The Daily Shot: 22-Jun-23

• The United Kingdom

• The United States

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

——————–

As a reminder, the next Daily Shot will be published on Monday, June 26th.

The United Kingdom

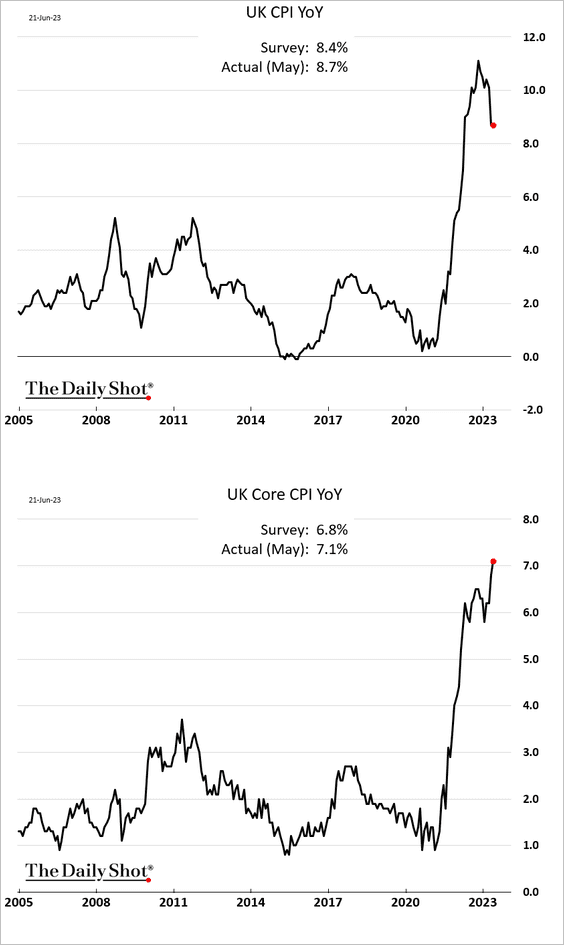

1. As we mentioned yesterday, the UK inflation report was well above expectations again, …

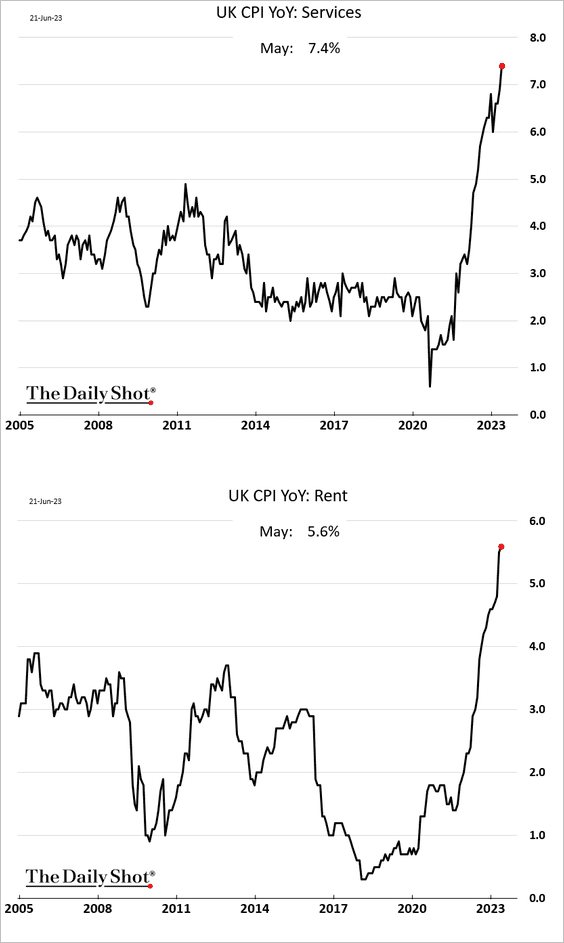

… with services driving the core CPI to multi-decade highs.

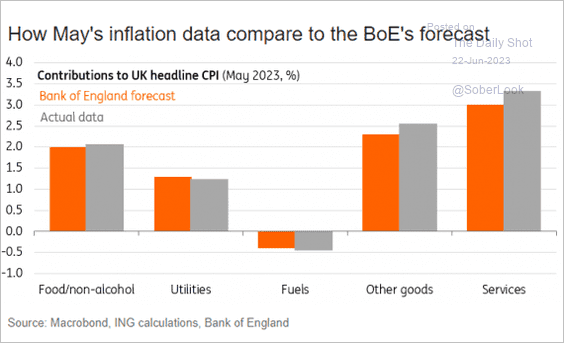

• Here is how inflation compares to the BoE’s forecast.

Source: ING

Source: ING

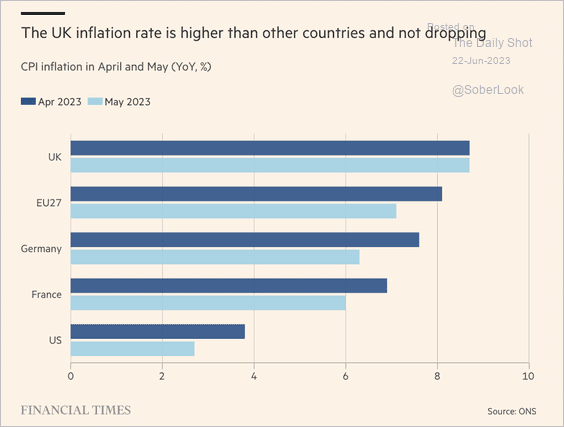

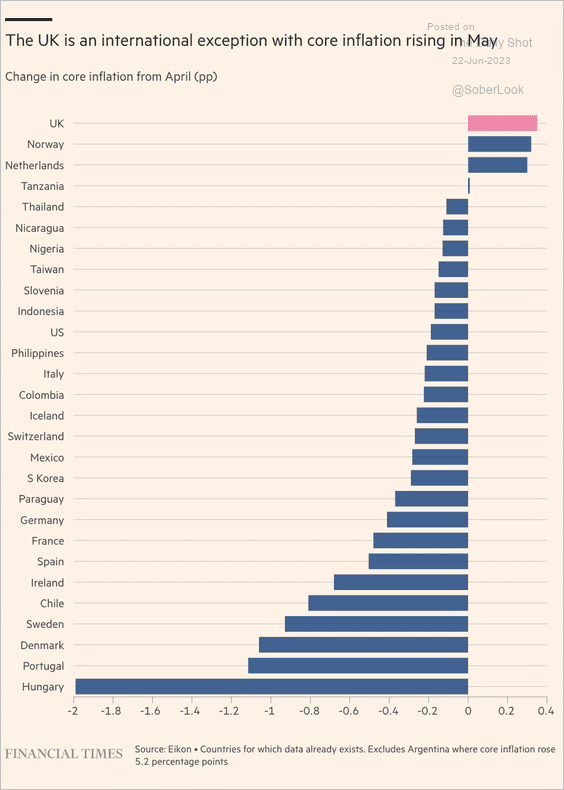

• UK inflation stands out relative to peers (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

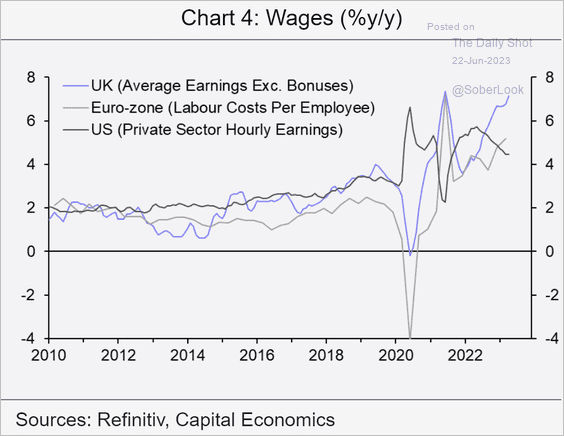

Elevated wage growth and extreme energy price shock explain why UK CPI has been outpacing other economies.

Source: Capital Economics

Source: Capital Economics

——————–

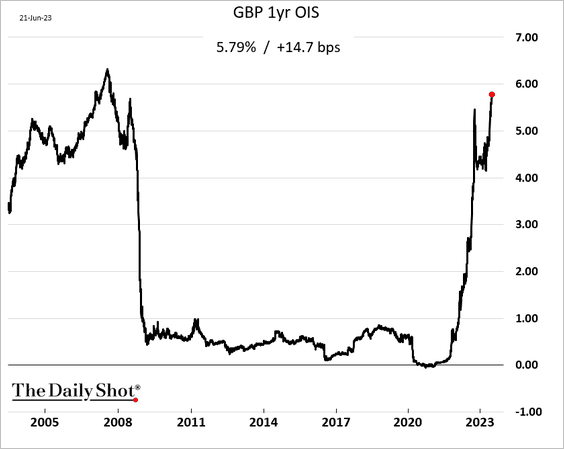

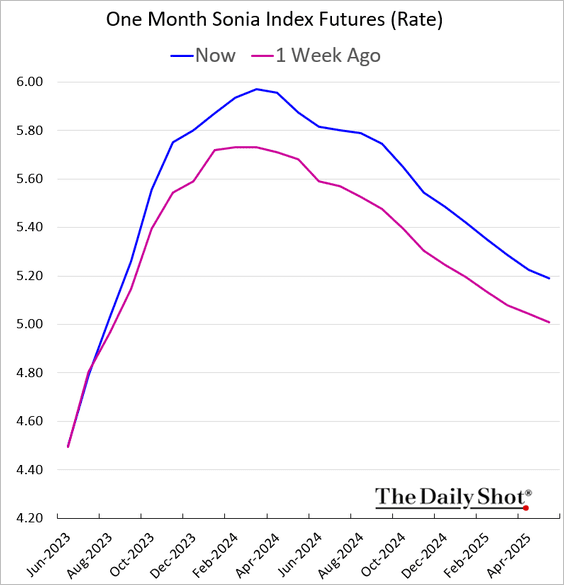

2. Short-term rates continue to surge, …

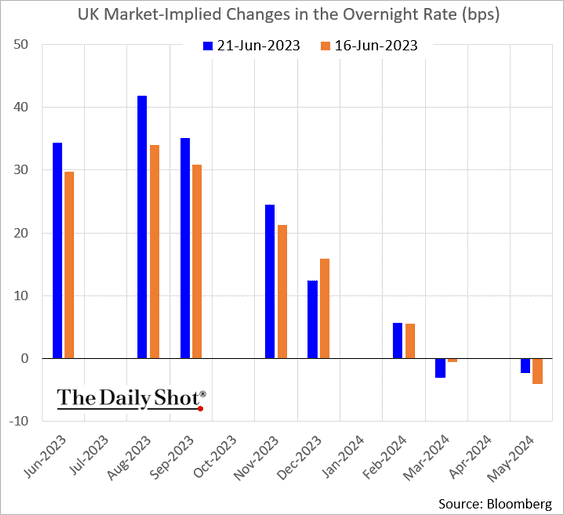

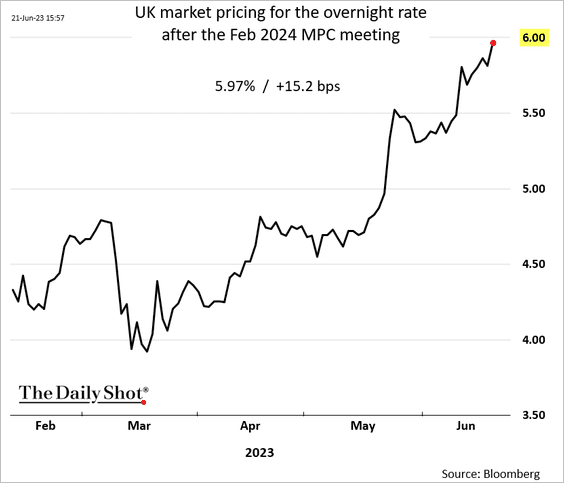

… with markets pricing multiple BoE rate hikes ahead. Moreover, market pricing now puts decent odds on one or more 50 bps increases. Are these expectations overdone?

• The terminal rate continues to climb, moving further out.

• Here is the market pricing for the overnight rate after the February MPC meeting.

