The Daily Shot: 14-Jun-23

• The United States

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

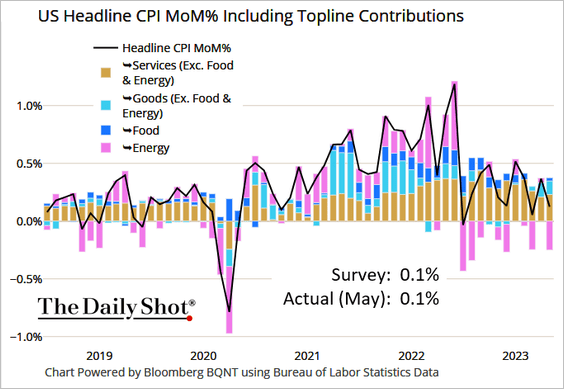

1. The CPI report was roughly in line with expectations, …

Source: @TheTerminal, Bloomberg Finance L.P.

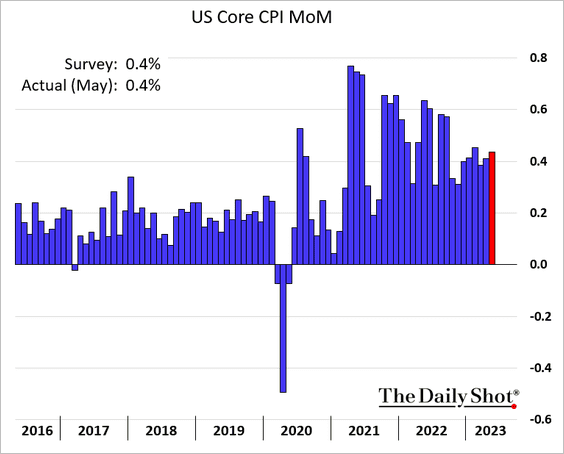

Source: @TheTerminal, Bloomberg Finance L.P.

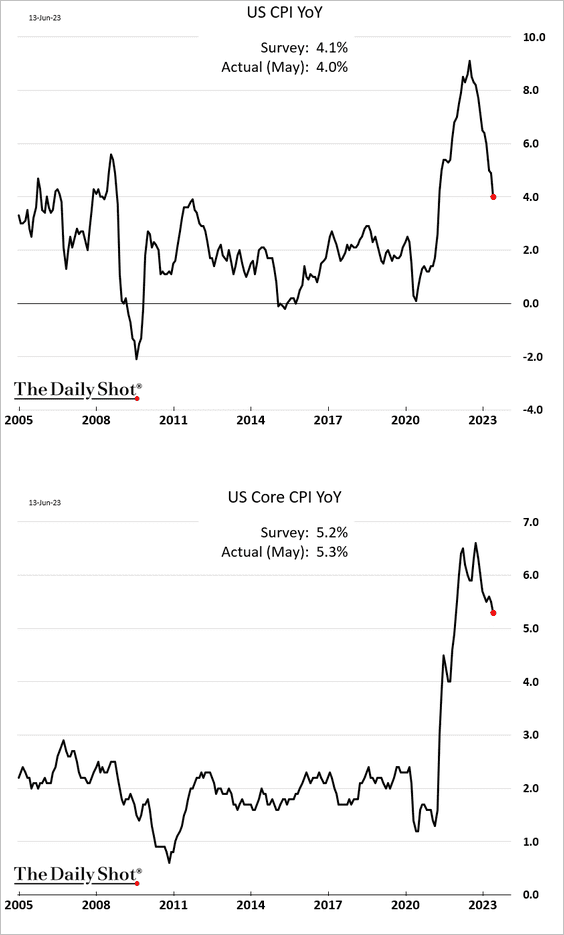

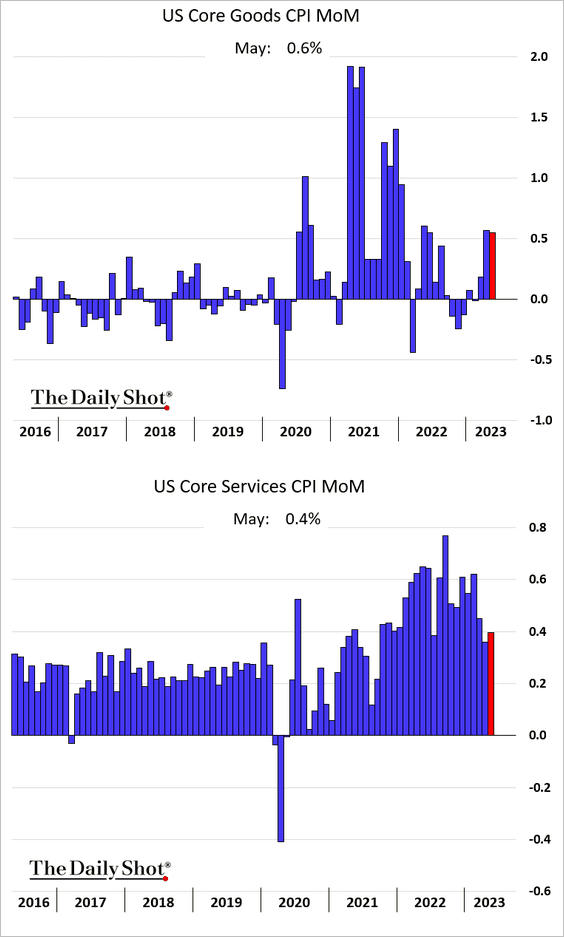

… with core inflation remaining stubbornly high.

Below is the year-over-year trend.

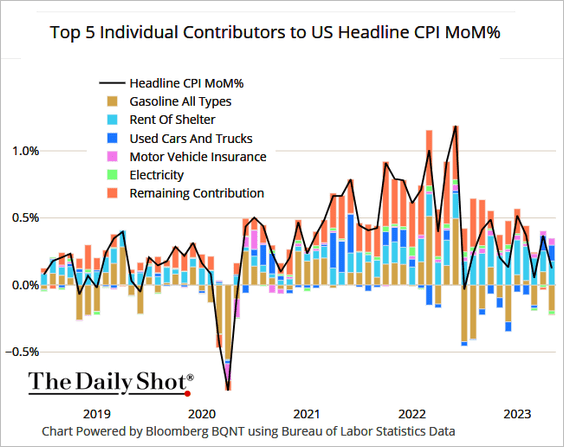

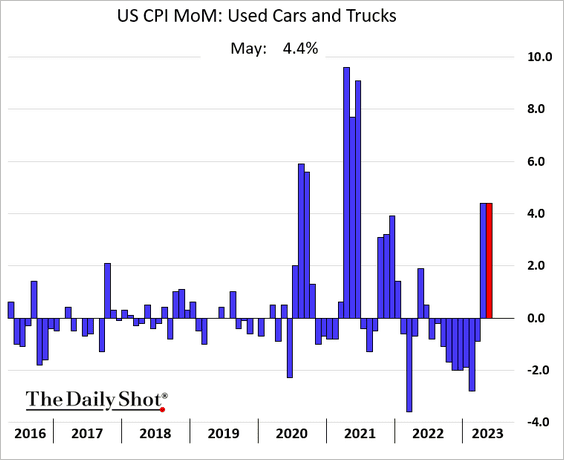

• Once again, used car prices gave the CPI a boost.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

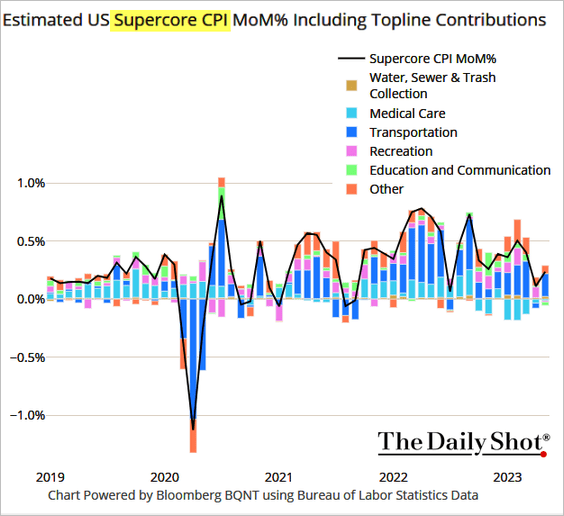

• The supercore CPI (core services ex housing) increased in May, …

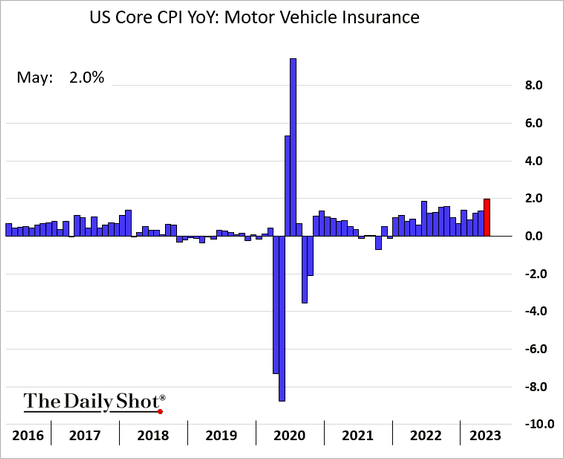

… with gains driven by car insurance costs, which saw the biggest increase since 2020.

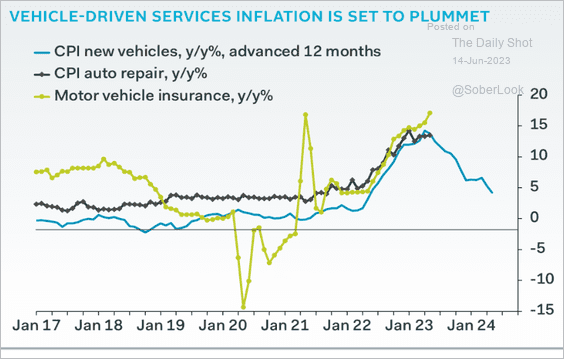

– The good news is that car insurance inflation tends to follow new vehicle prices with a lag.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

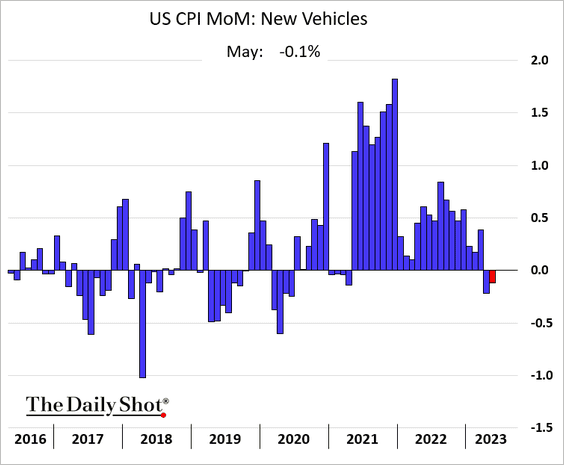

And new car prices declined again.

