The Daily Shot: 13-Sep-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Once again, let’s begin with some updates on inflation.

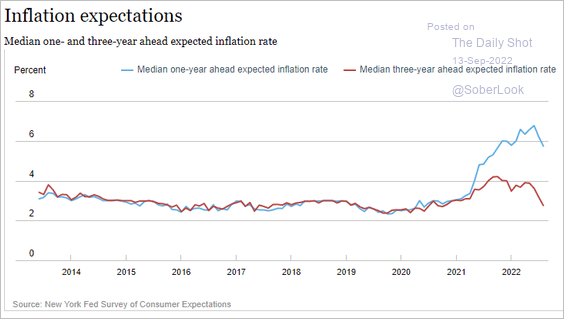

• Consumer inflation expectations continue to moderate …

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Source: Reuters Read full article

Source: Reuters Read full article

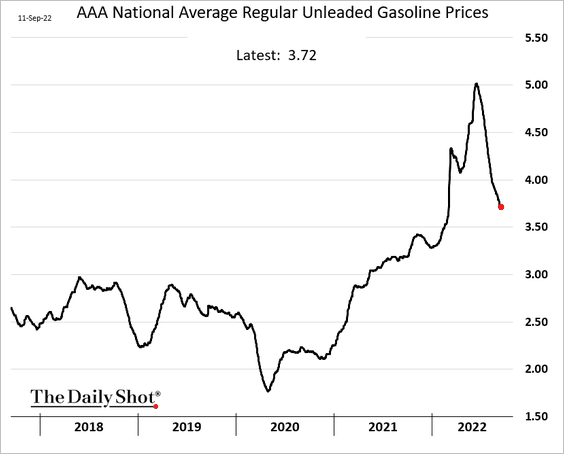

… as gasoline prices fall.

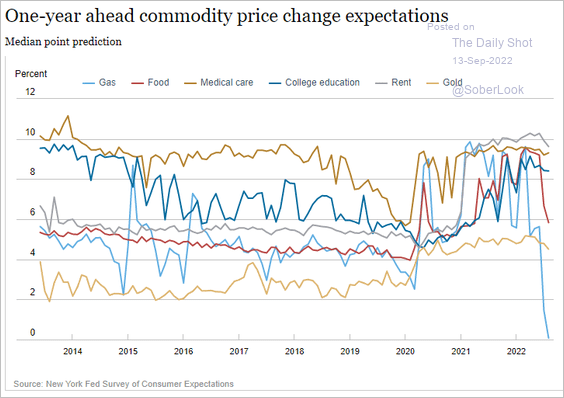

This chart shows households’ price change expectations for select items.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

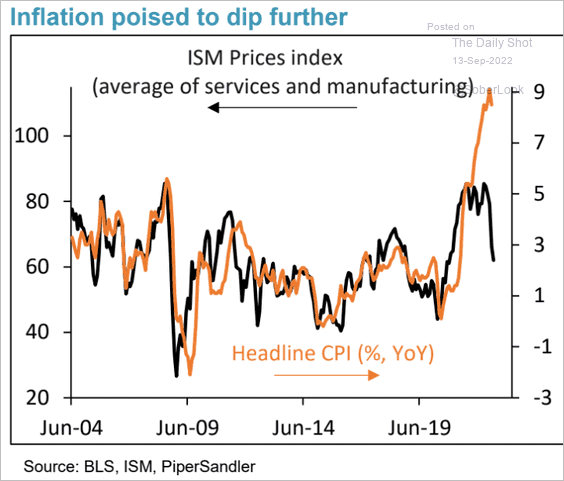

• The ISM PMI indicators (business surveys) point to easing inflationary pressures.

Source: Piper Sandler

Source: Piper Sandler

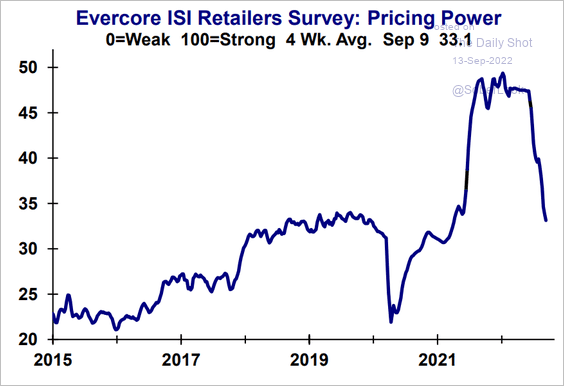

• Retailers’ pricing power is waning, according to a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

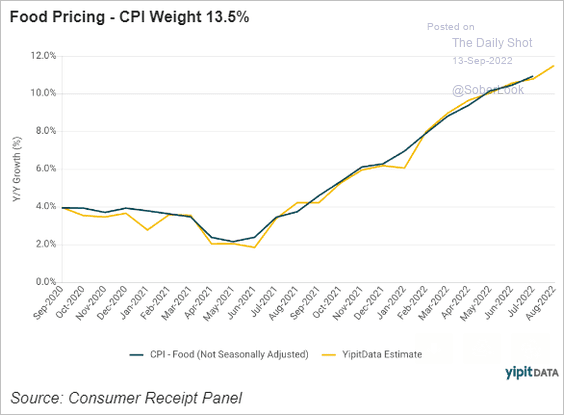

• Food inflation climbed further in August, according to YipitData.

Source: YipitData

Source: YipitData

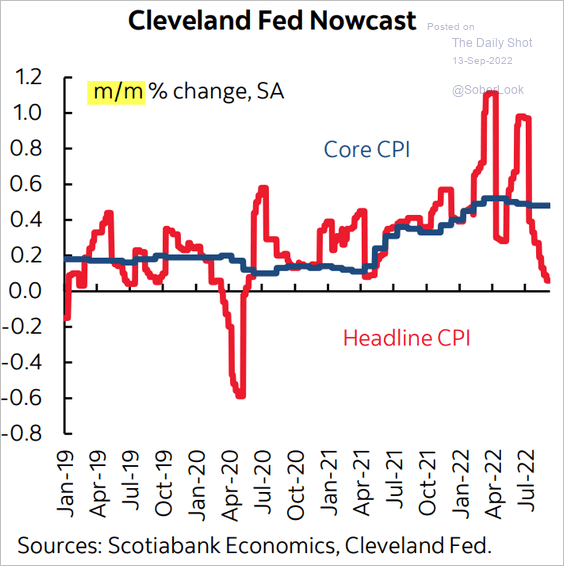

• The Cleveland Fed’s nowcast index shows elevated core inflation in August (similar to the estimates from Nomura).

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

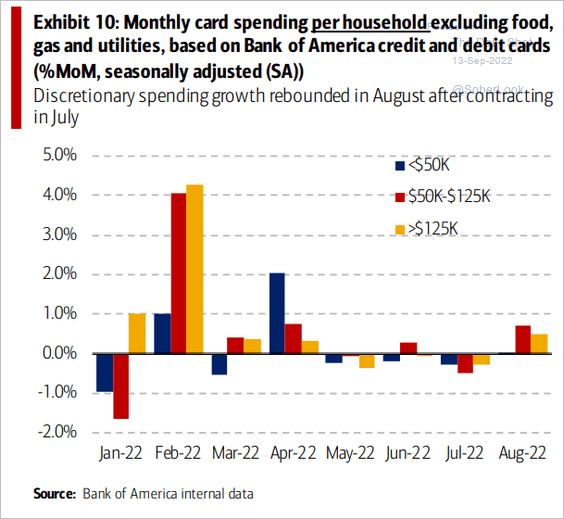

2. Credit card spending picked up in August, according to BofA.

Source: The Bank of America Institute

Source: The Bank of America Institute

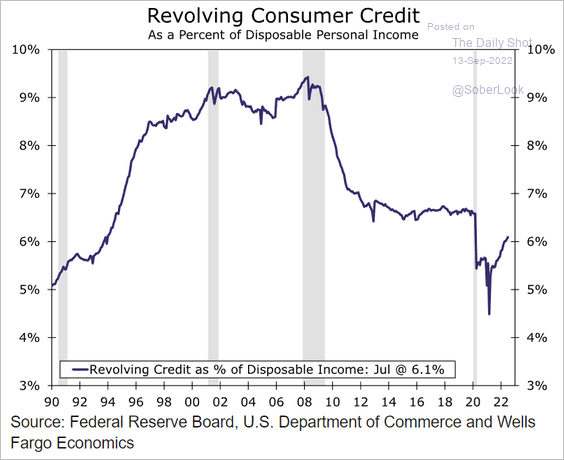

• Credit card debt as a share of disposable income remains below pre-COVID levels.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

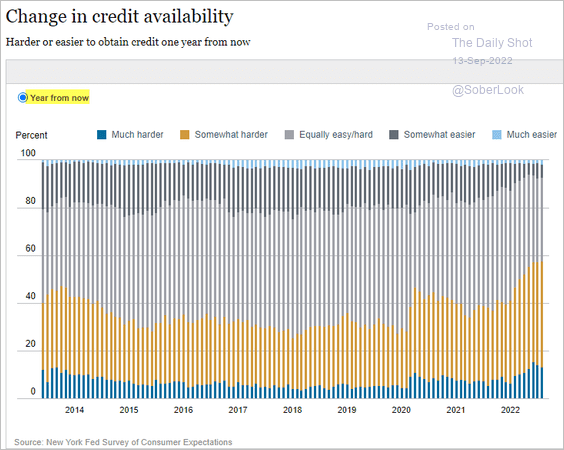

• Households expect tighter credit conditions ahead.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

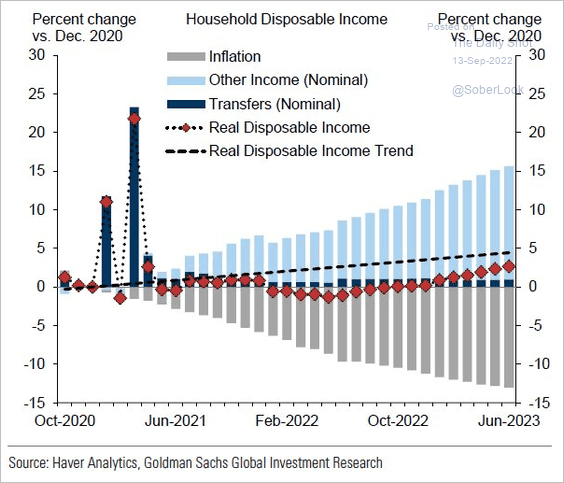

3. Real household income growth should return to positive territory by early next year, according to Goldman.

Source: Goldman Sachs; @tracyalloway

Source: Goldman Sachs; @tracyalloway

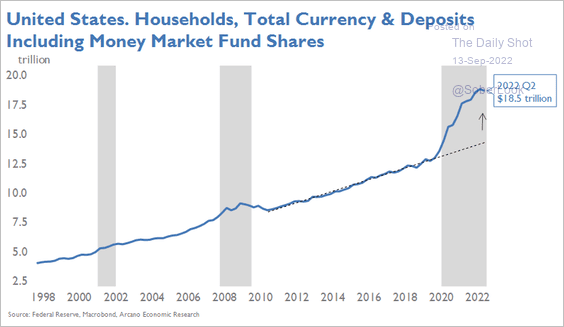

Households’ excess deposits remain elevated.

