The Daily Shot: 08-May-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

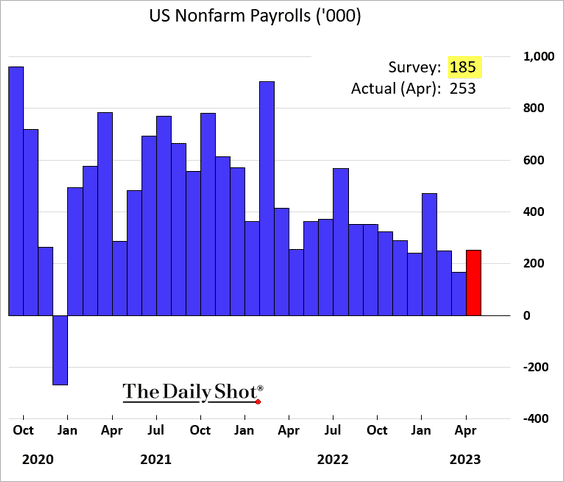

1. The April payrolls report topped expectations. Again.

Source: Reuters Read full article

Source: Reuters Read full article

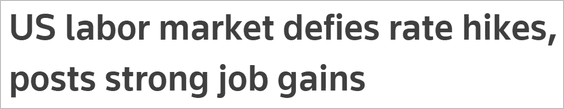

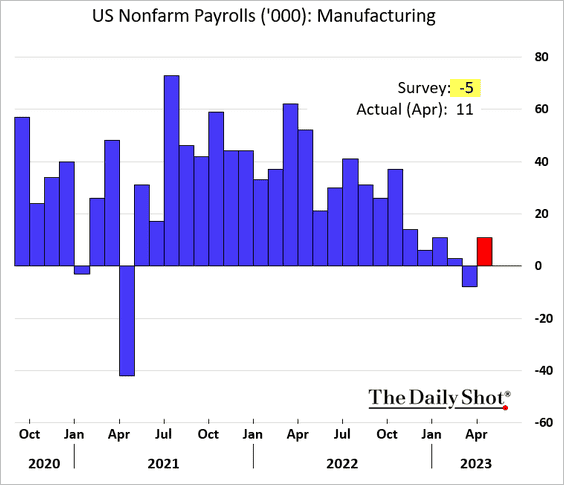

The upside surprise streak (12 months) has been unprecedented.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

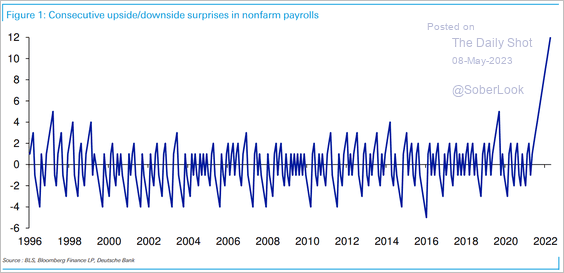

• Below are some sector trends.

– Manufacturing:

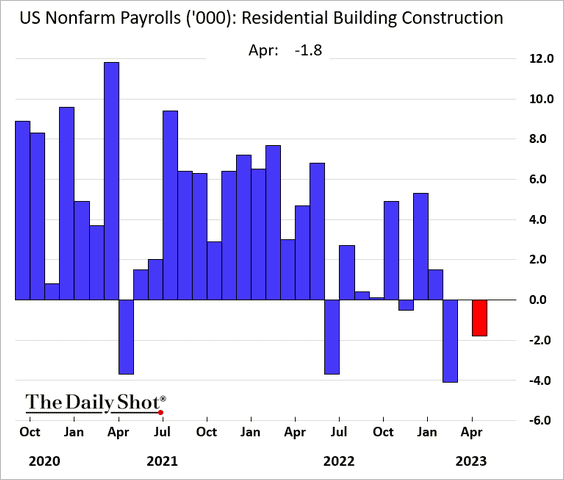

– Residential construction:

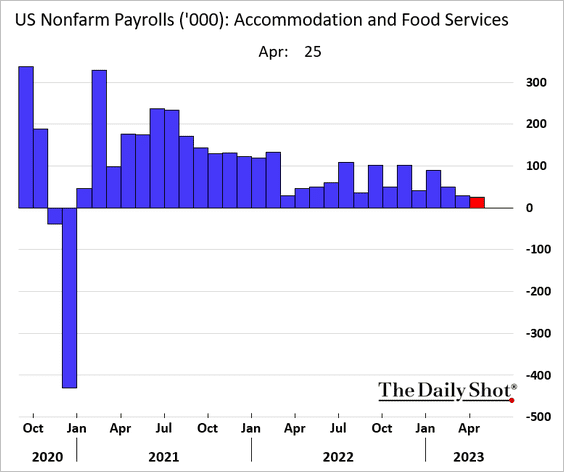

– Hotels and restaurants (hiring is slowing):

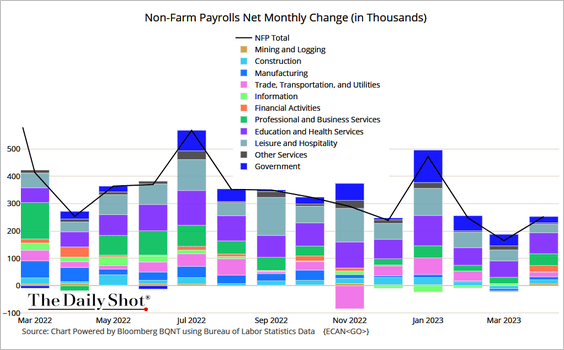

– Contributions to the total payrolls trend:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

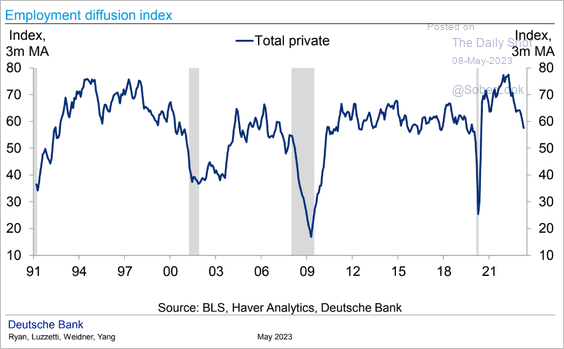

• The labor market breadth has been falling.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

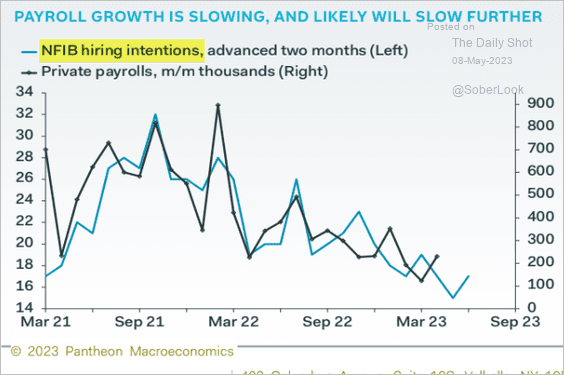

• Small business hiring intentions signal softer employment growth ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

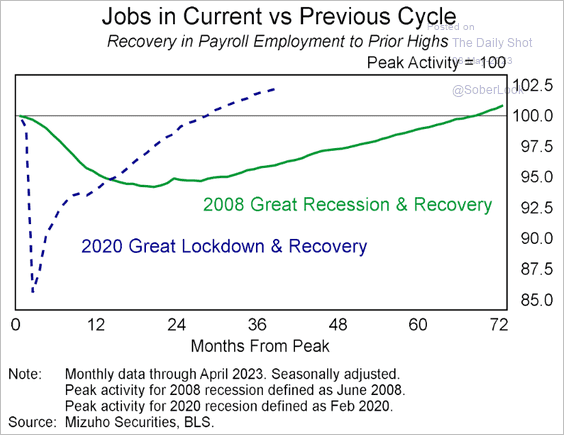

• This chart shows the current jobs trajectory versus the post-2008 recovery.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

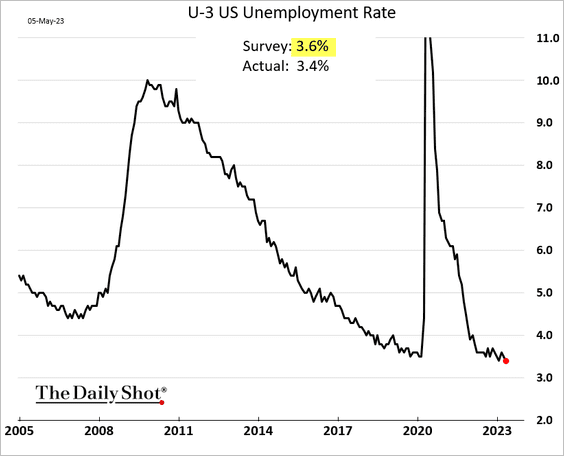

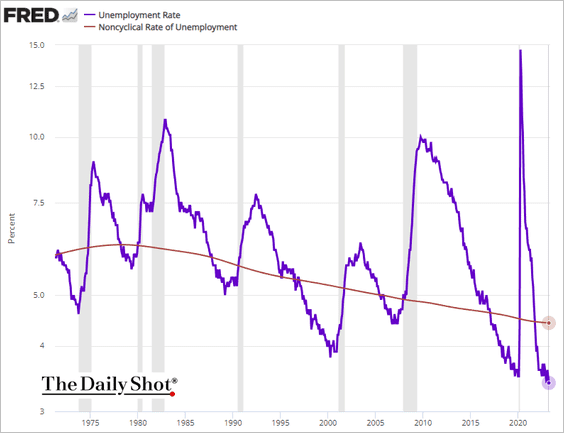

• The unemployment rate unexpectedly dipped to 3.4%.

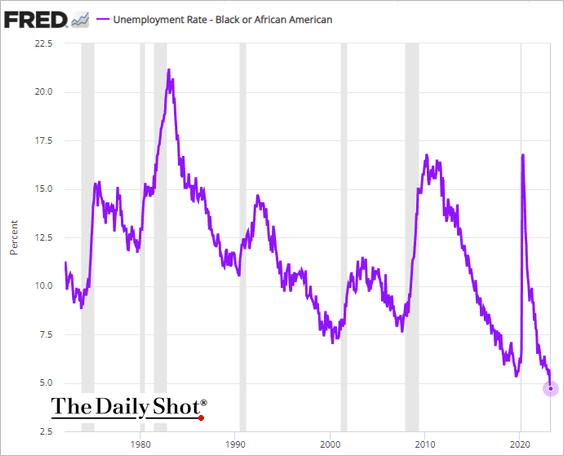

– The unemployment rate among African Americans dropped below 5% for the first time.

– Unemployment is running well below the “natural” unemployment rate, pointing to a persistently tight labor market.

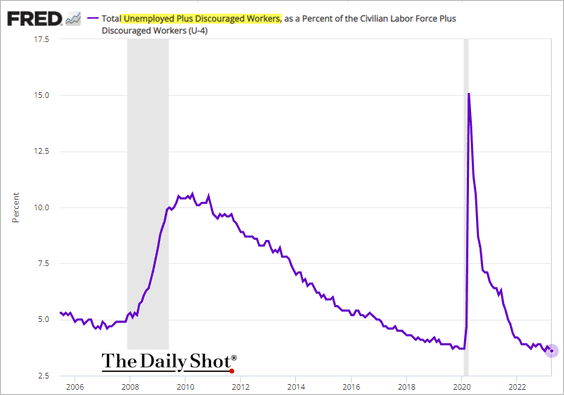

– The U-4 unemployment rate (below) includes discouraged workers.

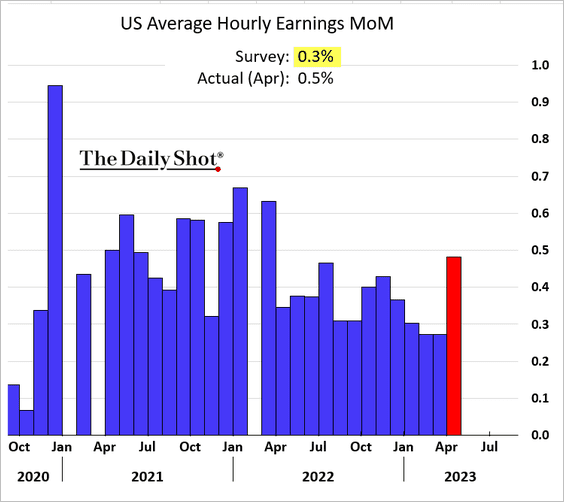

• The labor market strength is translating into stronger-than-expected wage growth, which could keep inflation elevated.

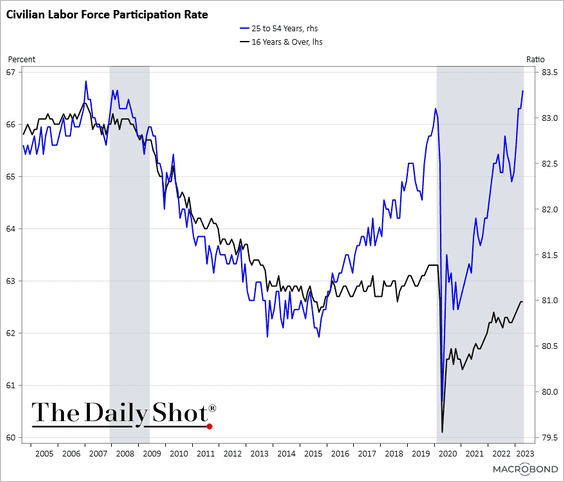

• Prime-age labor force participation has been surging, which in theory, should slow wage growth.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

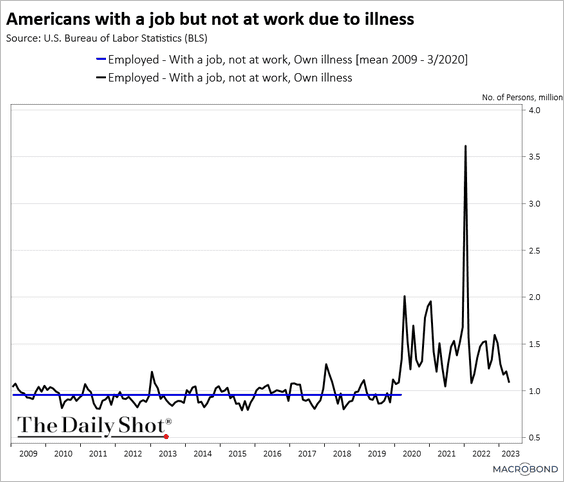

• Fewer Americans are not working due to illness.

