The Daily Shot: 01-Feb-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

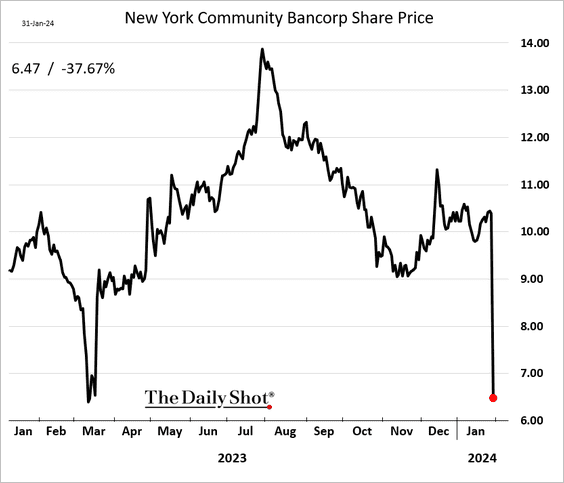

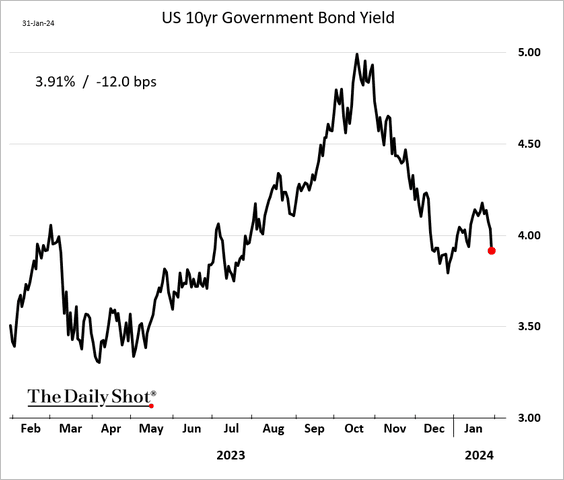

1. A confluence of events on Wednesday led to a sharp decline in equity prices and bond yields.

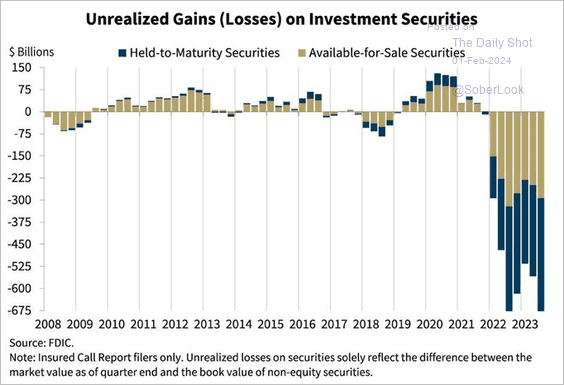

• Challenges facing New York Community Bancorp have reignited worries about the stability of smaller regional banks, focusing attention on issues related to real estate debt and depreciated bond portfolios (see Credit).

Source: MarketWatch Read full article

Source: MarketWatch Read full article

– Shares of regional banks tumbled.

– The 10-year Treasury yield dipped below 4%.

Below is the yield curve.

• The FOMC has shifted away from its tightening bias, but this adjustment does not necessarily signal an immediate interest rate cut. Here’s a comparison of the FOMC statement against the one from December.

Moreover, Chair Powell poured cold water on a March rate cut. The probability of a March rate reduction dipped below 35%.

Source: CNBC Read full article

Source: CNBC Read full article

• But that didn’t stop the 2-year Treasury yield from falling further.

Source: MUFG Securities

Source: MUFG Securities

The market sees the Fed cutting rates aggressively in 2024. Goldman still expects five reductions this year.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

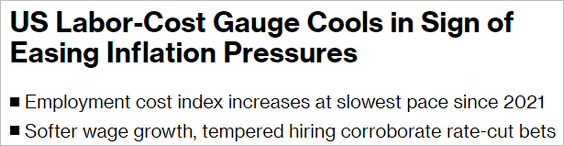

2. In addition to the renewed banking jitters, two economic data releases increase the chances of monetary easing.

• The ADP private payrolls report surprised to the downside.