Source: Arcano Partners

Source: Arcano Partners

——————–

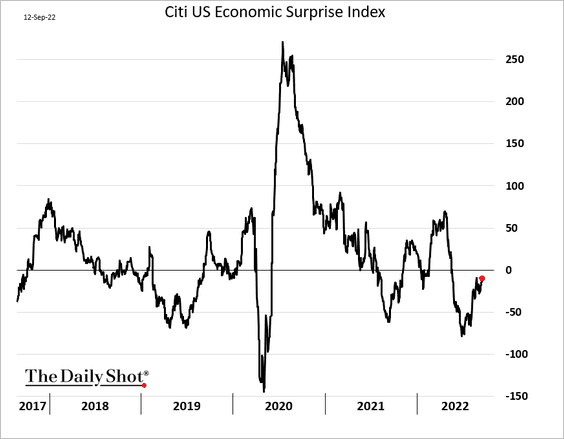

4. The Citi Economic Surprise Index is rebounding.

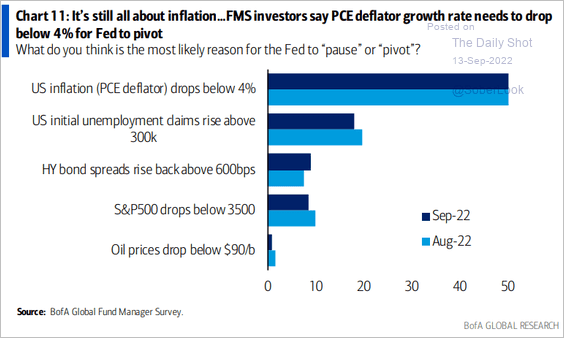

5. What could make the Fed “pivot” on rate hikes? (based on BofA’s survey of fund managers)

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Canada

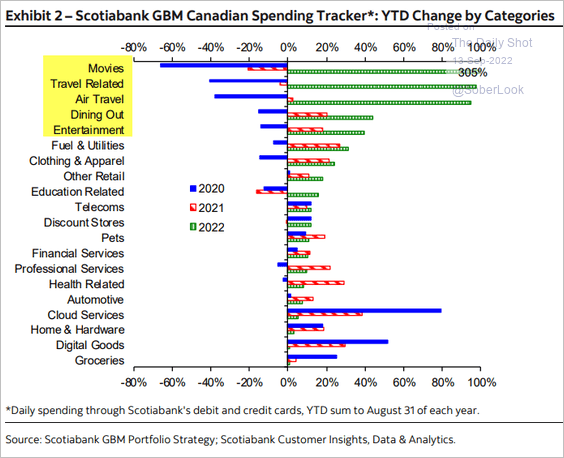

1. Canadians are spending on experiences this year.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

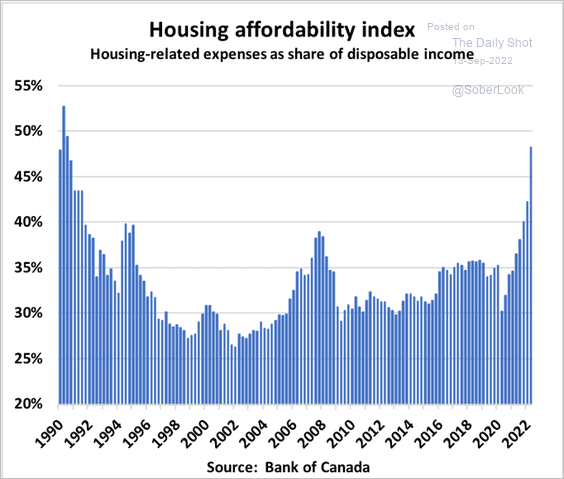

2. Housing affordability continues to worsen.

Source: @BenRabidoux

Source: @BenRabidoux

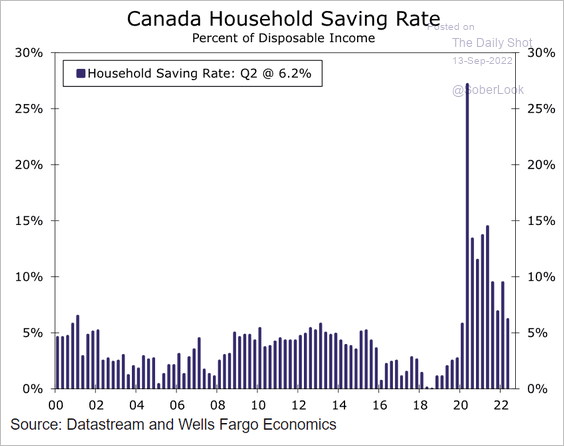

3. Canadians’ savings rate has been moderating.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

The United Kingdom

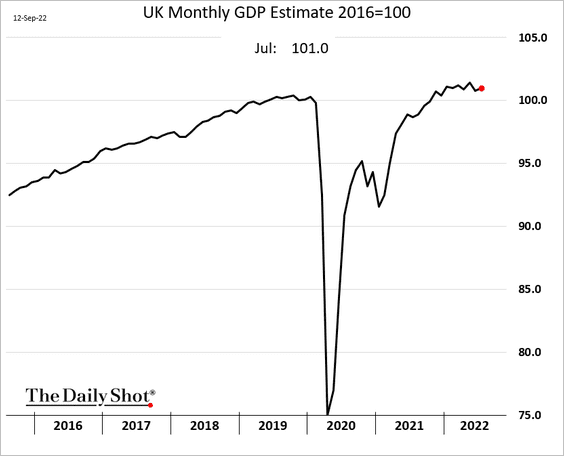

1. The GDP edged higher in July, but the gain was smaller than expected.

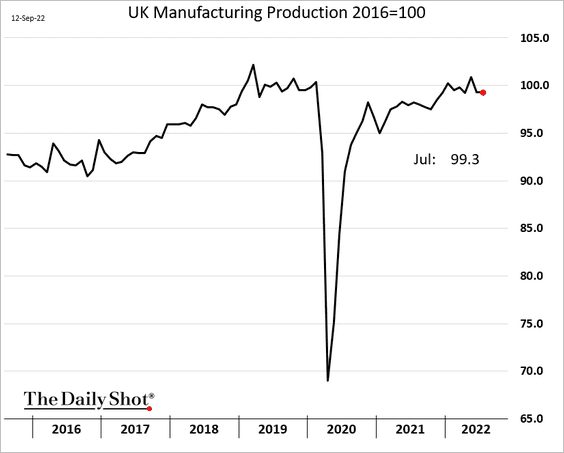

• Manufacturing production was unchanged.

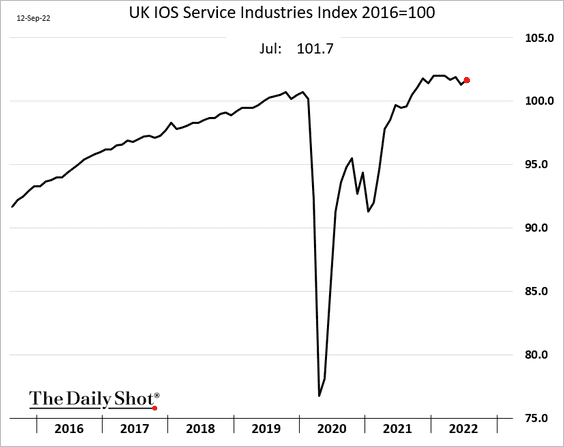

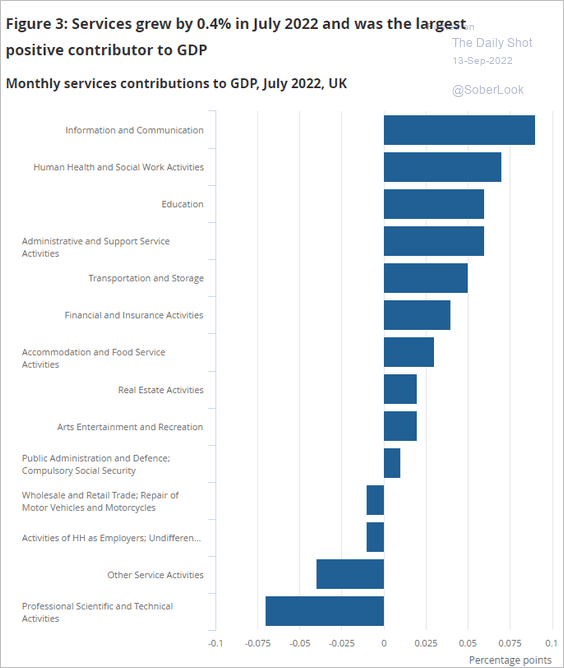

• Services output improved.

Source: ONS Read full article

Source: ONS Read full article

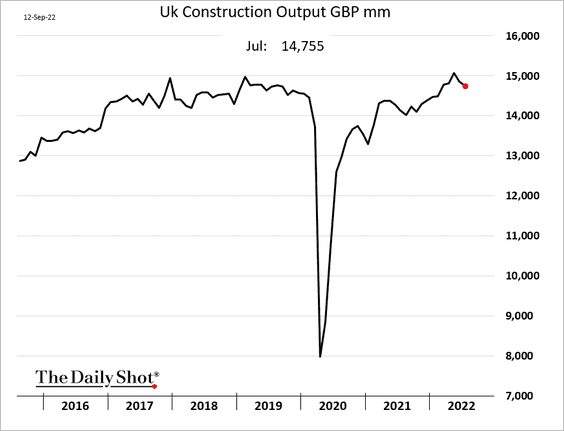

• Construction output continues to soften.

——————–

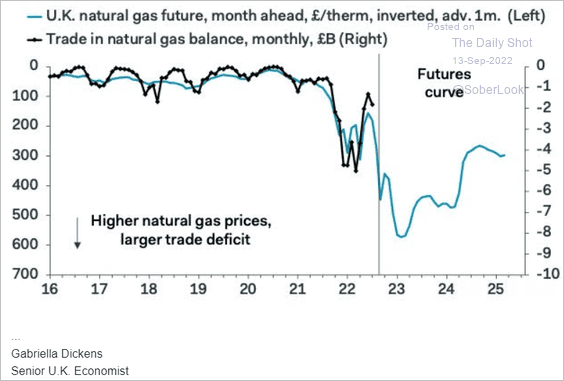

2. The trade balance will remain under pressure due to high natural gas costs.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

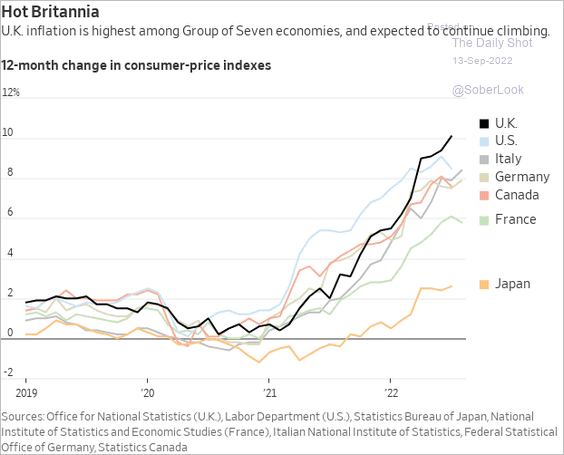

3. UK CPI has been outpacing other advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

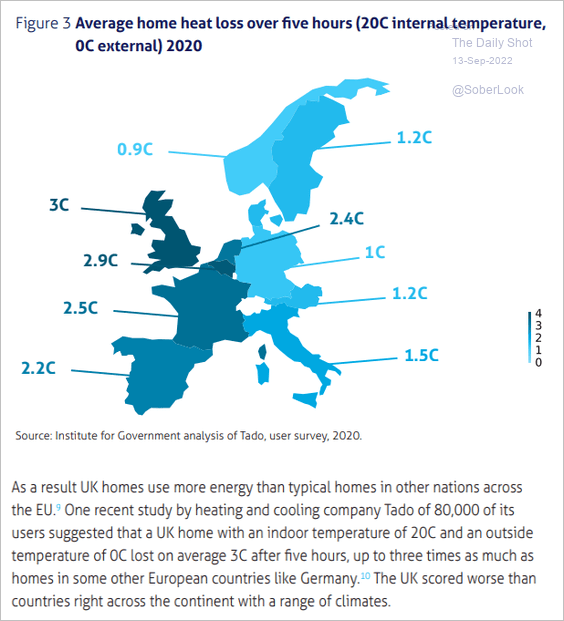

4. UK homes are not very energy-efficient.

Source: Institute for Government Read full article

Source: Institute for Government Read full article

Back to Index

The Eurozone

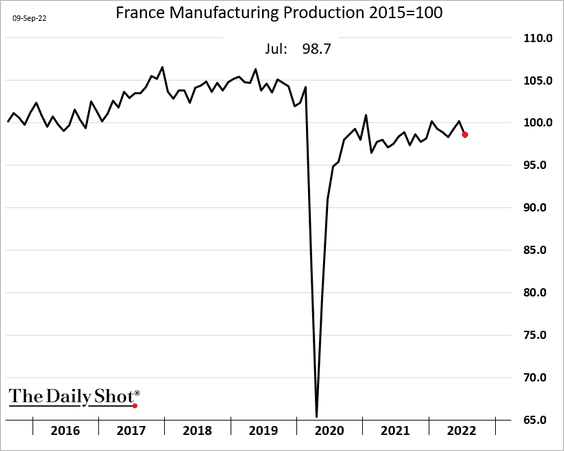

1. French manufacturing production declined in July, …

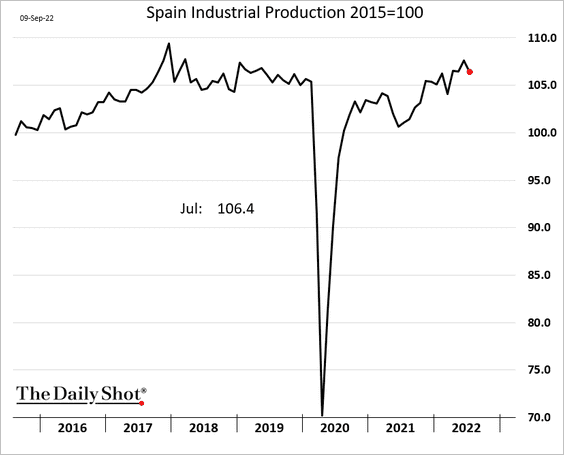

.. and so did Spain’s industrial production.

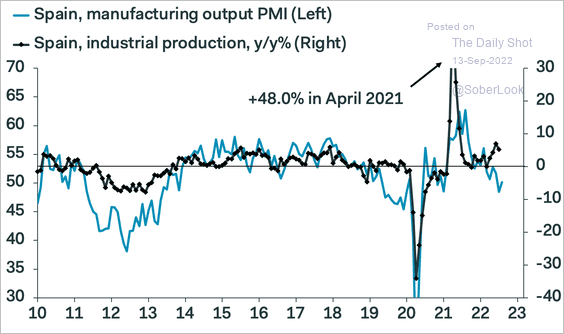

Spain’s industrial production could see further weakness ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

