The Daily Shot: 23-Dec-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives:

• Credit

• Global Developments

• Food for Thought

As a reminder, the next Daily Shot will be published on Monday, January 2nd.

The United States

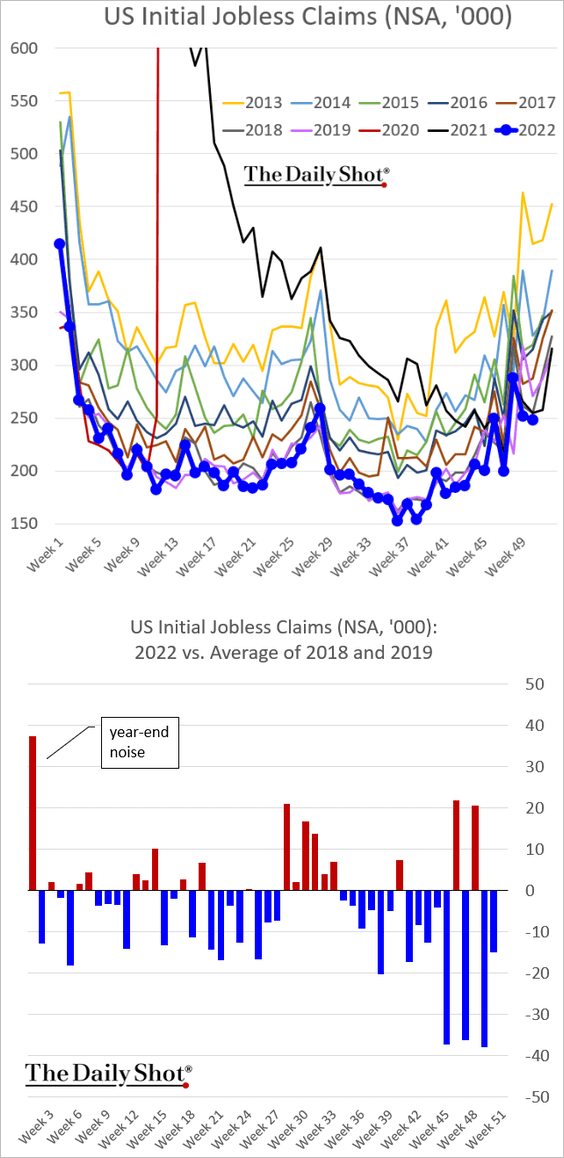

1. Unemployment applications are holding below pre-COVID levels (at multi-year lows), suggesting that recent layoffs are not having a meaningful impact on the labor market.

——————–

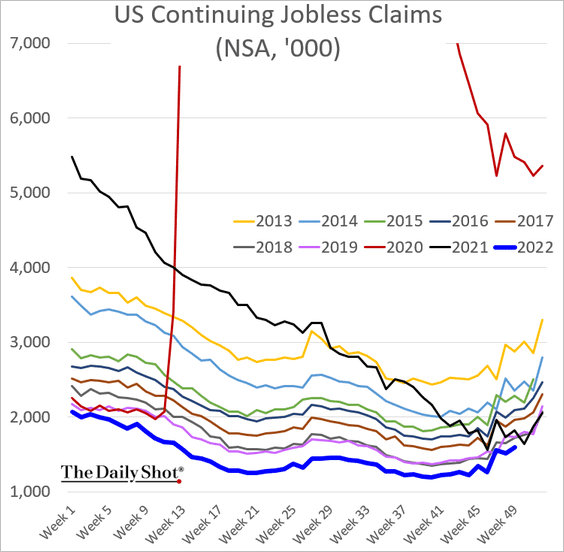

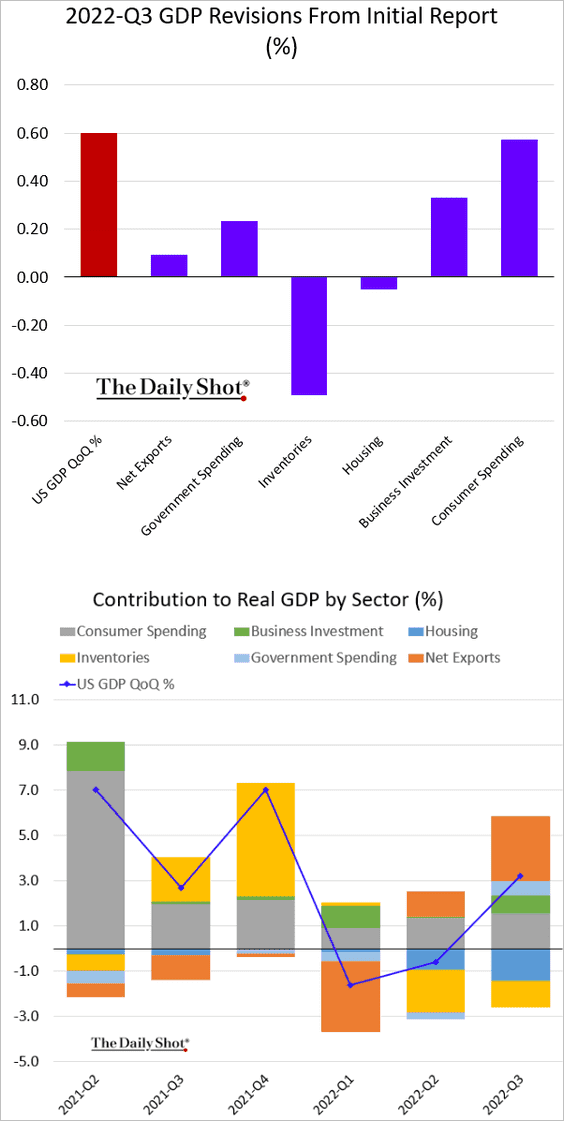

2. The Q3 GDP growth was revised higher again. Consumer spending and business investment were stronger than initially reported.

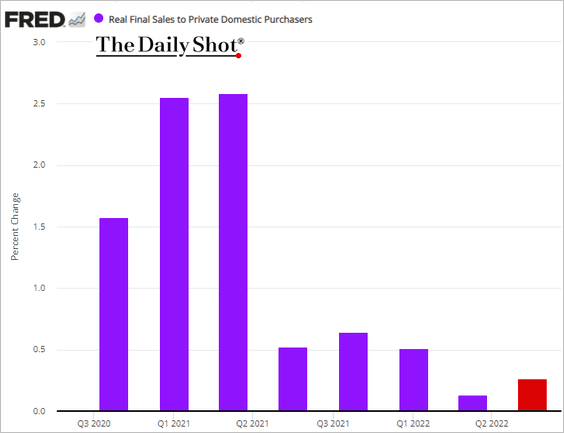

The index of real final sales to domestic purchasers (“core GDP”) was close to zero when the Q3 GDP was first reported. That turned out not to be the case.

The news of robust consumption in Q3 and remarkably low jobless claims sent stocks tumbling amid concerns that a recession will be required to tame inflation.

——————–

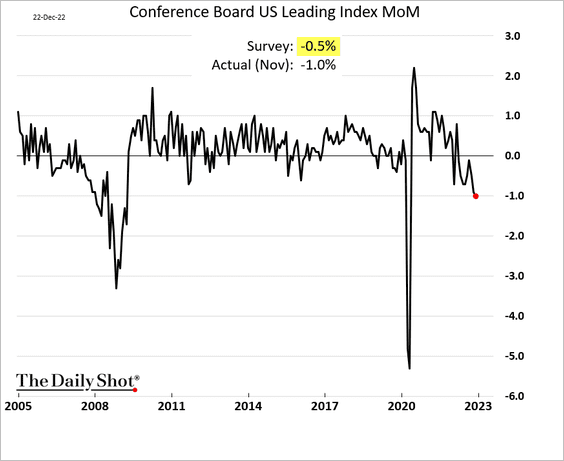

3. The Conference Board’s index of leading economic indicators saw the biggest monthly drop since the COVID shock.

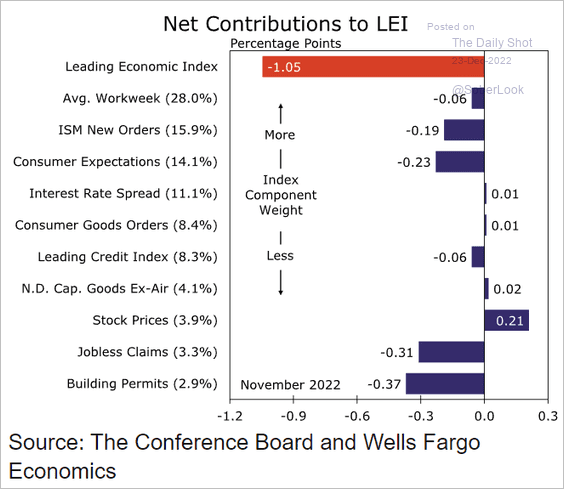

• Here are the contributions to the November change in the index.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

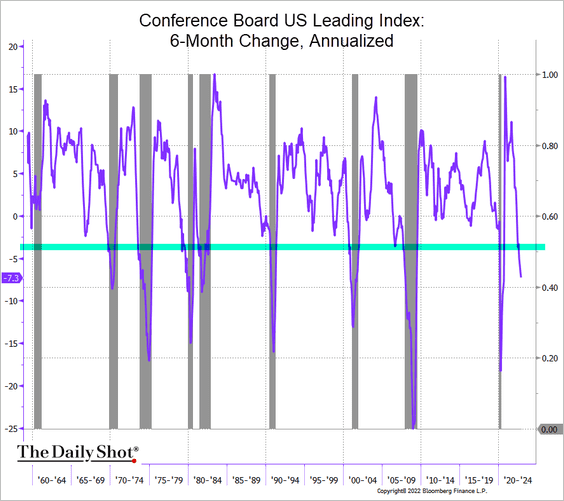

• The 6-month decline in the leading index has never been this large without a recession.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

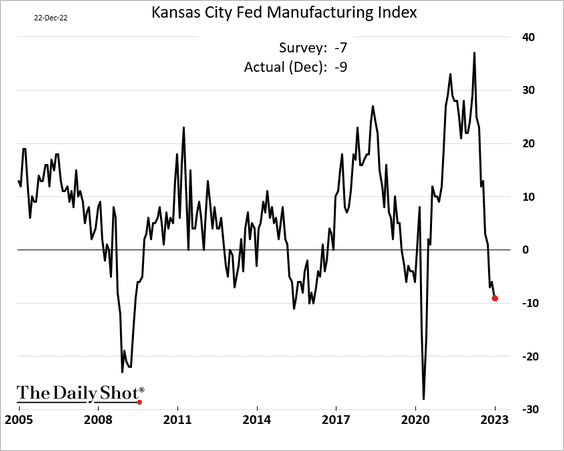

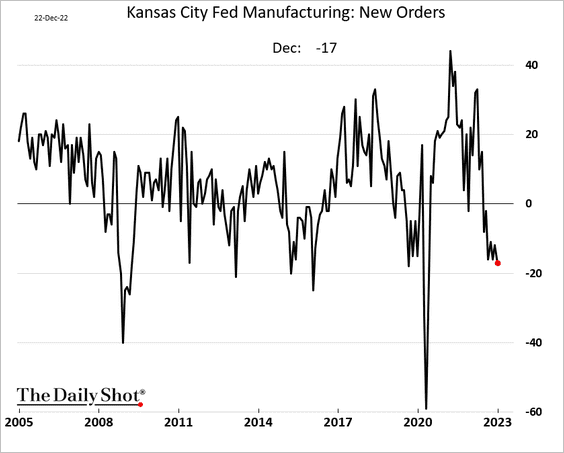

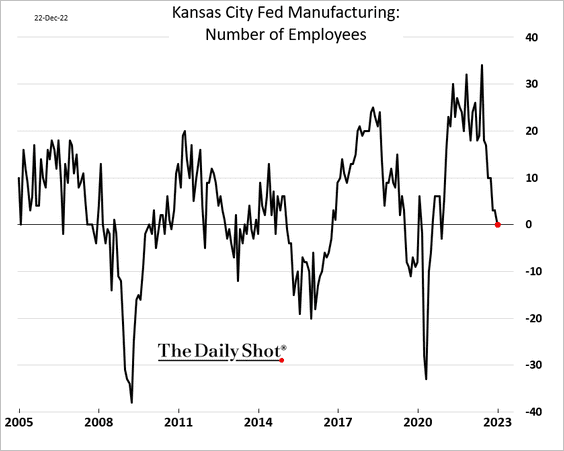

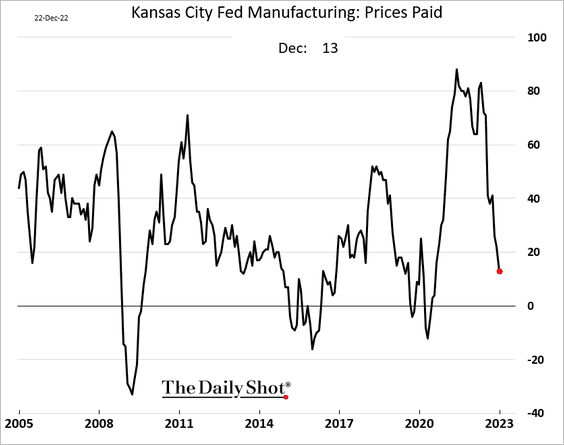

4. The Kansas City Fed’s manufacturing report showed rapid deterioration in the region’s factory activity.

• Demand is tumbling.

• Hiring has stalled.

• Price pressures continue to ease.

