The Daily Shot: 19-May-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Australia

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

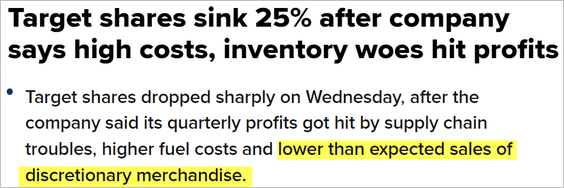

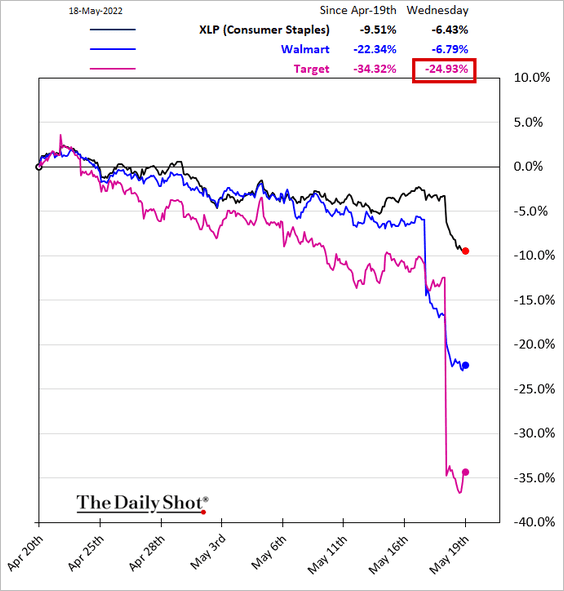

1. Earnings reports from Walmart and Target spooked investors on Wednesday, fueling fresh concerns about collapsing discretionary spending and impending recession. The stock market plunged.

Source: CNBC Read full article

Source: CNBC Read full article

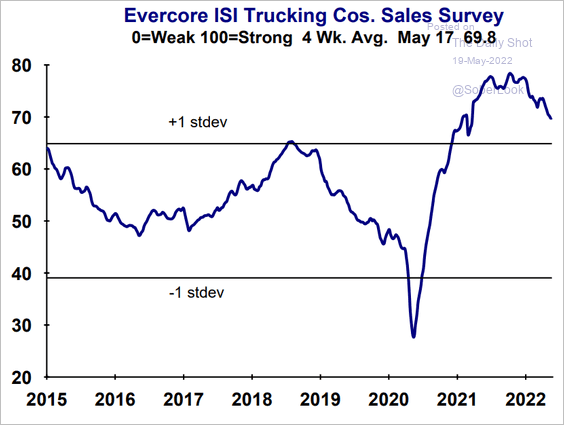

For now, high-frequency indicators point to a slowdown, not a recession.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

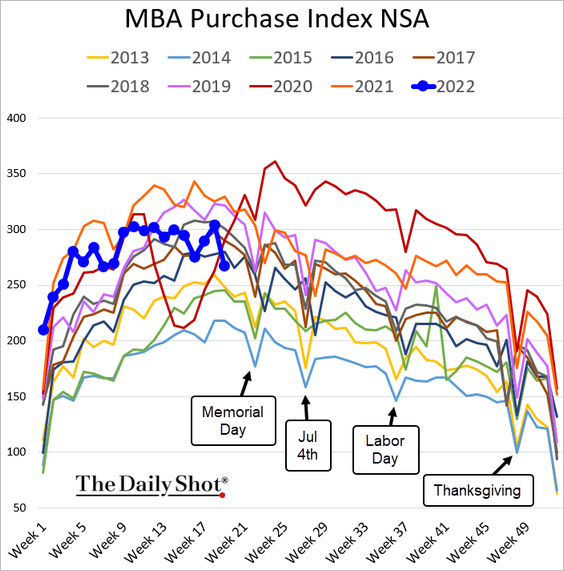

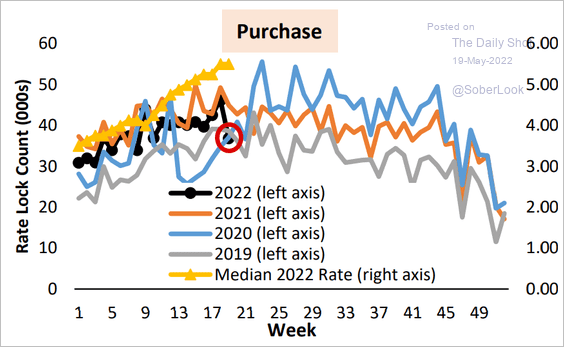

2. Next, we have some updates on the housing market.

• Mortgage applications to purchase a home and rate locks declined sharply last week.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

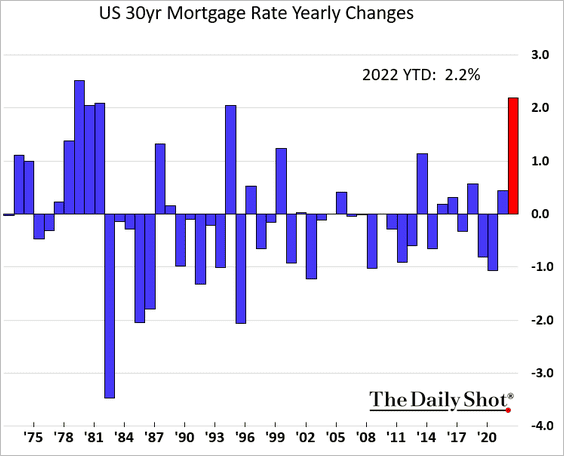

The fastest increase in mortgage rates in decades …

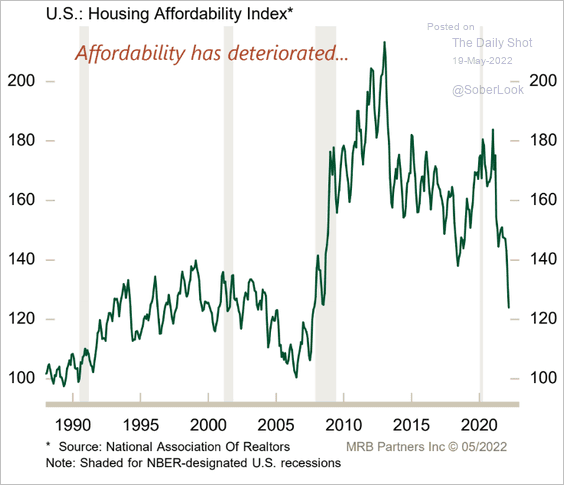

… and rapid gains in housing prices have been pressuring affordability.

Source: MRB Partners

Source: MRB Partners

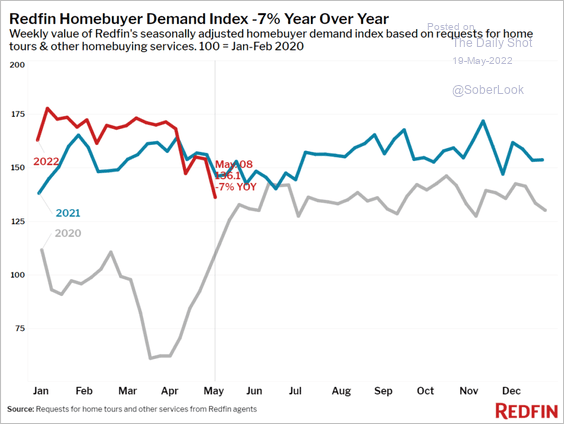

And it’s finally starting to take a toll on housing demand. The stock market rout is also raising concerns about housing.

Source: Redfin

Source: Redfin

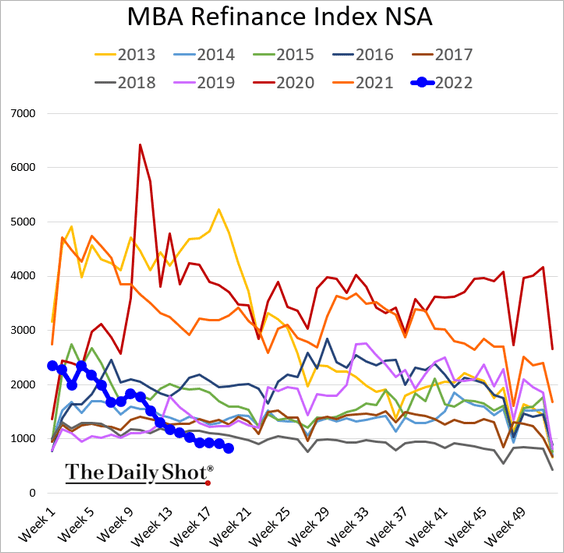

• Refi activity continues to shrink.

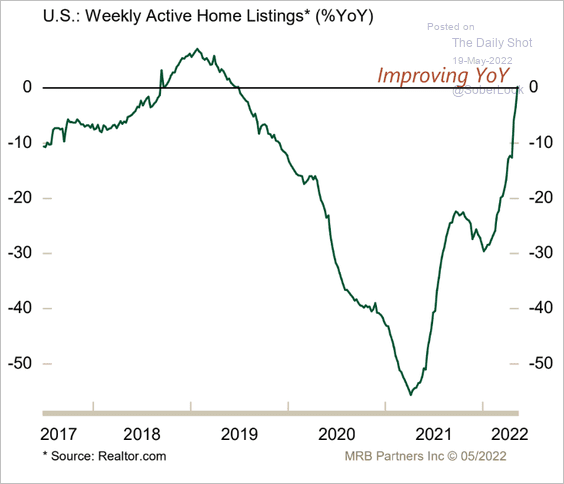

• Active home listings are no longer falling.

Source: MRB Partners

Source: MRB Partners

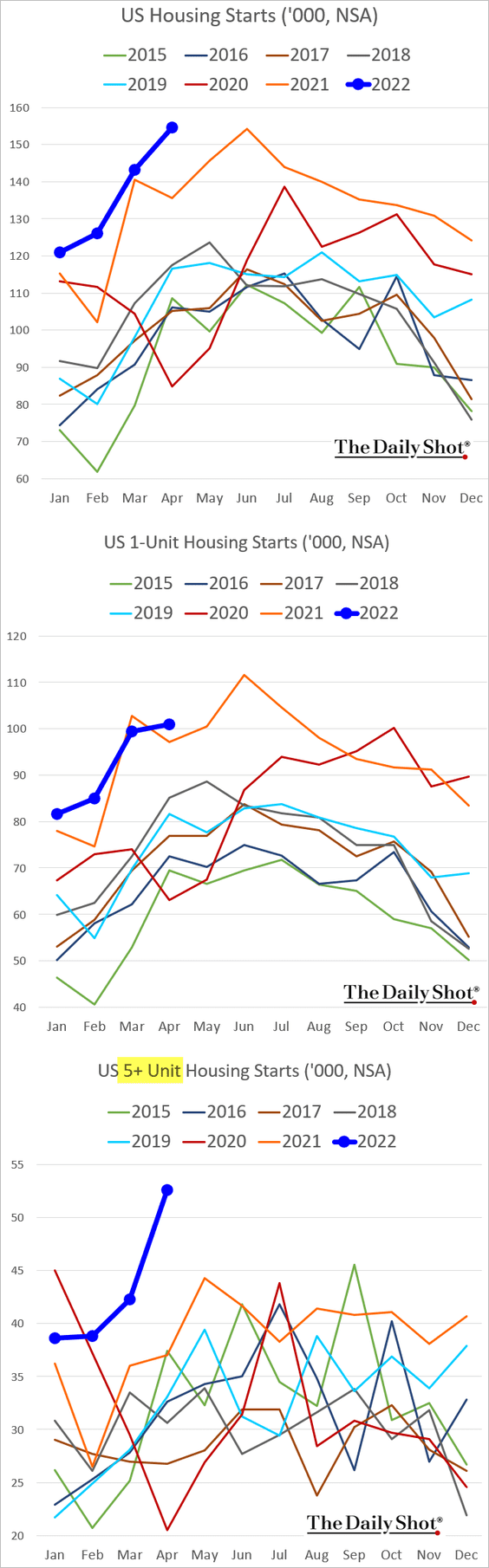

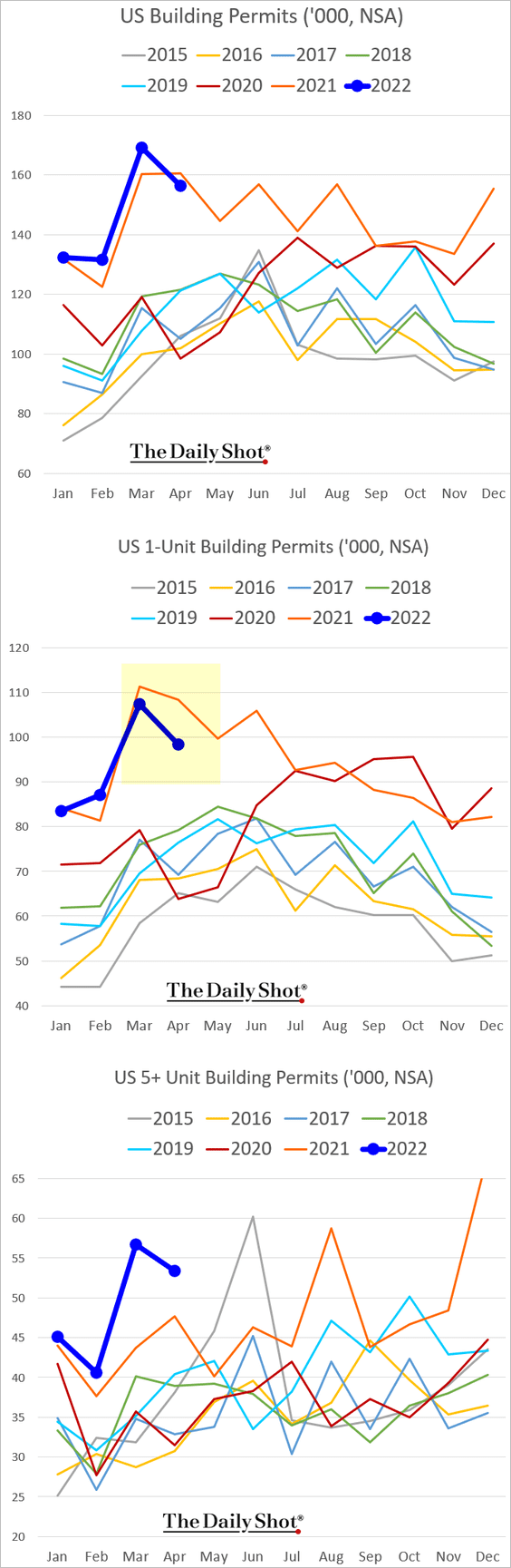

• Housing starts were strong last month, boosted by apartment construction (3rd panel).

