The Daily Shot: 14-Jul-23

• The United States

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Food for Thought

The United States

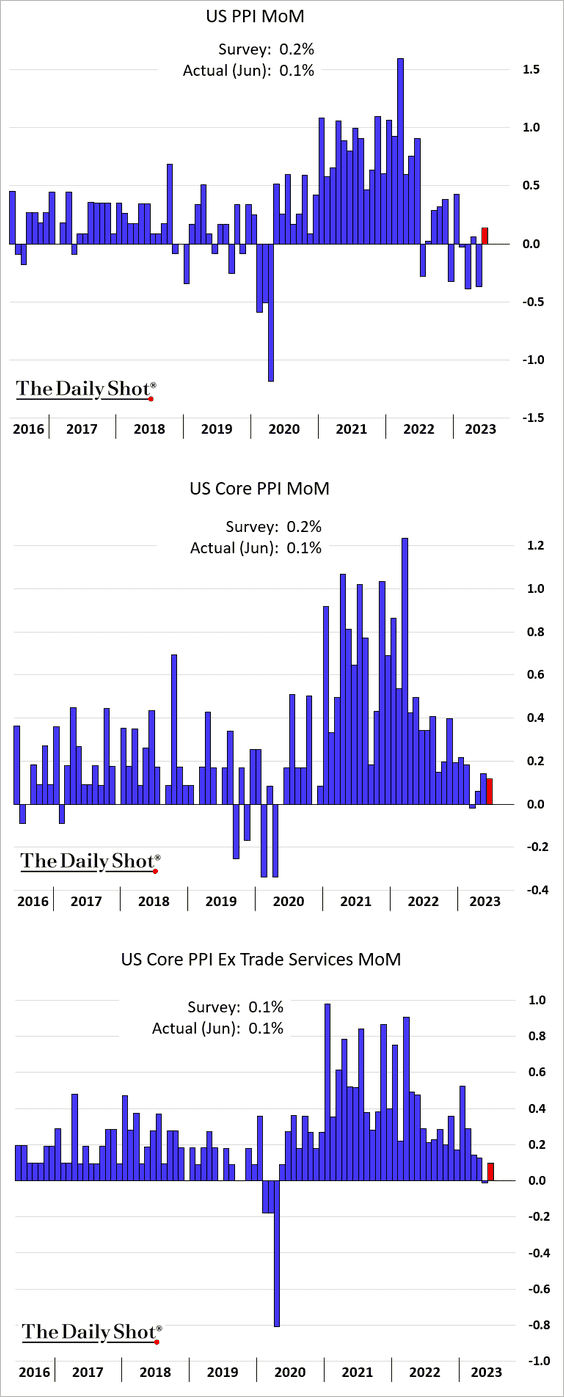

1. The PPI report provided further evidence of easing inflationary pressures, with the June headline and core figures coming in below forecasts.

Source: @economics Read full article

Source: @economics Read full article

• The core goods PPI change was negative for the first time since the COVID shock.

• Logistics costs continue to decline.

• On a year-over-year basis, the headline PPI is about to enter deflation.

Source: FHN Financial

Source: FHN Financial

• Upstream prices are declining.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• The US will import some disinflation from China.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

2. Next, we have some additional data on consumer inflation.

• Alternative core CPI measures showed slowing underlying inflation.

– Cleveland Fed’s Median CPI (monthly changes):

– Cleveland Fed’s Trimmed-Mean CPI:

– Atlanta Fed’s sticky CPI:

The sticky CPI is now annualizing at below 2%.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– New York Fed’s UIG:

Further reading

Further reading

• Here are some sector trends.

– Vehicles:

– Airfare:

Source: Scotiabank Economics

Source: Scotiabank Economics

– Housing:

Nomura sees rent inflation gradually heading lower, …

Source: Nomura Securities

Source: Nomura Securities

… based on leading indicators.

Source: ING

Source: ING

By the way, the massive divergence between wage growth and rent increases is not sustainable.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. The US dollar is crashing after benign inflation reports.

Source: barchart.com

Source: barchart.com

4. The wage tracker from the Atlanta Fed indicates a deceleration in wage growth, yet it remains elevated.

Job hopping is not nearly as lucrative as it was at its peak last year, pointing to easing labor market imbalances. The Great Resignation has lost its luster.

——————–

5. Jobless claims did not rise as much as they typically do during the July 4th week.

Nonetheless, continuing claims are now 30.5% above last year’s levels.

