The Daily Shot: 12-Jul-22

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some additional updates on the labor market.

• Labor force participation eased in June.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Is COVID still an issue?

Source: @WSJ Read full article

Source: @WSJ Read full article

• Here are the June payroll gains by sector.

Source: Scotiabank Economics

Source: Scotiabank Economics

• This chart shows wage growth trends by sector.

Source: The New York Times Read full article

Source: The New York Times Read full article

• Service jobs are still lagging.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The number of people working part-time for economic reasons hit a multi-year low (reducing underemployment).

Source: @WSJ Read full article

Source: @WSJ Read full article

• The share of women on payrolls is nearing 50% again.

• The percentage of Americans who are self-employed remains elevated.

Source: Federal Reserve Bank of St. Louis Read full article

Source: Federal Reserve Bank of St. Louis Read full article

• The payrolls report revisions have been negative in recent months.

Source: Quill Intelligence

Source: Quill Intelligence

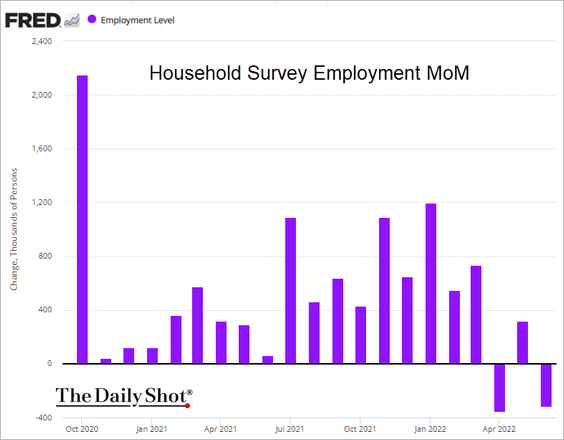

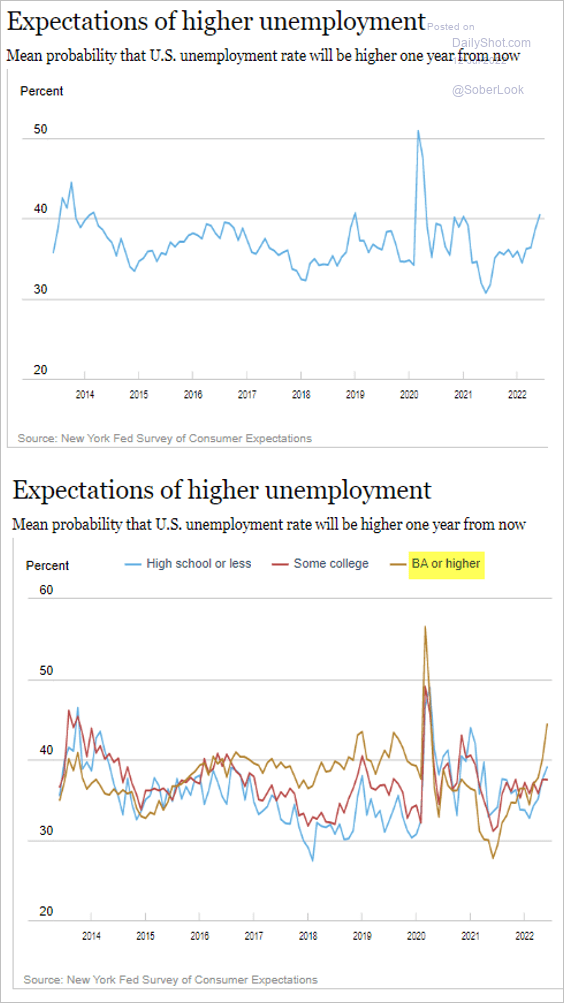

There are a couple of indicators that point to potential cracks in an otherwise hot labor market.

• The household survey showed job losses, diverging from the headline establishment survey. One of the differences is that the household survey includes “off-payroll” work.

• The NY Fed’s national survey signals increasing concerns about employment, especially among Americans with a college degree.

