The Daily Shot: 17-Jul-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

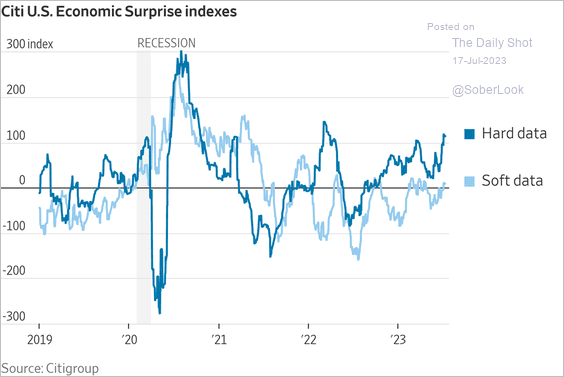

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

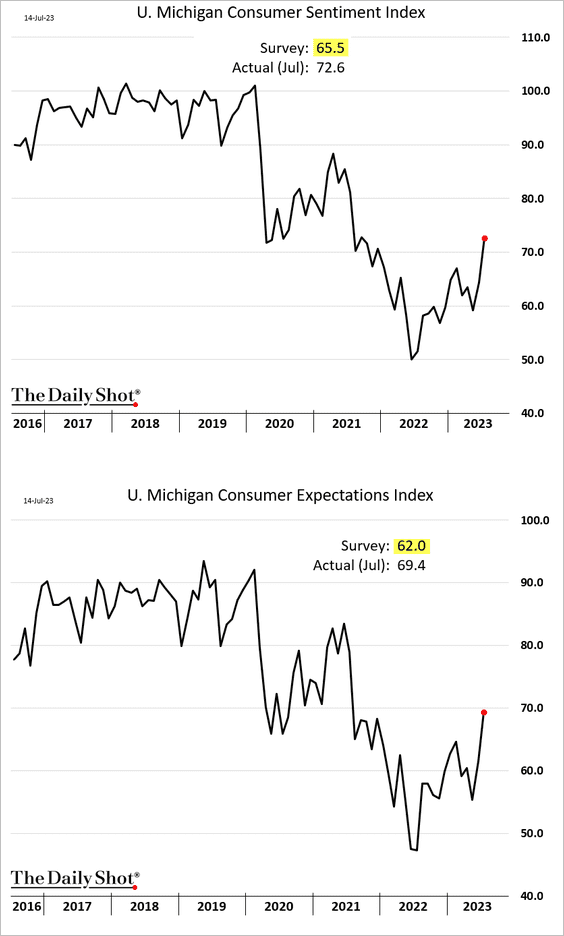

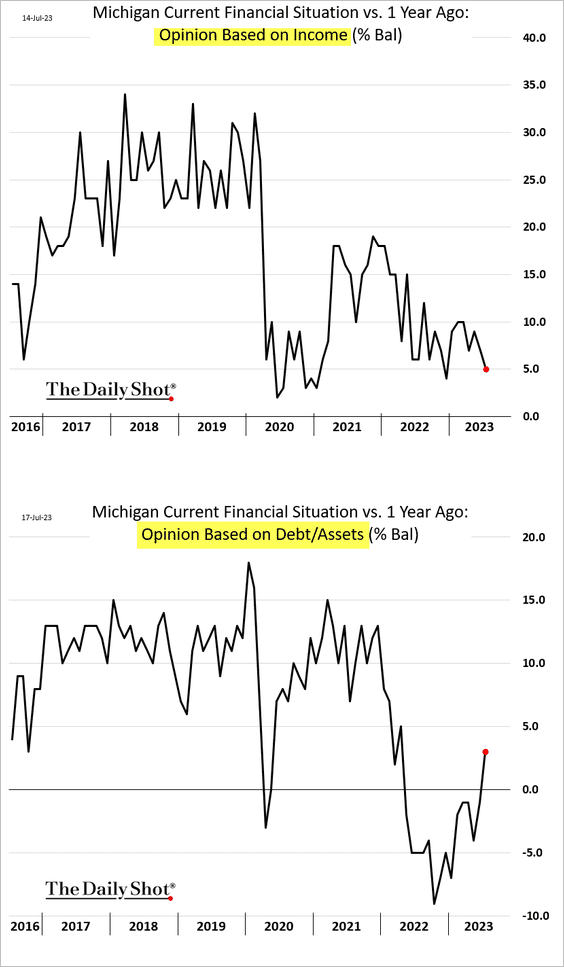

1. The U. Michigan consumer sentiment index jumped in July …

… boosted by the stock market rally and stabilization in home prices (improving household balance sheet).

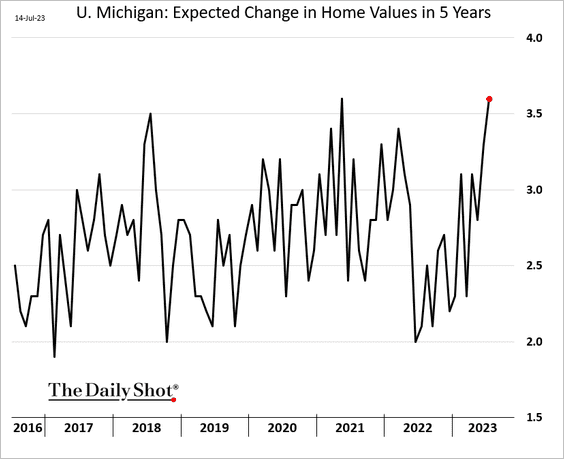

This index tracks consumer expectations for home prices.

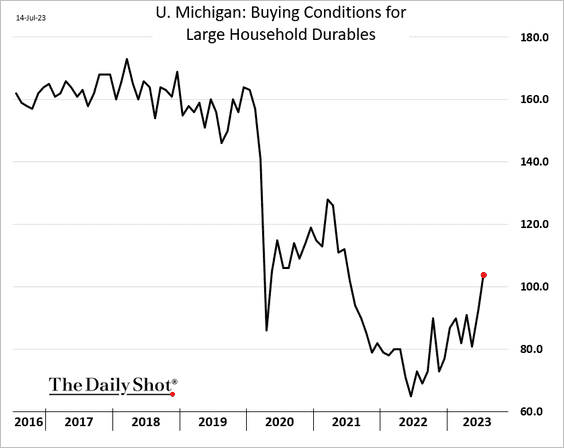

• Buying conditions for household durables surged.

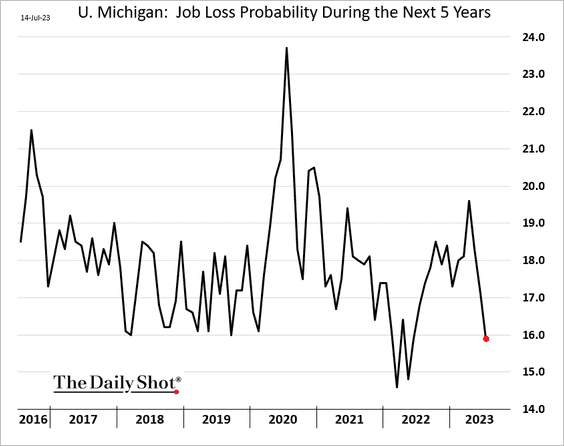

• More consumers are becoming unconcerned about job losses.

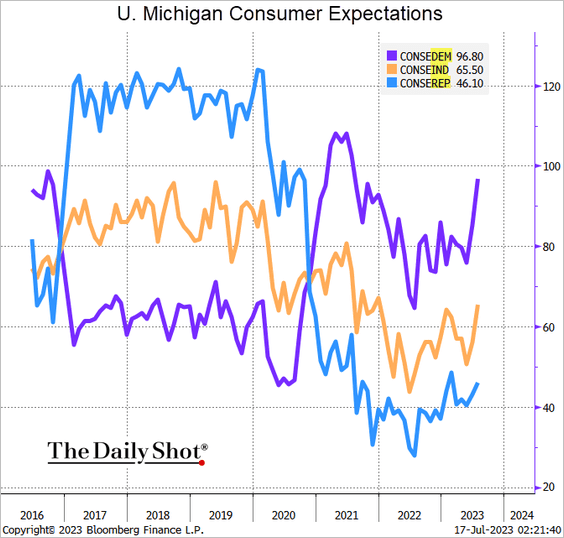

• Here is the consumer expectations index by political affiliation.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

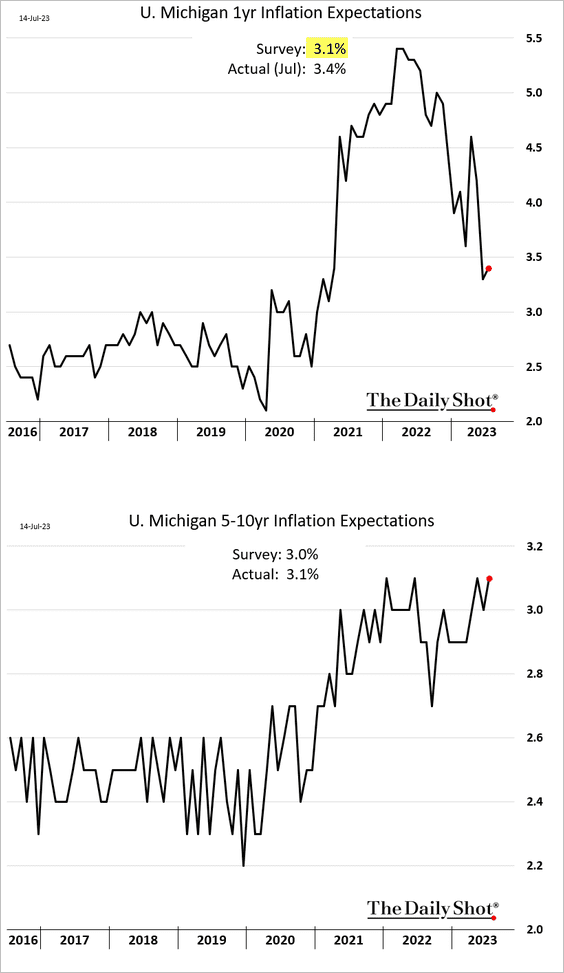

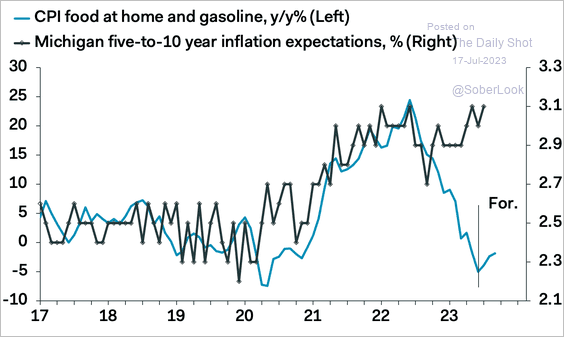

• Inflation expectations edged higher, …

… with long-term expectations remaining sticky. This is a concern for the Fed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

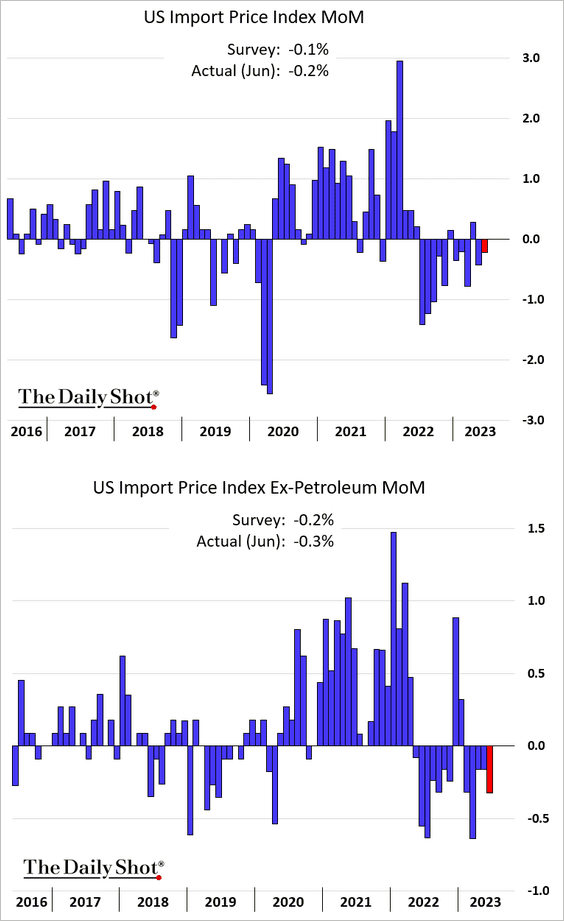

2. Import prices continue to drop.

The US is importing some disinflation from China.

