The Daily Shot: 25-Jul-22

• The United States

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The S&P Global Composite PMI moved into contraction territory this month (PMI < 50), signaling a pullback in business activity.

The weakness was driven by services.

Source: Barclays Research

Source: Barclays Research

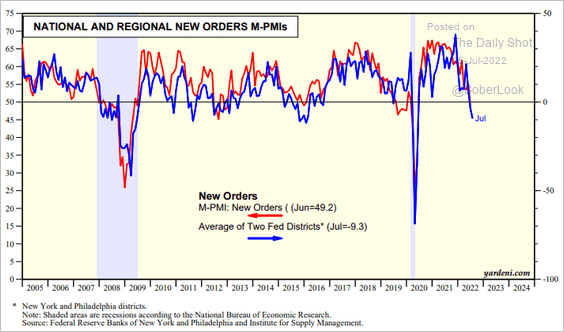

Separately, regional Fed indices point to a contraction in the ISM Manufacturing PMI (at the national level).

Source: Yardeni Research

Source: Yardeni Research

——————–

2. The Citi US Economic Surprise Index is falling again, …

… pulled lower by “soft data” (surveys). Soft data indicators tend to provide a more timely signal.

——————–

3. Bloomberg’s recession probability index keeps climbing.

Barclays Research doesn’t see a recession – just very slow growth.

Source: Barclays Research

Source: Barclays Research

——————–

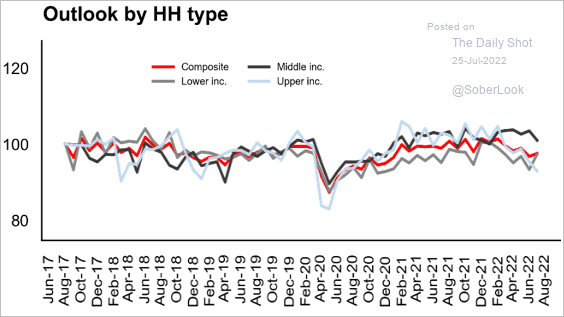

4. The Bain Consumer Health Index has been flat over the past four weeks, but there was a pullback among upper-income households.

Source: Bain & Company

Source: Bain & Company

• Credit card data continues to show robust spending.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @business Read full article

Source: @business Read full article

• Separately, there hasn’t been a pullback in securities-based borrowing among wealthy investors.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

5. Container shipping costs continue to moderate.

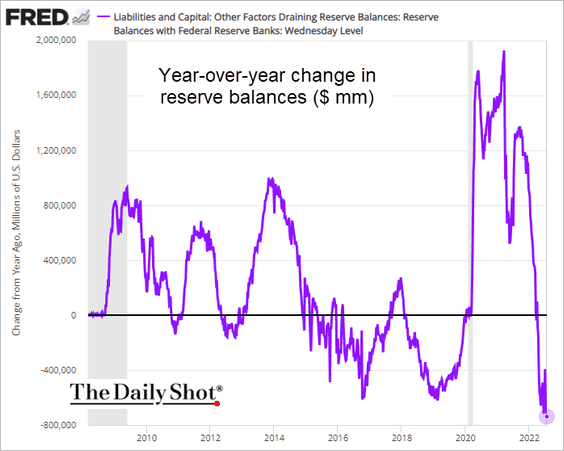

6. Liquidity has been decreasing as the Fed reverses quantitative easing. It’s a headwind for economic growth.

• Reserves:

• Broad money supply:

Source: Merrill Lynch

Source: Merrill Lynch

——————–

7. The market expects the Fed to hike rates by 75 bps this week and 50 bps in September.

The fed funds rate trajectory is no longer expected to reach 3.5%.

Back to Index

The United Kingdom

1. The PMI report was in line with expectations, outperforming the Eurozone.

But the orders-to-inventory ratio doesn’t look promising (2 charts).

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

2. Retail sales surprised to the upside.

3. Liz Truss maintains a substantial lead over Rishi Sunak in the betting markets.

Source: @PredictIt

Source: @PredictIt

Who will make a good PM?

Source: @OpiniumResearch, @ObserverUK

Source: @OpiniumResearch, @ObserverUK

Back to Index

The Eurozone

1. The July PMI report looks recessionary, coming in well below consensus estimates.

• Manufacturing:

– Eurozone:

Source: S&P Global PMI

Source: S&P Global PMI

– France:

– Germany (3 charts):

• Services:

– France:

– Germany:

• Eurozone composite PMI:

– Composite PMI new orders:

– More pain ahead?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Supply chain stress is easing.