Source: NY Fed

Source: NY Fed

——————–

2. The yield curve inversion hit the worst level since 2006.

3. The broad money supply has decreased over the past three months.

h/t Deutsche Bank Research

h/t Deutsche Bank Research

Deteriorating liquidity tends to slow economic growth. Here is the narrow money supply (M1).

Source: Longview Economics

Source: Longview Economics

——————–

4. Excess residential and corporate investment typically precede recessions. For now, investment levels are still below prior peaks.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

5. Next, we have some updates on inflation.

• A stronger US dollar should help ease goods inflation.

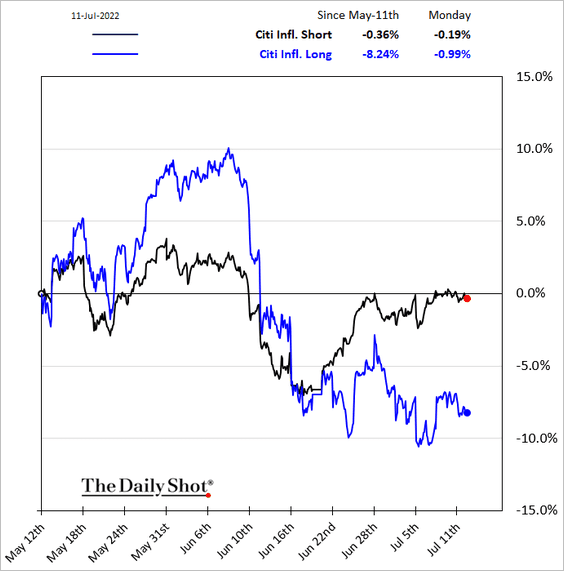

• The stock market is increasingly concerned about recession rather than inflation. Companies that benefit from rising prices have underperformed recently.

• The market says that the CPI has peaked. Again.

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

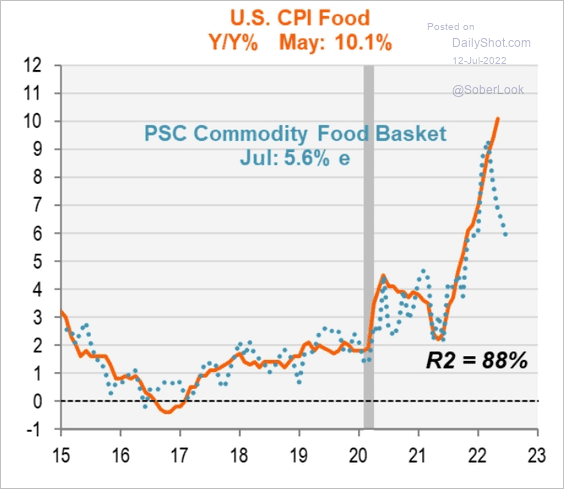

• Will we see a pullback in food inflation?

Source: Piper Sandler

Source: Piper Sandler

• Falling corporate margins should pull inflation lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

1. Consumer confidence continues to deteriorate.

2. More stocks are below their 200-day moving average and making new lows in the TSX Composite.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

3. Unlike the US, household savings remain above pre-pandemic levels.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The Eurozone

1. The euro is about to break parity.

A weak currency can be an advantage if you run a trade surplus. It’s painful in a deficit scenario.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Euro implied volatility has been climbing.

——————–

2. The euro used to be correlated with oil prices. Not anymore.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Here is the projected path for the ECB policy rate.

Source: @WeberAlexander, @markets Read full article

Source: @WeberAlexander, @markets Read full article

4. Economic forecasts increasingly point to stagflationary risks next year.

• 2023 growth projections:

• 2023 CPI projections:

Here are the 2023 projections for France.

