The Daily Shot: 09-May-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

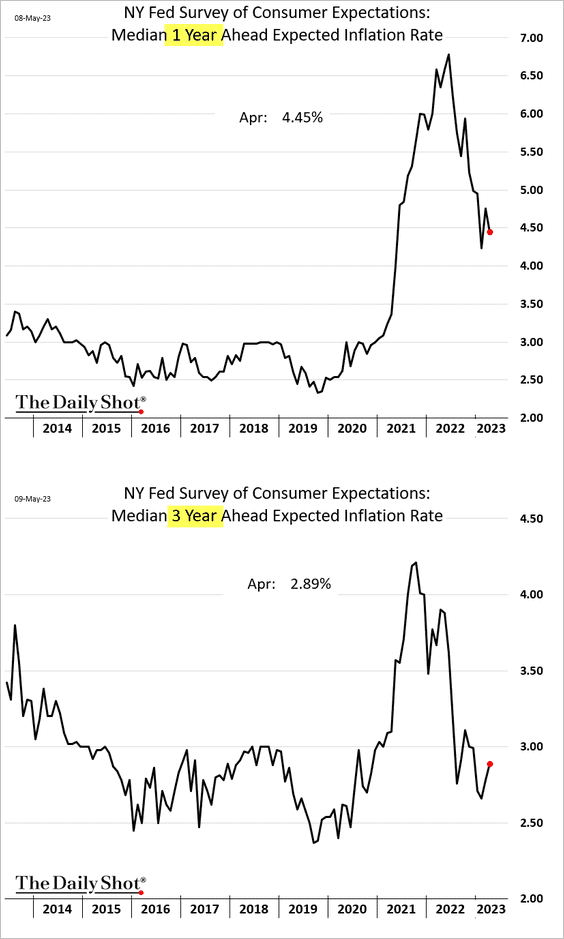

• The NY Fed’s national consumer survey showed a decline in the one-year inflation expectations but an increase in the three-year measure.

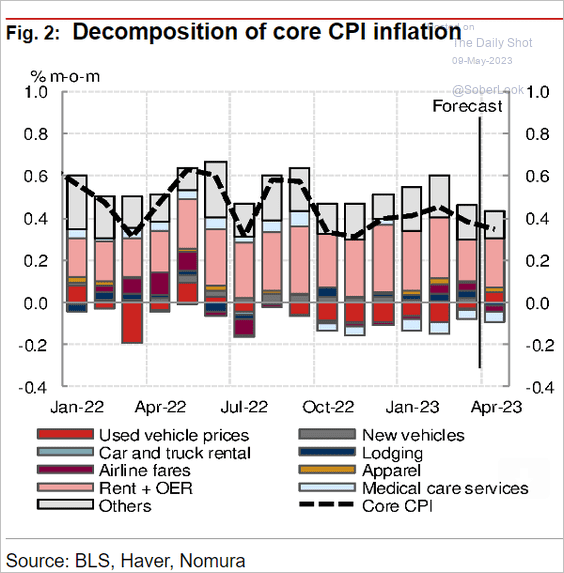

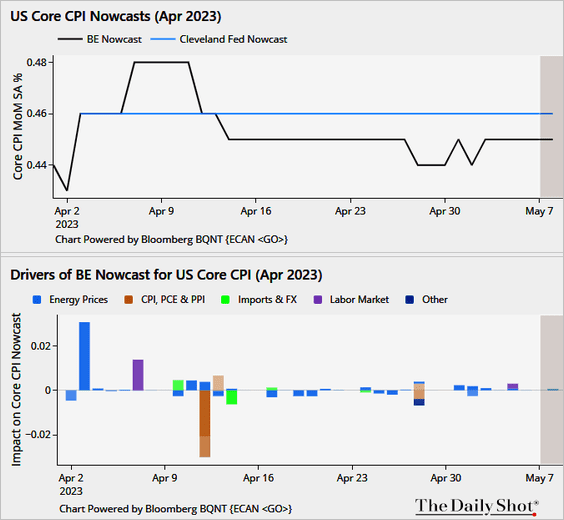

• What should we expect from the CPI report on Wednesday?

– Nomura sees a modest decrease in the monthly core CPI gain (to 0.34%), consistent with consensus.

Source: Nomura Securities

Source: Nomura Securities

– Blooberg’s nowcast model shows a higher figure of 0.45%.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

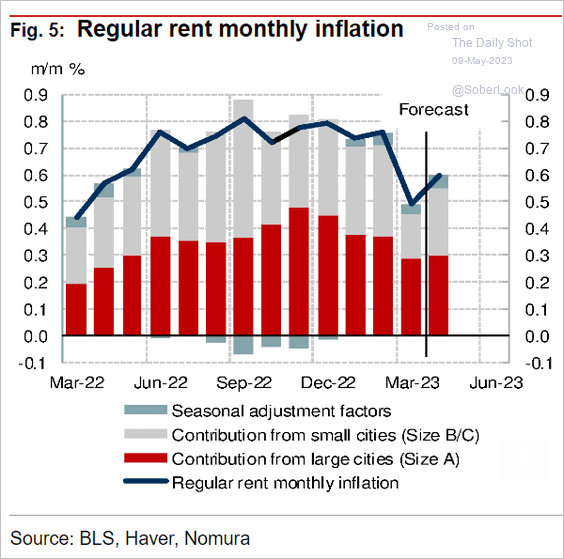

– Nomura expects an increase in rent inflation, which we saw in the Apartment List data.

Source: Nomura Securities

Source: Nomura Securities

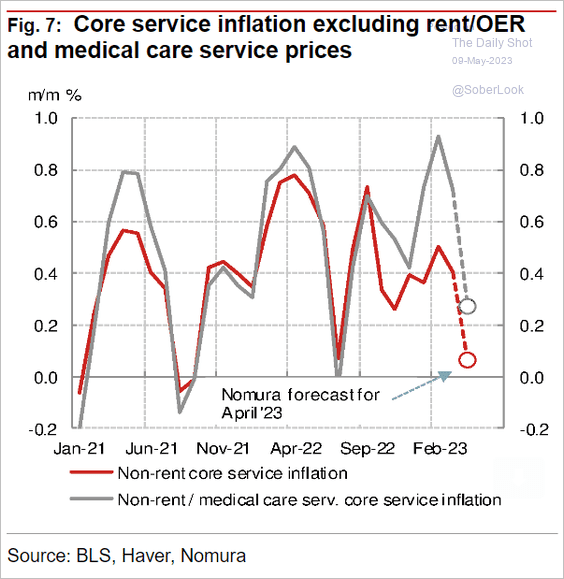

But supercore inflation is expected to drop.

Source: Nomura Securities

Source: Nomura Securities

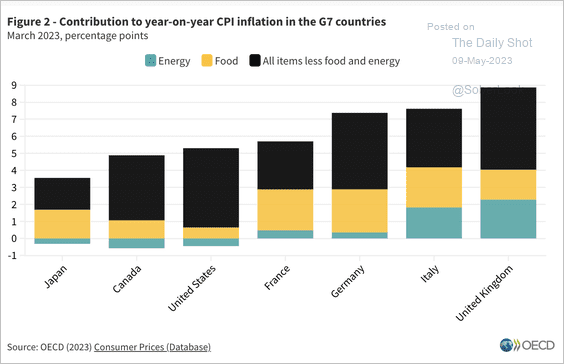

• US core inflation is a larger portion of the total CPI than in other G7 countries.

Source: OECD Read full article

Source: OECD Read full article

——————–

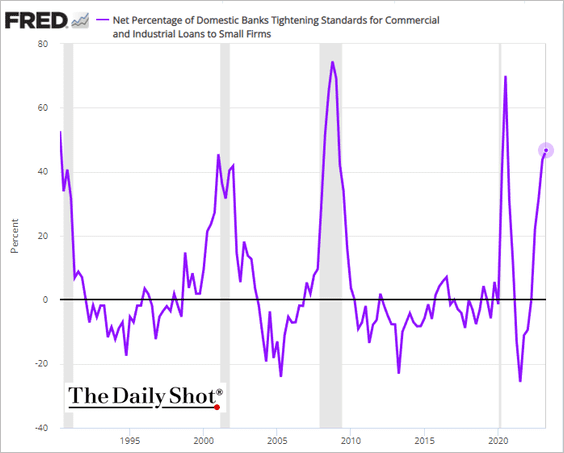

2. Banks continue to tighten lending standards.

Source: @axios Read full article

Source: @axios Read full article

Here is the percentage of lenders tightening standards on loans to small companies.

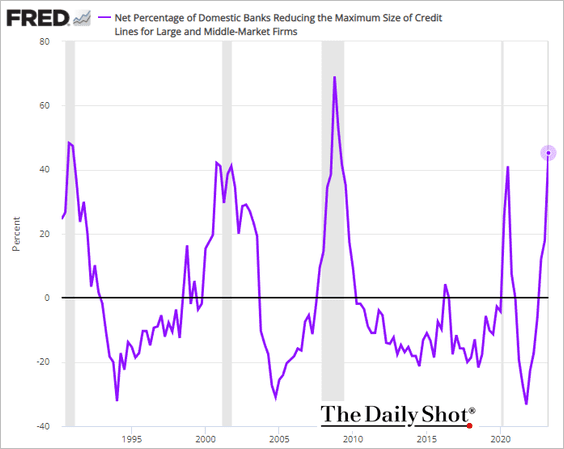

And this chart shows the share of banks reducing credit limits on large and middle-market firms.

There is more on the topic in the credit section.

