The Daily Shot: 22-Dec-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Cryptocurrency

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

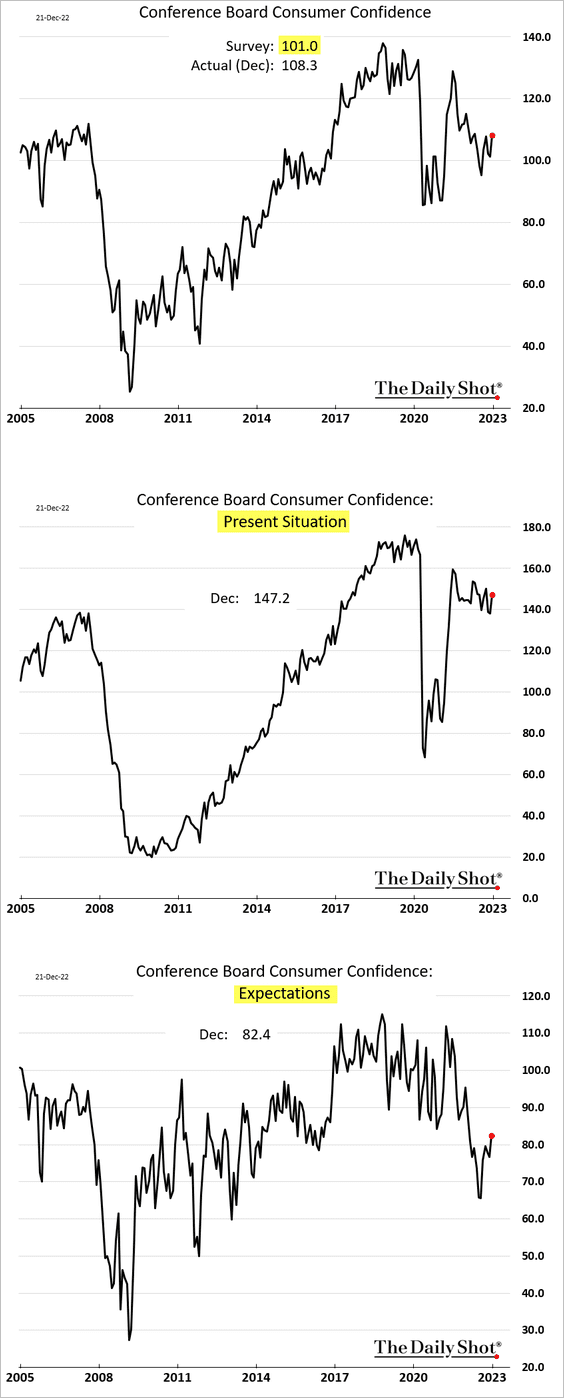

1. The Conference Board’s December consumer confidence index topped forecasts.

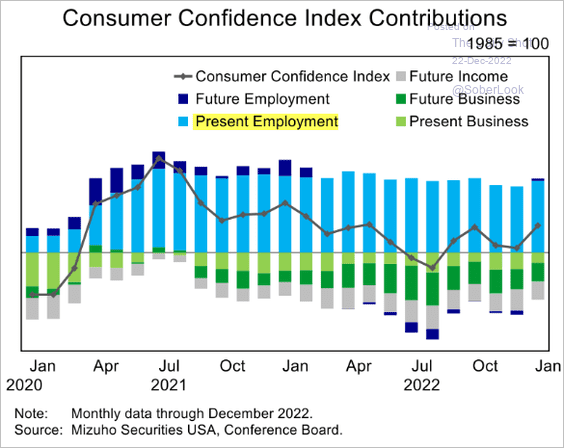

• Strong employment continues to support consumer confidence.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

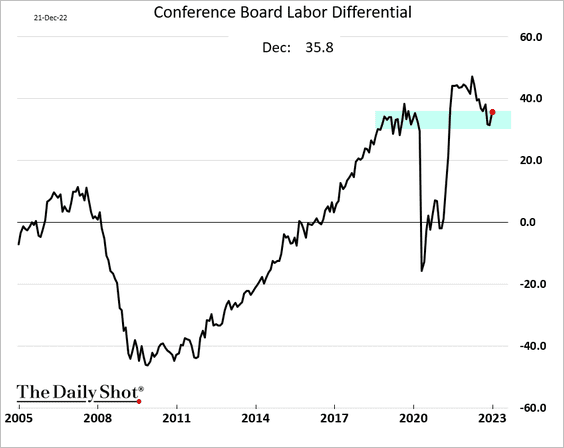

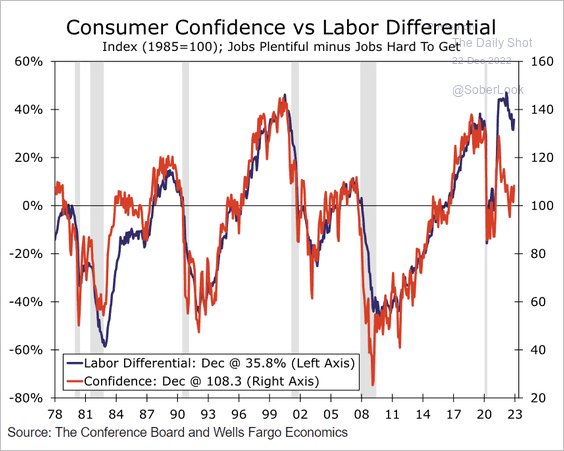

• The labor differential index (“jobs plentiful” – “jobs hard to get”) unexpectedly increased, signaling confidence in the jobs market. The index has diverged from the headline consumer confidence indicator (2nd chart).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

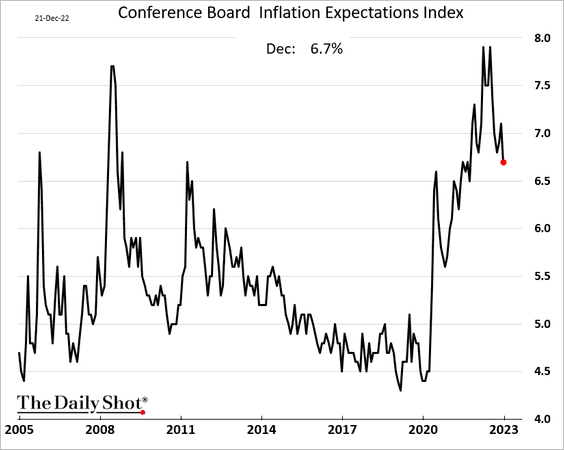

• Inflation expectations eased on softer gasoline prices.

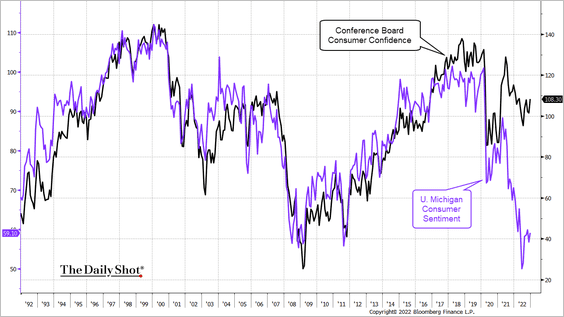

• The gap between the Conference Board’s and the U. Michigan’s confidence indicators remains wide.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

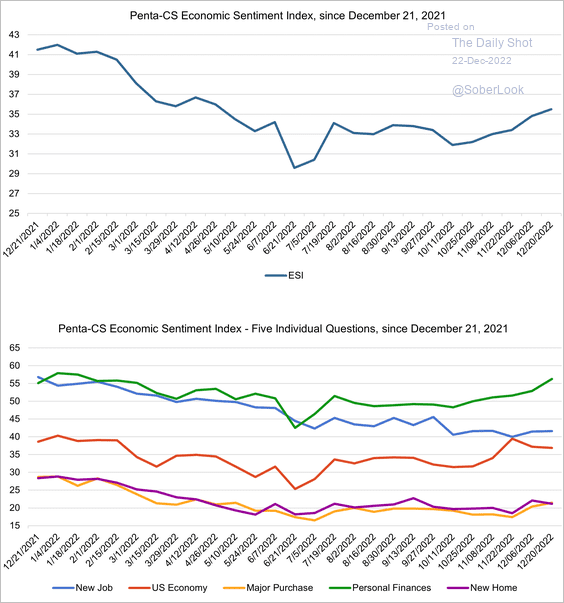

• Another sentiment indicator, the Penta-CivicScience Economic Sentiment Index, also showed improvement in recent weeks.

Source: @PentaGRP, @CivicScience

Source: @PentaGRP, @CivicScience

——————–

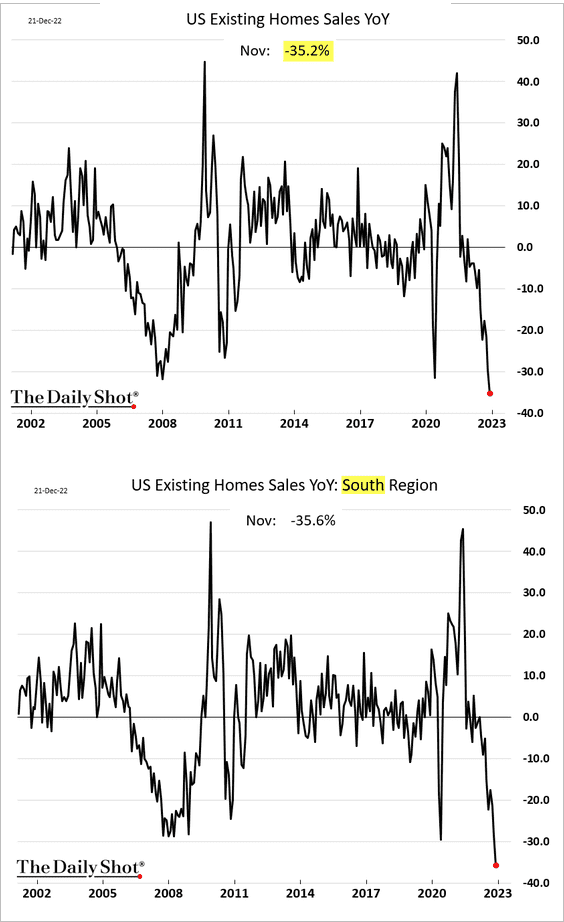

2. Next, we have some updates on the housing market.

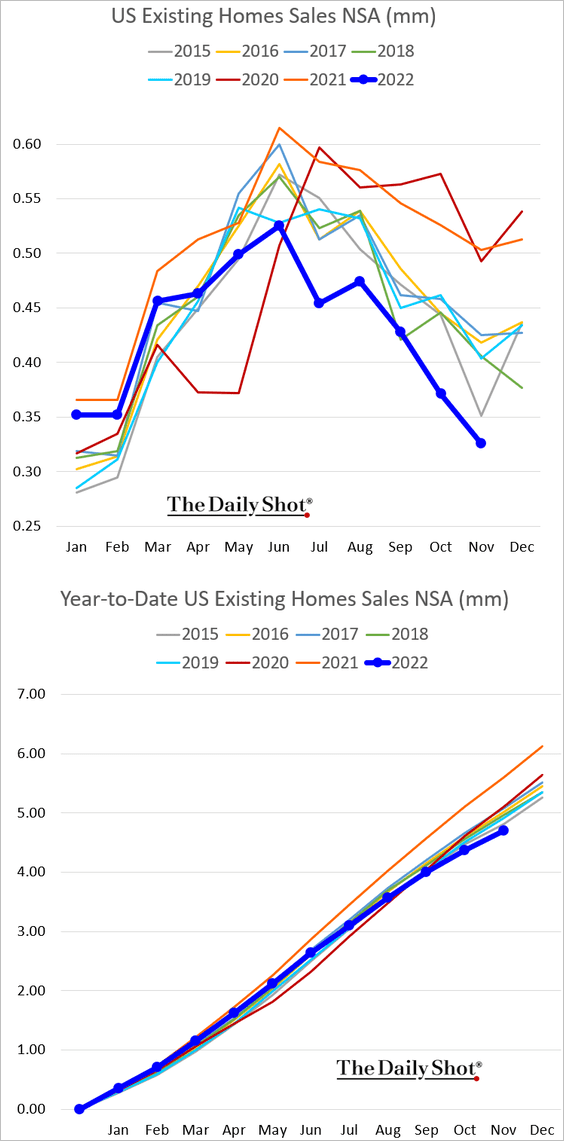

• Existing home sales continued to weaken last month, …

… and are now down 35% from November of 2021.

