The Daily Shot: 19-Jul-23

• The United States

• Canada

• The Eurozone

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

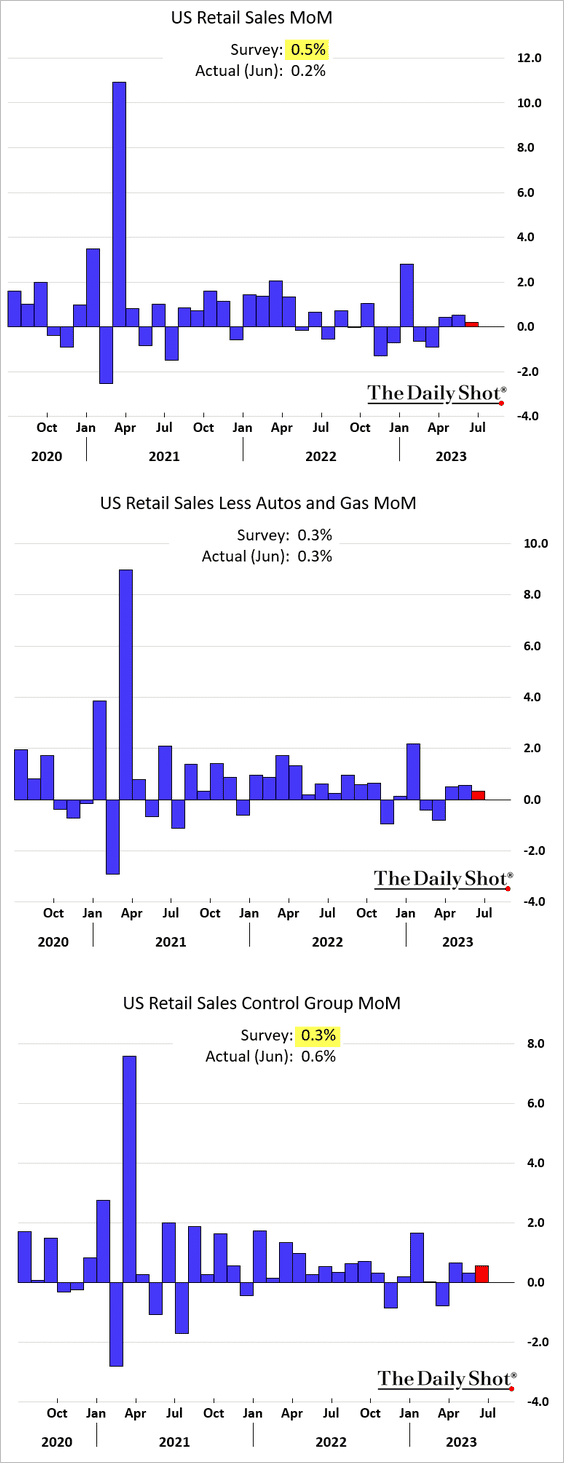

1. The headline retail sales index climbed less than expected in June. However, the “control group” (core retail sales) topped economists’ forecasts (3rd panel).

Source: Reuters Read full article

Source: Reuters Read full article

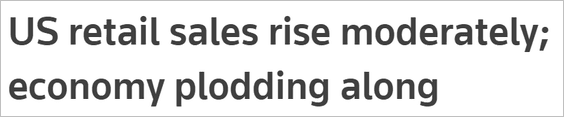

• The control group got a boost from online sales.

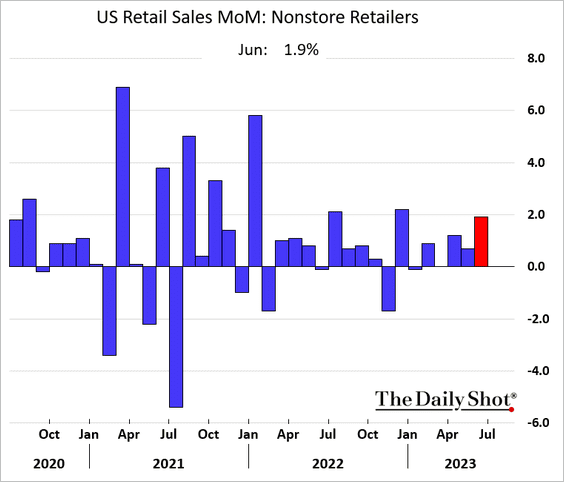

Here is the breakdown by sector.

Source: @GregDaco

Source: @GregDaco

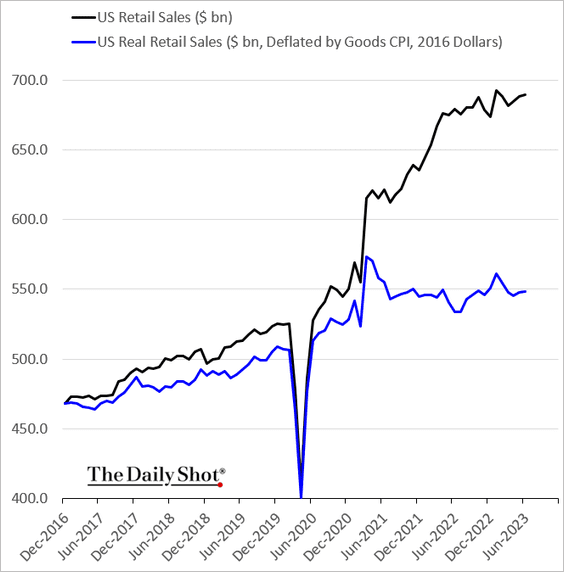

• This chart shows nominal and real retail sales levels.

——————–

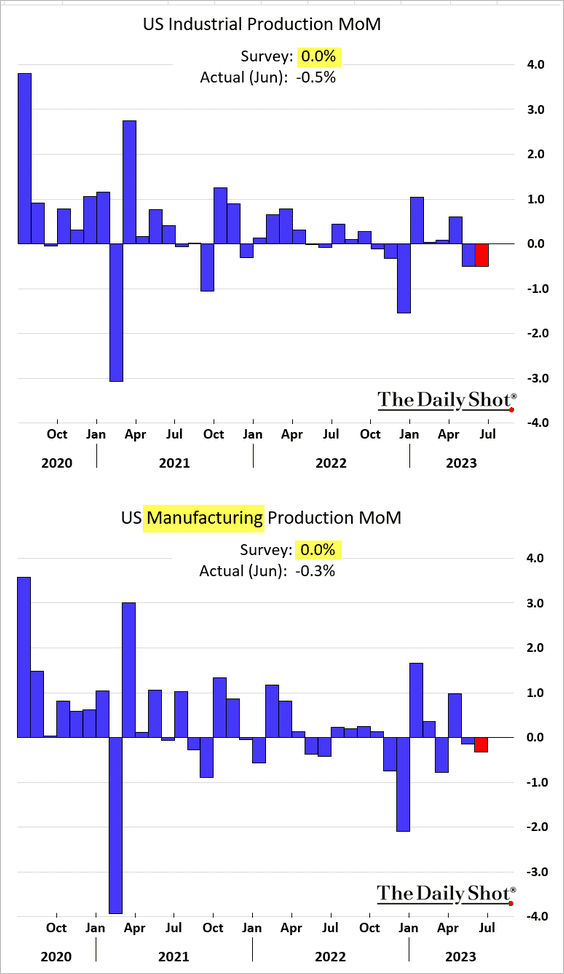

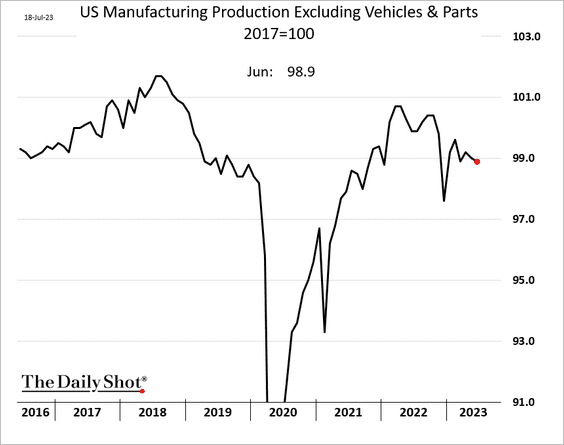

2. Industrial production declined again last month as manufacturing output contracted.

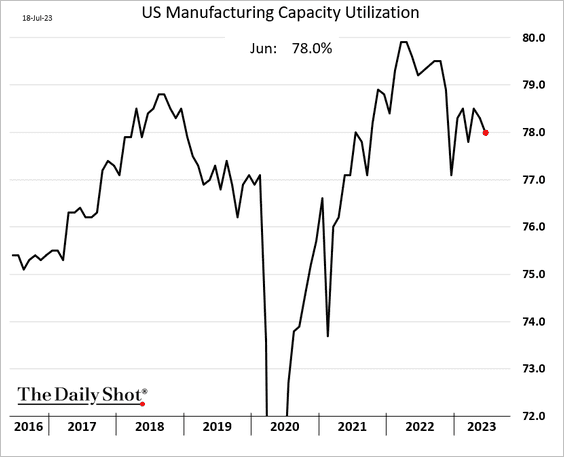

• Here is the capacity utilization.

