The Daily Shot: 13-May-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. Let’s benign with some updates on inflation.

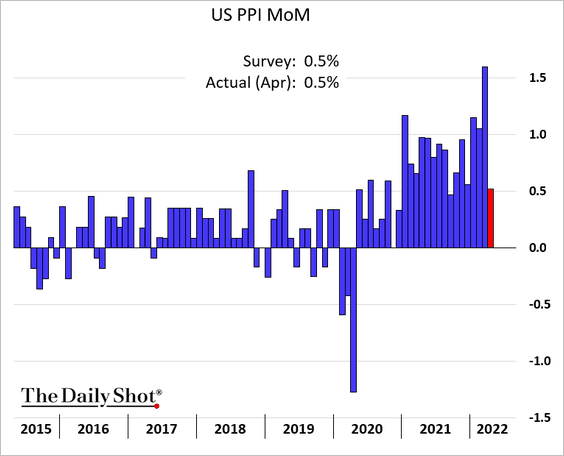

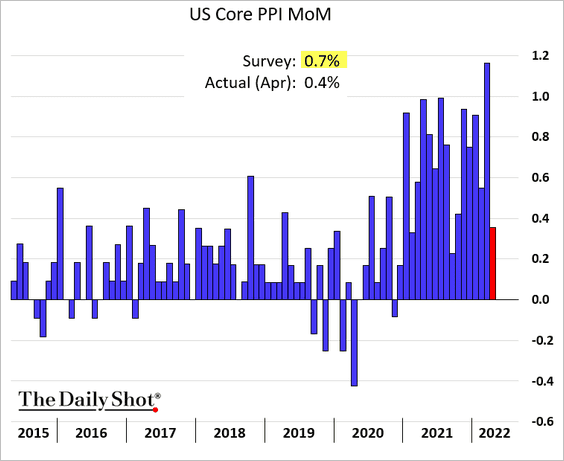

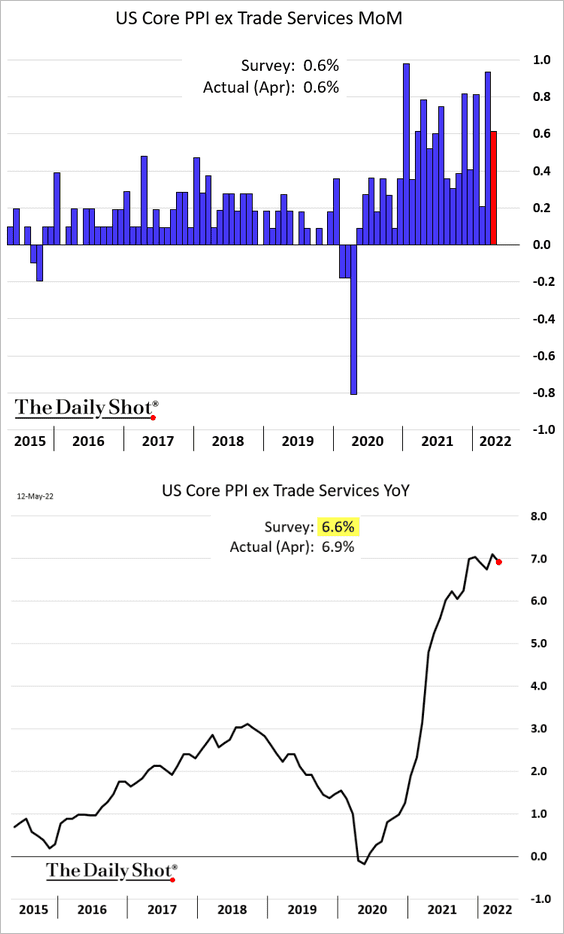

• The April PPI print was roughly in line with expectations, showing that wholesale inflation remains elevated. However, there were signs in the PPI report pointing to some moderation in the PCE inflation index (which will be reported later this month).

– Headline PPI (month-over-month):

– Core PPI:

– Excluding trade services (business makeups), the core PPI is still running hot (more on trade services in the equities section).

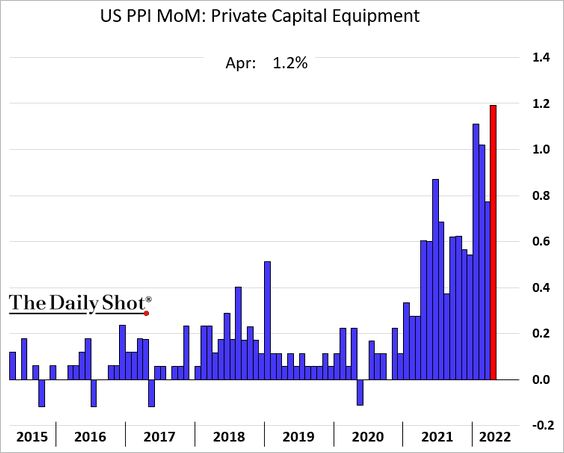

Here are a couple of examples.

– Capital equipment:

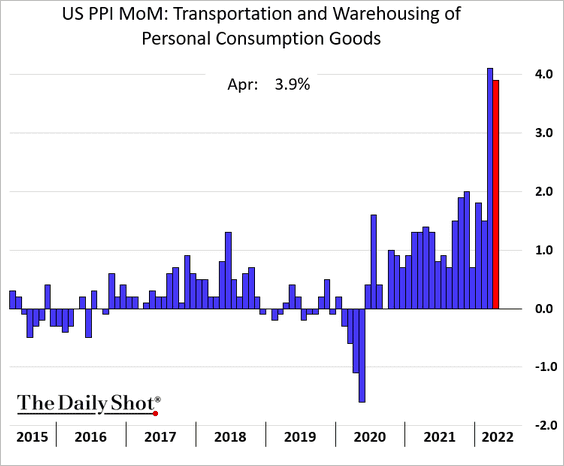

– Consumer goods logistics costs:

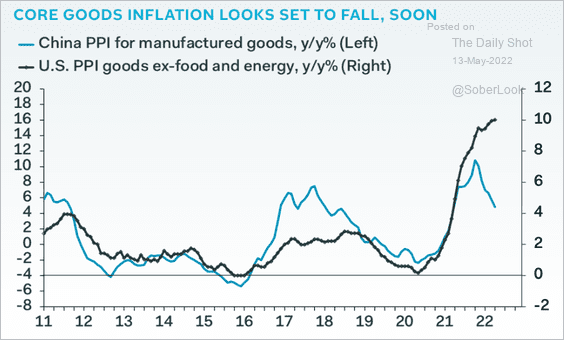

China’s PPI points to slower gains in US producer prices ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

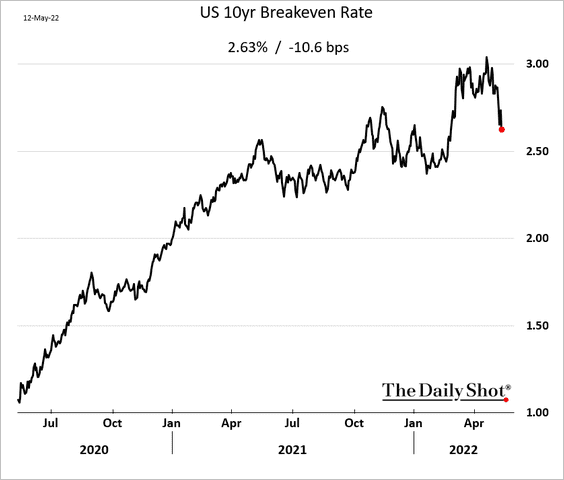

• Market-based inflation expectations are moderating.

• Next, we have additional data on the CPI report.

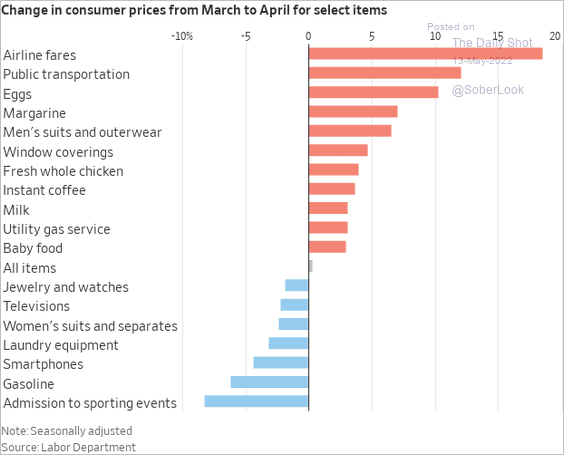

– Select items:

Source: @WSJ Read full article

Source: @WSJ Read full article

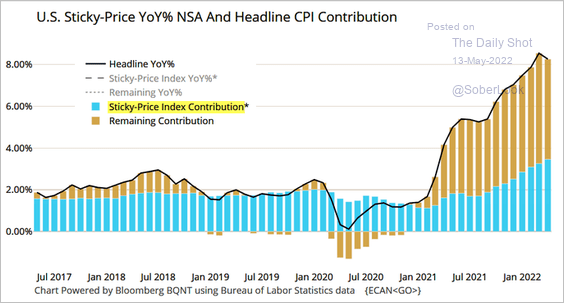

– Sticky inflation taking the lead:

Source: @M_McDonough

Source: @M_McDonough

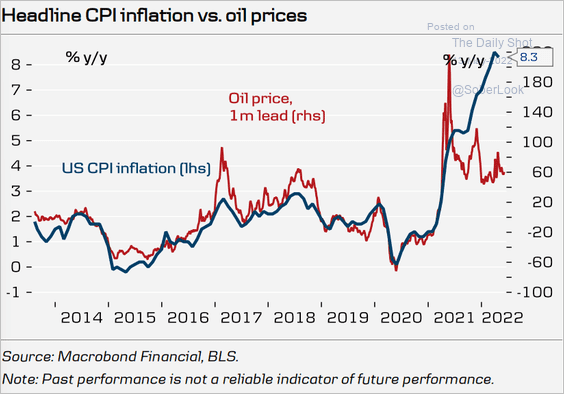

– Slower gains in oil prices:

Source: Danske Bank

Source: Danske Bank

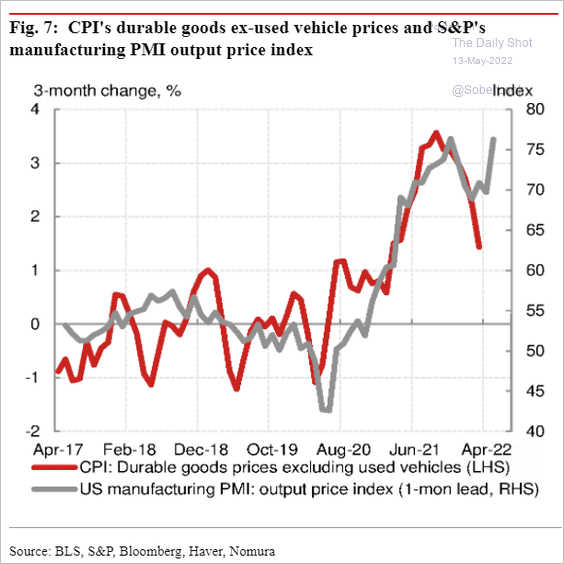

– Durable goods inflation (re-acceleration?):

Source: Nomura Securities

Source: Nomura Securities

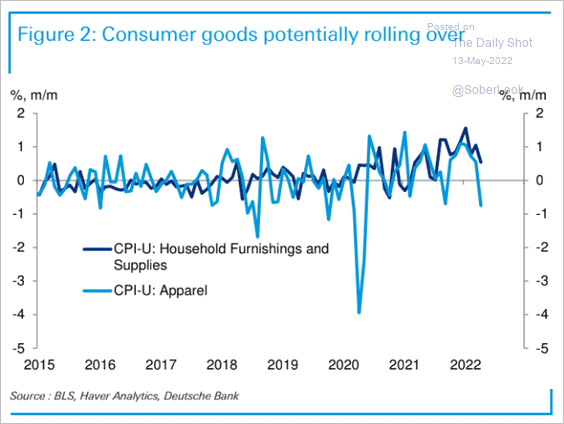

– Consumer goods inflation (rolling over due to weak demand?):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

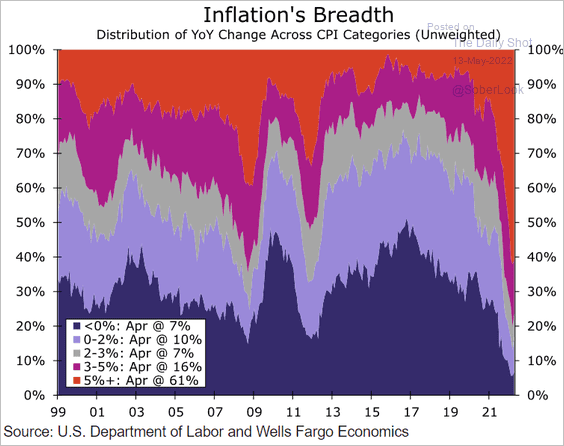

– CPI breadth:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

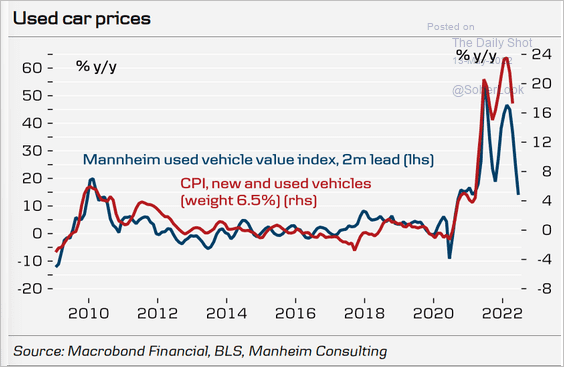

– Vehicles:

Source: Danske Bank

Source: Danske Bank

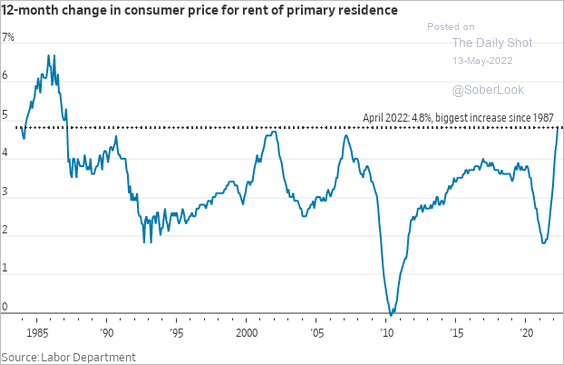

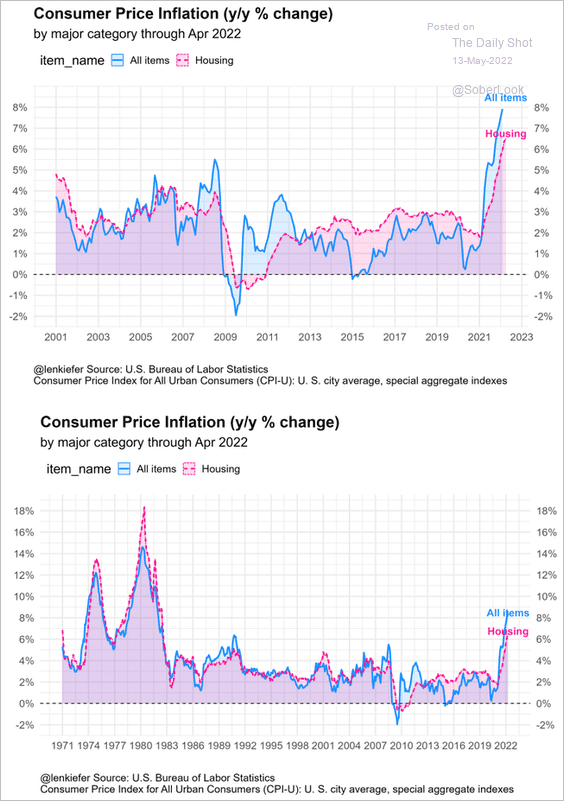

– Rent (year-over-year):

Source: @WSJ Read full article

Source: @WSJ Read full article

By the way, shelter inflation tends to peak above the overall CPI. There is plenty of room to go.