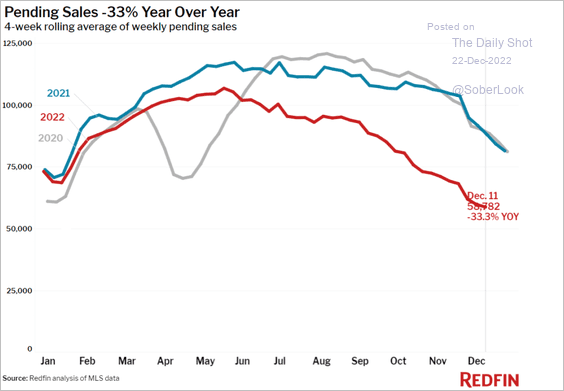

According to Redfin, pending sales are down 33%.

Source: Redfin

Source: Redfin

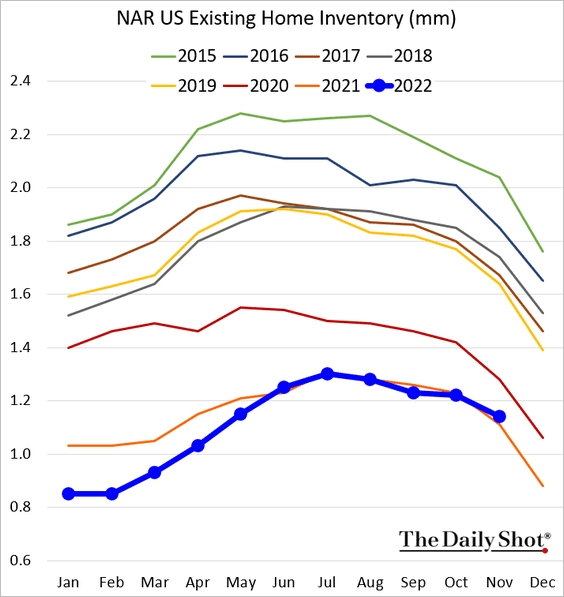

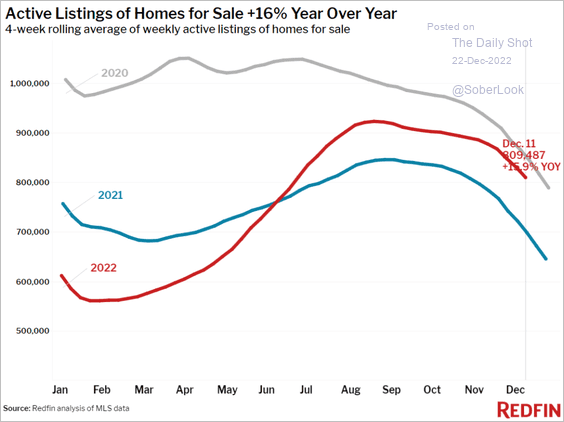

• Inventories remain tight and are only slightly above last year’s levels.

Here is the number of listing from Redfin.

Source: Redfin

Source: Redfin

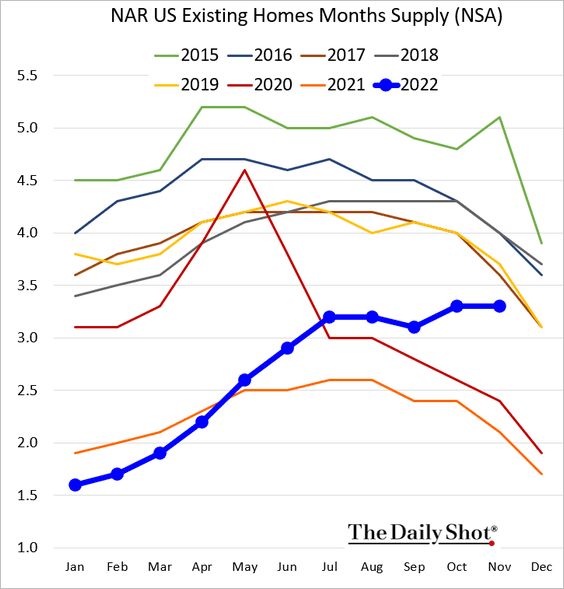

But inventories are rising when measured in months of supply as sales slow.

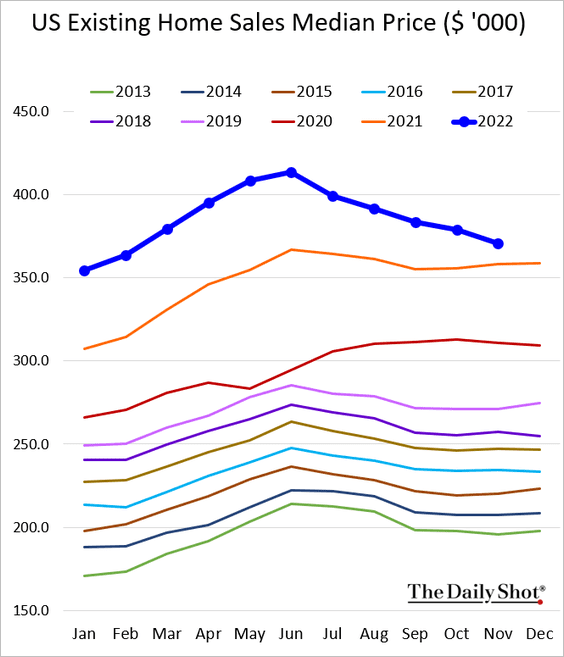

• The median sales price is falling but remains above last year’s level.

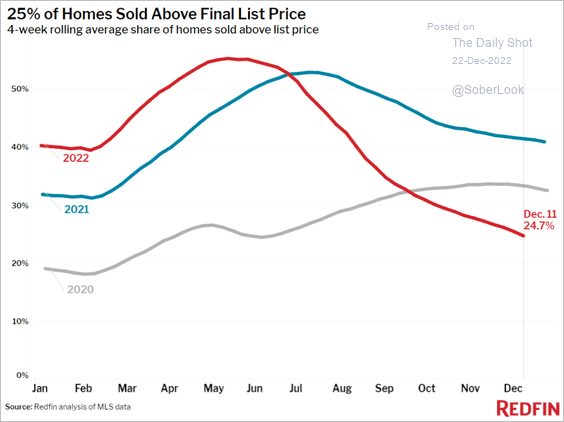

A quarter of housing transactions have been above the list price.

Source: Redfin

Source: Redfin

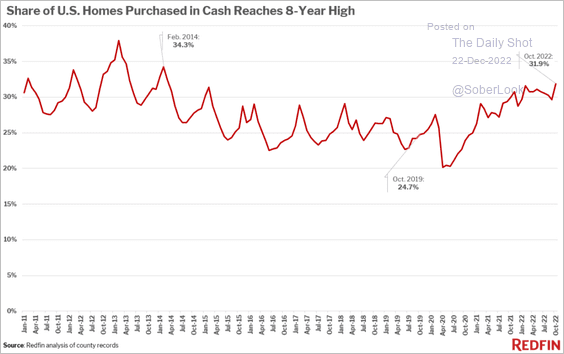

• The share of homes bought with cash hit a multi-year high.

Source: Redfin

Source: Redfin

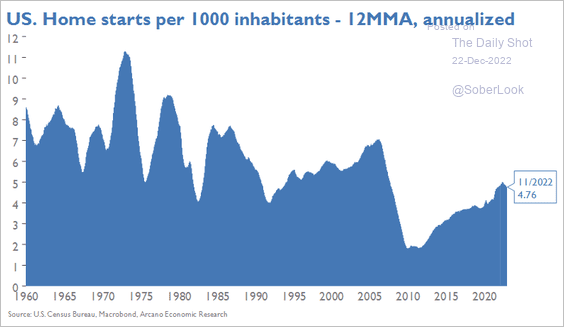

• Population-adjusted residential construction activity has been relatively modest.

Source: Arcano Economics

Source: Arcano Economics

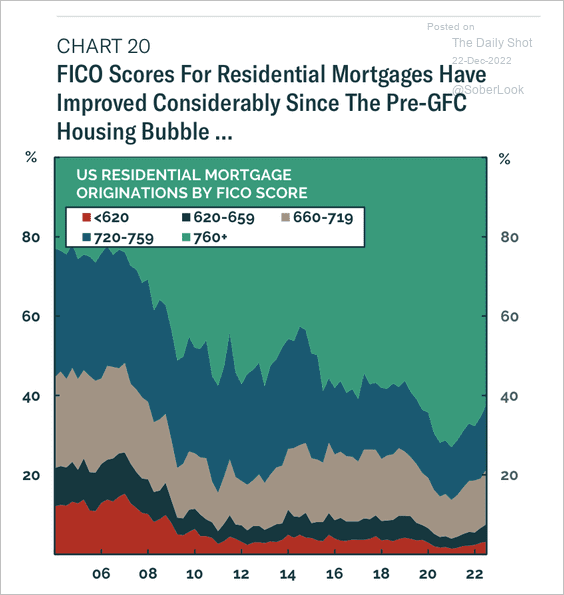

• The quality of mortgage lending has been strong since the financial crisis.

Source: BCA Research

Source: BCA Research

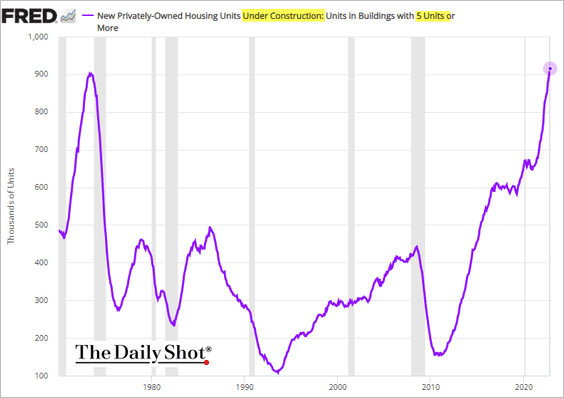

• The number of apartment units under construction hit a record high.

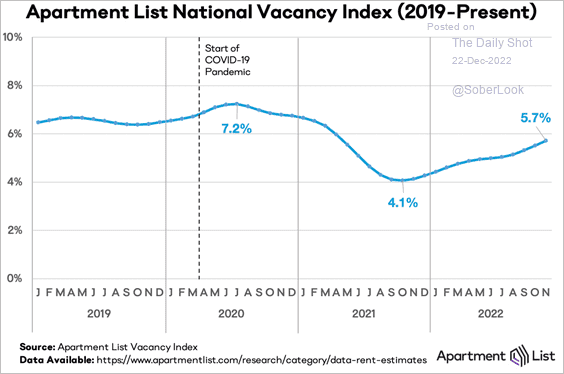

• Apartment vacancies have been grinding higher.