——————–

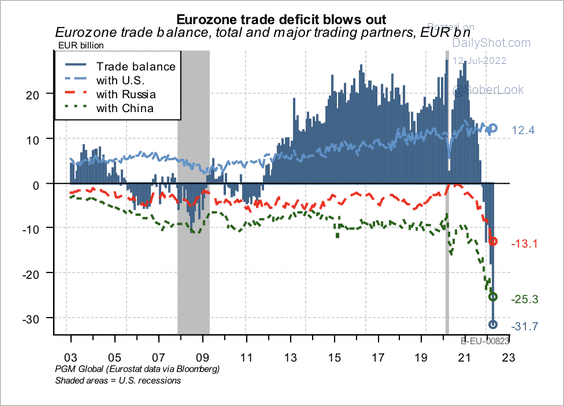

5. Chinese demand for eurozone goods has waned at the same time Eurozone import prices for Russian energy have surged (boosting trade deficit).

Source: PGM Global

Source: PGM Global

Back to Index

Asia – Pacific

1. Japan’s PPI continues to surprise to the upside.

2. Australia’s business confidence has been deteriorating.

Consumer confidence is approaching the 2020 lows.

But Australian household spending intentions remain robust.

Back to Index

China

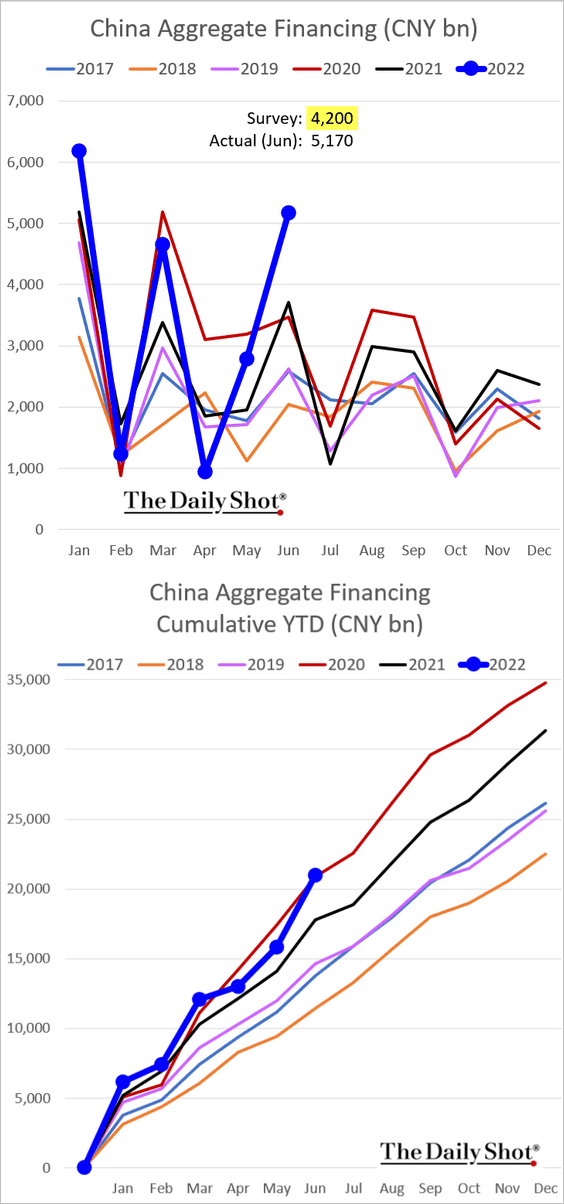

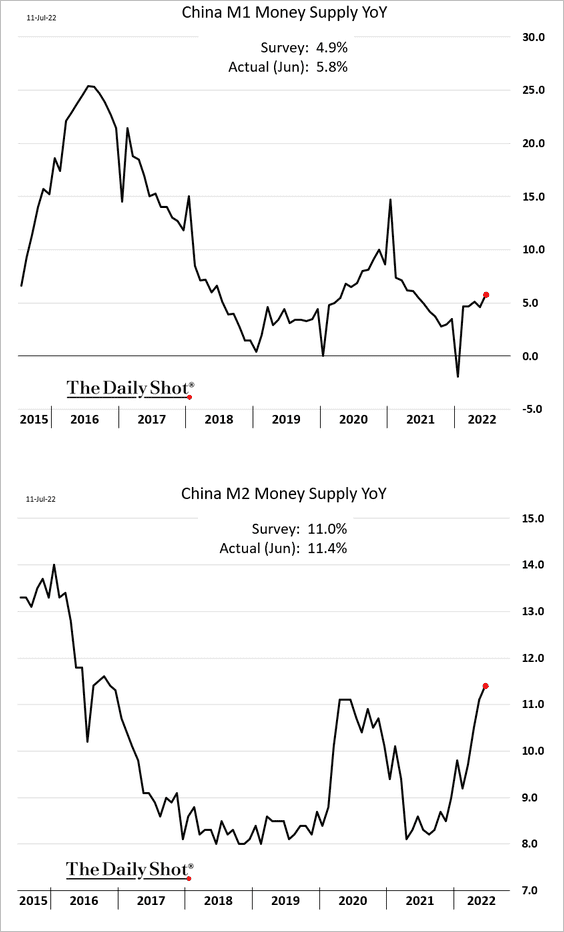

1. Bank lending surged in June.

Aggregate financing was well above forecasts as Bejing tries to accelerate economic growth after the lockdowns.

Source: ING

Source: ING

Money supply indicators also topped expectations.

——————–

2. Leveraged property developers remain under pressure.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

3. Consumption remains weak, …

Source: MRB Partners

Source: MRB Partners

… amid depressed consumer sentiment.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

1. The Colombian peso is plummetting.

This is really going to help …

Source: @bpolitics Read full article

Source: @bpolitics Read full article

It’s worth noting that Colombia’s manufacturing activity accelerated last month.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

2. Russia’s current account surplus hit another record high as energy sales surge.

3. The Philippine peso is at multi-year lows. Central bank governor Felipe Medalla wants the market to “determine” the peso’s value (translation: easy monetary policy).

A record trade deficit has exacerbated the situation.

Back to Index

Cryptocurrency

1. Bitcoin is back below $20k amid weakness in stocks.

2. Crypto investment funds saw inflows totaling $15 million last week, driven by US and Canadian exchanges (2 charts).