——————–

6. The budget deficit is much wider this year than in 2022, …

… as federal receipts shrink while outlays continue to grow.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

1. Key economic indicators held up better than expected in May.

• Services:

• Manufacturing production:

• Construction:

——————–

2. The trade deficit was wider than expected in May.

3. Improving real wages should support retail sales.

Source: ING

Source: ING

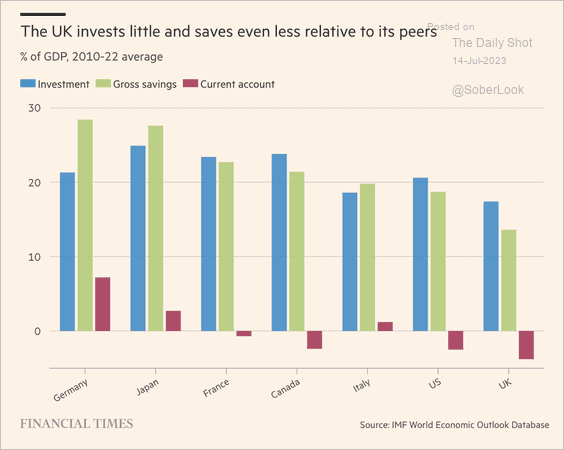

4. UK investment and savings have lagged other advanced economies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. The GDP per capita has also been lagging.

Source: Tony Blair Institute

Source: Tony Blair Institute

6. Job growth in London has been outpacing the rest of the UK.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

7. What do Britons think about Brexit? How do they view the relationship with the EU going forward?

Source: Tony Blair Institute

Source: Tony Blair Institute

Back to Index

The Eurozone

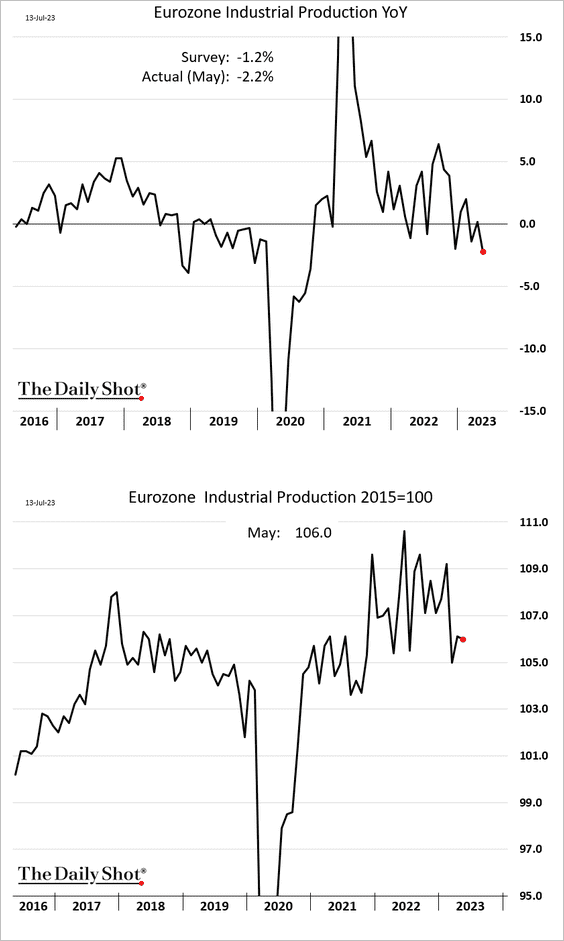

1. Industrial production is down on a year-over-year basis.

Source: @WindSonja, @markets Read full article

Source: @WindSonja, @markets Read full article

——————–

2. The ECB minutes were hawkish, pointing to more rate hikes ahead.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

However, the market took its cue from moderating US CPI, lowering the expected ECB rate trajectory.

Back to Index

Asia-Pacific

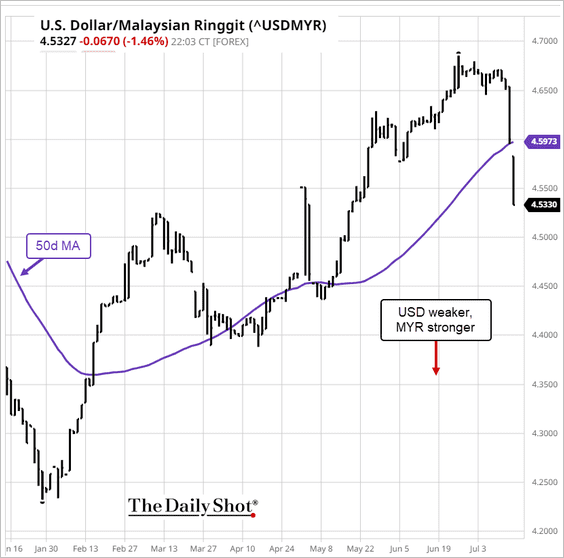

Asian currencies are surging against the dollar.