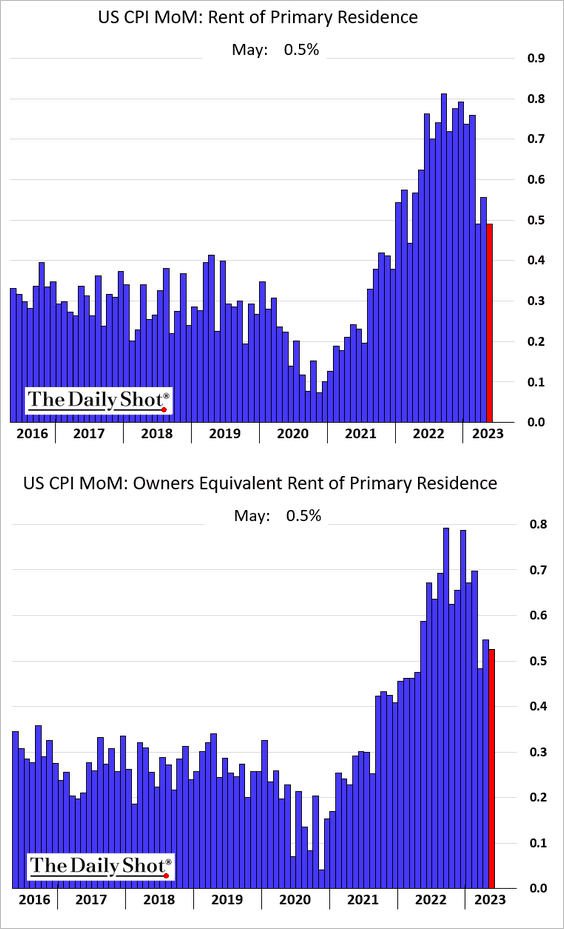

• Housing inflation is still running well above pre-COVID levels.

• Here are some additional CPI trends.

– Core goods and services:

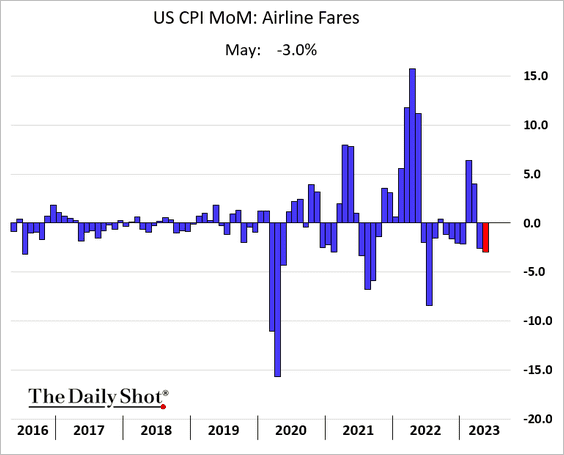

– Airline fares:

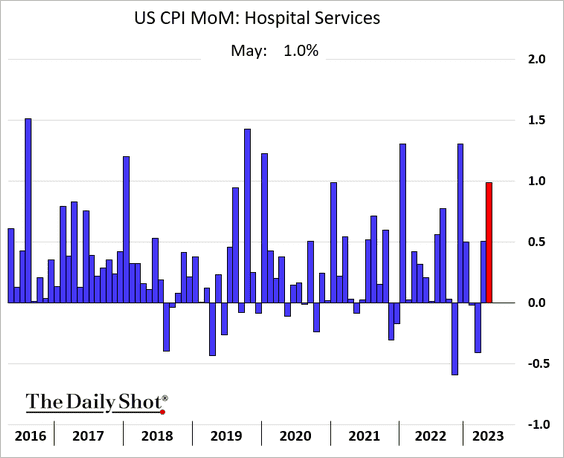

– Hospital services:

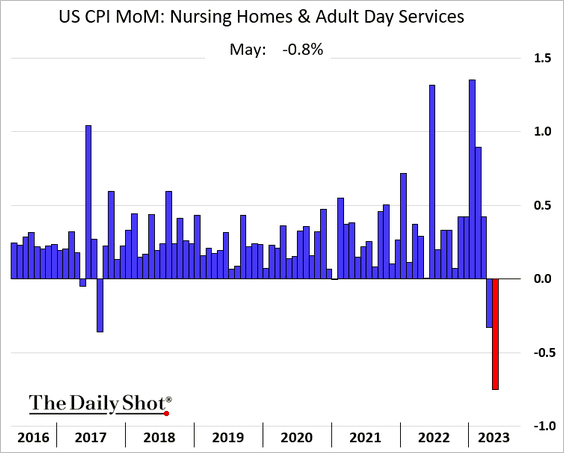

– Nursing homes:

We will have more data on the CPI report tomorrow.

——————–

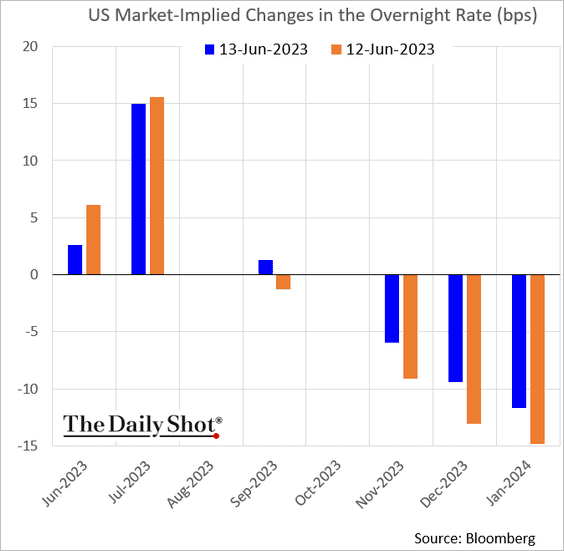

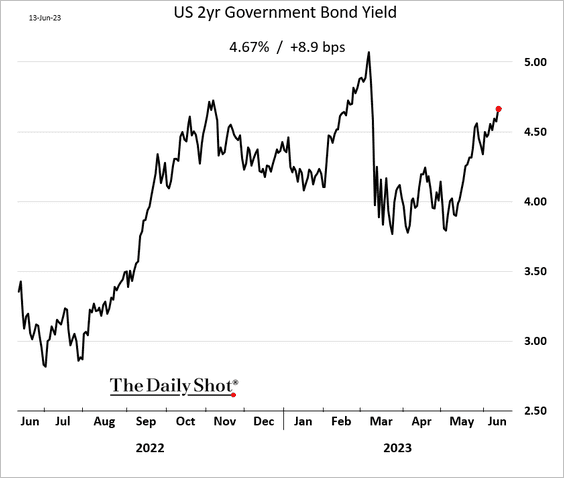

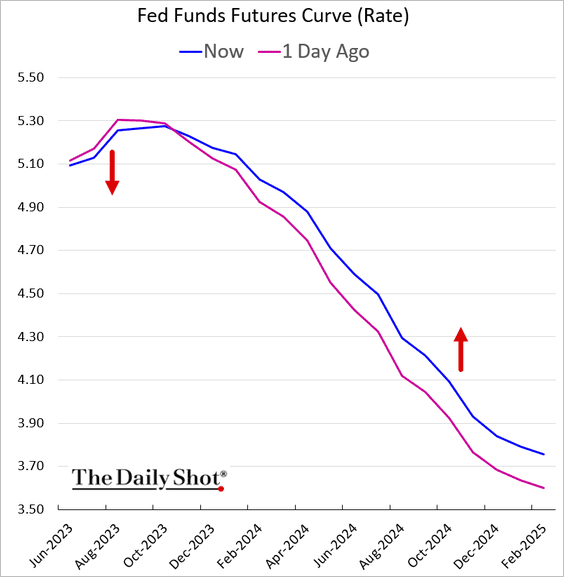

2. With no major surprises from the CPI report, the Fed is expected to keep rates unchanged today.

But Treasury yields climbed, …

… as the market moderated its expectations for rate cuts next year.

——————–

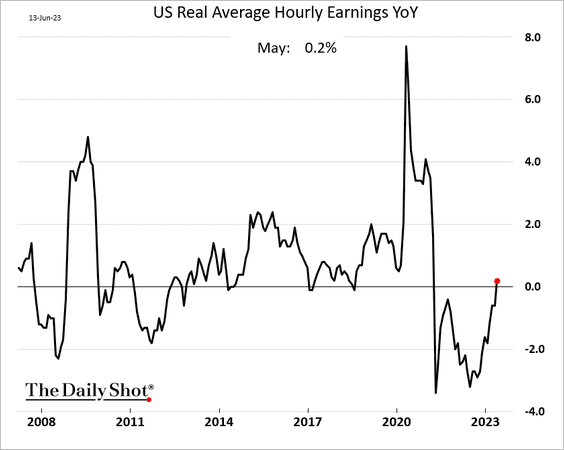

3. Real hourly wage growth moved back into positive territory.

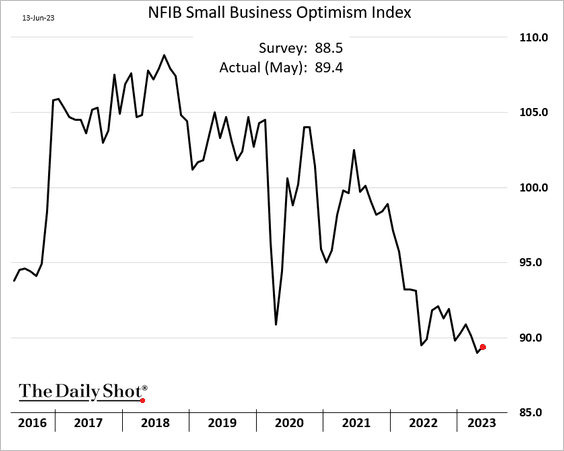

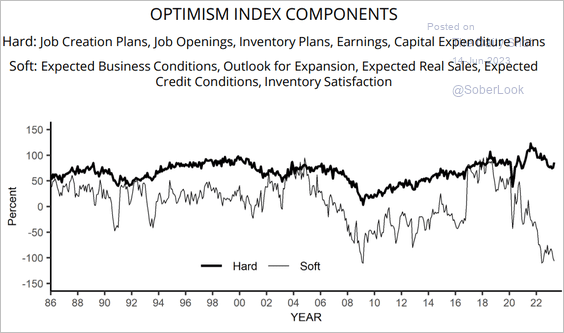

4. The NFIB Small Business Optimism Index edged higher in May, but sentiment remains depressed.

This survey often displays a lack of internal consistency because the NFIB is dominated by very small businesses. As a result, certain sections of the report closely resemble consumer sentiment measures rather than traditional business indicators.

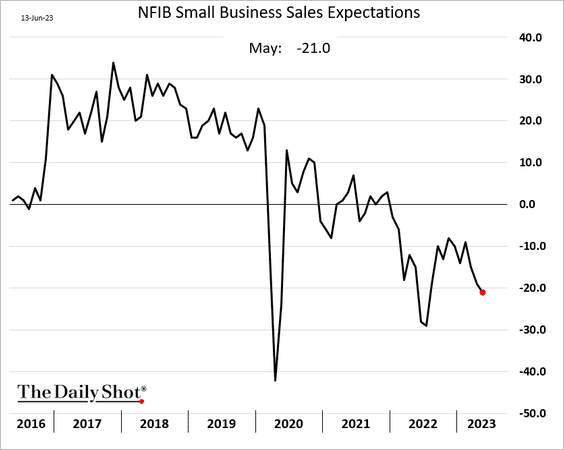

– Sales expectations keep falling.

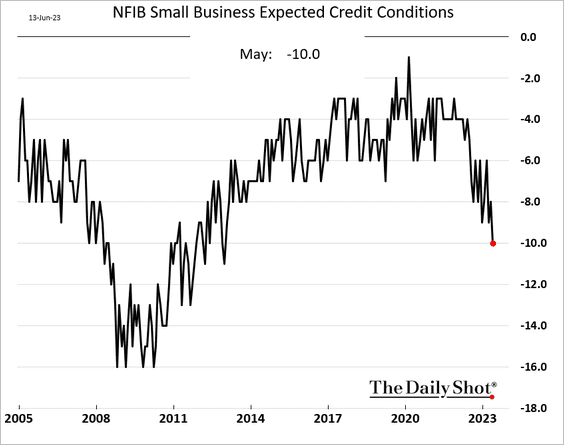

– Businesses are increasingly concerned about future credit conditions.