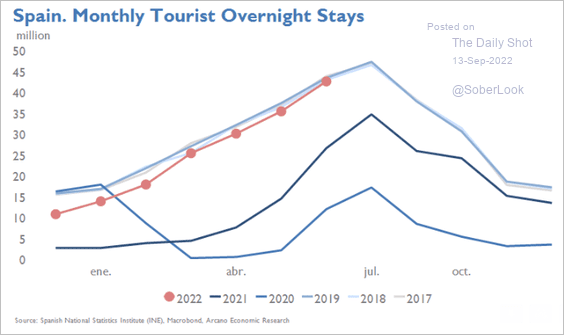

2. Spain’s tourism is nearing pre-COVID levels.

Source: Arcano Partners

Source: Arcano Partners

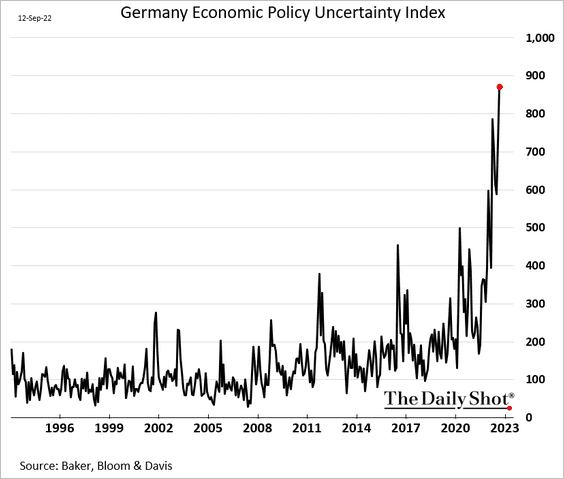

3. The Economic Policy Uncertainty Index for Germany hit a record high as the energy crisis takes a toll.

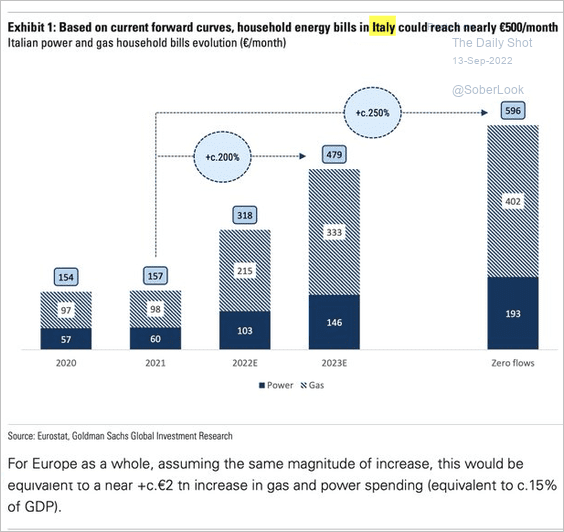

4. Italian household energy bills could reach nearly €500/month.

Source: @acemaxx, @GoldmanSachs

Source: @acemaxx, @GoldmanSachs

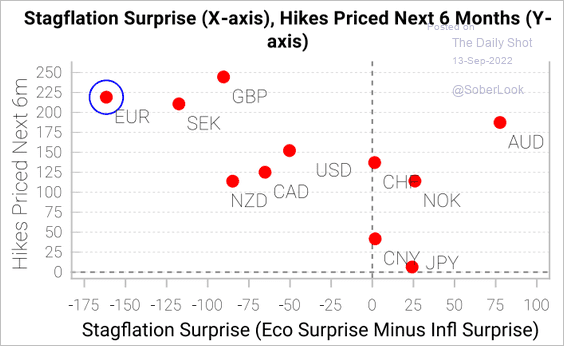

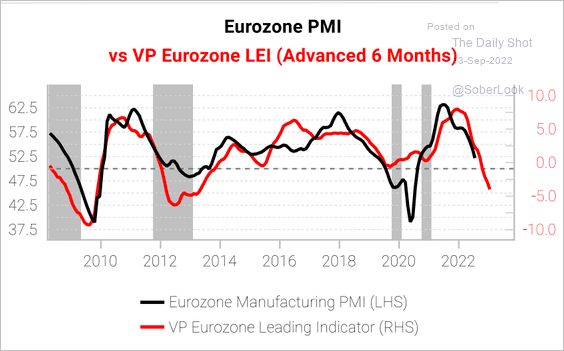

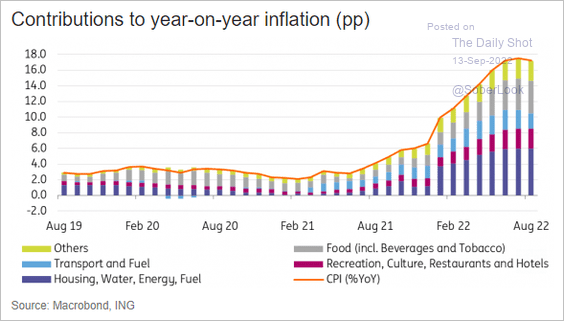

5. The Eurozone is facing stagflation just as the ECB ramps up rate hikes.

Source: Variant Perception

Source: Variant Perception

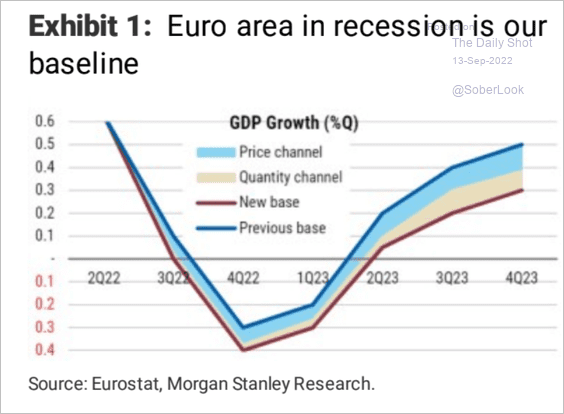

• Morgan Stanley expects a prolonged recession ahead.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Here is the Variant Perception’s leading index vs. the PMI.

Source: Variant Perception

Source: Variant Perception

——————–

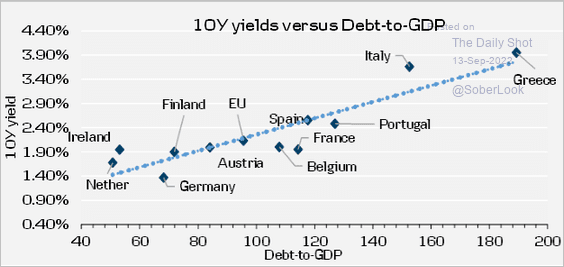

6. The Eurozone sovereign yields have lined up well with the debt-to-GDP ratios. Italy is a bit cheap due to election risks.

Source: @pietphc

Source: @pietphc

Back to Index

Europe

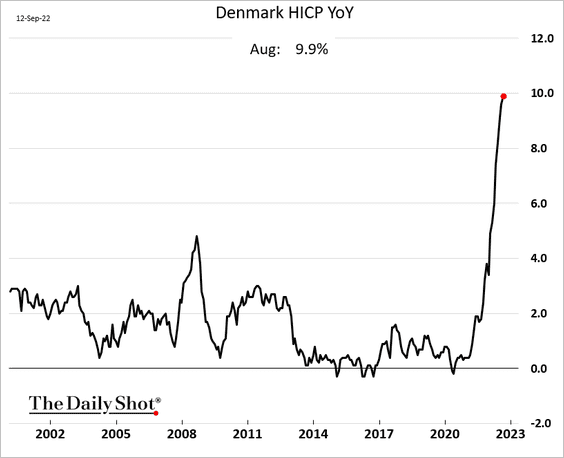

1. Denmark’s CPI is nearing 10%.

2. The Czech Republic’s CPI is starting to slow.

Source: ING

Source: ING

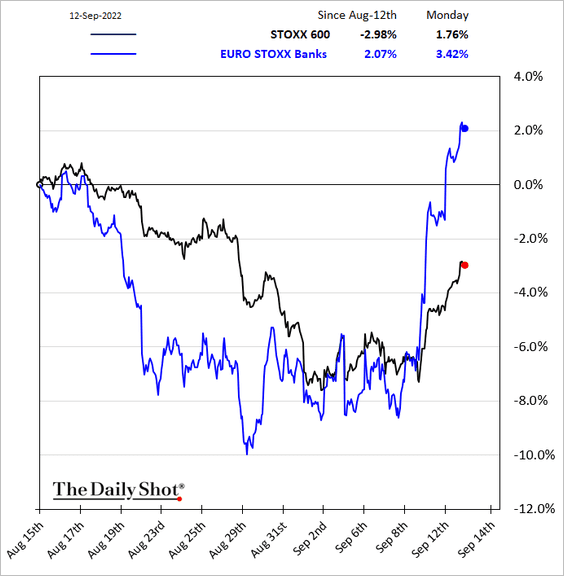

3. European bank shares have been outperforming in recent days.

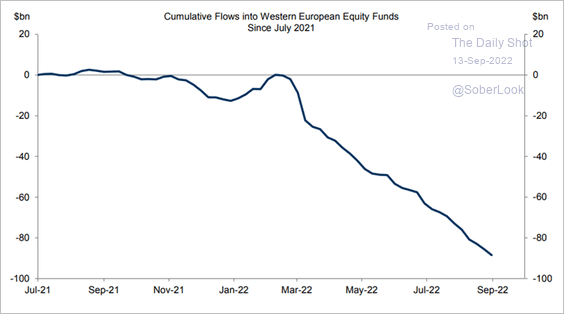

Outflows from European equities have been extreme, …

Source: @TCommodity

Source: @TCommodity

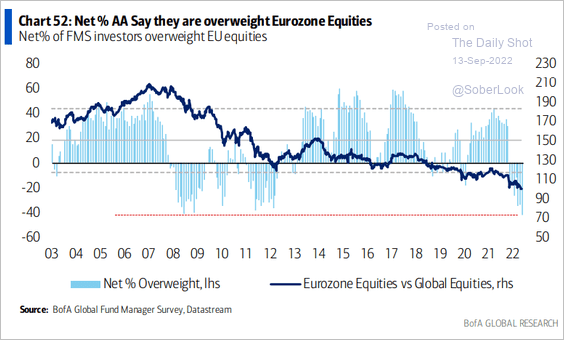

… amid bearish sentiment.

Source: BofA Global Research

Source: BofA Global Research

——————–

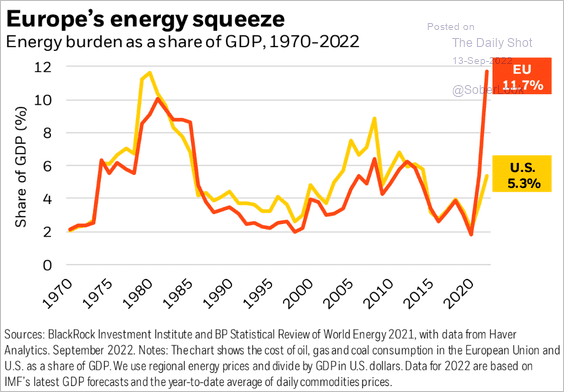

4. This chart shows the EU’s energy burden as a share of GDP compared to the US.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

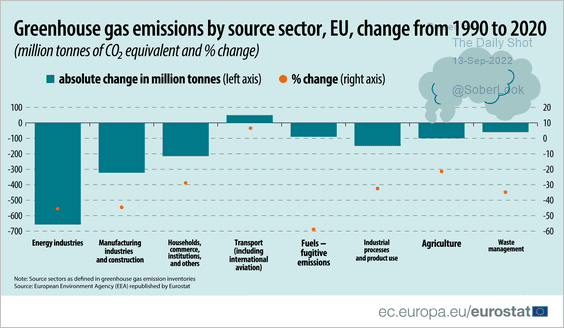

5. Finally, we have the EU’s decline in greenhouse gas emissions by industry.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