The healthcare sector, a key driver of last year’s employment growth along with Leisure & Hospitality and public school education, seems to be losing momentum.

• Growth in the employment cost index slowed sharply last quarter.

Source: @economics Read full article

Source: @economics Read full article

——————–

3. The Chicago PMI, which is heavily influenced by production at Boeing, moved deeper into contraction territory.

4. Mortgage applications are running at multi-year lows.

5. The US is facing a housing shortage due to underinvestment in new construction.

Source: Urban Institute Read full article

Source: Urban Institute Read full article

Back to Index

Canada

1. The GDP growth was stronger than expected in November.

2. Inflation has been trending lower across most categories.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The United Kingdom

1. Home price appreciation in January was stronger than expected.

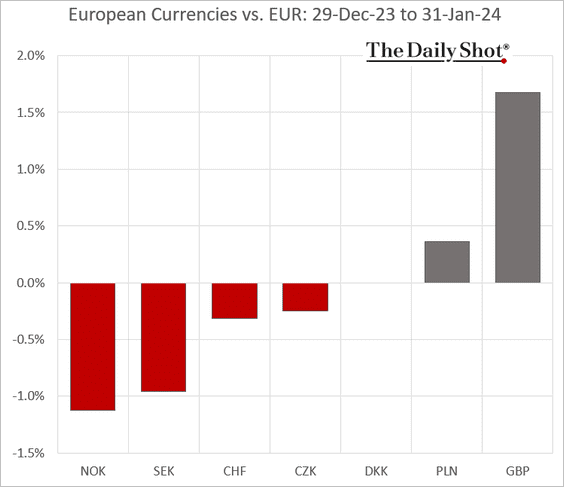

2. It was a good month for the pound.

• GBP/USD appears undervalued relative to its historical average.

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

1. Let’s begin with Germany.

• Unemployment appears to have stabilized.

• Retail sales tumbled in December.

• Inflation eased in January.

——————–

2. French inflation continues to moderate.

3. Recent supply chain pressures could lead to higher inflation.

Source: Alpine Macro

Source: Alpine Macro

4. Euro-area’s government debt issuance hit a record in January.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Europe

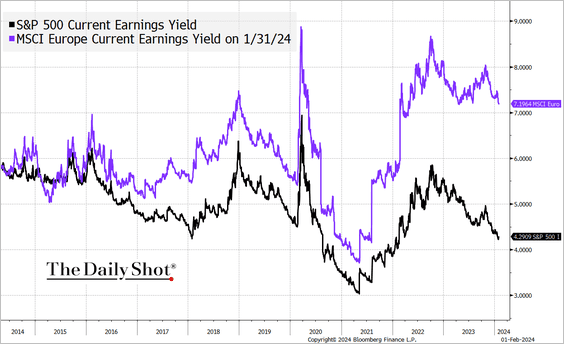

1. Based on current earnings yields, European stocks are very attractive relative to the US.

Source: @TheTerminal, Bloomberg Finance L.P. h/t John Authers

Source: @TheTerminal, Bloomberg Finance L.P. h/t John Authers

2. Here is a look at the rebound in EU tourist activity.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

1. Foreigners continue to load up on Japanese stocks.

2. The Taiwanese economy concluded 2023 with robust performance.

Manufacturing activity has almost stabilized.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

3. South Korea’s exports were up 18% on a year-over-year basis in January.

Manufacturing activity is back in growth territory.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

4. Australia’s residential construction activity finished last year on a soft note.

Back to Index

China

1. The manufacturing PMI report from S&P Global shows modest expansion in January.

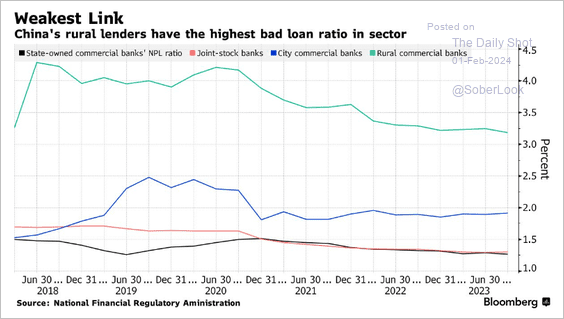

2. Beijing is taking measures to tackle the risks in China’s rural banking sector, characterized by high nonperforming loan ratios.

