The Daily Shot: 13-Jul-23

• The United States

• Canada

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

1. The June CPI report surprised to the downside, pointing to a broad slowdown in consumer inflation.

Source: CNBC Read full article

Source: CNBC Read full article

The core CPI increase was the lowest since early 2021.

• These charts show the contributions to the headline and core CPI indices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Below are the year-over-year CPI changes.

• The core goods CPI declined in June.

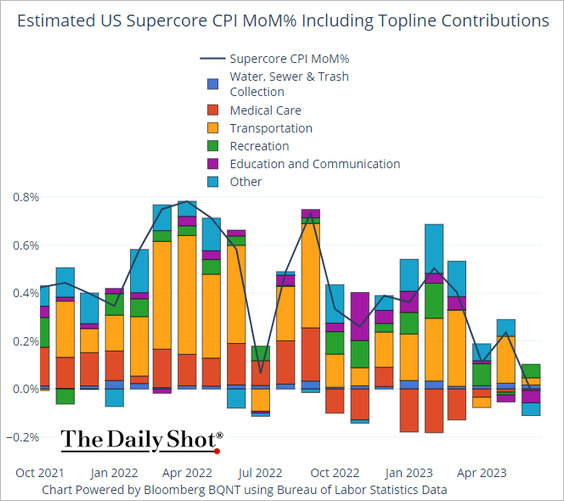

• The supercore CPI (services less housing) was flat on the month, a welcome development for the Fed.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Here is the supercore CPI year-over-year chart.

Source: Piper Sandler

Source: Piper Sandler

– This chart shows 3-month rolling changes in various core inflation indices.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Pantheon Macroeconomics expects further moderation in the core CPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

We will have more updates on the CPI report tomorrow.

——————–

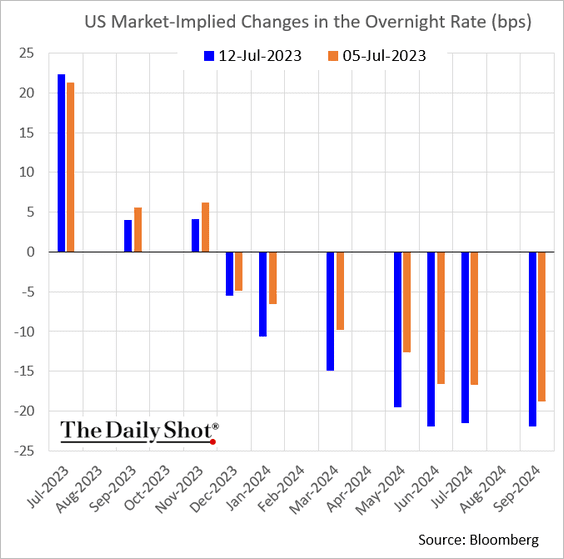

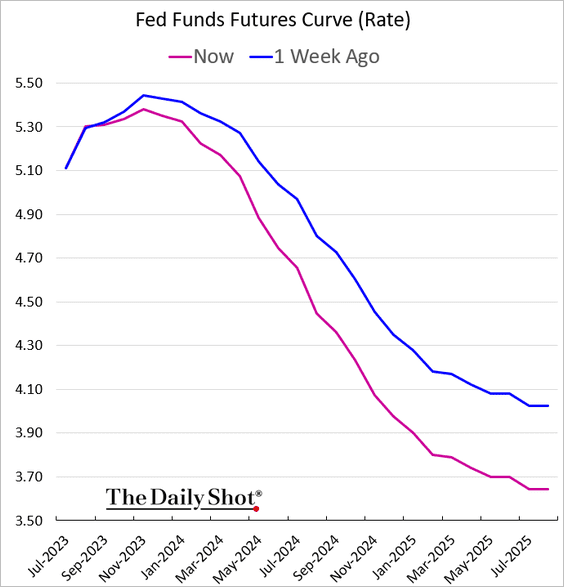

2. Despite the positive inflation news, the market still expects the Fed to raise rates this month.

But the July hike could mark the end of the hiking cycle.

