The Daily Shot: 31-Jan-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

We will continue to publish an abbreviated version of The Daily Shot over the next few days.

The United States

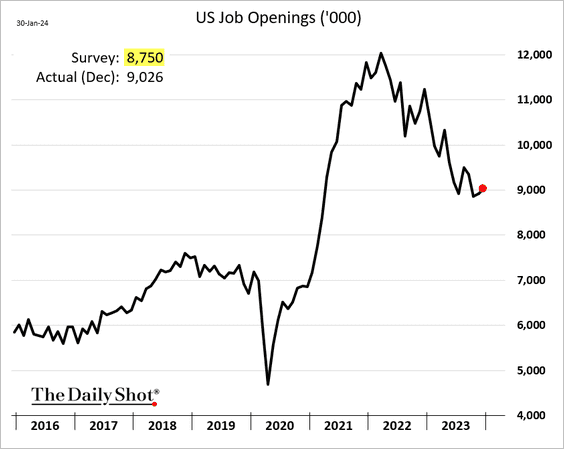

1. December saw another increase in job openings, surpassing expectations and underscoring the labor market’s ongoing resilience.

– This chart shows job openings per unemployed worker.

• Yet, the downward trend in quits (voluntary resignations) hints at diminishing employee confidence in the job market. Economists often consider this metric a more telling indicator of labor demand.

– December’s increase in job openings was largely propelled by the Professional and Business Services sector.

– Job openings in Leisure & Hospitality (restaurants/bars and hotels) keep falling.

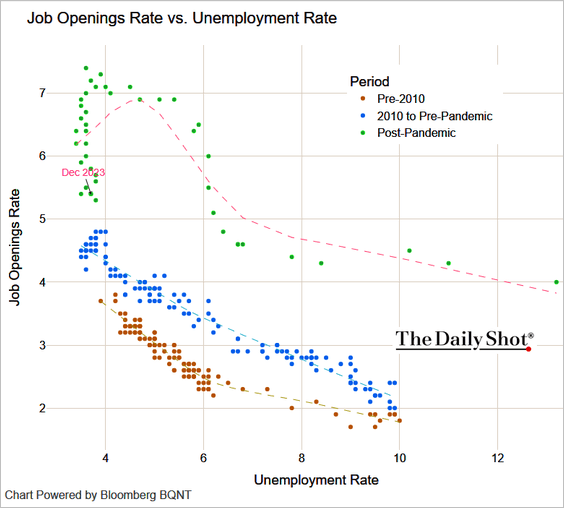

• Here is the Beveridge Curve.

——————–

2. The Conference Board’s consumer confidence index showed further improvement this month.

• The labor differential continues to rebound, once again signaling strength in the job market.

• Inflation expectations eased.

——————–

3. Home price appreciation slowed in November.

• Here is a look at Zillow’s home price appreciation by state (year-over-year).

Source: Goldman Sachs

Source: Goldman Sachs

• Resilient home prices across most of the country and mortgage rates stabilizing well below the highs …

… encourage homebuilders to ramp up construction.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

4. Household net wealth has moderated significantly along with CPI. However, the rebound in equity and house prices could become inflationary.

Source: Gavekal Research

Source: Gavekal Research

• Goldman expects real disposable income to rise this year across income categories.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

5. Productivity gains continue fueling more confidence in a soft landing for the US economy.

Source: @GregDaco

Source: @GregDaco

Back to Index

The United Kingdom

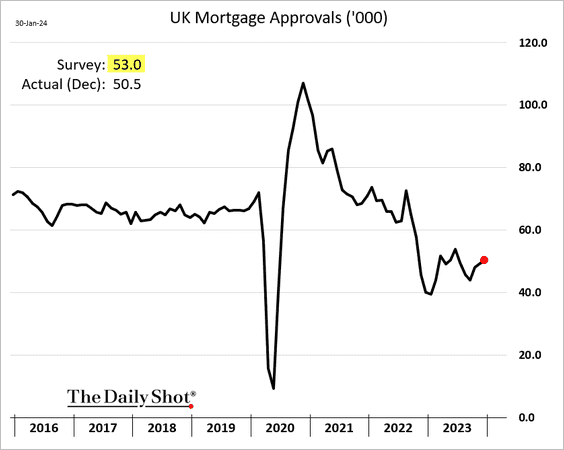

1. Mortgage approvals were softer than expected last month.

• Consumer credit growth remains robust.

Source: Longview Economics

Source: Longview Economics

• This chart shows wealth holdings by age.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

2. The Lloyds Bank business sentiment indicator is pushing toward multi-year highs.

3. UK banks are trading at historically low valuations.

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

1. The Eurozone’s economy managed to avoid a contraction last quarter (based on the first estimate).

• Germany’s GDP shrank.

