The Daily Shot: 06-May-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Unit labor costs climbed more than expected last quarter, spooking the markets (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Labor productivity plummeted. However, this result was distorted by the Q1 GDP weakness, driven by the trade deficit surge (that should reverse).

——————–

2. Next, we have some updates on the labor market.

• Unemployment applications remain very low.

• Morgan Stanley expects to see 475k new jobs created in April …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

… and the unemployment rate hitting 3.5%.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

3. Companies are boosting prices even in sectors with relatively low demand.

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

4. According to Bloomberg, retail traffic deteriorated sharply last week and is now well below last year’s levels for most categories.

Source: Colleen McElroy

Source: Colleen McElroy

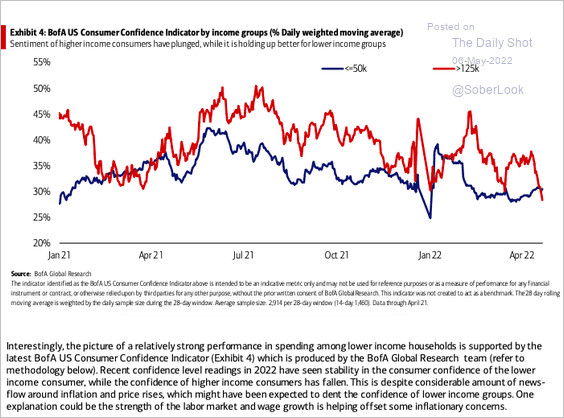

5. Sentiment among higher-earning Americans tumbled in recent weeks but is holding steady among those making under $50k. This trend does not bode well for consumer spending.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

6. What is the Fed’s “terminal rate” (the maximum fed funds rate in the current tightening cycle)? Here is the market pricing.

The 10yr Treasury yield is now firmly above 3%.

Back to Index

Canada

1. The Toronto-area housing market is feeling the pinch of higher interest rates.

Source: BMO; @SBarlow_ROB

Source: BMO; @SBarlow_ROB

2. This chart shows Canada’s net exports by sector.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

3. The budget deficit is expected to shrink over the next year.

Source: Oxford Economics

Source: Oxford Economics

And federal debt as a percent of GDP is expected to decline.

Source: Oxford Economics

Source: Oxford Economics

4. Oxford Economics expects stronger growth this year, but slower gains in 2023 and 2024.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

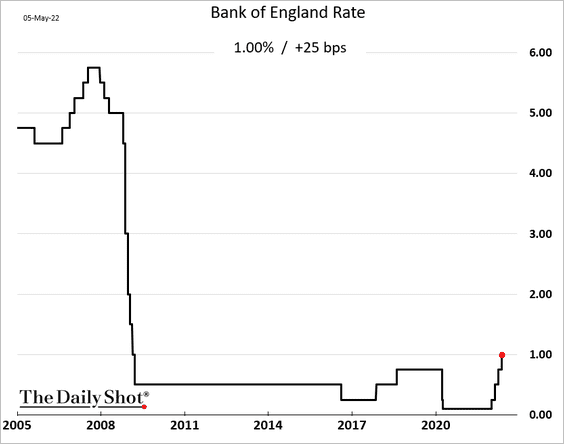

1. The BoE hiked rates again but struck a cautious tone. The central bank sees stagflation setting in.

Source: Reuters Read full article

Source: Reuters Read full article

• The CPI is projected to hit 10% this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

• The BoE sees no growth in 2023 and 2024.

Source: Scotiabank Economics

Source: Scotiabank Economics

• Three years out, inflation is expected to fall well below the target as rate hikes choke off economic growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The market expects the BoE to keep pushing rates higher.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

2. The pound tumbled in response to BoE’s comments.

3. The Markit PMI report shows companies rapidly boosting prices.

4. Car registrations remain depressed.

Back to Index

The Eurozone

1. The 10yr Bund yield is at long-term resistance.

h/t @AkshayChinchal4

h/t @AkshayChinchal4

2. The German breakeven rate (inflation expectations) tumbled this week.

3. Germany’s manufacturing output slumped in March (well below forecasts).

Vehicle orders were depressed.

——————–

4. Germany’s construction activity is back in contraction territory.

5. French manufacturing production edged lower in March.

Back to Index

Europe

1. Poland and the Czech Republic hiked rates again.

The Czech 2yr yield is nearing 6%.

The yield curve is heavily inverted.

——————–

2. The Swiss CPI is grinding higher but remains well below the levels we see in the Eurozone.

3. International companies see softer sales in Europe.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Asia – Pacific

1. The Tokyo core CPI surged as the drop in communication equipment prices came out of the year-over-year figures.

2. The Taiwan dollar remains under pressure.

3. New Zealand’s housing market is feeling the effect of higher rates.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

Back to Index

China

1. The renminbi continues to sink vs. USD.

Despite the recent selloff, the renminbi held up well in recent years relative to other EM currencies.