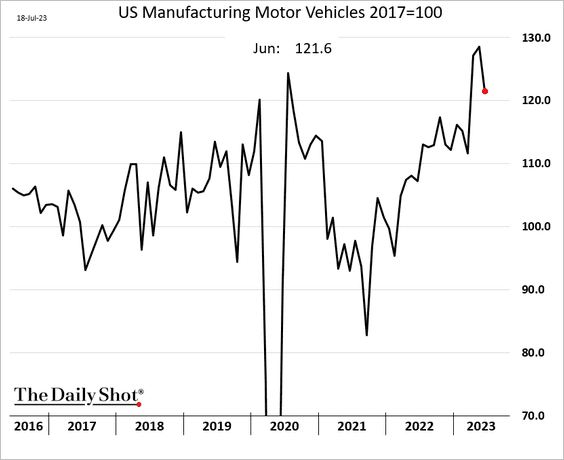

• Excluding automobile production …

… factory output has been trending lower.

h/t Pantheon Macroeconomics

h/t Pantheon Macroeconomics

——————–

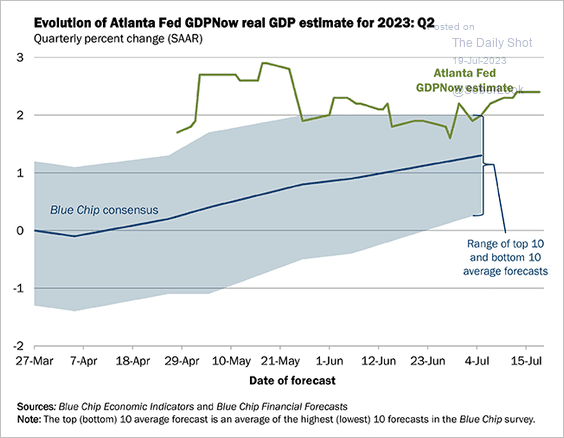

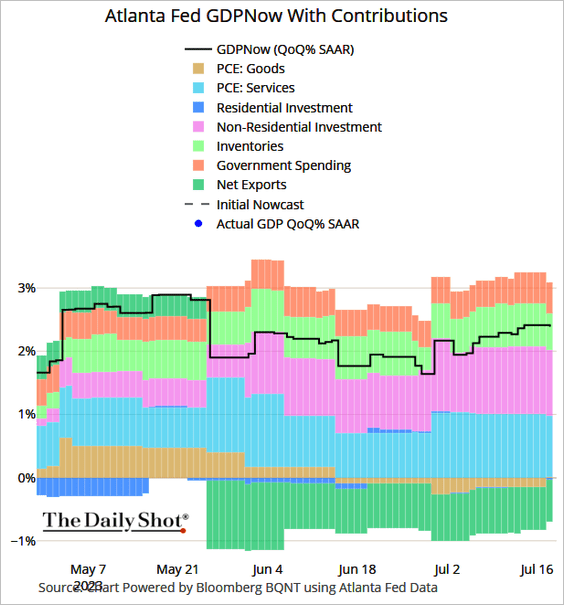

3. The GDPNow Q2 growth estimate is holding above 2% (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

Here is the attribution.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

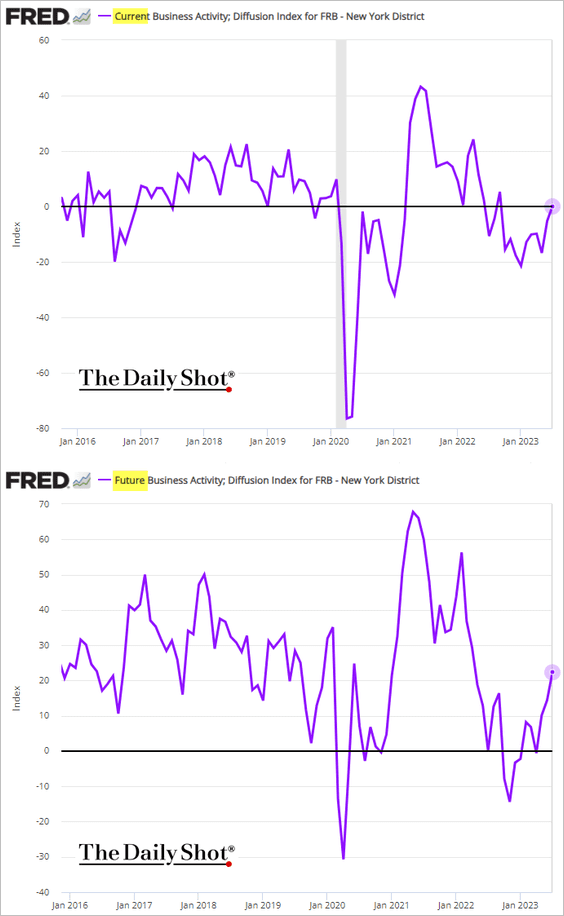

4. The NY Fed’s regional services index shows stabilization in business activity and a more upbeat outlook.

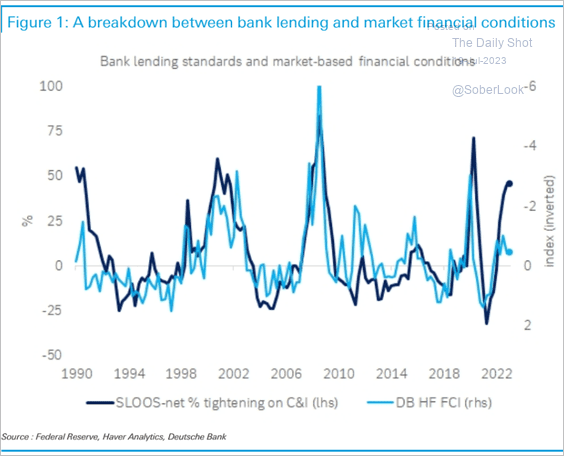

5. Market financial conditions have tightened much less than bank credit tightening would suggest.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

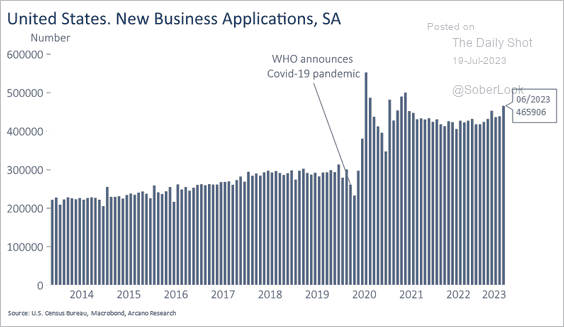

6. Business applications remain elevated.

Source: Arcano Economics

Source: Arcano Economics

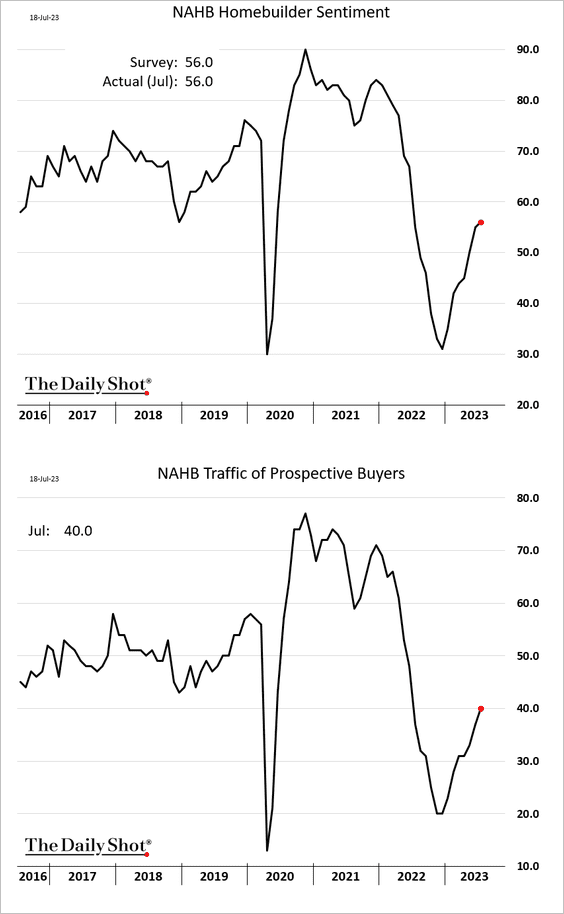

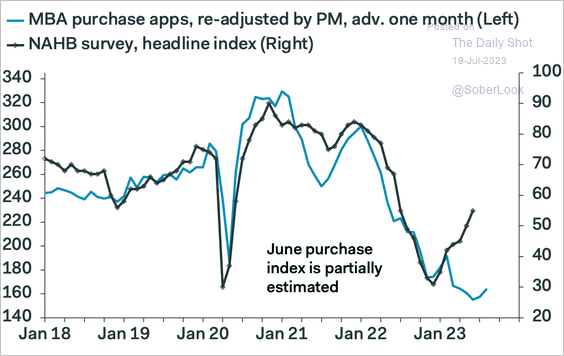

7. Next, we have some updates on the housing market.

• Homebuilder sentiment improved slightly this month.

But weak mortgage applications point to downside risks for residential construction.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

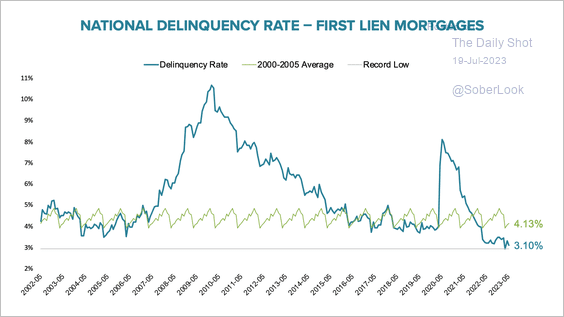

• The national delinquency rate among first-lien mortgages is near record lows.

Source: Black Knight

Source: Black Knight

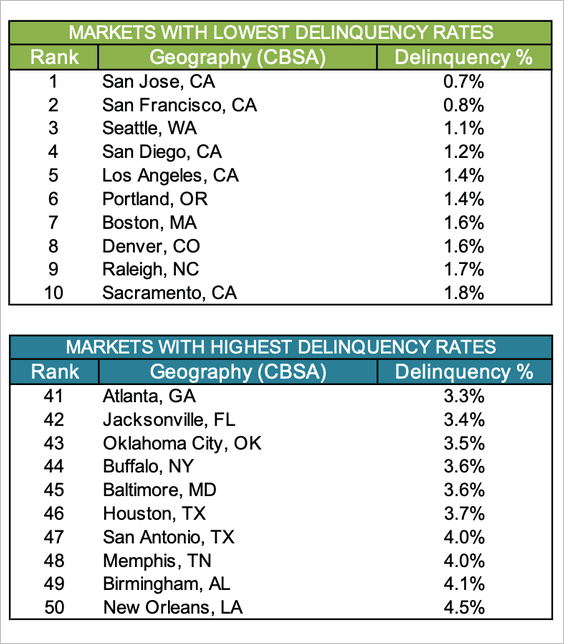

Here is a look at the highest and lowest delinquency rates by metro area.