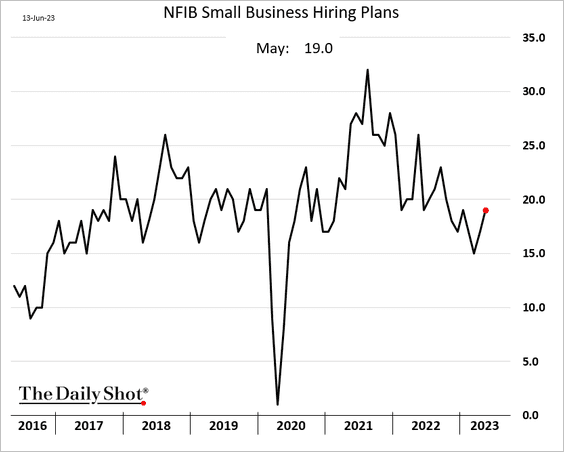

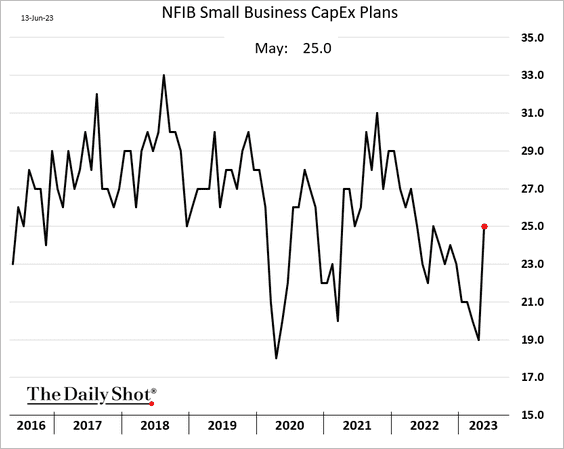

– And yet hiring and CapEx plans jumped.

This chart summarises the divergence.

Source: NFIB Read full article

Source: NFIB Read full article

Back to Index

The United Kingdom

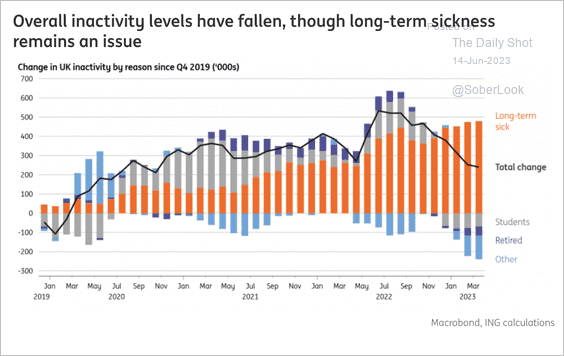

1. Labor force inactivity is declining amid rising cost of living.

Source: ING

Source: ING

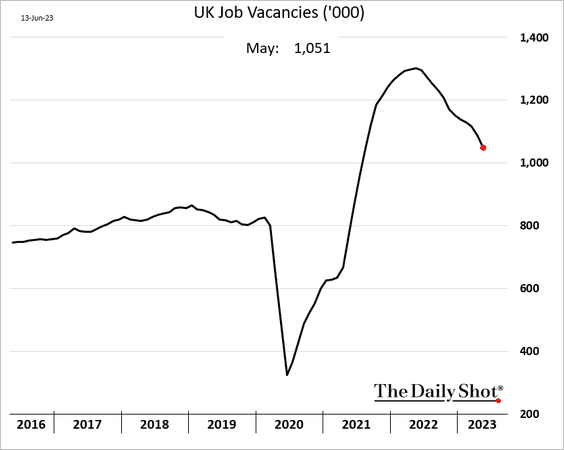

• Job vacancies continue to trend lower.

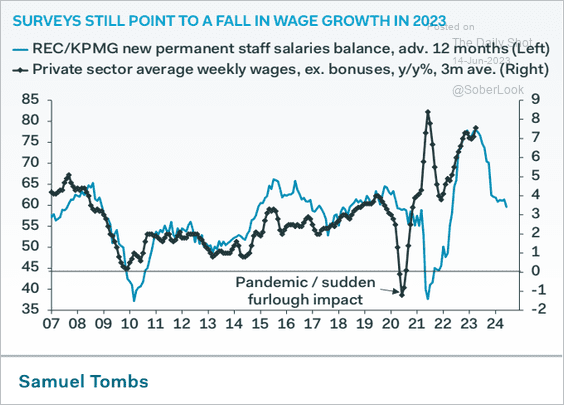

• Surveys point to slower wage growth ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

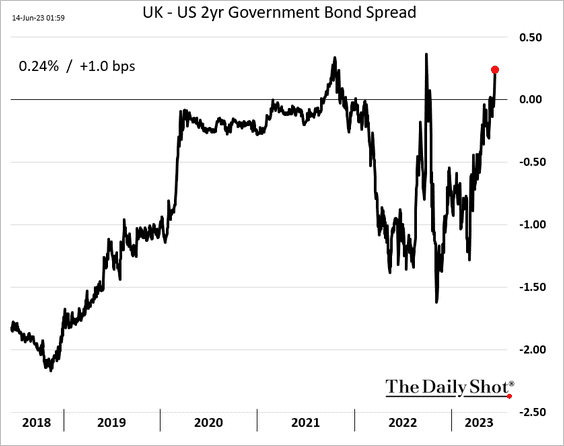

2. The UK-US 2-year yield differential is back in positive territory.

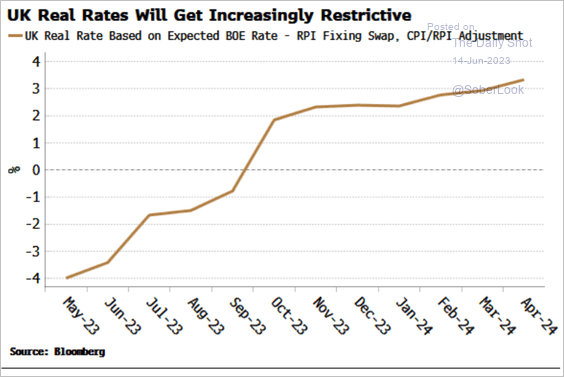

3. UK real rates are expected to keep rising.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Europe

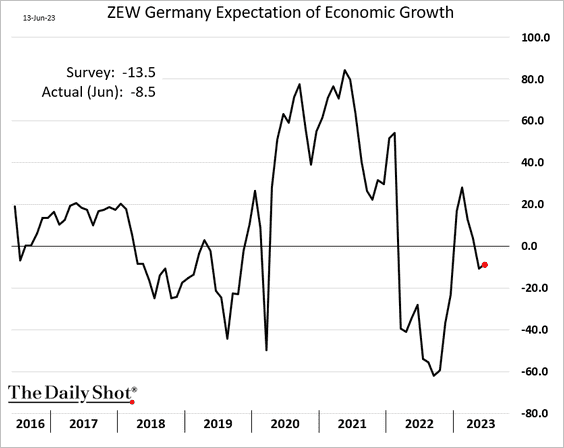

1. Germany’s ZEW expectations index unexpectedly edged higher this month.

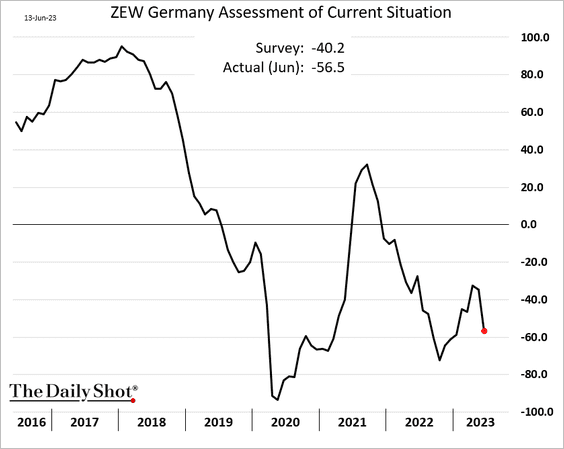

But the current situation index declined sharply.

——————–

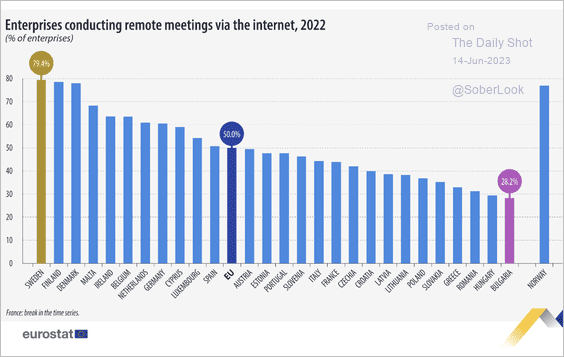

2. This chart shows the percentage of businesses conducting remote meetings across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

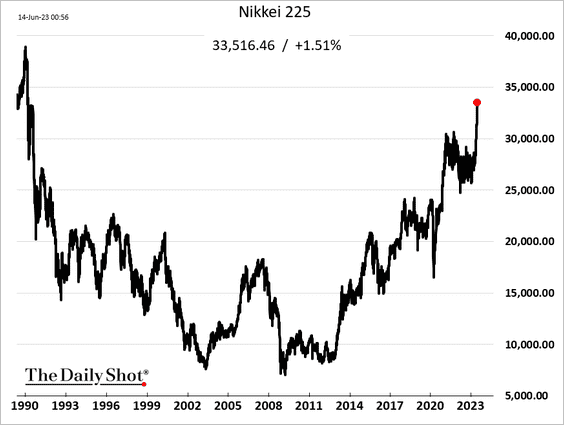

1. Japan’s share prices continue to surge.

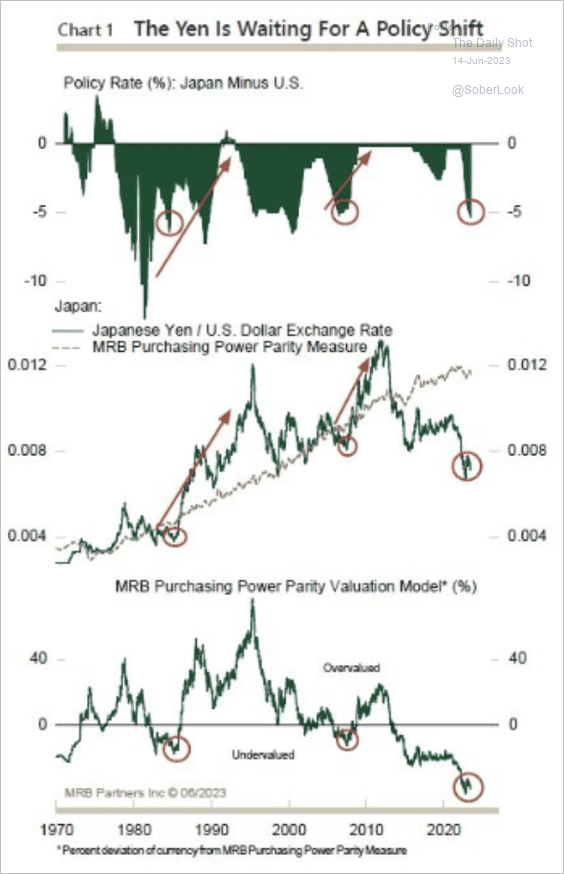

Separately, the yen appears deeply undervalued.