– The yen:

– The Taiwan dollar:

– The South Korean won:

• The Aussie dollar is at resistance.

Back to Index

China

1. The renminbi is rebounding.

2. The decline in industrial profits points to weaker manufacturing investment.

Source: BCA Research

Source: BCA Research

Consumer staples, utilities, and auto stocks have maintained uptrends relative to the broader A-share market.

Source: BCA Research

Source: BCA Research

——————–

3. So far, the savings drawdown has boosted consumer spending and retail sales, although sentiment is still relatively weak.

Source: MRB Partners

Source: MRB Partners

4. This chart shows China’s export changes by product (year-over-tear).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

1. Mexican industrial production jumped in May, boosted by construction. But factory output declined (2nd panel).

The Mexican peso continues to surge.

——————–

2. Next, we have some updates on Brazil.

• Service-sector output edged higher in May.

• Will we see a breakout in Brazil’s equities?

Source: BCA Research

Source: BCA Research

• Brazil’s population growth continues to slow.

Source: @TheDailyShot Further reading

Source: @TheDailyShot Further reading

——————–

3. Malaysia’s ringgit is surging, driven by equity and bond inflows.

Source: barchart.com

Source: barchart.com

4. Romania’s industrial production is down sharply relative to 2022.

Inflation is still above 10%.

——————–

5. Turkey’s industrial production climbed in May.

6. After some improvements this year, South Africa’s mining output was down again in May.

Back to Index

Cryptocurrency

1. It has been a good week for cryptos, with XRP outperforming top peers while Bitcoin Cash (BCH) consolidated recent gains.

Source: FinViz

Source: FinViz

Here is the month-to-date performance.

• XRP soared on Thursday after US courts ruled that the sale of Ripple’s XRP tokens did not constitute investment contracts. This essentially means that XRP is not a security.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

• By the way, XRP ranks third in Kaiko’s trading liquidity score, a strong improvement from Q1 when it ranked sixth.

Source: @KaikoData

Source: @KaikoData

• Coinbase shares surged on Thursday.

——————–

2. Also, on Thursday, the SEC charged Celsius and its founder/former CEO with violating securities laws.

Source: SEC Read full article

Source: SEC Read full article

——————–

• Market depth for Celsius’ altcoin holdings is very low. Liquidations could place significant pressure on markets.

Source: @KaikoData

Source: @KaikoData

——————–

3. The next bitcoin halving is roughly 280 days away.

Source: @glassnode

Source: @glassnode

4. Bitcoin’s 14-day price range has been extremely narrow. Will we see a volatile price move ahead?

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

1. Periods of low volatility during uptrends bode well for gold prices.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