Source: @business Read full article

Source: @business Read full article

Source: @business Read full article

Source: @business Read full article

China’s overall bank net interest margins are at historic lows.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

.

3. Households continue to save a large share of their income.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Emerging Markets

1. The ASEAN manufacturing PMI shifted back into growth mode in January.

Source: S&P Global PMI

Source: S&P Global PMI

2. Economists have once again upgraded their growth projections for India in 2024.

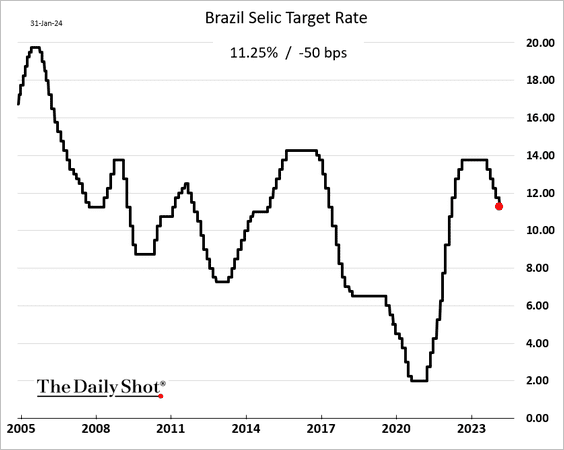

3. Brazil’s central bank cut its benchmark rate again.

4. Chile’s central bank delivered a decisive 100 bps rate reduction, …

… as industrial production weakened going into 2024.

——————–

5. Next, we have some EM performance data for January.

• Currencies (a rough month):

• Bond yields:

• Equity ETFs:

Back to Index

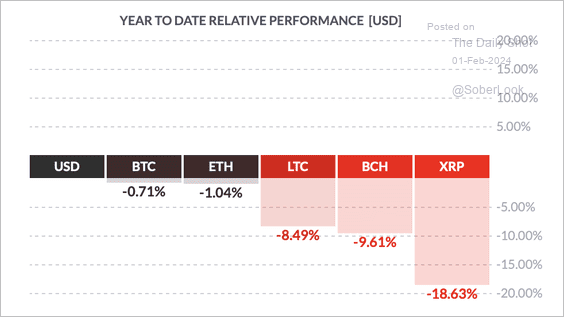

Cryptocurrency

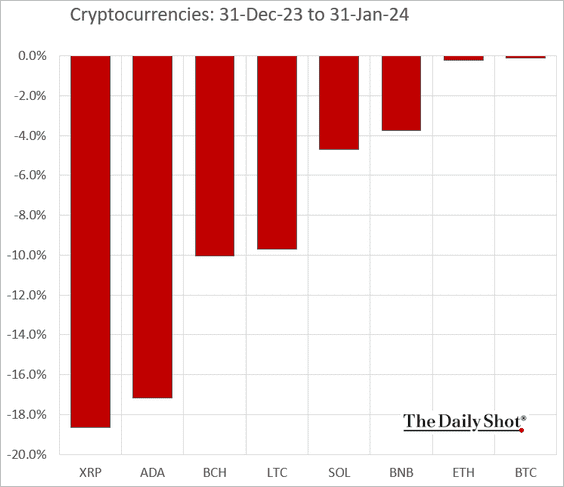

1. Bitcoin gave up most of its early-January gains, while Bitcoin Cash (BCH) lagged behind major cryptos.

Source: FinViz

Source: FinViz

Below is the market performance during the month of January.