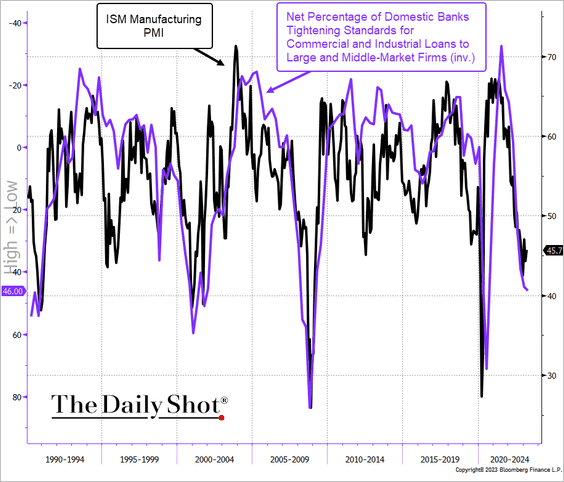

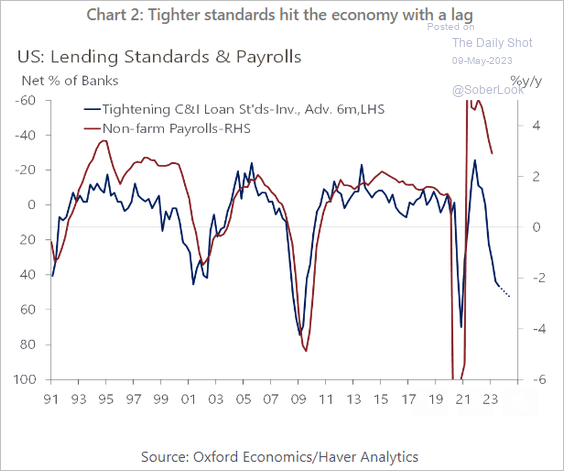

Tighter credit will put pressure on economic activity and jobs (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Oxford Economics

Source: Oxford Economics

——————–

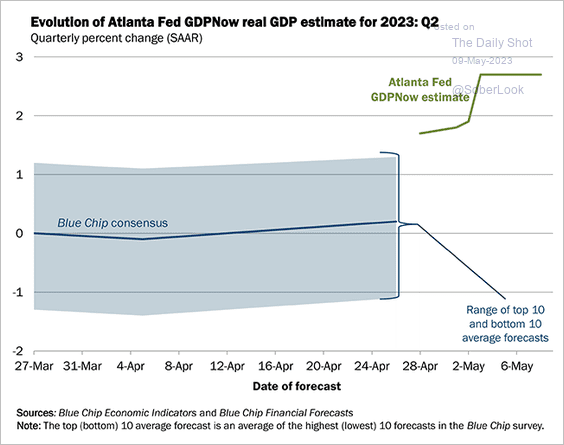

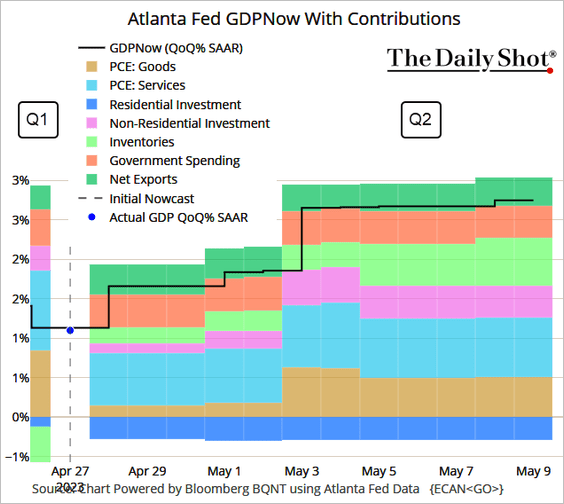

3. The Atlanta Fed’s GDPNow model is tracking 2.7% growth this quarter.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Here is the attribution.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

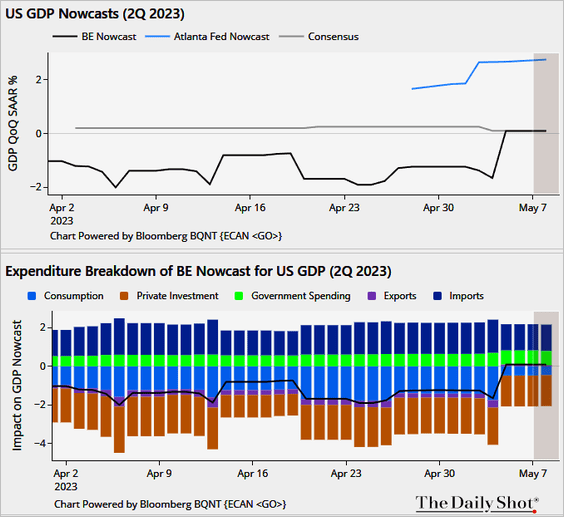

The Blomberg Economics nowcast model, however, is tracking zero growth.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

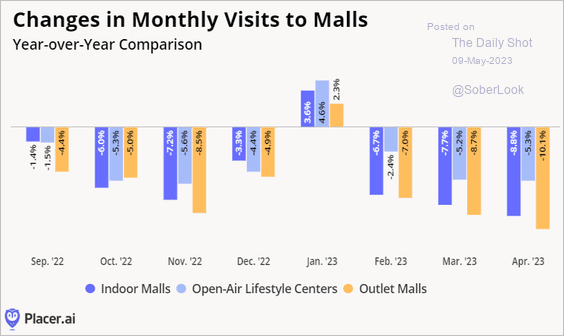

4. Mall visits are now substantially below last year’s levels.

Source: Placer.ai

Source: Placer.ai

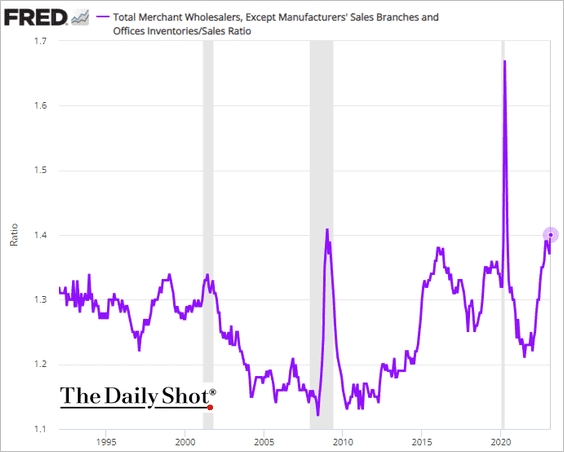

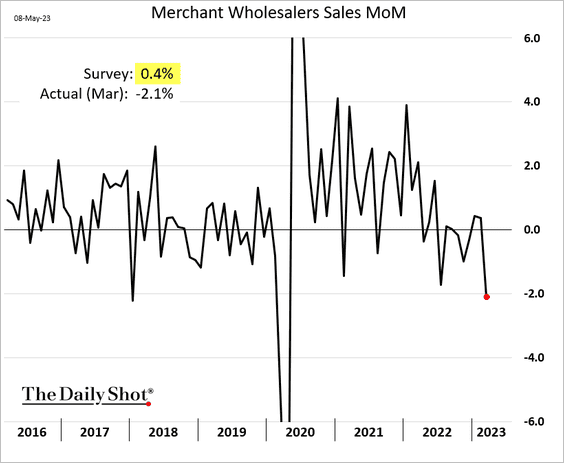

5. The wholesale inventory-to-sales ratio climbed further in March, …

… as sales unexpectedly tumbled.

——————–

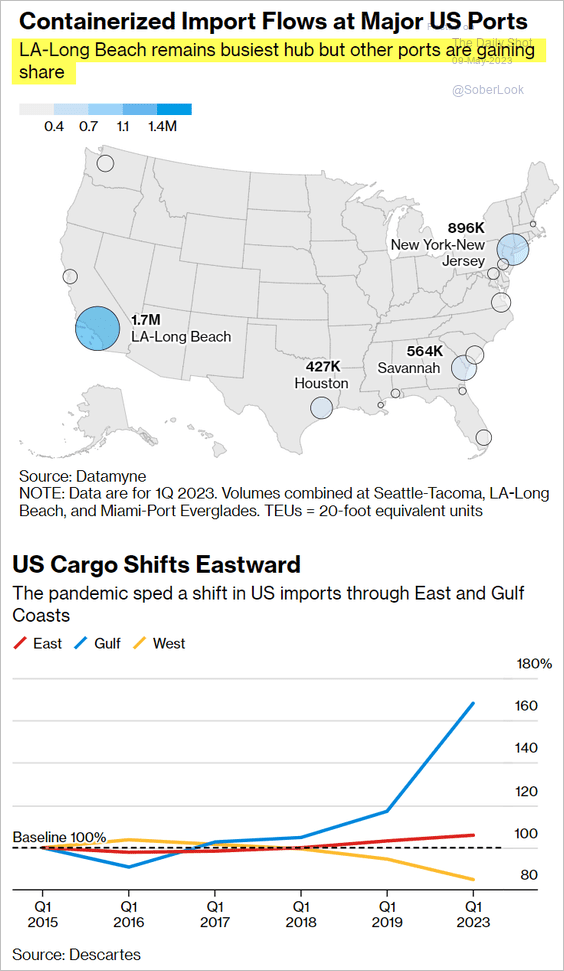

6. Companies have been traumatized by the COVID-era West Cost port backlog and have shifted some imports to other ports.

Source: @LouKCurtis, @economics Read full article

Source: @LouKCurtis, @economics Read full article

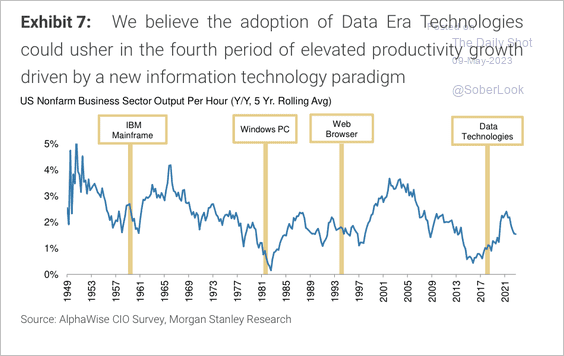

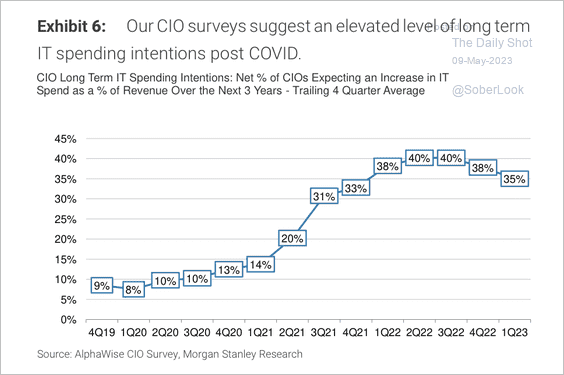

7. Greater IT spending could boost productivity growth. (2 charts)

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

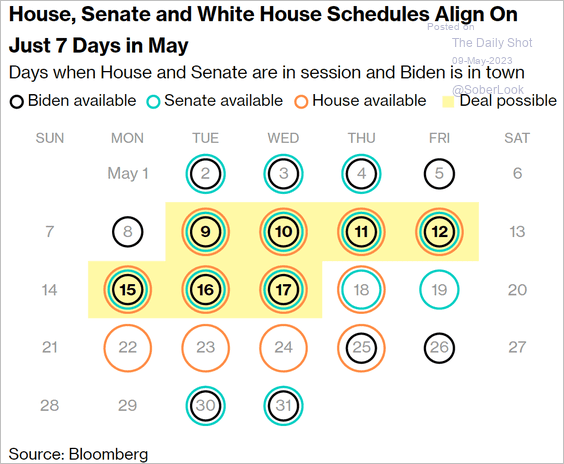

8. There is not a lot of time left in May to reach a deal on the debt ceiling.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Canada

