The Daily Shot: 13-Jun-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

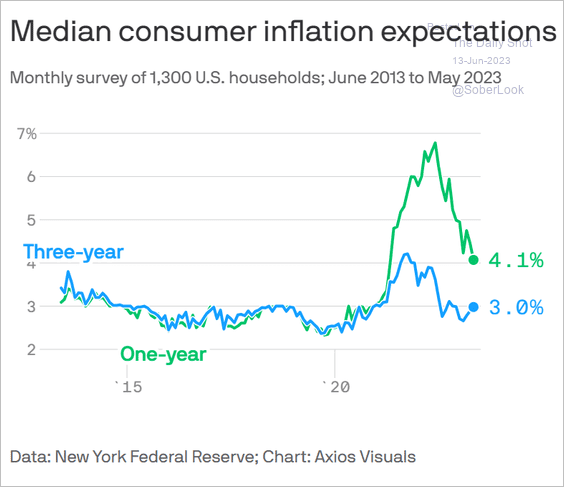

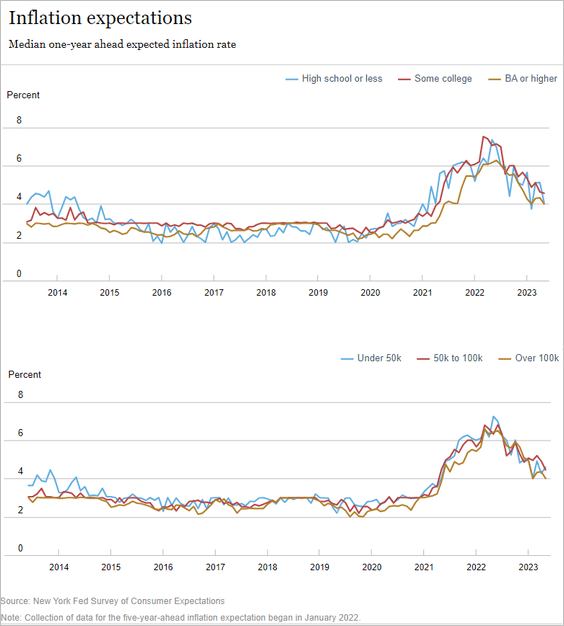

1. Let’s begin with some updates on inflation.

• According to the NY Fed’s consumer survey, one-year inflation expectations continue to trend lower. Longer-term expectations ticked up.

Source: @axios Read full article

Source: @axios Read full article

The decline in inflation expectations has been broad.

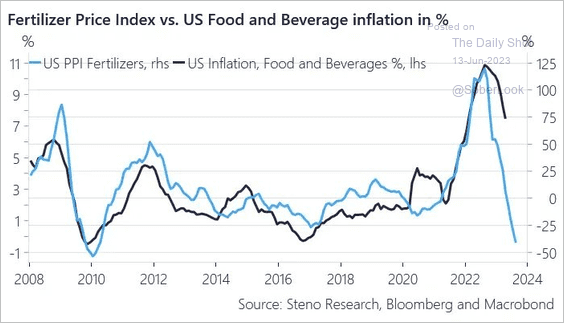

• Falling fertilizer prices should ease food inflation.

Source: @AndreasSteno Read full article

Source: @AndreasSteno Read full article

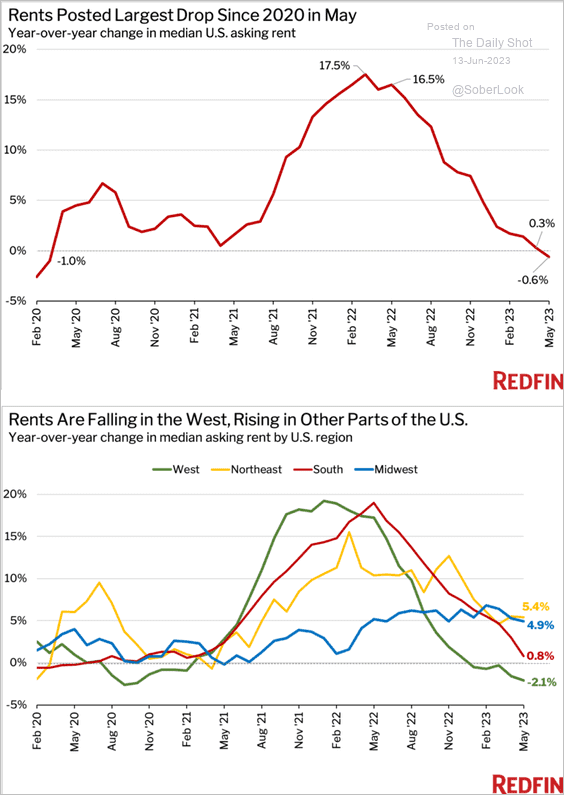

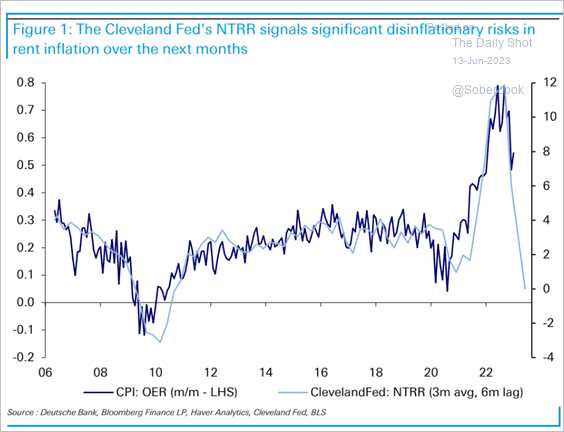

• Gains in rental costs have been slowing on a year-over-year basis.

Source: Redfin

Source: Redfin

Cleveland Fed’s data from repeat-rent leases (leases that are renewed for a second or subsequent term) signal sharp declines in rent inflation in the months ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

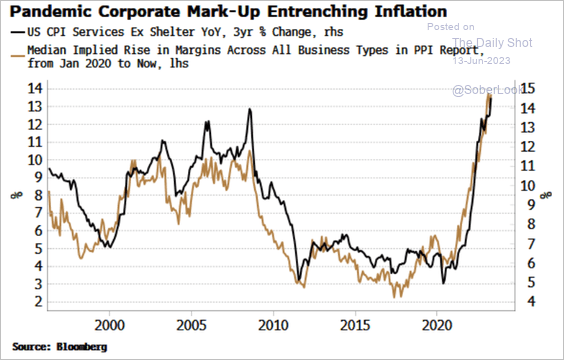

• Profit margins have been a key driver of inflation, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

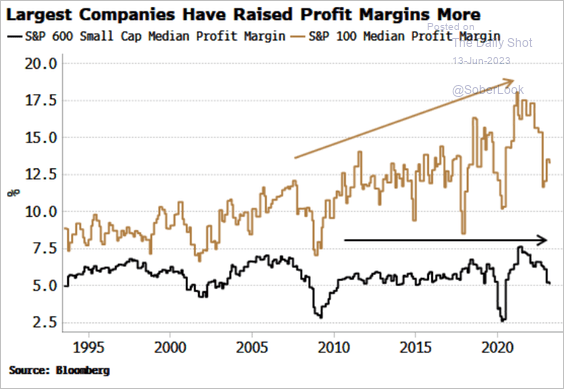

… with the largest companies using their dominance to boost margins.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

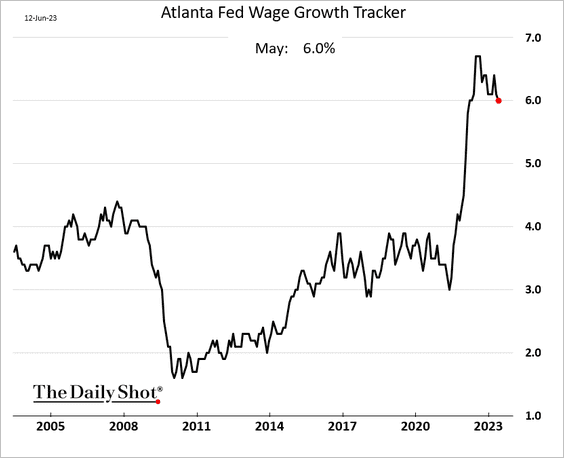

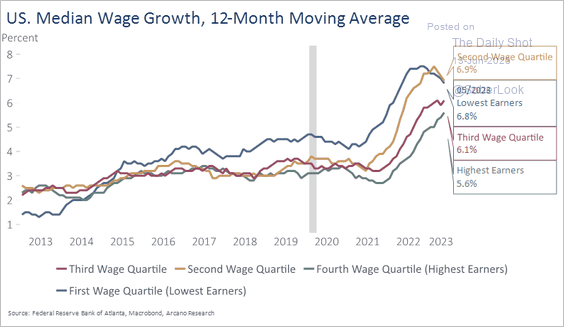

• Wage growth remains elevated.

This chart shows wage growth by quartile.

Source: Arcano Economics

Source: Arcano Economics

——————–

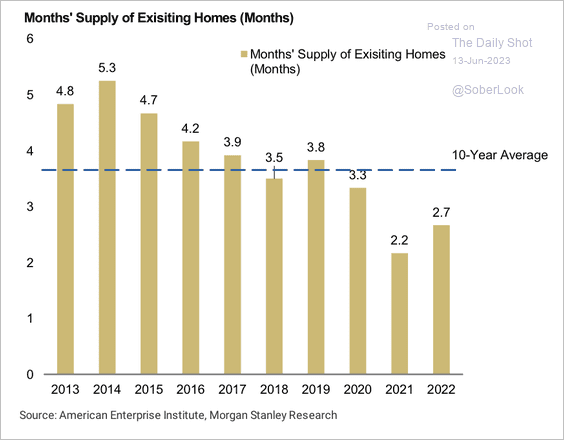

2. Next, we have some updates on the housing market.

• Housing supply remains tight but not getting worse.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

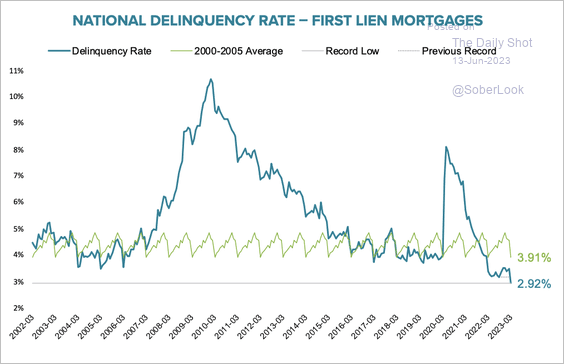

• The national mortgage delinquency rate fell below 3% for the first time in about 20 years and is down 13% year-over-year.

Source: Black Knight

Source: Black Knight

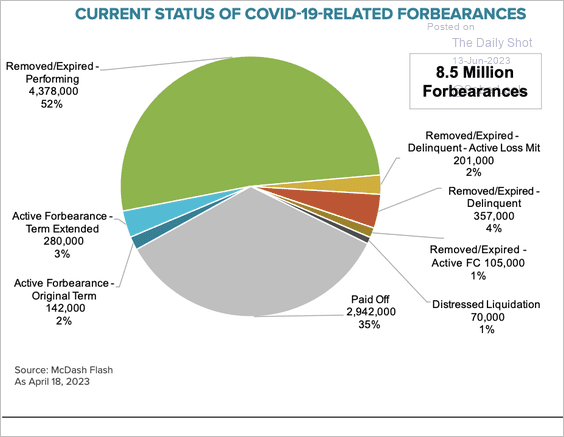

• Nearly 8.5 million borrowers have been in a forbearance plan at some point since the onset of the pandemic.

Source: Black Knight

Source: Black Knight

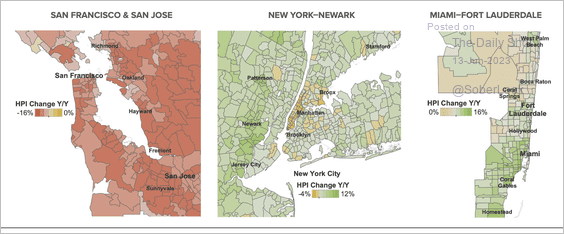

• Here is a look at annual home price growth within select metros.