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin-focused funds saw minor outflows last week, while Ethereum-focused funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

1. Industrial metals slump continues due to recession risks and a strong dollar.

• Aluminum:

• Copper:

• Bloomberg’s industrial metals index.

——————–

2. Precious metals are also weaker.

Back to Index

Energy

1. The Texas power grid is under pressure as the heat wave bears down on the Lone Star State.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

2. The decline in US manufacturing conditions points to lower petroleum demand (non-gasoline).

Source: Longview Economics

Source: Longview Economics

3. US industrial electricity prices remain elevated.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

4. Are analysts underestimating Russia’s ability to restore its crude oil output?

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Back to Index

Equities

1. Earnings projections are rolling over, but are the downward adjustments sufficient?

h/t Lu Wang, Isabelle Lee, Bloomberg

h/t Lu Wang, Isabelle Lee, Bloomberg

Source: BCA Research

Source: BCA Research

Unlike previous bear markets, significant earnings downgrades have yet to materialize despite falling stock prices.

Source: JP Morgan Research

Source: JP Morgan Research

——————–

2. Positioning remains bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Here is the aggregate equity futures positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

3. Valuations dispersion has been extreme.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

4. More pain for global stocks from central banks’ quantitative tightening?

Source: III Capital Management

Source: III Capital Management

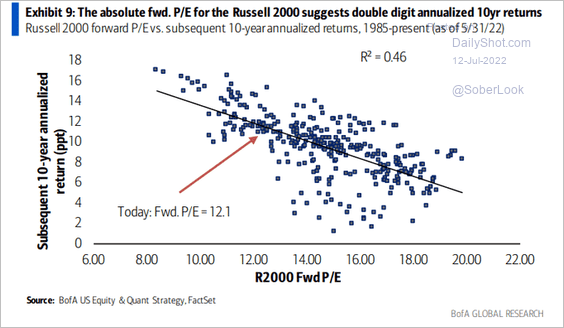

5. At current valuations, small-cap returns could be attractive over the next decade.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