——————–

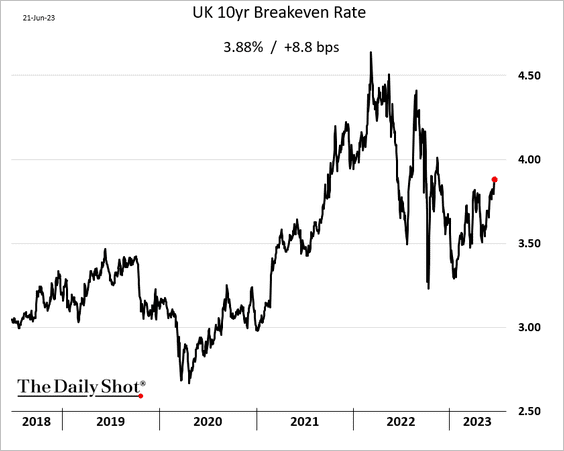

3. Long-term market-based inflation expectations are rising again.

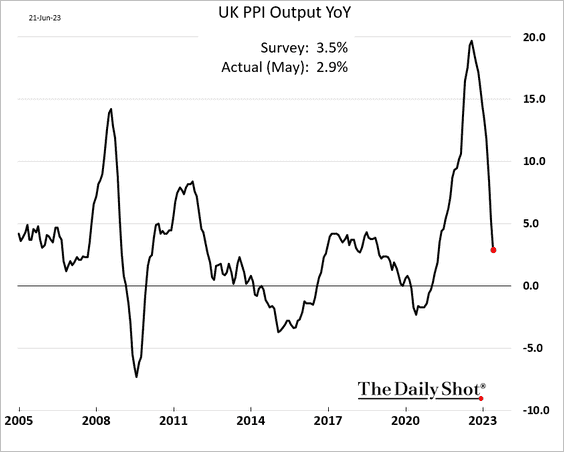

4. Producer prices offer a hopeful signal for the CPI.

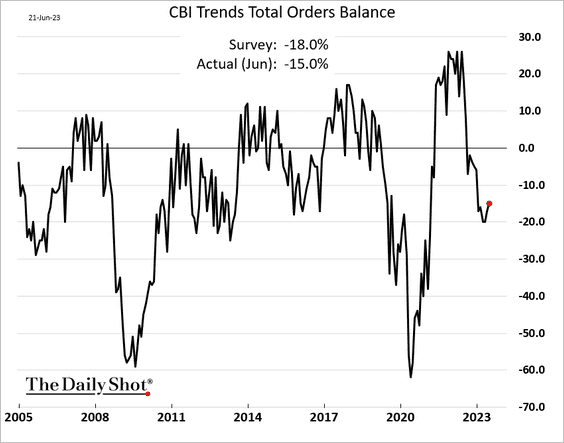

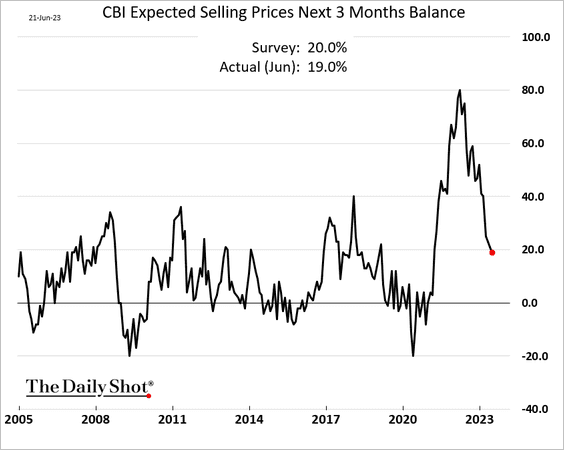

5. Industrial orders show signs of improvement.

Manufacturers are reducing the pace of price increases.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

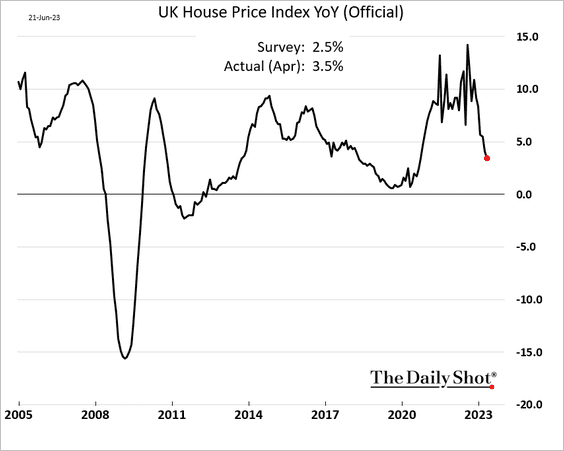

6. Home prices have been holding up better than expected.

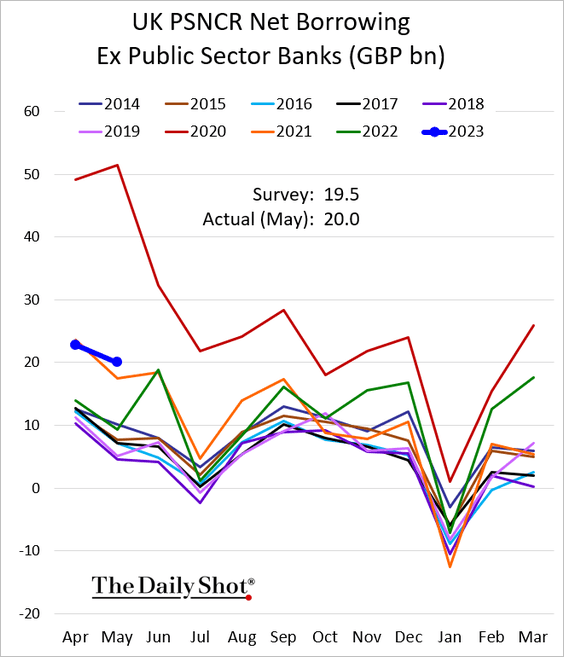

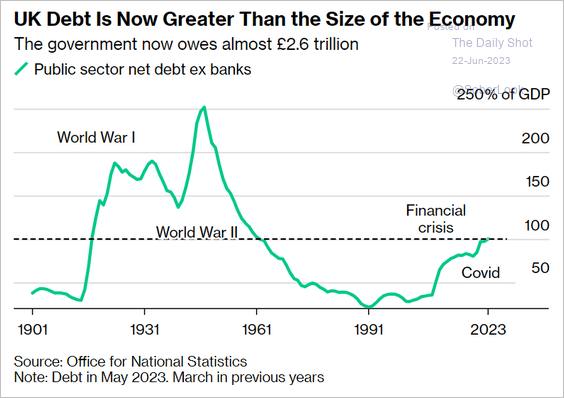

7. Government borrowing in May topped forecasts, …

… pushing the debt-to-GDP ratio above 100% for the first time in decades.

Source: @PhilAldrick, @markets Read full article

Source: @PhilAldrick, @markets Read full article

Back to Index

The United States

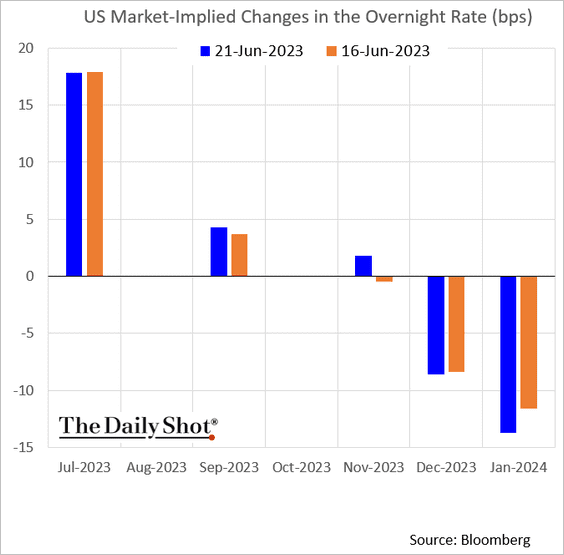

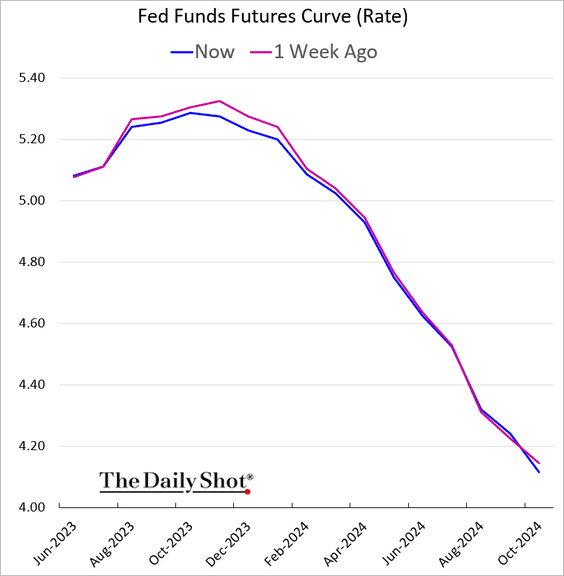

1. Chair Powell struck a hawkish tone on Wednesday.

Source: Reuters Read full article

Source: Reuters Read full article

The market is now pricing in a small chance of a rate hike in November.

The terminal rate moved higher.

——————–

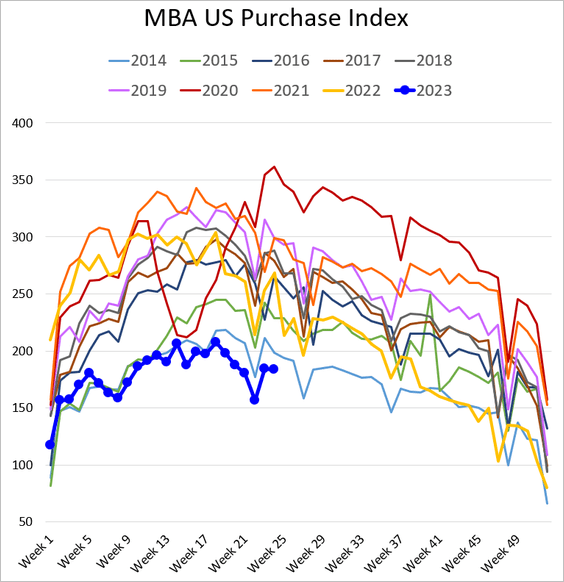

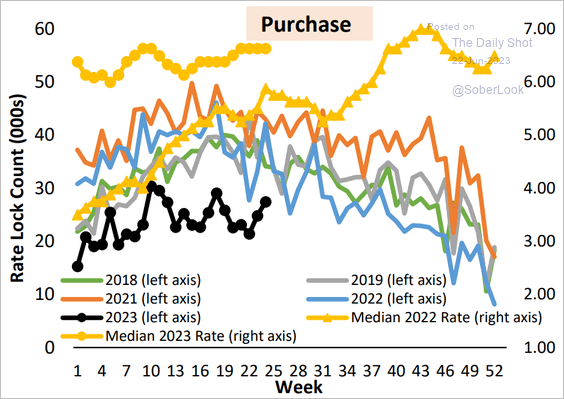

2. Mortgage applications appear to have stabilized below 2014 levels.

This chart shows the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

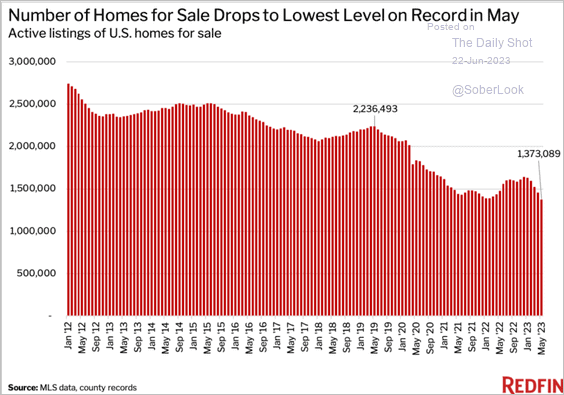

• The supply of homes for sale continues to sink.