But permits softened.

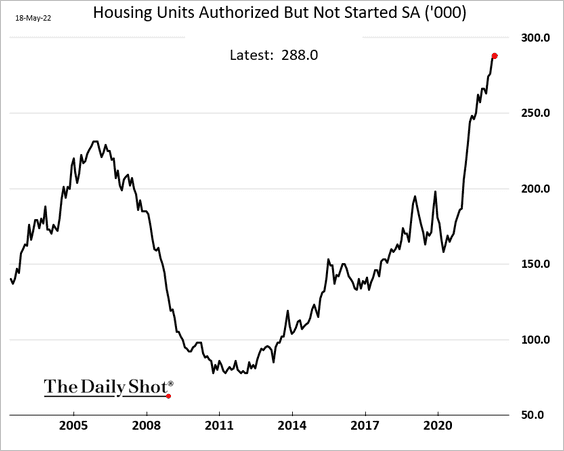

• Construction backlogs persist.

——————–

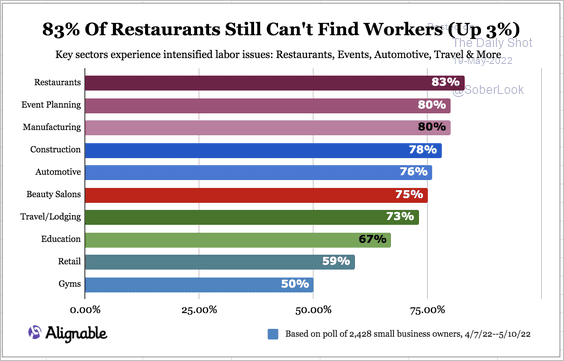

3. Here are the industries with the highest labor shortages among small businesses.

Source: Alignable.com

Source: Alignable.com

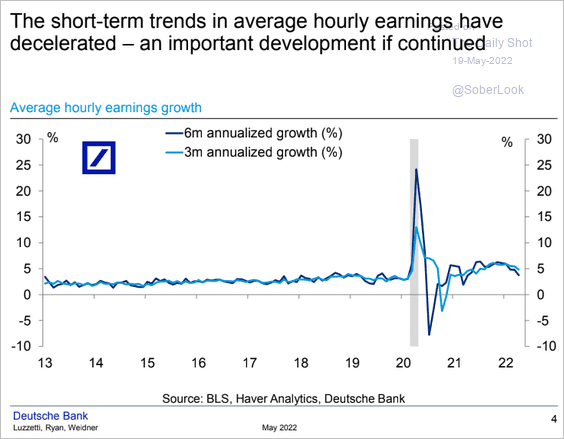

4. Wage growth decelerated recently. A trend?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

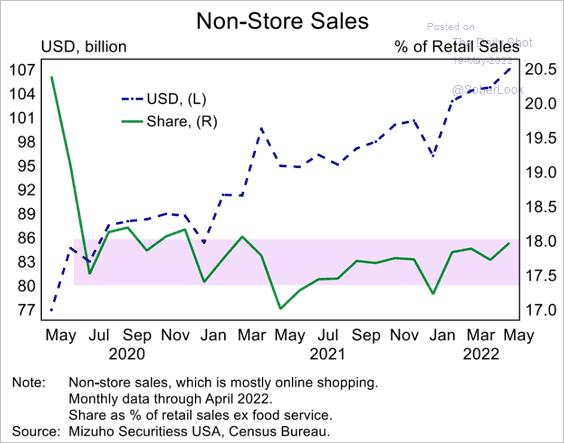

5. Internet-based retail activity as a share of total sales has been relatively stable after coming off the first COVID wave.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

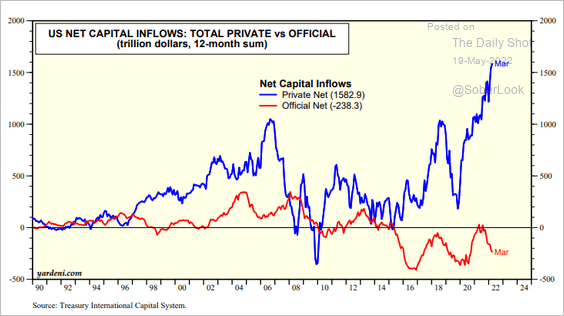

6. Private capital flows into the US have been surging, providing support for the dollar.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Canada

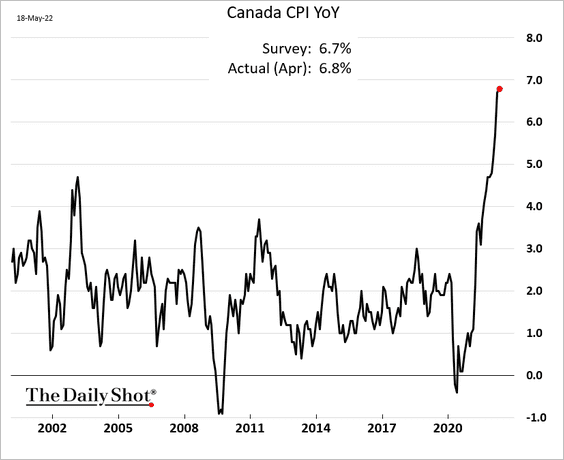

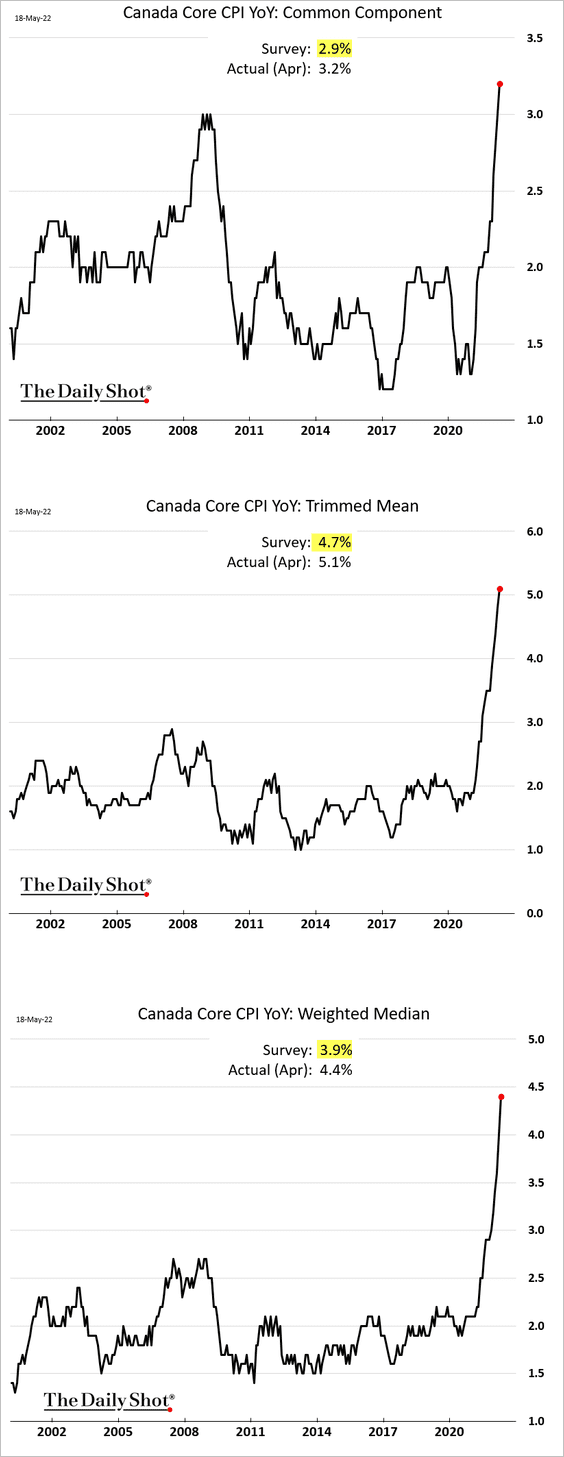

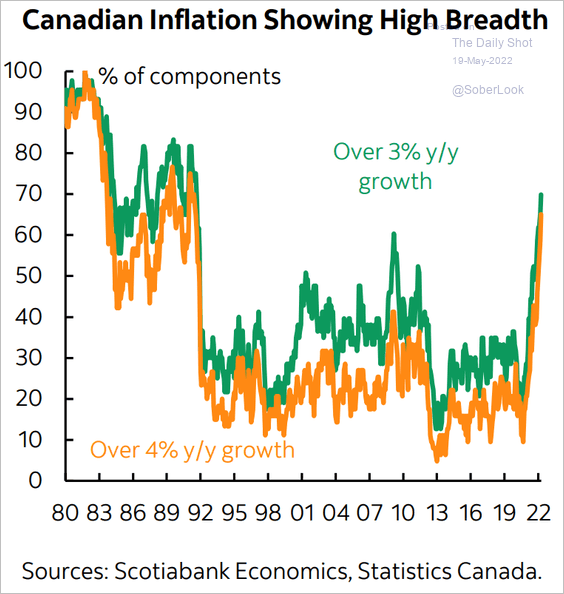

1. The April inflation report was just awful.

• The shocker was in the core inflation measures.

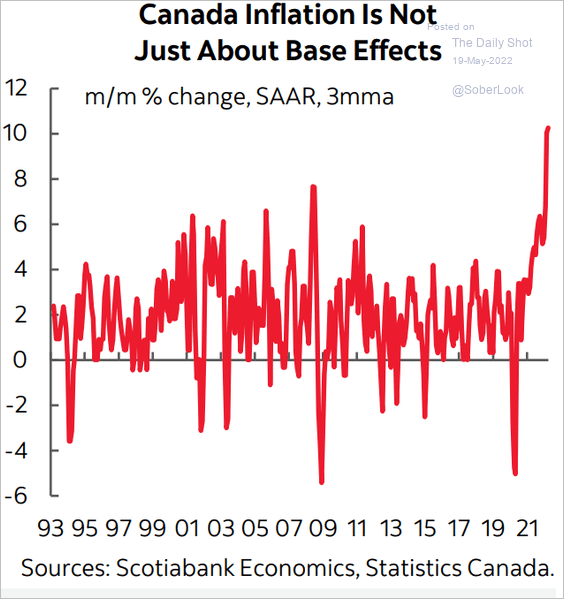

• It’s not just about base effects.