Source: Apartment List

Source: Apartment List

——————–

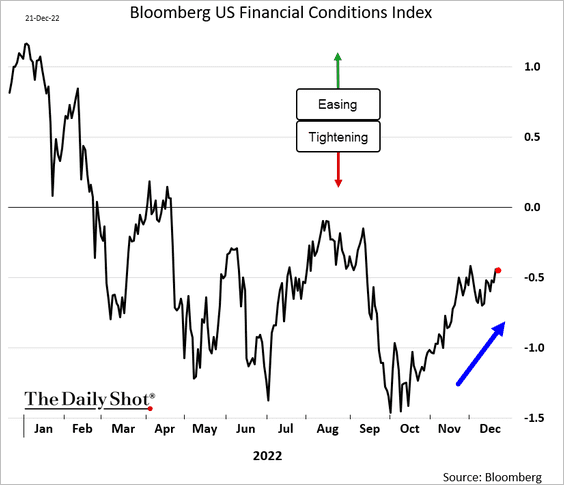

3. Easing US financial conditions could mean a higher terminal rate (the Fed will have to tighten more).

h/t @IraFJersey Read full article

h/t @IraFJersey Read full article

Back to Index

Canada

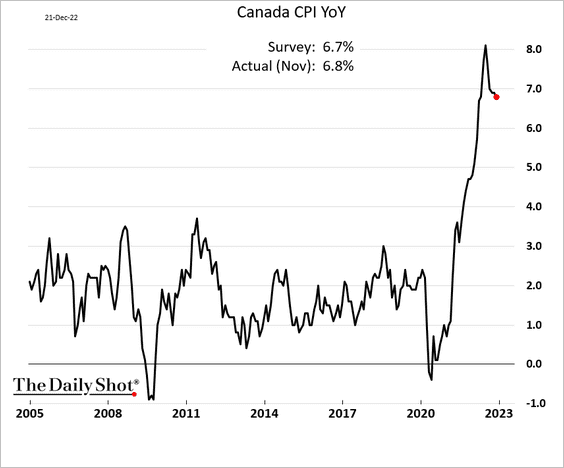

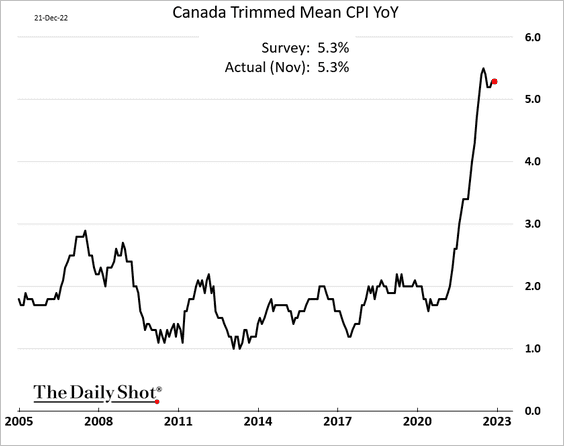

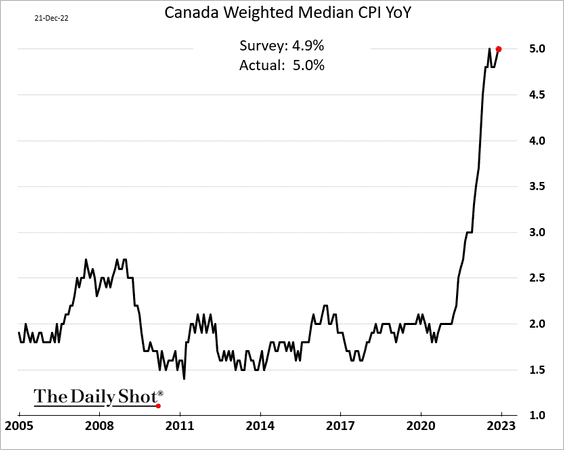

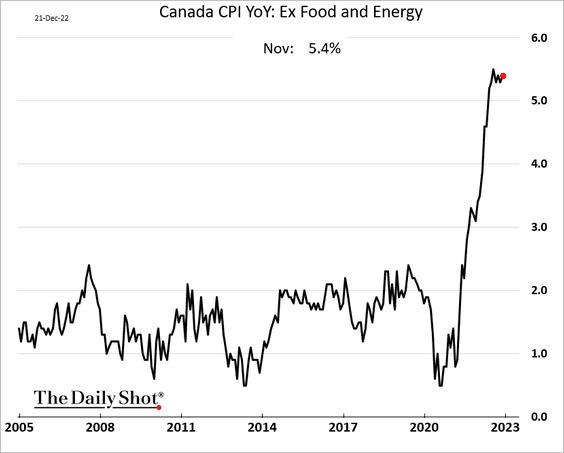

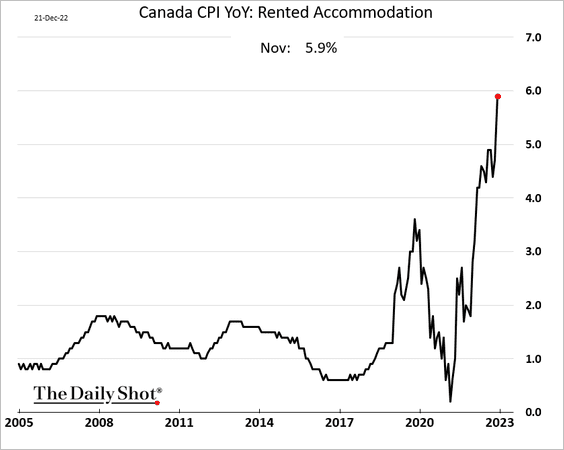

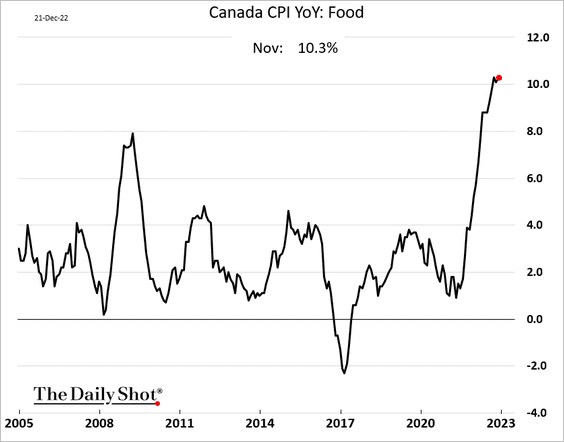

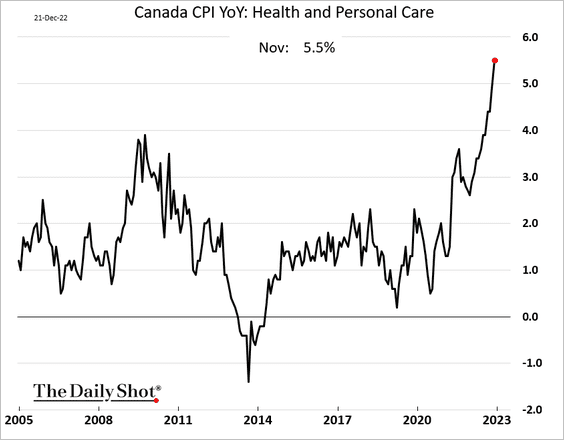

1. Inflation edged lower in November but remains stubbornly high.

• Core inflation measures topped expectations.

– Trimmed mean:

– Weighted median:

– CPI excluding food and energy:

• The surge in rent inflation boosted the core CPI.

• Here are a couple of other components.

– Food:

– Health and personal care:

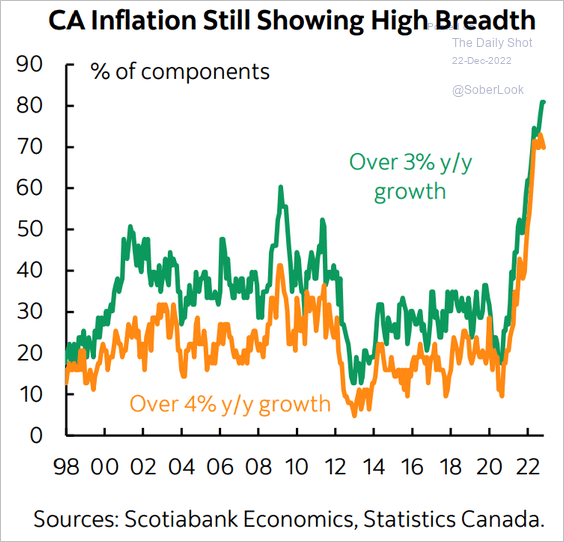

• The CPI breadth remains elevated.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

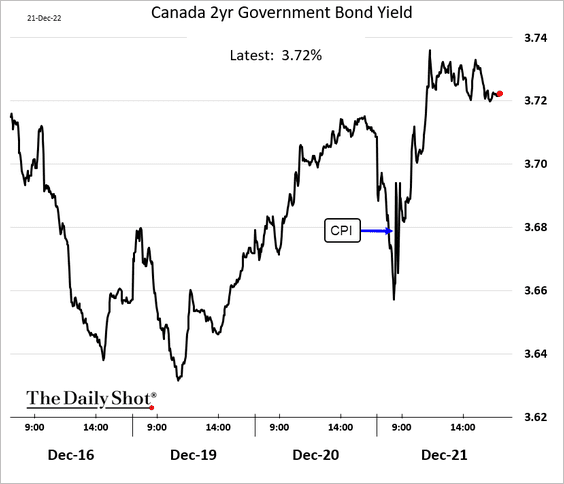

2. The 2-year yield climbed after the CPI report. Another BoC rate hike ahead?

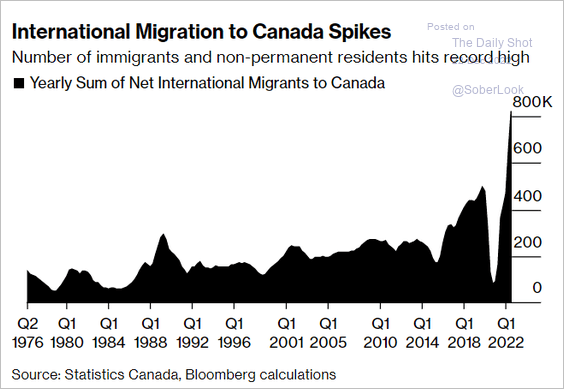

3. Canada’s economic growth will outperform other advanced economies over the long run.

Source: @rtkwrites, @business Read full article

Source: @rtkwrites, @business Read full article

Back to Index

The United Kingdom

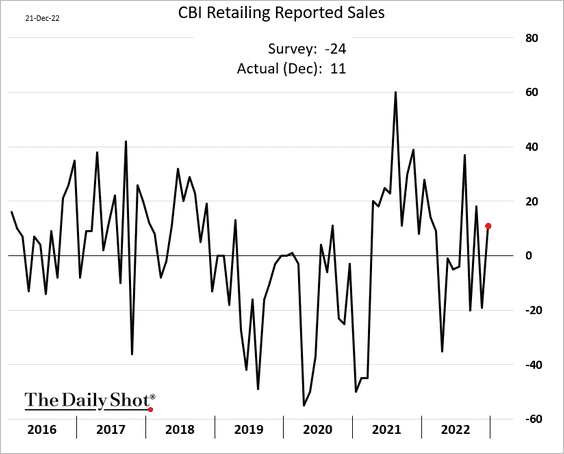

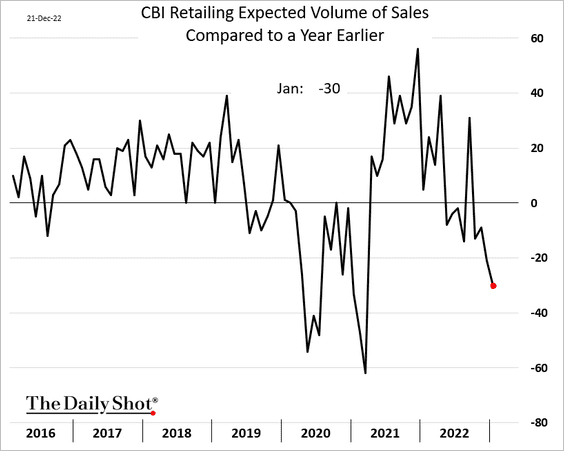

1. The CBI retail sales index unexpectedly increased this month.

Source: Reuters Read full article

Source: Reuters Read full article

• Retailers’ expectations remain depressed.

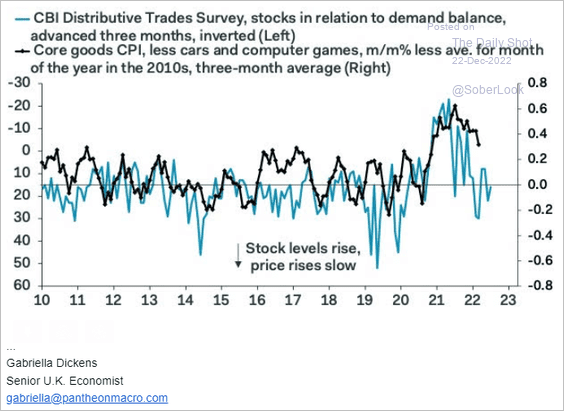

• CBI inventories relative to demand point to softer inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