——————–

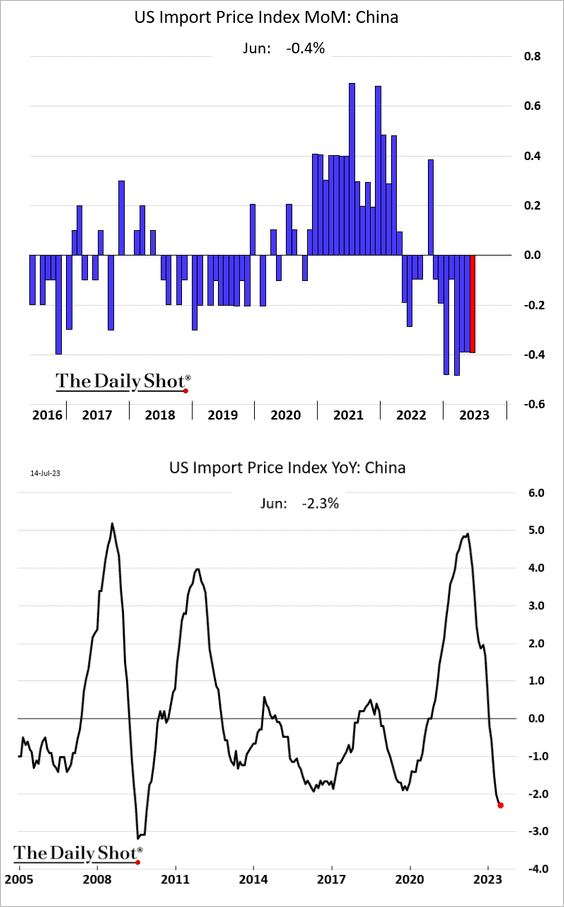

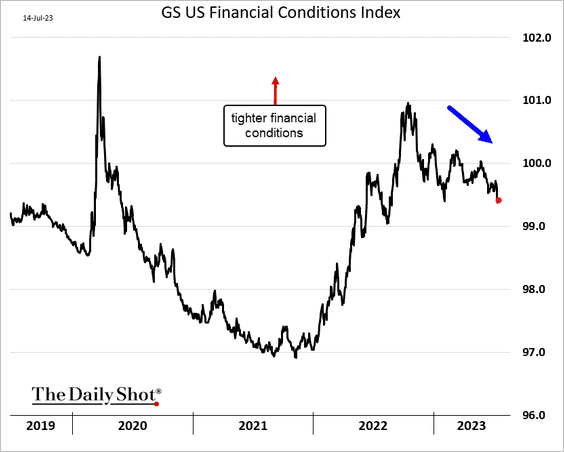

3. Shrinking profit margins could force businesses to raise prices or reduce staff.

Source: BCA Research

Source: BCA Research

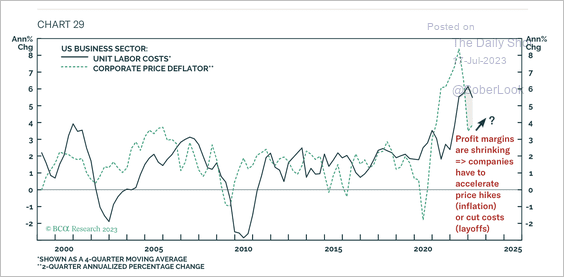

4. US financial conditions have been easing,

5. Economic surprises have been positive for hard data, while soft data (surveys) has been lagging.

Source: @WSJ Read full article

Source: @WSJ Read full article

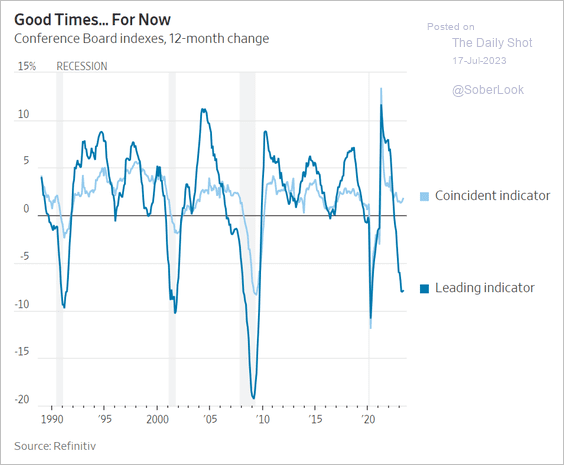

Related to the above, the Conference Board’s leading and coincident indices have diverged.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

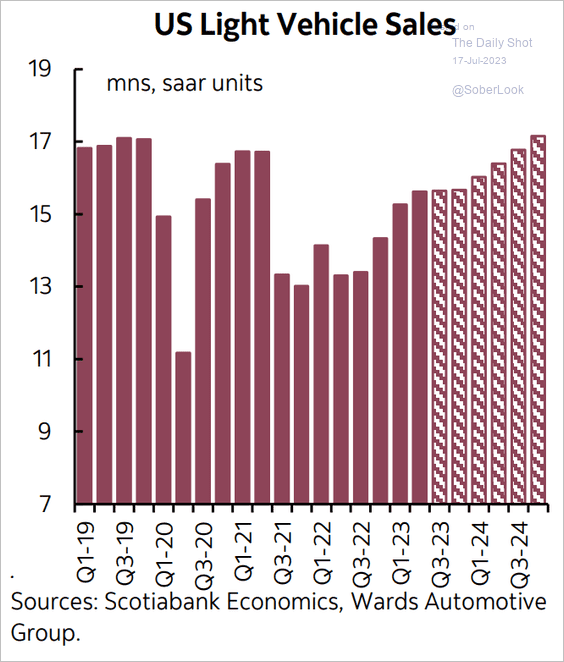

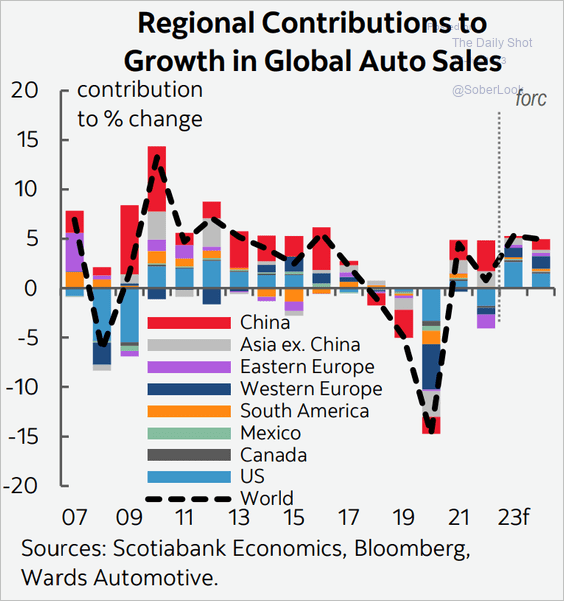

6. Automobile sales are expected to accelerate next year.

Source: Scotiabank Economics

Source: Scotiabank Economics

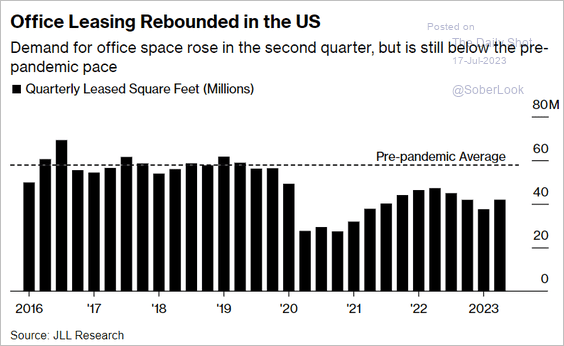

7. Demand for office space turned higher in Q2.

Source: @wealth Read full article

Source: @wealth Read full article

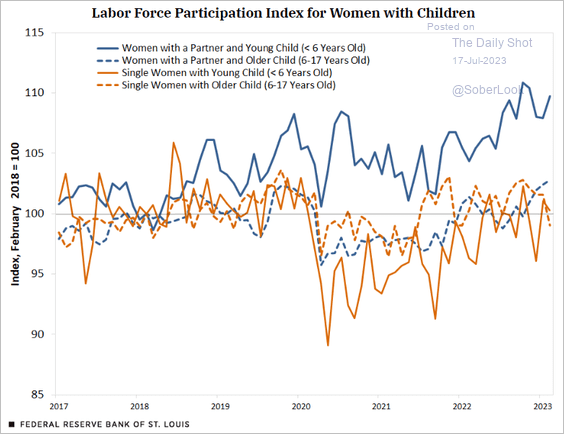

8. Next, we have labor force participation among women with children.

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

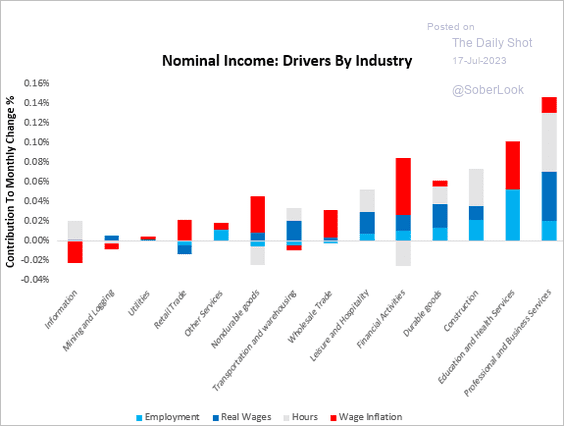

9. This chart shows the contributions to households’ nominal income by industry.

Source: Prometheus Research

Source: Prometheus Research

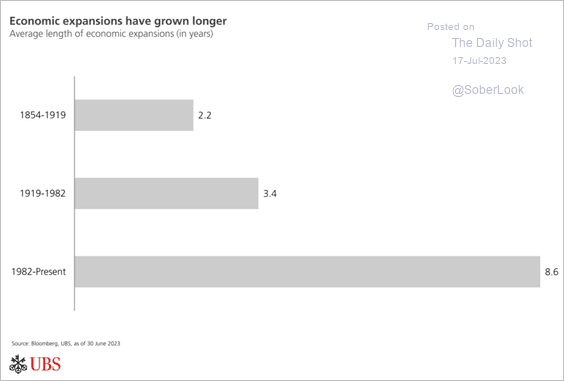

10. The duration of economic cycles has progressively increased over the course of the past century.

Source: UBS Research

Source: UBS Research

Back to Index

Canada

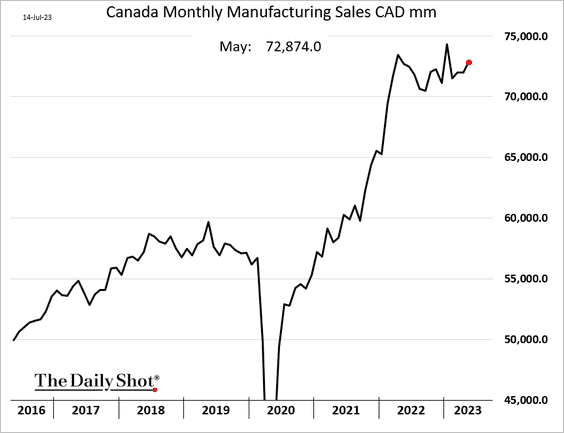

1. Manufacturing sales climbed in May.

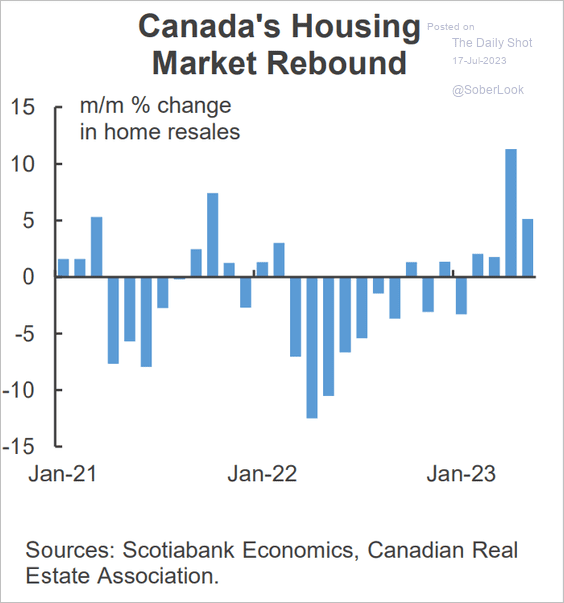

2. Home sales have been rebounding.

Source: Scotiabank Economics

Source: Scotiabank Economics

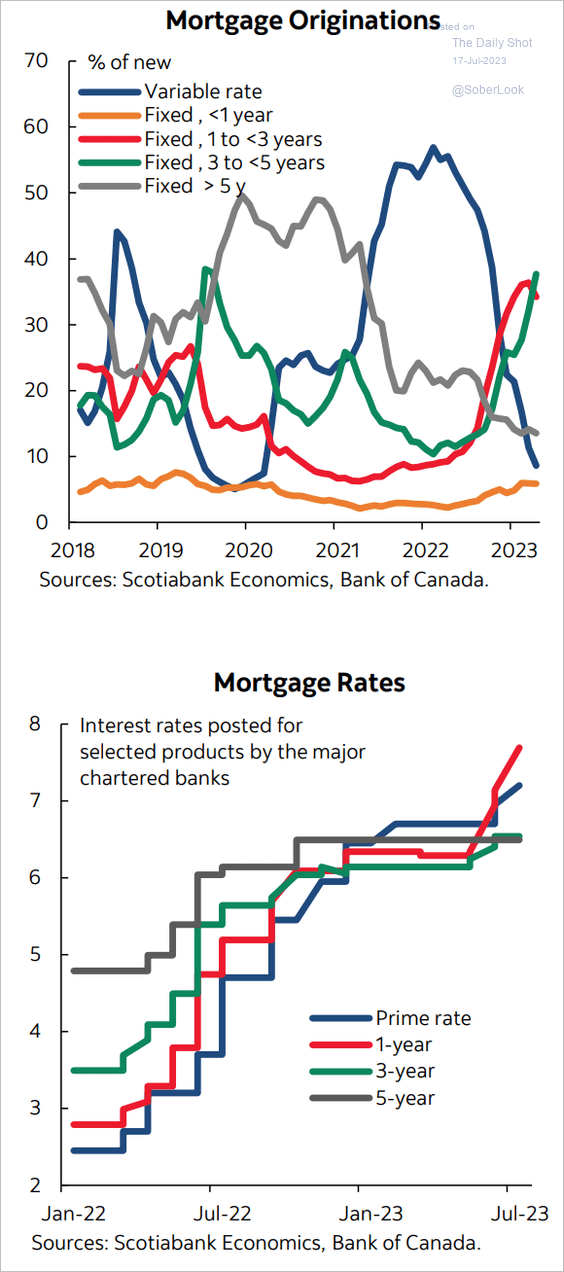

3. This chart shows mortgage originations and rates by mortgage type.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

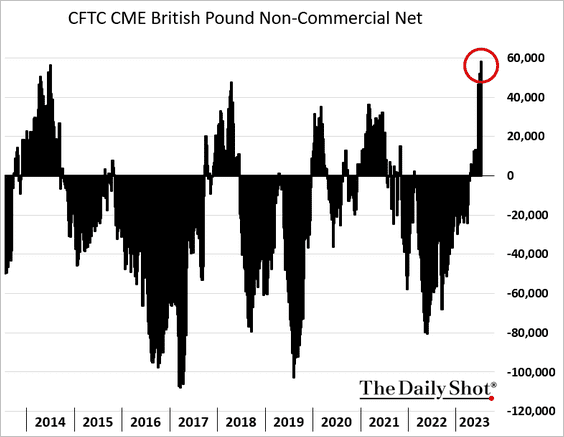

1. Speculative bets on the British pound hit a multi-year high.

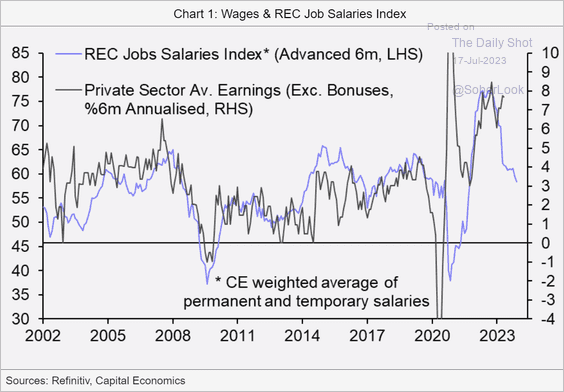

2. Is wage growth heading lower?

Source: Capital Economics

Source: Capital Economics

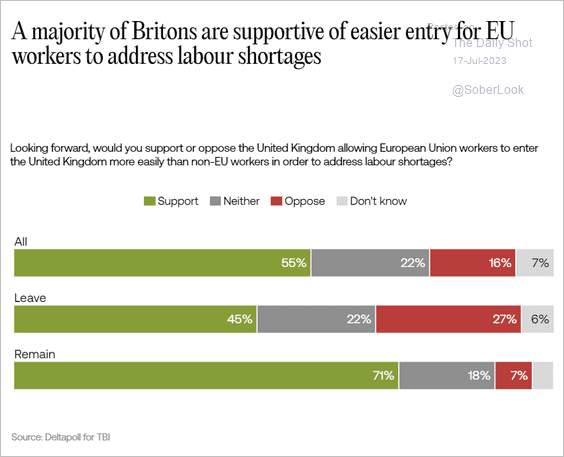

3. Should workers from the EU be granted a more streamlined access to the UK than workers from outside the European Union?