Source: MRB Partners

Source: MRB Partners

——————–

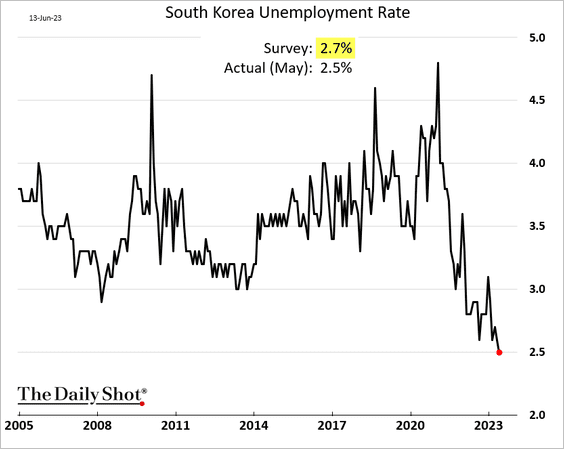

2. South Korea’s unemployment rate hit a record low.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

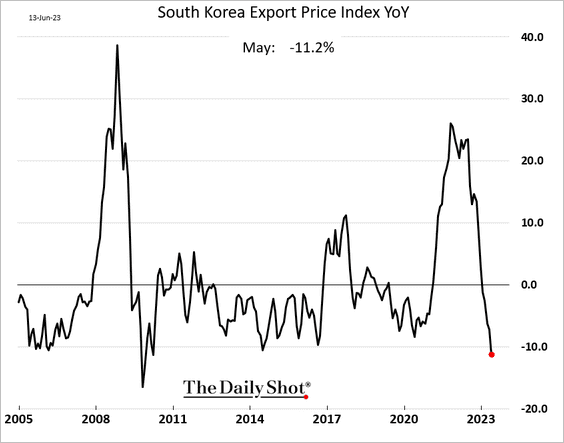

• South Korea’s export prices are down sharply on a year-over-year basis.

Back to Index

China

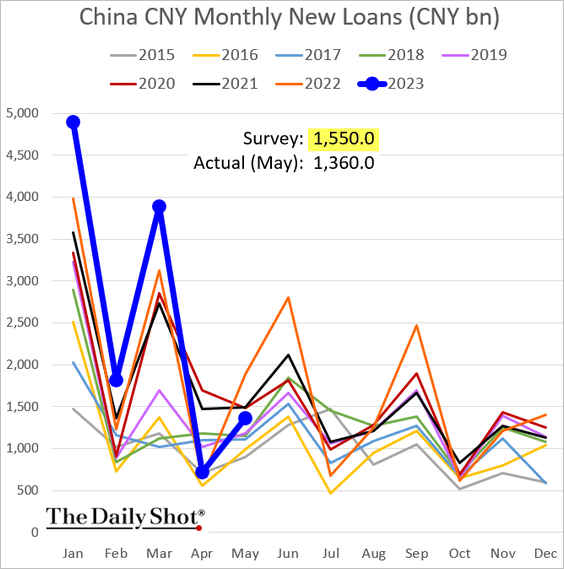

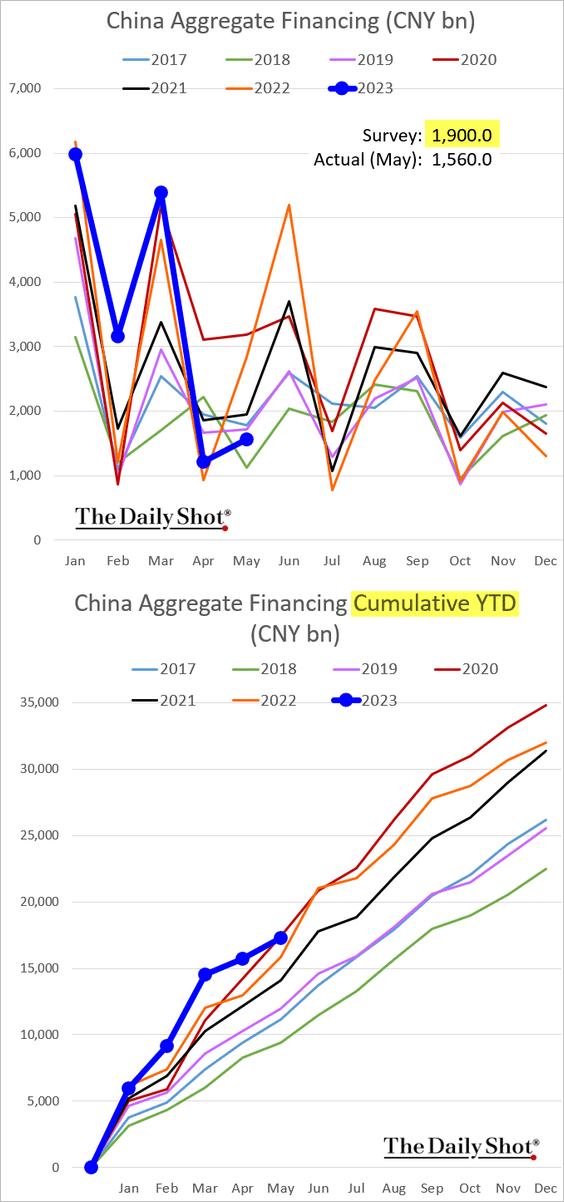

1. Credit expansion surprised to the downside.

• CNY loans:

• Aggregate financing:

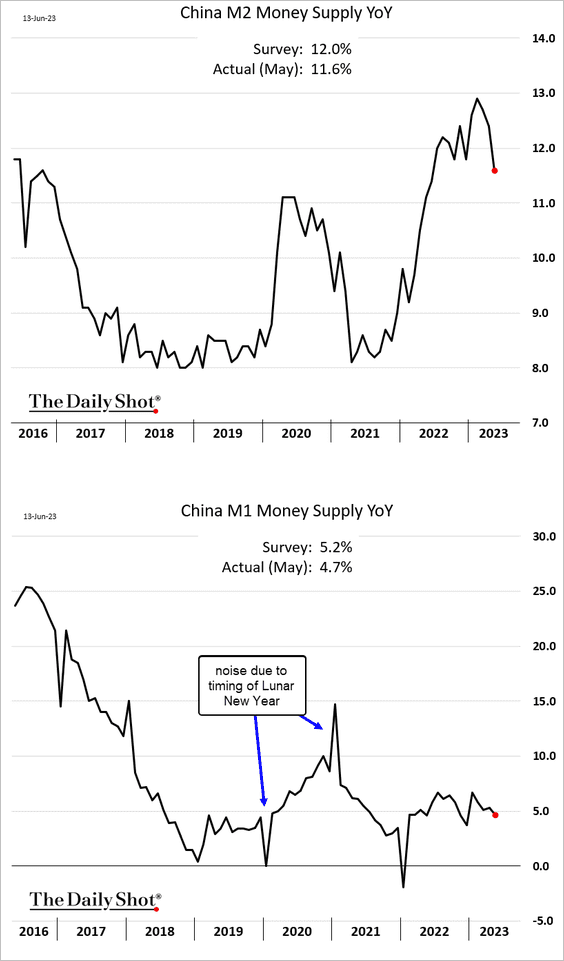

Money supply growth has been slowing.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

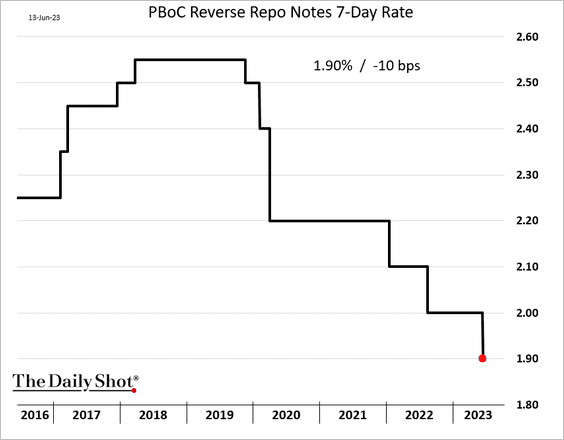

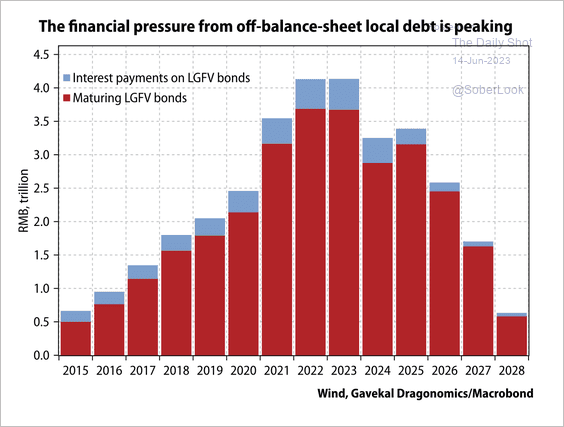

2. Beijing is introducing new stimulus, …

Source: @economics Read full article

Source: @economics Read full article

…starting with a rate cut.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

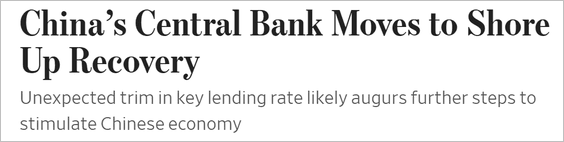

3. Local governments experienced large declines in tax revenue and land-use right sales last year.

Source: Gavekal Research

Source: Gavekal Research

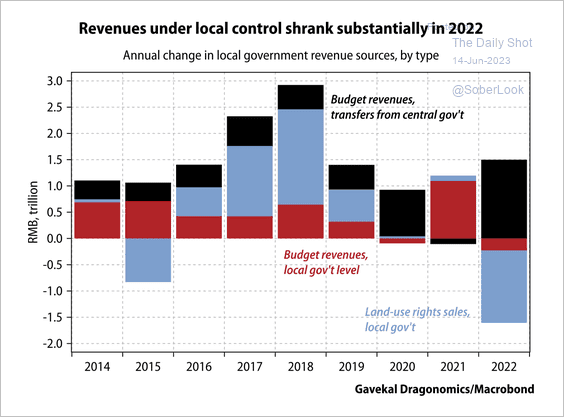

A large volume of local government financing vehicle bonds (LGFV) are coming due this year, raising the need for refinancing.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