——————–

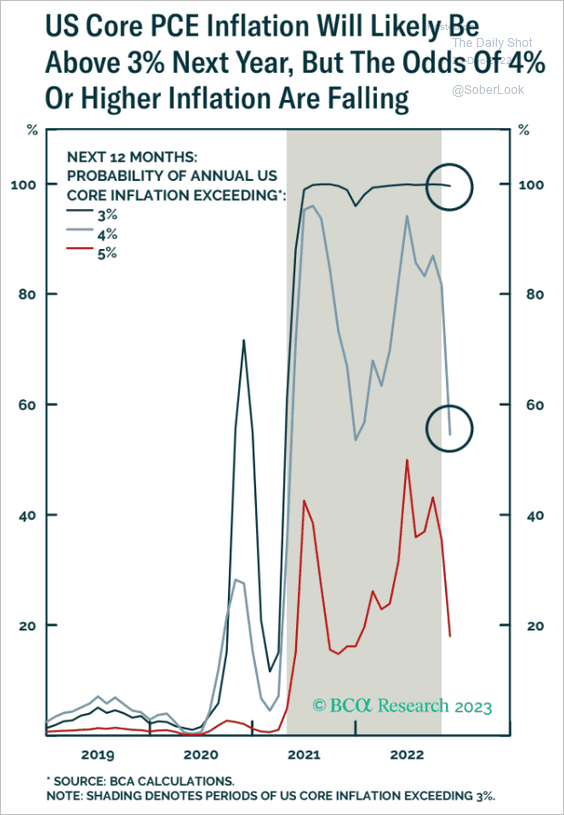

5. Next, we have some updates on inflation.

• Here are the probabilities of the core PCE inflation exceeding 3%, 4%, or 5% next year, according to BCA Research.

Source: BCA Research

Source: BCA Research

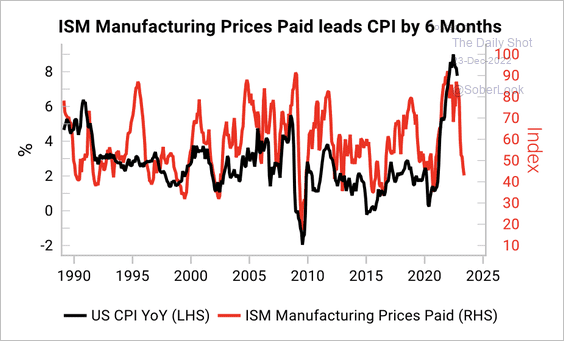

• There is a six-month lead between ISM prices paid and CPI. Inflation should continue to cool early next year.

Source: Variant Perception

Source: Variant Perception

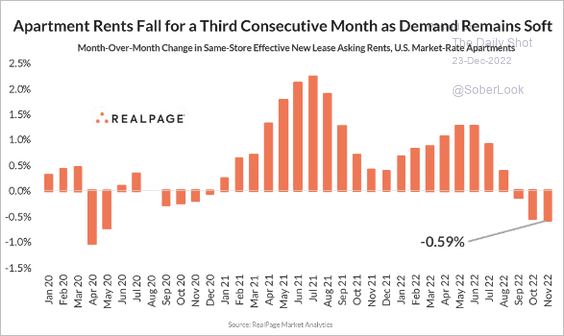

• Rents declined for the third consecutive month in November.

Source: RealPage

Source: RealPage

——————–

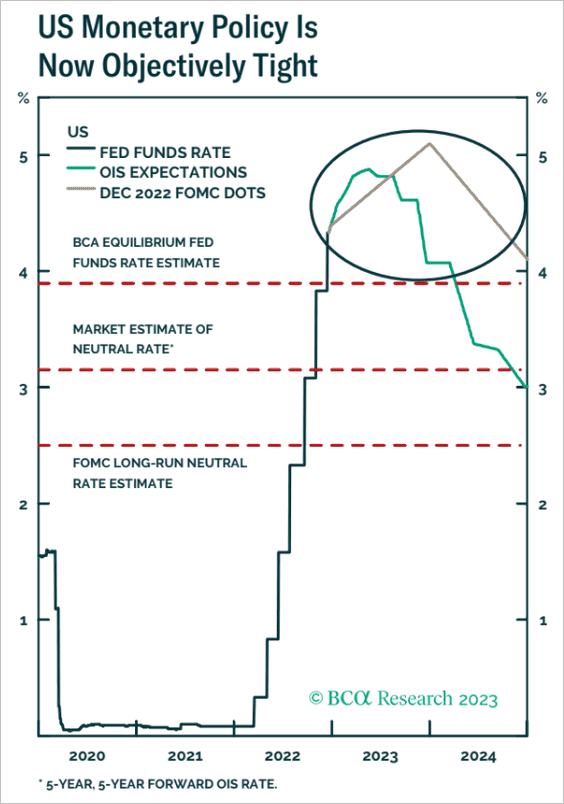

6. How restrictive will the Fed’s policy get? It depends on the estimates of the long-run neutral rate.

Source: BCA Research

Source: BCA Research

Back to Index

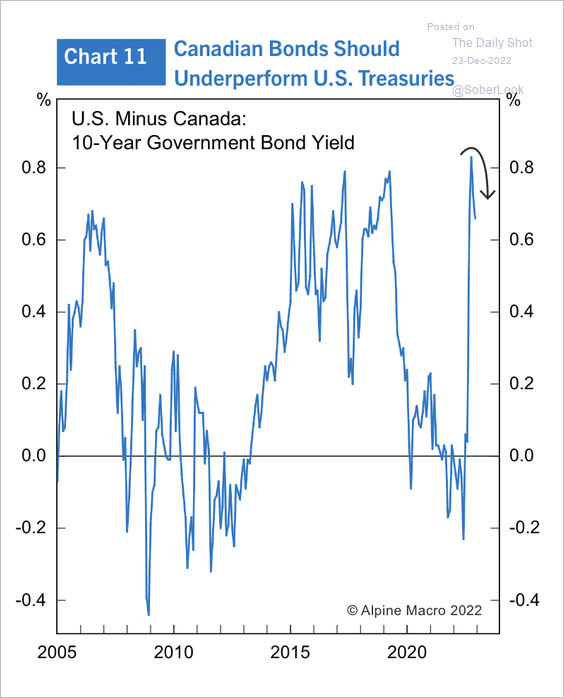

Canada

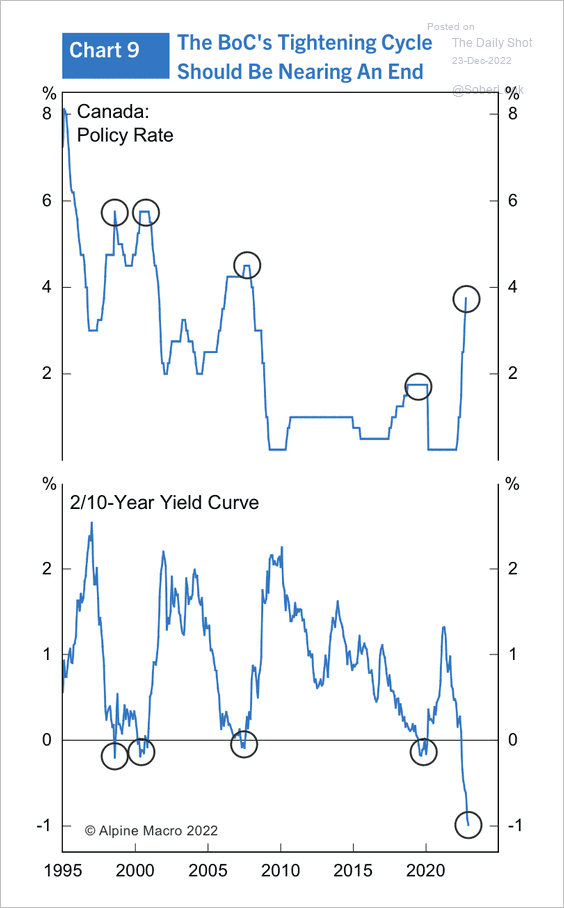

Alpine Macro sees less scope for the BoC to cut rates than the Fed next year. That could result in a firmer Canadian dollar but underperformance of Canadian bonds versus Treasuries. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Back to Index

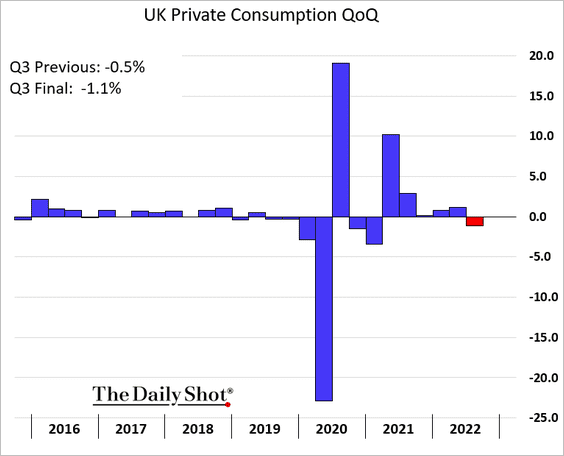

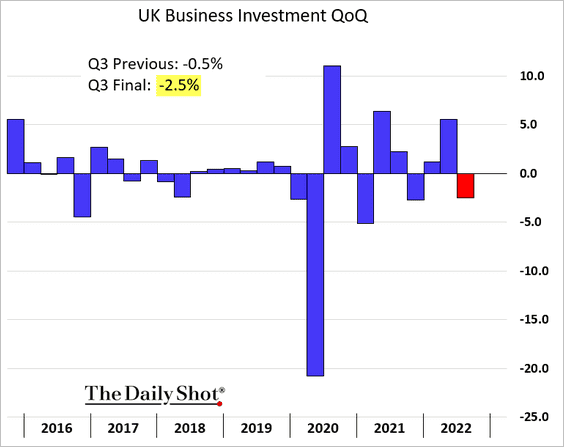

The United Kingdom

1. Consumption and business investment in Q3 were revised lower.

——————–

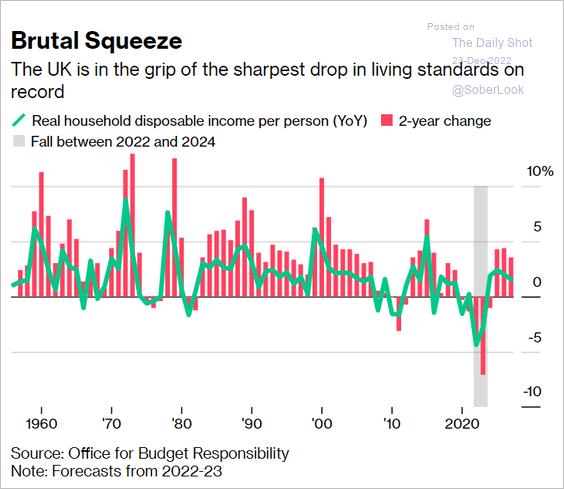

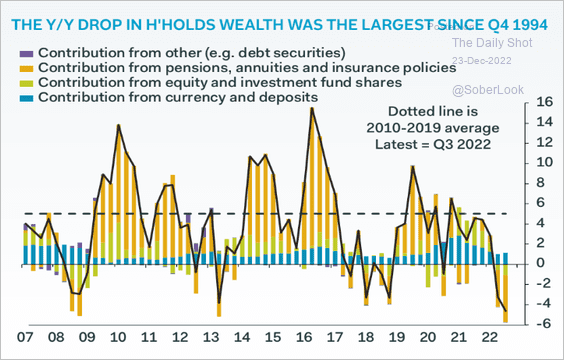

2. UK living standards are under pressure.

Source: @PhilAldrick, @tetley_liza, @business Read full article

Source: @PhilAldrick, @tetley_liza, @business Read full article

The decline in household wealth has been massive.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