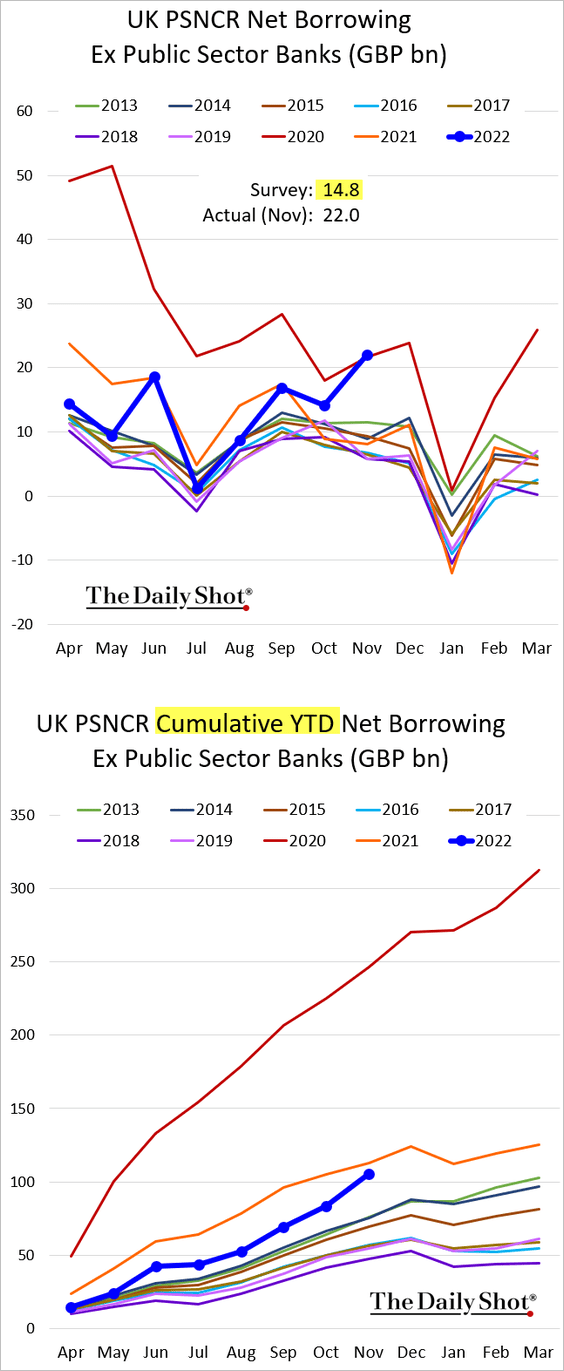

2. Government borrowing in November surprised to the upside.

Source: BBC Read full article

Source: BBC Read full article

——————–

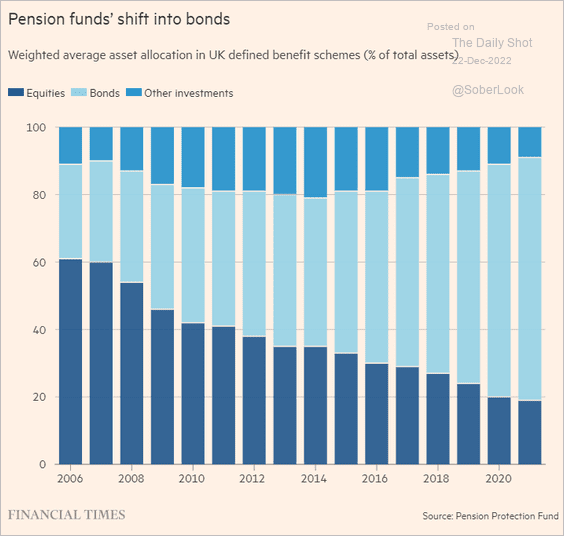

3. This chart shows pension funds’ asset allocation over time.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

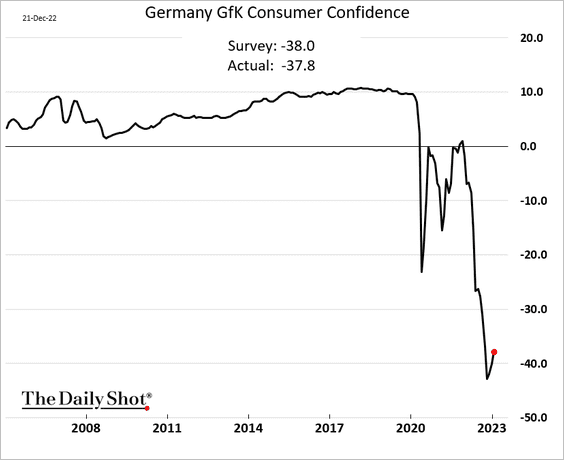

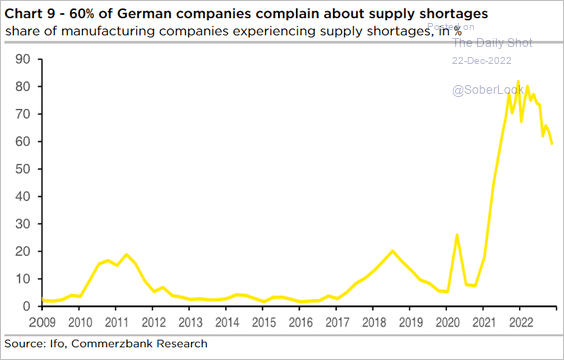

1. German consumer sentiment edged higher this month.

Separately, 60% of German companies are still dealing with supply shortages.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

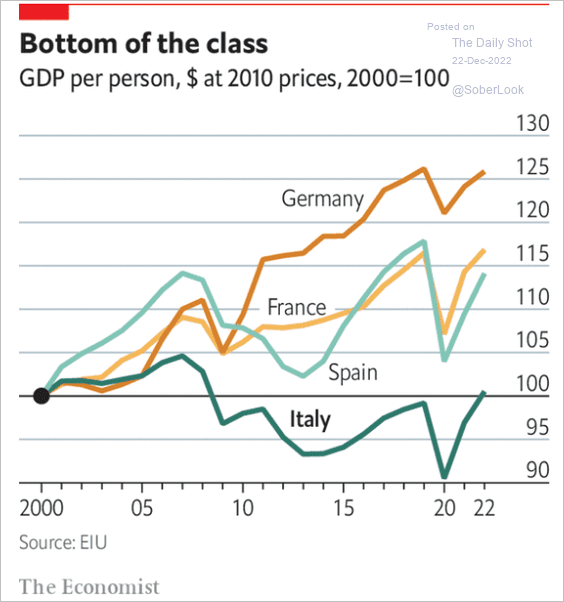

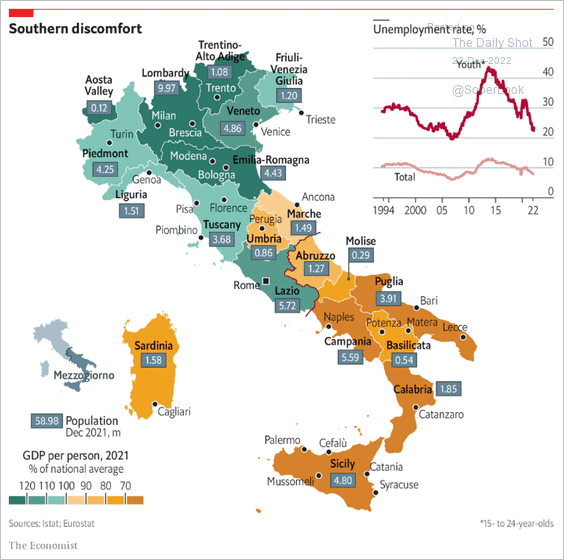

2. Italy’s GDP per capita continues to lag.

Source: The Economist Read full article

Source: The Economist Read full article

Here is the regional distribution of GDP per person.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

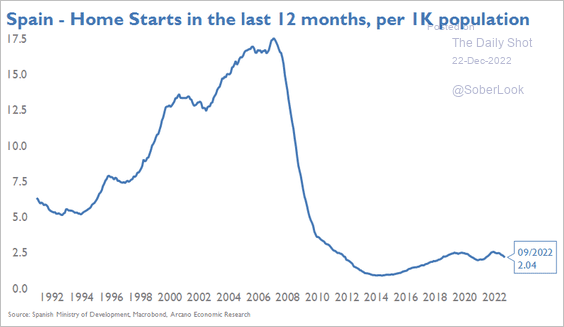

3. Spain’s housing starts have remained depressed since the financial crisis.

Source: Arcano Economics

Source: Arcano Economics

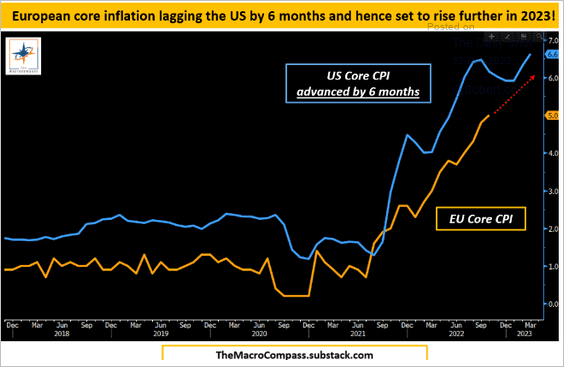

4. Will the euro-area core CPI follow the US higher?

Source: @MacroAlf

Source: @MacroAlf

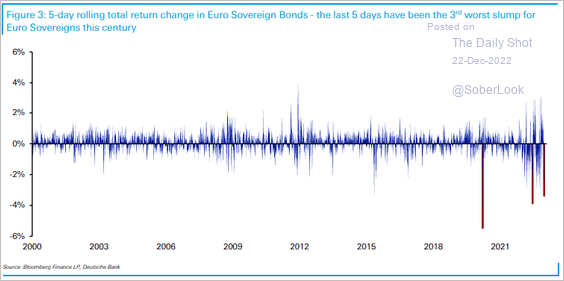

5. The Euro Sovereign Bond Index has seen its third-largest weekly slump of this century.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

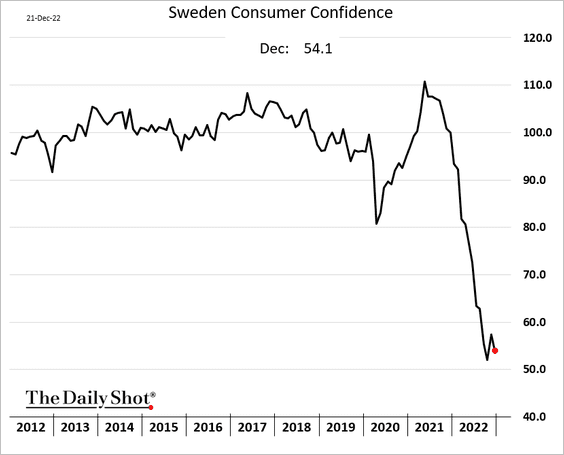

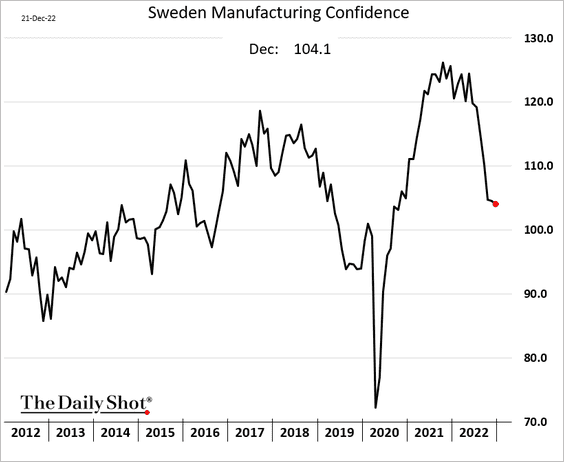

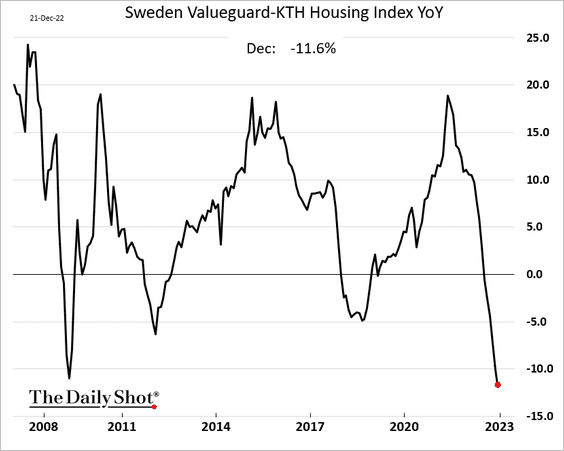

1. Let’s begin with Sweden.

• Consumer confidence declined again this month.

• Manufacturing confidence also edged lower.

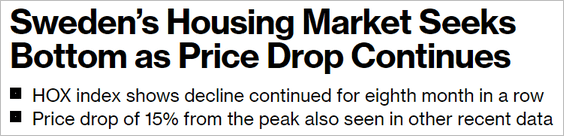

• Home prices continue to fall.