Source: @lenkiefer

Source: @lenkiefer

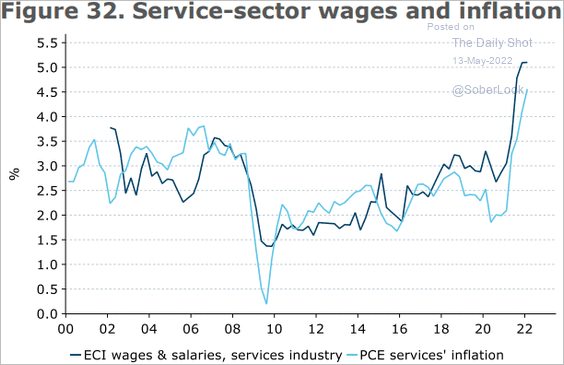

– Service-sector wages and inflation:

Source: @ANZ_Research

Source: @ANZ_Research

——————–

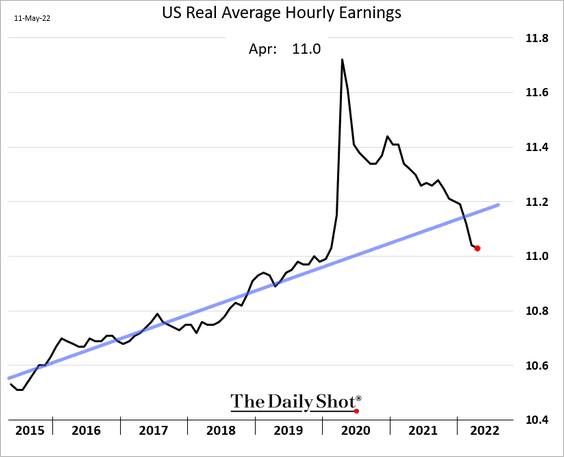

2. Real wages continue to weaken.

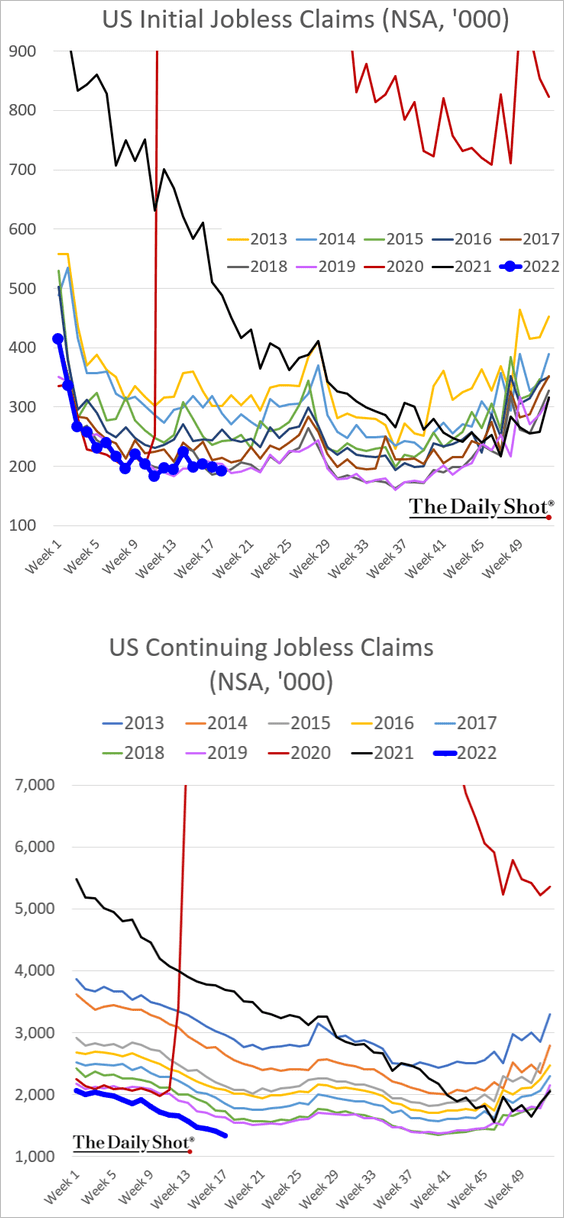

3. Jobless claims remain very low.

4. Next, we have some updates on US recession concerns.

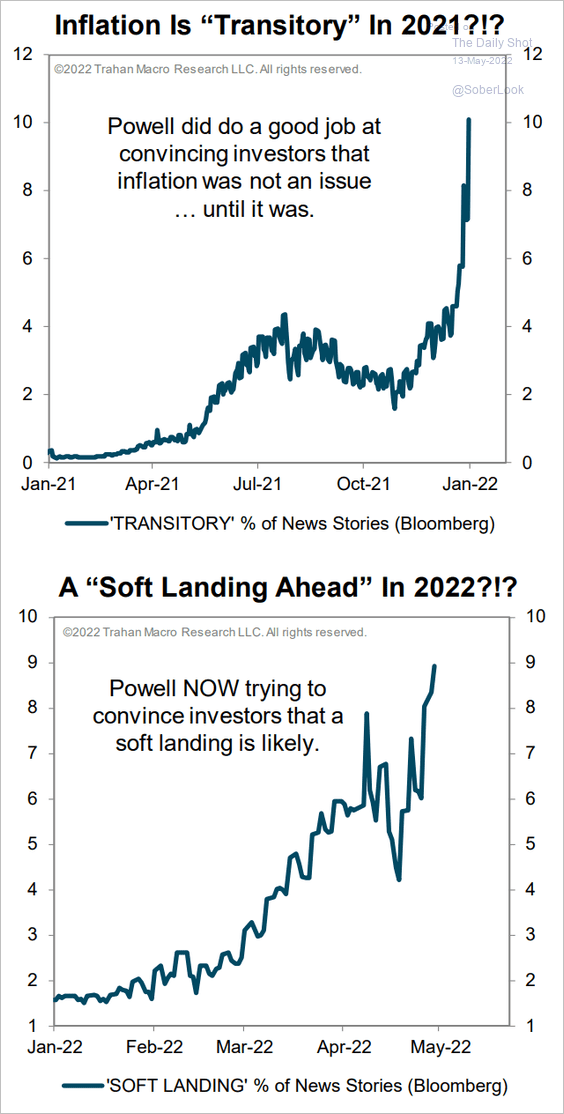

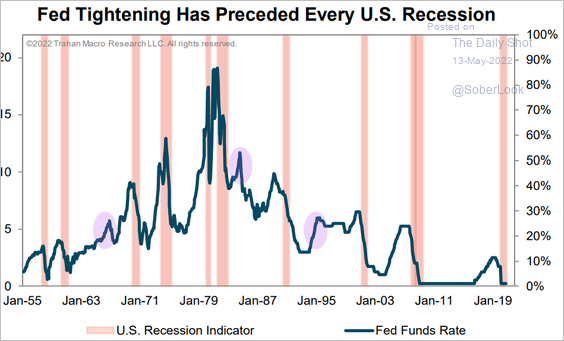

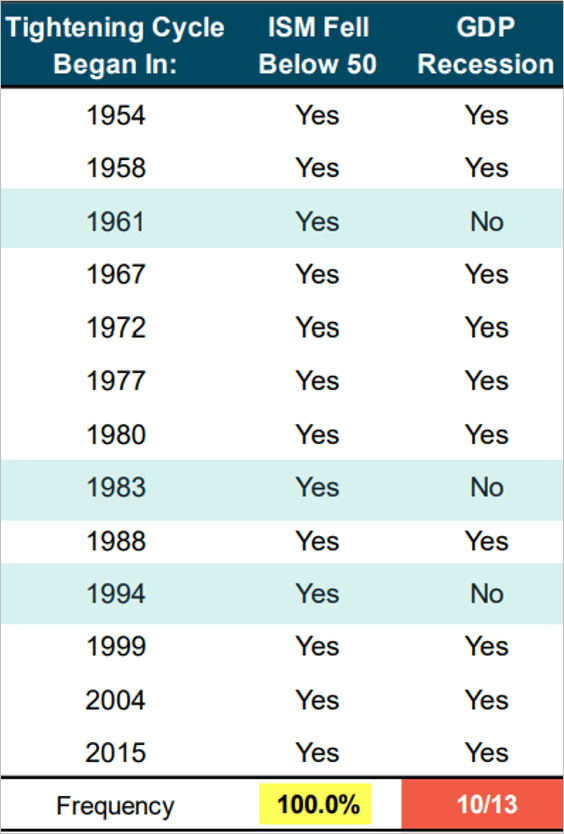

• Is a soft landing possible?

Source: Trahan Macro Research

Source: Trahan Macro Research

Yes, it is. But soft landings are relatively rare.

Source: Trahan Macro Research

Source: Trahan Macro Research

For example, each past hiking cycle ended up in a manufacturing contraction.

Source: Trahan Macro Research

Source: Trahan Macro Research

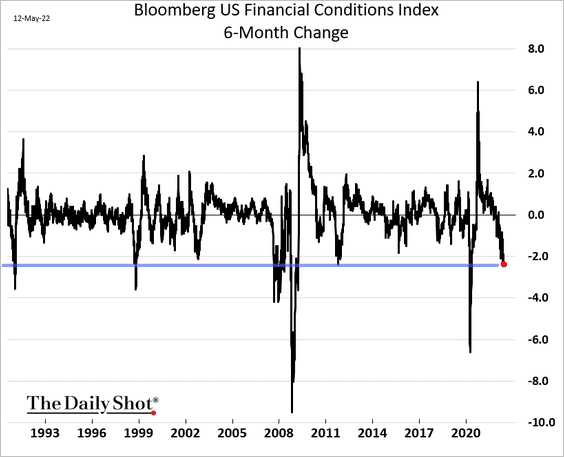

• The sharp deterioration in financial conditions indicates that markets expect a recession (2 charts).

h/t Deutsche Bank Research

h/t Deutsche Bank Research

Source: Trahan Macro Research

Source: Trahan Macro Research

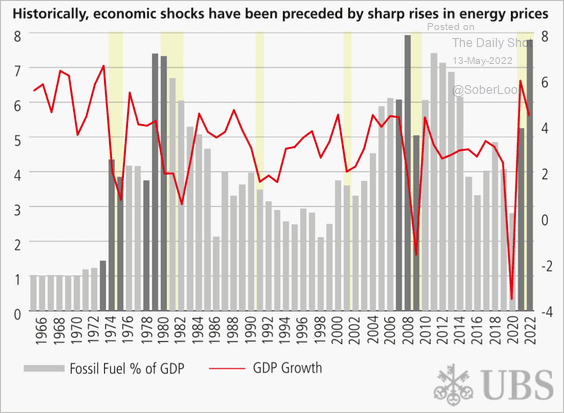

• Spikes in energy prices tend to signal economic shocks.

Source: UBS Asset Management

Source: UBS Asset Management

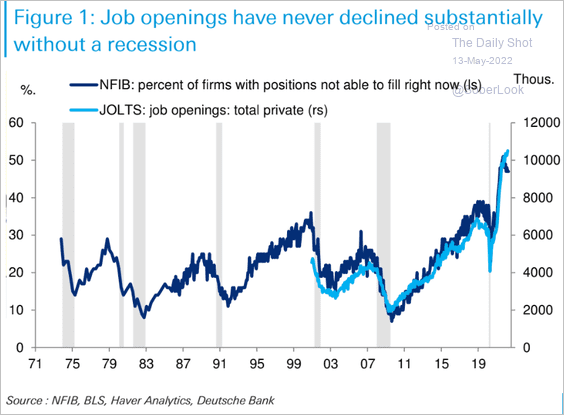

• How does the Fed reduce labor demand without causing a recession?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

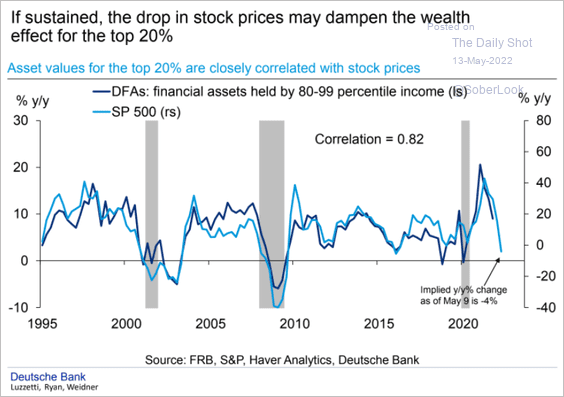

• Upper-income households’ wealth has taken a hit from the stock market rout. A significant spending pullback could follow.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

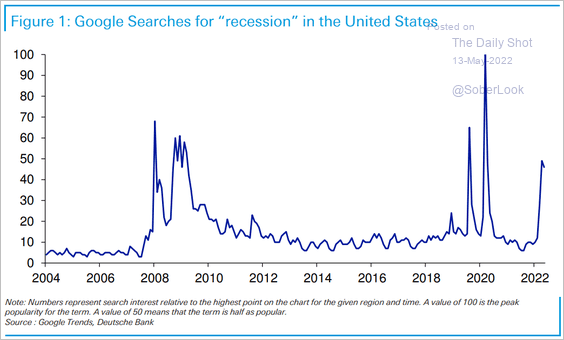

• Search activity for “recession” spiked again.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

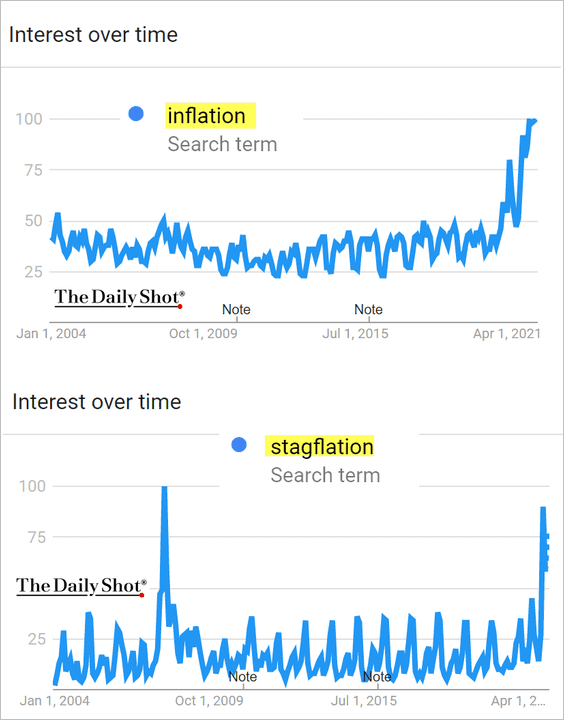

By the way, here is the search activity for “inflation” and “stagflation.”