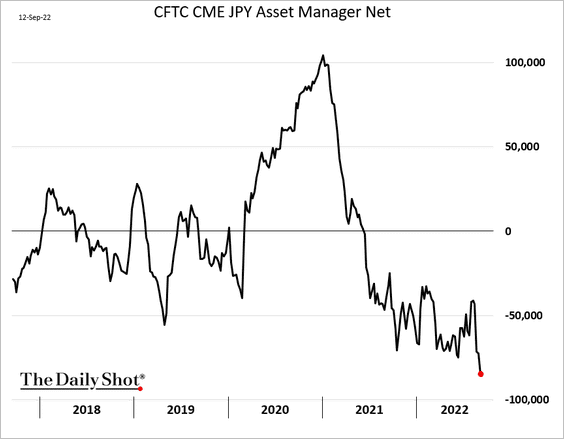

1. Asset managers are very bearish on the yen.

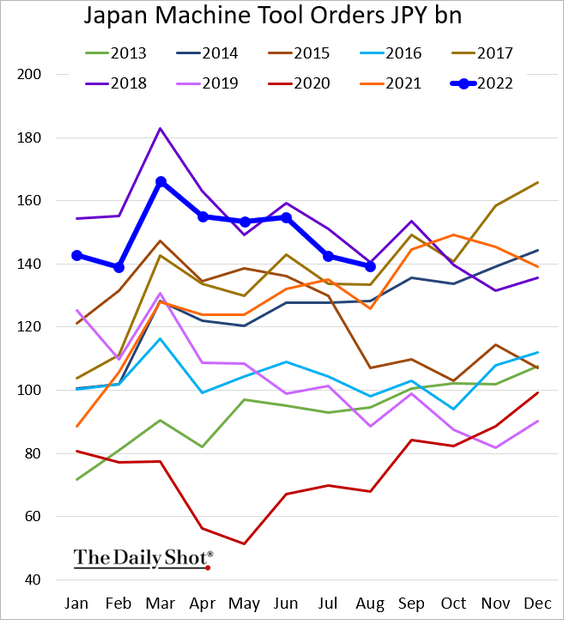

2. Machine tool orders have softened but remain above last year’s levels.

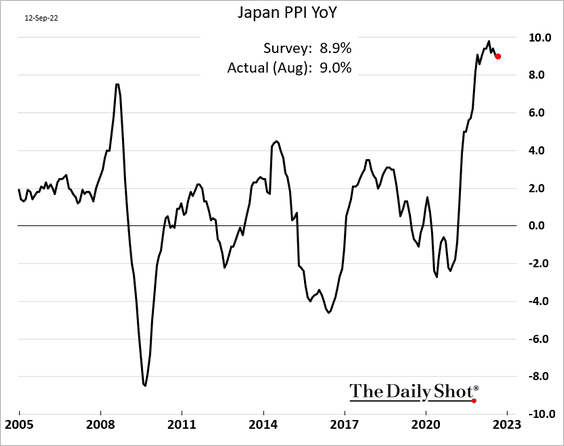

3. The PPI remains elevated.

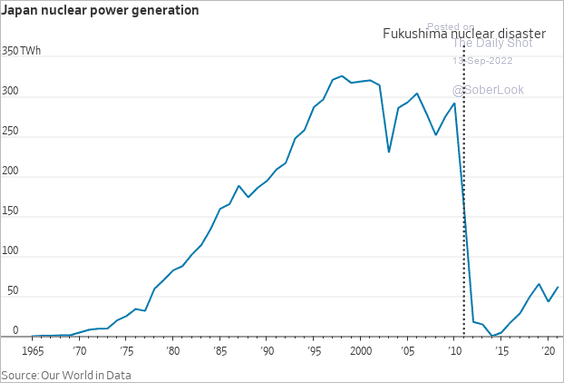

4. Nuclear power usage is starting to recover.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia – Pacific

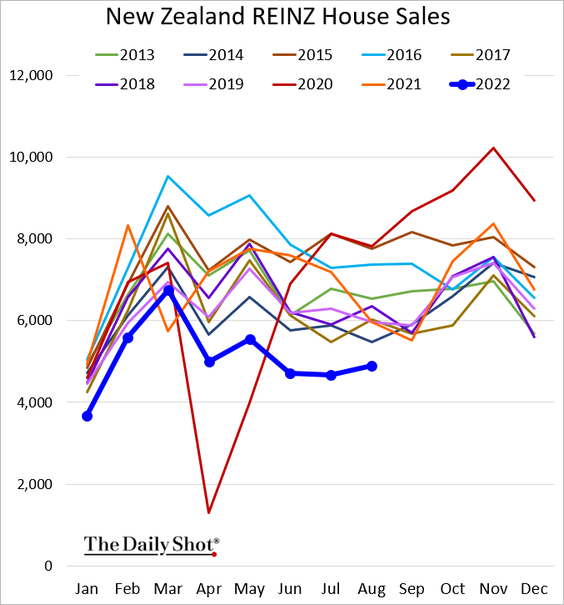

1. New Zealand’s home sales remain depressed.

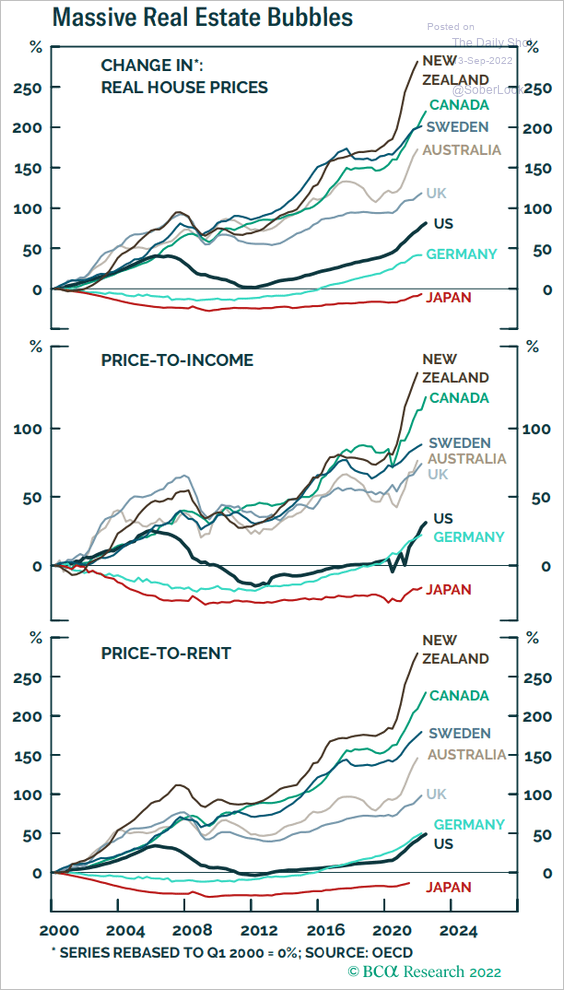

The nation’s housing market bubble has been extreme.

Source: BCA Research

Source: BCA Research

——————–

2. Next, we have some updates on Australia.

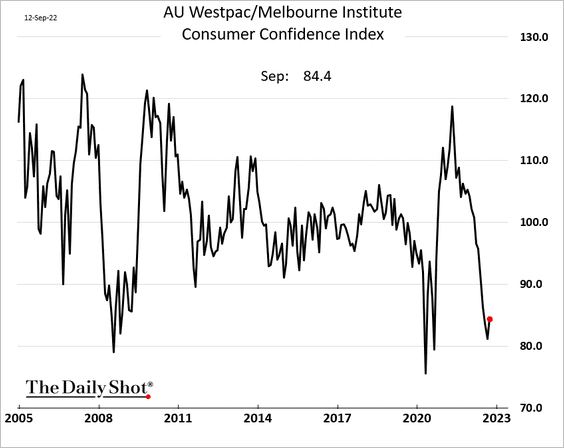

• Consumer confidence edged higher this month.

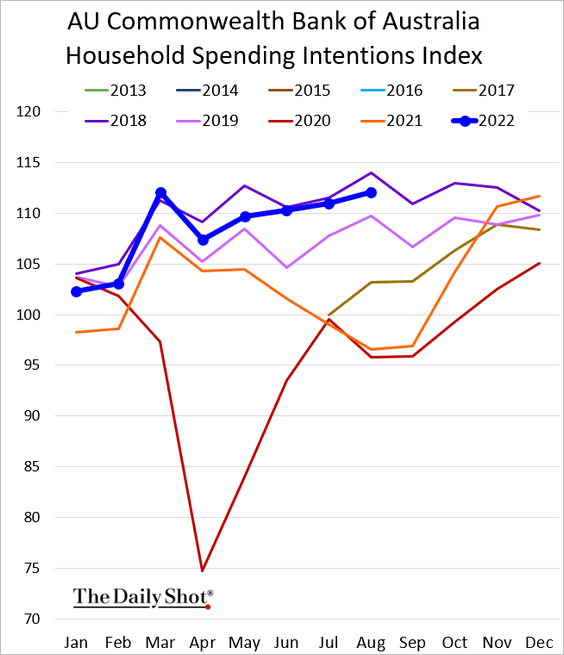

• Household spending intentions remain elevated.

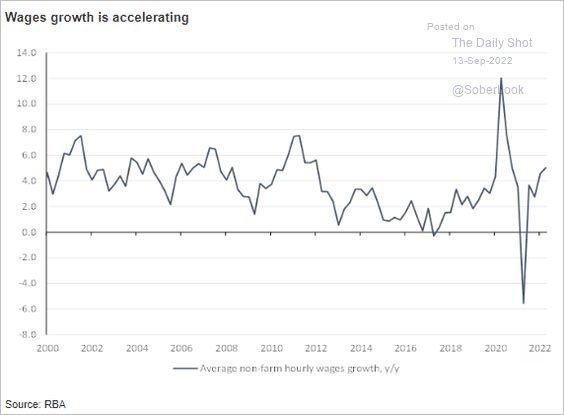

• Wage growth has been strengthening.

Source: @ANZ_Research

Source: @ANZ_Research

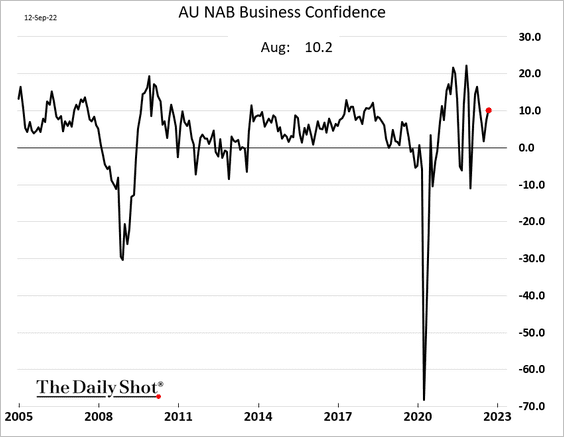

• Business confidence improved in August.

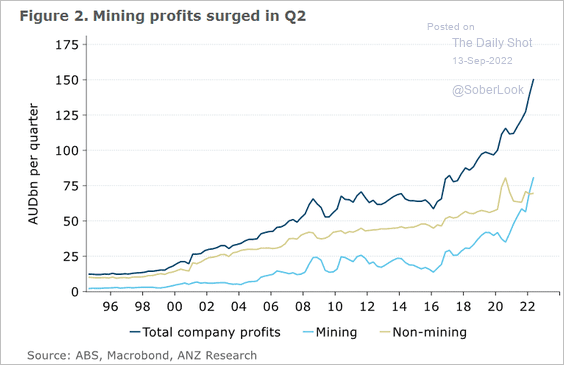

• Business profits have been surging, driven by mining.

Source: @ANZ_Research

Source: @ANZ_Research

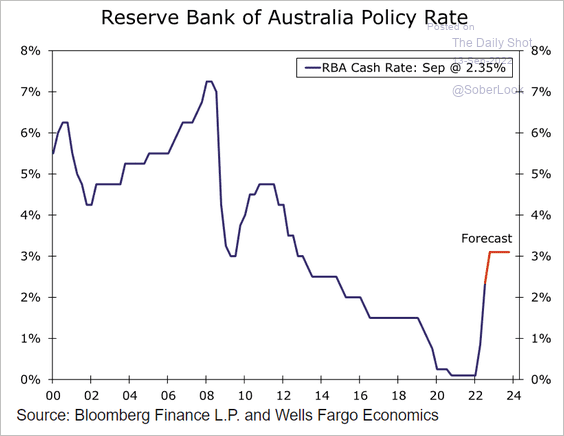

• How much will the RBA raise rates from here? Below is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

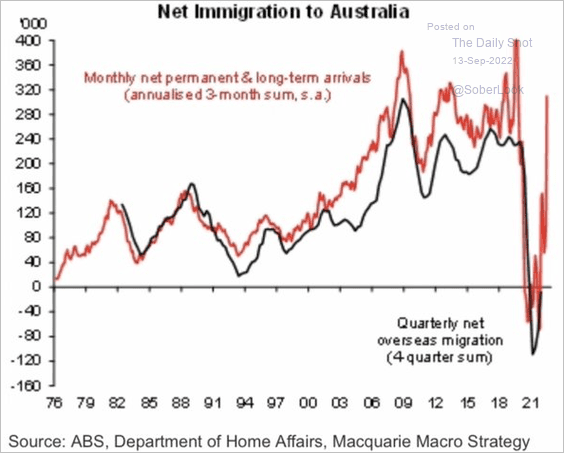

• Immigration is rebounding.

Source: Macquarie Macro Strategy; @ShaneOliverAMP

Source: Macquarie Macro Strategy; @ShaneOliverAMP

Back to Index

China

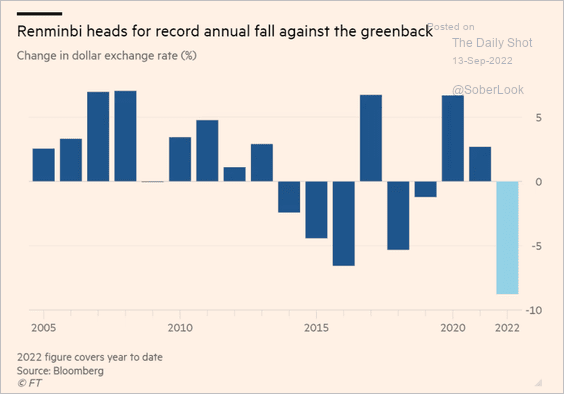

1. The renminbi’s decline this year has been extreme.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

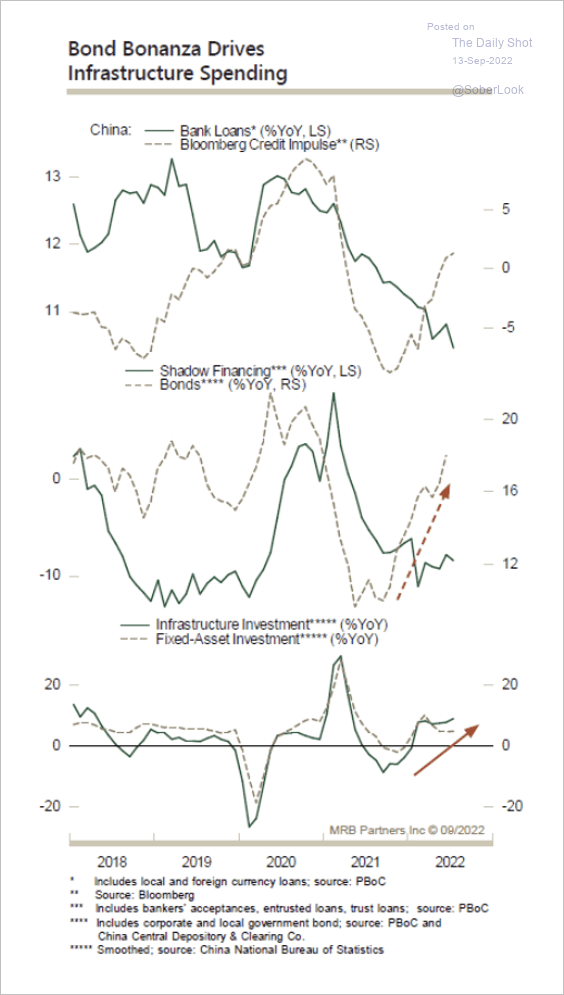

2. The surge in bond issuance and a trough in the credit impulse have driven infrastructure spending.

Source: MRB Partners

Source: MRB Partners

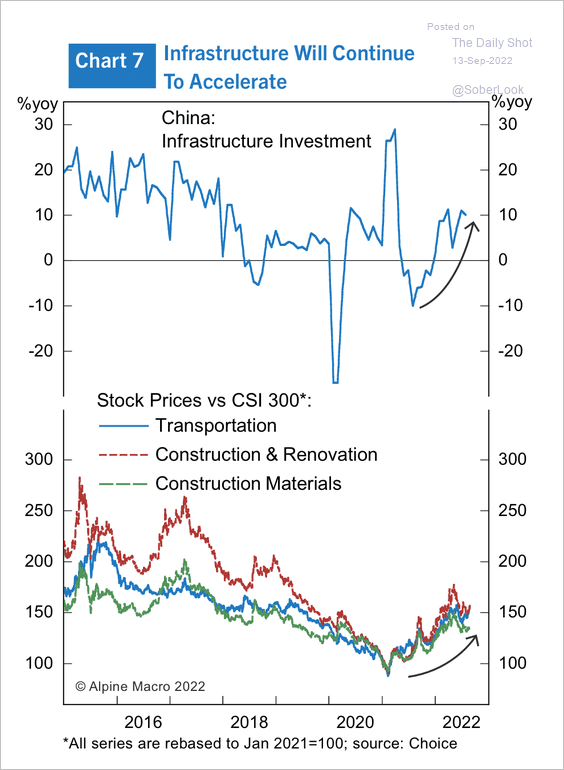

• Infrastructure has been a bright spot.

