The Daily Shot: 19-Jun-23

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

The Daily Shot will not be published this Friday, June 23rd.

Back to Index

The United States

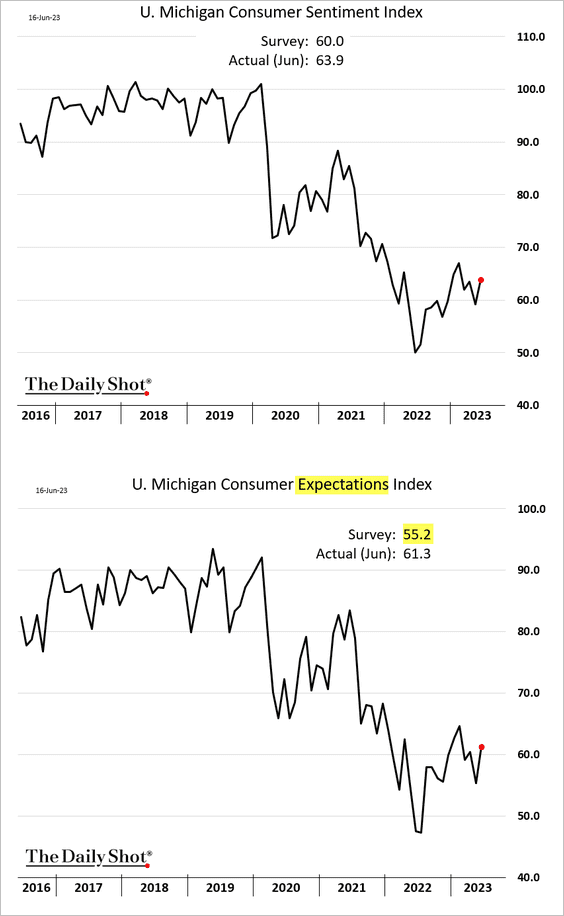

1. The U. Michigan consumer sentiment index showed some improvement this month, topping forecasts.

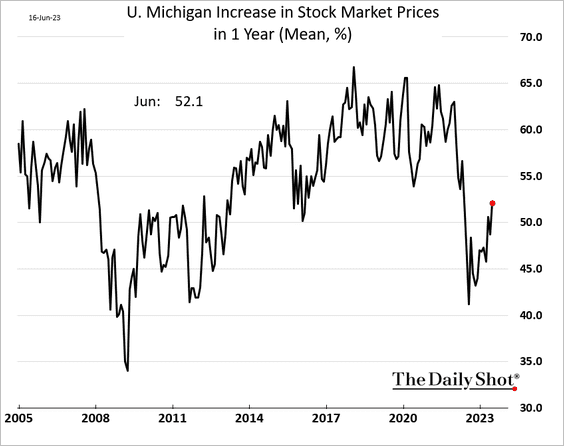

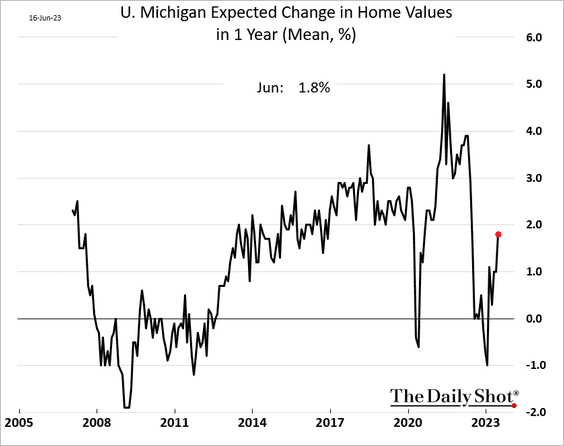

• Positive momentum in the stock market and reduced pessimism surrounding the housing market were a tailwind for sentiment this month.

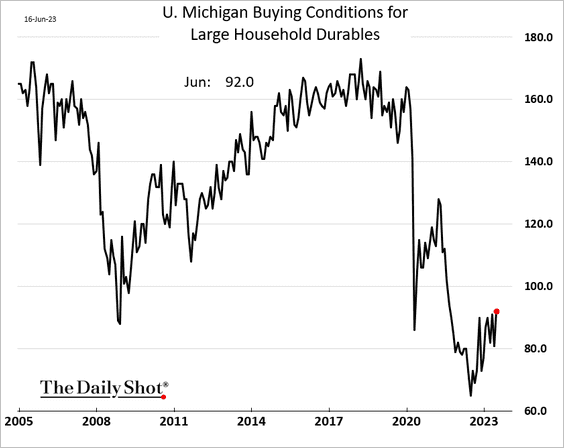

• Buying conditions have been rebounding from extreme lows.

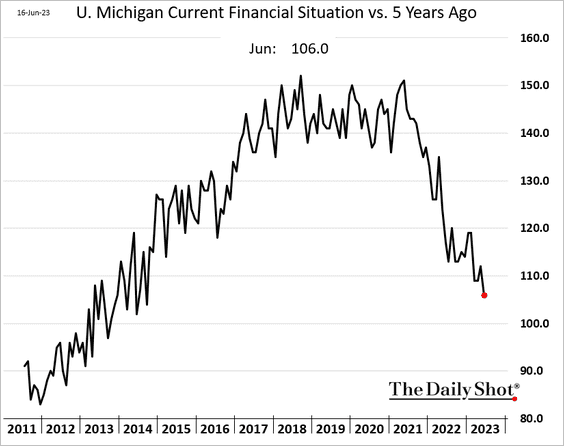

• However, consumers are growing more unsettled with their present financial circumstances in comparison to their situation five years ago.

——————–

2. Next, we have some updates on inflation.

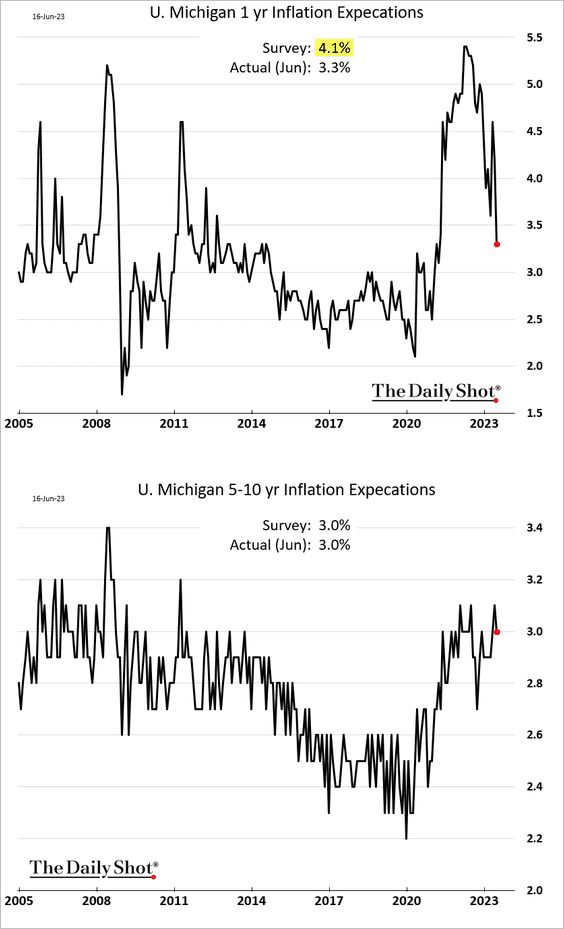

• The U. Michigan one-year inflation expectations index declined sharply this month. Longer-term inflation expectations remain elevated.

Source: Reuters Read full article

Source: Reuters Read full article

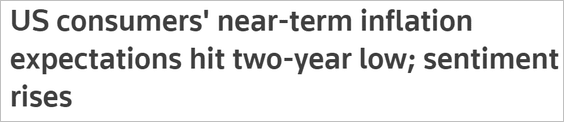

– The decrease in inflation expectations can be attributed, in part, to easing grocery prices.

Source: @WhiteHouseCEA

Source: @WhiteHouseCEA

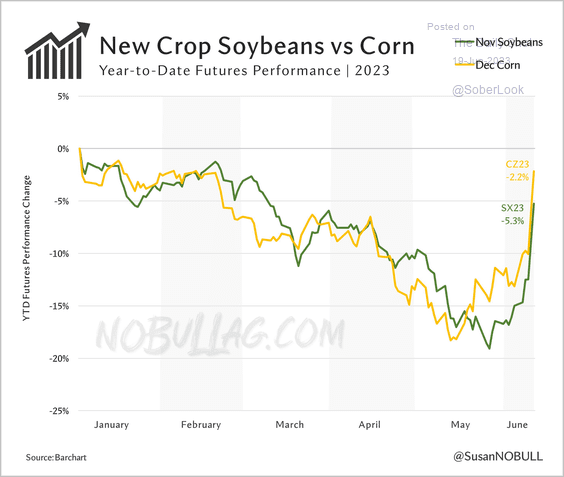

– However, the recent surge in grain prices is likely to reverse this trend.

Source: @SusanNOBULL

Source: @SusanNOBULL

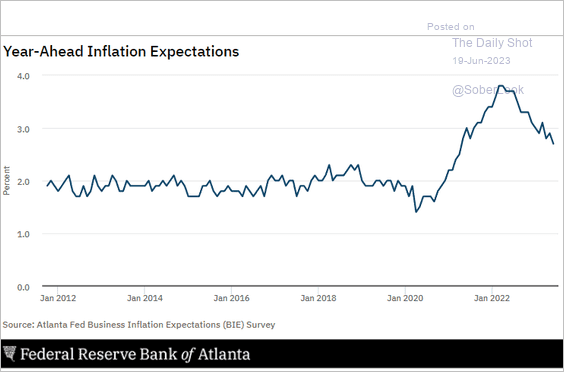

• Business inflation expectations are also moving lower.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

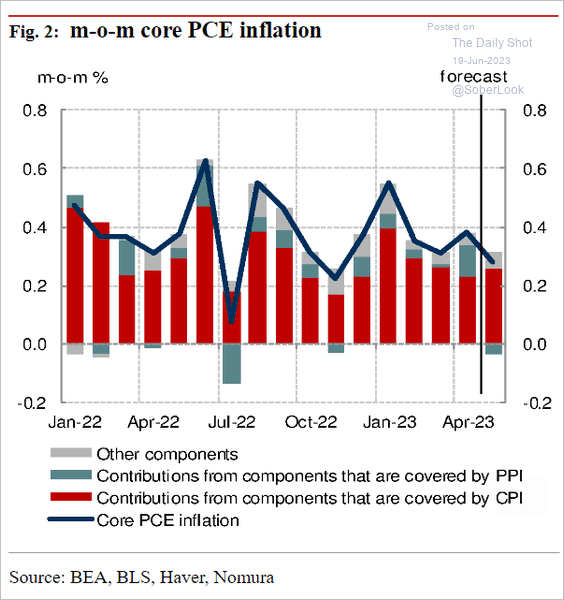

• Nomura expects a decline in the core PCE inflation figure for the month of May, …

Source: Nomura Securities

Source: Nomura Securities

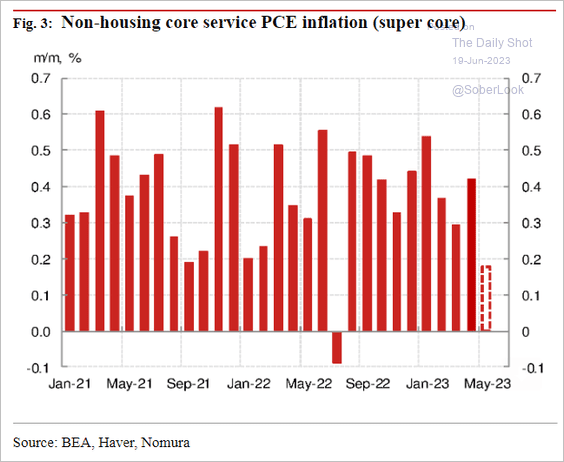

… with a sharp drop in the super-core PCE.

Source: Nomura Securities

Source: Nomura Securities

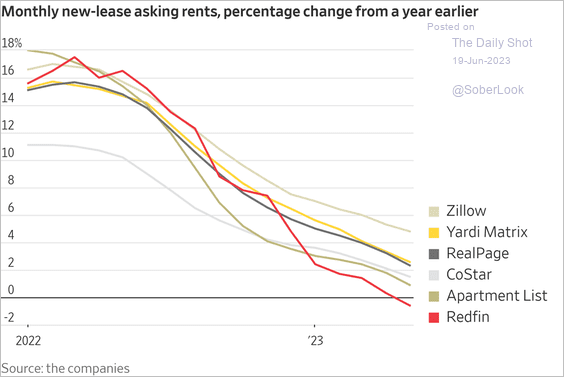

• Private measures of rent inflation continue to trend lower.

