The Daily Shot: 18-Jul-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

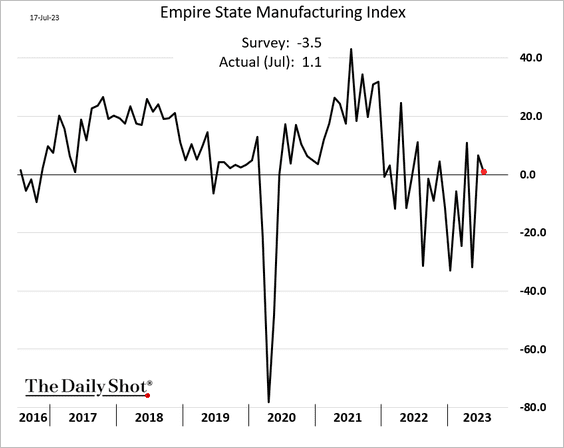

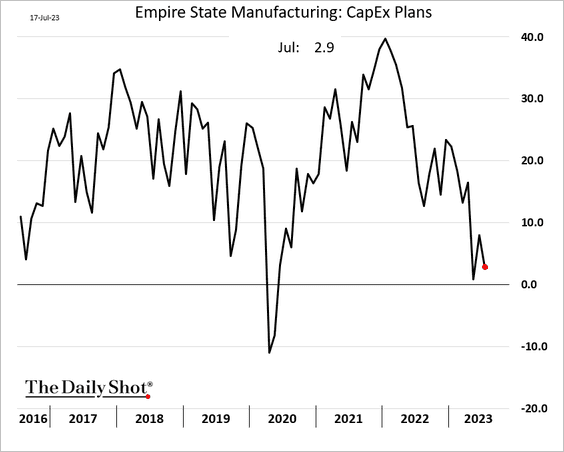

1. The NY Fed’s manufacturing index, the first regional report of the month, held in positive territory in July.

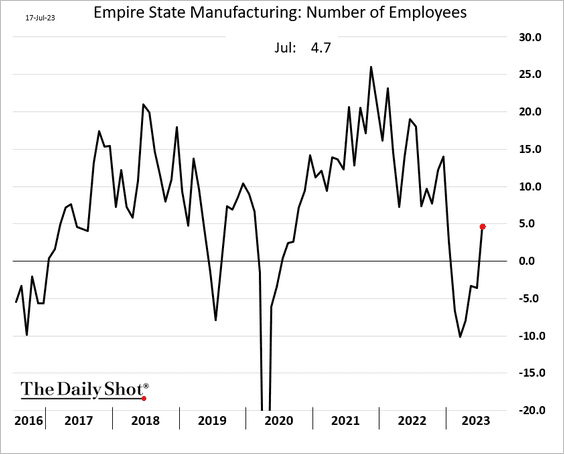

• Factories are hiring again, …

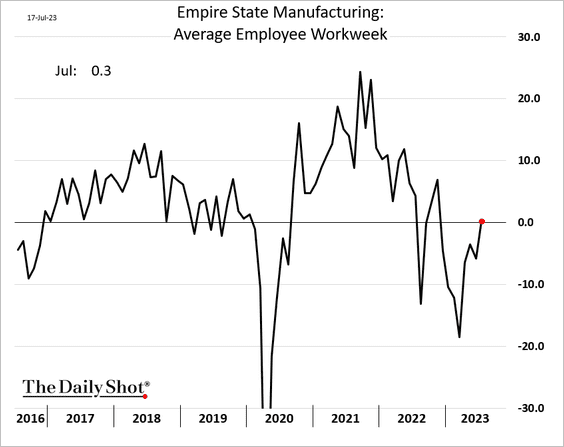

… and no longer cutting workers’ hours.

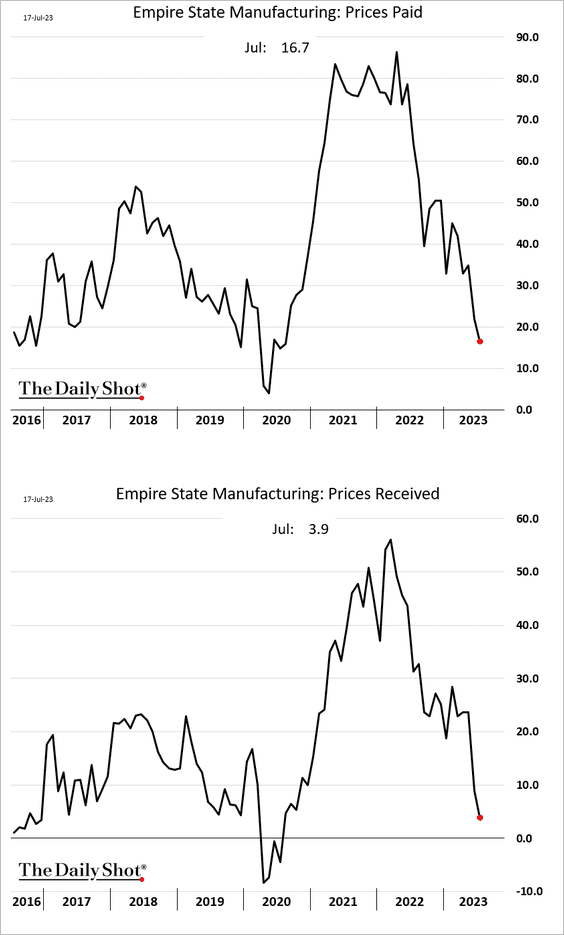

• Price gains continue to slow.

• CapEx plans remain soft.

——————–

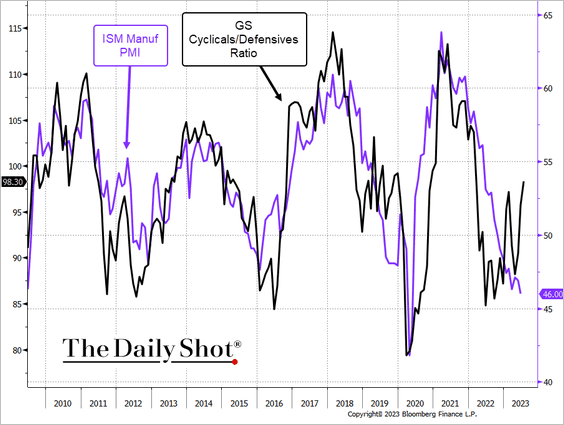

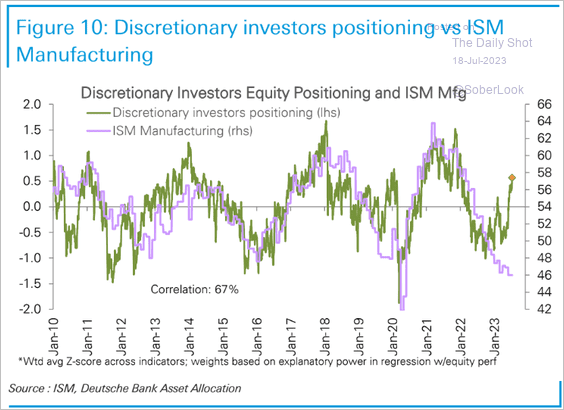

2. The stock market continues to signal a rebound in US manufacturing activity.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

This chart shows Deutsche Bank’s discretionary investors’ equity positioning versus the ISM Manufacturing PMI.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

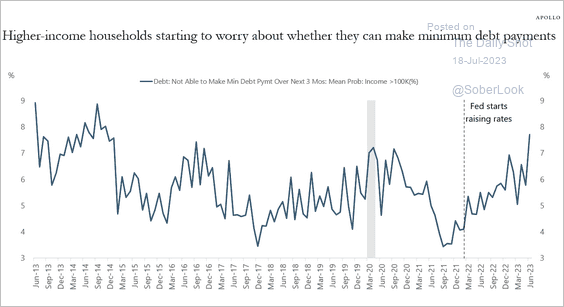

3. The proportion of higher-income households worried about making debt payments is rising.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

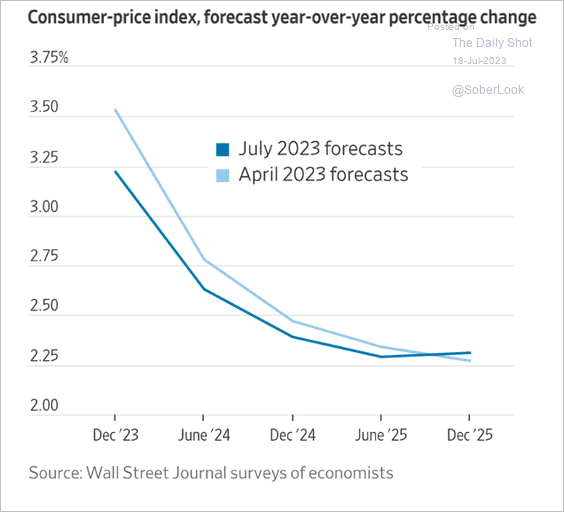

4. Here are the CPI forecasts based on the WSJ survey.

Source: @WSJ Read full article

Source: @WSJ Read full article

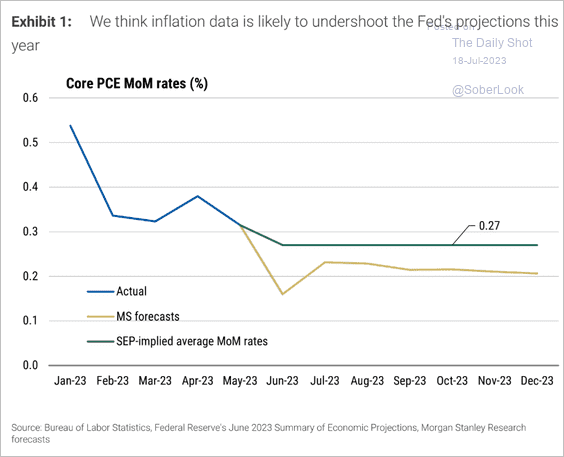

Morgan Stanley sees core inflation running below the Fed’s forecast this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

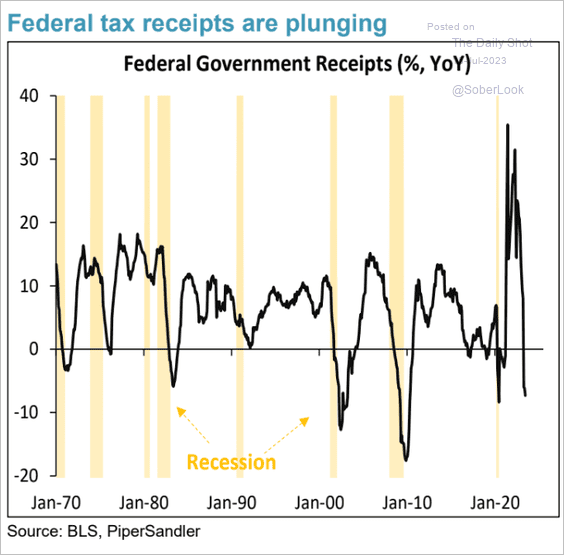

5. The drop in federal government receipts looks recessionary.

Source: Piper Sandler

Source: Piper Sandler

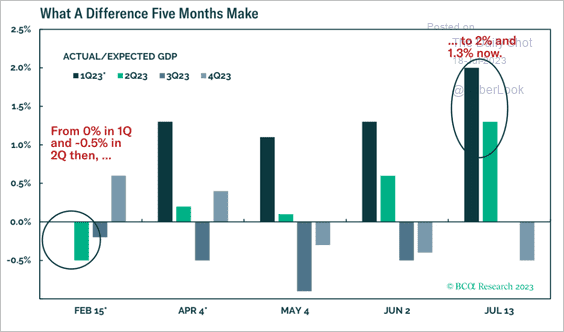

However, the recession “can” keeps getting kicked down the road.

Source: BCA Research

Source: BCA Research

——————–

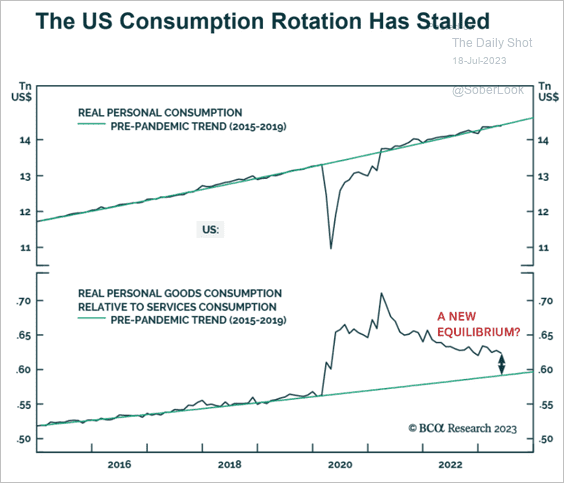

6. Goods consumption remains above trend relative to services consumption.

Source: BCA Research

Source: BCA Research

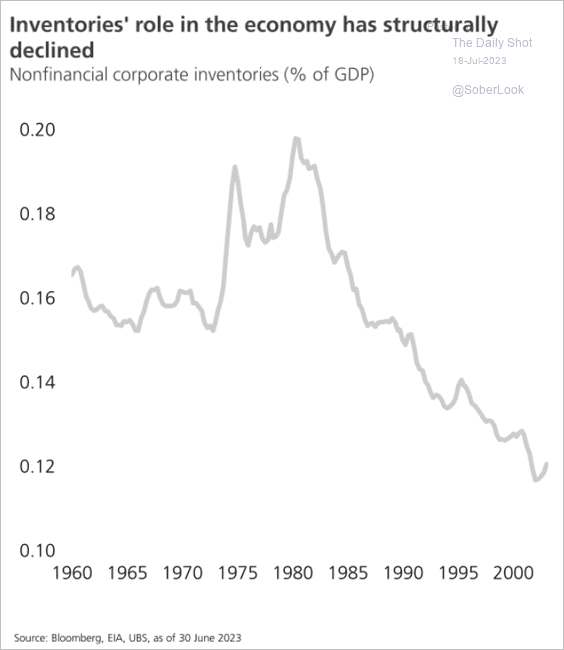

7. The chart illustrates the four-decade decline in corporate inventories as a percentage of GDP, underscoring their diminishing role in economic activity.