Source: Black Knight

Source: Black Knight

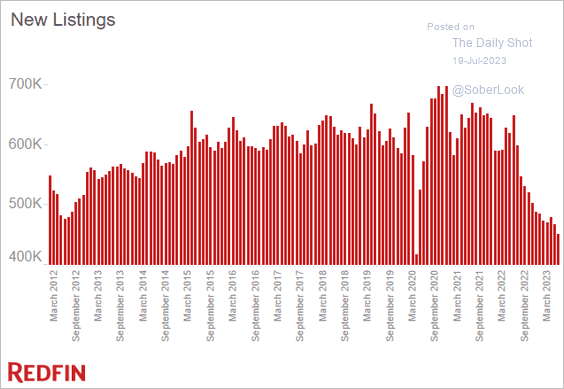

• US housing inventory continues to tighten, with new listings hitting the lowest level since the COVID shock.

Source: Redfin

Source: Redfin

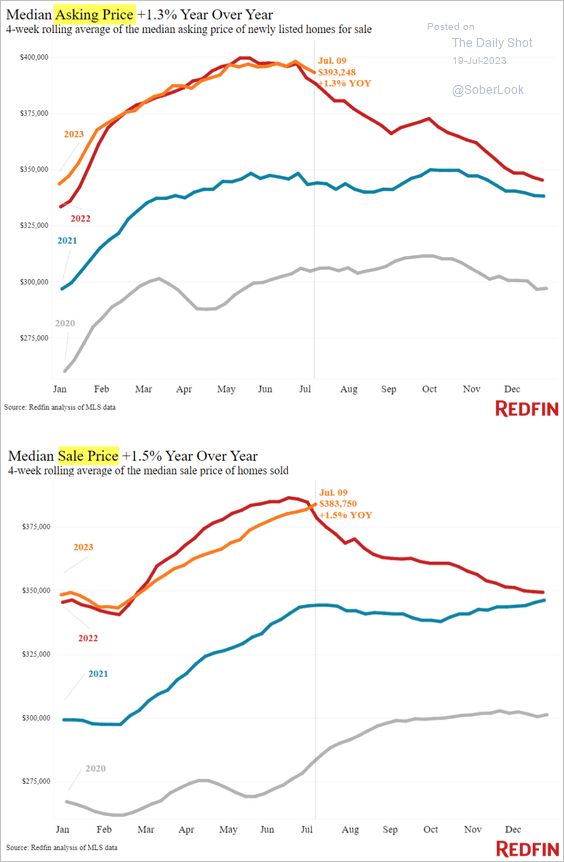

• The median sale price is now above last year’s levels.

Source: Redfin

Source: Redfin

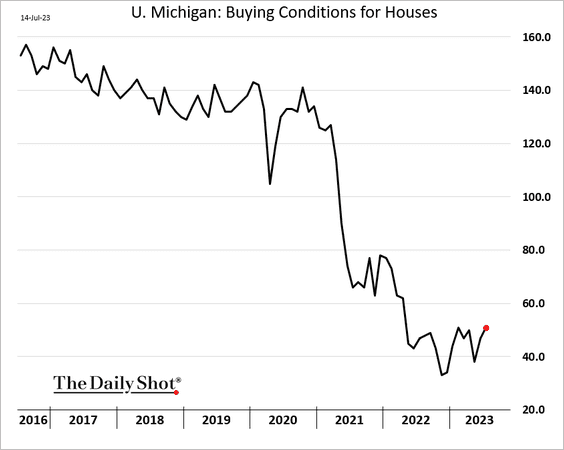

• The U. Michigan’s index of buying conditions for houses has stabilized but remains depressed.

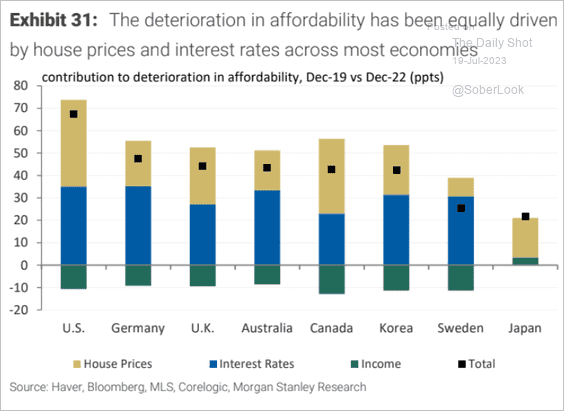

• US housing affordability deterioration has been more severe than in other advanced economies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Canada

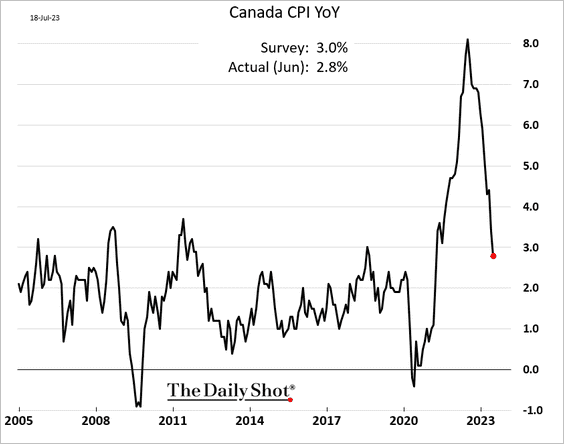

1. The headline CPI dipped below 3% in June.

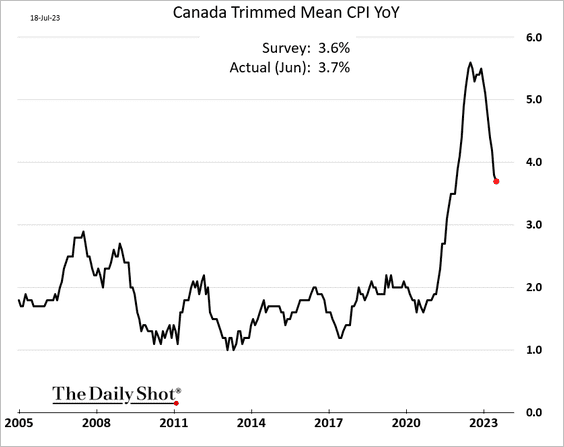

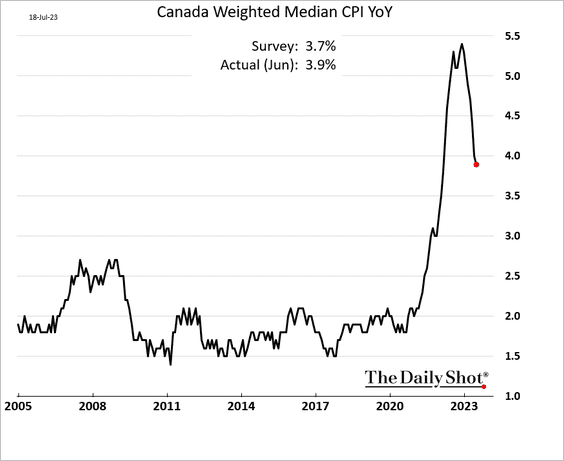

But core inflation topped expectations.

– Trimmed-mean:

– Median:

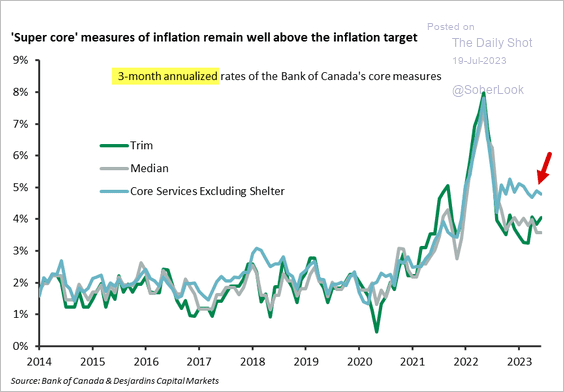

• “Super core” inflation is still running hot.

Source: Desjardins

Source: Desjardins

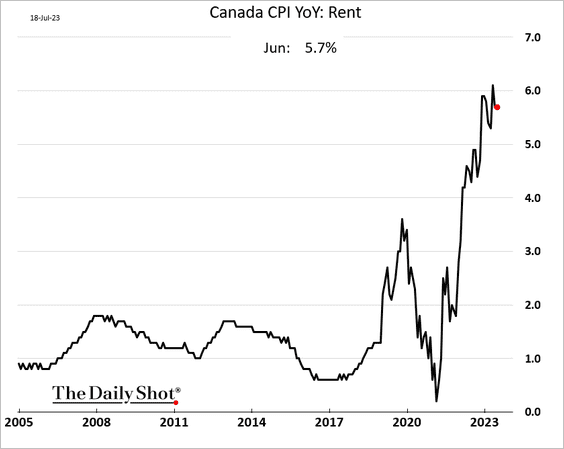

• Here is rent inflation.

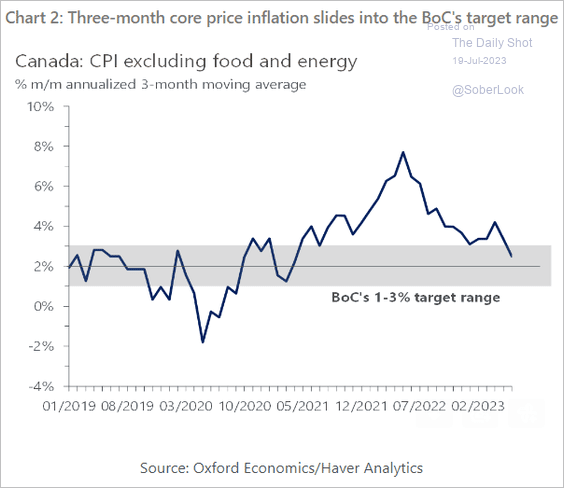

• The CPI index excluding food and energy is now inside the BoC’s target range.