Source: @WSJ Read full article

Source: @WSJ Read full article

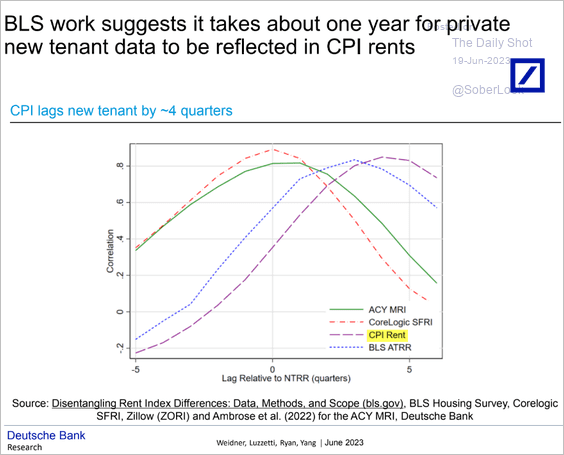

However, private new-tenant rent data takes about a year to show up in the CPI figures.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

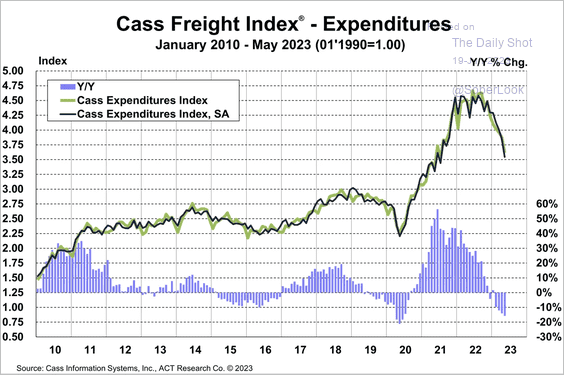

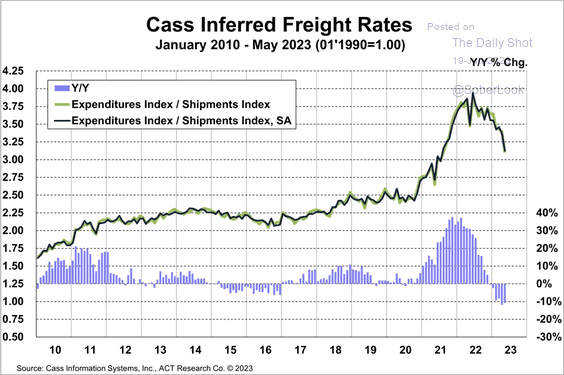

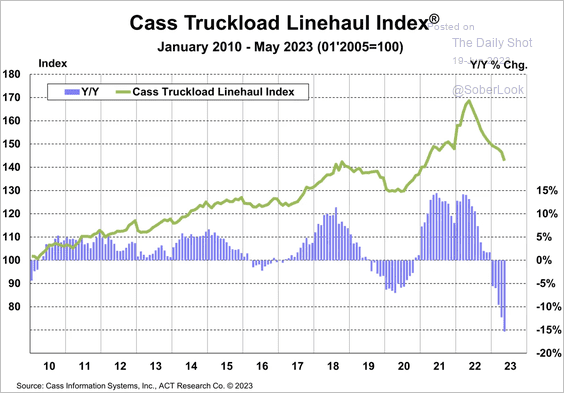

• Freight spending and costs have been rolling over.

Source: Cass Information Systems

Source: Cass Information Systems

Source: Cass Information Systems

Source: Cass Information Systems

Trucking industry prices are down sharply.

Source: Cass Information Systems

Source: Cass Information Systems

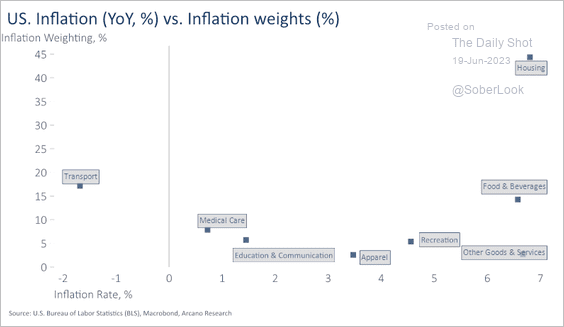

• Here is a look at US inflation components and their weights.

Source: Arcano Economics

Source: Arcano Economics

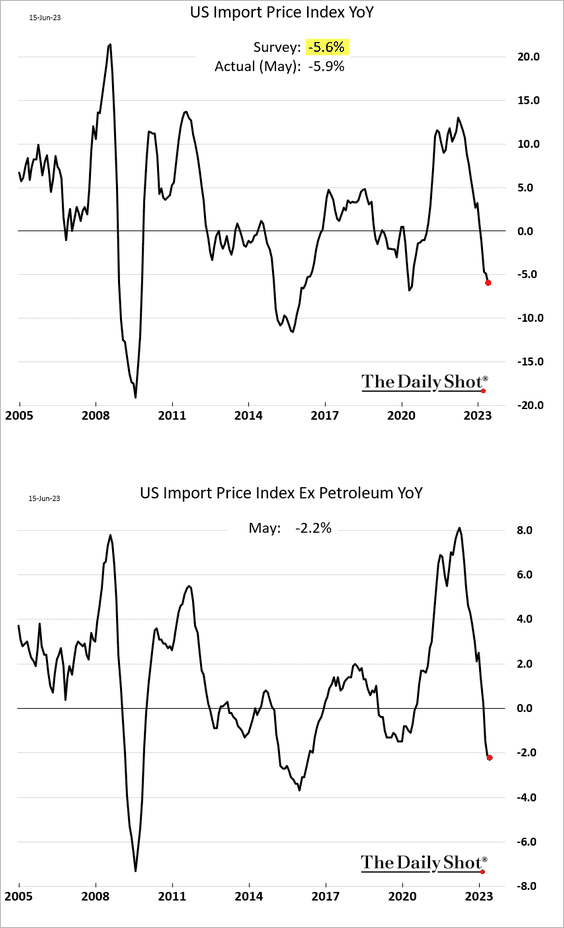

• Import prices are falling.

• Will semiconductor prices start rising again later this year?

![]() Source: Scotiabank Economics

Source: Scotiabank Economics

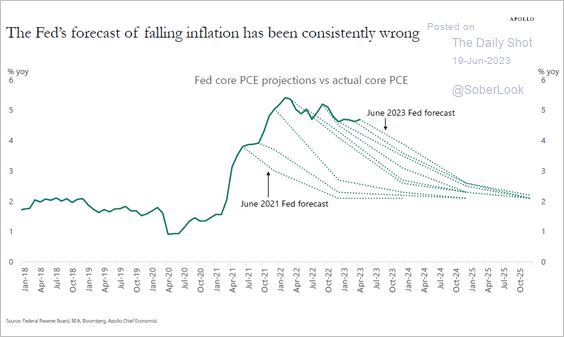

• Economists’ inflation forecasts have been persistently too low.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

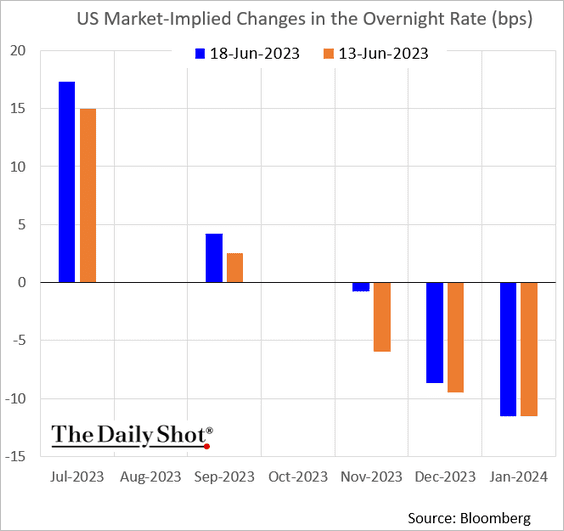

3. Fed officials are preparing the market for more rate increases.

Source: @Jonnelle, @economics Read full article

Source: @Jonnelle, @economics Read full article

Source: @SteveMatthews12, @economics Read full article

Source: @SteveMatthews12, @economics Read full article

A July hike increasingly looks likely. Could we also see one in September?

——————–

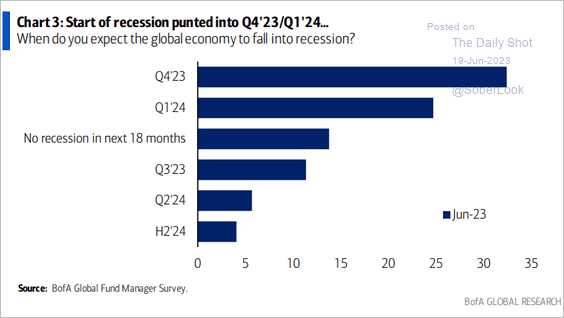

4. The timeline for recession expectations continues to be pushed further into the future.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

The United Kingdom

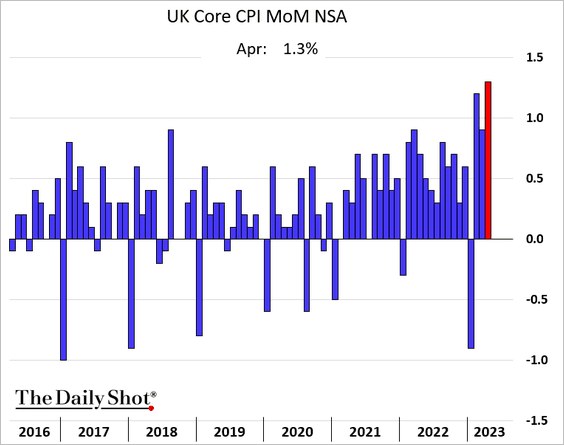

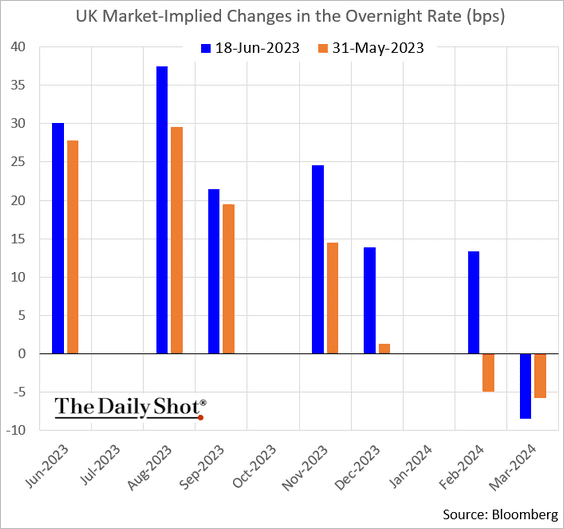

1. Elevated core inflation …

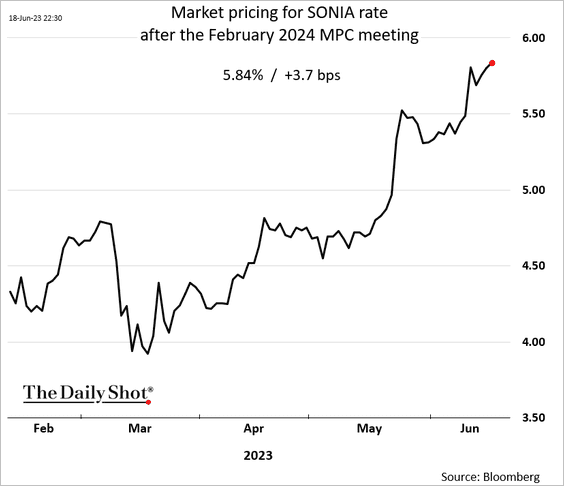

… is fueling bets on multiple BoE rate hikes ahead, going into next year.

• The market is pricing in an additional 140 bps of BoE rate hikes in this cycle. Too hawkish?

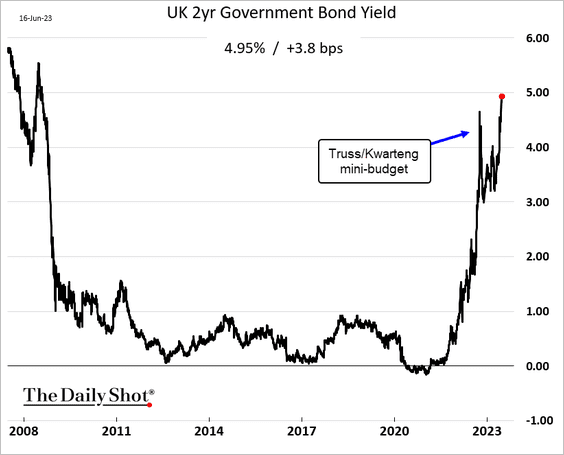

• Short-term gilt yields have been surging.

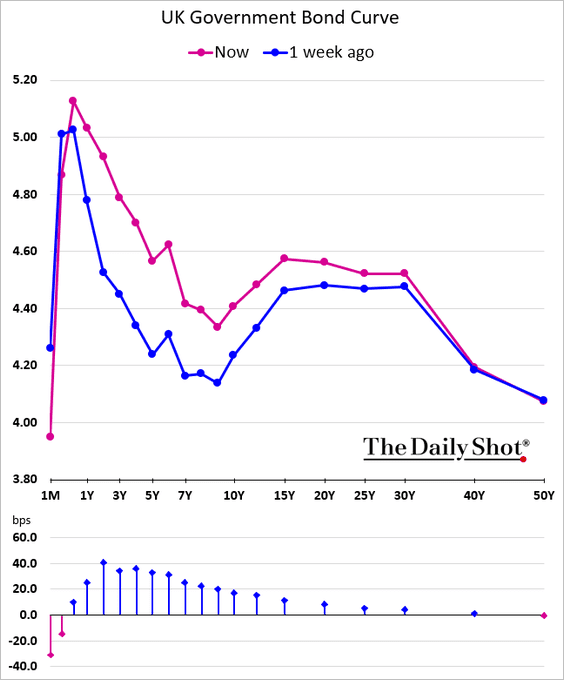

– Here is the yield curve.

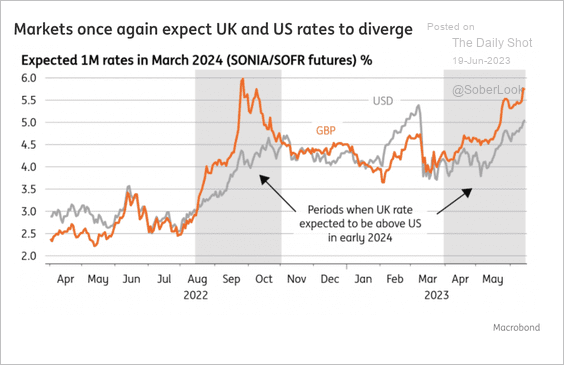

– UK short-term rate expectations are outpacing the US.