Source: Tony Blair Institute

Source: Tony Blair Institute

Back to Index

The Eurozone

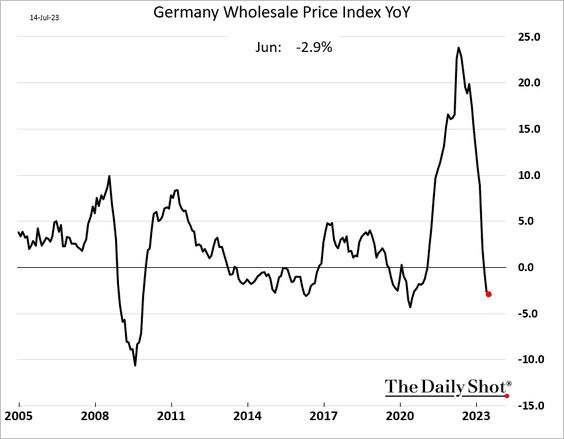

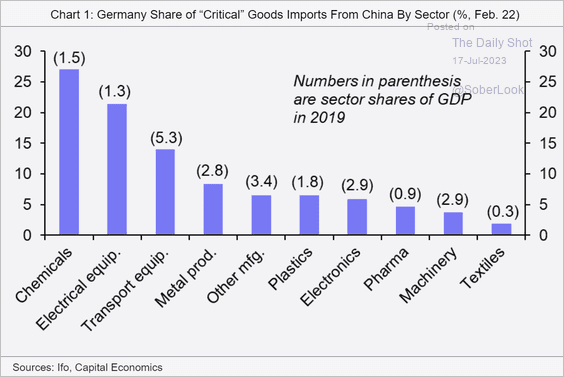

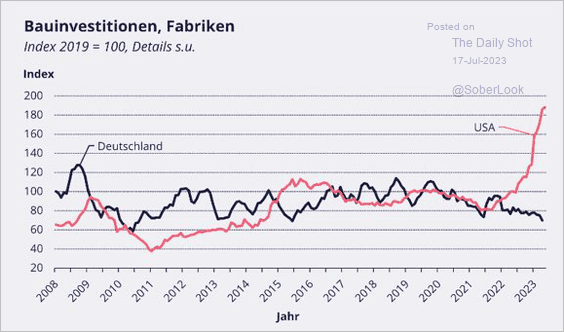

1. Let’s begin with Germany.

• Wholesale inflation:

• Critical imports from China:

Source: Capital Economics

Source: Capital Economics

• German vs. US manufacturing investment:

Source: @MichaelAArouet, @maxkrahe

Source: @MichaelAArouet, @maxkrahe

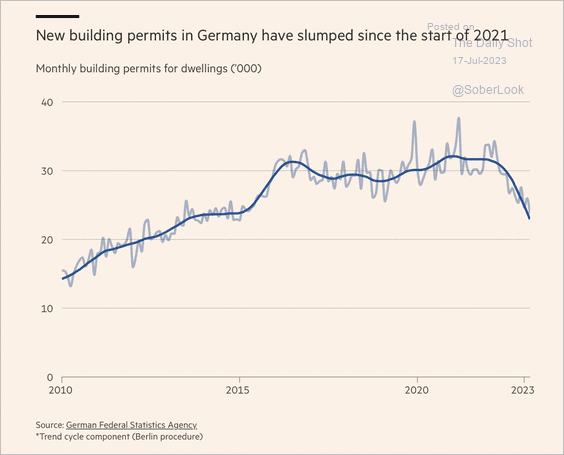

• New building permits:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

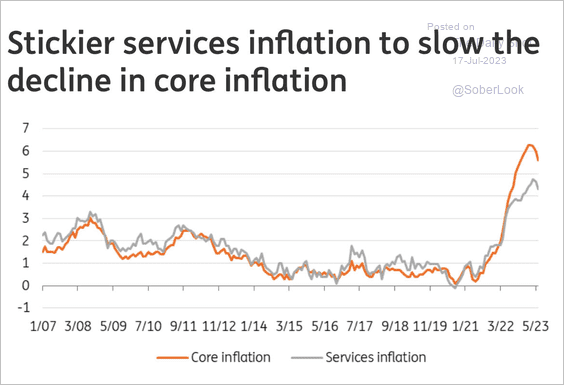

2. Italian sticky services inflation is expected to slow the CPI declines.

Source: ING

Source: ING

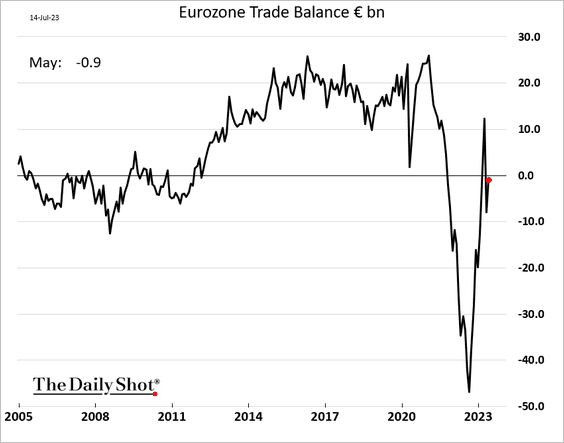

3. The euro-area trade balance is close to zero.

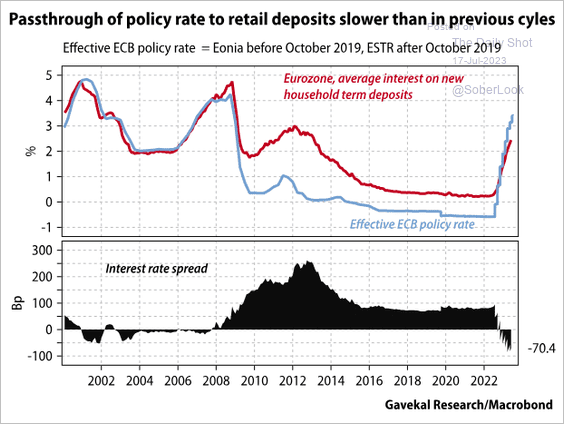

4. The ECB’s policy transmission has been less effective than in previous cycles as banks keep deposit rates depressed.

Source: Gavekal Research

Source: Gavekal Research

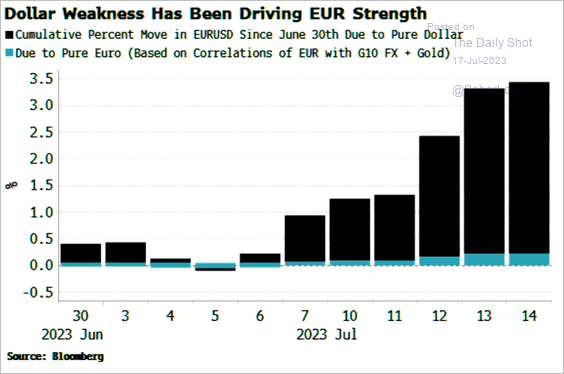

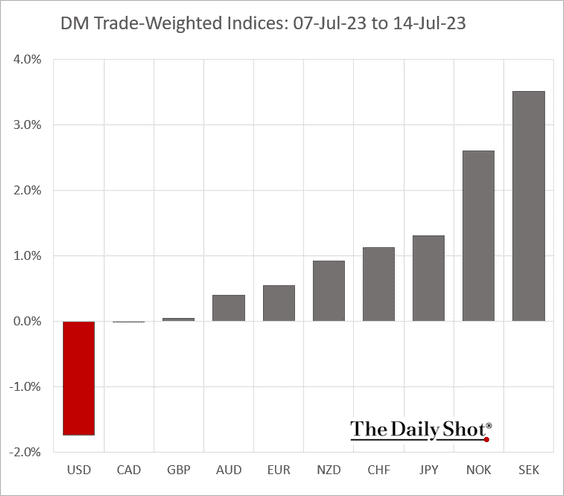

5. Gains in the euro this month have been mostly driven by the US dollar’s weakness.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Europe

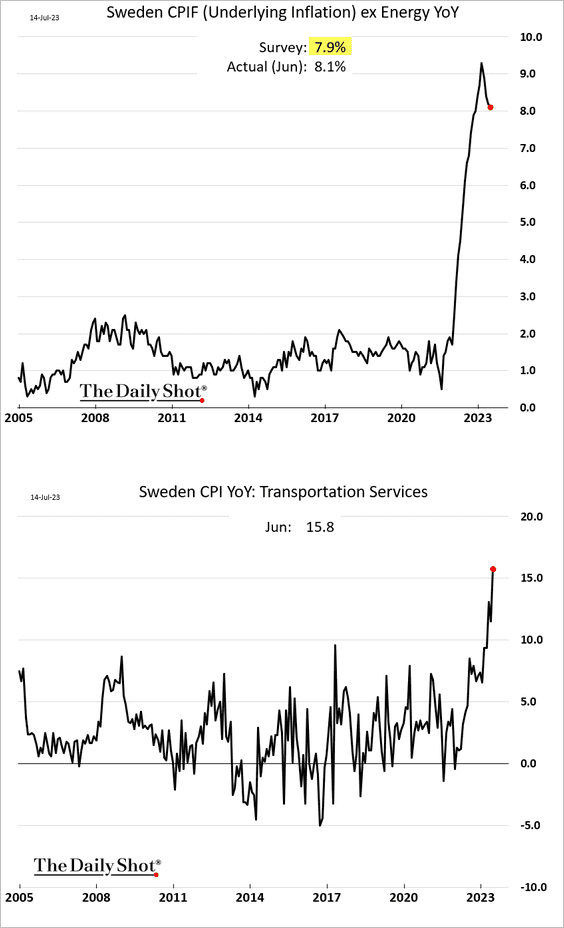

1. Sweden’s June CPI print surprised to the upside.

Source: BBC Read full article

Source: BBC Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

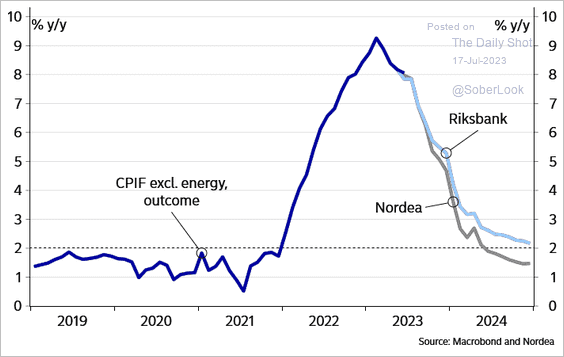

Here is a forecast from Nordea and Riksbank.

Source: Nordea Markets

Source: Nordea Markets

——————–

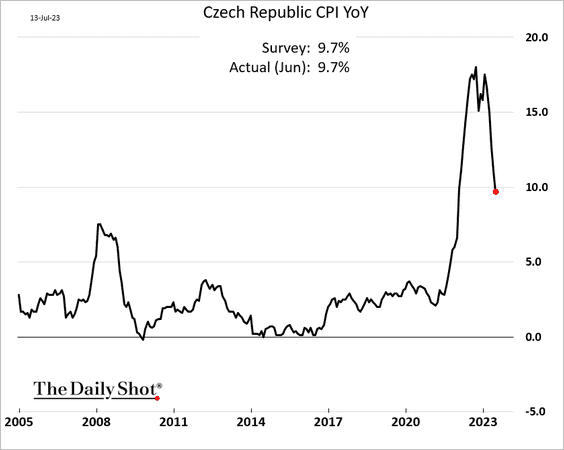

2. Czech inflation is moderating.

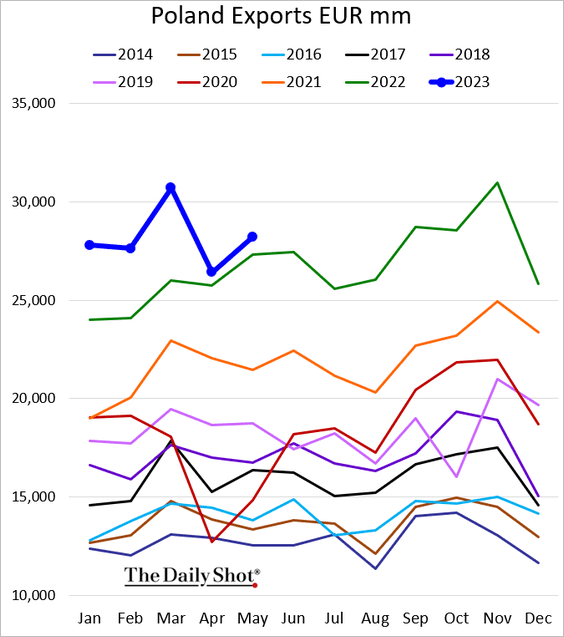

3. Poland’s exports remain above last year’s levels.

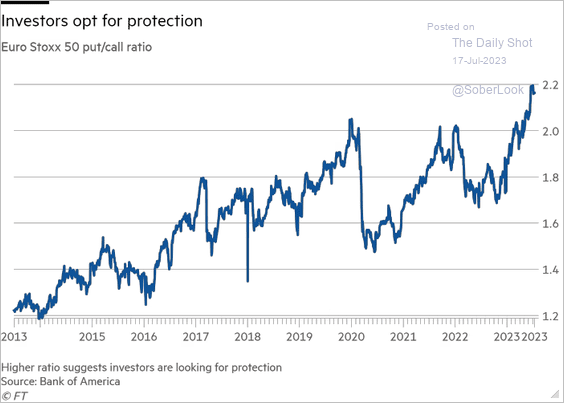

4. Stock traders have been increasingly cautious, with the put/call ratio hitting a new high.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Japan

