The Daily Shot: 12-May-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. The CPI report surprised to the upside. Inflation continues to run hot.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The core services CPI (ex. energy services) saw the biggest monthly gain in decades, …

… boosted by shelter …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

… and airline fares.

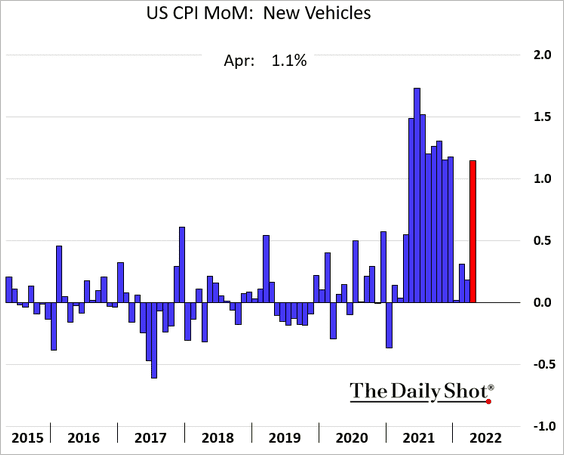

• New vehicle prices also surprised to the upside (although there was a methodology change in this series).

• Here are some of the CPI drivers.

Source: Nomura Securities

Source: Nomura Securities

• Since the Fed’s new policy is to target price levels rather than the inflation rate, here is the evolution of the CPI index vs. the 2% target.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Economists expect inflation to moderate in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

We will have more inflation data tomorrow.

——————–

2. Treasury yields jumped initially in response to the CPI report but retreated shortly after. The yield curve flattened.

The 10yr yield continues to decline this morning, …

… as the market prices in a deterioration in economic activity. The stock market is now signaling a manufacturing recession in the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• By the way, many economic indicators are pointing to lower bond yields.

Source: BCA Research

Source: BCA Research

Here is the ISM Manufacturing PMI vs. the 10yr Treasury yield.

Source: @jsblokland Read full article

Source: @jsblokland Read full article

——————–

3. Deutsche Bank’s model is signaling a further acceleration in residential rental costs..

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But the market isn’t sure that demand will be there. Shares of apartment properties and even single-family (2nd panel) rental firms have sold off sharply.

h/t @conorsen

h/t @conorsen

4. Next, we have some updates on the housing market.

• Mortgage applications have been remarkably strong, given the spike in loan rates.

Anecdotal evidence suggests that buyers have been in a hurry to lock in rates before they move higher. Here is the mortgage rate lock count.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

• But bankers now see slower demand for mortgages.

Source: Federal Reserve Board

Source: Federal Reserve Board

• Refi activity is collapsing.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

• ARM financing is picking up.

Source: @lenkiefer

Source: @lenkiefer

• Home price appreciation is holding up well, …

Source: Redfin

Source: Redfin

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

… even as affordability deteriorates.

Source: Redfin

Source: Redfin

• Consumers expect home price growth to remain high.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Inventories are tight.

Source: Redfin

Source: Redfin

• Demand has softened by only slightly.

Source: Redfin

Source: Redfin

• There are signs of increased contract cancelations. Here is the situation in Denver, for example.

Source: @AliWolfEcon

Source: @AliWolfEcon

——————–

5. Consumer sentiment continues to weaken.

Source: @HPS_CS, @HPSInsight, @CivicScience

Source: @HPS_CS, @HPSInsight, @CivicScience

Back to Index

The United Kingdom

1. The pound is under pressure. And it’s not all about the dollar (2nd panel).

2. The housing market held up well last month.

Back to Index

The Eurozone

1. Germany’s core CPI hit a multi-year high.

2. The ECB officials are gearing up to take action.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

This chart shows the market-implied trajectory of short-term rates.

Back to Index

Asia – Pacific

1. South Korea’s price pressures have been broad.

Source: @ANZ_Research

Source: @ANZ_Research

2. New Zealand’s home sales weakened sharply last month.

3. The Aussie dollar broke below support at 0.7 USD.

Source: barchart.com

Source: barchart.com

Back to Index

China

1. The renminbi resumed its decline.

This chart shows the US dollar’s 2-week appreciation against CNY in standard deviations.

Source: TS Lombard

Source: TS Lombard

——————–

2. Tentative signs of stabilization in the property market?

Source: BCA Research

Source: BCA Research

The stock market isn’t buying it. The rebound in property developers’ shares was short-lived.