Source: ING

Source: ING

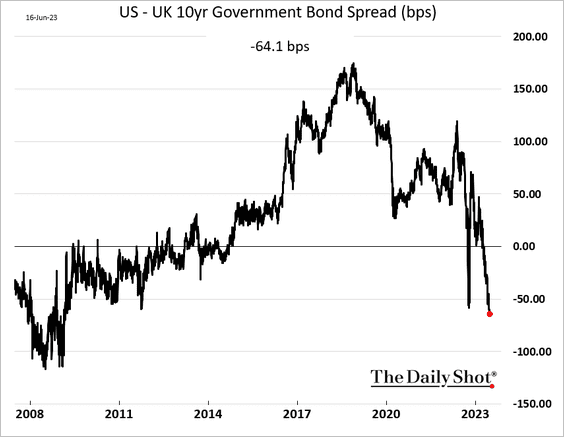

And here is a look at the US-UK 10yr spread.

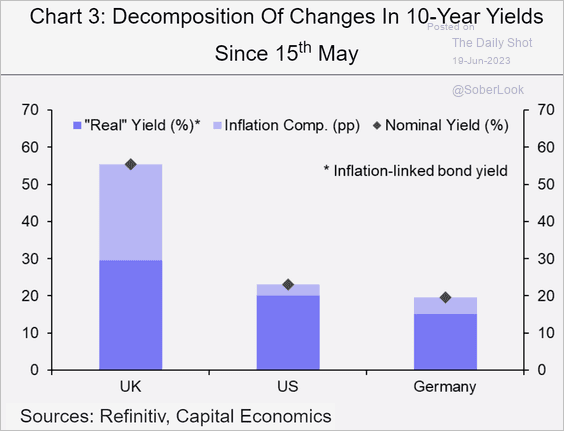

– Gilts are pricing in a lot of inflation.

Source: Capital Economics

Source: Capital Economics

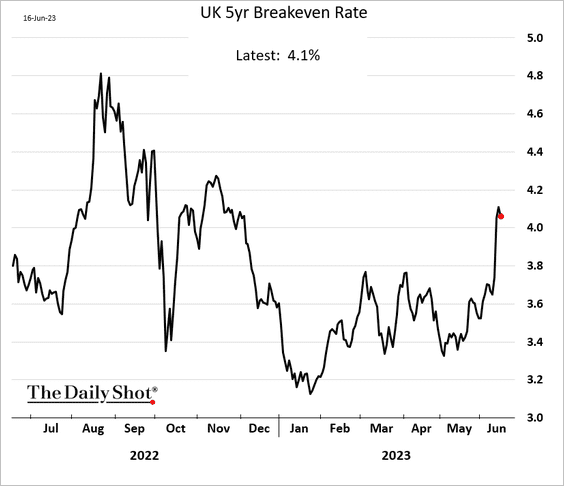

Market-based inflation expectations jumped this month.

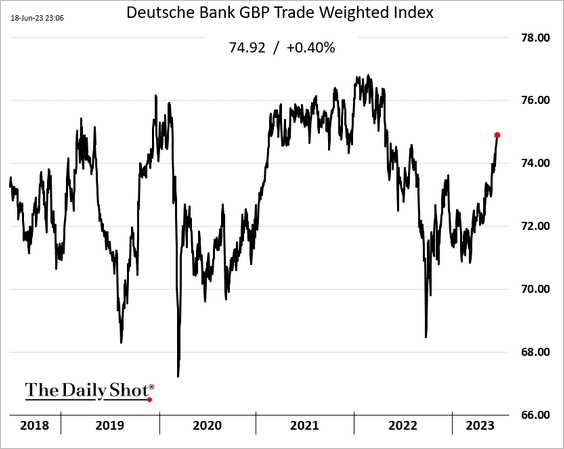

• The pound is surging.

——————–

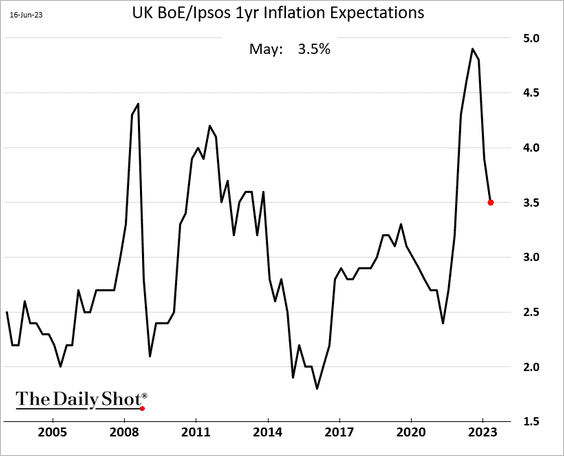

2. Consumer inflation expectations are moderating.

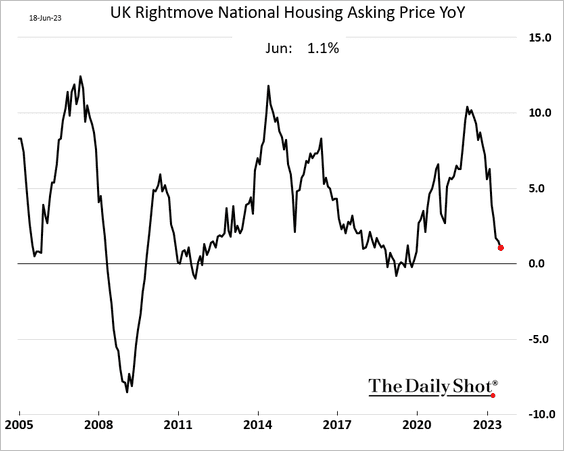

3. Home price appreciation continues to ease.

Back to Index

The Eurozone

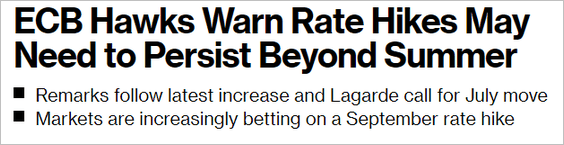

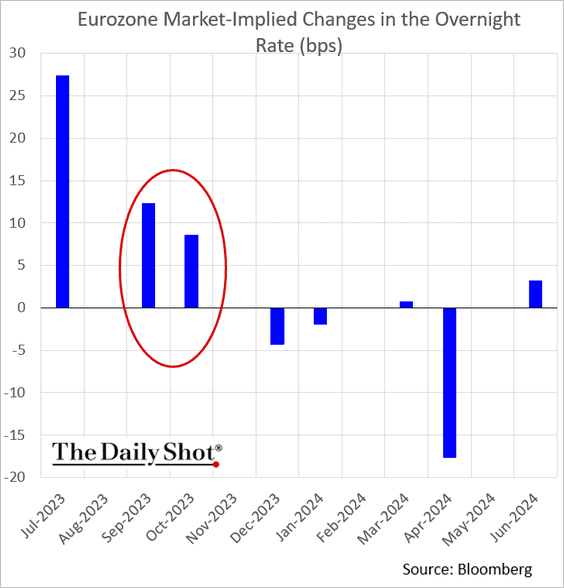

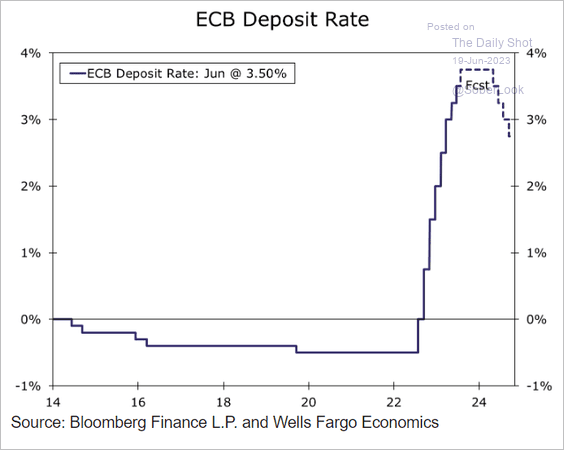

1. ECB officials signal potential rate hikes beyond this summer.

Source: @jrandow, @WeberAlexander, @economics Read full article

Source: @jrandow, @WeberAlexander, @economics Read full article

Wells Fargo sees the ECB being done next month.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

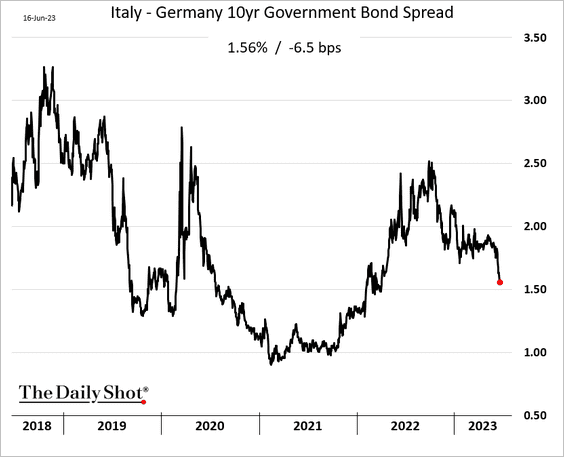

2. Italian bond spreads have been tightening rapidly.

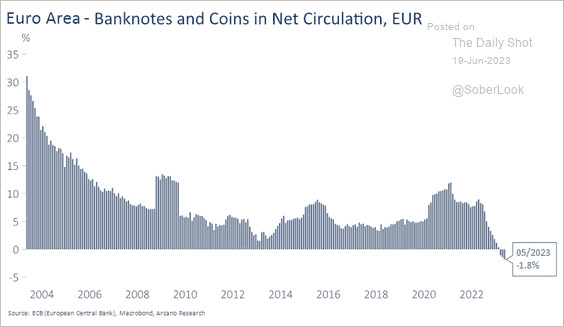

3. Here is a look at banknotes and coins in circulation.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Europe

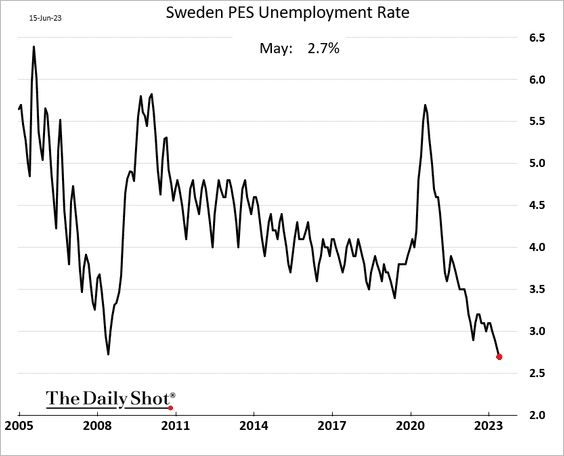

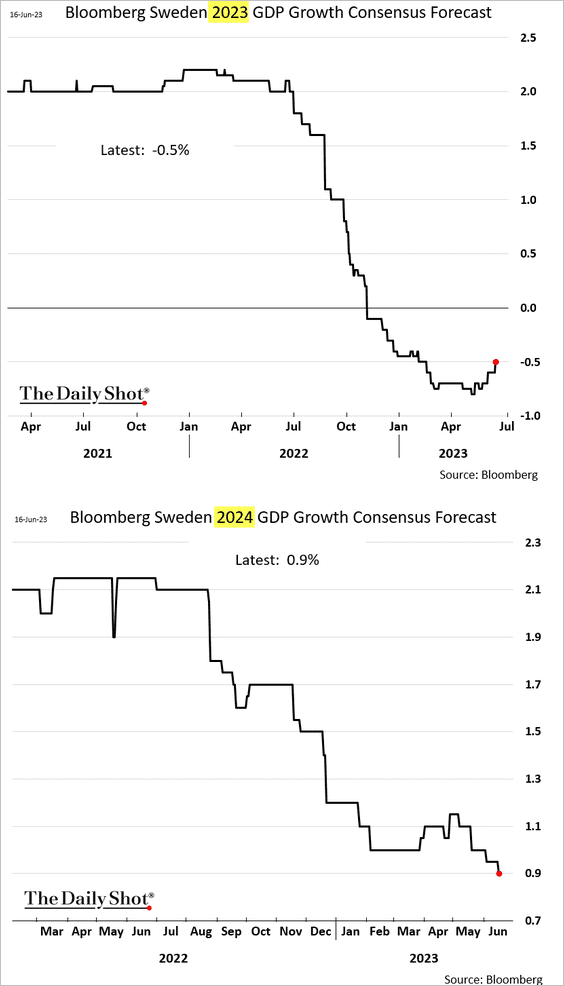

1. Sweden’s unemployment is at multi-year lows.

Economists have been revising their 2023 GDP forecasts higher while lowering growth projections for next year.