——————–

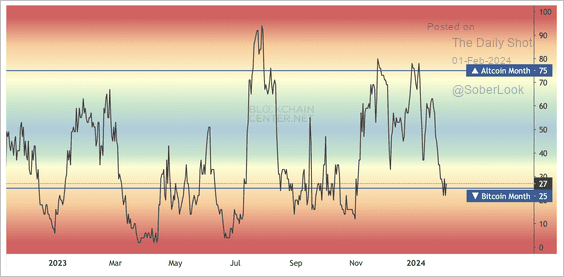

2. Only 27% of altcoins outperformed bitcoin over the past month – the lowest since October 2023.

Source: Blockchain Center

Source: Blockchain Center

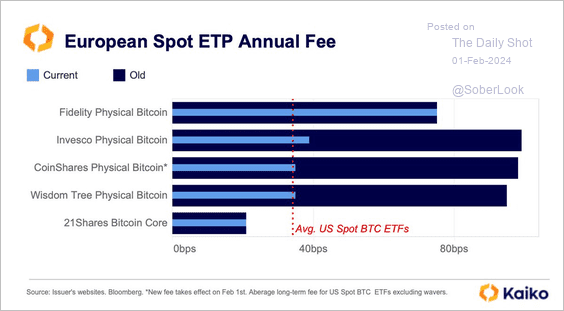

3. European spot-bitcoin ETFs cut fees last week, bringing them more in line with the US average.

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

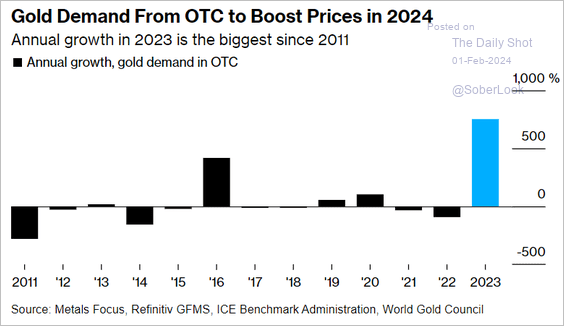

1. Gold demand growth in the OTC market was very strong last year.

Source: @markets Read full article

Source: @markets Read full article

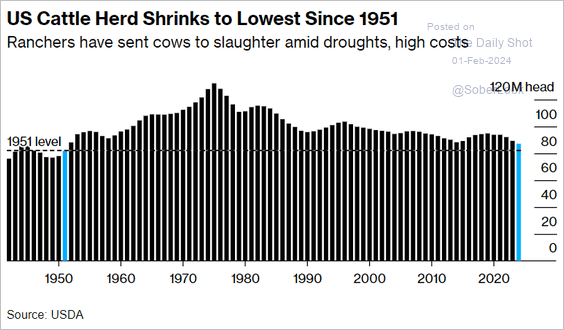

2. The size of the US cattle herd has reached its lowest point in decades.

Source: @markets Read full article

Source: @markets Read full article

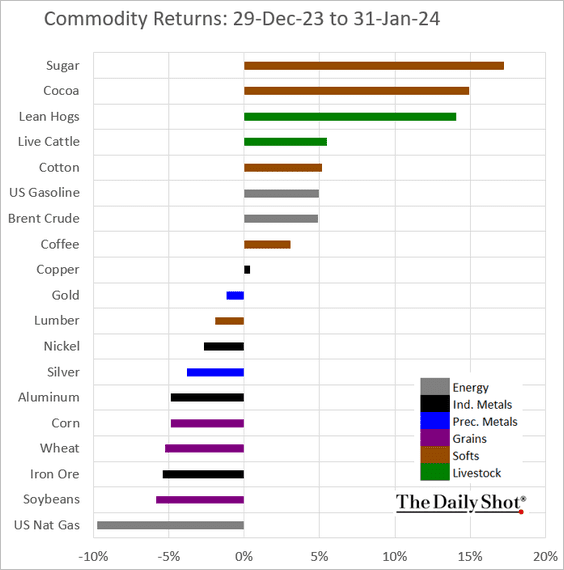

3. Here’s an overview of performance in key commodity markets for January.

Back to Index

Equities

1. Wednesday was a rough day for stocks.

2. Small caps tumbled, led by small/regional banks.

3. Retail investors were bullish going into the selloff.

Source: @WillieDelwiche; h/t @dailychartbook

Source: @WillieDelwiche; h/t @dailychartbook

4. Post-IPO stocks continue to widen their underperformance.

5. The S&P 500 tends to see a seasonal peak in mid-February.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

6. Next is the regional breakdown of the MSCI World Index.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

7. Here is a look at factor/style valuations relative to the past ten years.

8. Finally, we have some performance data for January.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance (Tesla was a drag on the “China sales” basket):