Source: UBS Research

Source: UBS Research

Back to Index

Canada

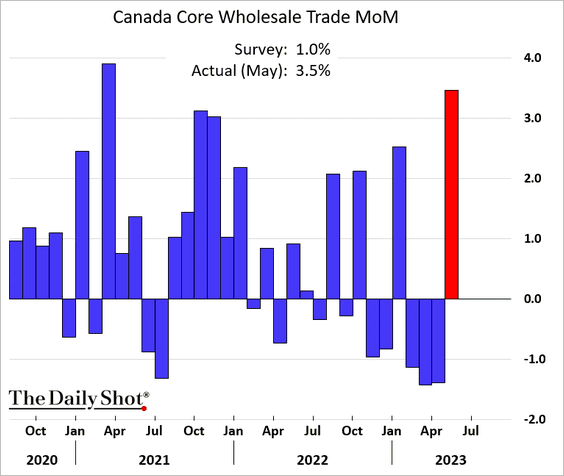

1. Wholesale trade jumped in May.

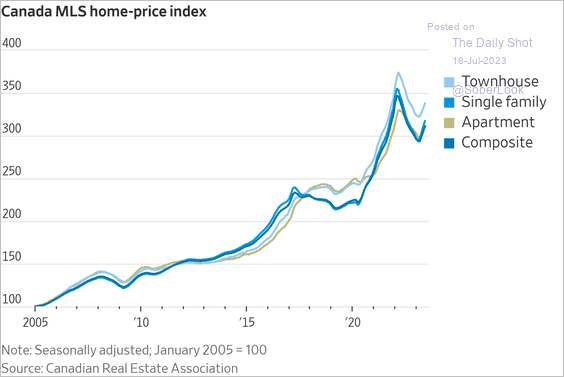

2. Home prices are rising again.

Source: @WSJ Read full article

Source: @WSJ Read full article

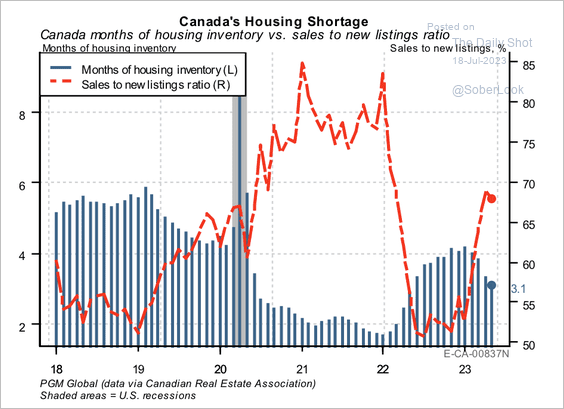

• Housing shortages remain a persistent problem, especially for newcomers.

Source: PGM Global

Source: PGM Global

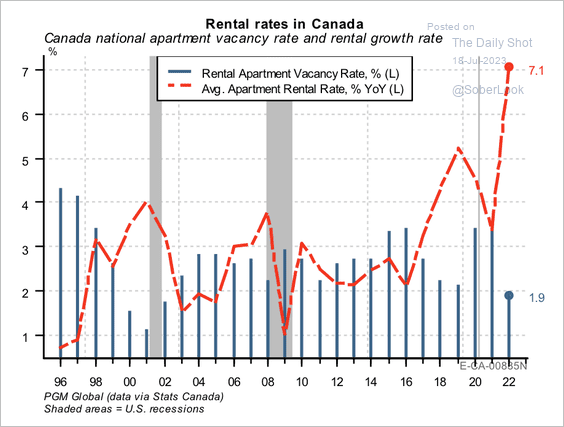

• The rental market is also tight.

Source: PGM Global

Source: PGM Global

Back to Index

The United Kingdom

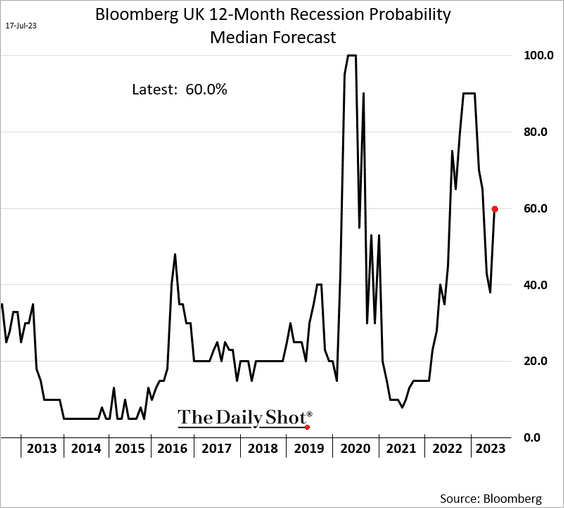

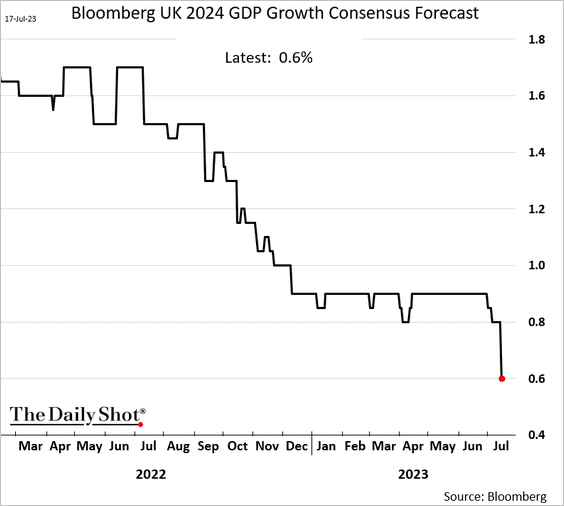

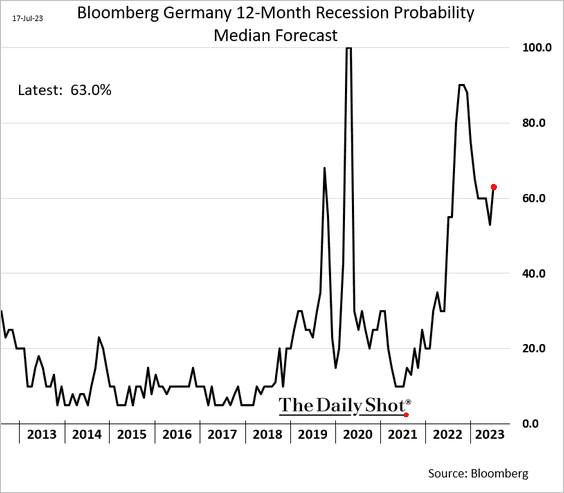

1. The probability of a recession in the next 12 months is at 60%, according to the latest Bloomberg survey.

Economists downgraded their forecasts for next year’s GDP growth.