Source: Oxford Economics

Source: Oxford Economics

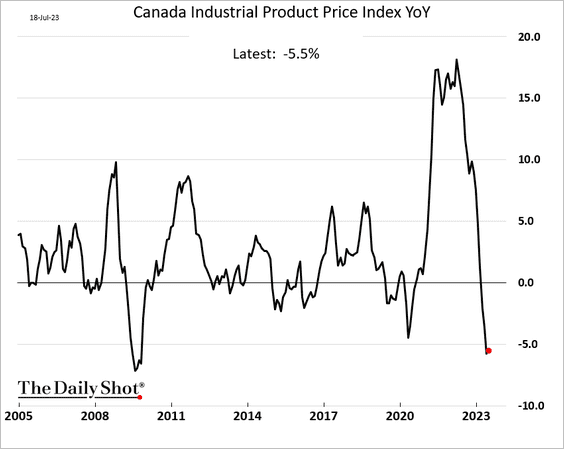

• Industrial PPI is deep in negative territory.

——————–

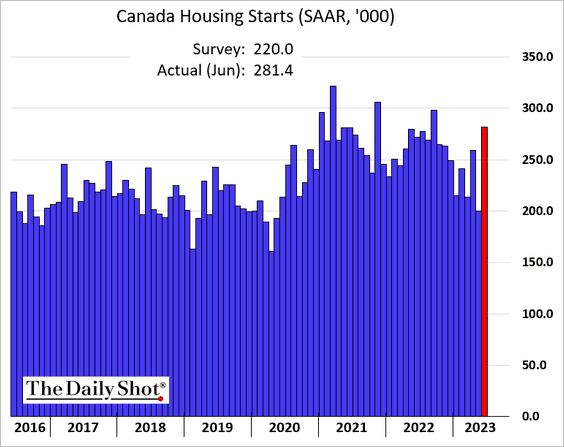

2. Housing starts surged last month.

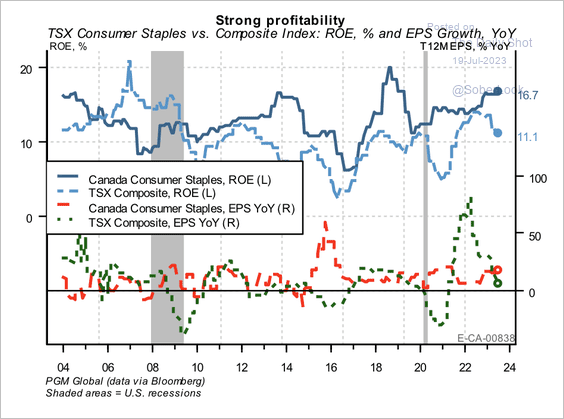

3. Profitability in the consumer staples sector is improving, with stronger earnings than the broader TSX Composite.

Source: PGM Global

Source: PGM Global

Back to Index

The Eurozone

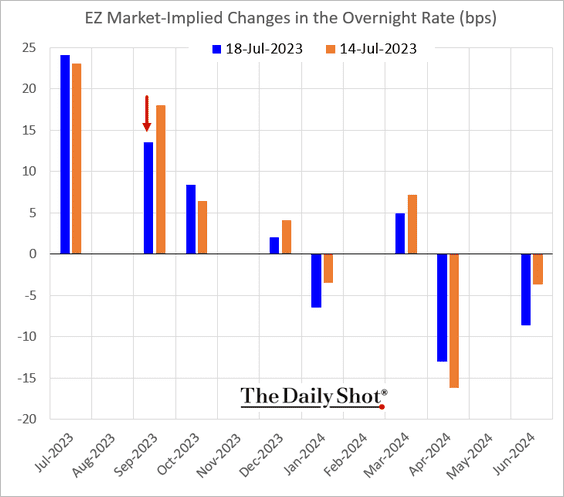

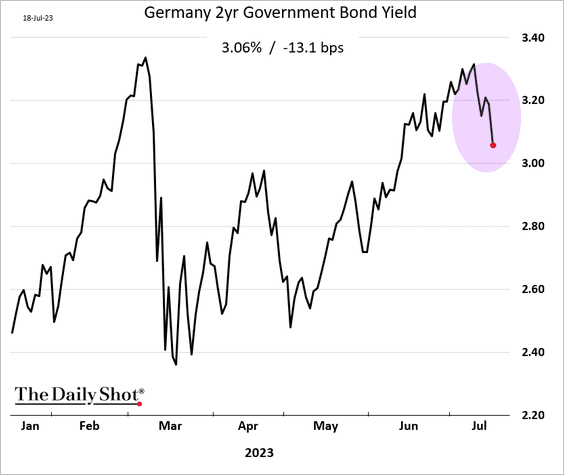

1. ECB’s Klaas Knot was a bit more dovish than expected.

Source: @economics Read full article

Source: @economics Read full article

• A September rate hike is now a coin toss.

• Bund yields dropped sharply.

——————–

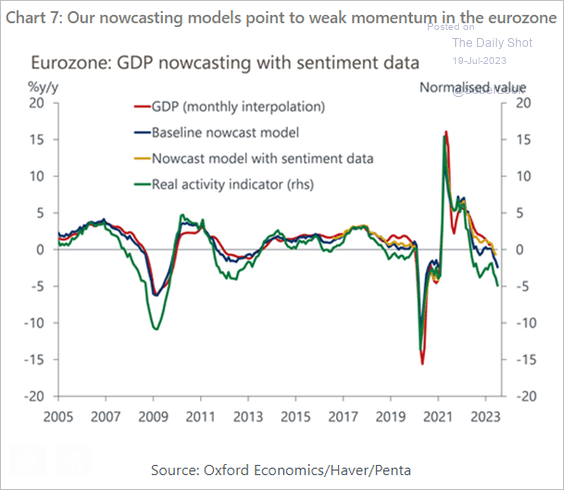

2. The Oxford Economics’ GDP tracker looks weak.

Source: Oxford Economics

Source: Oxford Economics

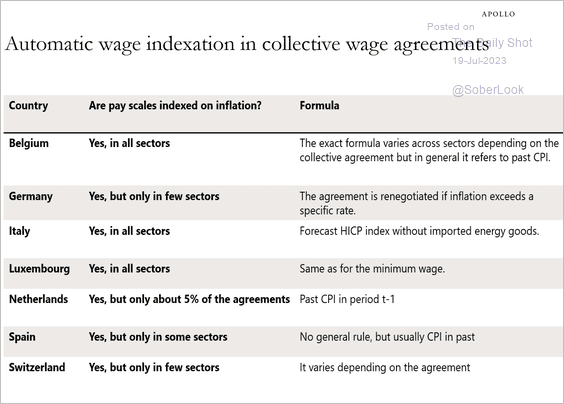

3. A built-in wage-price spiral?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

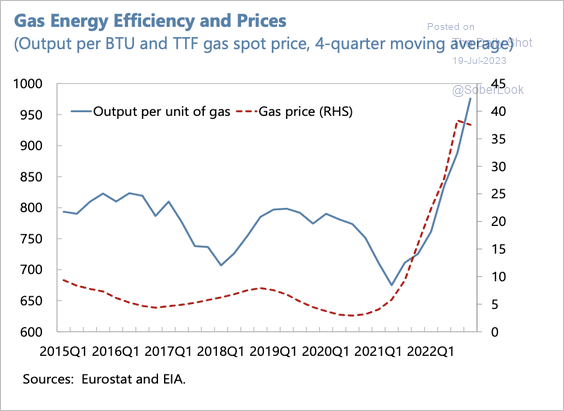

4. As natural gas prices spiked last year, German companies were able to do more with less gas.

Source: IMF Read full article

Source: IMF Read full article

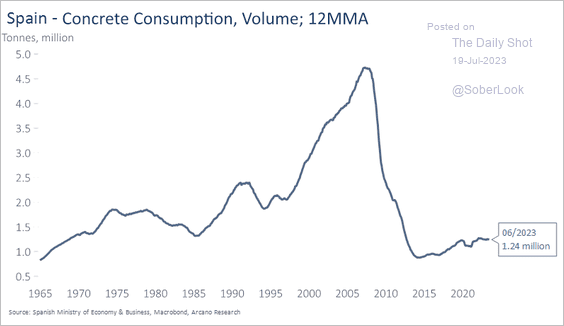

5. This chart shows Spain’s concrete consumption since 1965.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

China

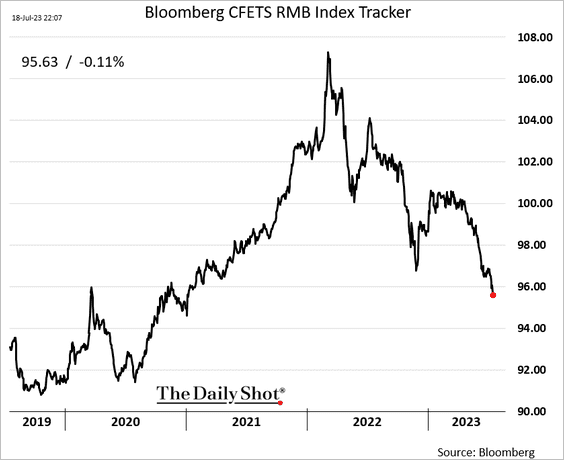

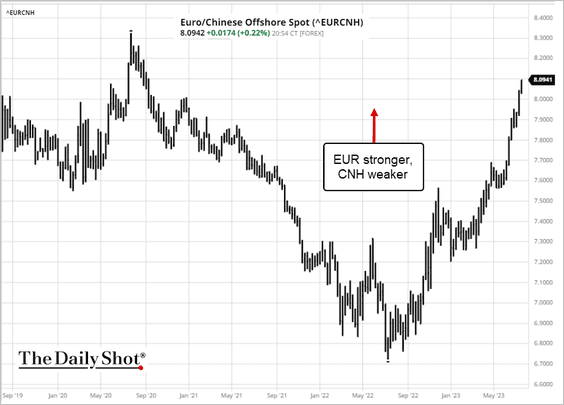

1. The renminbi remains under pressure.

• RMB against a basket of currencies:

• EUR/CNH:

Source: barchart.com

Source: barchart.com

——————–

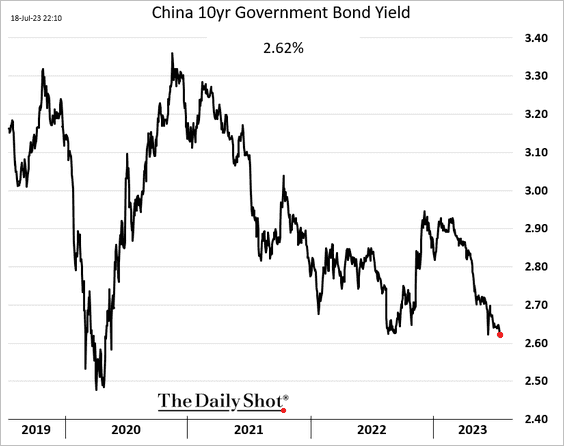

2. The 10-year yield hit the lowest level since the 2020 COVID shock.

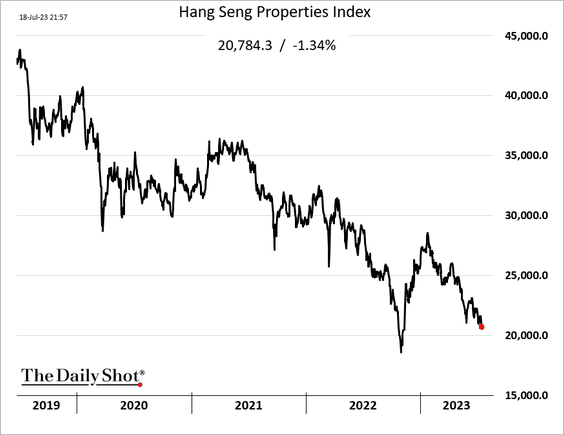

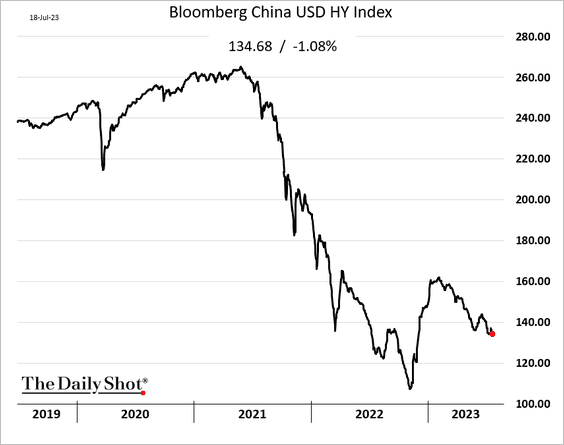

3. Property stocks and dollar-denominated bonds (mostly developers) continue to sink.

——————–

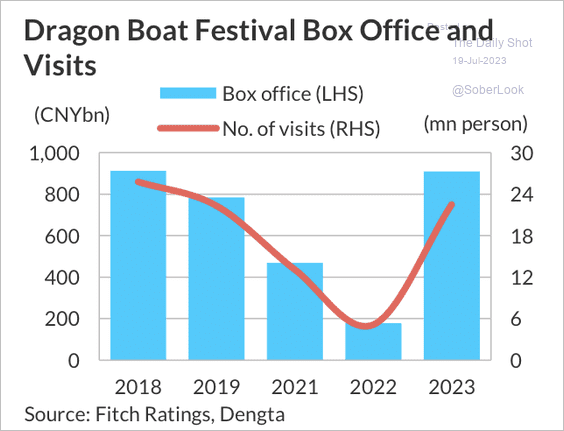

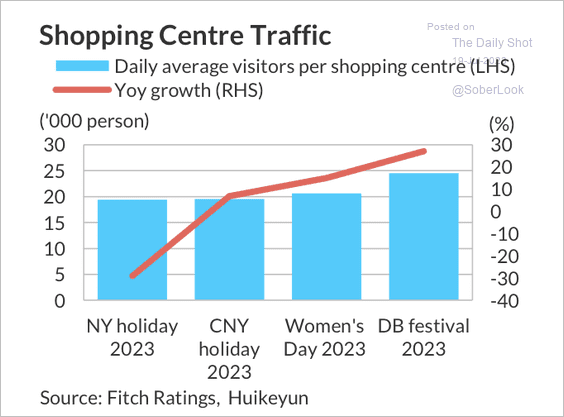

4. Holiday box office visits and shopping center traffic is recovering. (2 charts)

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

——————–

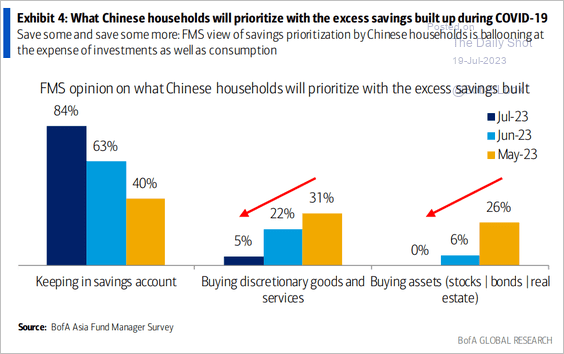

5. Fund managers increasingly see Chinese households prioritizing savings.

Source: BofA Global Research

Source: BofA Global Research

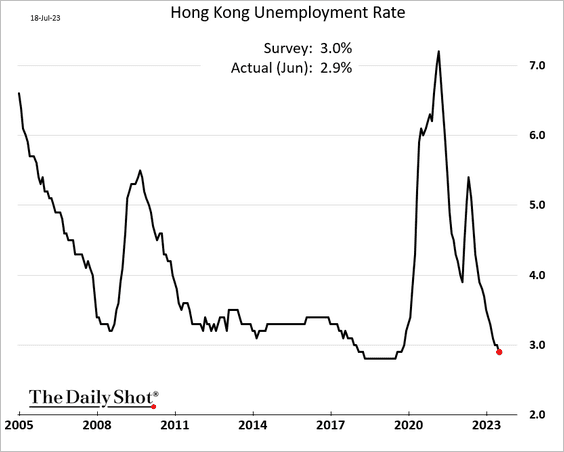

6. Hong Kong’s unemployment rate continues to fall.

Back to Index

Emerging Markets

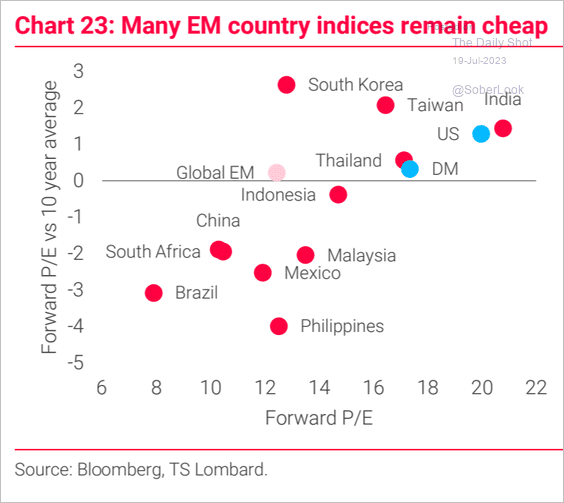

1. Here is a look at EM equity valuations.

Source: TS Lombard

Source: TS Lombard

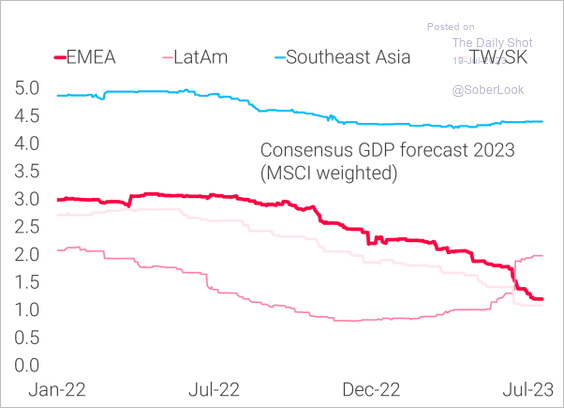

2. This chart shows the evolution of 2023 consensus GDP forecasts across regions.

Source: TS Lombard

Source: TS Lombard

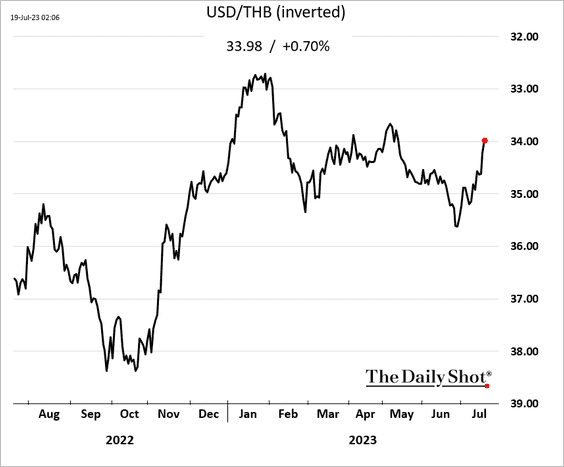

3. The Thai baht is rallying on hopes for easing political uncertainty.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

