The Daily Shot: 16-Jun-20

• Equities

• Credit

• Commodities

• Emerging Markets

• China

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

1. There is nothing like more government stimulus to reinvigorate the stock market.

• From the federal government:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• From the Fed:

Source: CNBC Read full article

Source: CNBC Read full article

Source: BNN Read full article

Source: BNN Read full article

Source: @BW Read full article

Source: @BW Read full article

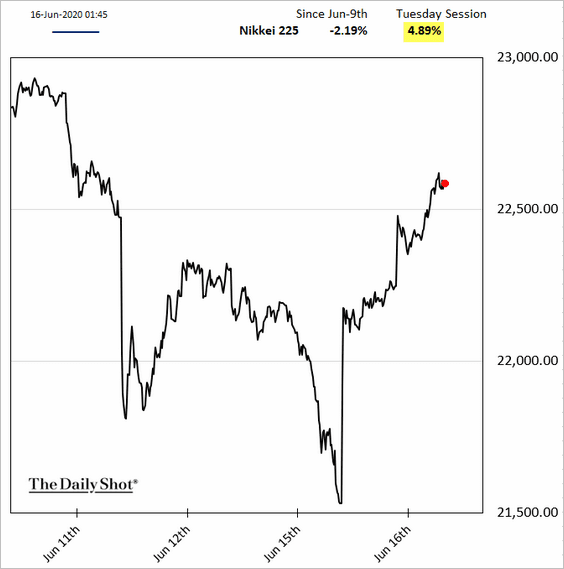

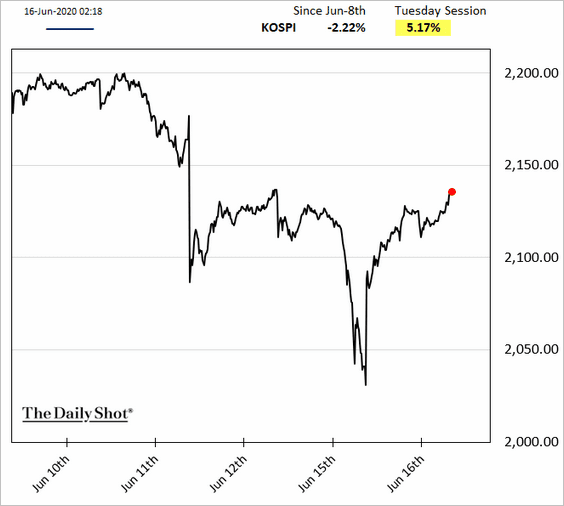

Asian markets rebounded.

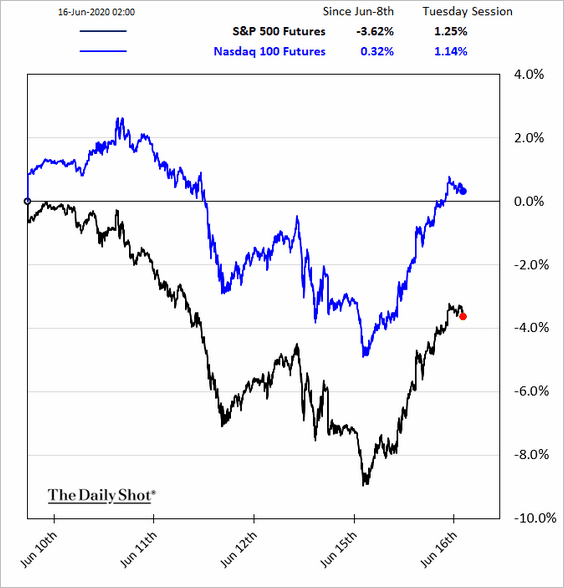

And US stock futures are up.

——————–

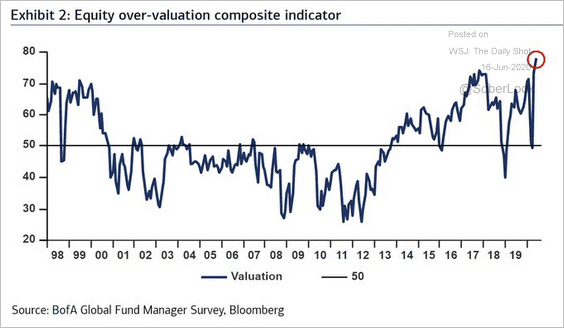

2. Some 78% of fund managers surveyed by BofA see the stock market as “overvalued.”

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

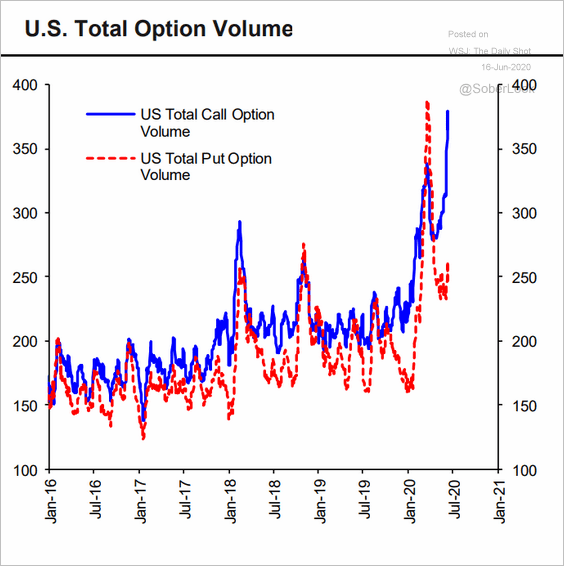

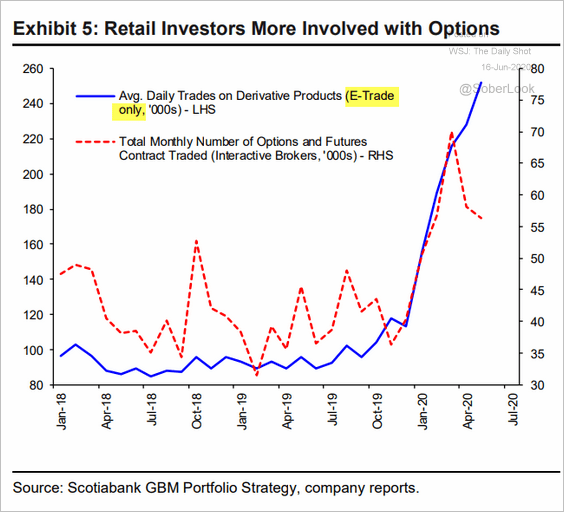

3. Call option volumes have been soaring.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

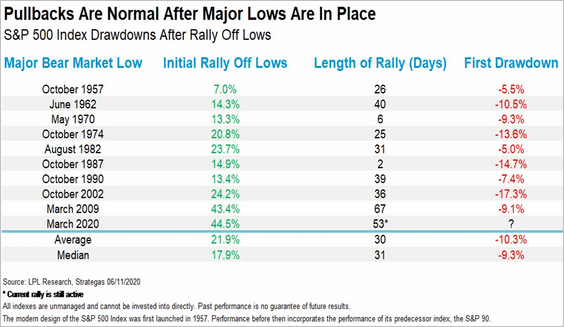

4. How large is the first drawdown after the market rallies from the lows?

Source: LPL Research

Source: LPL Research

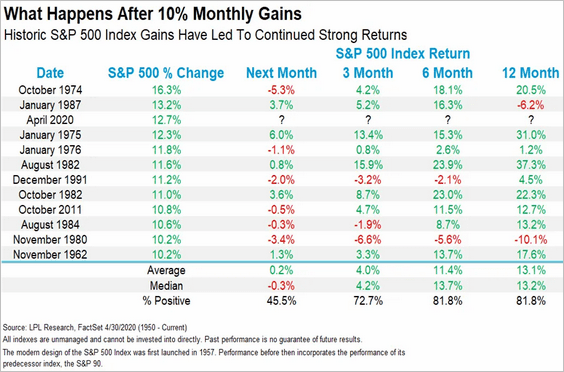

Hows does the market perform after a 10%+ monthly gain?