Source: TS Lombard

Source: TS Lombard

——————–

2. The Citi Economic Surprise Index deteriorated further due to the PMI miss.

3. Recession probabilities as rising.

• Forecasters have been downgrading next year’s growth, …

… while boosting CPI projections.

Source: ECB

Source: ECB

——————–

4. Weak global growth points to further declines in EUR/USD.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. Spanish short-term bond yields have been falling.

Back to Index

China

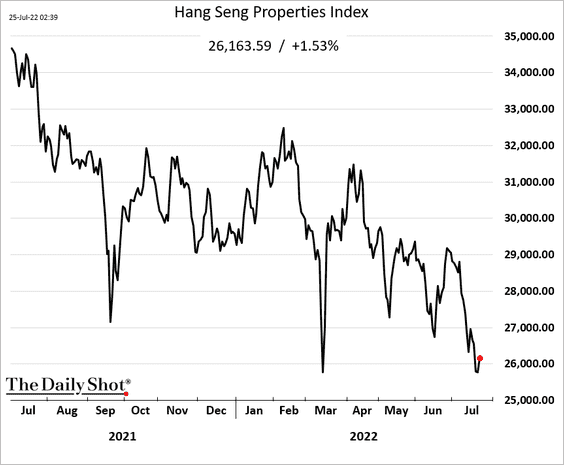

1. Property shares have stabilized as Bejing plans a massive bailout.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. The credit impulse remains weak, especially relative to previous cycles (2 charts).

Source: Gavekal Research

Source: Gavekal Research

Source: MRB Partners

Source: MRB Partners

——————–

3. Companies are focusing on financial investments rather than capital expenditures, similar to the 2014-2016 property market downturn.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

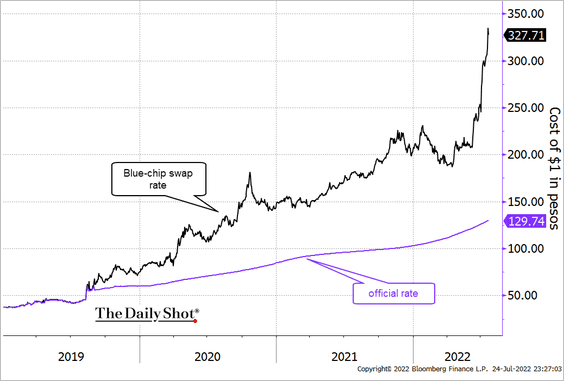

1. Financial risks deepen in Argentina.

Source: Reuters Read full article

Source: Reuters Read full article

• The gap between the official and unofficial peso exchange rate has blown out (higher value = weaker peso).

Source: Blue Dollar

Source: Blue Dollar

• Bond price:

——————–

2. The Indian central bank drew a line in the sand, defending the rupee from depreciating beyond 80 to the dollar.

Source: Reuters Read full article

Source: Reuters Read full article

Source: barchart.com

Source: barchart.com

India’s business activity is back in contraction territory, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

——————–

3. Russia’s central bank cut rates again.

4. The Turkish lira continues to weaken, nearing 18 to the dollar.

5. Next, we have some performance data from last week.

• Currencies:

• Equity ETFs:

• Local-currency bond yields:

——————–

6. EM financial conditions continue to tighten.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

1. Cryptos are under pressure again.

Bitcoin is at support.

——————–

2. Coinbase breaks above its 50-day moving average.

Source: Longview Economics

Source: Longview Economics

3. This map shows the status of central bank-issued digital currencies.

Source: Statista

Source: Statista

Back to Index

Commodities

1. Hedge funds are now betting against precious metals.

——————–

2. Wheat sank on Friday in response to the Ukraine news. Too much optimism about supply improvements?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. This chart shows last week’s performance across key commodity markets.

Back to Index

Energy

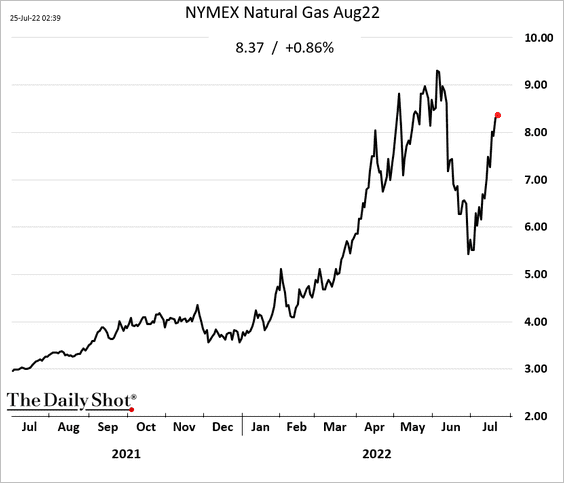

1. US natural gas futures continue to climb.

2. Analysts expect Gazprom’s natural gas production to deteriorate this month.

Source: UBS; Syz Group

Source: UBS; Syz Group

Back to Index

Equities

1. Let’s begin with some updates on earnings.

• S&P 500 2023 earnings expectations continue to moderate.

