The Daily Shot: 08-Feb-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Growth in consumer credit slowed sharply in December.

This chart shows the year-over-year trends.

Source: Oxford Economics

Source: Oxford Economics

• Growth in credit card debt stalled and was negative when adjusted for inflation.

Here is credit card debt relative to disposable personal income.

• Student debt was down $37 billion last quarter compared to 2022.

——————–

2. US households maintain a relatively strong financial position, as evidenced by the Financial Obligations Ratio remaining at comparatively low levels.

h/t Deutsche Bank Research

h/t Deutsche Bank Research

• Households’ financial assets surged since the pandemic, especially among high-income groups.

Source: MRB Partners

Source: MRB Partners

——————–

3. Perceptions of the economy have split massively along political party lines.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

4. Next, we have some updates on inflation.

• Fewer companies are mentioning inflation in earnings calls.

Source: BofA Global Research

Source: BofA Global Research

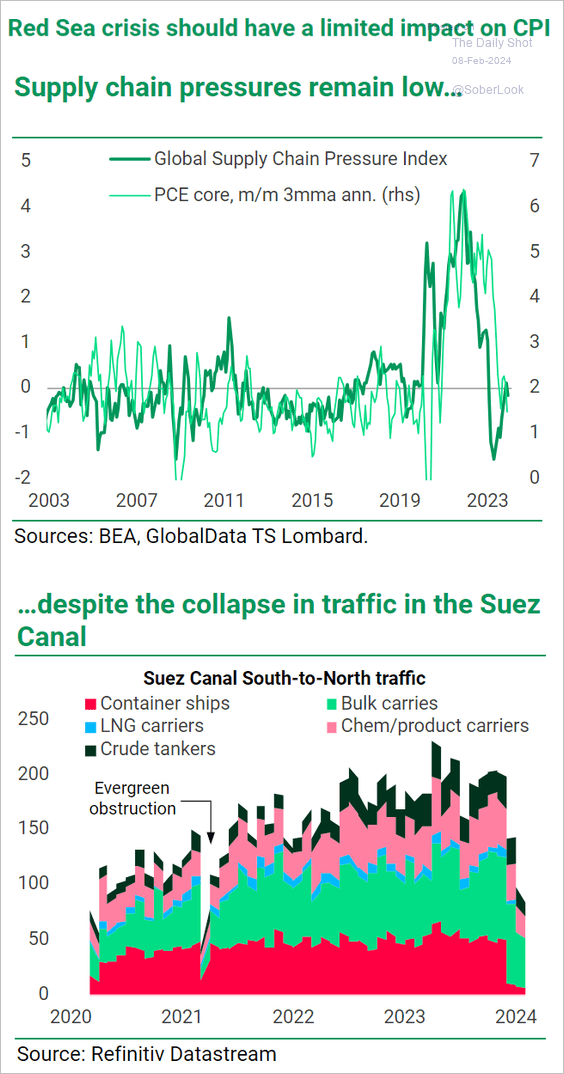

• Supply chain pressures are relatively low despite the Suez Canal fiasco.

Source: TS Lombard

Source: TS Lombard

• The Atlanta Fed’s wage growth tracker declined further last month but remains well above pre-COVID levels.

However, when adjusted for productivity, growth in employment costs is around 2%.

Source: Alpine Macro

Source: Alpine Macro

——————–

5. Mortgage applications are holding at multi-year lows.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

6. According to Optimal Blue, home price appreciation reached 5.9% (year-over-year) in January but is expected to ease from here.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

7. The trade balance was almost unchanged in December.

• Both imports and exports increased.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Here is the trade balance in services.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

The United Kingdom

1. According to the most recent RICS report, the housing market shows signs of revitalization.

Buyer interest is picking up momentum.

——————–

2. Signs point to the construction sector slump easing, but housing construction remains in the doldrums.

3. GBP/EUR is off to a strong start this year compared to its historical pattern.

Source: Convera

Source: Convera

Back to Index

The Eurozone

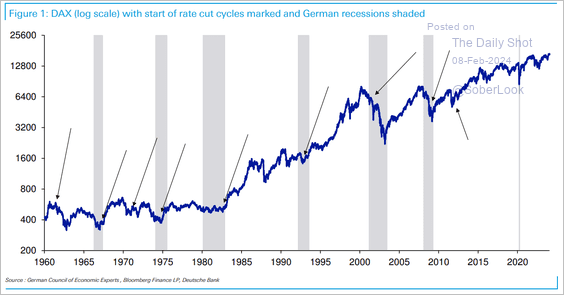

1. It is rare for the ECB to cut rates when stocks have not been declining for several months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Here is the breakdown of the ECB’s net securities purchases by country.