Source: LPL Research

Source: LPL Research

——————–

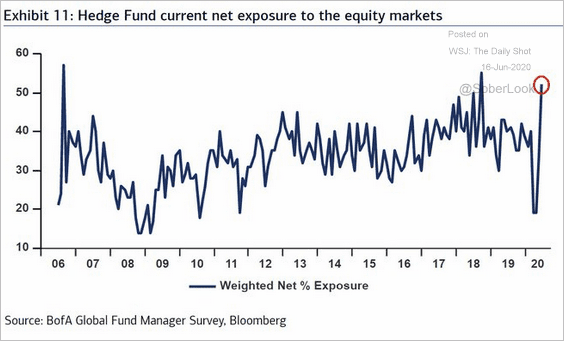

5. Hedge funds have boosted their exposure to the stock market.

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

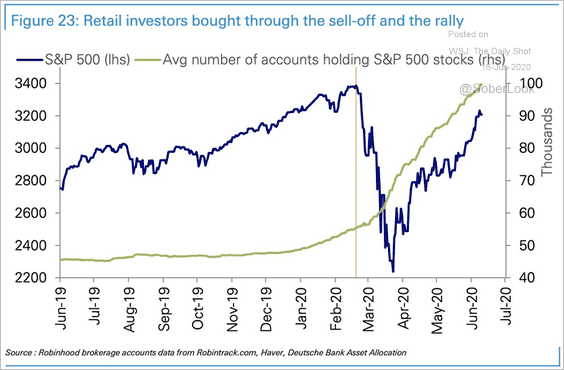

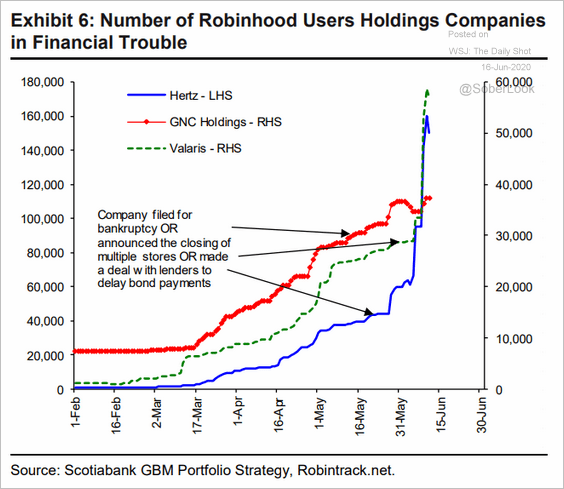

6. Analysts have been surprised by the aggressiveness of retail traders in this crisis.

Source: Barron’s Read full article

Source: Barron’s Read full article

Recent retail trader activity is very different from the post-2009 behavior when small investors abandoned stocks for years. Here are some trends.

• Average number of retail accounts holding S&P 500 stocks:

Source: @ISABELNET_SA, @DeutscheBank

Source: @ISABELNET_SA, @DeutscheBank

• Robinhood users holding shares of bankrupt firms:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• E-Trade options trading:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Credit