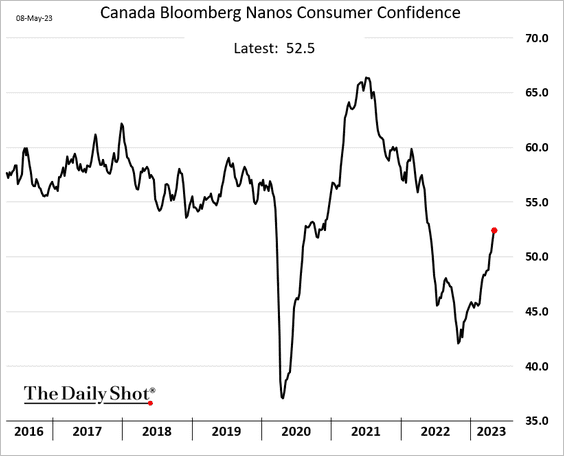

1. Consumer sentiment continues to rebound.

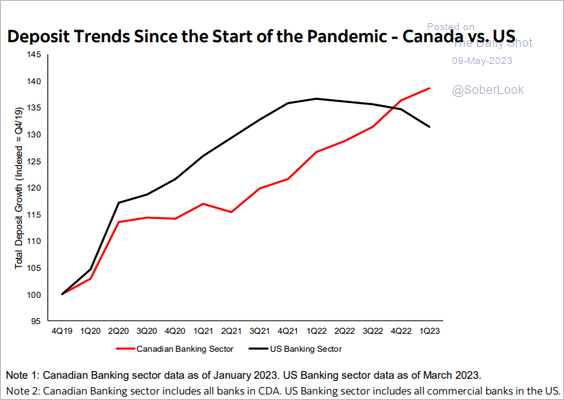

2. Canada’s banking sector has not experienced the declines in bank deposits seen in the US.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

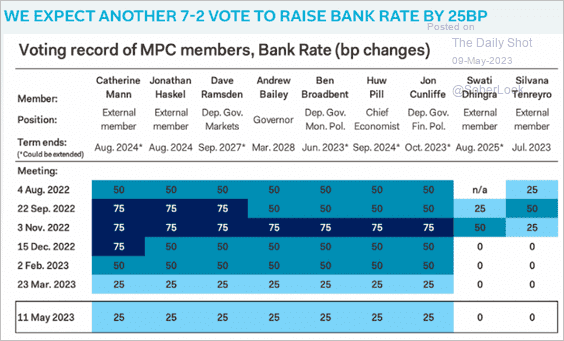

The United Kingdom

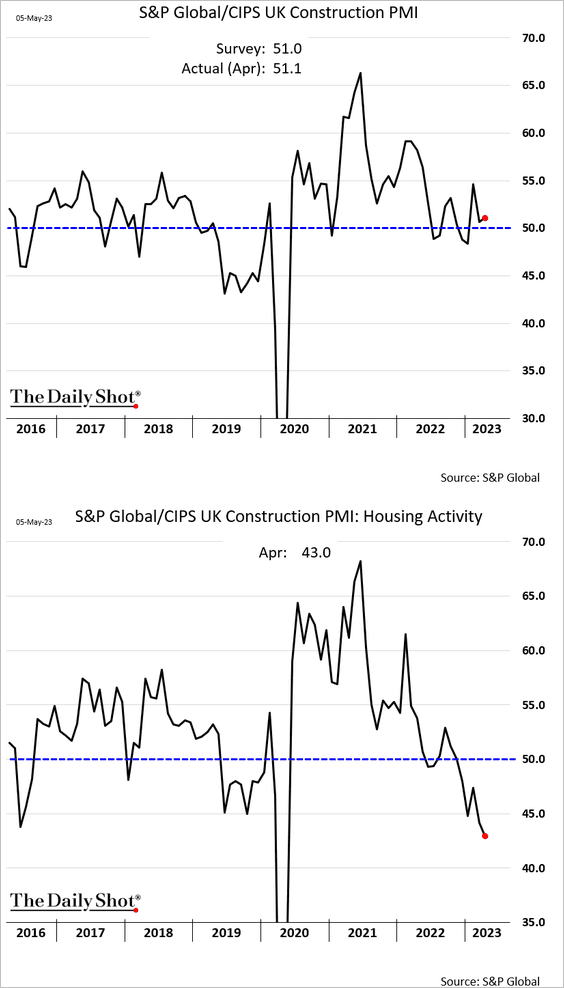

1. Construction activity stayed in growth mode last month, held up by non-residential structures. Housing construction activity, however, deteriorated further.

2. The market expects another BoE rate hike this week.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

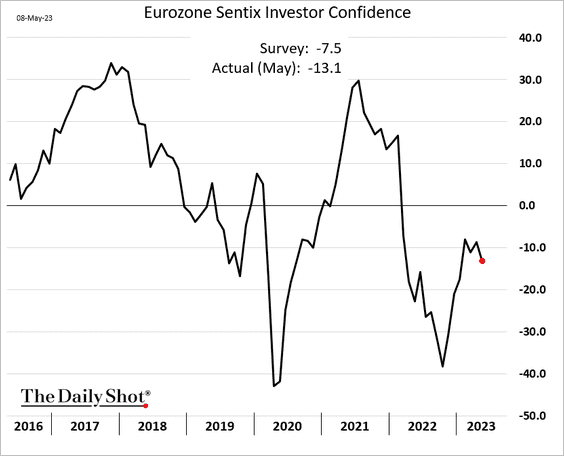

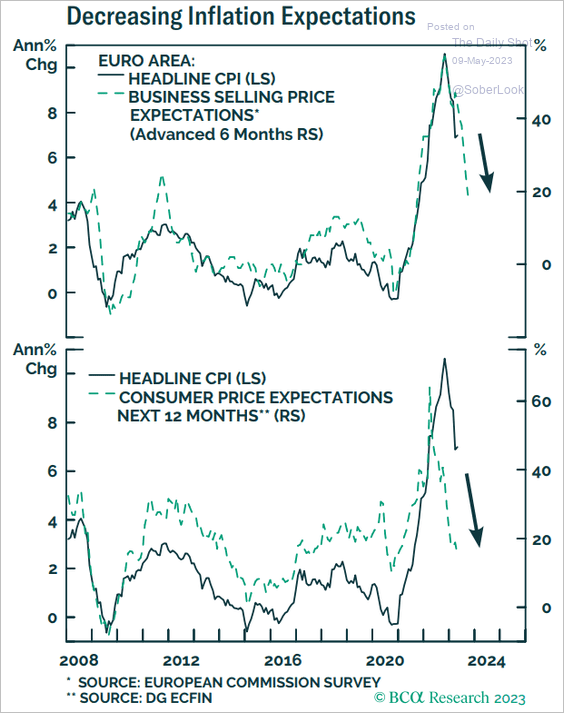

The Eurozone

1. Investor sentiment appears to be rolling over.

2. Inflation expectations continue to ease.

Source: BCA Research

Source: BCA Research

Back to Index

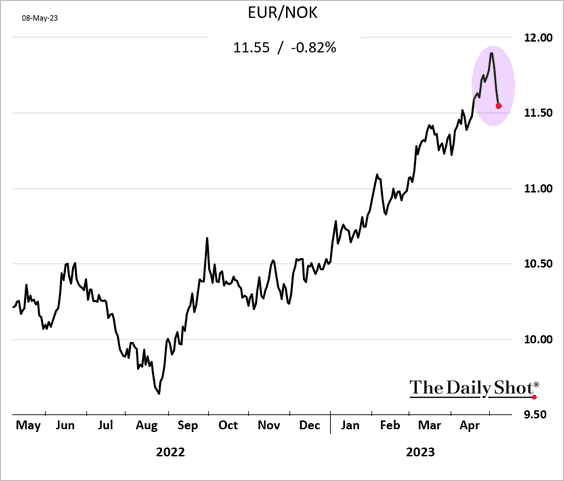

Europe

1. The Norwegian krone bounced from the lows after the rate hike. Will the rebound be sustained?

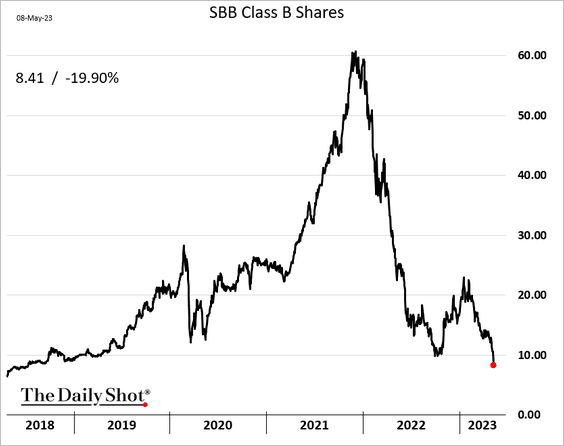

2. Sweden’s SBB is struggling amid the real estate rout.

Source: @CharlesCredit, @trabanton, @divyabalji, @markets Read full article

Source: @CharlesCredit, @trabanton, @divyabalji, @markets Read full article

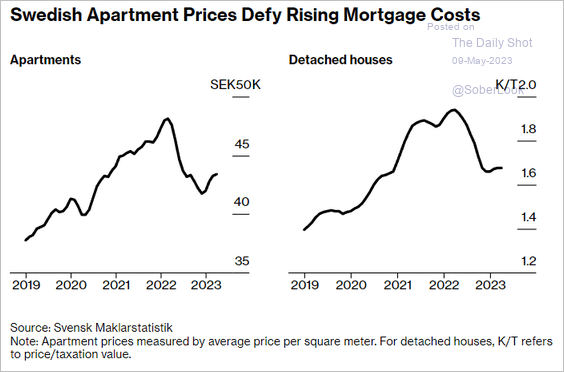

However, housing prices appear to be stabilizing.