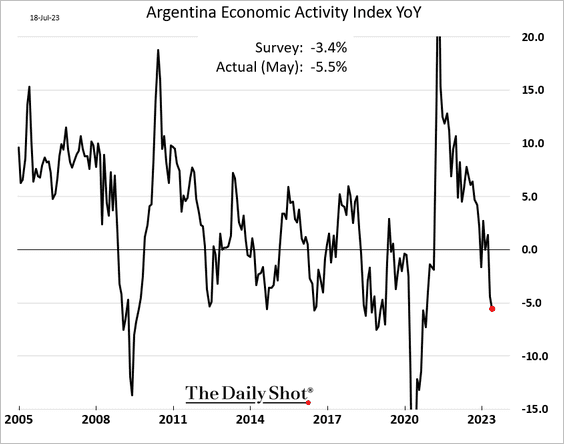

4. Argentina’s economy is shrinking rapidly.

Back to Index

Commodities

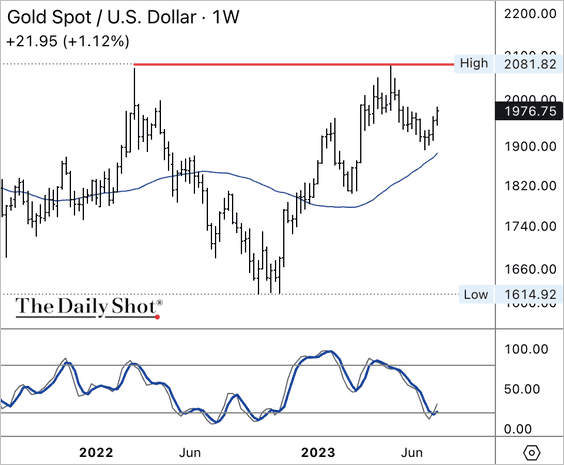

1. Gold is holding support above its 40-week moving average and is not yet overbought.

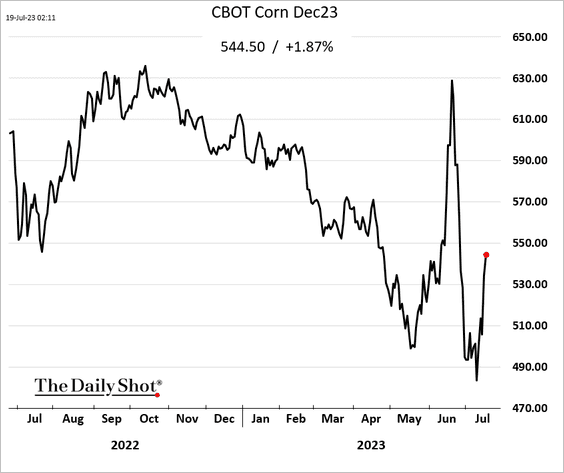

2. Anticipating drier and hotter conditions in the Midwest for the remainder of the month, corn futures are experiencing a rebound.

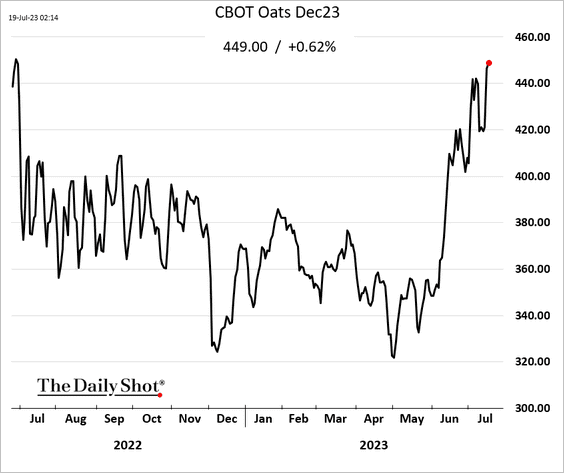

3. Oats futures are surging.

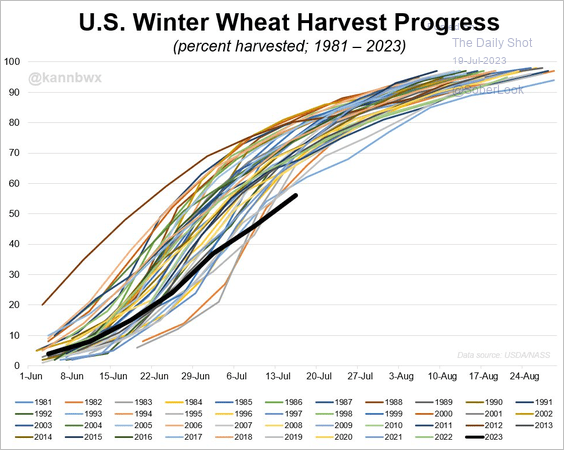

4. The pace of the US wheat harvest has been very sluggish.

Source: @kannbwx

Source: @kannbwx

Source: Brownfield Ag News Read full article

Source: Brownfield Ag News Read full article

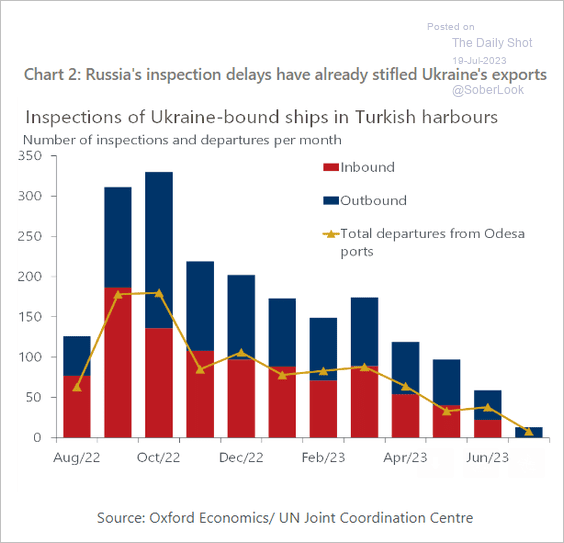

Separately, here’s the reason behind the relatively subdued response of the wheat market to Russia’s termination of the Ukraine export agreement.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Equities

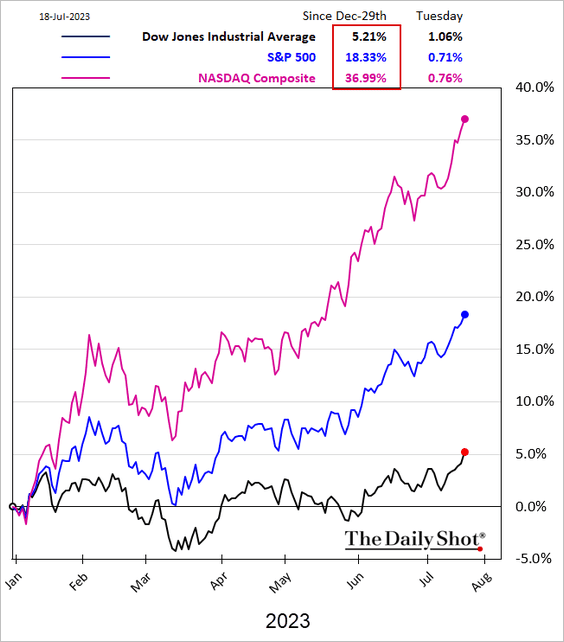

1. The year-to-date divergence among key US equity indices has been massive.

h/t @WSJ

h/t @WSJ

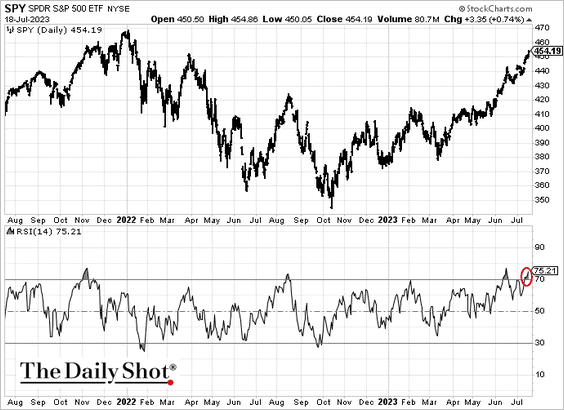

2. Technicals suggest that the market rally is stretched.

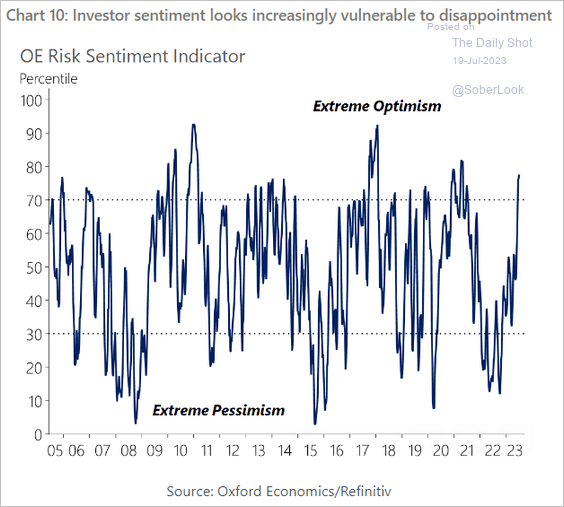

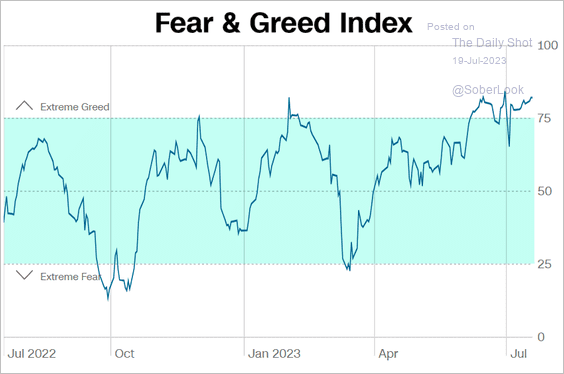

3. Investor sentiment is in “extreme optimism” territory.

• Oxford Economics sentiment index:

Source: Oxford Economics

Source: Oxford Economics

• CNN Business Fear/Greed Index:

Source: CNN Business

Source: CNN Business

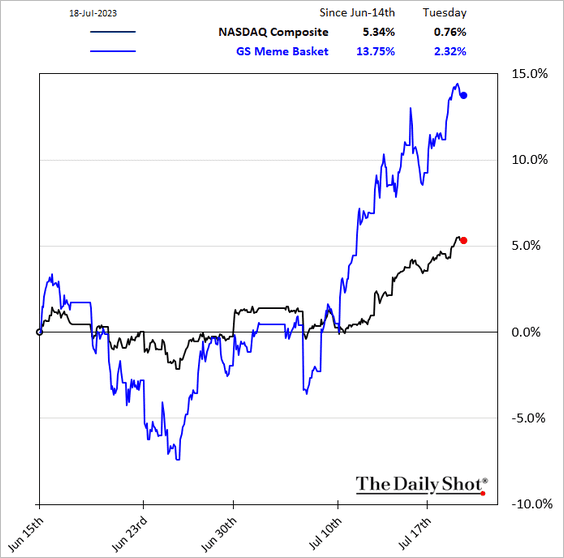

Speculative stocks have been outperforming.