Source: Black Knight

Source: Black Knight

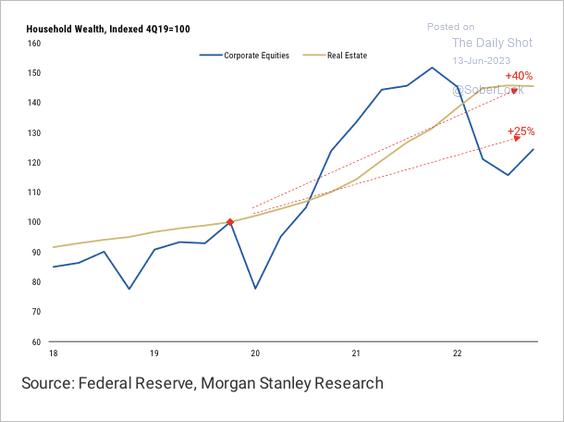

• Household real estate wealth is higher than equity wealth.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

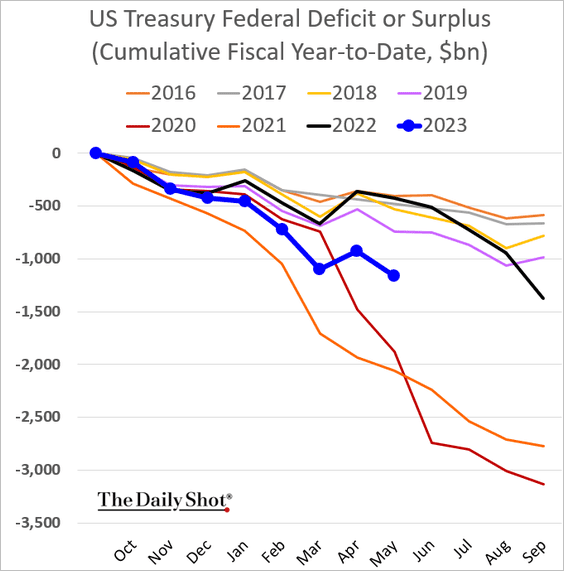

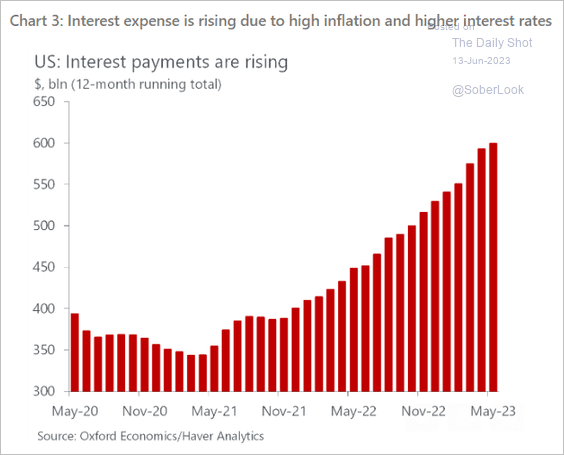

3. The budget deficit was somewhat wider than expected in May.

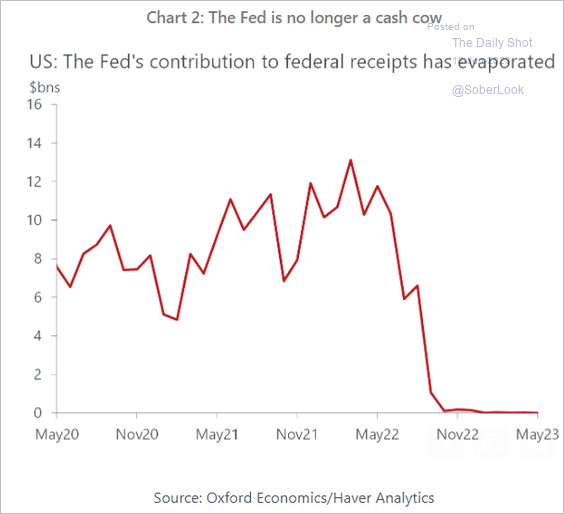

• The government is no longer receiving a dividend from the Fed.

Source: Oxford Economics

Source: Oxford Economics

• Interest expense continues to grow.

Source: Oxford Economics

Source: Oxford Economics

——————–

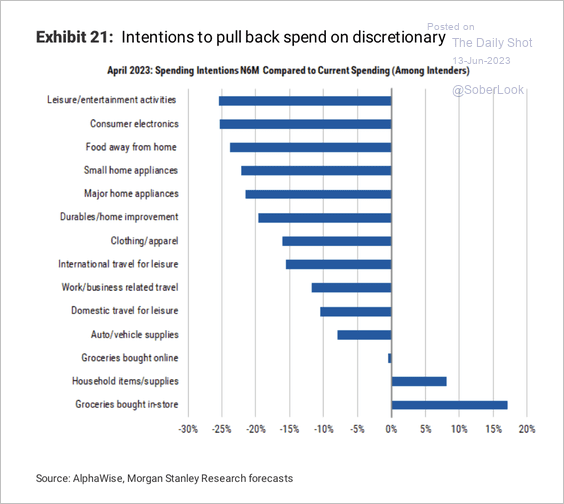

4. Consumers plan to sharply reduce discretionary spending over the next six months, according to a survey by Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

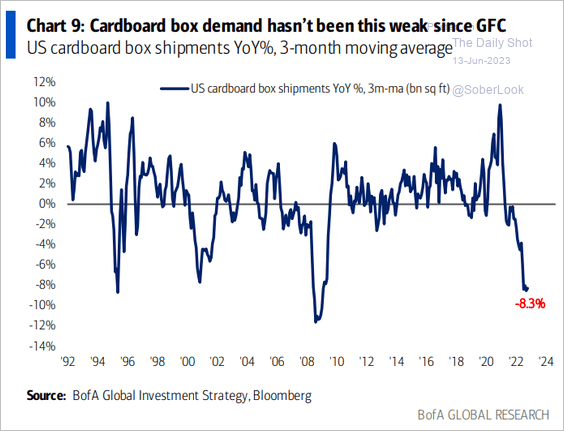

5. Subdued demand for cardboard boxes suggests a deceleration in economic activity.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

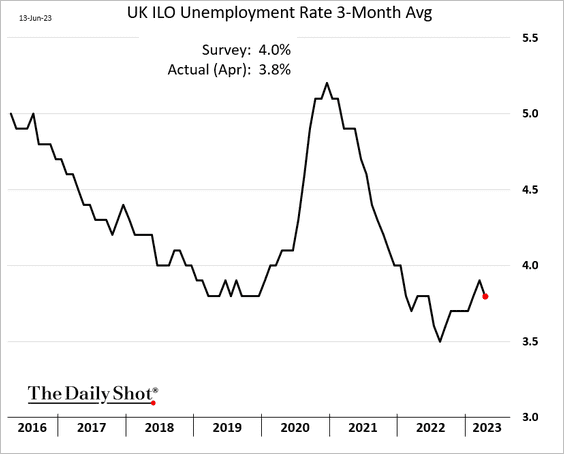

The United Kingdom

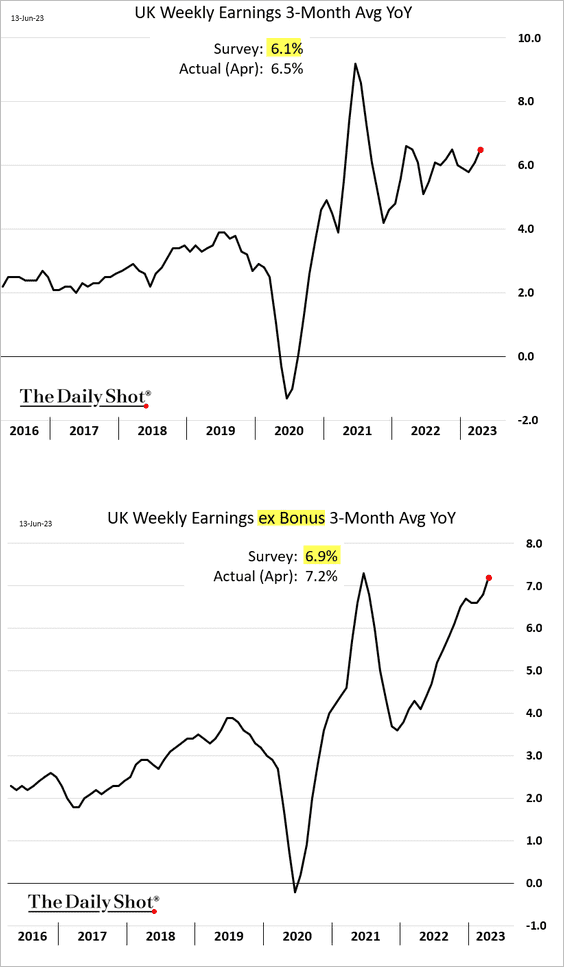

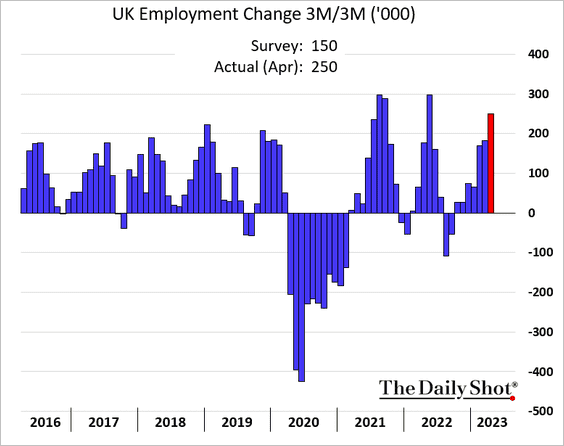

1. The latest employment report indicates that the labor market remains tight.

• The unemployment rate unexpectedly declined.

• Wage growth accelerated.

• Hiring increased more than expected this year.

——————–

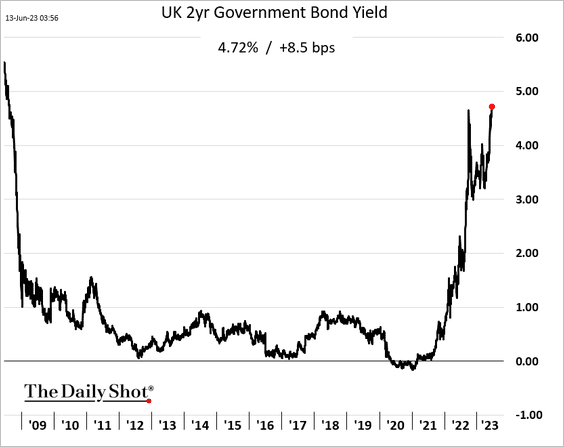

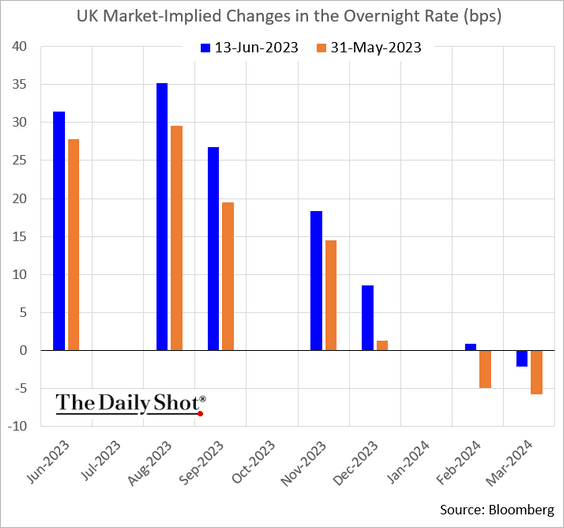

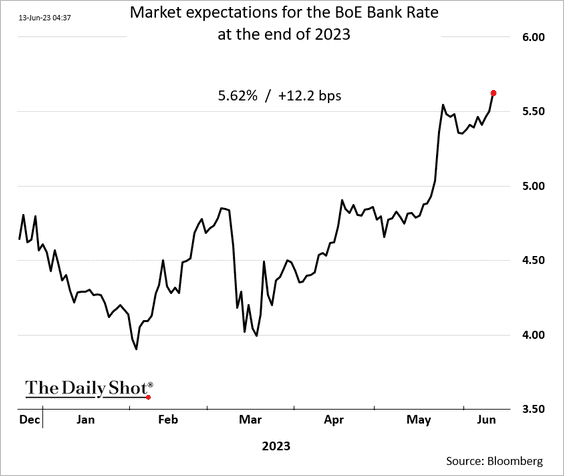

2. Gilt yields jumped in response to the employment report, with the 2-year rate reaching the highest level since 2008.

BoE rate hike expectations climbed again.

The market now expects the BoE policy rate to exceed 5.6% by the end of the year.