——————–

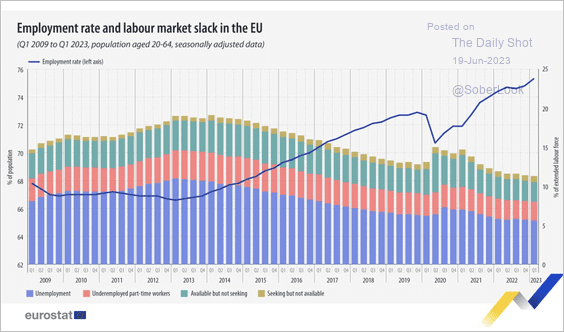

2. The chart below shows the labor market slack in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

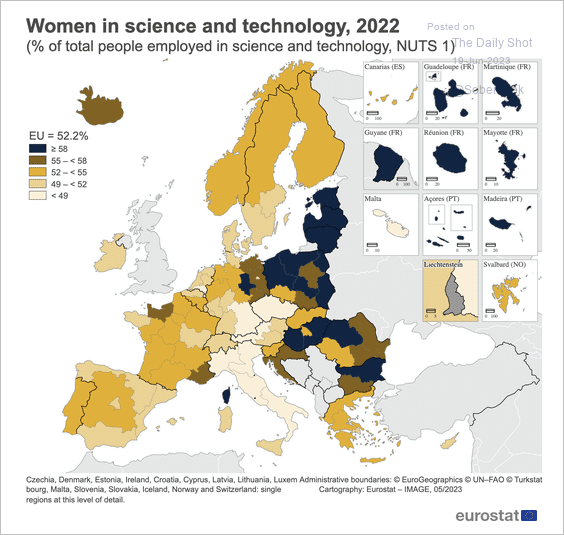

3. Here is a look at women in science and technology.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

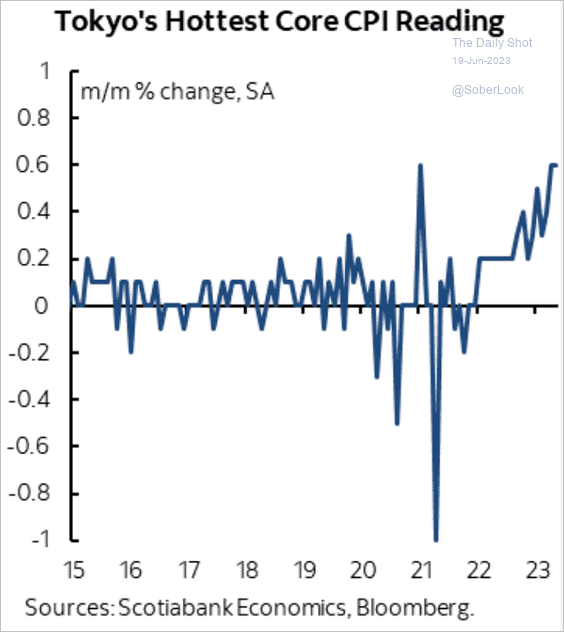

1. The Tokyo core CPI has been surging.

Source: Scotiabank Economics

Source: Scotiabank Economics

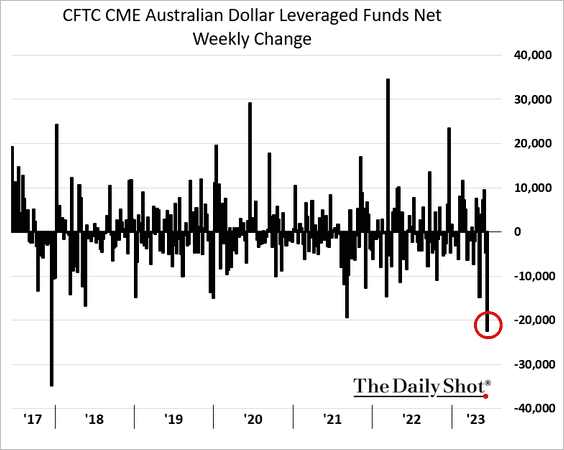

2. Hedge funds boosted their bets against the Aussie dollar last week.

Back to Index

China

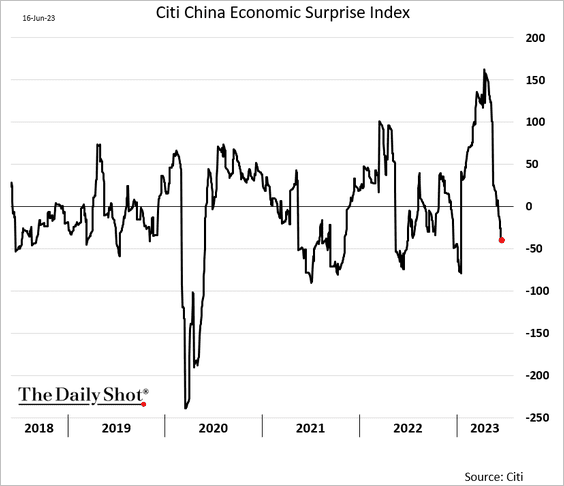

1. The Citi Economic Surprise Index has been deteriorating as the economic rebound loses steam.

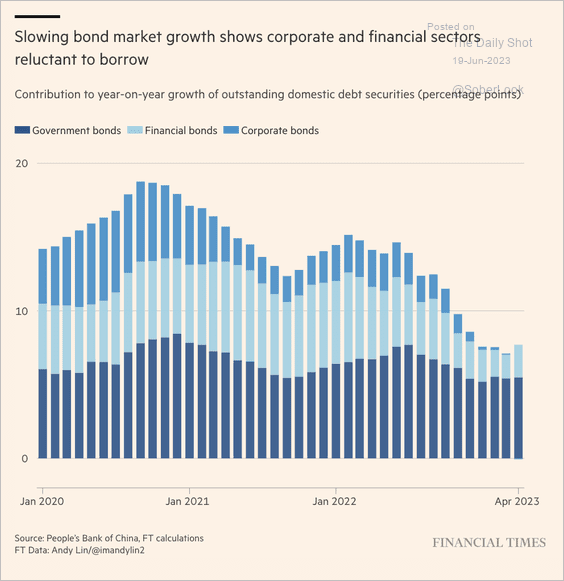

2. Corporate and financial debt securities growth has been slowing.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

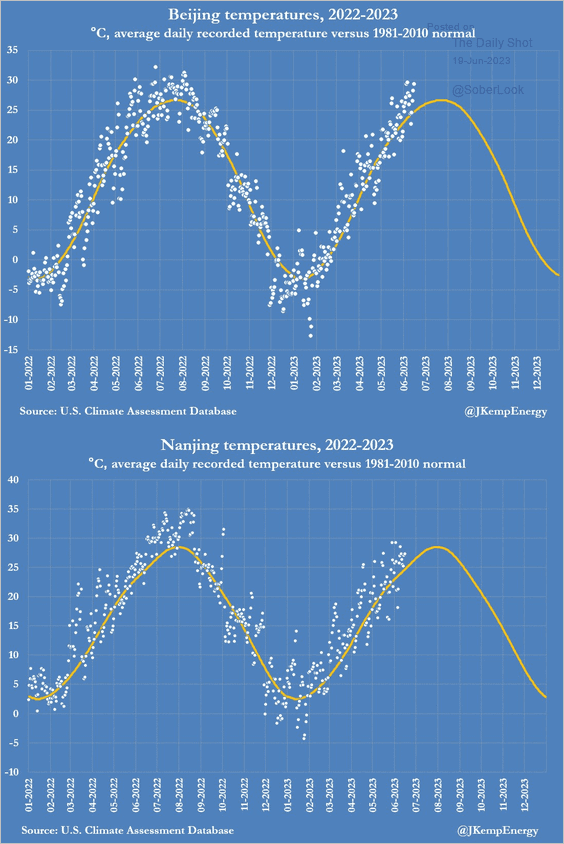

3. The scorching heat wave sweeping across various regions of China is intensifying the strain on the electricity grid.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Emerging Markets

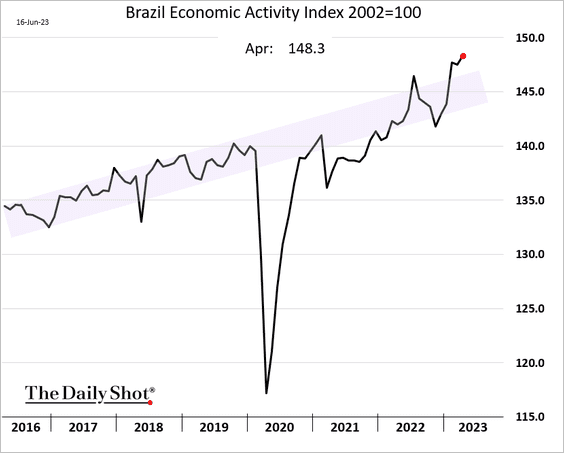

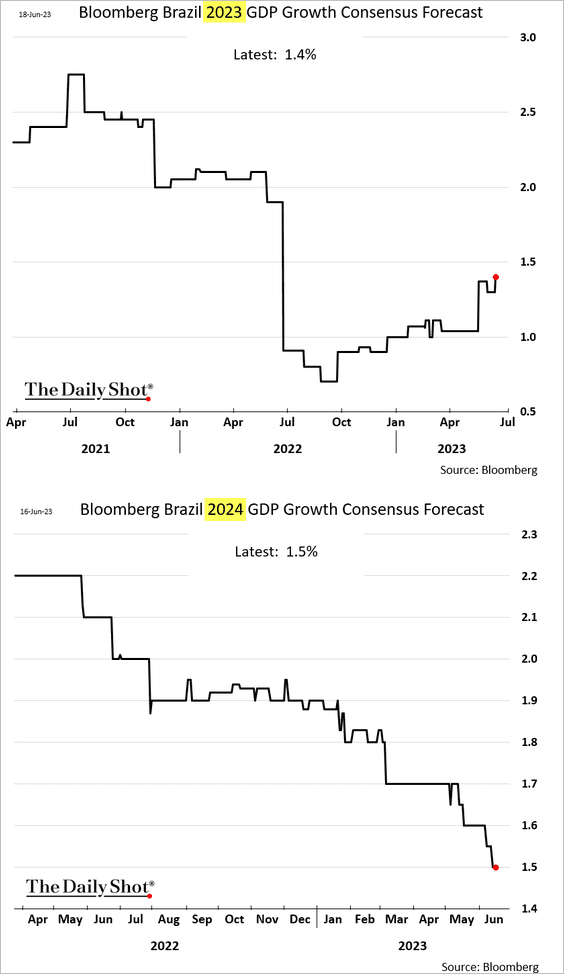

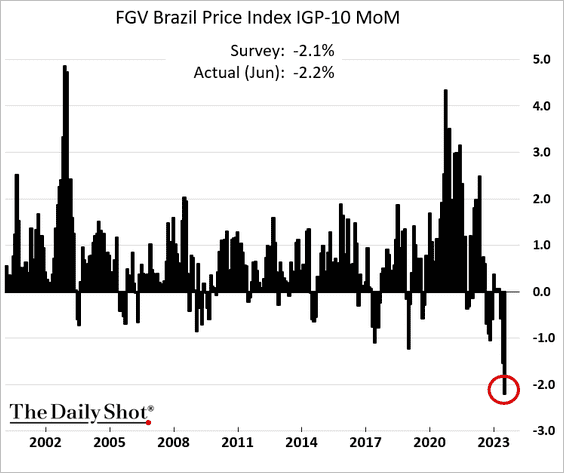

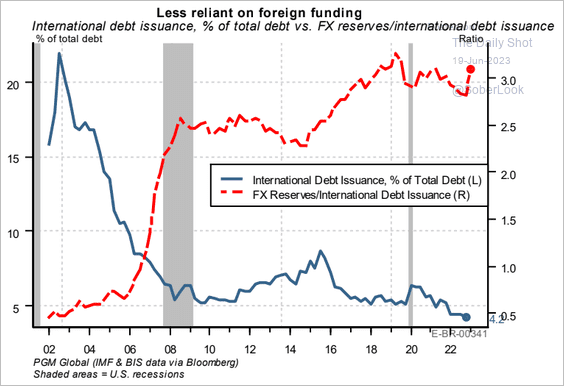

1. Let’s begin with Brazil.

• The economic activity index:

• Economists’ projections for the 2023 and 2024 GDP growth:

• The broad price index monthly change (includes consumer prices, producer prices, and construction costs):

• Decreased reliance on foreign funding:

Source: PGM Global

Source: PGM Global

——————–

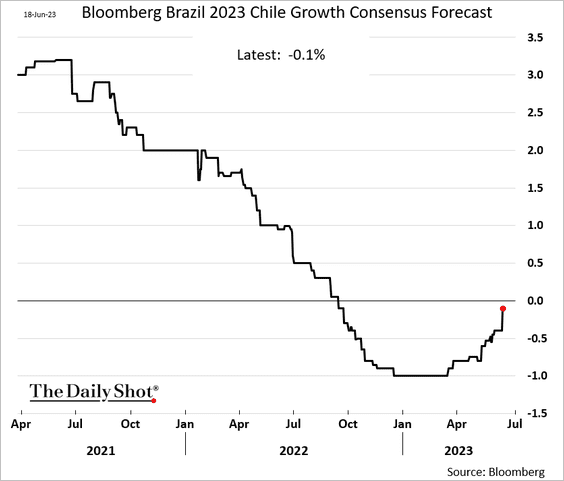

2. Economists have been upgrading their forecasts for Chile’s GDP growth this year.

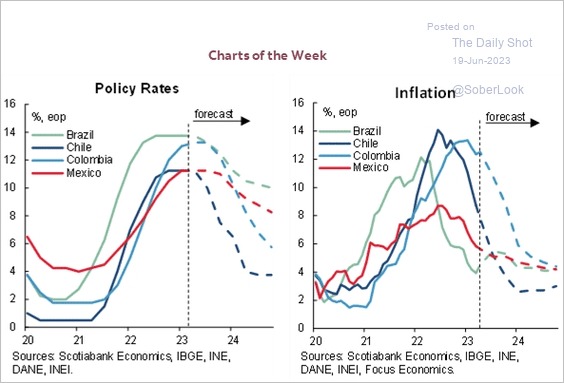

3. LatAm rate cuts are coming soon.

Source: Scotiabank Economics

Source: Scotiabank Economics

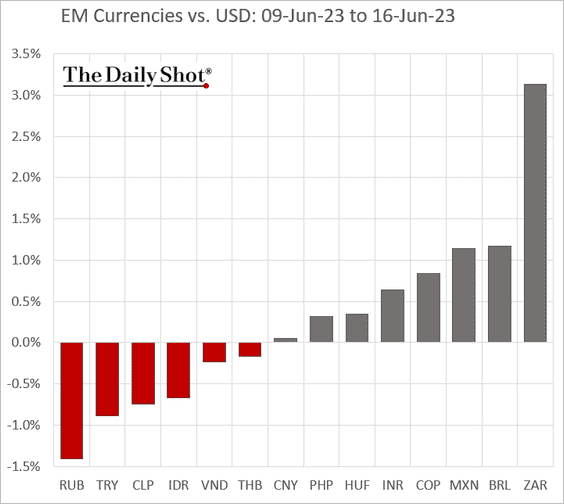

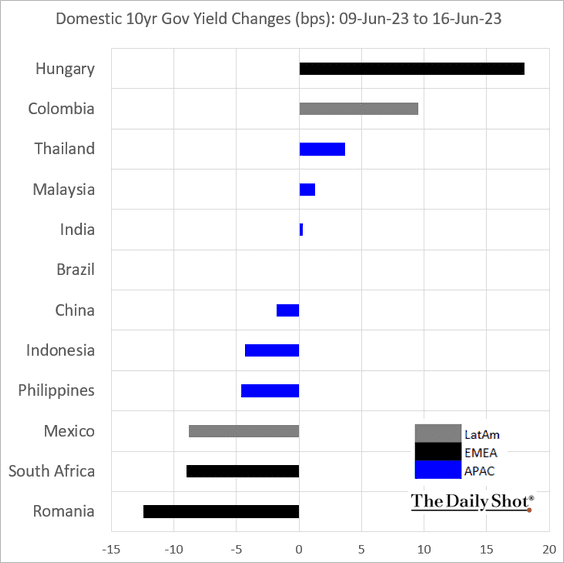

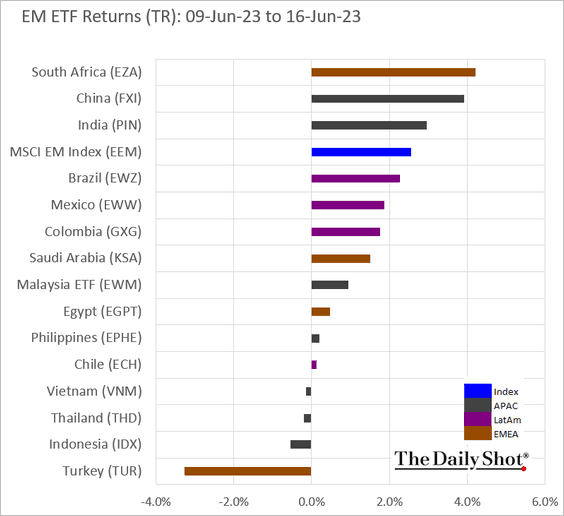

4. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

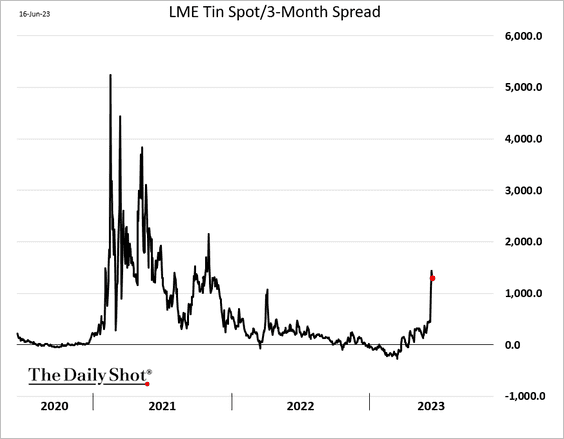

1. Tin is in backwardation again, signaling tightness in the market.

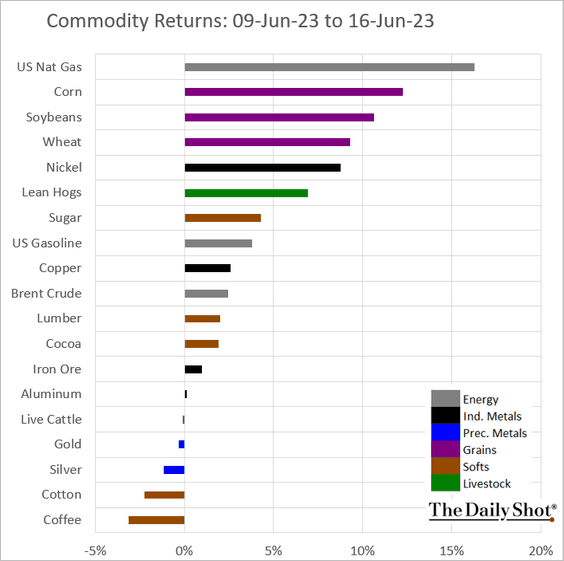

2. Below is last week’s performance across key commodity markets.

Back to Index

Equities

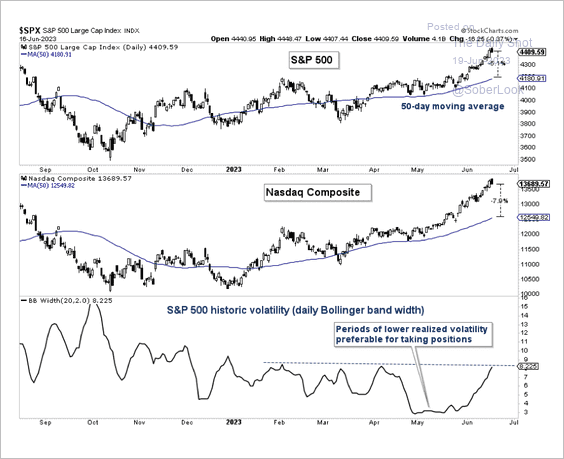

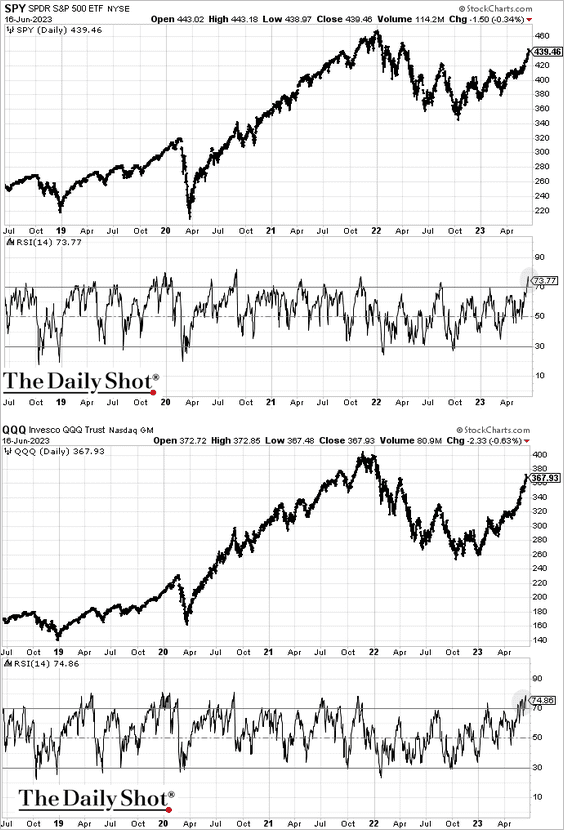

1. The S&P 500 and Nasdaq Composite appear extended over the short term.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Here are the RSI indicators.

——————–

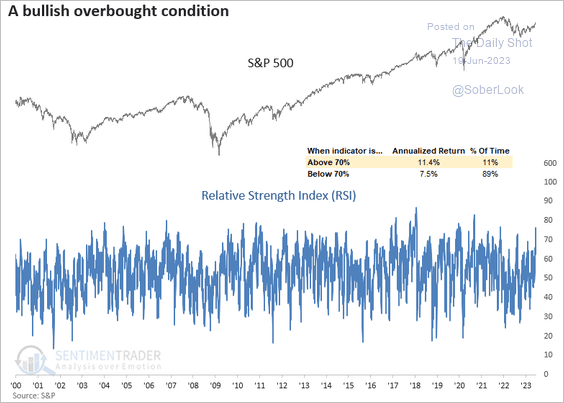

2. Historically, spikes in bullish price momentum precede higher returns. Stocks can remain overbought in an uptrend.

Source: SentimenTrader

Source: SentimenTrader

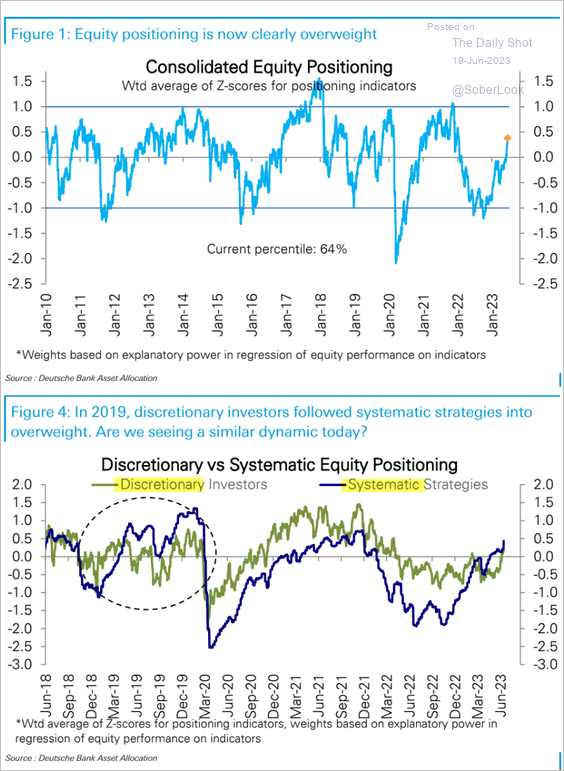

3. Deutsche Bank’s positioning indicator moved deeper into overweight territory, with both systematic and discretionary strategies rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4 Goldman’s equity desk is seeing long-only demand for the “everything else” trade.

Source: Goldman Sachs

Source: Goldman Sachs

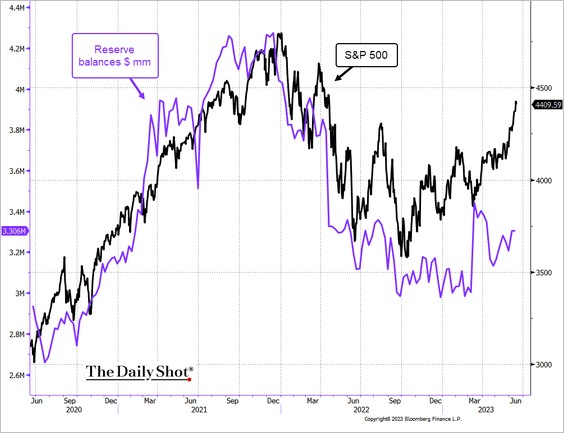

5. The S&P 500 has diverged from reserves (bank liquidity held at the Fed).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

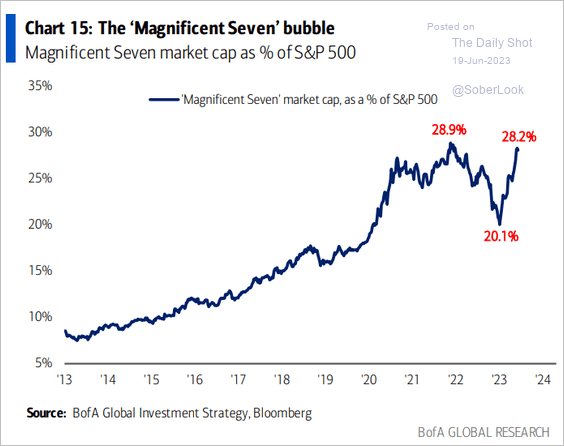

6. The mega-cap concentration in the S&P 500 is back near the peak.

Source: BofA Global Research

Source: BofA Global Research

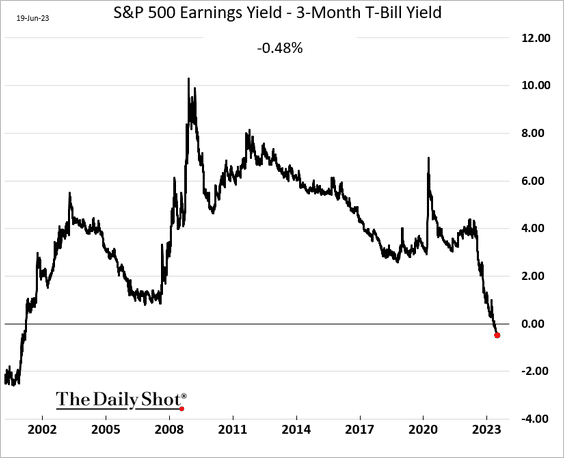

7. The S&P 500 earnings yield is now well below cash yield.

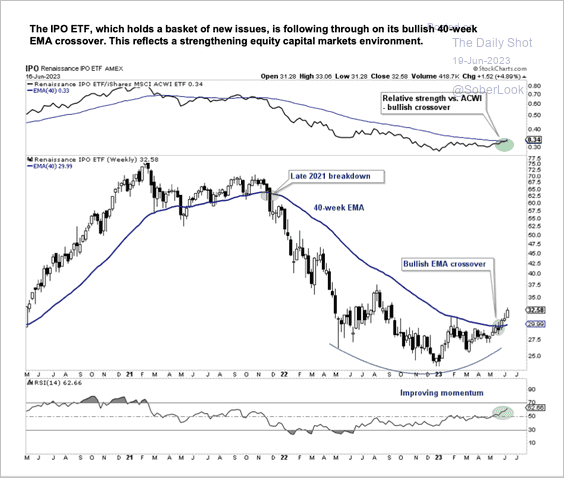

8. The Renaissance IPO ETF (IPO) is improving on an absolute and relative basis.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