——————–

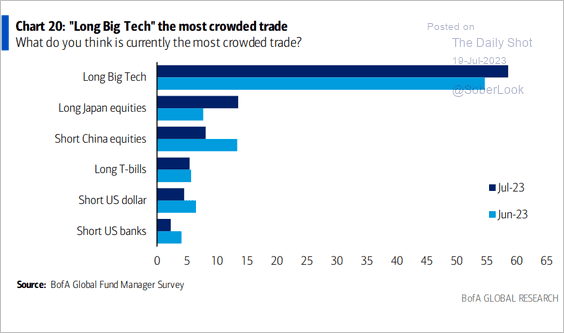

4. Fund managers view “long big tech” as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

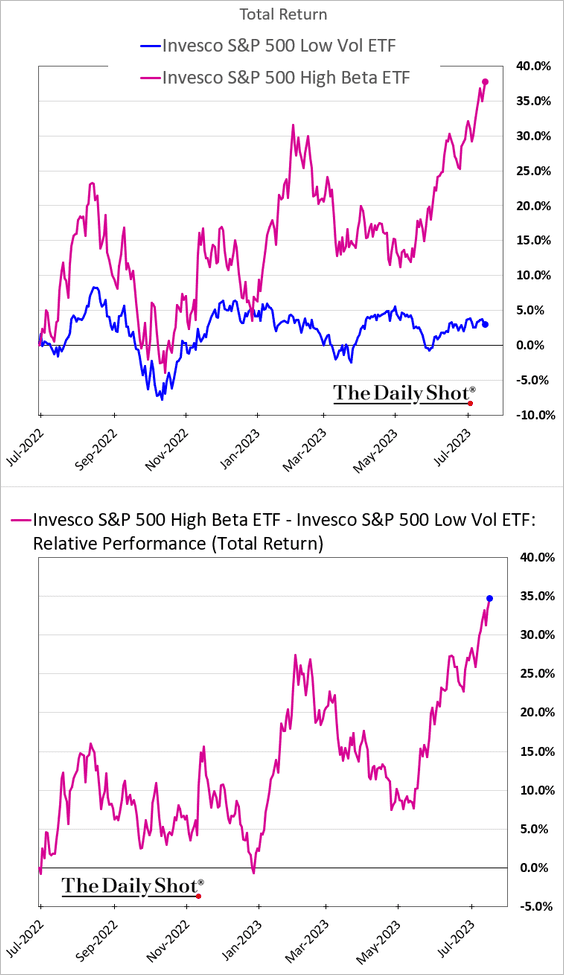

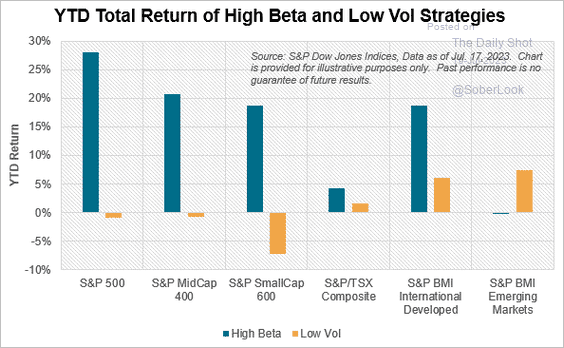

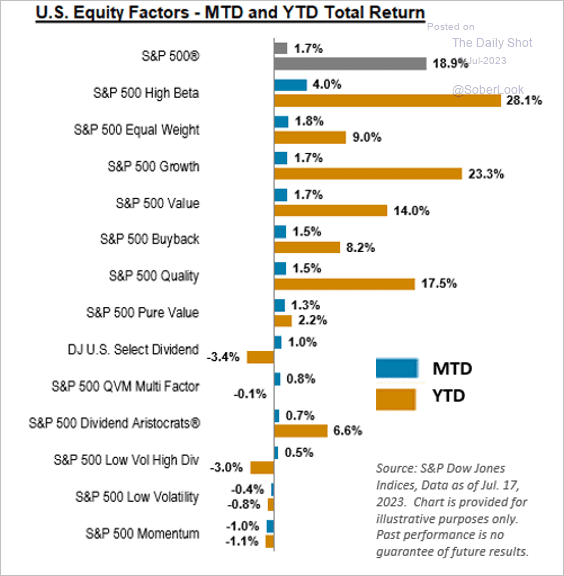

5. High-beta stocks have massively outperformed the low-vol factor.

Here is a look at high-beta vs. low-vol factor performance across various indices (YTD).

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

And this chart shows the year-to-date and month-to-date factor performance.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

