The Daily Shot: 07-Feb-24

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

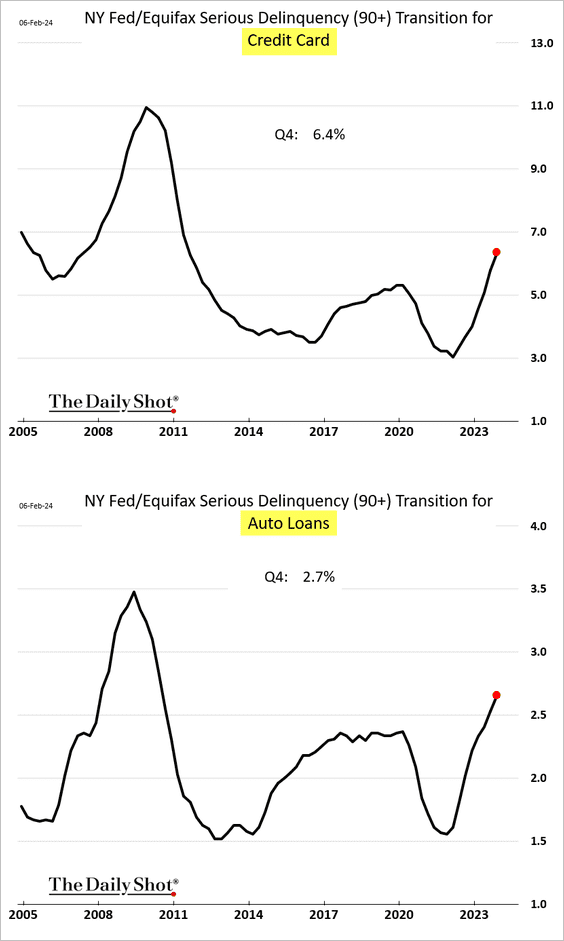

1. Consumer credit delinquencies keep moving higher, …

… especially among younger Americans.

——————–

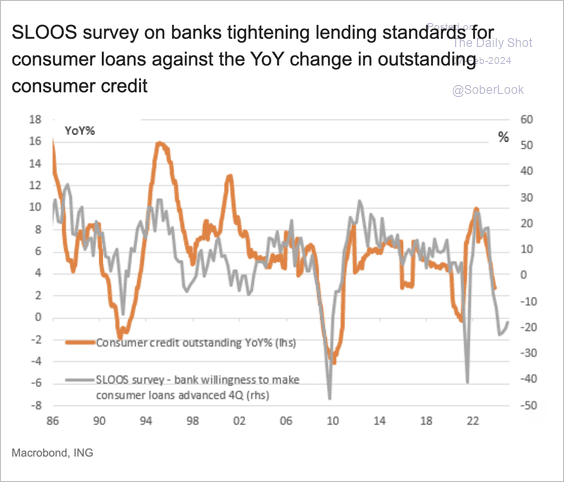

2. Tight lending standards still signal a slowdown in consumer credit ahead.

Source: ING

Source: ING

3. Despite recent slowdowns in price increases, Americans still perceive inflation as high, attributed to the elevated costs of highly visible and frequently purchased items.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Consumer sentiment has not kept pace with strong economic growth, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

… despite a relatively low Misery Index.

——————–

4. Restaurant spending slowed in January, partially due to cold weather in parts of the US.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

5. Tech layoffs are picking up again.

Source: Layoffs.fyi

Source: Layoffs.fyi

6. With current expectations of reduced inflation ahead, the Fed would have to lower rates by 75 basis points merely to maintain the current tightness of monetary policy.

Source: TS Lombard

Source: TS Lombard

And that’s exactly what the central bank is promising.

Source: Fortune Read full article

Source: Fortune Read full article

Concerns about an inflation resurgence keep Fed officials from signaling policy easing.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Canada

1. The Ivey PMI indicator, which includes public organizations, remains in expansion territory.

2. Building permits tumbled in December.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

1. Germany’s industrial production dropped more than expected in December as the manufacturing slump worsened.

• The nation’s construction sector remains in terrible shape.

• Germany’s economy lags DM peers.