Source: Redfin

Source: Redfin

——————–

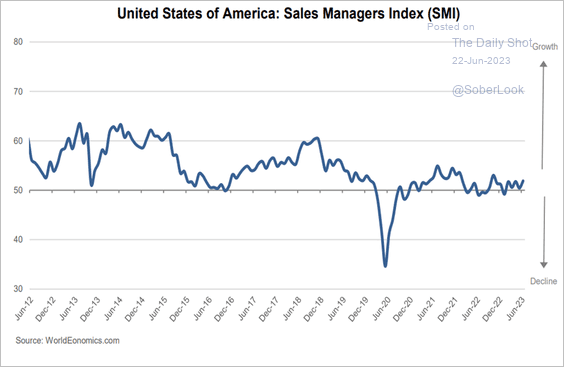

3. The World Economics SMI report shows business activity improving in June.

Source: World Economics

Source: World Economics

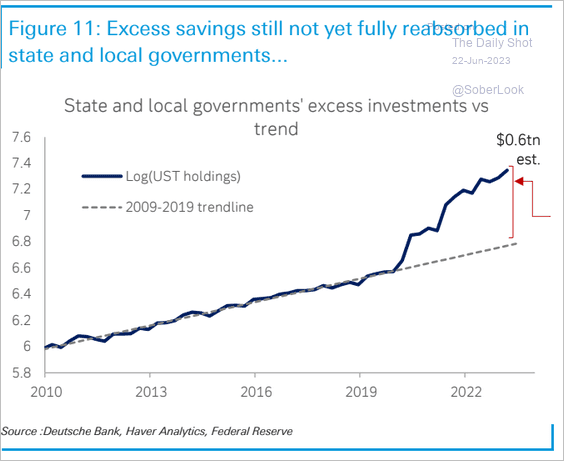

4. State and local governments are sitting on substantial excess savings (as evidenced by their holdings of Treasury securities).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

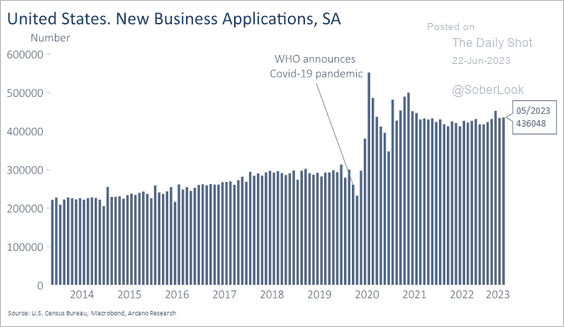

5. Business applications remain elevated.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

The Eurozone

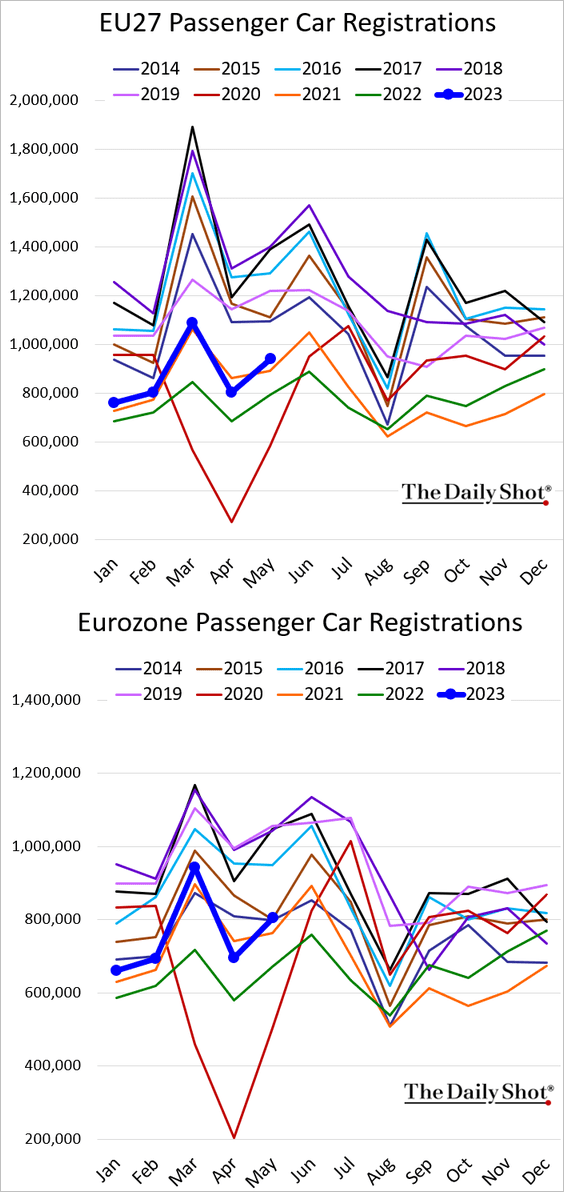

1. New vehicle registrations are back above 2021 levels in the EU and the Eurozone.

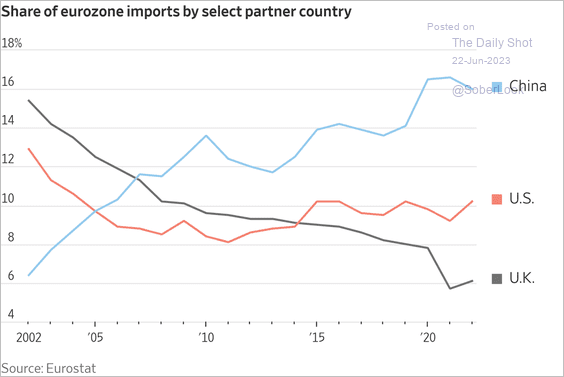

2. China remains a key trading partner for the Eurozone.

Source: @WSJ Read full article

Source: @WSJ Read full article

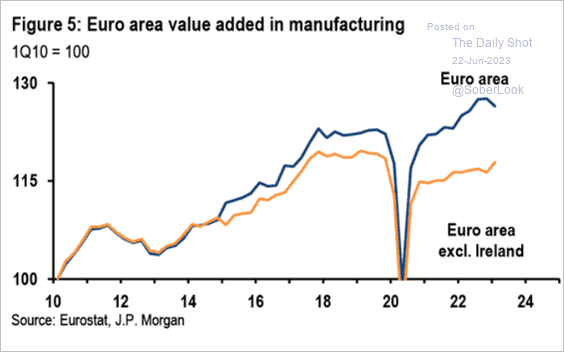

3. Ireland is distorting the euro-area manufacturing output figures.

III Capital Management: – Irish data continues to distort overall Euro area data due to Ireland’s role as a profit center for multi-nationals and a hub for multi-nationals’ intellectual property rights. The latest example was April industrial production data, which was reported at 1% month-over-month, but actually declined by 0.8% ex-Ireland. Overall, industrial output in Europe ex-Ireland remains below its pre-Covid level.

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

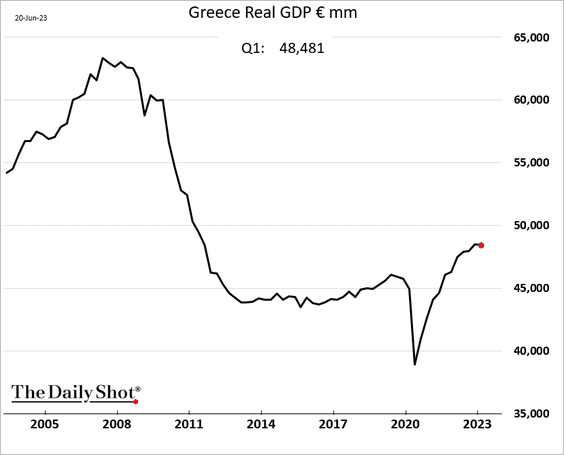

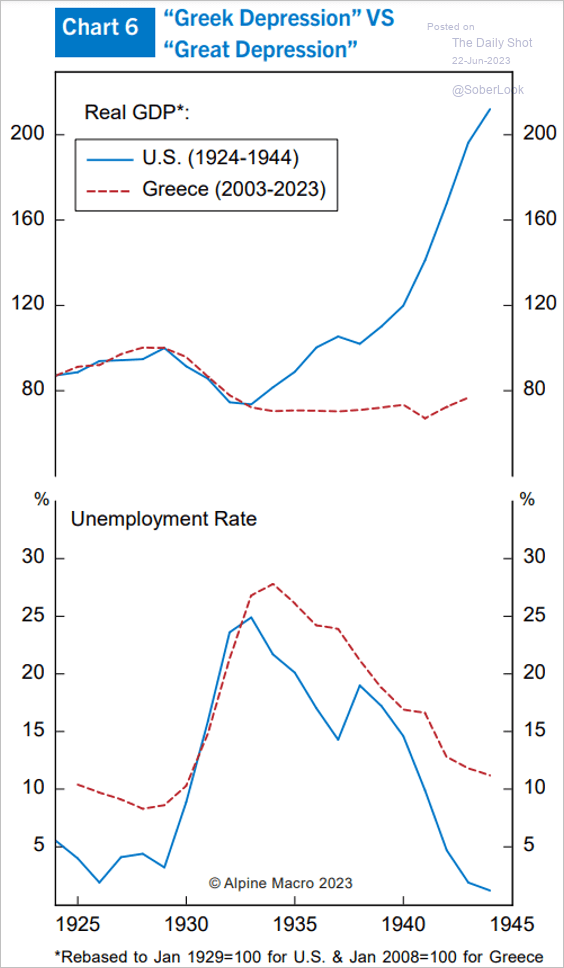

4. It will take a long time for Greece’s economy to return to the 2008 peak.

Source: Alpine Macro

Source: Alpine Macro

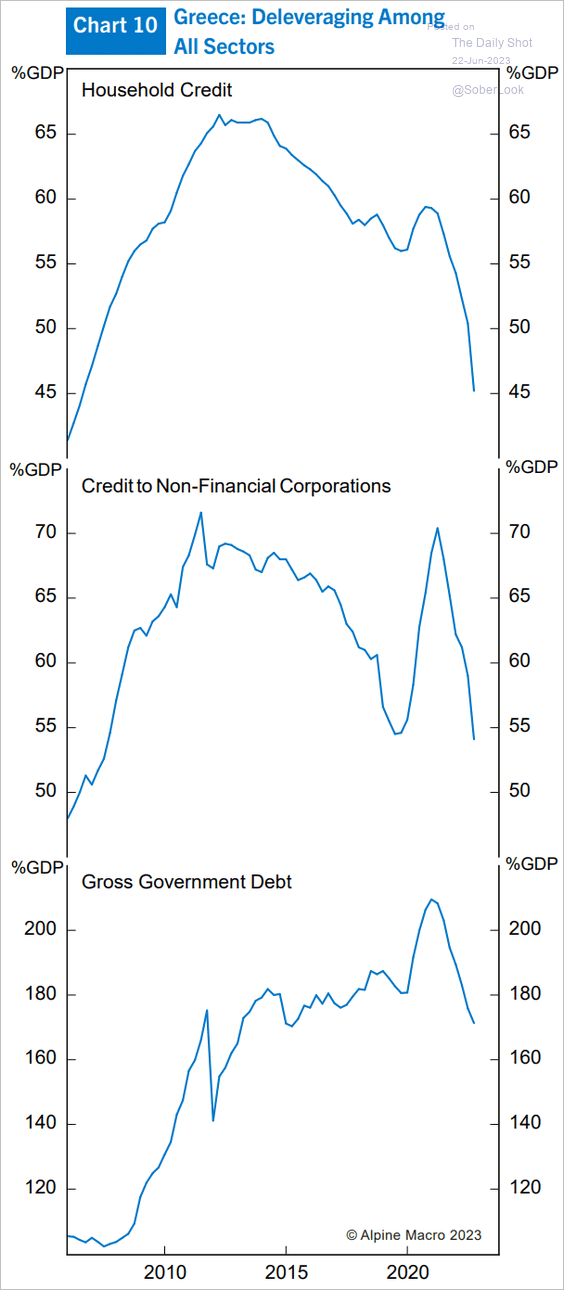

The deleveraging process in Greece is ongoing.