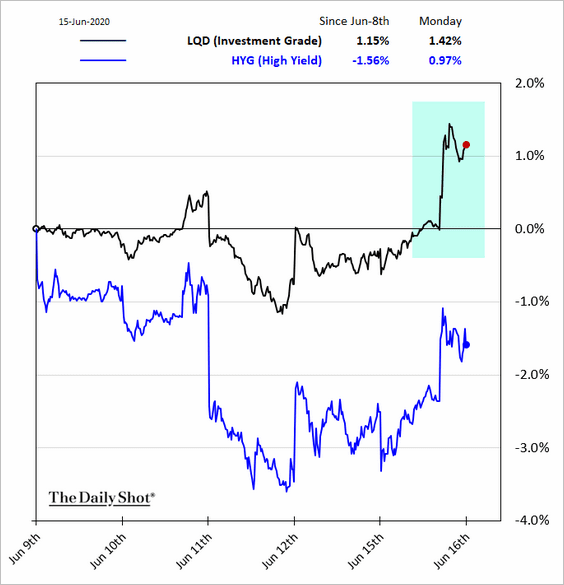

1. The Fed’s corporate debt buying announcement (see the equities section) sent bond markets sharply higher.

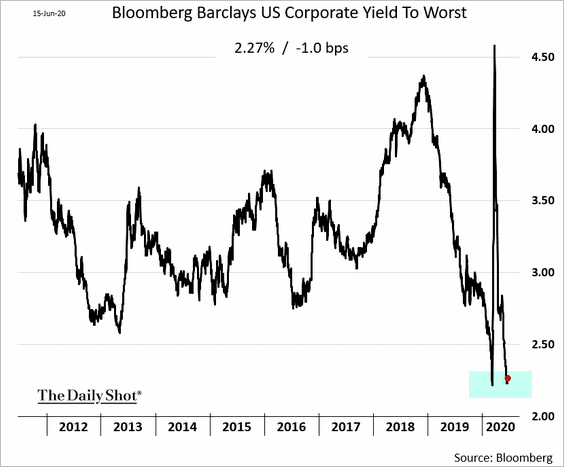

2. Investment-grade corporate borrowing costs are near record lows.

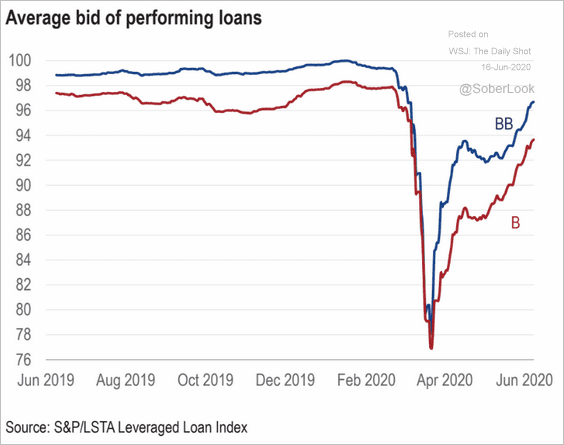

3. Leveraged loan prices have been rebounding.

Source: LCD, S&P Global Market Intelligence

Source: LCD, S&P Global Market Intelligence

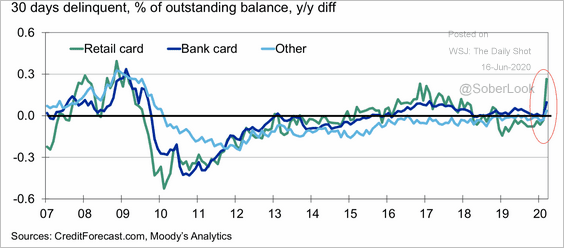

4. Credit card delinquencies have been rising, especially for retail (store-issued) cards.

Source: Moody’s Analytics

Source: Moody’s Analytics

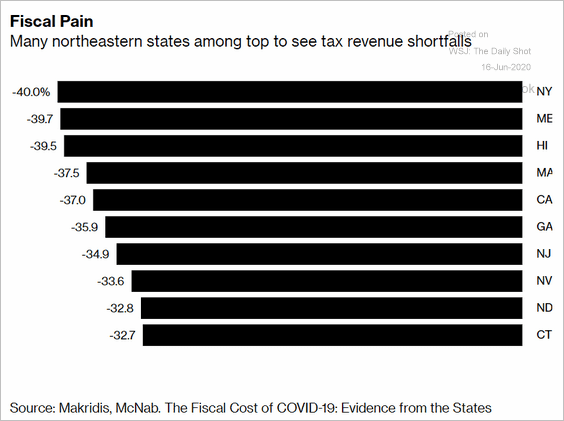

5. Many state budgets are under pressure.

Source: @GregDaco, @atanzi Read full article

Source: @GregDaco, @atanzi Read full article

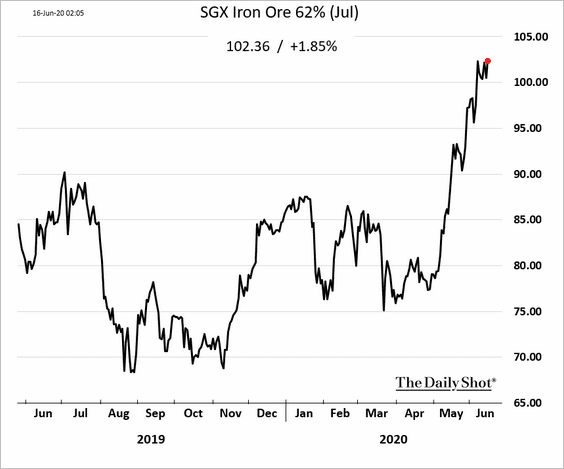

Commodities

1. Iron ore continues to grind higher.

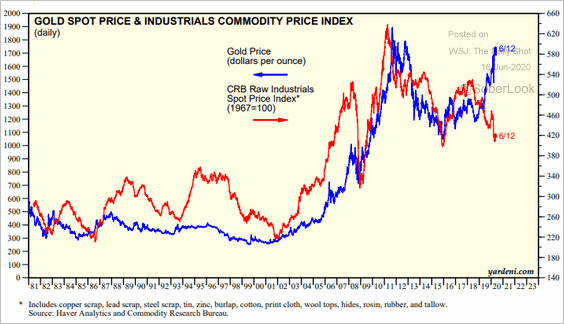

2. Gold and industrial commodities have diverged dramatically this year.

Source: Yardeni Research

Source: Yardeni Research

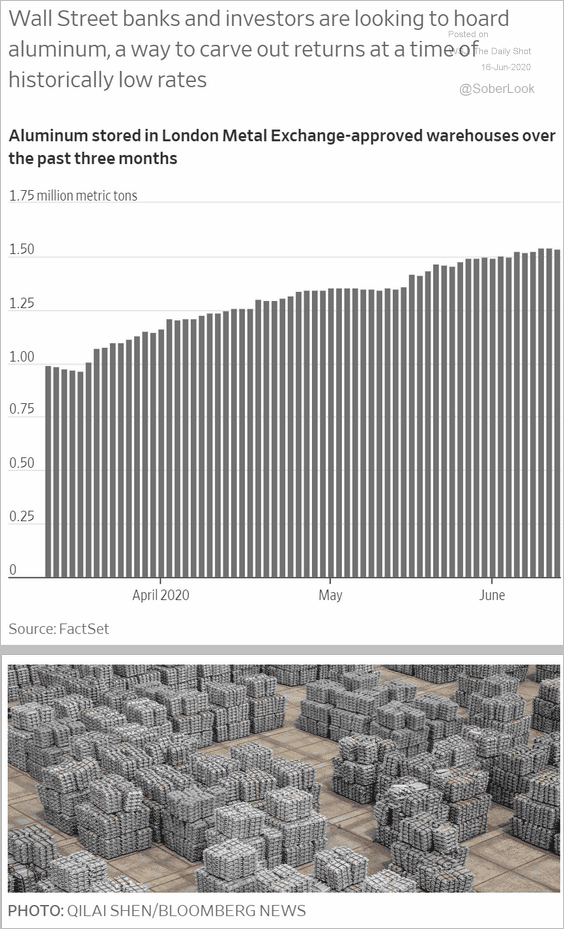

3. Aluminum traders are playing the cash & carry game, boosting stockpiles.

Source: @WSJ Read full article

Source: @WSJ Read full article

Emerging Markets

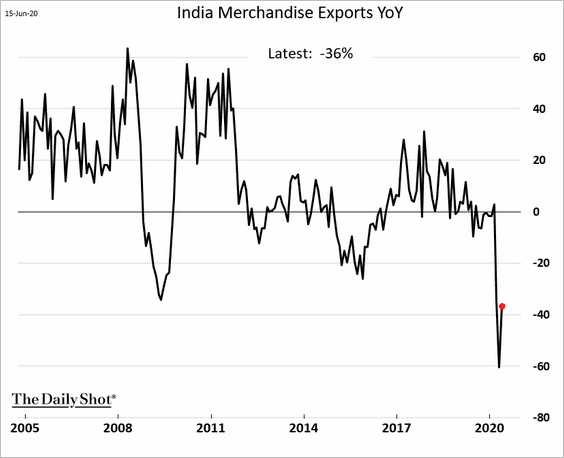

1. India’s exports increased last month but remain depressed.

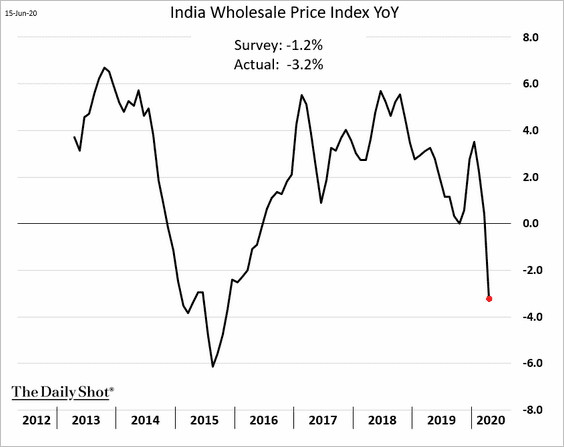

Separately, India’s wholesale inflation has moved deeper into negative territory in May.

——————–

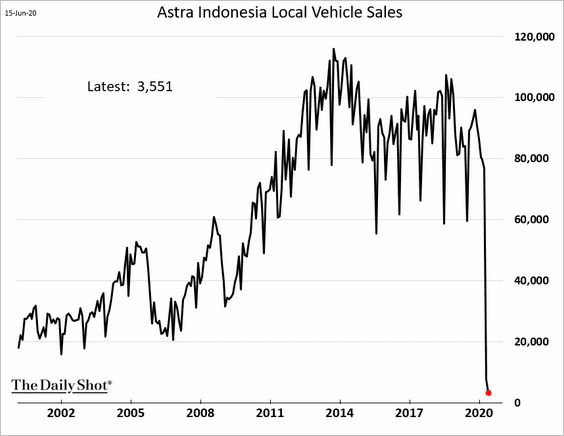

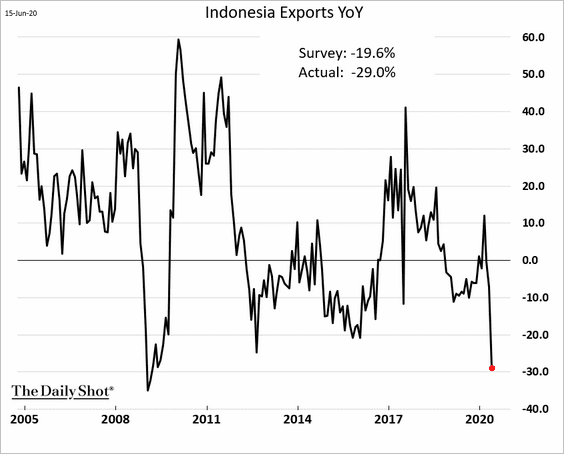

2. May was a tough month for Indonesia.

• Yesterday, we saw the drop in consumer confidence (chart).

• Vehicle sales ground to a halt.

• Exports registered the worst decline since 2009.