——————–

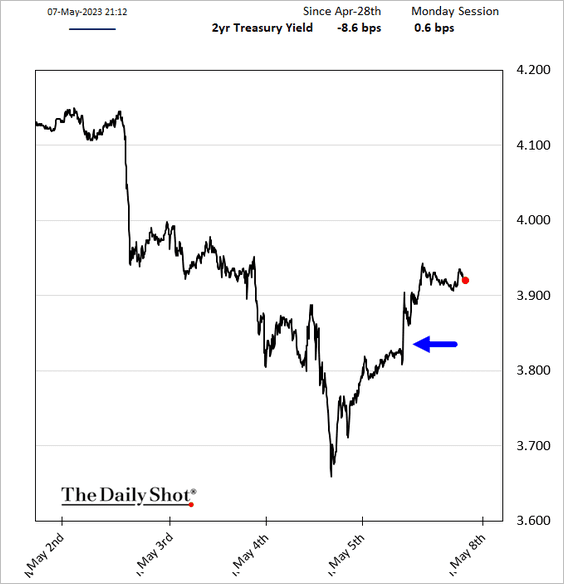

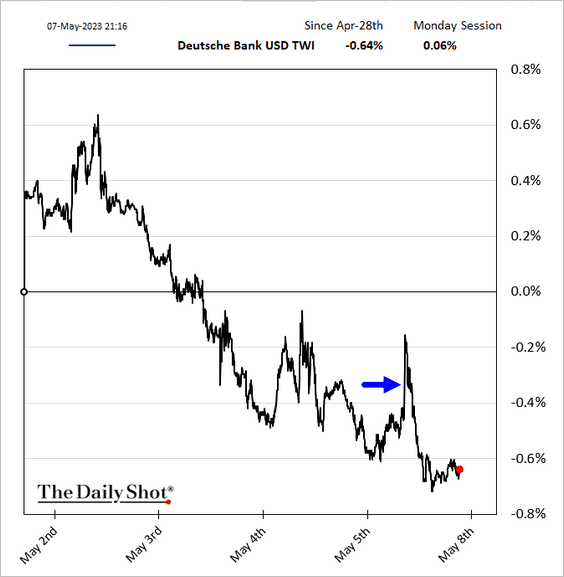

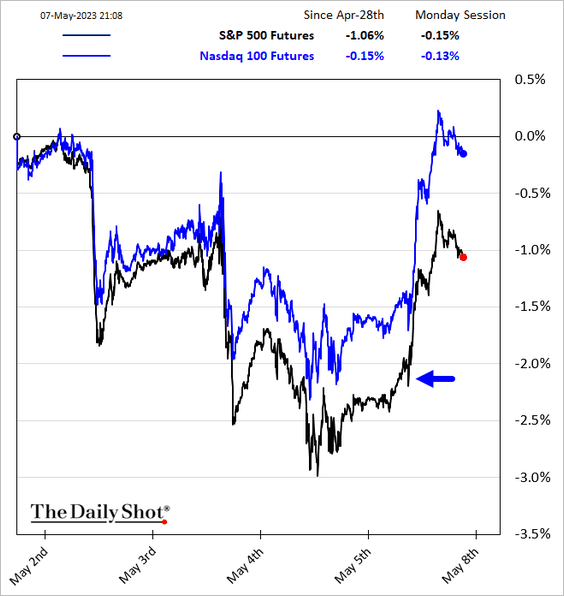

2. Below are some market reactions to the robust jobs report.

• Treasury yields:

• The dollar (fleeting gains):

• Equities:

——————–

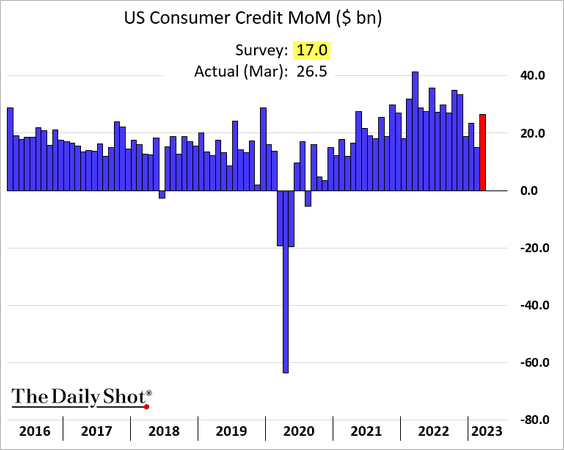

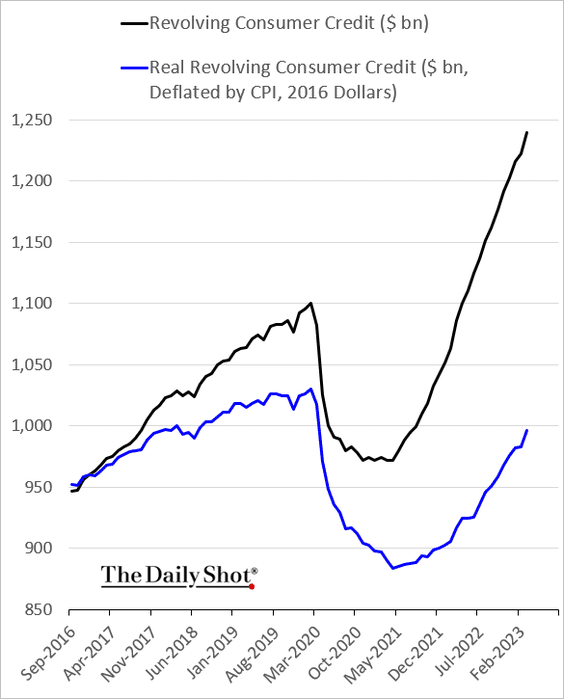

3. March consumer credit growth exceeded expectations, …

… boosted by growing credit card balances.

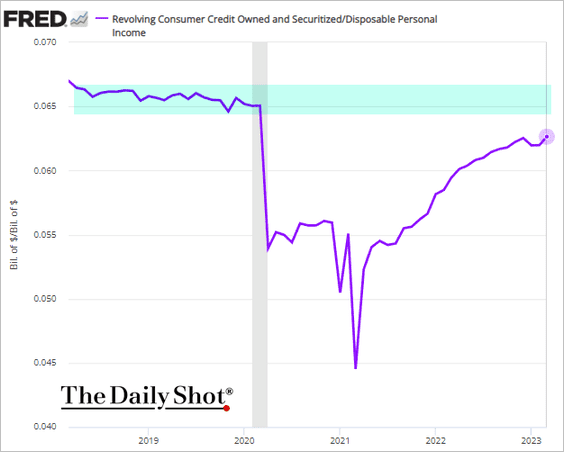

Credit card debt as a share of disposable income remains below pre-COVID levels.

——————–

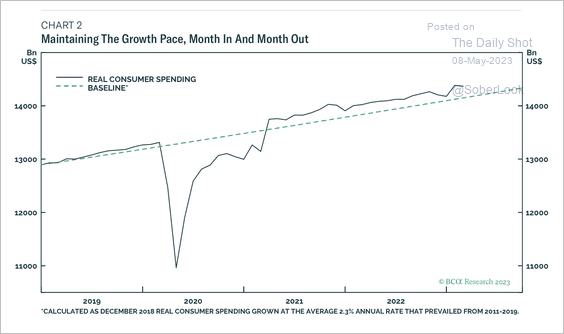

4. Real consumer spending is still above trend.

Source: BCA Research

Source: BCA Research

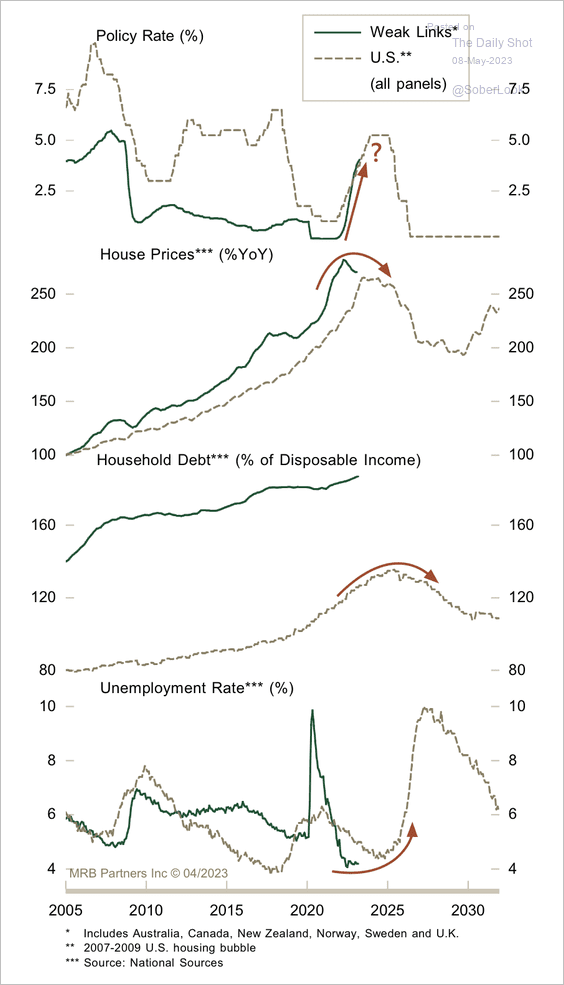

5. Will the US follow the 2008 recession roadmap?

Source: MRB Partners

Source: MRB Partners

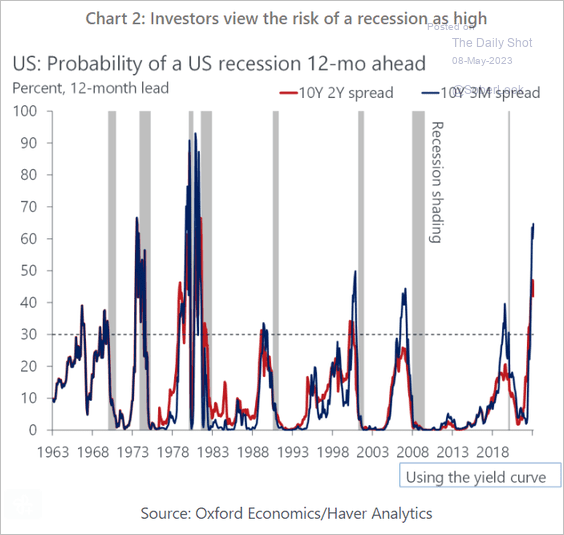

The inverted yield curve continues to signal a recession ahead.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

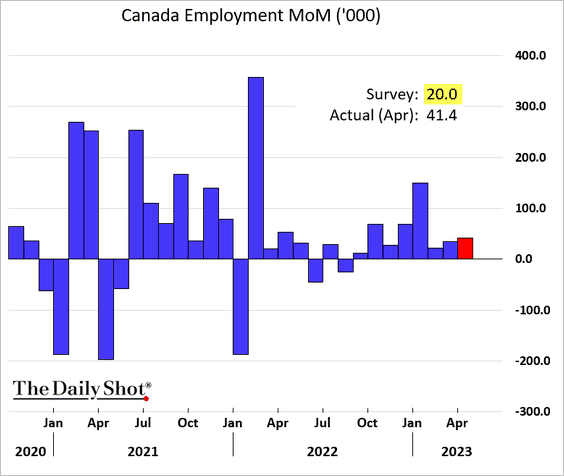

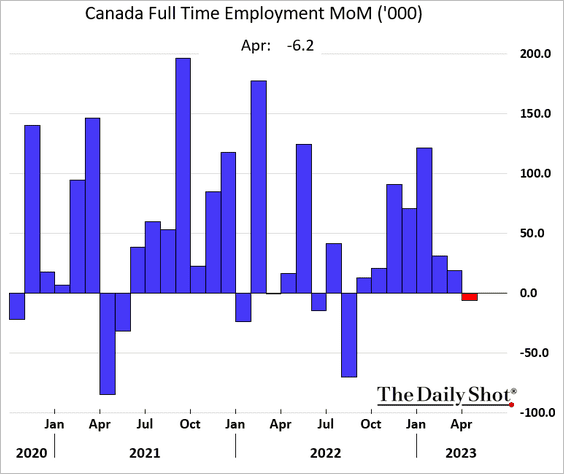

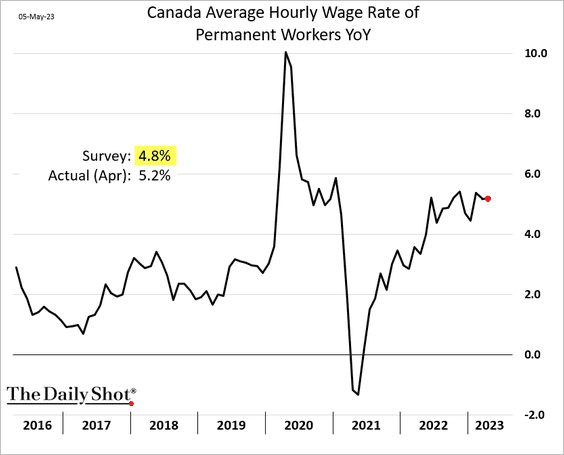

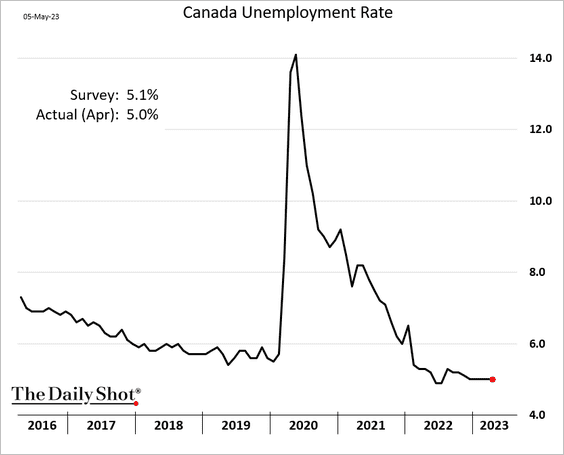

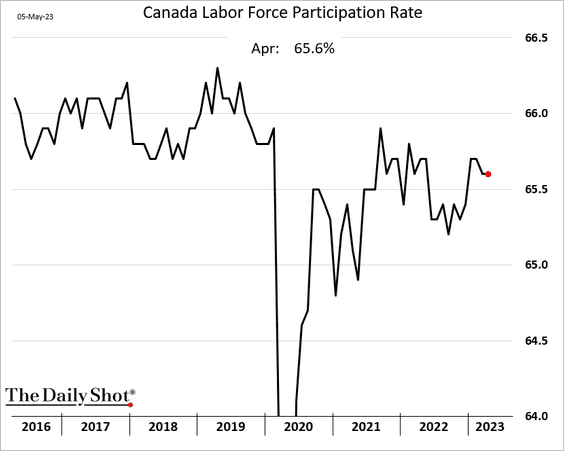

Canada

Canada’s April employment report was also strong.

However, the net job gains were all in part-time positions.

• Wage growth was well above expectations.

• The unemployment rate held steady, …

… and so did labor force participation.

Back to Index

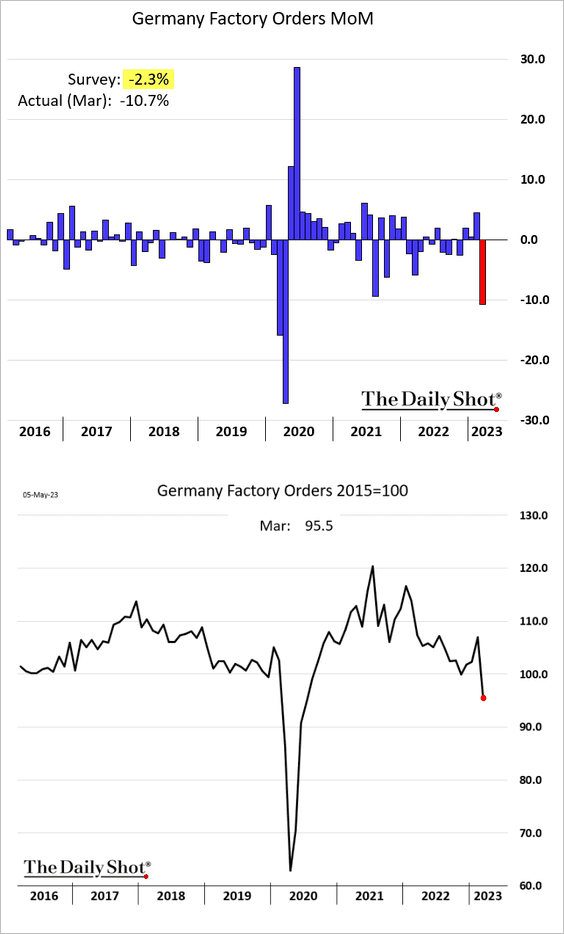

The Eurozone

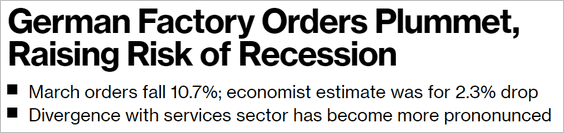

1. Germany’s factory orders unexpectedly tumbled in March, raising recession concerns.

Source: @WeberAlexander, @economics Read full article

Source: @WeberAlexander, @economics Read full article

Industrial production was also below expectations.