Source: @nicrolander, @markets Read full article

Source: @nicrolander, @markets Read full article

——————–

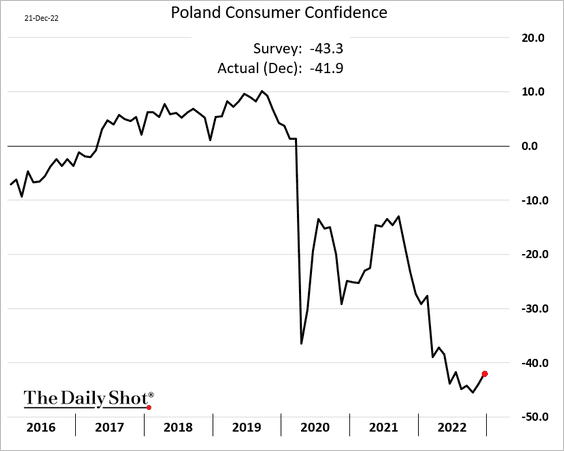

2. Poland’s consumer confidence appears to have bottomed.

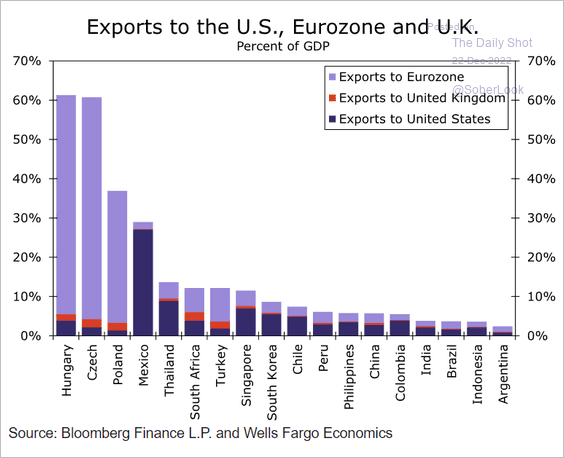

3. Central/Eastern European economies are heavily reliant on the Eurozone.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

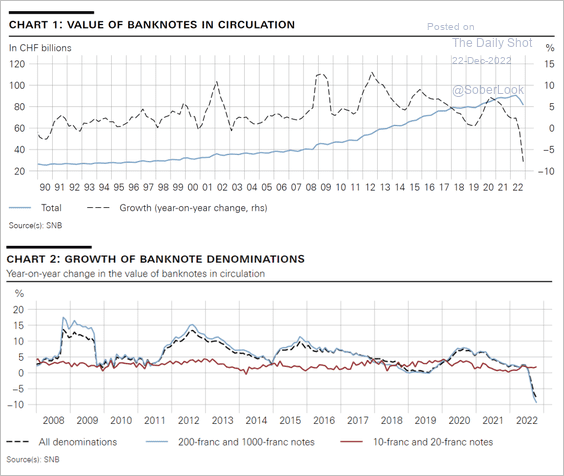

4. Positive interest rates in Switzerland – after the SNB rate hikes – reduced banknotes in circulation.

Source: BIS Read full article

Source: BIS Read full article

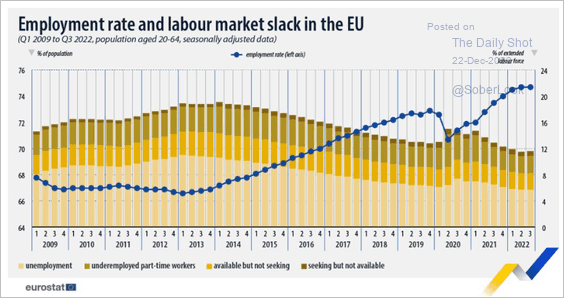

5. This chart shows the amount of labor slack in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

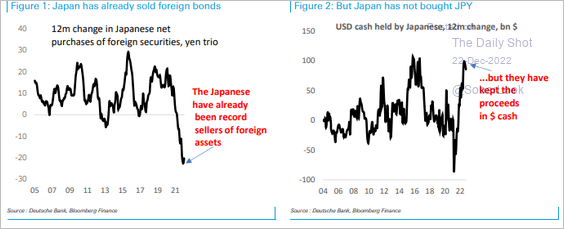

1. Japanese investors have been preemptive sellers of their global asset holdings, hoarding their cash offshore. This is partly why the yen weakened dramatically this year, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

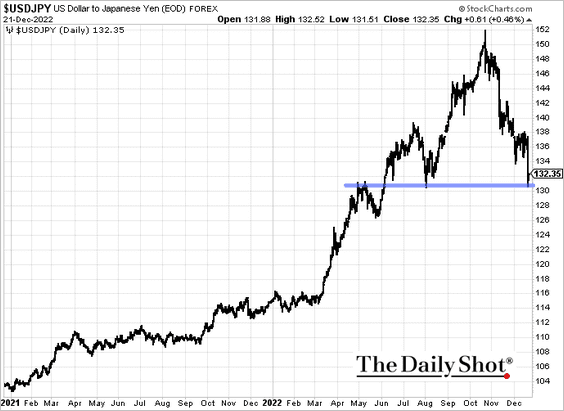

Dollar-yen is holding support.

——————–

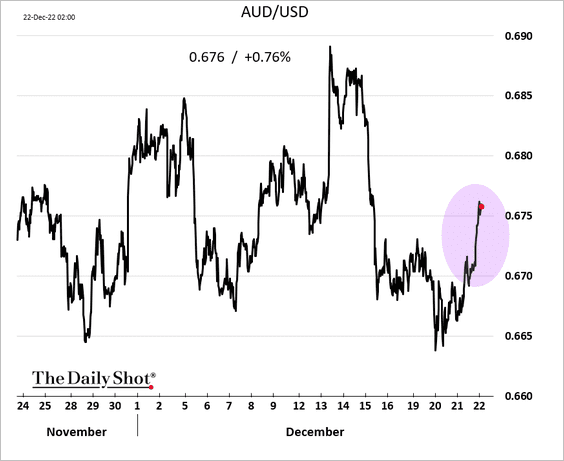

2. The China-Australia trade spat is thawing.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

The Aussie dollar climbed on the news.

Back to Index

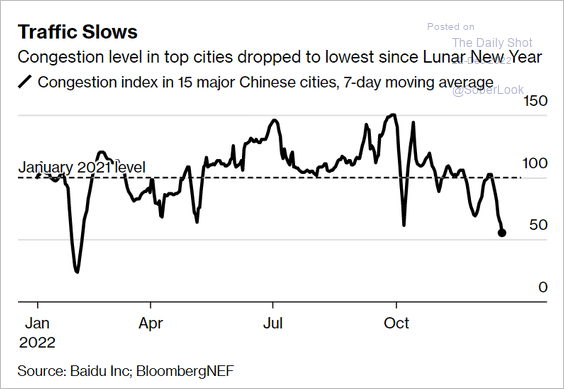

China

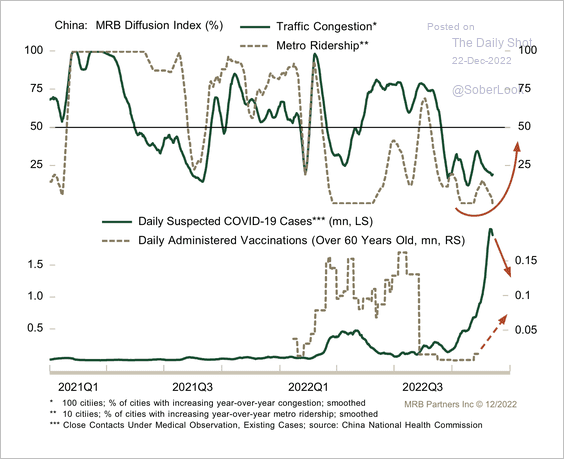

1. A successful reopening will require a reduction in COVID-19 cases and improved vaccination rates for the elderly.

Source: MRB Partners

Source: MRB Partners

Mobility has been deteriorating as the pandemic spreads.

Source: @hongjinshan, @markets Read full article

Source: @hongjinshan, @markets Read full article

——————–

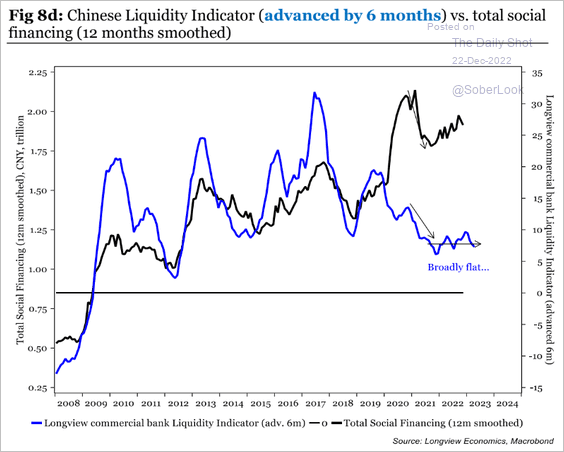

2. Credit growth has held up despite relatively tight monetary policy.

Source: Longview Economics

Source: Longview Economics

Back to Index

Cryptocurrency

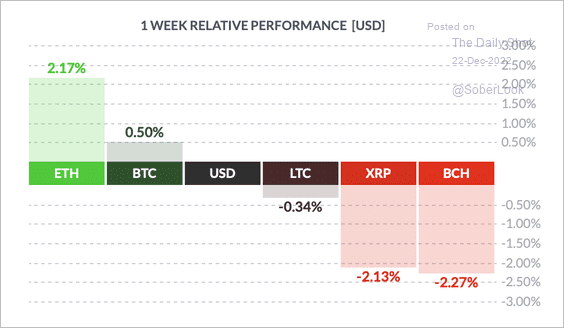

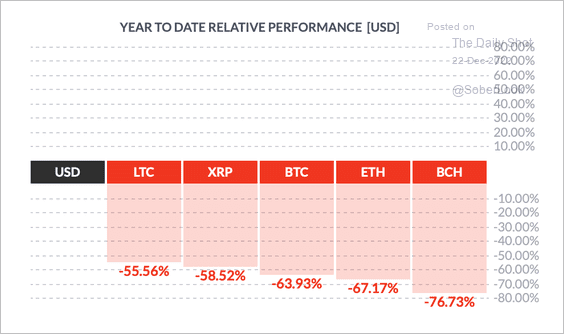

1. Ether (ETH) has outperformed other top cryptos over the past week.

Source: FinViz

Source: FinViz

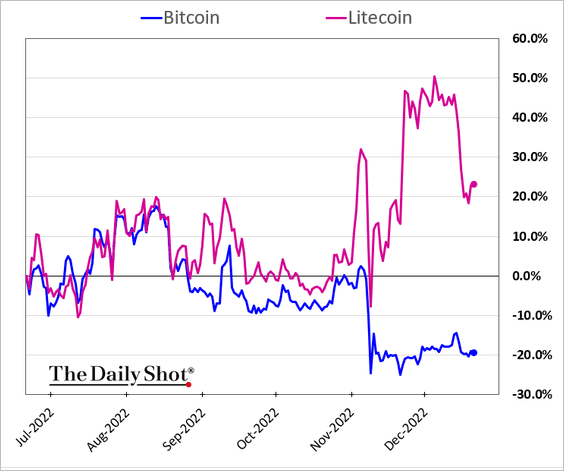

• Litecoin is holding on to some of its recent outperformance.

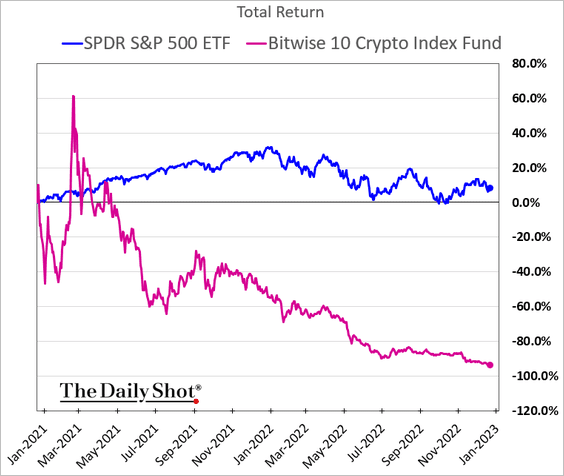

• It’s been a tough year for cryptos.

Source: FinViz

Source: FinViz

• The drawdown in the overall crypto market has been remarkable.

——————–

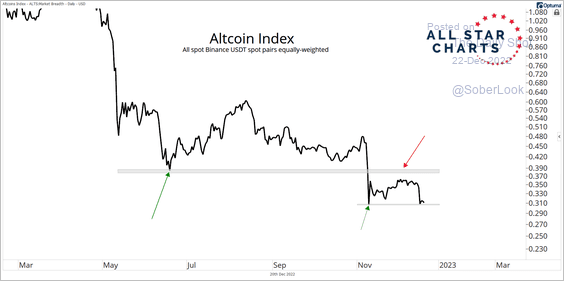

2. The altcoin index is testing support.

Source: @allstarcharts

Source: @allstarcharts

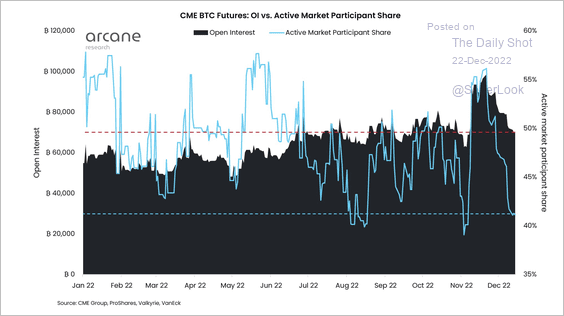

3. Open interest in bitcoin CME futures is declining along with the active market participant share (open interest held by non-ETFs).