——————–

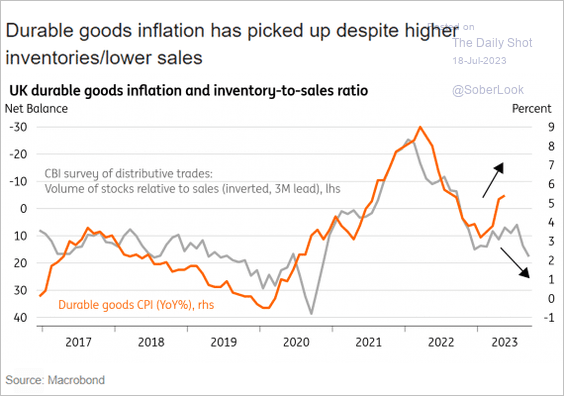

2. Durable goods inflation has been rising despite a higher inventory-to-sales ratio.

Source: ING

Source: ING

Back to Index

The Eurozone

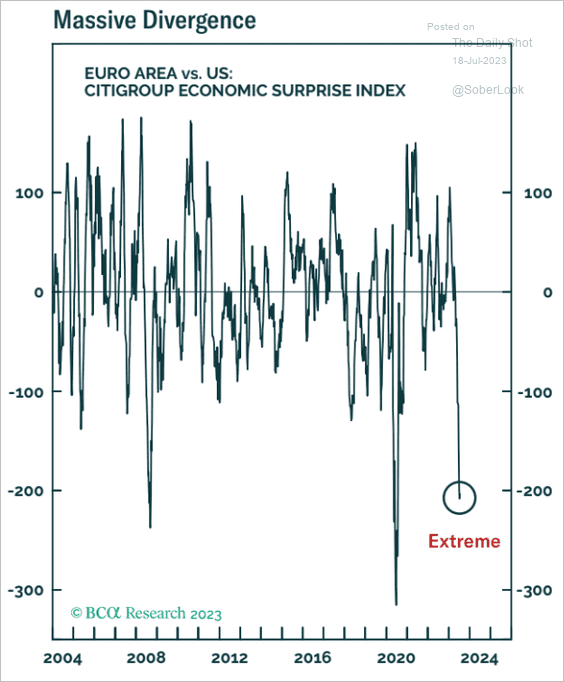

1. The gap between the euro-area and US economic surprises hit extreme levels.

Source: BCA Research

Source: BCA Research

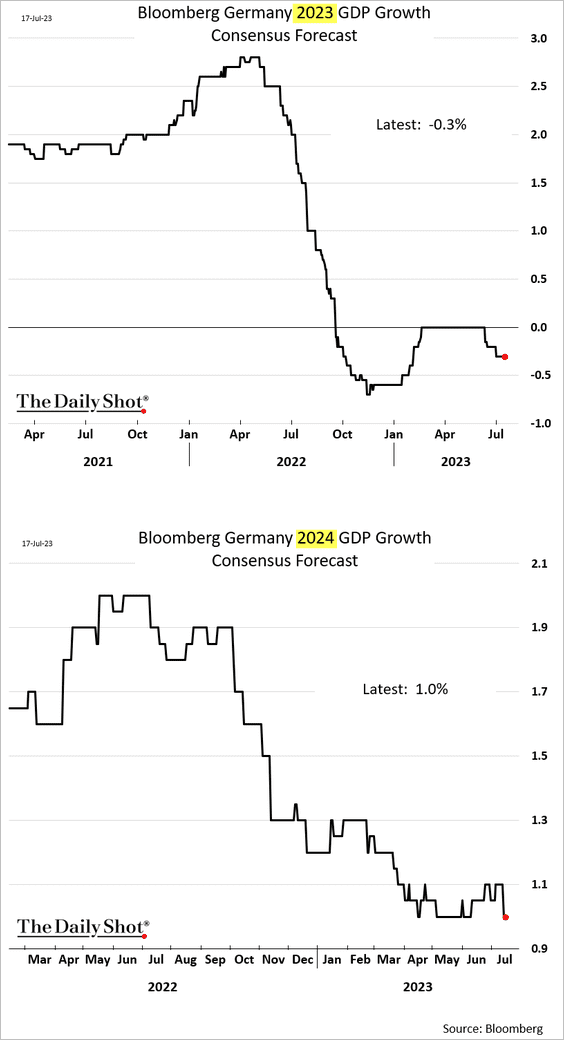

2. Economists are downgrading their projections for Germany’s economic growth.

——————–

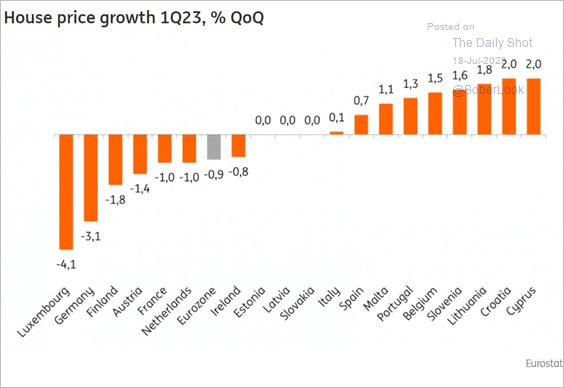

3. This chart shows the changes in house prices in Q1 by country.

Source: ING

Source: ING

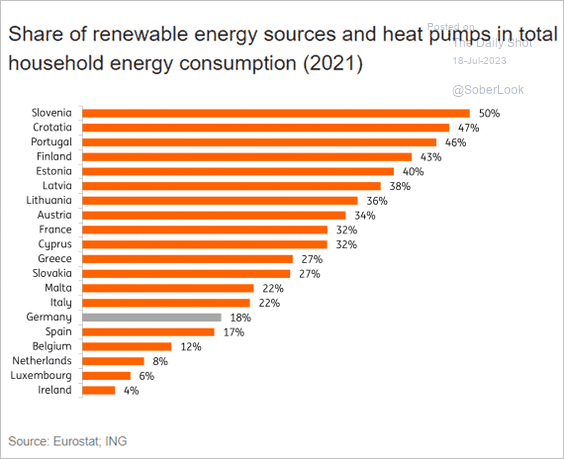

4. How “green” is household energy consumption across the Eurozone?

Source: ING

Source: ING

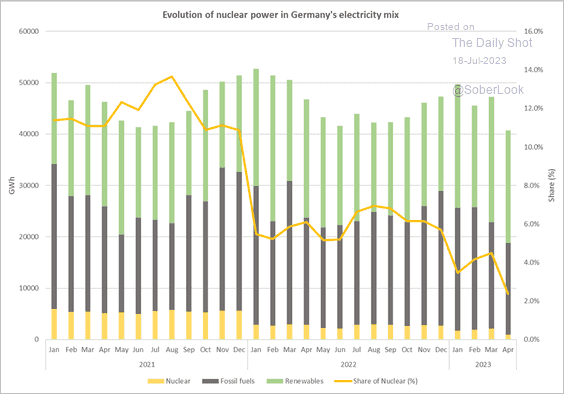

5. This is a mistake …

Source: IEA

Source: IEA

Back to Index

Asia-Pacific

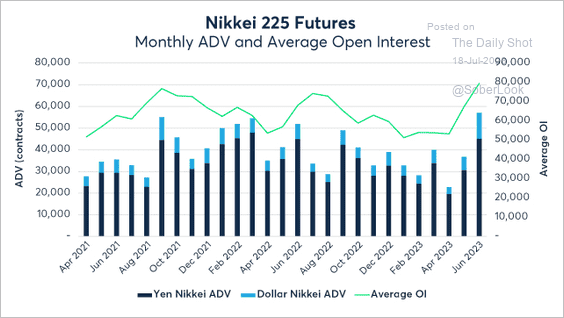

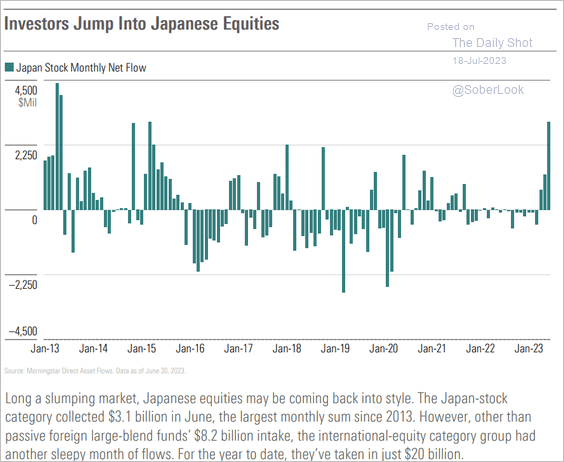

1. Nikkei 225 futures activity spiked as Japanese equities experienced a multi-decade high in Q2. 75% of trades occurred outside of Tokyo cash hours, according to CME Group.

Source: CME Group

Source: CME Group

Equity fund flows surged.

Source: Morningstar

Source: Morningstar

——————–

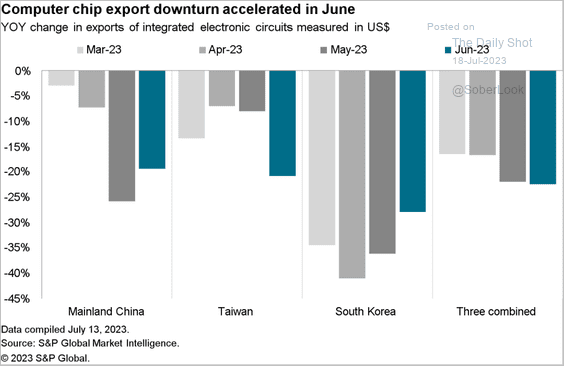

2. Integrated circuit exports remain depressed.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

China

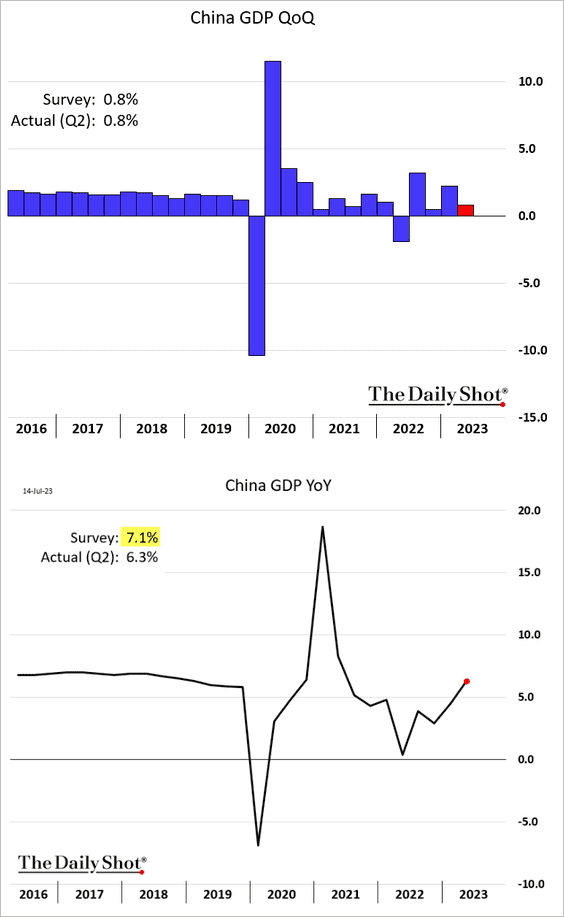

1. The post-lockdown economic rebound has been lackluster.

Source: @economics Read full article

Source: @economics Read full article

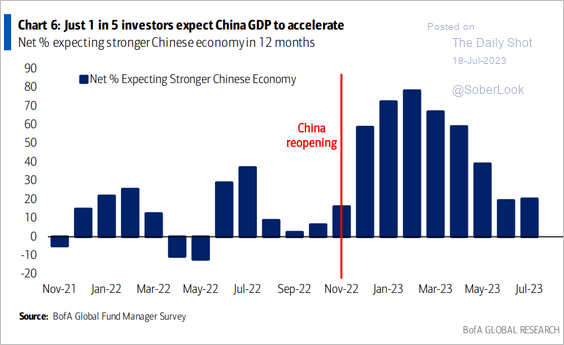

• Most investors don’t expect economic growth to accelerate.

Source: BofA Global Research

Source: BofA Global Research

——————–

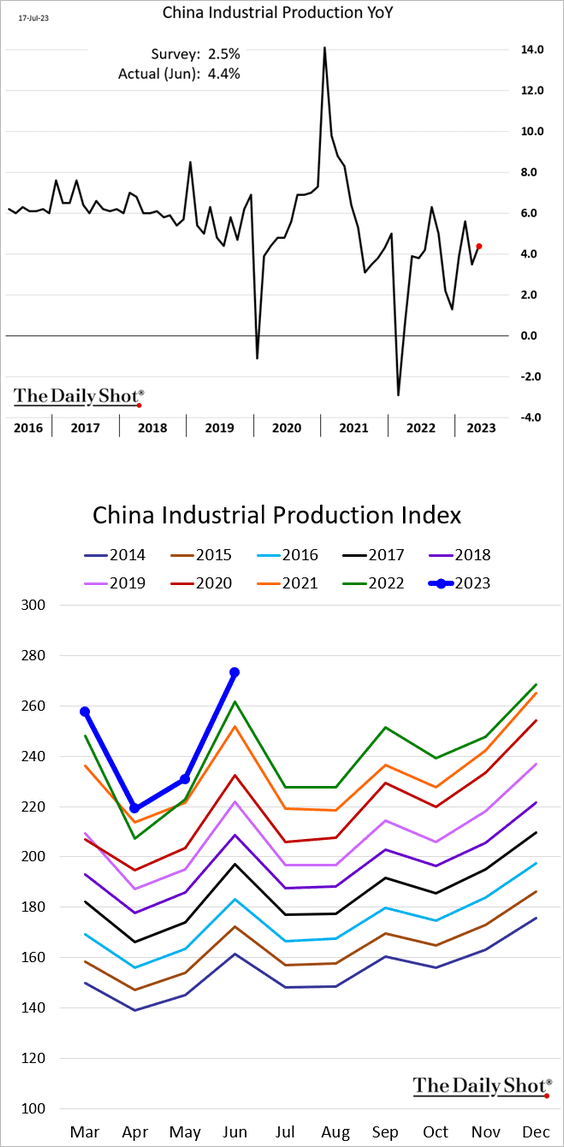

2. June industrial production growth was higher than expected.

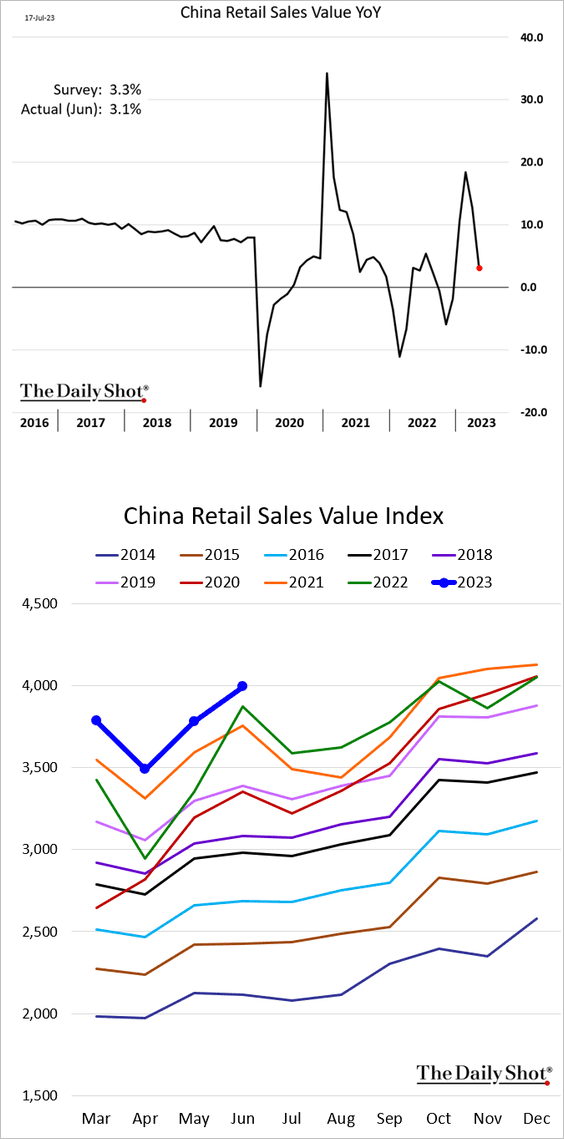

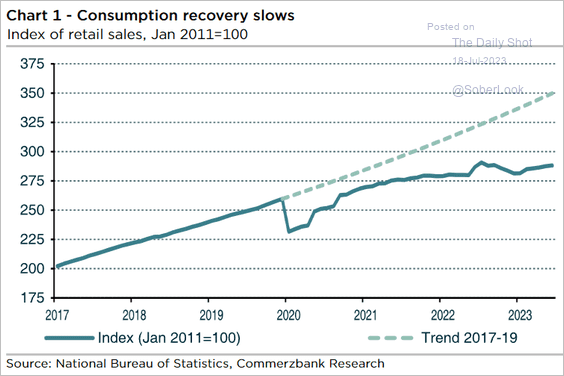

3. Although the year-over-year growth in retail sales has decelerated, it comes off a high baseline.

Here is a seasonally-adjusted index of retail sales.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

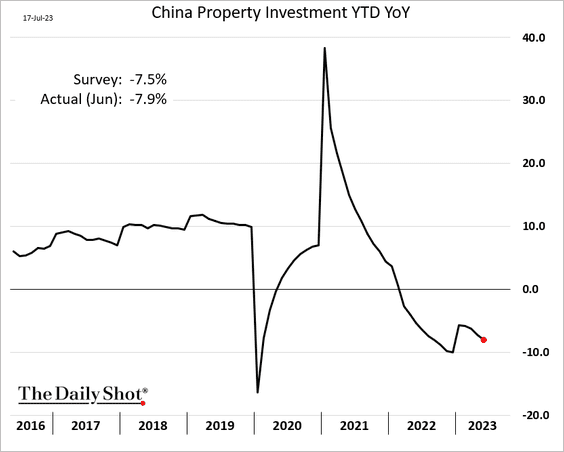

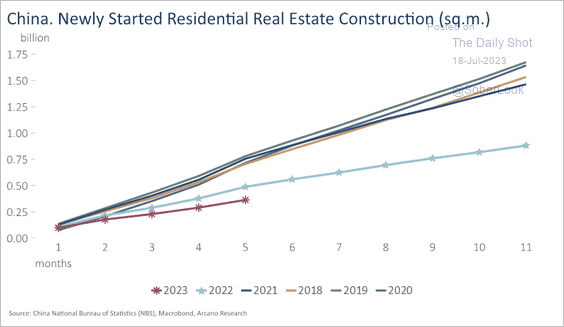

4. Property investment remains weak.

This chart shows China’s residential construction starts.