Source: Alpine Macro

Source: Alpine Macro

——————–

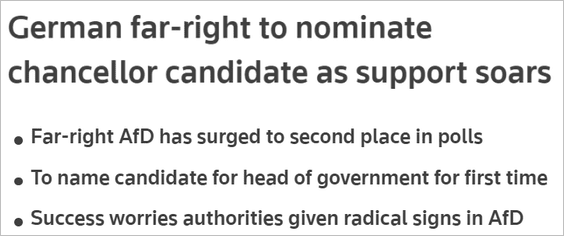

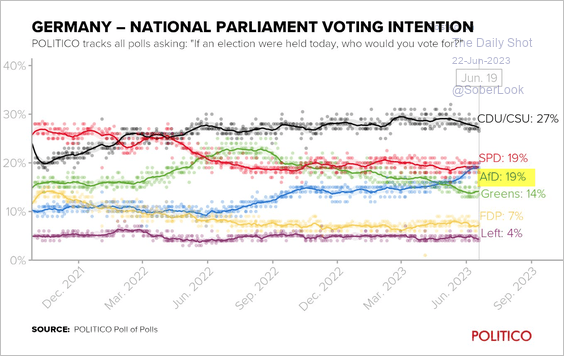

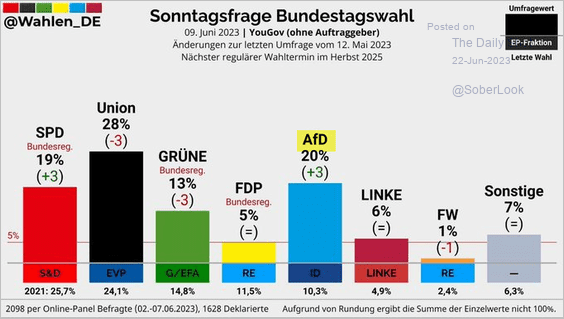

5. Putin is having a field day with this development.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @pollofpolls_EU