Source: @axios Read full article

Source: @axios Read full article

——————–

2. Despite Germany’s troubles, Eurozone equity indices are hitting record highs.

• Germany:

• The Netherlands:

• Italy:

• Europe:

——————–

3. Italian economic sentiment edged higher last month.

• Separately, Italy faces dire demographic challenges.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

4. Here is a look at euro-area inflation expectations.

5. Eurozone retail sales took a hit in December.

6. The EUR/USD exchange rate has been driven by market expectations of Fed policy.

Source: TS Lombard

Source: TS Lombard

Back to Index

Europe

1. Large European firms derive less than half of their revenues from Europe.

Source: @WSJ Read full article

Source: @WSJ Read full article

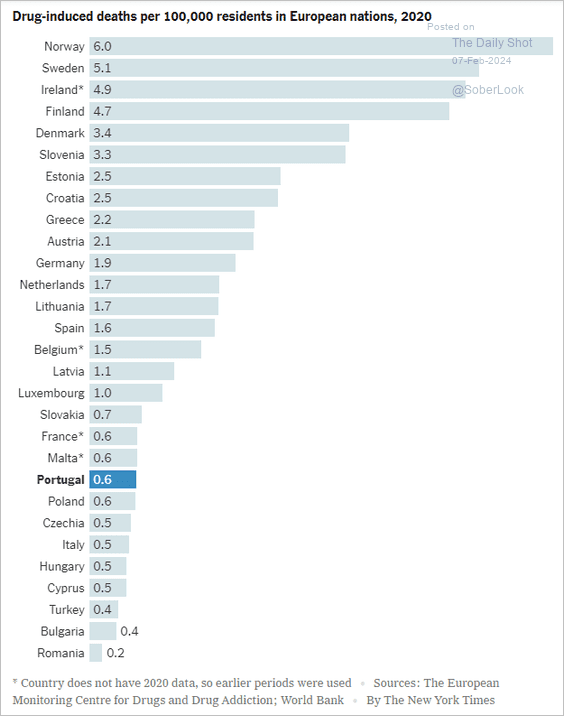

2. Here is a look at drug overdose rates.

Source: The New York Times Read full article

Source: The New York Times Read full article

Back to Index

Asia-Pacific

1. Taiwan’s inflation tumbled last month.

2. This chart shows single-person households in South Korea.

Source: USDA Read full article

Source: USDA Read full article

3. Australian retail sales were higher than expected last quarter.

4. New Zealand’s Q4 employment report topped forecasts. The unemployment rate increased less than expected.

Wage growth accelerated.

Bond yields jumped in response to the employment report.

Back to Index

China

1. Margin trades declined sharply this month as the market slumped. Will we see a rebound in leverage usage?

Source: @markets Read full article

Source: @markets Read full article

• Trading volume on China’s small-cap ETF surged as Beijing ramped up support.

![]() Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

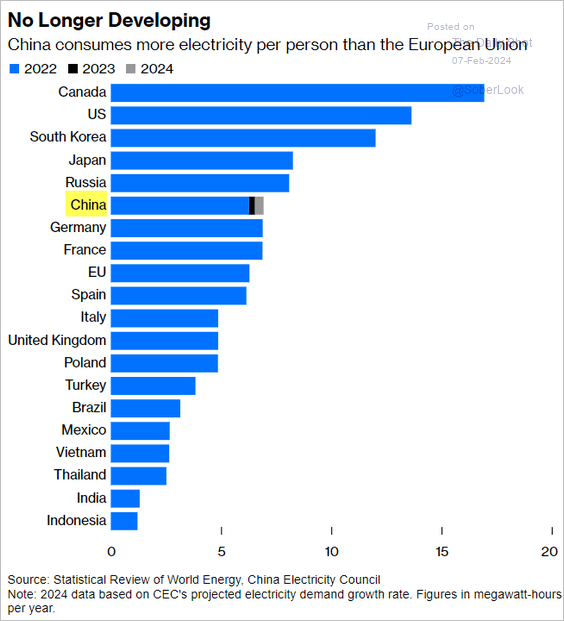

2. China consumes more electricity per person than the EU.

Source: @davidfickling, @opinion Read full article

Source: @davidfickling, @opinion Read full article

Back to Index

Emerging Markets

1. Brazil’s nonperforming loan levels are easing.

2. Argentina’s industrial production and construction activity slumped in December.

——————–

3. Asset allocators continue to rotate from China to India.

Source: @markets Read full article

Source: @markets Read full article

4. Malaysia’s factory output slowed going into the year-end.

5. The Philippine unemployment rate hit a new low.

6. There was a significant rise in EM debt upgrades in December, mostly attributed to issuers from Brazil.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Commodities