——————–

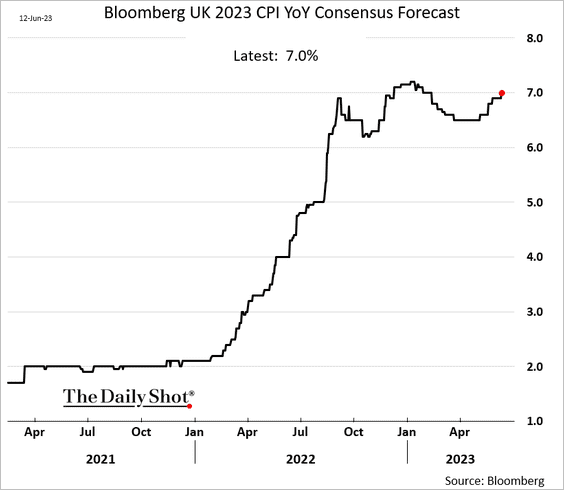

3. Economists have been revising their forecasts upward for UK CPI this year.

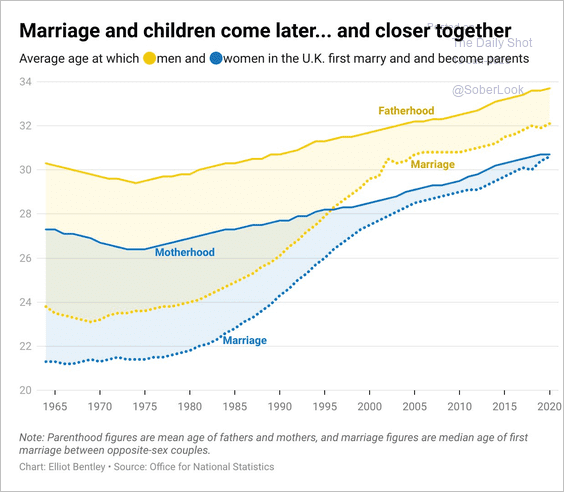

4. Marriage and parenthood are increasingly delayed in the UK.

Source: @elliot_bentley, @Datawrapper Read full article

Source: @elliot_bentley, @Datawrapper Read full article

Back to Index

The Eurozone

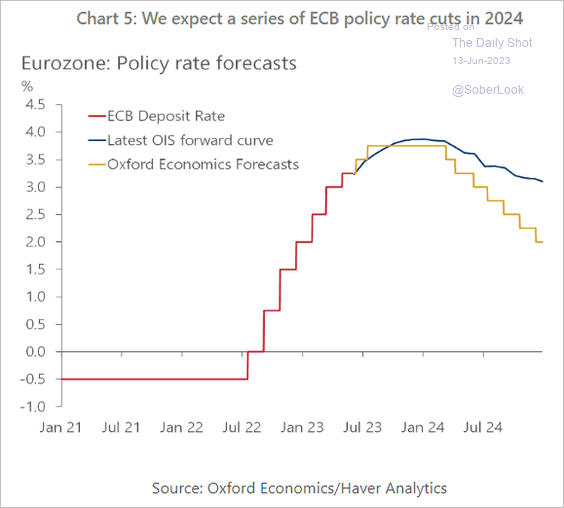

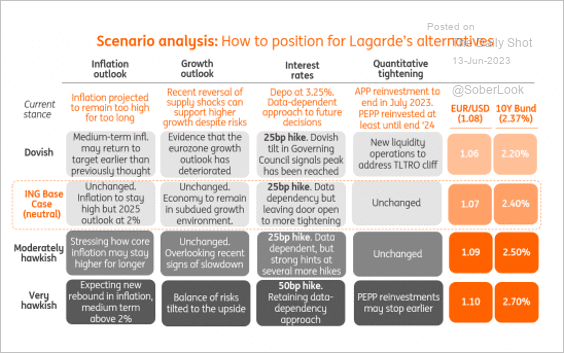

1. The ECB is expected to hike rates by 25 bps this week. Oxford Economics sees steeper rate cuts than the market next year.

Source: Oxford Economics

Source: Oxford Economics

Here are some scenarios from ING.

Source: ING

Source: ING

——————–

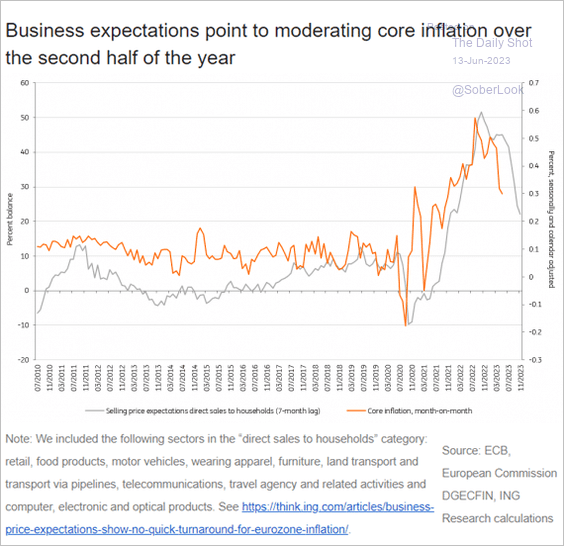

2. Business inflation expectations have been moderating

Source: ING

Source: ING

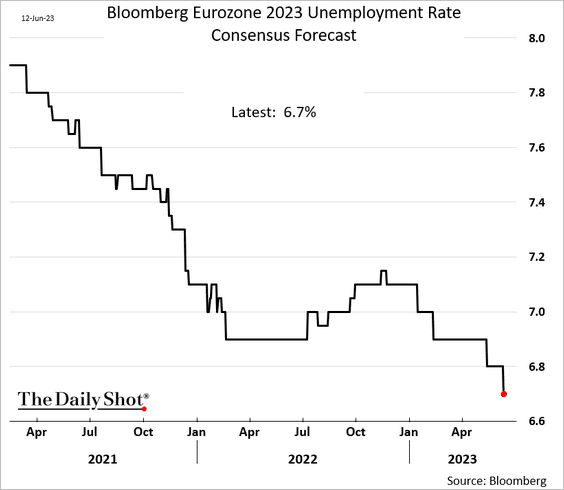

3. Economists have been cutting their forecasts for euro-area unemployment this year.

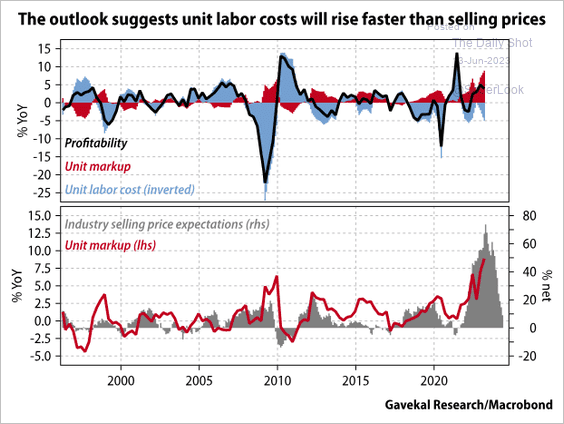

4. German manufacturers face a margin squeeze as labor costs outpace selling prices.

Source: Gavekal Research

Source: Gavekal Research

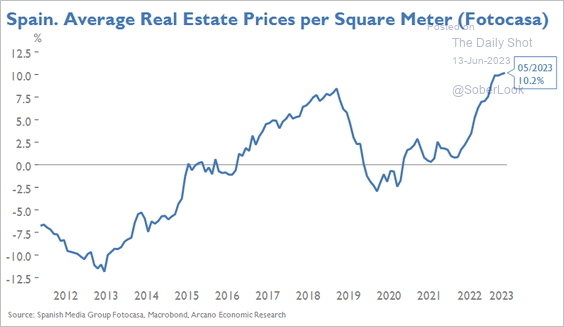

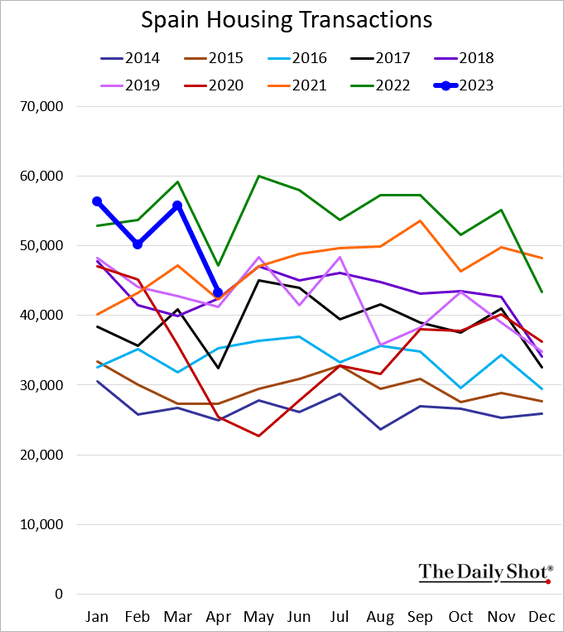

5. Spain’s property prices have been rising.

Source: Arcano Economics

Source: Arcano Economics

But home sales declined more than expected in April.

Back to Index

Europe

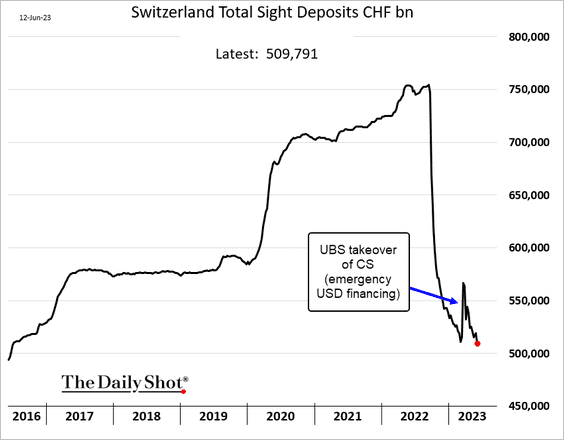

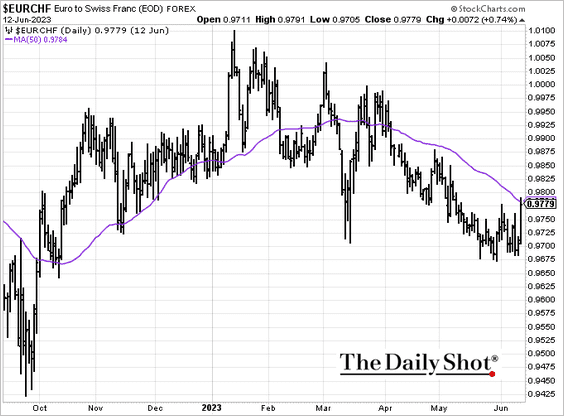

1. Switzeland’s central bank continues to reduce liquidity in the financial system.

Following the Swiss government’s agreement to extend the coverage of UBS losses, the Swiss franc experienced a decline. The government’s commitment now includes an additional 9 billion Swiss francs, surpassing the initial CHF 5 billion. But EUR/CHF hit resistance at the 50-day moving average.