Source: Scotiabank Economics

Source: Scotiabank Economics

• Inflation breadth has been widening.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

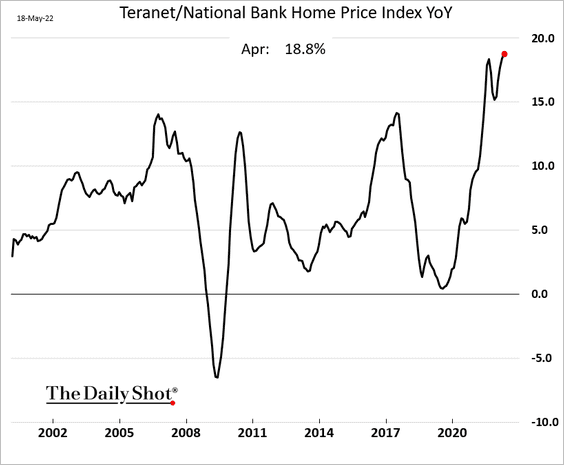

2. Home price appreciation shows no signs of easing.

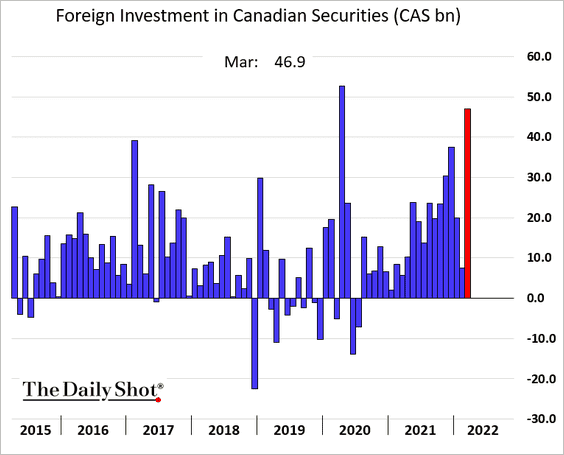

3. Foreign investors moved into Canadian securities in March.

Back to Index

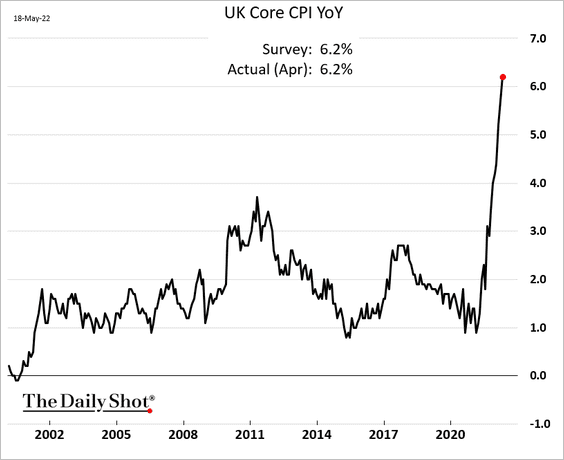

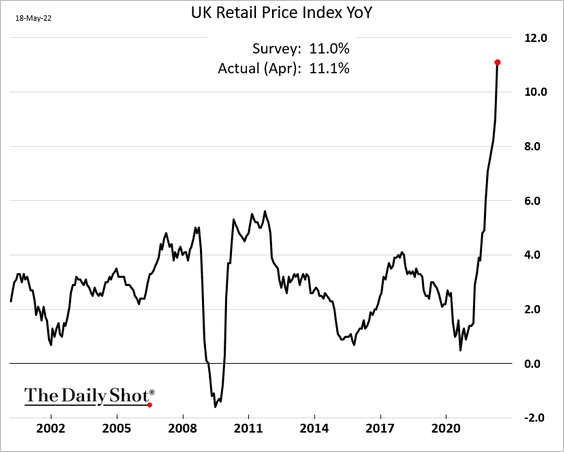

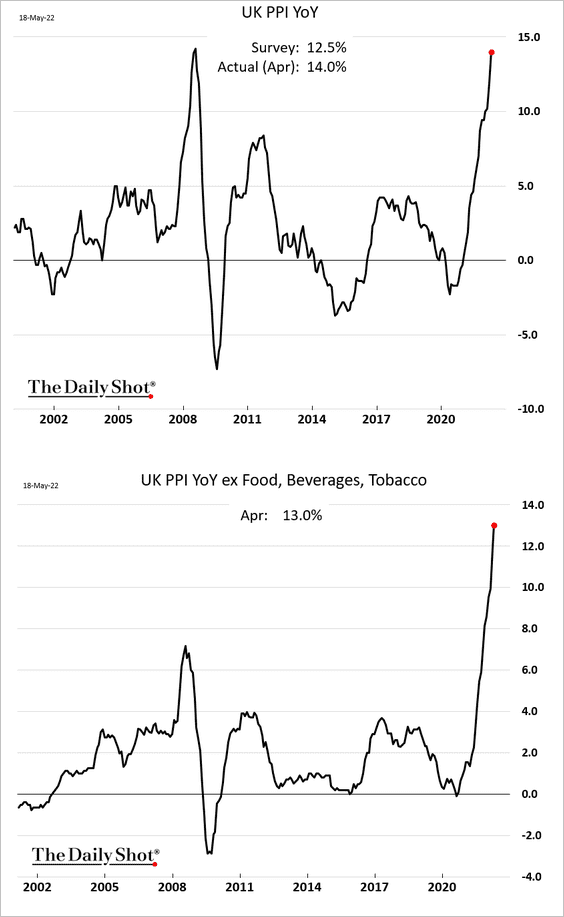

The United Kingdom

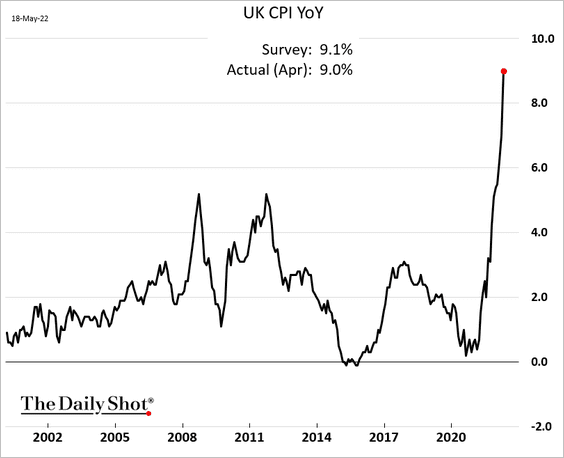

1. The CPI report was roughly in line with expectations, …

… as the core CPI smashed through 6%.

Retail price gains exceeded 11%.

2. The PPI surprised to the upside.

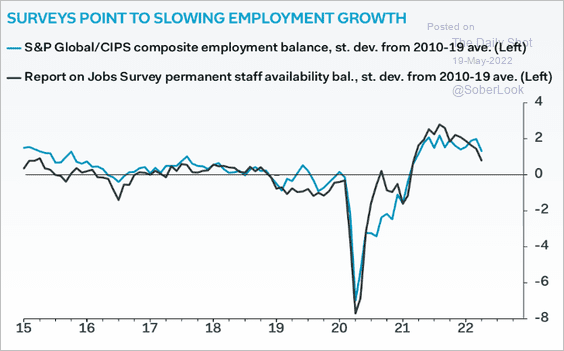

3. Employment growth is slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

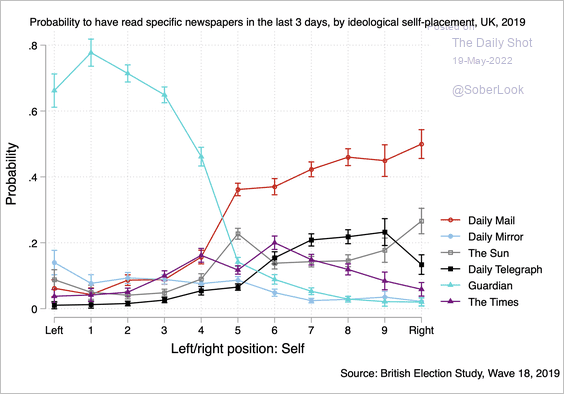

4. Here is a Food for Thought item. UK newspaper preferences by ideology:

Source: @alexandreafonso

Source: @alexandreafonso

Back to Index

The Eurozone

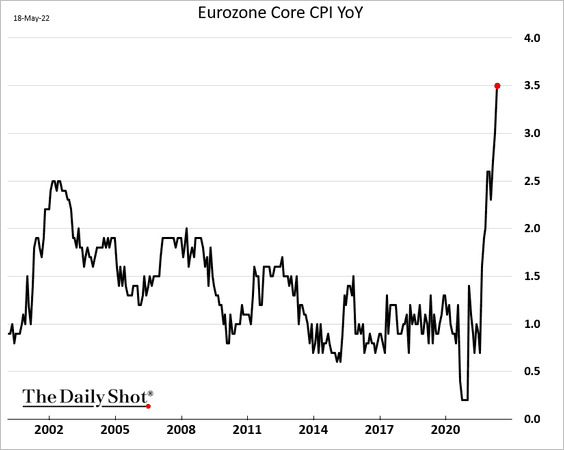

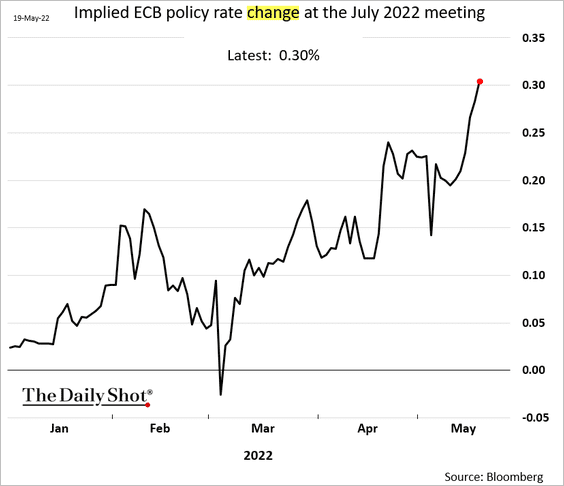

1. This chart shows why a rate hike is coming in July.

And it won’t be a 10 bps increase.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

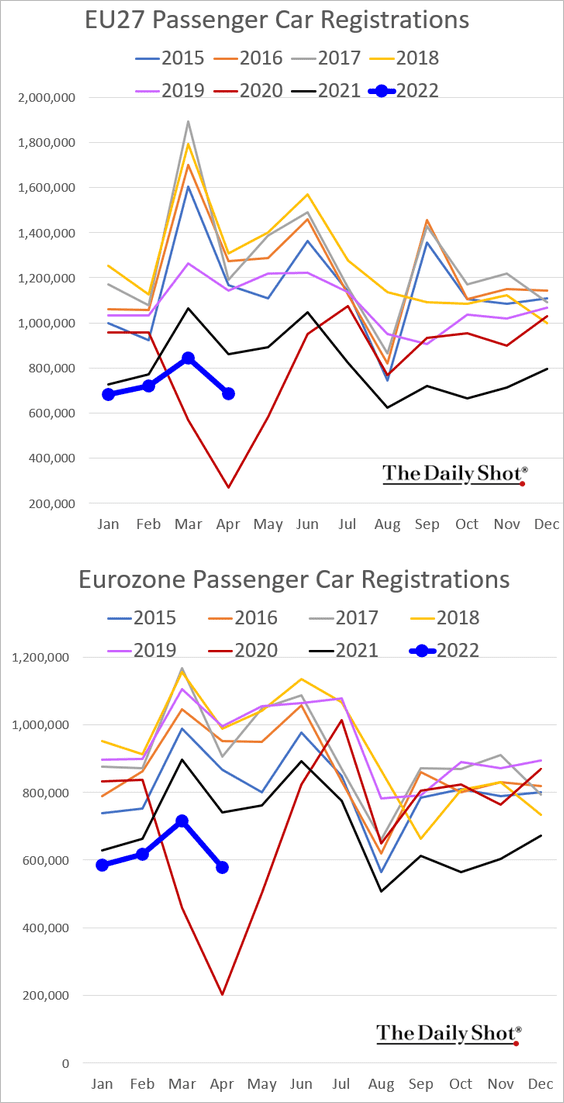

2. Car registrations remain soft.

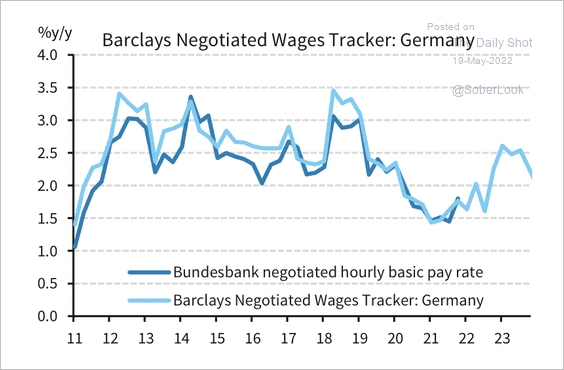

3. Barclays expects negotiated wage growth in Germany to increase toward 2.5% year-over-year.

Source: Barclays Research

Source: Barclays Research

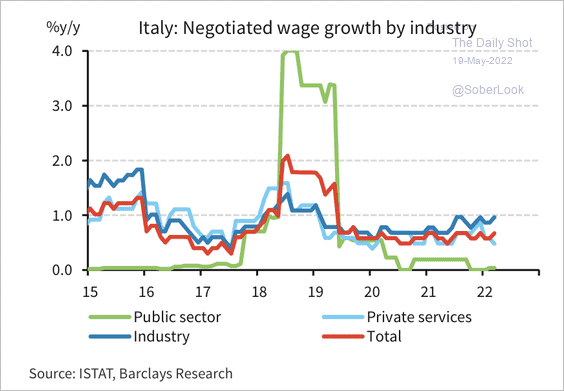

• Negotiated wage growth in Italy has been subdued across sectors.