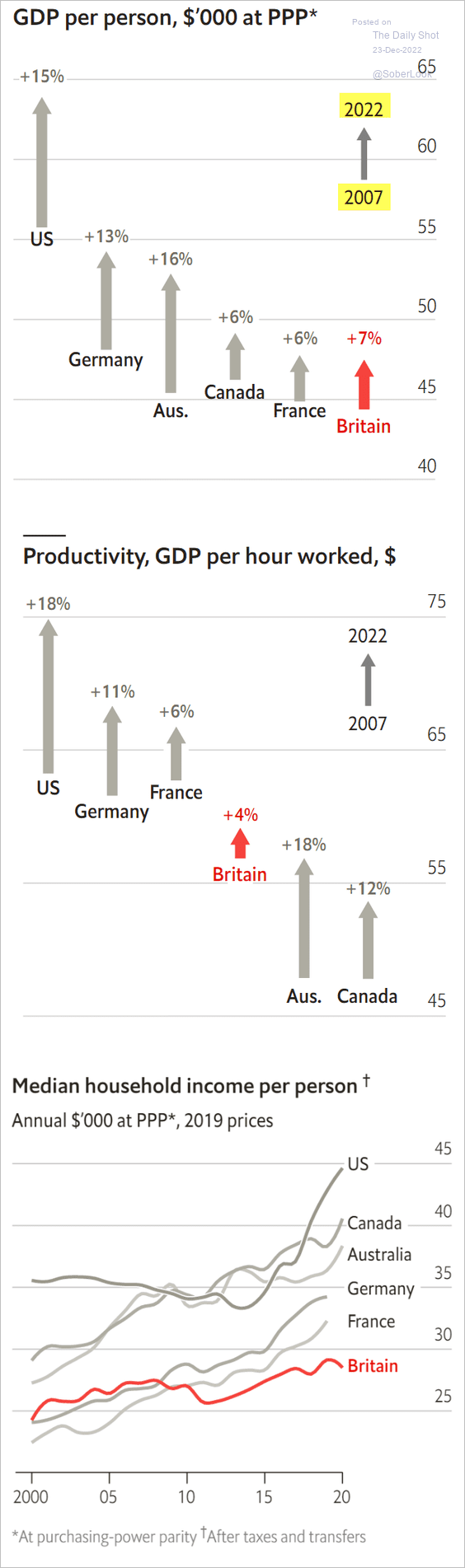

3. The UK’s economic indicators have not kept pace with those of other advanced economies.

Source: The Economist Read full article

Source: The Economist Read full article

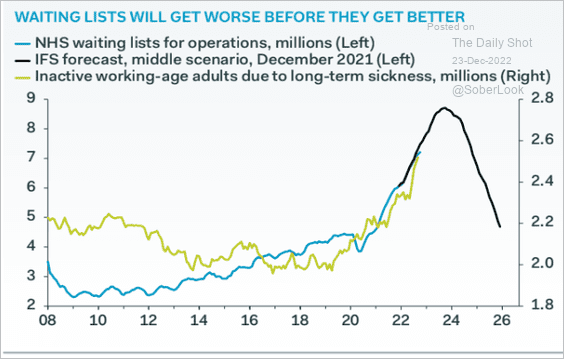

4. Hospital delays are yet to peak.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

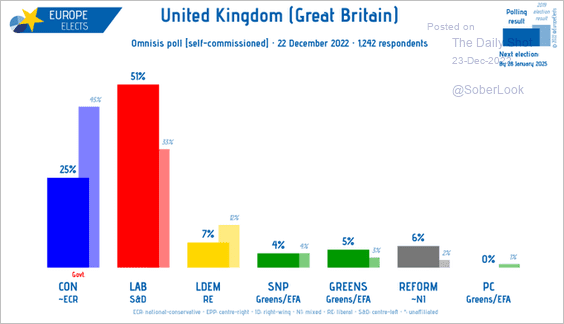

5. Finally, here is the latest political poll.

Source: @EuropeElects

Source: @EuropeElects

Back to Index

The Eurozone

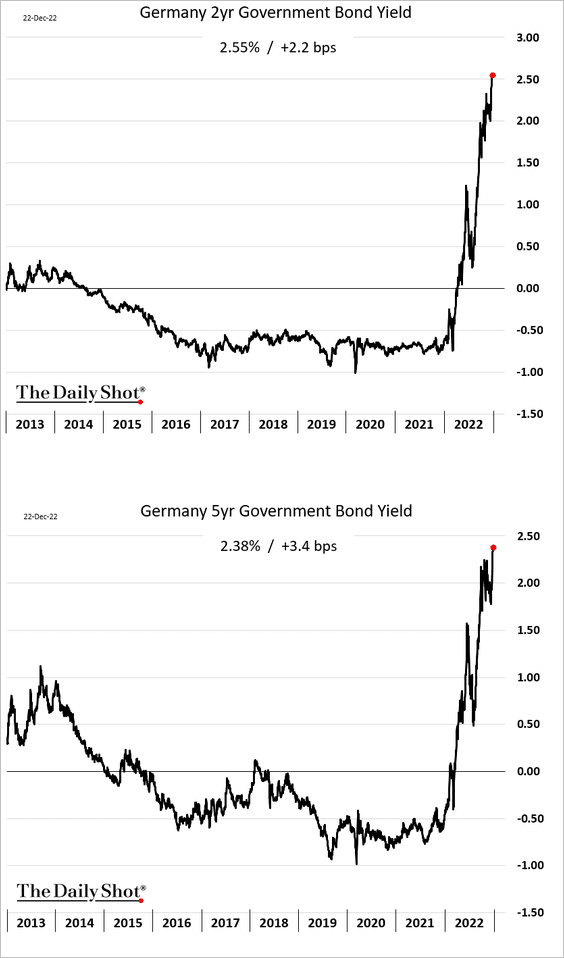

1. Short-term Bund yields continue to hit multi-year highs.

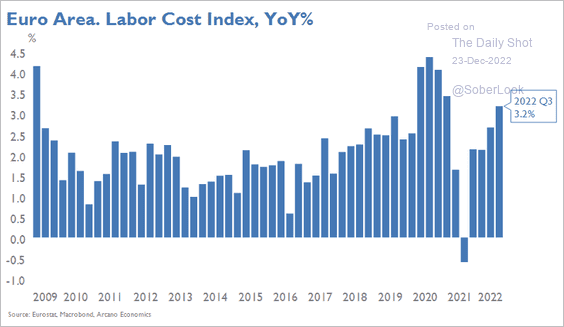

2. Growth in the euro-area labor costs has been accelerating.

Source: Arcano Economics

Source: Arcano Economics

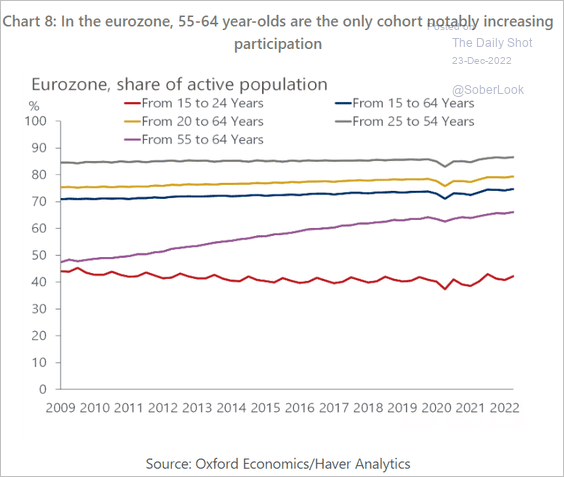

3. This chart shows labor force participation rates by age.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Europe

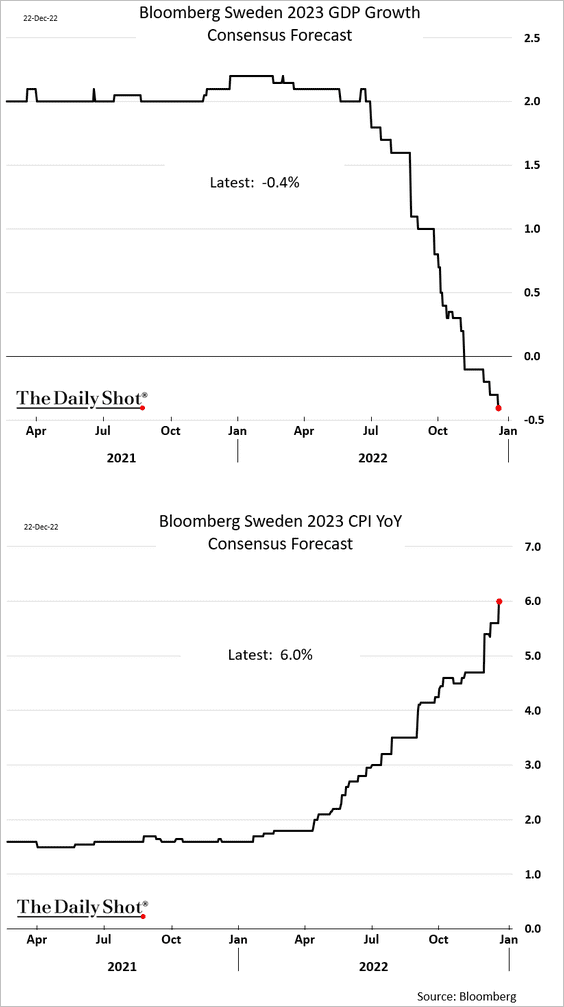

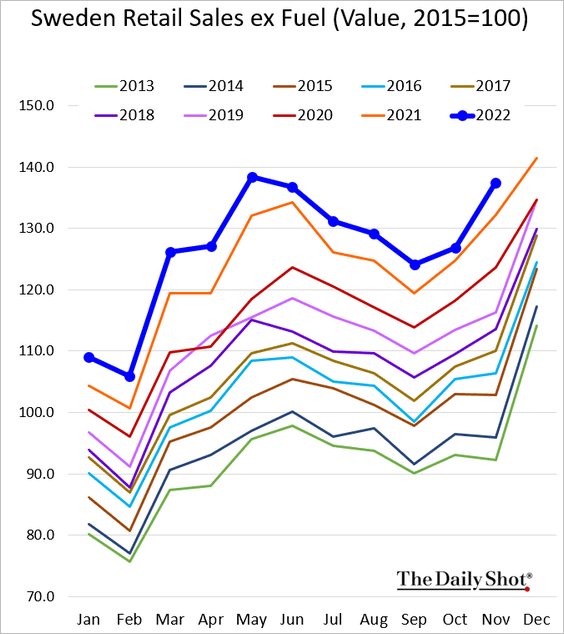

1. Sweden is on track for a difficult period of stagflation.

Nominal retail sales have been holding up.

——————–

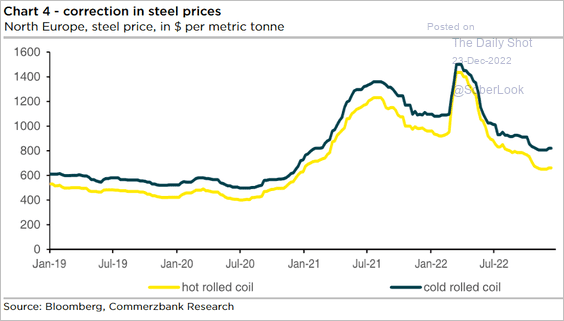

2. European steel prices have declined sharply from peak levels.

Source: Commerzbank Research

Source: Commerzbank Research

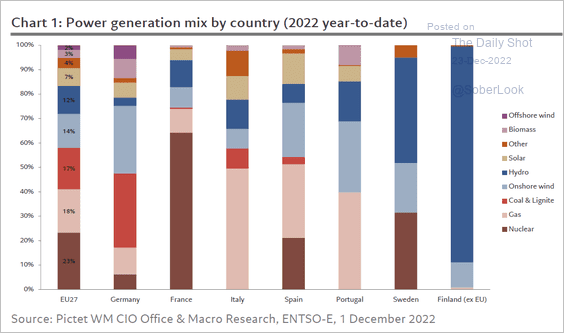

3. Next, we have the power generation mix by country.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

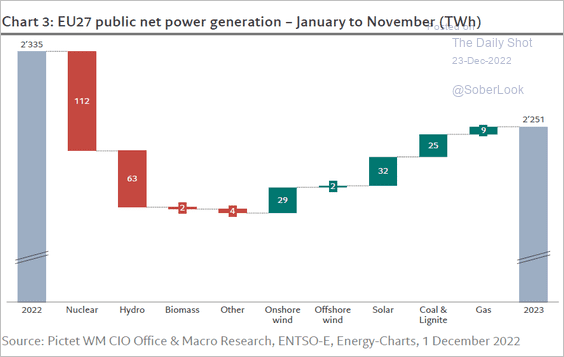

And here is the EU’s power generation net change from January to November.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

——————–

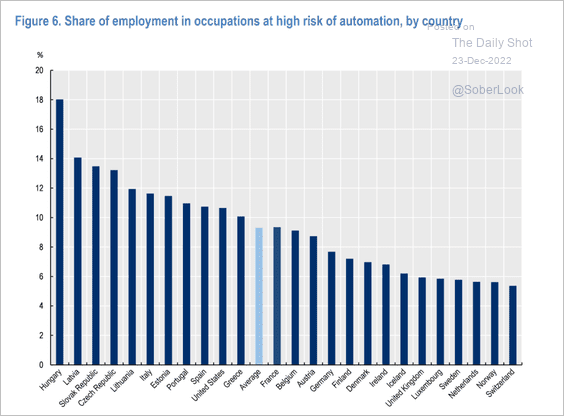

4. Which countries are the most vulnerable to automation?

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Asia – Pacific

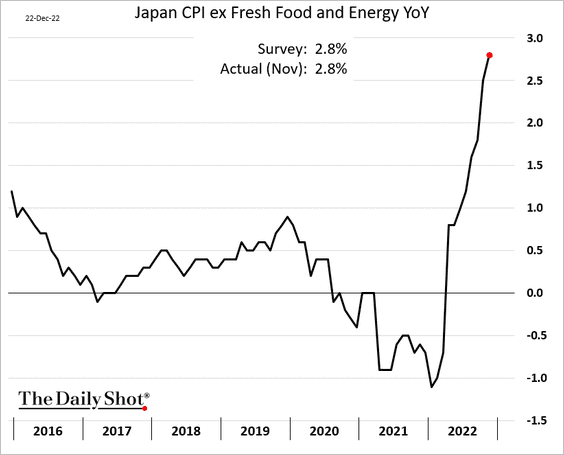

1. Japan’s core CPI continues to climb.

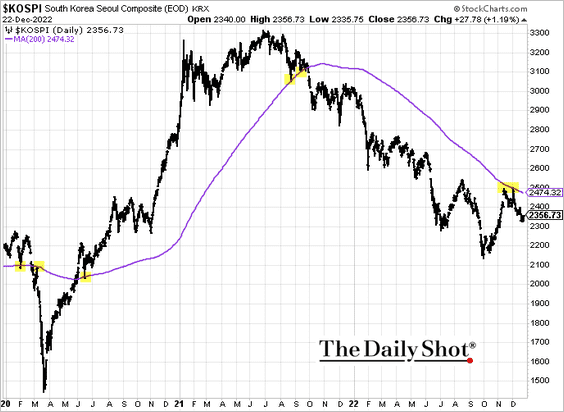

2. The KOSPI index has been holding resistance at the 200-day moving average.

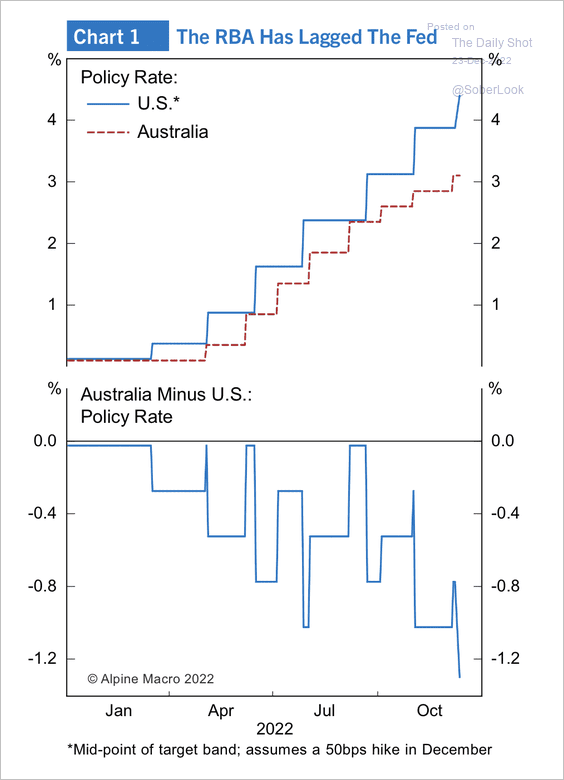

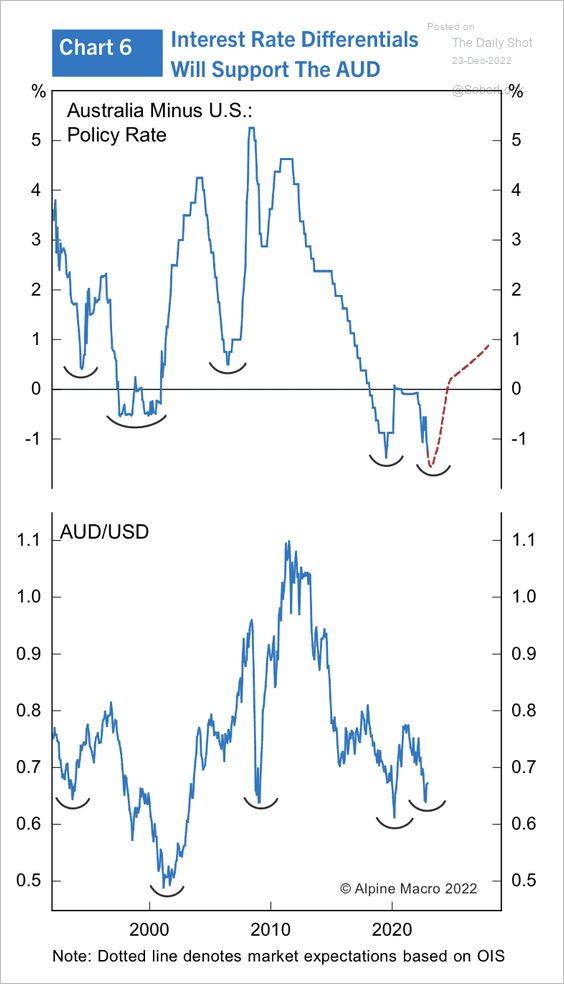

3. The RBA has lagged the Fed in tightening policy. It could also lag in making a dovish pivot, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