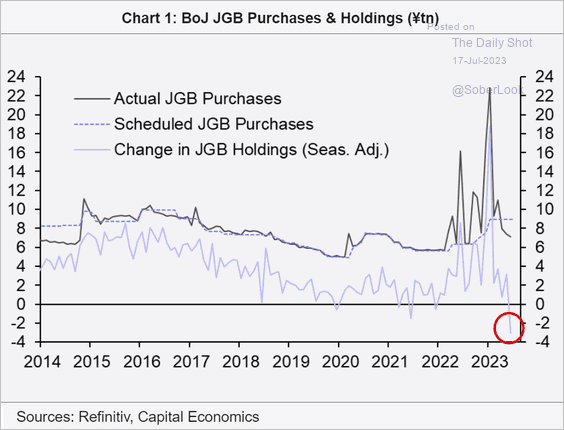

1. The BoJ’s JGB holdings declined sharply over the past month.

Source: Capital Economics

Source: Capital Economics

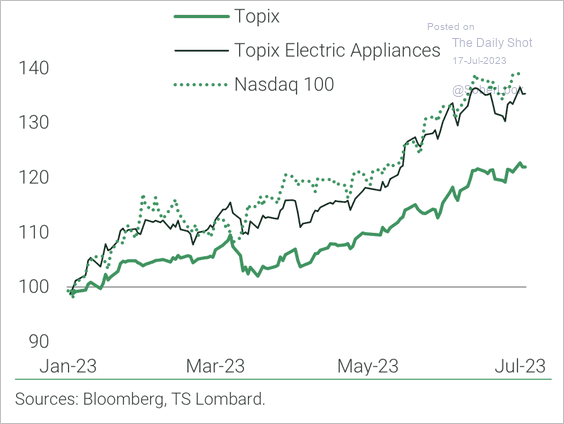

2. Japanese electric appliance stocks have traded in line with the Nasdaq 100 this year.

Source: TS Lombard

Source: TS Lombard

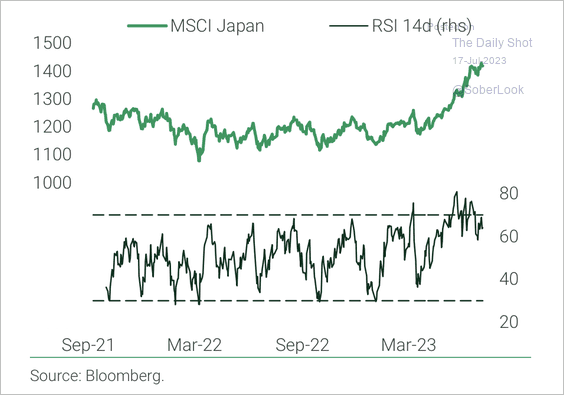

• The MSCI Japan Index appears overbought in the near term. Although, prices can remain overbought for some time in an uptrend, typically limiting pullbacks.

Source: TS Lombard

Source: TS Lombard

——————–

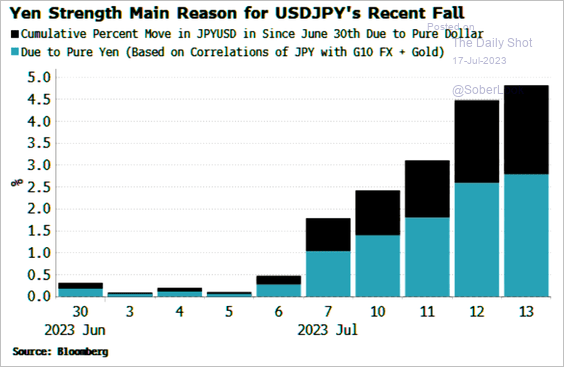

3. Here is the attribution of the yen’s gains this month.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

China

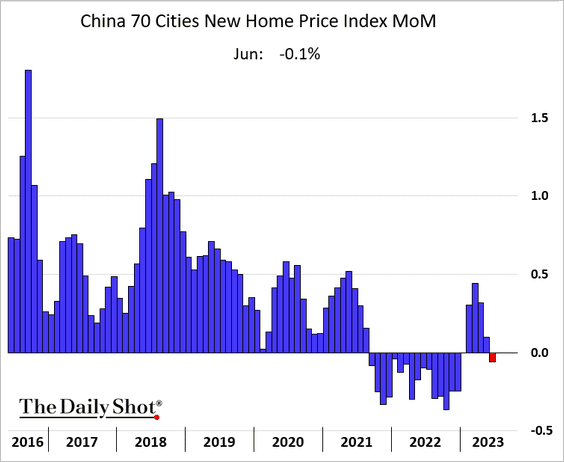

1. New home prices are falling again.

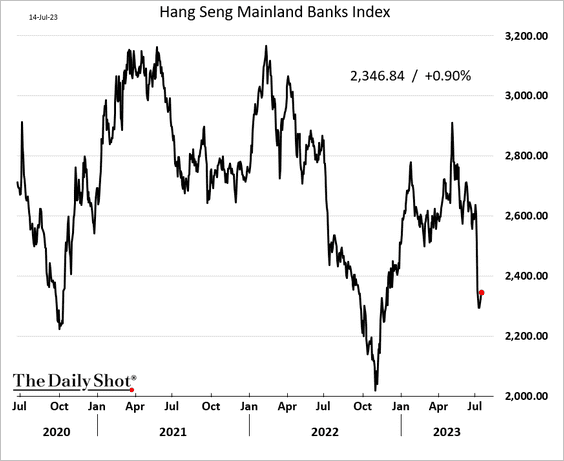

2. Bank shares appear to have stabilized.

h/t BofA Global Research

h/t BofA Global Research

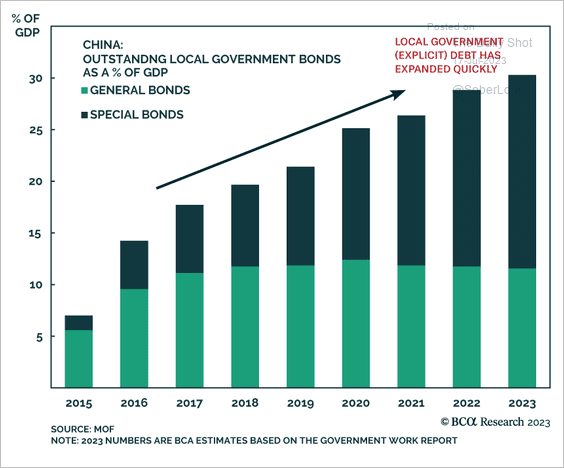

3. Local government debt continues to climb as a share of China’s GDP.

Source: BCA Research

Source: BCA Research

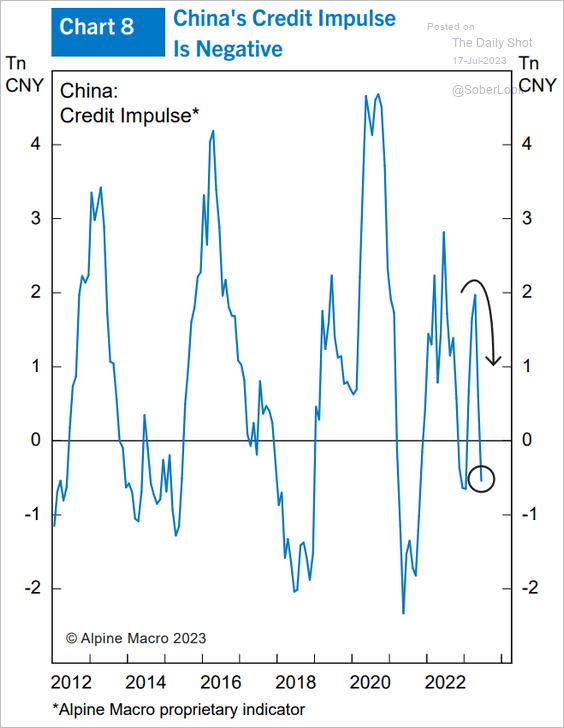

4. The credit impulse is back in negative territory, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

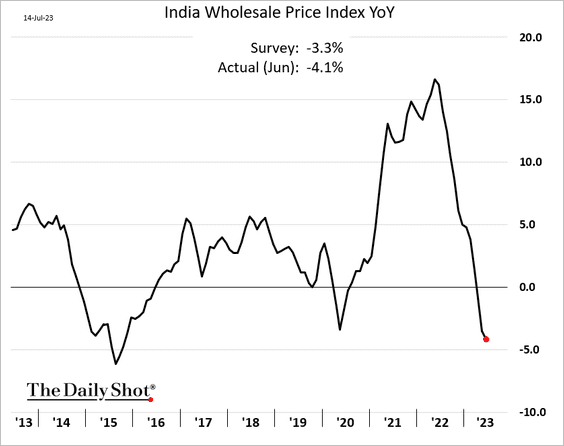

1. India’s wholesale prices continue to fall.

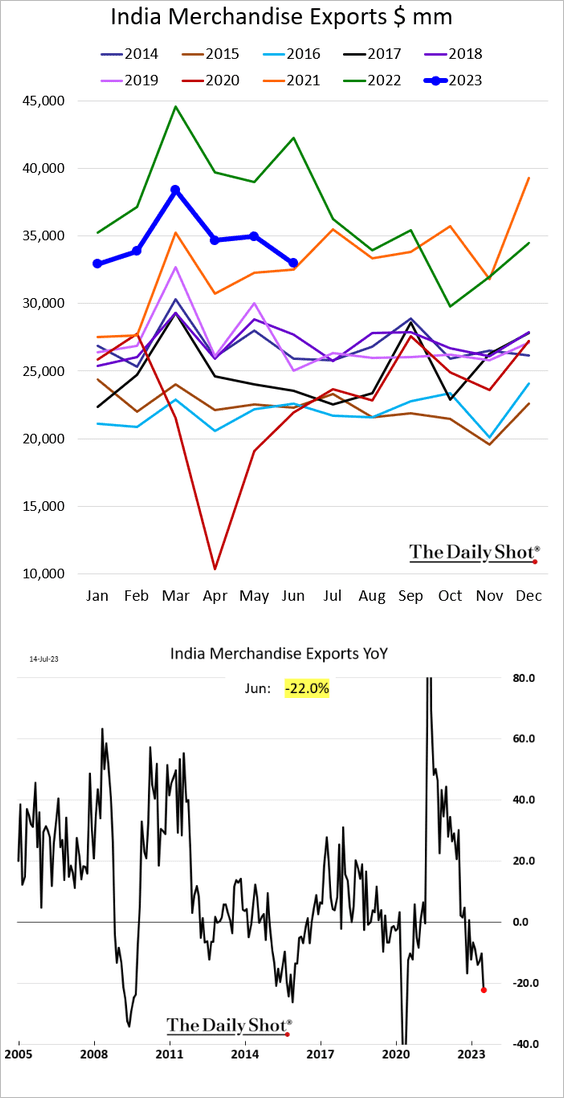

• India’s exports were down 22% year-over-year in June.

——————–

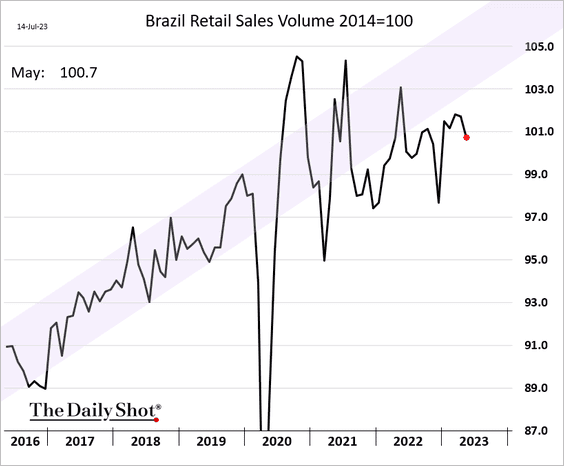

2. Brazil’s retail sales declined in May.

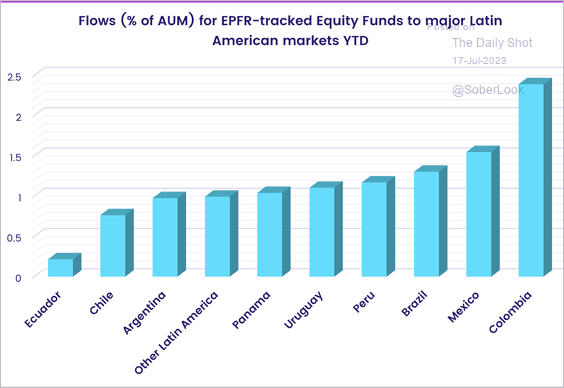

3. This chart shows year-to-date LatAm equity fund flows.

Source: EPFR

Source: EPFR

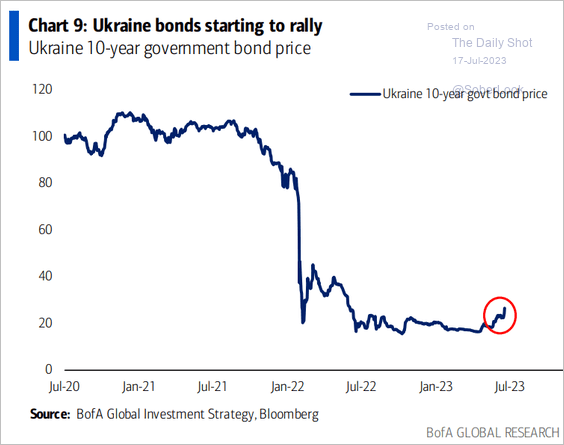

4. Ukrainian bounds are starting to recover.

Source: BofA Global Research

Source: BofA Global Research

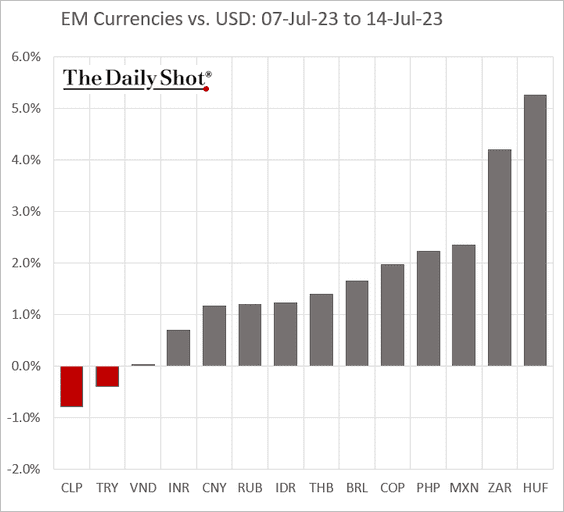

5. Next, we have some performance data from last week.

• Currencies:

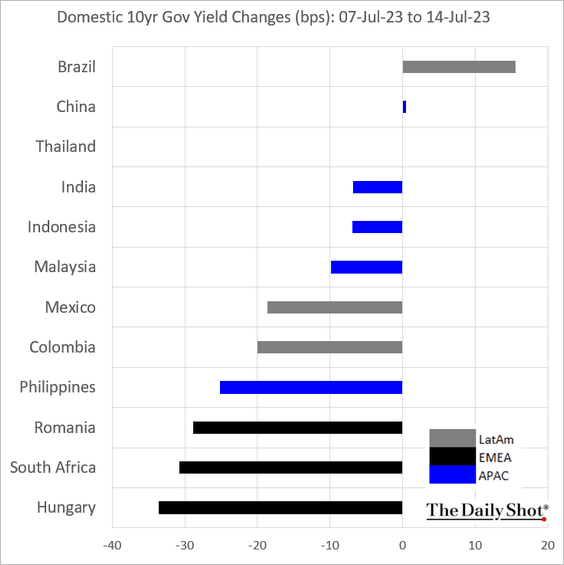

• Bond yields:

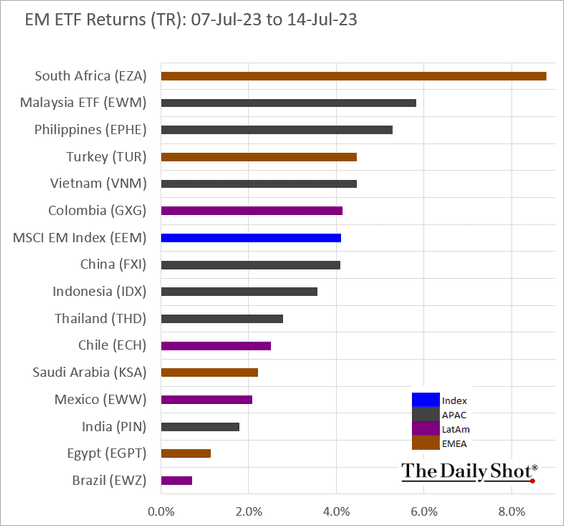

• Equity ETFs:

Back to Index

Cryptocurrency

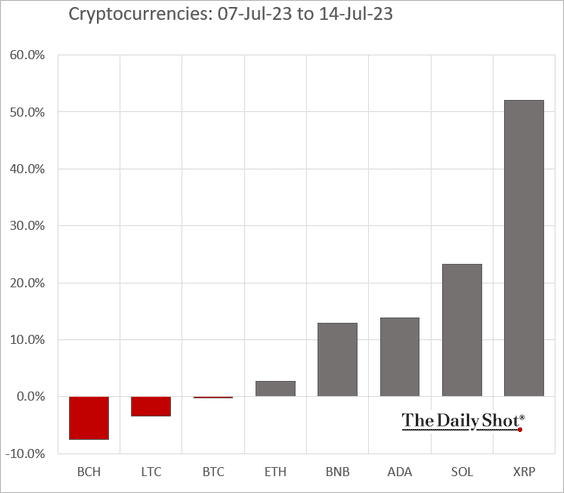

1. XRP was up more than 50% last week.

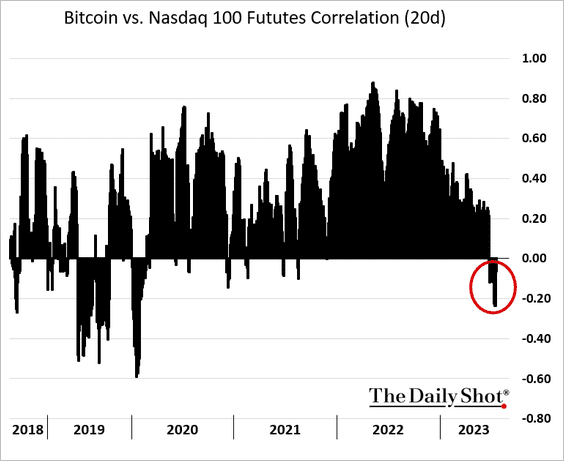

2. Bitcoin’s correlation to growth stocks has turned negative.

Back to Index

Commodities

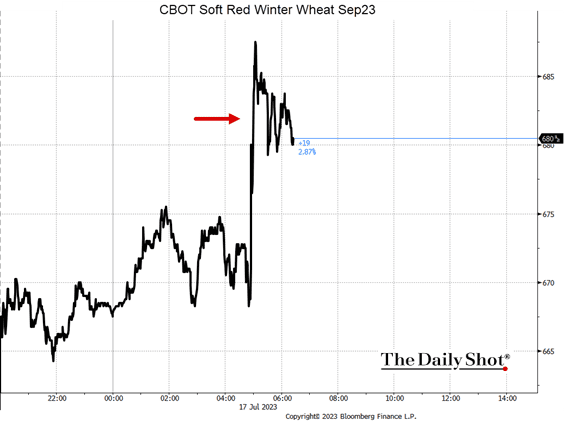

1. Wheat futures jumped this morning as the Ukraine grain export deal collapsed (see story).

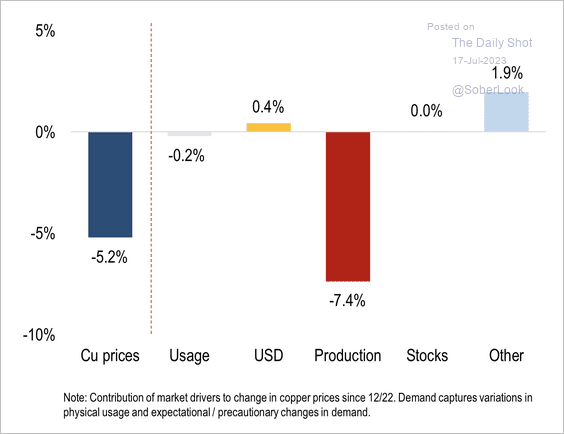

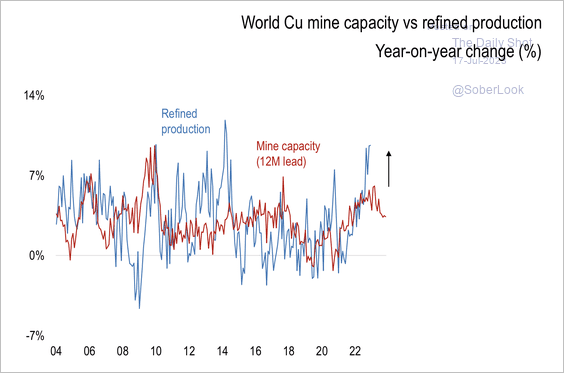

2. Recent copper price weakness has been supply related as ample mine supply fueled refined output. (2 charts)

Source: Nomura Securities

Source: Nomura Securities

Source: Nomura Securities

Source: Nomura Securities

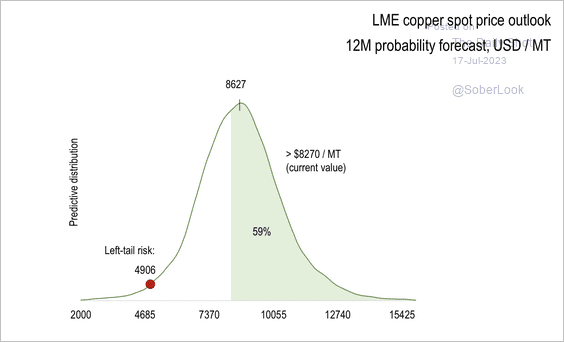

Numera Analytics expects a rebound in Chinese property construction to boost copper prices.

Source: Nomura Securities

Source: Nomura Securities

——————–

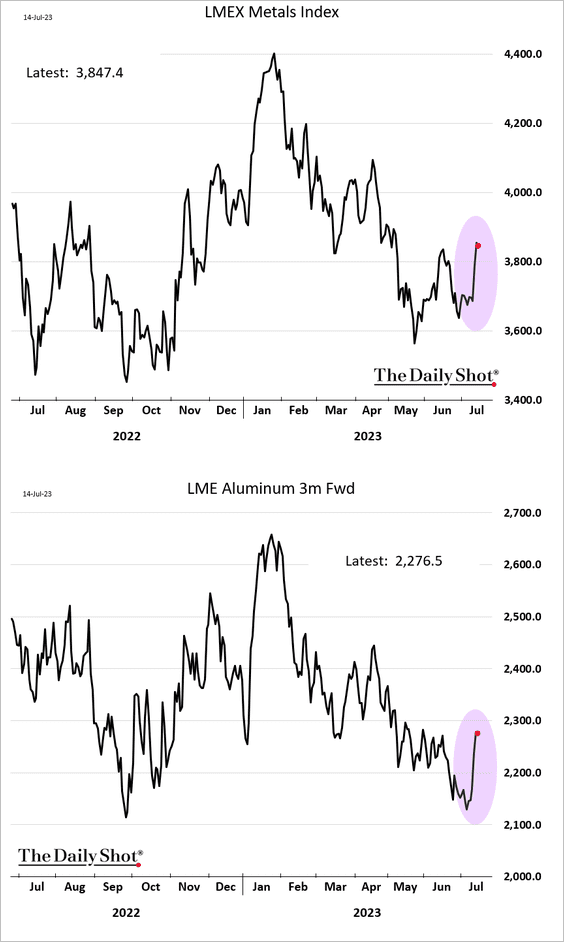

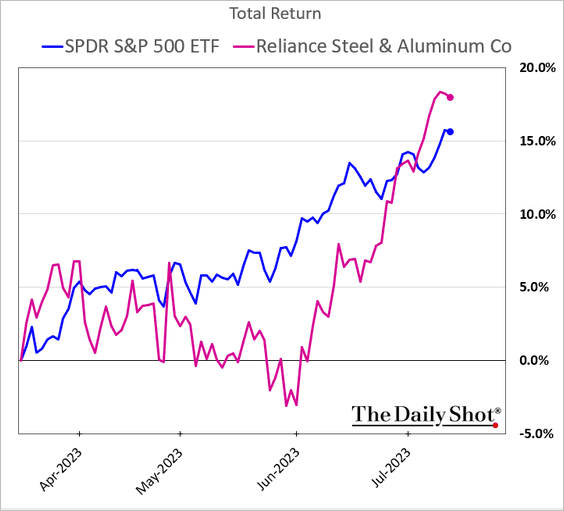

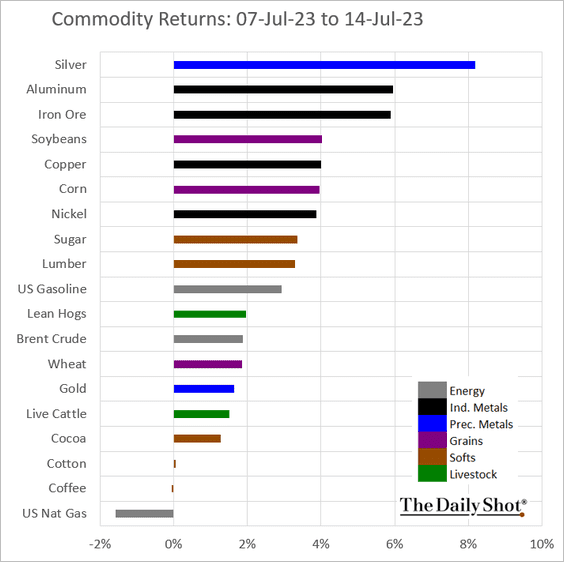

3. Industrial commodities got a boost from the US dollar weakness last week.

• Some metals equities have been outperforming.

——————–

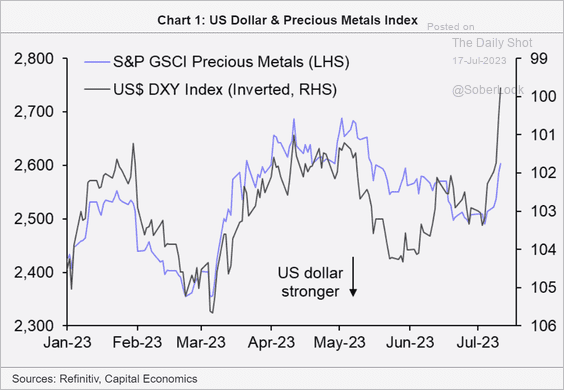

4. Precious metals also rallied in response to the dollar’s decline.

Source: Capital Economics

Source: Capital Economics

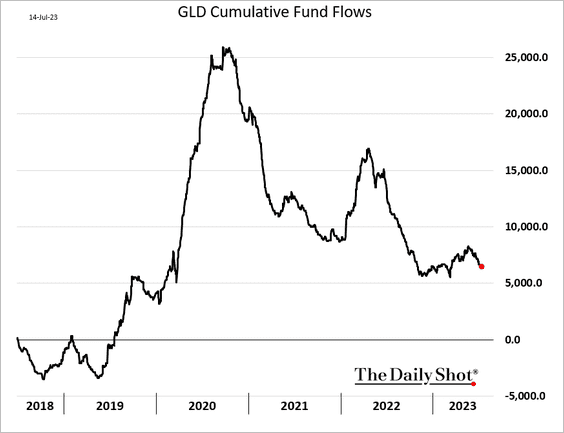

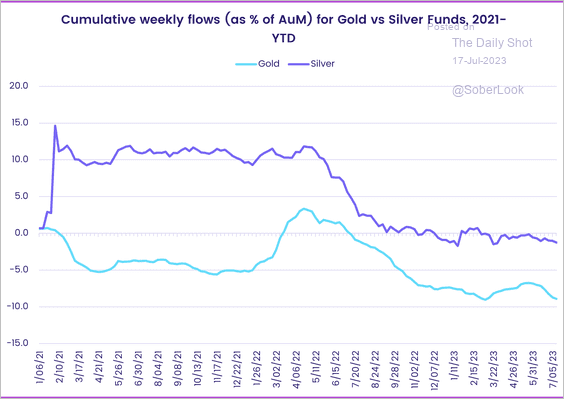

But precious metals’ fund flows continue to trend lower.