Source: Alpine Macro

Source: Alpine Macro

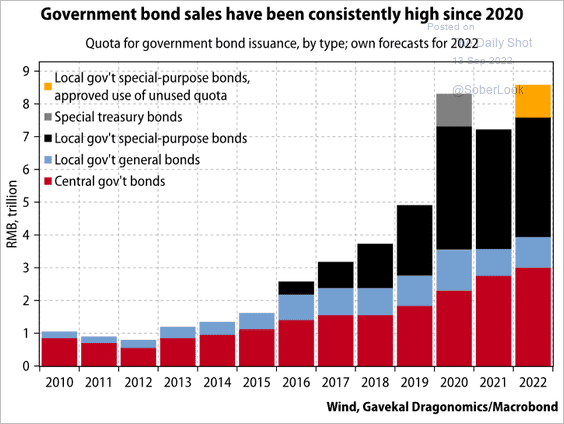

• Here are China’s government bond sales.

Source: Gavekal Research

Source: Gavekal Research

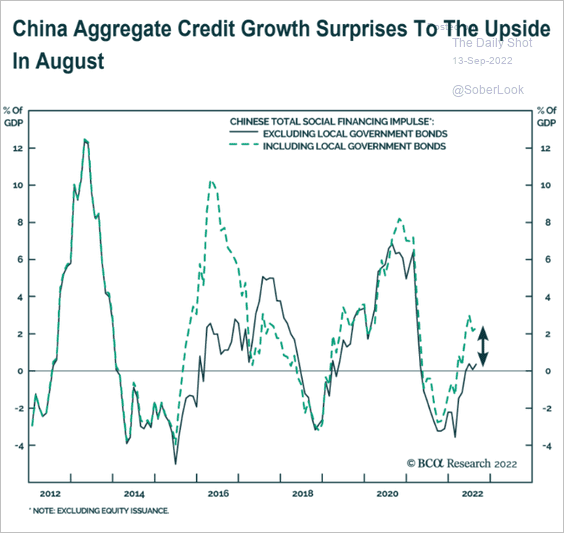

• Local government debt issuance boosted total credit expansion.

Source: BCA Research

Source: BCA Research

——————–

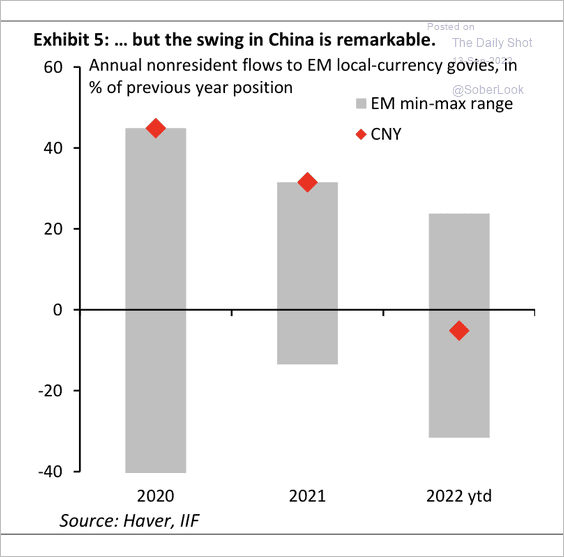

3. Flows into Chinese local government bonds took a sharp turn negative last quarter.

Source: IIF

Source: IIF

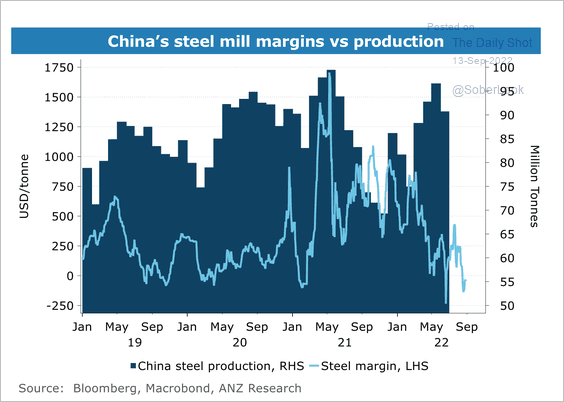

4. Steel mill margins continue to weaken.

Source: @ANZ_Research

Source: @ANZ_Research

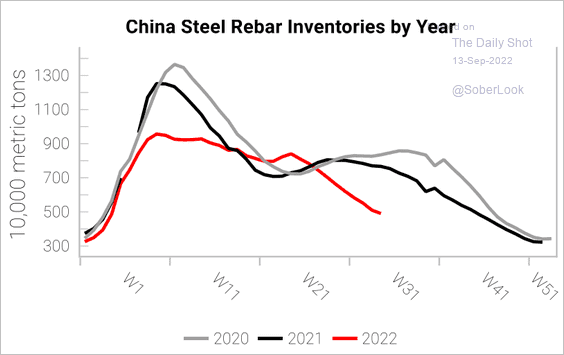

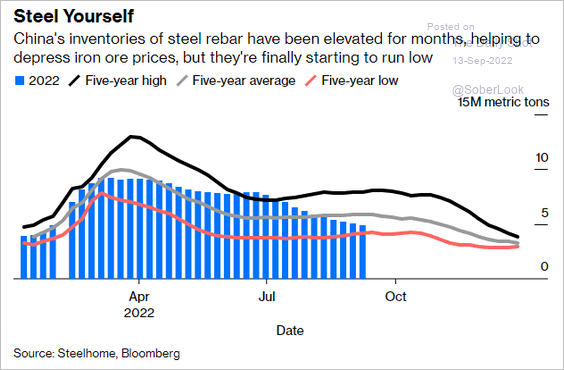

Steel and iron ore inventories are falling (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Emerging Markets

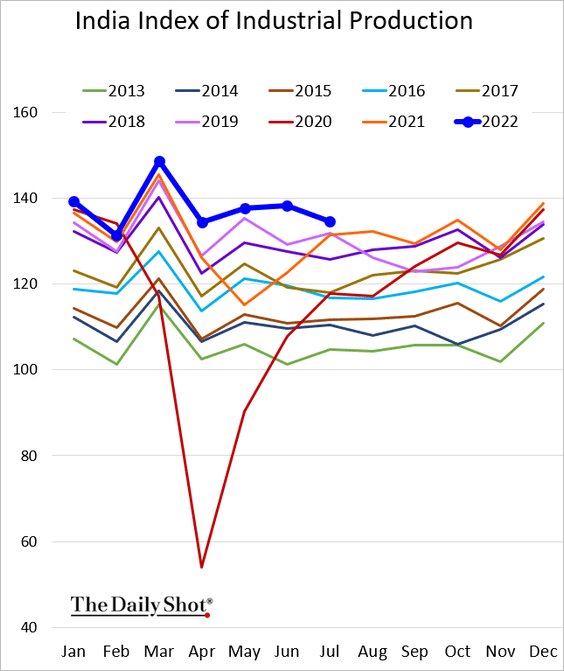

1. India’s industrial production remains robust.

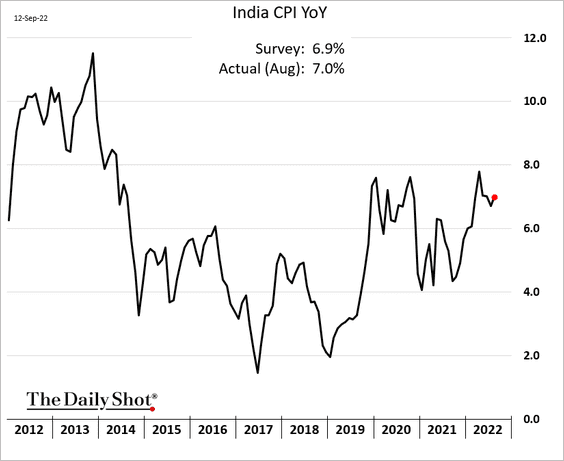

• Inflation ticked higher in August.

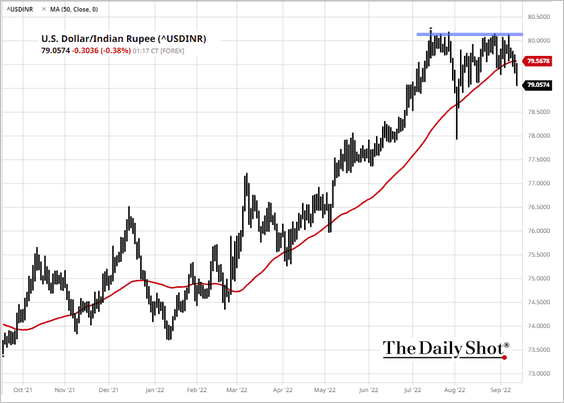

• The rupee is rebounding (USD/INR held resistance slightly above 80).

Source: barchart.com

Source: barchart.com

——————–

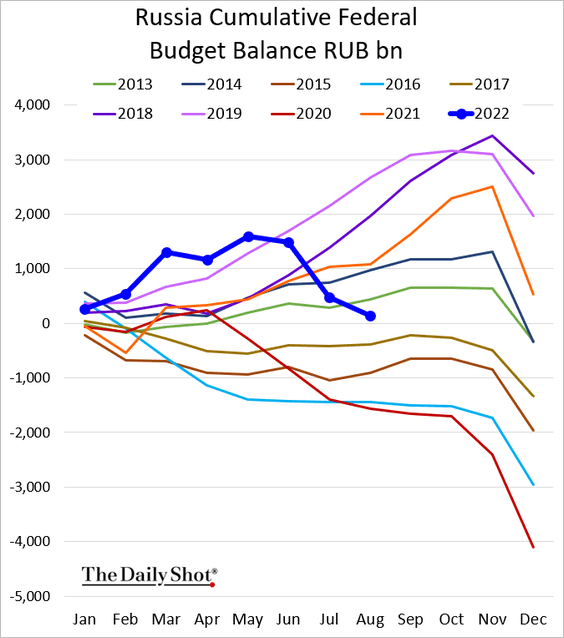

2. Waging war has become a costly affair for Russia, even with a surge in energy income.

Source: Russian Ministry of Finance

Source: Russian Ministry of Finance

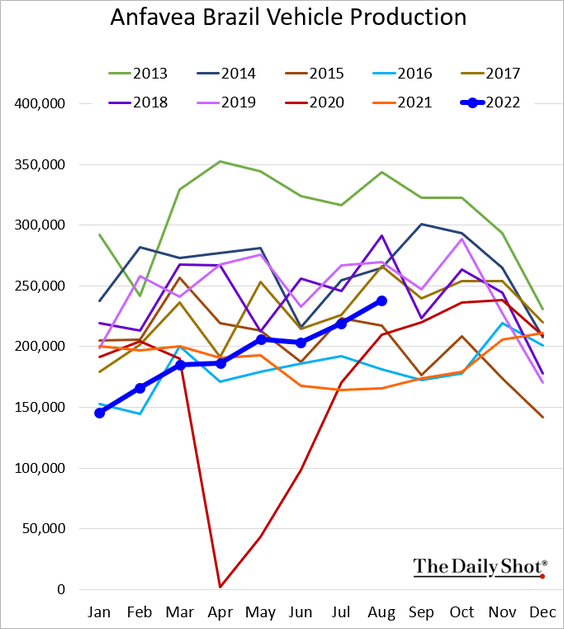

3. Brazil’s vehicle production is rebounding.

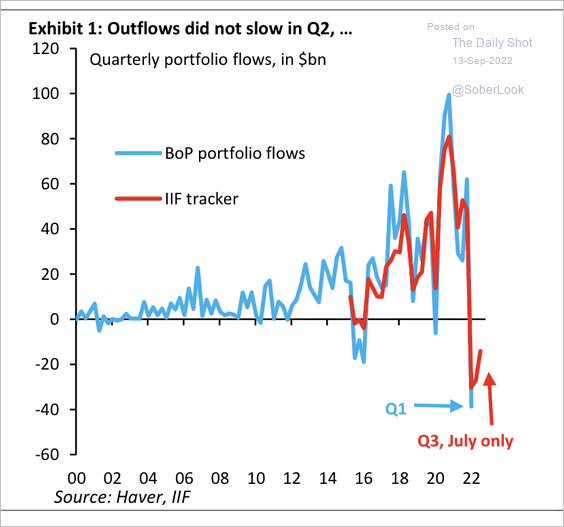

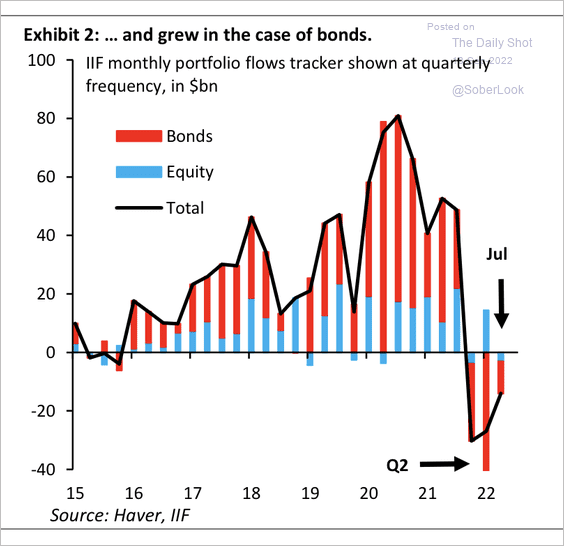

4. Outflows from local-currency government bonds remained exceptionally large last quarter, more than equities. (2 charts)