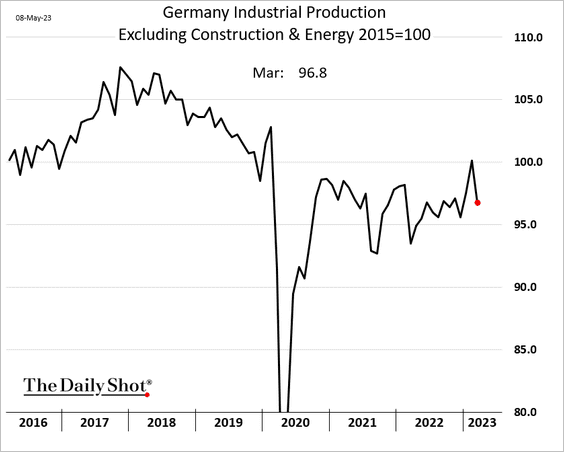

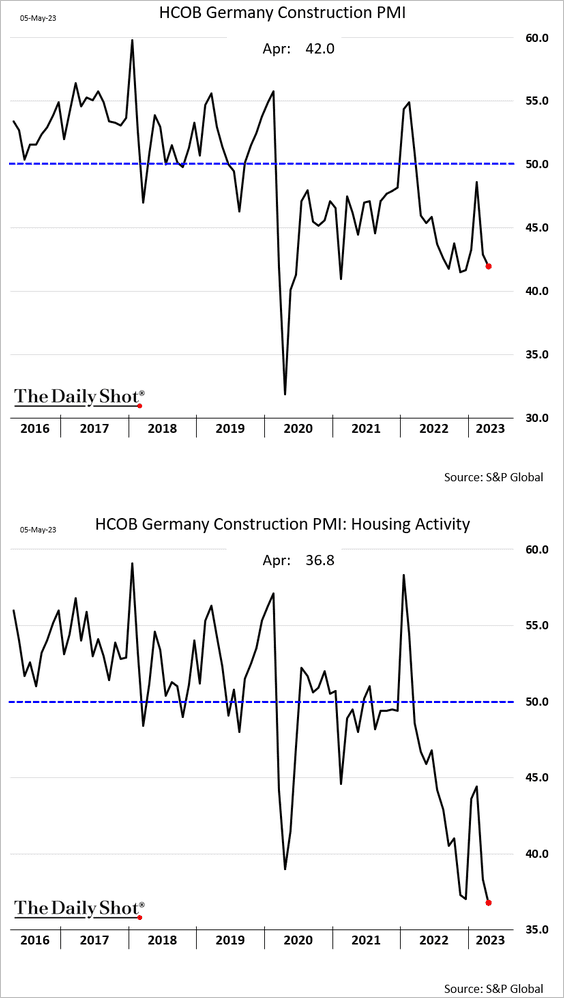

• Germany’s construction activity continues to shrink, depressed by plunging residential building activity.

——————–

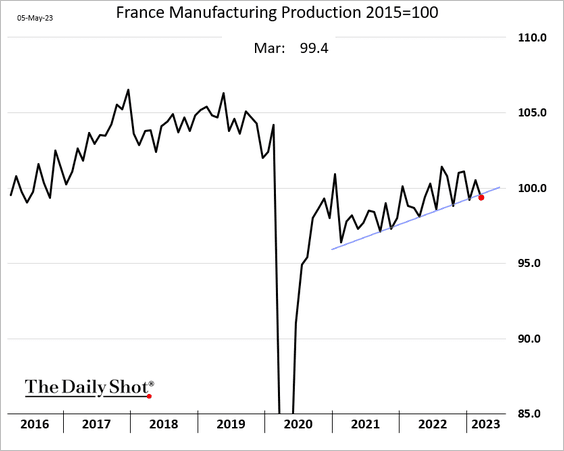

2. French manufacturing output softened in March.

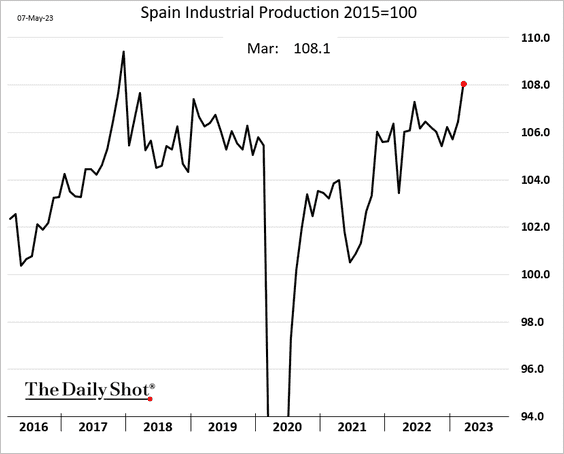

3. However, Spain’s industrial production has been surging.

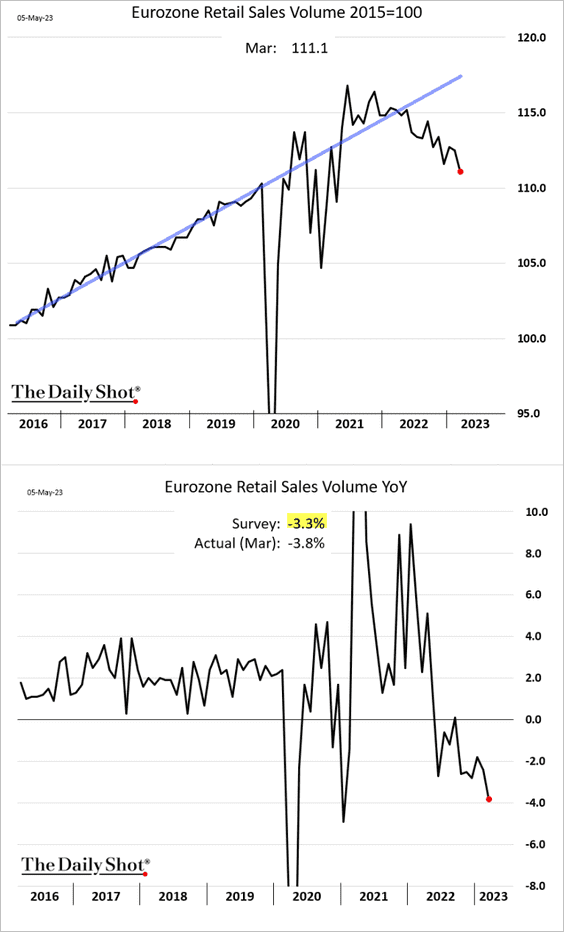

4. Euro-area March retail sales were below forecasts, with the downward trend remaining intact.

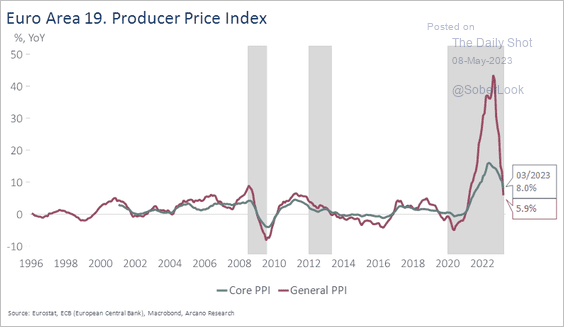

5. Here is the euro-area headline and core PPI.

Source: Arcano Economics

Source: Arcano Economics

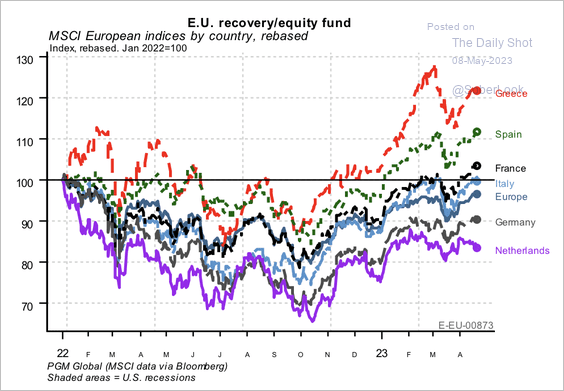

6. Southern European countries (less levered to Russian energy supplies) have led the region’s equity market recovery.

Source: PGM Global

Source: PGM Global

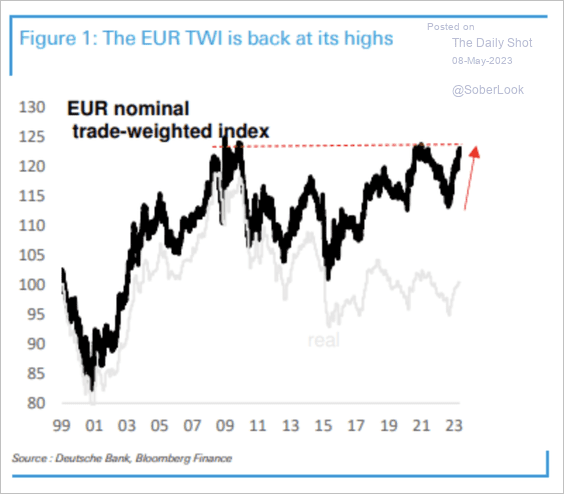

7. The euro trade-weighted index is testing long-term resistance.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

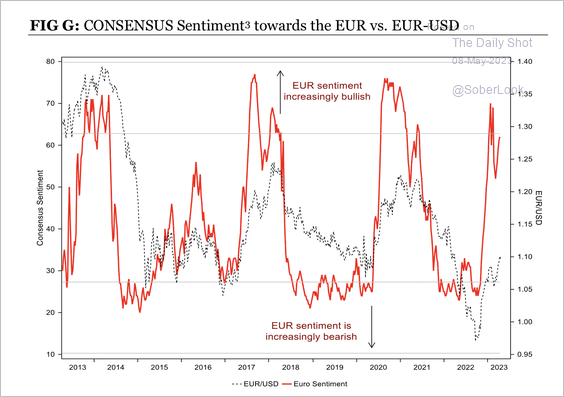

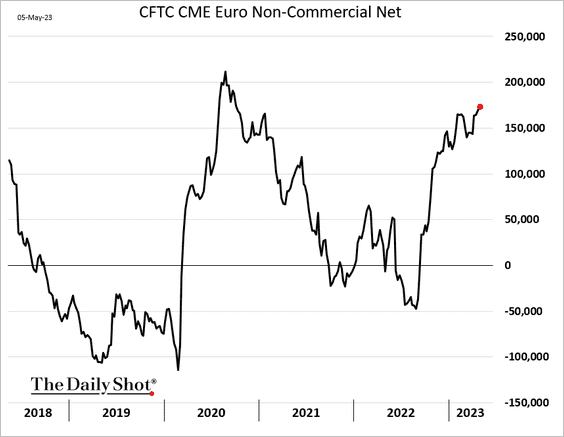

Euro sentiment is increasingly bullish, pointing to a pause in the EUR rally (2 charts).

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

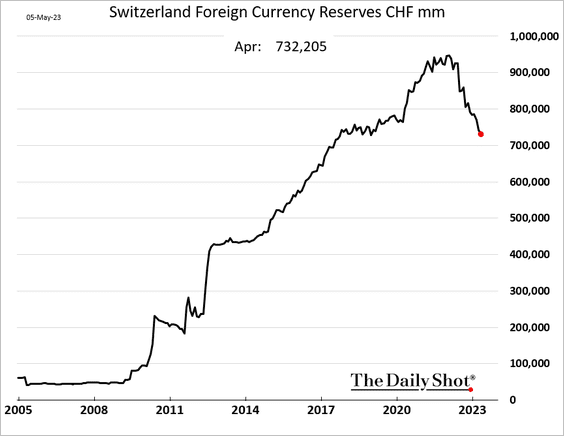

1. Swiss FX reserves continue to fall as the central bank cuts liquidity (a form of QT).

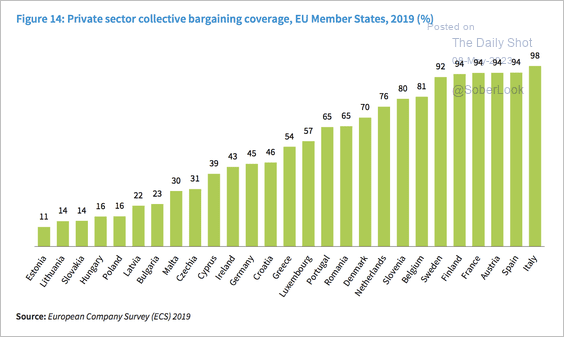

2. This chart shows private-sector collective bargaining coverage (unions negotiating on workers’ behalf) across the EU.

Source: Eurofound Read full article

Source: Eurofound Read full article

Back to Index

Asia-Pacific

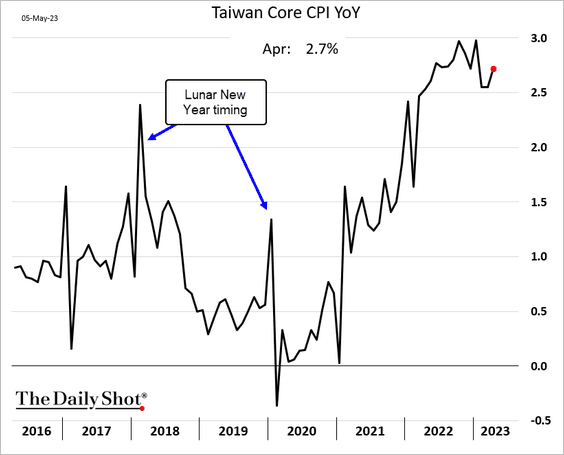

1. Taiwan’s core inflation increased in April.

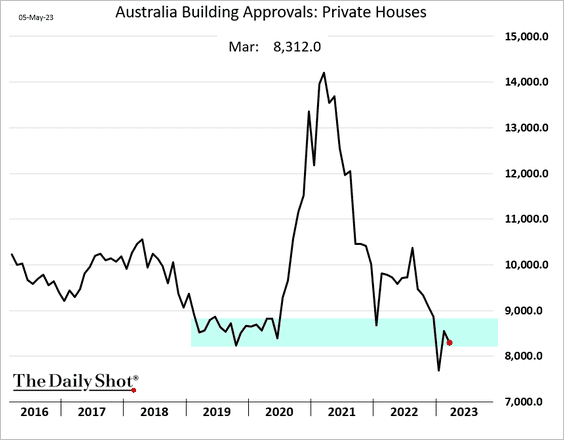

2. Australia’s residential building approvals were lower in March.

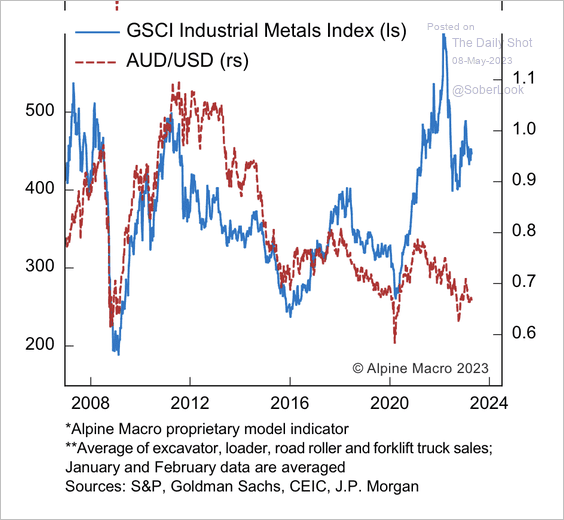

Separately, AUD/USD has not kept up with the rise in industrial metal prices.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