Source: Arcano Economics

Source: Arcano Economics

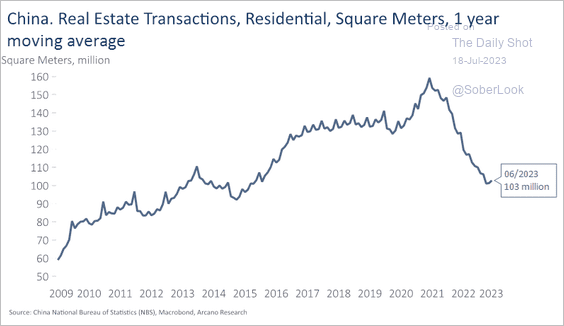

And here are residential real estate transactions.

Source: Arcano Economics

Source: Arcano Economics

——————–

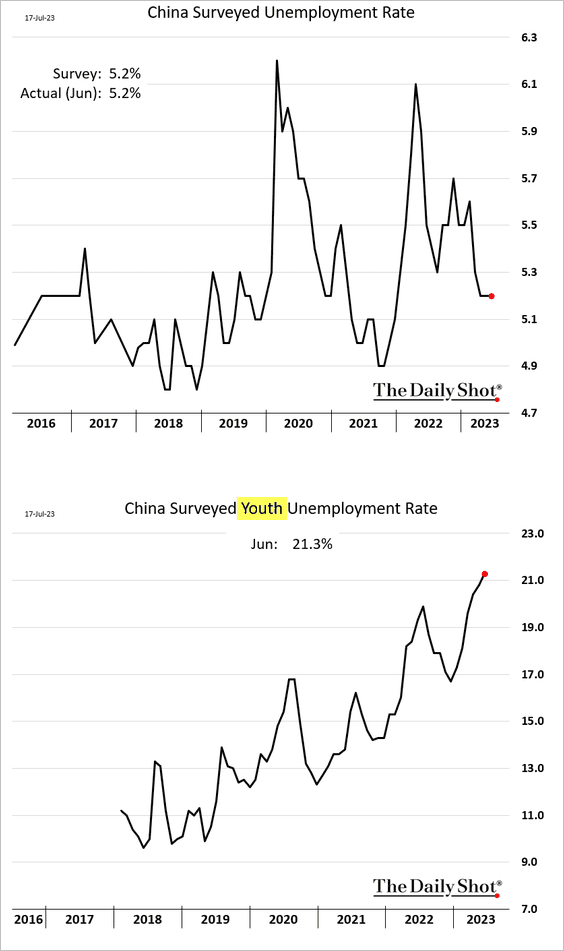

5. Youth unemployment continues to climb.

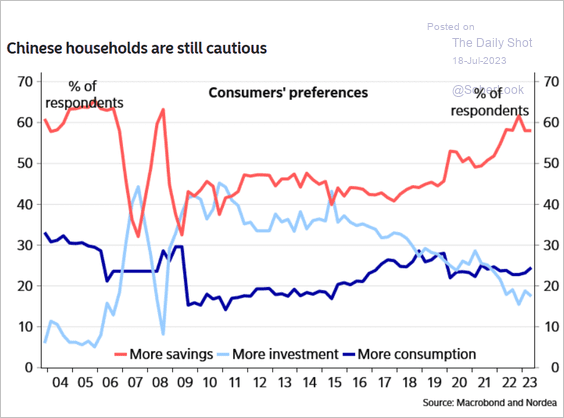

6. Households remain cautious.

Source: Nordea Markets

Source: Nordea Markets

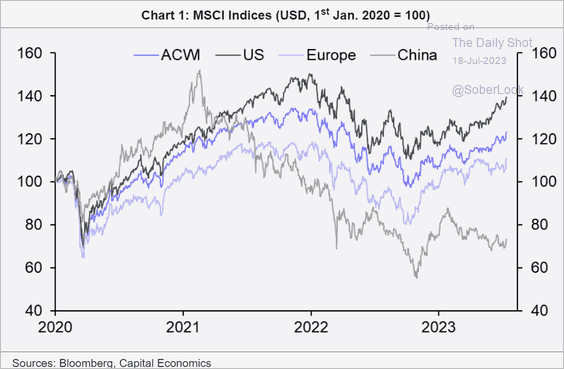

7. China’s equities continue to lag global peers, …

Source: Capital Economics

Source: Capital Economics

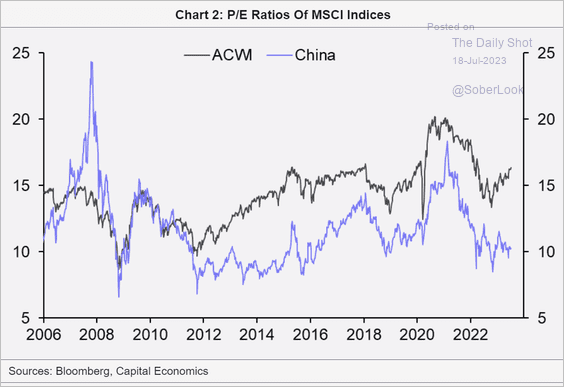

… trading at substantial discounts.

Source: Capital Economics

Source: Capital Economics

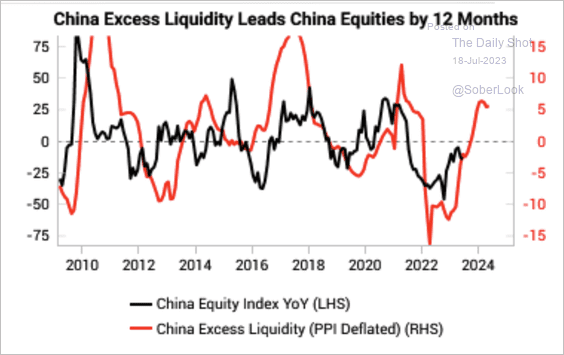

But the rise in excess liquidity could support equities, assuming monetary stimulus is absorbed by the real economy.

Source: Variant Perception

Source: Variant Perception

Back to Index

Emerging Markets

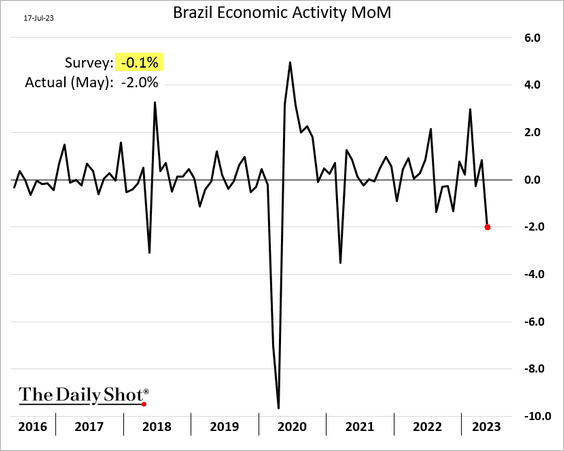

1. Brazil’s economic activity dropped sharply in May.

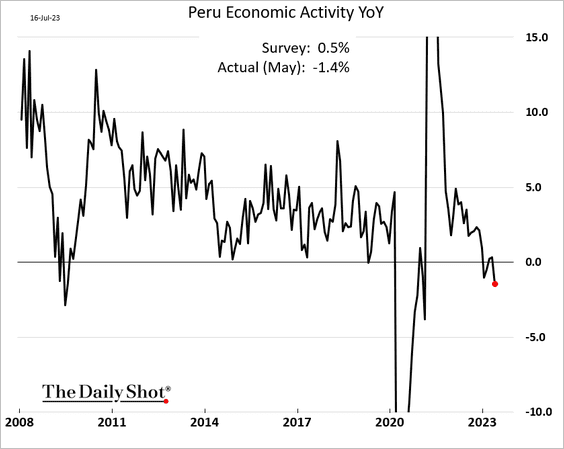

2. Is Peru in recession?

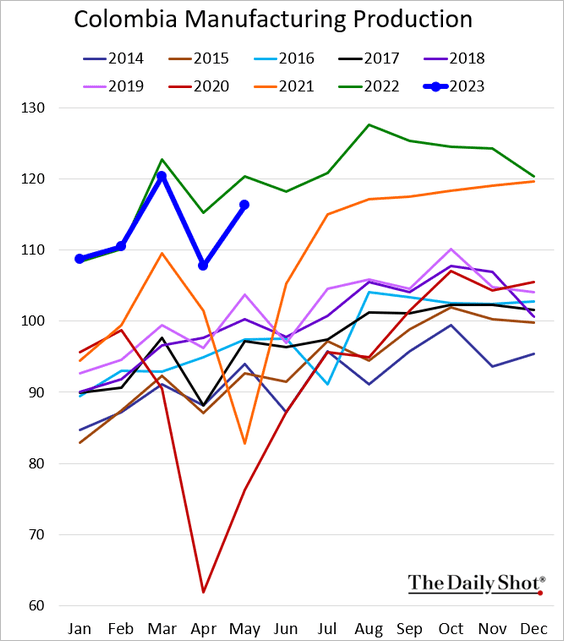

3. Colombia’s manufacturing output bounced in May.

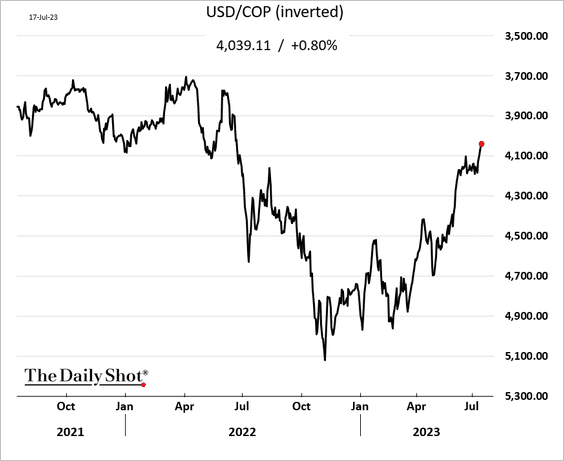

The Colombian peso is surging.

——————–

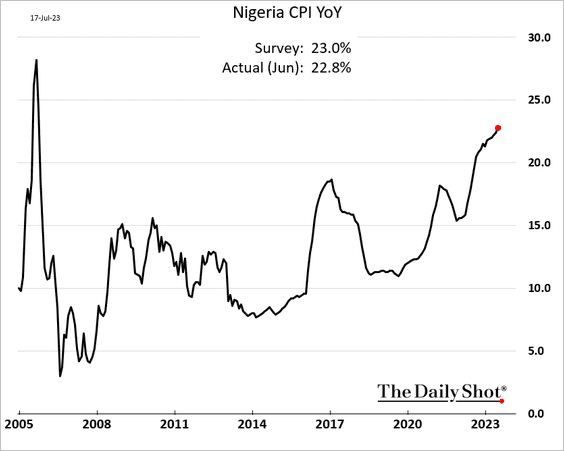

4. Nigeria’s CPI keeps rising.

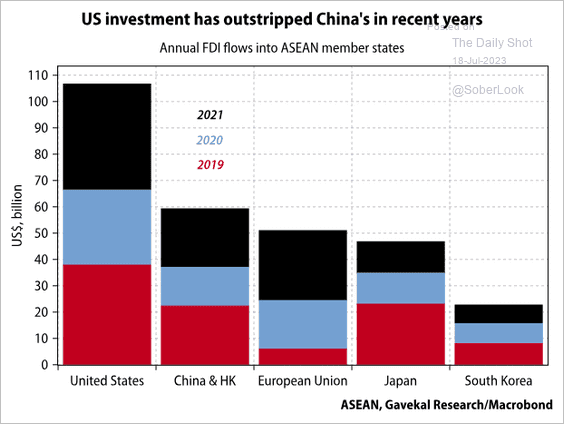

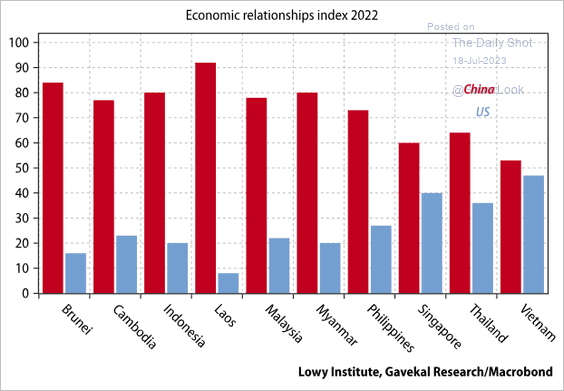

5. Next, let’s take a look at ASEAN’s economic relationship with China and the US.

• ASEAN map:

• Foreign direct investment:

Source: Gavekal Research

Source: Gavekal Research

• The Economic Influence Index:

Source: Gavekal Research

Source: Gavekal Research

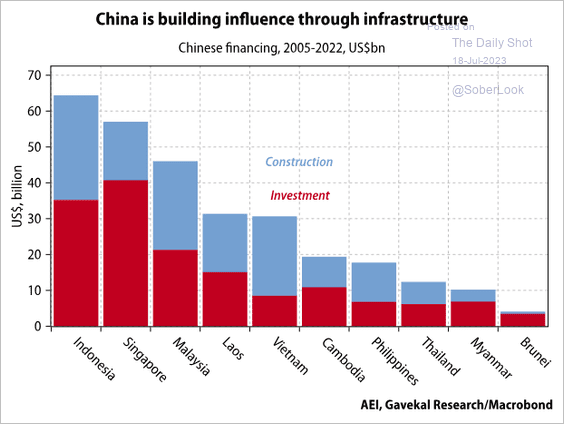

• China’s infrastructure investment:

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Cryptocurrency

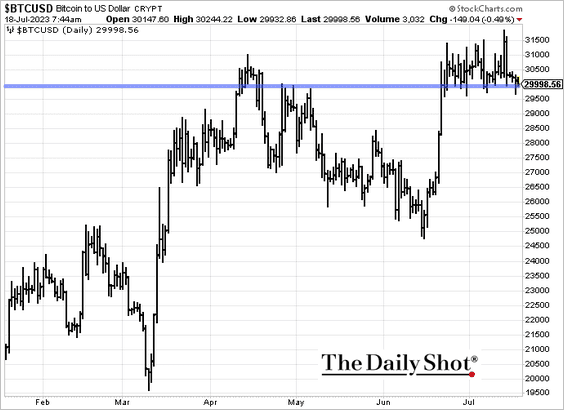

1. Bitcoin is testing support at 30k.

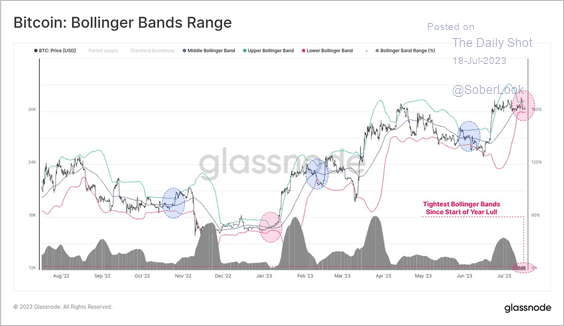

• Bitcoin continues to trade with relatively low volatility.