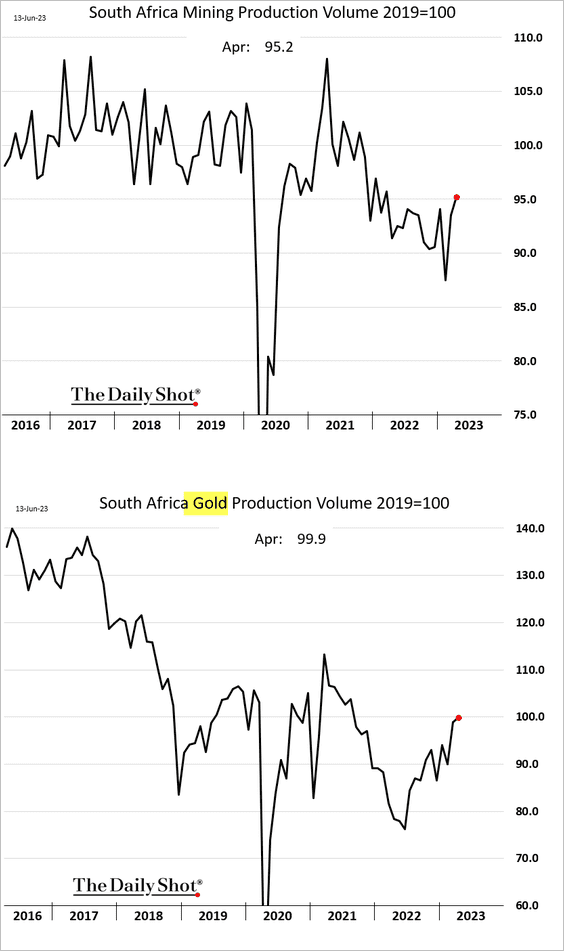

1. South Africa’s mining output is rebounding.

2. Egypt’s core inflation is back above 40%.

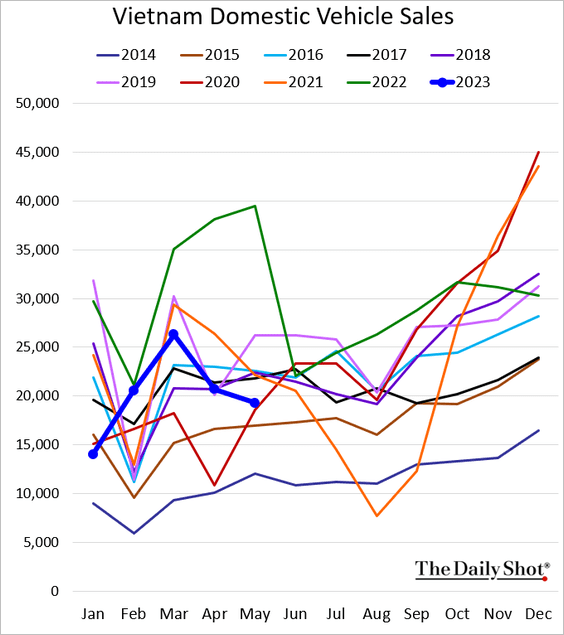

3. Vietnam’s domestic vehicle sales have been declining.

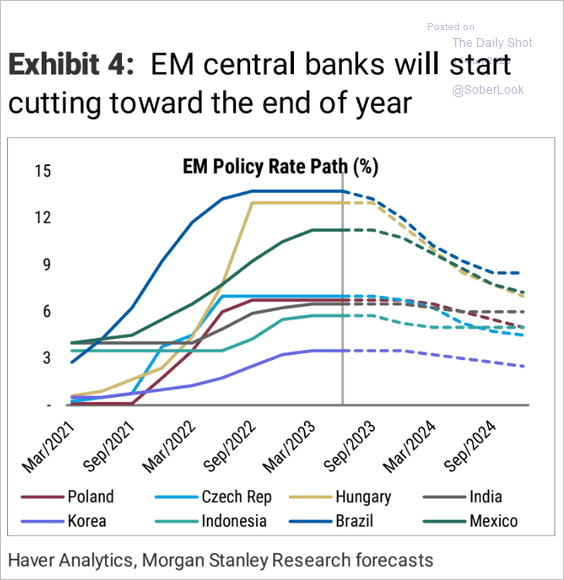

4. This chart shows Morgan Stanley’s projection for central bank policy trajectories.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Commodities

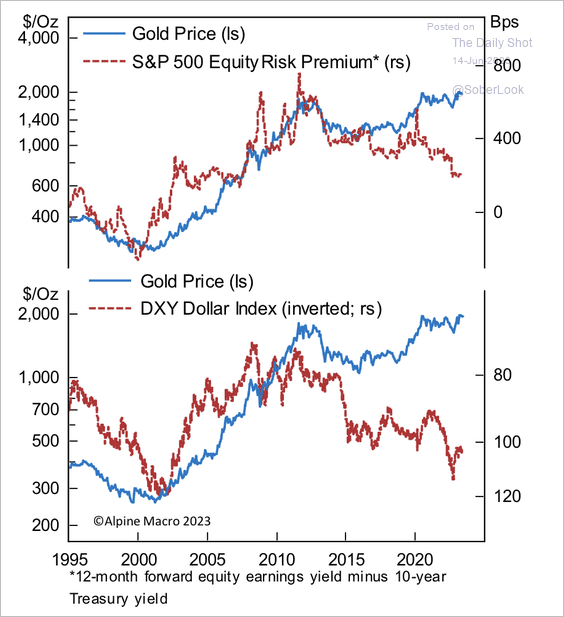

1. Gold is outperforming the US equity risk premium and its typical inverse correlation with the dollar.

Source: Alpine Macro

Source: Alpine Macro

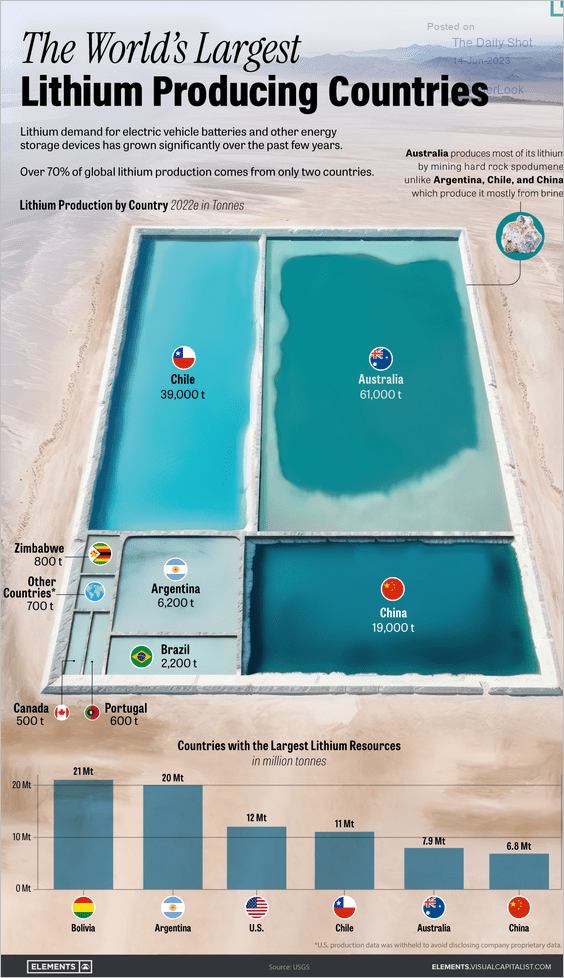

2. Here is a look at top lithium producers.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Energy

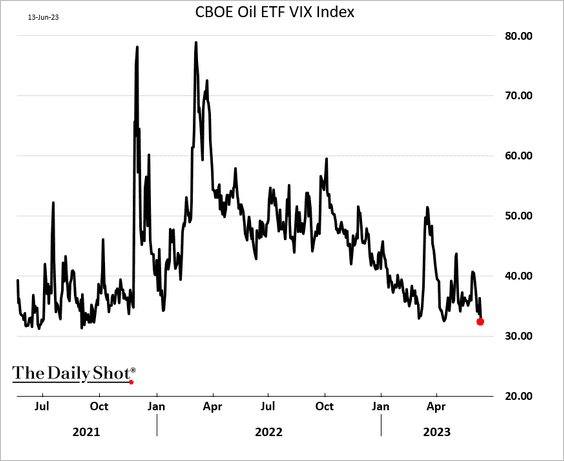

1. Oil market implied volatility has been falling.

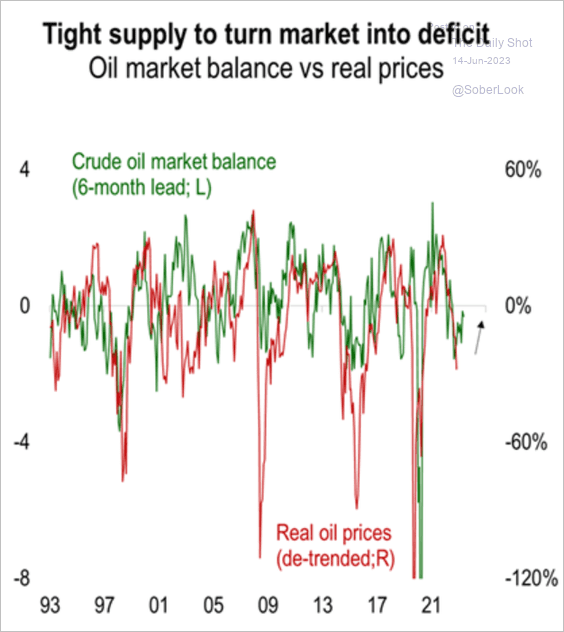

2. Analysts expect a deficit in oil markets.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

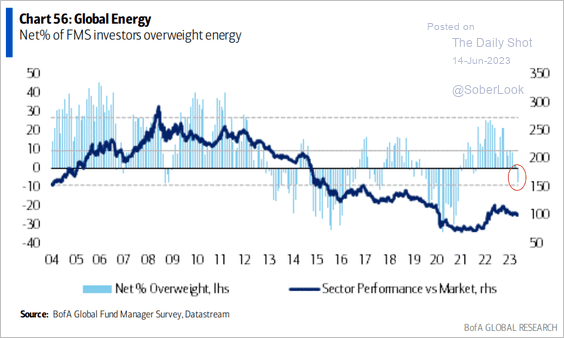

3. Fund managers have soured on energy stocks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Equities

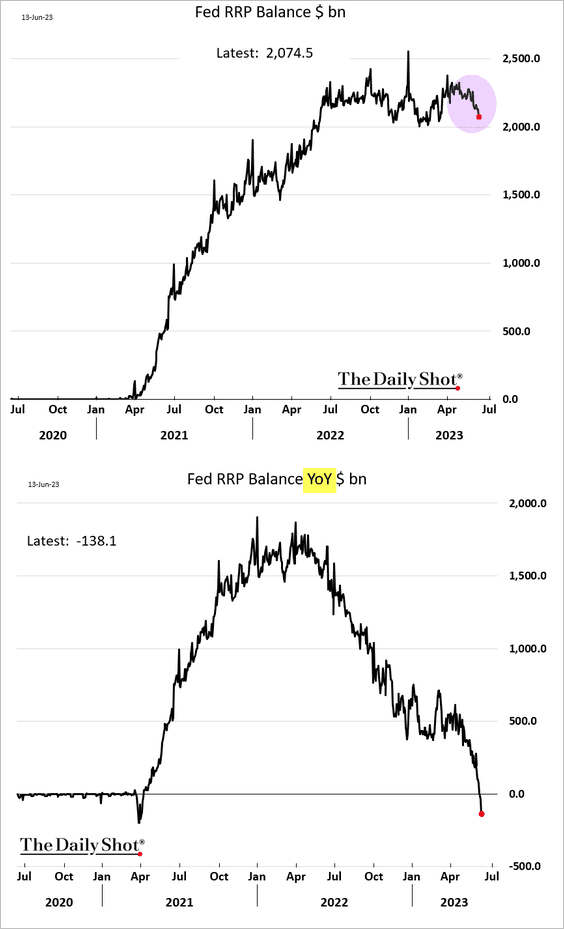

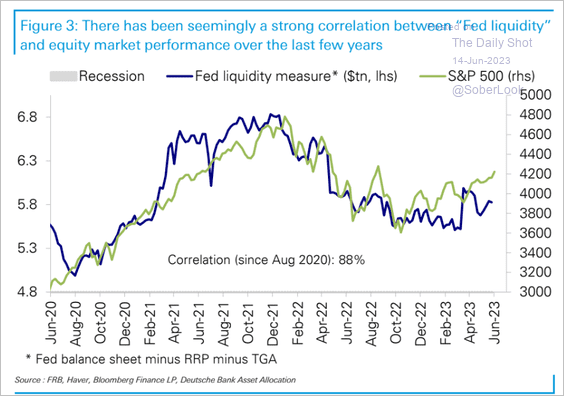

1. The Fed’s RRP (reverse repo) balances are rolling over, which should boost bank deposits and reserves.

The extra liquidity in the private sector tends to be a tailwind for stocks (2 charts).