Source: @nicrolander, @economics Read full article

Source: @nicrolander, @economics Read full article

——————–

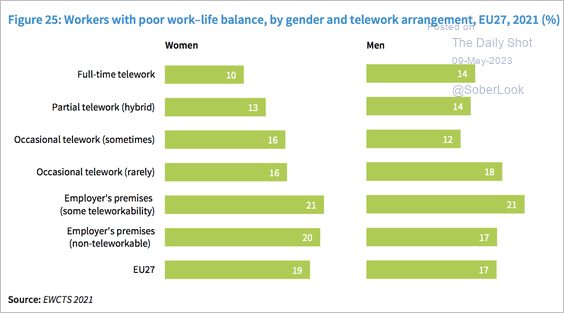

3. Here is a look at workers with poor work-life balance in the EU.

Source: Eurofound Read full article

Source: Eurofound Read full article

Back to Index

Japan

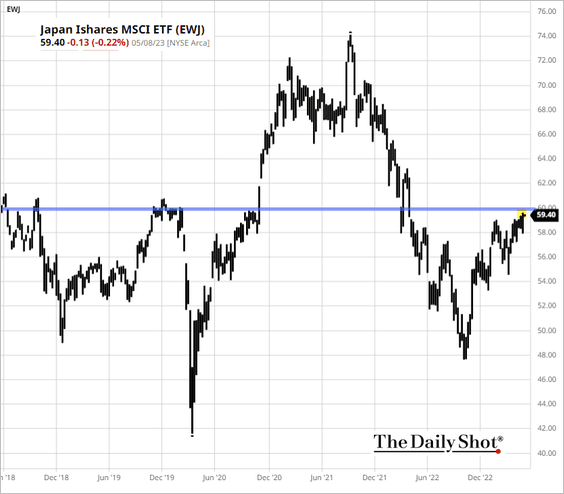

1. The iShares Japan ETF is at resistance.

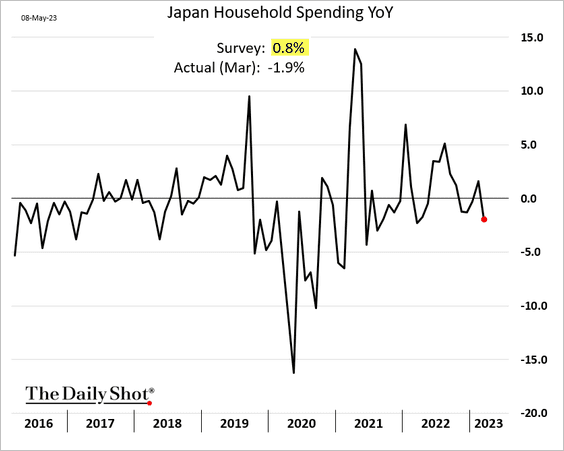

2. Household spending unexpectedly declined in March, …

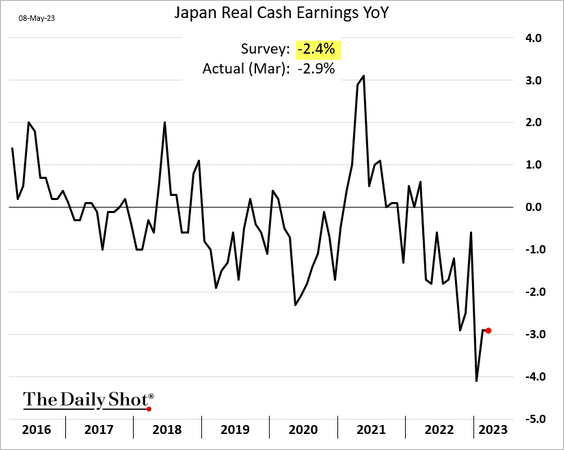

… as real wages remain in contraction mode.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Asia – Pacific

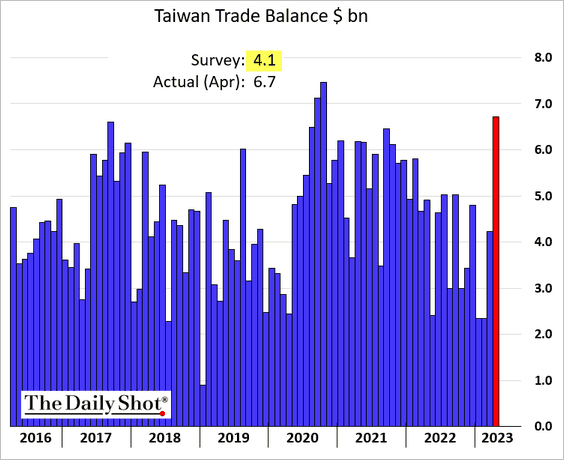

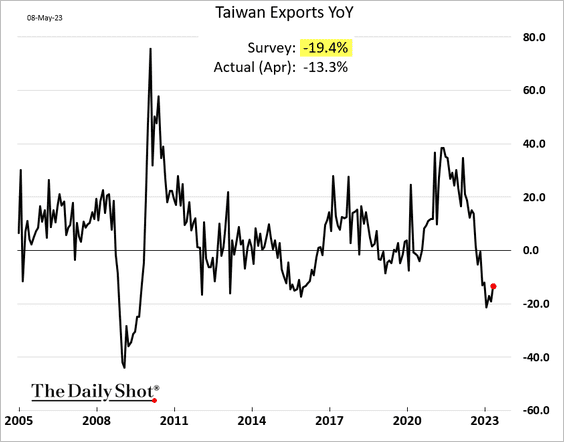

1. Taiwan’s trade surplus surged last month, …

… as exports show signs of stabilization.

——————–

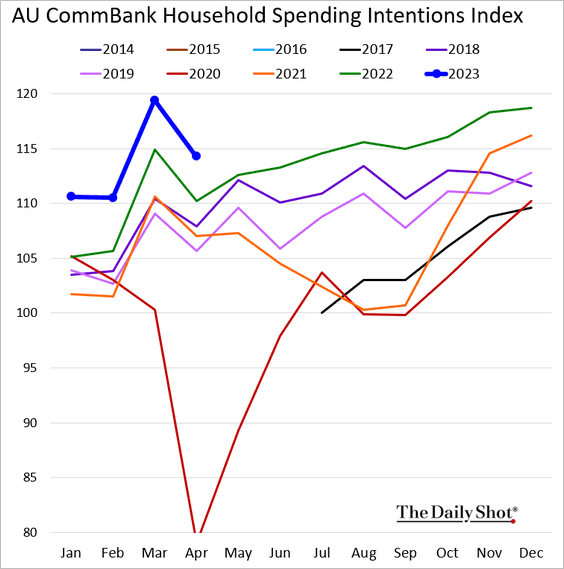

2. Australia’s household spending intentions remain strong.

Back to Index

China

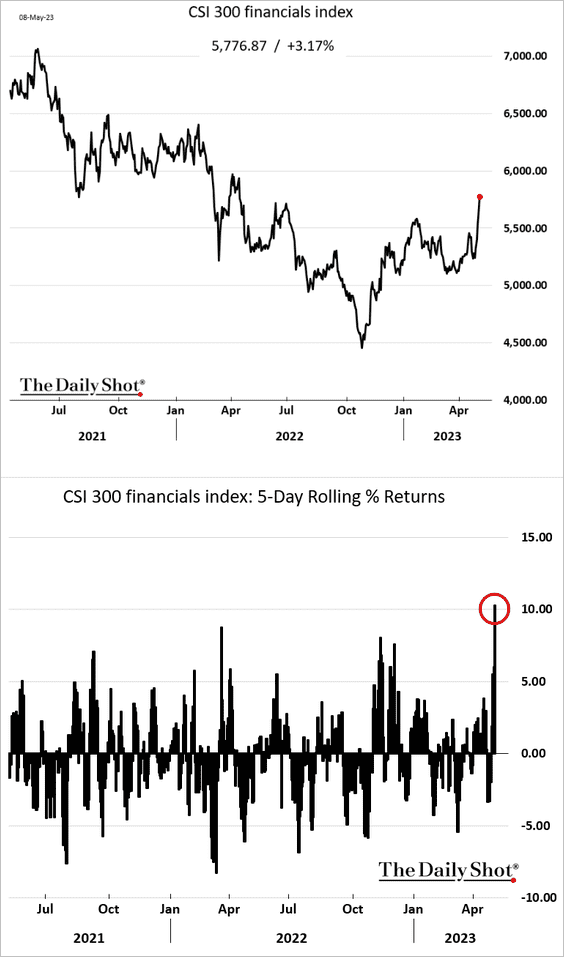

1. Bank shares have been rallying.

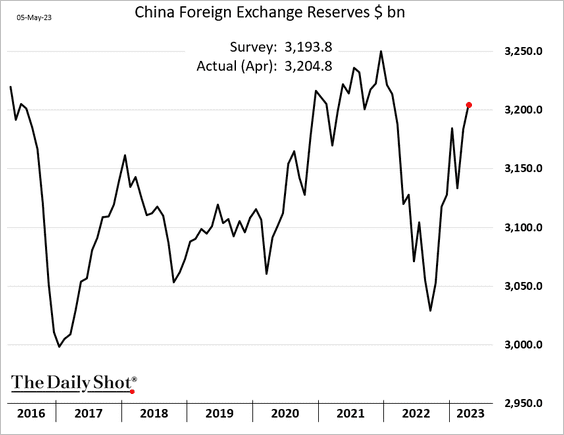

2. F/X reserves continue to rebound.

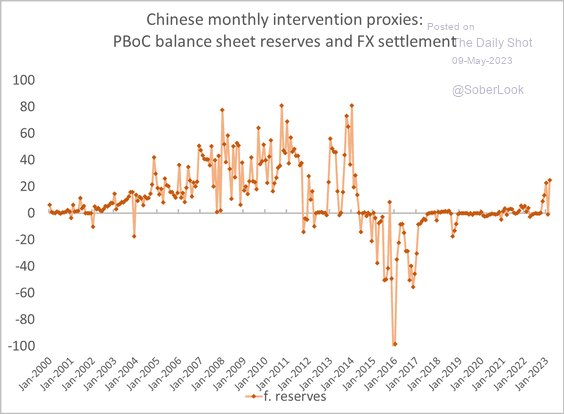

This chart shows the PBoC’s FX interventions.

