The Daily Shot: 05-Feb-24

• The United States

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

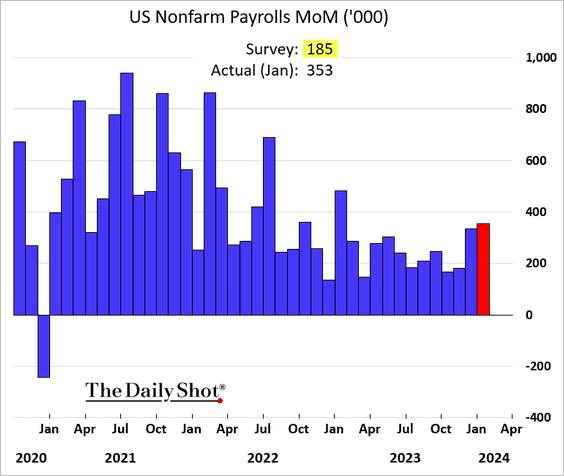

1. The January jobs figure was almost twice the expected, challenging the narrative of a decelerating labor market.

Here are the contributions.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– The pullback in healthcare hiring we saw in the ADP report appears to have been a false signal.

Source: @axios Read full article

Source: @axios Read full article

——————–

– However, the Household Survey once again showed a decline in jobs, further diverging from the Establishment Survey (above).

– Here is a look at the 6-month changes by sector.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The unemployment rate held steady last month, …

… but underemployment edged higher.

• The participation rate was unchanged, but prime-age participation ticked up.

– The share of Americans with disabilities who are working remains elevated.

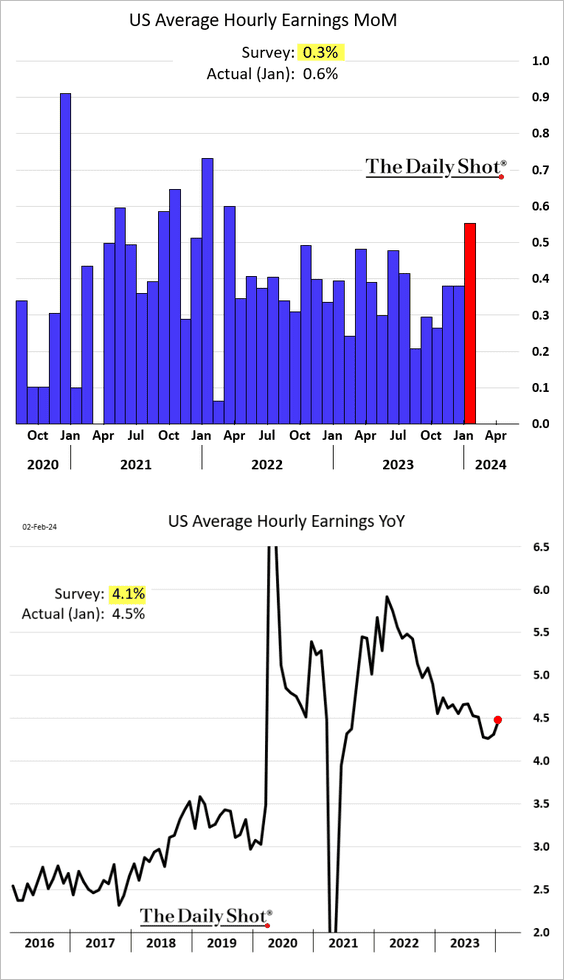

• Wage growth unexpectedly accelerated, further spooking the markets.

– But hours worked dipped to the lowest level since the COVID shock.

——————–

2. Fed rate cut expectations eased after the employment report.

– Probability of a March rate cut:

– The total expected rate reduction in 2024:

• Treasury yields surged, climbing further this morning.

——————–

3. The Citi Economic Surprise Index has been moving higher.

4. The University of Michigan’s final consumer sentiment index for last month confirmed a substantial uptick in sentiment.