Source: IIF

Source: IIF

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

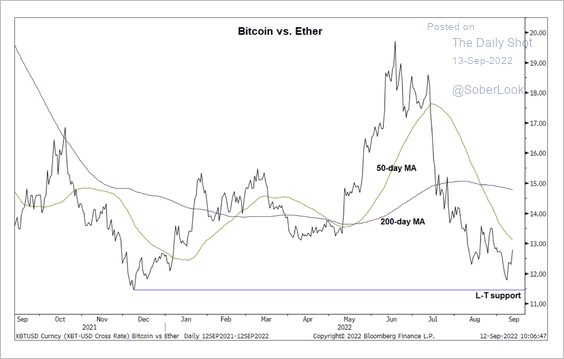

1. Bitcoin is above its 50-day moving average.

2. The BTC/ETH price ratio is holding support, which typically reflects a more defensive tone among crypto traders.

Source: @StocktonKatie

Source: @StocktonKatie

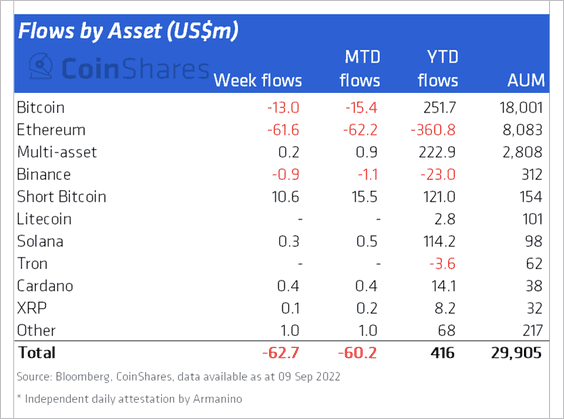

3. Crypto funds experienced outflows for the fifth consecutive week, driven by Ethereum-focused products.

Source: CoinShares Read full article

Source: CoinShares Read full article

Canadian crypto funds saw the most outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

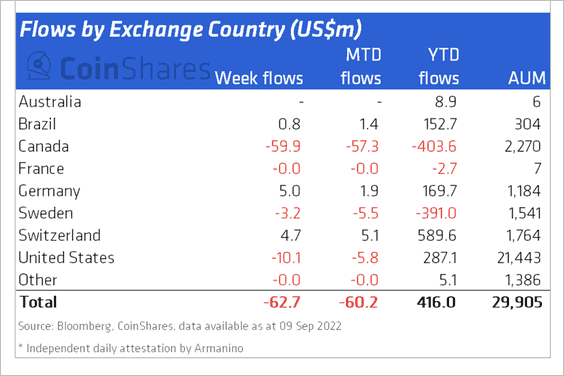

4. This chart shows the spot transaction volume across crypto exchanges.

Source: Blue Room

Source: Blue Room

Back to Index

Commodities

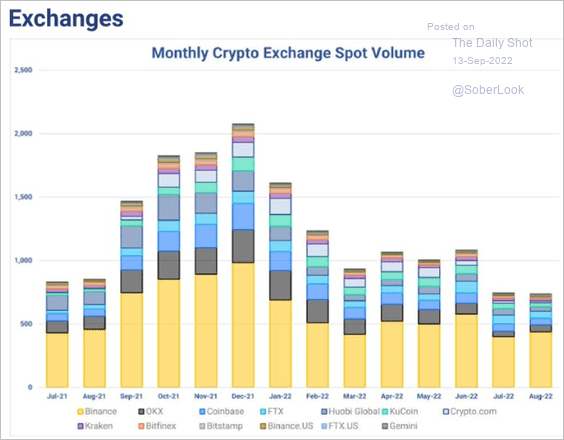

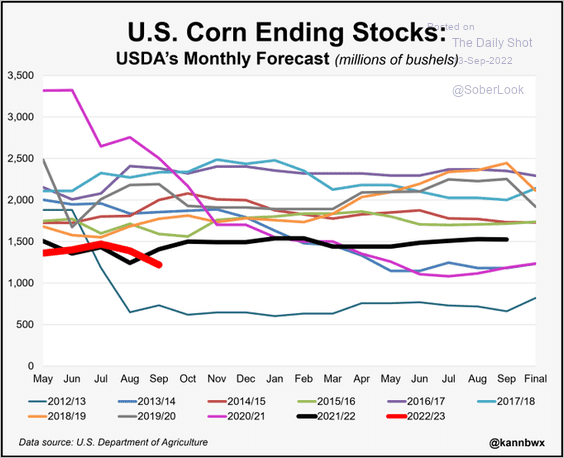

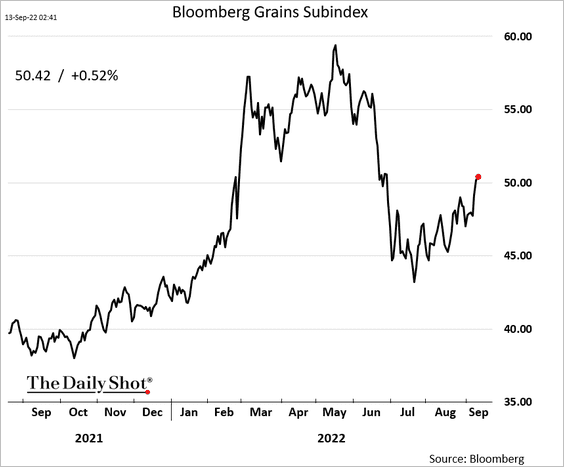

US soy and corn inventories are low for this time of the year.

Source: @kannbwx

Source: @kannbwx

Source: @kannbwx

Source: @kannbwx

Grain prices are rebounding.

Back to Index

Energy

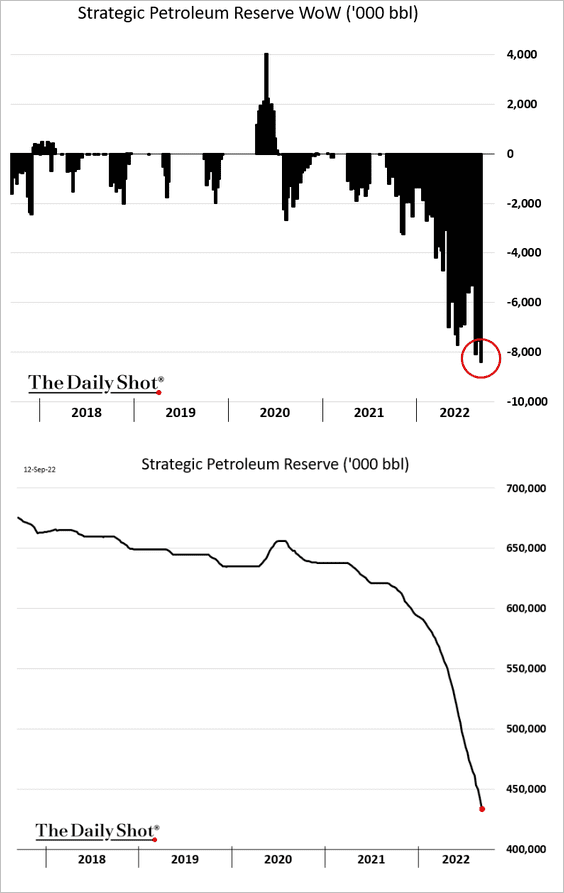

1. The US registered its largest oil release from the Strategic Petroleum Reserve last week.

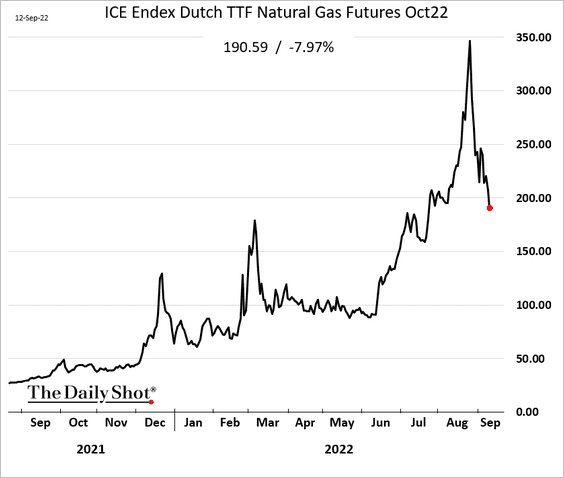

2. European natural gas futures continue to fall.

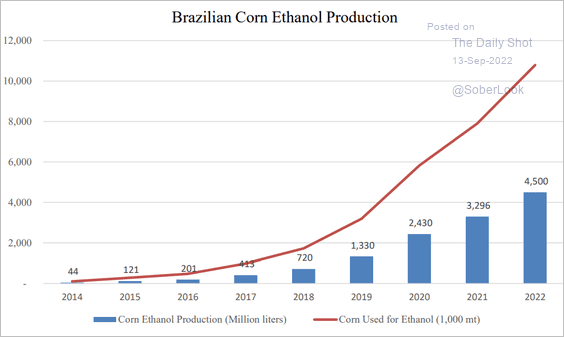

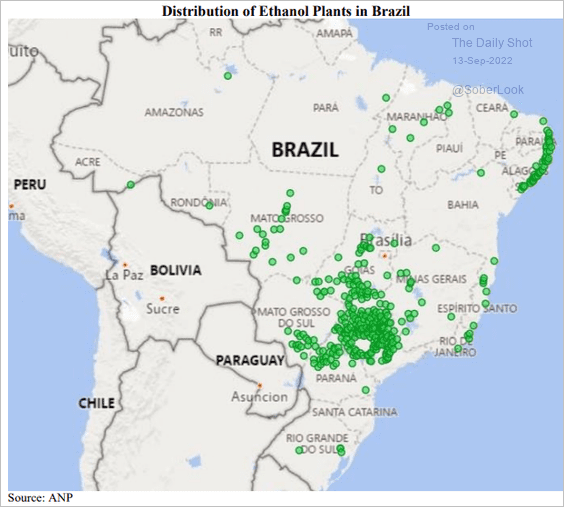

3. Brazil’s ethanol production keeps climbing.

Source: USDA Read full article

Source: USDA Read full article

Source: USDA Read full article

Source: USDA Read full article

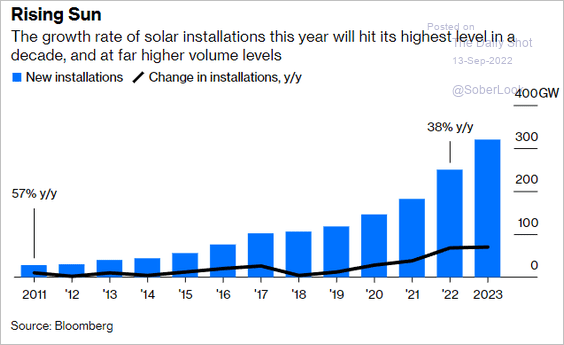

4. Solar installations are surging.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

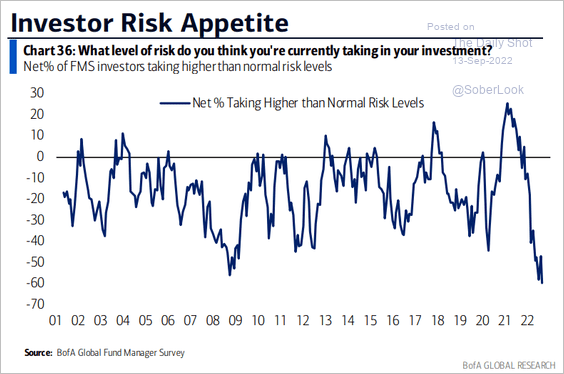

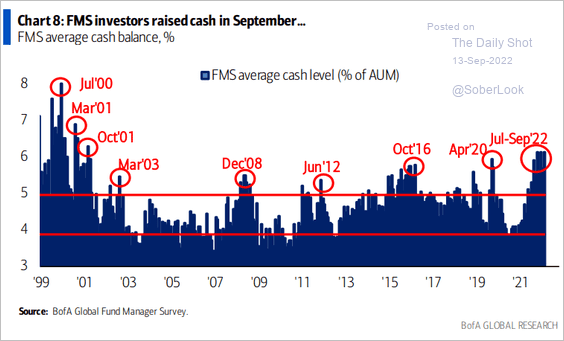

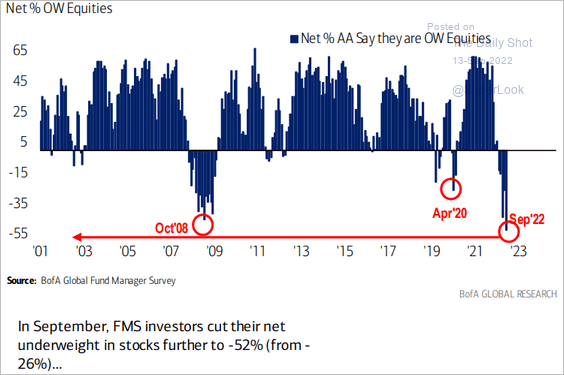

1. Professional investors’ risk aversion has reached extreme levels, according to BofA’s fund manager survey.

• Risk appetite:

Source: BofA Global Research

Source: BofA Global Research

• Cash levels:

Source: BofA Global Research

Source: BofA Global Research

• Allocation to equities:

Source: BofA Global Research

Source: BofA Global Research

——————–

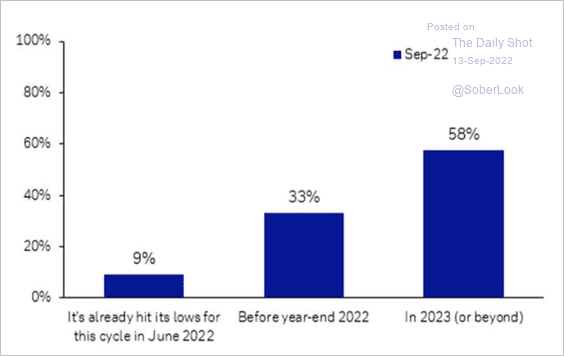

2. Most institutional investors surveyed by Deutsche Bank expect the S&P 500 to reach cycle lows in 2023 or beyond.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