Source: Google Trends

Source: Google Trends

Back to Index

The United Kingdom

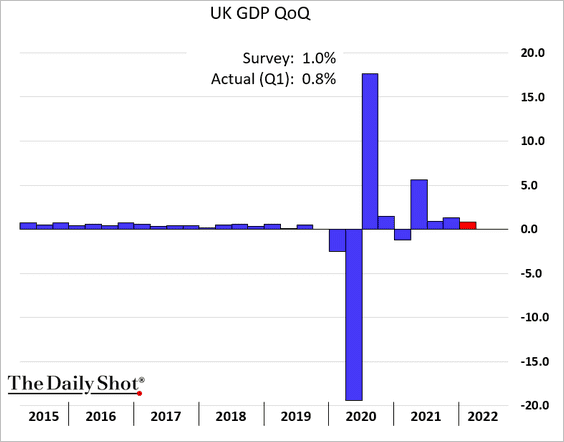

1. The Q1 GDP report was softer than expected.

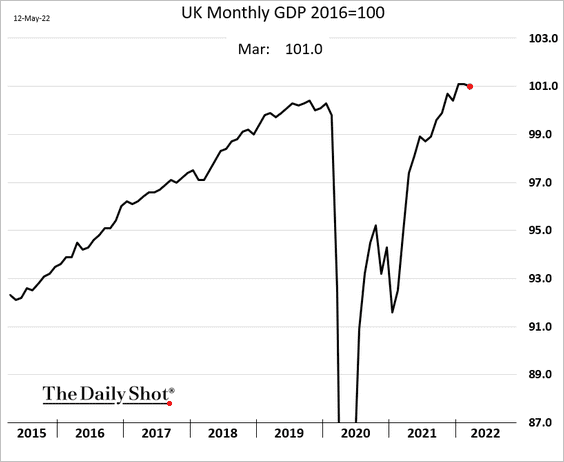

The monthly GDP estimate showed a slight decline in March.

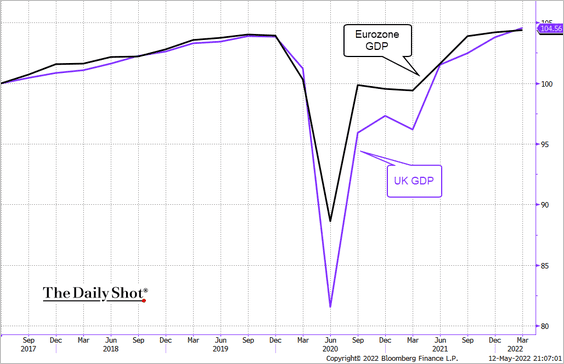

Nonetheless, the UK GDP has caught up with the Eurozone.

Source: Bloomberg

Source: Bloomberg

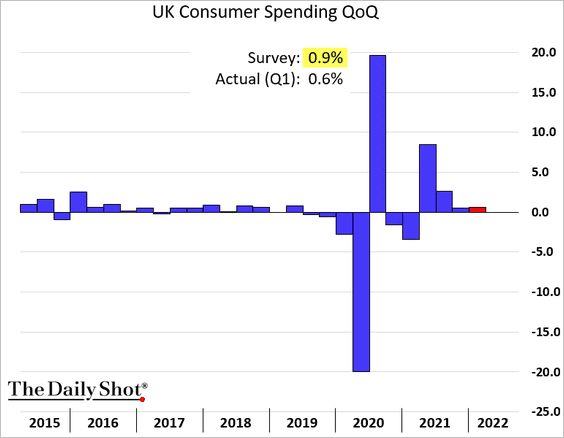

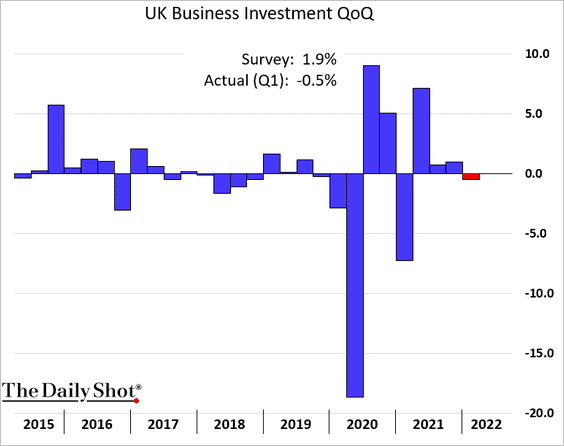

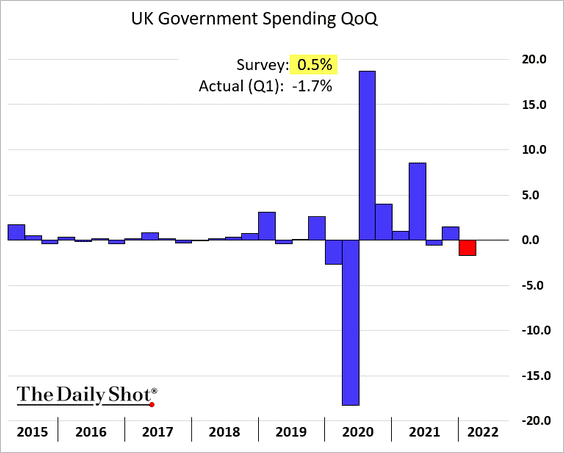

Domestic demand was soft last quarter.

• Consumer spending:

• Business investment:

• Government spending:

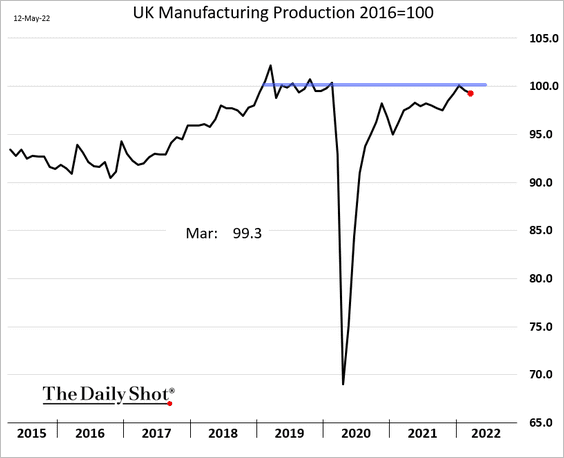

2. Manufacturing output is back below pre-COVID levels.

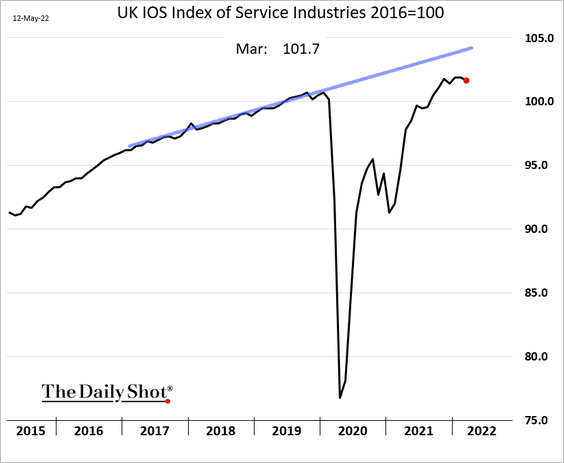

Service industries lost momentum in March.

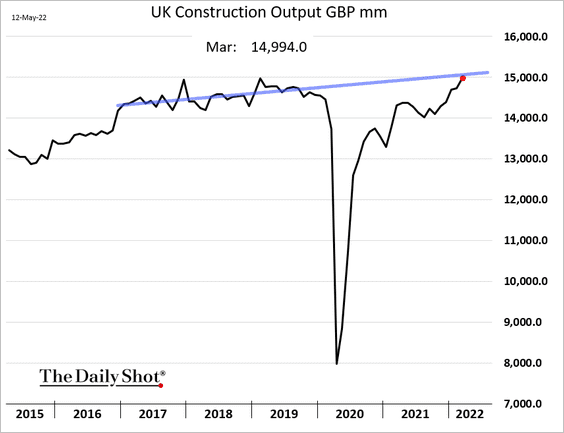

Construction output continued to rise.

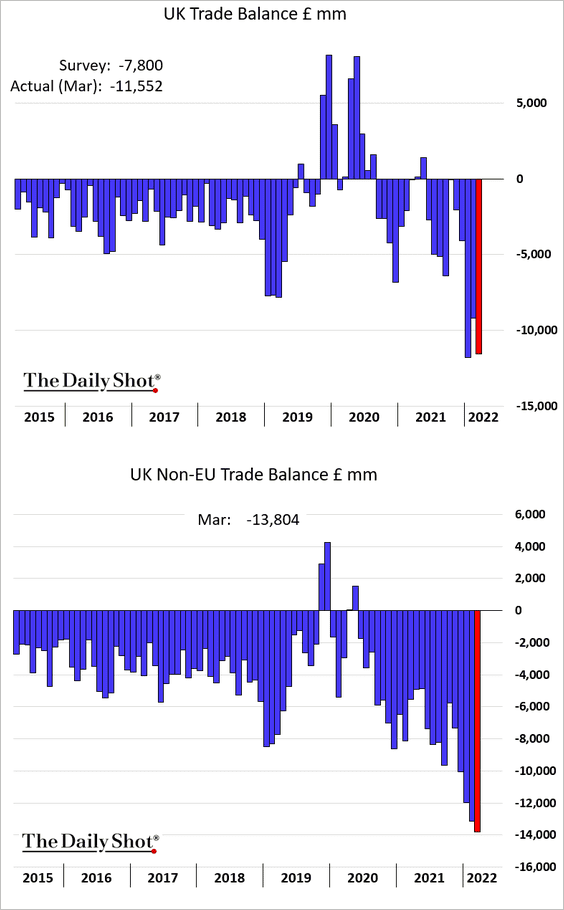

3. The trade deficit was wider than expected in March amid surging natural gas prices.

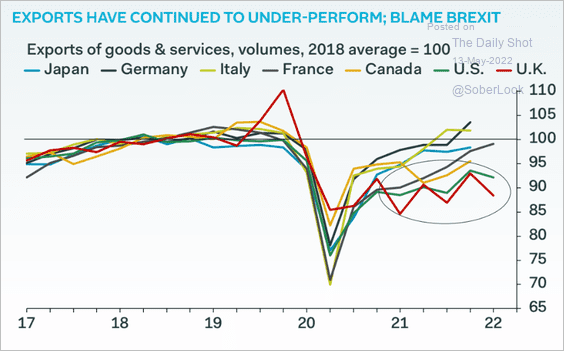

UK exports have been underperforming.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

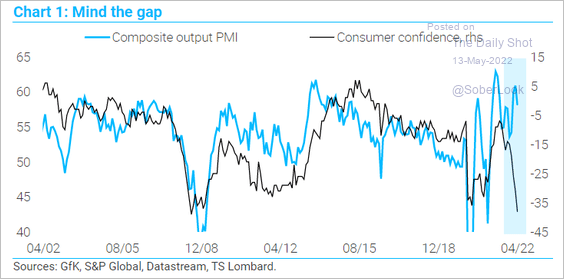

4. Weak consumer confidence points to downside risks for business output.

Source: TS Lombard

Source: TS Lombard

Back to Index

The Eurozone

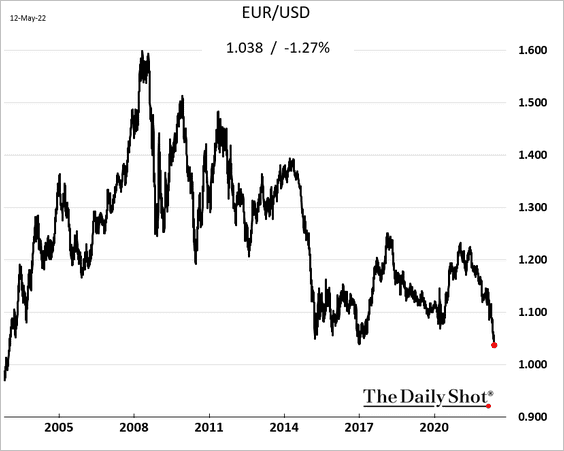

1. The euro is near a 2-decade low vs. USD.

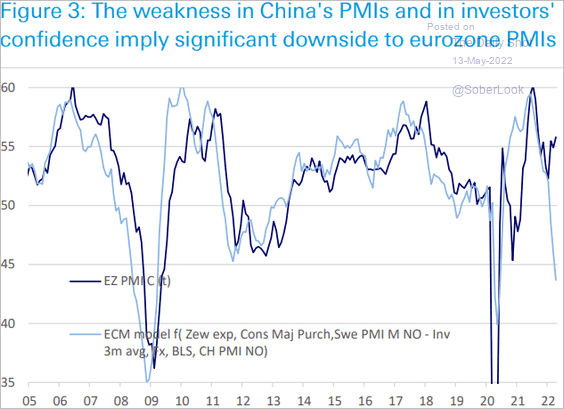

2. The positive correlation between China’s and Eurozone’s PMIs suggests downside risks for euro-area business activity.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

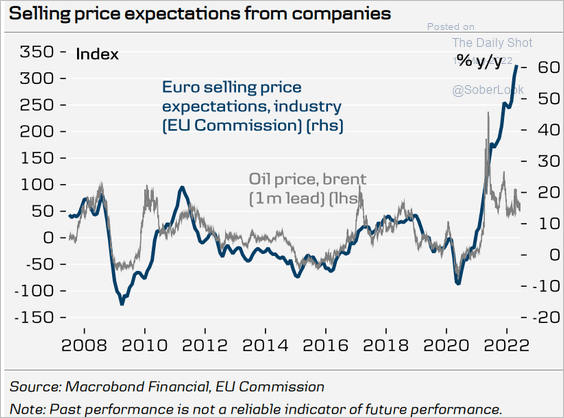

3. Business selling price expectations have been overshooting oil prices.

Source: Danske Bank

Source: Danske Bank

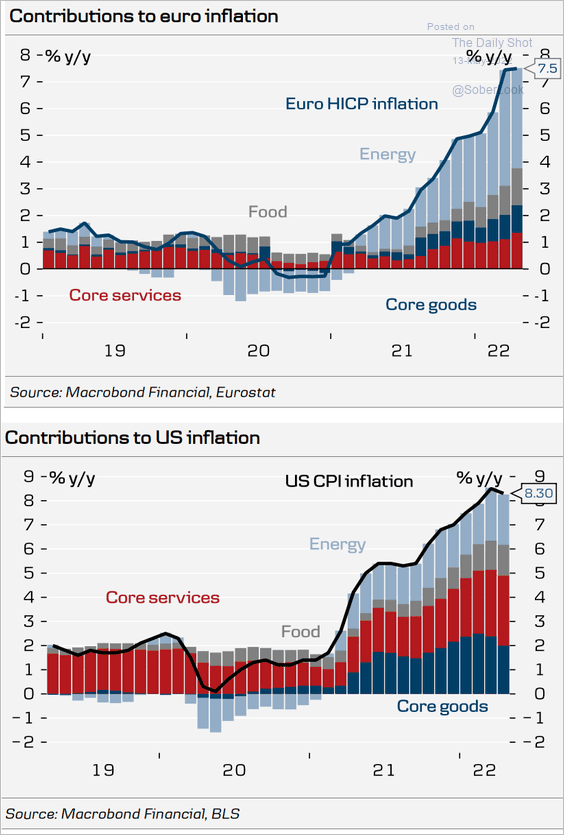

4. Energy is a much bigger component of the CPI than in the US.

Source: Danske Bank

Source: Danske Bank

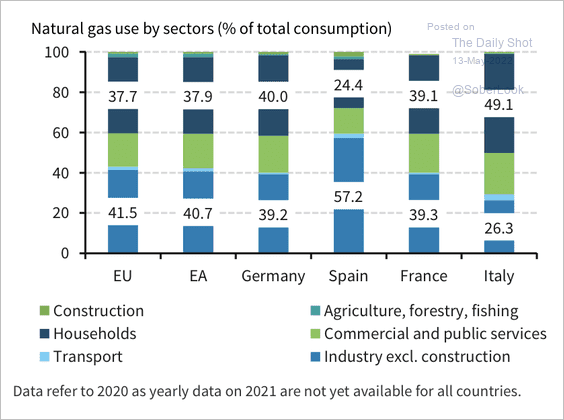

5. The industrial sector and households are the largest consumers of natural gas.

Source: Barclays Research

Source: Barclays Research

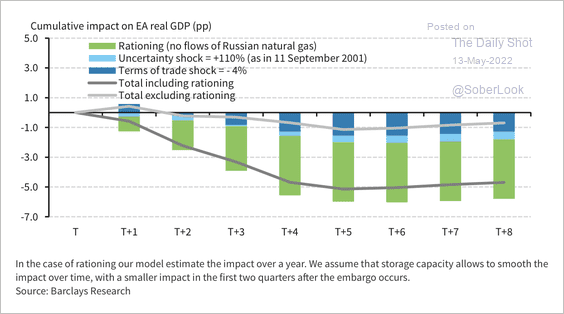

Euro-area GDP could decline by more than 5 percentage points in the case of an embargo on imports of Russian energy products, according to Barclays.