——————–

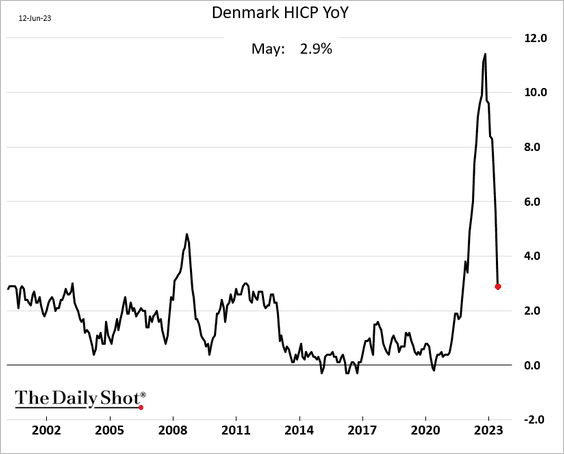

2. Denmark’s CPI is crashing.

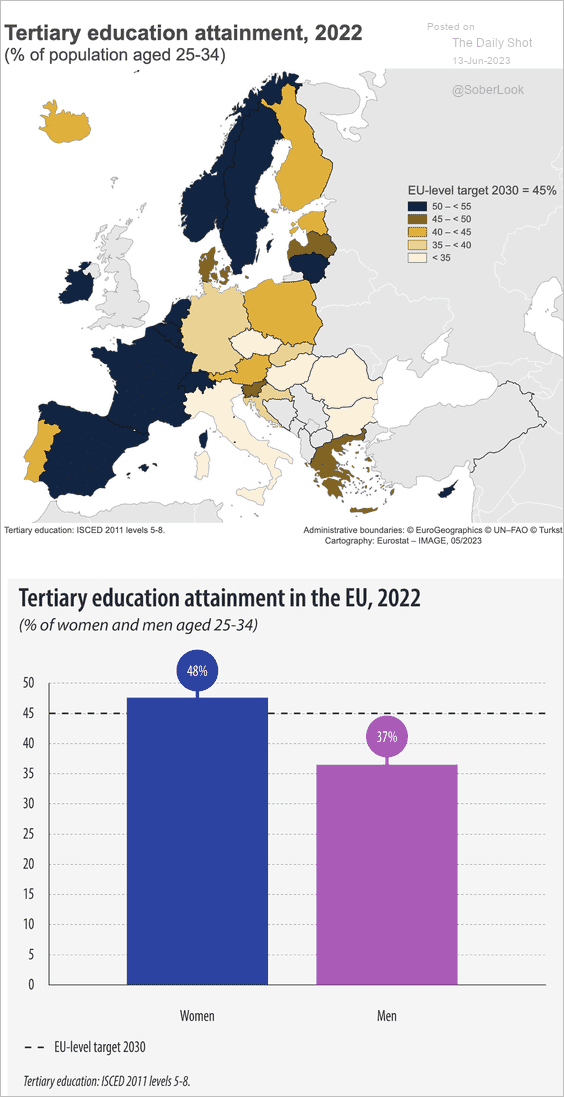

3. Here is a look at post-secondary education in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

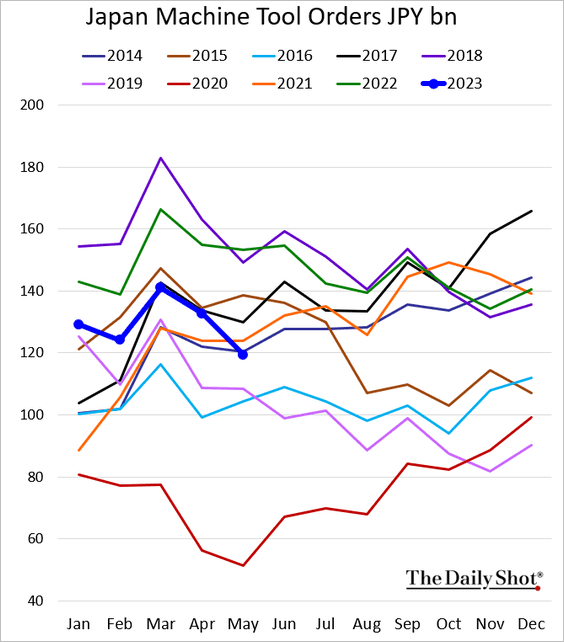

1. Machine tool orders declined sharply in May.

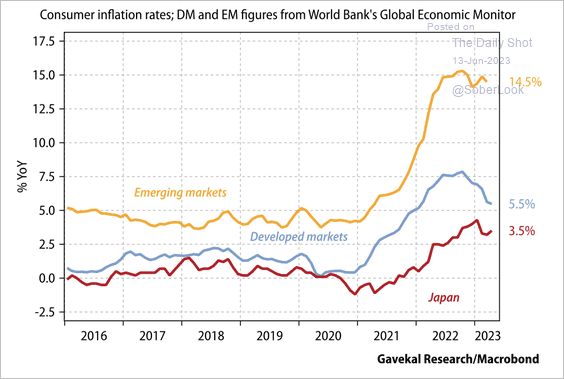

2. The rise in COVID-era inflation has been weak relative to global peers.

Source: Gavekal Research

Source: Gavekal Research

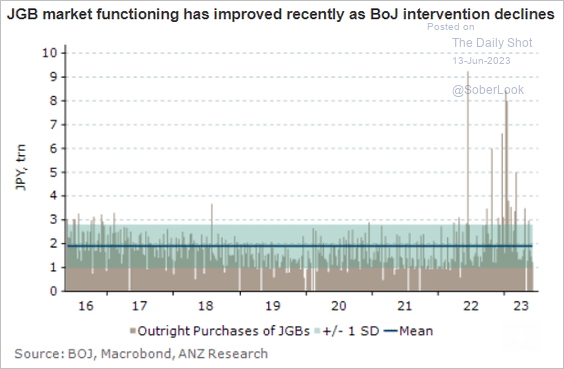

3. The BoJ has slowed its interventions in the JGB market.

Source: @ANZ_Research

Source: @ANZ_Research

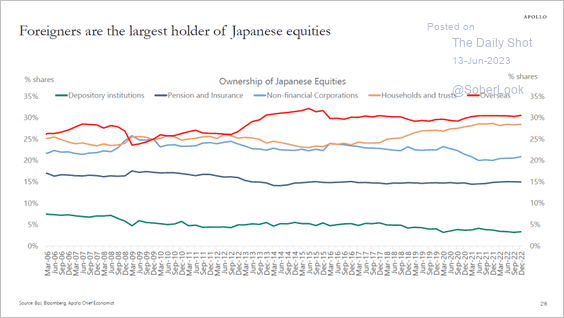

4. Who owns Japanese equities?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Asia-Pacific

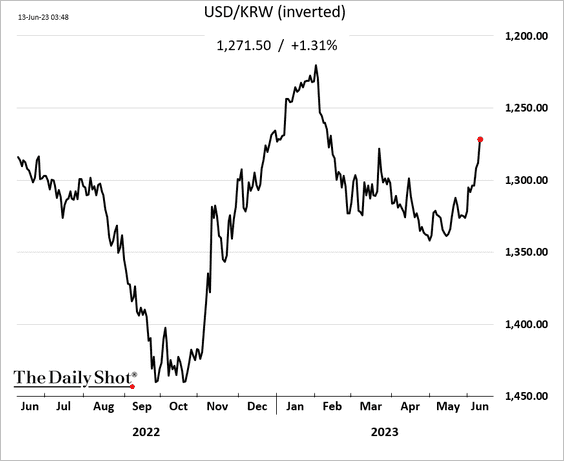

1. The South Korean won is surging.

2. Has the downturn in the semiconductor industry bottomed?

![]() Source: @ANZ_Research

Source: @ANZ_Research

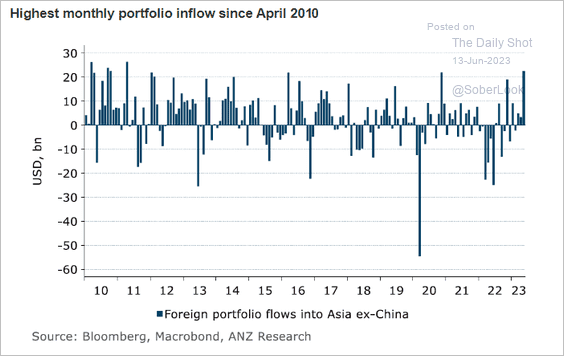

3. Portfolio flows into Asia (ex-China) surged recently.

Source: @ANZ_Research

Source: @ANZ_Research

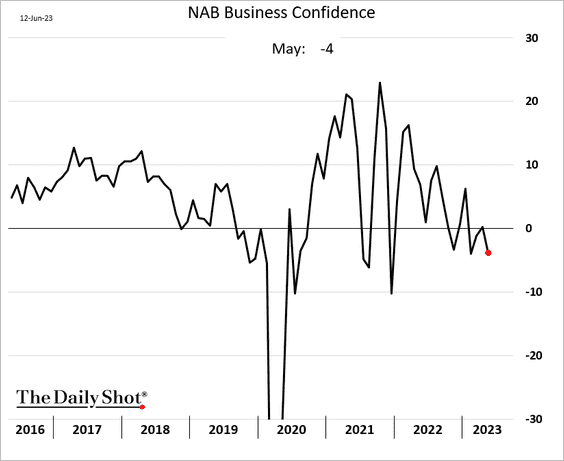

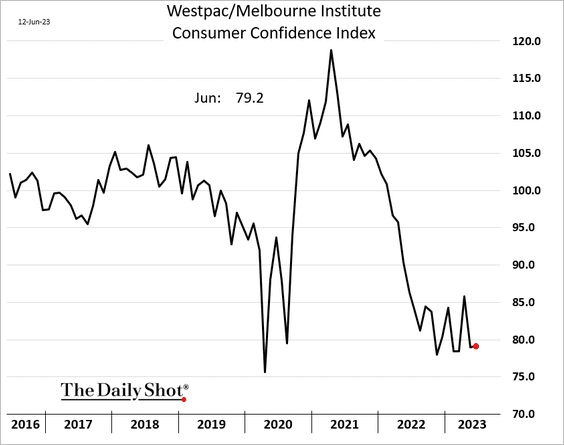

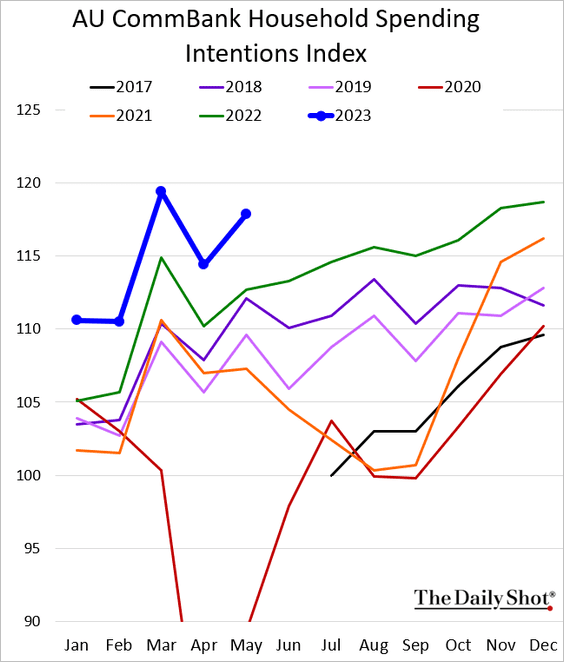

4. Next, we have some updates on Australia.

• Business confidence (not good):

• Consumer confidence (still depressed):

• Household spending intentions (strong):

Back to Index

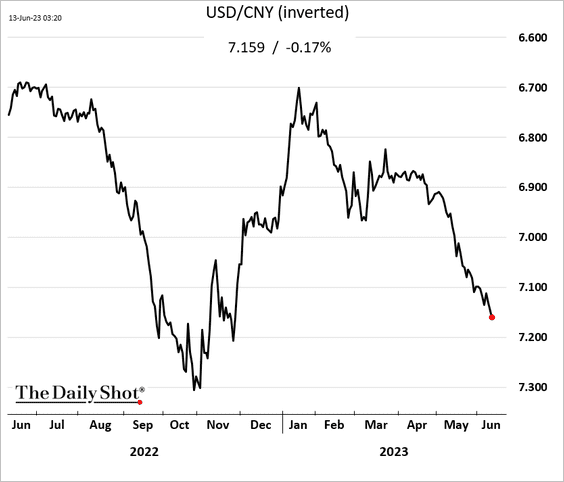

China

1. China’s bond yields and the currency continue to sink.

——————–

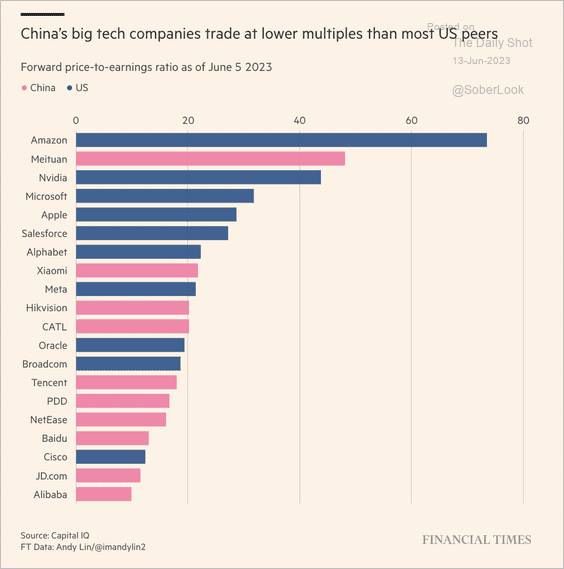

2. China’s tech firms trade at a discount to US peers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

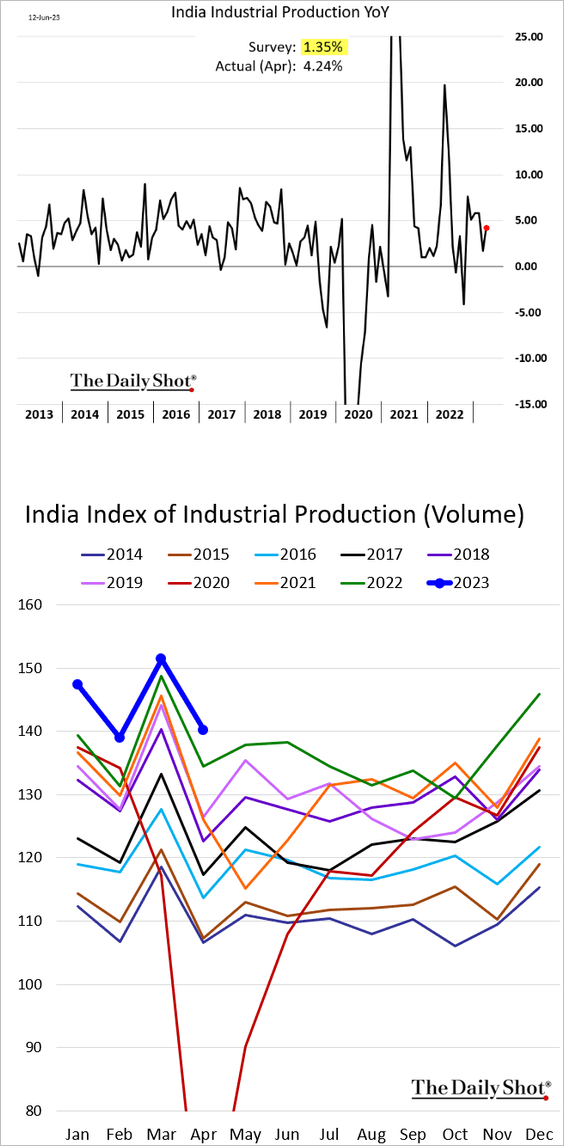

1. India’s industrial production topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

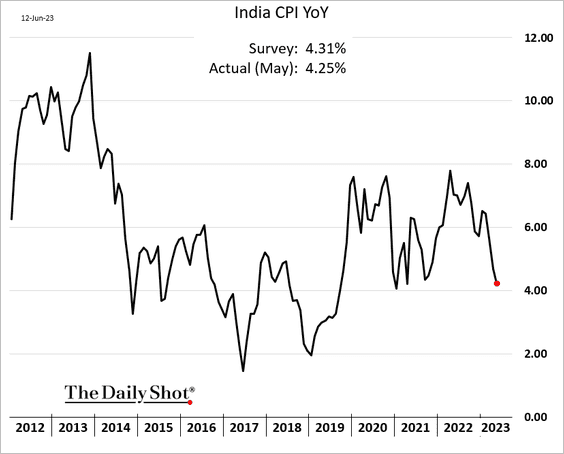

• Inflation continues to slow.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