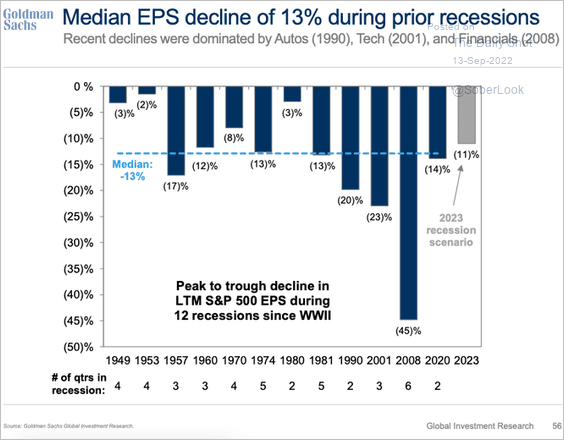

3. How much of a decline in earnings should we expect in a recession scenario?

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

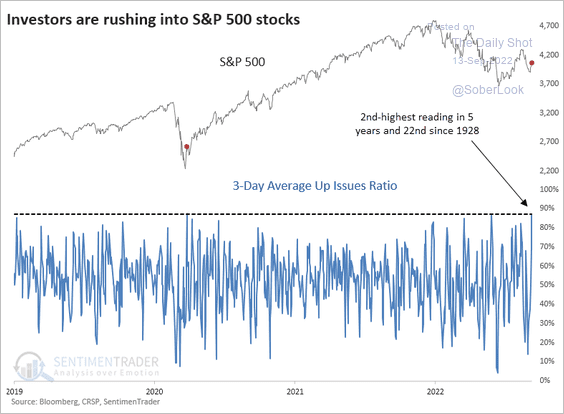

4. The current rebound has been broad.

Source: SentimenTrader, h/t @pav_chartbook

Source: SentimenTrader, h/t @pav_chartbook

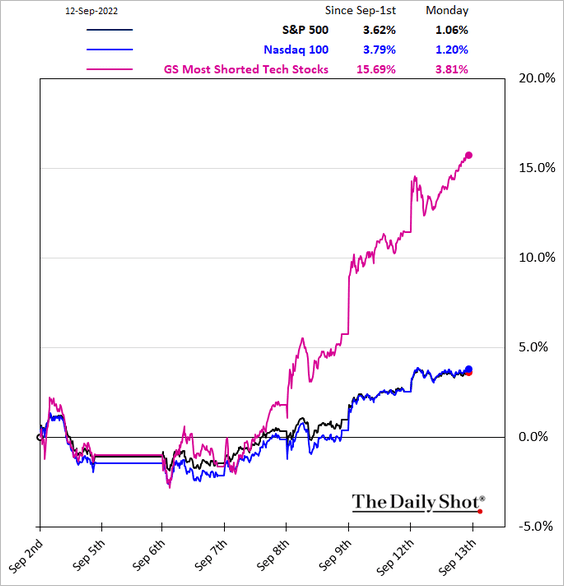

5. Most-shorted tech names staged a sharp rally in recent days amid short-covering.

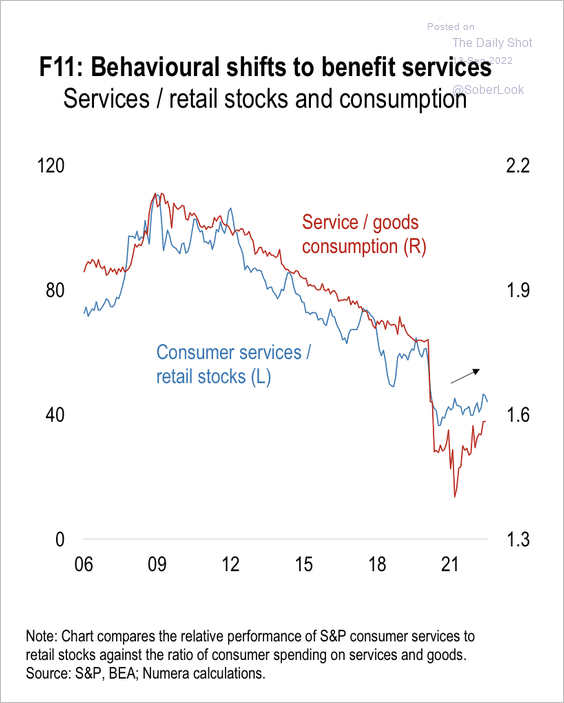

6. A shift in spending patterns away from goods should benefit consumer services over retail stocks.

Source: Numera Analytics

Source: Numera Analytics

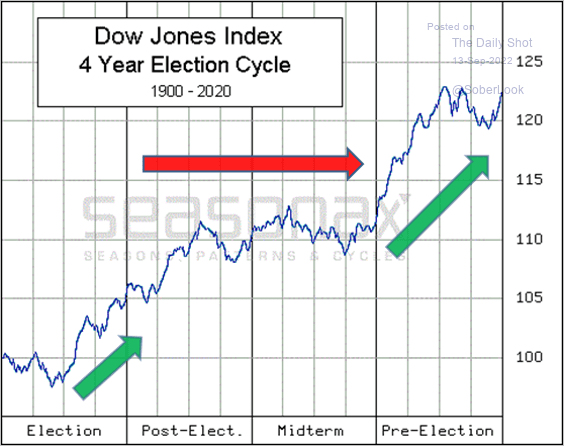

7. The US market tends to strengthen after the midterm elections.

Source: @MikeZaccardi

Source: @MikeZaccardi

Back to Index

Credit

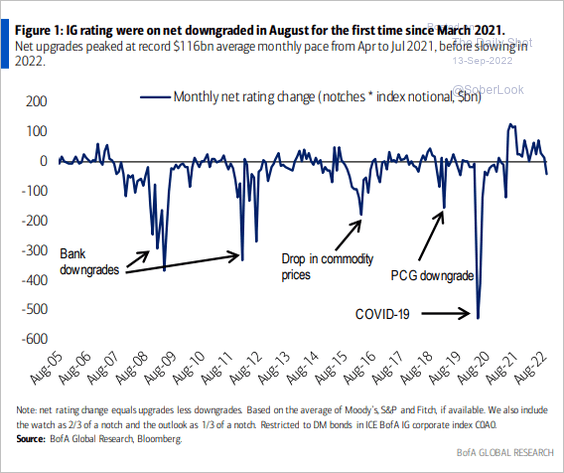

1. Investment-grade bond ratings shifted to net downgrades in August.

Source: BofA Global Research

Source: BofA Global Research

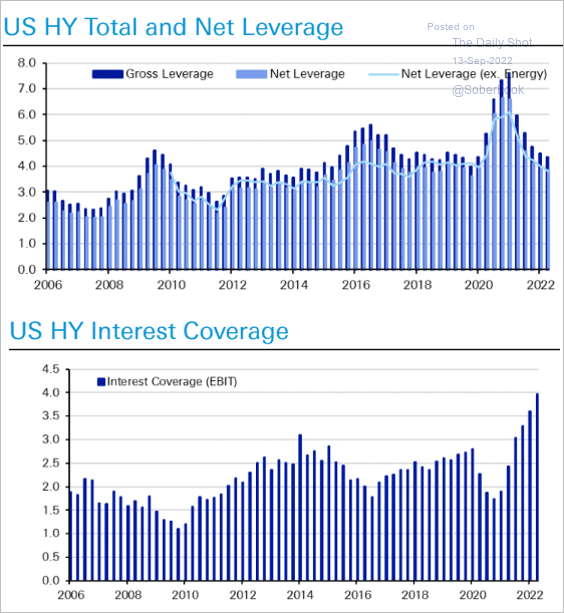

2. US HY leverage is back at pre-COVID levels. Interest coverage continues to climb.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

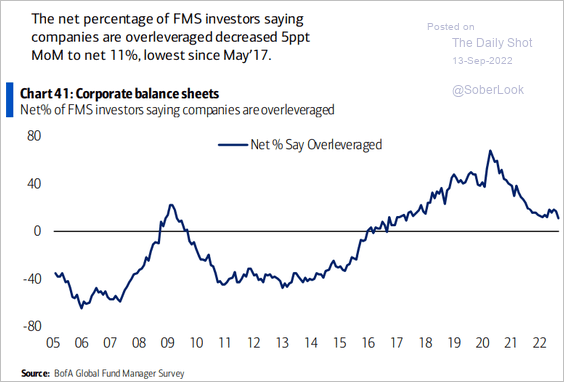

Investors don’t consider companies to be overleveraged anymore.

Source: BofA Global Research

Source: BofA Global Research

——————–

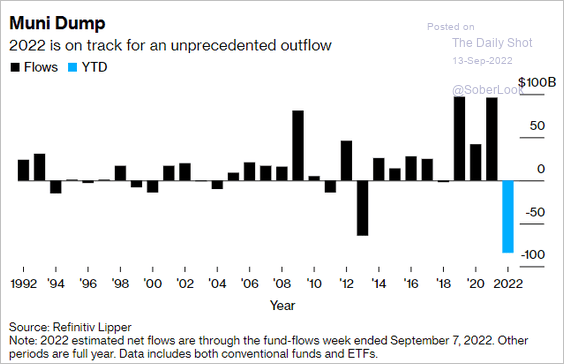

3. Outflows from muni funds this year have been unprecedented.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Rates

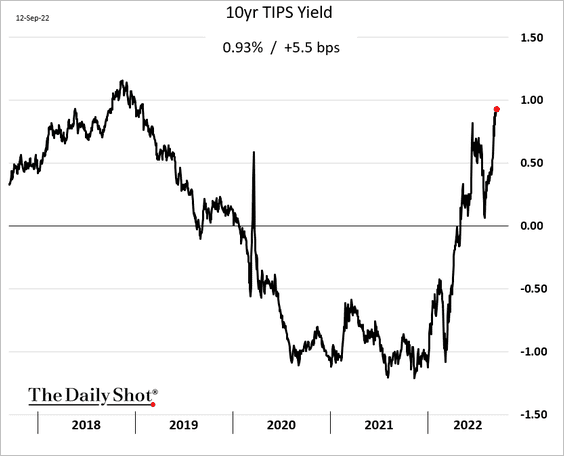

1. US real yields keep climbing, which could pose a risk for growth stocks.

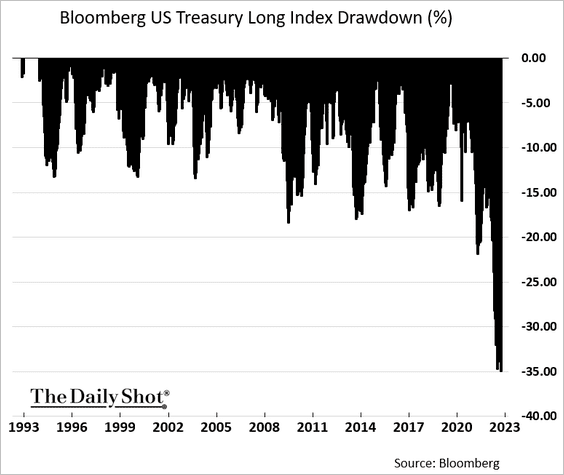

2. The drawdown in long-dated Treasuries reaches 35%.

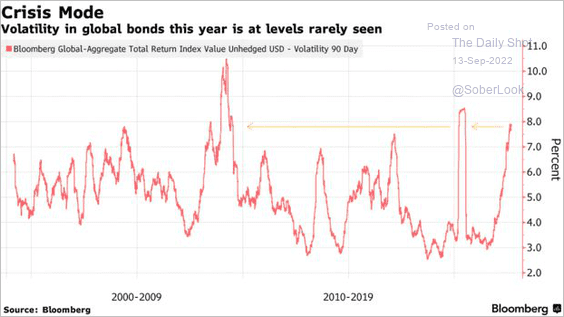

3. Global bond volatility remains elevated.

Source: @GarfieldR1966, @markets Read full article

Source: @GarfieldR1966, @markets Read full article

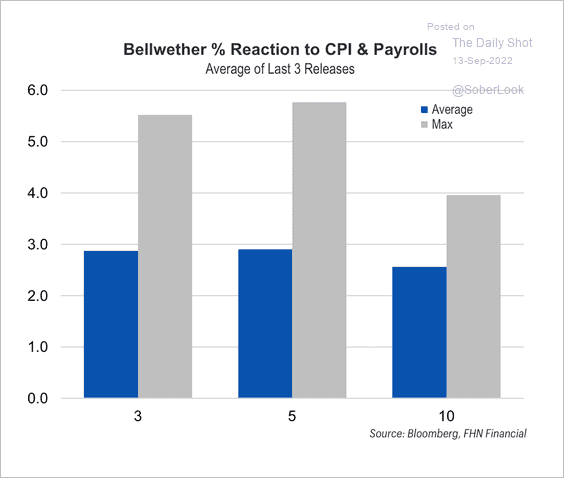

4. This chart shows the reaction to recent CPI and payroll releases, weighted by yield variance, across the 3-year, 5-year, and 10-year Treasury tenors. The 5-year has been the most volatile.