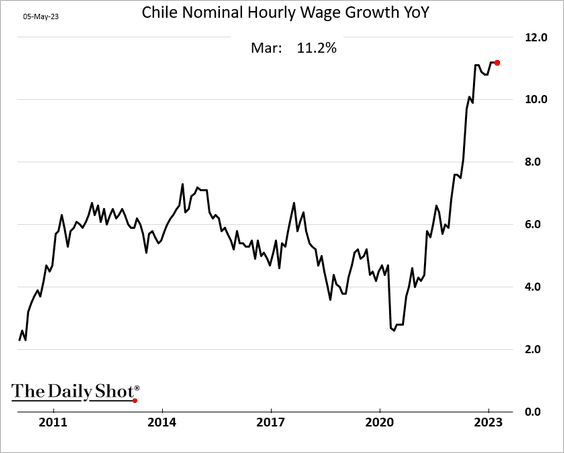

1. Wage growth has been holding above 11% in Chile.

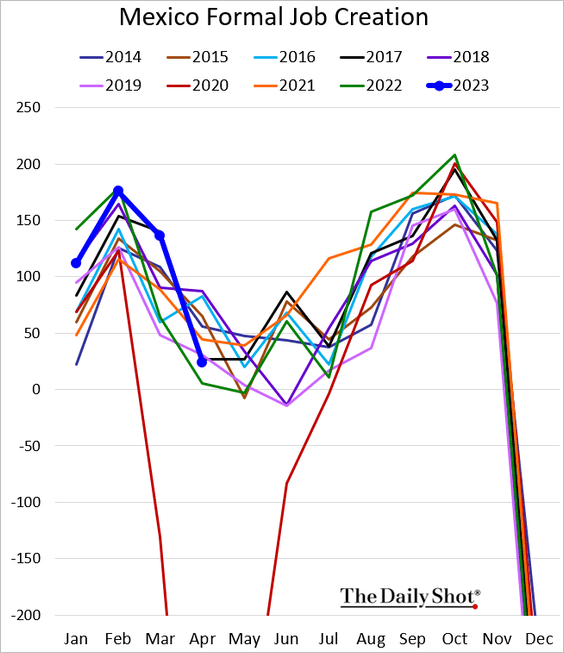

2. Mexico’s formal job creation is slowing.

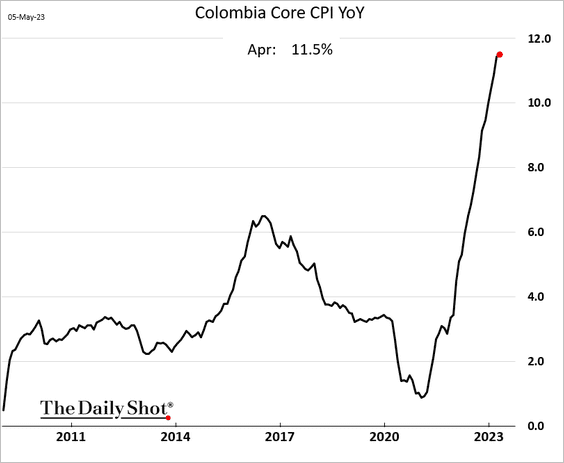

3. Colombia’s core inflation remains elevated.

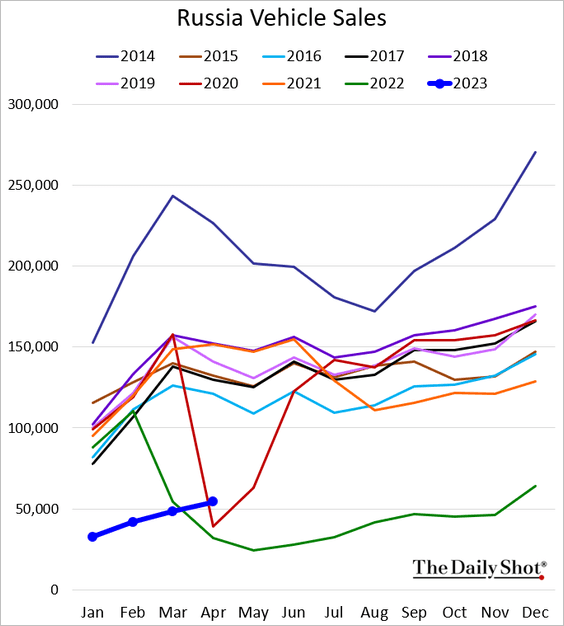

4. Russian vehicle sales are above last year’s levels but remain depressed.

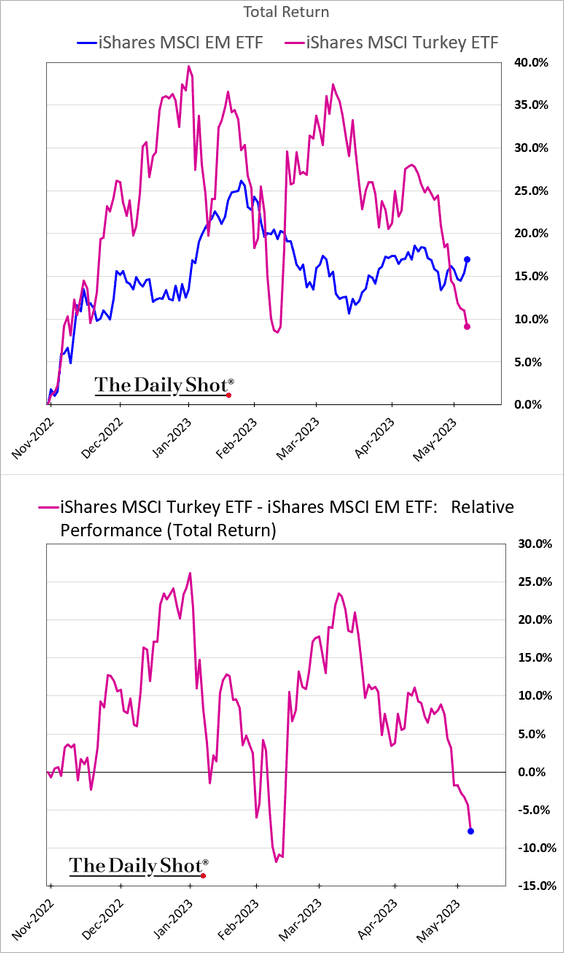

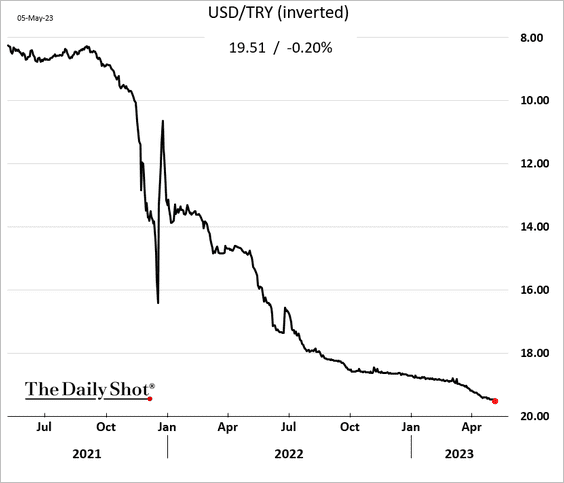

5. Turkey’s assets have been under pressure ahead of the elections.

• Equity ETF:

• The lira:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

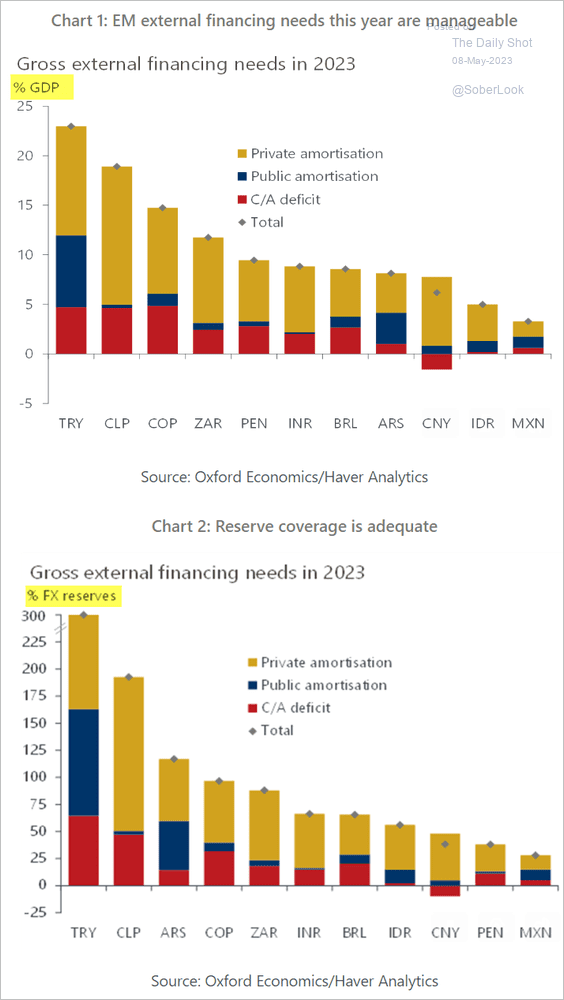

6. These charts show external financing needs by sector as a share of GDP and FX reserves.

Source: Oxford Economics

Source: Oxford Economics

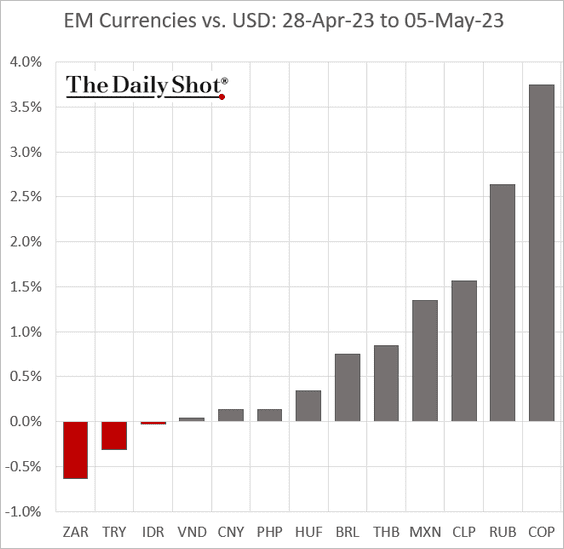

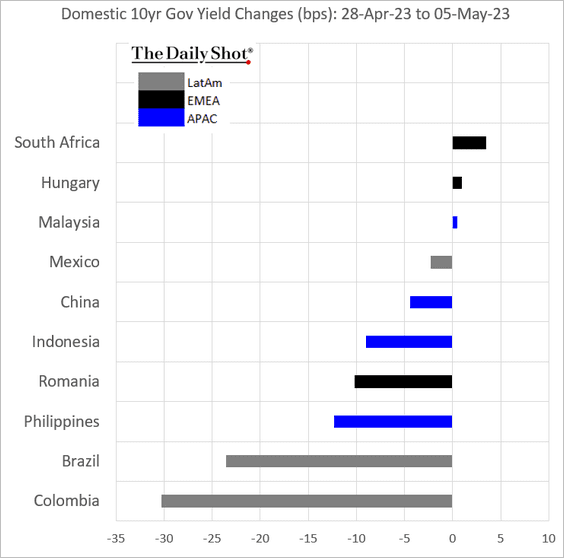

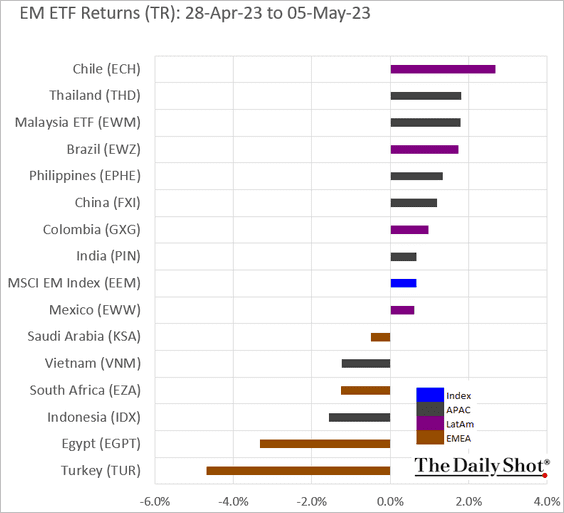

7. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

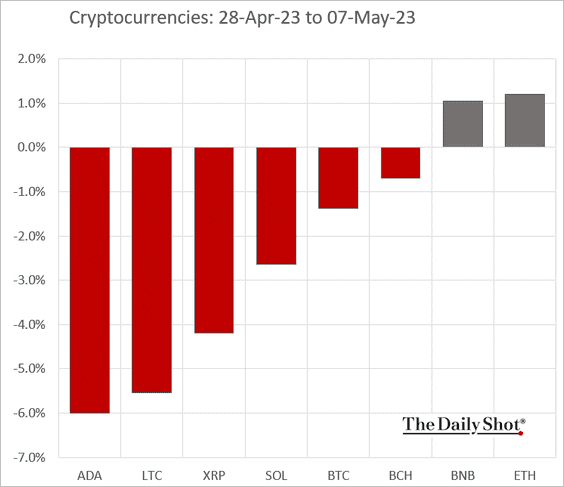

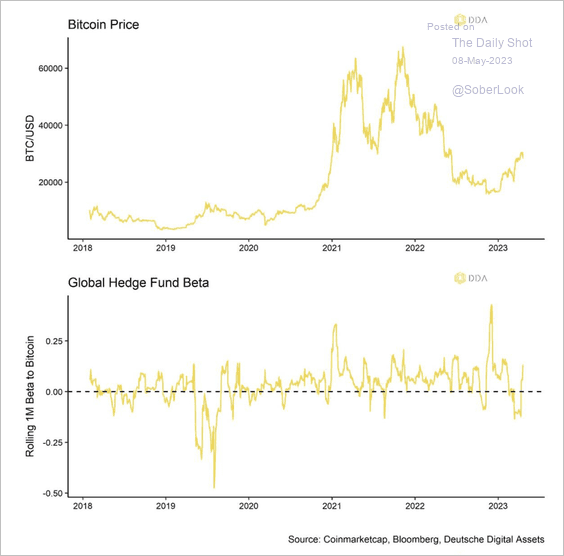

Cryptocurrency

1. Let’s start with last week’s performance.

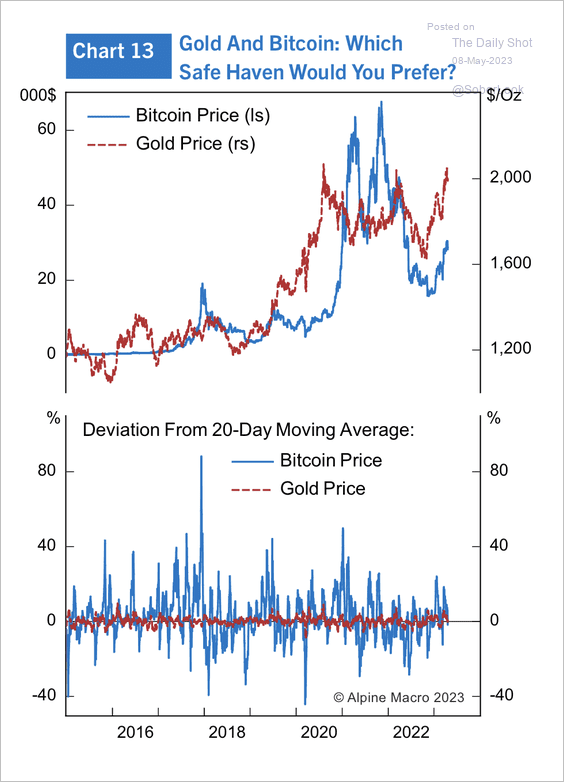

2. Bitcoin and gold have been rising, although price swings in BTC are more extreme.

Source: Alpine Macro

Source: Alpine Macro

3. Global hedge fund beta to bitcoin has increased.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

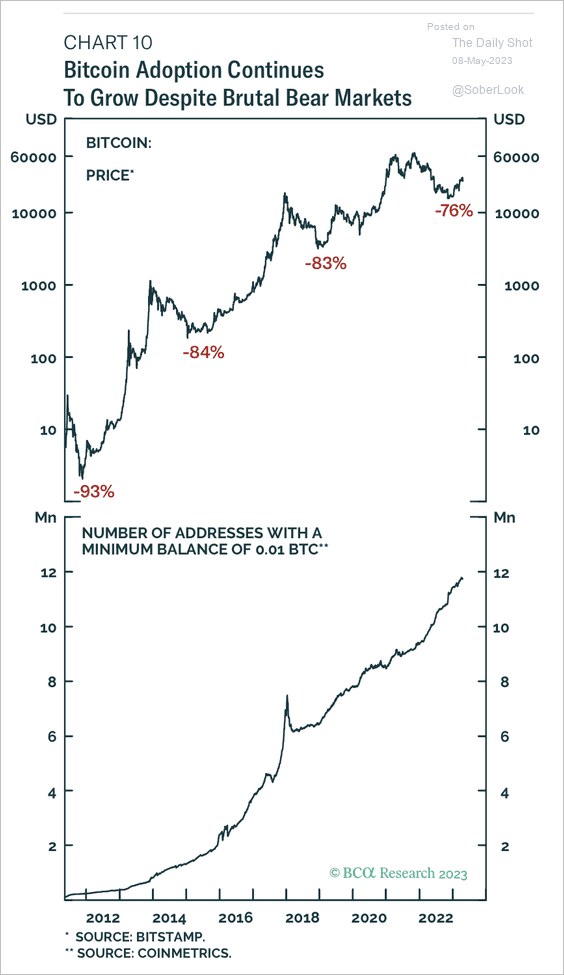

4. Bitcoin adoption has been resilient despite deep drawdowns.

Source: BCA Research

Source: BCA Research

Back to Index

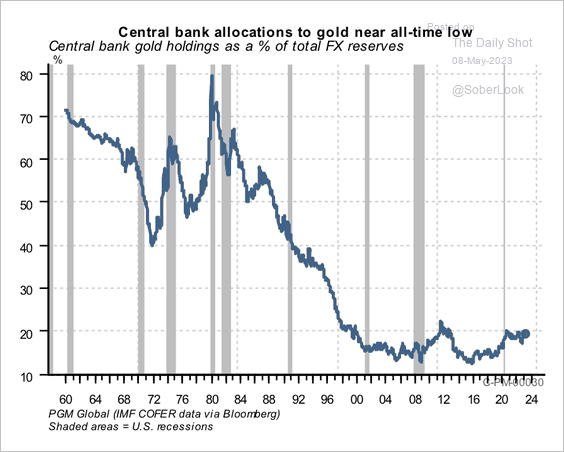

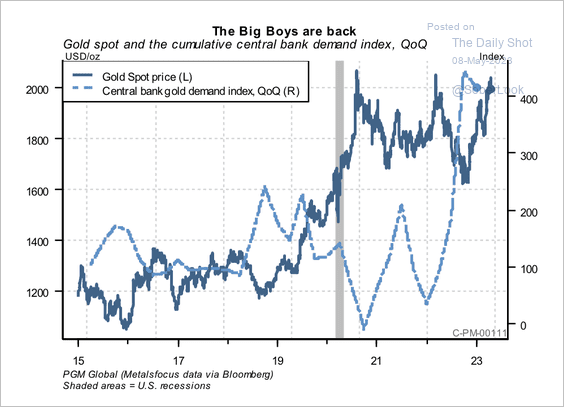

Commodities

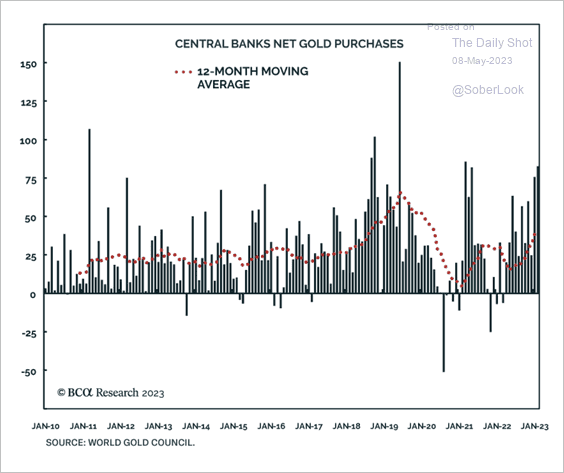

1. Let’s begin with some updates on gold.

• Central bank holdings of gold have declined since the 1980s, …

Source: PGM Global

Source: PGM Global

… although demand has increased in recent years, particularly in China, Russia, and Turkey, according to PGM Global. (2 charts)

Source: PGM Global

Source: PGM Global

Source: BCA Research

Source: BCA Research

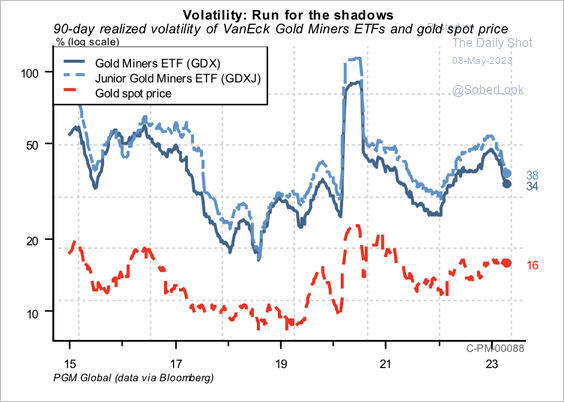

• Gold mining stocks typically have higher price volatility relative to the base metal.

Source: PGM Global

Source: PGM Global

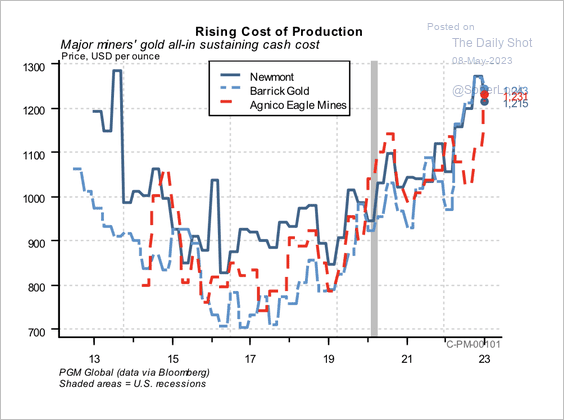

– Gold miners have experienced a rising cost of production in recent years.

Source: PGM Global

Source: PGM Global

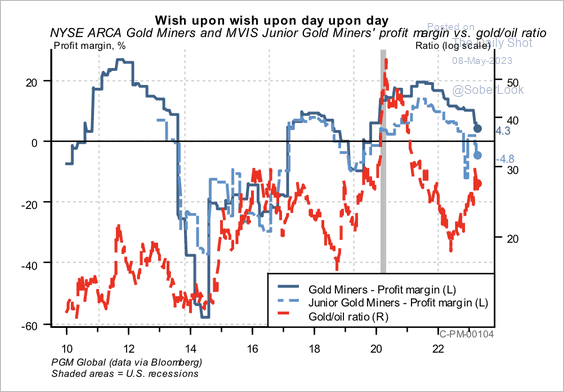

• A sustained rise in the gold/oil price ratio typically supports a rebound in gold miners’ profit margins.

Source: PGM Global

Source: PGM Global

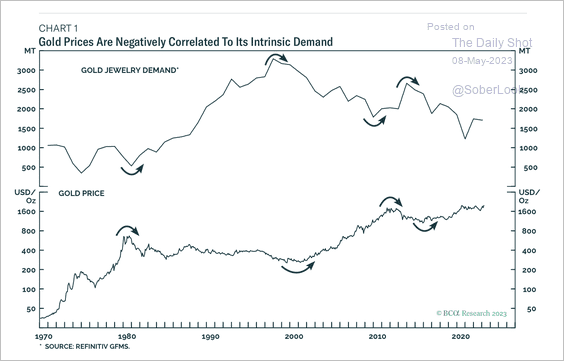

• Gold prices have almost no correlation with jewelry demand.

Source: BCA Research

Source: BCA Research

——————–

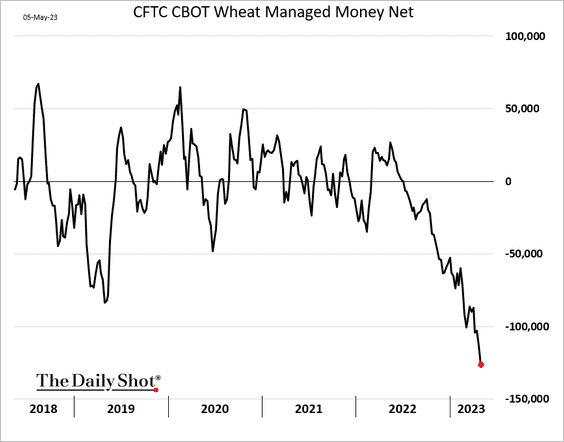

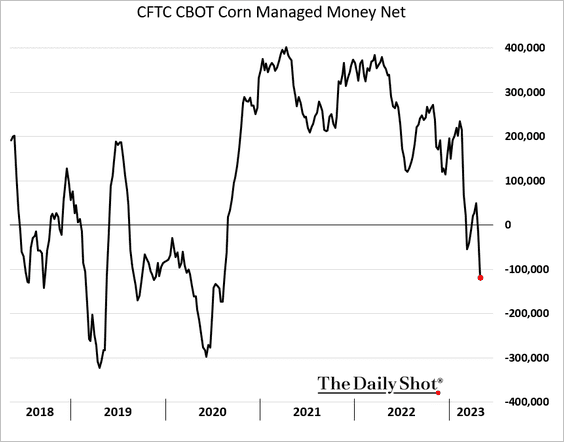

2. Funds continue to press their bets against wheat amid ample global supplies.

Positioning in corn futures is now also negative.

——————–

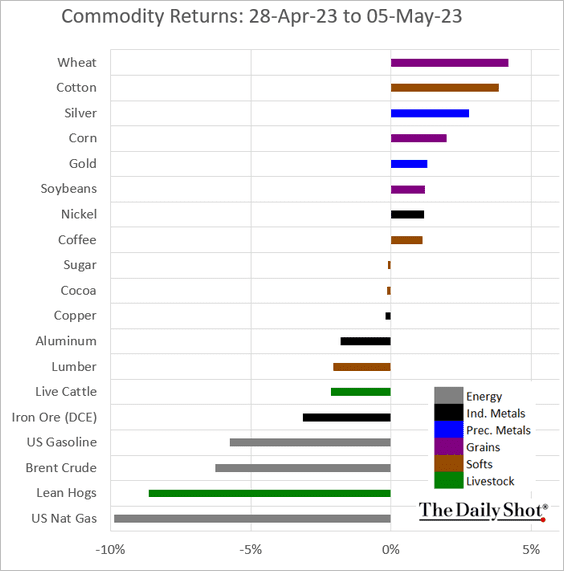

3. Here is a look at last week’s performance across key commodity markets.

Back to Index

Equities

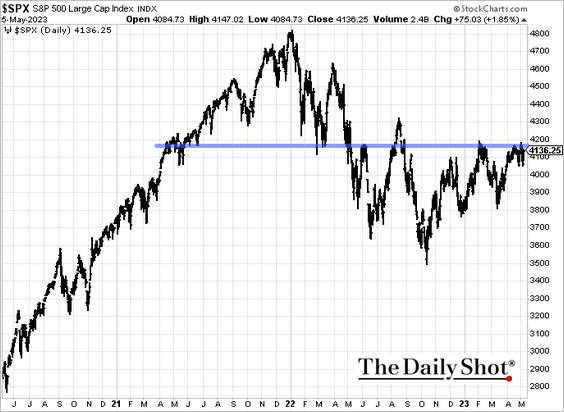

1. The S&P 500 is nearing resistance again.

2. The S&P 500 financials index has been testing support.

Source: @JessicaMenton, @lena_popina, @brebradham, @markets Read full article

Source: @JessicaMenton, @lena_popina, @brebradham, @markets Read full article

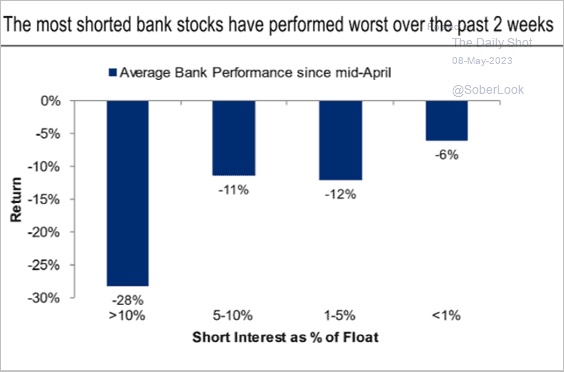

3. The most shorted banks saw the biggest drawdowns.

Source: Citi Private Bank

Source: Citi Private Bank

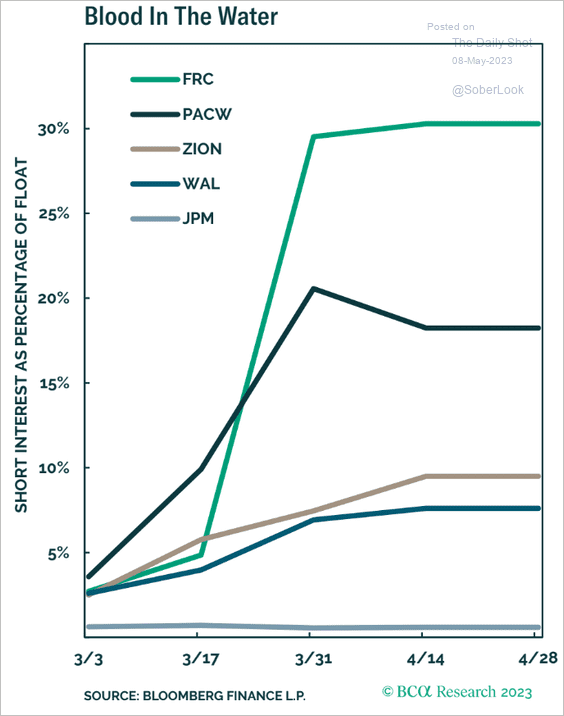

Here is the evolution of short interest.

Source: BCA Research

Source: BCA Research

——————–

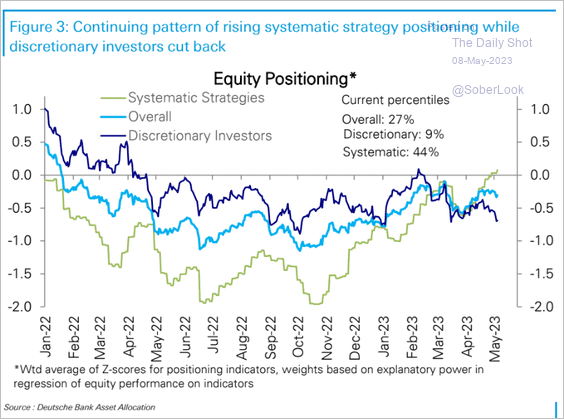

4. According to Deutsche Bank, systematic strategies (such as risk-parity) are increasing their exposure to stocks. However, discretionary investors are turning more bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

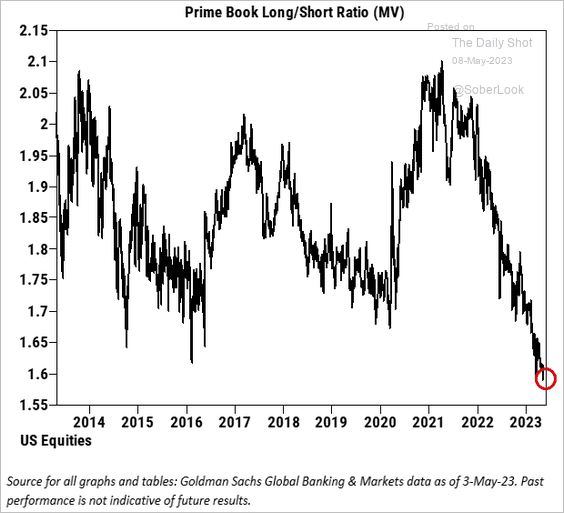

Hedge fund clients haven’t been this bearish on stocks in at least a decade.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

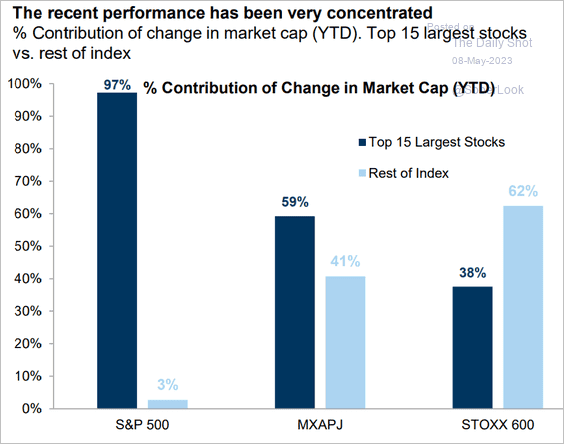

5. US stock market’s recent performance has been far more concentrated than indices in Asia and Europe.

Source: Goldman Sachs

Source: Goldman Sachs

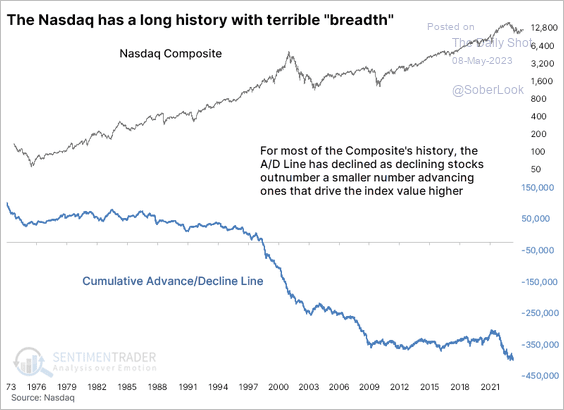

• Since the tech bubble, a smaller number of advancing stocks have driven the Nasdaq index to new highs.