——————–

3. Locktowns continue to put pressure on the economy.

• Shanghai truck freight:

Source: Fitch Ratings

Source: Fitch Ratings

• Port waiting times:

Source: Fitch Ratings

Source: Fitch Ratings

• Car sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

4. The Hong Kong dollar fell to the weak end of its permitted trading band. The central bank intervened.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

Back to Index

Emerging Markets

1. Let’s begin with Brazil.

• Retail sales continued to rebound in March.

• Car sales are still soft.

• Inflation remains a challenge for the central bank.

——————–

2. Car sales in Russia plummeted over the past two months.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

3. Malaysia’s central bank unexpectedly hiked rates.

4. EM inflation keeps surprising to the upside.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

Some EM countries could enter a period of stagflation.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Cryptocurrency

1. Panic is setting in as bitcoin dips well below 30k.

Ether is underperforming.

——————–

2. Isn’t bitcoin supposed to provide protection against inflation? Here is what happened after the CPI report.

Source: @M_McDonough

Source: @M_McDonough

Bitcoin now basically trades like a high-beta stock.

——————–

3. The Terra blockchain’s native token, LUNA, lost most of its value. LUNA is supposed to absorb price shocks of the blockchain’s algo stablecoin, TerraUSD (UST).

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinGecko

Source: CoinGecko

——————–

4. Tether is now also below par.

Source: Google.com

Source: Google.com

5. Coinbase has been crashing.

Source: Insider Read full article

Source: Insider Read full article

——————–

6. Bitcoin’s trading volume ticked higher over the past few days, albeit by less than previous spikes.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

7. Bitcoin’s CME futures open interest continues to decline.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

8. Futures leverage increased over the past few weeks, which could lead to sharp price swings if more liquidations or deleveraging occurs.

Source: @glassnode

Source: @glassnode

9. Implied volatility rose to the highest level since March.

Source: Skew Read full article

Source: Skew Read full article

——————–

10. Bitcoin’s put/call ratio increased.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

11. Bitcoin’s fractal dimension measure signals a trend reversal.

Source: BCA Research

Source: BCA Research

Back to Index

Energy

1. US distillates inventories are at multi-year lows, …

… driven by shortages on the East Coast.

——————–

2. Gasoline inventories are also tightening, …

… but demand hasn’t been great.

3. US crude oil inventories have improved a bit.

——————–

4. European natural gas prices are higher after Ukraine cut off some of the Russian flows (going through parts of occupied territory).

Source: @WSJ Read full article

Source: @WSJ Read full article

Natural gas storage levels in eastern Europe are relatively high, and supply has become increasingly diversified (2 charts).

Source: IIF

Source: IIF

Source: IIF

Source: IIF

Back to Index

Equities

1. Stock market pain continued after a worse-than-expected CPI report.

We are 2% away from the S&P 500 going into bear-market land.

Given the surge in real yields, there could be more downside risk for the Nasdaq 100 vs. the S&P 500.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

——————–

2. Stocks and bonds have been correlated for the first time in years as the Fed tightens (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

3. Various technical indicators, such as this one from BCA Research, suggest that the market is in oversold territory.

Source: BCA Research

Source: BCA Research

Here is the S&P 500 forward PE ratio vs. VIX.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

4. This chart decomposes stock declines in advanced economies.

Source: Numera Analytics

Source: Numera Analytics

5. Hedge funds have been cutting exposure to stocks.

Source: @CycleWacher

Source: @CycleWacher

6. VIX ETFs (ETNs) have been experiencing outflows.

7. Consumer discretionary stocks have been getting crushed as the market increasingly expects a pullback in spending.

Here are some additional sector performance charts.

• Tech and semiconductors:

![]()

• Defensive sectors:

– Utilities:

– Consumer staples:

– Healthcare:

Back to Index

Credit

1. European investment-grade bonds saw a historic correction.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

2. The duration of US investment-grade bonds is decreasing as yields climb.

Source: PGM Global

Source: PGM Global

3. New-issue CLO spreads are widening.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. The US dollar keeps grinding higher.

USD strength has persisted despite the hypothesis that US economic sanctions against other countries would induce dollar weakness.

Source: BCA Research

Source: BCA Research

Even currencies of commodity exporters have been under pressure vs. USD.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

2. Real wages are falling.

Source: BCA Research

Source: BCA Research

3. Which countries are most exposed to variable-rate mortgages.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

1. Gasoline prices around the world:

Source: Statista

Source: Statista

2. Biggest obstacles to shopping for groceries online:

Source: Appinio, Spryker Read full article

Source: Appinio, Spryker Read full article

3. Printed book sales:

Source: Statista

Source: Statista

4. Concerns about COVID in the US:

Source: Gallup Read full article

Source: Gallup Read full article

5. Beer consumption per capita:

——————–

Back to Index