6. The divergence between bank stocks’ relative performance and bond yields has been extreme.

Source: @TheTerminal, Bloomberg Finance L.P., h/t @jessefelder

Source: @TheTerminal, Bloomberg Finance L.P., h/t @jessefelder

7. The energy sector price held support at the 200-day moving average.

Source: Truist Advisory Services

Source: Truist Advisory Services

Energy-sector valuations look attractive.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

8. Retail investors have been rotating out of the “retail tech basket” into tech mega-caps (which they consider a defensive play).

Source: Vanda Research

Source: Vanda Research

9. The Reddit crowd is not limited to the US. Here are the most actively searched stocks on Google in the EU.

Source: CMC Markets

Source: CMC Markets

10. US households haven’t been this bearish in a while.

11. Hedge funds had the worst month since the 2020 COVID shock.

Back to Index

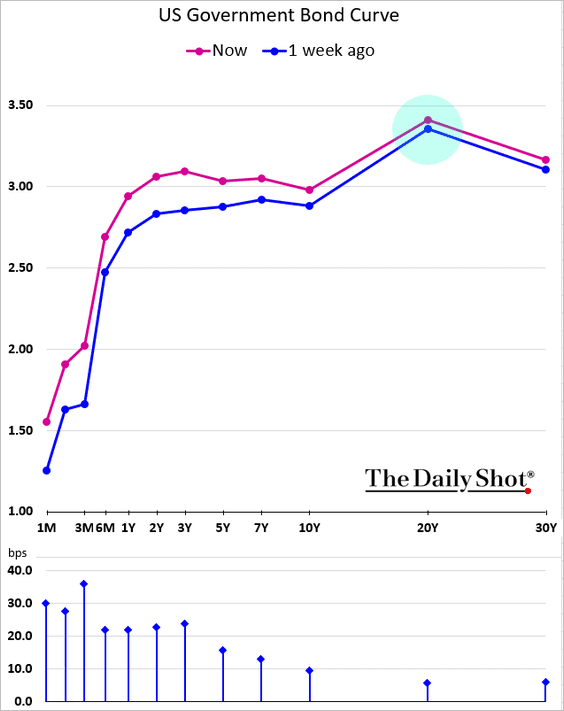

Rates

1. The 20yr Treasury yield is dislocated (investors looking for liquidity prefer the 10yr or the long bond).

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

——————–

2. The 5yr, 5yr forward inflation swap rate (long-term inflation expectations) is testing support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