Source: @Brad_Setser

Source: @Brad_Setser

——————–

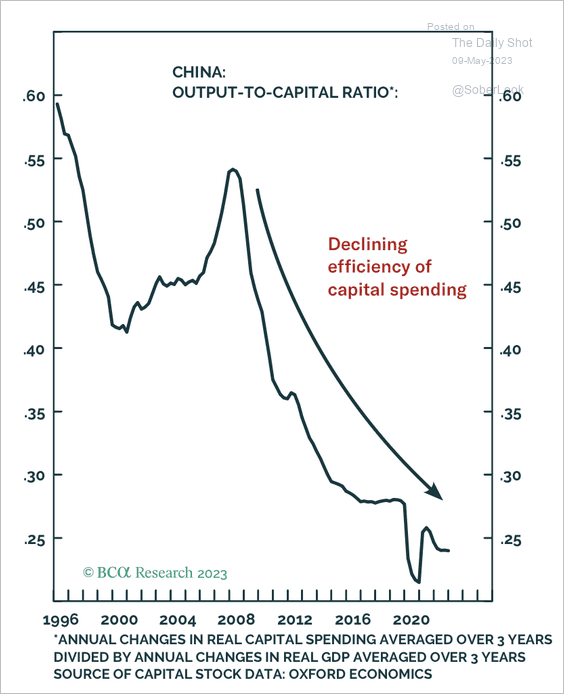

3. China’s capital stock is becoming less efficient.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

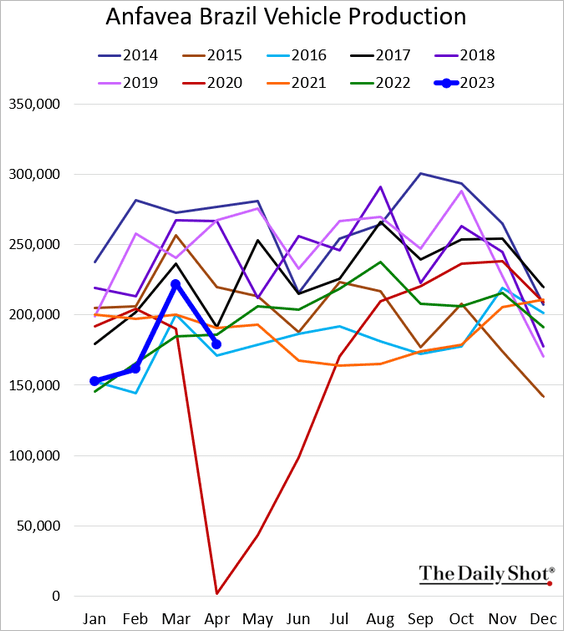

1. Brazil’s vehicle production dipped back below last year’s levels.

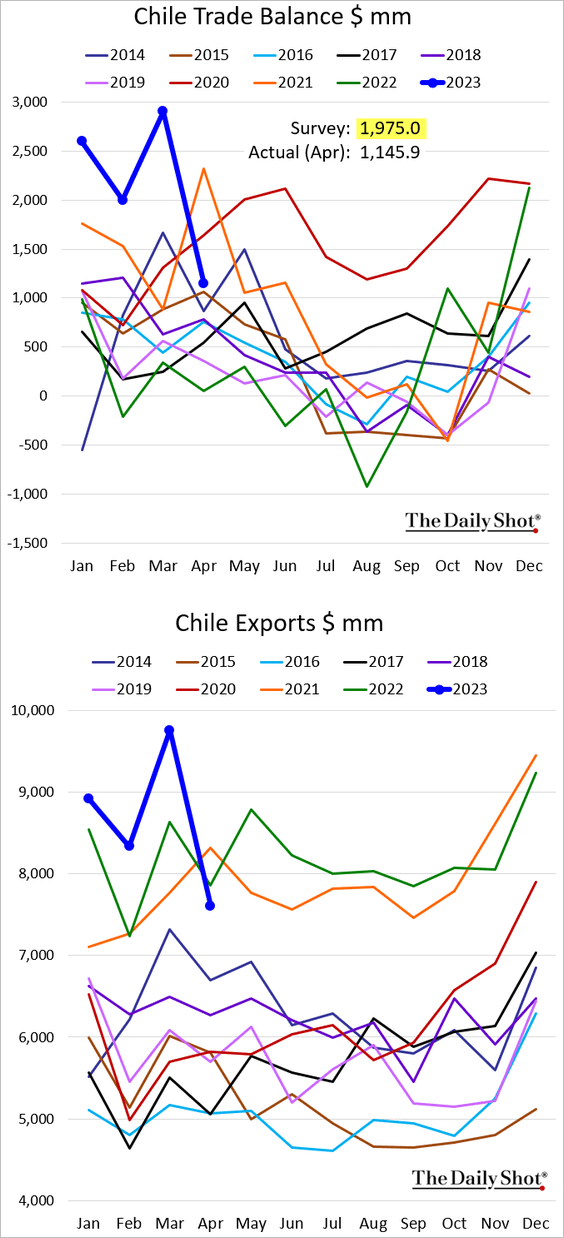

2. Chile’s trade surplus declined sharply last month as exports fell.

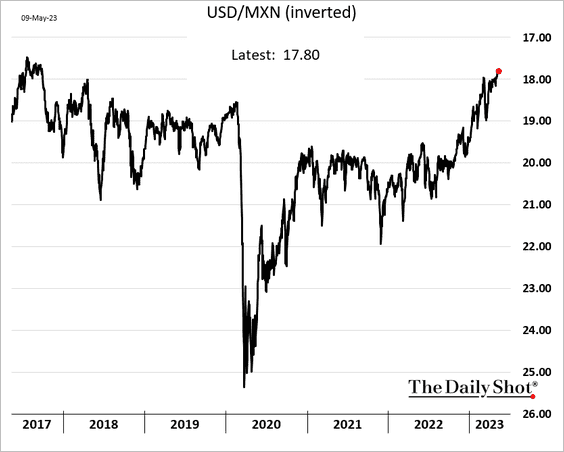

3. The Mexican peso is trading near the strongest levels vs. USD since 2017.

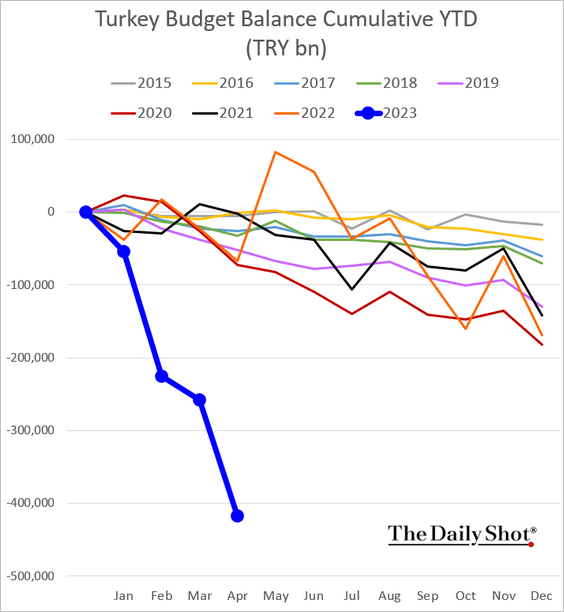

4. Turkey’s government deficit has blown out due to pre-election spending (and recently exacerbated by the earthquake).

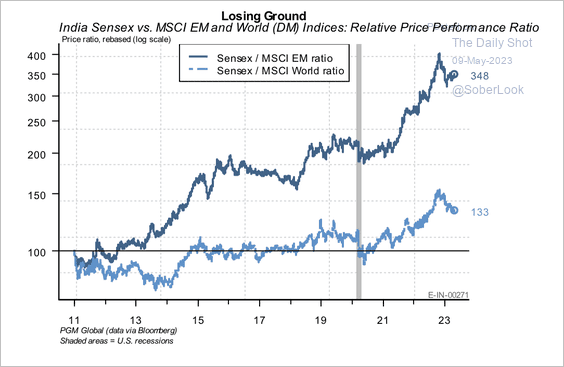

5. Indian stocks have been losing ground relative to EM and global peers.

Source: PGM Global

Source: PGM Global

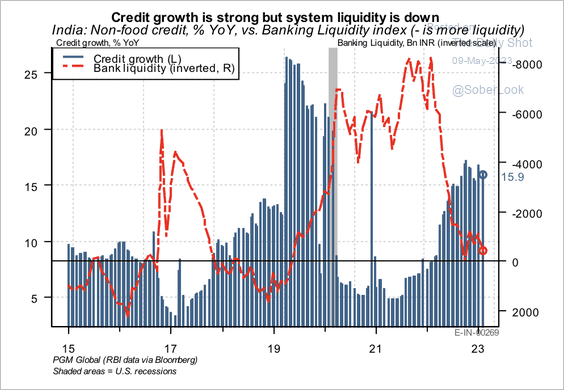

• India’s liquidity conditions have tightened, partly because of the significant government bond issuance crowding out credit issuance to the private sector, according to PGM Global.

Source: PGM Global

Source: PGM Global

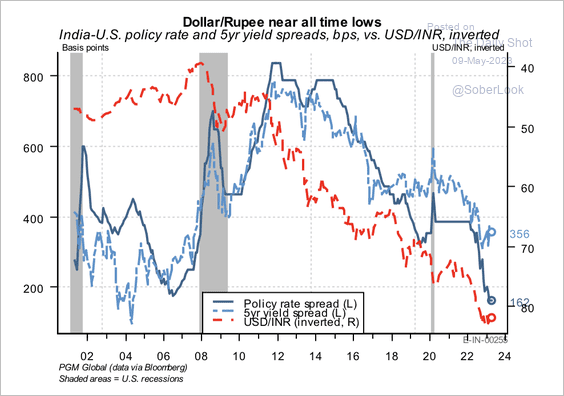

• The rise in USD/INR has stabilized along with interest rate differentials.