Source: MUFG Securities

Source: MUFG Securities

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

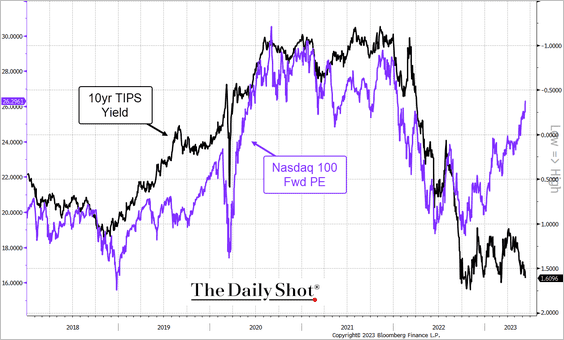

2. The Nasdaq 100 valuation continues to diverge from real rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

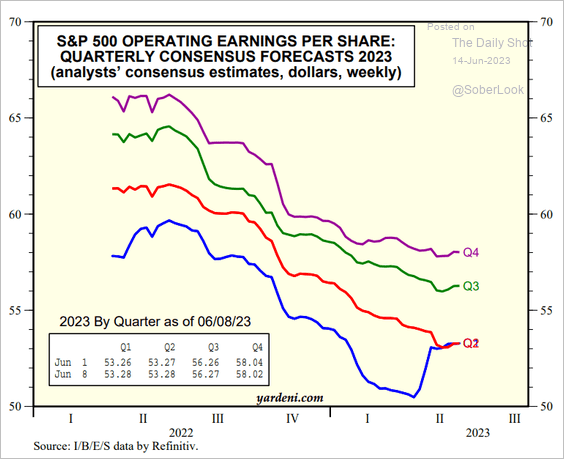

3. S&P 500 earnings estimates for 2023 have been stable.

Source: Yardeni Research

Source: Yardeni Research

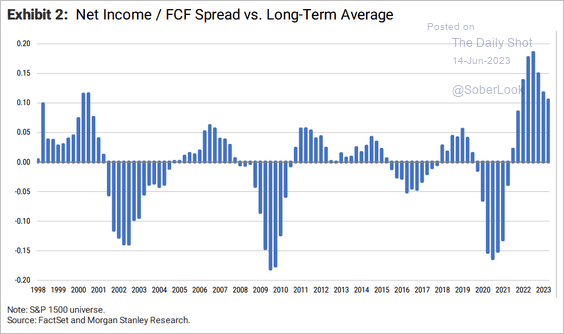

4. According to Morgan Stanley, “the gap between reported earnings and cash flow remains the widest in ~25 yrs, driven by excess inventory, inflation and capitalized costs that have yet to flow thru the P&L.”

Source: Morgan Stanley Research

Source: Morgan Stanley Research

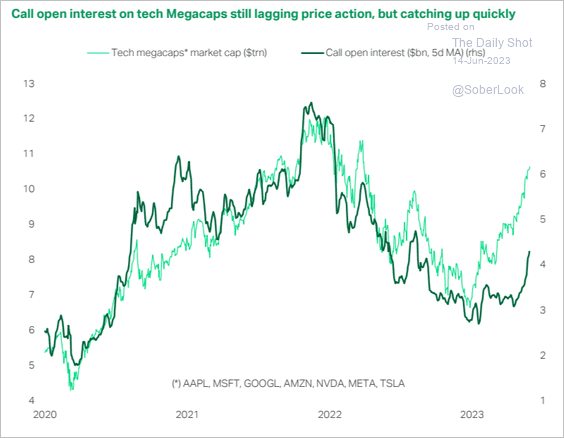

5. Demand for call options on mega-cap shares keeps rising.

Source: TS Lombard

Source: TS Lombard

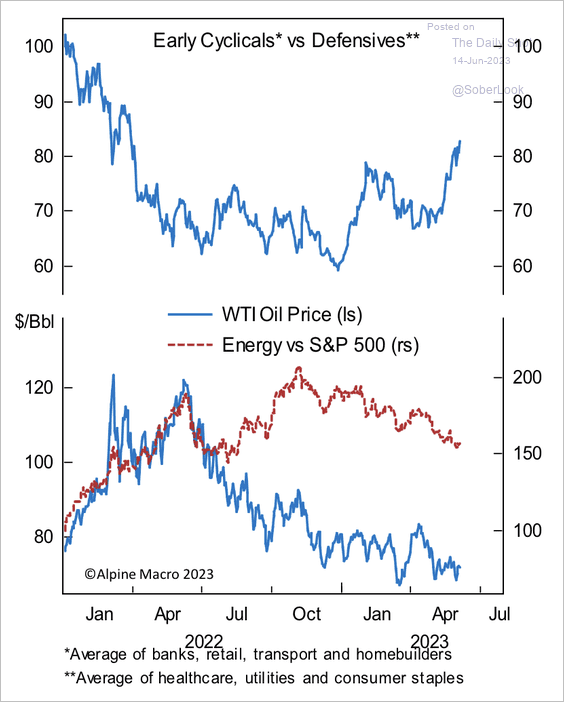

6. US early cyclicals have outperformed defensive stocks, taking leadership from energy.

Source: Alpine Macro

Source: Alpine Macro

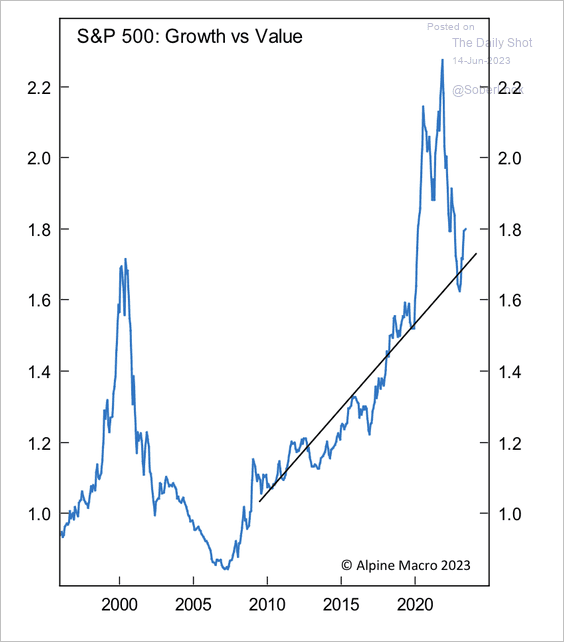

7. So far, the S&P 500 growth/value ratio remains in an uptrend despite its sharp correction.

Source: Alpine Macro

Source: Alpine Macro

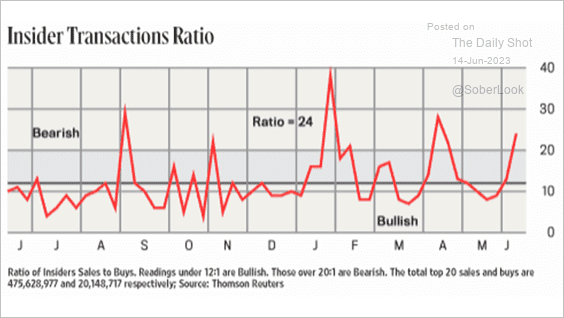

8. Insiders have been buying.

Source: @thomsonreuters

Source: @thomsonreuters

Back to Index

Credit

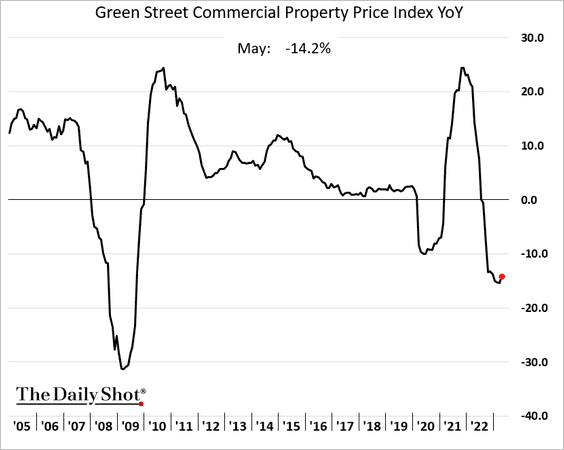

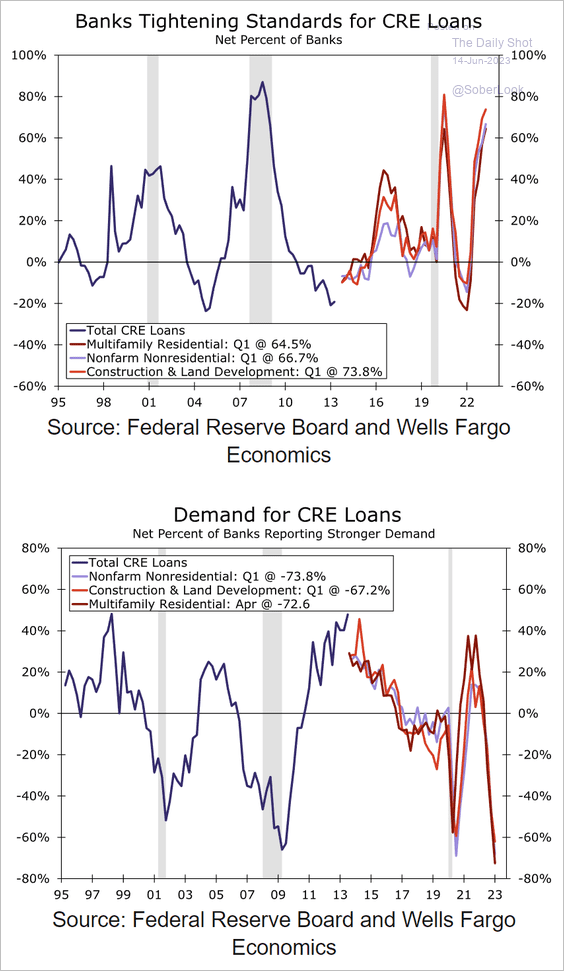

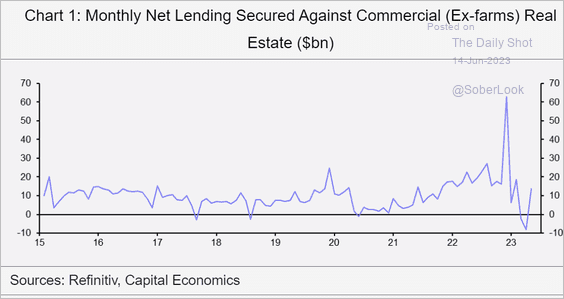

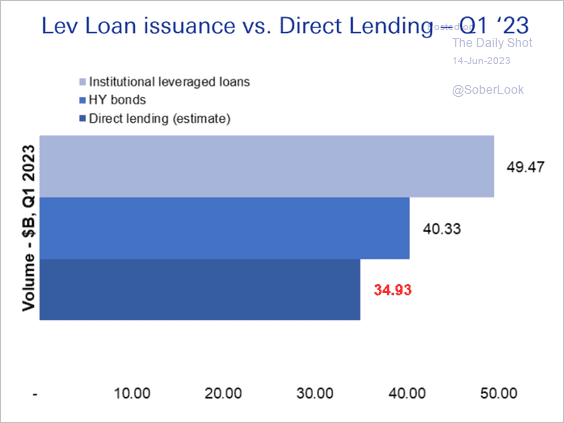

1. Let’s start with some updates on commercial real estate (CRE).

• Aggregate commercial property year-over-year price changes (stabilizing?):