Here are the contributions to the index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

5. Railcar loadings have improved over the past six months.

Source: TS Lombard

Source: TS Lombard

6. Legislative initiatives like the Inflation Reduction Act, CHIPS Act, and the Bipartisan Infrastructure Law are exerting a greater impact on trade policy.

Source: JP Morgan Research

Source: JP Morgan Research

• Moreover, geopolitical tensions intensify changes in trade decisions.

Source: JP Morgan Research

Source: JP Morgan Research

• As a result, we are already seeing dramatic shifts in trade patterns.

Source: JP Morgan Research

Source: JP Morgan Research

Back to Index

The Eurozone

1. The sharp decline in Germany’s truck toll mileage points to weaker real GDP, which could also weigh on the broader euro area.

Source: PGM Global

Source: PGM Global

2. French factory output strengthened in December.

Back to Index

Asia-Pacific

1. In December, Singapore’s retail sales saw the biggest year-over-year decline since early 2021.

2. Australia’s inflation tracker eased last month.

Back to Index

China

1. The mainland stock market benchmark is at a five-year low.

• Tech shares remain under pressure.

• Domestic investors increasingly look abroad.

Source: @markets Read full article

Source: @markets Read full article

• Beijing is desperately trying to stem the market rout.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. China’s government bond yields continue to drop.

3. This chart shows the largest global bankruptcies.

Source: @axios Read full article

Source: @axios Read full article

4. Beijing is increasingly focused on infusing liquidity into the struggling property sector.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

5. The PMI report from S&P Global points to ongoing expansion in China’s services sector.

Back to Index

Emerging Markets

1. Many EM currencies have been under pressure.

Here is the Chilean peso.

——————–

2. Brazil’s industrial production accelerated in December.

3. India’s services sector remains remarkably strong.

Source: S&P Global PMI

Source: S&P Global PMI

4. Thai inflation continues to slow.

5. Finally, we have some performance data from last week.

• Currencies:

• Bond Yields:

• Equity ETFs:

Back to Index

Commodities

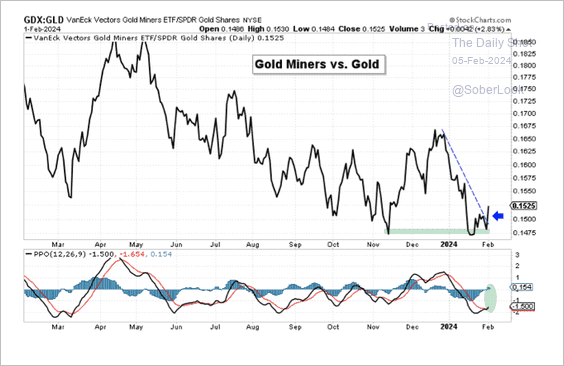

1. Gold ETF holdings have diverged from gold prices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The VanEck Gold Miners ETF (GDX) is starting to outperform the SPDR Gold ETF (GLD).

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

2. Nickel remains in the doldrums.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. The sharp rebound in orange juice prices continues.

4. Traders are increasingly bearish on soybeans and corn, …

… but are upbeat on coffee.

——————–

5. Finally, here is a look at last week’s performance.

Back to Index

Equities

1. The S&P 500 hit another record high and is closing in on 5,000.

2. S&P 500 valuations keep rising even as real yields are no longer falling.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Deutsche Bank’s positioning index signals that investors are overweight stocks, though not yet at extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Goldman’s indicator points to a similar situation.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• This chart shows speculative positioning in the Nasdaq 100 futures.