Source: SentimenTrader

Source: SentimenTrader

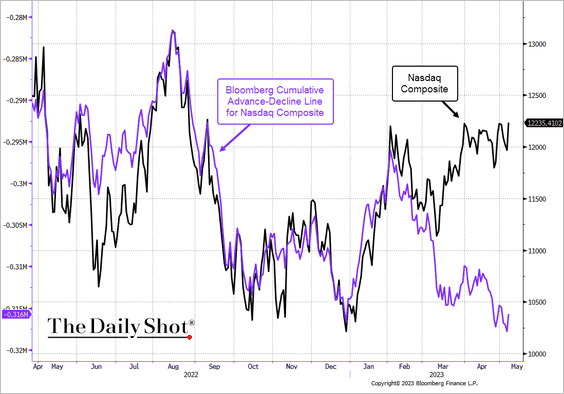

The Nasdaq Composite breadth deteriorated further this year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

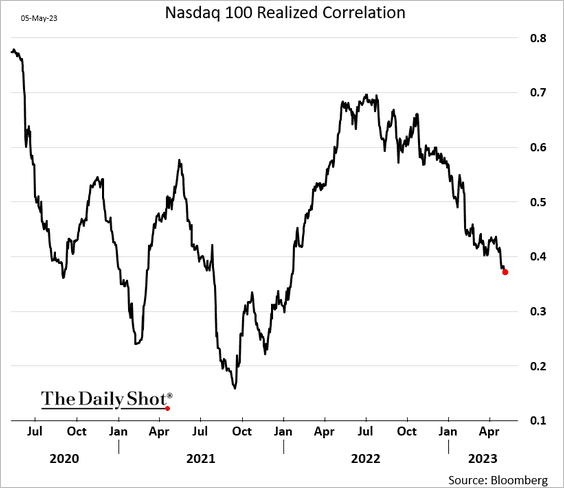

6. The Nasdaq 100 correlation continues to trend lower.

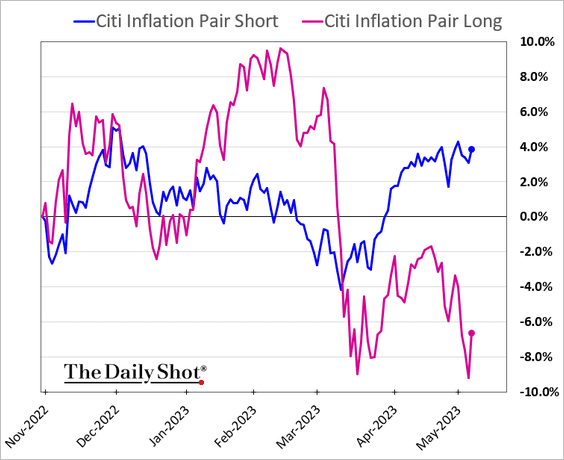

7. Stocks that tend to outperform during periods of higher inflation have been lagging lately.

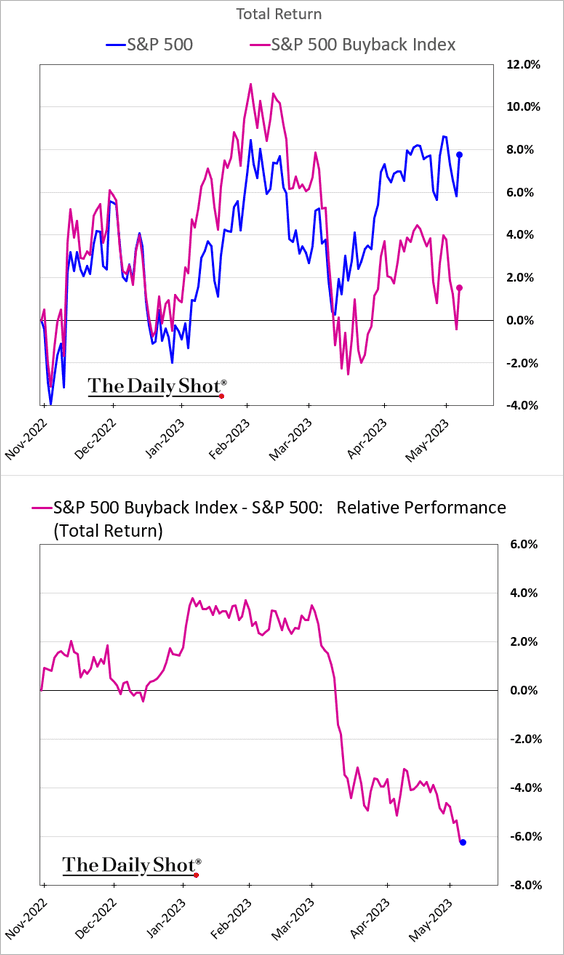

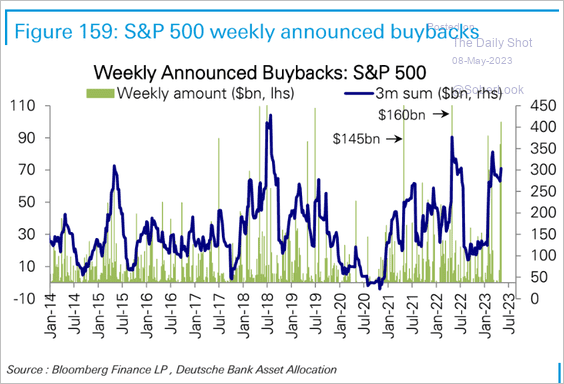

8. Companies known for share buybacks have been underperforming, …

… even as buyback activity has been robust.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

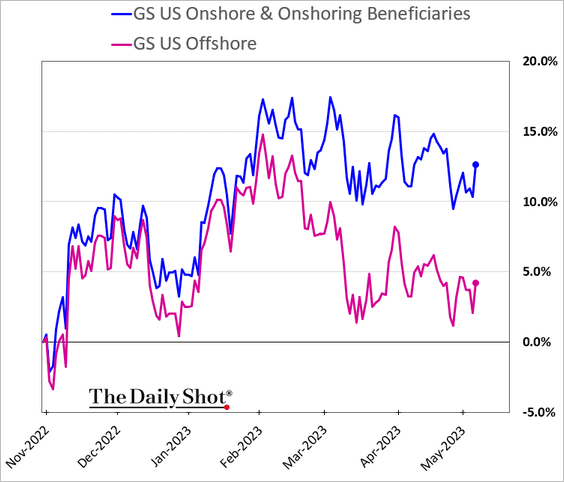

8. Companies that are focused on onshoring or nearshoring have been outperforming.

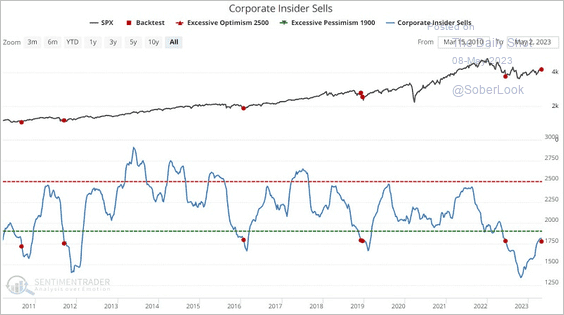

9. There has been an absence of selling among S&P 500 corporate insiders.

Source: SentimenTrader

Source: SentimenTrader

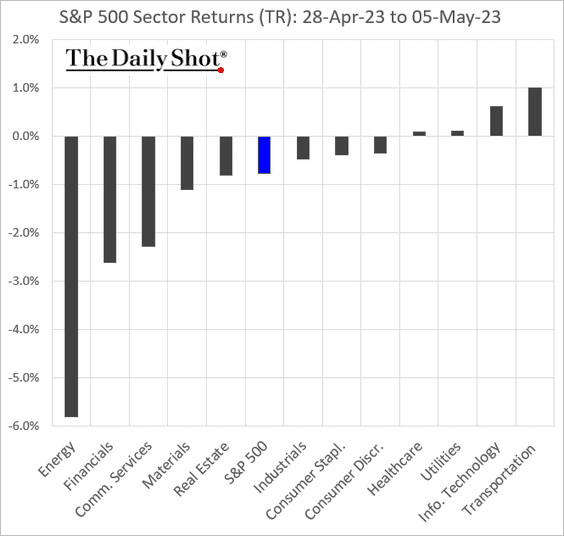

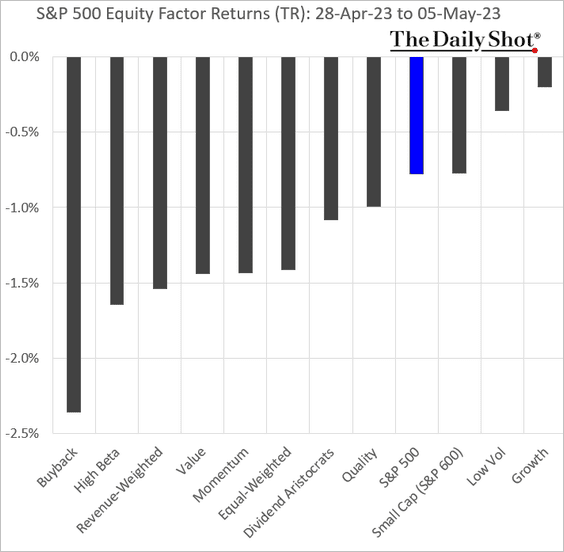

10. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

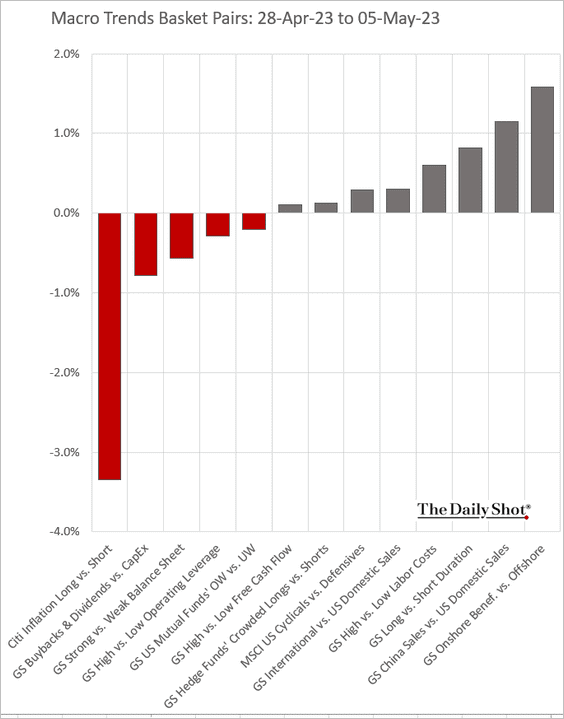

• Macro basket pairs’ relative performance:

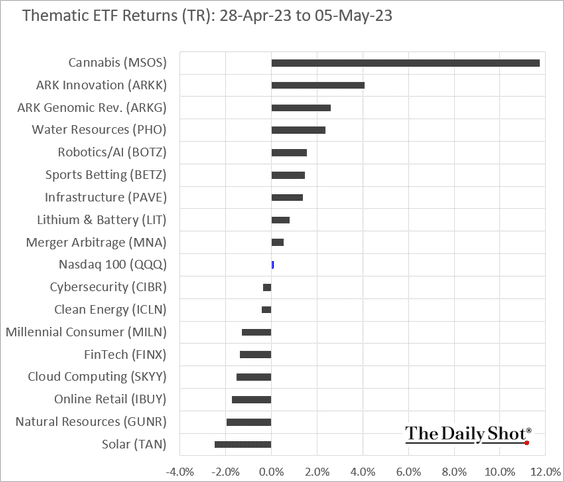

• Thematic ETFs:

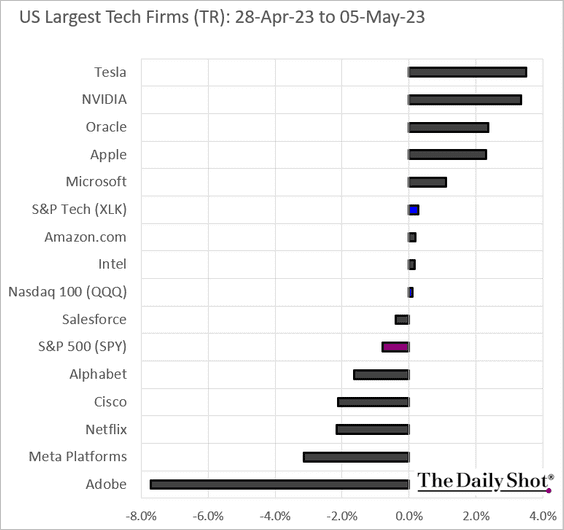

• Largest US tech firms:

Back to Index

Alternatives

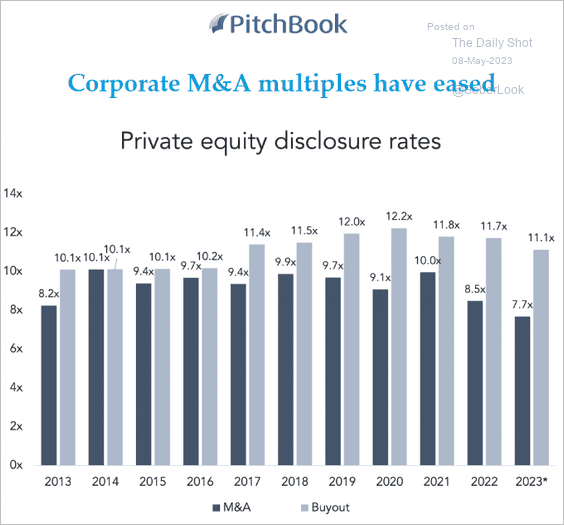

1. Private equity M&A multiples are moderating.

Source: @theleadleft

Source: @theleadleft

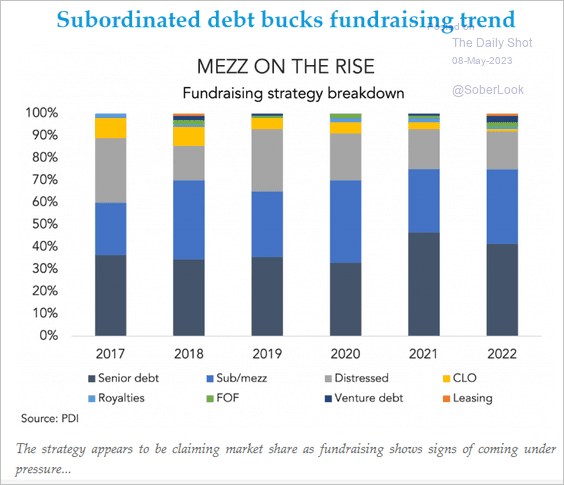

2. This chart shows fundraising across credit asset classes.

Source: @theleadleft

Source: @theleadleft

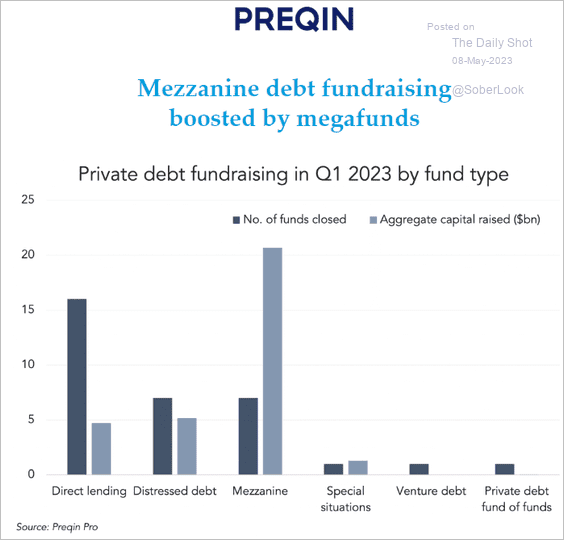

Megafunds have been dominating mezz fund capital raises.