——————–

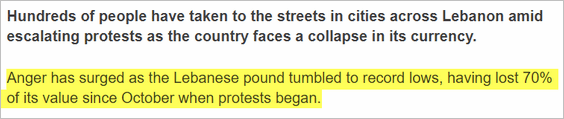

3. Lebanon’s inflation soared as the currency weakened.

Source: BBC Read full article

Source: BBC Read full article

——————–

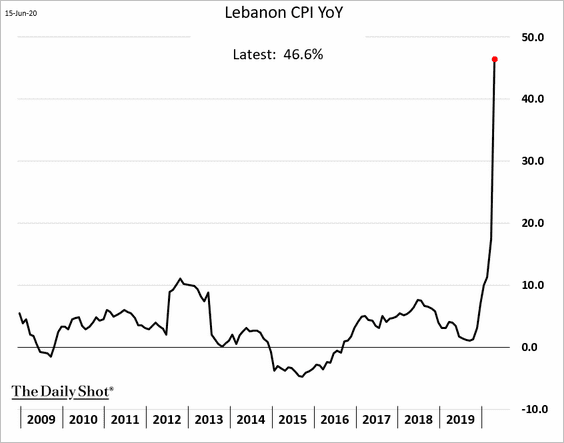

4. On the other hand, Israel is facing the worst deflation since 2004.

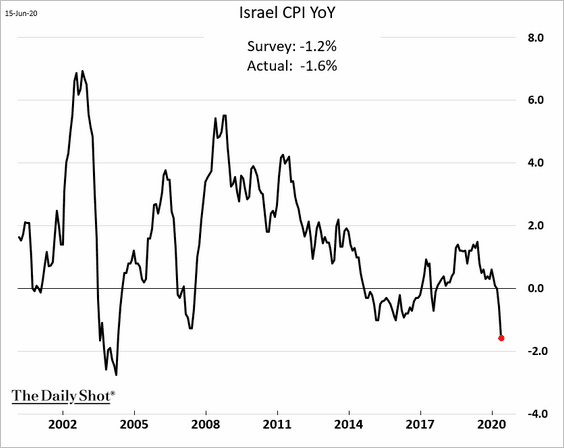

5. Mexico’s formal job creation tumbled.

Source: Goldman Sachs

Source: Goldman Sachs

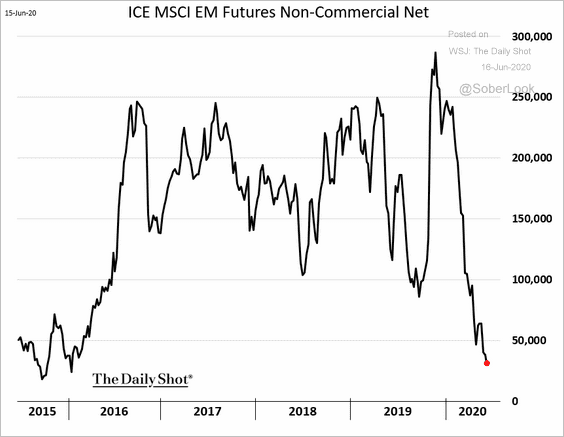

6. Speculative accounts are becoming increasingly cautious on EM equity futures.

h/t Srinivasan Sivabalan

h/t Srinivasan Sivabalan

China

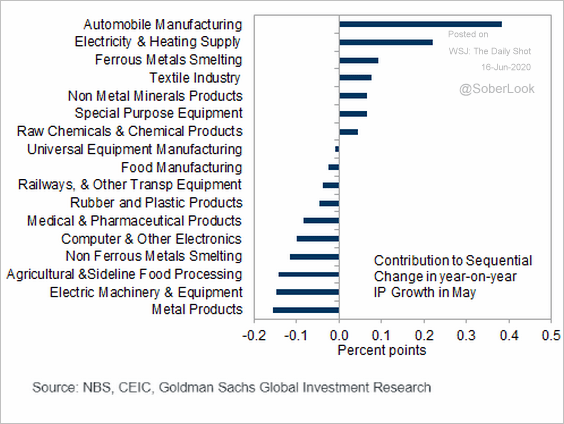

1. Here are the contributions to China’s industrial production growth in May.

Source: Goldman Sachs

Source: Goldman Sachs

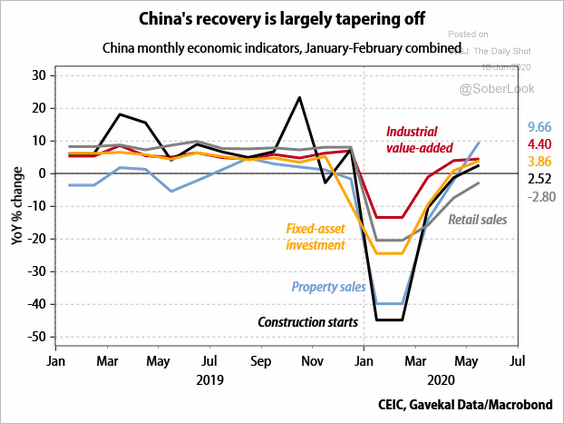

2. Is the rebound losing momentum?

Source: Gavekal

Source: Gavekal

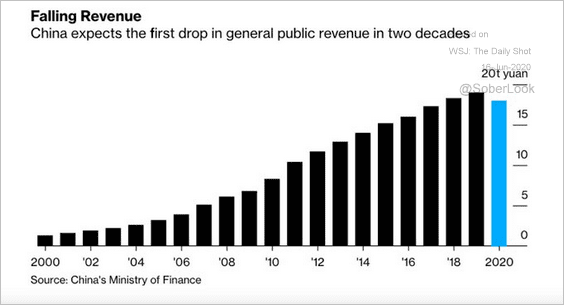

3. Tax revenue is expected to drop for the first time in two decades.

Source: @acemaxx, @next_china Read full article

Source: @acemaxx, @next_china Read full article

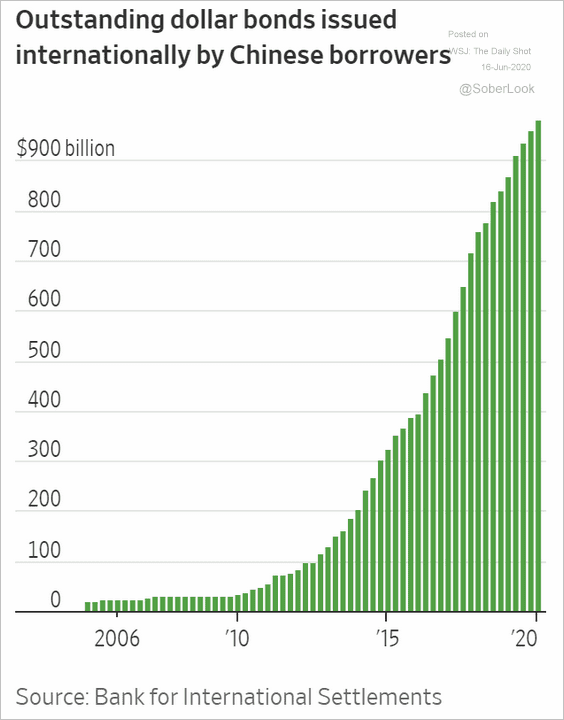

4. The rise in China’s dollar-denominated debt has been impressive.

Source: @WSJ Read full article

Source: @WSJ Read full article

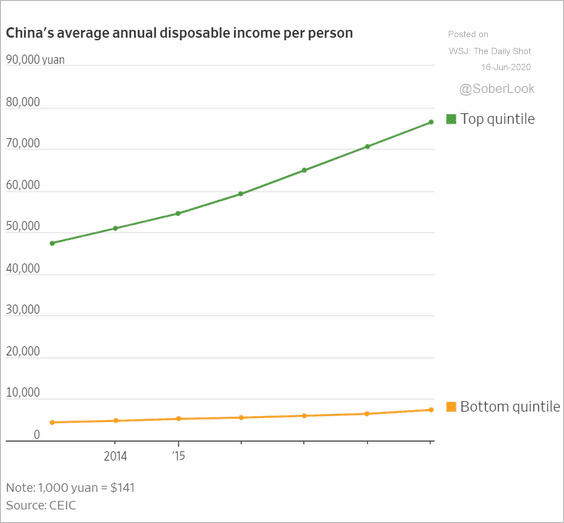

5. Income inequality continues to widen.

Source: @WSJ Read full article

Source: @WSJ Read full article

The Eurozone

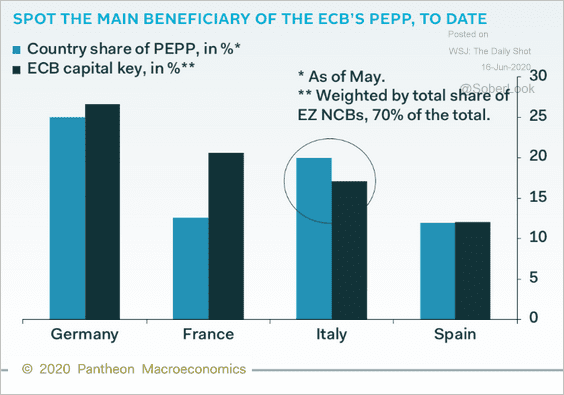

1. Italy benefitted the most from the ECB’s recent deviation from the capital keys.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

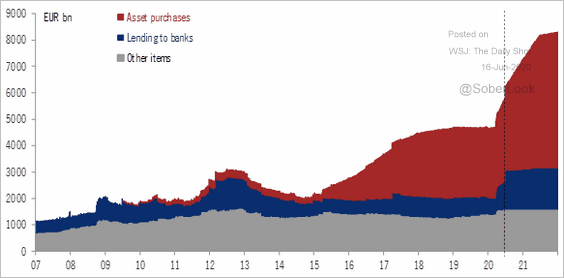

2. Here is a forecast for the ECB’s balance sheet from Pictet Wealth Management.

Source: @fwred

Source: @fwred

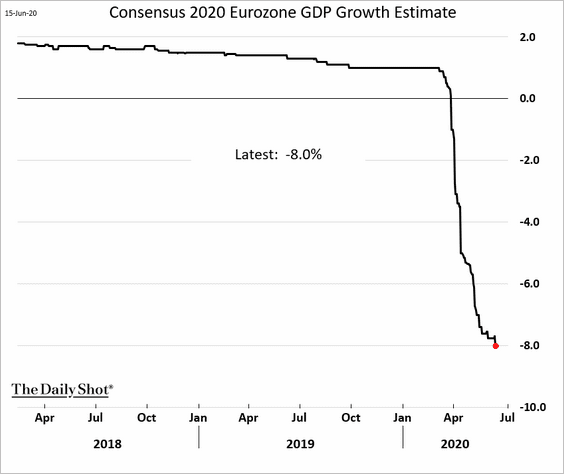

3. Economists again downgraded their projections for the euro-area 2020 GDP.

Source: @TheTerminal

Source: @TheTerminal

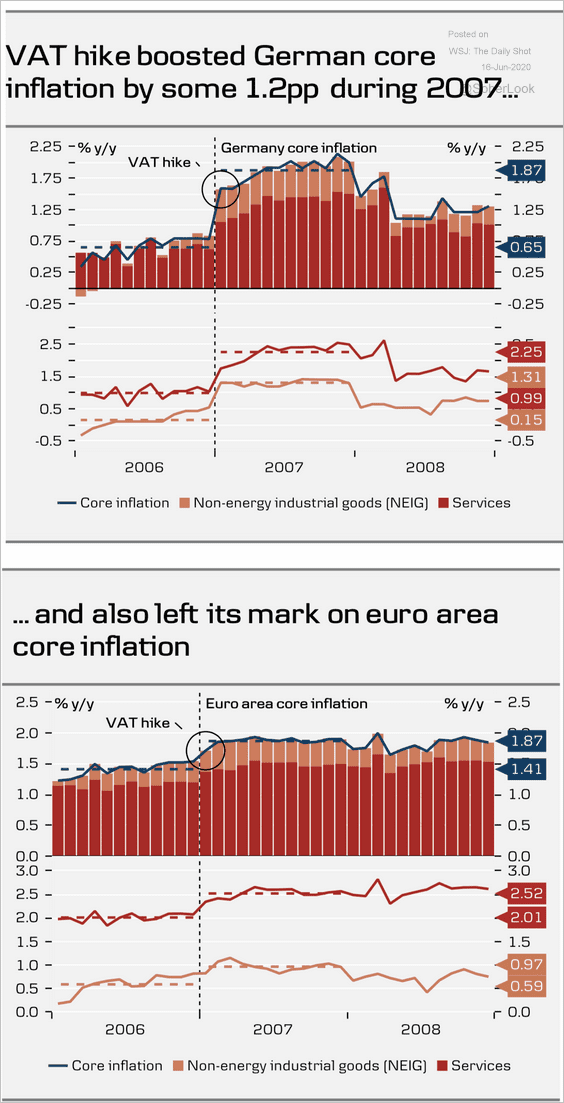

4. As part of Germany’s fiscal stimulus, the government will temporarily cut VAT (consumption tax) rates from 19% to 16%. In 2007 the VAT rate hike boosted inflation, and now we are likely to see some of those CPI gains reversed.