Source: Barclays Research

Source: Barclays Research

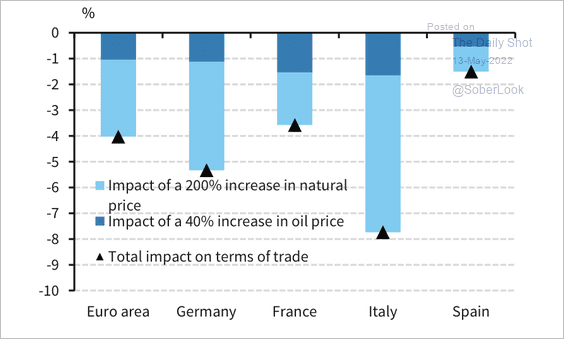

And terms of trade could deteriorate if natural gas and oil prices continue to rise.

Source: Barclays Research

Source: Barclays Research

Back to Index

Europe

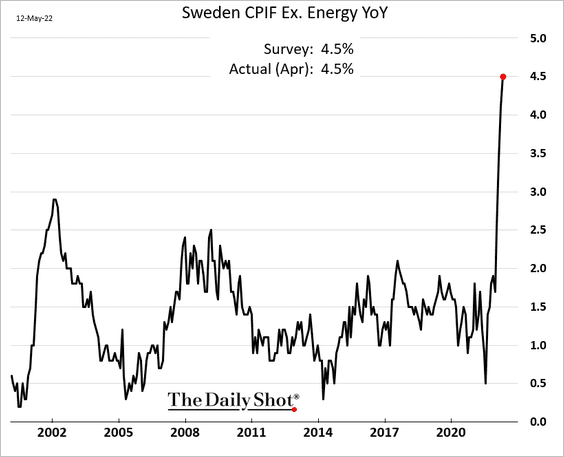

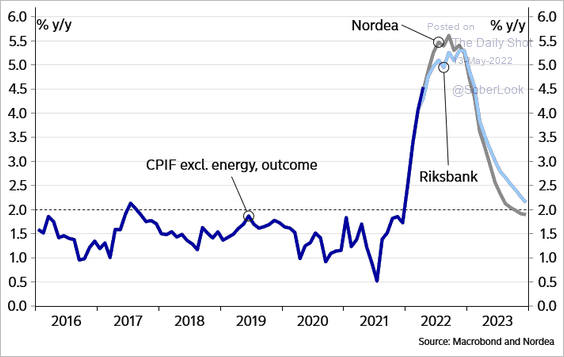

1. Sweden’s CPI continued to surge last month …

… and is yet to peak.

Source: Nordea Markets

Source: Nordea Markets

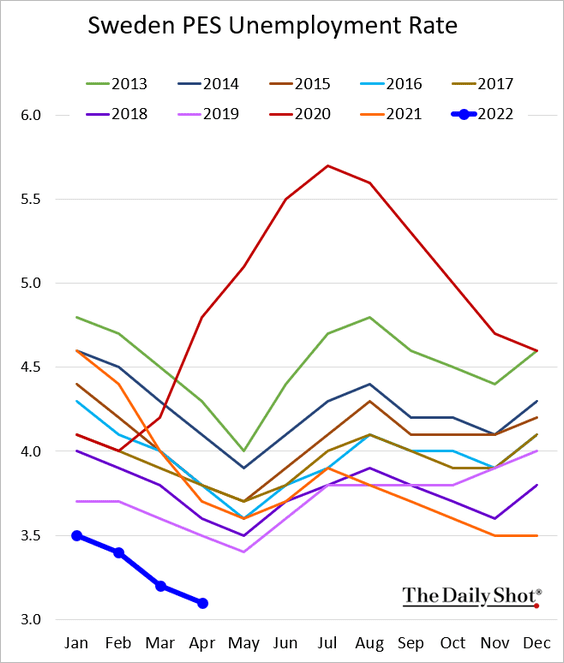

The unemployment rate is falling rapidly.

——————–

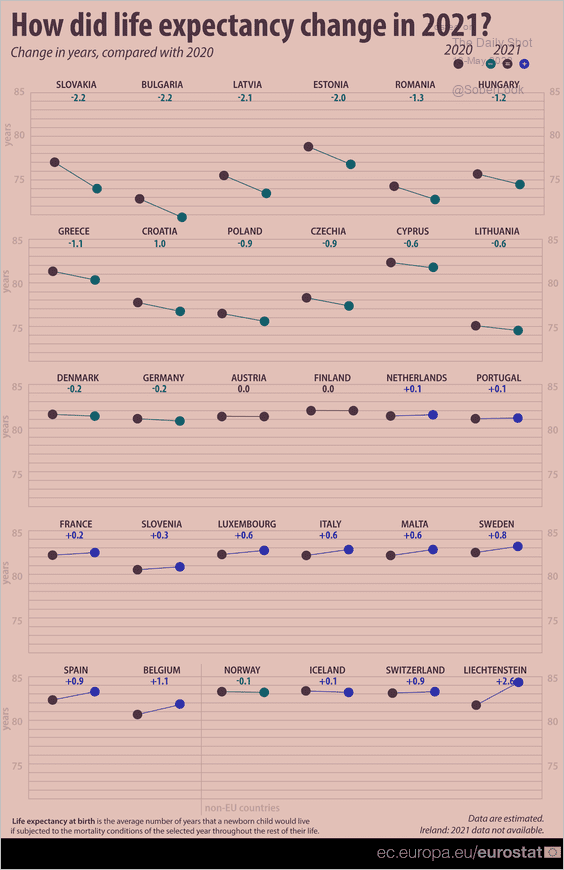

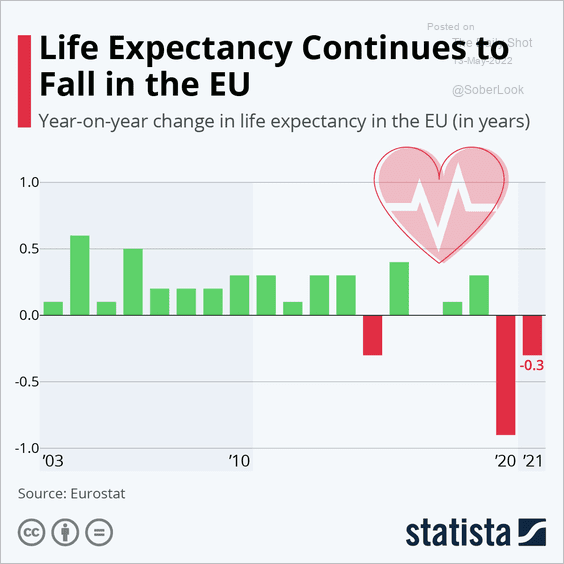

2. Next, we have some data on life expectancy changes across Europe (2 charts).

Source: @EU_Eurostat Read full article

Source: @EU_Eurostat Read full article

Source: Statista

Source: Statista

Back to Index

Asia – Pacific

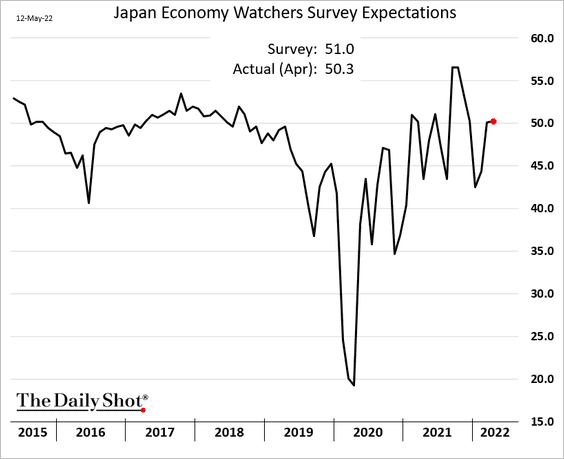

1. Japan’s Economy Watchers Expectations index was roughly unchanged last month.

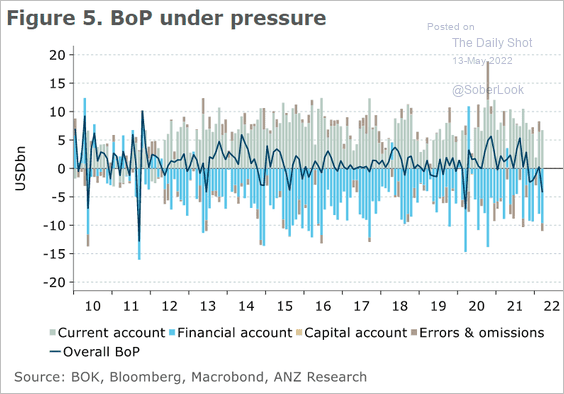

2. South Korea’s balance of payments is under pressure as demand from China slows.

Source: @ANZ_Research

Source: @ANZ_Research

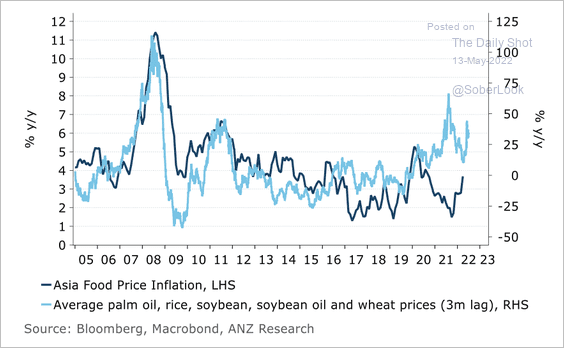

3. Asia’s food inflation has been fairly modest.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

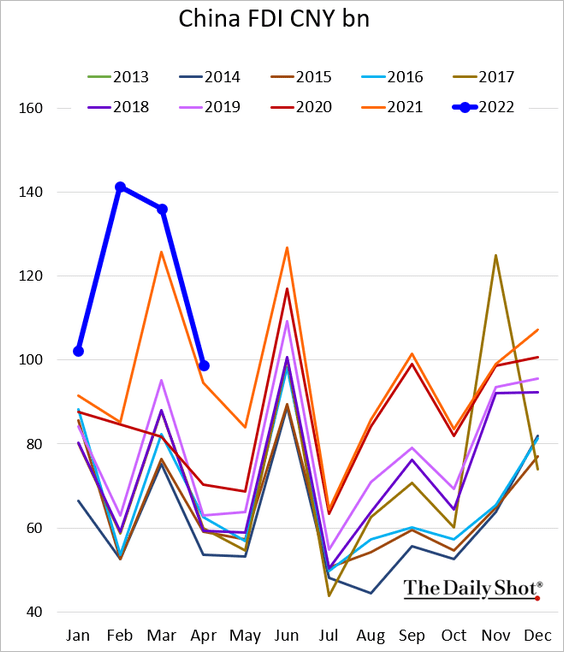

1. Foreign direct investment slowed more than usual in April.

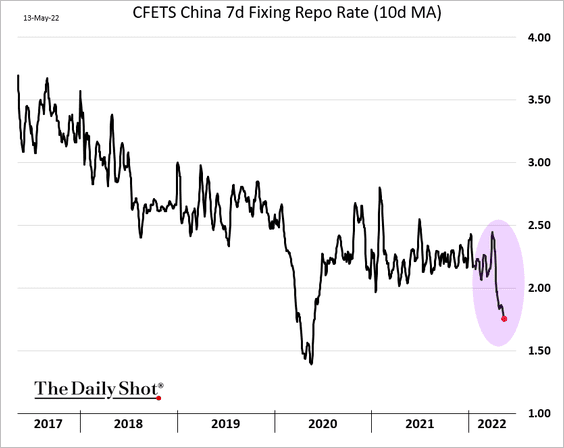

2. The PBoC is letting short-term rates move substantially lower without officially cutting rates.

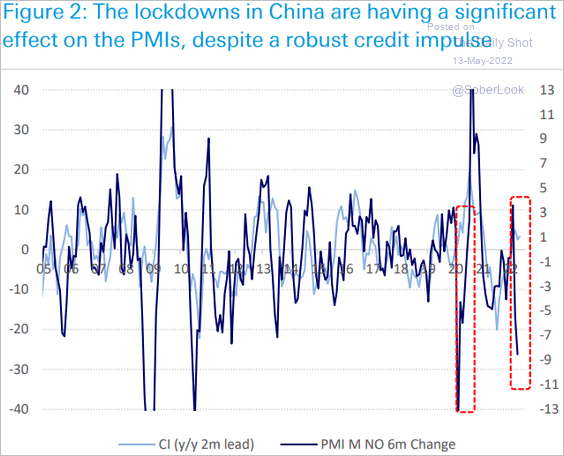

3. The latest round of lockdowns in China has been driving PMIs sharply lower despite an improving credit impulse.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