Source: EPFR

Source: EPFR

——————–

5. Here is last week’s performance across key commodity markets.

Back to Index

Energy

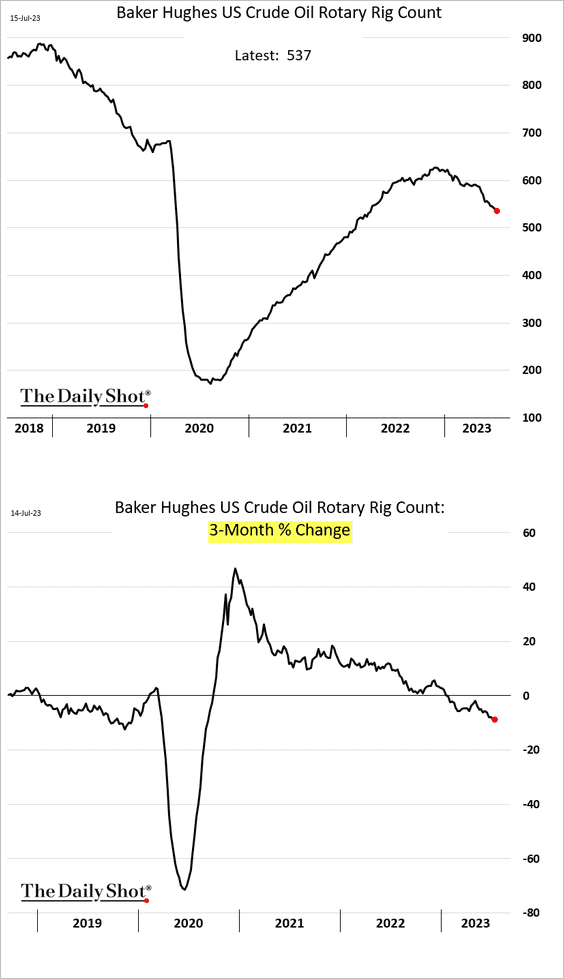

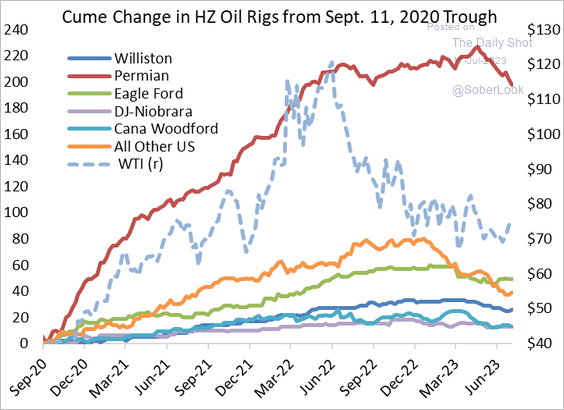

1. US rig count continues to sink, …

… driven mostly by the Permian region.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

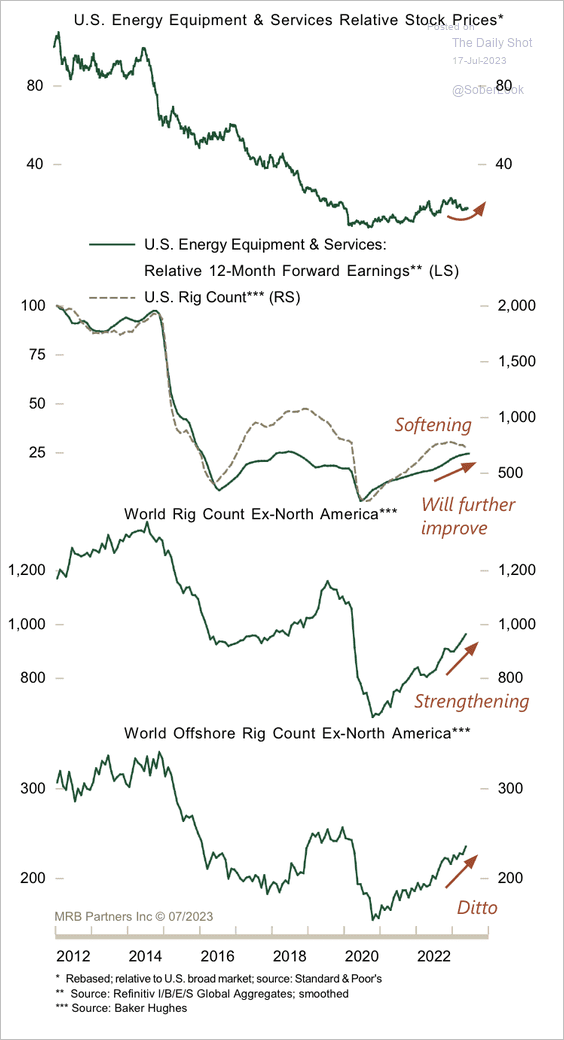

2. Weak energy prices have weighed on equipment and services firms, although some fundamentals are improving.

Source: MRB Partners

Source: MRB Partners

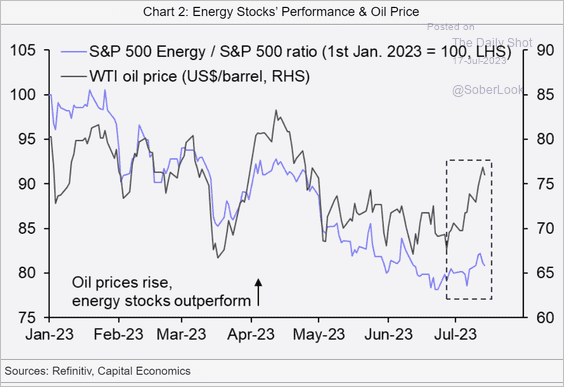

3. Energy stocks’ relative performance keeps lagging behind crude oil prices.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

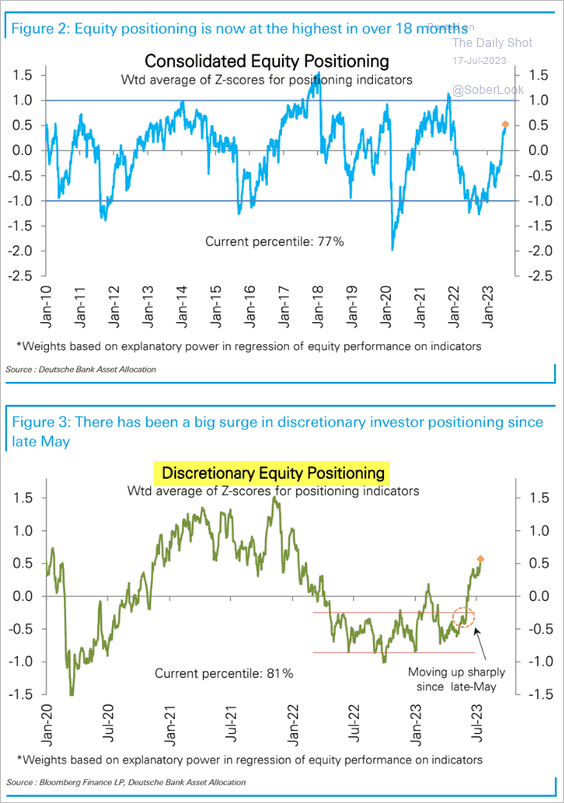

1. Deutsche Bank’s positioning index continues to show rising allocations to equities, increasingly driven by discretionary bets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

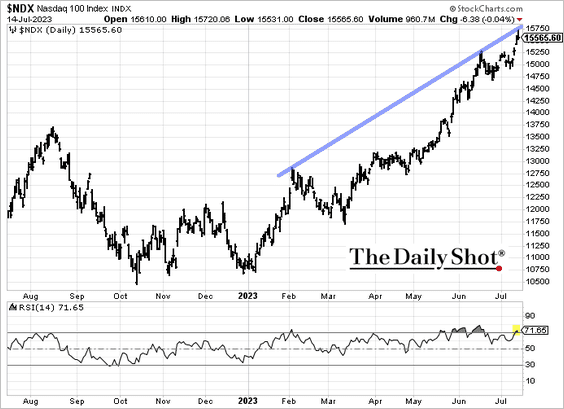

2. Time for a pullback in the Nasdaq 100?

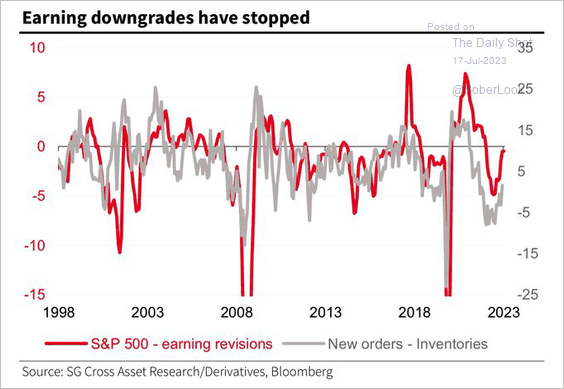

3. Earnings downgrades have stopped.

Source: TD Securities; @WallStJesus

Source: TD Securities; @WallStJesus

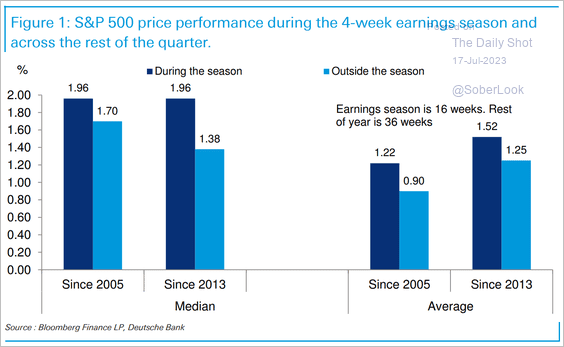

4. On average, earnings season accounts for a disproportionate amount of the annual S&P 500 price performance.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

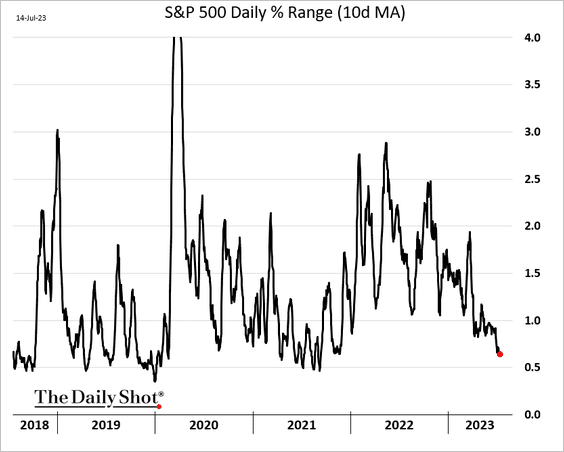

5. Intradeay volatility has been moving lower.

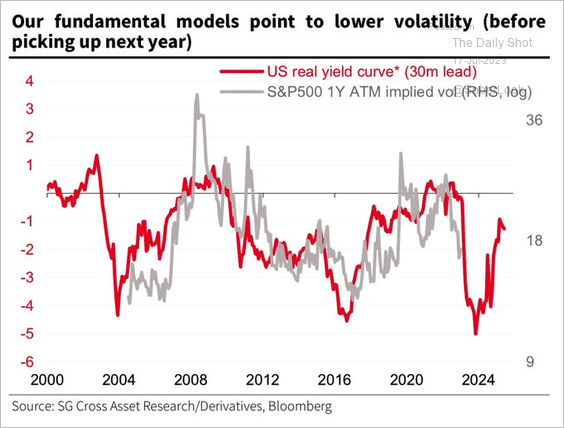

• Volatility is expected to rebound next year.