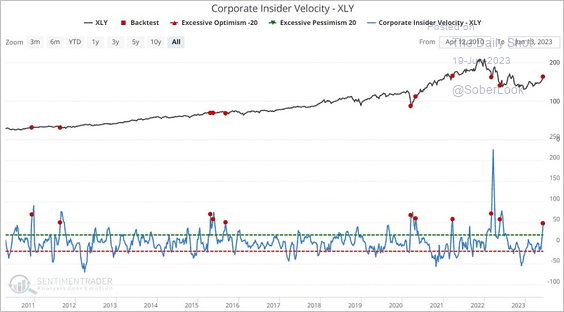

9. Corporate insiders have turned bullish on S&P 500 consumer discretionary stocks.

Source: SentimenTrader

Source: SentimenTrader

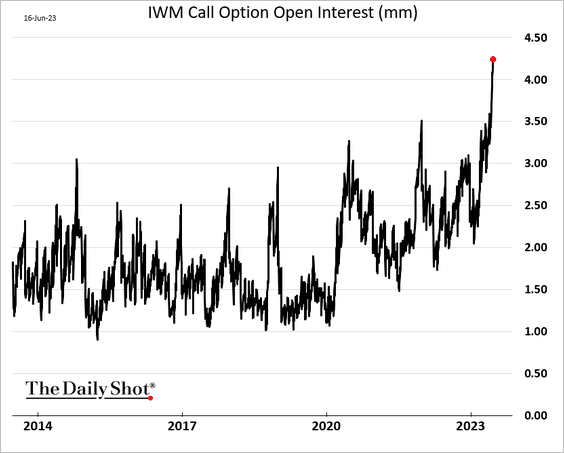

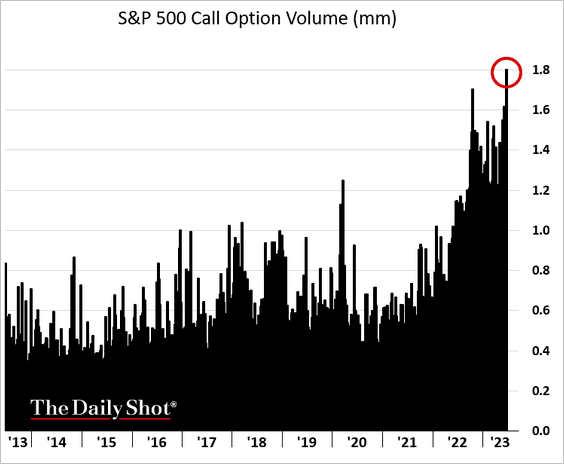

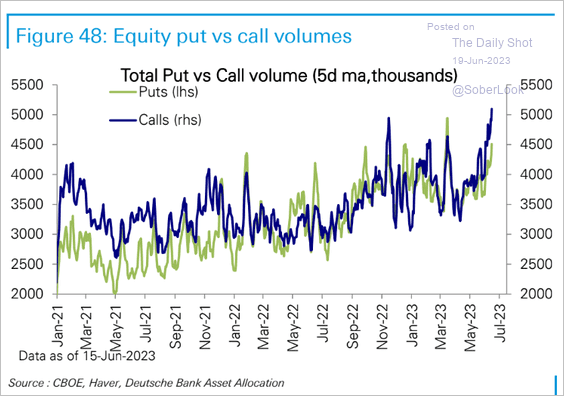

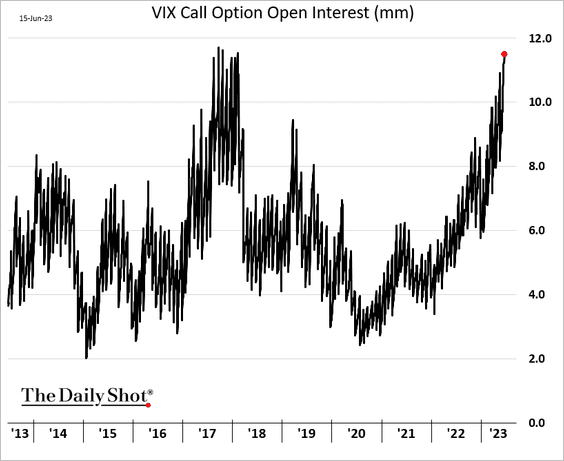

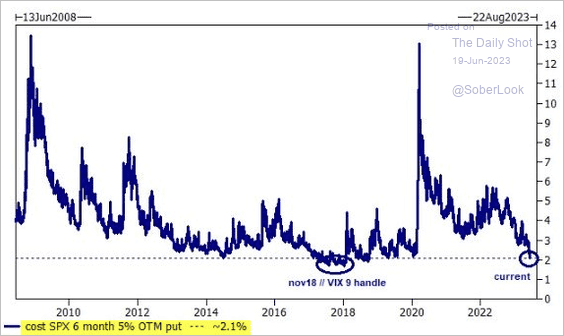

10. Next, let’s look at some trends in the options market.

• IWM (Russell 2000 ETF) call option open interest hit a new high.

• Here is the S&P 500 call option trading volume.

– The total call option volume has also been climbing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• But the VIX call option open interest has been surging as well (bets on higher vol).

• Put options are becoming cheap.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

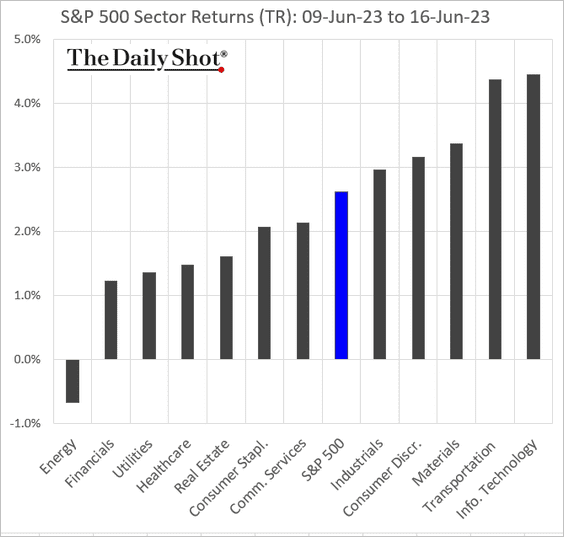

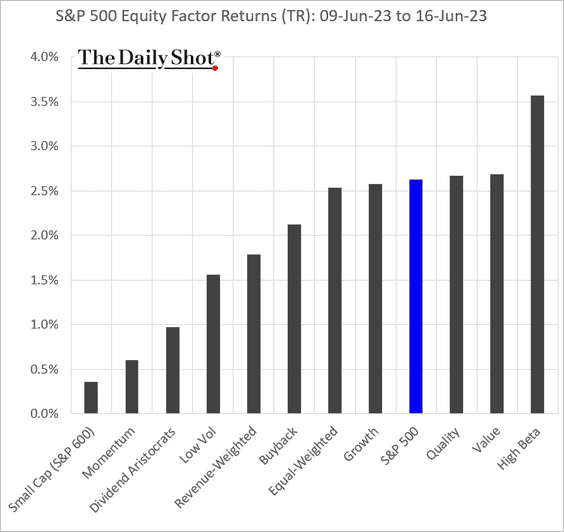

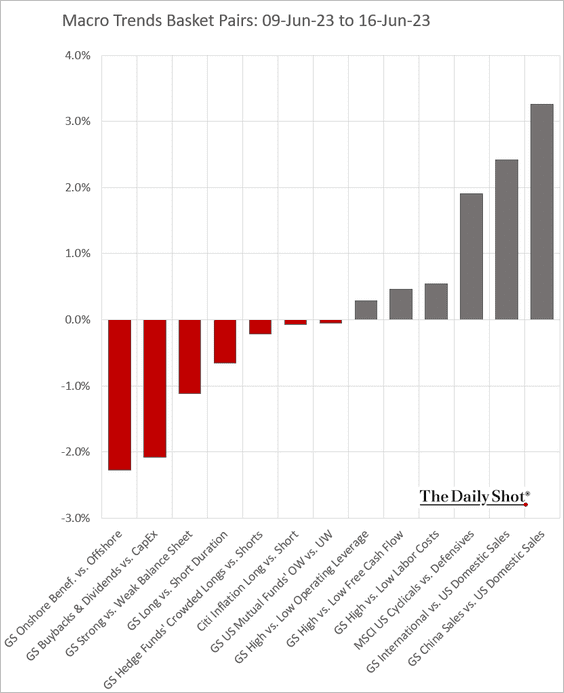

11. Finally, we have last week’s performance data.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

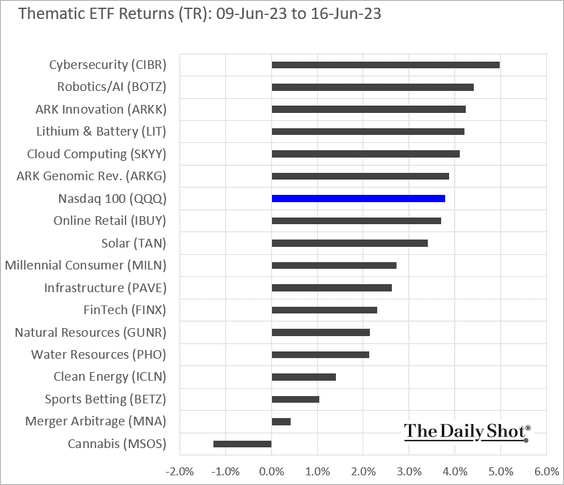

• Thematic ETFs:

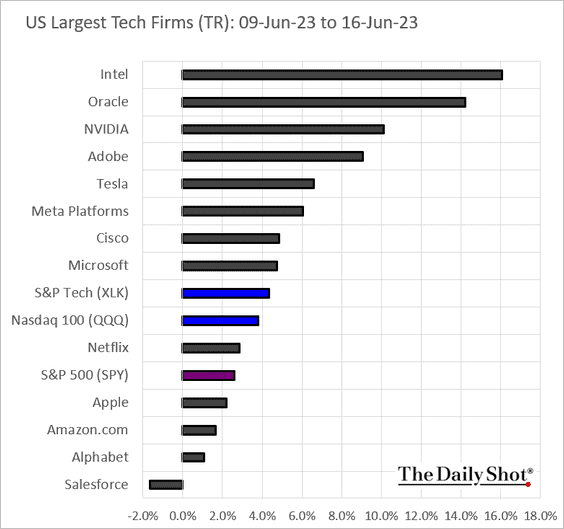

• Largest US tech firms:

Back to Index

Alternatives

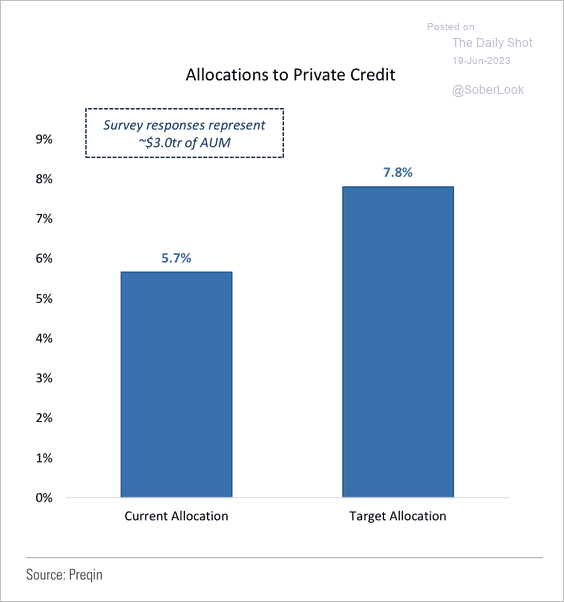

1. Institutions are under-allocated to private credit relative to their targets by at least 200 basis points.

Source: Goldman Sachs

Source: Goldman Sachs

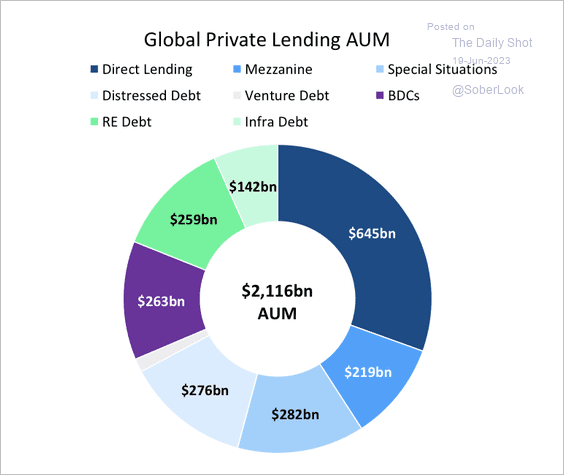

2. Direct lending accounts for the largest part of private credit assets under management, with a balanced mix across other categories.

Source: Goldman Sachs

Source: Goldman Sachs

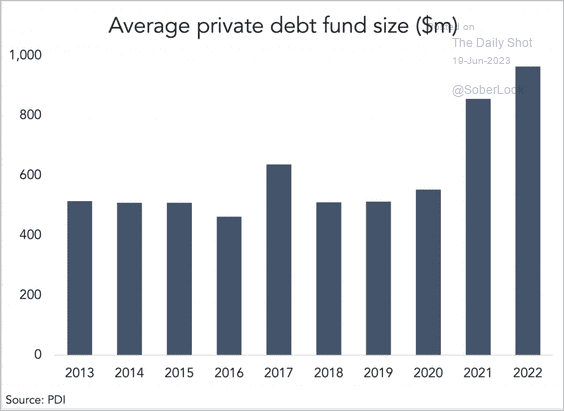

3. The average private debt fund size has been climbing.

Source: @theleadleft

Source: @theleadleft

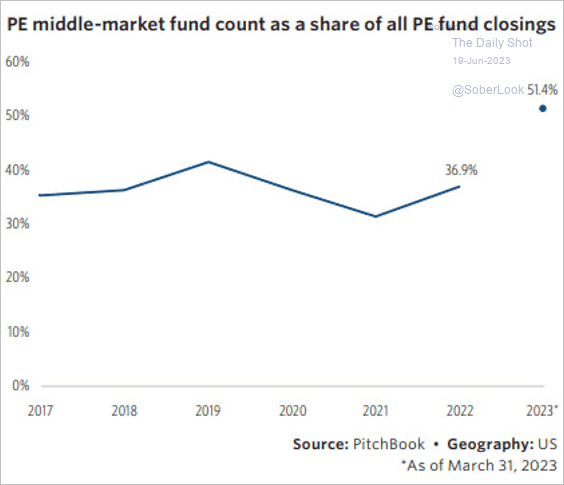

4. The middle market’s share of private equity funds is at its highest in years.

Source: PitchBook

Source: PitchBook

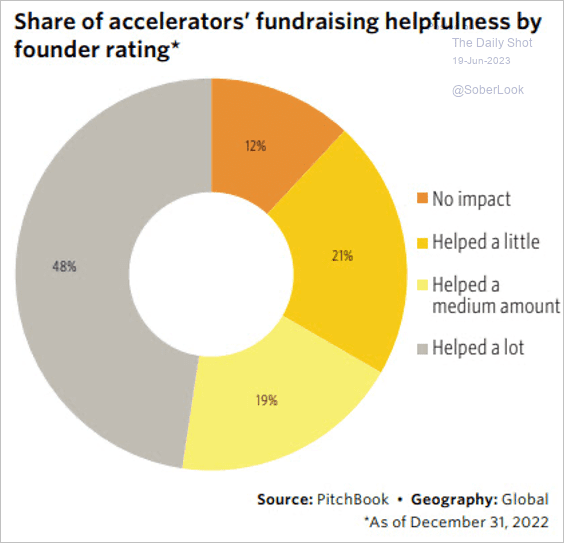

5. Venture accelerators have provided a pivotal advantage for entrepreneurs in the US with an impressive track record. According to PitchBook, 50% to 70% of cohort companies successfully secure funding within three years of completing an accelerator program.