Interest rate differentials could support AUD/USD if the RBA is slower to make a dovish pivot.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

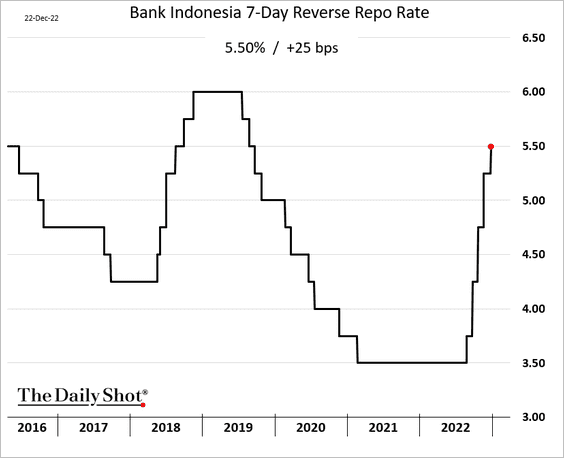

1. Indonesia’s central bank raised rates by 25 bps after three consecutive 50 bps increases.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

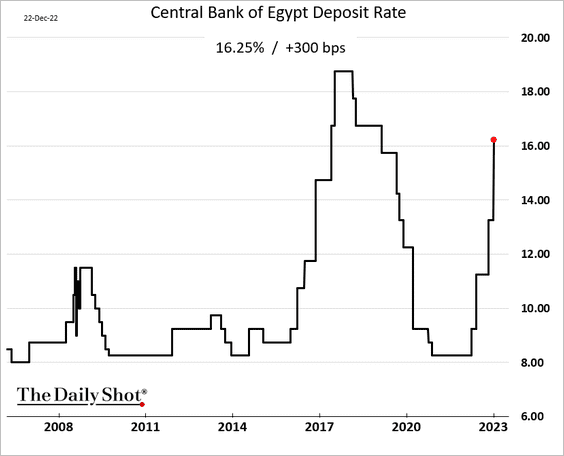

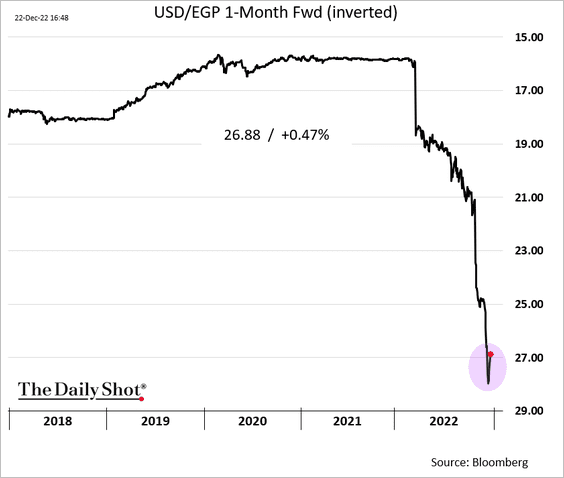

2. Egypt’s central bank hiked its benchmark rate by 300 bps …

Source: @MiretteMagdy7, @TTablawy, @business Read full article

Source: @MiretteMagdy7, @TTablawy, @business Read full article

… to stabilize the pound.

——————–

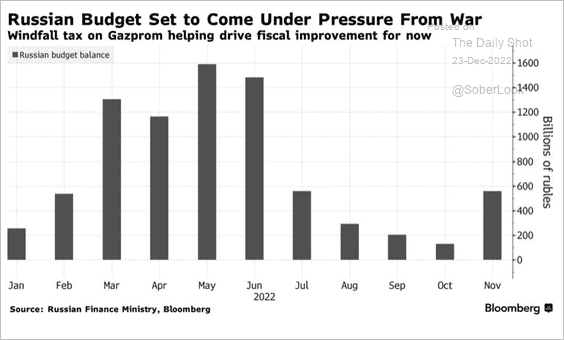

3. Russia’s budget is expected to come under pressure amid slower energy exports and softer prices.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

Commodities

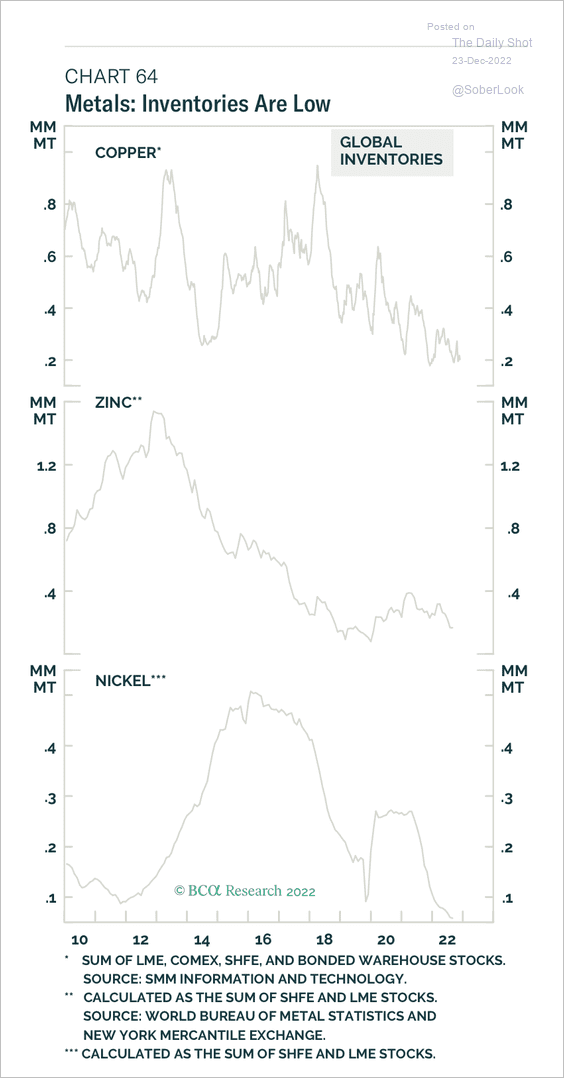

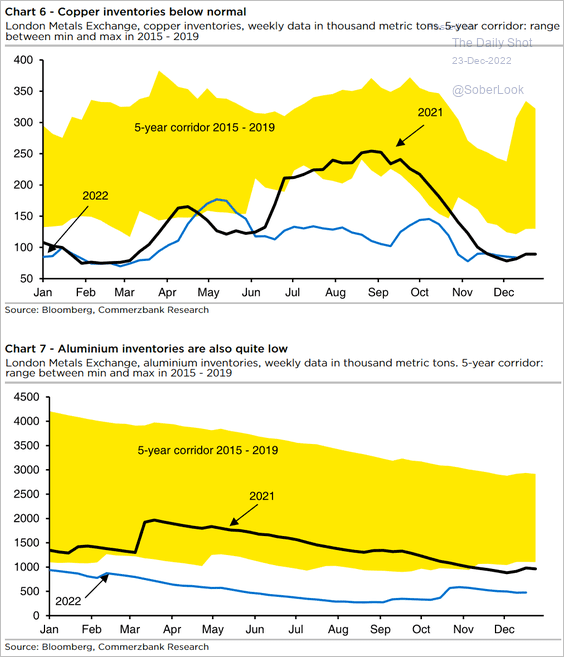

1. Metals inventories remain at exceptionally low levels (2 charts).

Source: BCA Research

Source: BCA Research

Source: Commerzbank Research

Source: Commerzbank Research

——————–

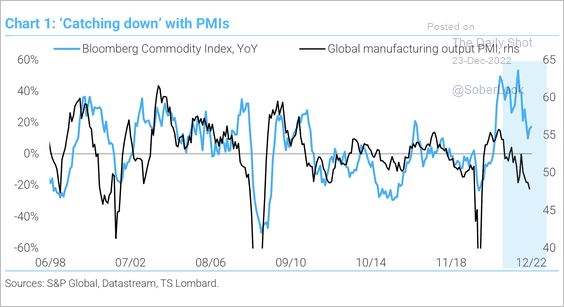

2. The slowdown in global manufacturing has been weighing on commodity prices.

Source: TS Lombard

Source: TS Lombard

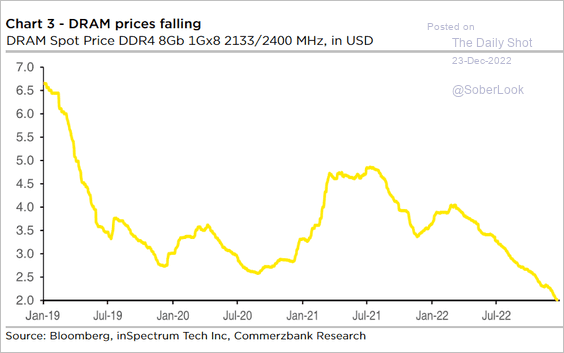

3. Computer memory prices are hitting multi-year lows.

Source: Commerzbank Research

Source: Commerzbank Research

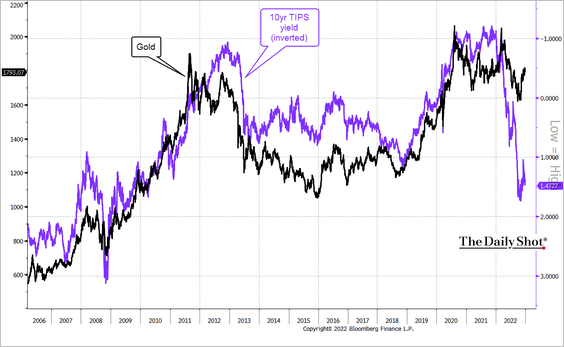

4. Elevated US real yields are a headwind for gold.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @t1alpha

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @t1alpha

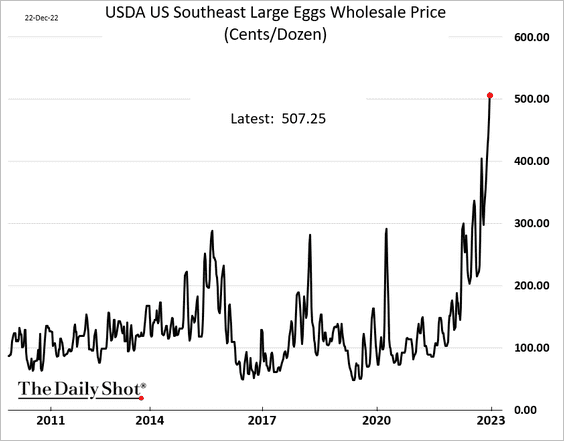

5. The bird flu has led to unprecedented increases in egg prices in the US.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

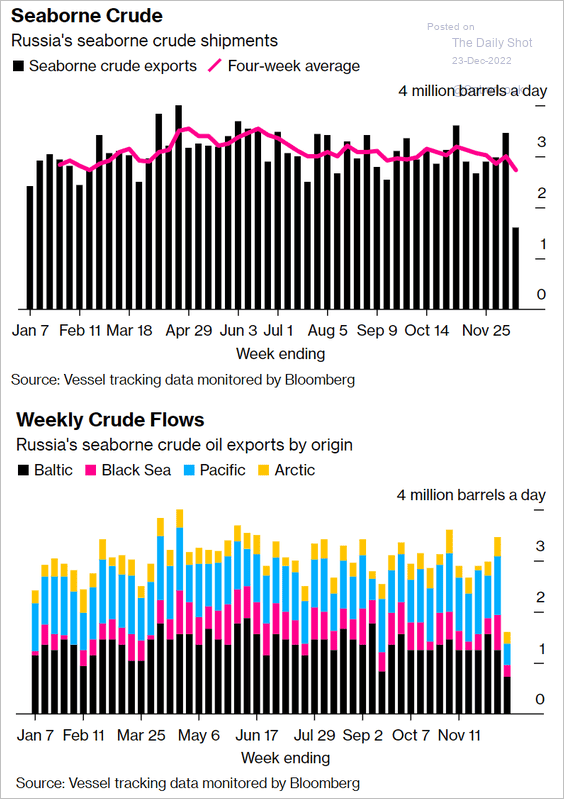

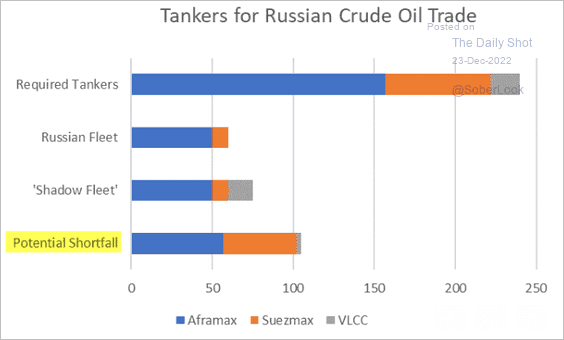

1. Russian oil shipments tumbled, …

Source: @JLeeEnergy, @markets Read full article

Source: @JLeeEnergy, @markets Read full article

… amid tanker shortages.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

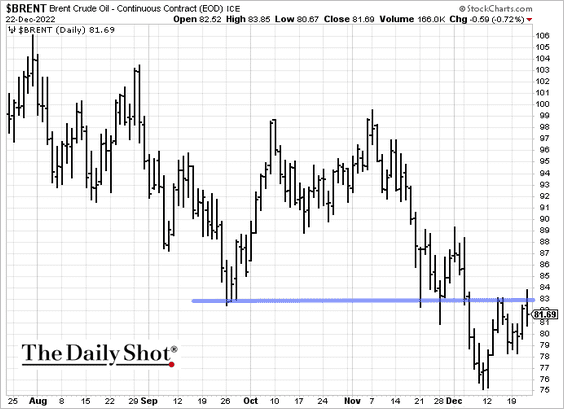

2. Despite the drop in Russia’s oil sales, Brent crude held resistance.

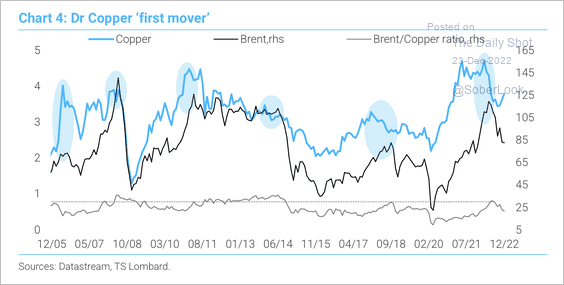

• A peak in the copper price typically precedes a decline in the Brent oil price.