• Treasury yields declined sharply.

• The dollar tumbled (3 charts).

• The dollar’s weakness boosted commodities (2 charts).

• Stocks climbed, with the S&P 500 hitting the highest level since early 2022.

——————–

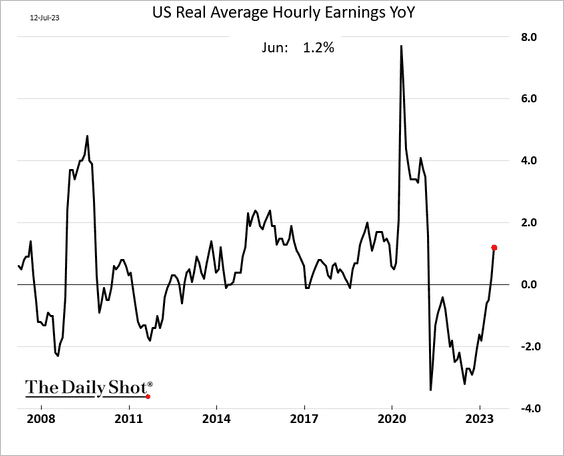

3. Real wage growth is rebounding as inflation moderates.

4. Freight costs continue to fall.

Source: Cass Information Systems

Source: Cass Information Systems

• Rail traffic remains soft.

Source: Association of American Railroads

Source: Association of American Railroads

• Is the truckload cycle bottoming?

Source: Cass Information Systems

Source: Cass Information Systems

——————–

5. The Fed’s Beige Book signaled slow growth but no recession for now.

Source: @apgmonteiro, @economics Read full article

Source: @apgmonteiro, @economics Read full article

• Here is the Oxford Economics Beige Book sentiment index.

Source: Oxford Economics

Source: Oxford Economics

• Inflation is becoming less of a concern.

Source: Oxford Economics

Source: Oxford Economics

• The Beige Book report suggests that labor market imbalances are easing.

Labor demand remained healthy, though some contacts reported that hiring was getting more targeted and selective. Employers continued to have difficulty finding workers, particularly in health care, transportation, and hospitality, and for high-skilled positions in general. However, many Districts reported that labor availability had improved and that some employers were having an easier time hiring than they were having previously. Employers also reported that the unusually high turnover rates in recent years appear to be returning to pre-pandemic norms. Wages continued to rise, but more moderately. Contacts in multiple Districts reported that wage increases were returning to or nearing pre-pandemic levels.

——————–

6. The stock market is signaling a stabilization in US manufacturing activity.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

7. The Earnest Analytics Spend Index doesn’t bode well for retail sales (as of June).

Source: Earnest Analytics

Source: Earnest Analytics

8. Mortgage applications remain depressed.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

Back to Index

Canada

1. The BoC hiked rates as expected.

• The market is leaning toward this rate increase being the last one in this cycle.

• Bond yields declined, pulled lower by the US downside CPI surprise.

——————–

2. Oxford Economics sees Canadian economic growth well below the BoC’s forecasts.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

1. The May GDP decline was smaller than expected.

Source: @LucyGJWhite, @economics Read full article

Source: @LucyGJWhite, @economics Read full article

We will have more data on May’s economic activity tomorrow.

——————–

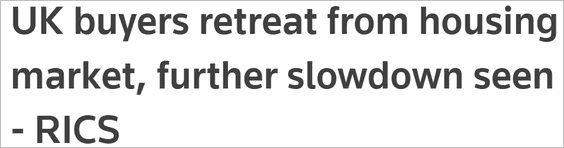

2. The RICS report shows the housing market struggling, …

Source: Reuters Read full article

Source: Reuters Read full article

… as mortgage rates keep climbing.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

3. This chart shows the spread between the 10-year Treasury and gilts.

4. Canary Wharf vacancies surge as financial firms reduce their office footprint.

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Finally, here are the latest voting intentions polls.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

1. Two measures of Germany’s unemployment have diverged sharply.

Source: Gavekal Research

Source: Gavekal Research

2. Demand for European bond ETFs has been rising.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. Here is the population of EU member states.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

1. Let’s begin with South Korea.

• The central bank left rates unchanged but signaled a hawkish stance.

