The Daily Shot: 06-Feb-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The ISM Services PMI rebounded last month from levels close to stagnation in December. Some economists are skeptical about this bounce in service sector activity.

• Demand growth improved.

• Employment returned to growth mode.

• Gains in input costs accelerated.

——————–

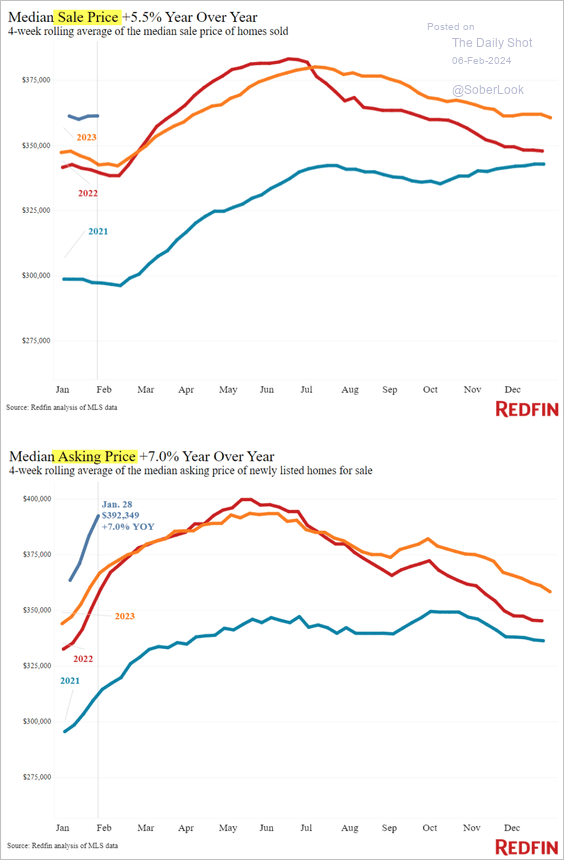

2. Next, we have some updates on the housing market.

• New listings have been running slightly above 2023 levels.

Source: Redfin

Source: Redfin

• Asking and sale prices are at record highs for this time of the year.

Source: Redfin

Source: Redfin

• New homes continue to represent over 30% of the total housing market listings.

Source: Redfin

Source: Redfin

• Fewer banks are tightening lending standards on mortgages.

Source: Federal Reserve Board

Source: Federal Reserve Board

But demand remains extremely weak.

Source: Federal Reserve Board

Source: Federal Reserve Board

——————–

3. A somewhat smaller share of banks have been tightening credit standards on consumer loans.

Source: Federal Reserve Board

Source: Federal Reserve Board

4. Economists continue to boost their forecasts for this year’s GDP growth.

• Goldman is much more optimistic about the US economy than consensus estimates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Core inflation projections have moved lower.

——————–

5. The resilient economy could delay Fed rate cuts.

Source: BCA Research

Source: BCA Research

7. Finally, here are some updates on the labor market.

• Job growth in high-wage sectors appears to have peaked for now.

Source: @economics Read full article

Source: @economics Read full article

• Here is another illustration of the divergence between the Establishment Survey (the official payrolls report) and the Household Survey.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• In the current earnings season, which sectors are most frequently discussing “layoffs” during their earnings calls?

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

• The significant increase in wage growth and the decrease in hours worked in January can be partly attributed to weather conditions. A reversal of these trends is likely in February.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• WARN data signal an uptick in layoffs to come.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

1. Services activity held deep in contraction territory last month.

2. Consumer confidence is rebounding.

3. A growing number of unemployed Canadians are out of work as a result of the employer’s decision rather than voluntary departure.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The United Kingdom

1. The UK services PMI continues to signal a rebound in economic activity.

Source: S&P Global PMI

Source: S&P Global PMI

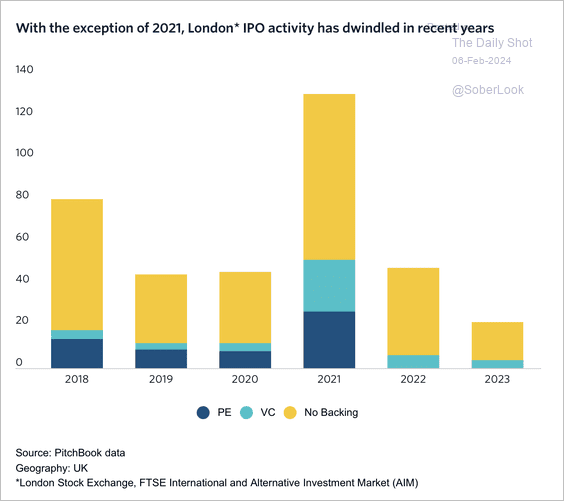

2. London’s IPO activity has weakened over the past two years as more British companies decided to list in New York or elsewhere in Europe.