Source: @glassnode

Source: @glassnode

——————–

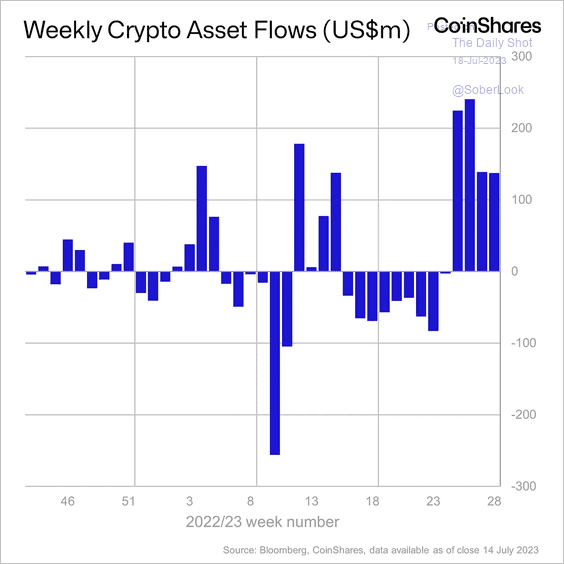

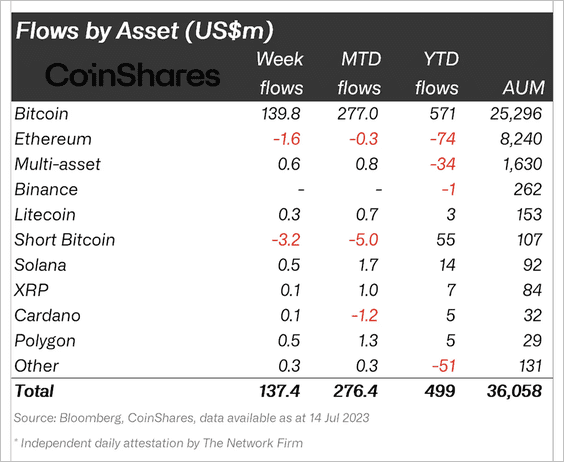

2. Crypto funds continued to see inflows last week. According to CoinShares, this has been the largest run of inflows since late-2021.

Source: CoinShares Read full article

Source: CoinShares Read full article

Long-bitcoin funds accounted for most inflows last week, while investors exited short-bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

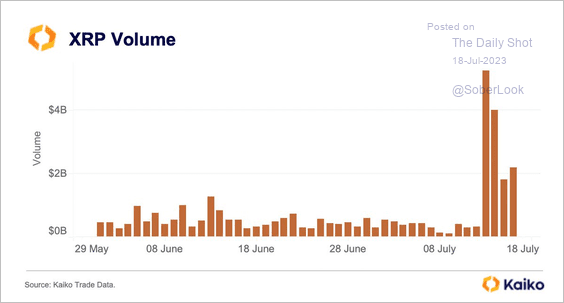

3. XRP’s trading volume spiked over the past week.

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

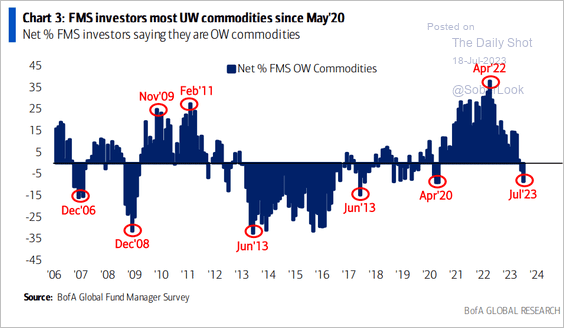

1. Fund managers are underweight commodities.

Source: BofA Global Research

Source: BofA Global Research

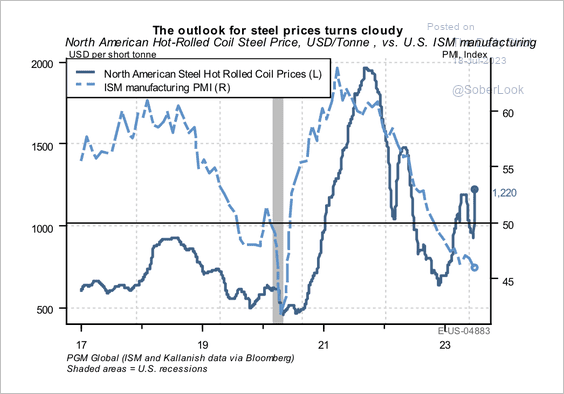

2. North American steel prices have diverged from the ISM manufacturing PMI.

Source: PGM Global

Source: PGM Global

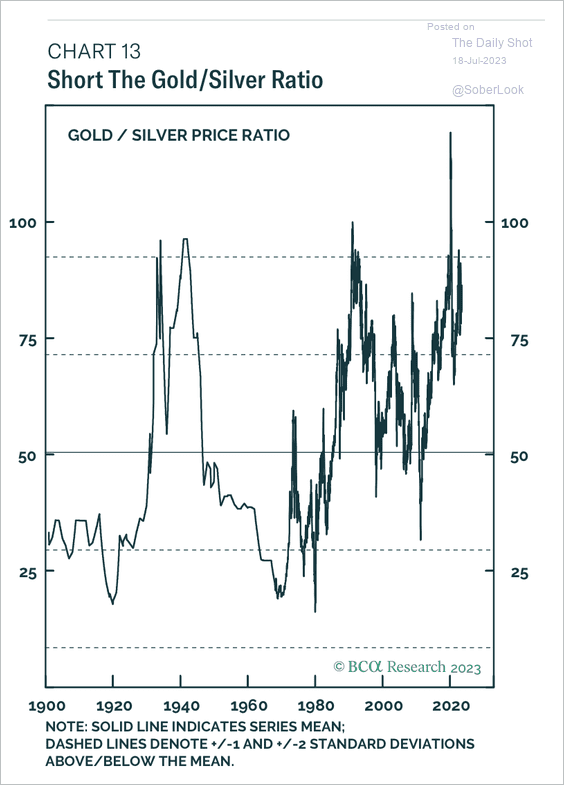

3. The gold/silver price ratio appears extended.

Source: BCA Research

Source: BCA Research

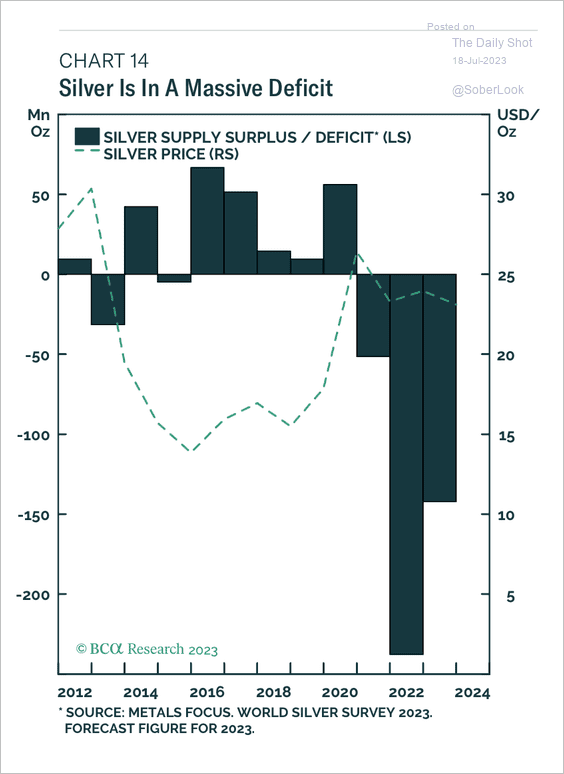

• Silver demand has exceeded supply by a large margin.

Source: BCA Research

Source: BCA Research

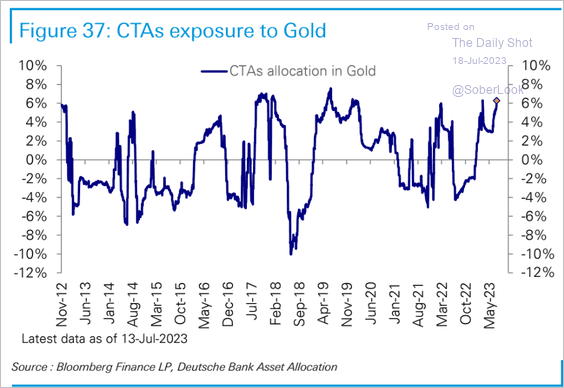

• CTAs have been boosting their exposure to gold.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

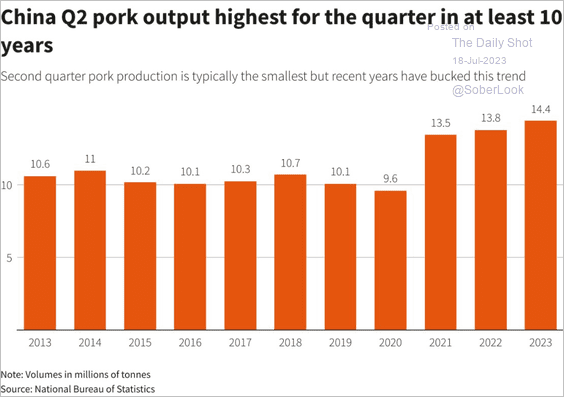

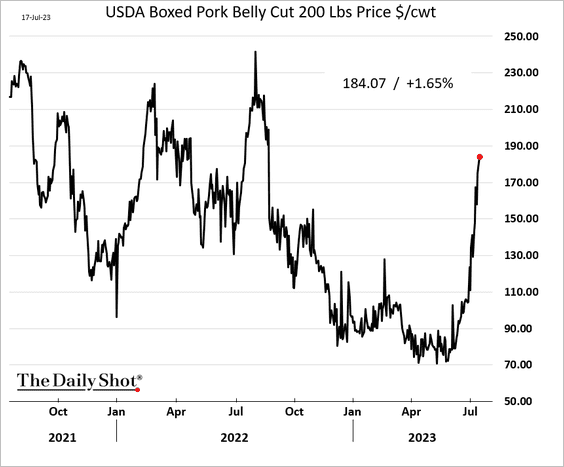

4. China’s pork output continues to climb.

Source: Reuters Read full article

Source: Reuters Read full article

Nonetheless, US pork belly prices are surging.