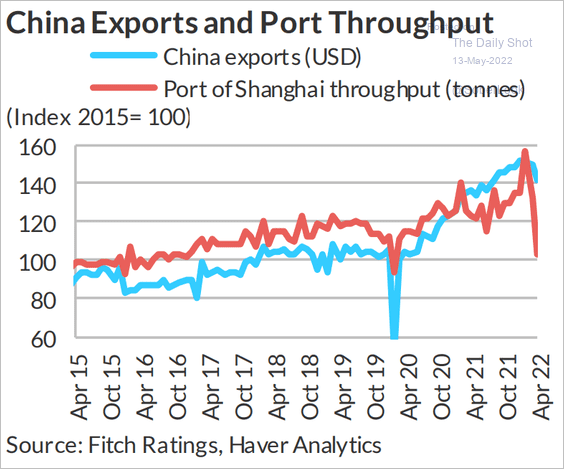

4. The lockdowns will take a further toll on China’s exports.

Source: Fitch Ratings

Source: Fitch Ratings

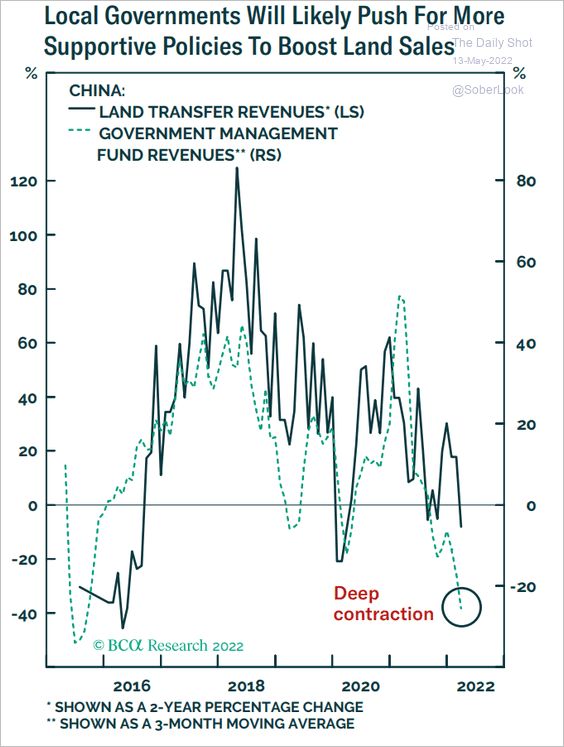

5. Local governments’ land sales have been depressed, weakening revenues.

Source: BCA Research

Source: BCA Research

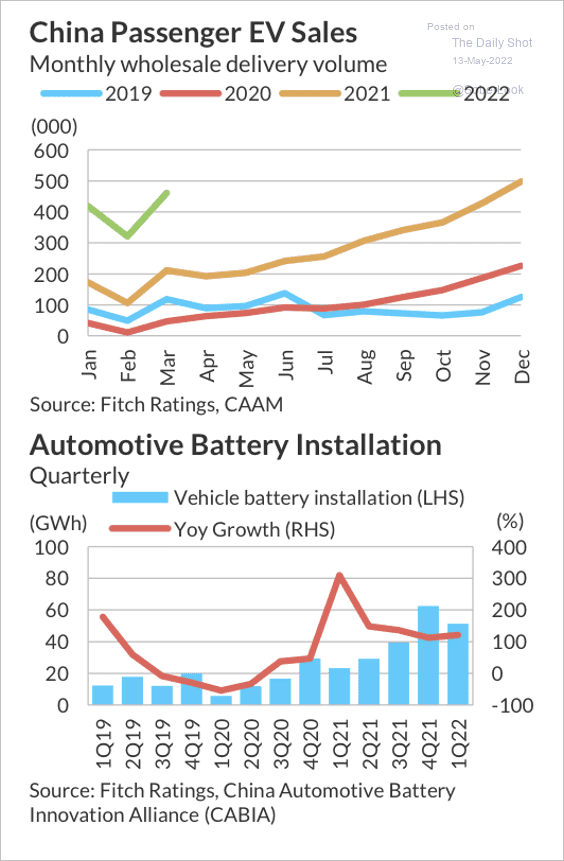

6. Electric vehicle sales and battery installations were strong in March despite recent price increases. The situation has probably changed since then.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

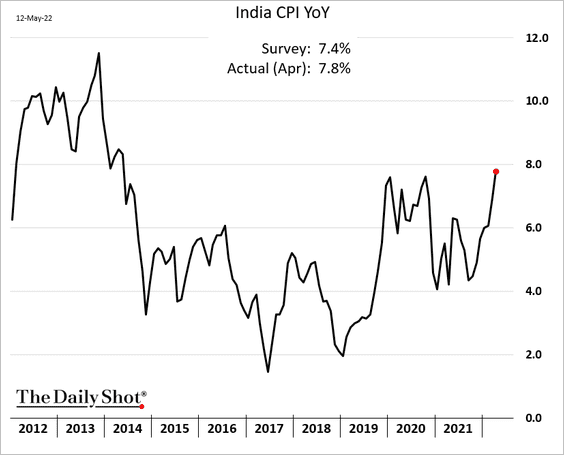

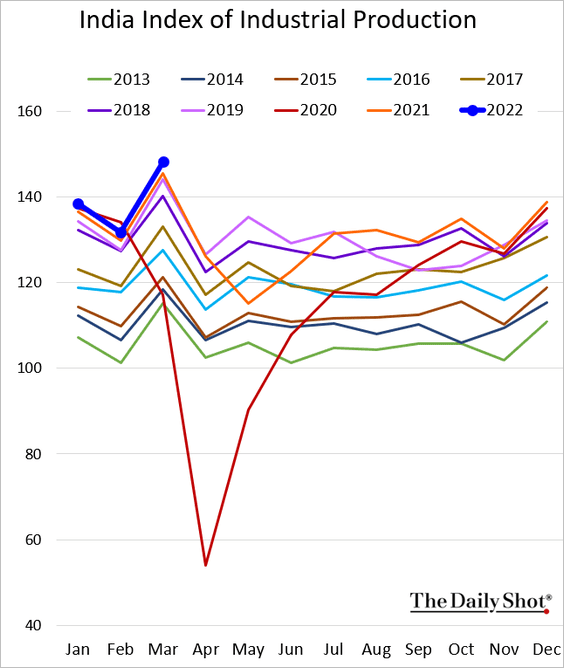

1. India’s CPI was higher than expected last month.

Industrial production hit a record high in March.

——————–

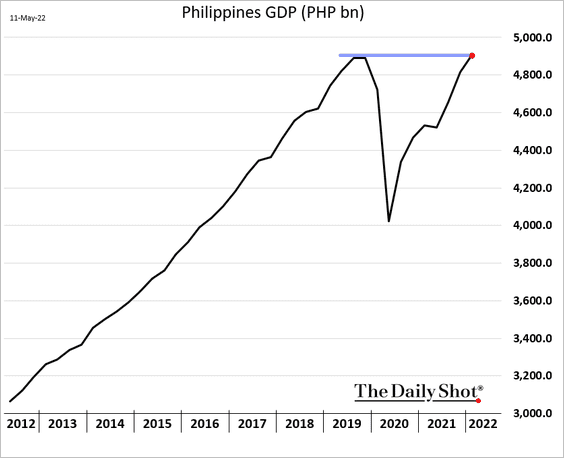

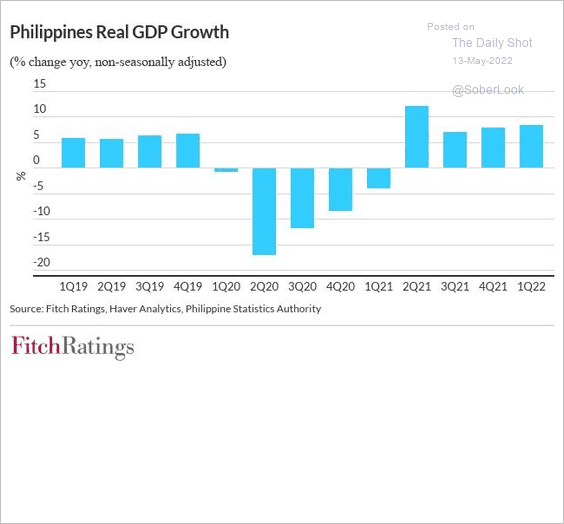

2. The Philippines’ GDP has fully recovered from the pandemic slump (topping forecasts).

Source: Fitch Ratings

Source: Fitch Ratings

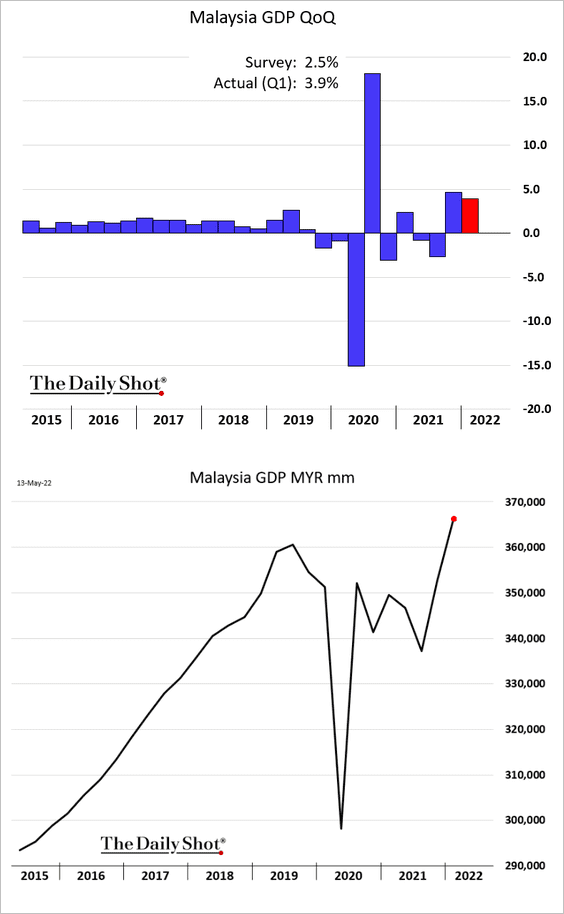

3. Malaysia’s Q1 GDP was also stronger than expected.

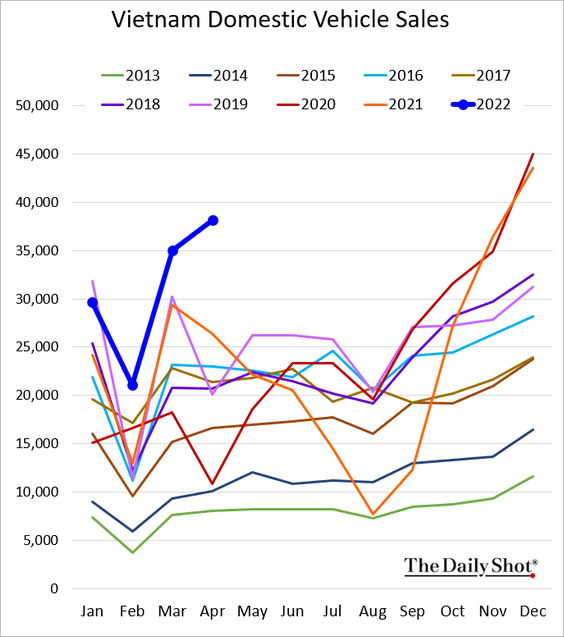

4. Vietnam’s vehicle sales are surging.

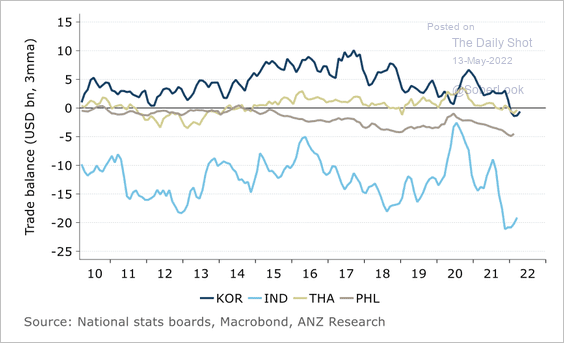

5. Trade balances are under pressure in some Asian economies.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

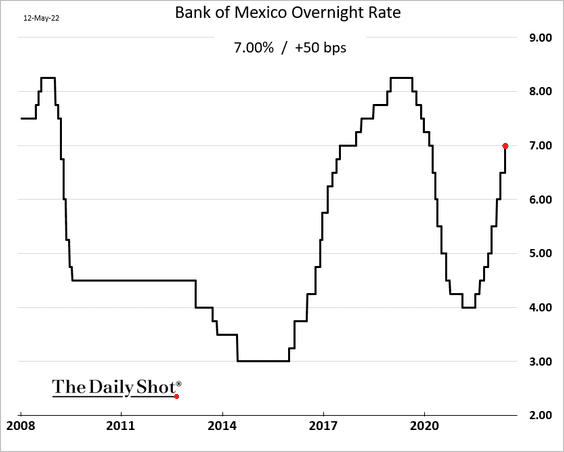

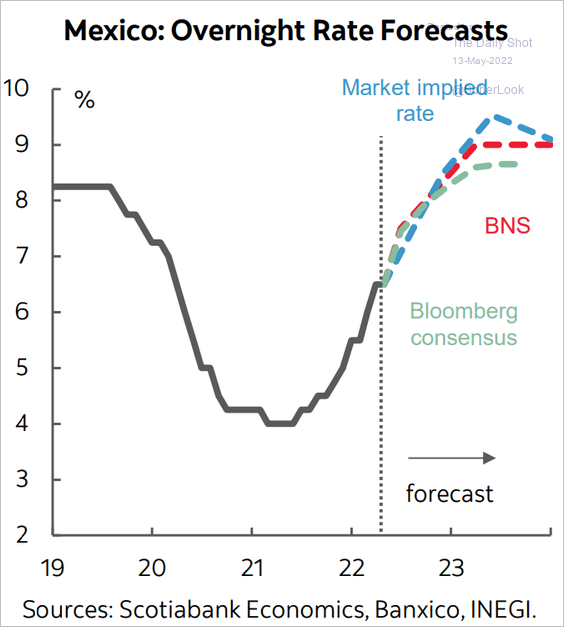

6. Banxico hiked rates by 50 bps again.

How far will Banxico press its rate hikes?

Source: Scotiabank Economics

Source: Scotiabank Economics

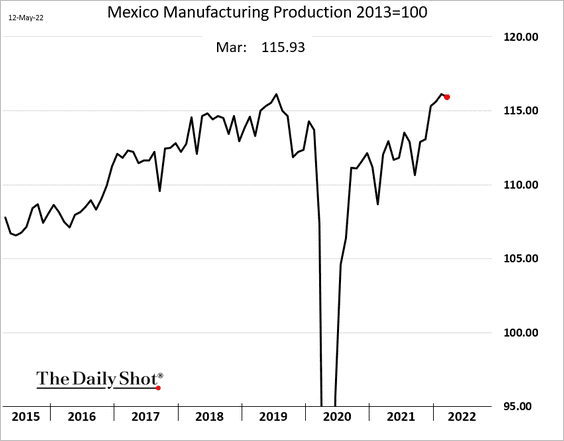

Mexico’s manufacturing output ticked lower in March.