——————–

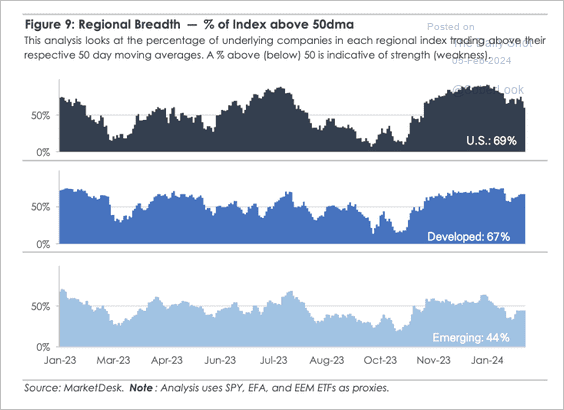

4. Global market breadth is holding up.

Source: MarketDesk Research

Source: MarketDesk Research

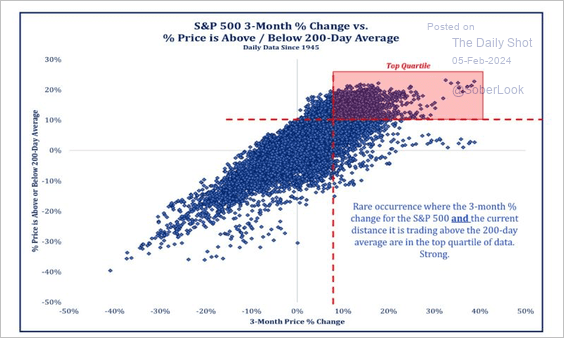

• S&P 500 breadth and momentum are in the top quartile historically.

Source: Strategas Securities

Source: Strategas Securities

• So far, US small-caps have not participated in the breadth expansion.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

5. BofA sees global earnings growth picking up over the next 12 months.

Source: BofA Global Research

Source: BofA Global Research

6. A boost in share buybacks this year?

Source: Reuters Read full article

Source: Reuters Read full article

7. This chart shows the biggest single-day market cap gains.

Source: @markets Read full article

Source: @markets Read full article

8. IPO performance has been lackluster.

Source: @markets Read full article

Source: @markets Read full article

9. Margins are expected to climb this year.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

Here is Goldman’s forecast for the Magnificent 7 margins vs. the rest of the S&P 500.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

10. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

\

\

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest tech firms:

Back to Index

Credit

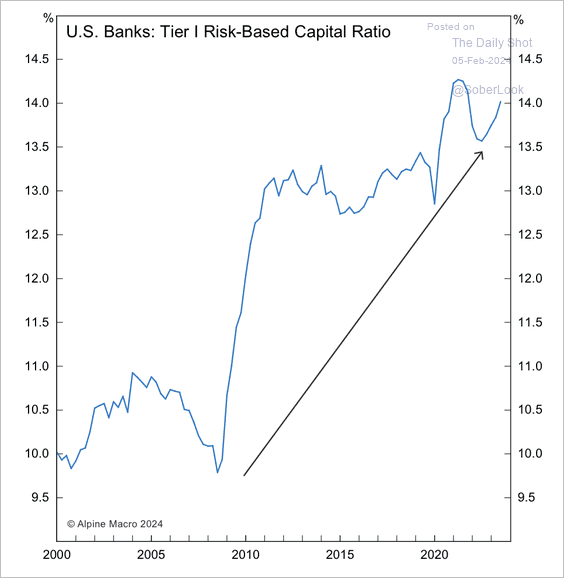

1. US banks’ capital buffers remain robust.

Source: Alpine Macro

Source: Alpine Macro

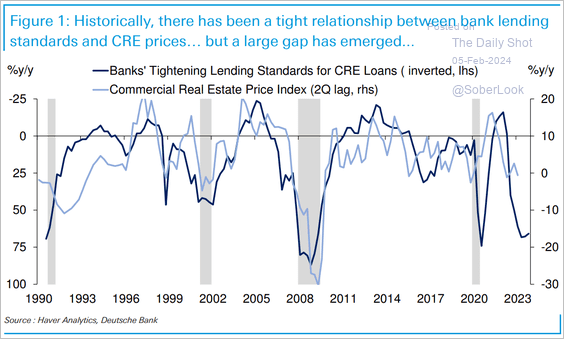

2. Tighter lending standards point to further declines in commercial real estate prices.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. BDCs took a hit after the NY Community Bancorp news.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

4. Finally, we have some performance data from last week.

Back to Index

Global Developments

1. Balance of payments levels are normalizing, with creditor nations seeing a deterioration in surpluses, while there has been an improvement in deficit nations.