Source: @pollofpolls_EU

Source: @Wahlen_DE

Source: @Wahlen_DE

Back to Index

Europe

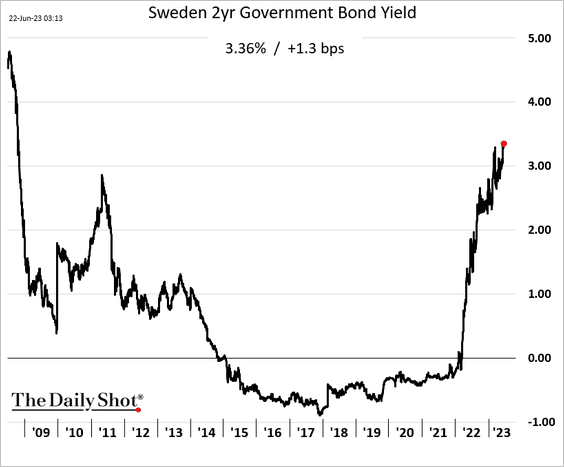

1. Sweden’s short-term bond yields continue to climb.

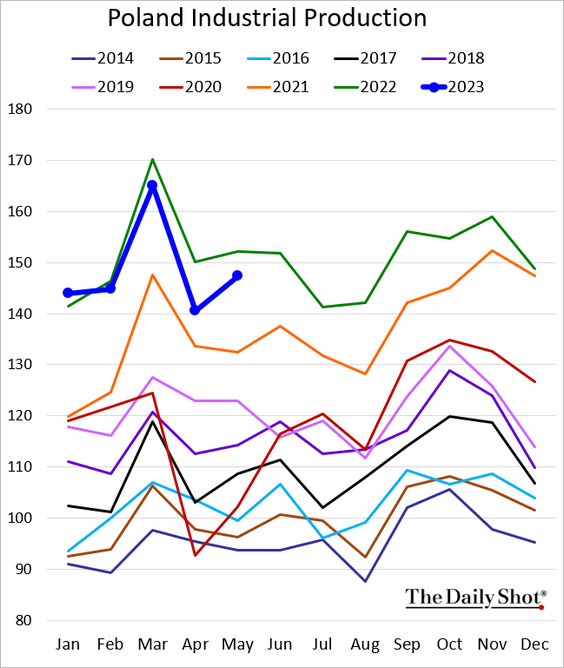

2. Poland’s industrial production bounced in May but remained below last year’s levels.

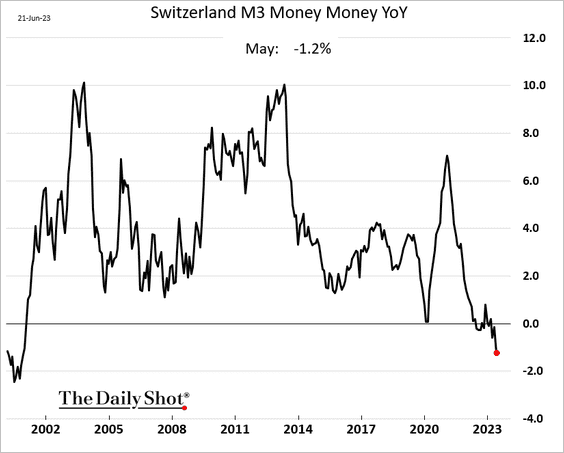

3. This chart shows the Swiss broad money supply (year-over-year).

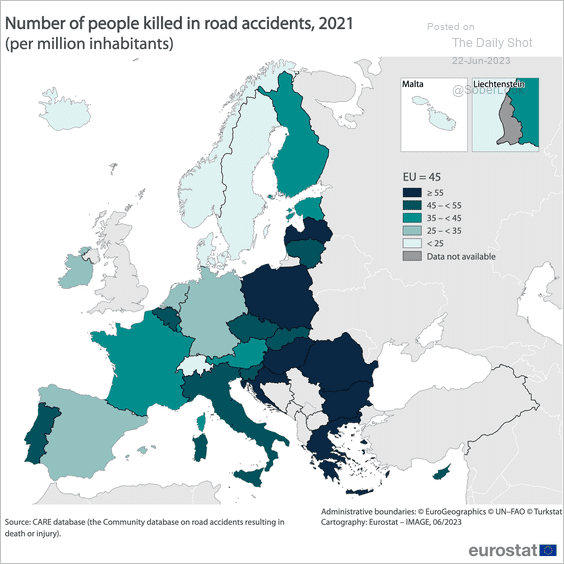

4. Finally, we have some data on road accident fatalities across Europe.

Source: @EU_Eurostat Read full article

Source: @EU_Eurostat Read full article

Back to Index

Asia-Pacific

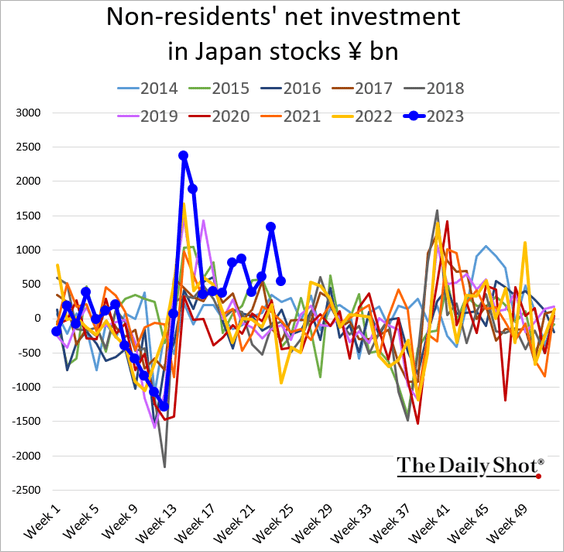

1. Foreign purchases of Japanese stocks remain elevated.

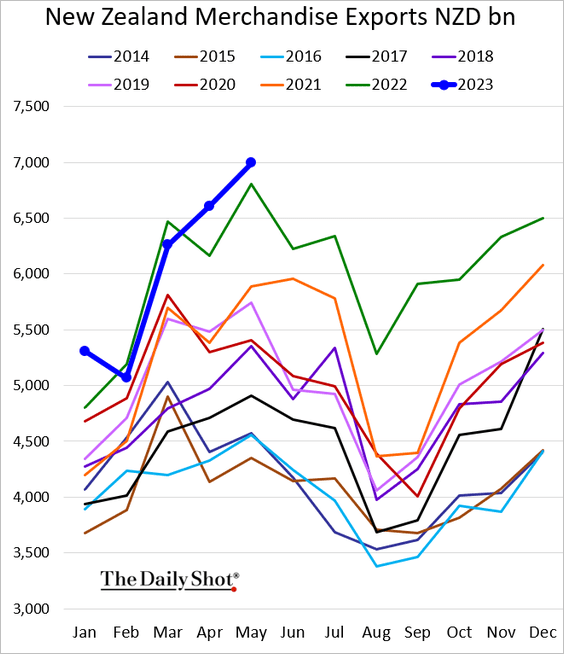

2. New Zealand’s exports hit a record high.

Back to Index

China

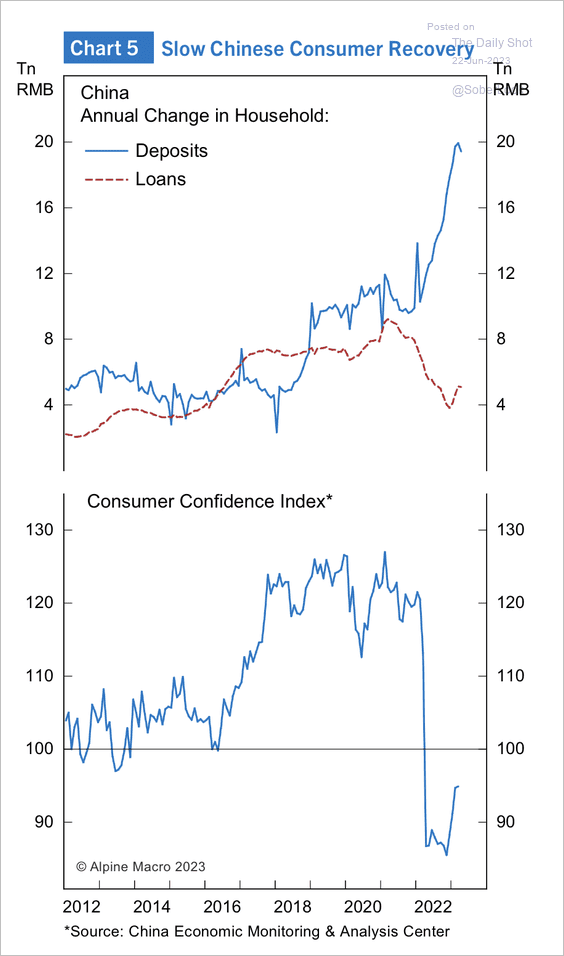

1. Consumer confidence is improving, but loan growth has been slow.

Source: Alpine Macro

Source: Alpine Macro

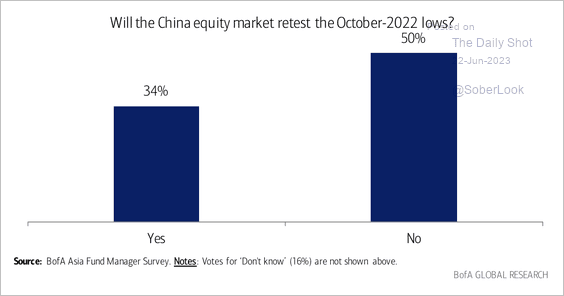

2. Only a third of investors surveyed by BofA think Chinese equities will retest the October 2022 price low.

Source: BofA Global Research

Source: BofA Global Research

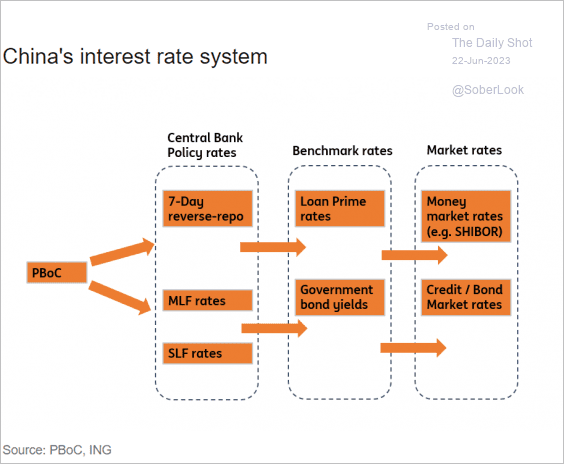

3. Here is an illustration of China’s interest rate system.

Source: ING

Source: ING

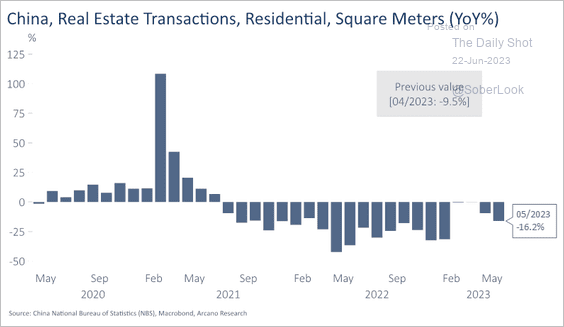

4. Residential real estate transactions remain below last year’s levels.

Source: Arcano Economics

Source: Arcano Economics

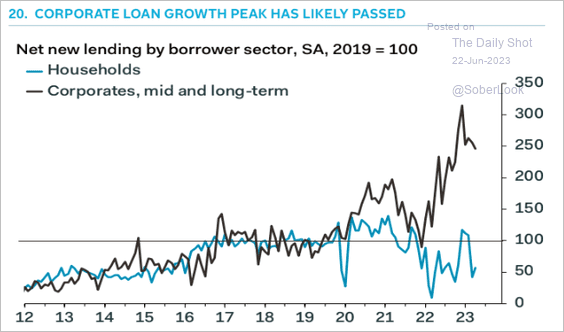

5. Has corporate loan growth peaked?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

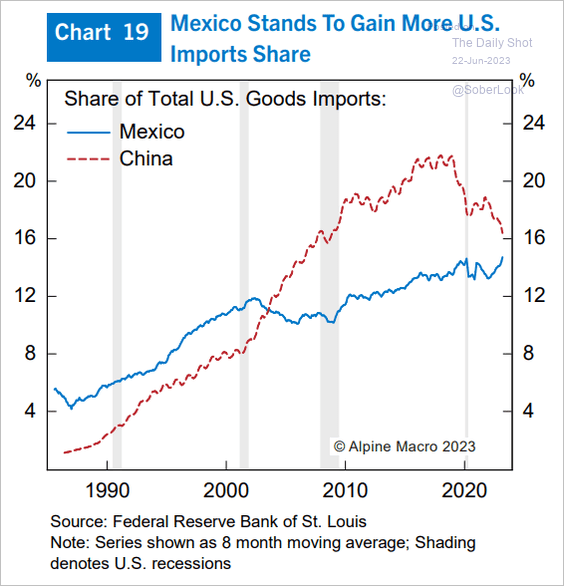

1. Mexico stands to gain from the US-China decoupling.

Source: Alpine Macro

Source: Alpine Macro

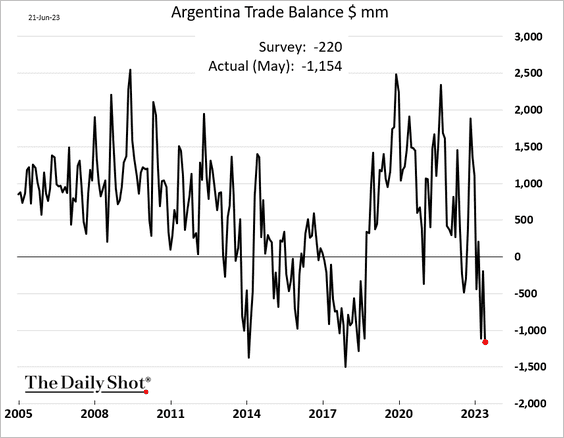

2. Argentina’s trade deficit has widened sharply.

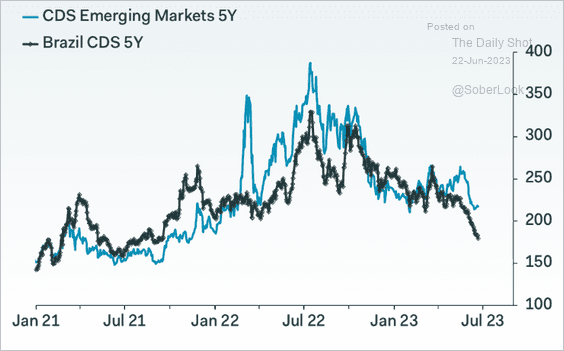

3. Brazil’s CDS spread is below the EM average.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

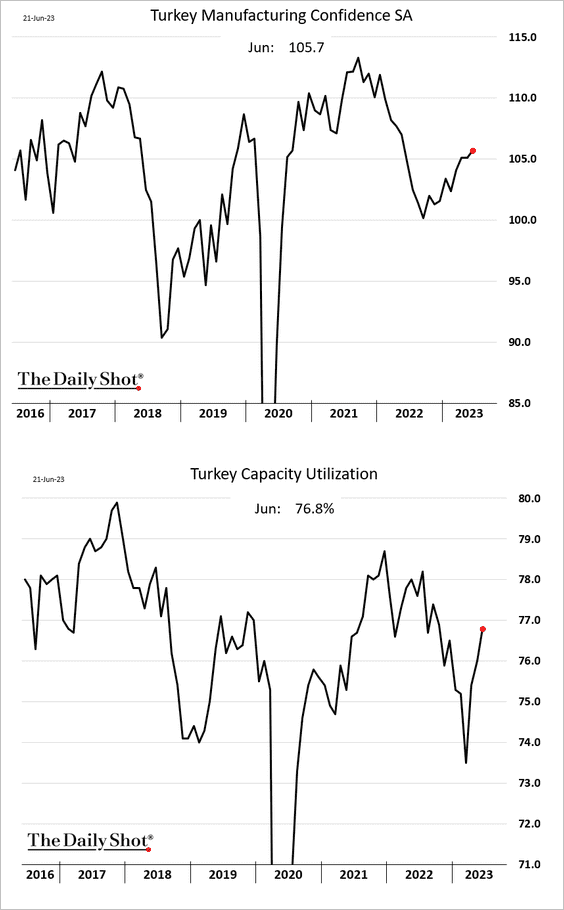

4. Turkey’s manufacturing confidence is improving.

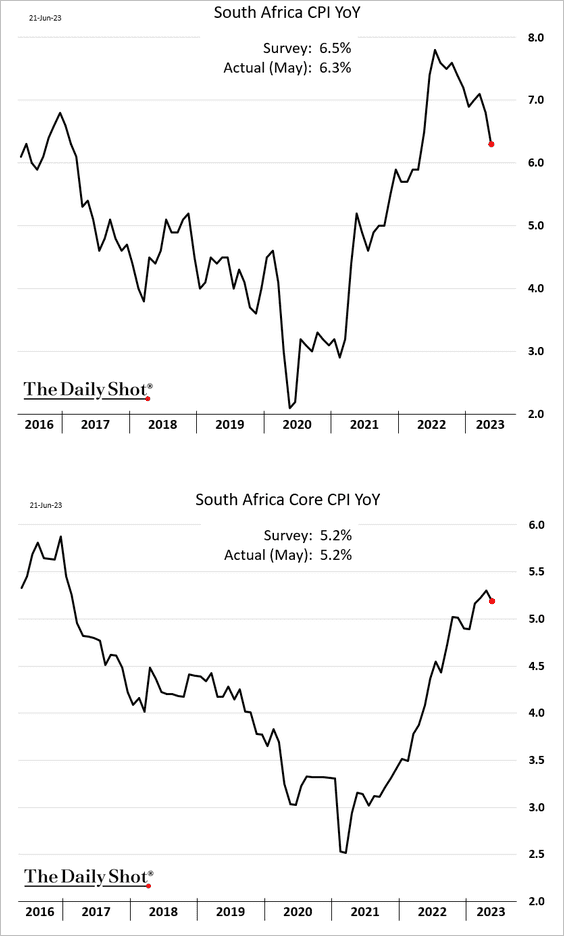

5. South Africa’s inflation is moderating.

Back to Index

Cryptocurrency

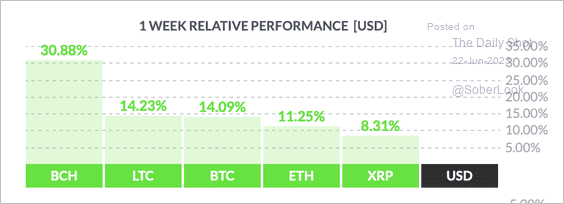

1. It has been a strong week for cryptos so far, with Bitcoin Cash outperforming peers.

Source: FinViz

Source: FinViz

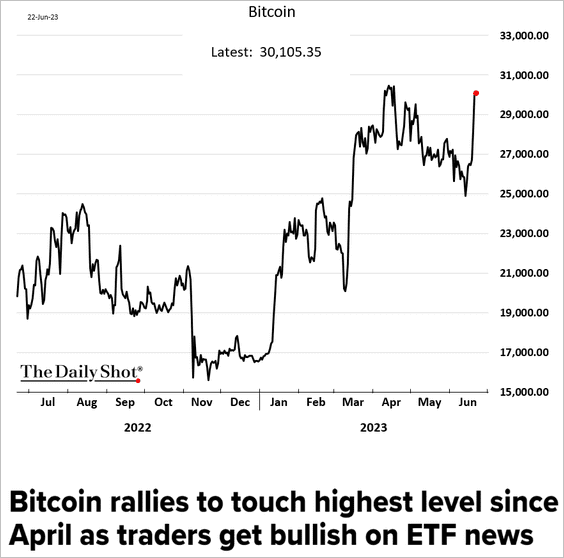

2. Bitcoin has been surging on hopes that cash bitcoin ETFs will finally be approved in the US.

Source: CNBC Read full article

Source: CNBC Read full article

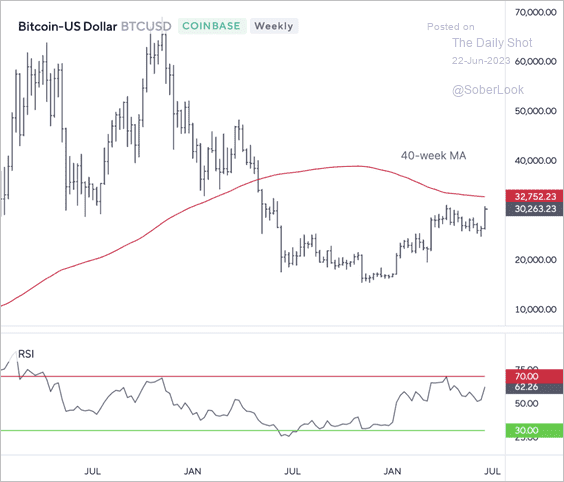

• Bitcoin extended gains, but is not yet overbought. Next resistance is at the 40-week moving average near $32K.

Source: Symbolik

Source: Symbolik

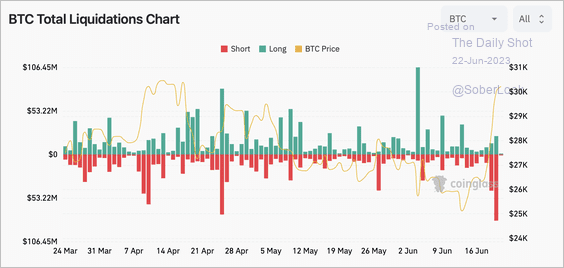

• BTC’s rally past $30K triggered another spike in short liquidations.

Source: CoinGlass

Source: CoinGlass

——————–

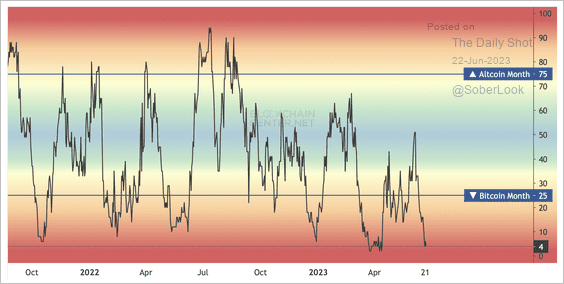

3. Only 4% of altcoins have outperformed BTC over the past month. Traders continue to prefer bitcoin during this rally, which is unusual for risk-on phases.