Earnings expectations ex-energy are down substantially.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

• So far, earnings downgrades for Q2 are not extreme, even when excluding energy.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Large earnings upgrades for energy stocks have been offset by cuts elsewhere.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The early part of the earnings season tends to be more supportive of equities.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

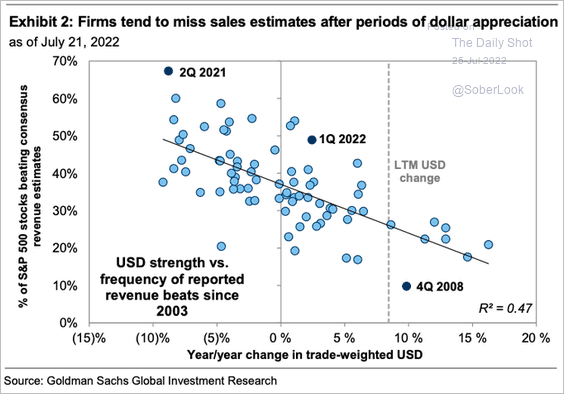

• A strong US dollar tends to result in more downside sales surprises.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

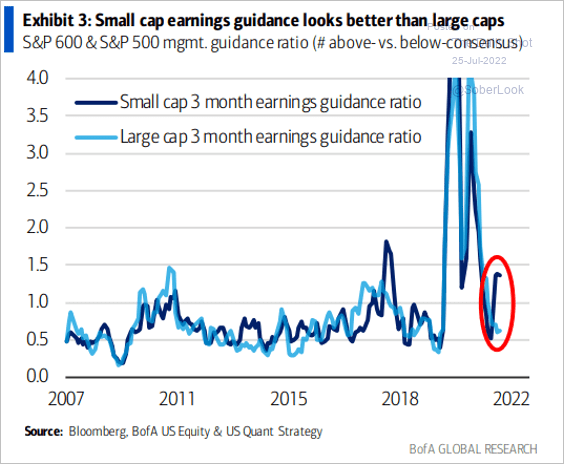

• Small-cap earnings guidance is outpacing large caps.

Source: BofA Global Research

Source: BofA Global Research

• There is a large divergence between US and global ex-US earnings.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• As we mentioned previously, softer economic activity points to weaker earnings growth ahead.

Source: MarketDesk Research

Source: MarketDesk Research

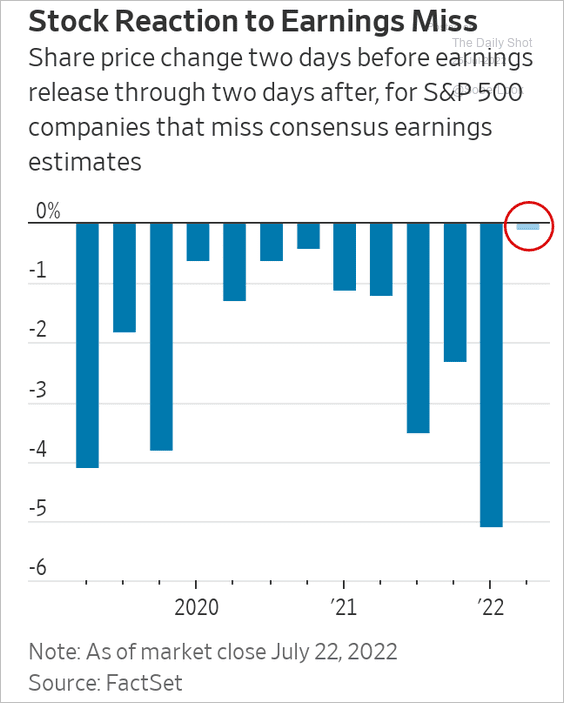

• The market has been very forgiving with the Q2 earnings misses.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

2. Last week’s rally is consistent with bearish positioning ahead of the earnings season.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. The S&P 500 has experienced a lot of whipsaws lately.