1. US corn and soybeans remain under pressure.

——————–

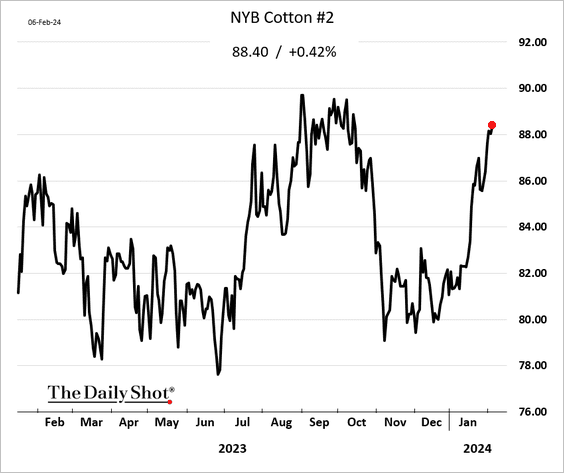

2. Cotton futures have been rallying.

Back to Index

Energy

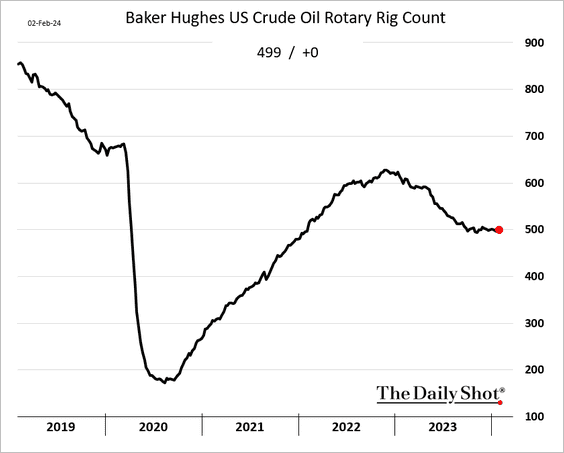

1. The US rig count is holding near 500.

Fracking activity showed some improvement last week.

——————–

2. Amid freezing conditions in parts of the country, US natural gas consumption reached a new daily record in January.

Source: @EIAgov

Source: @EIAgov

Nonetheless, natural gas futures are toying with $2/mmbtu.

Back to Index

Equities

1. VIX has been below 15 for 61 trading sessions in a row.

• Volatility skew indicates a highly bullish sentiment among options traders.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

——————–

2. The S&P 500 and 60% equity/40% bond portfolio significantly outpaced the 10-year Treasury on a total return basis during the post-pandemic inflation environment.

Source: Alpine Macro

Source: Alpine Macro

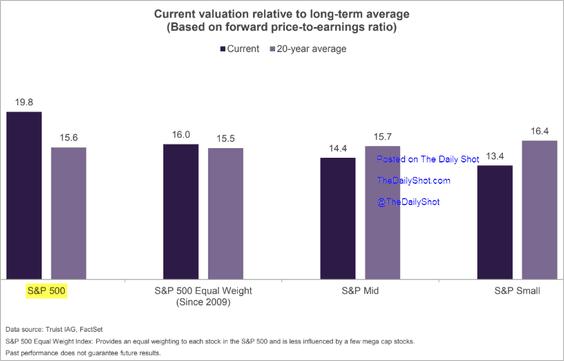

3. Here is a look at US valuations for the S&P 500, equal-weight, mid-cap, and small-cap indices, relative to their 20-year average.

Source: Truist Advisory Services

Source: Truist Advisory Services

• US small-caps are extremely undervalued versus large-caps.

Source: Alpine Macro

Source: Alpine Macro

• International markets are trading in line with longer-term valuations.

Source: Truist Advisory Services

Source: Truist Advisory Services

• Current valuation spreads between growth and value stocks indicate a period of low forward returns for growth.