Source: TS Lombard

Source: TS Lombard

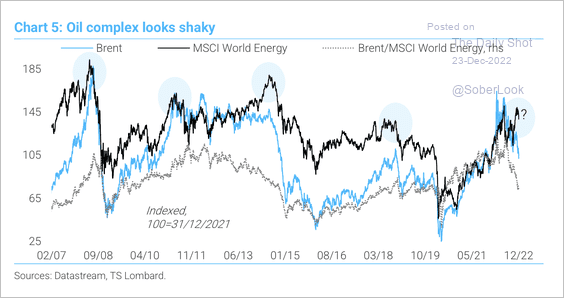

The relationship between oil prices and energy stocks sends a similar message.

Source: TS Lombard

Source: TS Lombard

——————–

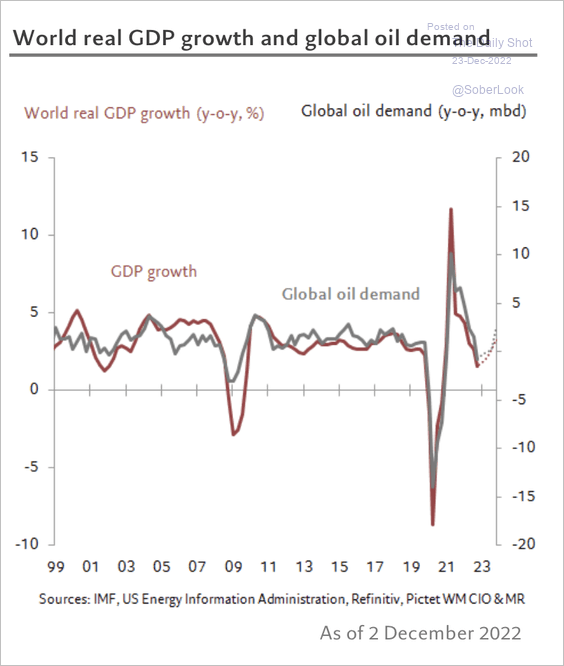

3. Pictet expects global oil demand to rise next year, driven by a recovery in Western economies and a reopening in China.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

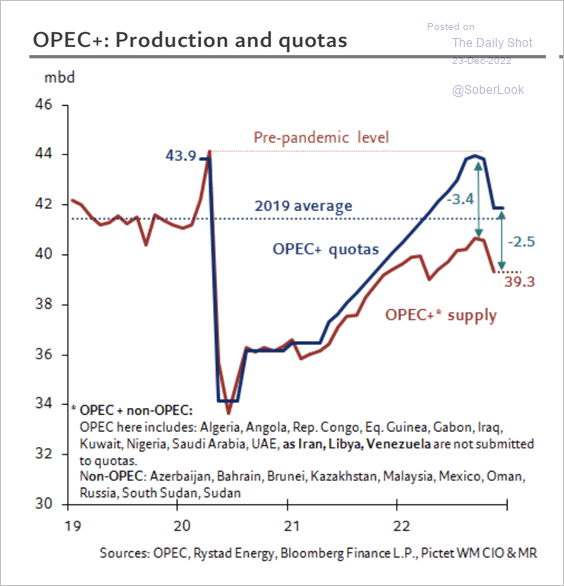

4. Most OPEC+ members are unable to fill their production quotas.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

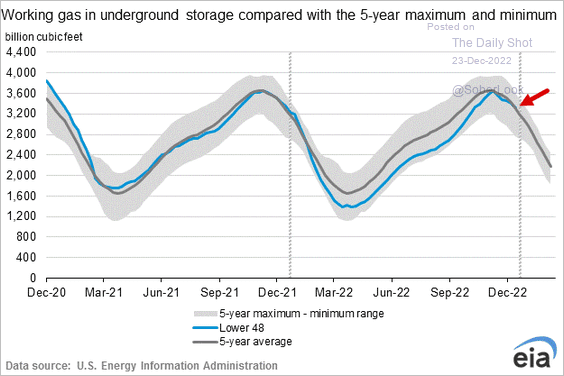

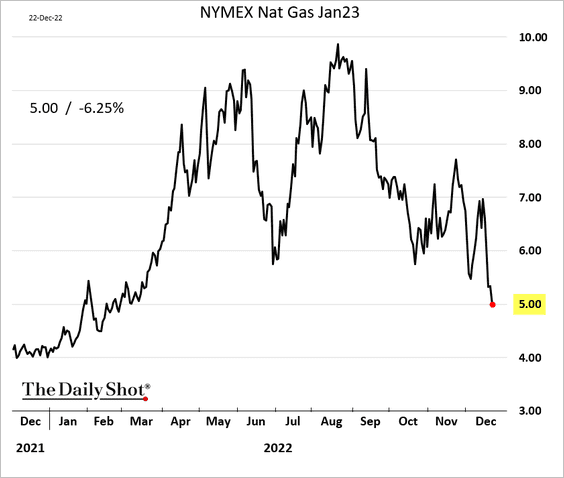

5. US natural gas in storage is now slightly above the five-year average.

Gas futures dipped to $5/MMBtu.

——————–

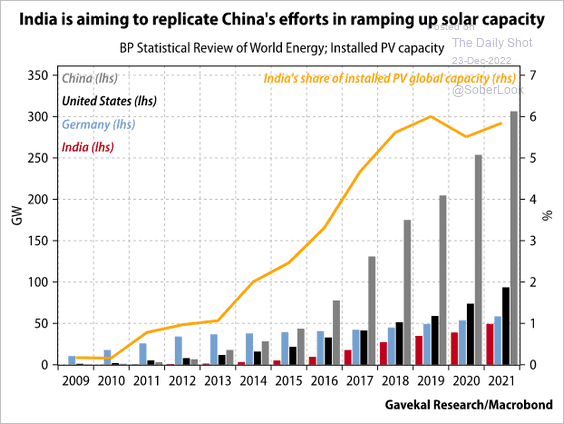

6. Next, we have solar power capacity in China, the US, Germany, and India.

Source: Gavekal Research

Source: Gavekal Research

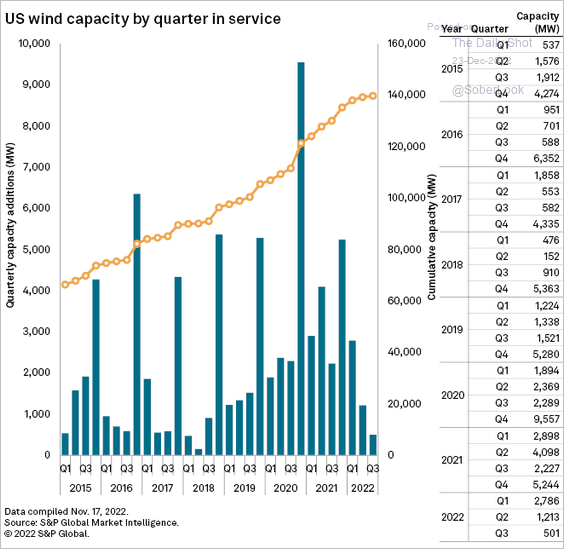

7. US wind capacity additions have slowed.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Equities

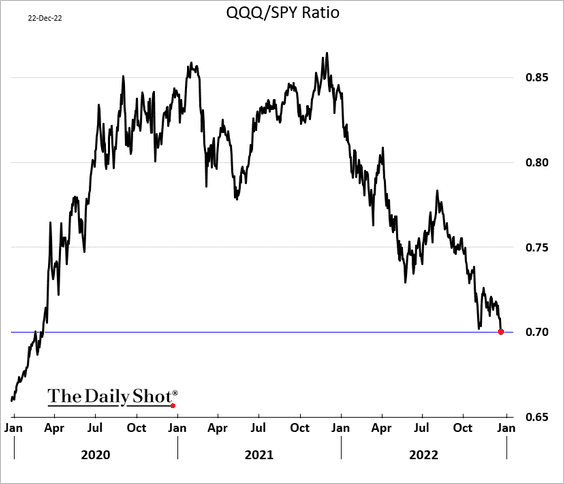

1. The QQQ/SPY ratio (Nasdaq 100/S&P 500) hit the lowest level since early 2020.

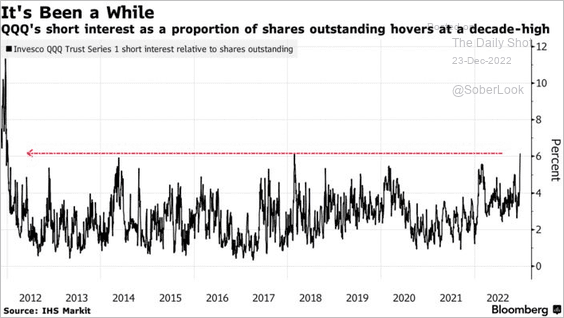

The QQQ short interest has surged to multi-year highs.

Source: @jwittenstein, @lena_popina, @markets Read full article

Source: @jwittenstein, @lena_popina, @markets Read full article

——————–

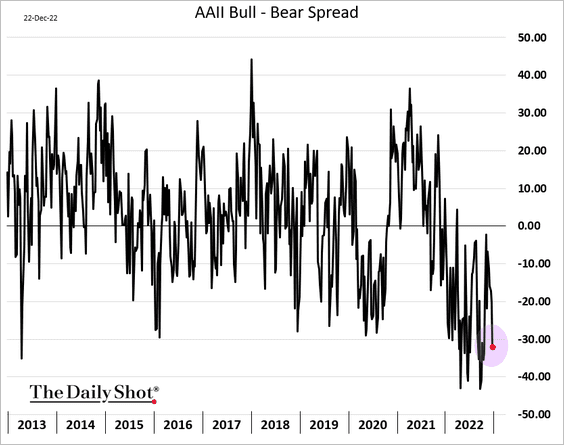

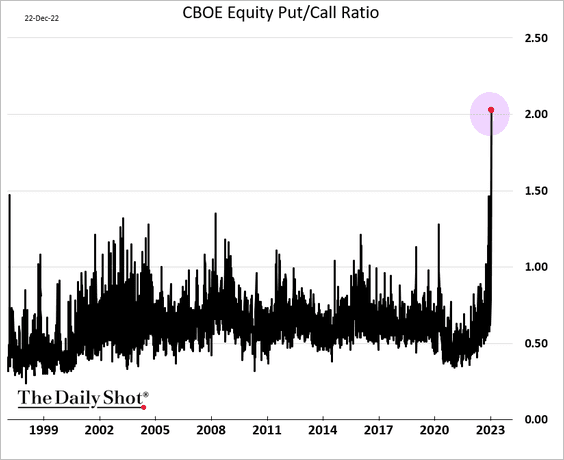

2. Investor sentiment has deteriorated again.

Traders bought a lot of downside protection going into the holiday week. The CBOE single-stock put/call ratio hit a record high.

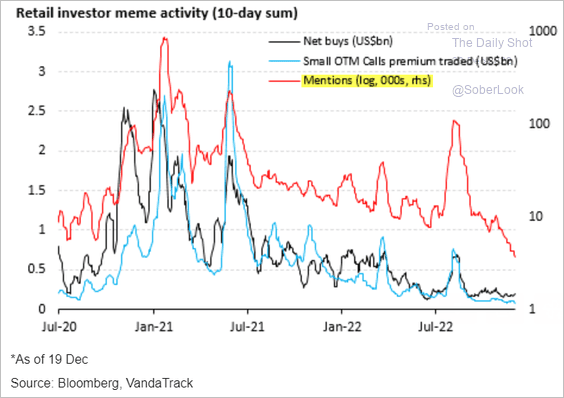

By the way, the Reddit crowd’s online meme chatter has collapsed.