• CRE credit supply and demand:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• CRE lending (a surprise bounce):

Source: Capital Economics

Source: Capital Economics

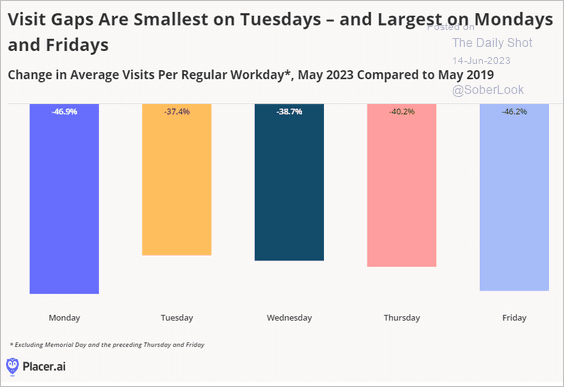

• Office visits (still about 40% below 2019 levels):

Source: Placer.ai

Source: Placer.ai

Source: Placer.ai

Source: Placer.ai

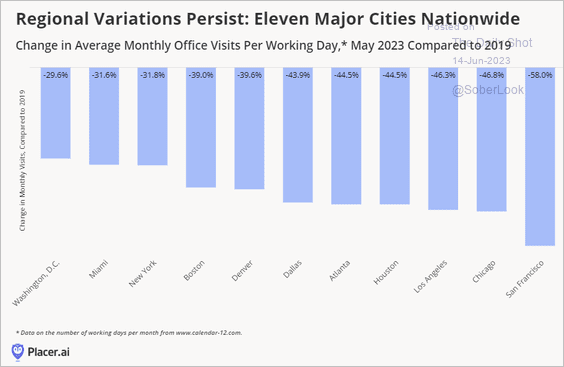

• Origin of capital going into CRE:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

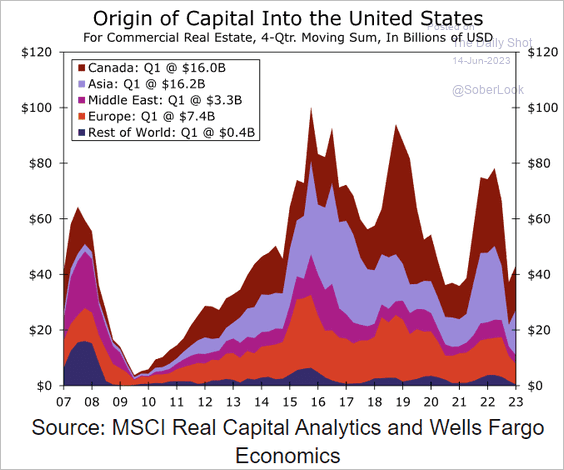

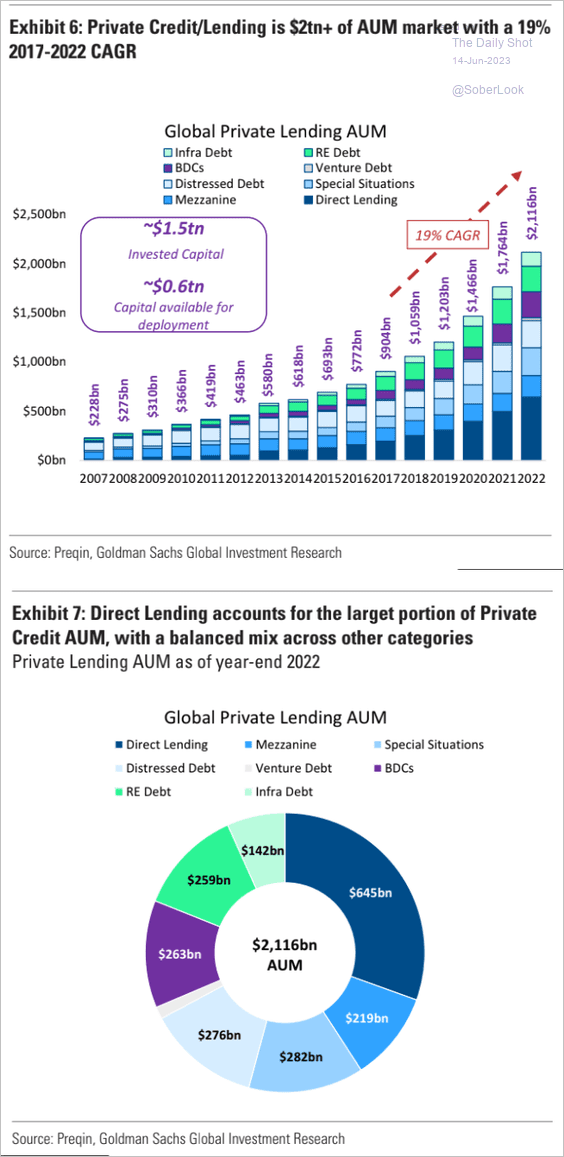

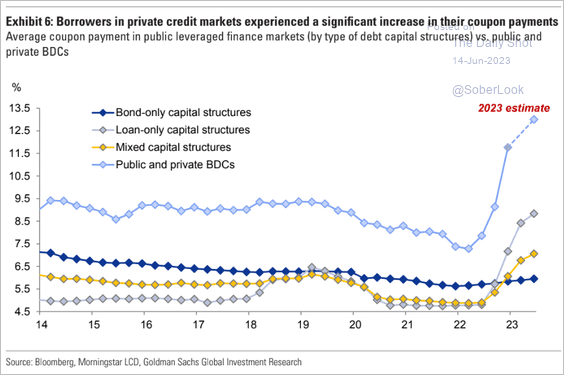

2. Next, we have some updates on private corporate credit.

• Direct lending market vs. the leverage finance market in Q1:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Private credit growth:

Source: Goldman Sachs

Source: Goldman Sachs

• Private credit loan interest:

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Rates

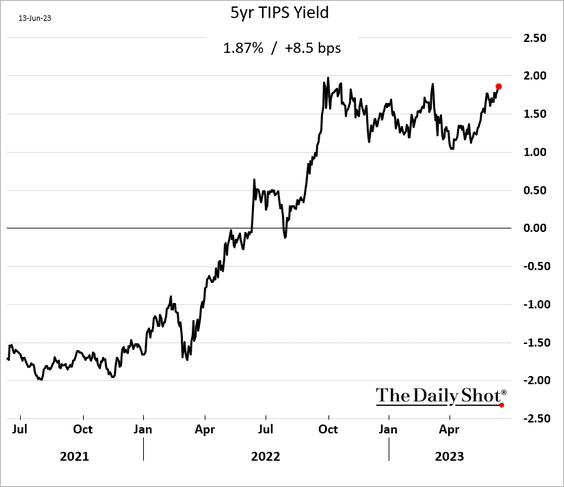

1. US real yields are surging again, which tends to be a headwind for growth stocks.

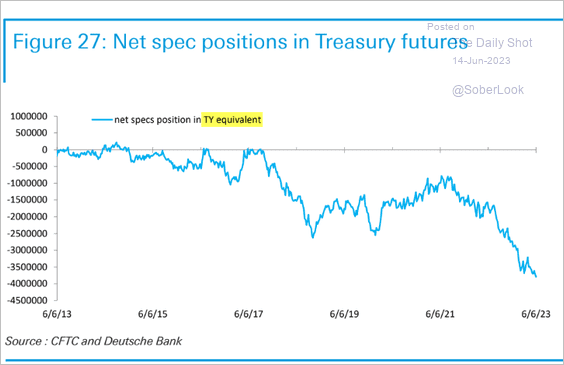

2. Treasury futures positioning remains extraordinarily bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

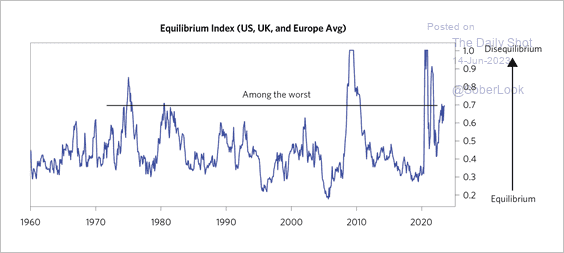

1. According to Bridgewater, the US, Europe, and UK economies have veered away from equilibrium, with risk premiums on assets falling relative to cash.

Source: Bridgewater Associates Read full article

Source: Bridgewater Associates Read full article

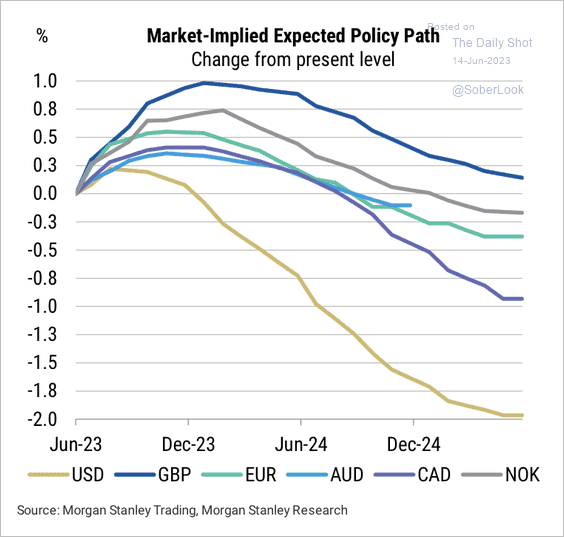

2. The Fed is priced to cut far more than other G10 central banks.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

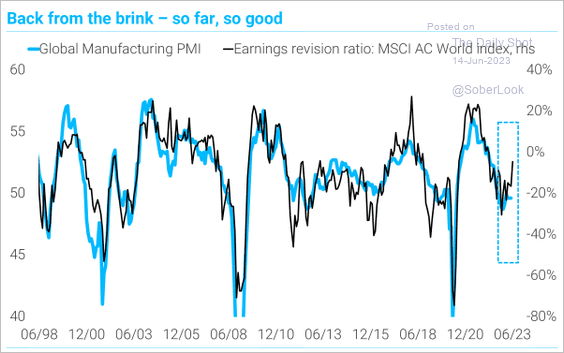

3. Positive corporate earnings revisions signal a rebound in global manufacturing.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