Source: Stifel

Source: Stifel

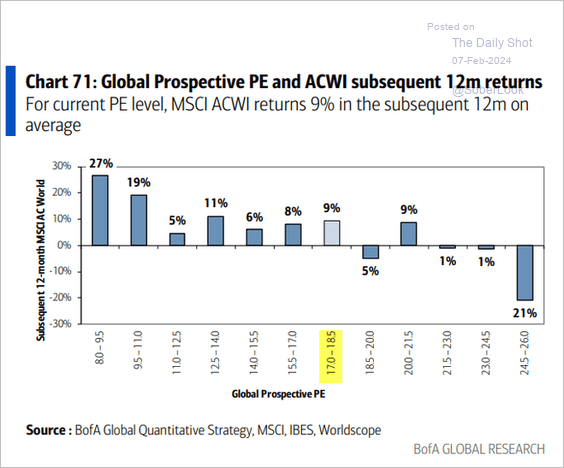

• Based on current valuations, the MSCI global equity index returns 9% in the subsequent 12-month period.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

4. Large- and small-cap correlations to real rates have diverged.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

5. Flows into tech funds have been remarkable. Energy continues to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Here is a breakdown of US growth and value ETF sector weights.

Source: Alpine Macro

Source: Alpine Macro

7. Improving market breadth could benefit value stocks relative to growth stocks.

Source: Stifel

Source: Stifel

8. Long-duration stocks have been outperforming in recent days.

Back to Index

Credit

1. New York Community Bancorp’s common and preferred shares tumbled again on Tuesday. Bonds are not trading much.

• Moody’s downgraded NYBC to junk.

Moody’s Investors Service (Moody’s) today has downgraded all long-term and some short-term ratings and assessments of New York Community Bancorp, Inc. (NYCB, long-term issuer rating to Ba2 from Baa3), and its lead bank, Flagstar Bank, NA, (long-term deposits to Baa2 from A3) including the baseline credit assessment to ba1 from baa2.

…

Today’s rating action reflects multi-faceted financial, risk-management and governance challenges facing NYCB.

…

NYCB is highly concentrated in rent regulated multi-family properties, a segment which has historically performed well for them. However, this cycle may be different. While vacancy rates are low for this CRE segment, properties may face different challenges this cycle due to higher interest expense when refinanced and already higher maintenance costs due to inflationary pressures. These higher costs may prove more challenging for owners of rent regulated properties to pass along through rent increases to tenants. Beyond rent-regulated, the bank has a significant concentration of low fixed-rate multifamily loans. This type of loan portfolio faces refinancing risk.

——————–

2. A rebound in business loan growth ahead?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

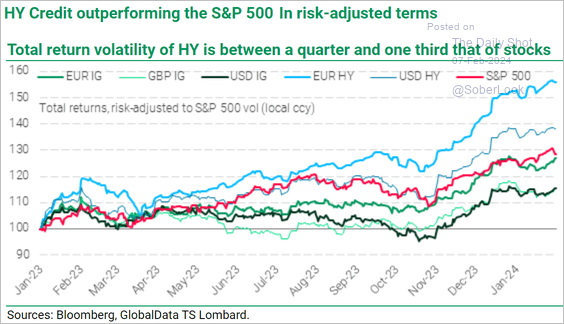

3. High-yield bonds have been outperforming the S&P 500 on a risk-adjusted basis.

Source: TS Lombard

Source: TS Lombard

4. There is significant value dispersion within the US investment-grade bond universe.

Source: VanEck Read full article

Source: VanEck Read full article

5. US investment-grade issuer leverage has been moving lower.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

Food for Thought

1. US growth in working-age population:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

2. COVID-era changes in job listings on Indeed:

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Text message scams:

Source: USAFacts

Source: USAFacts

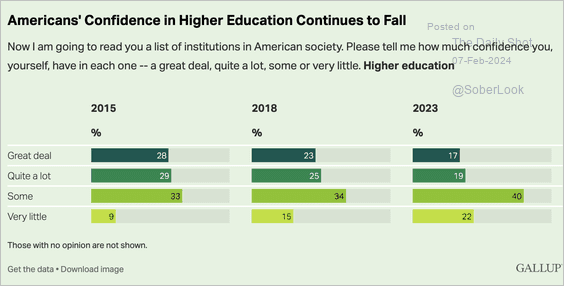

4. Trust in higher education:

Source: Gallup Read full article

Source: Gallup Read full article

5. Venezuelans on the move:

Source: @WSJ Read full article

Source: @WSJ Read full article

6. Toyota and Tesla share prices:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

7. Dry January participants’ alcohol replacement:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index