Source: Danske Bank

Source: Danske Bank

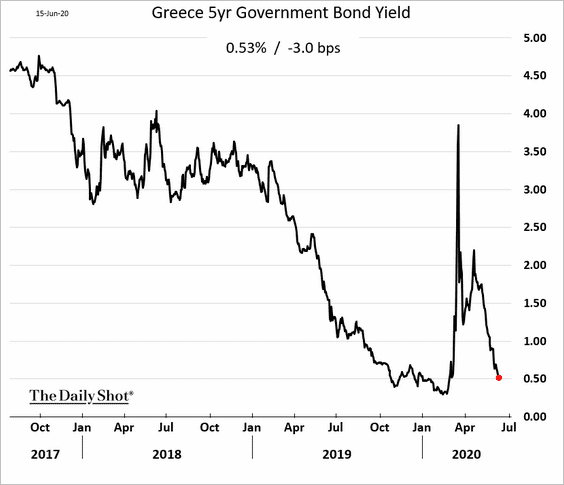

5. Greek bond yields are almost back to pre-crisis lows.

Canada

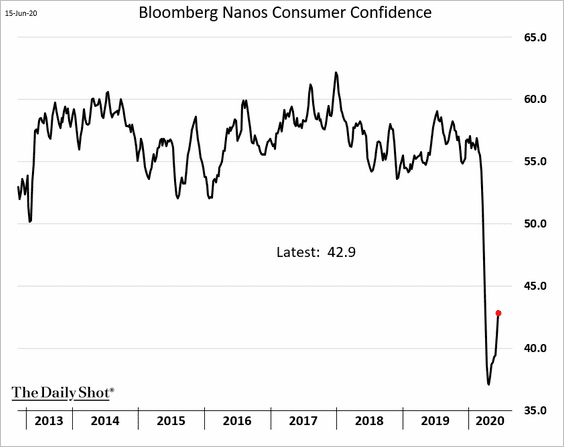

1. Consumer confidence is gradually recovering.

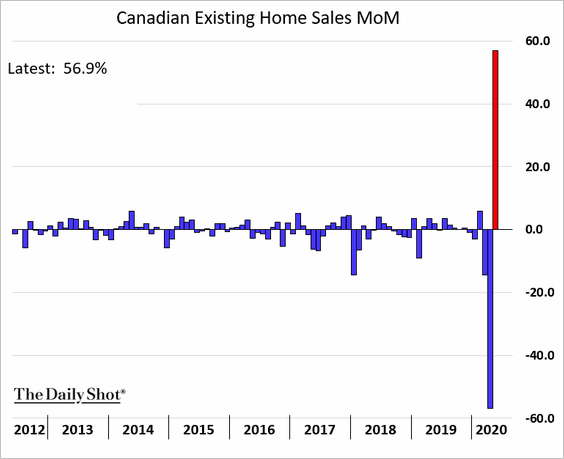

2. Home sales rebounded last month.

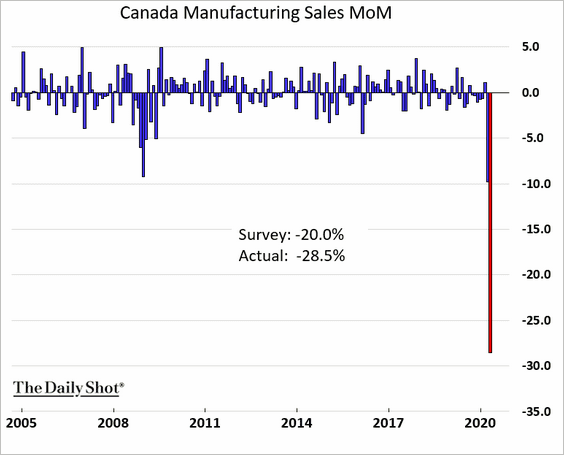

3. Manufacturing sales plummetted in April, …

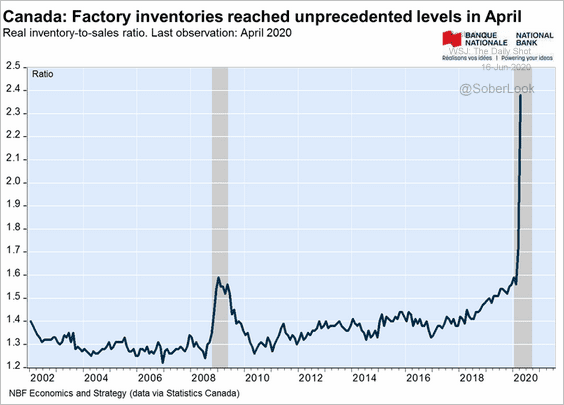

… as the inventory-to-sales ratio hit a new record.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

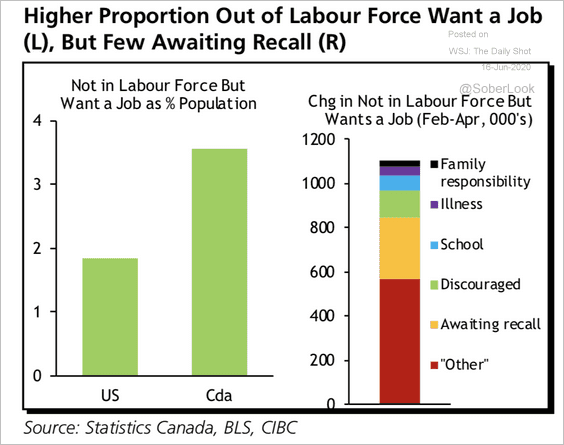

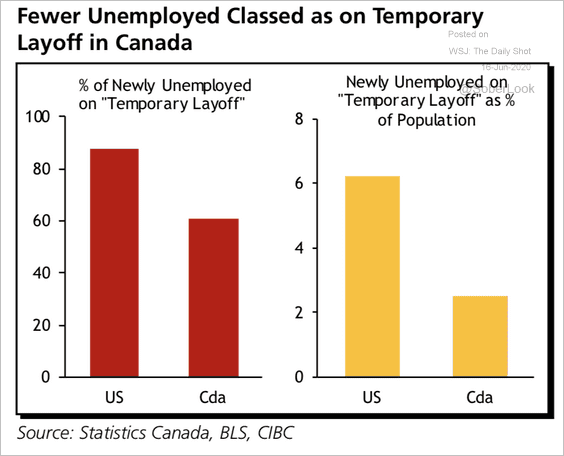

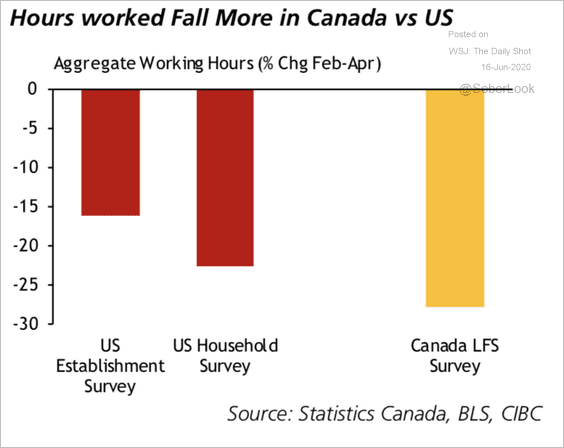

4. Next, we have some comparisons between the US and Canadian labor markets.

• Not in the labor force but want a job:

Source: CIBC Capital Markets

Source: CIBC Capital Markets

• “Temporary layoffs”:

Source: CIBC Capital Markets

Source: CIBC Capital Markets

• Hours worked:

Source: CIBC Capital Markets

Source: CIBC Capital Markets

The United States

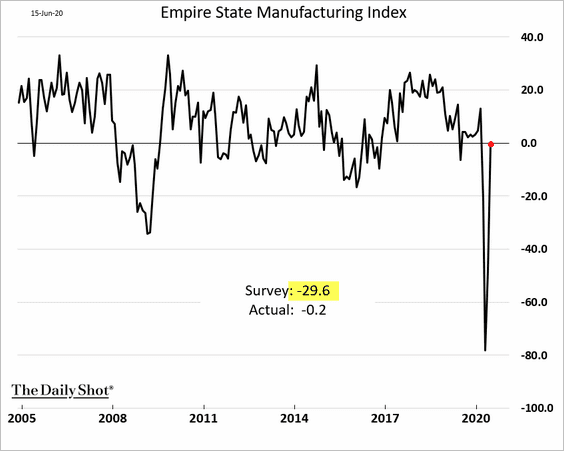

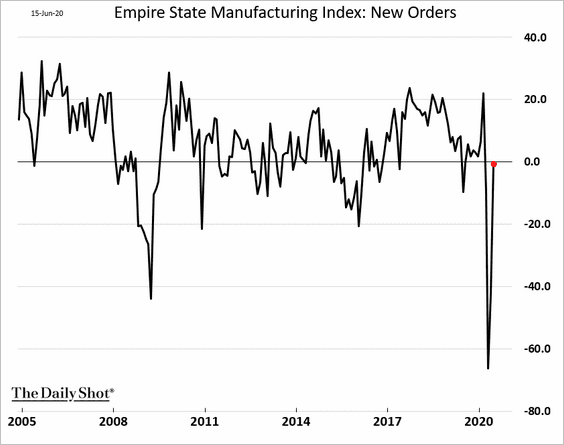

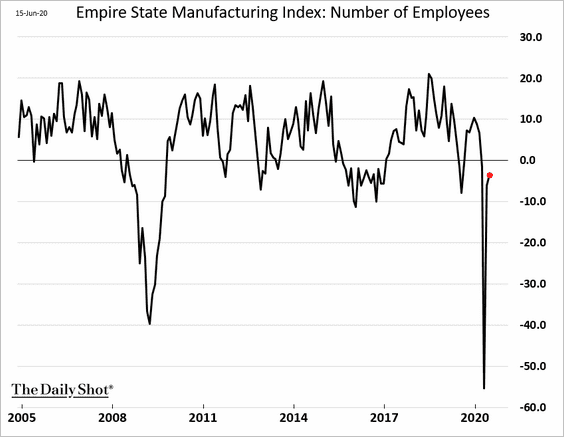

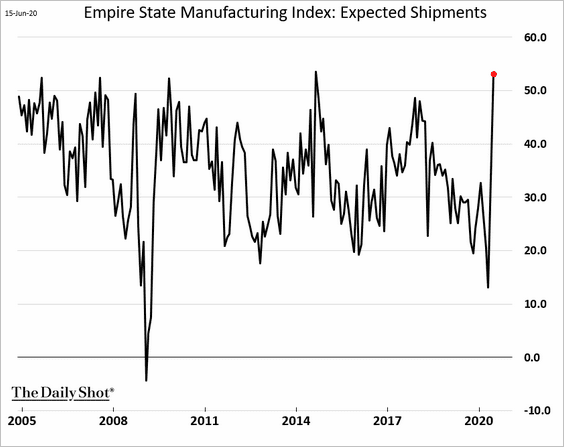

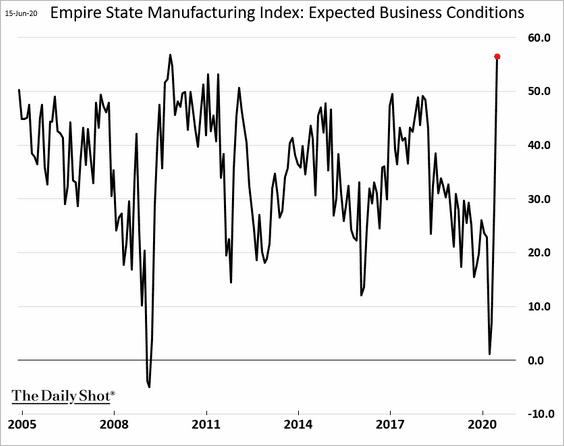

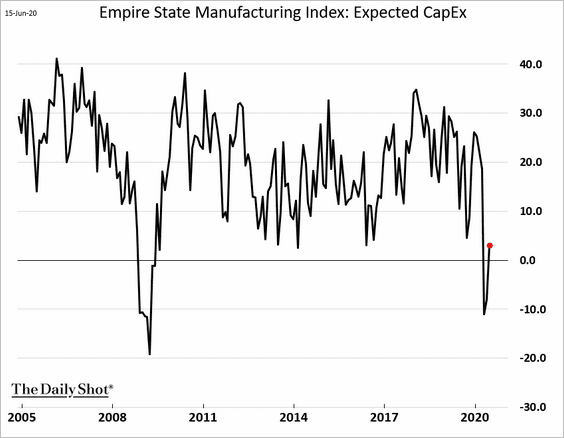

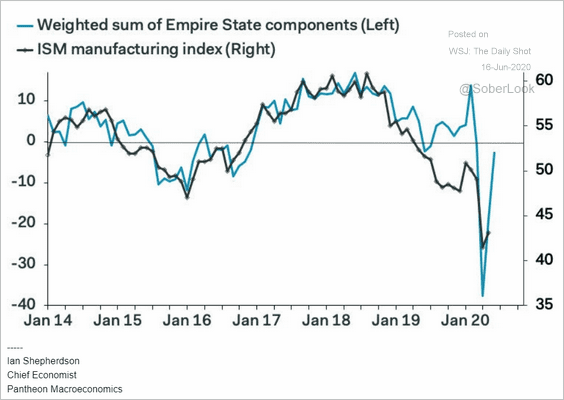

1. The NY Fed’s regional factory report (Empire State Manufacturing) topped economists’ forecasts, showing a surprising rebound.

• The headline index:

• New orders:

• Employment:

Forward-looking indicators were particularly strong.

• Expected shipments:

• Future business conditions:

CapEx expectations bounced from the lows but remain soft.

The NY Fed’s report bodes well for factory activity at the national level (ISM).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

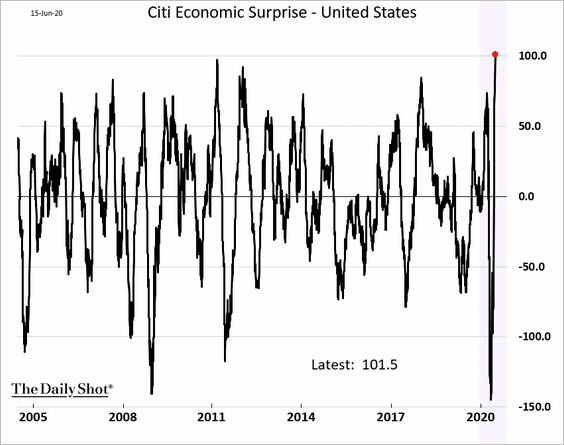

2. The Empire State Manufacturing report sent the Citi Economic Surprise Index to a record high.

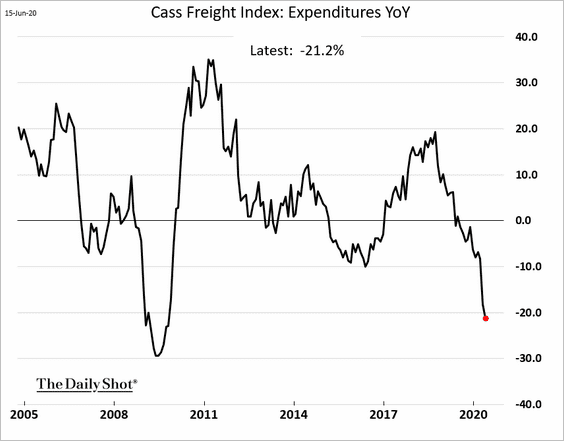

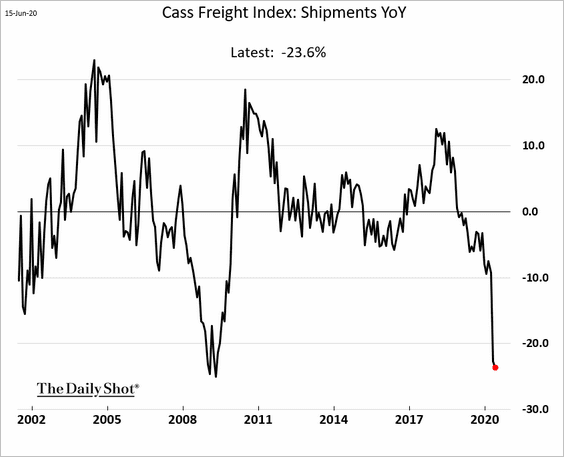

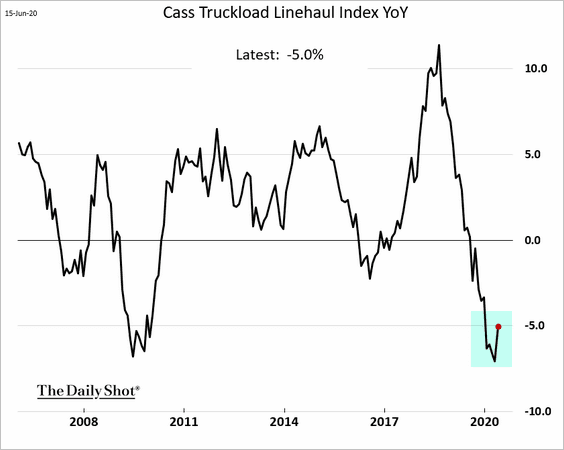

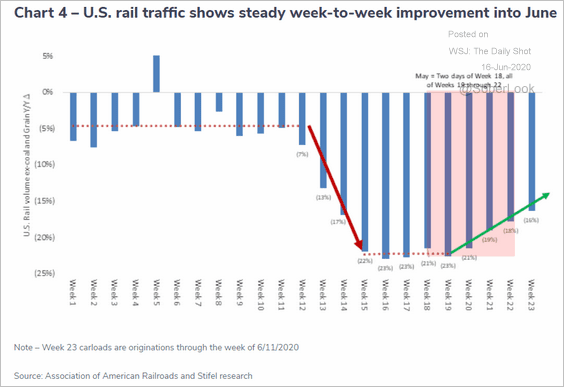

3. It’s going to be a long recovery for the freight industry. The US freight recession, which started before the pandemic, has been disastrous.

• Freight expenditures:

• Freight shipments:

The truckload linehaul index has stabilized.

Rail traffic is gradually recovering.