——————–

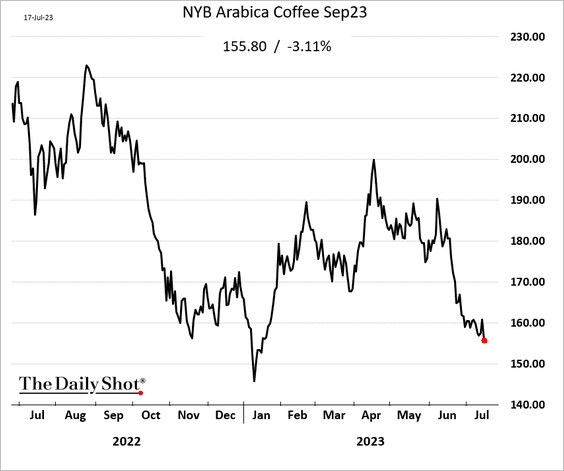

5. Arabica coffee futures hit the lowest level since January.

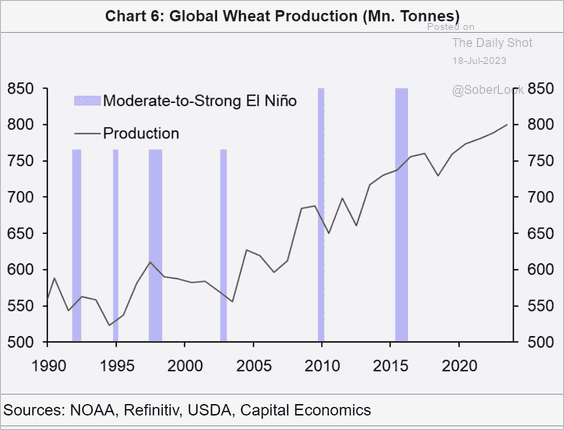

6. How does El Niño impact wheat production?

Source: Capital Economics

Source: Capital Economics

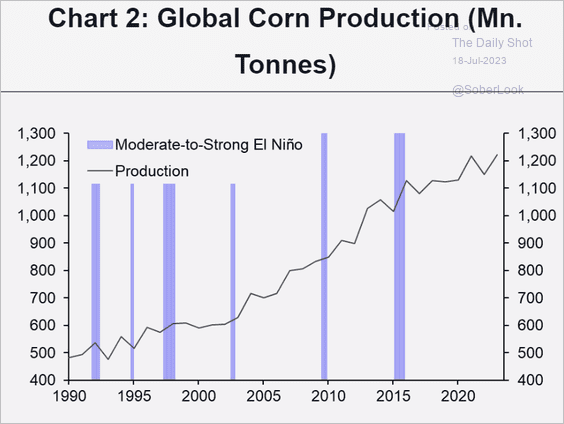

How about corn output?

Source: Capital Economics

Source: Capital Economics

Back to Index

Energy

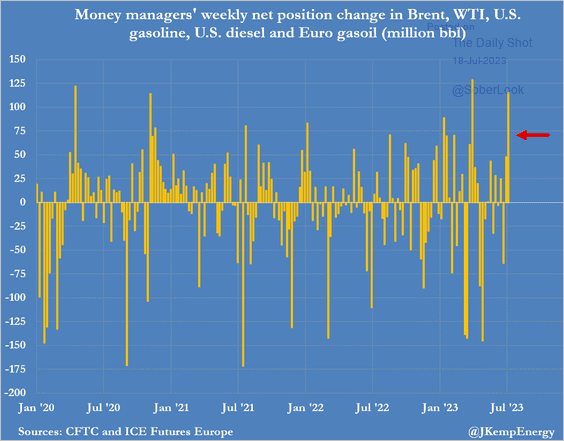

1. Money managers boosted their exposure to crude oil and refined products last week.

Source: @JKempEnergy

Source: @JKempEnergy

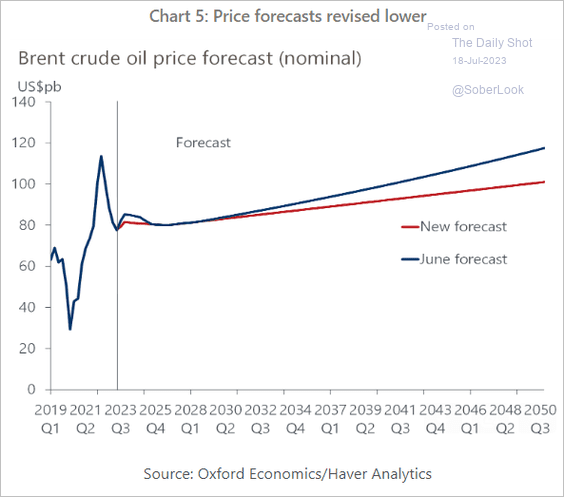

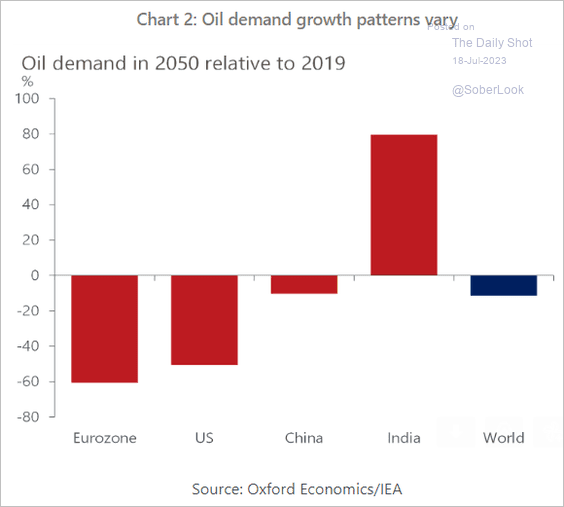

2. Oxford Economics lowered its forecast for Brent prices …

Source: Oxford Economics

Source: Oxford Economics

… on weaker expected demand.

Source: Oxford Economics

Source: Oxford Economics

——————–

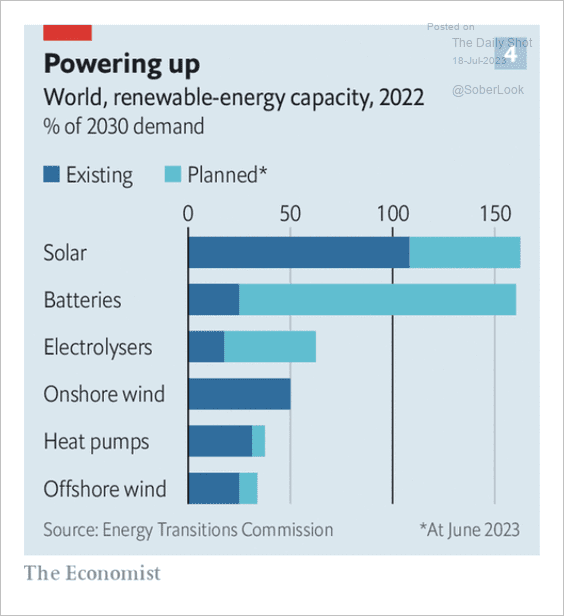

3. A significant global expansion of utility-scale battery installations is slated for the upcoming years.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

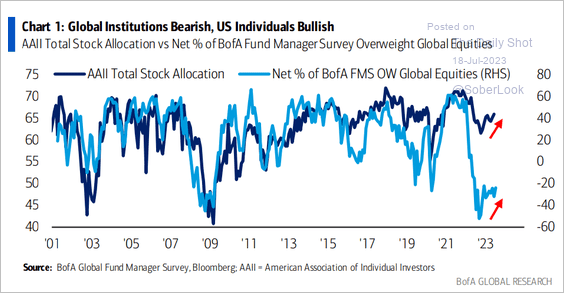

1. According to BofA’s fund manager survey, the disparity in sentiment between institutional and retail investors has reached unprecedented levels.

Source: BofA Global Research

Source: BofA Global Research

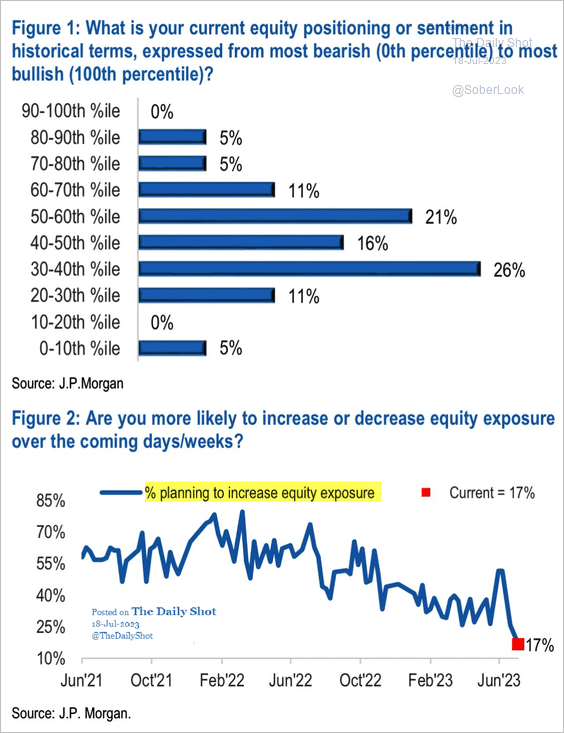

• JP Morgan’s clients are bearish.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

——————–

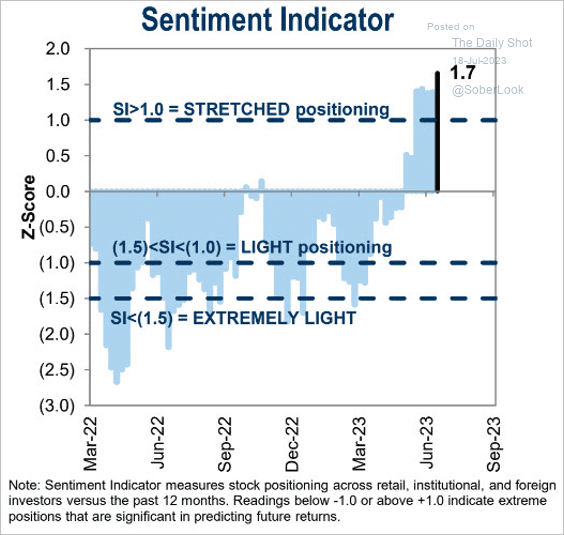

2. Equity positioning is stretched, according to Goldman.

Source: Goldman Sachs; h/t @dailychartbook

Source: Goldman Sachs; h/t @dailychartbook

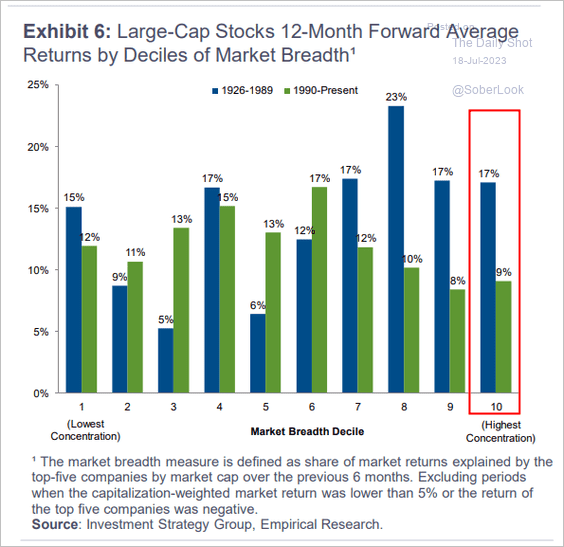

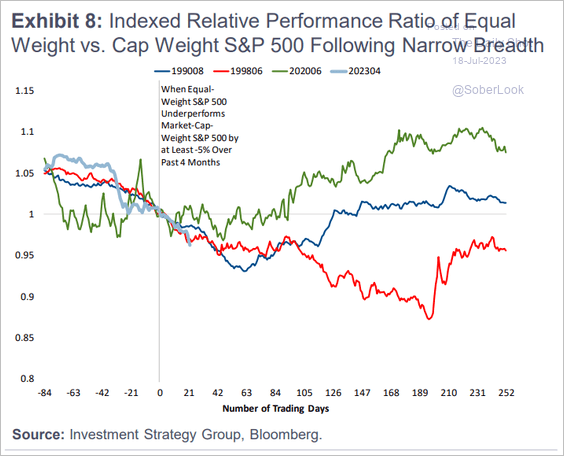

3. Poor breadth does not necessarily portend weak returns over the following year.

Source: Goldman Sachs

Source: Goldman Sachs

• Market participation tends to widen.