• The French economy was flat.

• But Italy and Spain surprised to the upside.

——————–

2. Economic sentiment was roughly flat this month.

But services confidence continues to rebound.

——————–

3. Spain’s January CPI topped expectations.

4. Similar to the US, heavy bond issuance in the euro-area could put upward pressure on yields.

Source: Nordea Markets

Source: Nordea Markets

5. EUR/USD is trading below its 200-day moving average.

Source: barchart.com

Source: barchart.com

Back to Index

Europe

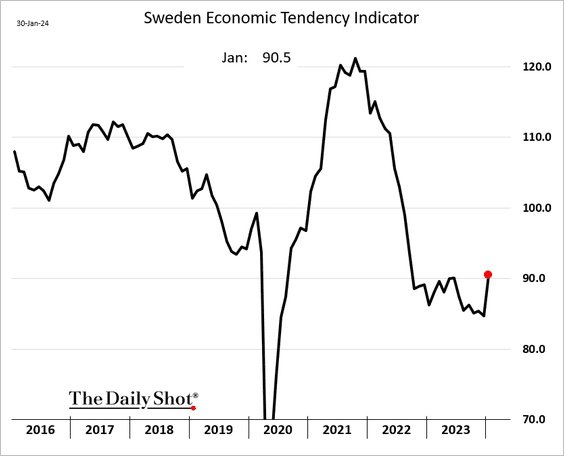

1. Sweden’s economic sentiment (business and consumer) jumped this month.

2. Here is a look at tourism in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. Industrial production climbed last month (albeit below forecasts).

2. Retail sales declined sharply in December.

Back to Index

Asia-Pacific

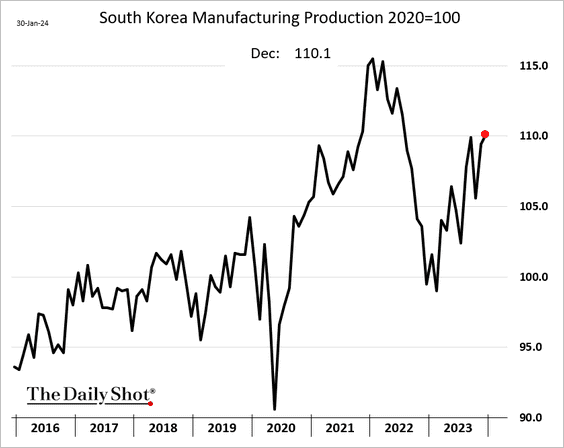

1. South Korea’s manufacturing output continues to trend higher.

2. Australia’s CPI slowed sharply last quarter, surprising to the downside.

Bond yields dropped.

Back to Index

China

1. The official index of factory activity held in contraction territory this month.

Non-manufacturing firms reported modest growth.

——————–

2. The Shanghai Shenzhen CSI 300 Index hit the lowest level in five years as stock investors remain skeptical of Beijing’s stimulus measures.

The recent selloff in China’s smaller growth companies has been particularly severe.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. The 10-year government bond yield hit a multi-year low.

4. The recovery in sales revenue and profit margins has been weak.

Source: China Beige Book

Source: China Beige Book

5. The average loan rate across sectors continues to decline.

Source: China Beige Book

Source: China Beige Book

6. Significant cuts in mortgage rates have yet to stimulate a rebound in property sales.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

1. Mexico’s economy barely grew last quarter, …

… despite robust government spending.

——————–

2. The Philippines finished 2023 on a strong note.

Back to Index

Commodities

1. Cocoa futures continue to surge.

2. Orange juice prices saw a massive rebound in recent days.

3. Here is a look at China’s corn imports.

Source: @SusanNOBULL

Source: @SusanNOBULL

Back to Index

Energy

1. US ethanol production tumbled last week, with bitter cold temperatures causing operational disruptions at plants throughout the Midwest.

2. The upturn in global money supply has coincided with the rise in oil prices.

Source: The Crude Chronicles

Source: The Crude Chronicles

Back to Index

Equities

1. The AI magic isn’t happening fast enough for investors. Tech stocks are down after the close.

Source: barchart.com

Source: barchart.com

Source: @technology Read full article

Source: @technology Read full article

——————–

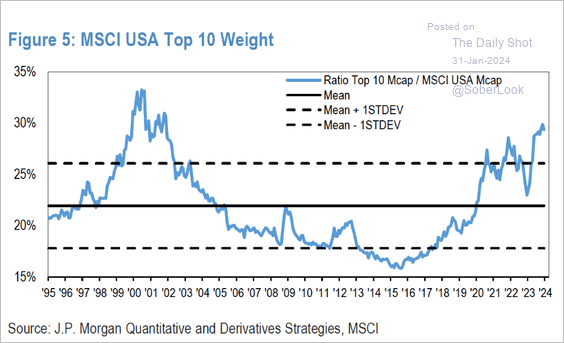

2. The US market remains highly concentrated.

Source: @markets Read full article

Source: @markets Read full article

• Fund managers view long “magnificent seven” stocks as the most crowded trade, according to a survey by BofA.