Source: PGM Global

Source: PGM Global

The currency also has remained relatively firm despite light credit impulse and a significant sell-off in Chinese equities.

Source: PGM Global

Source: PGM Global

——————–

2. Financial conditions continue to tighten.

3. State-owned developers’ onshore bond issuance rebounded last quarter.

Source: Fitch Ratings

Source: Fitch Ratings

4. Hong Kong’s retail sales slumped in March.

Back to Index

Emerging Markets

1. Chile’s central bank announced another aggressive rate hike.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Chile’s vehicle sales remain healthy.

——————–

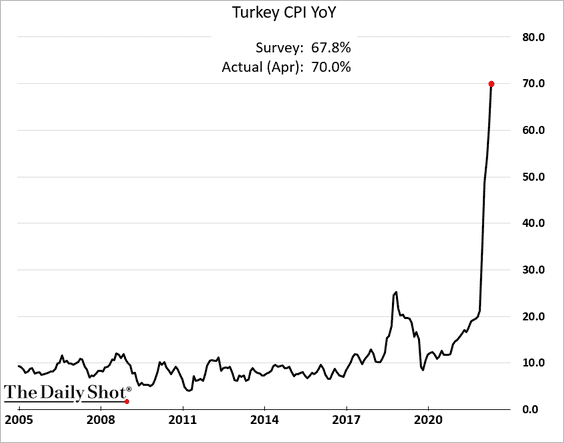

2. Turkey’s CPI hit 70%.

3. EM total leverage continues to climb.

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

1. Bitcoin dipped below the uptrend support line.

2. The correlation between bitcoin and US growth equities is hitting record highs. Both are responding to the Fed’s policy tightening.

Here is the Nasdaq Composite and Bitcoin on Thursday,

Source: @M_McDonough

Source: @M_McDonough

——————–

3. Thursday’s sell-off triggered a spike in long BTC liquidations.

Source: Coinglass Read full article

Source: Coinglass Read full article

4. A large amount of BTC open interest was closed out during the sell-off.

Source: @glassnode

Source: @glassnode

5. The Luna Foundation Guard accumulated more BTC in its stablecoin reserve.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

6. A million-dollar typo caused a stir in crypto markets.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

1. Gold is trading around fair value, according to Numera Analytics.

Source: Numera Analytics

Source: Numera Analytics

2. The silver-to-gold ratio hit the lowest level since mid-2020.

3. Similar to energy, capital spending in the metals and mining sector has not kept pace with rising prices.

Source: PGM Global

Source: PGM Global

Back to Index

Energy

1. Across US regions, the average breakeven prices to profitably drill a new well range from $48/barrel to $69/barrel.

Source: Longview Economics

Source: Longview Economics

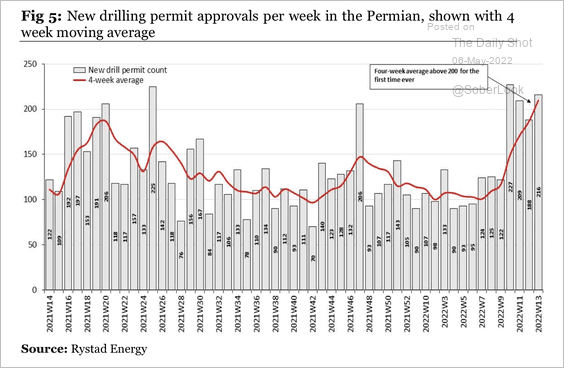

2. The number of newly approved drilling permits has increased to record high levels, which typically leads production by six-to-twelve months, according to Longview.

Source: Longview Economics

Source: Longview Economics

3. OPEC continues to produce below available quotas. This underproduction is expected to persist through the remainder of 2022.

Source: Capital Economics

Source: Capital Economics

4. OECD commercial crude oil stocks are rapidly drawing down.

Source: Capital Economics

Source: Capital Economics

5. US natural gas is nearing $9/mmbtu.

Back to Index

Equities

1. The market swings this week have been spectacular.

Source: @R_Perli

Source: @R_Perli

• The Nasdaq 100 and the Nasdaq Composite took a 5% hit on Thursday, …

… as real rates surge.

• The Nasdaq 100 underperformance is widening.

——————–

2. The put-call ratio continues to signal anxiety in the market.

3. The S&P 500 forward P/E ratio is nearing support at 17x.

Consumer discretionary and technology P/E multiples are rapidly converging with utilities.