Source: Goldman Sachs

Source: Goldman Sachs

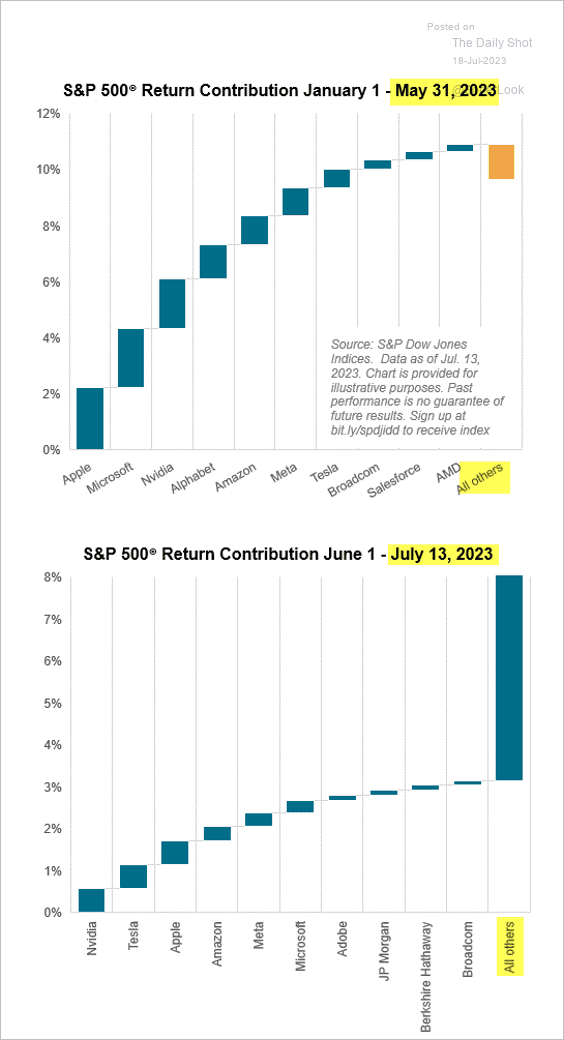

This chart illustrates this year’s improvement in breadth.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

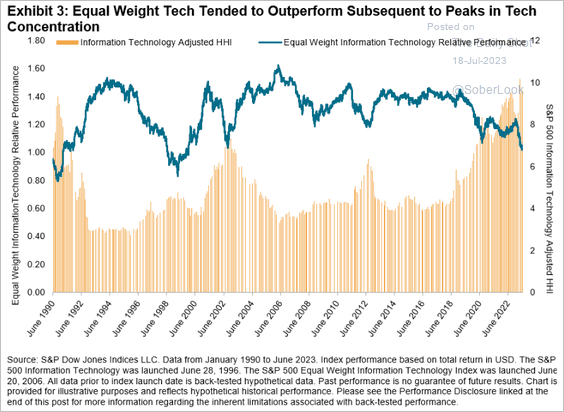

• The equal-weight index tends to rebound after tech concentration peaks.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

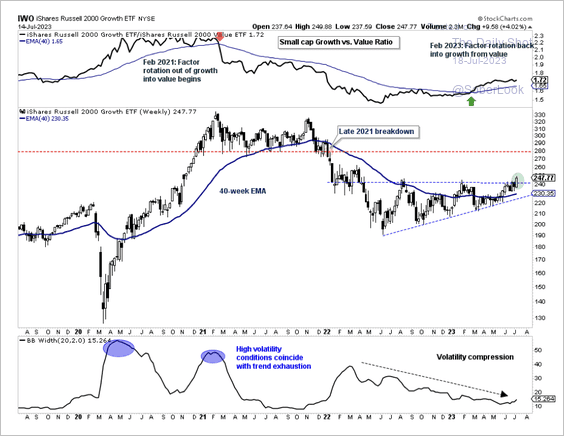

4. US small-cap growth stocks are improving after a period of low volatility.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

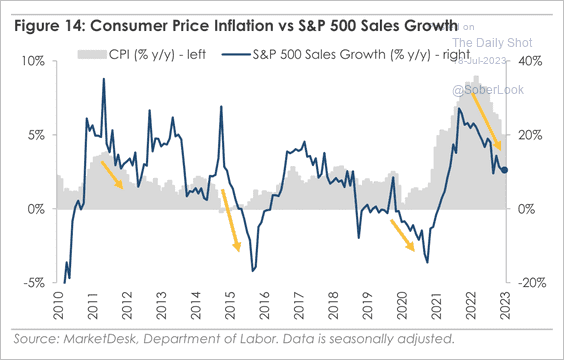

5. Corporate sales growth historically slows as inflation eases, creating potential margin pressure.

Source: MarketDesk Research

Source: MarketDesk Research

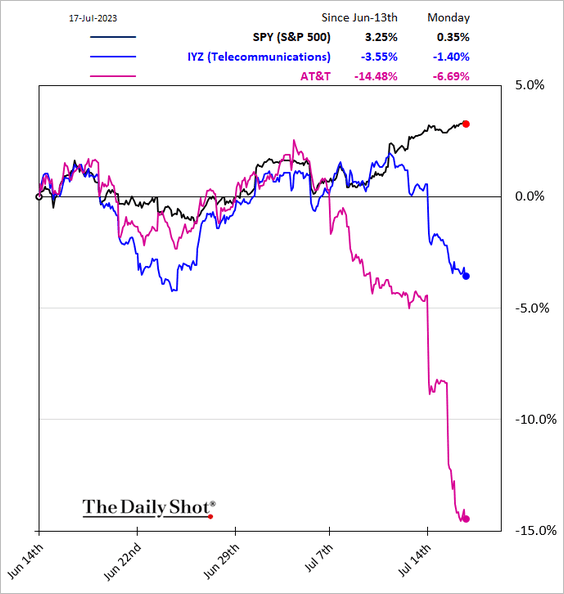

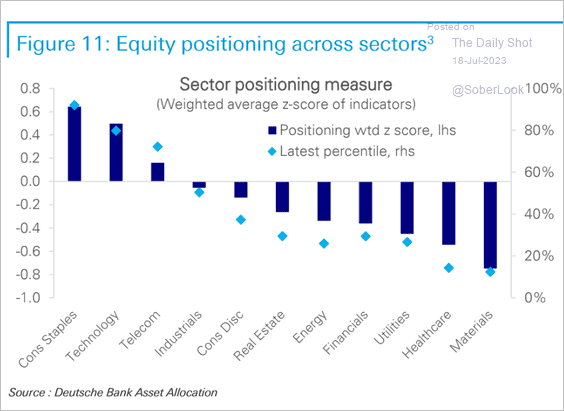

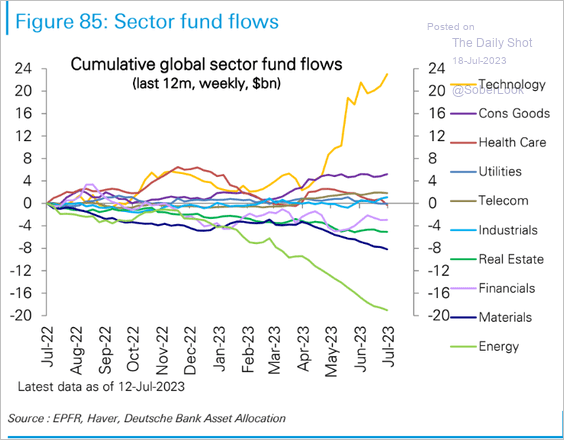

6. Next, we have some sector trends.

• Telecoms (under pressure):

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

• Deutsche Bank’s positioning indicator:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Fund flows:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

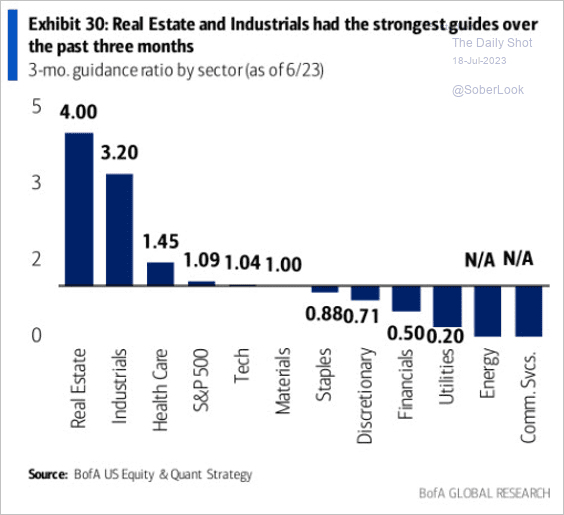

• Which sectors had the strongest earnings guidance?

Source: BofA Global Research; h/t @dailychartbook

Source: BofA Global Research; h/t @dailychartbook

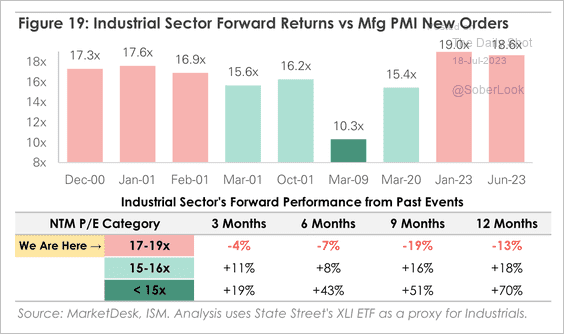

• Weak ISM manufacturing PMIs typically precede higher returns for US industrial stocks only when valuations are low.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

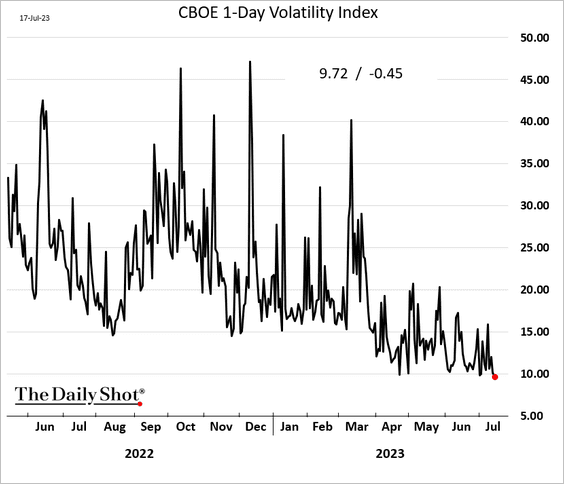

7. The one-day implied volatility index hit a new low.

.

Back to Index

Rates

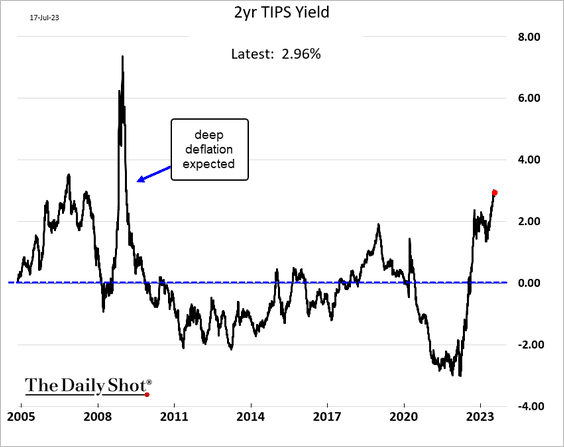

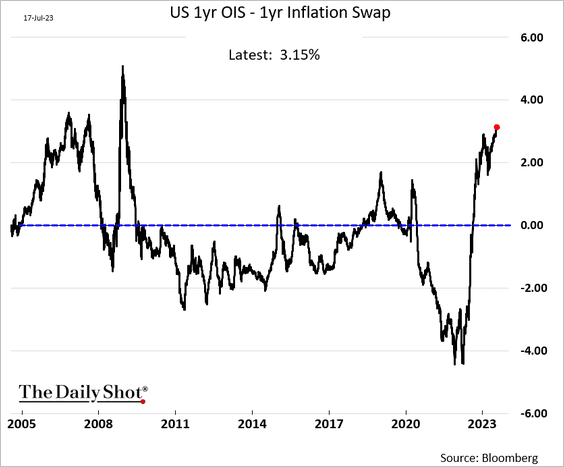

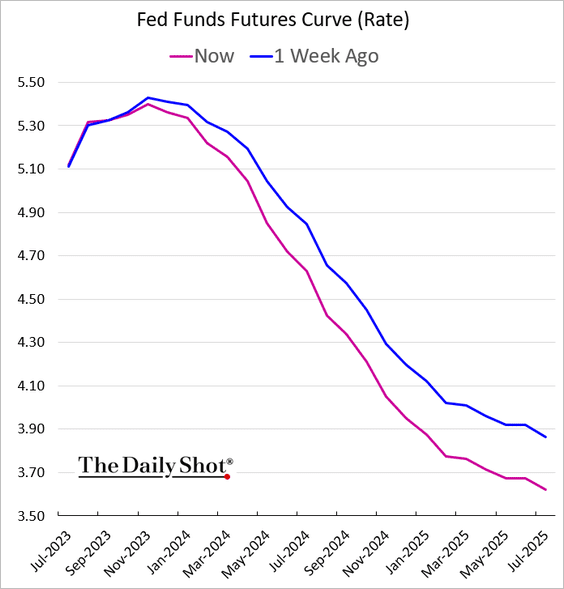

1. Market-based real short-term rates show that the Fed’s policy is restrictive.

• 2yr TIPS yield:

• Real 1yr OIS:

The market is now expecting steeper Fed rate cuts ahead.