Source: @VetleLunde

Source: @VetleLunde

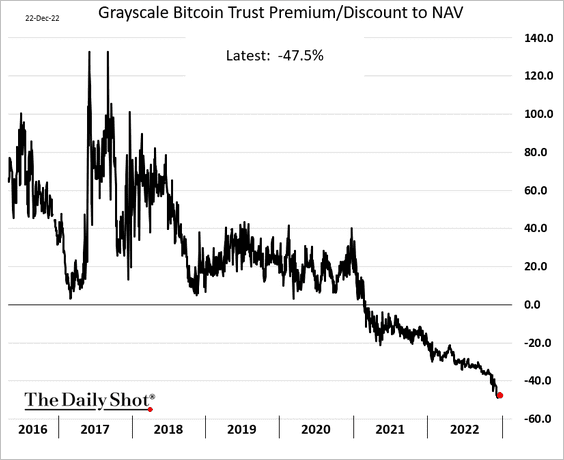

4. Grayscale is under pressure to ease GBTC’s massive discount to NAV.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

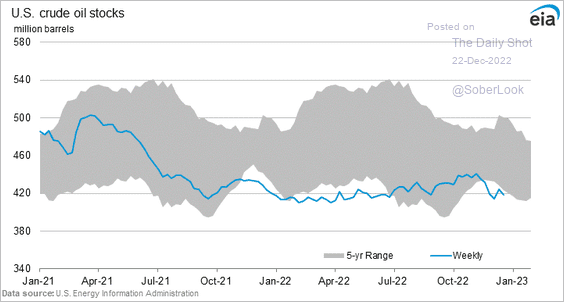

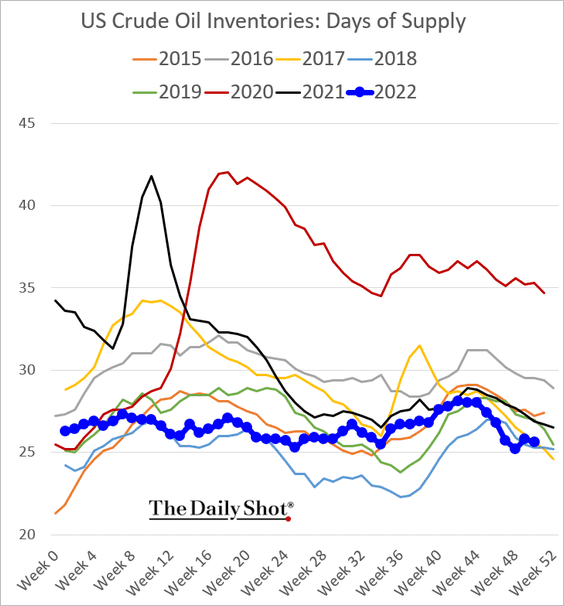

1. US oil inventories are holding below the 5-year range.

Source: @EIAgov

Source: @EIAgov

Here are the inventories measured in days of supply.

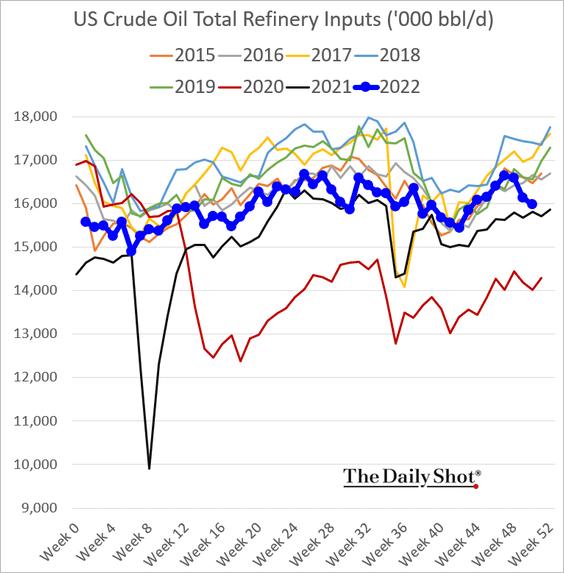

2. Refinery runs declined sharply over the past couple of weeks.

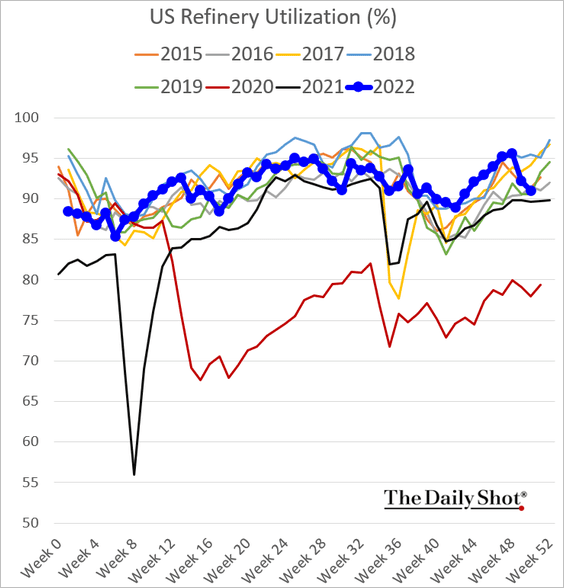

This chart shows US refinery utilization.

——————–

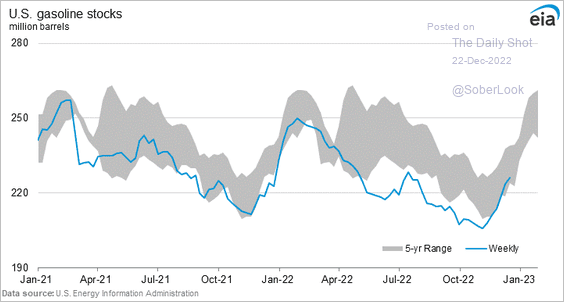

3. US gasoline inventories remain inside the 5-year range, …

Source: @EIAgov

Source: @EIAgov

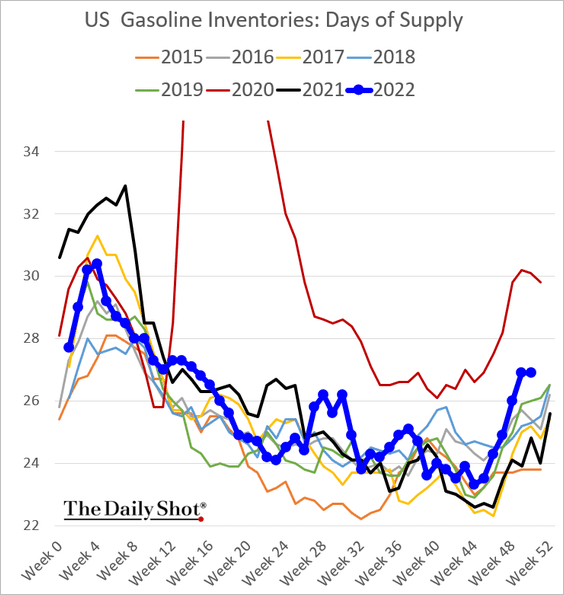

… and are elevated when measured in days of supply (due to softer demand).

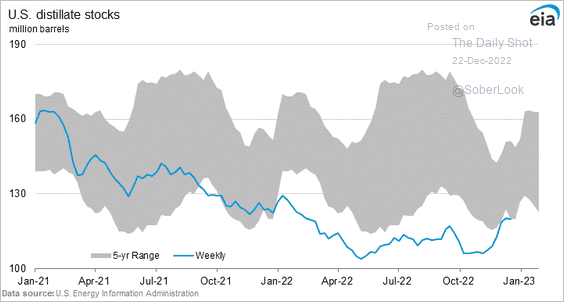

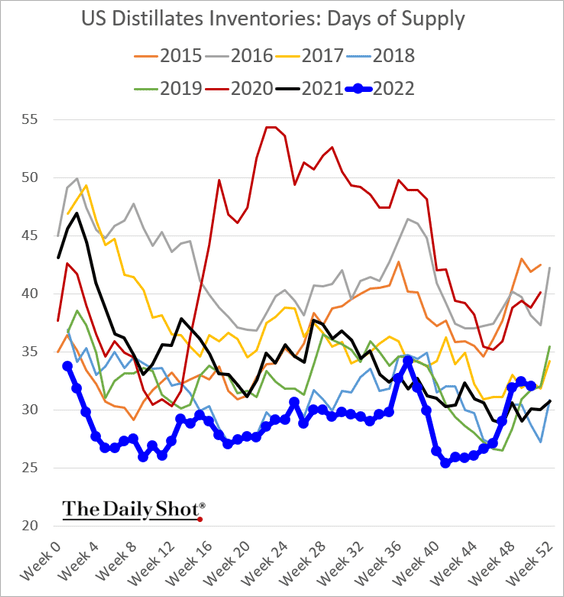

Here are the trends for distillates inventories.

Source: @EIAgov

Source: @EIAgov

——————–

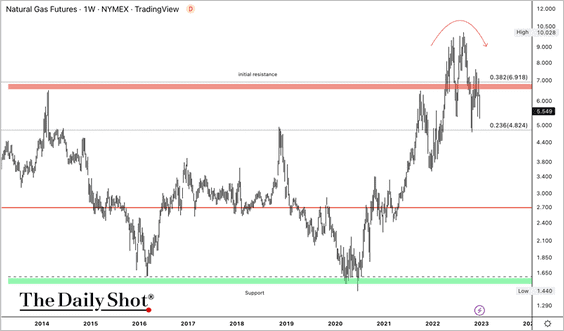

4. US weather models have shifted notably warmer for late December and January. However, there is concern that current freeze conditions could force production interruptions.

Source: Natural Gas Intelligence Read full article

Source: Natural Gas Intelligence Read full article

The front-month NYMEX Natural Gas futures contract failed to sustain a break above long-term resistance.

——————–

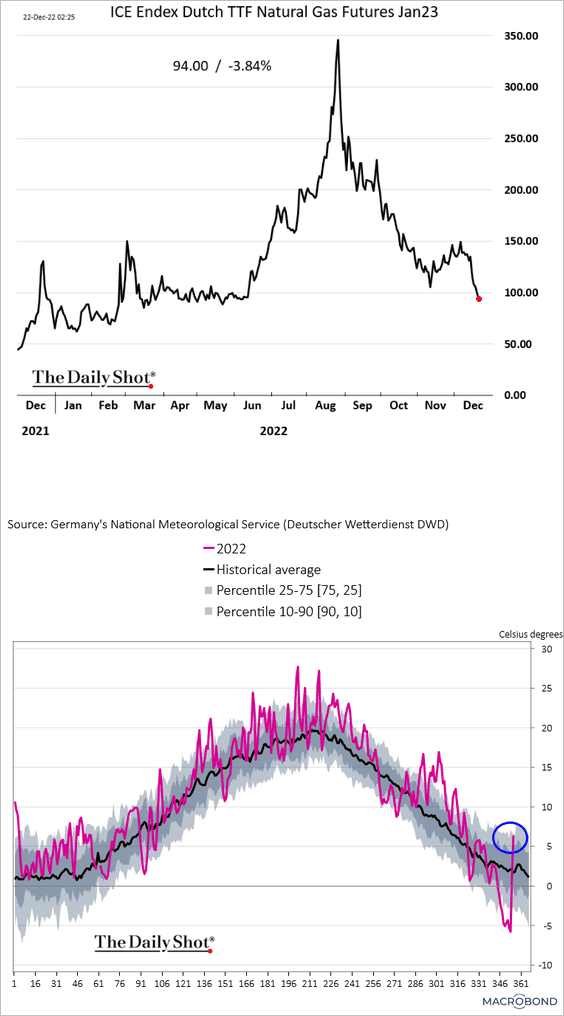

5. European natural gas prices keep moving lower as temperatures rebound (2nd panel).

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Back to Index

Equities

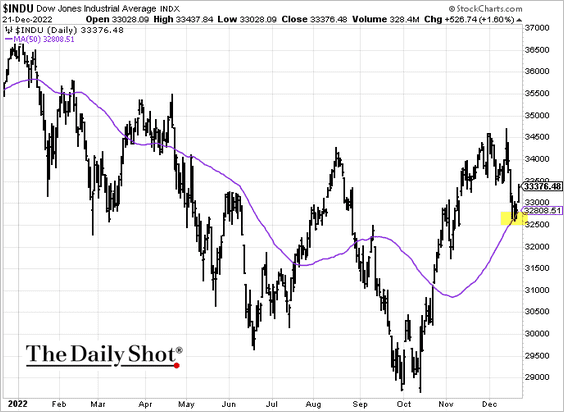

1. The Dow held support at the 50-day moving average.

h/t @themarketear

h/t @themarketear

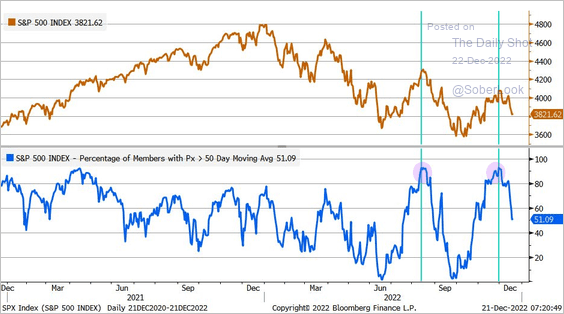

2. The market tends to peak when the proportion of S&P 500 members that are above their 50-day moving average exceeds 90%.