Source: Barclays Research

Source: Barclays Research

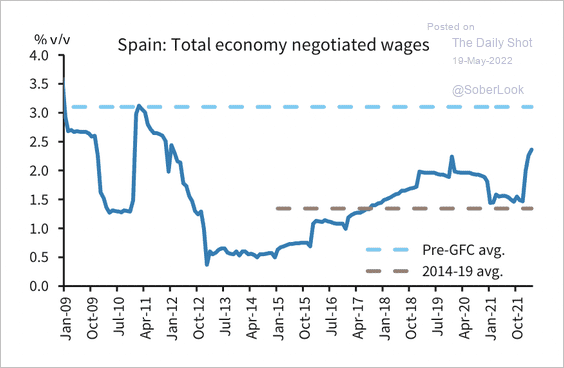

• Negotiated wage growth in Spain is rising.

Source: Barclays Research

Source: Barclays Research

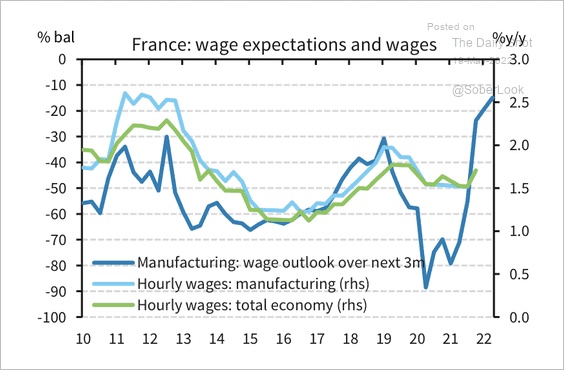

• Manufacturers in France expect to raise wages over the next three months.

Source: Barclays Research

Source: Barclays Research

Back to Index

Japan

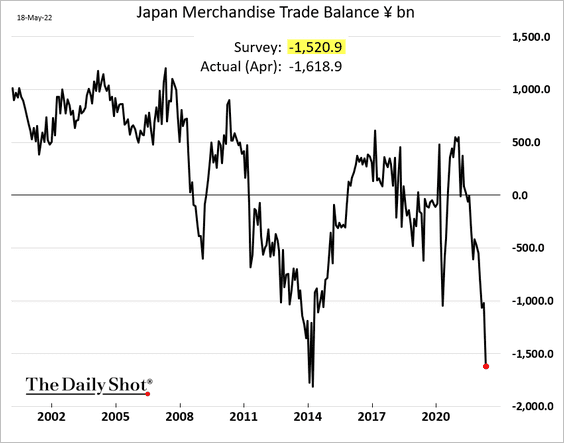

1. The trade deficit widened further as lofty energy prices and a weak yen boosted import costs. At the same time, China’s lockdowns hurt exports.

Source: ABC News Read full article

Source: ABC News Read full article

——————–

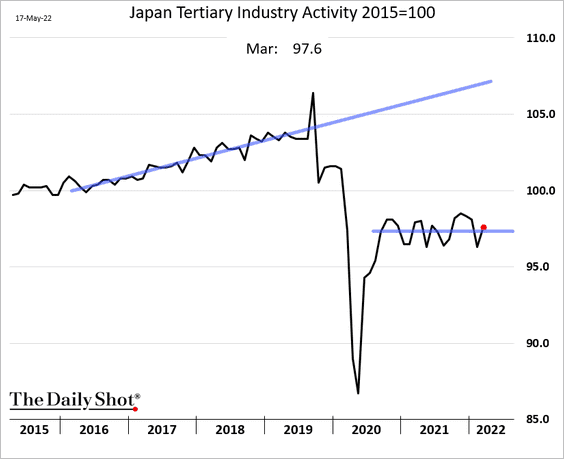

2. Service sector activity improved in March, but there is no upward trend here.

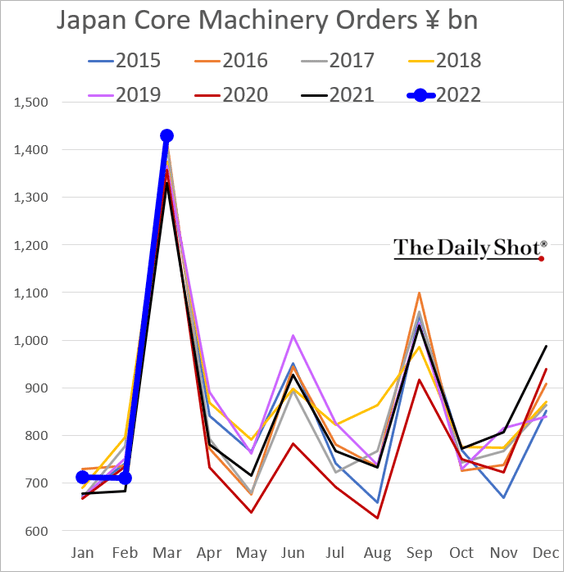

3. Core machinery orders were strong in March.

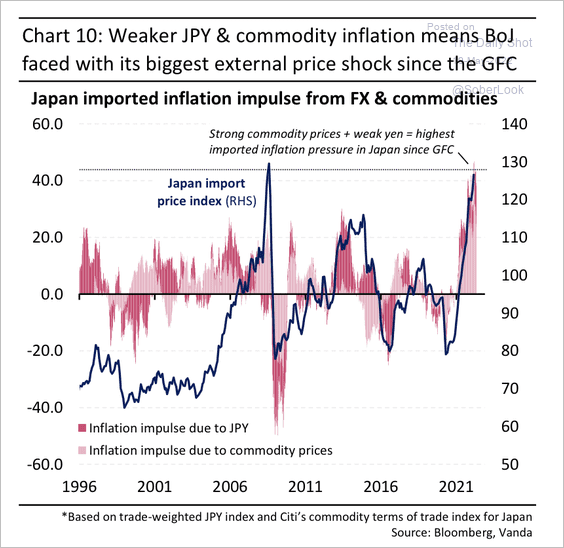

4. The weak yen and high commodity prices are contributing to rising inflation.

Source: Vanda Research

Source: Vanda Research

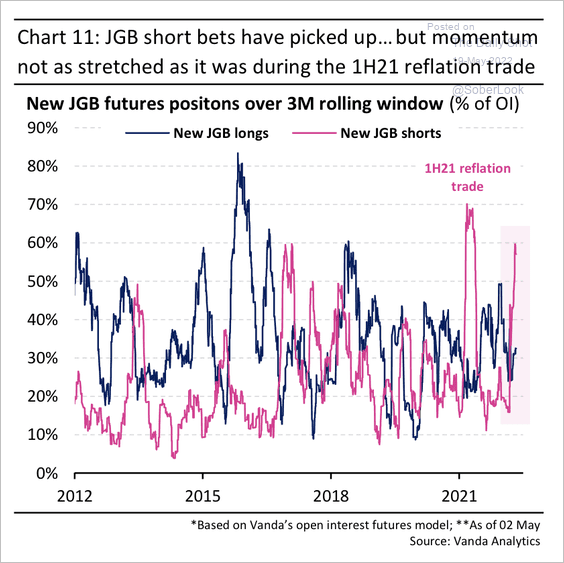

5. Speculative short positions in Japanese government bonds increased in recent months, albeit still below last year’s peak.

Source: Vanda Research

Source: Vanda Research

Back to Index

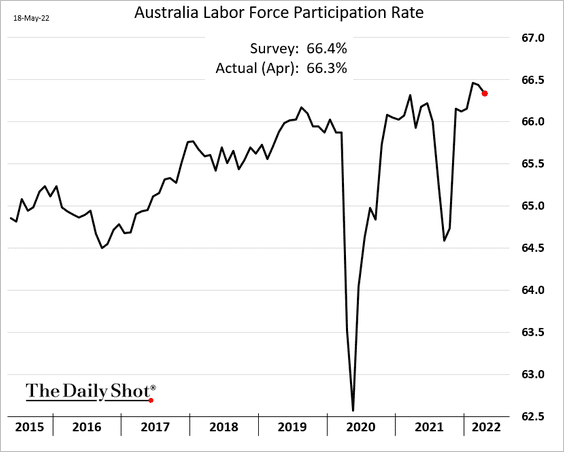

Australia

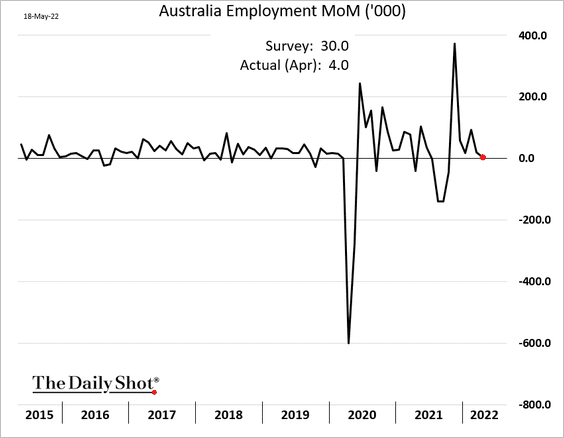

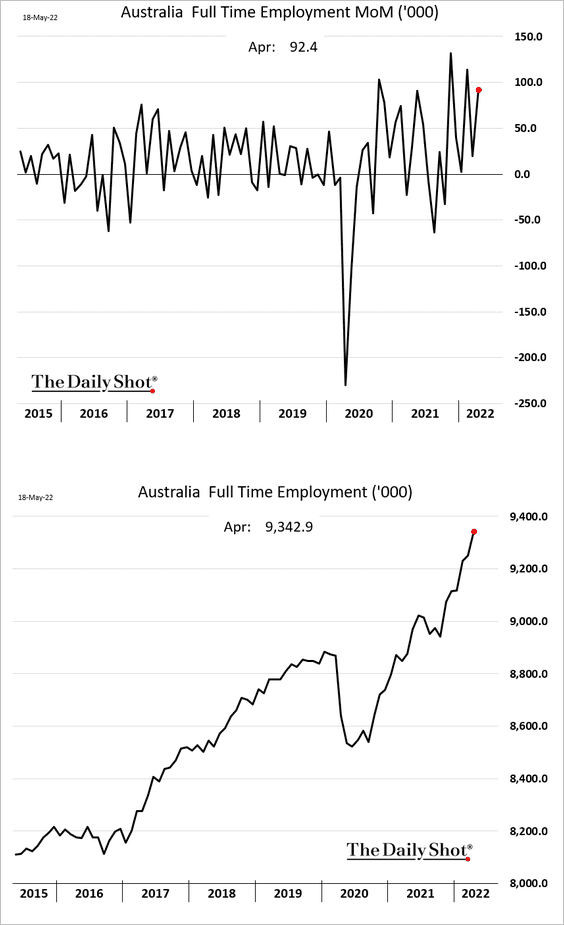

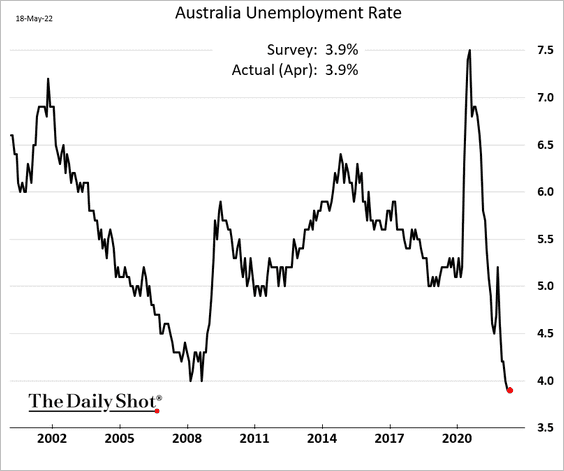

The employment report was disappointing.

But full-time jobs continue to surge.

The unemployment rate is holding below 4%.

The participation rate ticked lower.