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

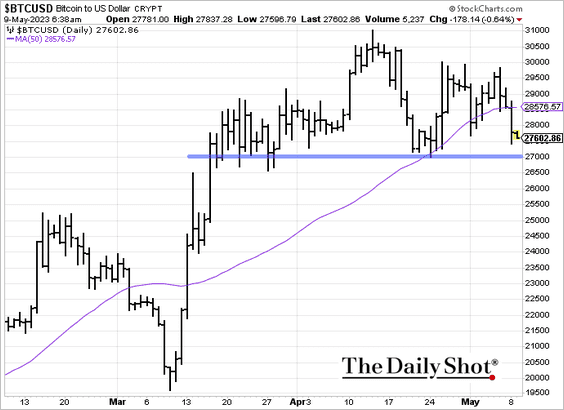

1. Bitcoin dipped below the 50-day moving average amid concerns about Binance halting withdrawals.

Source: @Suvajourno, @sidcoins, @crypto Read full article

Source: @Suvajourno, @sidcoins, @crypto Read full article

——————–

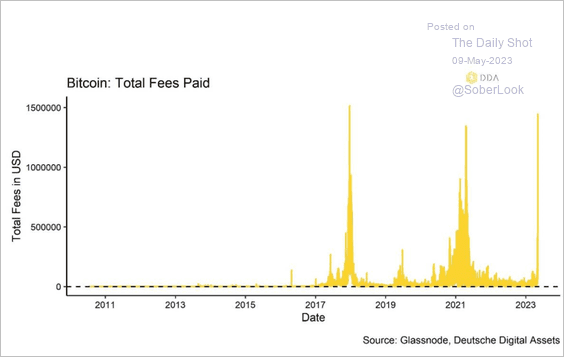

2. Total fees paid for bitcoin transactions surged in recent days.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

Source: Decrypt Read full article

Source: Decrypt Read full article

Back to Index

Commodities

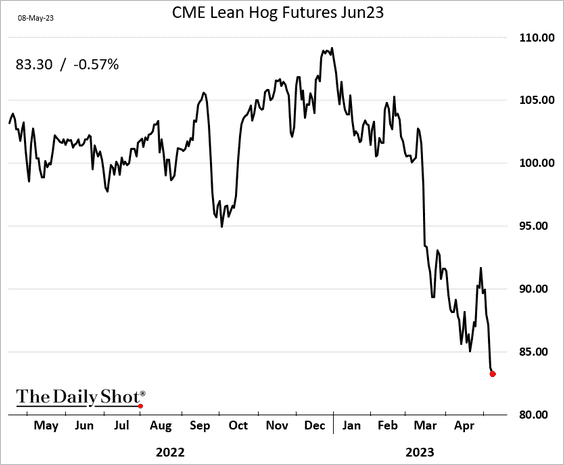

1. Chicago hog futures remain under pressure.

Source: Foodmarket Read full article

Source: Foodmarket Read full article

——————–

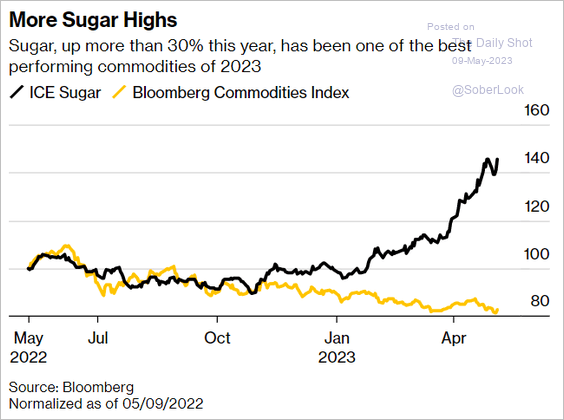

2. Sugar is up more than 30% this year.

Source: @cangsizhi, @markets Read full article

Source: @cangsizhi, @markets Read full article

Back to Index

Equities

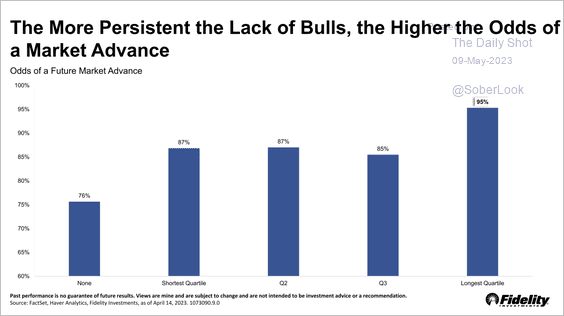

1. Net short S&P 500 positioning is back to the bottom quartile, which typically precedes a market advance over the next year.