Source: @lizannsonders

Source: @lizannsonders

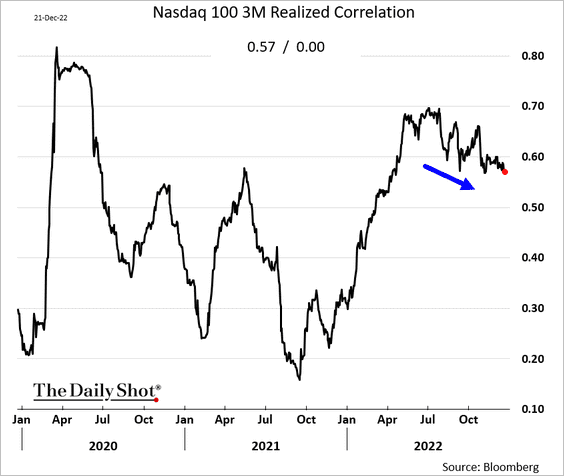

3. The correlation among Nasdaq 100 members has been drifting lower.

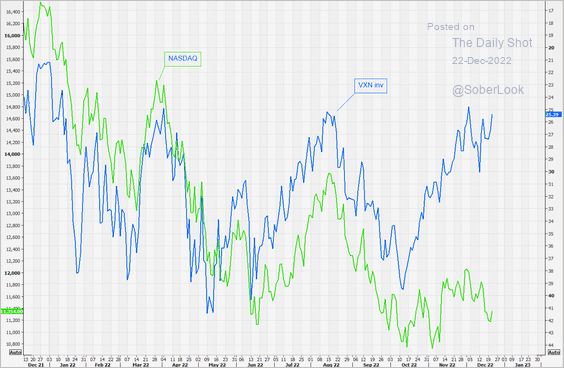

4. The Nasdaq Composite has diverged from VXN (VIX-equivalent).

h/t @themarketear

h/t @themarketear

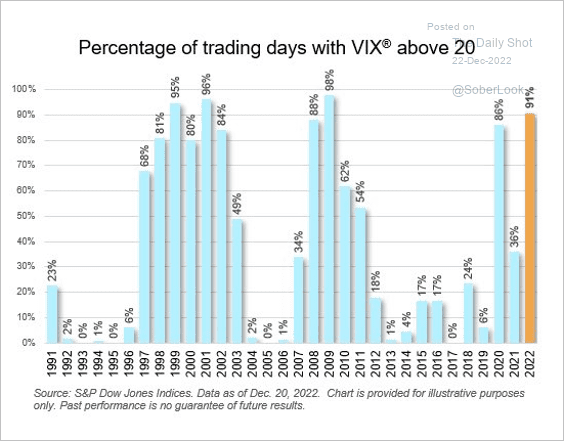

5. VIX has been above 20 for most of the year.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

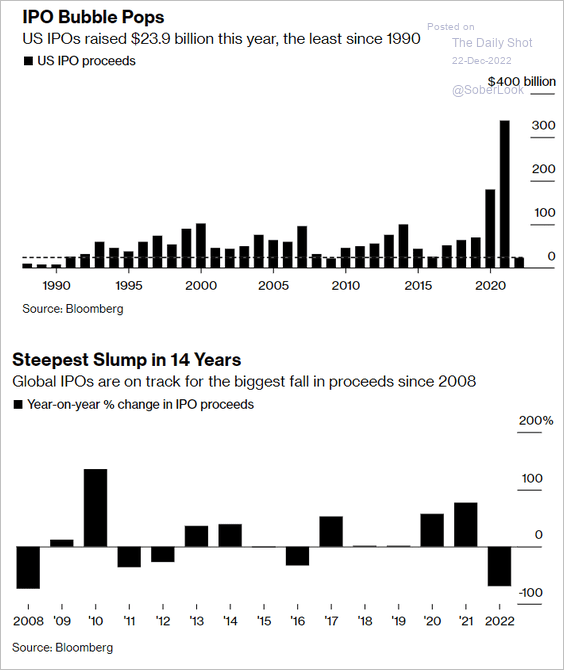

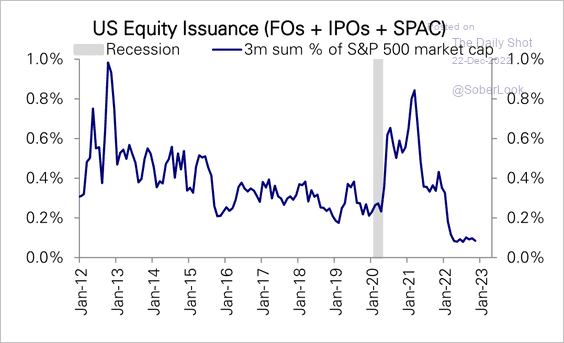

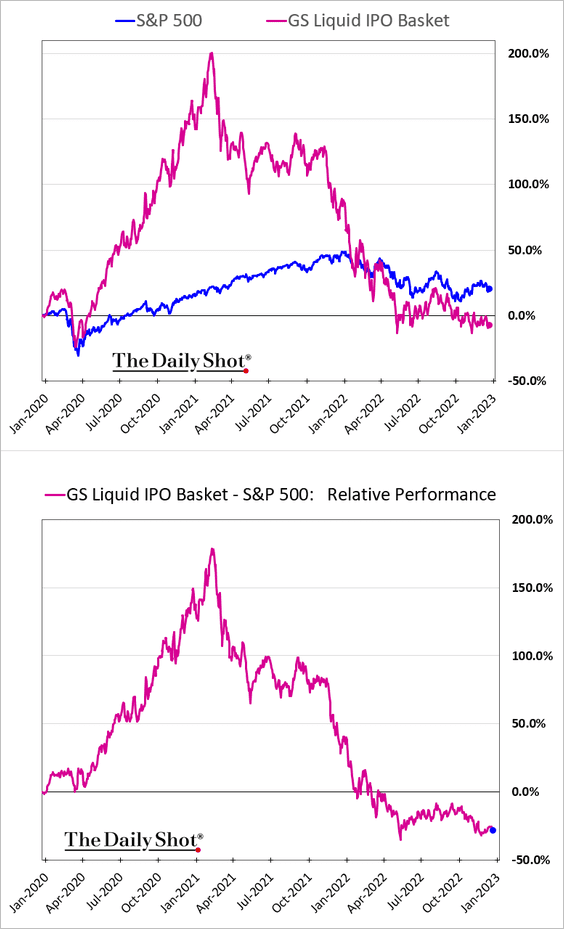

6. The IPO bubble has popped.

• Issuance (2 charts):

Source: @julia_fioretti, @Swetha_Gopinath, @filipepacheco, @markets Read full article

Source: @julia_fioretti, @Swetha_Gopinath, @filipepacheco, @markets Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Performance:

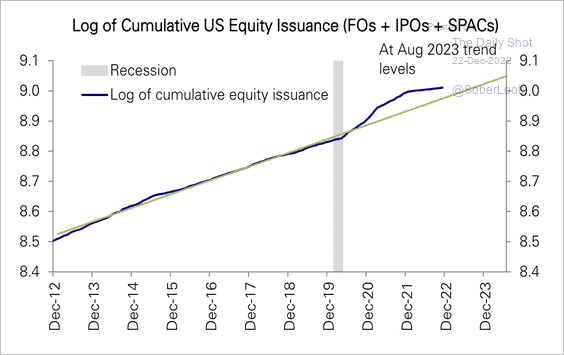

There is still room for 2021 excess issuance to decline. This chart shows cumulative equity issuance.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

7. It’s not all doom and gloom out there.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

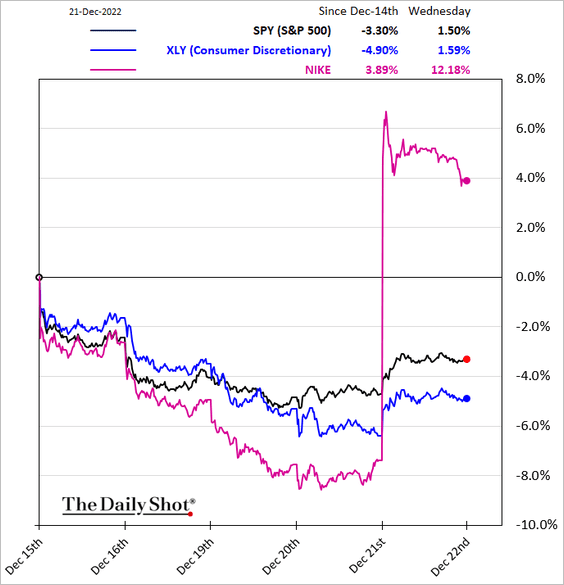

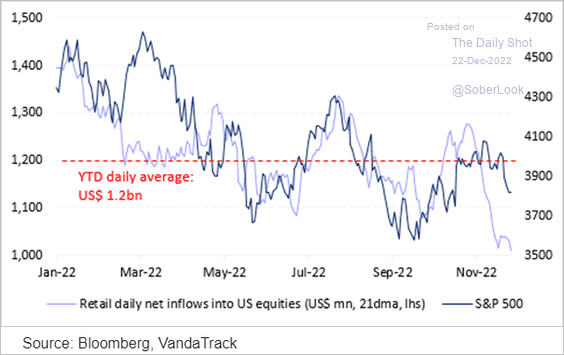

8. Next, we have some updates on retail investors.

• Inflows remain soft.

Source: Vanda Research

Source: Vanda Research

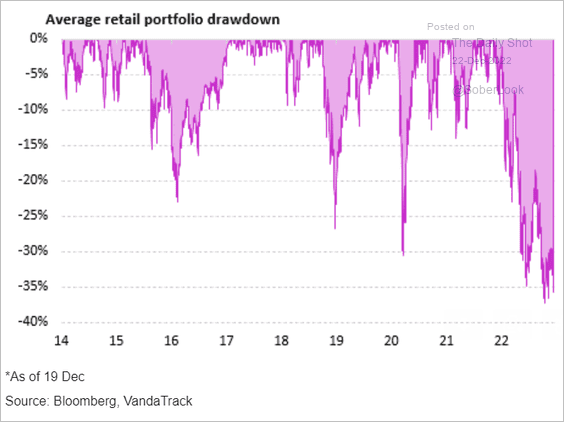

• Retail investors’ average portfolio drawdown is around 35%.

Source: Vanda Research

Source: Vanda Research

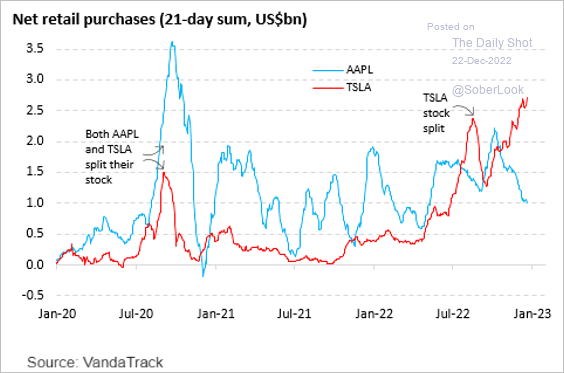

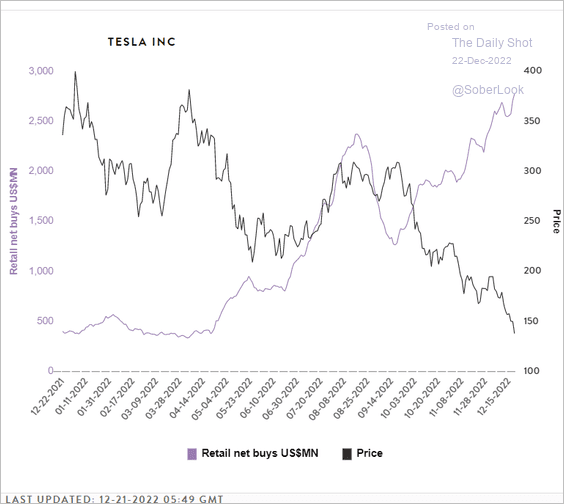

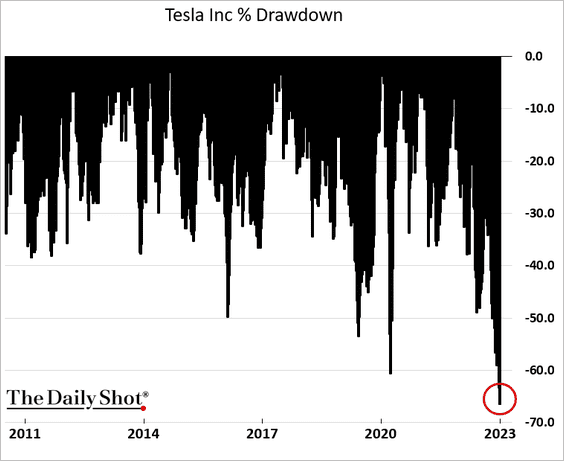

• Retail investors keep boosting their purchases of Tesla …

Source: Vanda Research

Source: Vanda Research

… as prices drop.