Source: BCA Research

Source: BCA Research

• Balance of payment flows could be negative for the dollar.

Source: BCA Research

Source: BCA Research

——————–

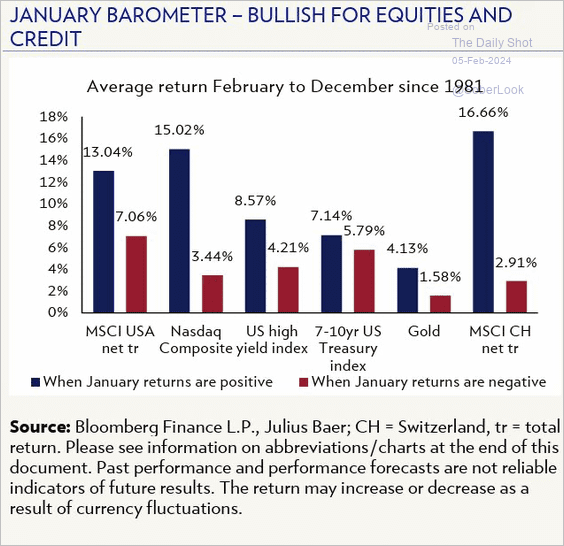

2. January returns tend to set the tone for the remainder of the year.

Source: Mensur Pocini; Julius Baer Read full article

Source: Mensur Pocini; Julius Baer Read full article

3. Finally, we have some DM performance data from last week.

• Currencies:

• Bond yields:

• Large-cap equities:

——————–

Food for Thought

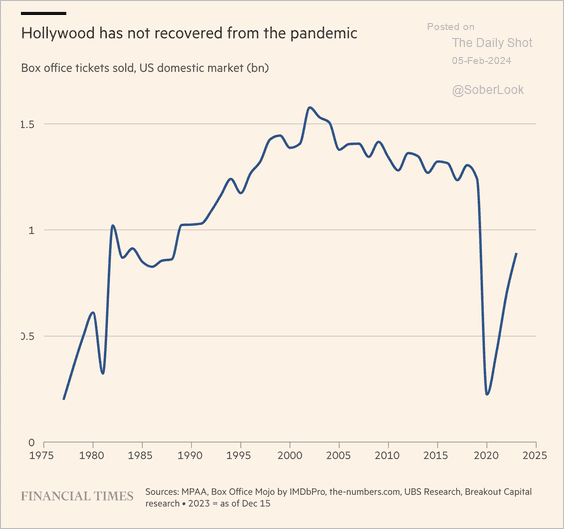

1. Box office tickets sold:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Car owners’ negative equity:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

3. Meta’s revenue:

Source: Reuters Read full article

Source: Reuters Read full article

4. Defense companies’ growing order books:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Mexico raiding inactive fentanyl labs to pacify the US:

Source: Reuters Read full article

Source: Reuters Read full article

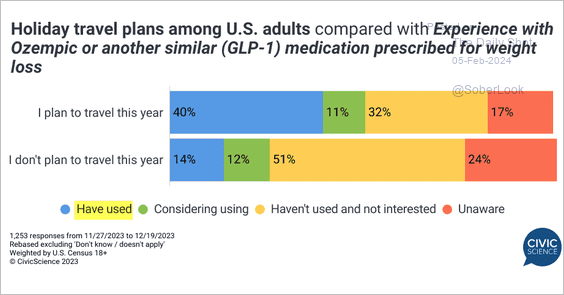

6. Diet pills and travel plans:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

7. Political party identification:

Source: Gallup Read full article

Source: Gallup Read full article

8. How do people in different countries spend their time?

Source: Our World in Data

Source: Our World in Data

——————–

Back to Index