——————–

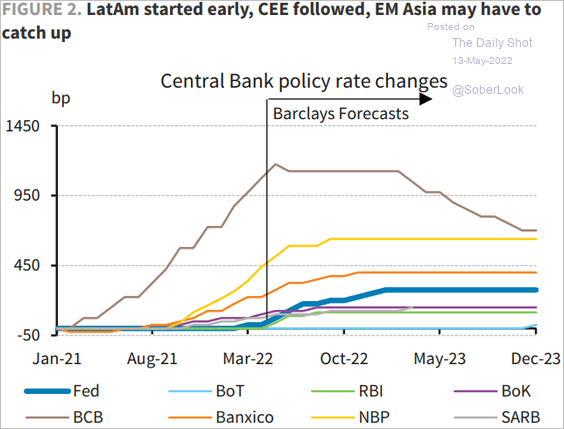

7. Here is a look at projected rate hike cycles in select economies

Source: Barclays Research

Source: Barclays Research

Back to Index

Cryptocurrency

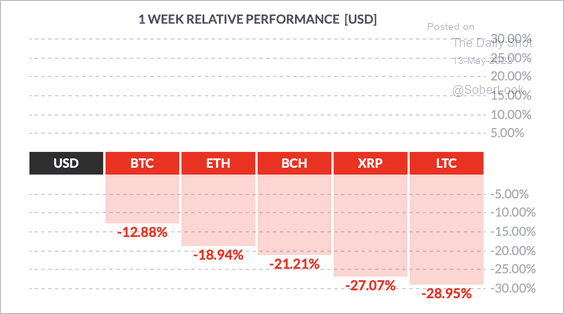

1. It’s been a tough week for cryptos.

Source: FinViz

Source: FinViz

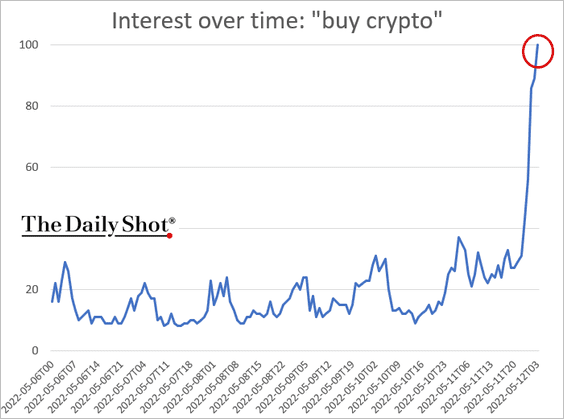

2. Online search activity for “buy crypto” surged during yesterday’s selloff.

Source: Google Trends

Source: Google Trends

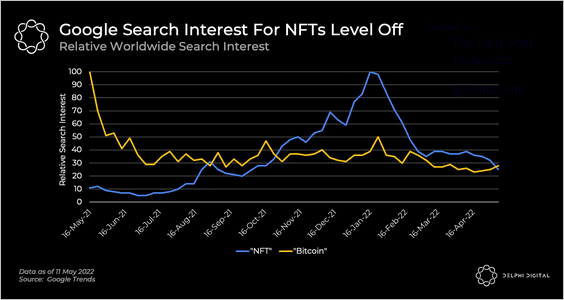

Google searches for NFT spiked in January, but have since declined.

Source: @Delphi_Digitial

Source: @Delphi_Digitial

——————–

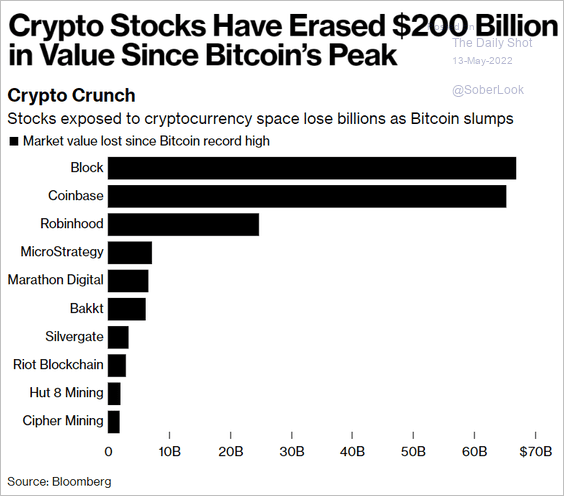

3. According to Bloomberg, crypto stocks erased some $200 bn in market value since the bitcoin peak.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

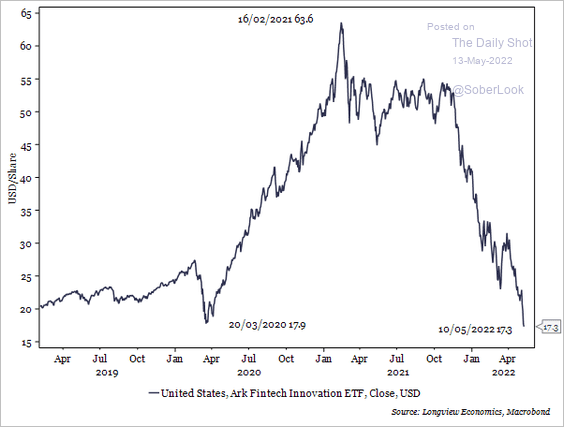

The overall fintech sector has been under severe pressure.

Source: Longview Economics

Source: Longview Economics

——————–

3. Bitcoin’s market cap relative to the total crypto market cap is breaking out of a short-term downtrend, which could signal risk-off conditions.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

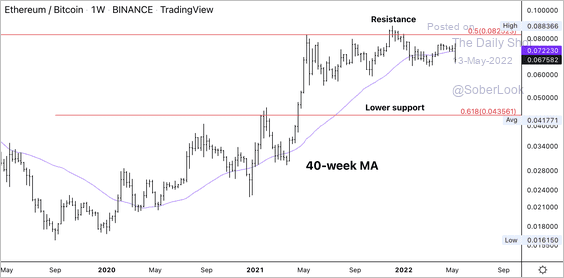

4. The ETH/BTC price ratio is declining from a long-term resistance level.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

5. Terra temporarily shut down its blockchain, which meant no transactions of its algorithmic (un)stable coin UST, LUNA, or the project’s other cryptos could be processed.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

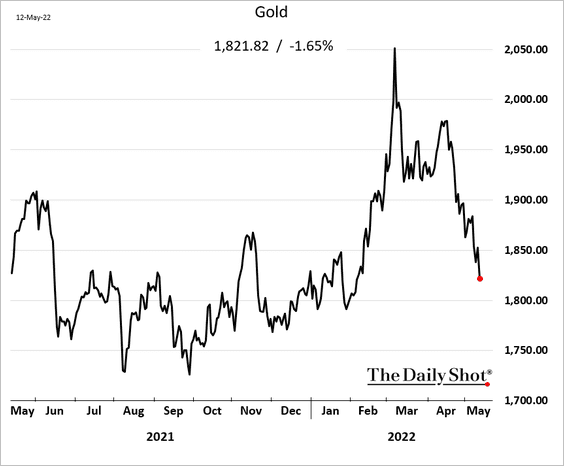

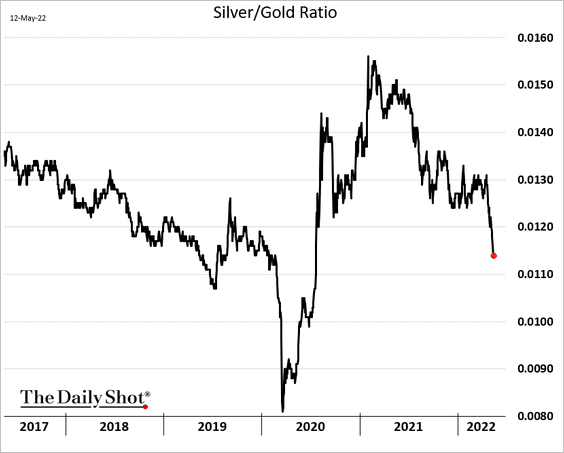

1. Precious metals have been selling off as the dollar surges.

Here is the silver-to-gold ratio.

——————–

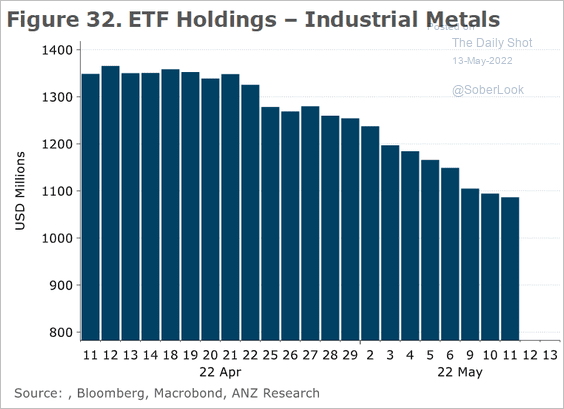

2. Next, we have ETF holdings of industrial metals.

Source: @ANZ_Research

Source: @ANZ_Research

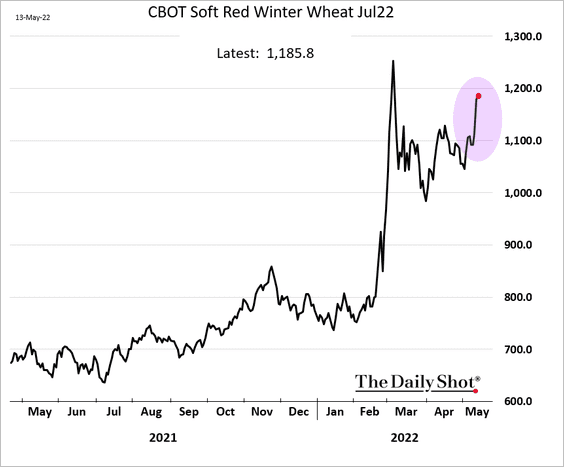

3. Wheat futures surged on Thursday.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

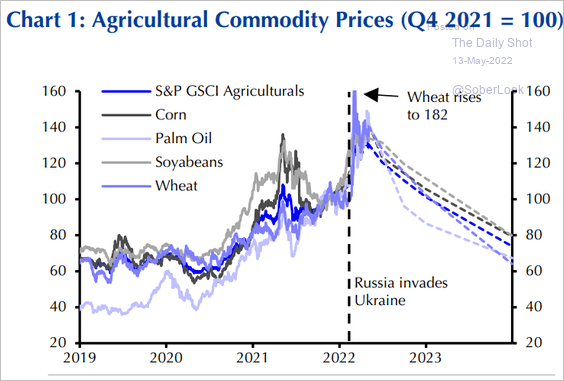

4. This chart shows agricultural price projections from Capital Economics.

Source: Capital Economics

Source: Capital Economics

5. Chicago hog futures continue to tumble.

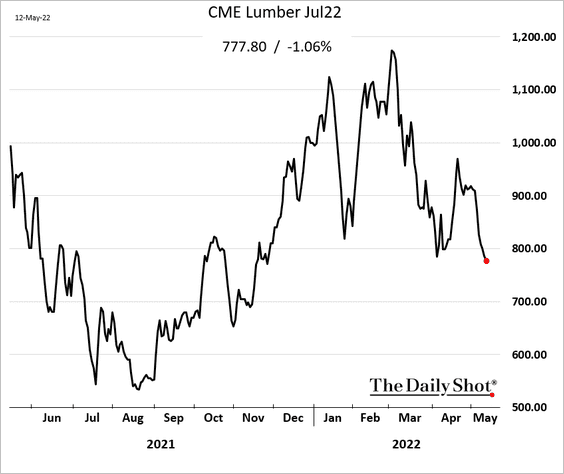

6. US lumber futures are trending lower.

Back to Index

Energy

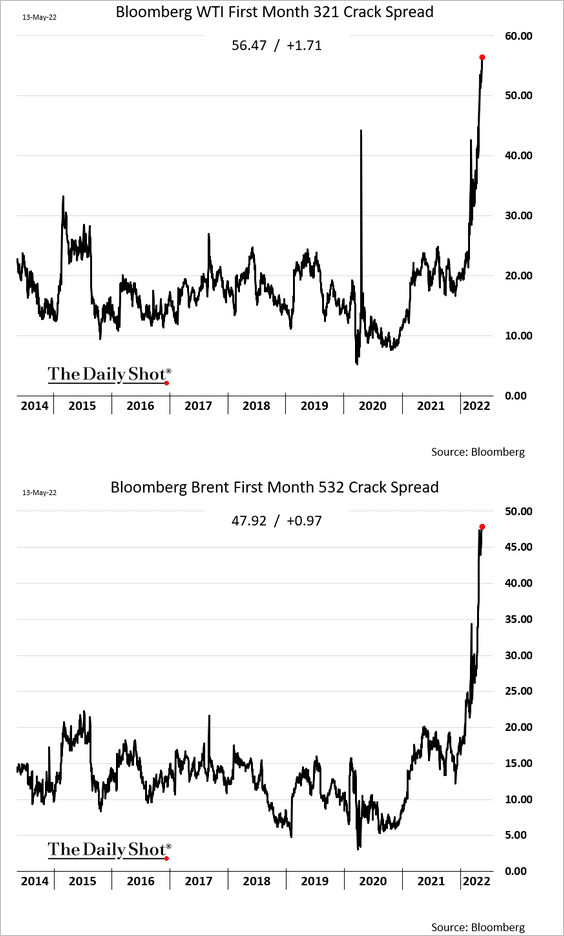

1. Crack spreads continue to surge, boosting refinery margins.

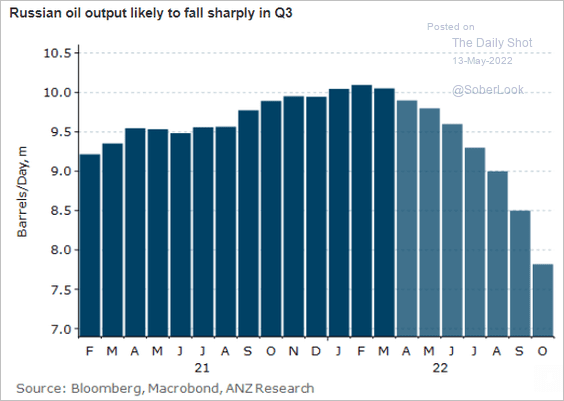

2. Russian oil output is likely to fall sharply later this year, putting further pressure on supplies.

Source: @ANZ_Research

Source: @ANZ_Research

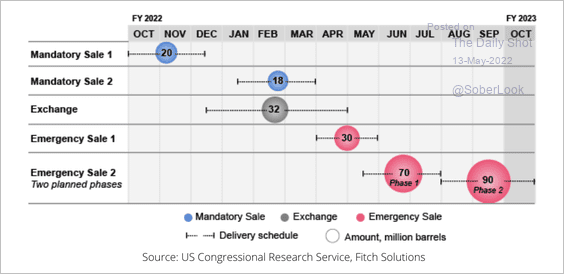

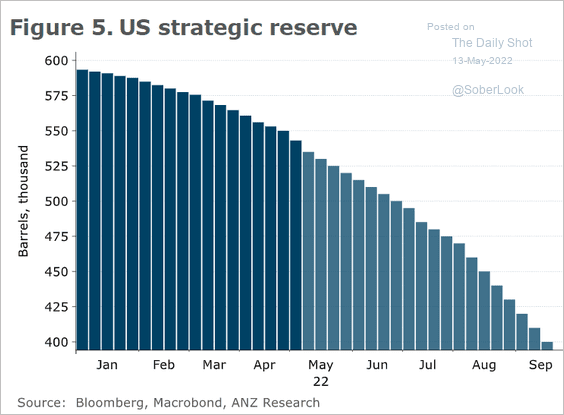

3. Here is a look at the US strategic petroleum reserve release schedule.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: @ANZ_Research

Source: @ANZ_Research

——————–

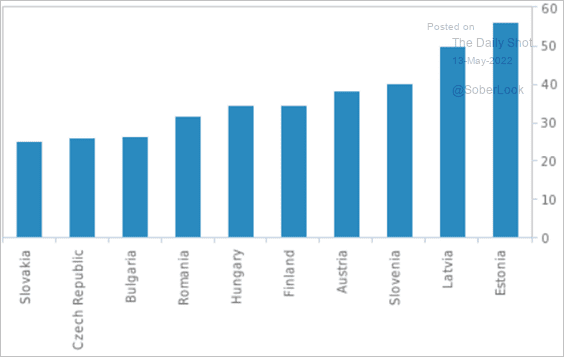

4. Many Central/Eastern European countries depend heavily on Russian oil imports.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