Source: BofA Global Research

Source: BofA Global Research

——————–

3. Financials have been rebounding.

——————–

4. A smaller share of JP Morgan’s clients plan to increase their equity exposure.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

5. Based on the S&P 500 options skew, investors are not worried about this week’s FOMC meeting.

Source: Nomura Securities; @WallStJesus

Source: Nomura Securities; @WallStJesus

6. Options markets have been increasingly bullish.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

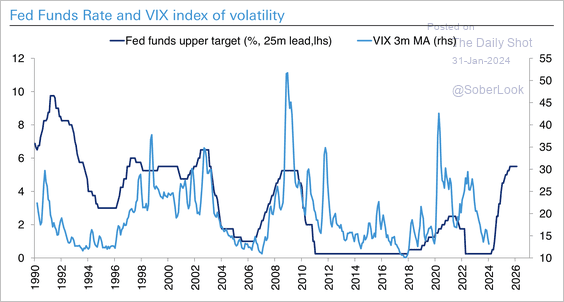

7. Movements in the VIX have often lagged the Fed funds rate by about two years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

1. US “blue-chip” firms issued a record amount of debt in January.

Source: @markets Read full article

Source: @markets Read full article

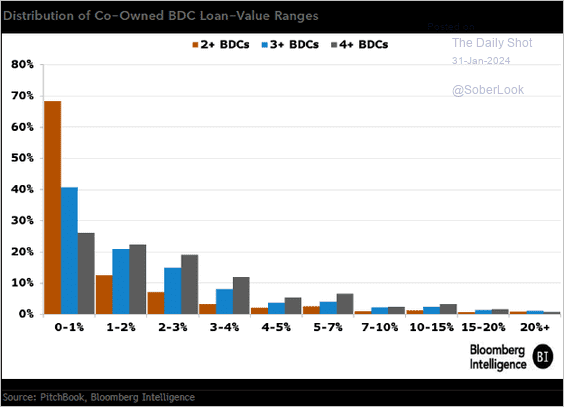

2. Loans held by multiple BDCs may not be marked at the same level.

Source: Ethan L Kaye, Bloomberg Intelligence Read full article

Source: Ethan L Kaye, Bloomberg Intelligence Read full article

Expect these variations in marks to widen when volatility increases (2Q20 was more volatile than 3Q23).

Source: Ethan L Kaye, Bloomberg Intelligence Read full article

Source: Ethan L Kaye, Bloomberg Intelligence Read full article

Back to Index

Rates

The market is forecasting an aggressive rate-cut cycle in the US. But the market is usually wrong, as indicated by the dashed lines reflecting historical projections.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Nevertheless, market expectations are driving easier financial conditions, which ironically may allow the Fed to delay cuts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

1. American workers are pressing their bosses for better pay:

Source: @jeffsparshott, @greg_ip

Source: @jeffsparshott, @greg_ip

2. Labor union approval rates:

Source: Bruce Mehlman Read full article

Source: Bruce Mehlman Read full article

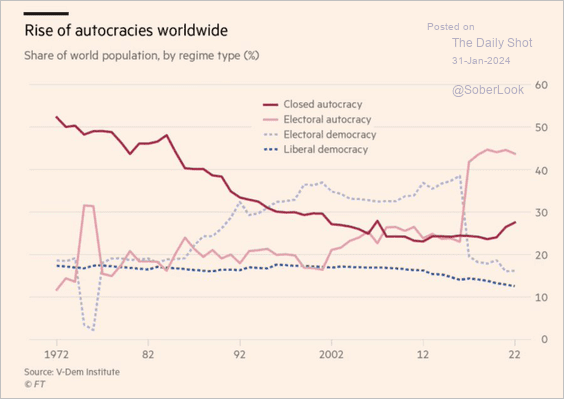

3. The rise of autocracies:

Source: @FT Read full article

Source: @FT Read full article

4. Clogged US immigration courts:

Source: The New York Times Read full article

Source: The New York Times Read full article

• Migrant flows/processing in 2023:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

5. The literal meaning of every state’s name:

Source: Wide Open Country Read full article

Source: Wide Open Country Read full article

——————–

Back to Index