Source: SG Markets Cross Asset Research; @WallStJesus

Source: SG Markets Cross Asset Research; @WallStJesus

——————–

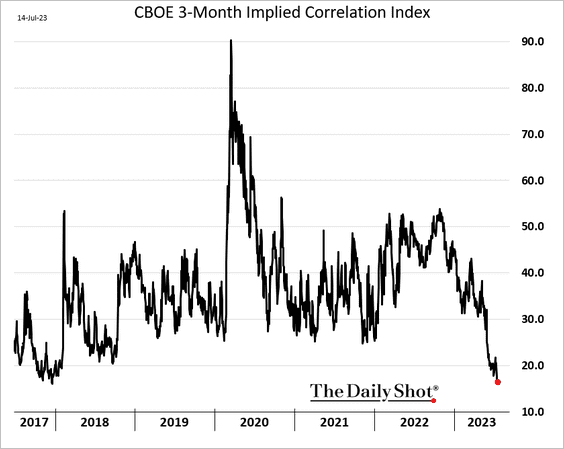

6. Implied equity correlations hit a multi-year low.

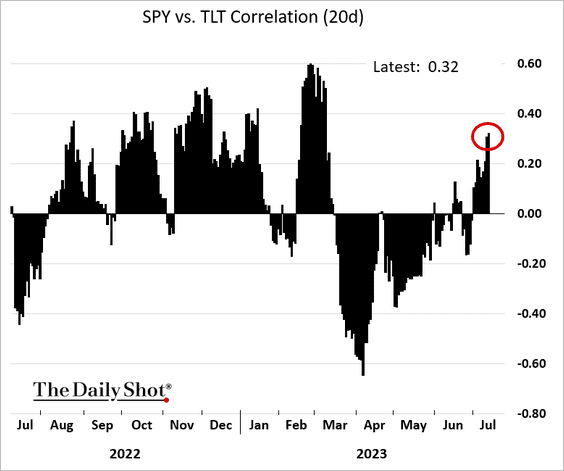

7. Stock/bond correlations continue to move deeper into positive territory.

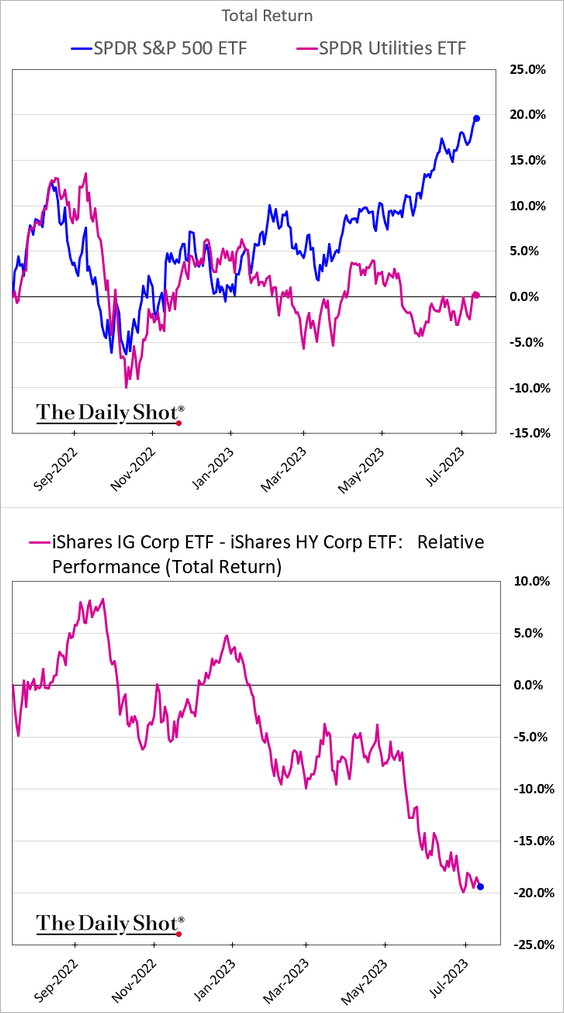

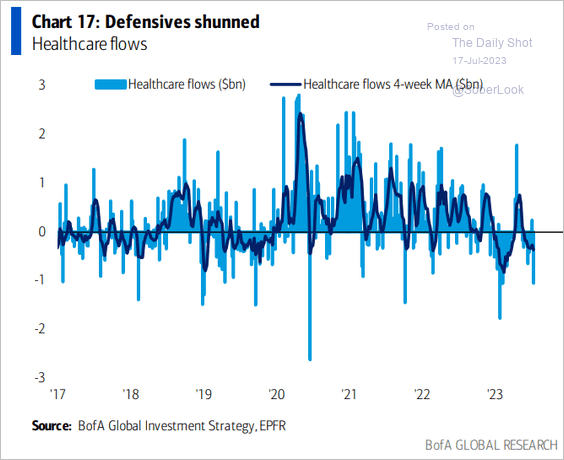

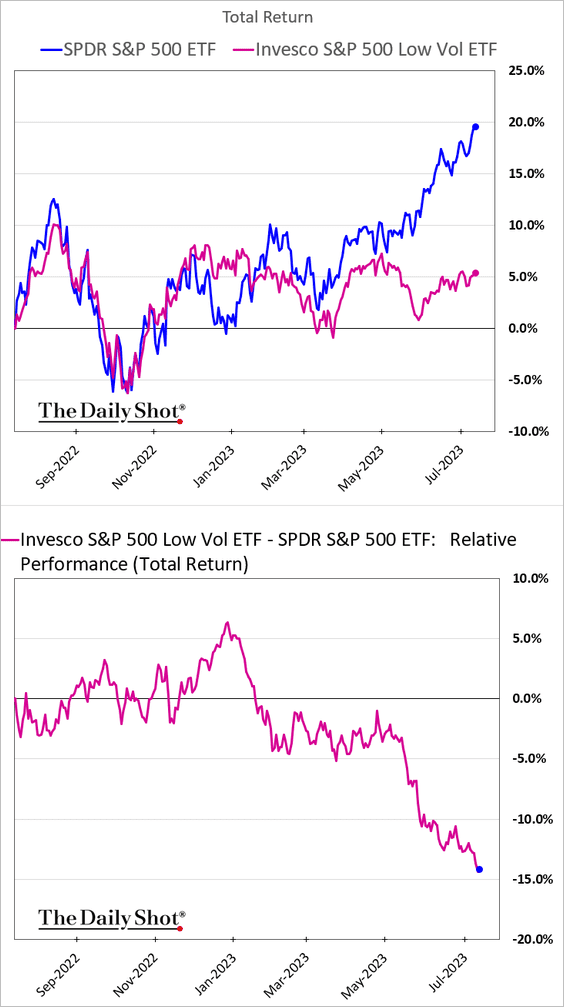

8. Defensive stocks have been underperforming …

… amid fund outflows.

Source: BofA Global Research

Source: BofA Global Research

• Low-vol stocks keep lagging.

——————–

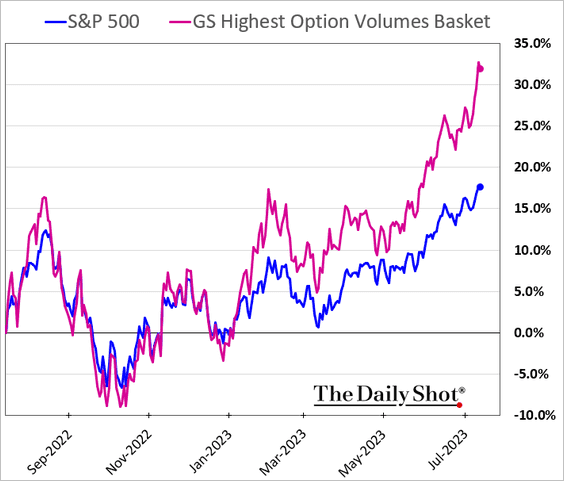

9. Stocks with high options volumes have been widening their outperformance.

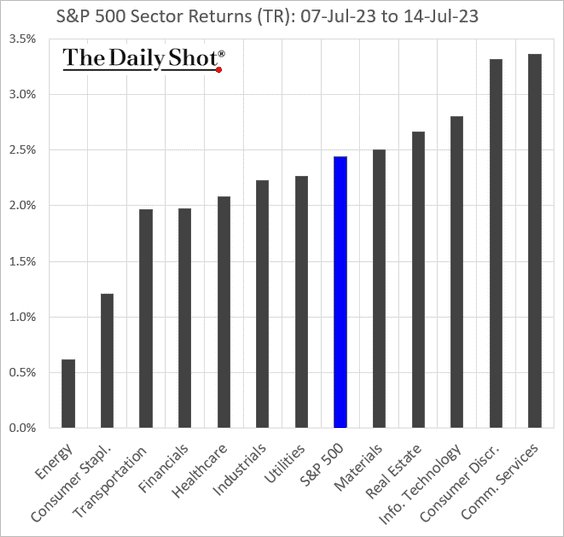

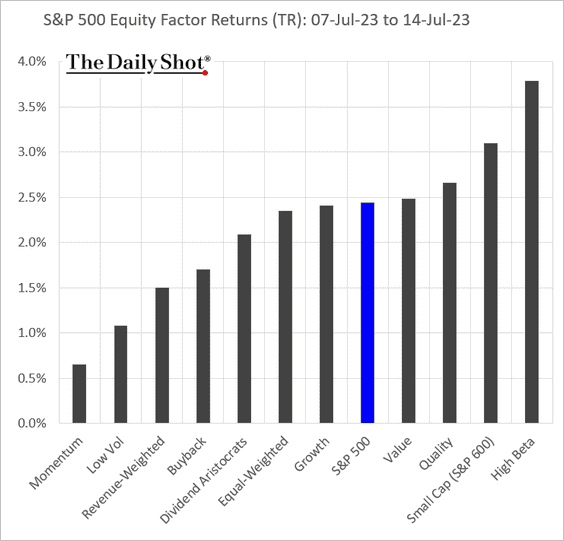

10. Finally, we have some performance data from last week.

• Sectors:

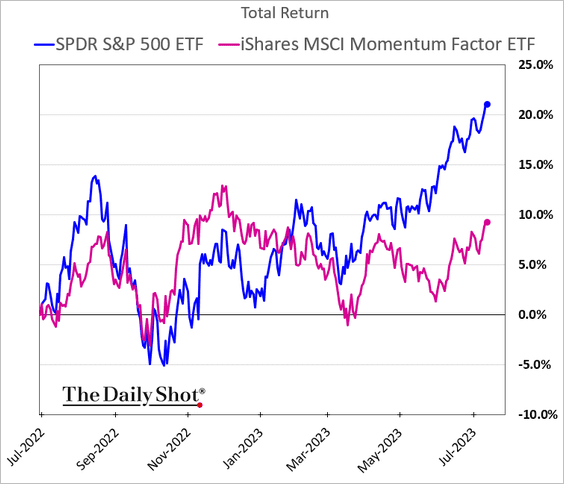

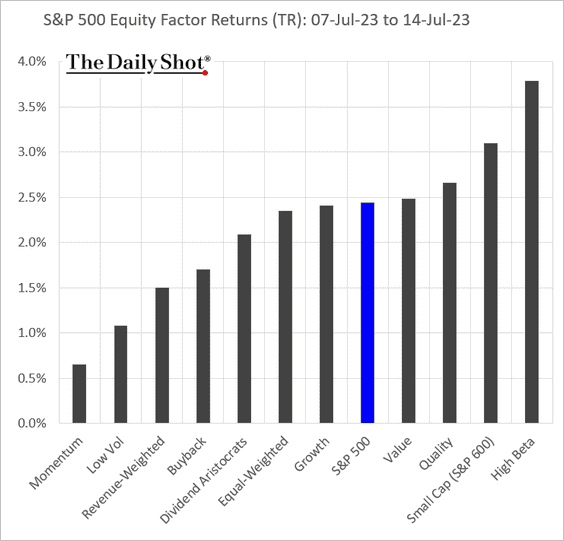

• Equity factors:

Momentum continues to underperform.

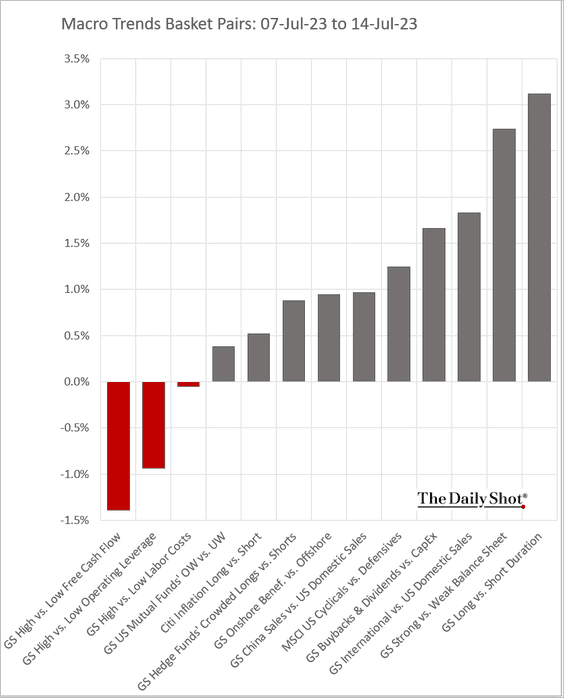

• Macro baskets’ relative performance:

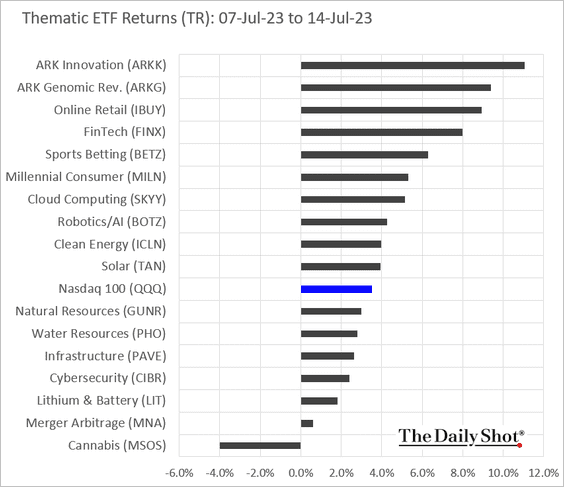

• Thematic ETFs:

• Largest US tech firms:

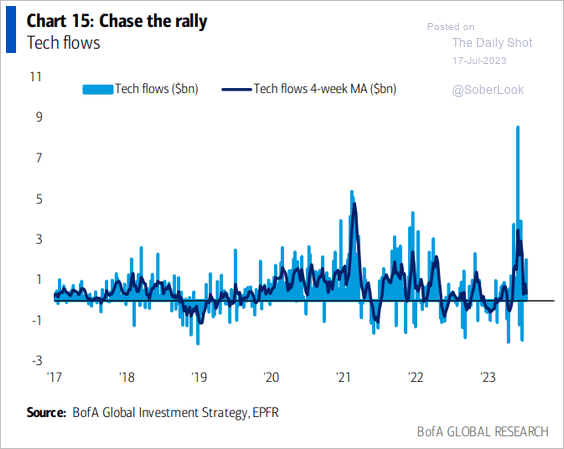

By the way, tech flows remain positive.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Credit