Source: @DanielKral1

Source: @DanielKral1

3. This chart shows the components of Germany’s industrial production slump.

Source: @DanielKral1

Source: @DanielKral1

4. Spain’s industrial production edged lower in September.

Back to Index

Europe

1. Is the SNB selling the franc again?

Fundamentals do not favor the Swiss franc.

Source: Gavekal Research

Source: Gavekal Research

——————–

2. Here is a look at the share of renewable energy sources in transportation.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. The Nikkei 225 is nearing its 1990 peak.

2. The correlation between USD/JPY and the S&P 500 has broken down.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

China

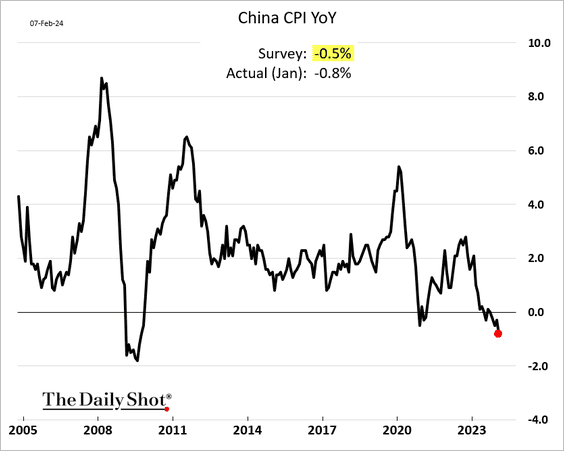

1. China’s disinflationary pressures persist, partly reflecting weak domestic demand. In January, the CPI had its biggest year-over-year decline since the GFC.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

Below are some CPI components.

• Core inflation:

• Services:

• Consumer goods:

• Food:

——————–

2. The PPI also remains in deflation territory.

3. Beijing is pulling out all the stops to boost stock prices.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• The FTSE China A50 Index experienced an oversold bounce and is approaching resistance at its 40-week moving average.

Back to Index

Emerging Markets

1. Brazil’s retail sales dropped in December.

• The public budget blew out going into the year-end.

——————–

2. Chile’s trade surplus hit a multi-year high.

• The nation’s wage growth is moderating.

——————–

3. Mexico’s consumer sentiment is holding up.

4. India’s remittances are massive.

Source: Capital Economics

Source: Capital Economics

Back to Index

Commodities

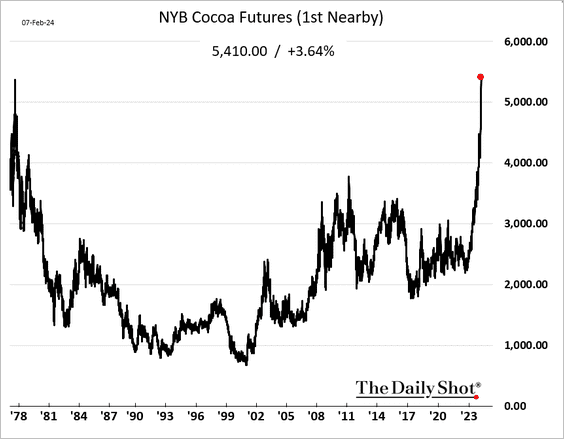

1. Cocoa futures hit a record high, taking out the 1977 peak.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

2. US corn futures hit the lowest level since 2020.

3. Frozen orange juice prices are nearing last year’s peak.

Back to Index

Energy

1. US oil inventories jumped last week, but refined product stockpiles declined sharply.

• Weekly changes:

• Barrels:

2. Gasoline demand is rebounding after the January freeze.

3. Refinery utilization and inputs are still quite low.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

4. US crude oil production is back near record highs.

5. Crack spreads are rebounding.

6. US natural gas dipped below $2/mmbtu.

7. Big oil paid out a lot of cash to investors last year.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

1. The S&P 500 hit another record high and is back in overbought territory.

2. Shares of regional banks continue to struggle.

• The regional banks’ implied volatility response in the latest banking turmoil has been relatively modest.