Source: PitchBook

Source: PitchBook

Back to Index

Credit

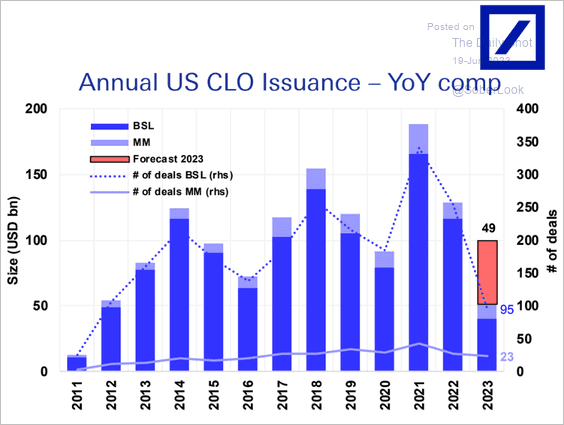

1. This chart shows US CLO issuance with a forecast from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

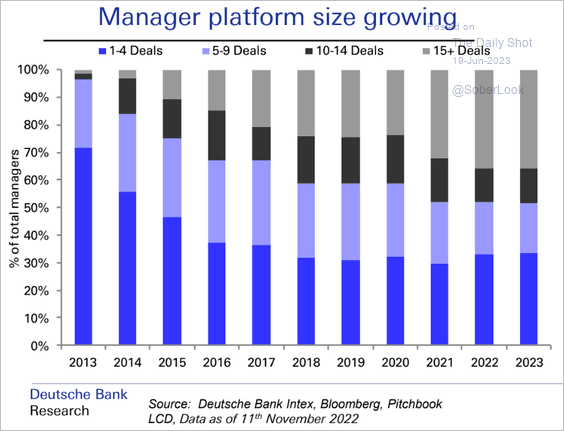

Bigger managers are increasing their market share.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

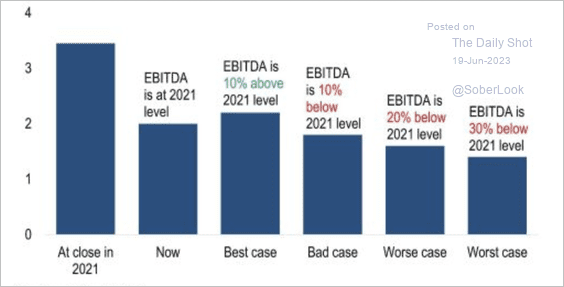

2. Here is a look at interest coverage ratios of the 20 largest leveraged buyouts in 2021.

Source: PitchBook Read full article

Source: PitchBook Read full article

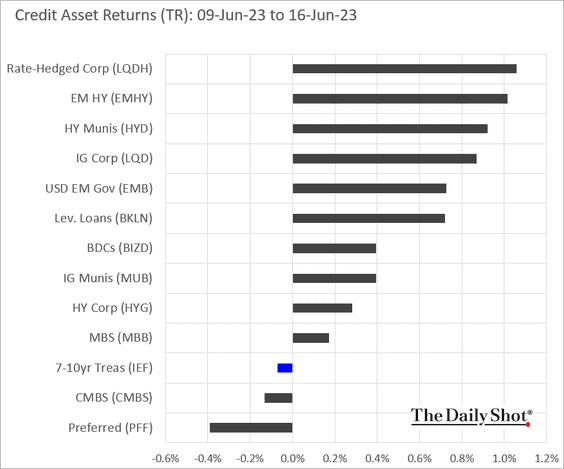

3. Below is last week’s performance by asset class.

Back to Index

Rates

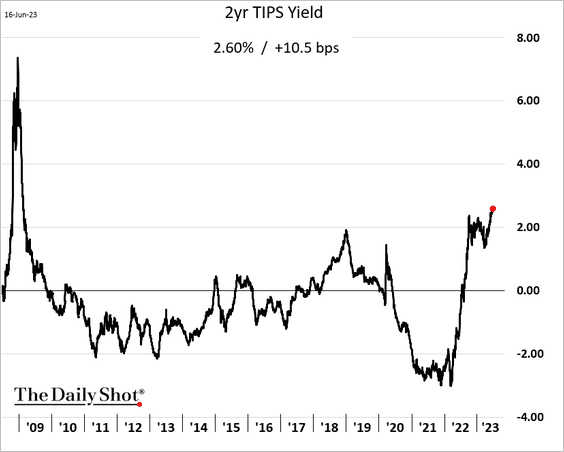

1. The 2-year TIPS yield (US short-term real yield) hit a multi-year high.

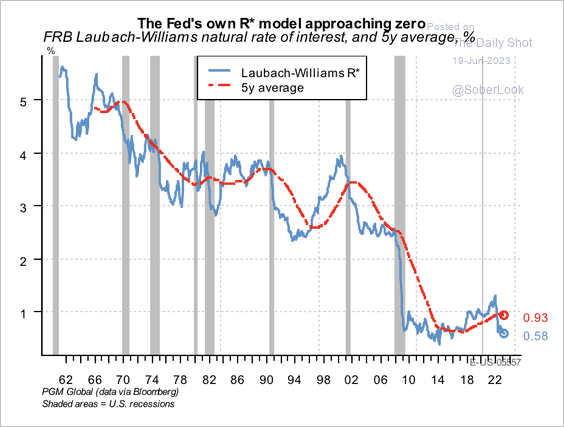

2. The US neutral rate (r*) is approaching zero as the aftereffects of the pandemic linger and reduce potential GDP growth, according to PGM Global.