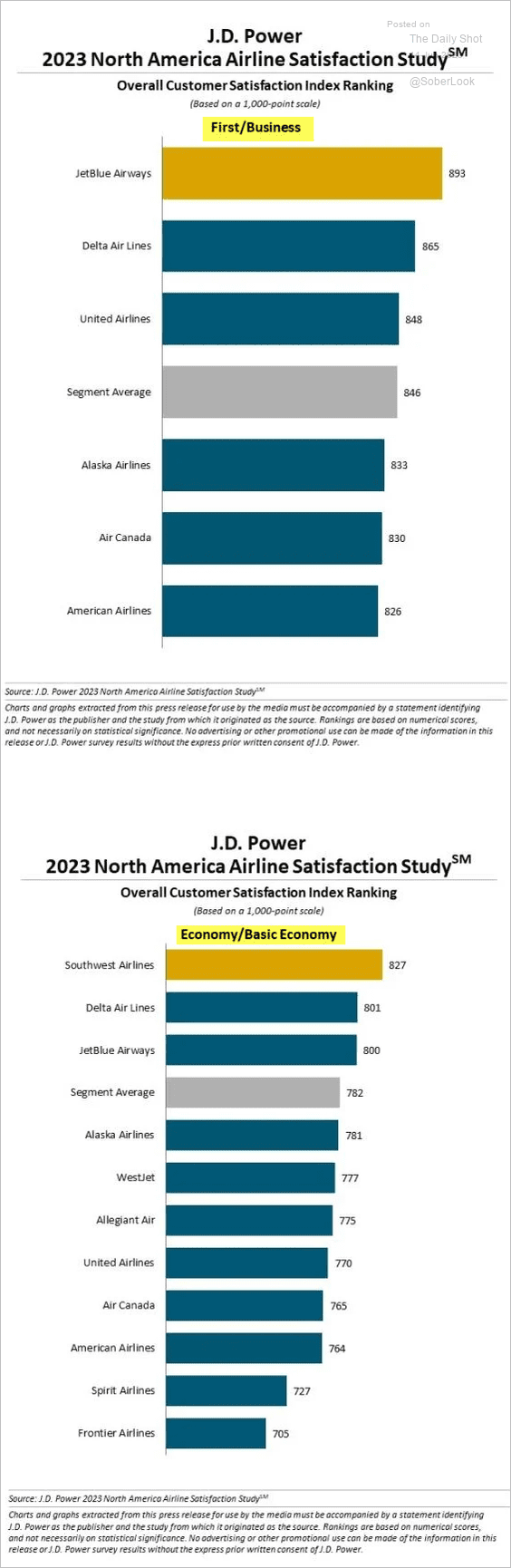

1. Airline satisfaction survey:

Source: J.D.Power

Source: J.D.Power

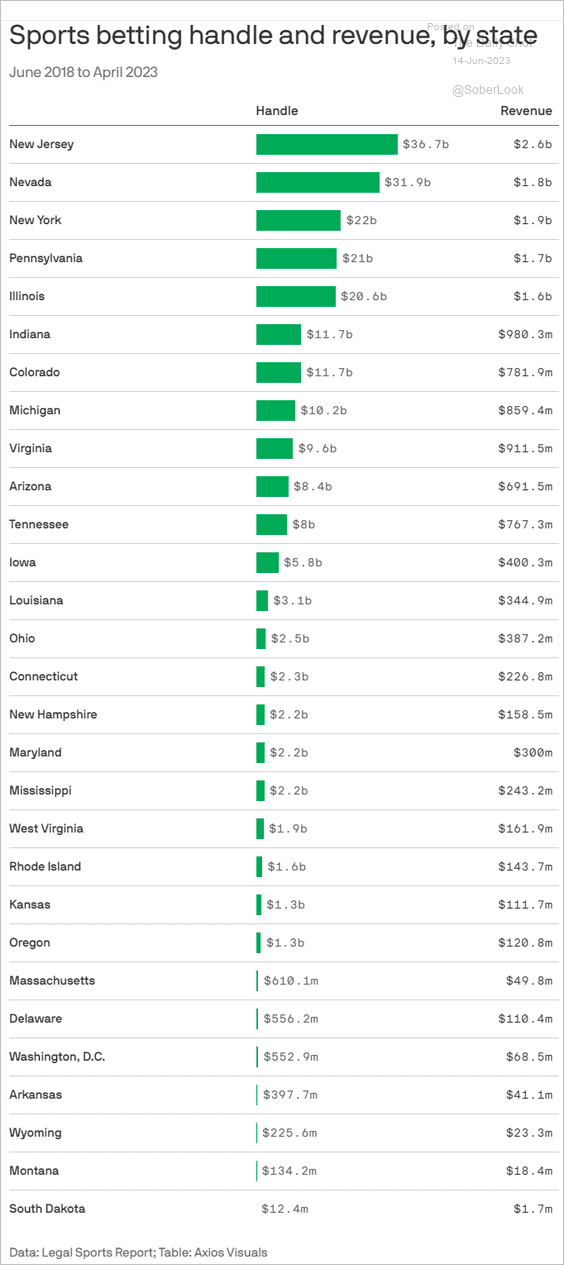

2. Amounts wagered on sports events since June 2018 by state:

Source: @axios Read full article

Source: @axios Read full article

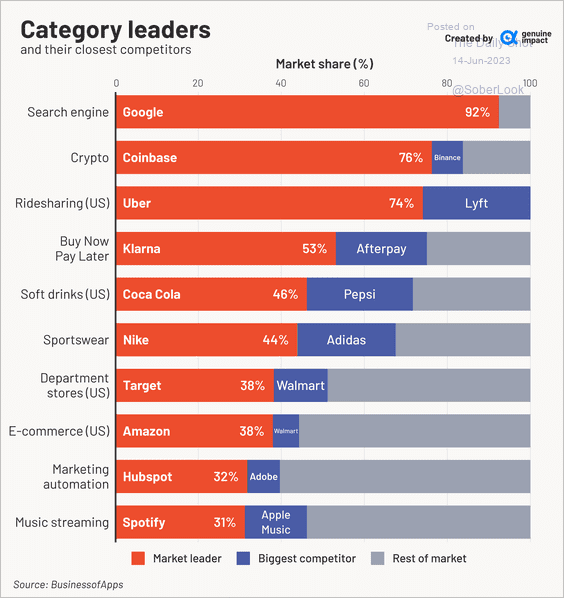

3. Category leaders:

Source: @genuine_impact

Source: @genuine_impact

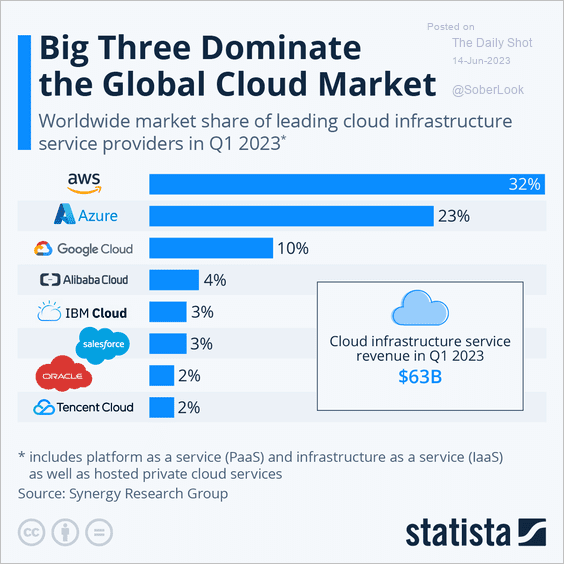

4. Cloud infrastructure market share:

Source: Statista

Source: Statista

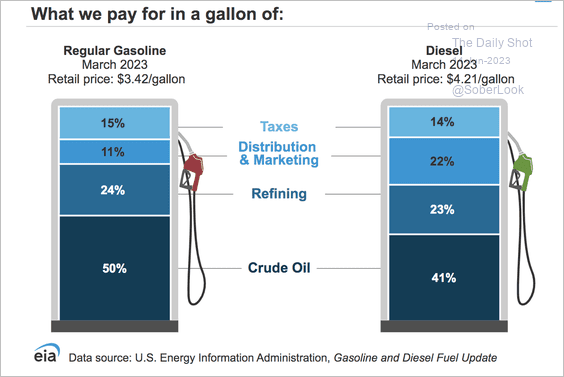

5. Components of gasoline and diesel prices at the pump:

Source: @EIAgov

Source: @EIAgov

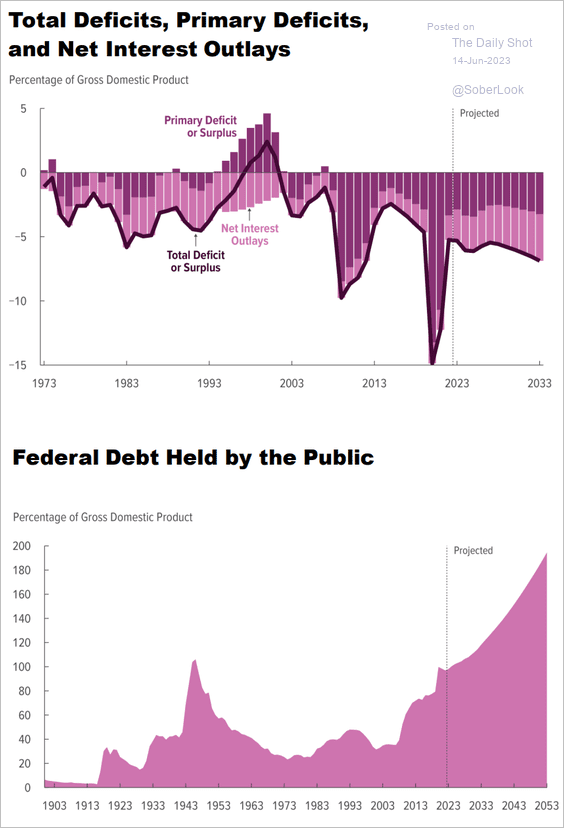

6. The CBO’s latest projections of federal government deficit and debt:

Source: CBO

Source: CBO

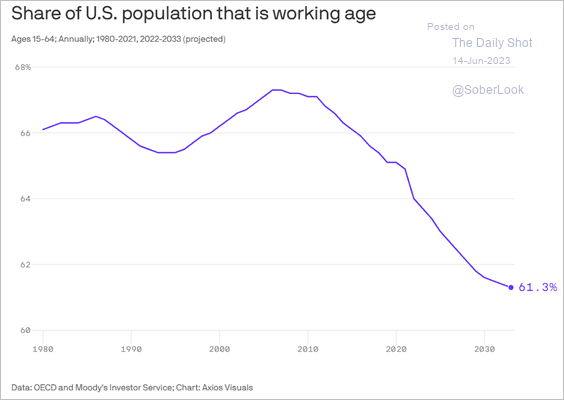

7. Share of working-age Americans in the total population over time:

Source: @axios Read full article

Source: @axios Read full article

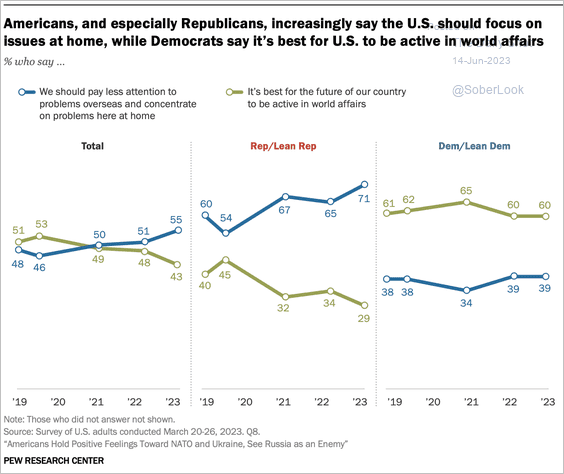

8. Focus on domestic vs. international issues:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

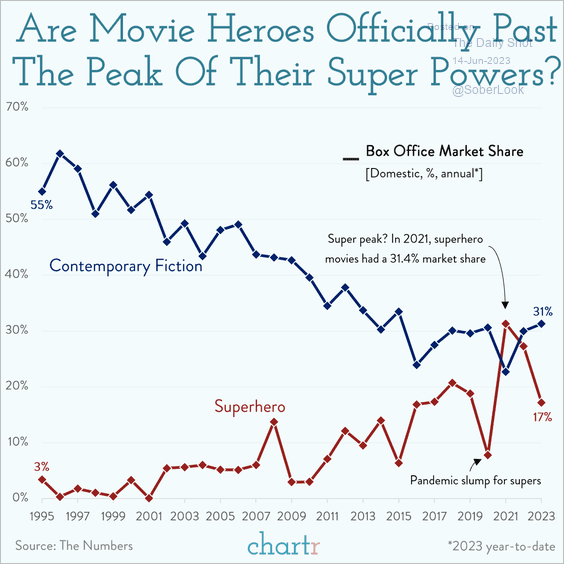

9. Peak superheroes?

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index