Source: PitchBook

Source: PitchBook

3. It’s been a rough couple of days for GBP/USD.

Back to Index

The Eurozone

1. Germany’s manufacturing orders surged in December.

However, according to Commerzbank Research, the gains were driven by big-ticket items (such as aircraft, ships, etc.). Excluding these volatile items, the downward trend in factory orders remains intact.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

2. In December, Germany’s trade surplus reached its highest level in years.

• Although both exports and imports decreased, the decline in imports was more pronounced.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The trade gap with China narrowed last year.

Source: @economics Read full article

Source: @economics Read full article

——————–

3. The Eurozone’s final services PMI figure for January showed ongoing contraction.

4. Investor sentiment is rebounding.

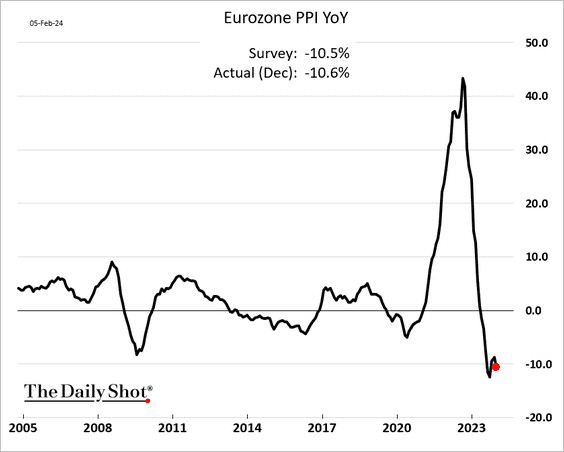

5. In December, the Eurozone’s PPI was down over 10% on a year-over-year basis.

Back to Index

Europe

1. Sweden’s services sector is back in growth mode.

2. Here is a look at the EU’s waste exports.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. Real wages remained below 2022 levels in December.

2. Household spending was weaker than expected.

Back to Index

China

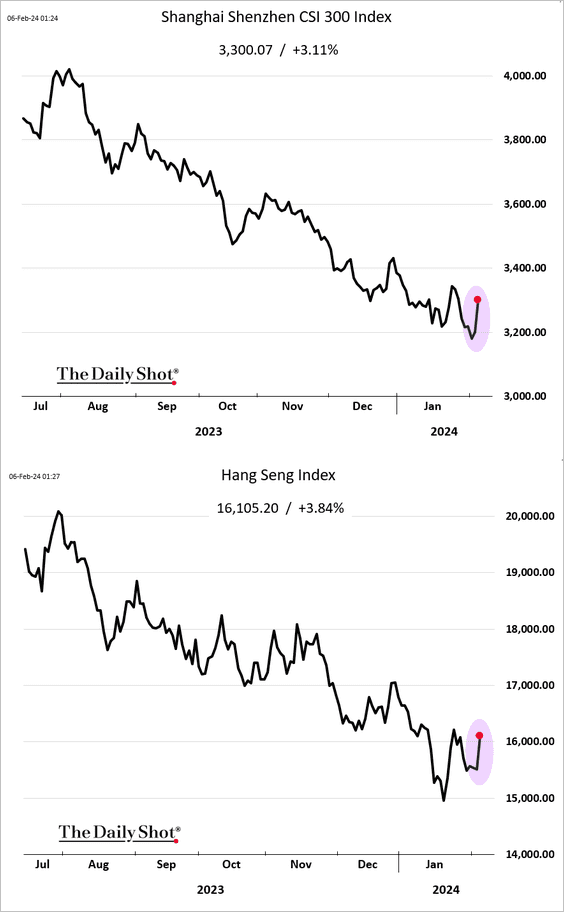

1. Stocks jumped after China’s sovereign fund promised to buy more equity ETFs. Beijing’s stock market bailout is in full swing.