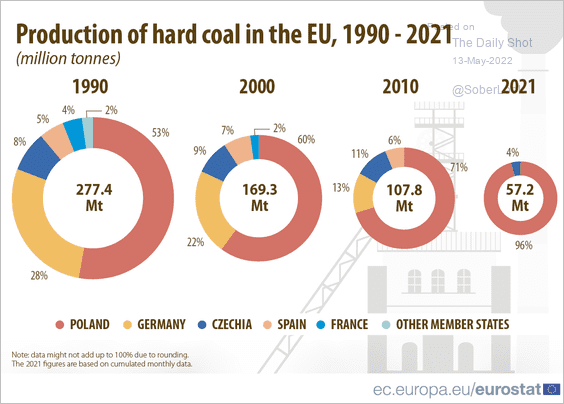

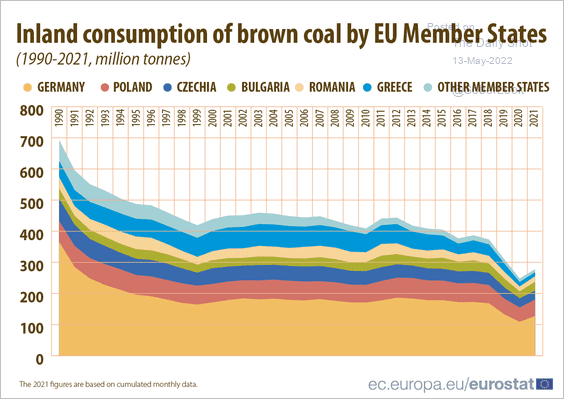

5. Next, we have some data on coal production and consumption in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Equities

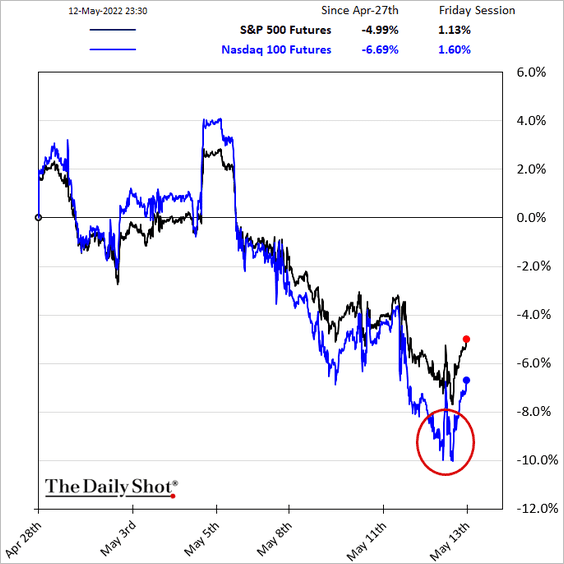

1. Dip buyers stepped in on Thursday.

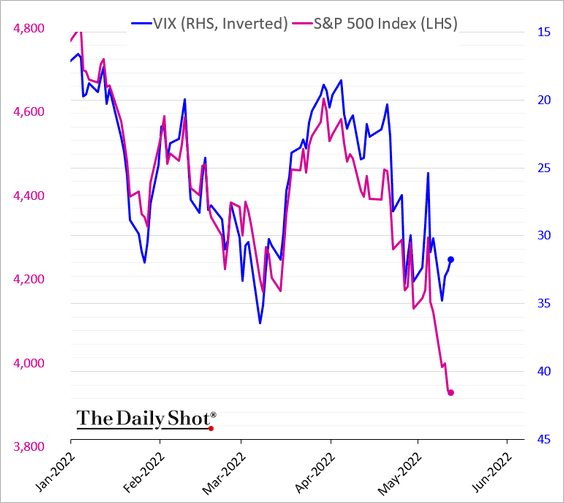

2. VIX has decoupled from the S&P 500, which could indicate that we are not at the “capitulation” point yet.

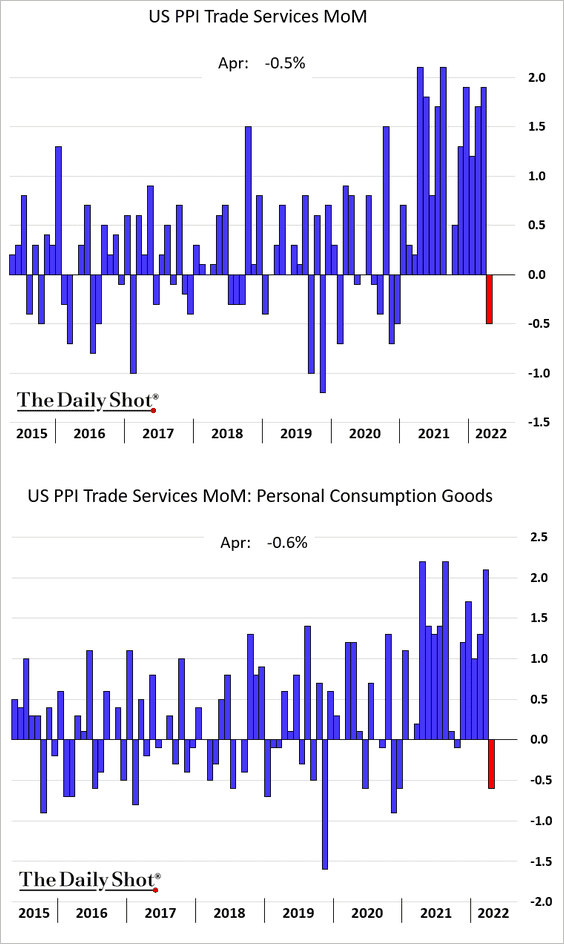

3. The PPI report shows signs of margin pressures. “Trade services” are basically business markups.

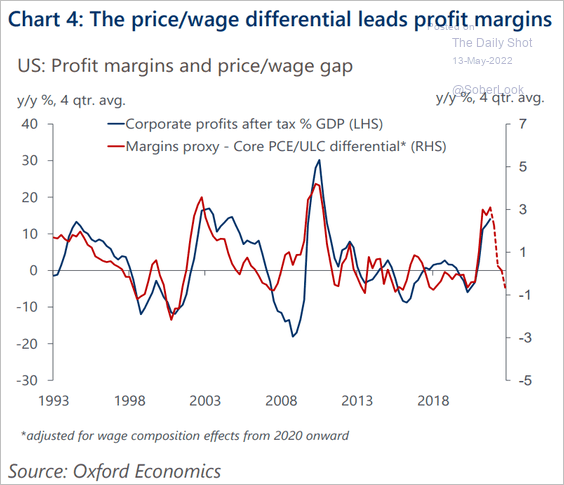

The price/wage gap is also signaling weaker margins ahead.

Source: Oxford Economics

Source: Oxford Economics

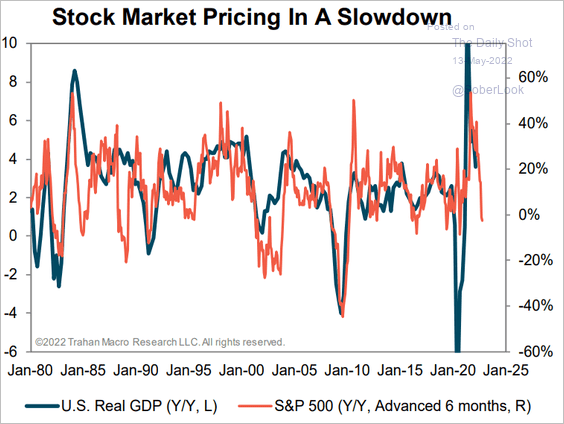

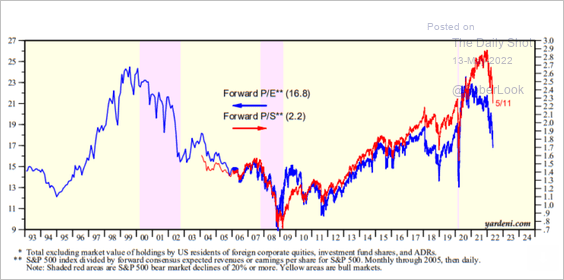

The market expects slower economic growth/recession to cut both revenues and margins, pushing PE ratios sharply lower.

Source: Yardeni Research

Source: Yardeni Research

——————–

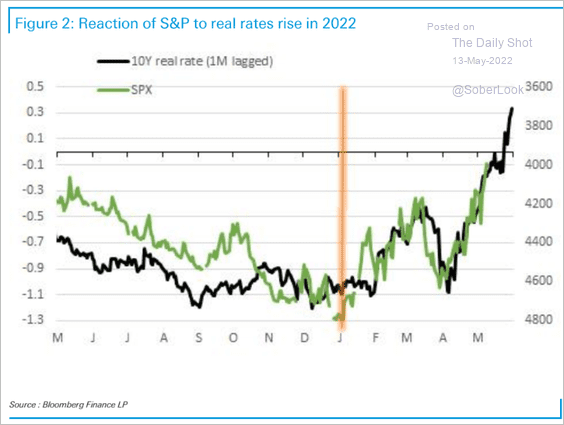

4. Real rates remain a risk for equities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

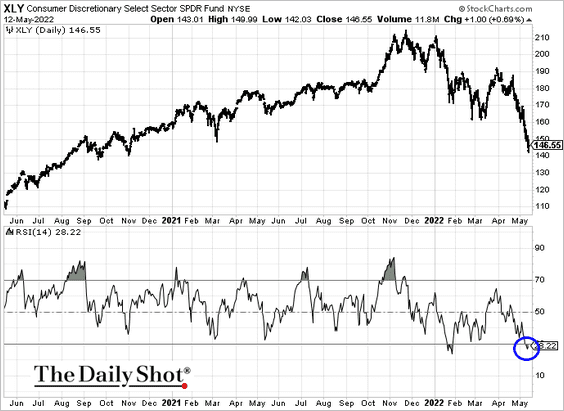

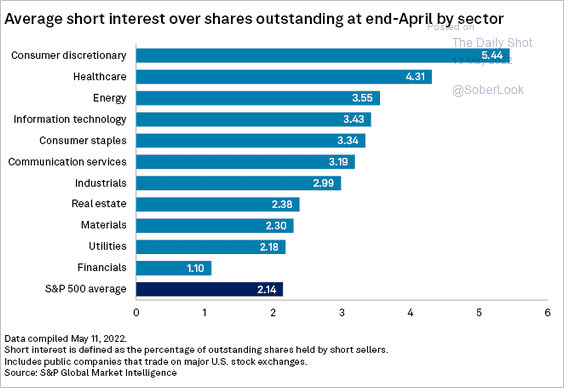

5. Consumer discretionary stocks look oversold.

We may see some short-covering ahead.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

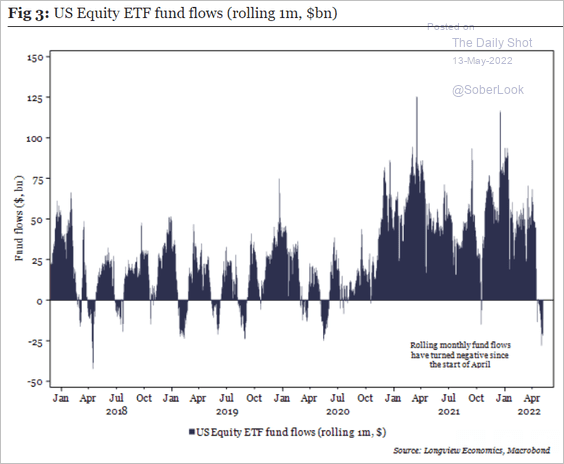

6. Equity ETFs have been experiencing the biggest outflows since early 2020.

Source: Longview Economics

Source: Longview Economics

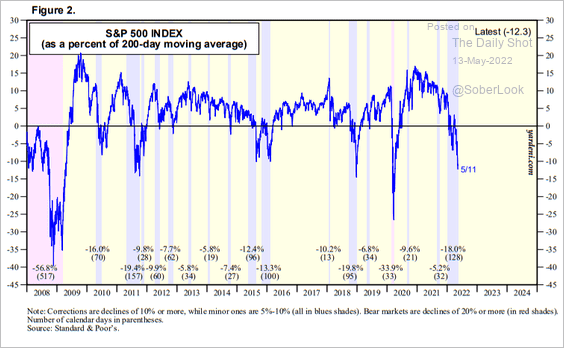

7. Here is the S&P 500 relative to its 200-day moving average.

Source: Yardeni Research

Source: Yardeni Research

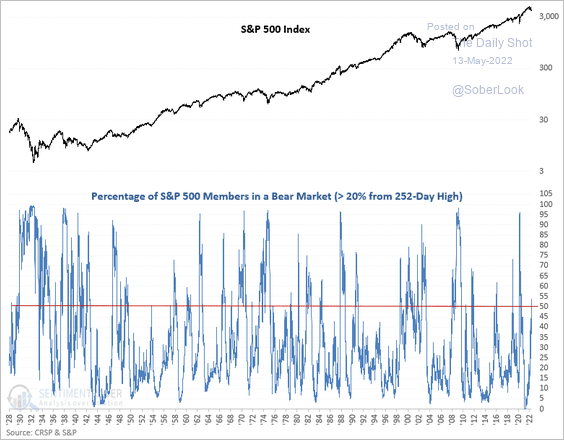

8. Over half of S&P 500 stocks are in a bear market (down 20% or more from their 52-week highs).

Source: SentimenTrader

Source: SentimenTrader

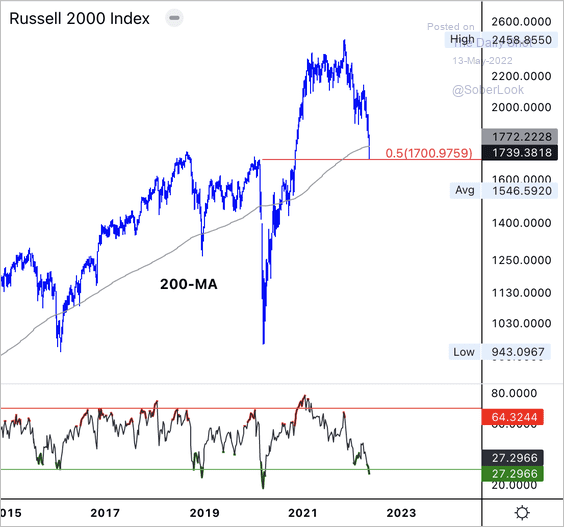

9. The Russell 2,000 small-cap index is testing support.

Source: Dantes Outlook

Source: Dantes Outlook

.

Back to Index

Credit

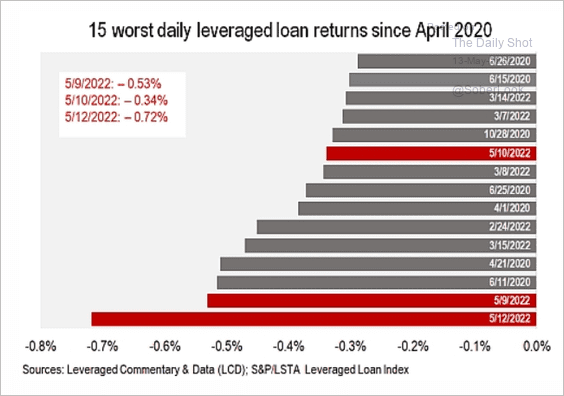

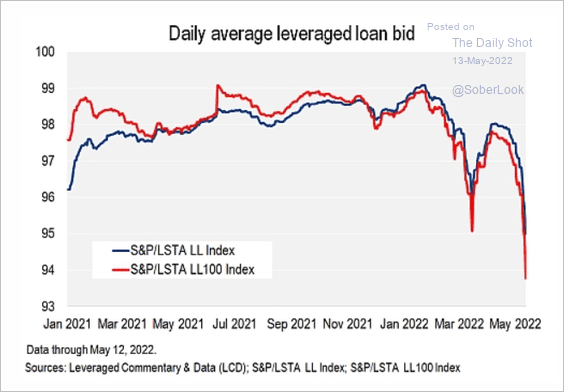

1. May has been a tough month for leveraged loans.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

Source: @lcdnews Read full article

Source: @lcdnews Read full article

——————–

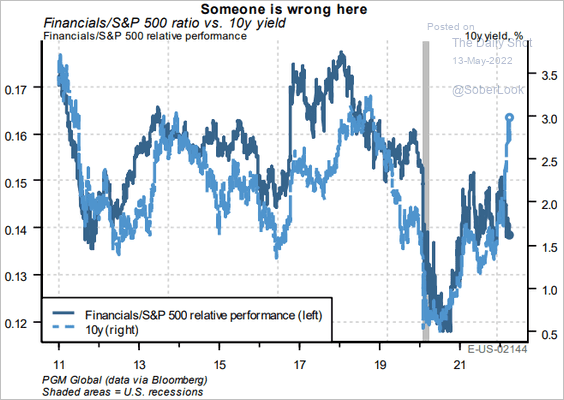

2. Financials’ weak relative performance in response to higher yields suggests that markets are pricing in deteriorating credit conditions in the US.