——————–

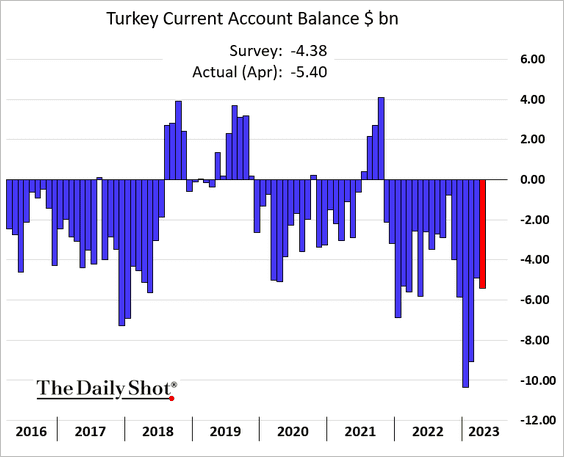

2. Turkey’s current account deficit was wider than expected.

Source: @berilakman, @markets Read full article

Source: @berilakman, @markets Read full article

——————–

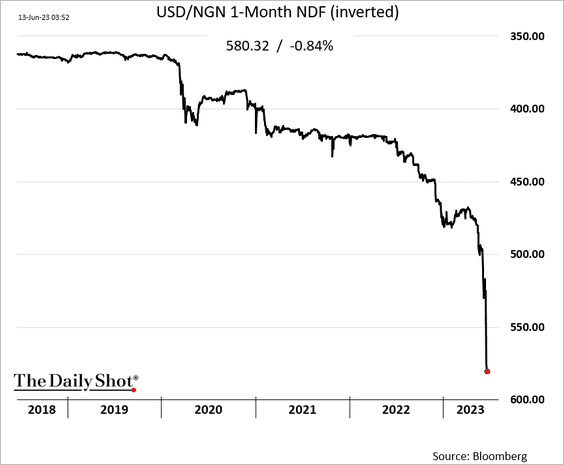

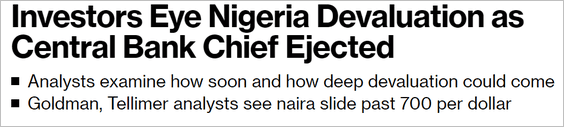

3. The Nigerian naira is crashing.

Source: @markets Read full article

Source: @markets Read full article

——————–

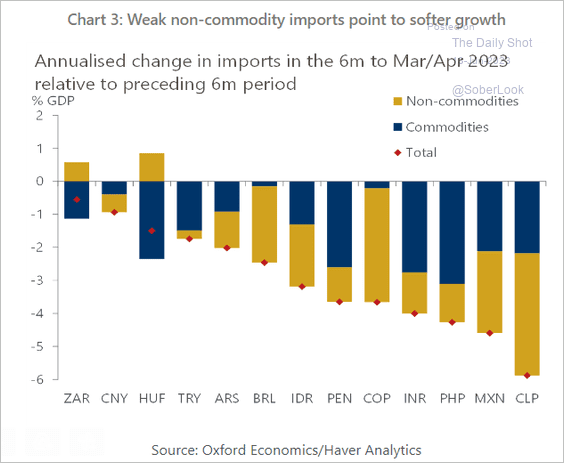

4. Imports slowed in many EM economies.

Source: Oxford Economics

Source: Oxford Economics

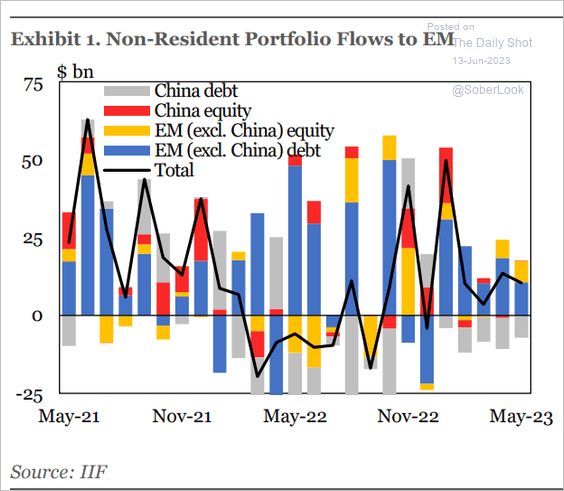

5. Portfolio flows remain positive (outside of China).

Source: IIF

Source: IIF

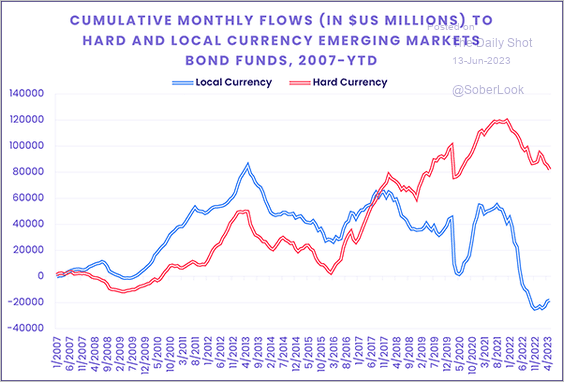

6. Here is a look at cumulative flows into hard- and local-currency EM debt funds.

Source: EPFR

Source: EPFR

Back to Index

Cryptocurrency

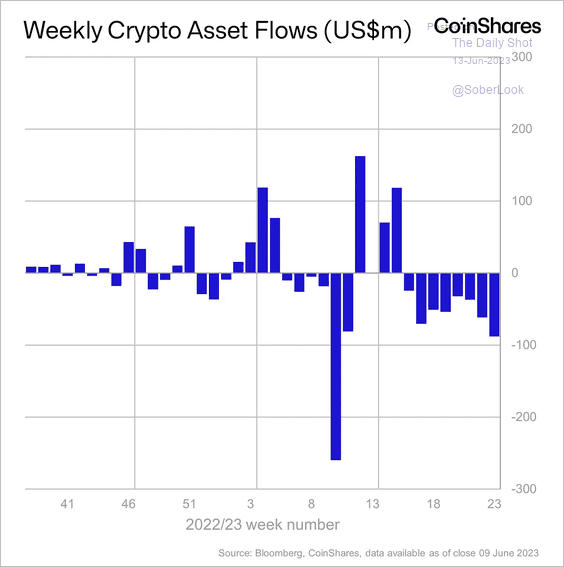

1. Crypto funds have seen an eight-week run of outflows, led by Bitcoin and Ethereum-related products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

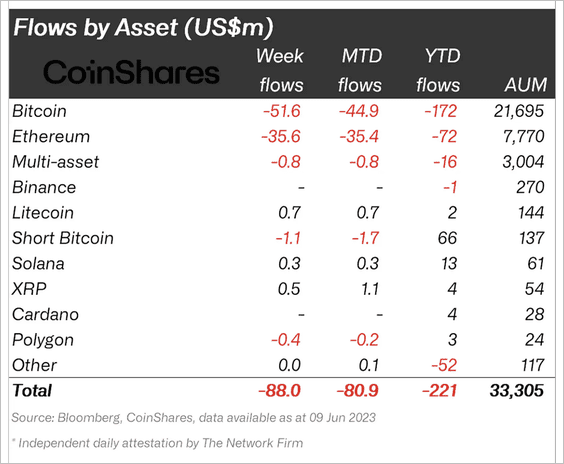

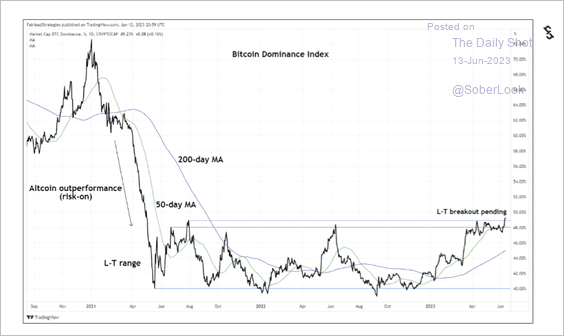

2. Market liquidity on Binance’s US exchange dropped significantly since the SEC lawsuit announcement.

Source: @KaikoData

Source: @KaikoData

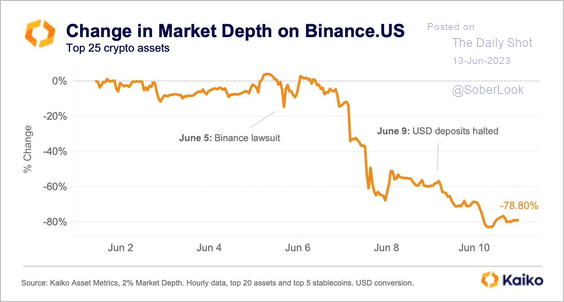

3. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) is attempting to break out of a long-term range.

