The Daily Shot: 21-Jun-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

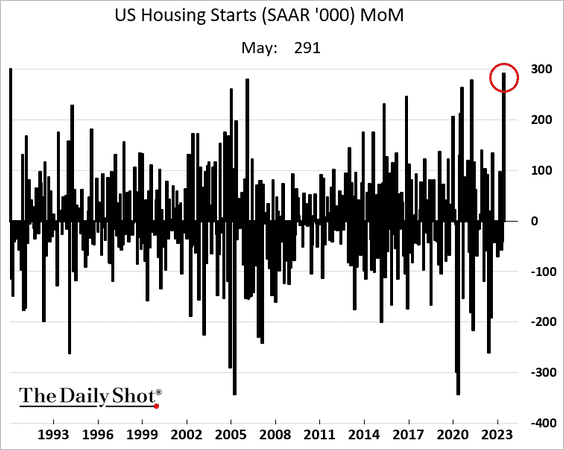

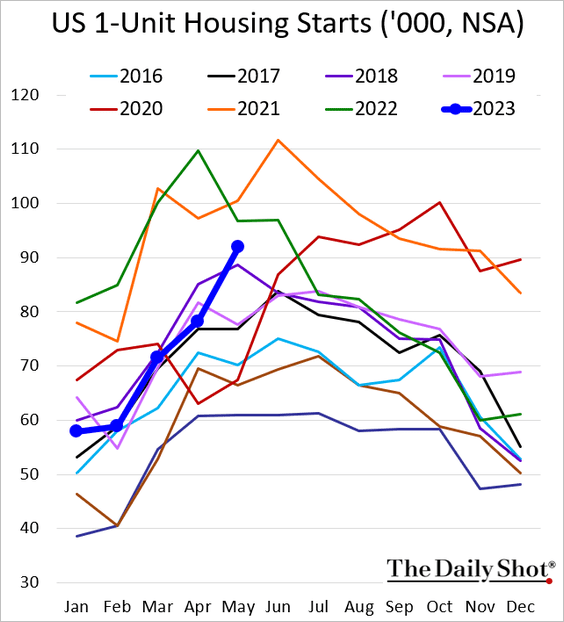

1. The May residential construction report was a shocker, with housing starts hitting a multi-year high for this time of the year.

Building permits were also stronger than expected.

Here are the seasonally-adjusted trends.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• The seasonally-adjusted gain in housing starts was the highest in decades.

Source: Reuters Read full article

Source: Reuters Read full article

• Both single-family and multifamily starts showed strength.

• The number of single-family homes under construction continues to fall, …

But multi-family units hit a record high.

• Falling construction costs have provided a significant boost to homebuilders.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Shares of homebuilders have been outperforming.

——————–

2. The GDPNow model has the Q2 growth hovering around 2% (annualized).

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Here is the attribution. Residential investment is no longer a drag on economic growth.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

3. The Philly Fed’s regional services index shows companies continuing to struggle in June. The indicator of sales dropped sharply.

• Service firms are rapidly reducing staff.

• Companies are now cutting prices.

By the way, here is the Philly Fed’s district.

——————–

4. There has been a growing divergence between wages and productivity in recent years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. This chart displays the proportion of imported goods originating from China.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The United Kingdom

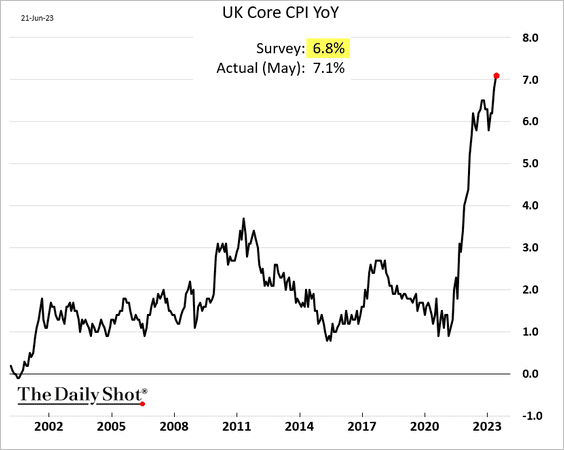

1. The CPI report delivered yet another shocker, with core inflation breaching 7%. We will have more on the inflation report tomorrow.

2. Short-term gilt yields continue to surge, …

… as the yield curve inversion deepens.