Source: Blockchain Center

Source: Blockchain Center

Back to Index

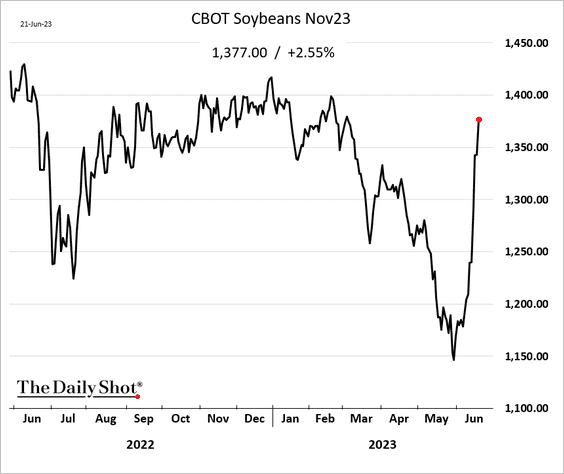

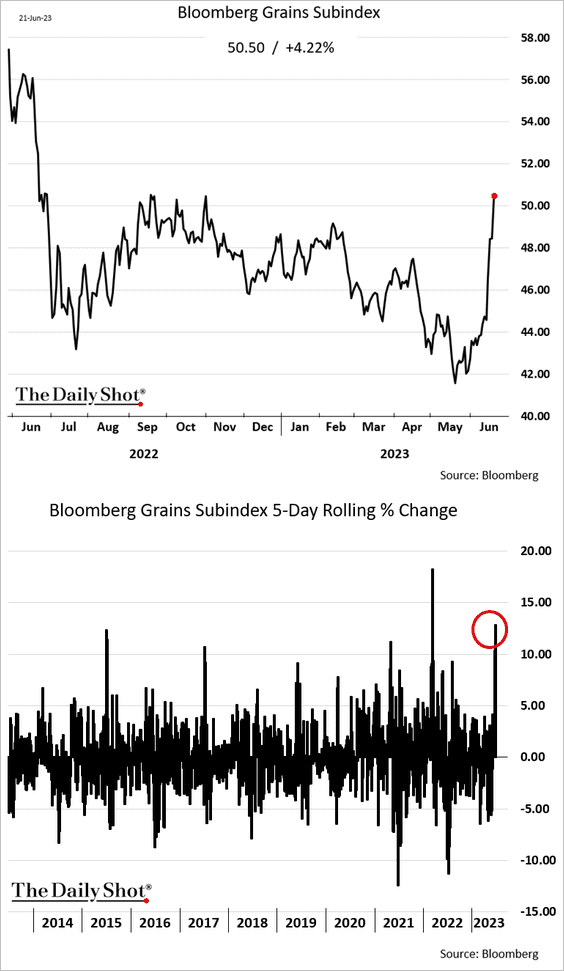

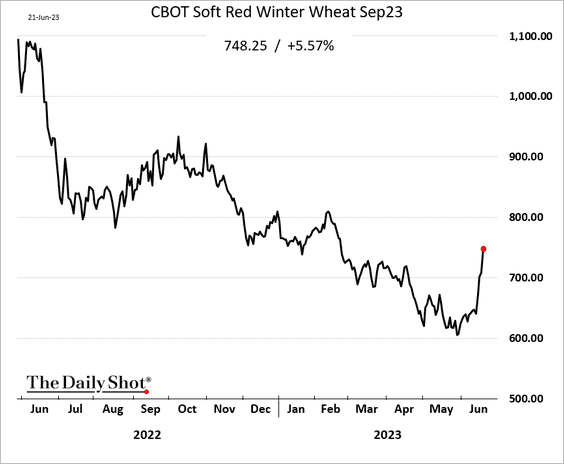

Commodities

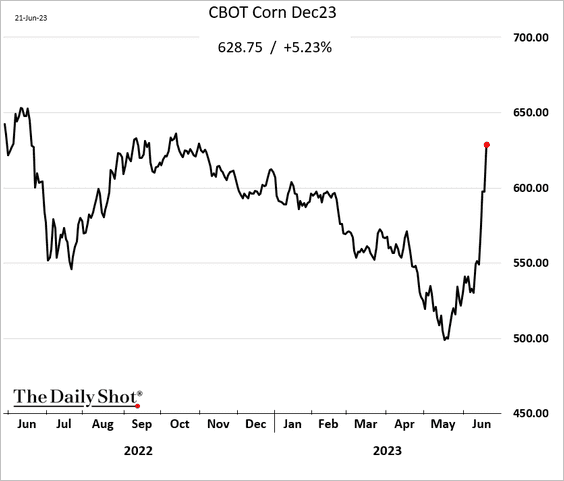

1. US grains continue to surge as crop conditions deteriorate.

Source: Farm and Dairy Read full article

Source: Farm and Dairy Read full article

• Corn:

• Soybeans:

• Bloomberg’s grains index:

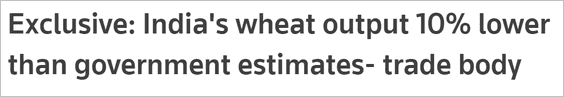

• Wheat also got a boost from some international news.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

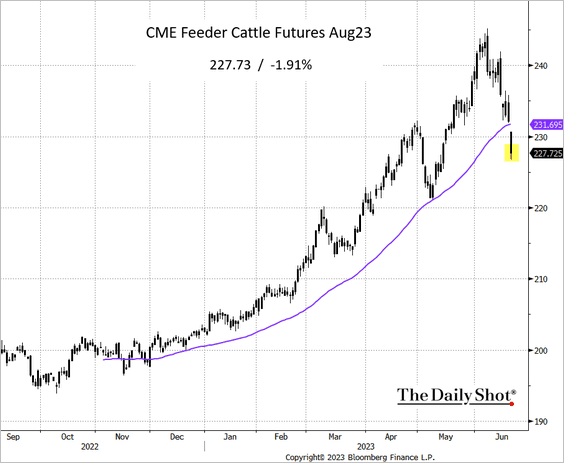

2. Feeder cattle broke below the 50-day moving average as grain prices soared.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

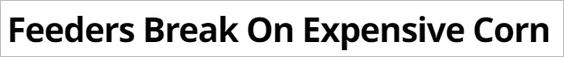

3. Here is a look at the changes in global steel production.

Source: Capital Economics

Source: Capital Economics

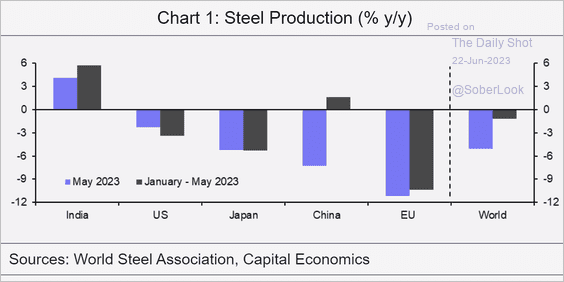

4. Nuclear reactors are expected to double by 2050, which could support uranium prices.

Source: PGM Global

Source: PGM Global

Back to Index

Equities

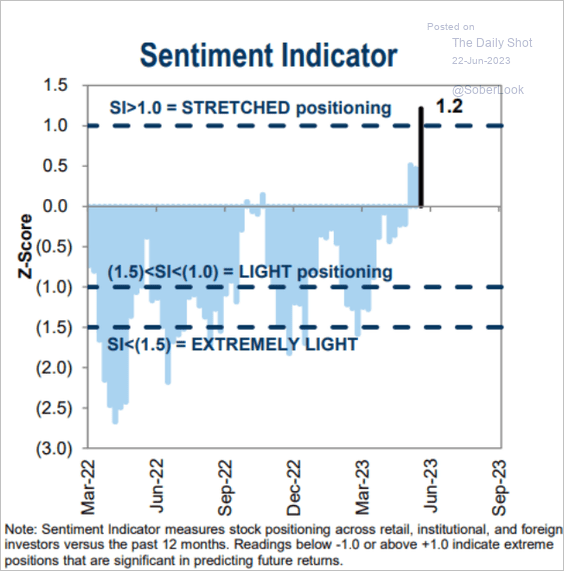

1. Goldman’s positioning indicator has moved into “stretched” territory.

Source: Goldman Sachs

Source: Goldman Sachs

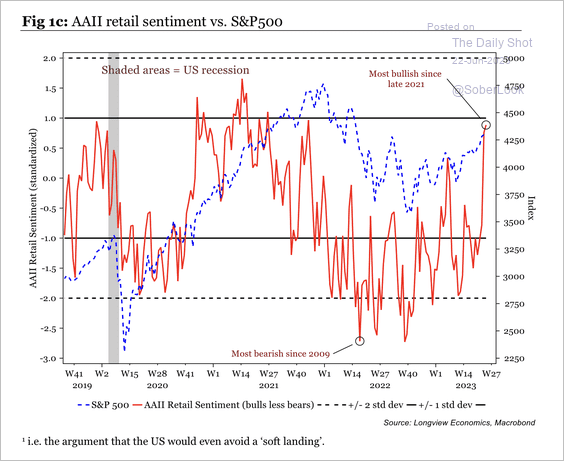

2. US retail sentiment is the most bullish since late-2021, shortly before the recent bear market began.

Source: Longview Economics

Source: Longview Economics

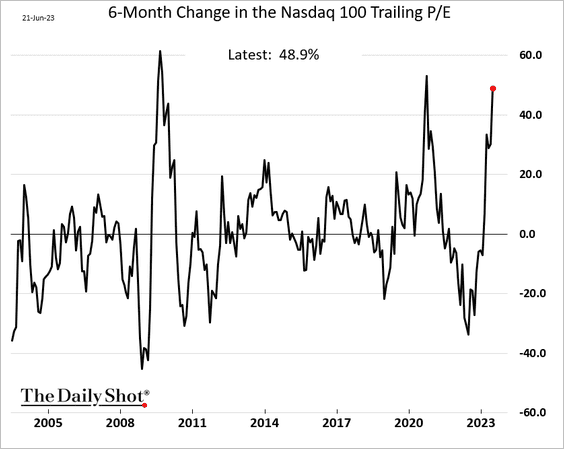

3. The Nasdaq 100 trailing PE ratio jumped by almost 50% over the past six months – a highly unusual move.

h/t @themarketear

h/t @themarketear

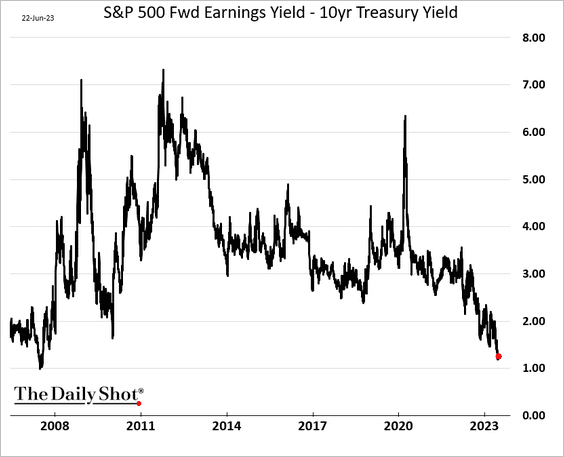

4. The S&P 500 equity risk premium is nearing the pre-GFC lows.

Further reading

Further reading

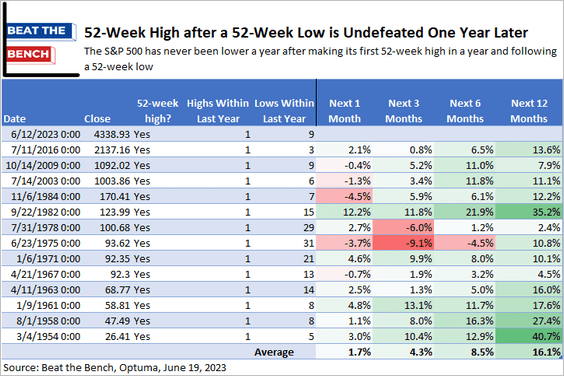

5. The S&P 500 is typically higher one year after rising from a 52-week low to a 52-week high. Pullbacks are likely during the next one-to-three months.