Source: Barclays Derivatives Research; @WallStJesus

Source: Barclays Derivatives Research; @WallStJesus

——————–

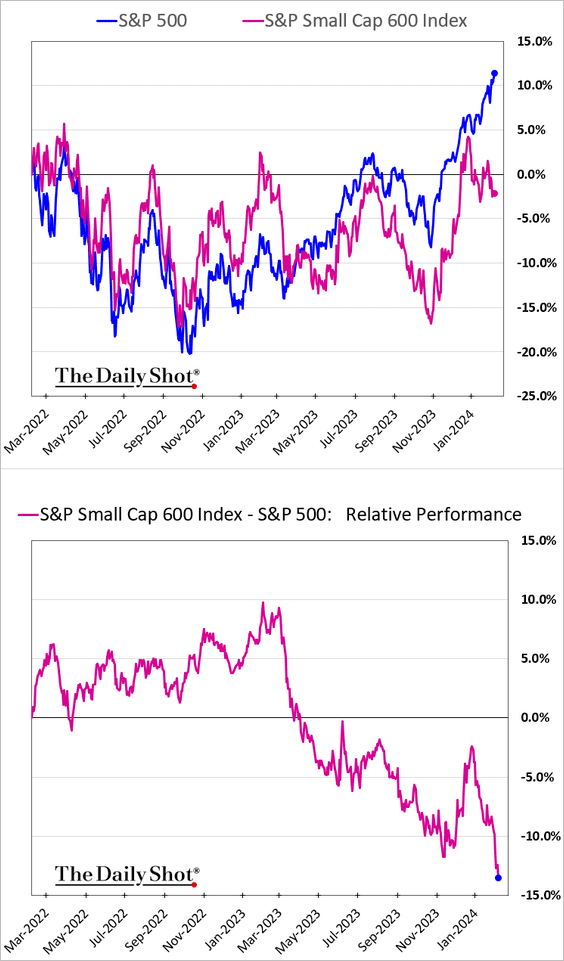

3. Small-cap underperformance widened in recent days, exacerbated by pressure on smaller banks.

4. The Q4 earnings data showed renewed margin pressures.

Source: Oxford Economics

Source: Oxford Economics

Will margin pressures persist into 2024? Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

5. Last year, a record number of S&P 500 members underperformed the index.

Source: Gavekal Research

Source: Gavekal Research

6. Aerospace and Defence stocks typically outperform the S&P 500 after major geopolitical events.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Credit

1. Office REITs are extending their underperformance as attention once again shifts to regional banks’ commercial real estate debt holdings.

2. Large banks are easing lending standards on business loans while regional/small banks are tightening standards. This is not a good outcome for small businesses.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

3. Bankruptcy filings slowed in January.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

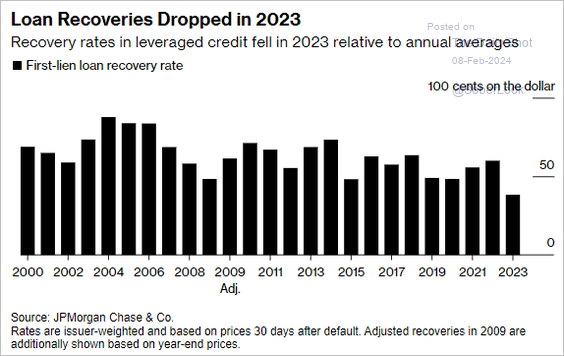

4. Leveraged loan recovery rates are at multi-year lows.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

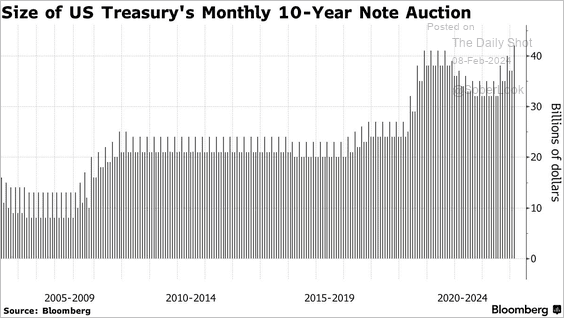

1. The Treasury significantly increased coupon auction sizes since the August refunding and announced increases for the February through April quarter. Supply continues to adjust for rising deficits and Fed redemptions.