Source: The Straits Times Read full article

Source: The Straits Times Read full article

——————–

2. Having lost pricing power, some of China’s exporters are struggling.

Source: Reuters Read full article

Source: Reuters Read full article

3. The market has been flooded with pork ahead of the holidays, which is adding to deflationary pressures.

Source: @economics Read full article

Source: @economics Read full article

4. The weak lending environment remains a headwind for Chinese real estate stocks.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

1. Turkey’s core inflation is holding above 70%.

2. The Philippine CPI continues to tumble.

3. According to the PMI report, Brazil’s services sector activity accelerated last month.

Source: S&P Global PMI

Source: S&P Global PMI

4. Argentina’s domestic vehicle sales hit a multi-year low.

5. The LatAm default rate remains elevated relative to other EM regions ex-China.

Source: S&P Global Ratings

Source: S&P Global Ratings

6. Real interest rates are still restrictive across most EMs.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Cryptocurrency

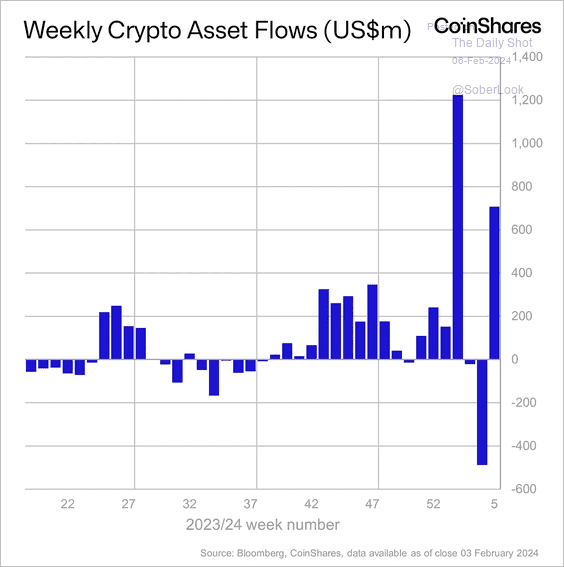

1. Crypto funds saw large inflows last week led by newly listed US spot-BTC products.

Source: CoinShares Read full article

Source: CoinShares Read full article

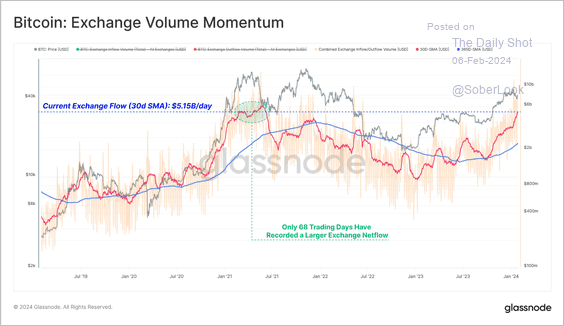

2. Bitcoin exchange volumes are recovering alongside the crypto price.

Source: @glassnode

Source: @glassnode

3. XRP sold off on Binance and OKX exchanges after last week’s hack of Ripple’s co-founder. (CVD stands for Cumulative Volume Delta – a measure of total buying and selling).

Source: @KaikoData

Source: @KaikoData

Source: CoinTelegraph Read full article

Source: CoinTelegraph Read full article

——————–

4. Here is a look at the month-to-date performance across some of the more liquid cryptos.

5. The BTC/ETH price ratio held support.

6. LINK/USD broke above a two-month trading range.

Back to Index

Commodities

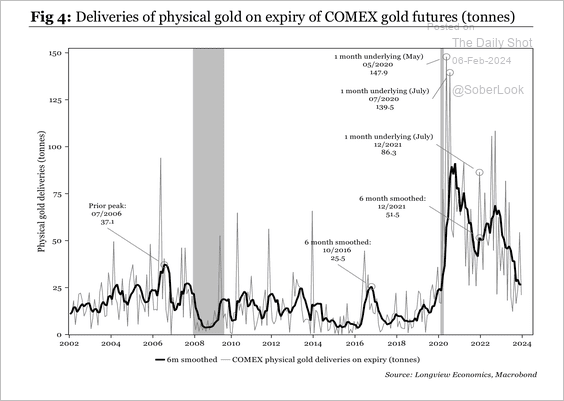

1. Physical gold deliveries have trended lower in recent years, possibly because investors and governments have chosen to hoard gold as geopolitical risks increased.