Source: @economics Read full article

Source: @economics Read full article

• ING is forecasting modest growth over the next few quarters.

Source: ING

Source: ING

• Export prices have been tumbling.

——————–

2. New Zealand’s home sales were well above 2022 levels in June.

Source: Times Read full article

Source: Times Read full article

The market is putting very low odds on additional RBNZ rate hikes in this cycle.

——————–

3. Australia’s consumer sentiment edged higher this month.

Inflation expectations remain elevated.

Back to Index

China

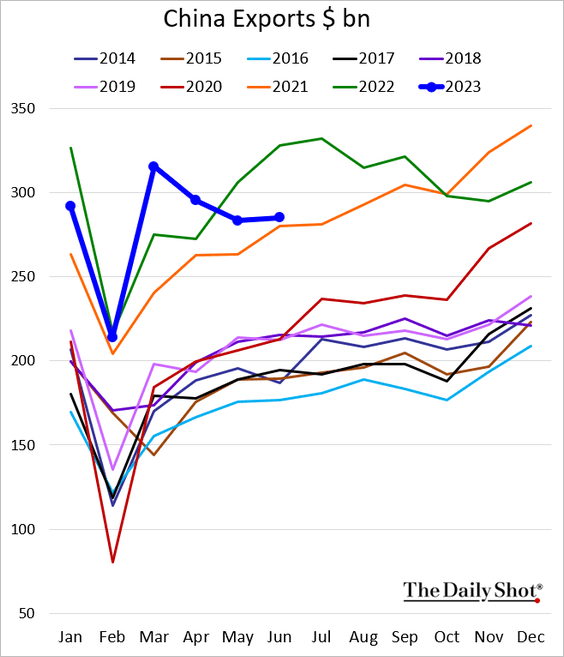

1. Exports were lower than expected last month (well below 2022 levels).

Source: @markets Read full article

Source: @markets Read full article

• Imports softened as well.

• Here is the trade balance (2 charts).

——————–

2. Growth in broad money supply is running substantially above nominal GDP growth. Where will this extra money go?

Source: Gavekal Research

Source: Gavekal Research

3. The renminbi is undervalued on a purchasing-parity basis.

Source: Gavekal Research

Source: Gavekal Research

4. This chart shows residential and nonresidential construction investment.

Source: Longview Economics

Source: Longview Economics

Back to Index

Emerging Markets

1. Let’s begin with India.

• Industrial production is holding up well.

• The CPI was a bit higher than expected, boosted by some food items.

Here is the core CPI.

Source: ING

Source: ING

• India’s infrastructure stocks have outperformed amid robust investment.

Source: TS Lombard

Source: TS Lombard

——————–

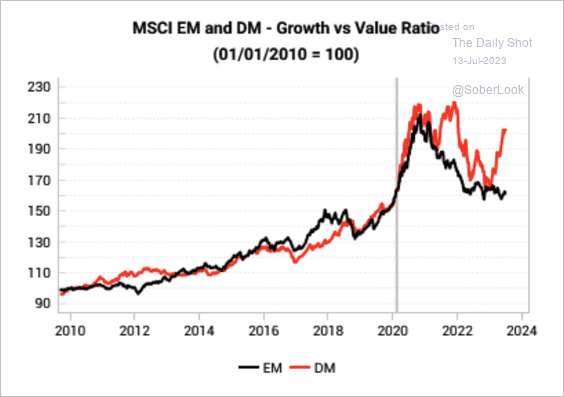

2. EM’s growth/value ratio has significantly underperformed DM’s this year.

Source: Variant Perception

Source: Variant Perception

3. EM local-currency bond yields have declined relative to DM bonds.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Variant Perception’s regime indicator still favors developed markets over EM.