Source: Vanda Research

Source: Vanda Research

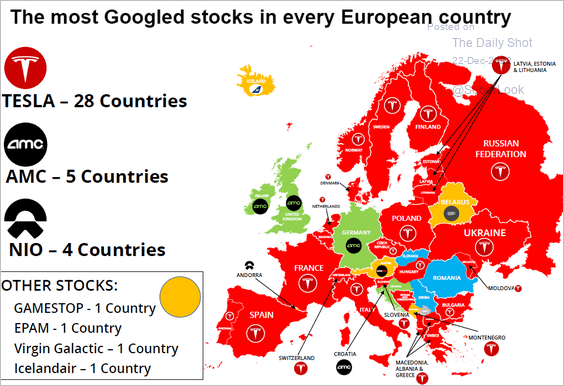

And the trend is not limited to the US.

Source: Bonusetu.com

Source: Bonusetu.com

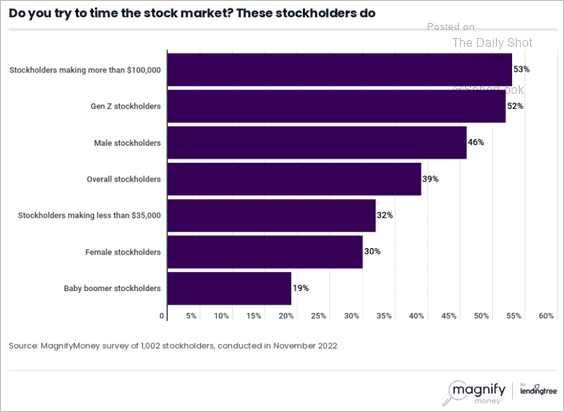

• Who is trying to time the stock market?

Source: MagnifyMoney

Source: MagnifyMoney

Back to Index

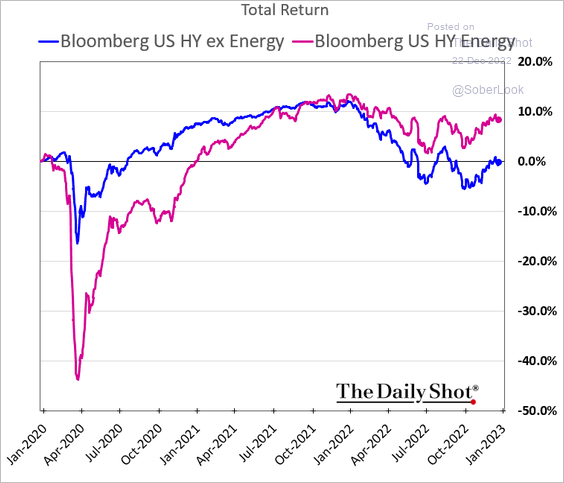

Credit

Energy-sector high-yield bonds have been outperforming.

h/t @jtcrombie

h/t @jtcrombie

Back to Index

Global Developments

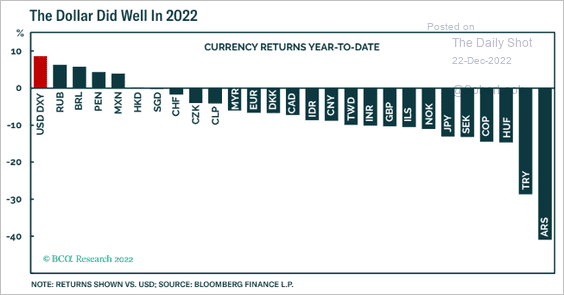

1. The US dollar performed well this year.

Source: BCA Research

Source: BCA Research

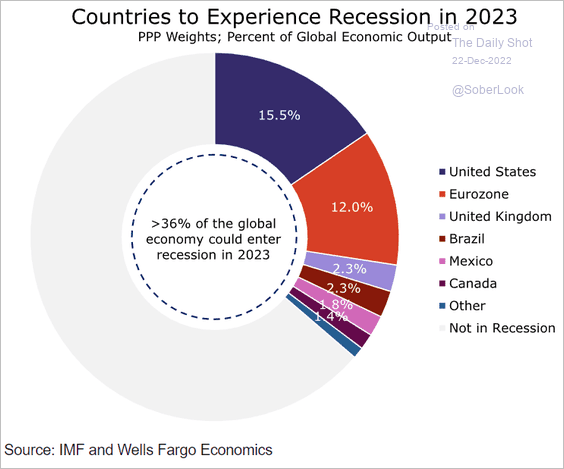

2. Here is the global GDP share that is expected to enter a recession next year.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

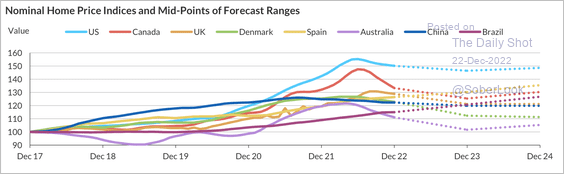

3. Fitch expects home price growth to modestly pick up in 2024 for most countries as recessionary pressures recede.

Source: Fitch Ratings

Source: Fitch Ratings

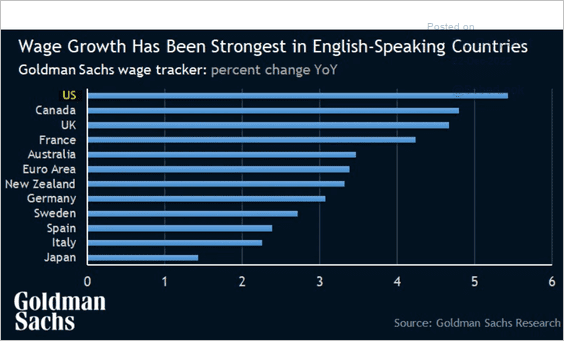

4. This chart shows wage growth in advanced economies.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

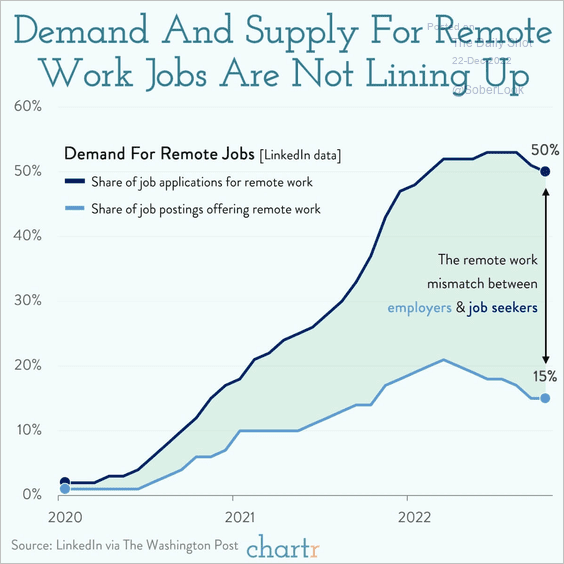

1. Supply/demand for remote-work jobs:

Source: @chartrdaily

Source: @chartrdaily

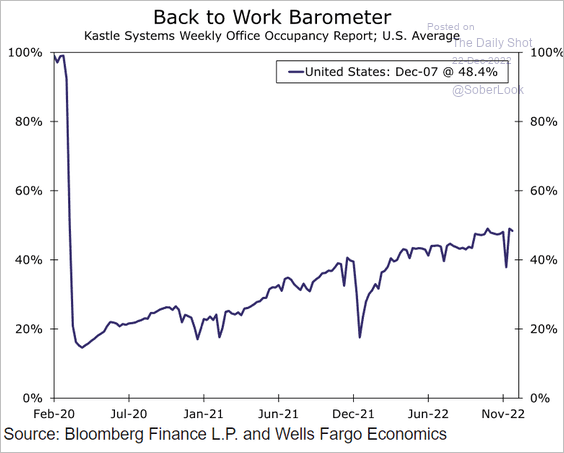

2. Office occupancy rates:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

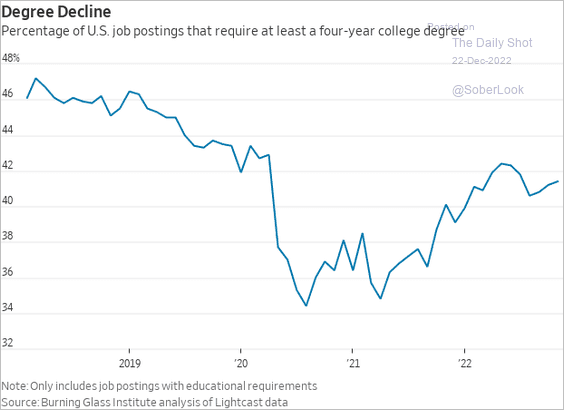

3. US job postings that require a college degree:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. US employment in the semiconductor industry:

![]() Source: USAFacts

Source: USAFacts

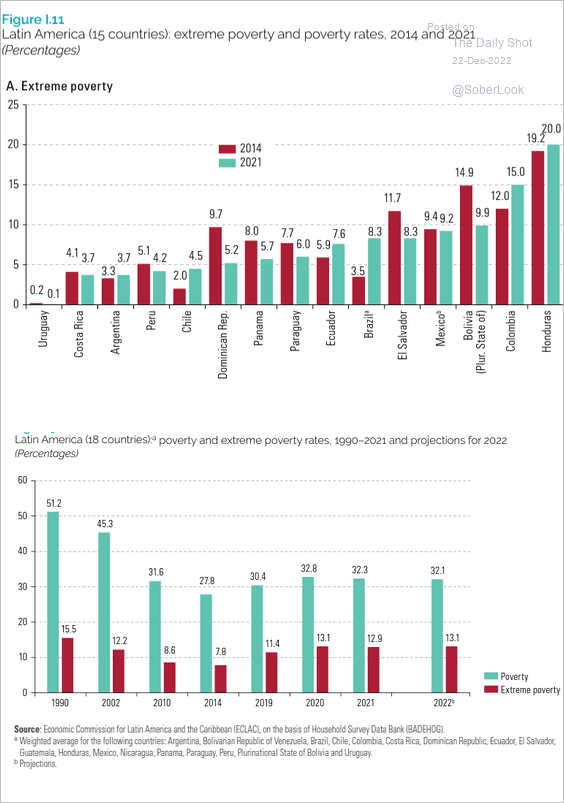

5. Extreme poverty levels across Latin America:

Source: UN Read full article

Source: UN Read full article

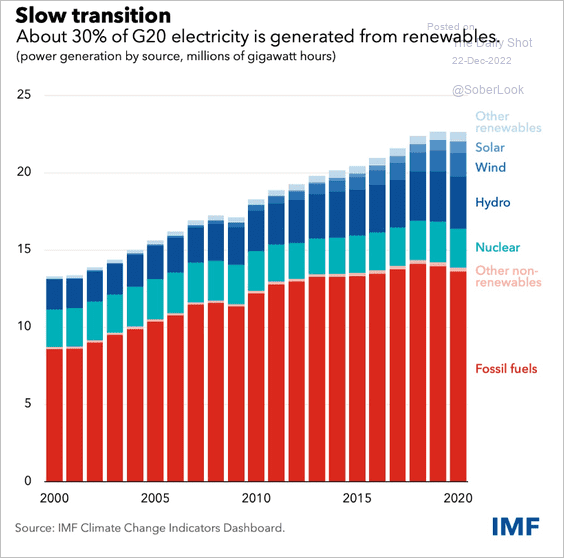

6. Renewables’ share of the G20 electricity generation:

Source: IMF Read full article

Source: IMF Read full article

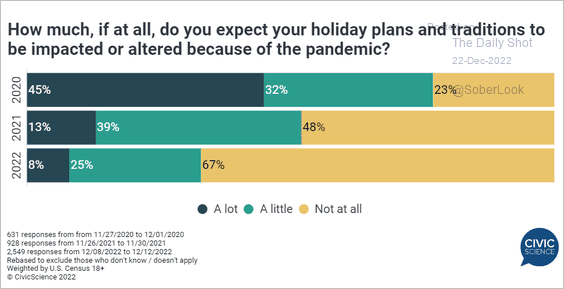

7. Holiday plans impacted by the pandemic:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index