2. Iron ore futures resumed their rally.

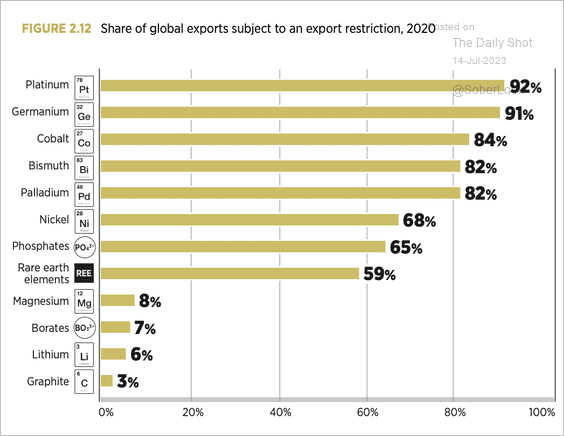

3. Here is a look at global export restrictions on critical materials.

Source: IRENA

Source: IRENA

4. Olive oil prices hit a record high due to the Spanish drought.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

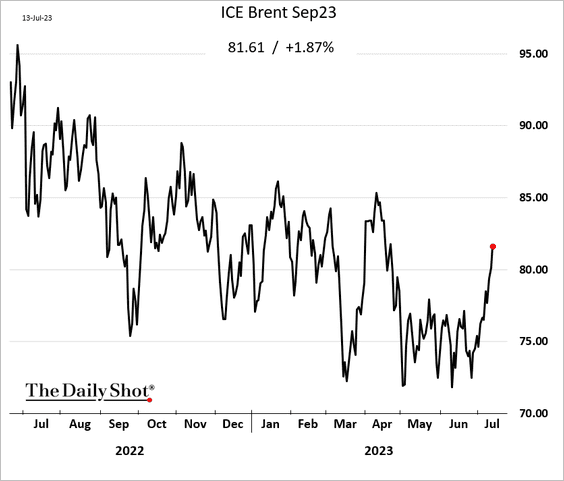

Energy

1. Crude oil prices continue to surge.

2. Here is a look at expected oil demand growth by source/product.

Source: IEA

Source: IEA

Source: IEA

Source: IEA

——————–

3. The southern and western regions of the US are currently grappling with severe heatwave conditions.

Source: NOAA

Source: NOAA

Source: Reuters Read full article

Source: Reuters Read full article

Nonetheless, natural gas prices have been falling, …

… amid elevated inventories.

——————–

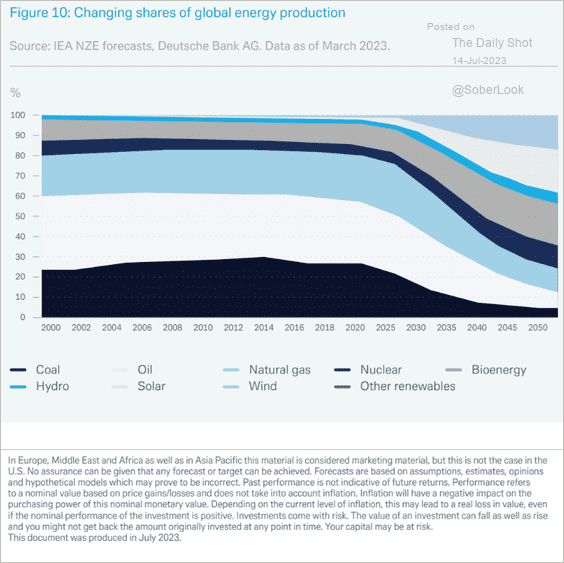

4. This chart illustrates the evolving share of global energy production across various fuel types.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Equities

1. The S&P 500 forward P/E ratio is back above pre-COVID levels, nearing 20x.

2. Equity funds continue to see inflows.

Source: BofA Global Research

Source: BofA Global Research

Here is a longer-term view of fund flows into equities vs. bonds and cash.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

——————–

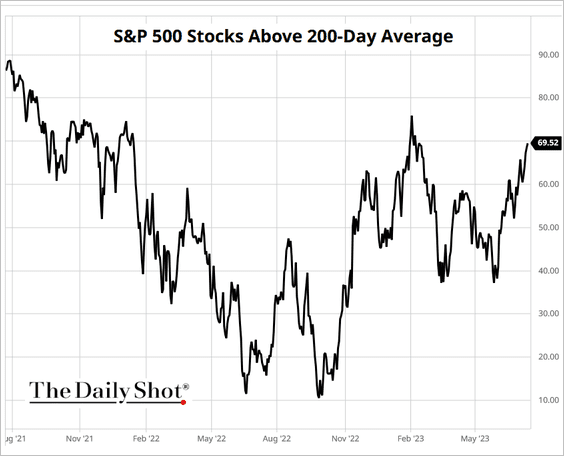

3. The NYSE new highs-new lows index made a year-to-date high, reflecting improving market breadth.

Source: @the_chart_life

Source: @the_chart_life

This chart shows the percentage of S&P 500 stocks that are above their 200-day moving average.

Source: barchart.com

Source: barchart.com

——————–

4. Retail purchases of stocks and ETFs are off the recent highs.

Source: Vanda Research

Source: Vanda Research

Here is a look at retail purchases by sector relative to this year’s peak.

Source: Vanda Research

Source: Vanda Research

——————–

5. Investment managers have been boosting allocation to stocks.

Source: NAAIM

Source: NAAIM

6. Macro hedge funds’ stock exposure has been correlated with economic surprises.

Source: Nomura; @dailychartbook

Source: Nomura; @dailychartbook

7. How did stocks perform after previous tightening cycles?

Source: Macrobond

Source: Macrobond

8. Despite bonds being much more attractive than stocks based on technicals and fundamentals (see chart), investor sentiment is markedly favoring stocks.