Source: Cass Information Systems

Source: Cass Information Systems

——————–

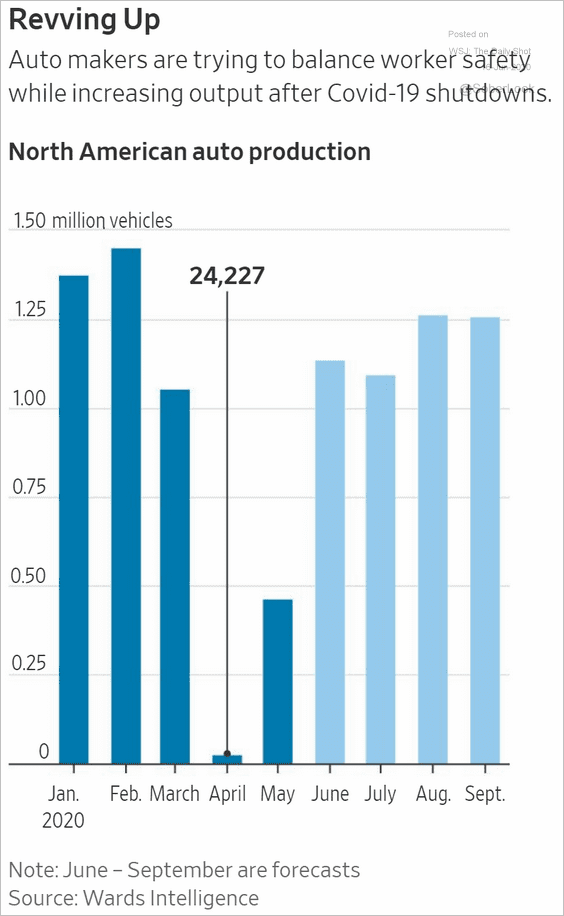

4. Auto production is expected to return to more “normal” levels this summer.

Source: @WSJ Read full article

Source: @WSJ Read full article

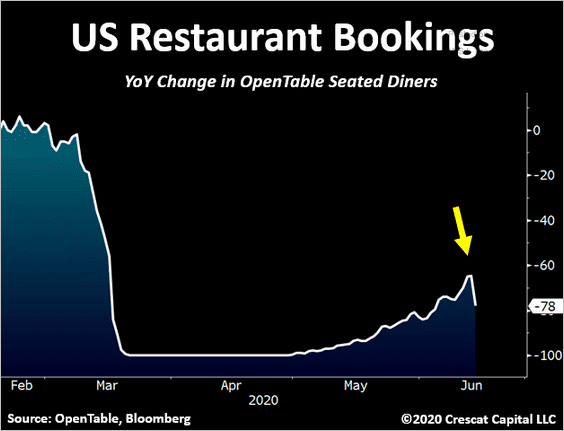

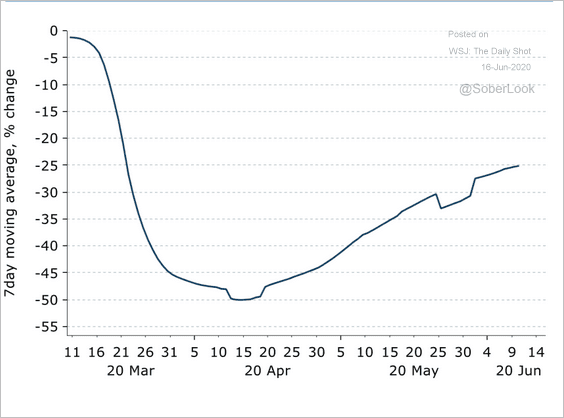

5. The rebound in restaurant bookings appears to be fading.

Source: @TaviCosta

Source: @TaviCosta

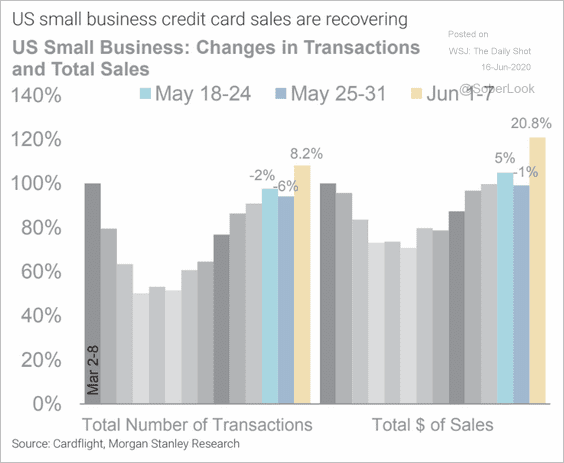

6. Small business credit card transactions continue to recover.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Local businesses are opening up.

Source: ANZ Research

Source: ANZ Research

——————–

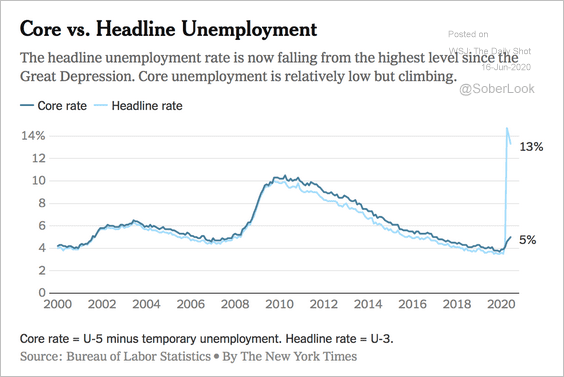

7. Some analysts are closely monitoring the “core” unemployment rate, which includes those who were permanently laid off as well as discouraged and marginally attached workers.