Back to Index

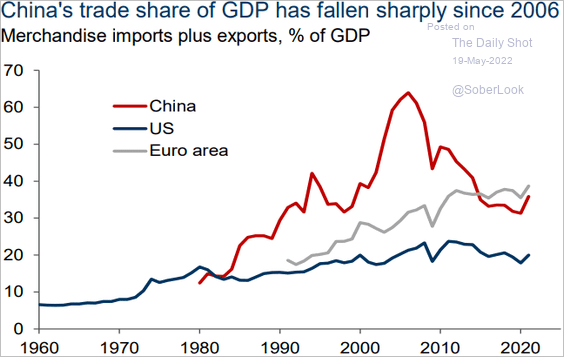

China

1. Trade as a share of GDP has been trending lower.

Source: Goldman Sachs

Source: Goldman Sachs

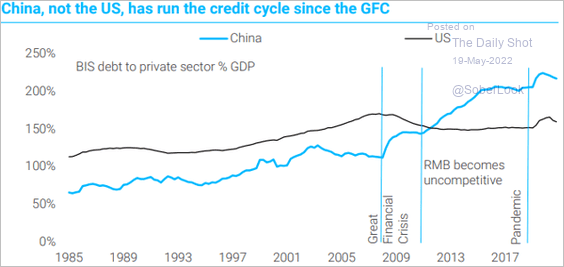

2. Credit expansion outpaced the US since the GFC.

Source: TS Lombard

Source: TS Lombard

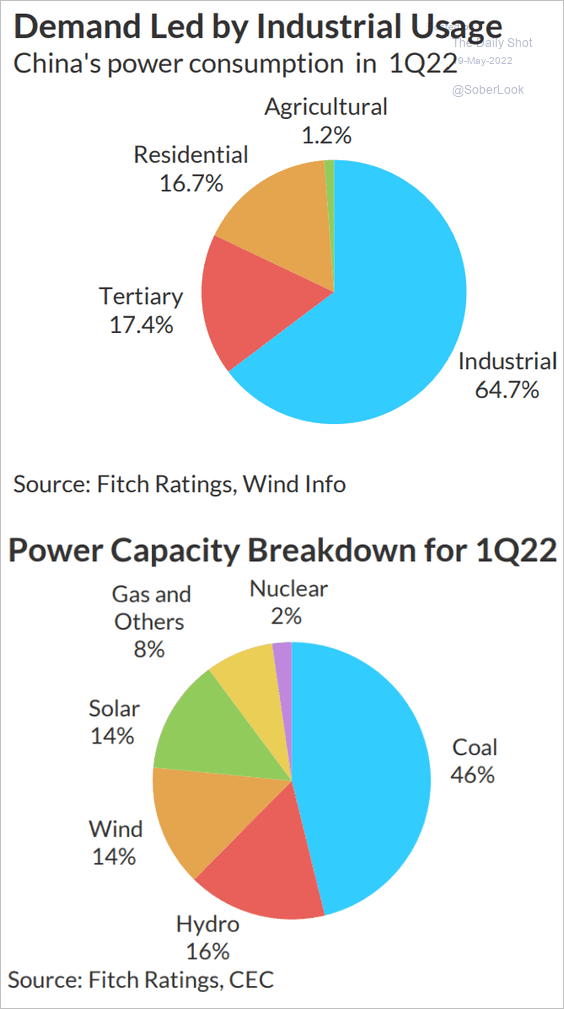

3. This chart shows China’s power demand and fuel types used.

Source: Fitch Ratings

Source: Fitch Ratings

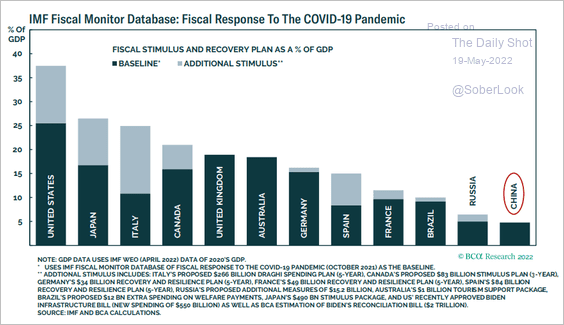

4. China’s fiscal response to the pandemic has been relatively muted.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

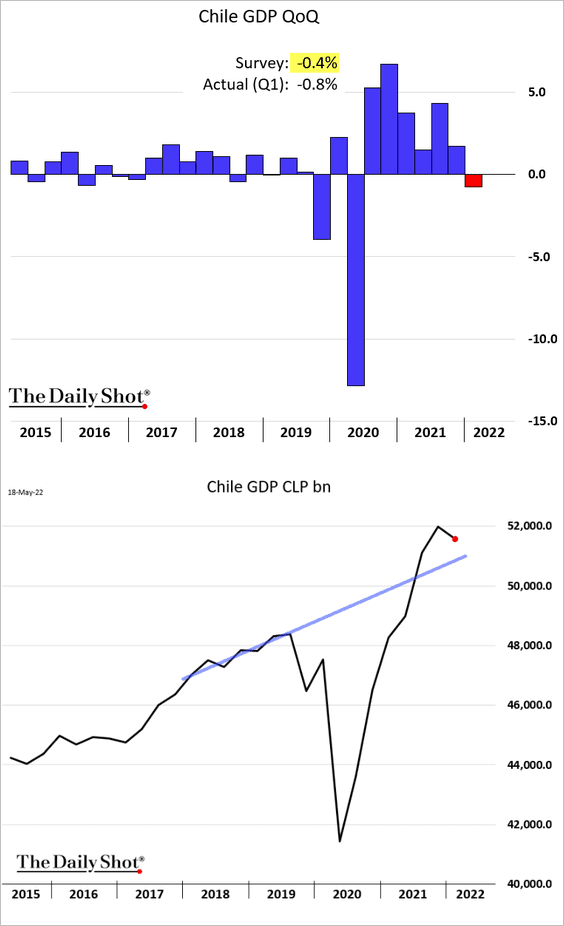

1. Chile’s GDP decline was larger than expected last quarter. But the GDP remains above the pre-COVID trend.

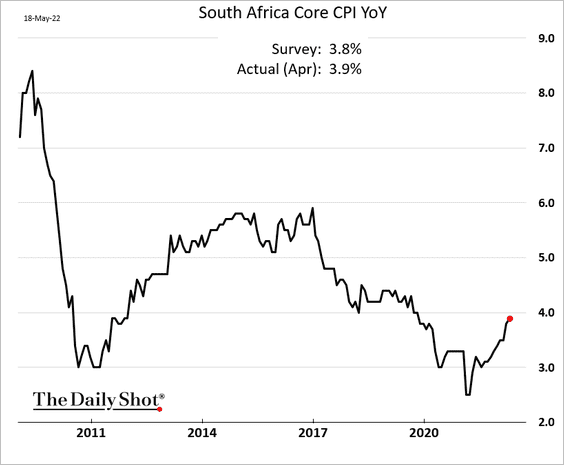

2. South Africa’s inflation is grinding higher.

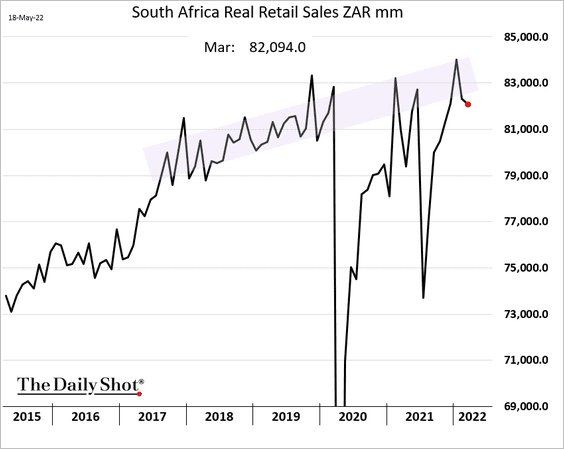

Retail sales dipped below the pre-COVID trend.