Back to Index

The Eurozone

1. Market pricing shows that a September ECB rate hike now looks very likely. The implied terminal rate keeps rising.

Deutsche Bank expects the ECB to hold a 3.75% terminal rate for at least a year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

2. Longer-term inflation expectations are now almost at par with the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Construction output has been easing, …

… with the PMI signaling further downside risks for the sector.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

4. The current account surplus narrowed sharply in April.

5. Germany’s PPI is nearing zero.

Back to Index

Europe

1. The Swedish krona hit a record low vs. the euro.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @nicrolander, @markets Read full article

Source: @nicrolander, @markets Read full article

——————–

2. Who holds EU government debt?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

1. South Korea’s exports are holding up.

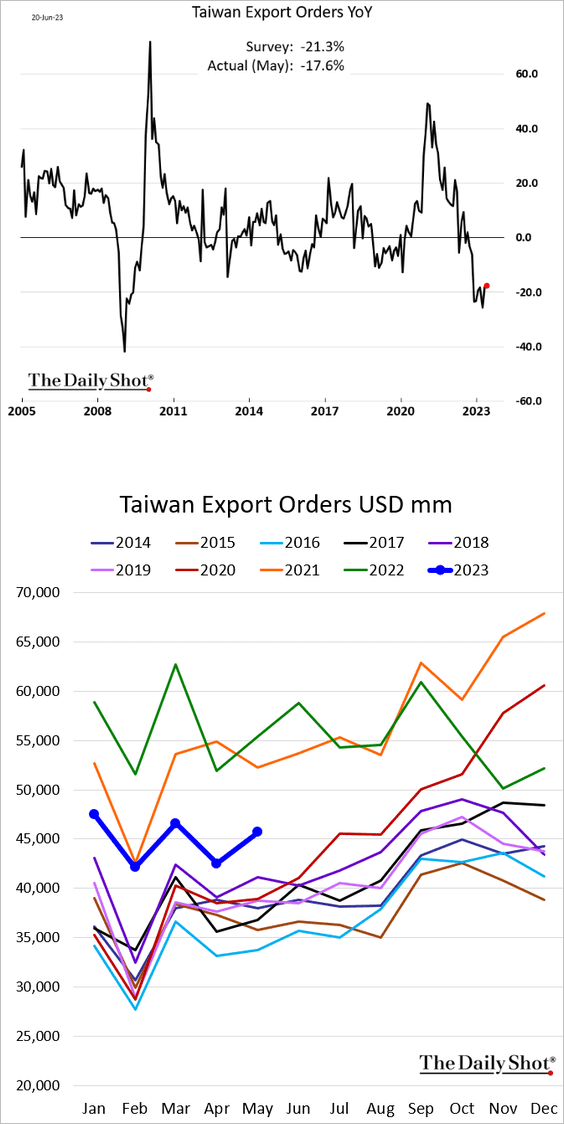

2. Taiwan’s export orders have stabilized but remain well below last year’s levels.

3. Australia’s leading index dipped below pre-COVID levels last month.

Residential investment faces downside risks as building approvals slump.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

1. The renminbi continues to slide amid monetary and fiscal stimulus.

Investors have turned more bearish on the yuan over the next 12 months.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. Business activity slowed sharply this month. The World Economics SMI index shows much weaker growth in services …

Source: World Economics

Source: World Economics

… and a contraction in manufacturing.

Source: World Economics

Source: World Economics

——————–

3. Similar to the US and Eurozone, there has been a notable divergence between manufacturing and services.

Source: IIF

Source: IIF

Back to Index

Emerging Markets

1. Mexican retail sales jumped in April, topping expectations.

2. Colombia’s economy is contracting on a year-over-year basis.

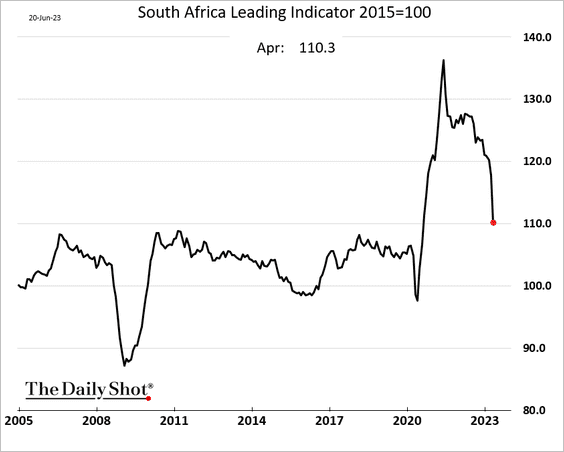

3. South Africa’s leading indicator tumbled in April.

4. Vietnam’s electronics exports have been surging.

Source: Gavekal Research

Source: Gavekal Research

5. Capital flows to EM ex-China are holding up. (2 charts)

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

6. This chart shows equity returns since May 1st for tech and non-tech sectors.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