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

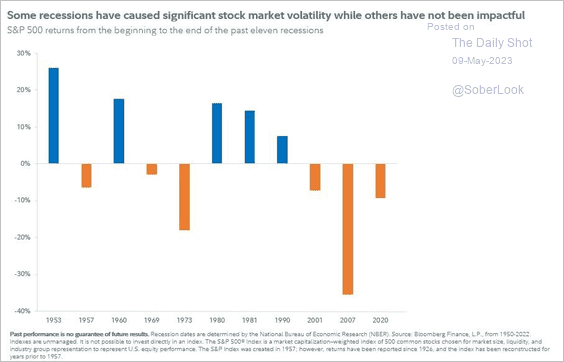

2. Of the last 11 recessions, five ended with stocks higher than when the recession began.

Source: Fidelity Investments

Source: Fidelity Investments

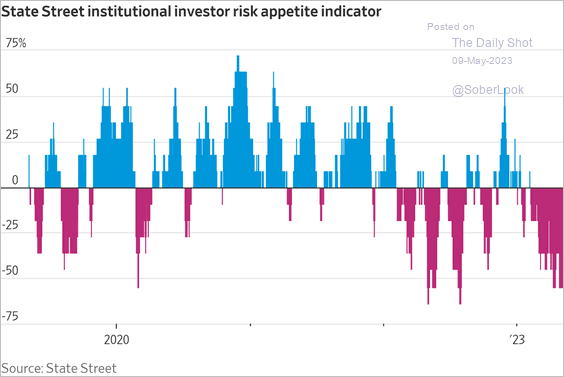

3. Institutional risk appetite remains depressed.

Source: @WSJ Read full article

Source: @WSJ Read full article

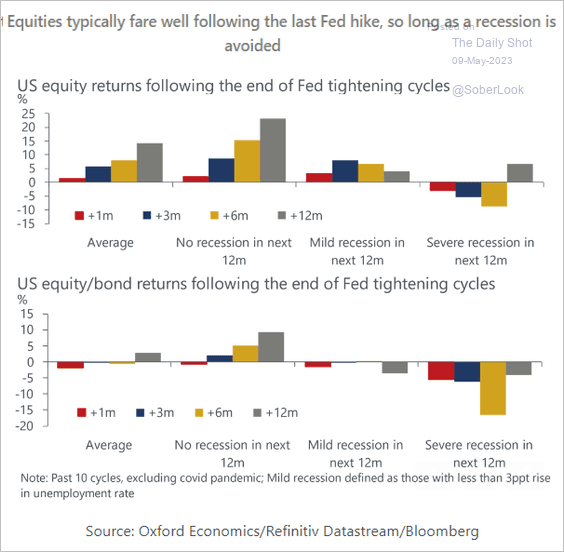

4. How do stocks perform after the Fed’s last hike?

Source: Oxford Economics

Source: Oxford Economics

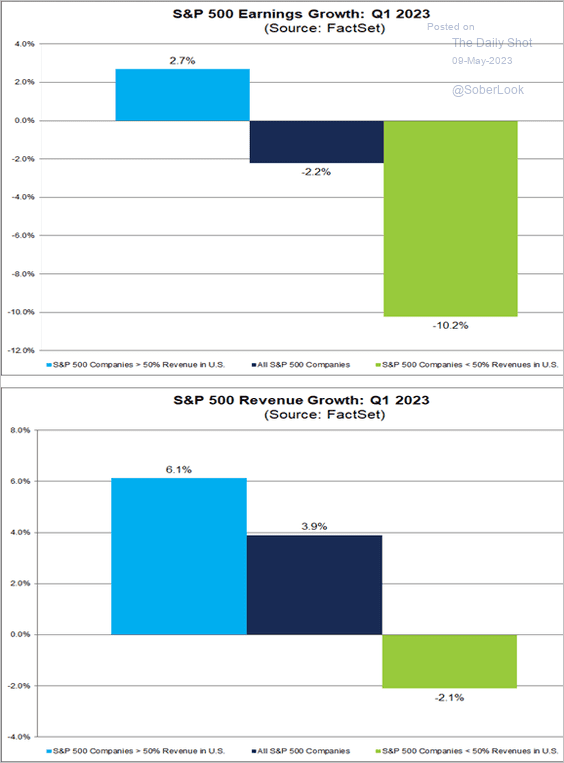

5. Significant exposure to non-US revenues was a disadvantage in Q1.

Source: @FactSet Read full article

Source: @FactSet Read full article

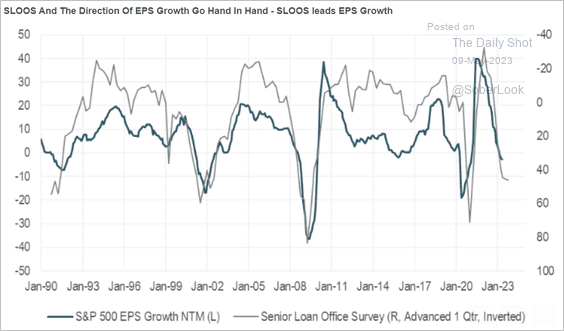

6. Tighter credit conditions point to weaker earnings ahead.

Source: Piper Sandler

Source: Piper Sandler

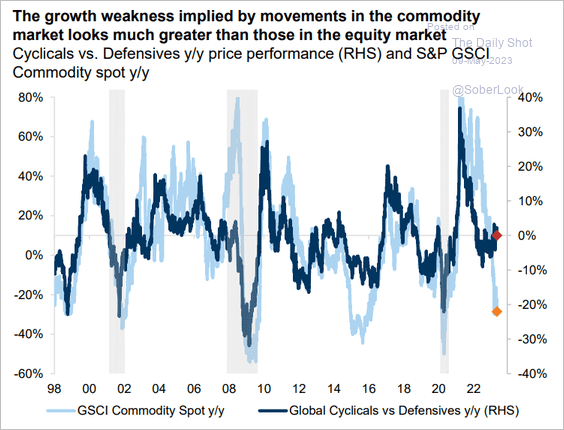

7. Commodities are pricing a larger economic downturn than equities.

Source: Goldman Sachs

Source: Goldman Sachs

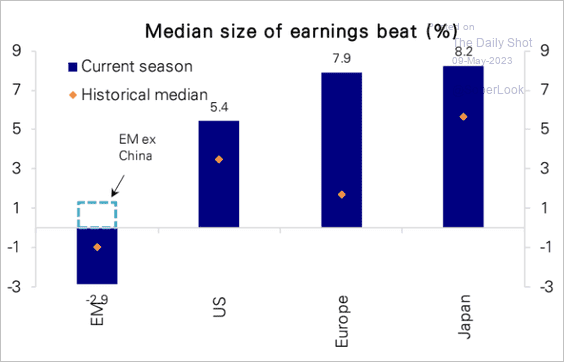

8. Here is a look at earnings beats in key markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

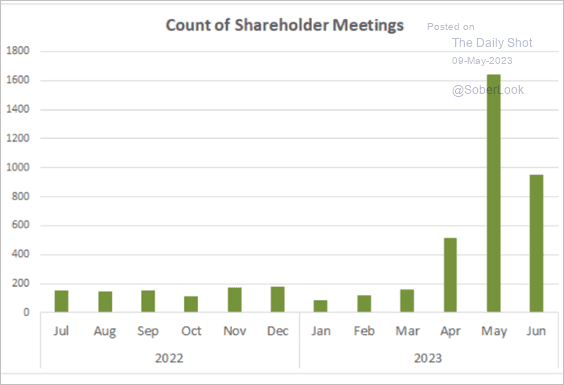

9. There are a lot of shareholder meetings in the second quarter.

Source: @FactSet Read full article

Source: @FactSet Read full article

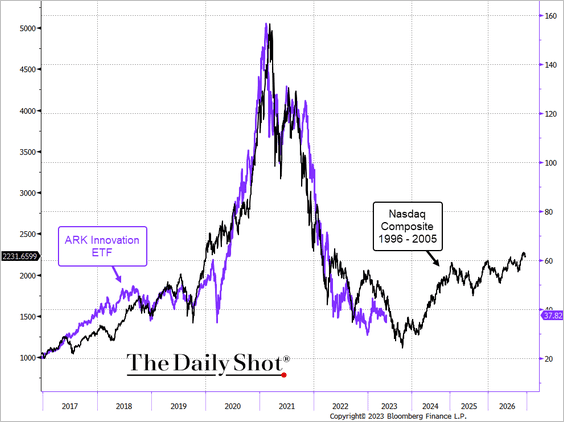

10. ARK Innovation continues to follow the dot-com analog.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

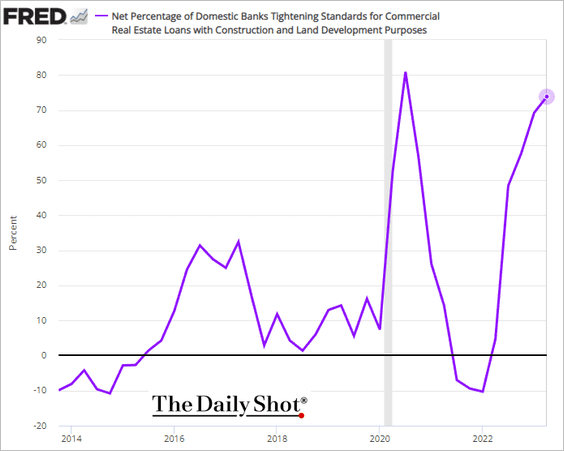

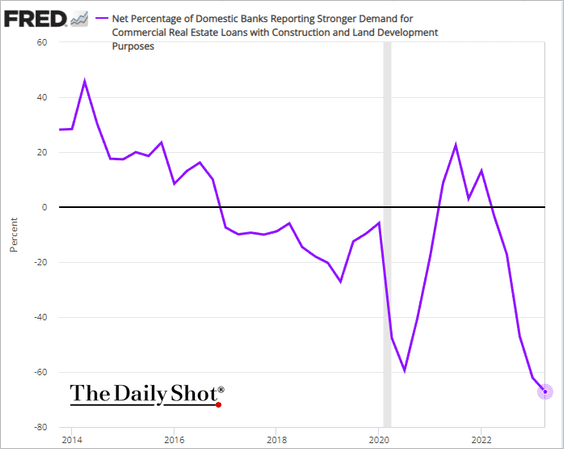

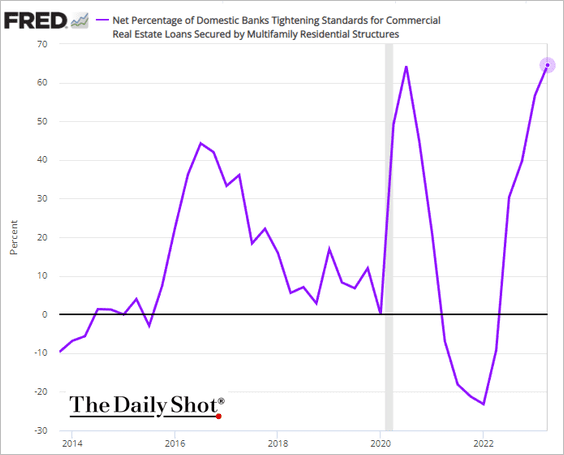

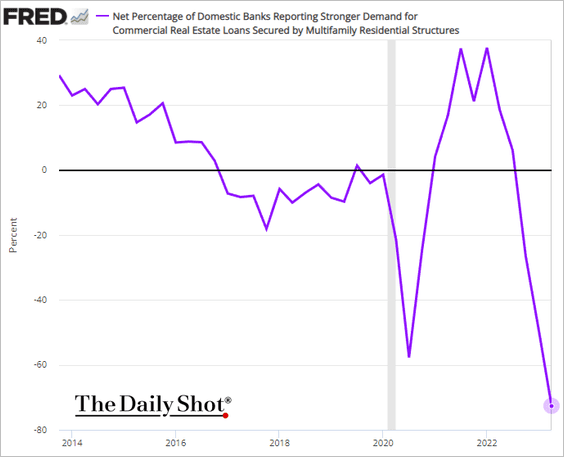

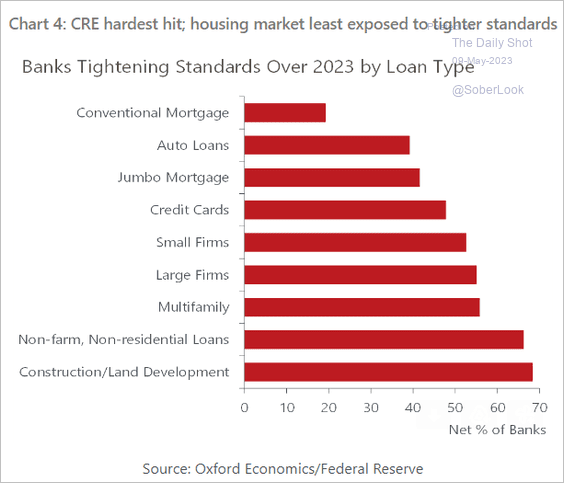

1. The sharpest credit tightening was in construction and development loans, …

… as demand crashes.

Credit in multi-family housing also tightened massively.

Here is the summary of banks tightening lending standards.

Source: Oxford Economics

Source: Oxford Economics

——————–

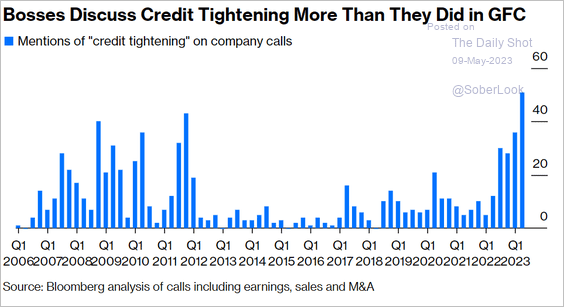

2. Credit tightening is increasingly discussed on earnings calls.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

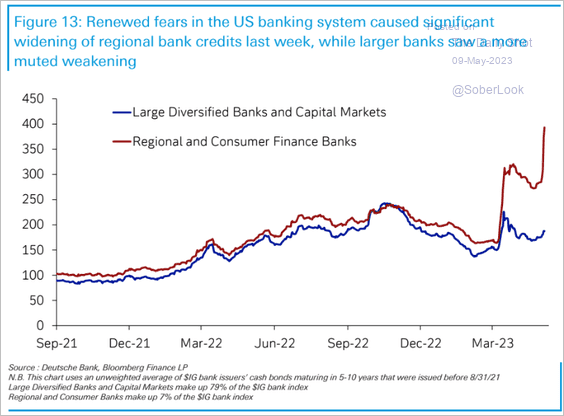

3. Regional banks’ bond spreads have risen significantly.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

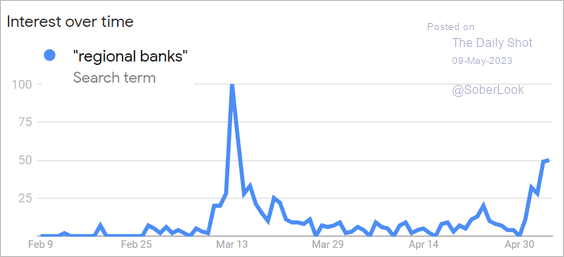

By the way, here is the Google search activity for “regional banks.”