Source: SentimenTrader

Source: SentimenTrader

4. Financials held their long-term support.

Source: @allstarcharts

Source: @allstarcharts

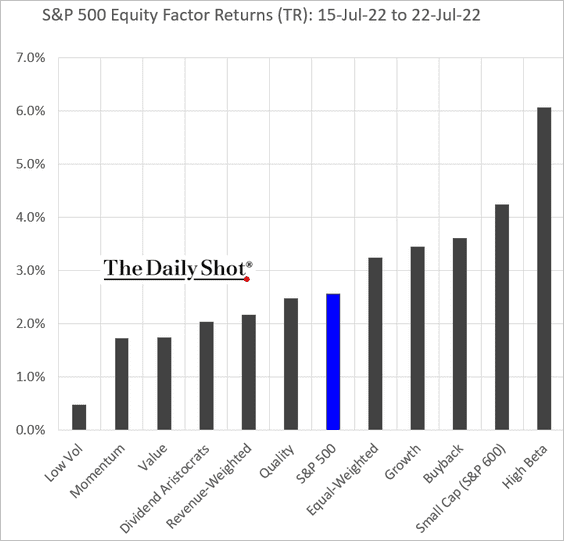

5. Next, we have some performance data from last week.

• Sectors:

• Factors:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. Financial fragility of households and corporations is rising, although still well below the historical average.

Source: S&P Global Ratings

Source: S&P Global Ratings

2. Here is last week’s performance by asset class.

Back to Index

Rates

1. Treasury yields dropped sharply last week, with the 30-year dipping below 3%.

Source: barchart.com

Source: barchart.com

• Real yields were down as well.

• Most fund managers see lower yields ahead.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. The inflation curve is becoming more inverted (the market is pricing steeper inflation declines ahead).

Source: Alpine Macro

Source: Alpine Macro

——————–

3. Periods of high inflation tend to see flatter yield curves relative to those with low inflation.

Source: Desjardins

Source: Desjardins

Back to Index

Global Developments

1. So far, the performance of commodities, equities, and fixed income have been in line with performance seen during previous high growth and inflation environments.

Source: Desjardins

Source: Desjardins

2. Here is a look at the sector composition across global equity markets.

Source: MRB Partners

Source: MRB Partners

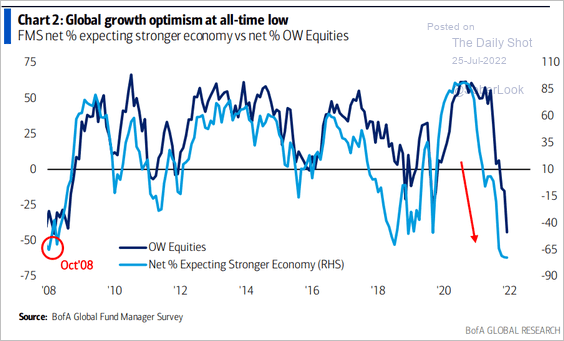

3. Fund managers’ economic growth optimism is below 2008 lows.

Source: BofA Global Research

Source: BofA Global Research

4. Next, we have last week’s performance data for advanced economies.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

1. Younger Democrats are less wedded to the party than older Democrats.

Source: The Economist Read full article

Source: The Economist Read full article

2. Views on policies surrounding transgender individuals by religious group:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

3. Interest in delivery by drone:

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

4. Maternal mortality rates:

Source: The Economist Read full article

Source: The Economist Read full article

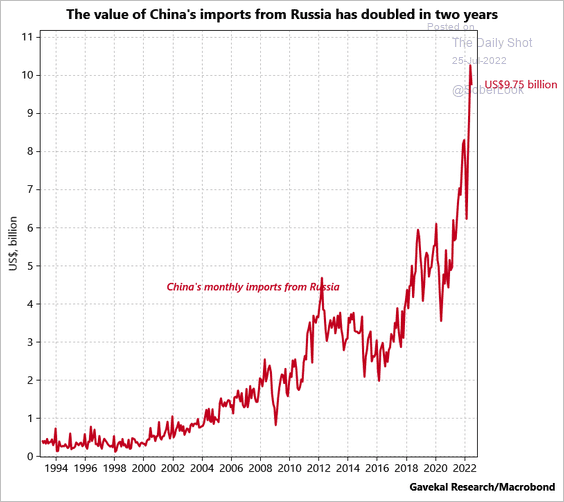

5. China’s imports from Russia:

Source: Gavekal Research

Source: Gavekal Research

6. Boeing airplane deliveries:

Source: @chartrdaily

Source: @chartrdaily

7. Cocaine slang terms, according to the DEA:

Source: @PotResearch Read full article

Source: @PotResearch Read full article

Back to Index