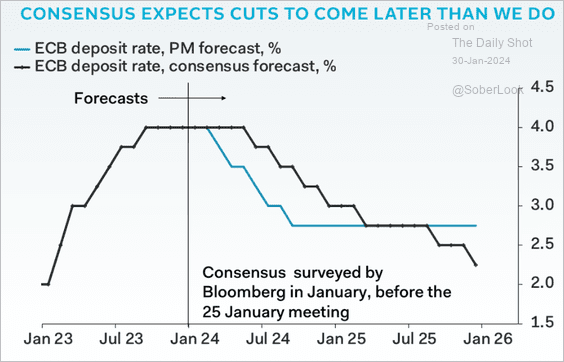

• Underlying inflation in the euro area has fallen considerably.

Source: Nordea Markets

Source: Nordea Markets

– Inflation momentum is declining faster in the euro area than in the US.

Source: Danske Bank

Source: Danske Bank

• Falling inflation and soft economic activity point to ECB rate cuts, which could arrive sooner than the market expects.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Reuters Read full article

Source: Reuters Read full article

——————–

4. Shipping costs from Asia appear to be stabilizing.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Japan

1. Business activity picked up momentum this month.

2. Tokyo’s core inflation declined faster than expected.

3. The unemployment rate is trending lower.

Back to Index

China

1. The PBoC cut the reserve ratio (RRR) to stabilize the stock market and boost economic activity.

But equity investors want more …

——————–

2. A Hong Kong court ordered the liquidation of Evergrande. Here is the bond price.

3. Autos, electrical equipment, and utilities experienced an increase in investment in recent years.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

1. Mexico’s inflation continues to ease.

• Economists have been upgrading their GDP growth estimates for 2024 (along with the US).

Source: Bloomberg

Source: Bloomberg

——————–

2. The strength of India’s business sector has carried over into 2024.

Back to Index

Cryptocurrency

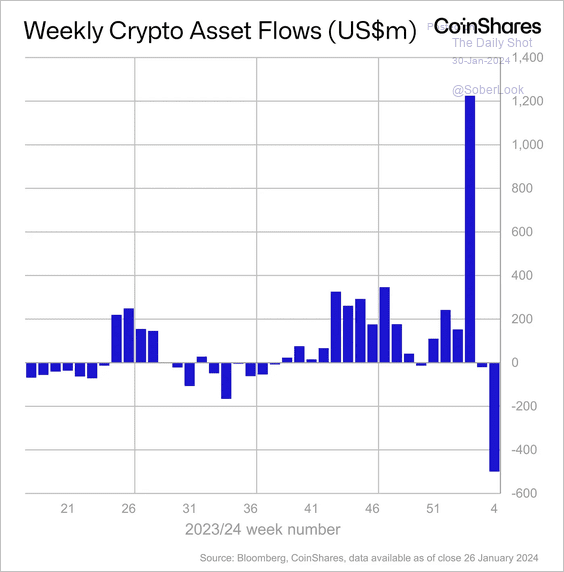

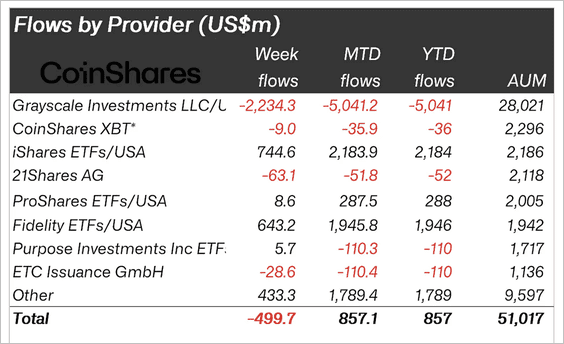

1. Crypto funds saw significant outflows last week, mostly driven by incumbent bitcoin ETF issuer Grayscale. (2 charts).

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

2. Cumulative fund flows so far this year:

Source: @FarsideUK

Source: @FarsideUK

3. As of Monday’s close, Grayscale’s GBTC remains the most liquid US spot-bitcoin ETF, although iShare’s IBIT is close behind.

Source: @JSeyff

Source: @JSeyff

4. This chart shows the number of BTC held by US spot-bitcoin ETFs, excluding GBTC.

Source: @Capital15C

Source: @Capital15C

Back to Index

Commodities

US soybean and corn futures remain under pressure.

Back to Index

Energy

US natural gas futures are nearing $2/mmbtu.

Back to Index

Equities

1. The S&P 500 hit a new high, marking its sixth record close in the past seven trading sessions. The index is now in overbought territory.