Source: @Marcomadness2

Source: @Marcomadness2

——————–

4. Thematic ETFs are getting some capital inflows.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

——————–

5. Next, we have some sector updates.

• Banks:

• Consumer Discretionary:

• Tech:

• Industrials:

• Metals & Mining:

• Energy:

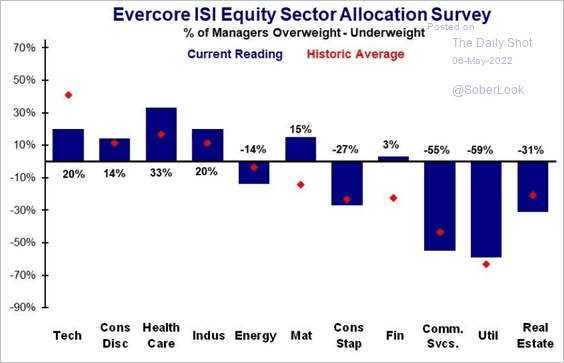

Finally, this chart from Evercore ISI shows how institutional investors are allocated across sectors vs. long-term averages.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Credit

1. The drawdown in high-yield bonds continues to worsen.

2. Green bond issuance has slowed.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Rates

1. T-bill demand continues to surge as investors exit risk assets. The bill spread to OIS hit the widest level since the financial crisis.

2. Here is the attribution of bond yield gains in the US, UK, and Germany in April.

Source: Barclays Research

Source: Barclays Research

Back to Index

Global Developments

1. The US dollar continues to climb.

• The US currency is now testing resistance.

Source: SentimenTrader

Source: SentimenTrader

• Below is the year-to-date performance across DM currencies.

Source: Capital Economics

Source: Capital Economics

• This chart shows the Capital Economics forecast for currency moves relative to USD for the rest of the year.

Source: Capital Economics

Source: Capital Economics

——————–

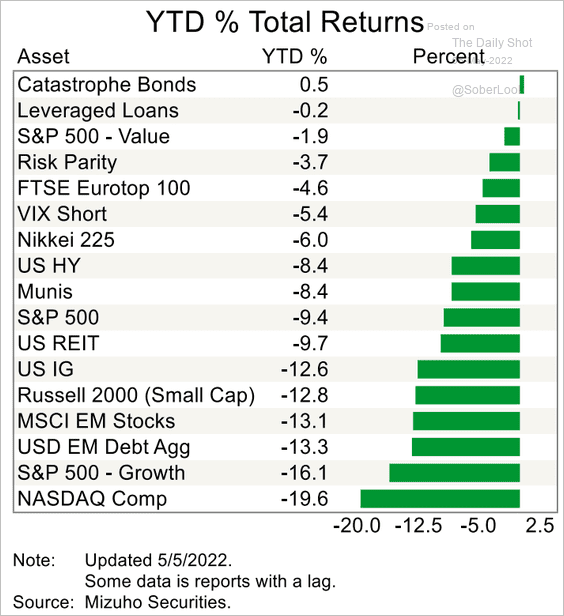

2. Finally, we have the year-to-date returns by asset class.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

Food for Thought

1. US households’ savings and checking account balances:

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

2. The change in income status since 1971:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

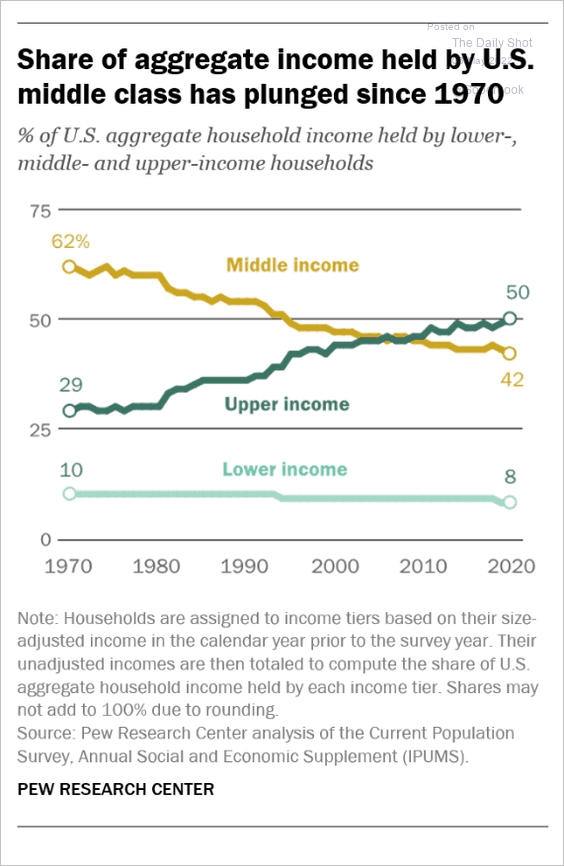

3. The decline in middle-class income share:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

4. Support for airport mask mandates:

Source: @axios Read full article

Source: @axios Read full article

5. Support for cannabis legalization:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

6. The most searched news site in each state:

Source: @statspanda1 Read full article

Source: @statspanda1 Read full article

7. Support for Ukraine as a share of GDP:

Source: The Economist Read full article

Source: The Economist Read full article

8. The longest living animals:

——————–

Have a great weekend!

Back to Index