Source: @theleadleft

Source: @theleadleft

Back to Index

Credit

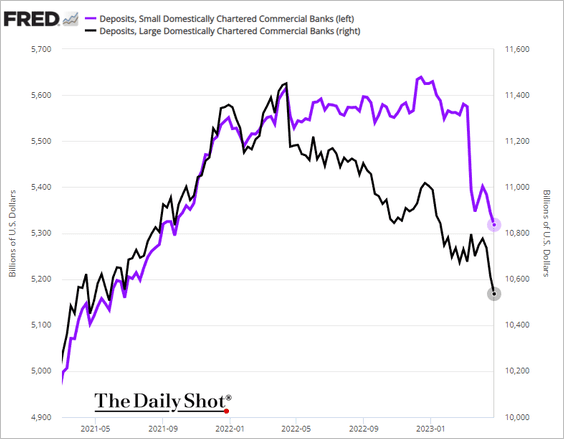

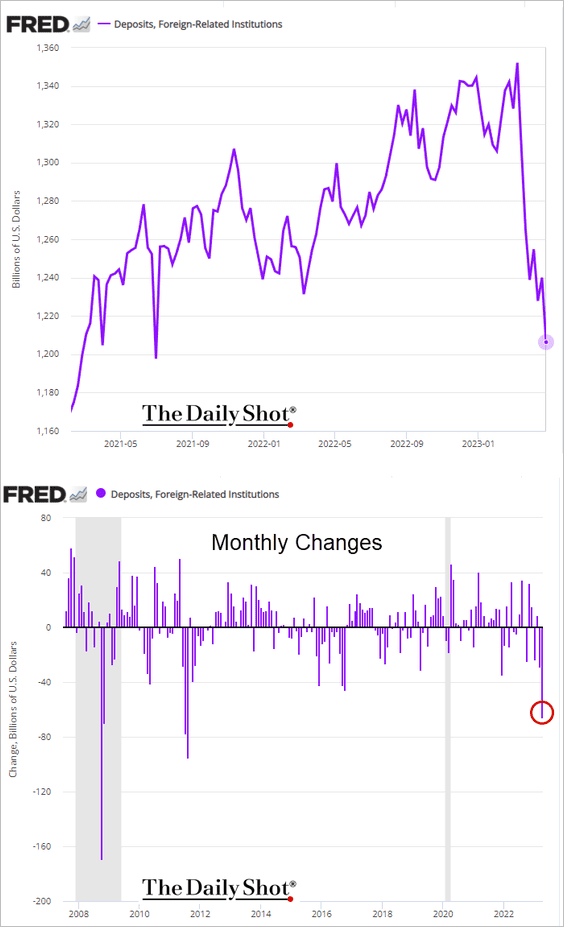

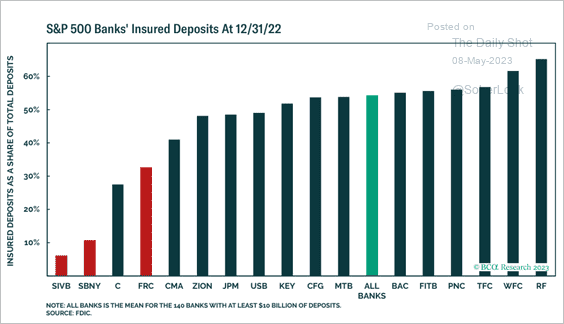

1. Bank deposits declined further going into April month-end.

• Foreign banks’ US dollar deposits saw the largest monthly decline since 2011.

• Here is a look at US banks’ insured deposits.

Source: BCA Research

Source: BCA Research

——————–

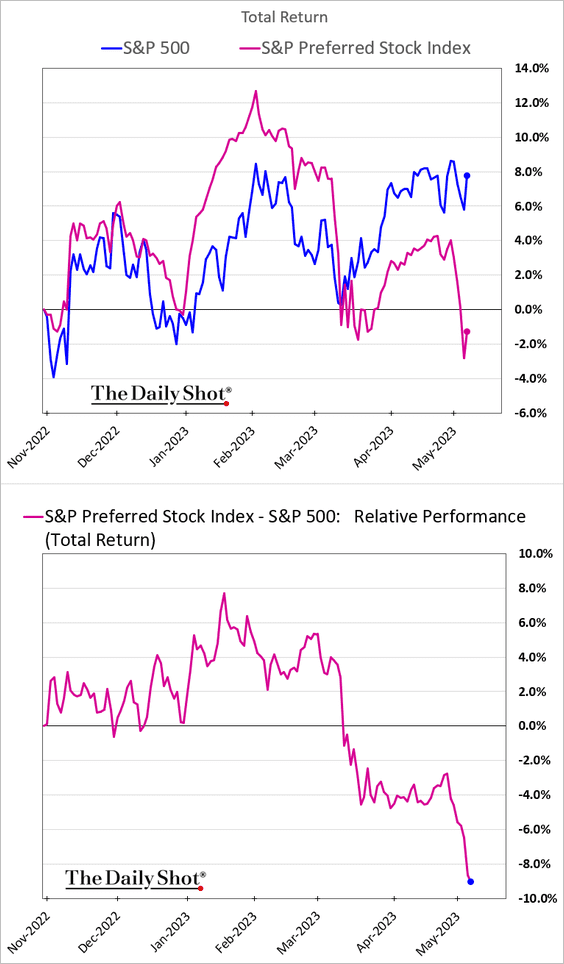

2. The banking sector turmoil has been fueling the rout in preferred shares.

Source: @tasosvos, @markets Read full article

Source: @tasosvos, @markets Read full article

——————–

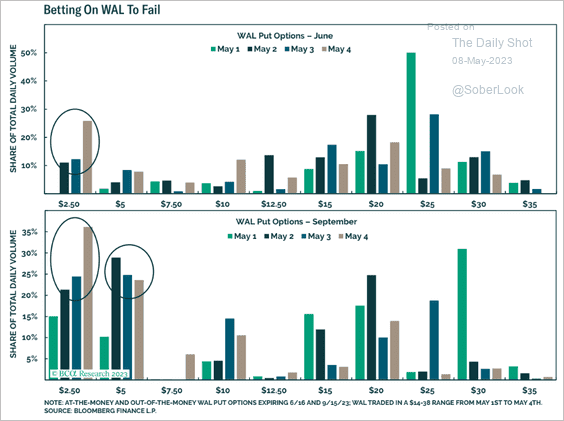

3. There are a lot of options bets on Western Alliance Bancorp failing.

Source: BCA Research

Source: BCA Research

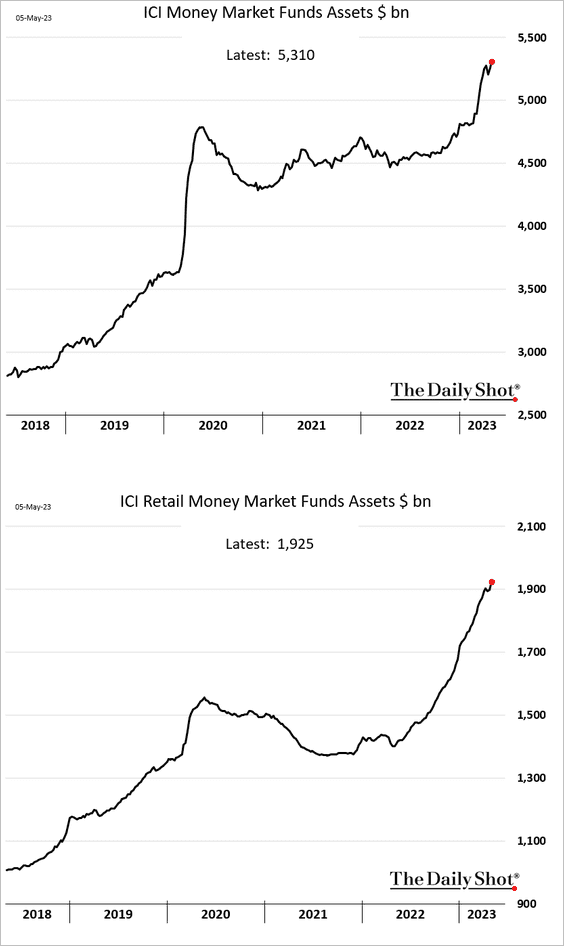

4. Money market AUM continues to climb.

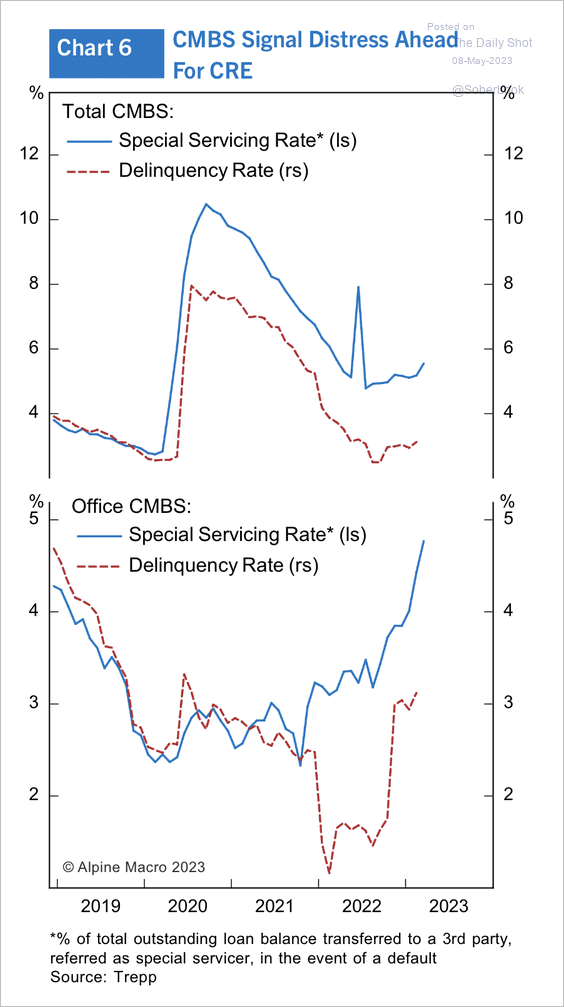

5. Rising delinquencies and special servicing rates point to further weakness in commercial mortgage-backed securities (CMBS), particularly in the office space.