——————–

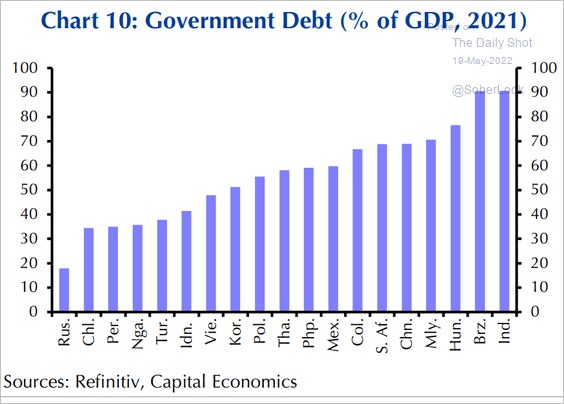

3. Here are the government debt-to-GDP ratios for select economies.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

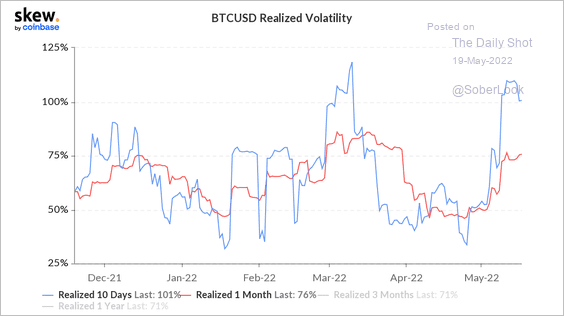

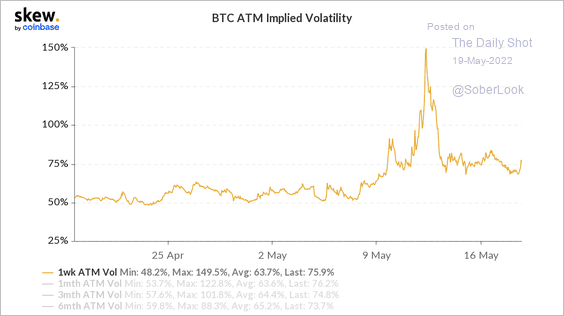

1. Bitcoin’s realized and implied volatility remains elevated (2 charts).

Source: Skew Read full article

Source: Skew Read full article

Source: Skew Read full article

Source: Skew Read full article

——————–

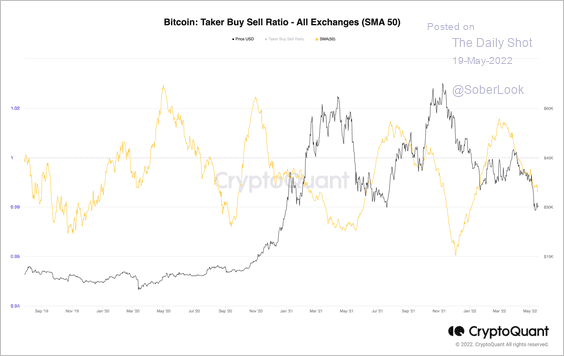

2. Bitcoin’s buy/sell volume (yellow line) declined over the past two months, indicating persistent selling pressure.

Source: @cryptoquant_com

Source: @cryptoquant_com

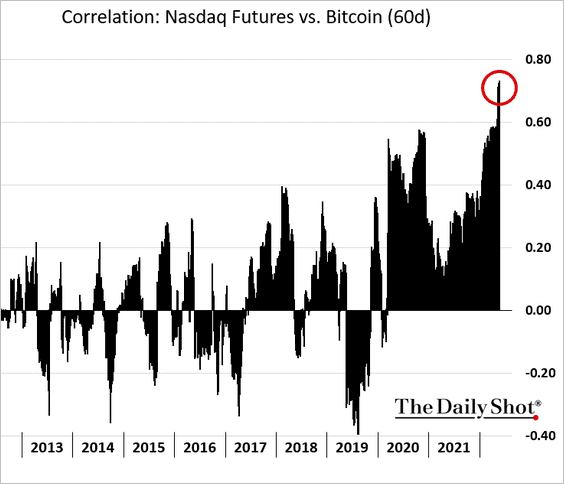

3. Bitcoin’s correlation to stocks keeps rising.

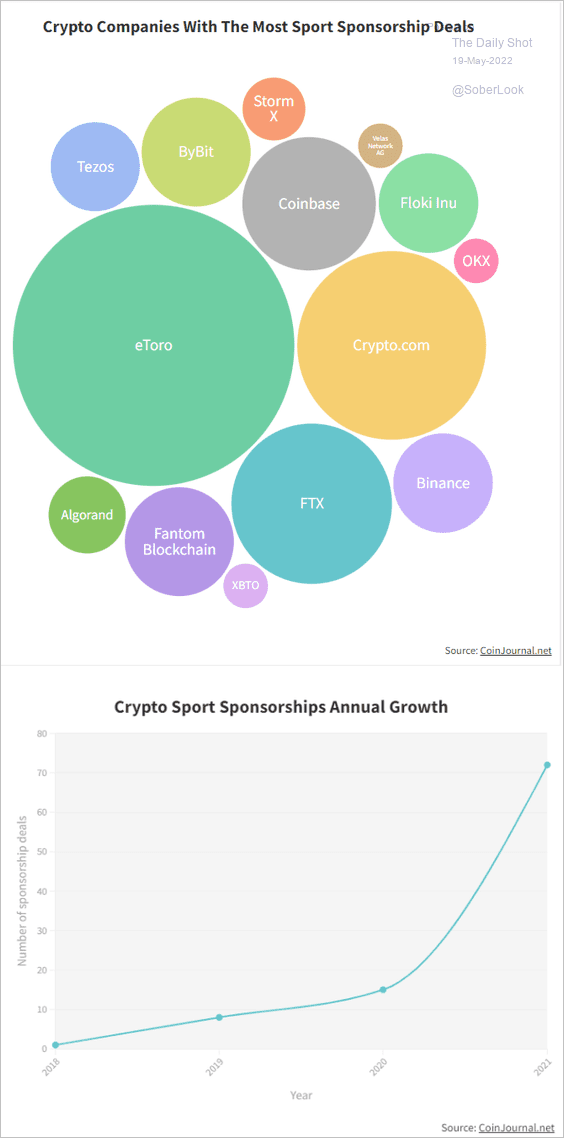

4. Finally, we have crypto companies with the most sports sponsorship deals.

Source: Coin Journal Read full article

Source: Coin Journal Read full article

Back to Index

Energy

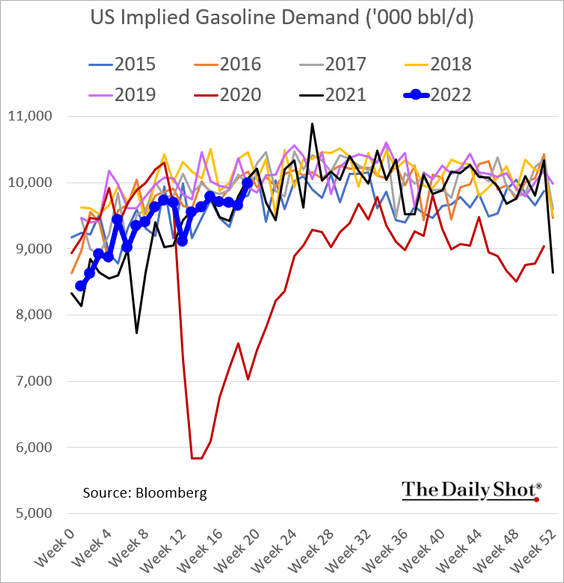

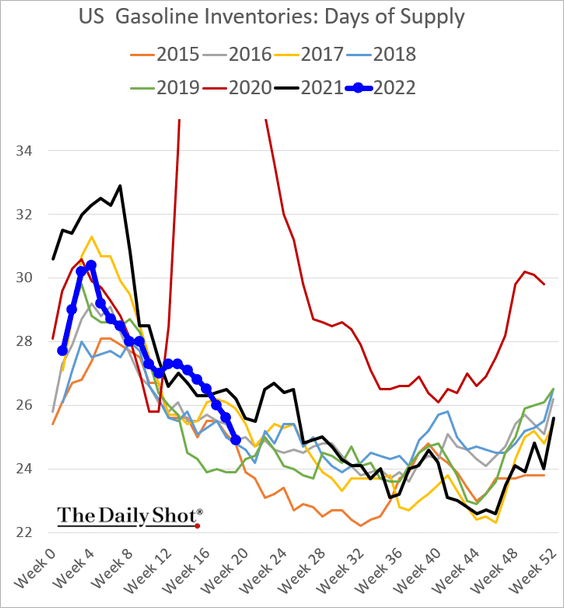

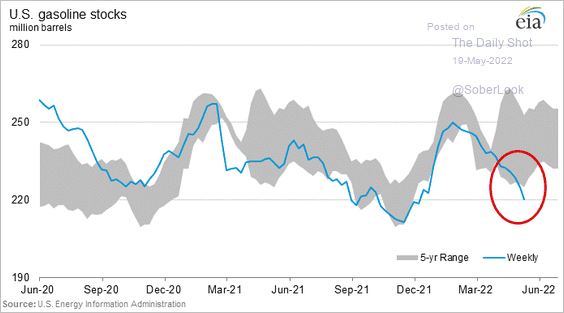

1. US gasoline demand has strengthened.

And gasoline inventories are now falling quicker than they usually do this time of the year.

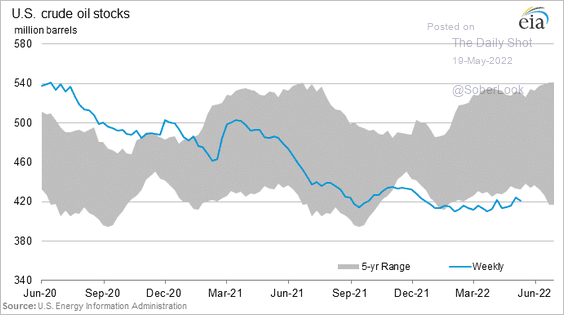

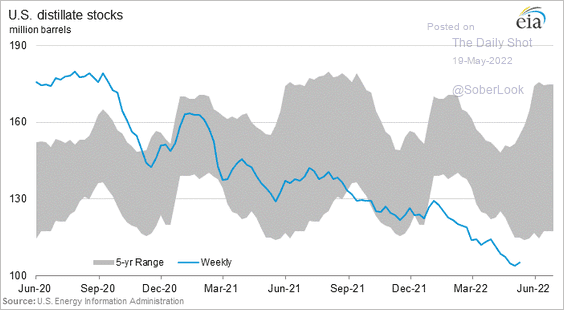

• Crude oil and distillates inventories are also very low.

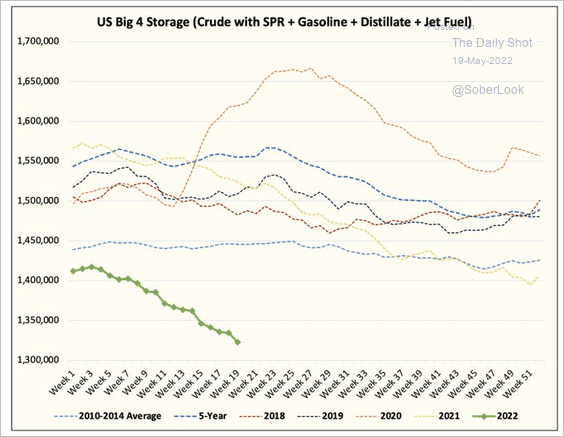

• This chart shows total US inventories, including the strategic petroleum reserve.

Source: @HFI_Research

Source: @HFI_Research

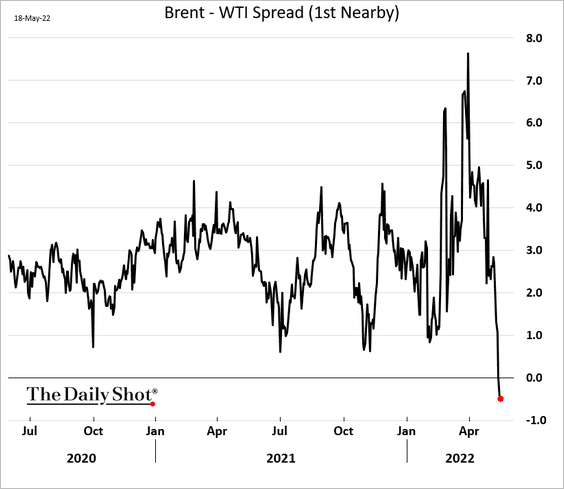

• The Brent-WTI spread moved into negative territory amid robust domestic demand in the US.

——————–

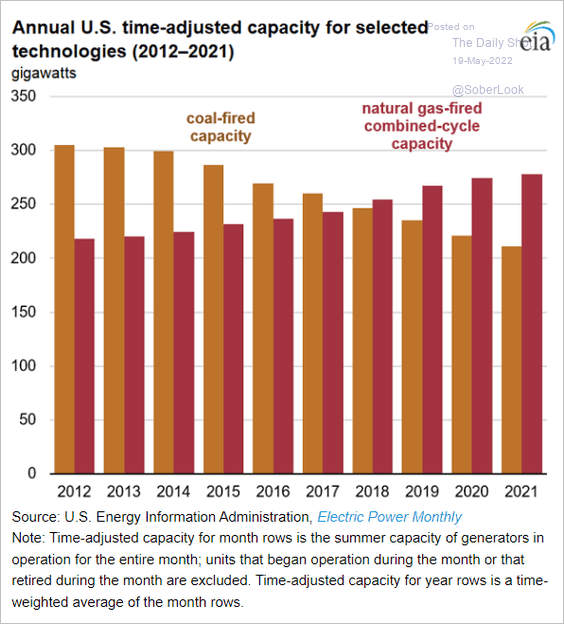

2. Next, we have the US coal vs. natural gas power generation capacity. Here is a quick description of “combined cycle power plant.”

Source: EIA Read full article

Source: EIA Read full article

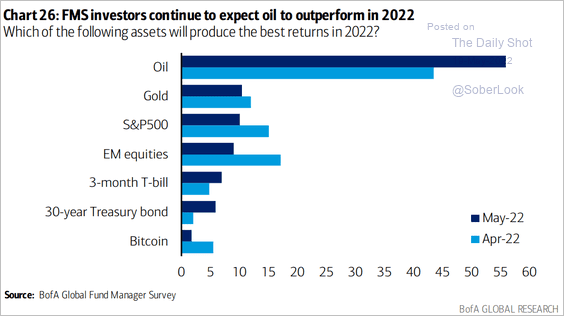

3. Fund managers expect crude oil to outperform other asset classes.

Source: BofA Global Research

Source: BofA Global Research

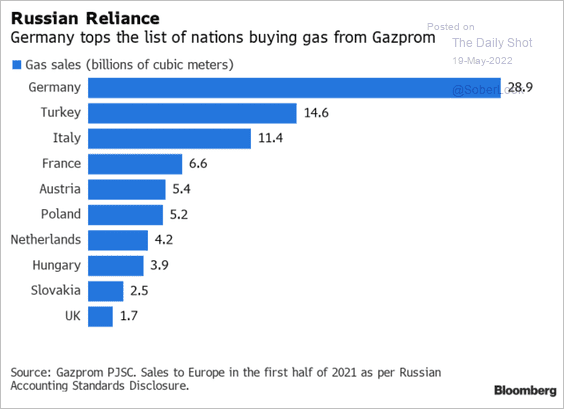

4. Who are Gazprom’s top clients?

Source: Stefan Ulrich, Arun Toora, BloombergNEF Read full article

Source: Stefan Ulrich, Arun Toora, BloombergNEF Read full article

Back to Index

Equities

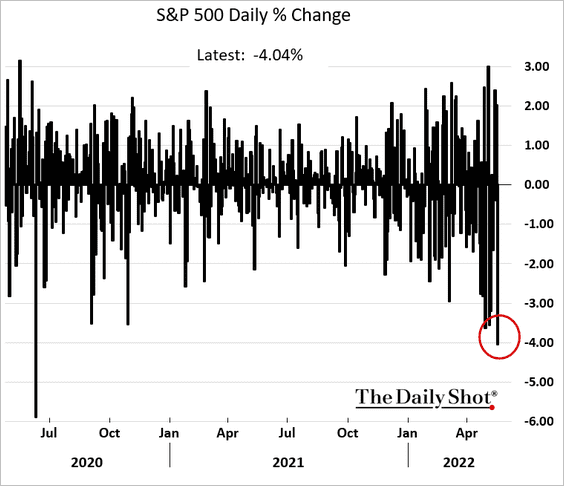

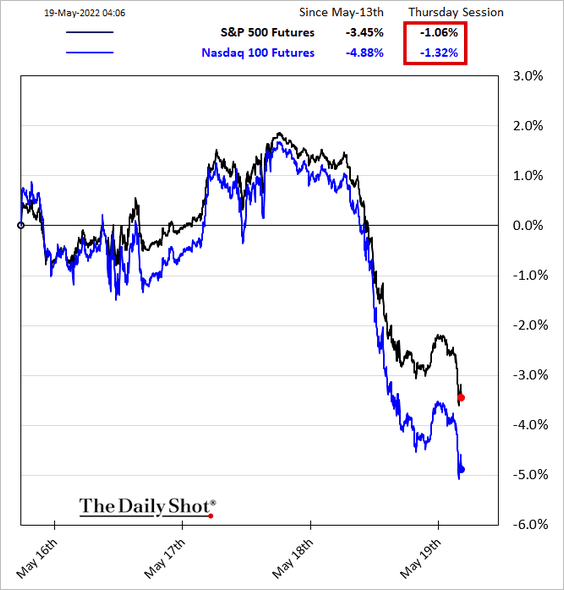

1. Wednesday was an ugly day for the stock market amid recession concerns.

And futures point to more pain on the way.

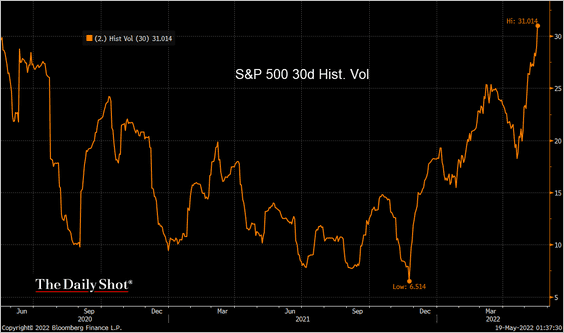

Volatility continues to rise.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

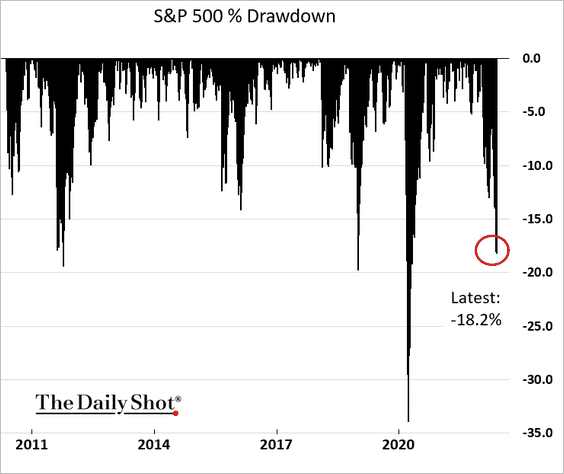

We are nearing the official end of the COVID-era bull market.