Source: Longview Economics

Source: Longview Economics

• The PBoC’s gold reserves sharply increased over the past year.

Source: Longview Economics

Source: Longview Economics

——————–

2. Cocoa futures have gone parabolic. Time to stockpile chocolate bars?

Back to Index

Equities

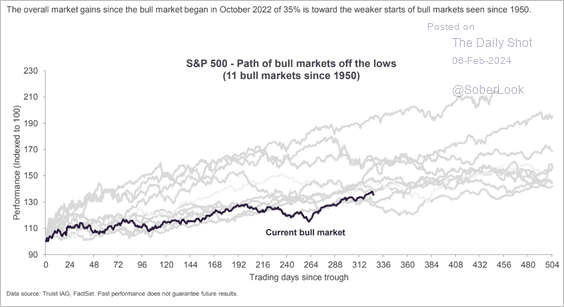

1. In a historical context, the current bull market has shown relatively modest strength.

Source: Truist Advisory Services

Source: Truist Advisory Services

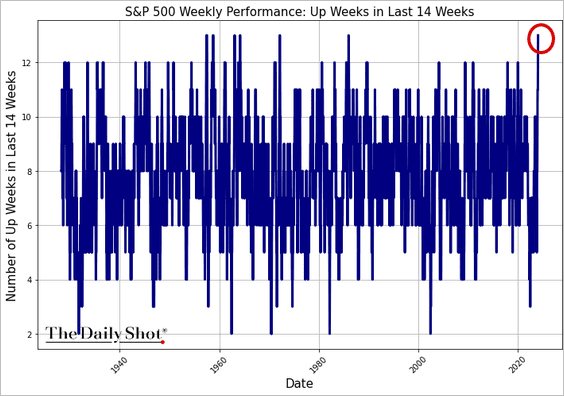

2. It has been a while since the S&P 500 was up in 13 out of 14 weeks.

3. The equal-weight index underperformance accelerated this year.

Global stocks show a similar trend.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

4. An AI bubble?

Source: BofA Global Research

Source: BofA Global Research

5. Next, let’s take a look at some trends in the Magnificent 7 stocks (the largest tech megacaps).

• Expected sales growth vs. the rest of the S&P 500:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Valuations:

Source: Goldman Sachs; @GunjanJS

Source: Goldman Sachs; @GunjanJS

• The Magnificent 7 weight in the S&P 500 and their earnings contribution to the index:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

5. The scarcity of bearish investors could limit further gains in the stock market.

h/t Truist Advisory Services

h/t Truist Advisory Services

6. The S&P 500 typically trades sideways during the first three months of an election year.

Source: @granthawkridge

Source: @granthawkridge

• Here’s an analysis of the S&P 500’s performance under various partisan configurations.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

7. The S&P 500 finally overtook T-bills on a total return basis from the start of 2022.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

8. Meme stocks are struggling this year.

Back to Index

Credit

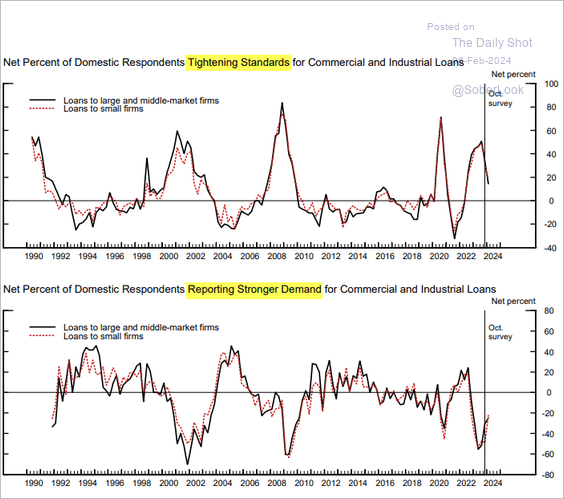

1. A declining number of banks are imposing stricter standards on business loans, yet demand continues to be weak.

Source: Federal Reserve Board

Source: Federal Reserve Board

• For commercial real estate loans, the proportion of banks tightening standards is twice as high compared to business loans, with demand remaining depressed.