Source: Oxford Economics

Source: Oxford Economics

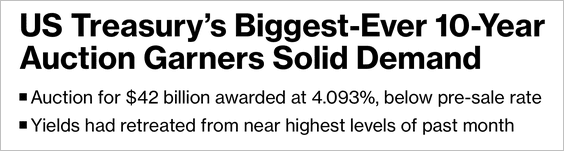

A record-high 10-year note auction was met with solid demand on Wednesday, sending yields lower.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

2. Dealers’ outright coupon Treasury positions continue to climb.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

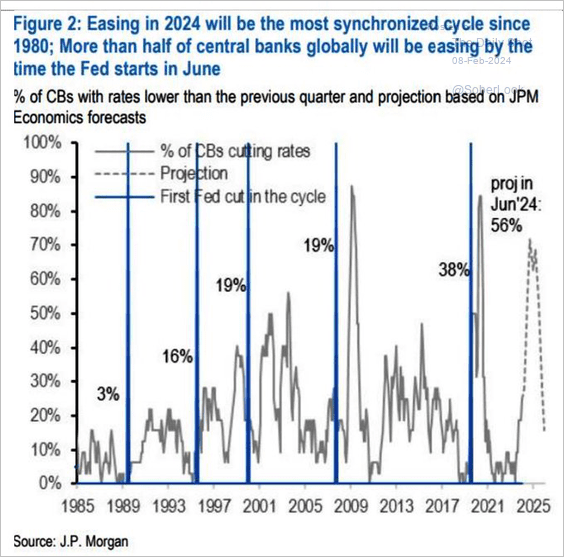

1. According to JP Morgan Global Research, 56% of central banks will be easing by the time the Fed starts cutting rates.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

2. Here is a look at public debt-to-GDP ratios.

Source: OECD Read full article

Source: OECD Read full article

3. Global real estate funds are starting to see positive returns.

Source: PitchBook

Source: PitchBook

4. Flows into risky assets relative to safe assets improved this year.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

Food for Thought

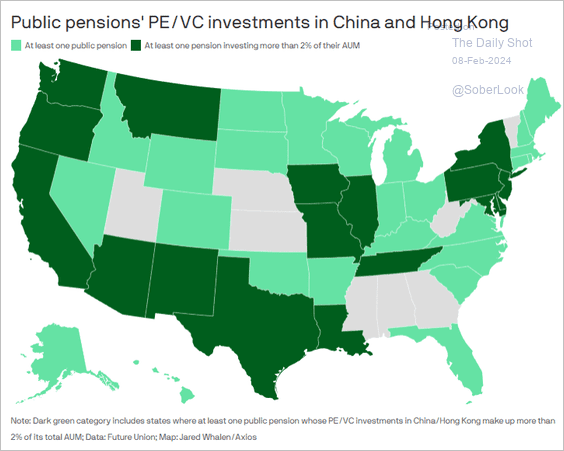

1. Public pensions investing in China:

Source: @axios Read full article

Source: @axios Read full article

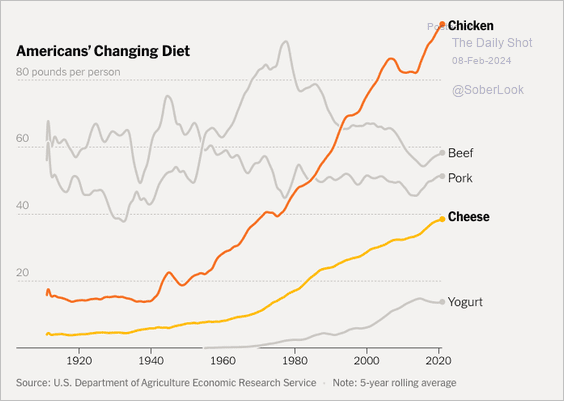

2. Americans’ changing diet:

Source: The New York Times Read full article

Source: The New York Times Read full article

3. Hospital beds per 1000 people:

Source: Codera Analytics

Source: Codera Analytics

4. Mentions of AI on earnings calls:

Source: @JeffreyKleintop

Source: @JeffreyKleintop

5. Laws enacted by the US Congress:

Source: Bruce Mehlman Read full article

Source: Bruce Mehlman Read full article

6. Live TV viewership:

Source: @axios Read full article

Source: @axios Read full article

7. Super Bowl spending:

Source: Statista

Source: Statista

——————–

Back to Index