Source: @scottcharts

Source: @scottcharts

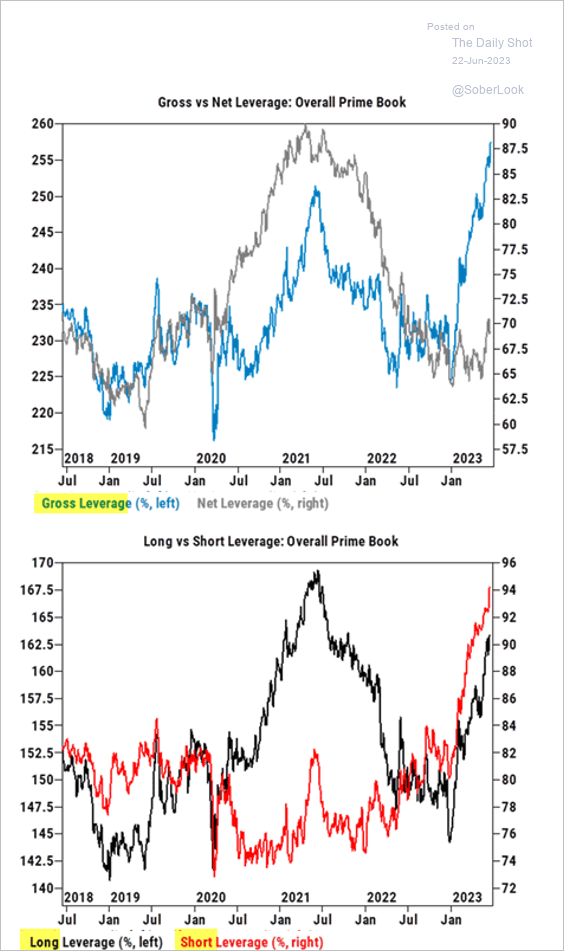

6. Hedge funds’ gross leverage has been surging this year.

Source: Goldman Sachs

Source: Goldman Sachs

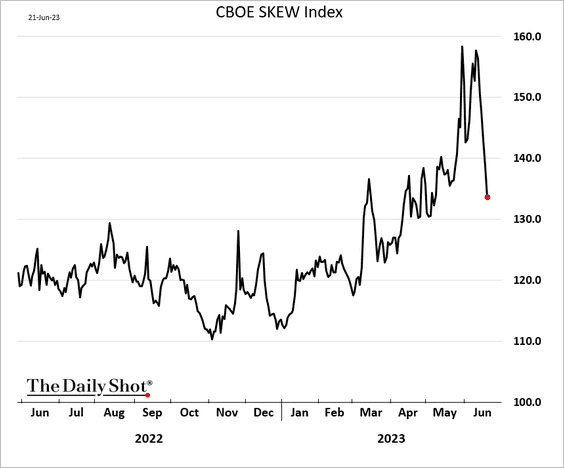

7. The CBOE skew index is tumbling.

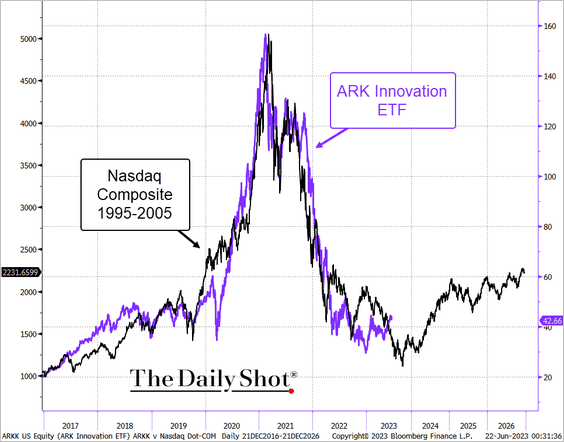

8. ARK Innovation continues to follow the dot-com analog.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Credit

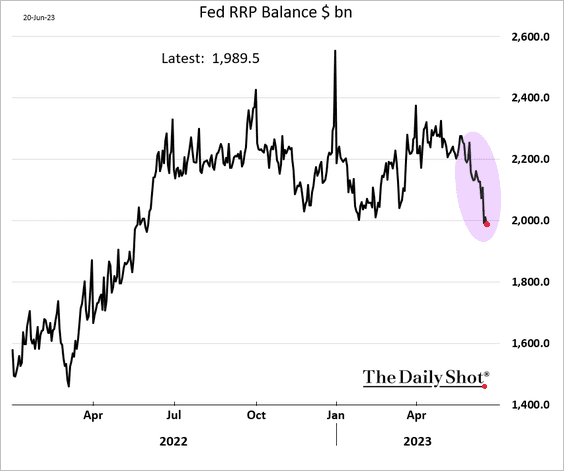

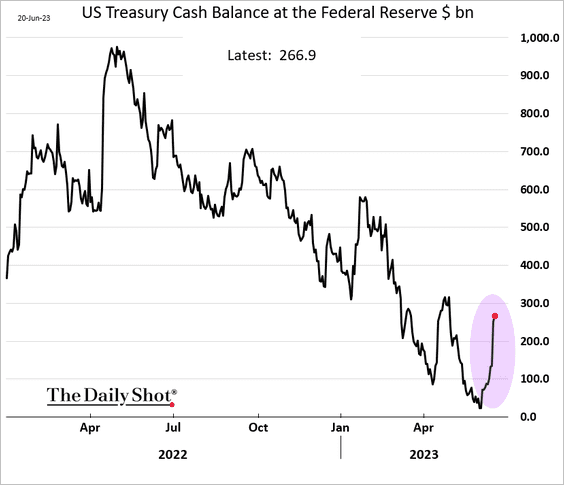

1. The Fed’s RRP balances keep moving lower, …

… offsetting the liquidity drain from the US Treasury rebuilding its holdings at the Fed.

——————–

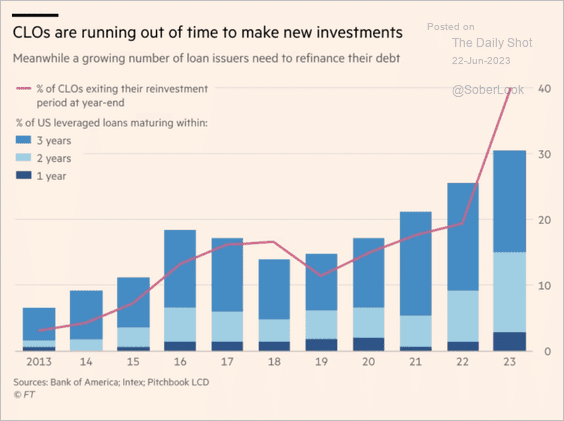

2. With many existing CLOs ending their reinvestment periods, new CLOs will have no shortage of product to buy.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

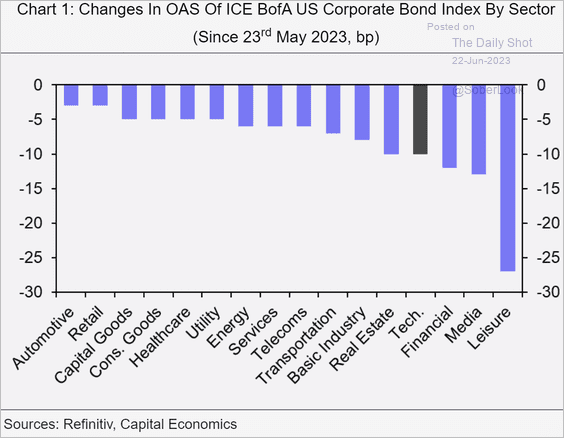

3. This chart shows corporate bond spread compression since May 23rd.

Source: Capital Economics

Source: Capital Economics

Back to Index

Rates

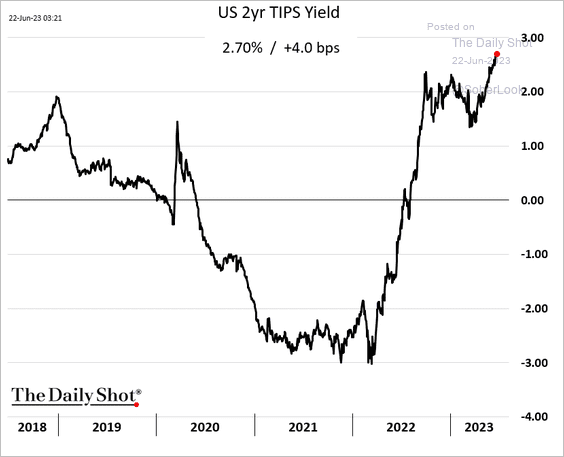

1. US short-term real yields keep rising.

Source: @axios

Source: @axios

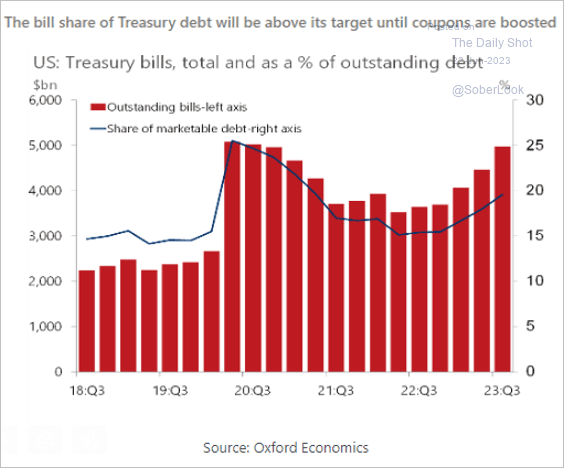

2. The T-bill share of the Treasury market is expected to climb further as the US Treasury boosts its post-debt-ceiling issuance.

Source: Oxford Economics

Source: Oxford Economics

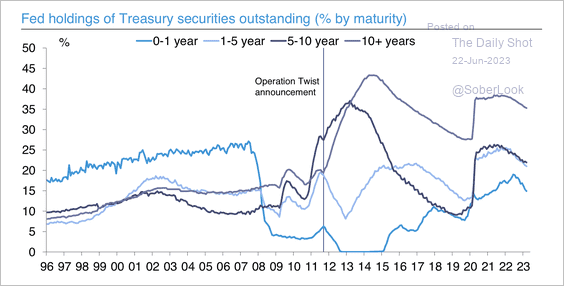

3. The Fed owns the highest concentration of 10+ year Treasuries, with roughly 36% outstanding.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