Source: Federal Reserve Board

Source: Federal Reserve Board

• This chart shows bank expectations across loan types for this year.

Source: Oxford Economics

Source: Oxford Economics

——————–

2. 2024 corporate credit issuance has been exceptionally heavy this year.

Source: JP Morgan Research; @GunjanJS

Source: JP Morgan Research; @GunjanJS

3. Here is a look at the slump in commercial real estate prices.

Source: @wealth Read full article

Source: @wealth Read full article

Back to Index

Rates

1. It’s been a rough couple of days for long-term Treasuries.

However, on a week-over-week basis, much of the action has been at the shorter end of the curve.

——————–

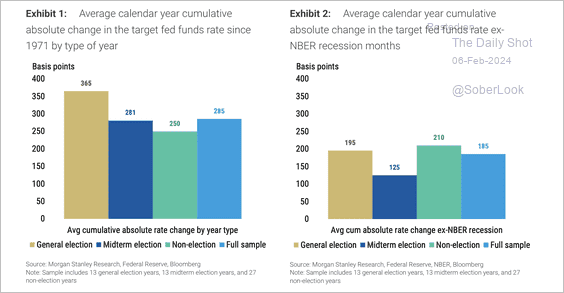

2. The Fed changes policy rates just as much during election years as non-election years.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

3. Treasuries’ real return is still negative for foreign investors.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Nonetheless, Treasuries have been popular abroad.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Global Developments

1. BofA’s model indicates a trough in global economic activity.

Source: BofA Global Research

Source: BofA Global Research

2. Global financial conditions have been easing.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

3. Factory activity stabilized last month. The second panel shows the January PMIs by country/region.

Source: S&P Global PMI

Source: S&P Global PMI

• Leading indicators point to further improvements in manufacturing going forward.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

4. Peak globalization?

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

1. The median age of US homebuyers:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

2. Manhattan homes bought with cash:

Source: @axios Read full article

Source: @axios Read full article

3. The cost of sending USD 200 across borders from selected countries:

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

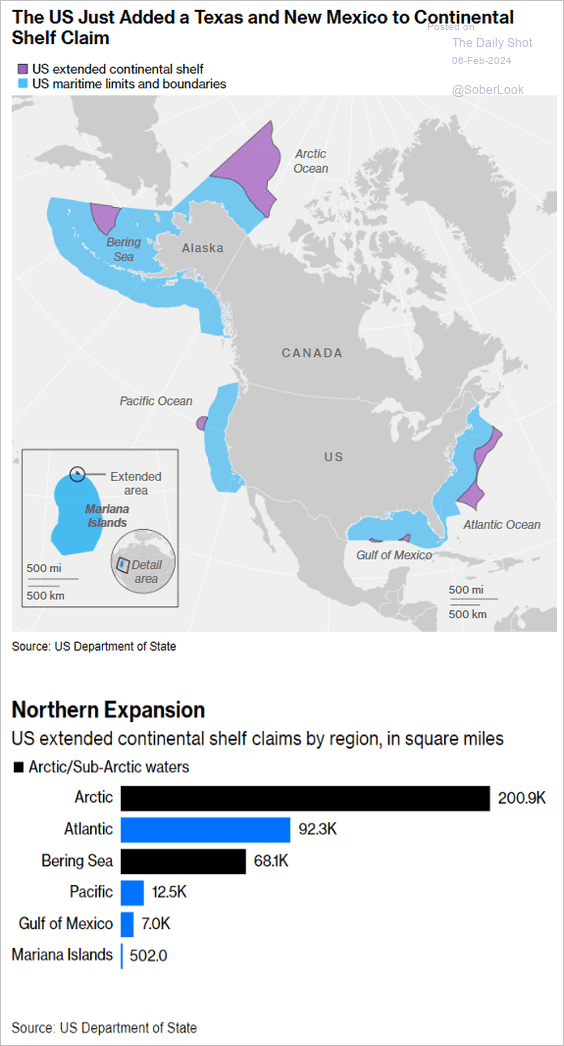

4. Expanded seabed claims:

Source: @opinion, @liamdenning Read full article

Source: @opinion, @liamdenning Read full article

5. Americans with US passports:

Source: @Datawrapper

Source: @Datawrapper

6. The most dangerous times to drive:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index