Source: @jasongoepfert; h/t @dailychartbook

Source: @jasongoepfert; h/t @dailychartbook

9. Small caps have been outperforming this month.

10. AI stocks surged this week.

11. Companies with a limited focus on ESG have been outperforming since May.

Back to Index

Alternatives

1. Capital deployment was down about 34% year-over-year in Q1 across Morgan Stanley’s coverage of private equity firms.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Deal activity has been highest in professional services, industrials, and energy transition.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

2. Median US seed-stage startup valuations continued their upward trend in Q1. Greater participation among corporate venture capital and large investors helped boost seed-stage deal metrics, according to PitchBook.

Source: PitchBook

Source: PitchBook

US venture-growth deal value is expected to fall below $50 billion this year. PitchBook data shows 90% of the capital invested in this stage was tied to deals with nontraditional firms.

Source: PitchBook

Source: PitchBook

Back to Index

Credit

1. Will the stock rally boost high-yield bond prices?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

On the other hand, elevated bankruptcies could put pressure on the high-yield market.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

2. Middle-market syndicated lending has been slowing.

Source: @theleadleft

Source: @theleadleft

3. US banks continue to tighten lending standards, especially for commercial real estate loans.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Banks have been less willing to lend to consumers, which typically coincides with recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Deutsche Bank expects US bank loan loss provisions to remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

1. Retail investors have been loading up on bond ETFs.

Source: Vanda Research

Source: Vanda Research

2. The liquidity drawdown from the US Treasury boosting its cash holdings at the Fed (after the debt ceiling was lifted) has been offset by falling balances at the Fed’s RRP facility. This should keep US bank deposits relatively stable.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

Food for Thought

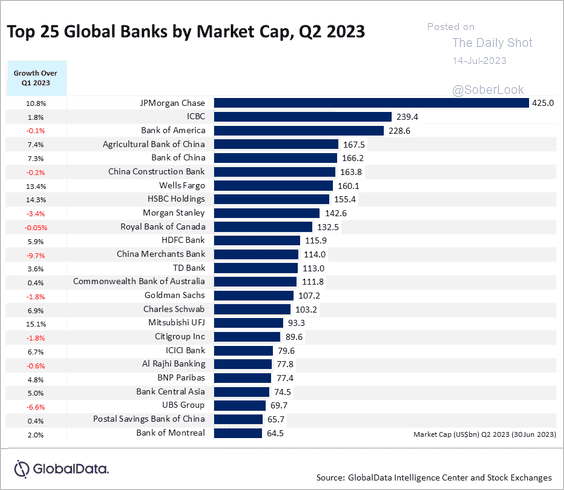

1. Top 25 global banks by market cap:

Source: GlobalData

Source: GlobalData

2. Investment in US manufacturing:

Source: The Economist Read full article

Source: The Economist Read full article

3. Year-over-year changes in China’s exports by destination:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

4. Global residents’ perceptions of their local area as a “good place” for gay and lesbian people to live:

Source: Gallup Read full article

Source: Gallup Read full article

5. Poverty rates among young adults who experienced childhood poverty:

Source: @axios Read full article

Source: @axios Read full article

6. Online use of languages vs. share of native language speakers:

Source: @chartrdaily

Source: @chartrdaily

7. Annual working hours by country:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

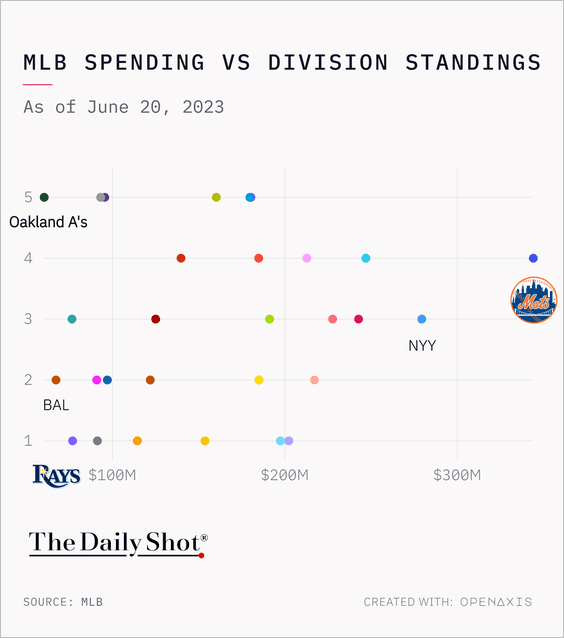

8. MLB spending vs. division standings:

Source: @TheDailyShot

Source: @TheDailyShot

——————–

Have a great weekend!

Back to Index