——————–

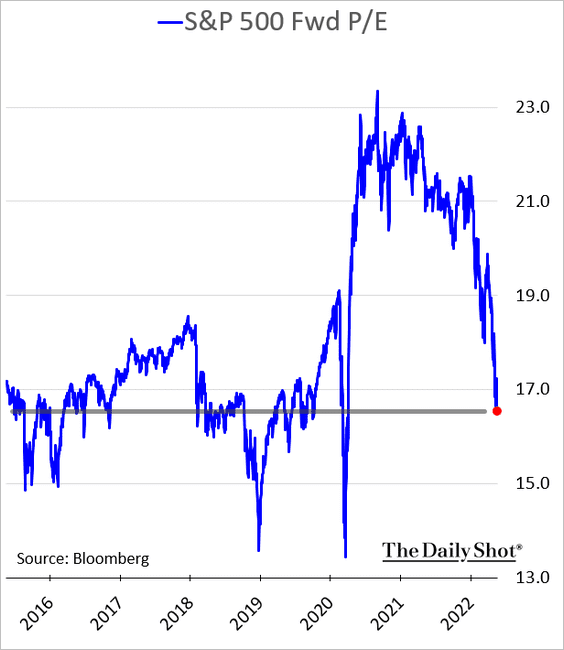

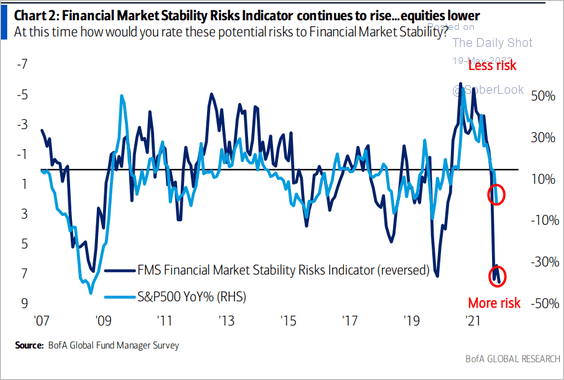

2. There is room to move much lower on valuations from here, especially since the market is losing faith in analysts’ earnings estimates.

BofA’s Financial Market Stability Risks Indicator points to further losses.

Source: BofA Global Research

Source: BofA Global Research

——————–

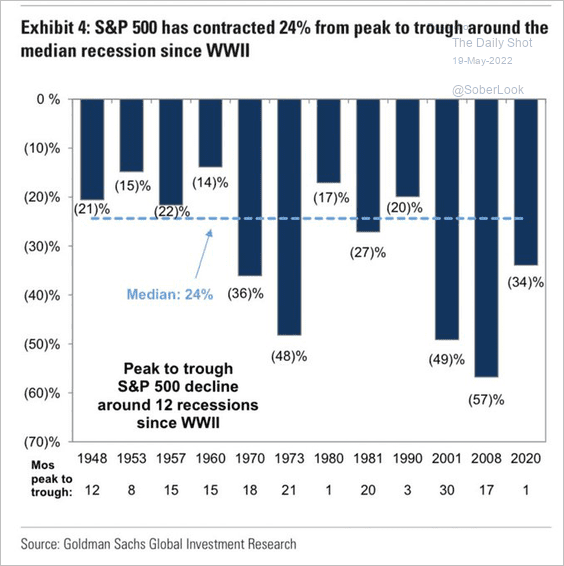

3. How did stocks perform during past recessions?

Source: Goldman Sachs

Source: Goldman Sachs

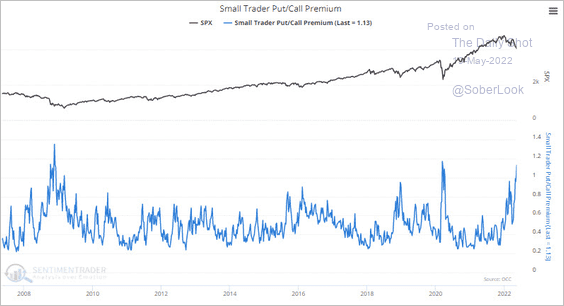

4. The put/call ratio among small traders remains elevated.

Source: SentimenTrader

Source: SentimenTrader

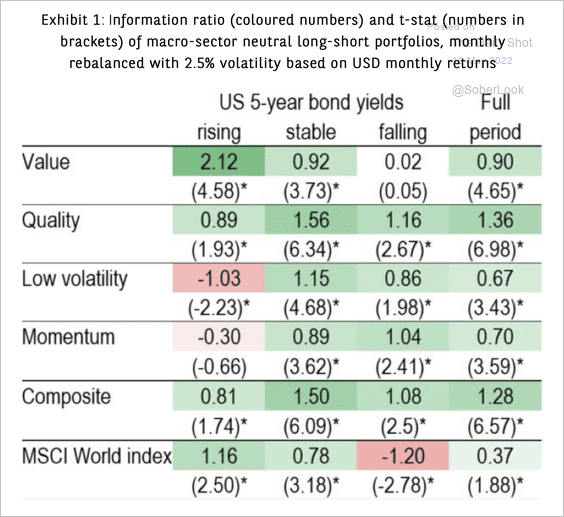

5. This table shows the risk-adjusted returns of long/short factor portfolios based on changes in the 5-year Treasury yield. Value stocks tend to outperform when rates rise.

Source: BNP Paribas Asset Management Read full article

Source: BNP Paribas Asset Management Read full article

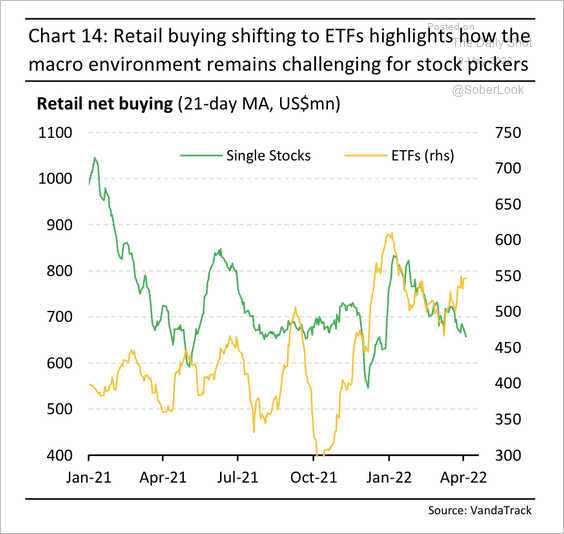

6. Retail buying has shifted from single stocks to ETFs.

Source: Vanda Research

Source: Vanda Research

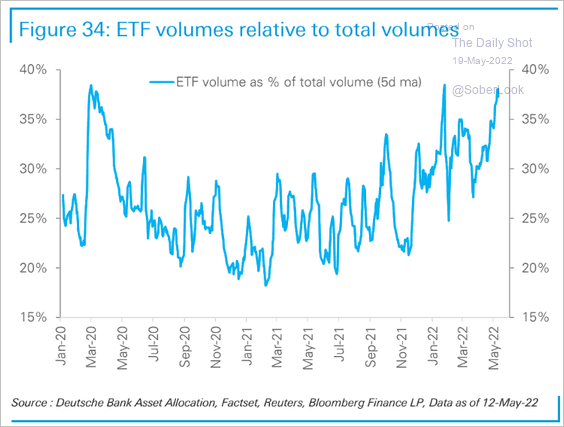

ETF volume as a share of total trading activity has been rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

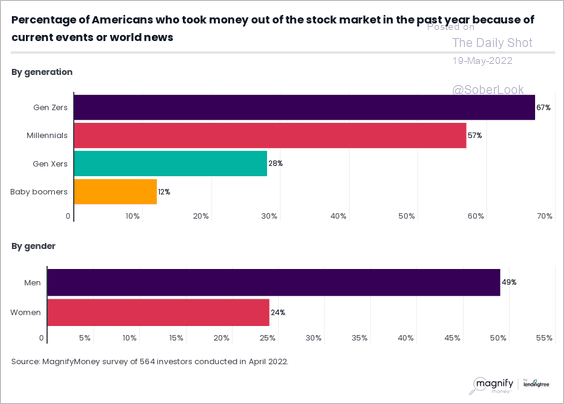

7. Finally, we have the percentage of Americans who took money out of the stock market because of recent events.

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

Back to Index

Credit

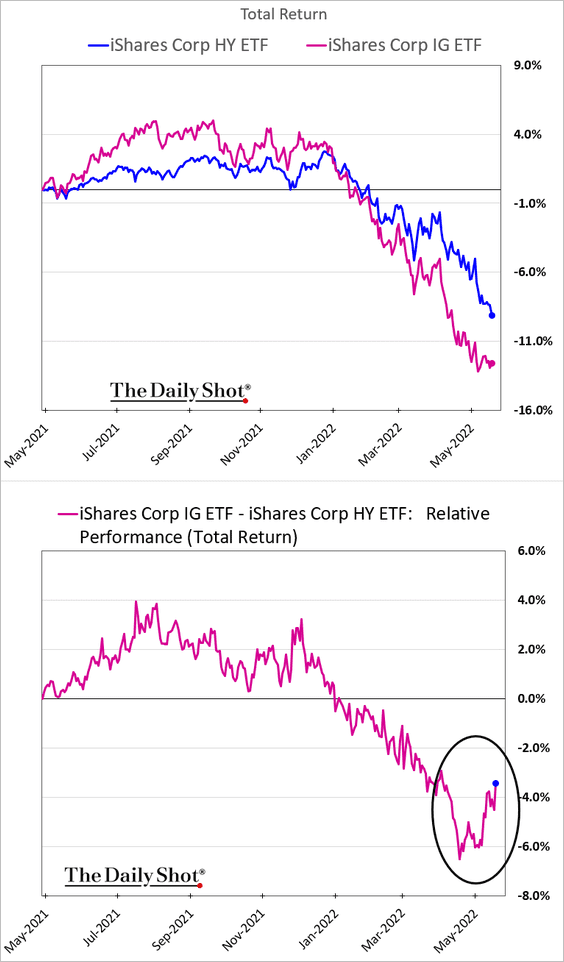

1. Recession concerns are taking a toll on credit. High-yield bonds are starting to underperform investment-grade debt.

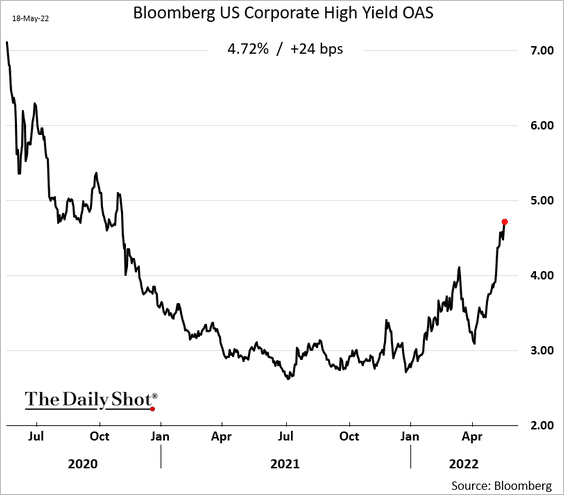

High-yield spreads continue to widen.