Source: FHN Financial

Source: FHN Financial

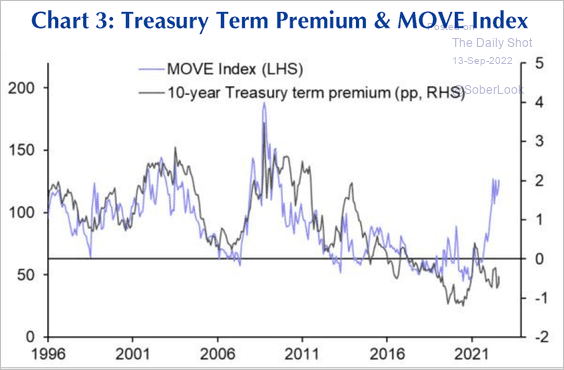

5. Treasury term premium has diverged from market volatility.

Source: Capital Economics

Source: Capital Economics

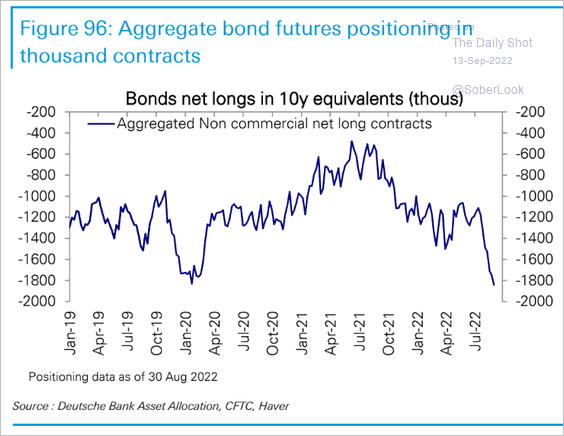

6. Positioning in Treasury futures has been increasingly bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

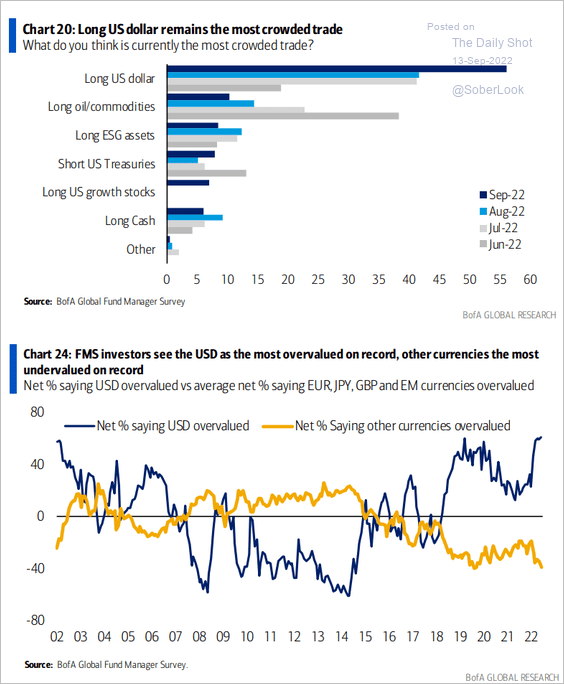

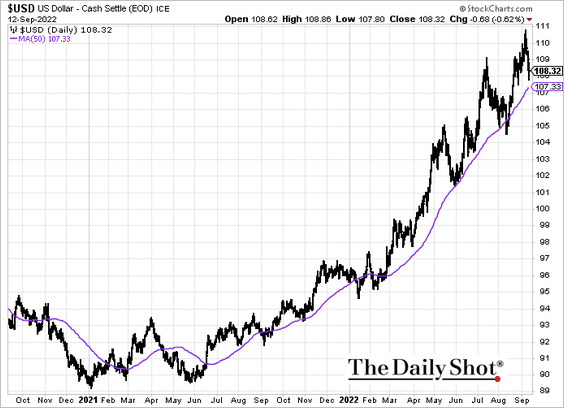

1. Long US dollar is the most crowded trade according to fund managers (based on a survey from BofA).

Source: BofA Global Research

Source: BofA Global Research

The US dollar index (DXY) is about to test support at the 50-day moving average.

——————–

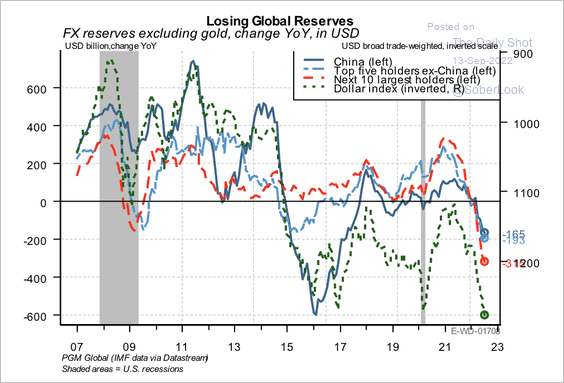

2. Central banks have been depleting their currency reserves, mainly the dollar.

Source: PGM Global

Source: PGM Global

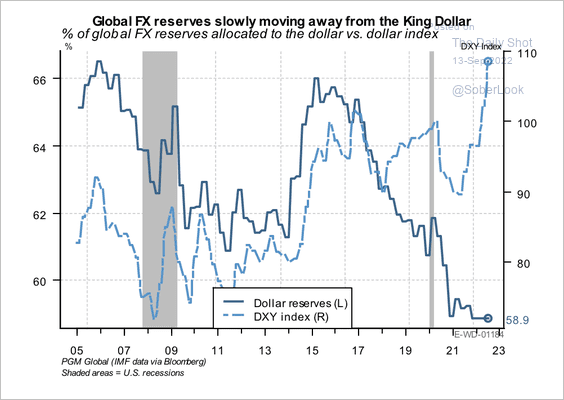

However, the dollar has not weakened despite lower reserve allocations.

Source: PGM Global

Source: PGM Global

——————–

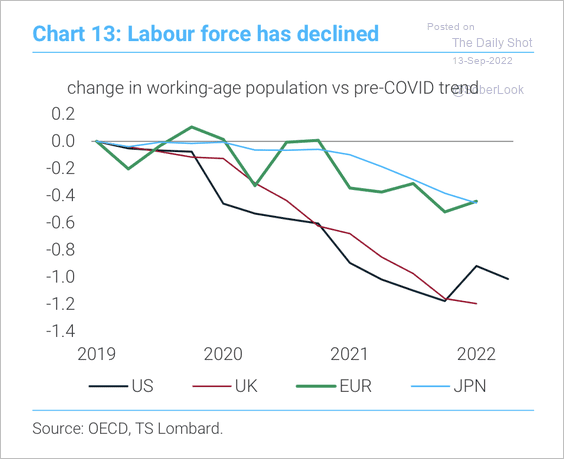

3. The working-age population in the largest advanced economies has declined over the past few years.

Source: TS Lombard

Source: TS Lombard

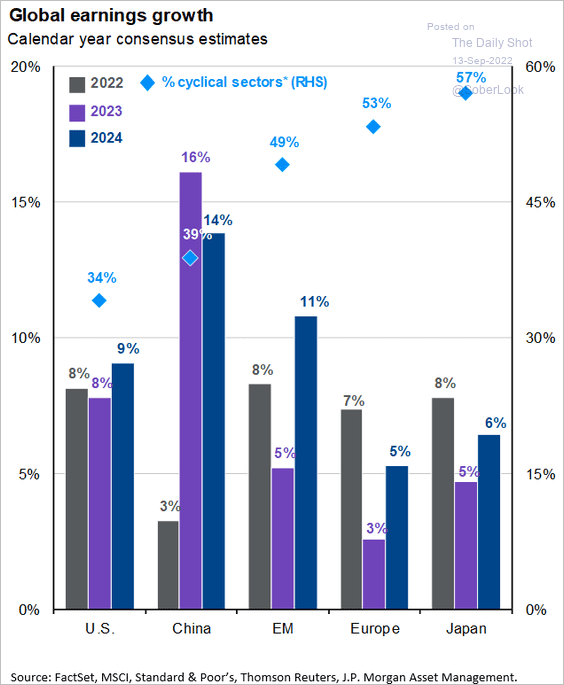

4. This chart shows corporate earnings growth estimates.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

Food for Thought

1. Biggest buyers of semiconductor tools:

![]() Source: Gavekal Research

Source: Gavekal Research

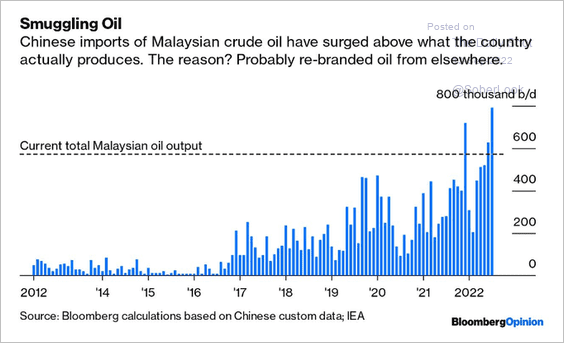

2. China’s purchases of smuggled oil from Russia, Iran, and Venezuela:

Source: @JavierBlas

Source: @JavierBlas

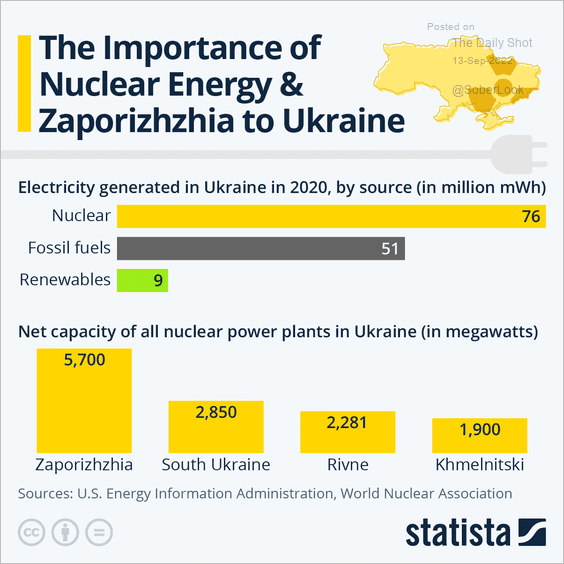

3. Ukraine and nuclear energy:

Source: Statista

Source: Statista

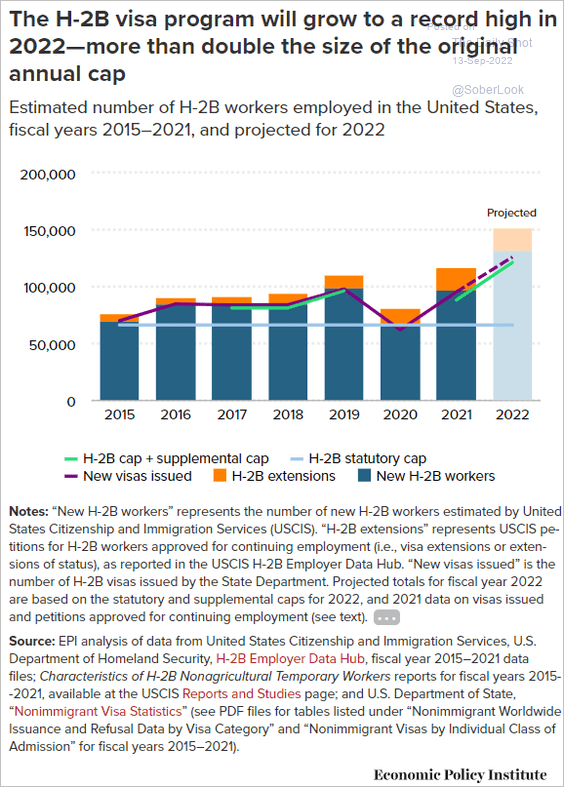

4. The H-2B visa program:

Source: EPI Read full article

Source: EPI Read full article

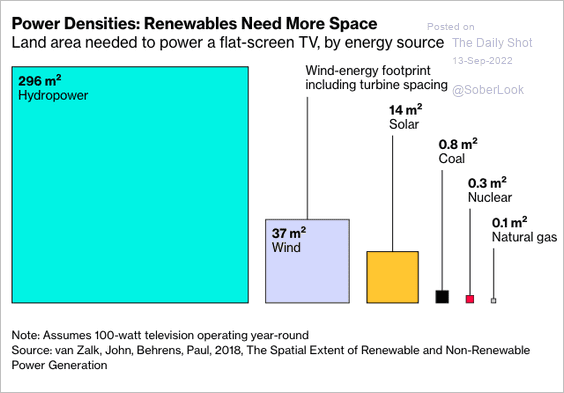

5. Land area needed to power a TV, by energy source:

Source: @shannonosaka, @climate Read full article

Source: @shannonosaka, @climate Read full article

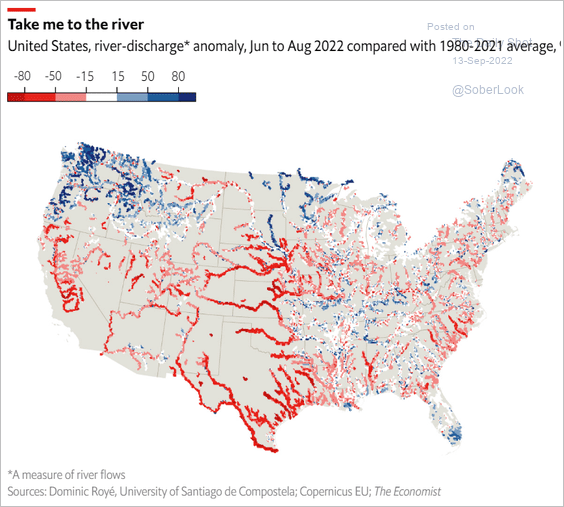

6. Rivers running dry:

Source: The Economist Read full article

Source: The Economist Read full article

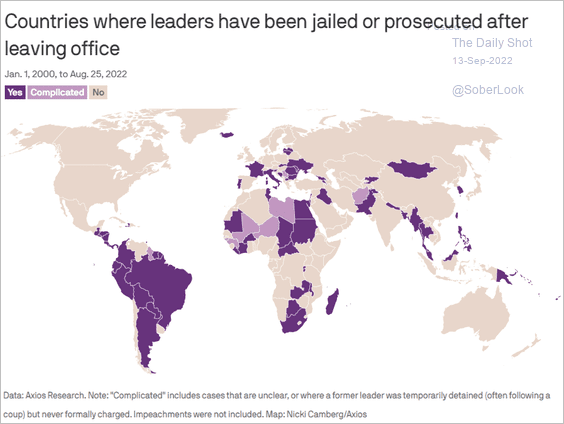

7. Former leaders jailed or prosecuted:

Source: @axios Read full article

Source: @axios Read full article

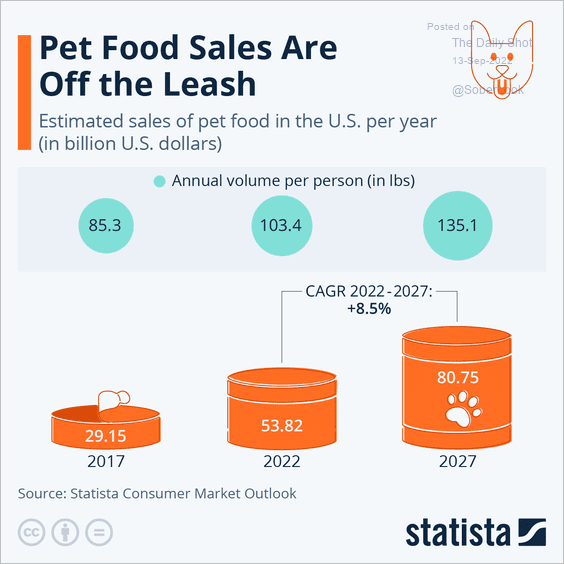

8. Pet food sales:

Source: Statista

Source: Statista

——————–

Back to Index