Source: Variant Perception

Source: Variant Perception

Back to Index

Commodities

1. Wheat has reversed the recent bounce.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

2. Gold is entering a seasonally strong period.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. Copper has been consolidating.

h/t Longview Economics

h/t Longview Economics

Back to Index

Energy

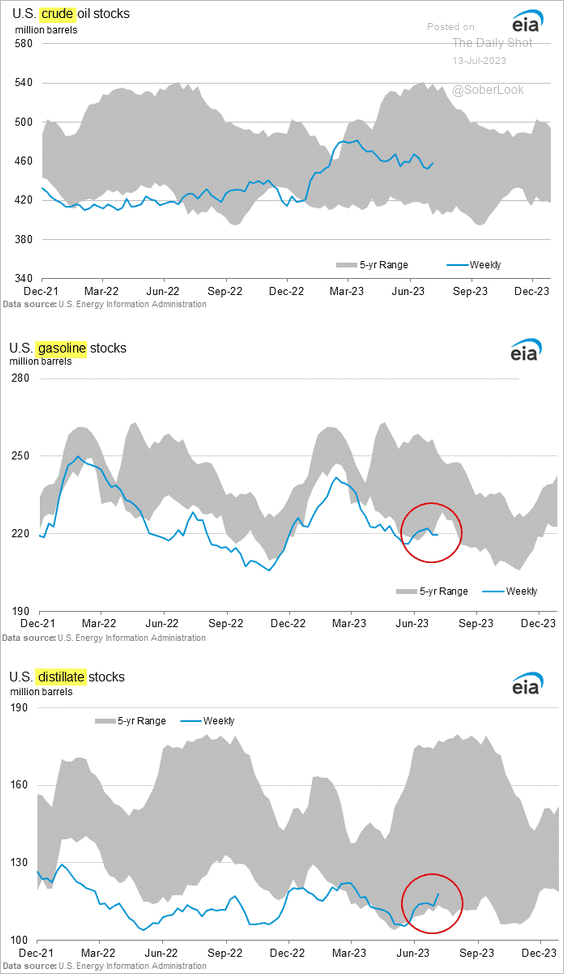

1. US oil inventories jumped last week.

Here is the inventory measured in days of supply.

Nonetheless, Brent managed to climb above $80/bbl.

2. Gasoline inventories were flat last week, but distillate stockpiles rose sharply.

Here are the inventory levels for crude oil, gasoline, and distillates.

3. US refinery runs jumped last week.

Back to Index

Equities

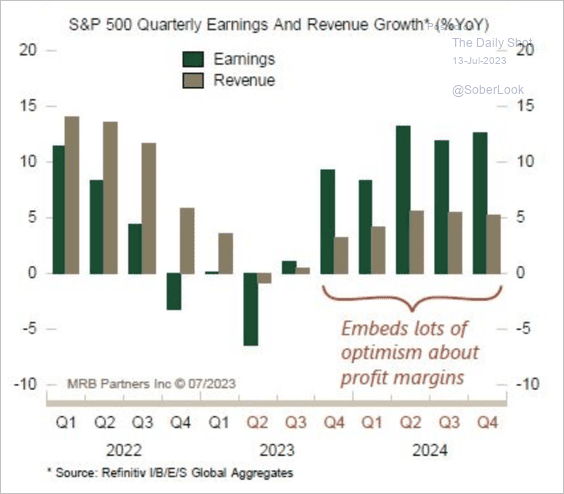

1. Analysts expect earnings growth to reaccelerate.

Source: MRB Partners

Source: MRB Partners

The relative earnings momentum of US growth stocks has improved.

Source: MRB Partners

Source: MRB Partners

——————–

2. Discretionary investors’ positioning has diverged from the ISM Manufacturing PMI.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Retail investors remain bullish.