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

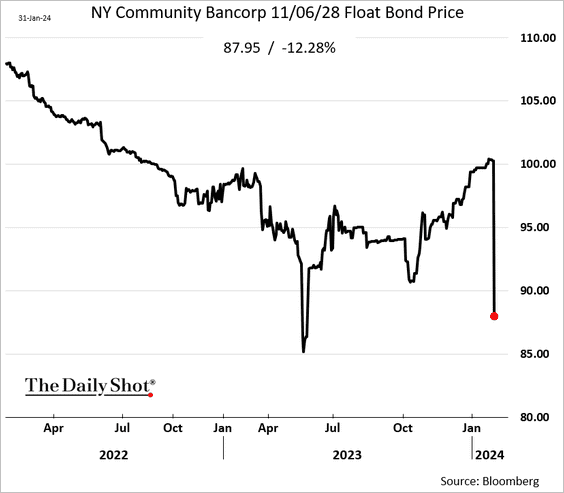

1. The New York Community Bancorp’s bonds tumbled amid stability concerns.

In addition to worries about office debt exposure at US small/regional banks, investors see potential issues with underwater bond portfolios.

——————–

2. Spreads on AAA-rated CLO tranches have been tightening.

Source: @markets Read full article

Source: @markets Read full article

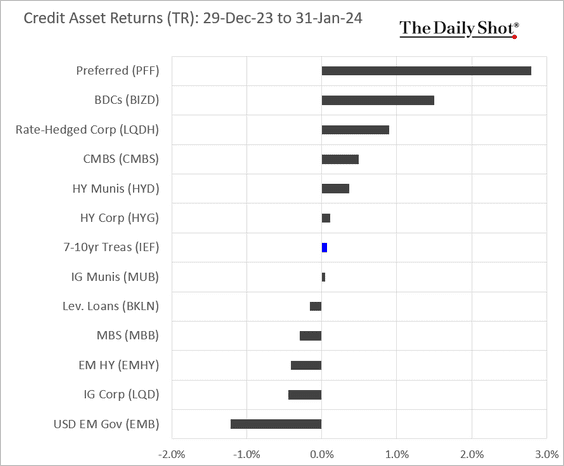

3. Here is a look at credit asset performance in January.

Back to Index

Global Developments

1. BofA’s financial market stability risk indicator rose as geopolitical tensions escalated last year.

Source: BofA Global Research

Source: BofA Global Research

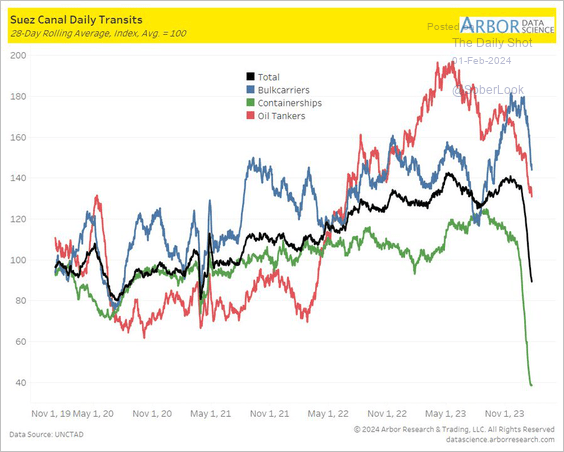

2. Here is a look at the Suez Canal traffic.

Source: @DataArbor; h/t @dailychartbook

Source: @DataArbor; h/t @dailychartbook

3. Finally, we have some performance data for the month of January.

• Currencies:

• Bond yeilds:

• Large-cap equities:

——————–

Food for Thought

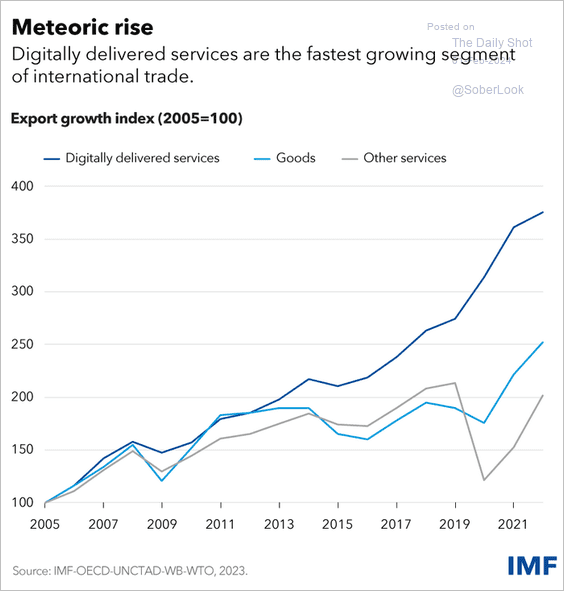

1. Digital services exports:

Source: IMF Read full article

Source: IMF Read full article

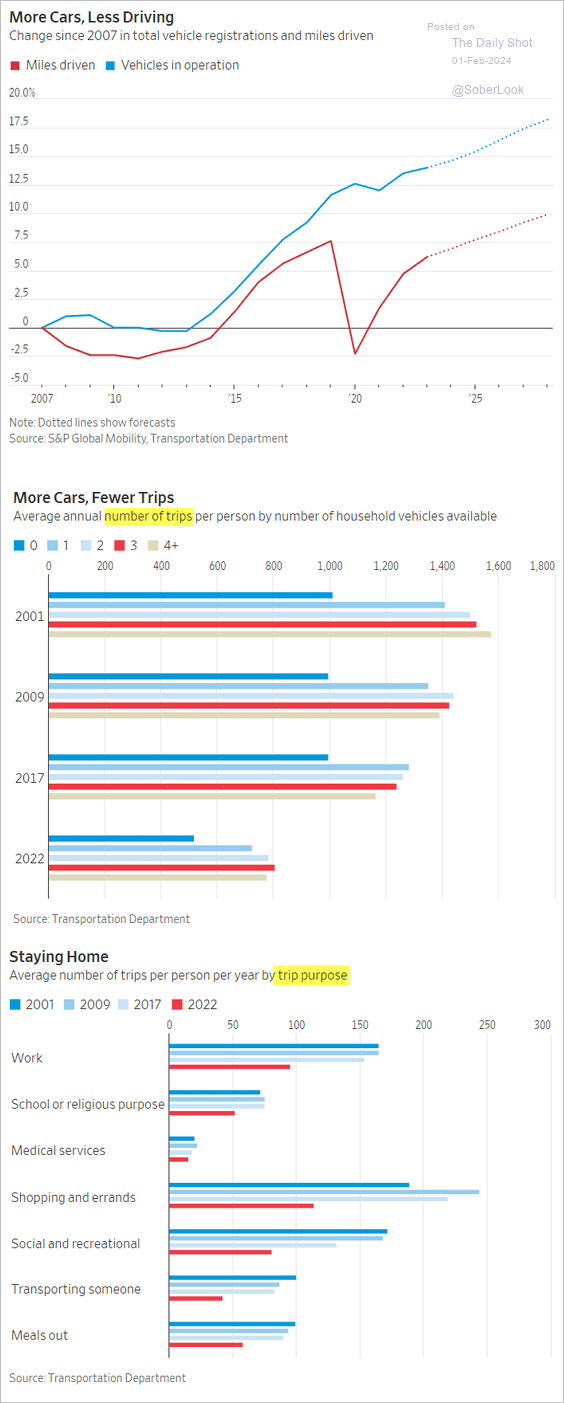

2. The divergence between vehicles on the road and miles driven:

Source: @WSJ Read full article

Source: @WSJ Read full article

3. The US federal government’s interest expense:

Source: CRFB

Source: CRFB

4. College graduation rates:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

5. Most uniquely searched game-day recipes in every state:

Source: DRGNews.com

Source: DRGNews.com

——————–

Back to Index