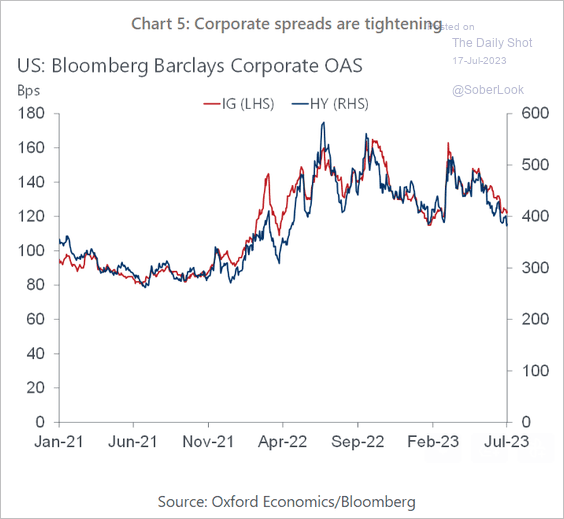

1. Corporate spreads continue to tighten.

Source: Oxford Economics

Source: Oxford Economics

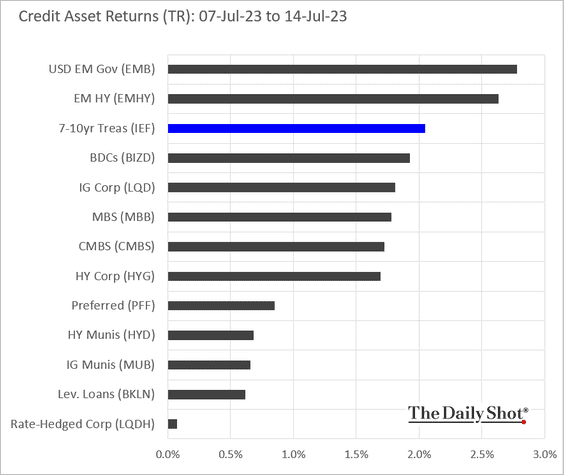

2. Here is last week’s performance by asset class.

Back to Index

Global Developments

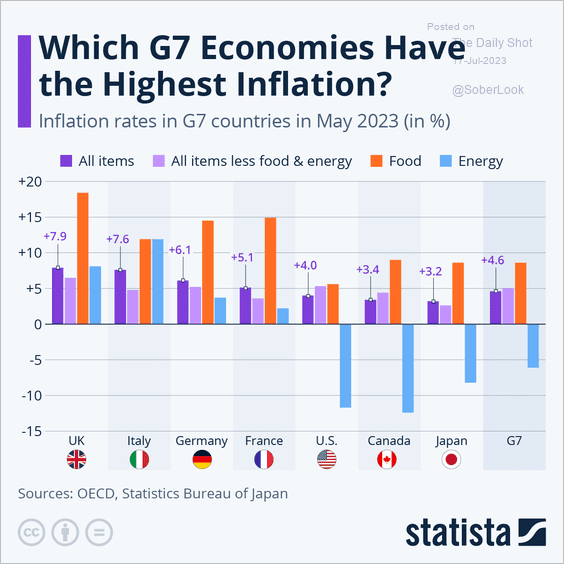

1. This chart shows consumer inflation across G7 economies.

Source: Statista

Source: Statista

2. Which regions will drive growth in global automobile sales?

Source: Scotiabank Economics

Source: Scotiabank Economics

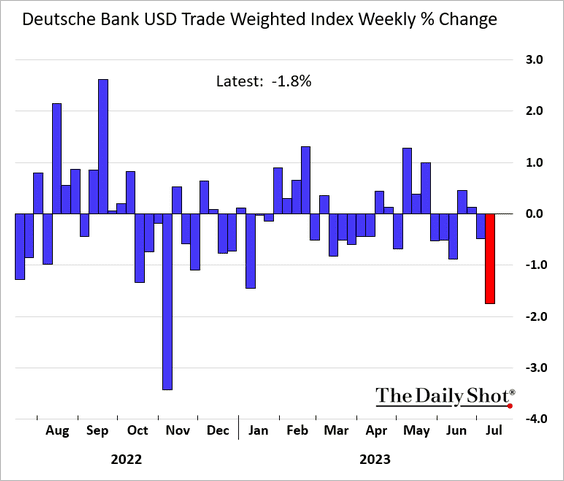

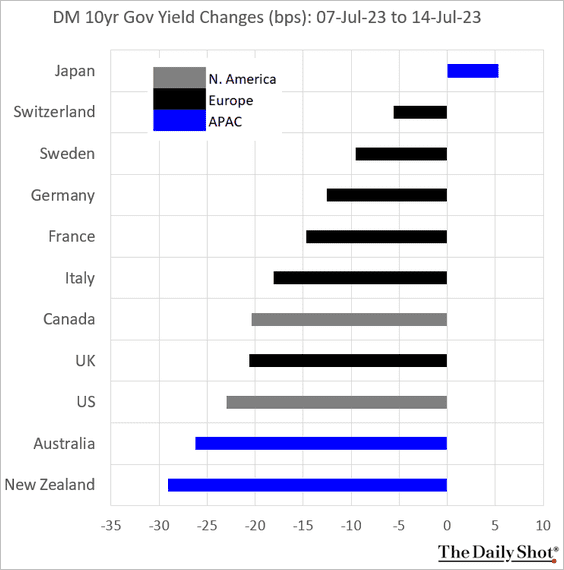

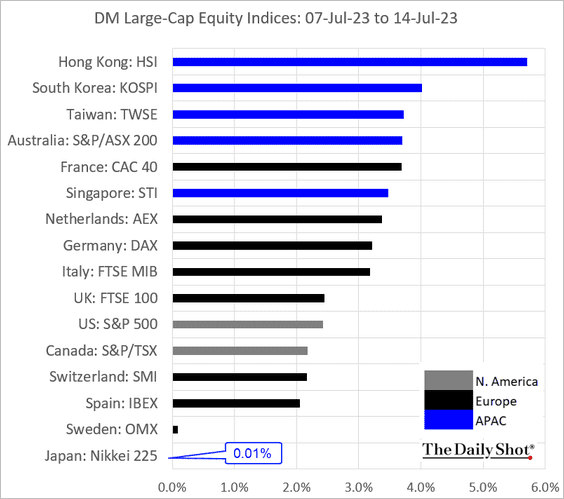

3. Here is last week’s performance for advanced economies.

• Currency indices:

It was a rough week for the US dollar.

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

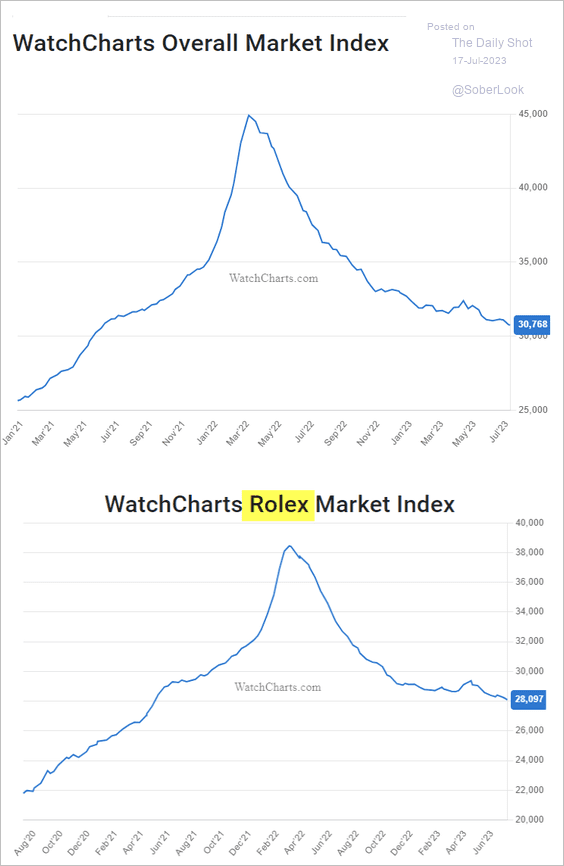

1. The luxury watch market (a classic bubble):

Source: WatchEnthusiasts

Source: WatchEnthusiasts

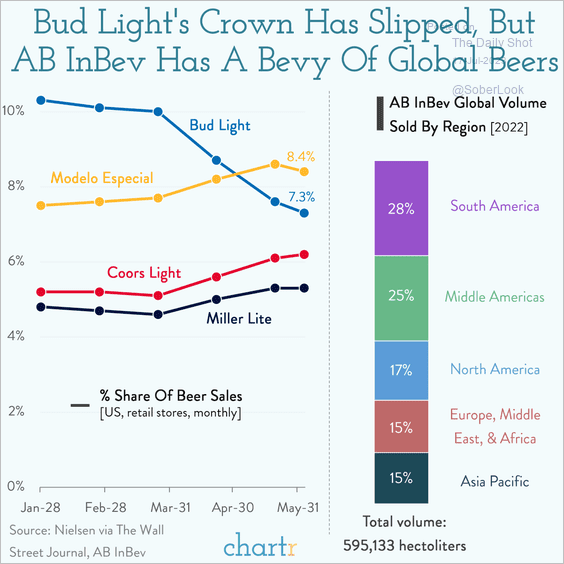

2. AB InBev global sales:

Source: @chartrdaily

Source: @chartrdaily

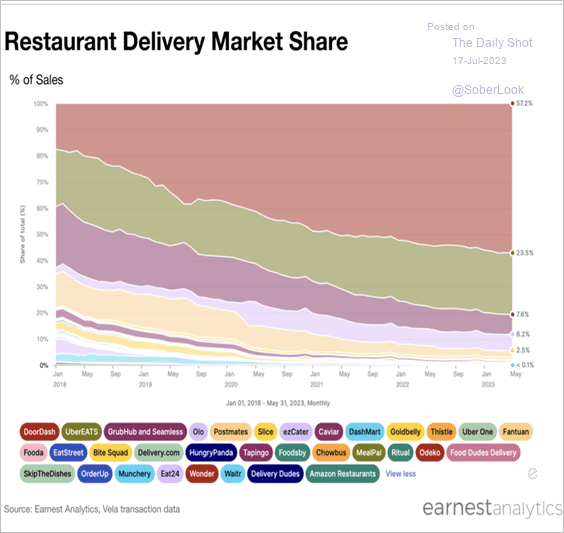

3. Restaurant delivery market share:

\

\

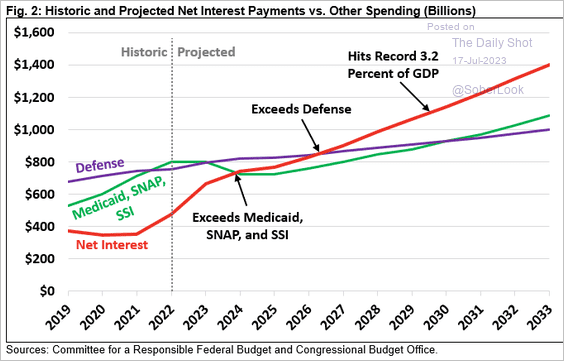

4. US federal government’s interest costs:

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

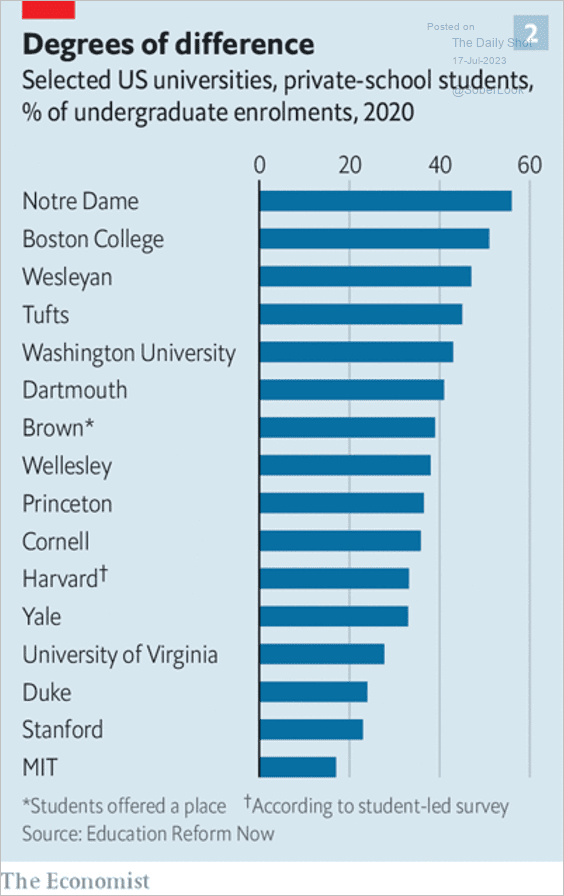

5. Private-school students as a share of undergraduate enrollments:

Source: The Economist Read full article

Source: The Economist Read full article

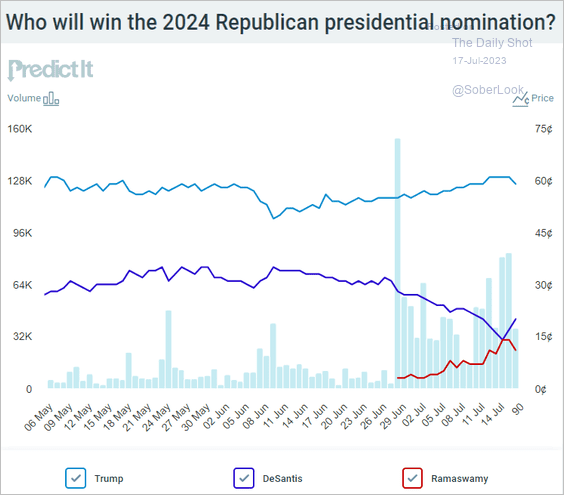

6. GOP presidential nomination probabilities in the betting markets:

Source: @PredictIt

Source: @PredictIt

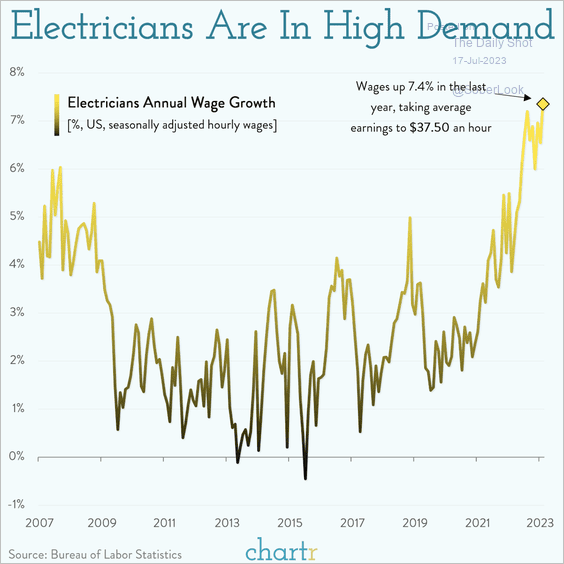

7. Electricians’ wage growth:

Source: @chartrdaily

Source: @chartrdaily

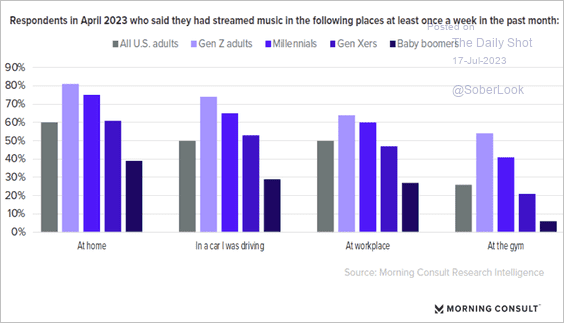

8. Places to stream music:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Back to Index