Source: PGM Global

Source: PGM Global

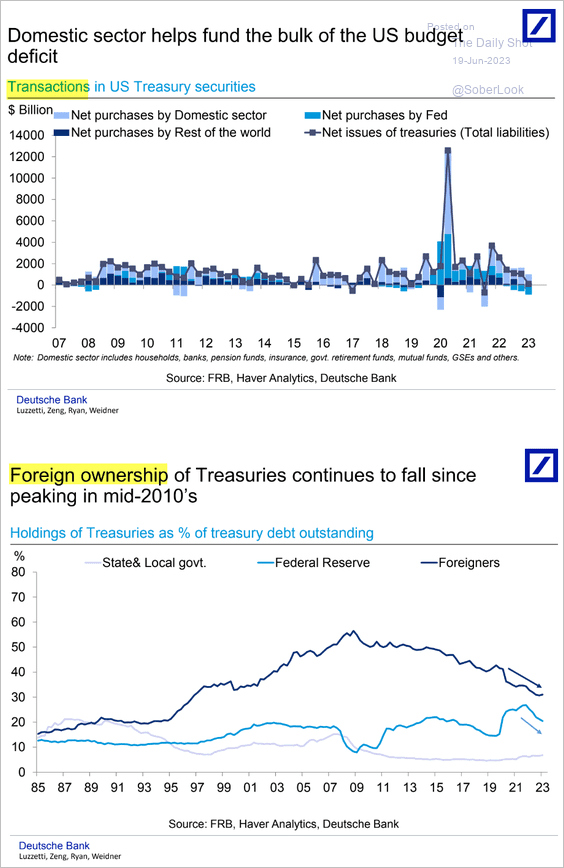

3. Who buys Treasuries?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

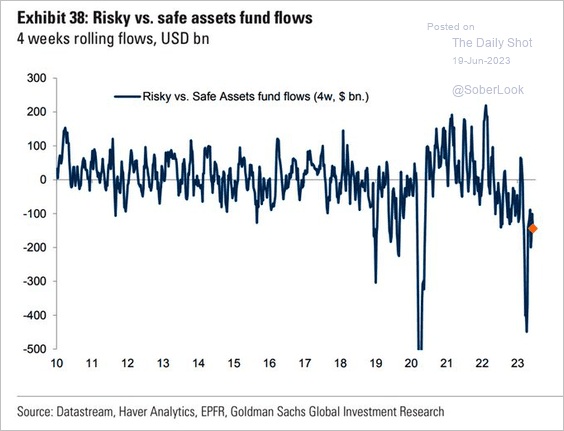

1. Fund flows into safe assets are still outpacing risky assets.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

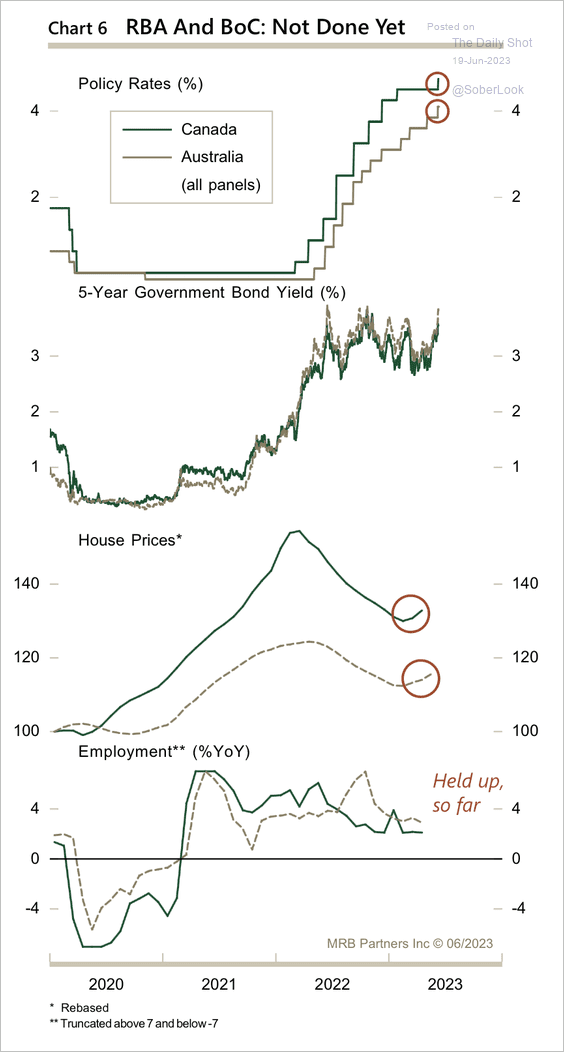

2. The RBA and BoC have maintained their tightening cycle as house prices remain elevated.

Source: MRB Partners

Source: MRB Partners

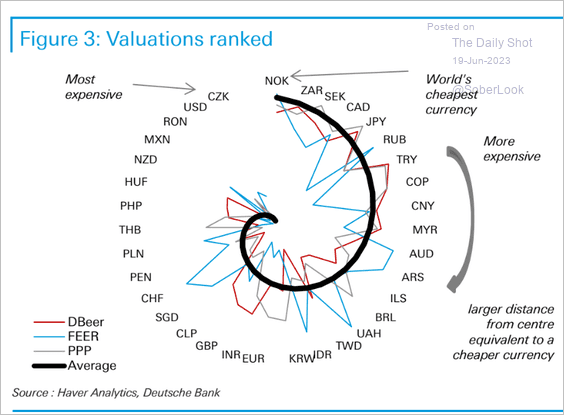

3. Which are the most overvalued/undervalued currencies?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

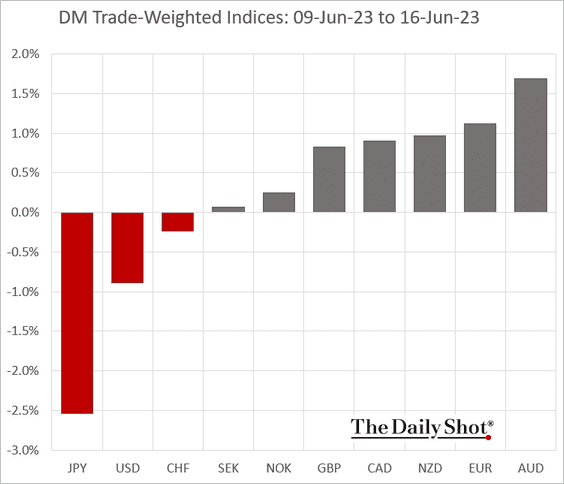

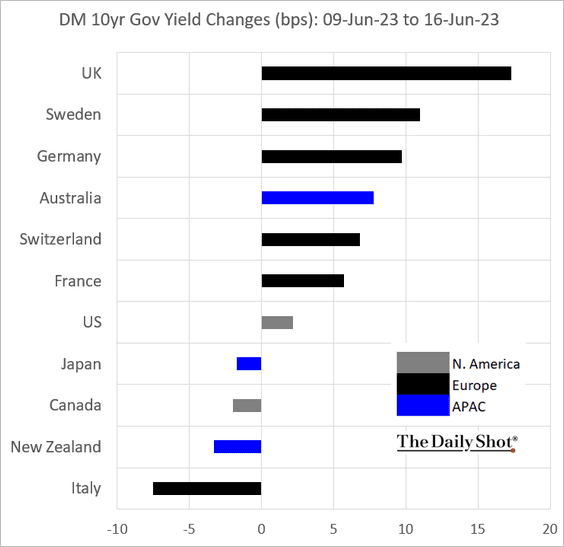

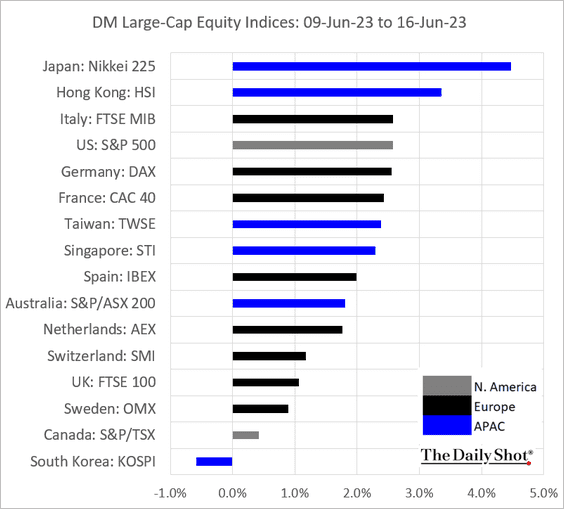

4. Finally, we have last week’s DM performance data.

• Currencies:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

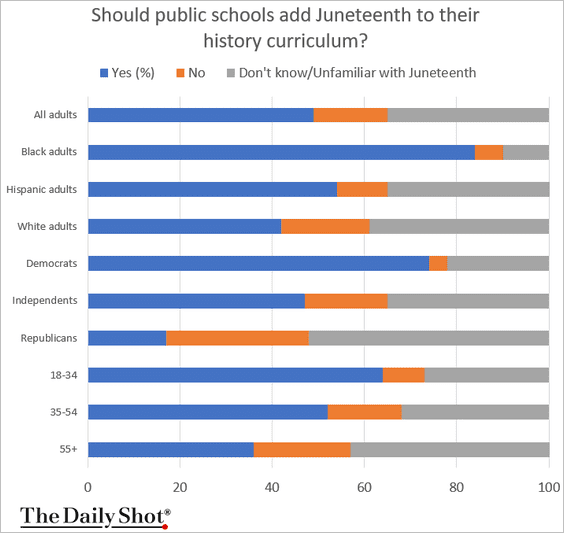

1. Views on Juneteenth being taught in public schools:

Source: Gallup Read full article

Source: Gallup Read full article

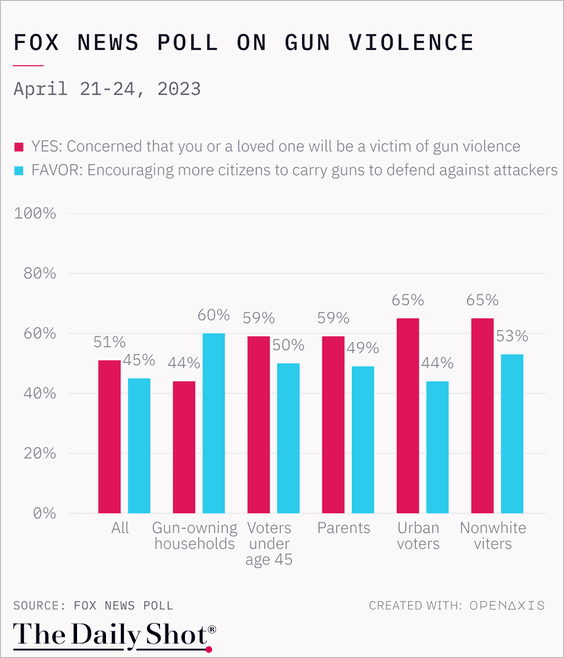

2. Concerns about gun violence:

Source: @TheDailyShot

Source: @TheDailyShot

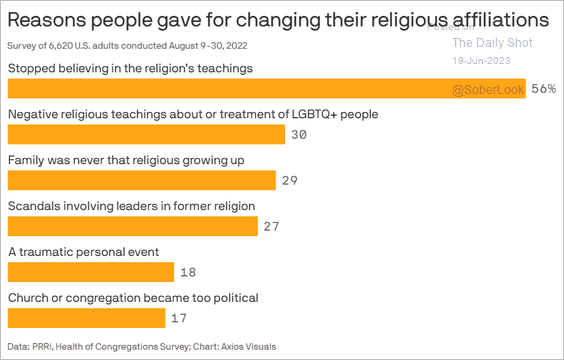

3. Switching religions:

Source: @axios Read full article

Source: @axios Read full article

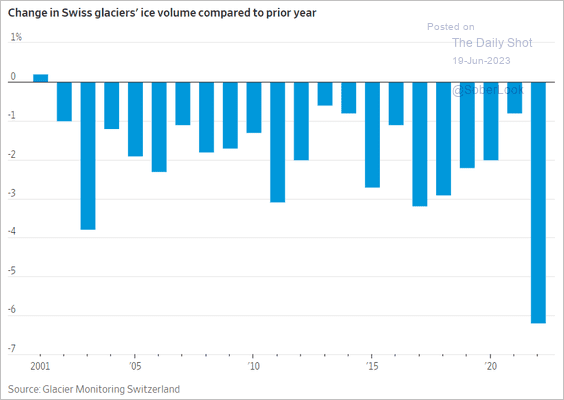

4. Melting European glaciers:

Source: @WSJ Read full article

Source: @WSJ Read full article

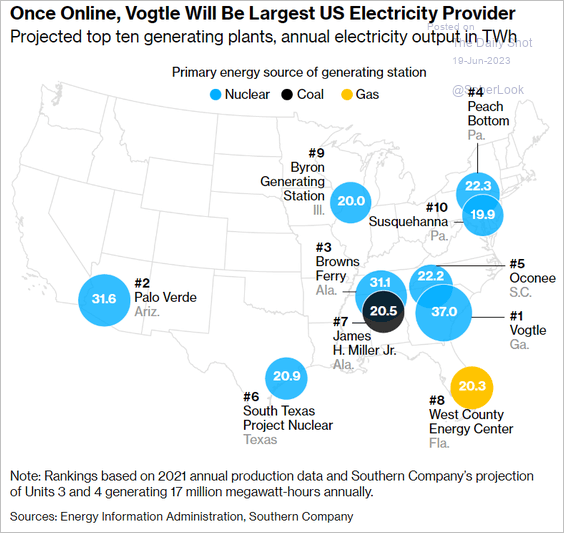

5. Projected top ten power plants:

Source: @business Read full article

Source: @business Read full article

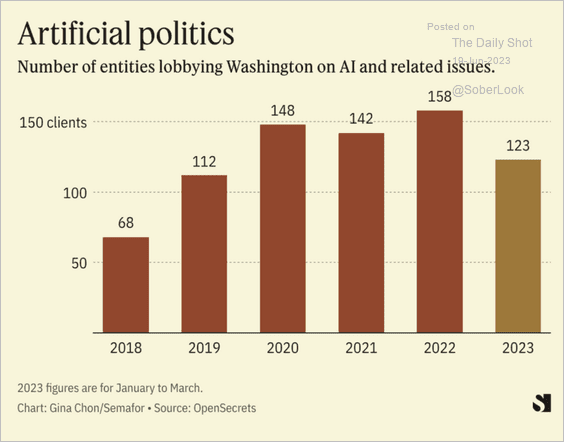

6. AI-related lobbying efforts:

Source: Semafor

Source: Semafor

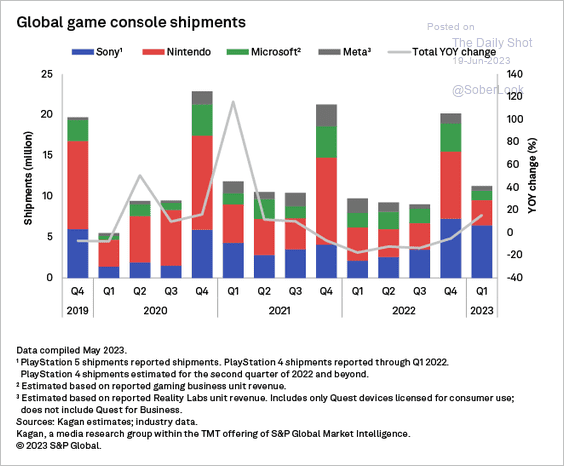

7. Global game console shipments:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

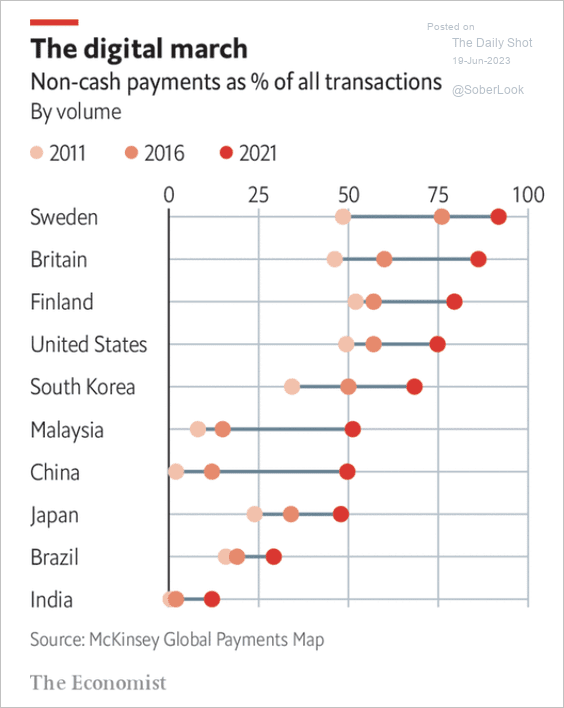

8. Non-cash payments:

Source: The Economist Read full article

Source: The Economist Read full article

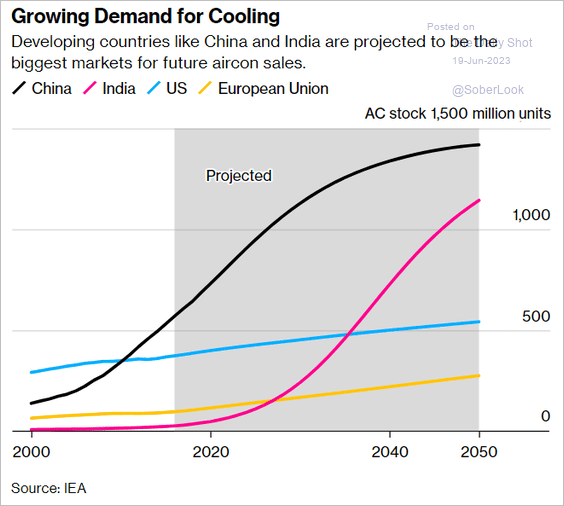

9. Air conditioner sales forecast:

Source: @ainefquinn, @markets Read full article

Source: @ainefquinn, @markets Read full article

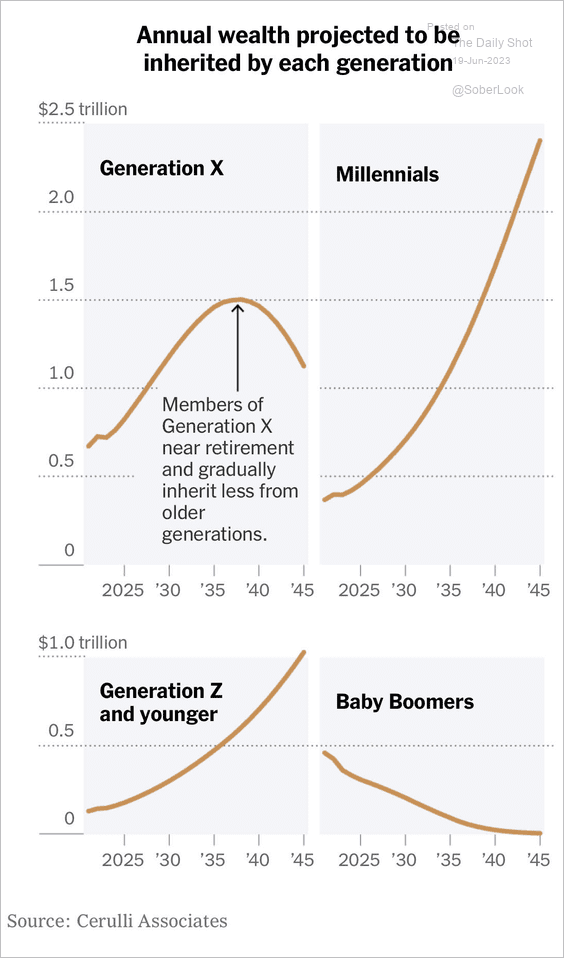

10. Projected wealth inherited by each generation:

Source: The New York Times Read full article

Source: The New York Times Read full article

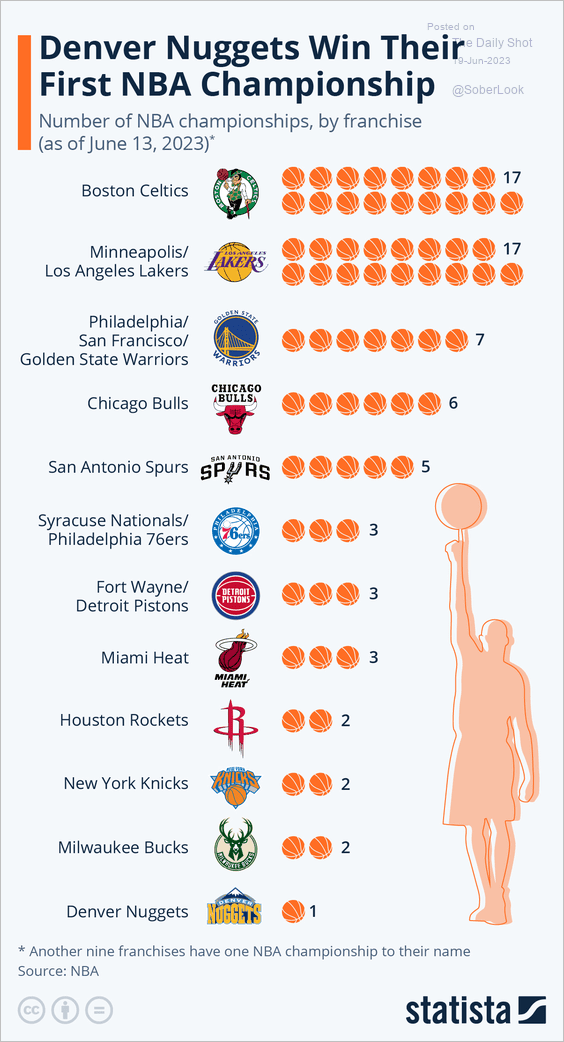

11. NBA championships:

Source: Statista

Source: Statista

——————–

Back to Index