Source: Alpine Macro

Source: Alpine Macro

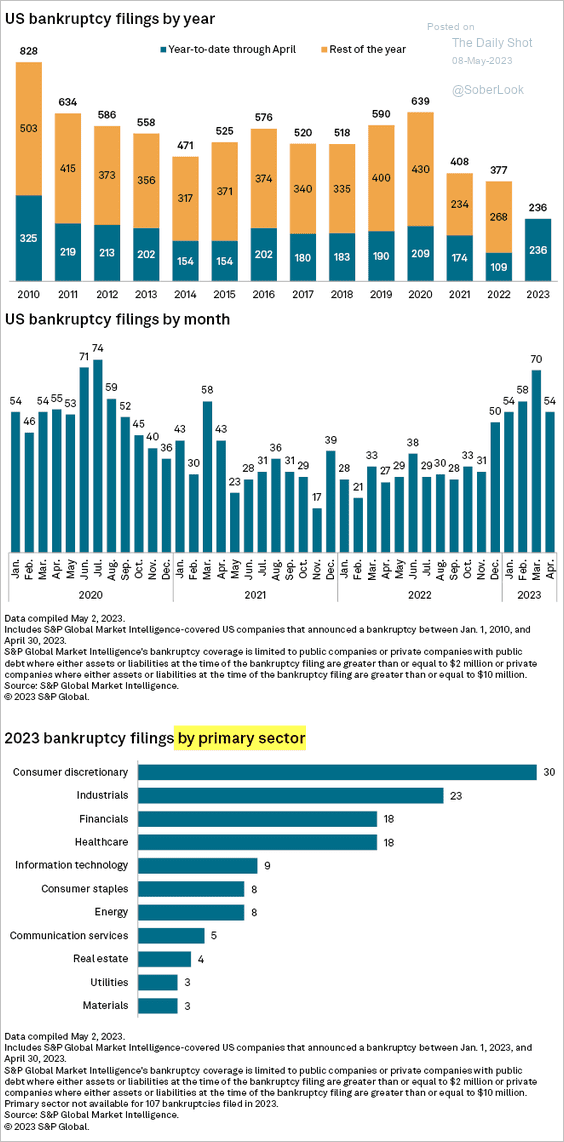

6. US large and middle-market corporate defaults remain elevated.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

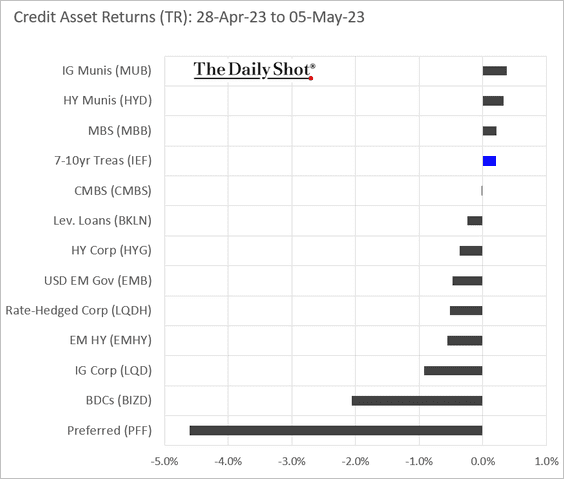

7. Finally, we have last week’s performance by asset class.

Back to Index

Rates

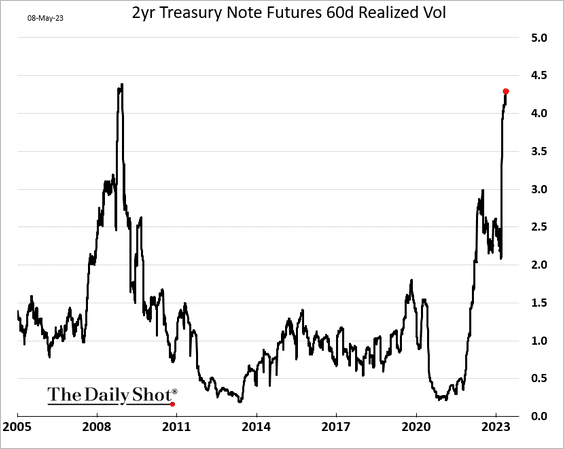

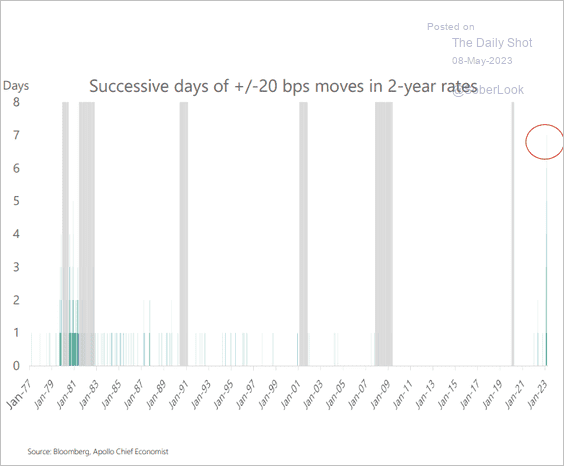

1. Short-term rates volatility remains elevated.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

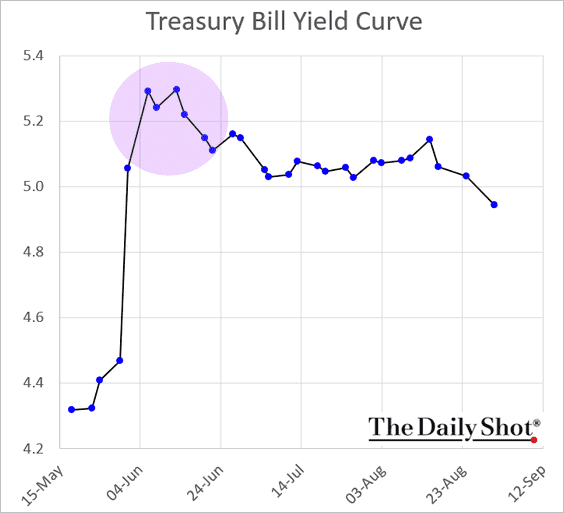

2. The T-bill market has zeroed in on a June X-date (when the US Treasury runs out of emergency funding).

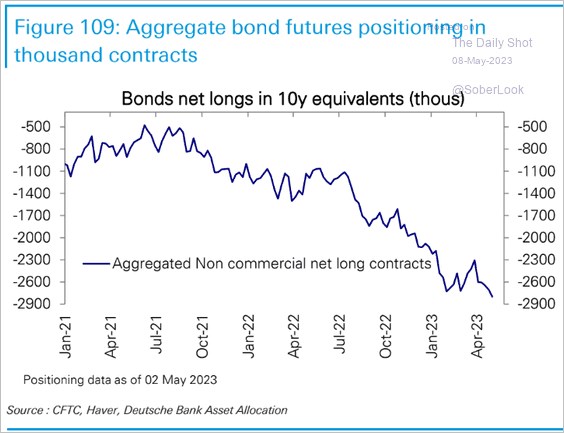

3. Treasury futures positioning remains exceptionally bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

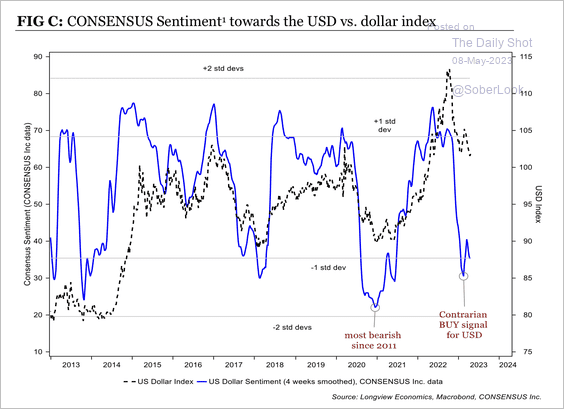

1. Dollar sentiment is moderately bearish.

Source: Longview Economics

Source: Longview Economics

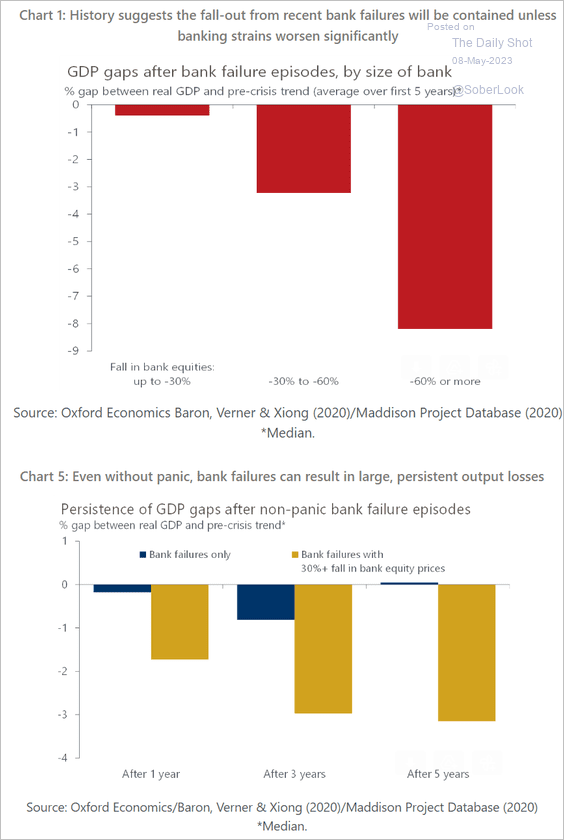

2. How do bank failures impact economic growth?

Source: Oxford Economics

Source: Oxford Economics

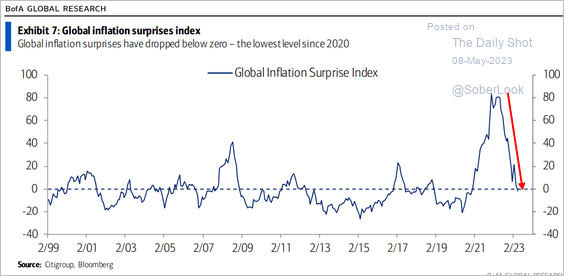

3. Inflation has been surprising to the downside (on average).

Source: BofA Global Research

Source: BofA Global Research

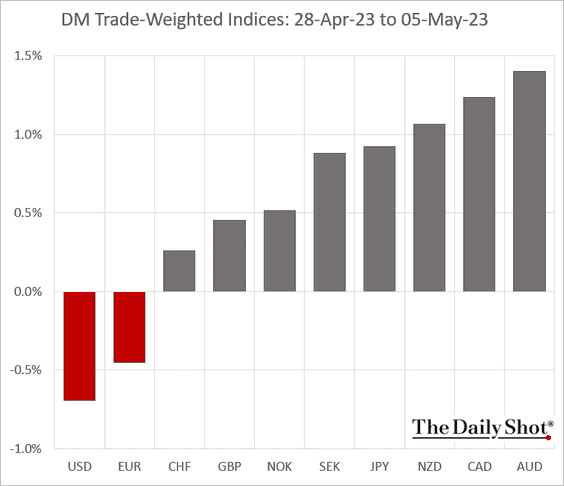

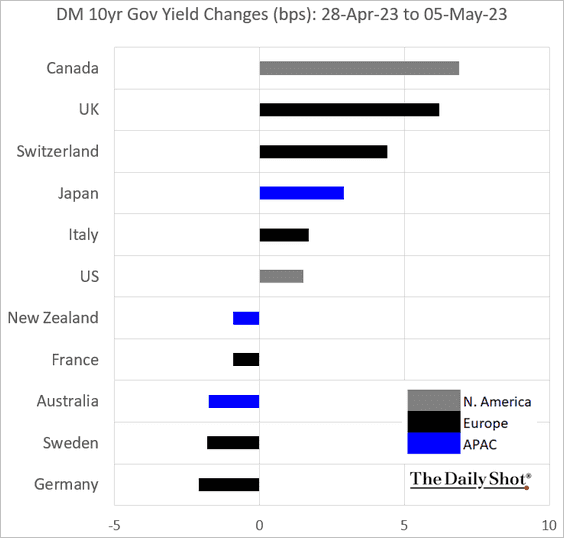

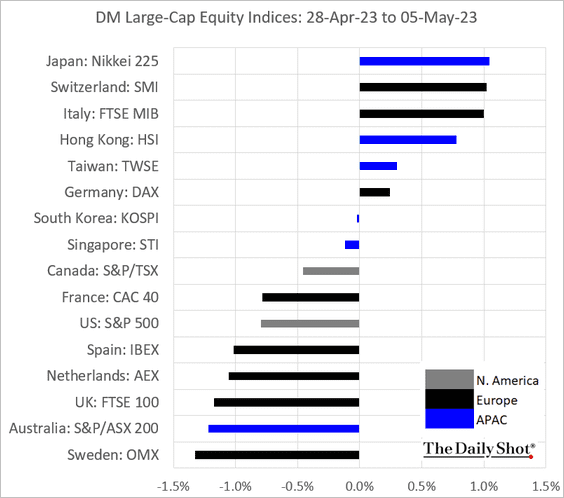

4. Finally, we have last week’s performance data.

• Currency indices:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

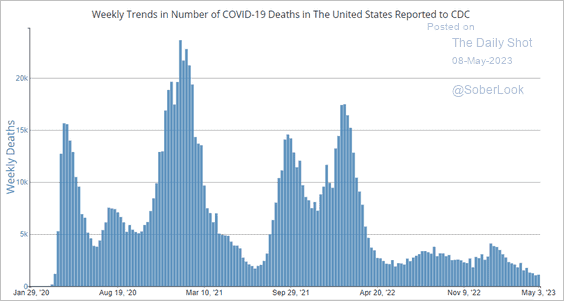

1. US COVID-related deaths:

Source: CDC

Source: CDC

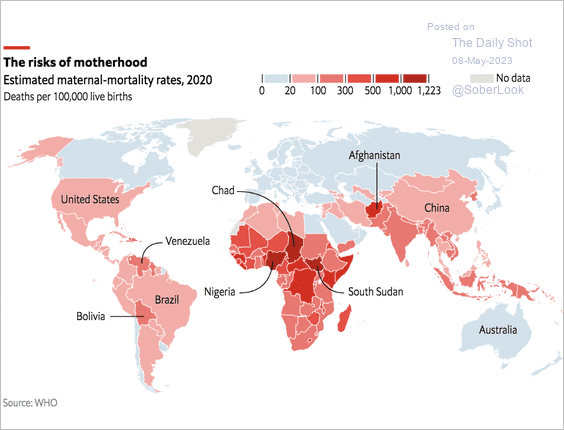

2. Maternal mortality rates:

Source: The Economist Read full article

Source: The Economist Read full article

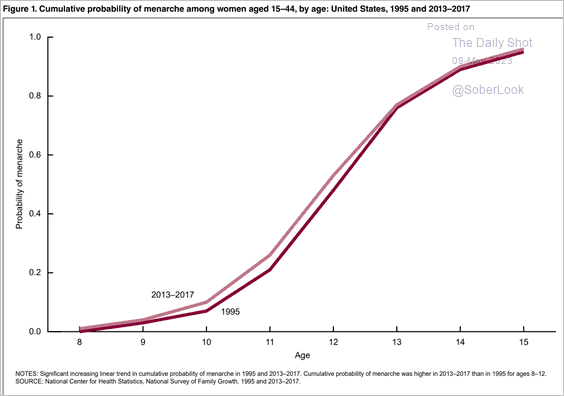

3. The percentage of girls who have undergone menarche, by age:

Source: NCHS

Source: NCHS

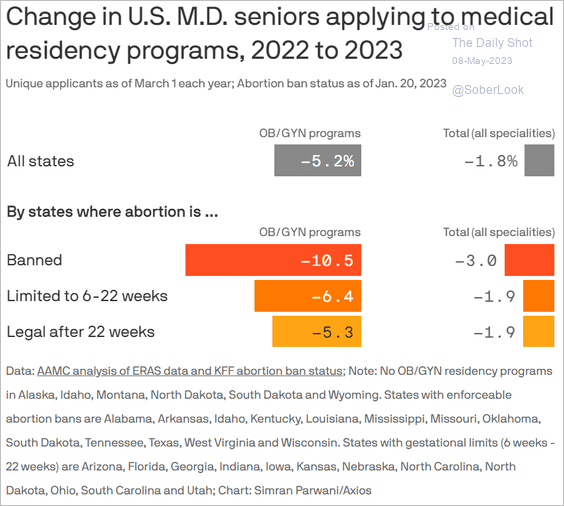

4. Doctors avoiding residencies in states with abortion bans:

Source: @axios Read full article

Source: @axios Read full article

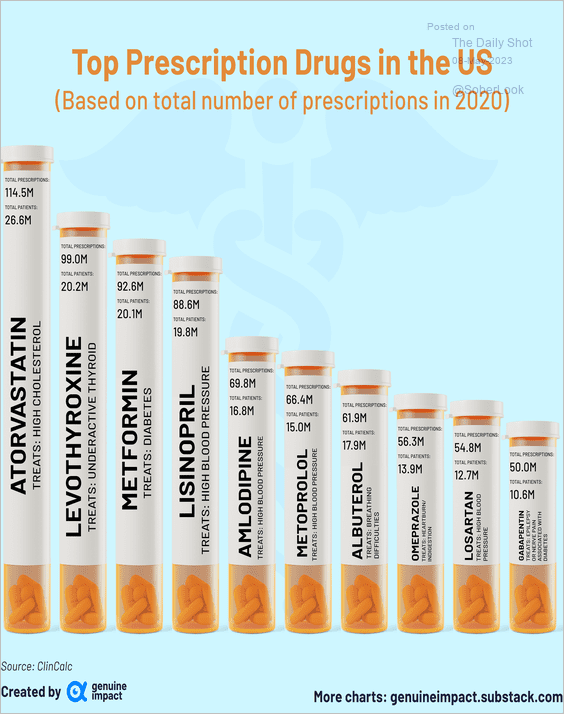

5. Top prescription drugs in the US:

Source: @genuine_impact

Source: @genuine_impact

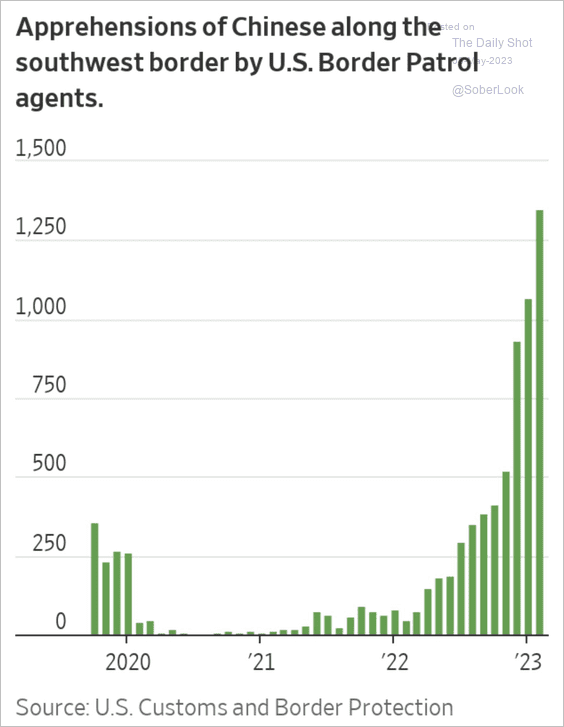

6. Chinese migrants trying to enter the US via Mexico:

Source: @WSJ Read full article

Source: @WSJ Read full article

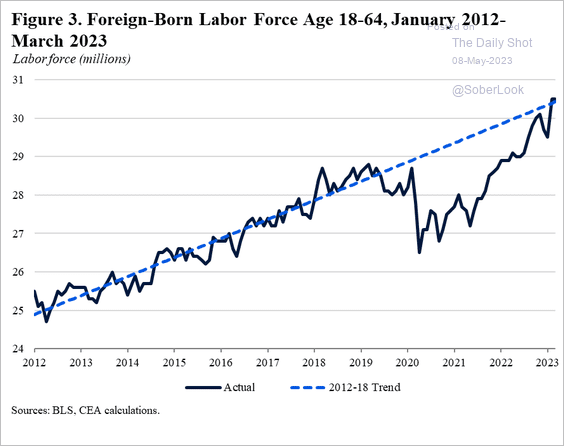

7. US foreign-born labor force:

Source: The White House

Source: The White House

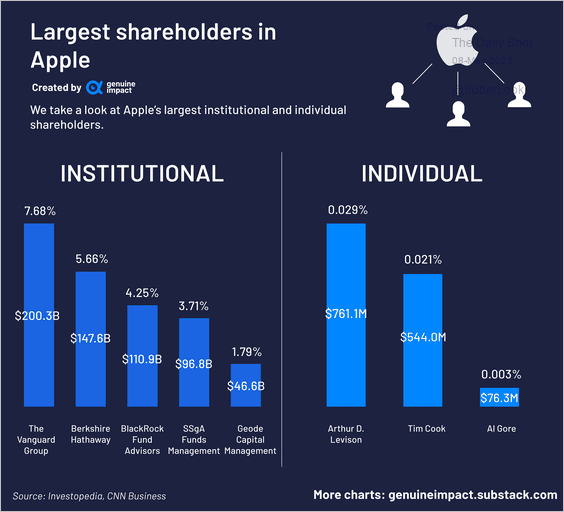

8. The largest shareholders in Apple:

Source: @GenshinImpact

Source: @GenshinImpact

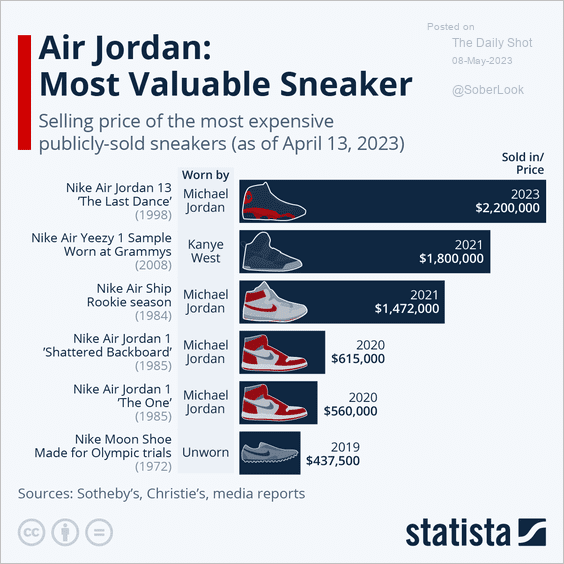

9. Most valuable sneakers:

Source: Statista

Source: Statista

——————–

Back to Index