Source: Google Trends

Source: Google Trends

——————–

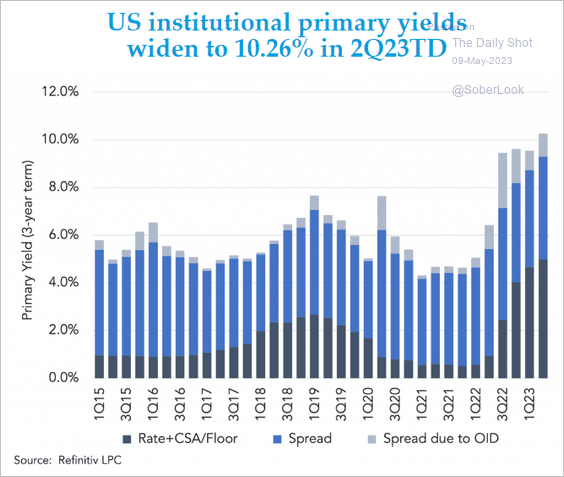

4. Primary-market leveraged loan yields keep climbing.

Source: @theleadleft

Source: @theleadleft

——————–

Food for Thought

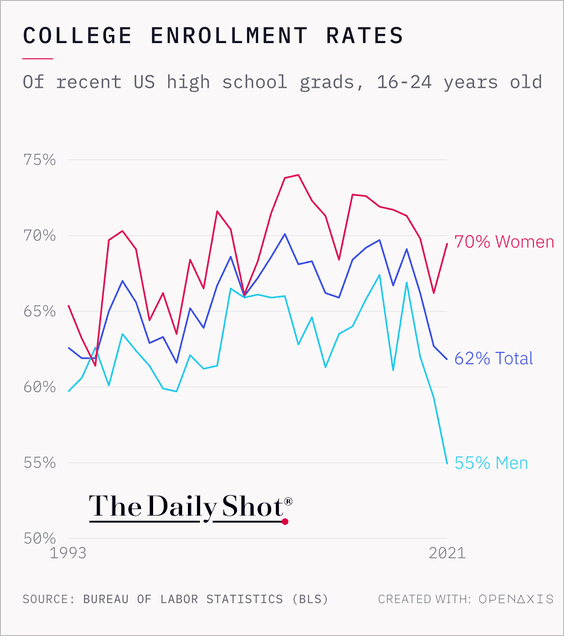

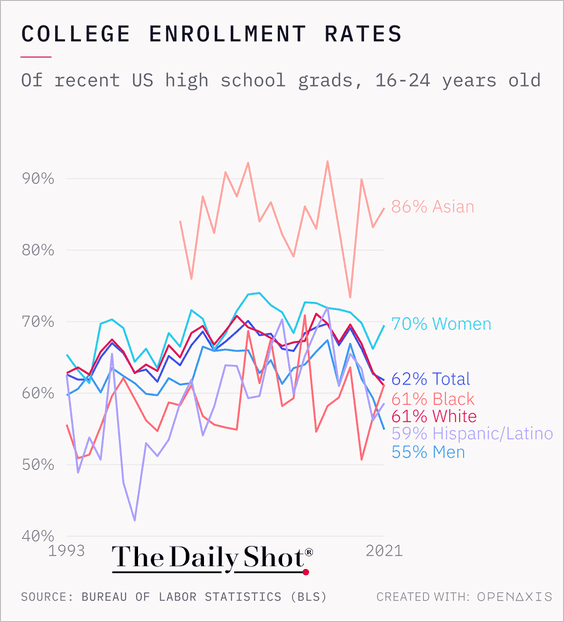

1. US College enrollment rates (2 charts):

Source: @TheDailyShot

Source: @TheDailyShot

Source: @TheDailyShot

Source: @TheDailyShot

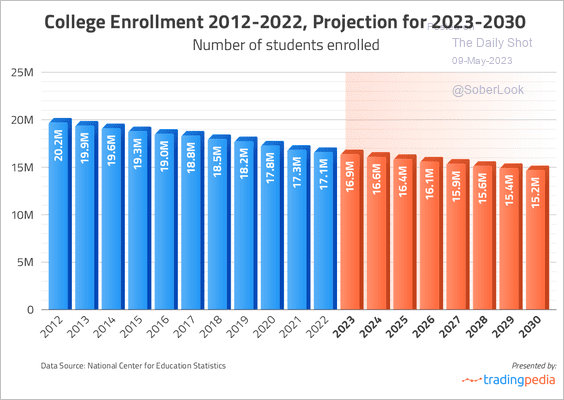

2. College enrollment projections:

Source: Trading Pedia Read full article

Source: Trading Pedia Read full article

——————–

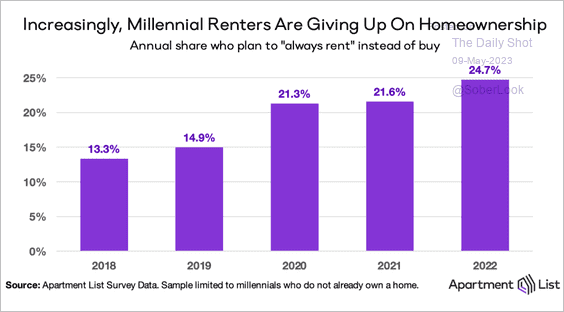

3. Millennial renters:

Source: Apartment List

Source: Apartment List

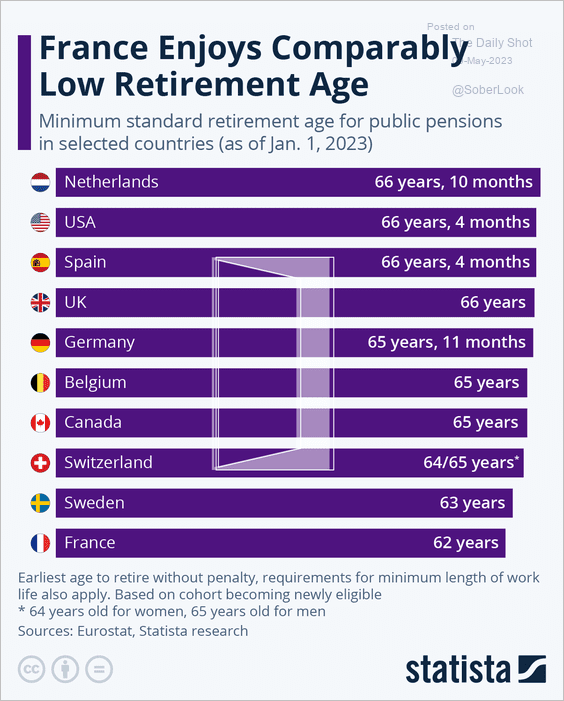

4. Minimum standard retirement age for public pensions:

Source: Statista

Source: Statista

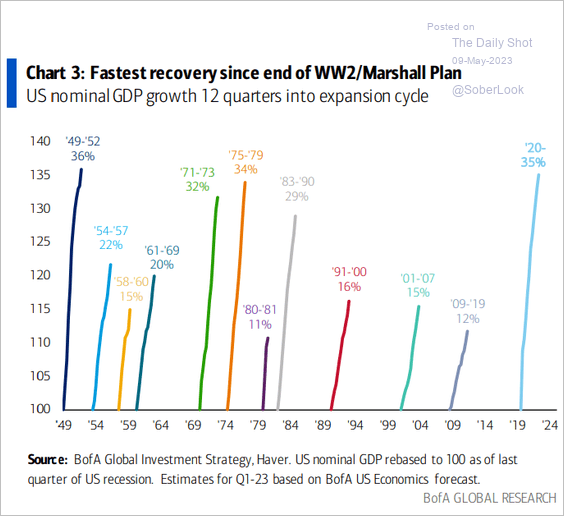

5. US post-recession GDP recoveries:

Source: BofA Global Research

Source: BofA Global Research

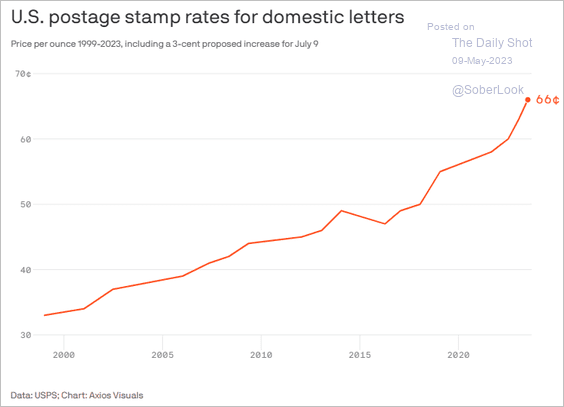

6. US postage stamp rates:

Source: @axios Read full article

Source: @axios Read full article

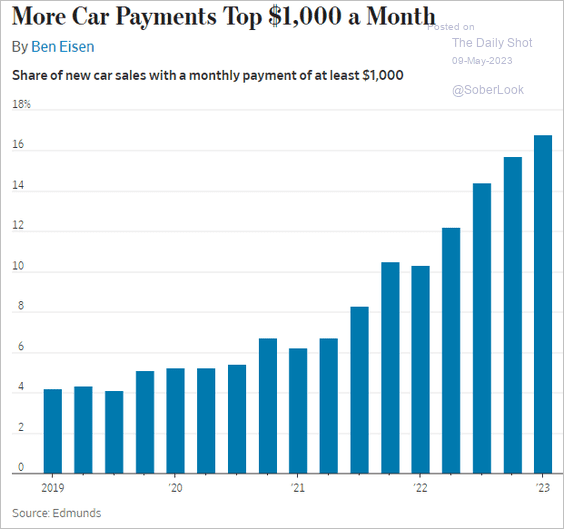

7. Monthly car payments of at least $1,000.

Source: @WSJ Read full article

Source: @WSJ Read full article

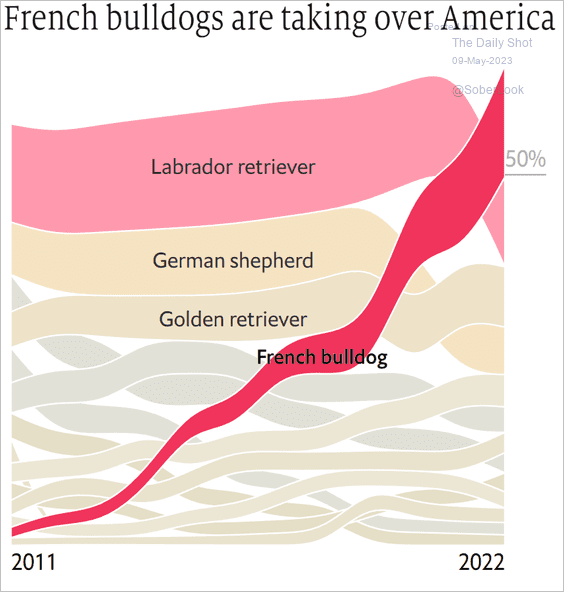

8. French bulldog popularity in the US:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index