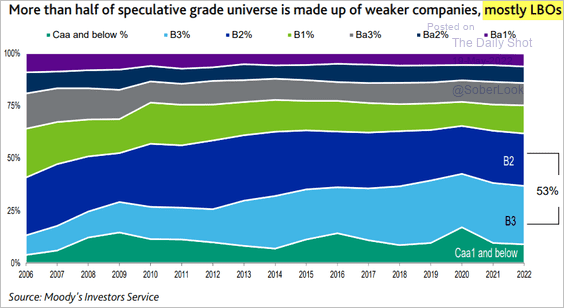

The high-yield universe has a large concentration of very leveraged debt.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

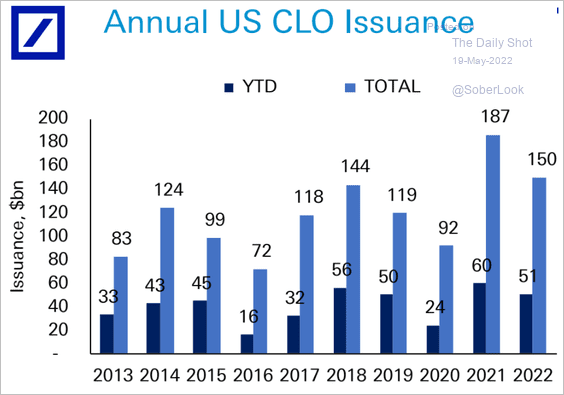

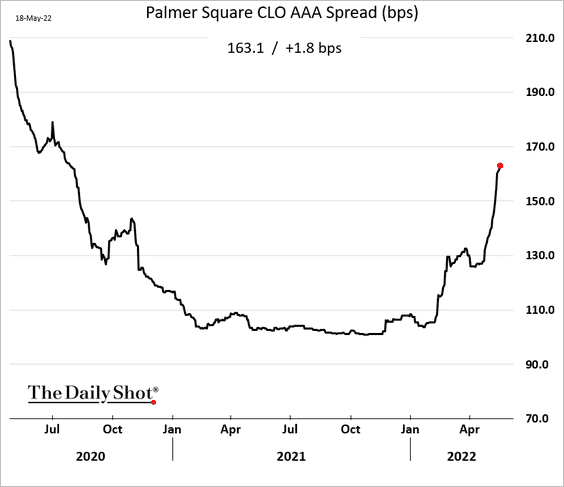

2. CLO activity has been robust, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… even as AAA spreads widen.

——————–

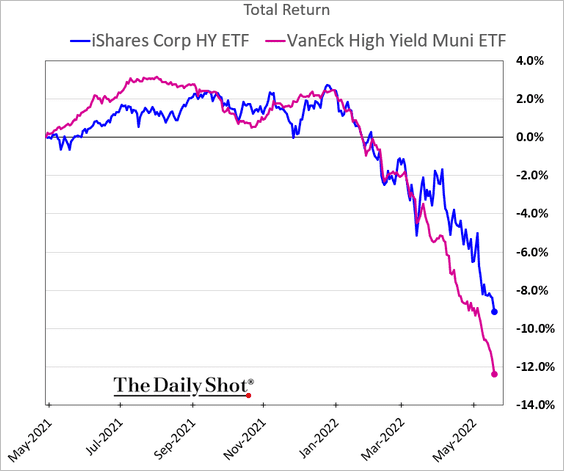

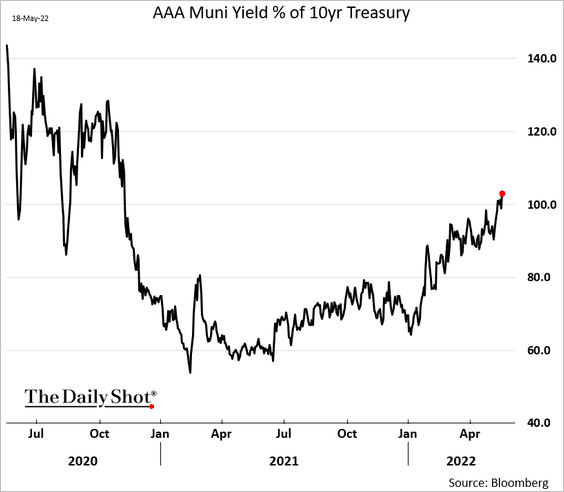

3. Munis have been tumbling.

• High-yield munis (vs. HY corporates):

• AAA muni yield ratio to Treasuries:

Back to Index

Rates

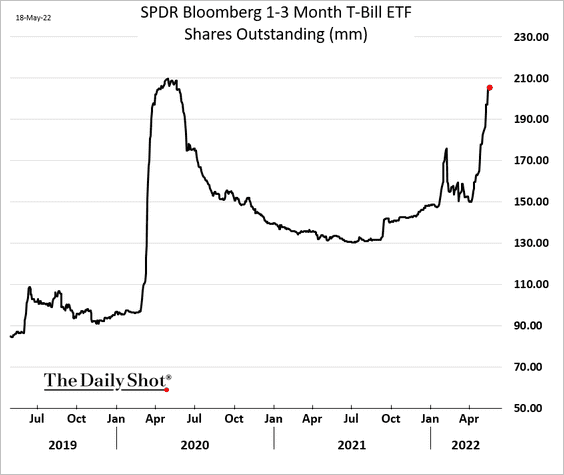

1. Treasury bill demand is showing up in ETF flows.

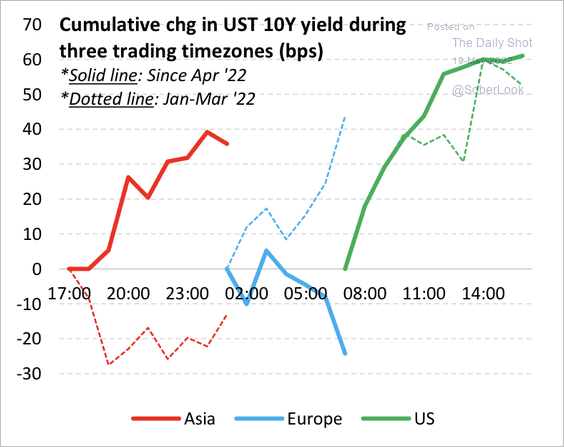

2. A large portion of Treasury selling has occurred during Asia hours over the past month.

Source: Vanda Research

Source: Vanda Research

——————–

Food for Thought

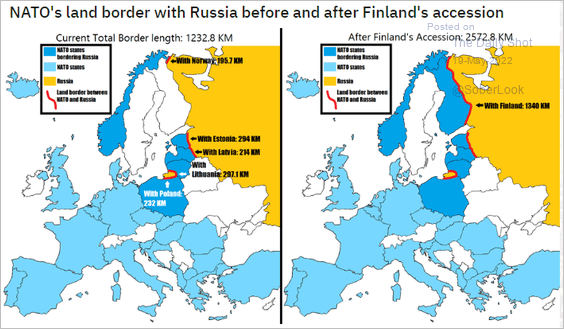

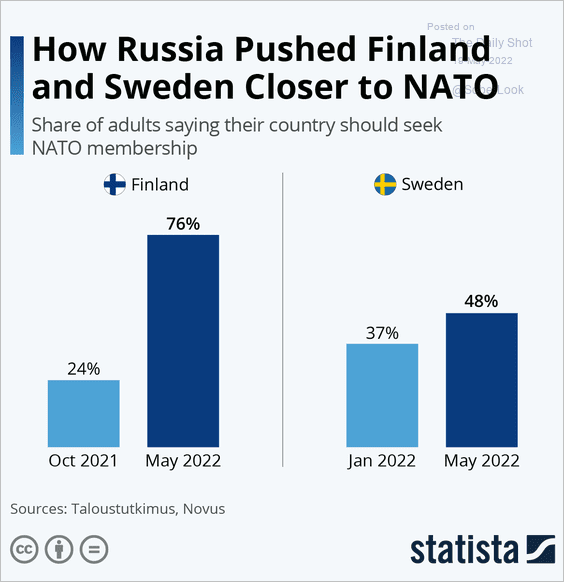

1. Potential expansion of NATOs land border with Russia:

Source: @TheBigDataStats Read full article

Source: @TheBigDataStats Read full article

Source: Statista

Source: Statista

——————–

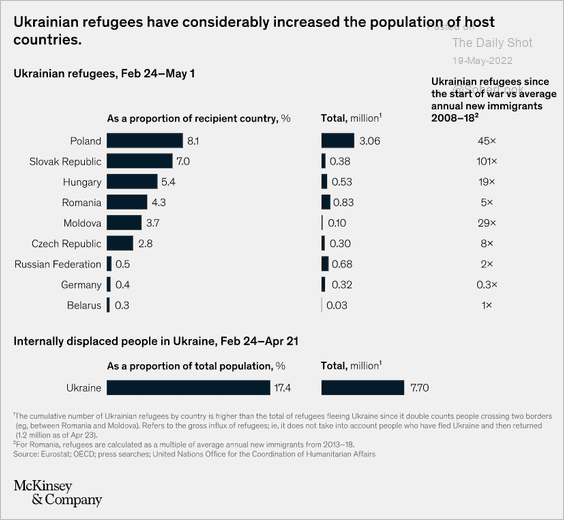

2. Ukrainian refugees boosting the population of host countries (which should improve their GDP growth):

Source: McKinsey & Company

Source: McKinsey & Company

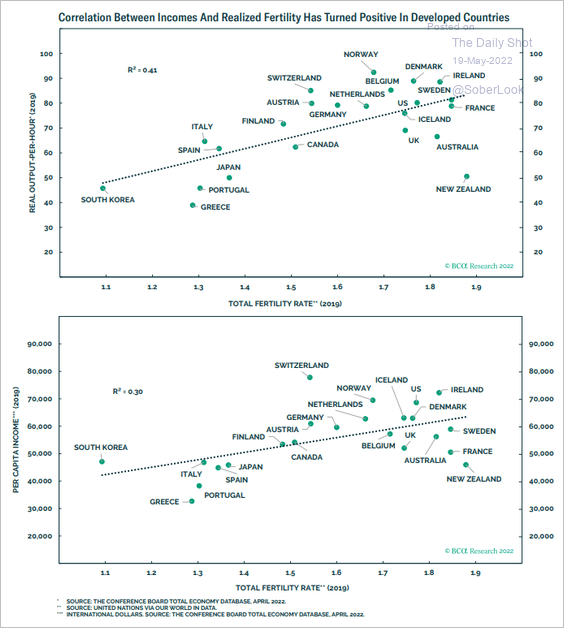

3. Incomes vs. fertility rates:

Source: BCA Research

Source: BCA Research

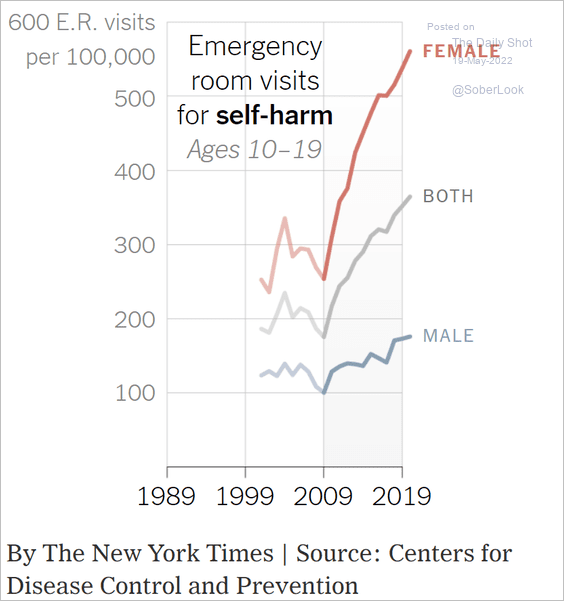

4. Emergency room visits for self-harm by children and adolescents:

Source: The New York Times Read full article

Source: The New York Times Read full article

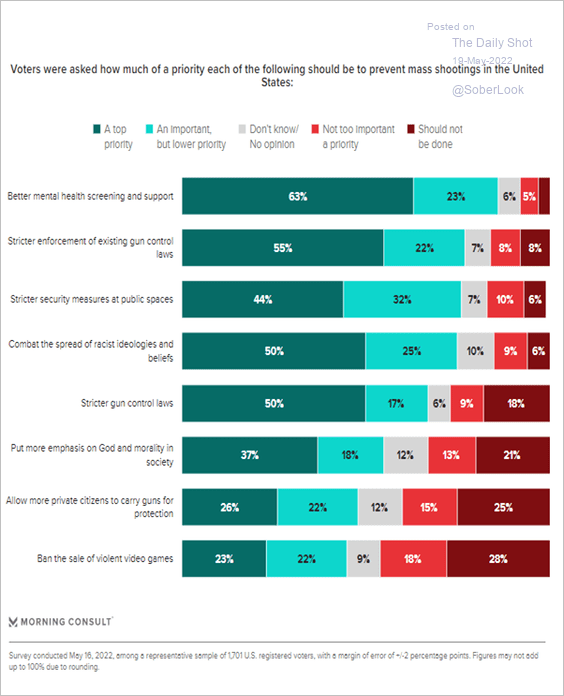

5. Priorities in preventing mass shootings:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

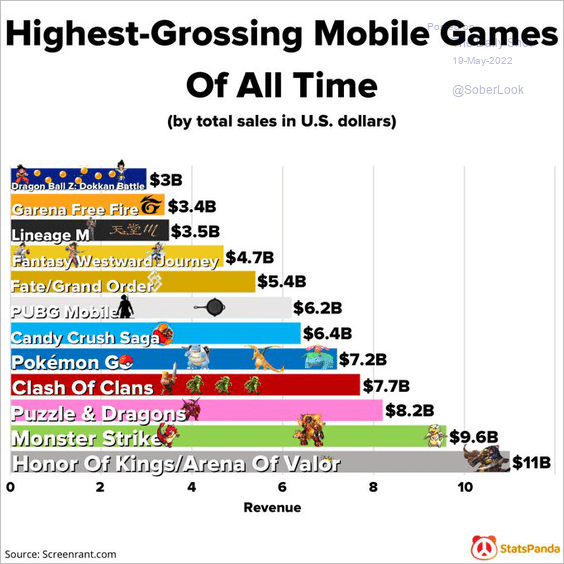

6. Highest-grossing mobile games:

Source: @statspanda1 Read full article

Source: @statspanda1 Read full article

——————–

Back to Index