Source: @StocktonKatie

Source: @StocktonKatie

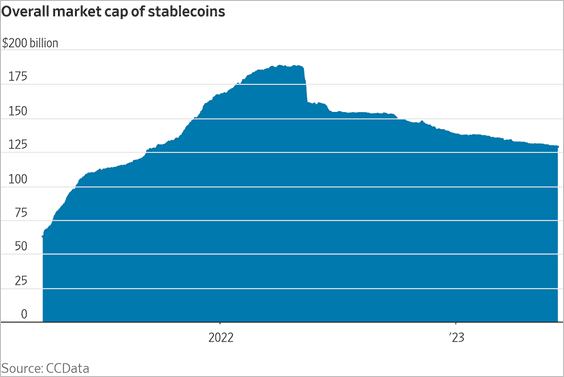

4. Stablecons’ market cap continues to trend down.

Back to Index

Commodities

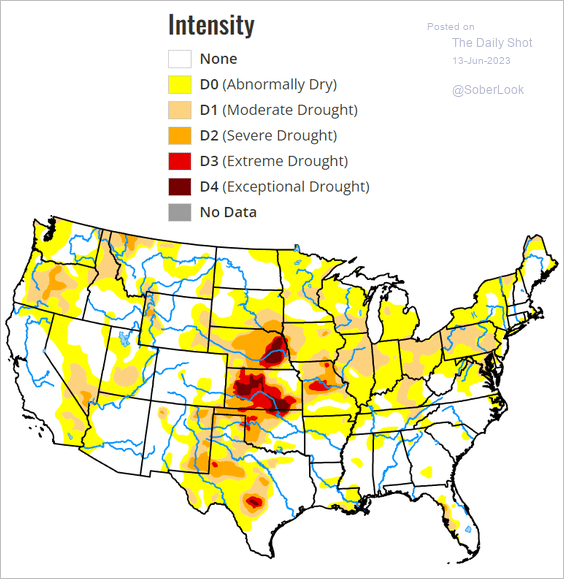

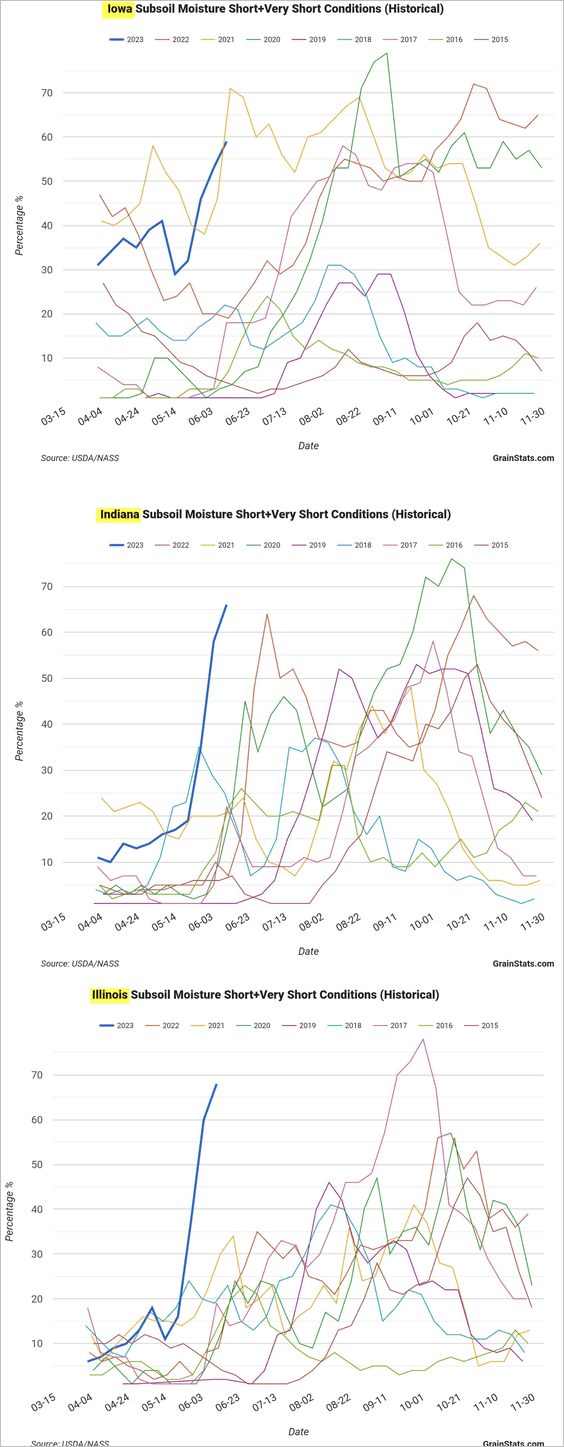

1. Midwest drought conditions have been severe.

Source: National Drought Mitigation Center

Source: National Drought Mitigation Center

——————–

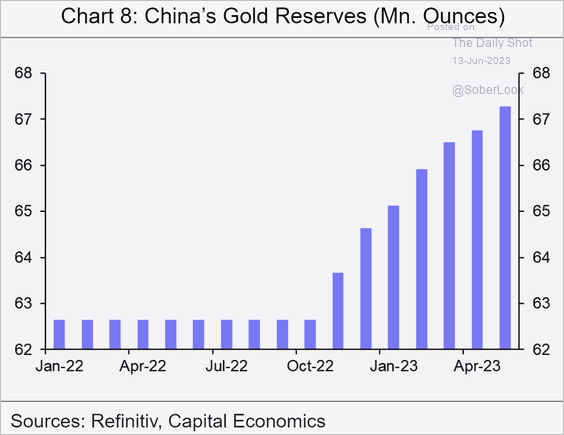

2. This chart shows China’s gold reserves.

Source: Capital Economics

Source: Capital Economics

Back to Index

Energy

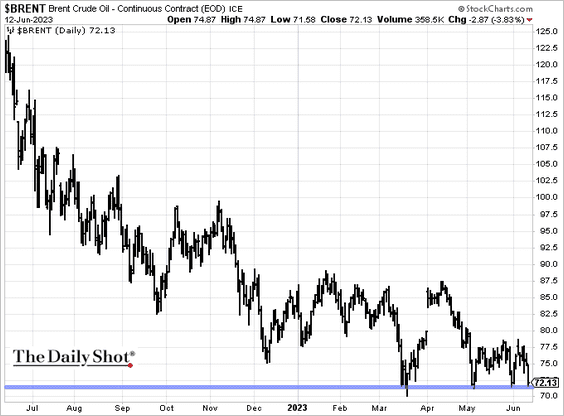

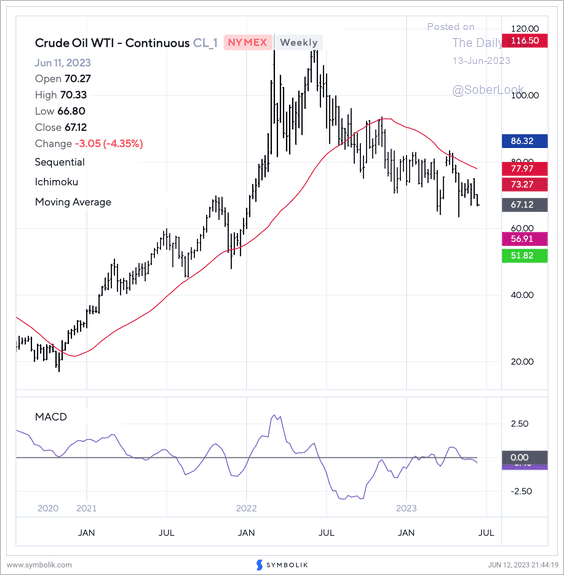

1. OPEC’s efforts to bolster oil prices are being undermined by Russia, which is flooding the market with low-cost oil to finance its ongoing war with Ukraine.

• The Iran rumors are also capping oil prices.

Source: @axios Read full article

Source: @axios Read full article

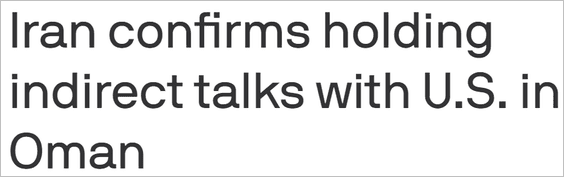

• The global oil market remains in surplus.

Source: PGM Global

Source: PGM Global

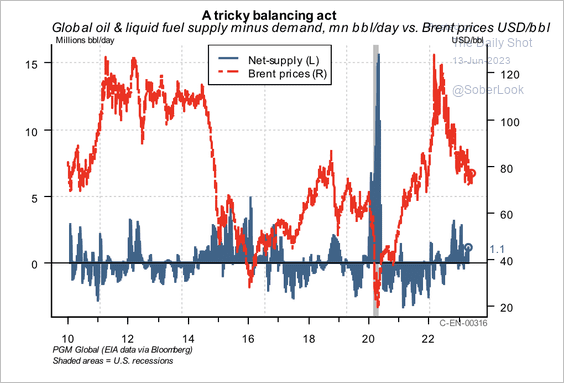

• The front-month WTI oil futures contract remains below its 40-week moving average with negative momentum.

Source: Symolik

Source: Symolik

——————–

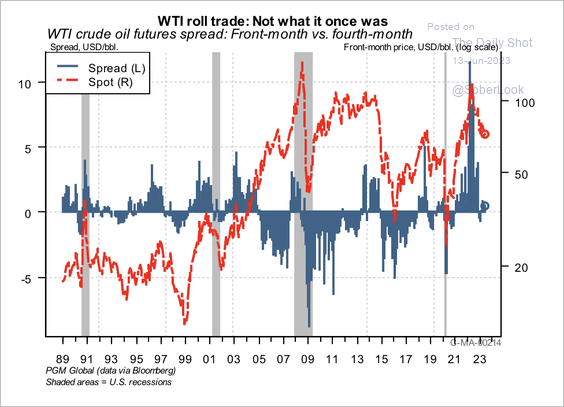

2. There is a small positive roll yield (backwardation) in WTI oil futures.

Source: PGM Global

Source: PGM Global

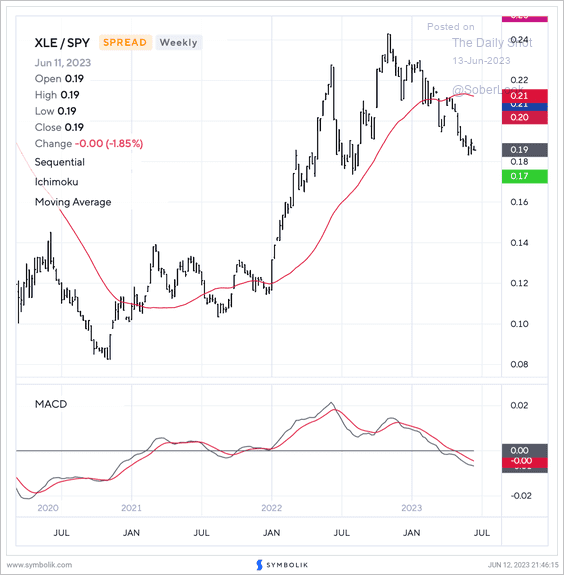

3. The SPDR Energy Sector ETF (XLE) reversed roughly 30% of its uptrend relative to the S&P 500. The XLE/SPY ratio is also capped below its 40-week moving average.

Source: Symolik

Source: Symolik

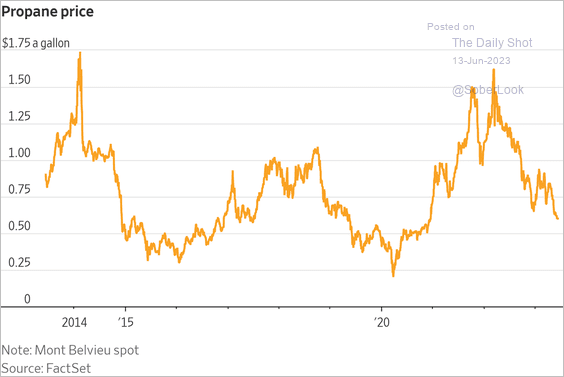

4. US propane prices continue to sink.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

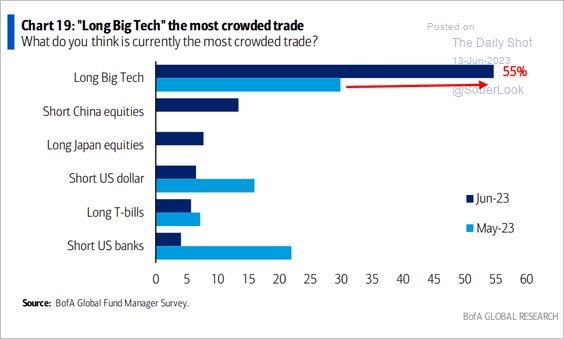

1. Bets on tech mega-caps are increasingly viewed as a crowded trade.

Source: BofA Global Research Read full article

Source: BofA Global Research Read full article

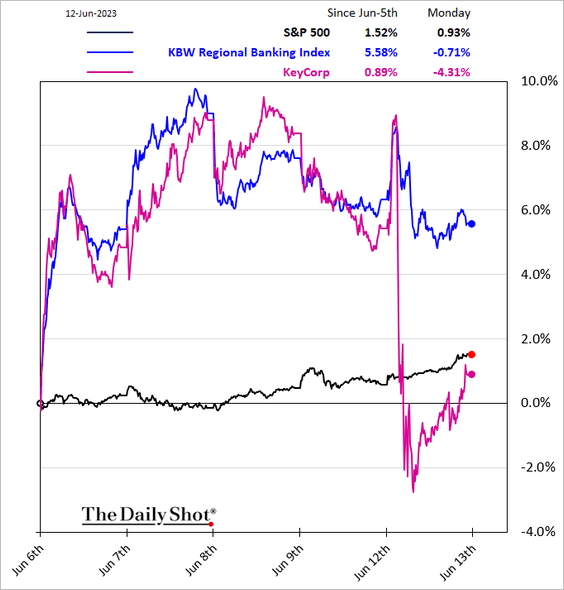

2. The rebound in regional banks is stalling. KeyCorp dropped on a gloomy outlook for net interest income.

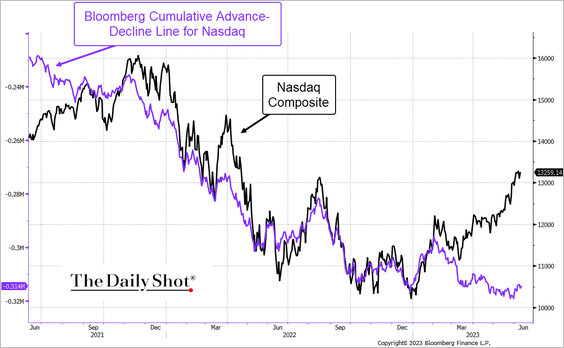

3. Market breadth has been weak.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

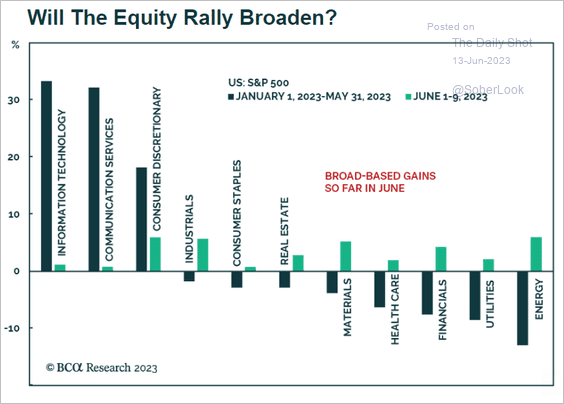

But will the rally broaden?

Source: BCA Research

Source: BCA Research

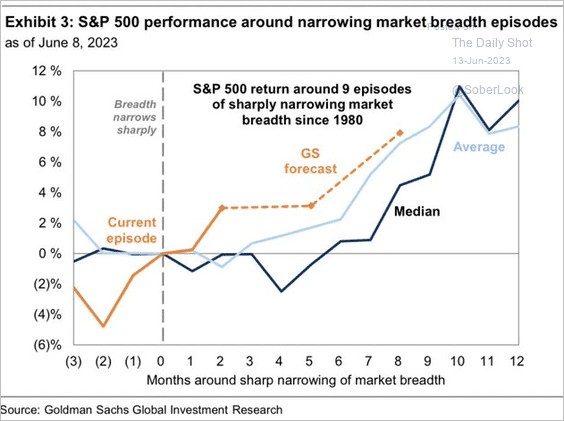

Goldman sees the broader market “catching up.”