Source: Vanda Research

Source: Vanda Research

——————–

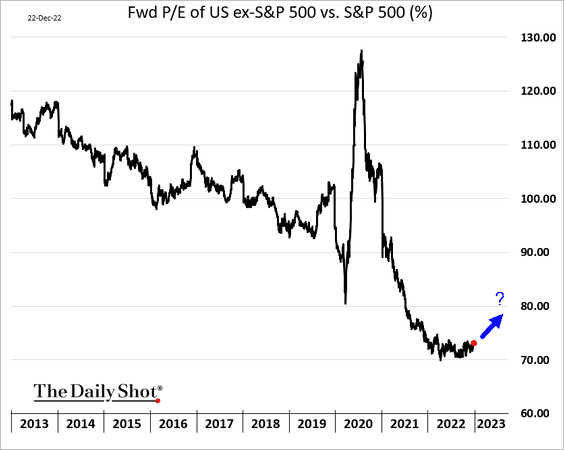

3. Have the non-S&P 500 stock valuations (mid-caps, small-caps, etc.) bottomed relative to the S&P 500?

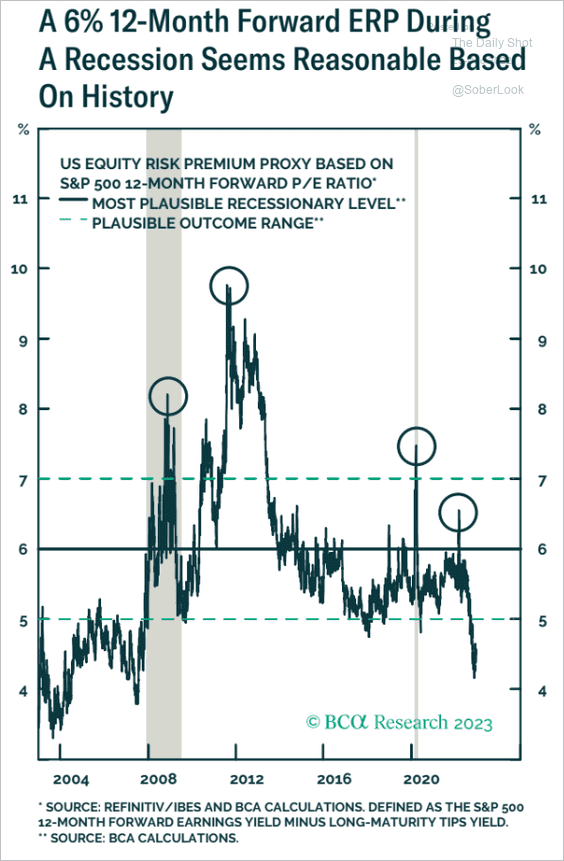

4. The S&P 500 risk premium is too low as recession looms.

Source: BCA Research

Source: BCA Research

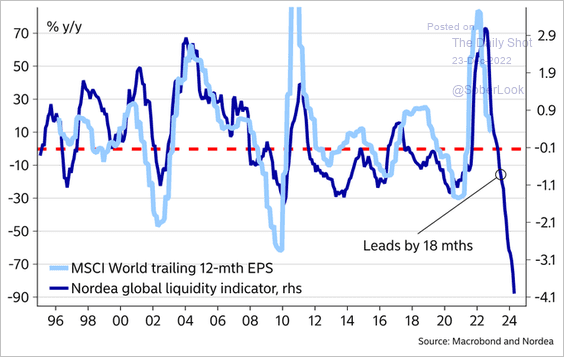

5. Tight liquidity is signaling rapid declines in earnings globally.

Source: @MikaelSarwe

Source: @MikaelSarwe

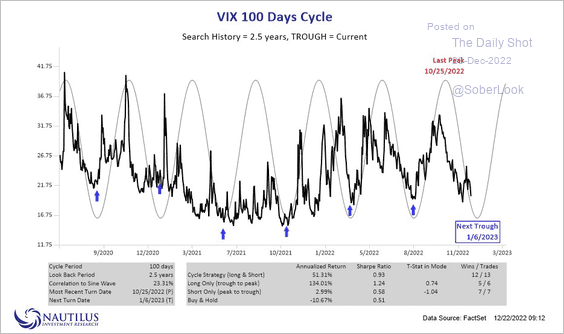

6. Are we set for another upcycle in VIX?

Source: @NautilusCap

Source: @NautilusCap

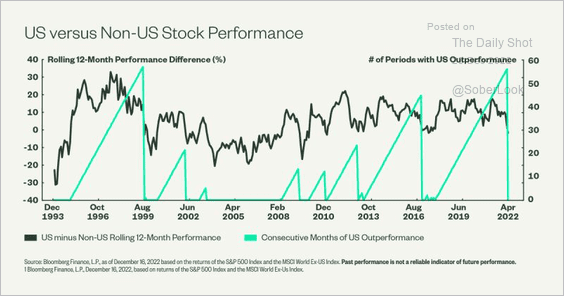

7. This has been a long streak of US stocks outperforming non-US DM stocks since 2018 – just one period shy of the record set in 1999. Could we see a reversal next year?

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

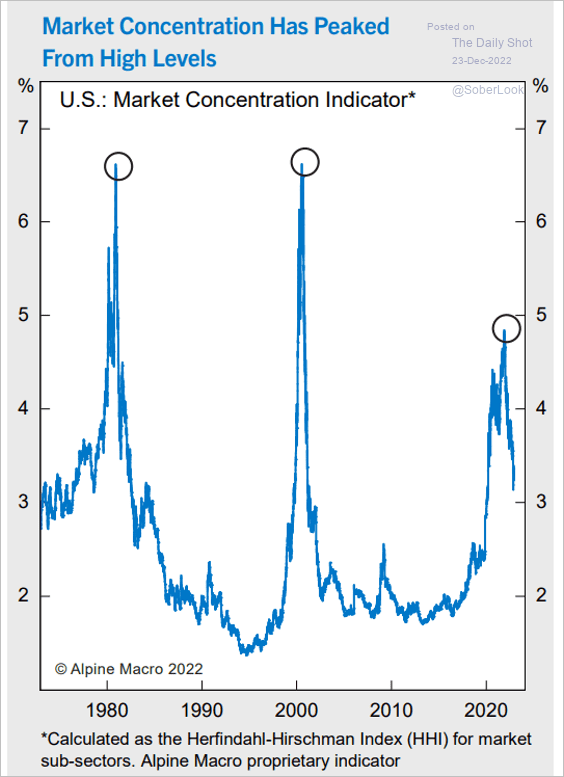

8. US market concentration is well off the highs.

Source: Alpine Macro

Source: Alpine Macro

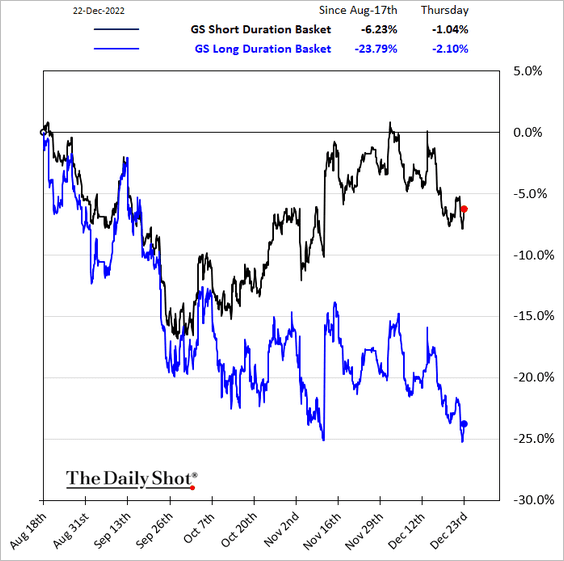

9. Long-duration stocks (companies that are expected to generate much of their cash flow in the distant future) have underperformed sharply in recent months.

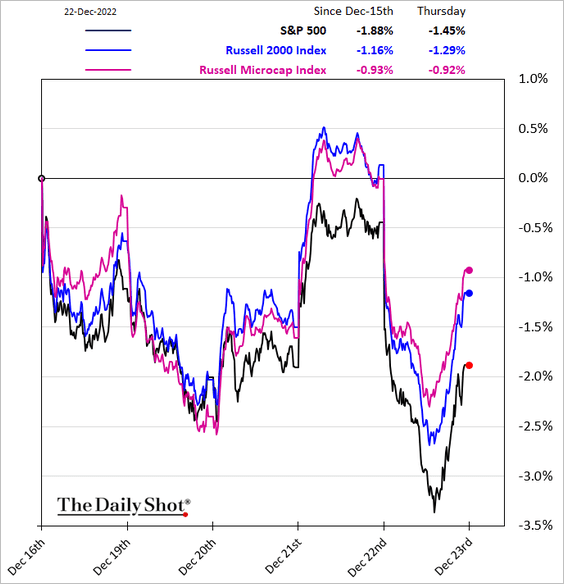

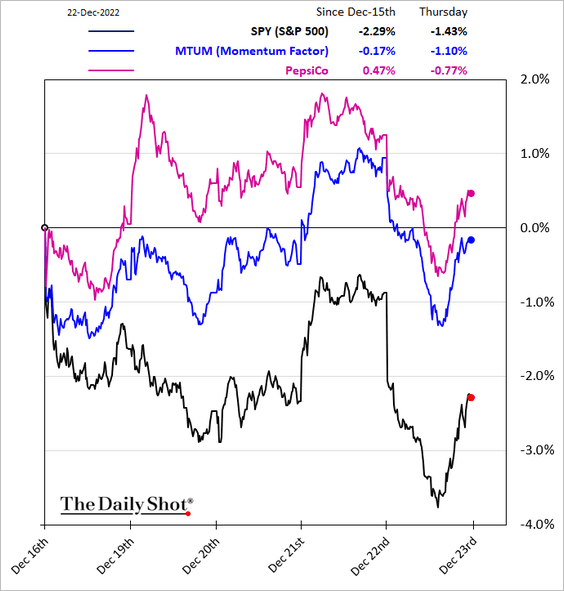

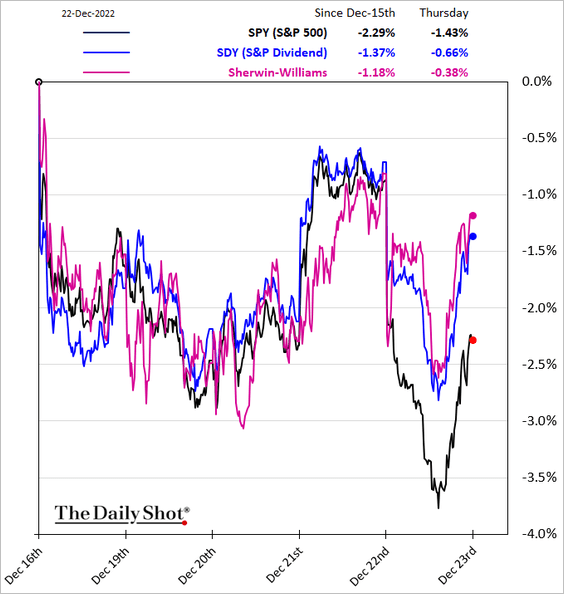

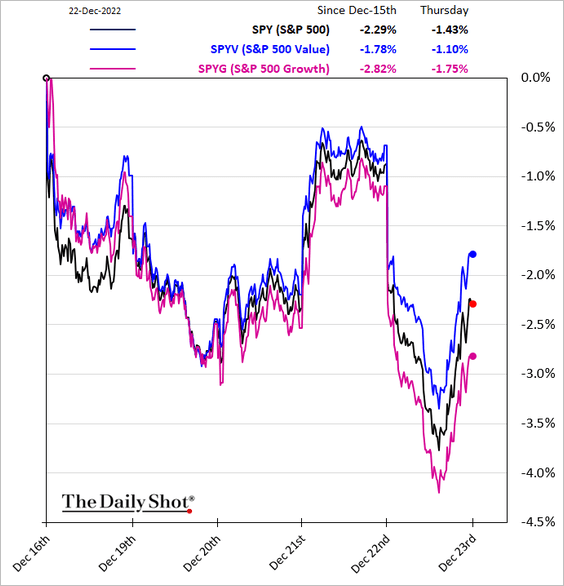

10. Below are some equity factor performance charts (over the past five business days).

• Small caps and microcaps:

• Momenum:

• Dividend yield:

• Value vs. growth:

——————–

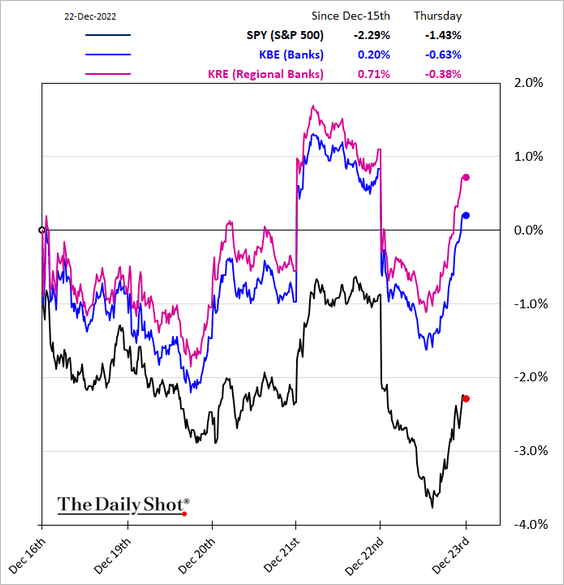

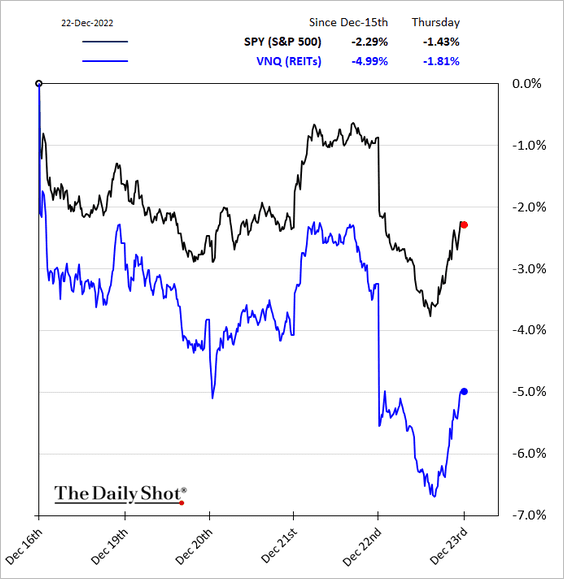

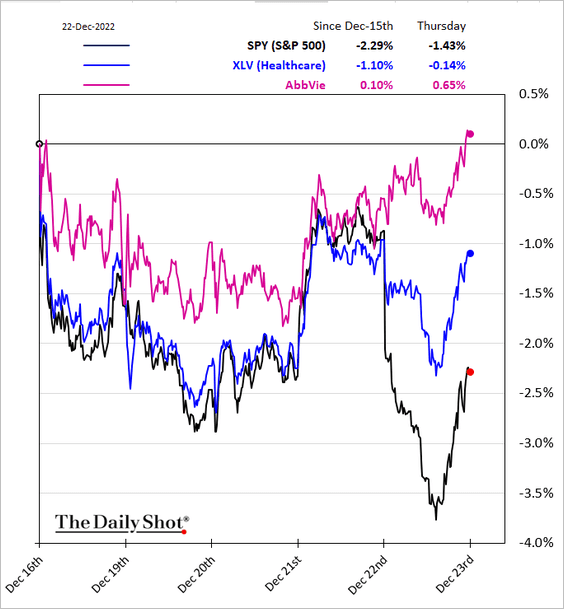

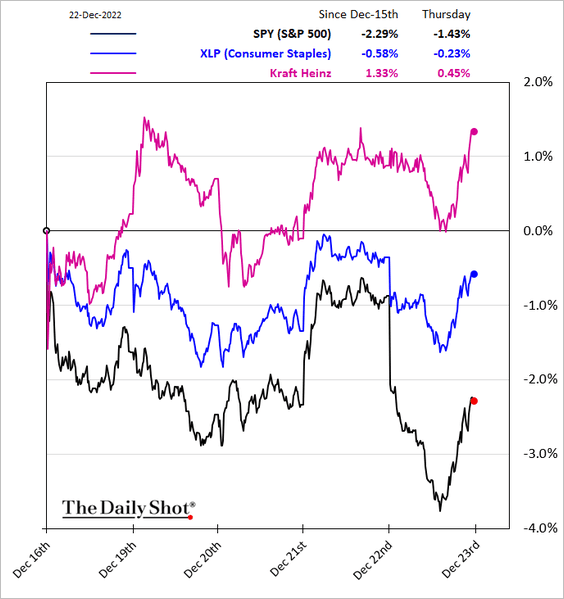

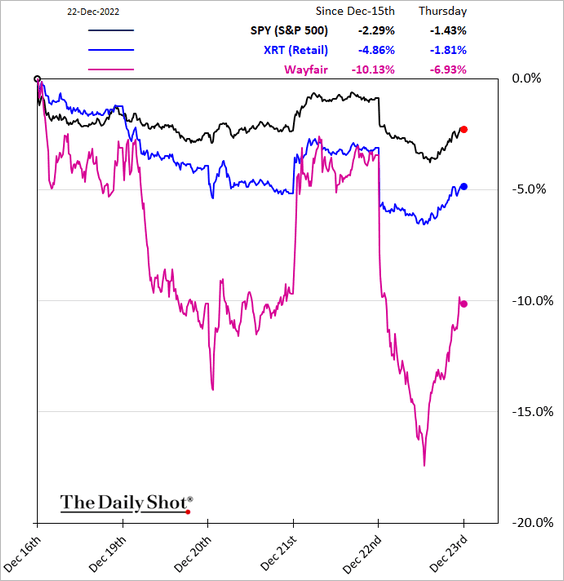

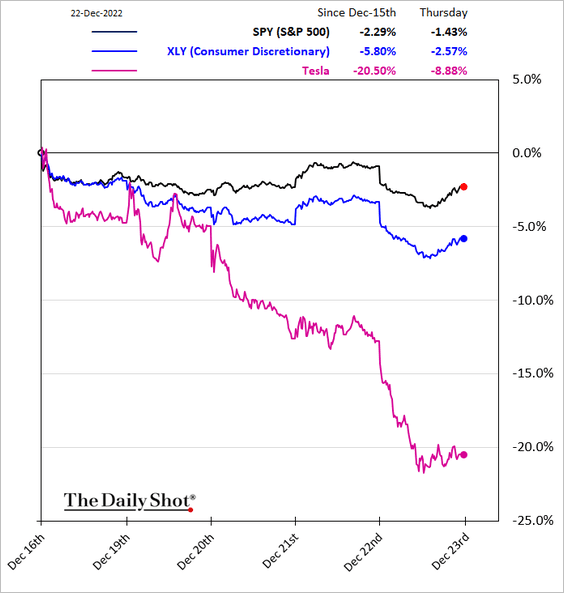

11. Finally, we have some sector performance data.

• Banks:

• REITs:

• Healthcare:

• Consumer staples:

• Retail and consumer discretionary:

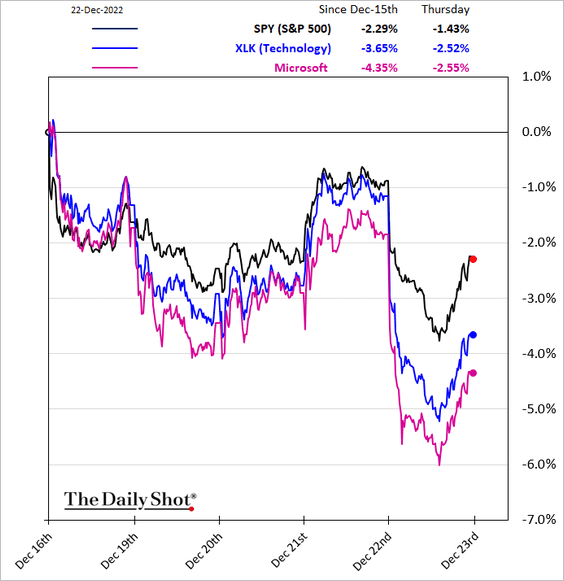

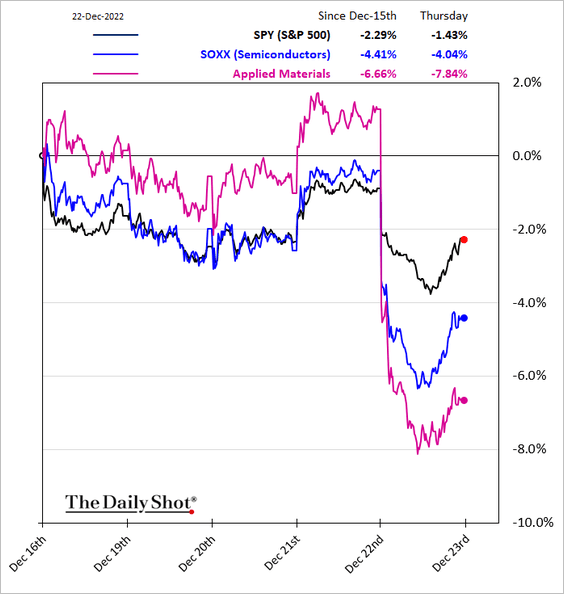

• Tech and semiconductors:

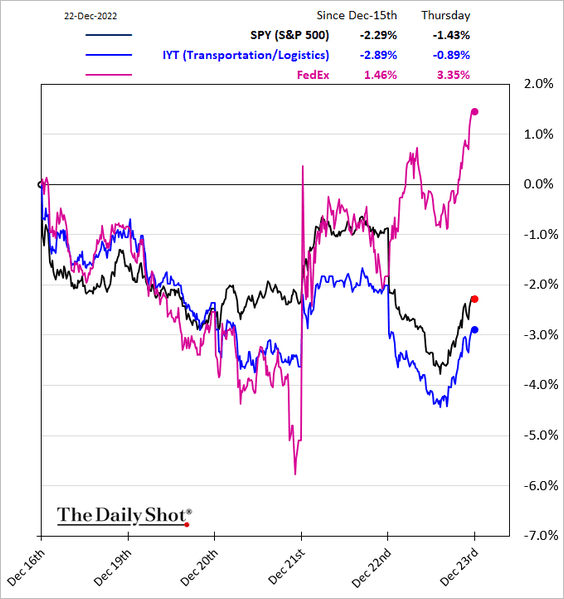

• Transportation/logistics:

Back to Index

Alternatives:

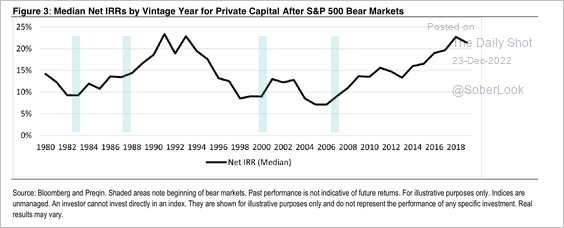

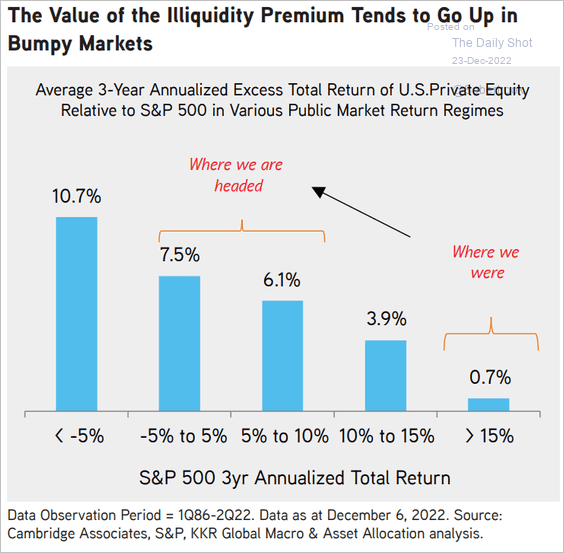

1. Private capital returns typically improve after bear markets.

Source: Citi Private Bank

Source: Citi Private Bank

2. Private equity investors will expect higher investment outperformance relative to public markets.

Source: KKR Global Institute

Source: KKR Global Institute

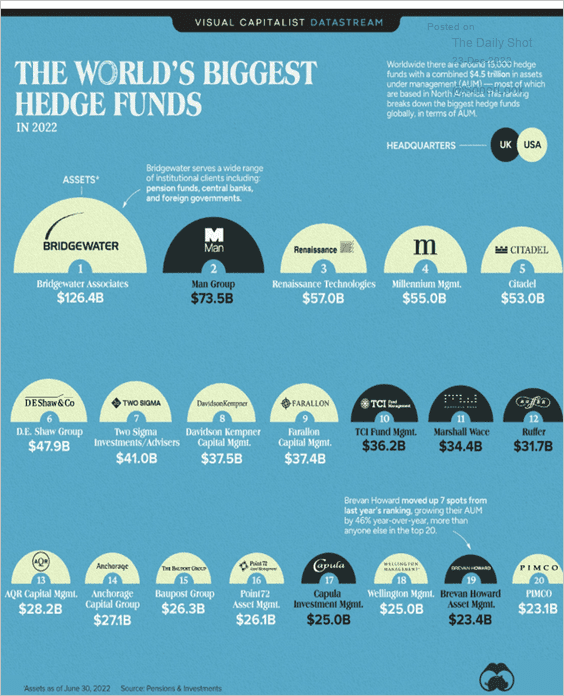

3. Here are the biggest hedge funds.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Credit

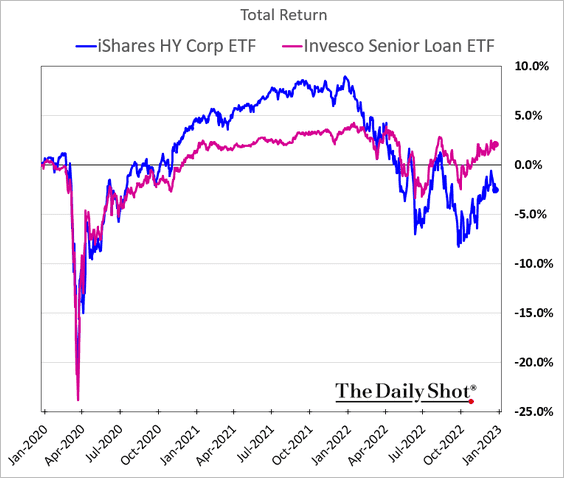

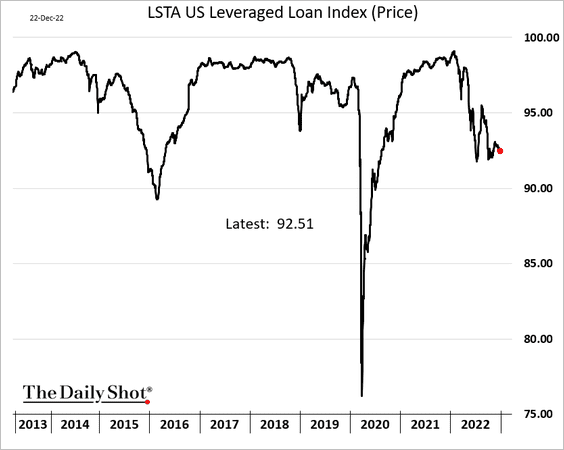

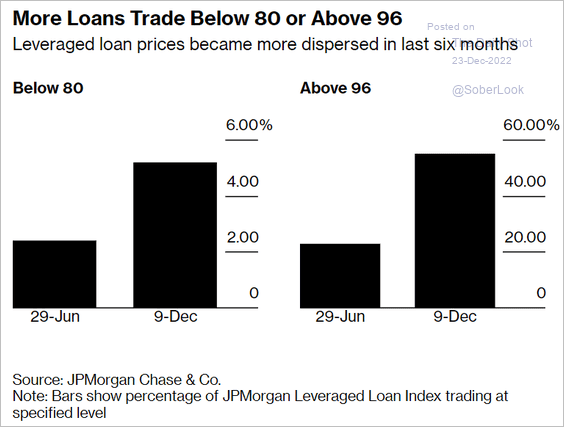

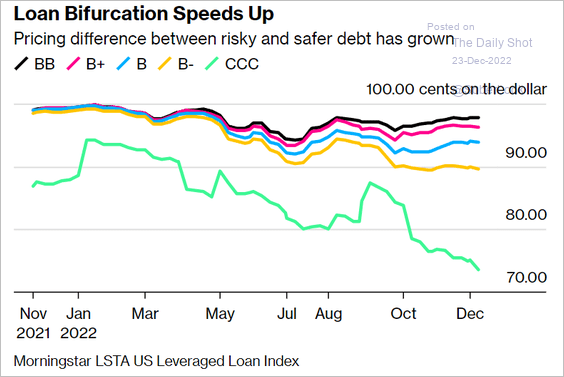

• On a total-return basis, leveraged loans have outperformed HY bonds since the start of the pandemic.

• But loan prices remain depressed (on average), …

… and bifurcated (2 charts).