2. Deutsche Bank’s positioning index signals a growing investor appetite for stocks, though the shift towards an overweight stance has not reached extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Flows into tech funds remain robust (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. A positive January typically signals a positive year for the S&P 500.

Source: @RyanDetrick

Source: @RyanDetrick

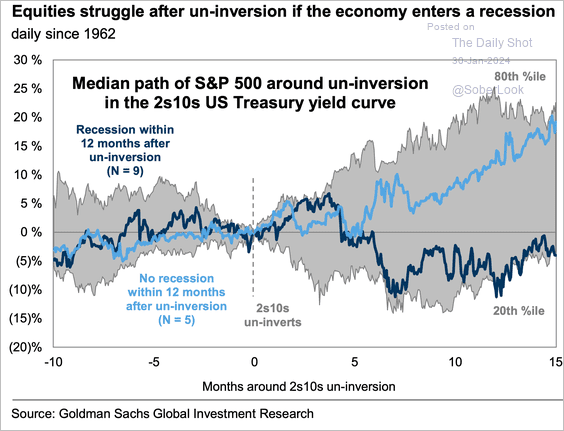

5. What happens to stock prices after the yield curve “un-inverts”?

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Credit

1. Leveraged loan default rates have risen over the past two years. Troubled companies and their lenders are increasingly turning to distressed exchanges to avoid costly bankruptcy proceedings, according to PitchBook.

Source: PitchBook

Source: PitchBook

• January is typically a busy month for leveraged loan activity.

Source: PitchBook

Source: PitchBook

——————–

2. Low office occupancy rates indicate hybrid work is a lasting trend.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Rates

1. The average real Fed funds rate at the first rate cut is 3% (median 2.8%). In this cycle, the real rate could exceed the historical average if inflation continues to decline.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. The 2-year Treasury yield remains below long-term resistance with declining momentum.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. Heavy bond issuance could place upward pressure on yields.

Source: Nordea Markets

Source: Nordea Markets

4. The Fed has signaled it may reduce the level of QT to ease pressure on government funding and thereby cool volatility in rates markets.

Source: 3Fourteen Research

Source: 3Fourteen Research

Back to Index

Global Developments

1. Globally, the bond-equity correlation is breaking down.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

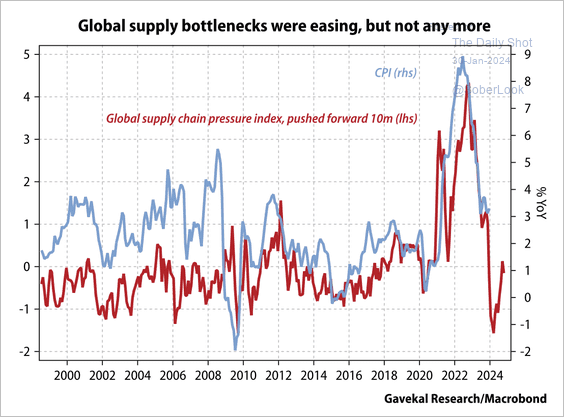

2. The recent rise in global supply chain bottlenecks could slow the decline in inflation.

Source: Gavekal Research

Source: Gavekal Research

——————–

Food for Thought

1. A growing wave of theft in US retail:

Source: @WSJ Read full article

Source: @WSJ Read full article

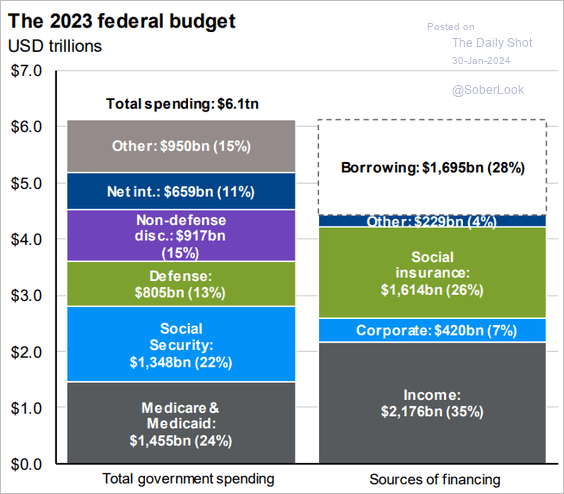

2. The US federal budget:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

3. Political polarization:

Source: Alpine Macro

Source: Alpine Macro

4. How much snow is typically required to cancel school?

Source: Alexandr Trubetskoy/Reddit

Source: Alexandr Trubetskoy/Reddit

——————–

Back to Index