1. BTC saw a spike in short liquidations during the return above $25K support.

Source: CoinGlass

Source: CoinGlass

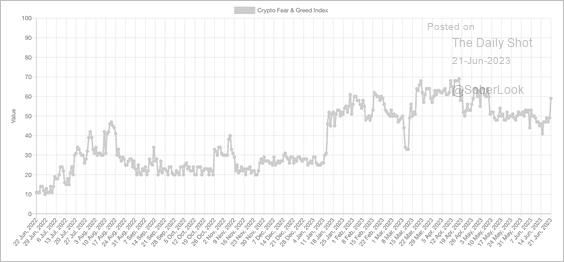

2. The Crypto Fear & Greed Index entered “greed” territory on Tuesday.

Source: Alternative.me

Source: Alternative.me

3. Entities with a balance of under 100 BTC have increased their holdings over the past month, according to data recorded on the blockchain.

Source: @glassnode

Source: @glassnode

4. Bitcoin’s implied volatility remains very low.

Source: The Block Research

Source: The Block Research

5. Ether’s put/call ratio has been elevated this year.

Source: The Block Research

Source: The Block Research

Back to Index

Commodities

1. Industrial metals are testing support.

Source: TS Lombard

Source: TS Lombard

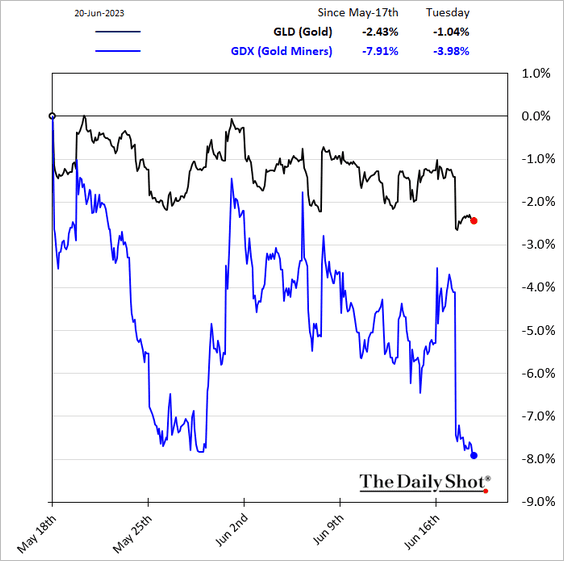

2. Shares of gold miners took a hit on Tuesday.

3. Indonesia’s green-economy metals production is mostly powered by fossil fuels, particularly coal.

Source: @cangsizhi, @markets Read full article

Source: @cangsizhi, @markets Read full article

4. Persistent drought conditions have taken a toll on the state of the US corn crop.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

1. Electricity prices in Texas surged as the heat wave takes a toll.

Source: Electric Reliability Council of Texas

Source: Electric Reliability Council of Texas

——————–

2. Global jet fuel demand continues to climb.

Source: @BloombergNEF Read full article

Source: @BloombergNEF Read full article

3. OECD crude and liquid fuel stockpiles rose toward their five-year average, which weighed on oil prices.

Source: TS Lombard

Source: TS Lombard

4. China’s oil imports are expected to move higher.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

5. Who is importing Russian oil?

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

1. The S&P 500 has gained an average of 43% in the first year of bull markets since 1950.

Source: @callieabost

Source: @callieabost

2. EPS estimates for 2023 and 2024 have stabilized after sharp declines.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

3. Passive flows into Target Date Funds, driven by employment, could have a meaningful impact on stock prices.

Source: PGM Global

Source: PGM Global

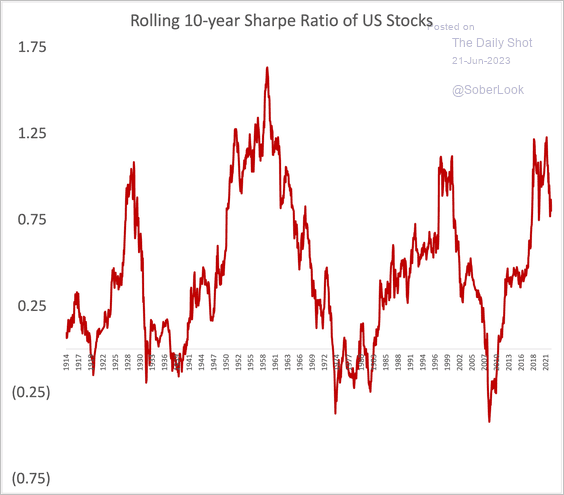

4. US stocks’ rolling 10-year Sharpe ratio crossed above one before entering the recent bear market. This is consistent with previous bubble peaks.