1. Advanced economies registered outsize housing price gains over the past 12 months.

Source: Oxford Economics

Source: Oxford Economics

2. There are more job vacancies than unemployed people in the US, Germany and UK – a sign of tight labor markets.

Source: JP Morgan Research

Source: JP Morgan Research

3. The Swiss watch price index points to tumbling demand for luxury goods.

Source: @watchcharts_com

Source: @watchcharts_com

——————–

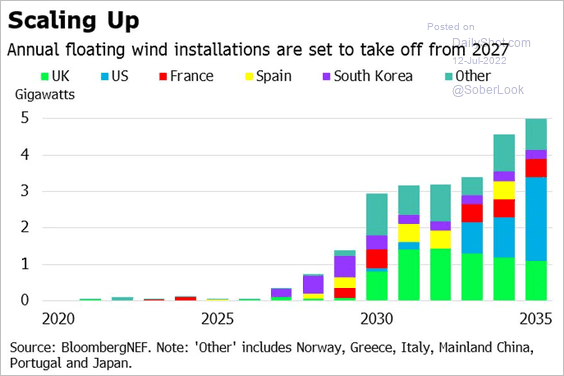

Food for Thought

1. Floating wind installations:

Source: @BloombergNEF

Source: @BloombergNEF

2. Global coal trade:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

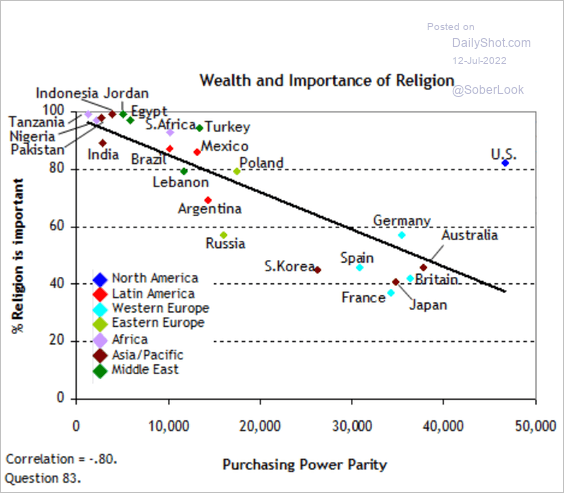

3. Countries’ wealth and importance of religion:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

4. Average age at marriage:

Source: @OpenAxisHQ Read full article

Source: @OpenAxisHQ Read full article

5. Suicide rates among US adolescents:

Source: KFF Read full article

Source: KFF Read full article

6. Taiwan’s views on unification/independence:

Source: Election Study Center, NCCU

Source: Election Study Center, NCCU

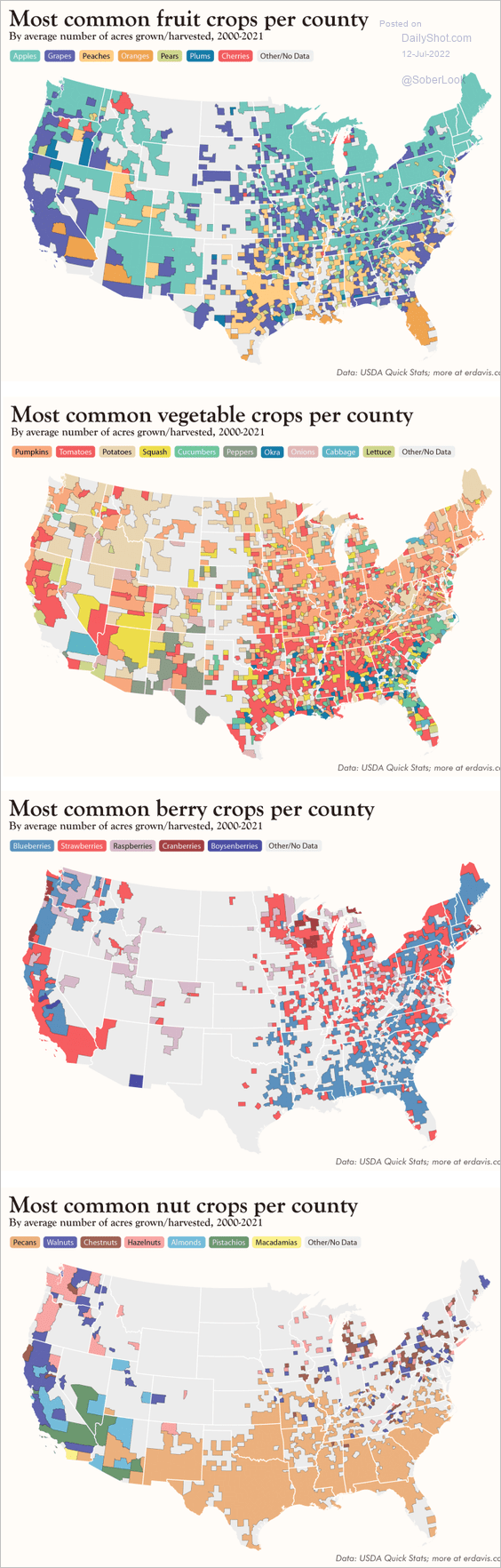

7. Most common crop by county:

Source: Data Stuff

Source: Data Stuff

——————–

Back to Index