Source: @JedKolko, @UpshotNYT Read full article

Source: @JedKolko, @UpshotNYT Read full article

Global Developments

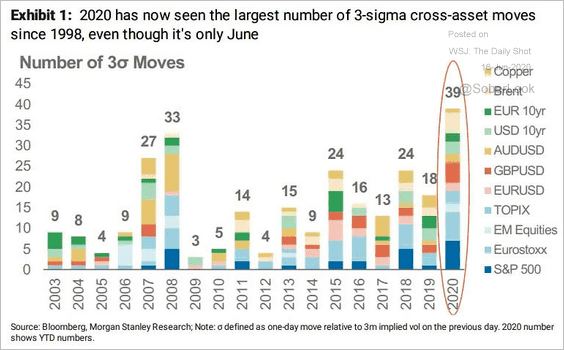

1. Volatility across asset classes has been extreme this year.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

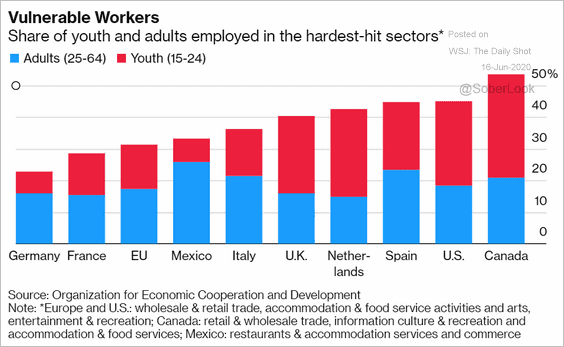

2. Younger workers are often employed in the hardest-hit sectors.

Source: @markets Read full article

Source: @markets Read full article

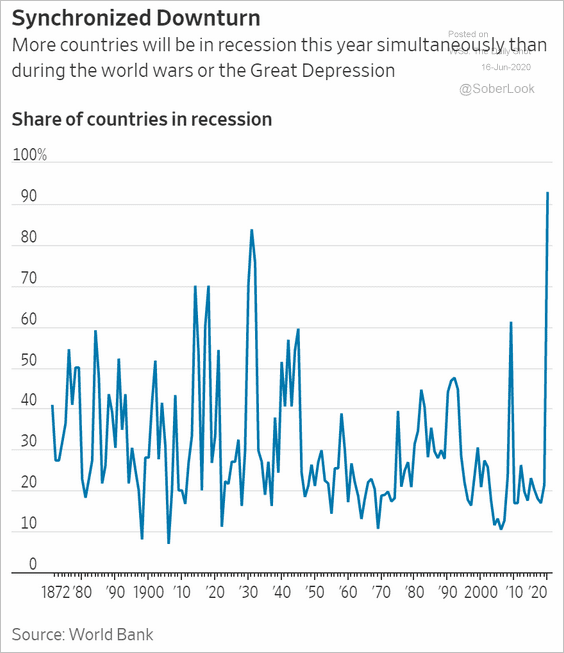

3. This chart shows the percentage of countries in recession (going back to 1872).

Source: @WSJ Read full article

Source: @WSJ Read full article

Food for Thought

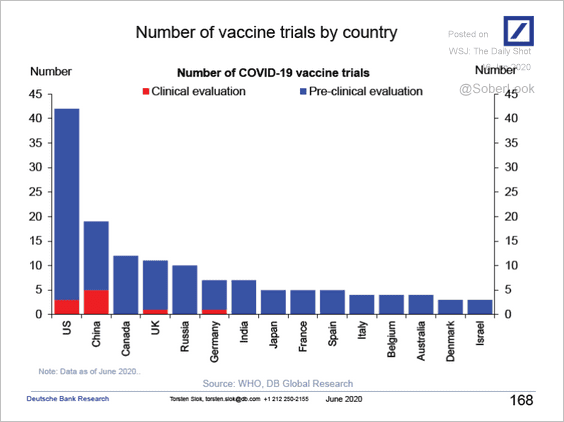

1. COVID-19 vaccine trials:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

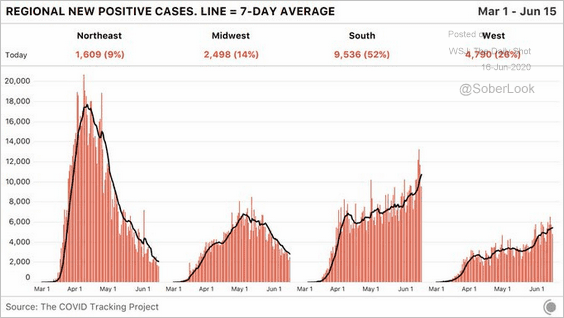

2. New positive cases in the US, by region:

Source: @COVID19Tracking

Source: @COVID19Tracking

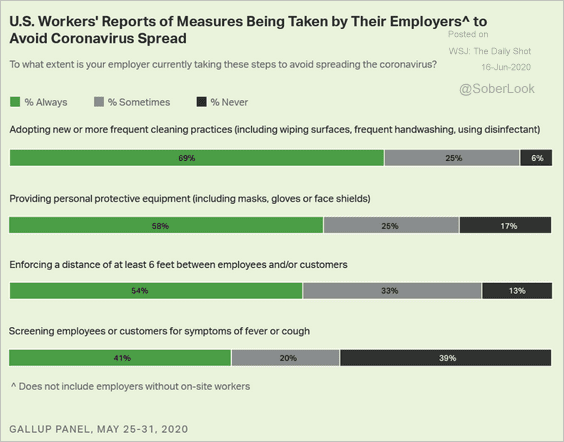

3. What are employers doing to avoid coronavirus spread?

Source: Gallup Read full article

Source: Gallup Read full article

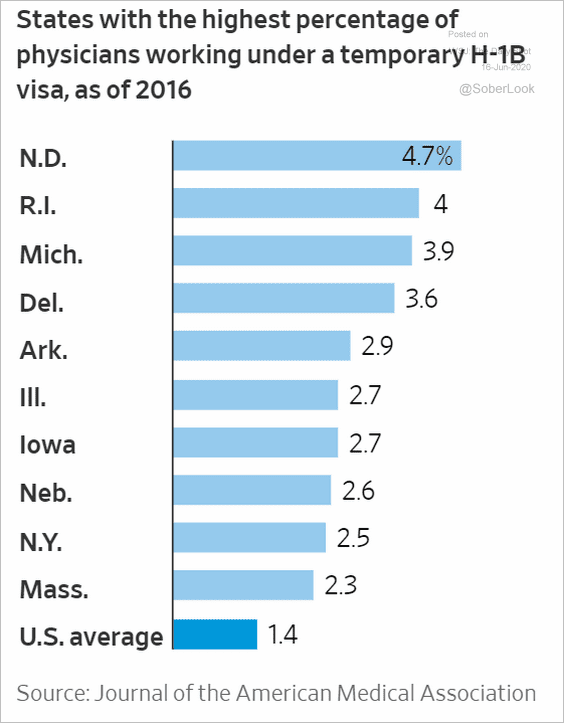

4. States with the highest percentage of physicians working under a temporary H-1B visa:

Source: @WSJ Read full article

Source: @WSJ Read full article

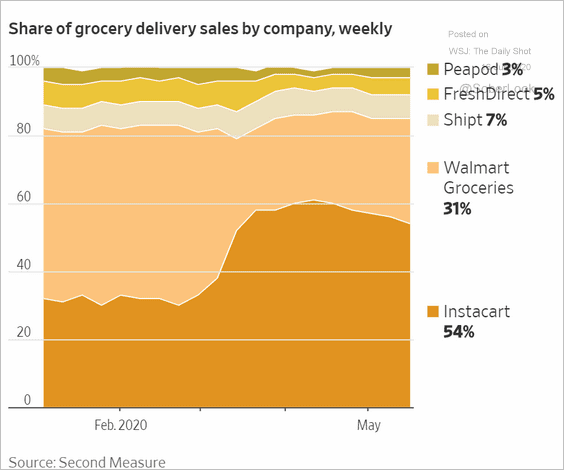

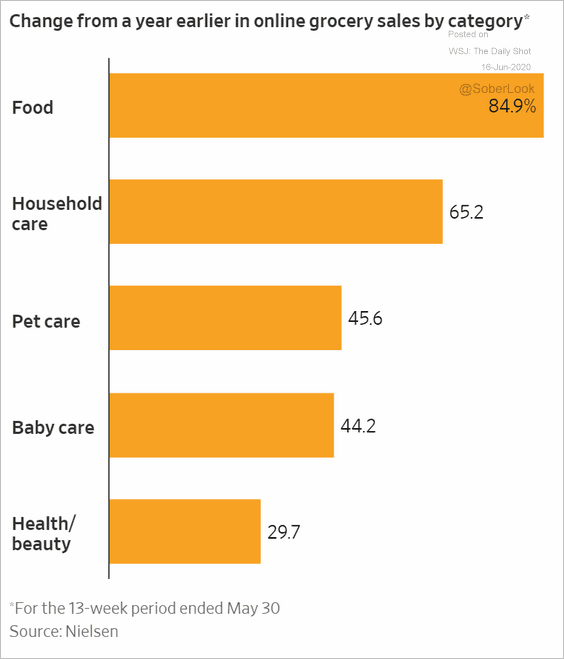

5. Online grocery business trends (3 charts):

• Grocery delivery market share over time:

Source: @WSJ Read full article

Source: @WSJ Read full article

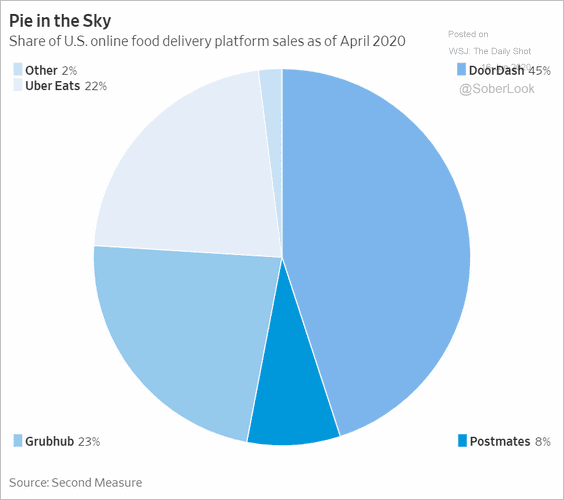

• Online food delivery platforms:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Online grocery sales (year-over-year change):

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

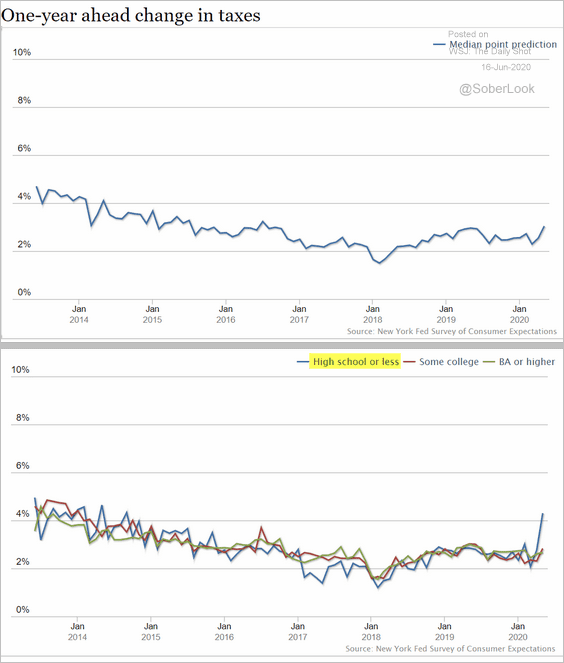

6. Americans expect tax increases over the next year.

Source: NY Fed

Source: NY Fed

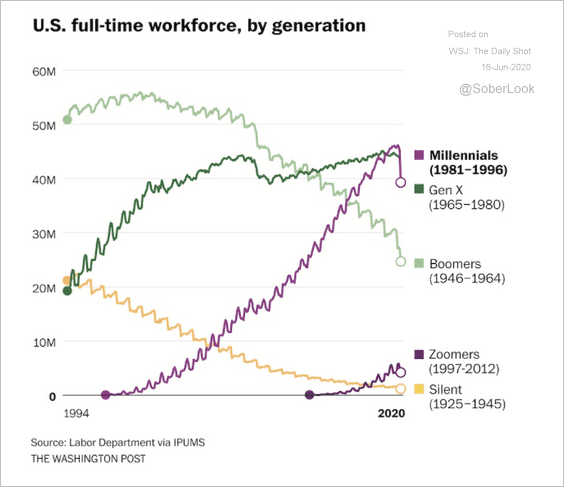

7. The US labor force by generation:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

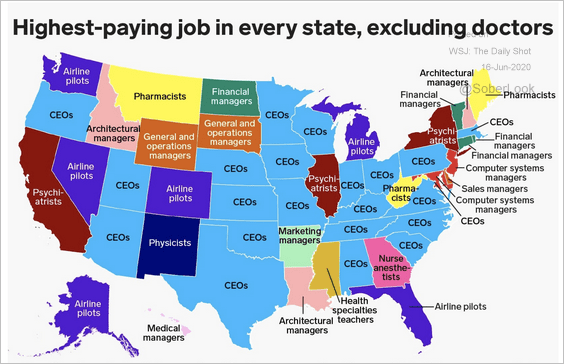

8. The highest-paying job in every state:

Source: @businessinsider Read full article

Source: @businessinsider Read full article

——————–