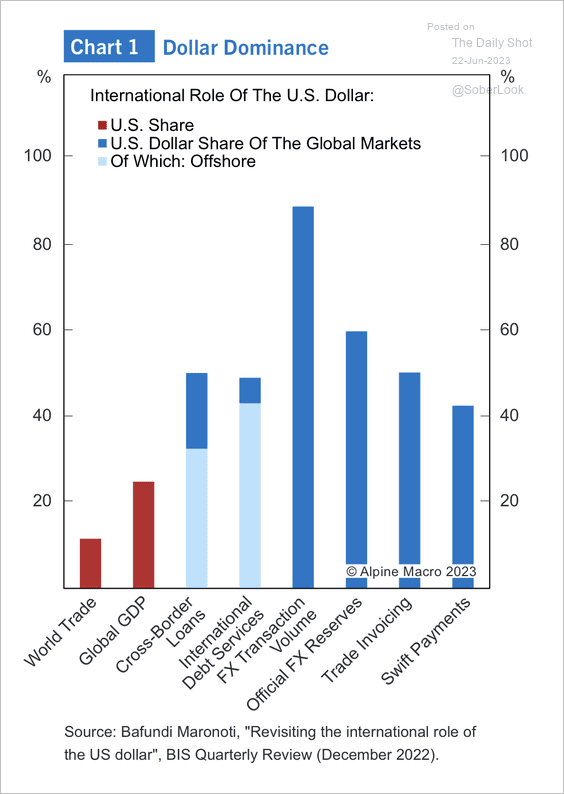

1. The dollar remains dominant in global markets.

Source: Alpine Macro

Source: Alpine Macro

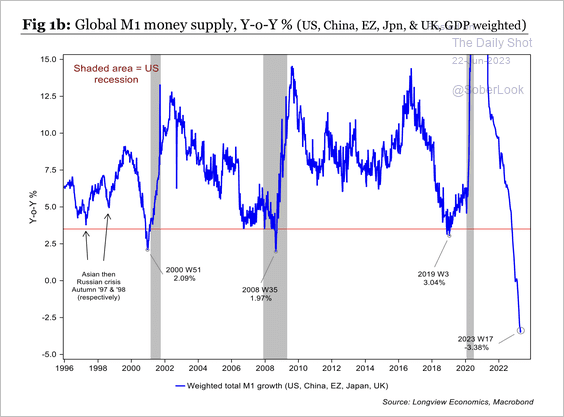

2. Global M1 money supply has declined sharply.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

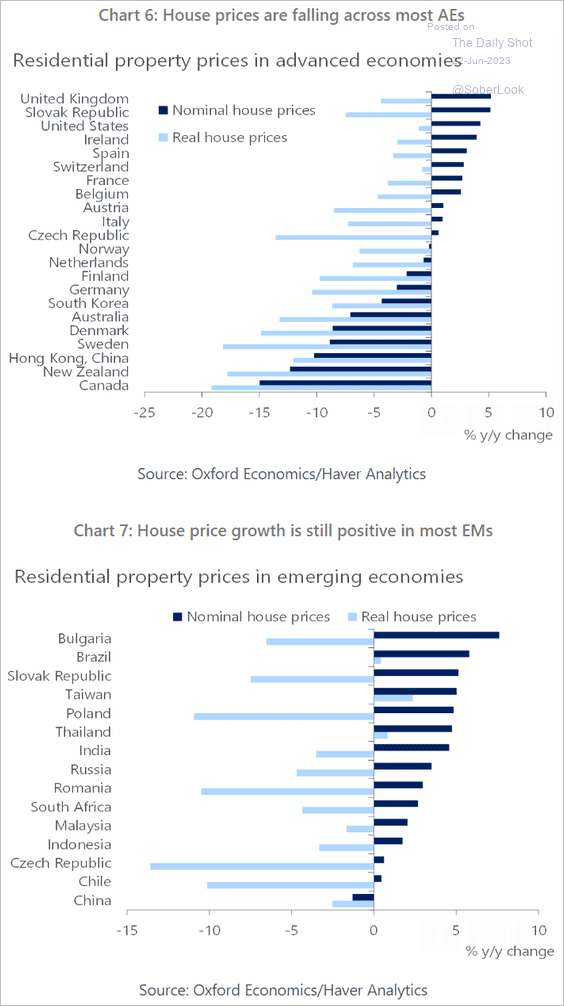

3. Next, we have nominal and real year-over-year house price changes.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

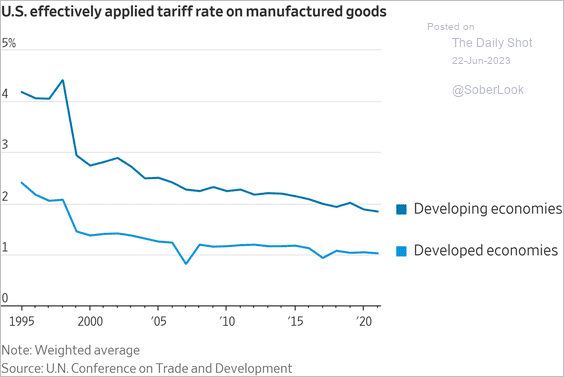

1. US tariffs on manufactured goods:

Source: @WSJ Read full article

Source: @WSJ Read full article

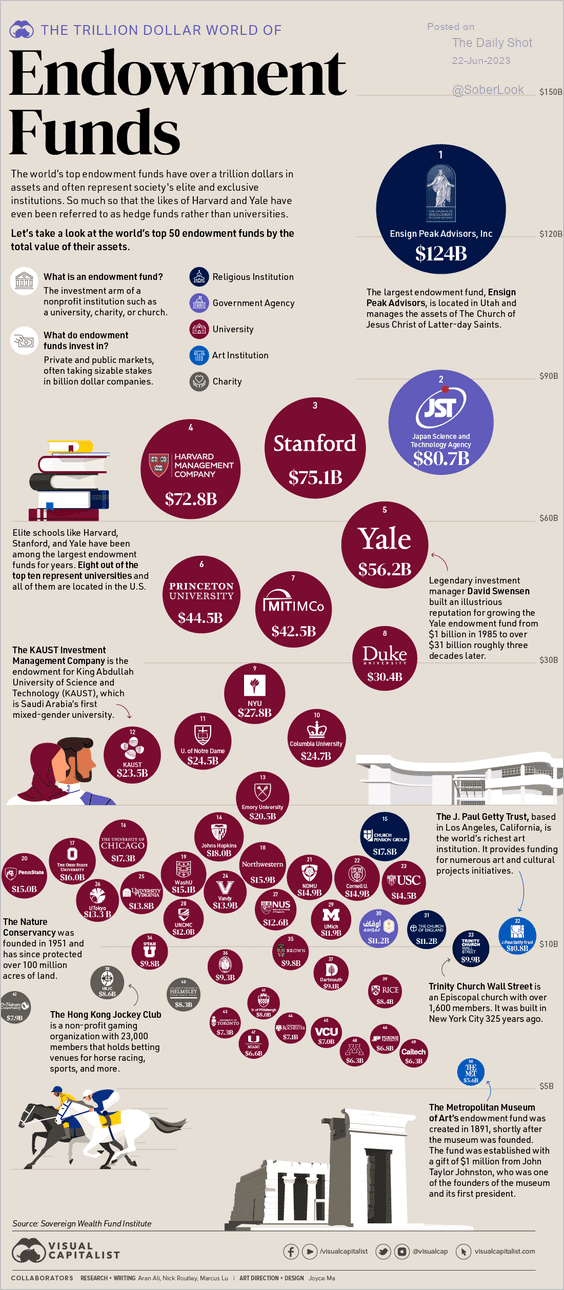

2. Endowment funds:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

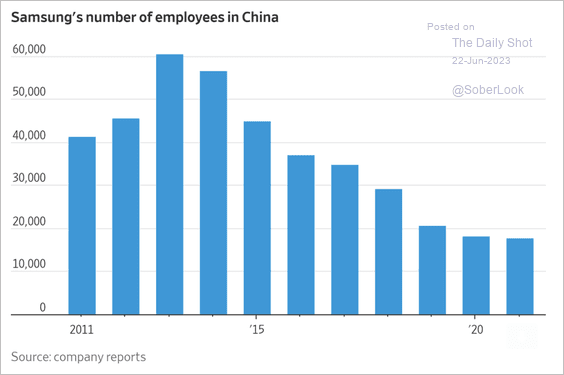

3. Samsung Electronics’ number of employees in China:

Source: @WSJ Read full article

Source: @WSJ Read full article

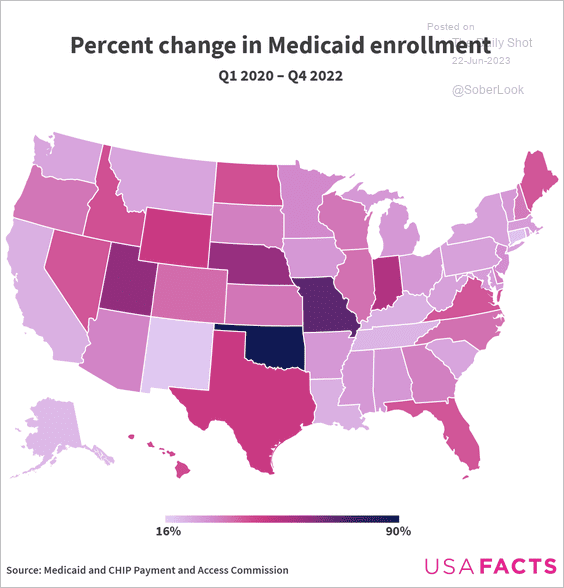

4. Changes in Medicaid enrollment:

Source: USAFacts

Source: USAFacts

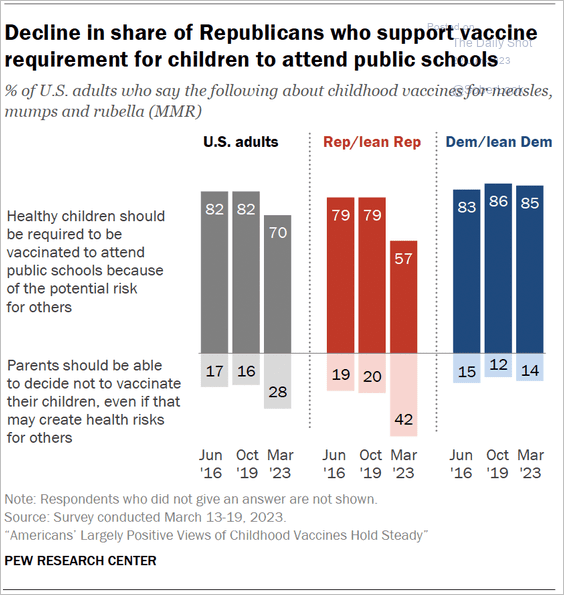

5. Views on MMR vaccine requirements to attend public schools:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

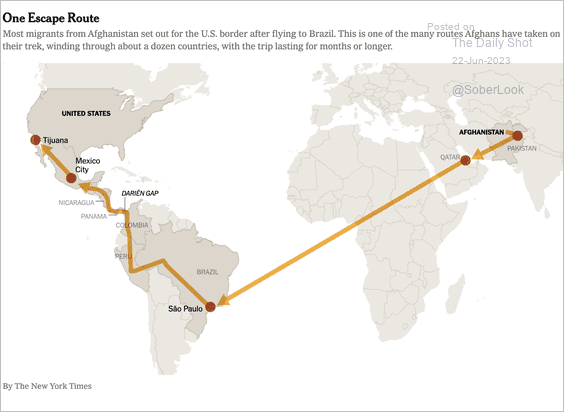

6. Afghan refugees’ perilous journey:

Source: The New York Times Read full article

Source: The New York Times Read full article

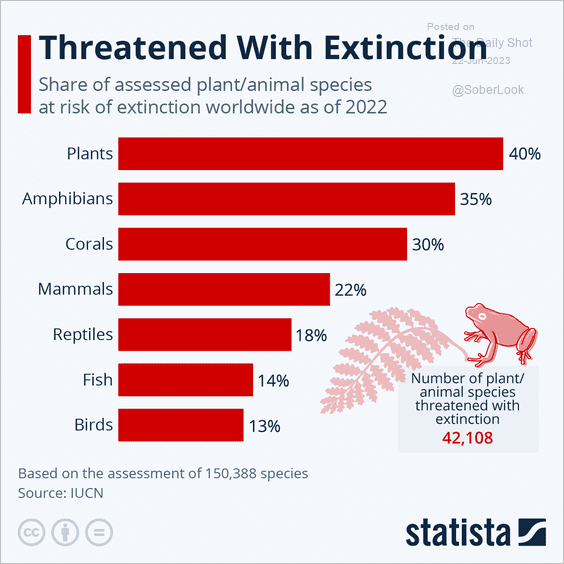

7. Plants and animals at risk of extinction:

Source: Statista

Source: Statista

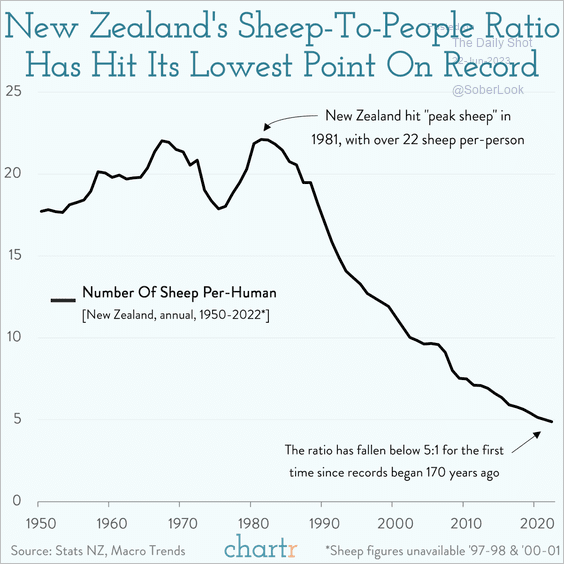

8. New Zealand’s sheep-to-people ratio:

Source: @chartrdaily

Source: @chartrdaily

——————–

As a reminder, the next Daily Shot will be published on Monday, June 26th

Have a great weekend!

Back to Index