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

——————–

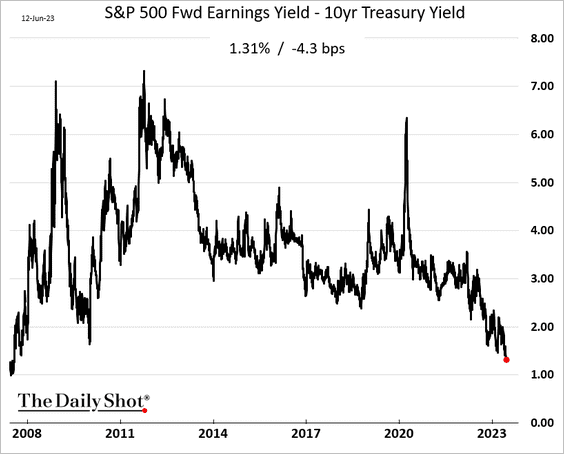

4. The S&P 500 risk premium continues to fall.

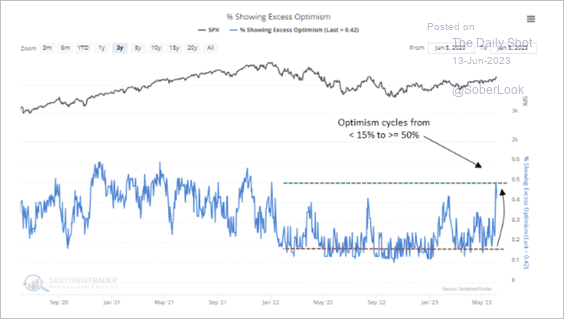

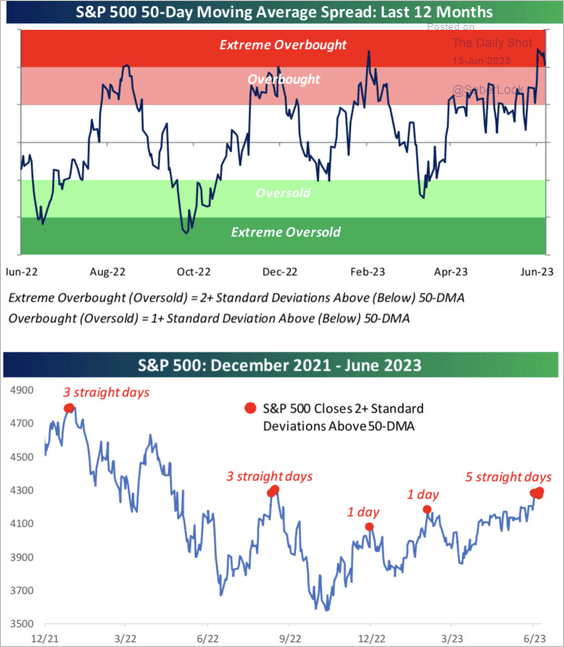

5. Most sentiment indicators are showing excessive optimism, which typically precedes a brief period of consolidation. This typically occurs during the start of a market transition from a downtrend to uptrend, according to SentimenTrader.

Source: SentimenTrader

Source: SentimenTrader

• Could we see a short-term peak?

Source: @bespokeinvest

Source: @bespokeinvest

——————–

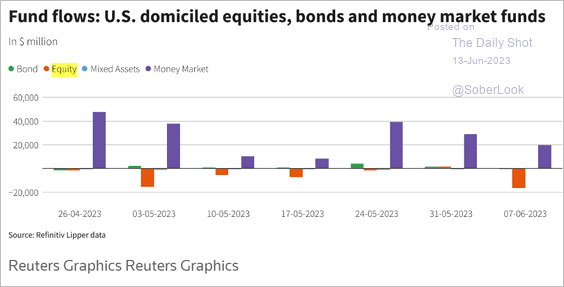

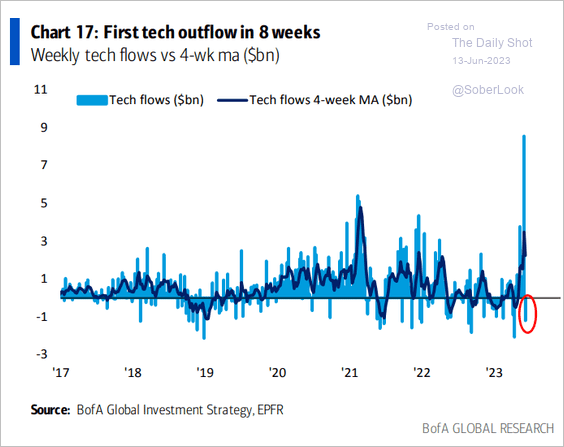

6. Last week saw some equity outflows (2 charts).

Source: Reuters Read full article

Source: Reuters Read full article

Source: BofA Global Research

Source: BofA Global Research

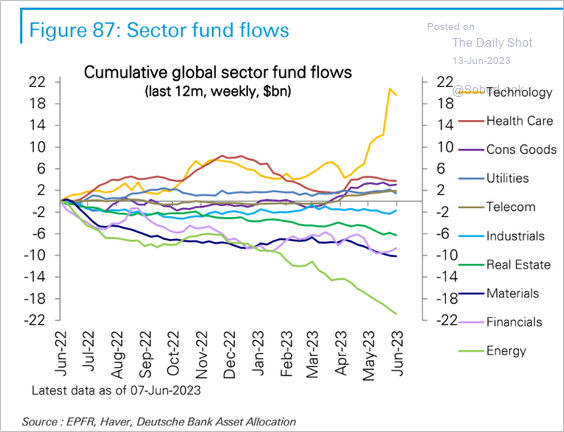

Here is an updated sector fund flows chart.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

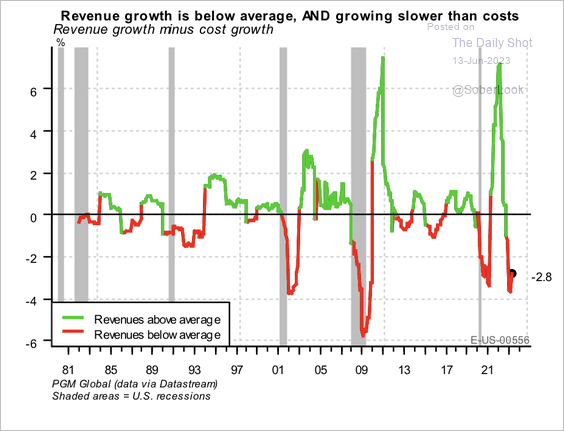

7. Cost growth continues to outpace revenue growth for US firms, although the pace has slowed over the past quarter.

Source: PGM Global

Source: PGM Global

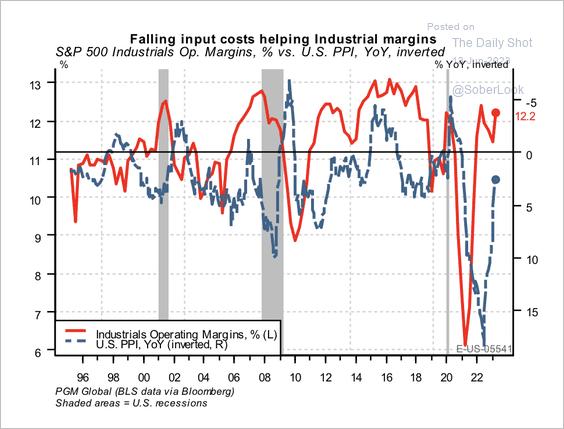

However, falling energy and material prices helped lower input costs in the industrial sector, helping margins improve.

Source: PGM Global

Source: PGM Global

——————–

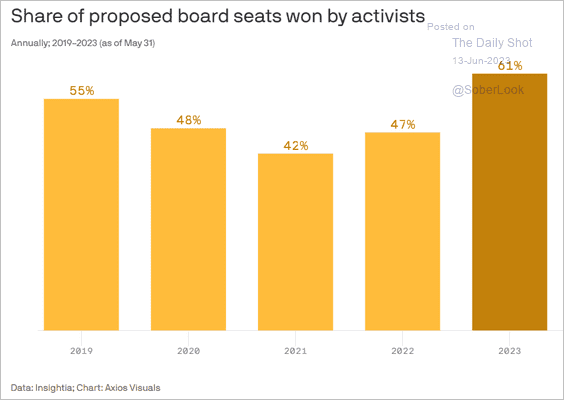

8. Activist investors are achieving greater success.

Source: @axios Read full article

Source: @axios Read full article

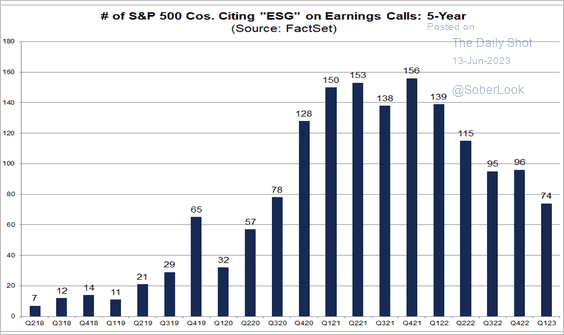

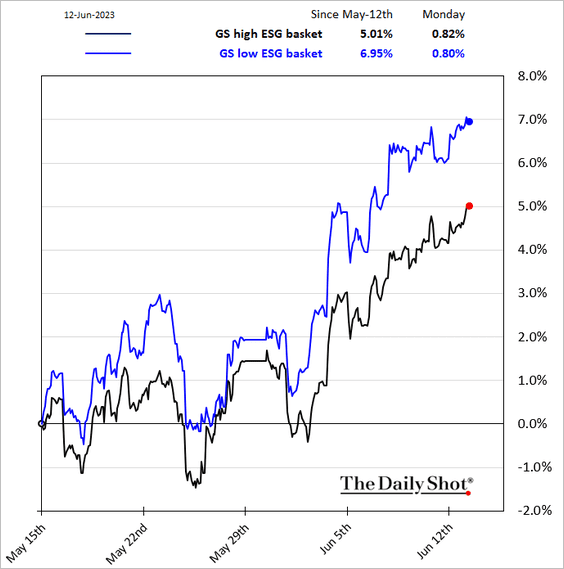

9. There is less talk about ESG on earnings calls, …

Source: @FactSet Read full article

Source: @FactSet Read full article

… as the market no longer rewards ESG emphasis.

Back to Index

Credit

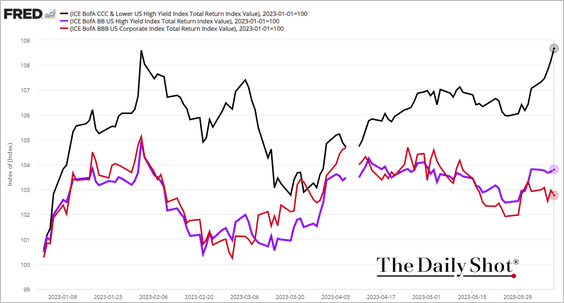

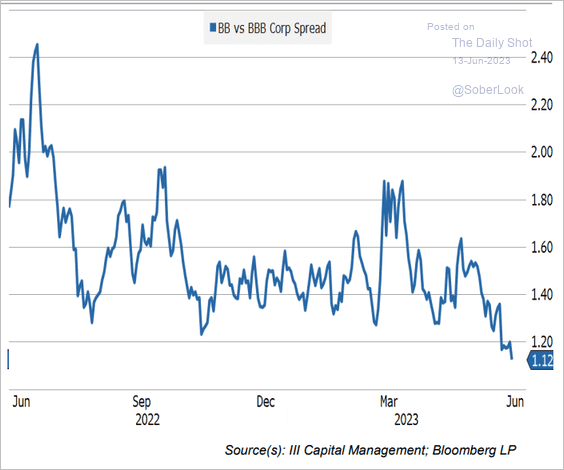

1. The lowest-rated HY bonds have outperformed this year.

The BB-BBB spread continues to tighten.

Source: III Capital Management

Source: III Capital Management

——————–

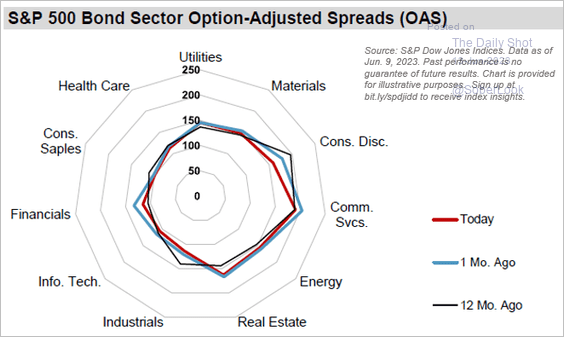

2. How do corporate sector bond spreads compare to historical levels?

S&P Dow Jones Indices: – In a sign of increasing risk appetite across asset classes, corporate credit spreads have declined in recent weeks, but the trajectory of spreads was rather uneven across sectors. While Consumer Discretionary and Industrials are trading much tighter than they were a month and a year ago, Financials and Real Estate option-adjusted spreads are appreciably wider than they were this time last year.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

3. The average maturity time in the high-yield market has decreased to 5.2 years as the demand for short-term bonds and refinancing activities lead to earlier due dates.