Source: PGM Global

Source: PGM Global

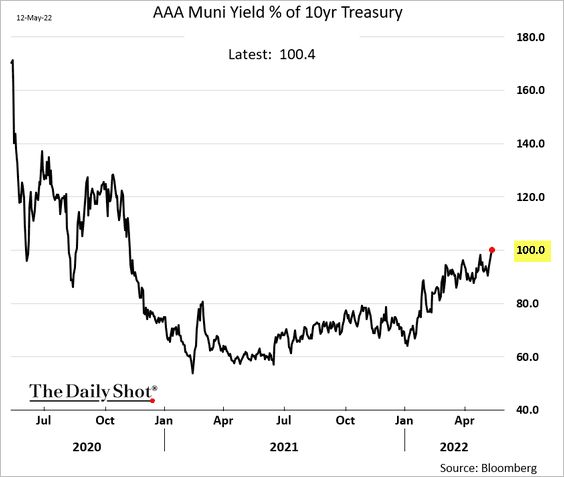

3. Munis haven’t been this cheap relative to Treasuries since 2020.

Back to Index

Global Developments

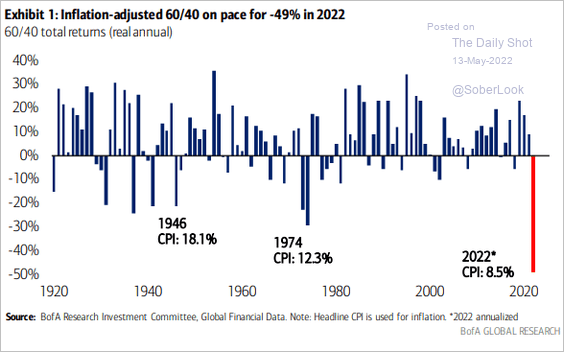

1. Let’s start with the yearly inflation-adjusted performance of a 60-40 portfolio.

Source: BofA Global Research

Source: BofA Global Research

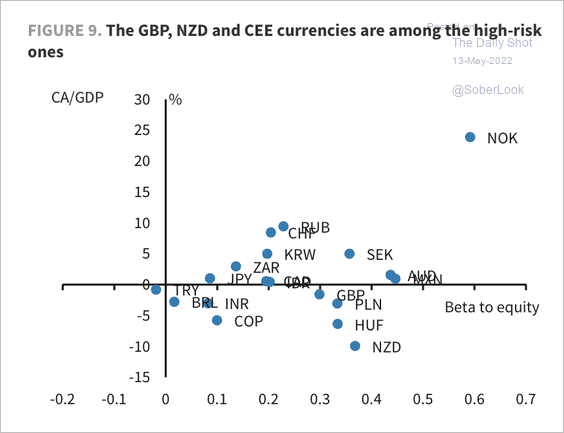

2. Here is a look at currency sensitivity to equities.

Source: Barclays Research

Source: Barclays Research

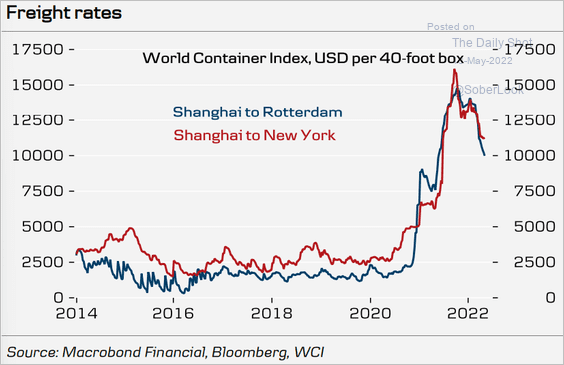

3. Container freight rates are moderating.

Source: Danske Bank

Source: Danske Bank

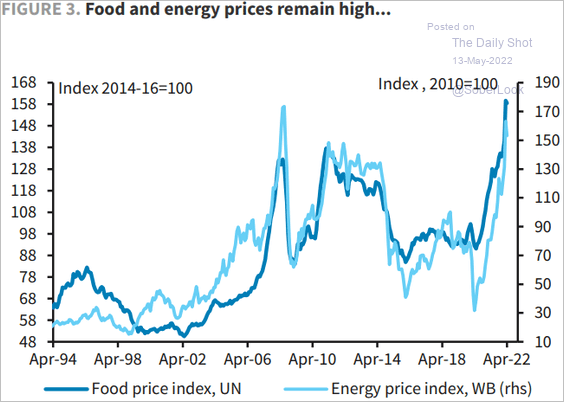

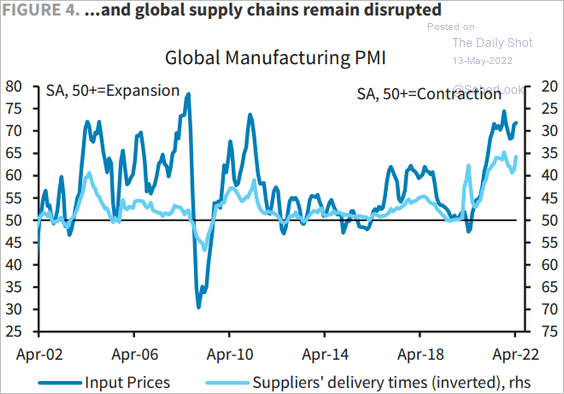

4. The surge in food and energy prices, in addition to disrupted global supply chains, points to persistent inflation (two charts).

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

——————–

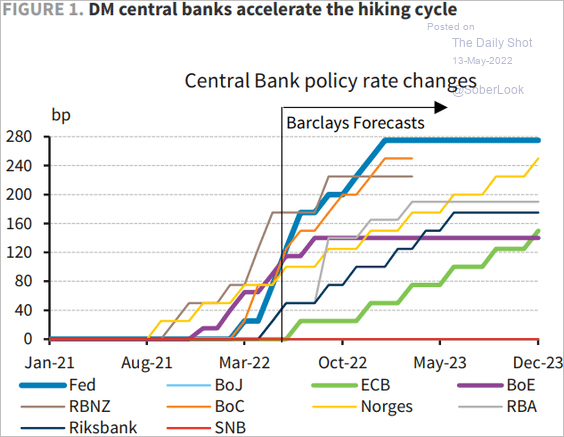

5. With inflation spiking higher across the G10, central banks are “synchronizing” their hiking cycles.

Source: Barclays Research

Source: Barclays Research

——————–

Food for Thought

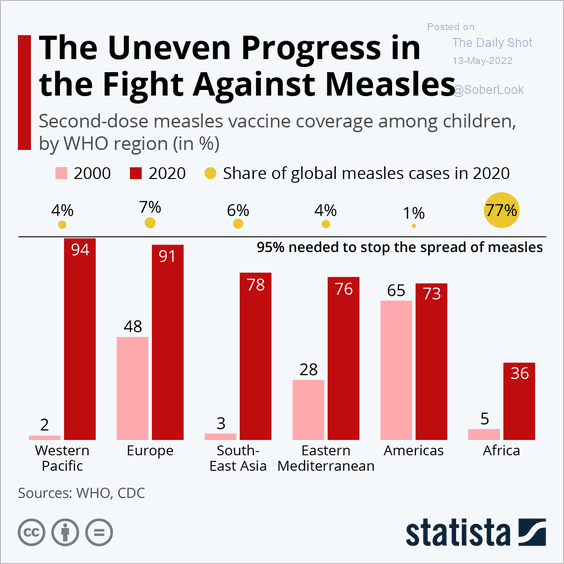

1. Measles vaccine coverage:

Source: Statista

Source: Statista

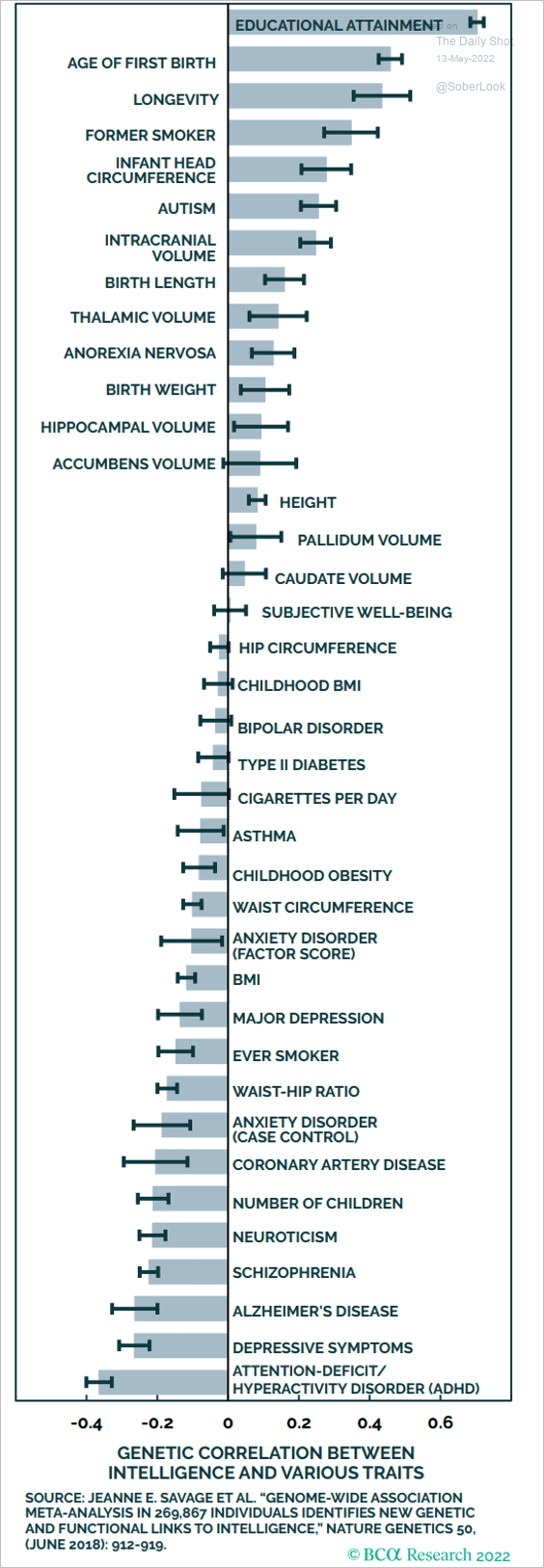

2. Correlations between IQ scores and various traits:

Source: BCA Research

Source: BCA Research

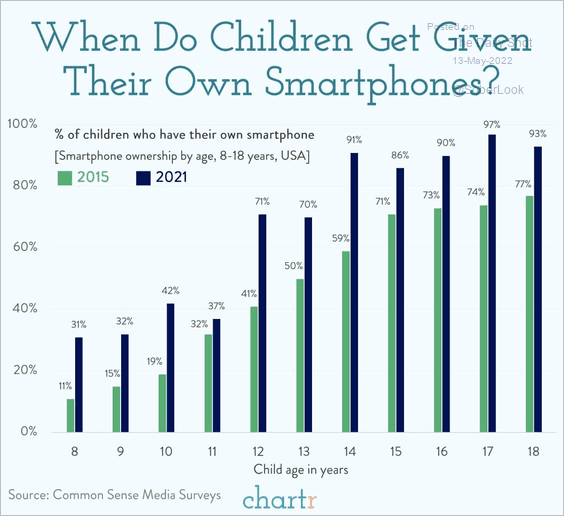

3. Children who have their own smartphone:

Source: @chartrdaily

Source: @chartrdaily

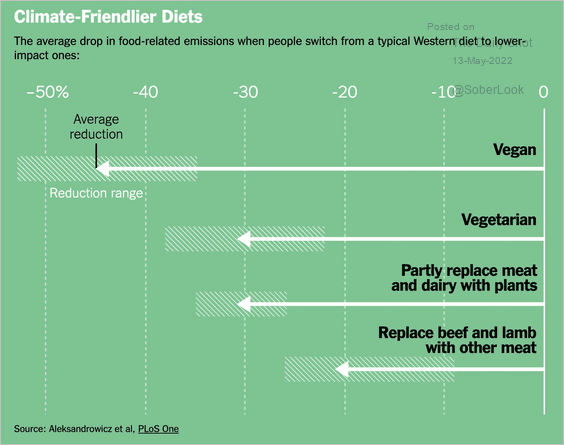

4. Diet impact on food-related emissions:

Source: @jburnmurdoch, @PopovichN

Source: @jburnmurdoch, @PopovichN

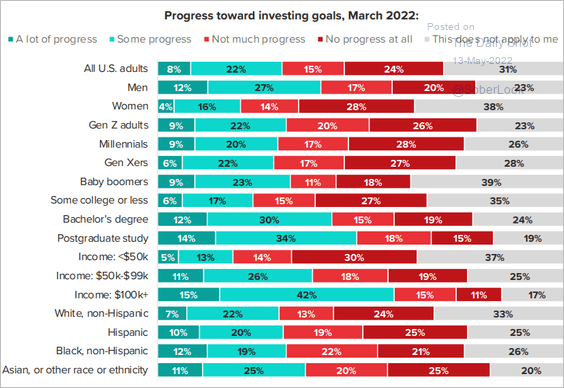

5. Progress toward investing goals:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

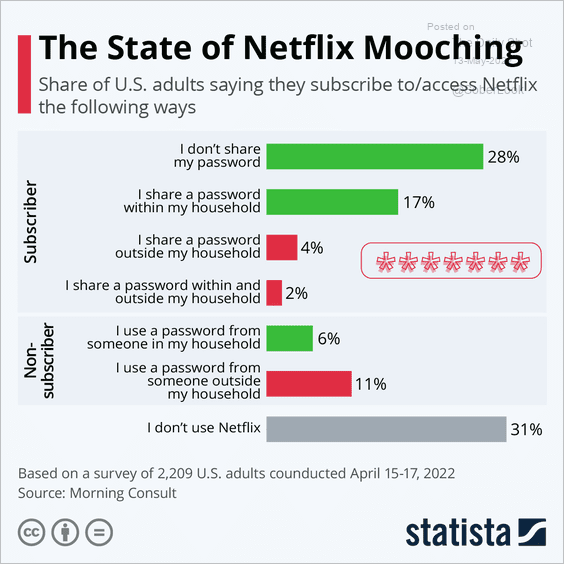

6. The state of Netflix mooching:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index