Source: Yardeni Research

Source: Yardeni Research

4. The gap between the S&P 500 and Fed liquidity continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

5. Companies with high levels of free cash flow have underperformed sharply.

Relative to the Russell 1000 Index (large caps), companies with high levels of free cash flow exhibit greater levels of return-on-equity and earnings growth while trading at historically low valuations.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

6. VIX has been running below realized volatility.

Source: Variant Perception

Source: Variant Perception

7. US growth stocks appear overvalued relative to interest rates.

Source: MRB Partners

Source: MRB Partners

8. Oxford Economics expects a pullback in stocks over the near term.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Rates

1. The Treasury curve continues to steepen.

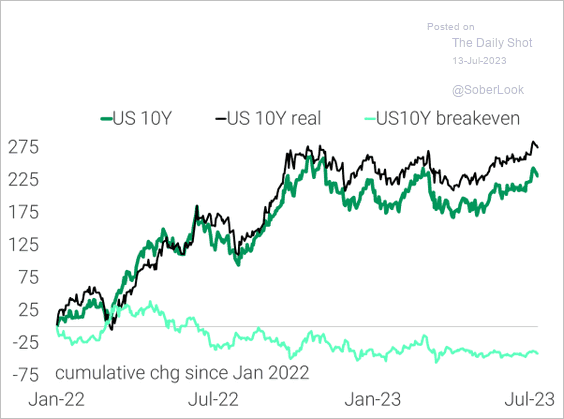

2. Real rate increases have outpaced nominal rates, lowering inflation expectations.

Source: TS Lombard

Source: TS Lombard

3. Here is a forecast for Treasury yields from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

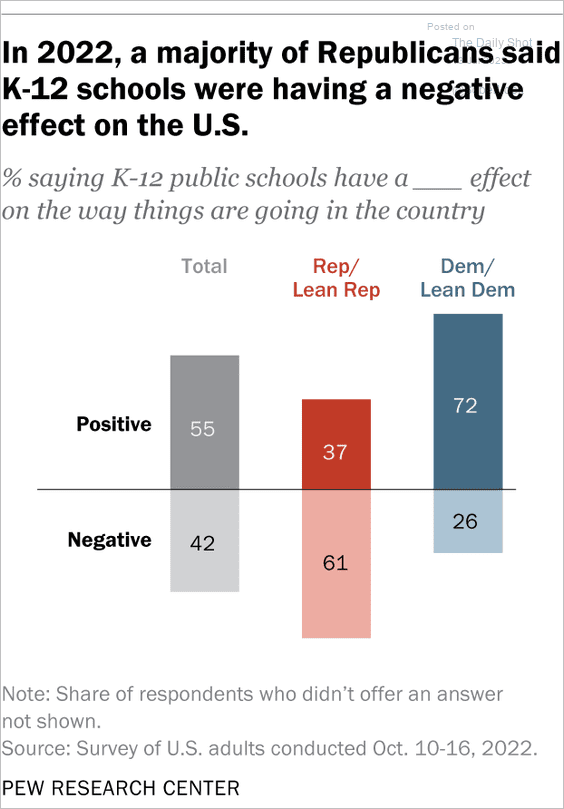

1. Views on the impact of K-12 schools on the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

2. Americans’ confidence in higher education:

Source: Gallup Read full article

Source: Gallup Read full article

3. Views on federal agencies:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

4. How will AI adoption impact productivity?

Source: Goldman Sachs; @ericwallerstein

Source: Goldman Sachs; @ericwallerstein

5. Countries with an increase in nuclear warheads

Source: Statista

Source: Statista

6. Amazon’s revenues on Prime Day:

Source: Statista

Source: Statista

7. Views on tipping:

Source: Bankrate Read full article

Source: Bankrate Read full article

8. Inflation-adjusted wholesale sales of alcoholic beverages (year-over-year):

Source: Quill Intelligence

Source: Quill Intelligence

——————–

Back to Index