Source: @Tobin_Tweets, @markets Read full article

Source: @Tobin_Tweets, @markets Read full article

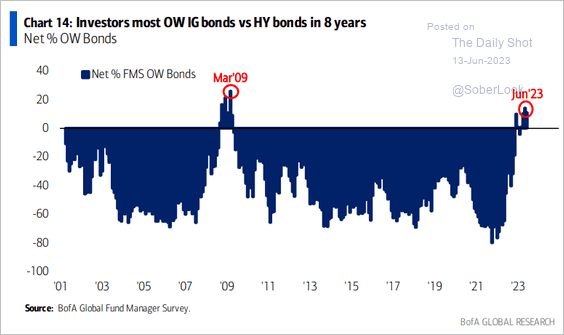

4. Investors are now overweight corporate bonds.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

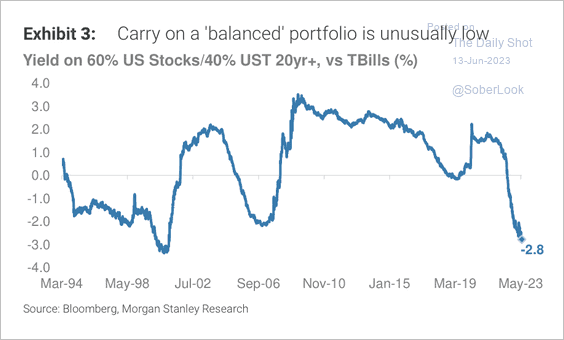

1. The yield on a 60/40 portfolio of US stocks and 20+ year Treasuries, relative to cash, is near a 30-year low.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

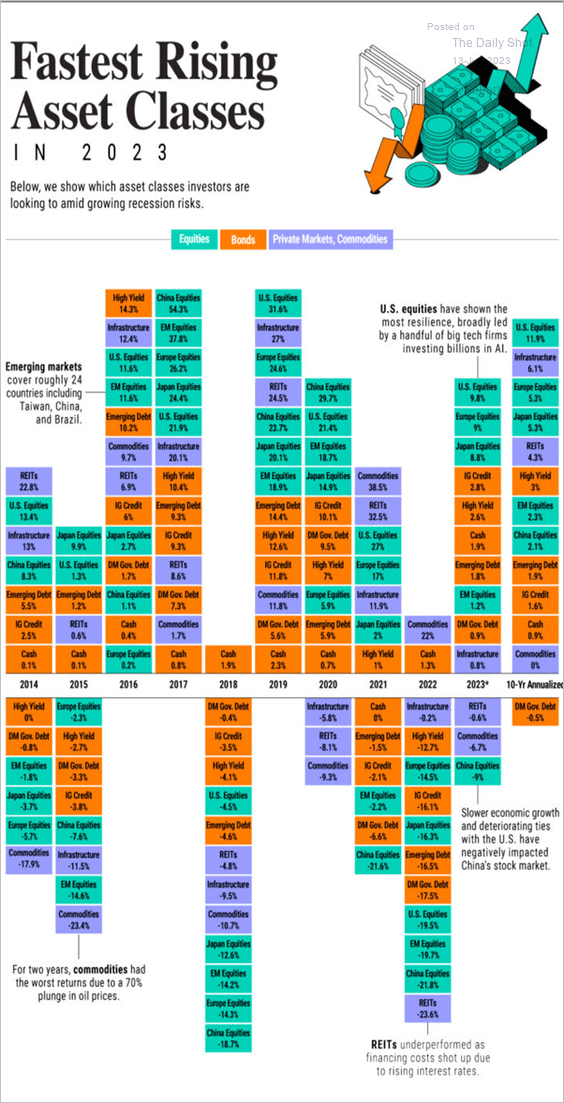

2. Here is a look at asset class performance by year.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

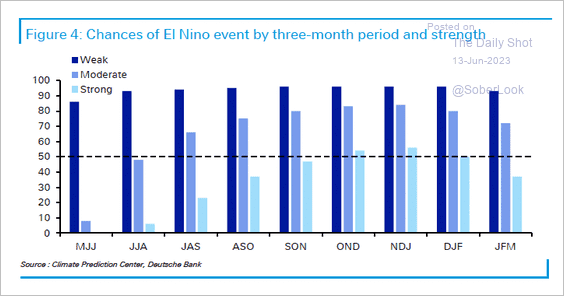

3. There is a 56% chance of a strong El Niño toward the end of the year – the first since the 2014-2016 event.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

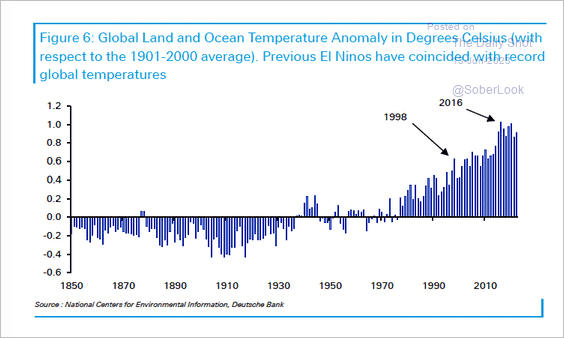

Previous El Niños have coincided with record global temperatures.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

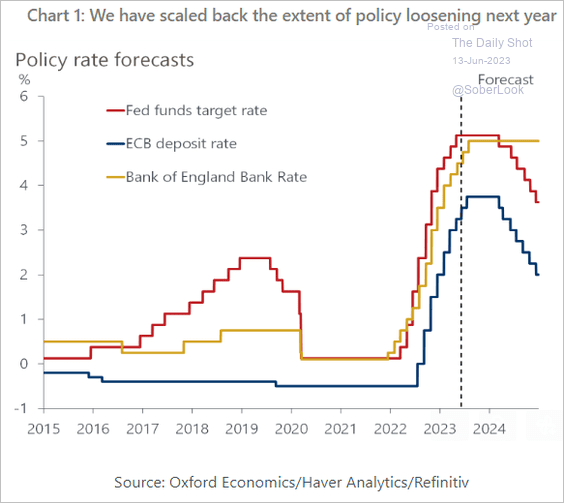

4. Oxford Economics predicts that the Fed has completed its cycle of rate hikes, while they anticipate the ECB and the BoE will each deliver two additional hikes of 25 basis points in this cycle.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

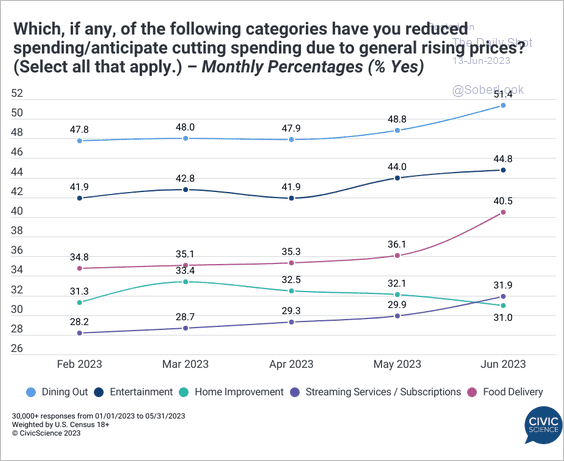

1. Reducing spending due to rising prices:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

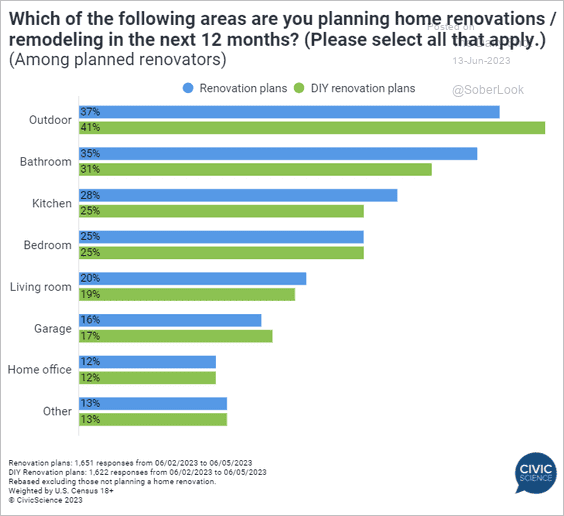

2. Planned home renovations:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

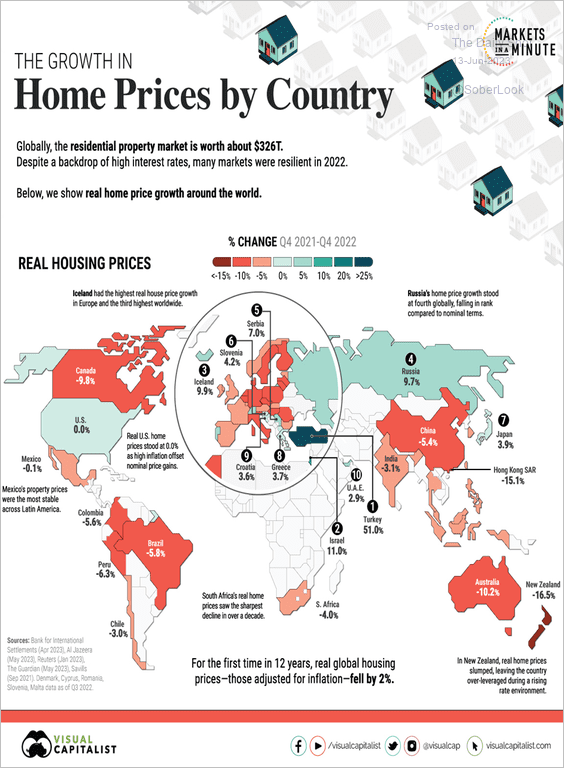

3. Gains in house prices by country (adjusted for inflation):

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

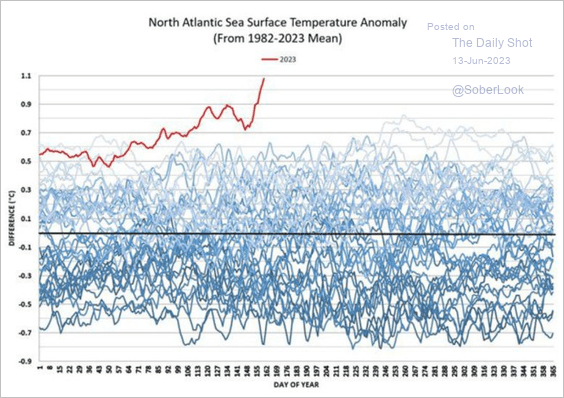

4. The upcoming hurricane season could be rough.

Source: Andreas Steno Larsen

Source: Andreas Steno Larsen

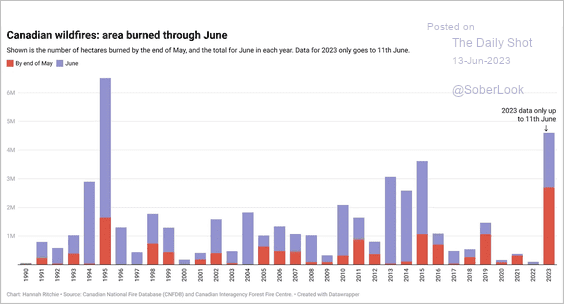

5. Canadian area burned by wildfires through June 11th:

Source: Hannah Ritchie Read full article

Source: Hannah Ritchie Read full article

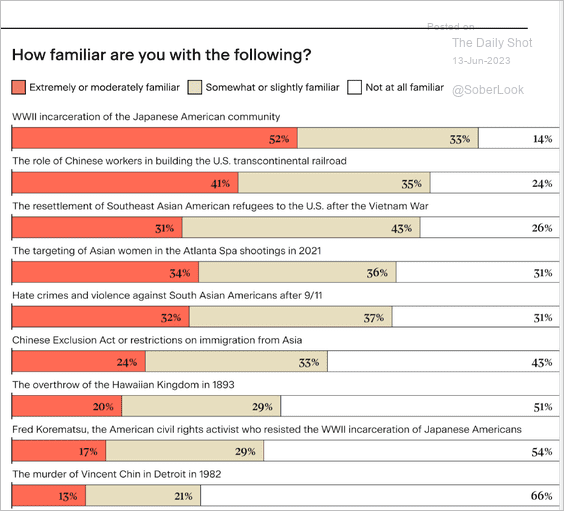

6. Familiarity with historical Asian American events:

Source: STAATUS Index

Source: STAATUS Index

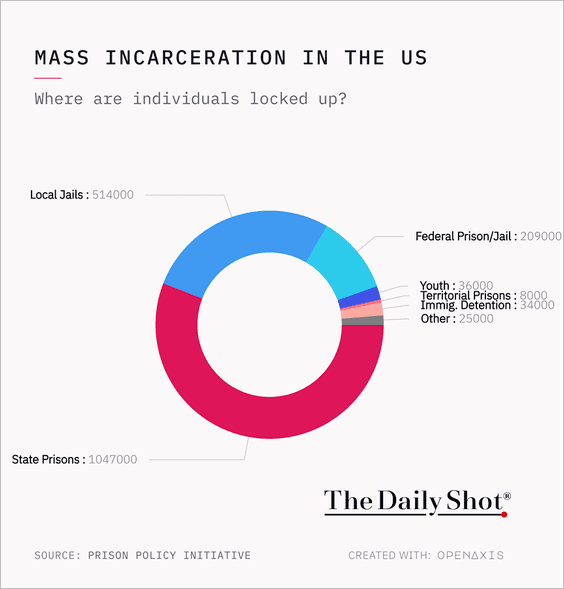

7. Mass incarceration in the US:

Source: @TheDailyShot

Source: @TheDailyShot

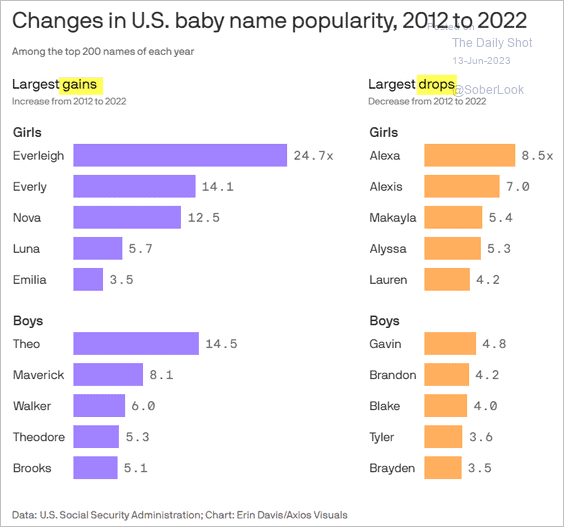

8. Changes in baby name popularity:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index