Source: @MebFaber

Source: @MebFaber

5. This chart shows short interest by sector relative to historical averages as well as recent changes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

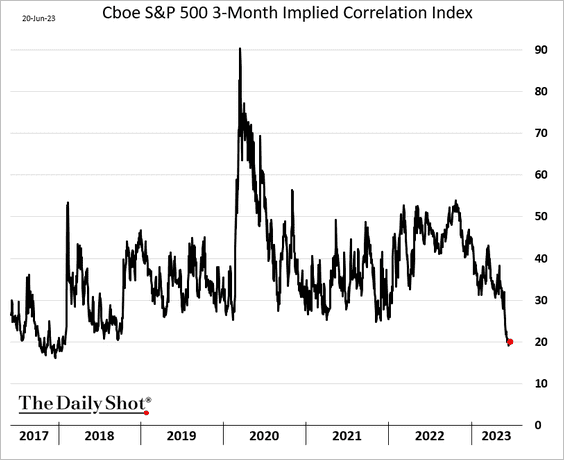

6. The S&P 500 3-month implied correlation is at multi-year lows.

h/t III Capital Management

h/t III Capital Management

7. VIX has been declining, but demand for VIX call options has been robust. Below is the VVIX-to-VIX ratio.

8. Finally, here is the S&P 500 implied volatility term structure.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Rates

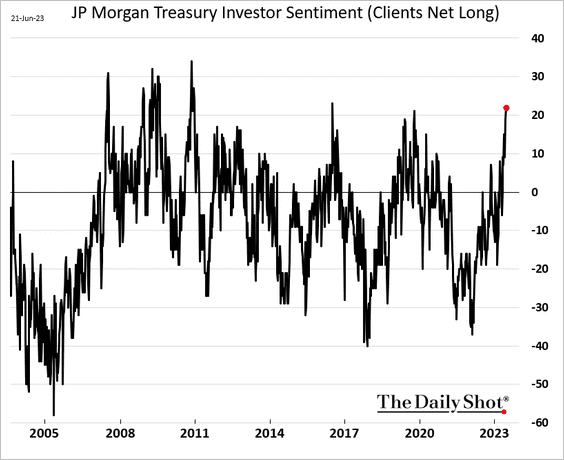

1. Treasury futures positioning remains extremely bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

However, hedge funds are betting on a more dovish Fed rate trajectory.

And JP Morgan’s clients are in love with Treasuries again.

——————–

2. The Fed has increased its projected terminal rate for the fourth time this cycle. According to MRB Partners, the Fed has underestimated the resilience of the economy and the persistence of inflation.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

1. Voters by birth year in highly contested states:

Source: Catalist Read full article

Source: Catalist Read full article

2. Global executions:

Source: Statista

Source: Statista

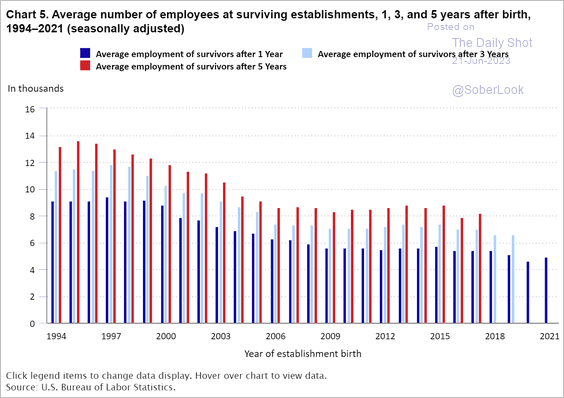

3. Average employment at newly formed businesses:

Source: BLS Read full article

Source: BLS Read full article

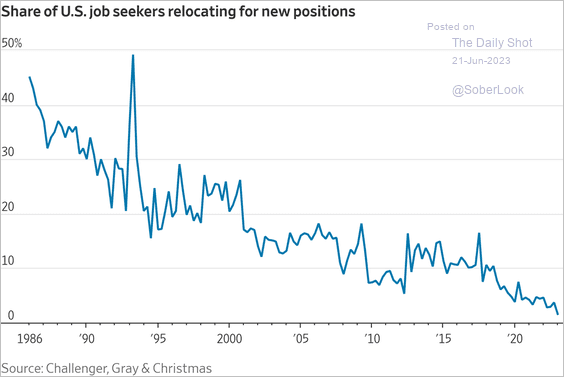

4. Relocating for a new job:

Source: @jeffsparshott

Source: @jeffsparshott

5. Fastest-growing US cities:

Source: Census Bureau Read full article

Source: Census Bureau Read full article

6. Working-poor in OECD countries:

Source: OECD Read full article

Source: OECD Read full article

7. Bicyclist fatalities:

Source: @axios Read full article

Source: @axios Read full article

8. The COVID-era surge in wedding costs:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index