——————–

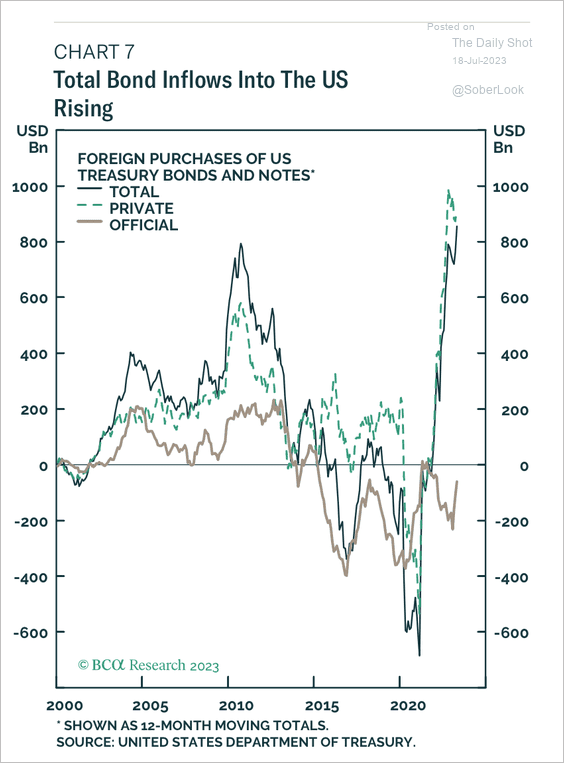

2. Higher US rates have led to a strong influx of Treasury purchases.

Source: BCA Research

Source: BCA Research

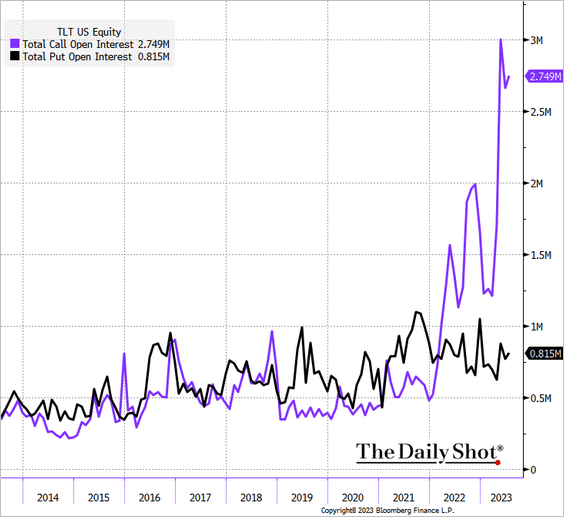

3. Options traders are betting on a rally in long-term Treasuries.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

Food for Thought

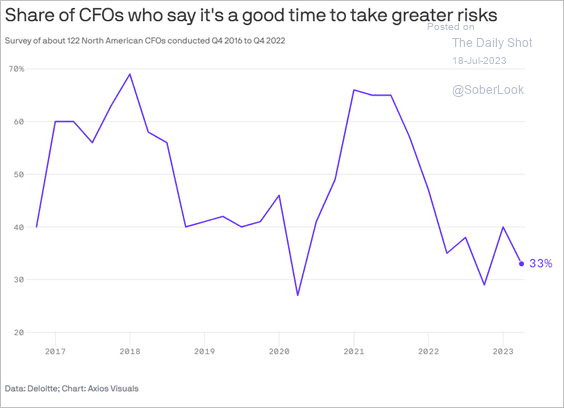

1. Risk-averse CFOs:

Source: @axios Read full article

Source: @axios Read full article

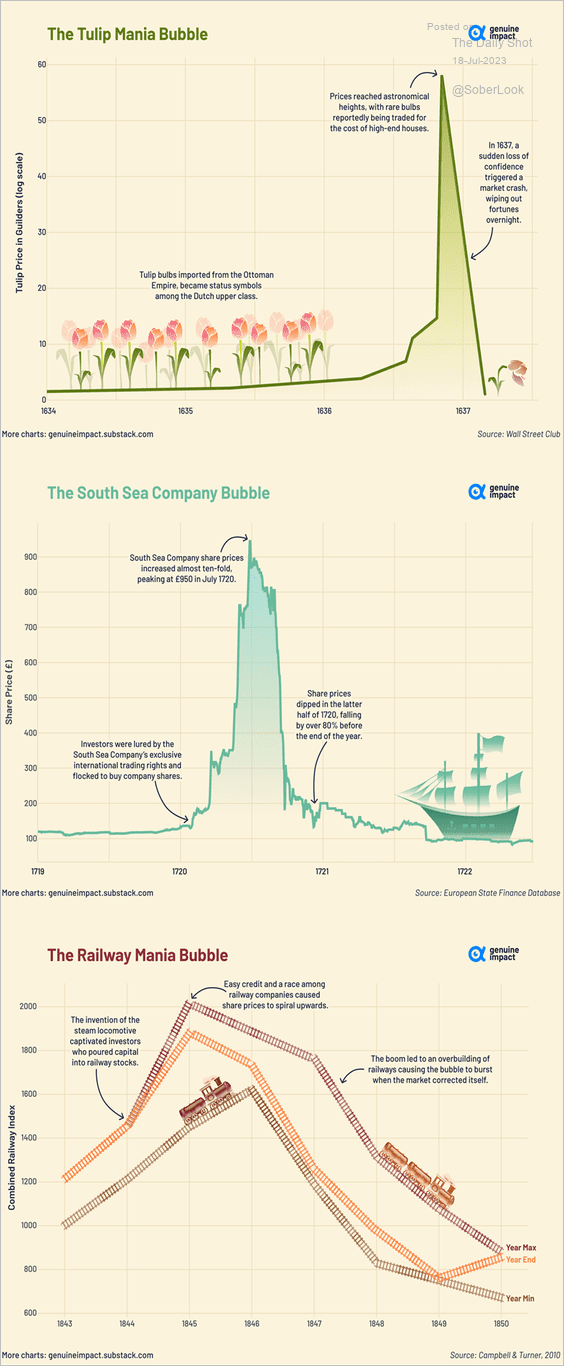

2. Some famous asset bubbles:

Source: @genuine_impact

Source: @genuine_impact

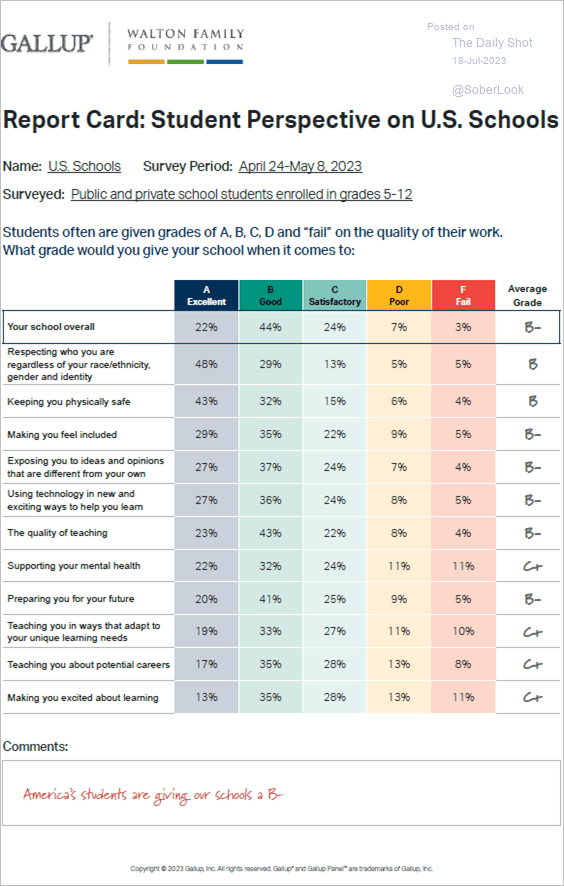

3. Students’ perception of US public schools:

Source: Gallup Read full article

Source: Gallup Read full article

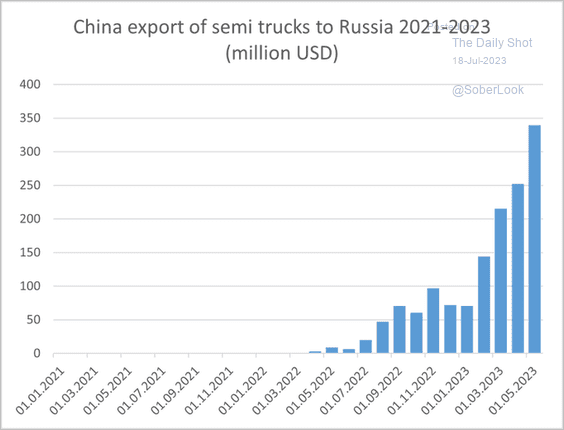

4. China’s exports of semi trucks to Russia:

Source: @jakluge

Source: @jakluge

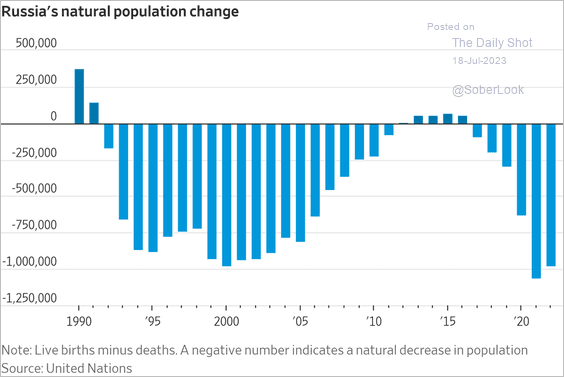

5. Changes in Russia’s population:

Source: @WSJ Read full article

Source: @WSJ Read full article

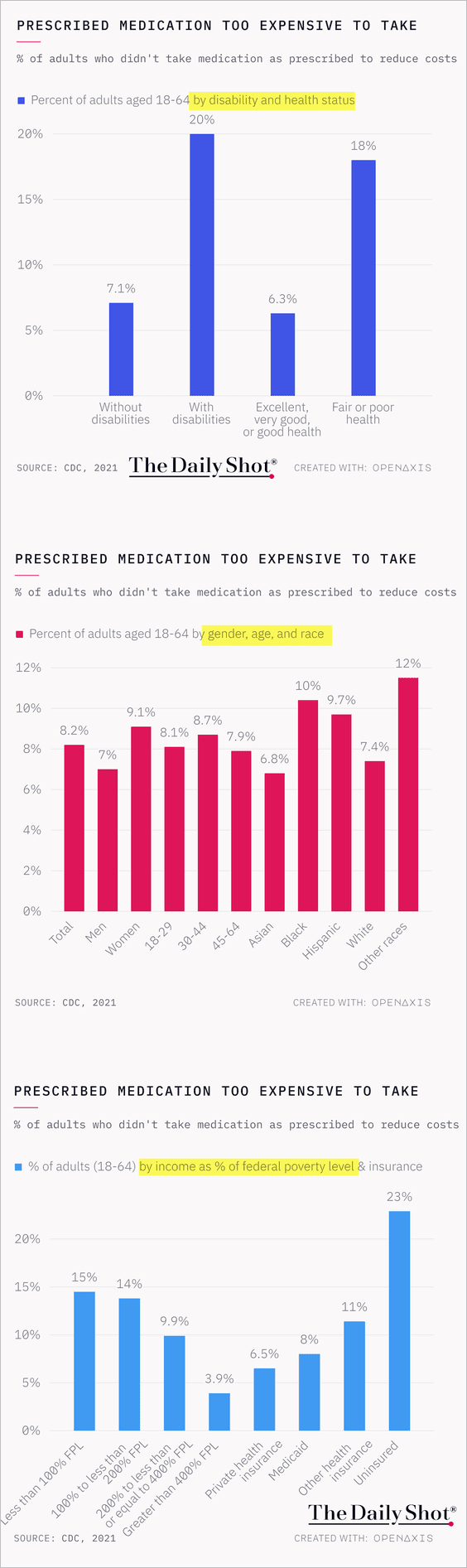

6. Medications too expensive to take:

Source: @TheDailyShot

Source: @TheDailyShot

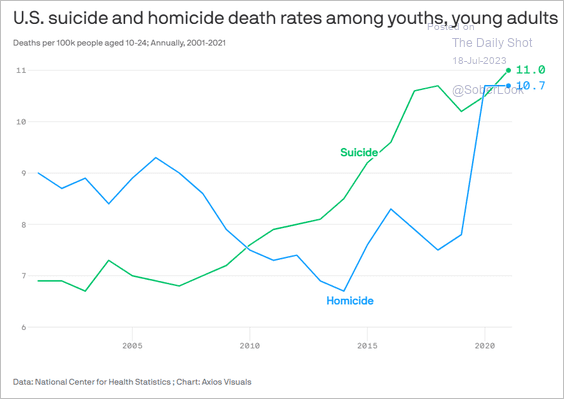

7. US youth suicide and homicide rates:

Source: @axios Read full article

Source: @axios Read full article

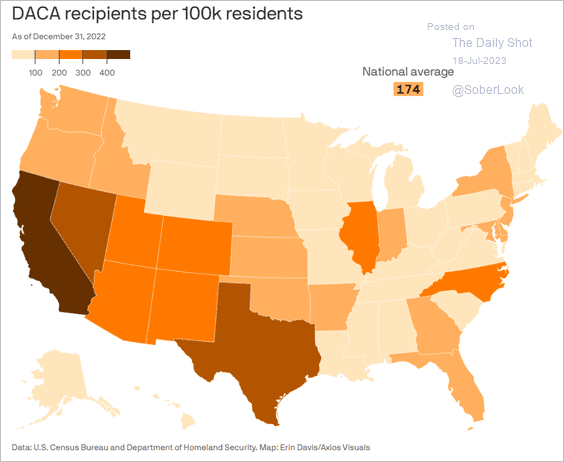

8. DACA recipients:

Source: @axios Read full article

Source: @axios Read full article

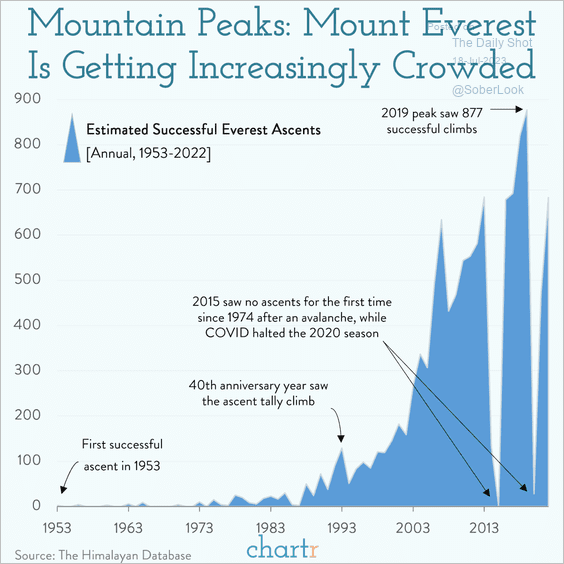

9. Successful Everest ascents:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index