Source: @ArroyoNieto, @markets Read full article

Source: @ArroyoNieto, @markets Read full article

Source: @ArroyoNieto, @markets Read full article

Source: @ArroyoNieto, @markets Read full article

Back to Index

Global Developments

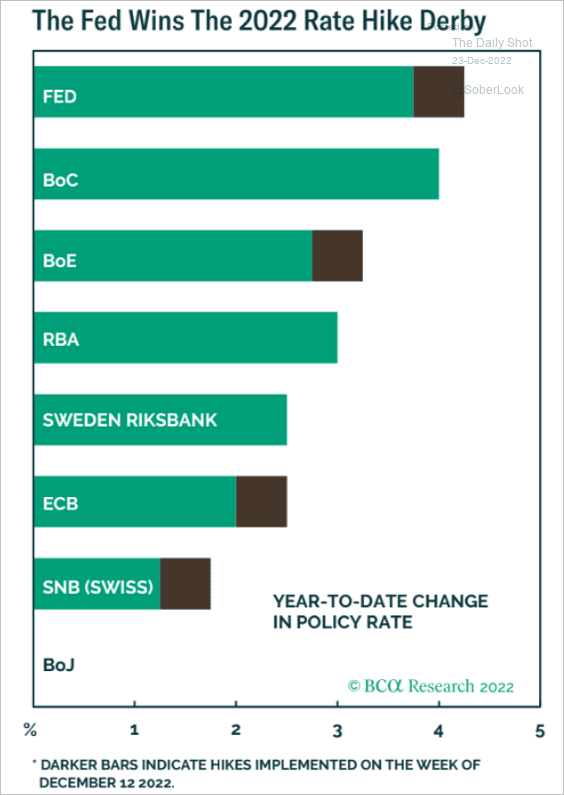

1. Of all the DM central banks, the Fed has tightened the most this year.

Source: BCA Research

Source: BCA Research

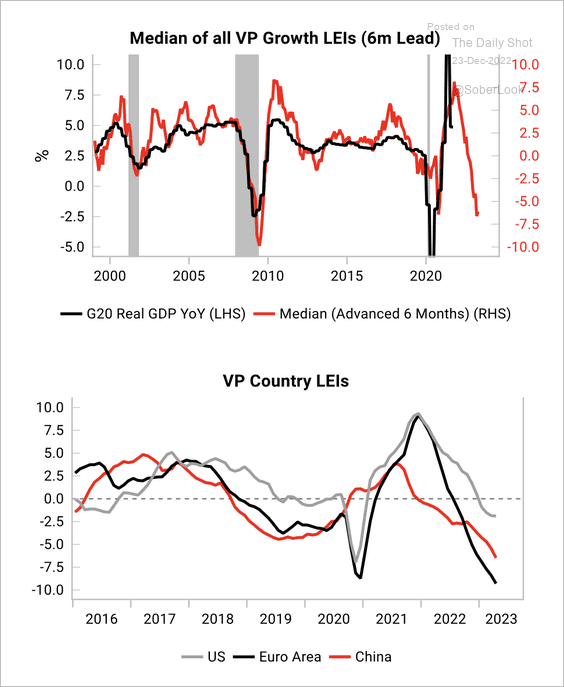

2. Variant Perception’s leading economic indicators are near financial crisis lows, with the US, China, and Eurozone firmly negative.

Source: Variant Perception

Source: Variant Perception

——————–

Food for Thought

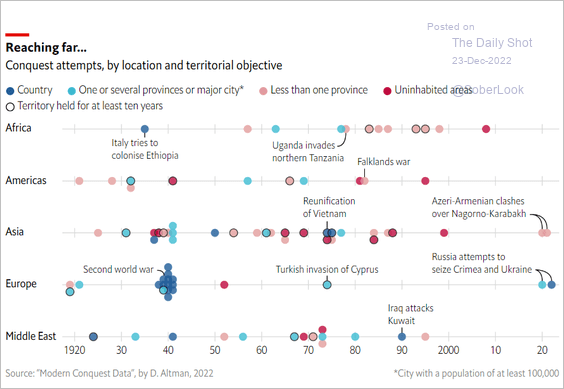

1. Conquest attempts over the past 100 years:

Source: The Economist Read full article

Source: The Economist Read full article

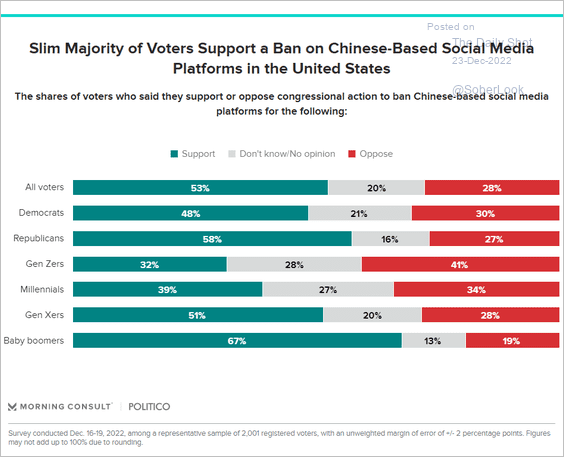

2. Views on banning TikTok in the US:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

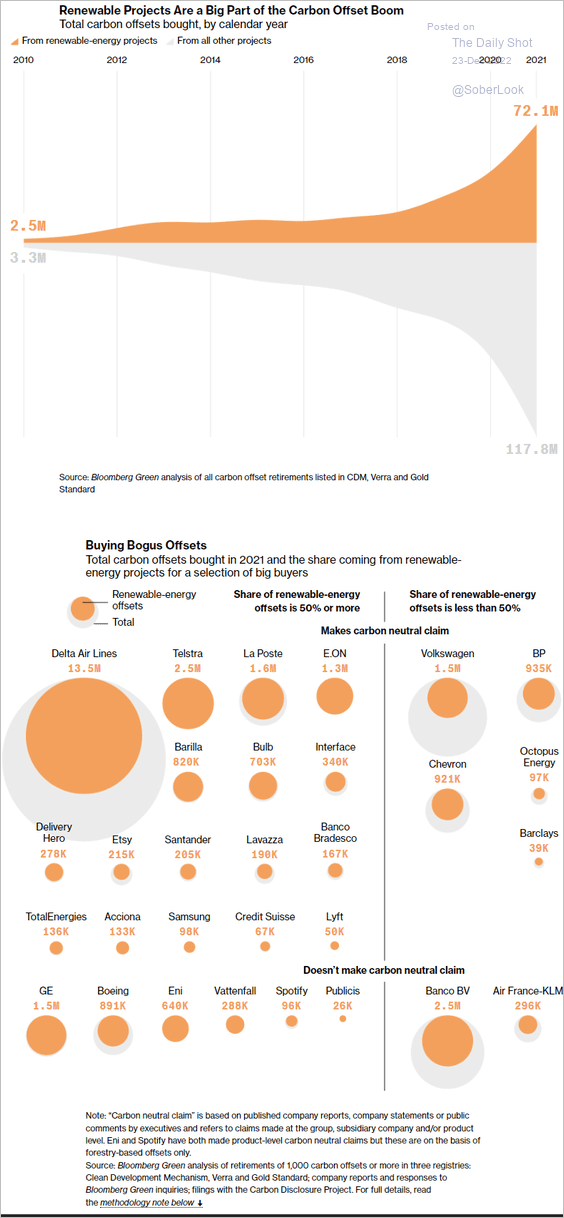

3. Carbon neutrality from “renewable” projects:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

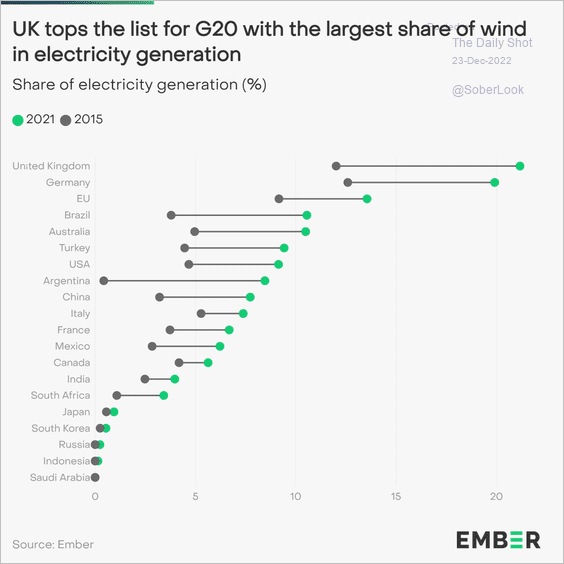

4. Share of wind in electricity generation:

Source: @EmberClimate Read full article

Source: @EmberClimate Read full article

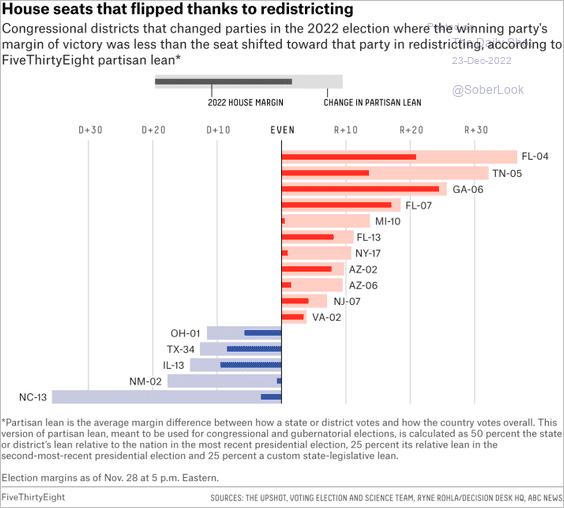

5. House seats flipped due to redistricting:

Source: FiveThirtyEight, @baseballot, @elena___mejia Read full article

Source: FiveThirtyEight, @baseballot, @elena___mejia Read full article

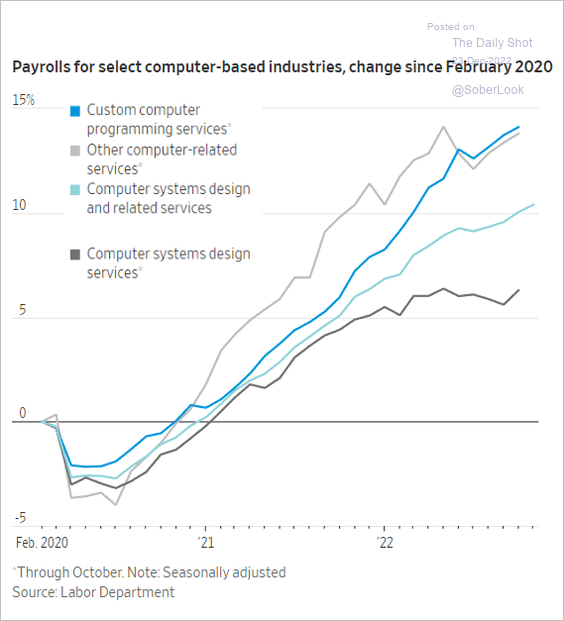

6. Job growth in select computer-related services:

Source: @WSJ Read full article

Source: @WSJ Read full article

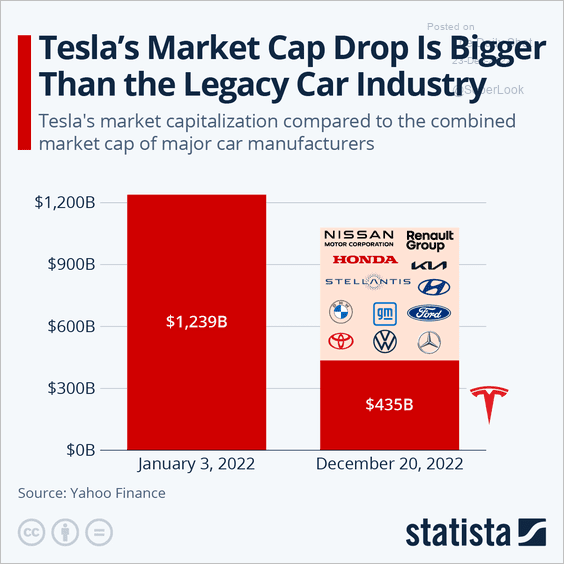

7. Tesla’s market cap drop in 2022:

Source: Statista

Source: Statista

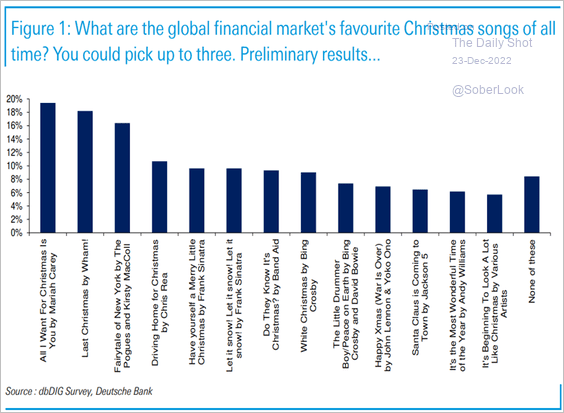

8. Favorite Christmas songs:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

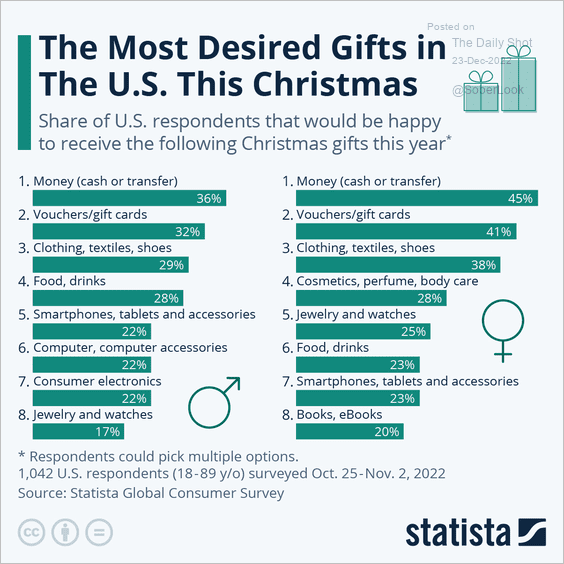

9. The most desired Christmas gifts:

Source: Statista

Source: Statista

——————–

As another year comes to a close, we would like to thank you for your continued support.

We wish you a joyous holiday season and a happy New Year!

The next Daily Shot will be published on Monday, January 2nd.

Back to Index