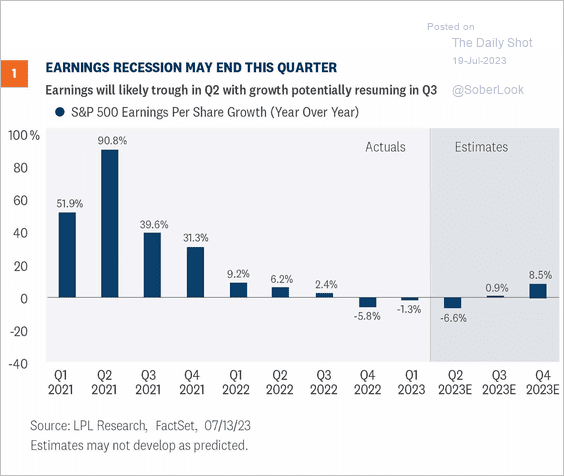

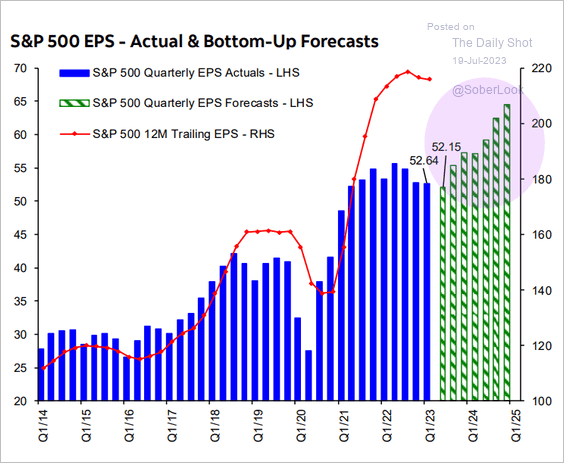

6. Analysts’ estimates suggest that the earnings recession is ending (2 charts).

Source: LPL Research

Source: LPL Research

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

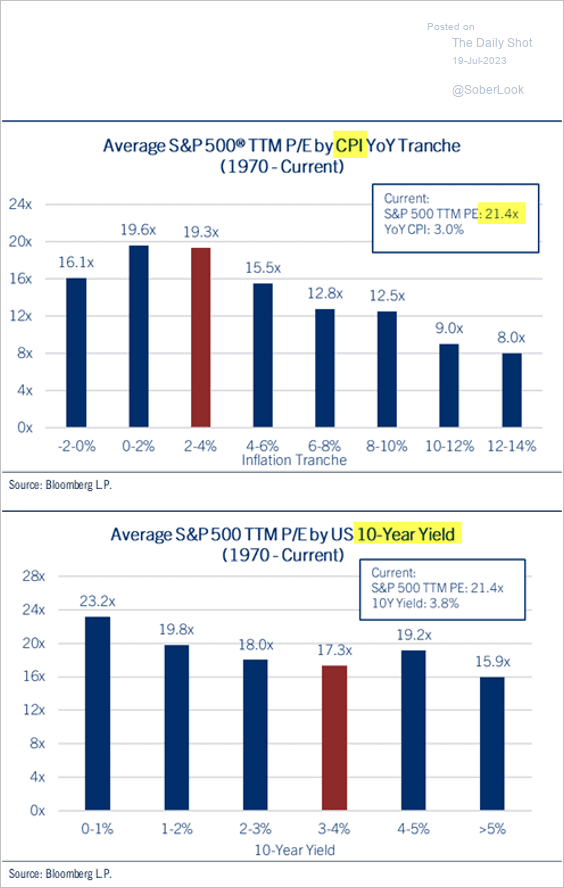

7. What were the average P/E ratios under different CPI and 10yr yield regimes (since 1970)?

Source: John Lynch, Comerica Wealth Management

Source: John Lynch, Comerica Wealth Management

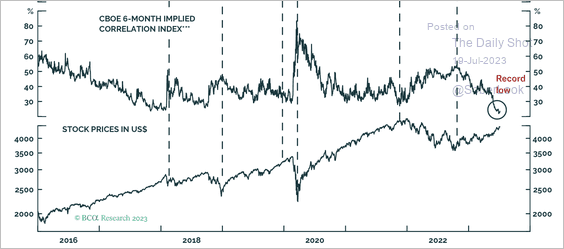

8. The implied correlation among US stocks is the lowest in 17 years. Are we overdue for a vol spike?

Source: BCA Research

Source: BCA Research

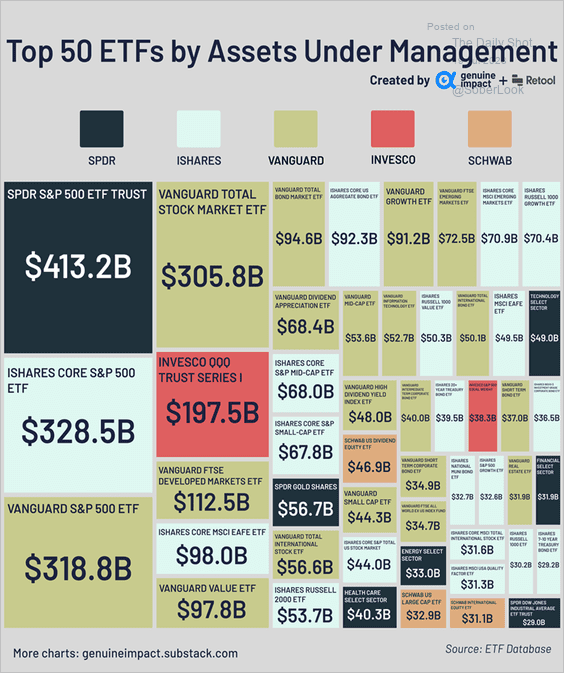

9. Here is a look at the top 50 ETFs by AUM (enlarge chart here)

Source: @genuine_impact

Source: @genuine_impact

Back to Index

Credit

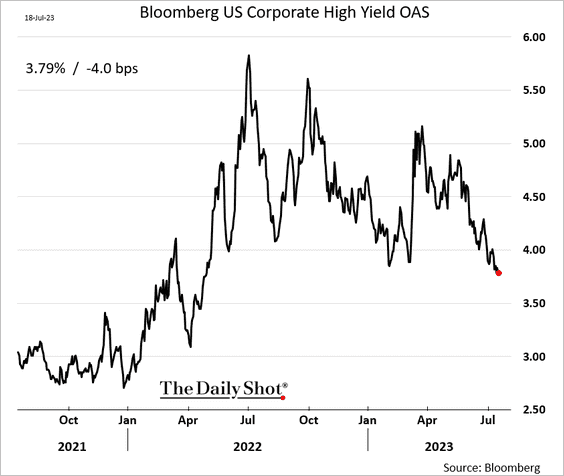

1. High-yield spreads continue to tighten.

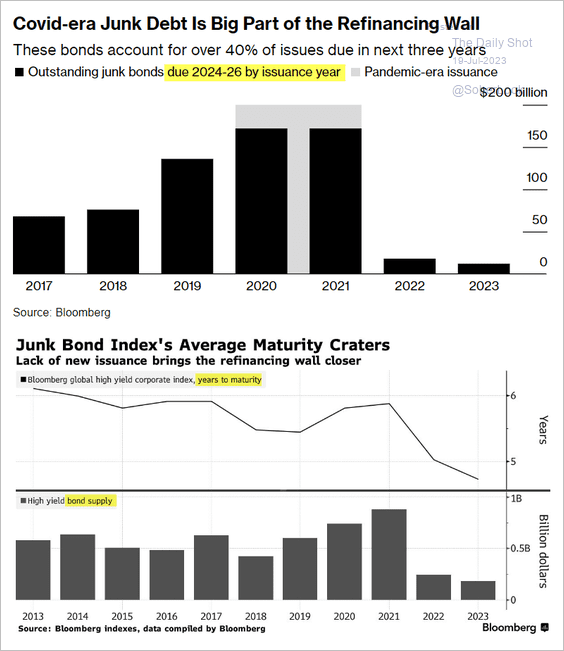

2. Low issuance has brought the HY debt maturity wall closer.

Source: @tasosvos, @eleanorrduncan, @markets Read full article

Source: @tasosvos, @eleanorrduncan, @markets Read full article

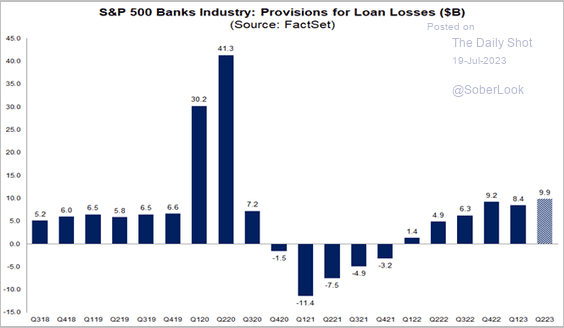

3. Here is a look at US banks’ loan-loss provisions.

Source: @FactSet Read full article

Source: @FactSet Read full article

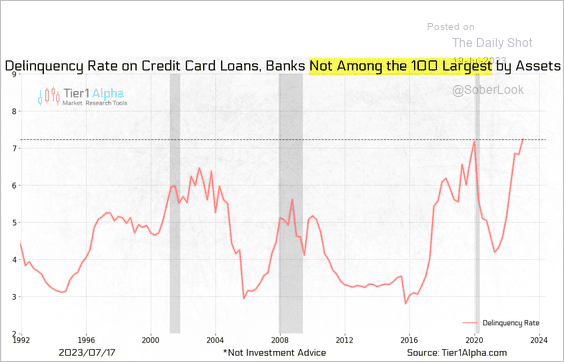

• This chart shows credit card delinquency rates at small banks.

Source: @t1alpha

Source: @t1alpha

——————–

Rates

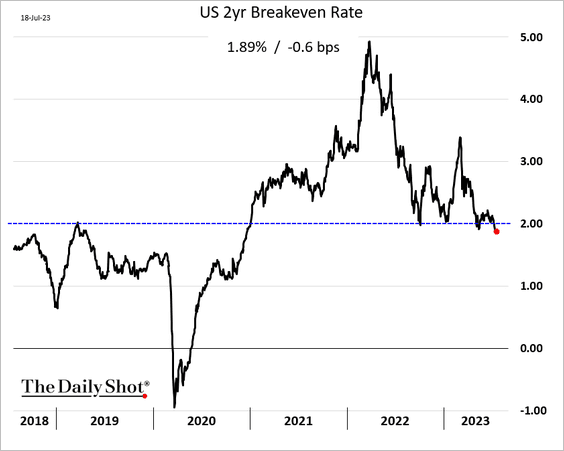

1. The 2-year US breakeven rate (inflation expectations) dipped below 2%.

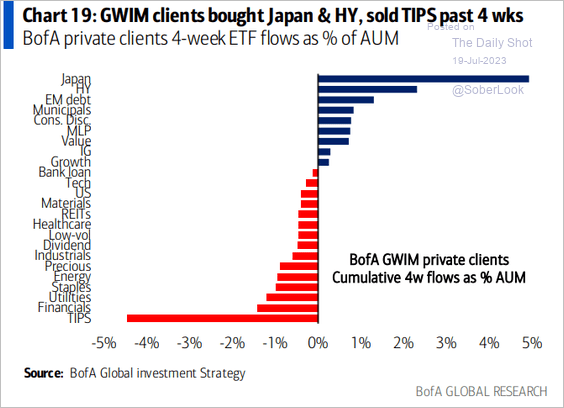

2. BofA’s private clients continue to dump inflation-linked Treasuries.

Source: BofA Global Research

Source: BofA Global Research

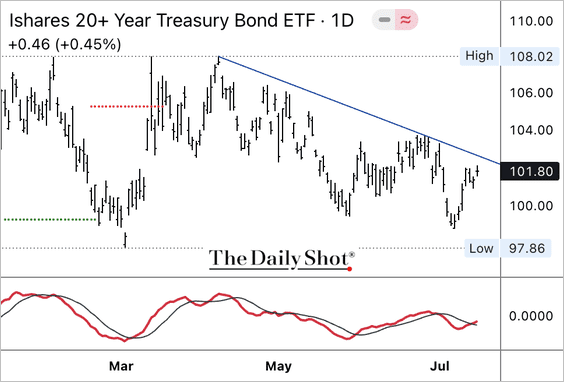

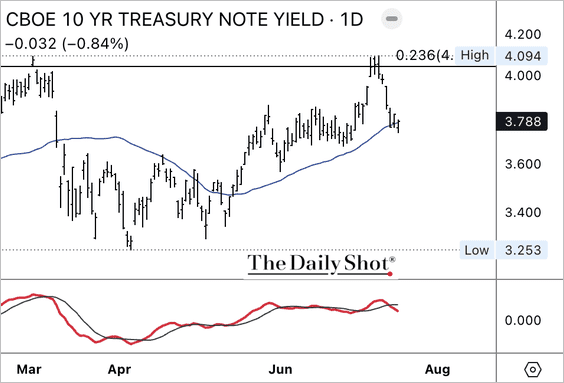

3. The iShares 20+ Treasury Bond ETF (TLT) is testing downtrend resistance, although momentum is improving.

Conversely, the 10-year Treasury yield broke below support as upside momentum weakened.

——————–

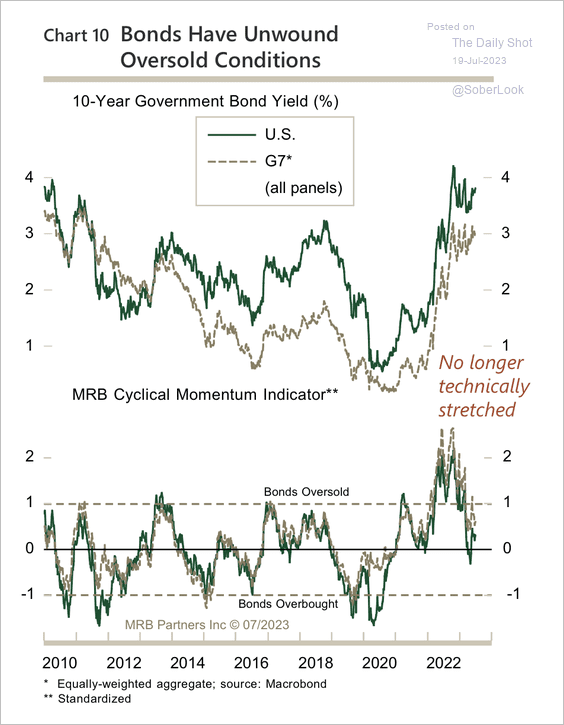

4. G7 government bond yields are no longer oversold. MRB Partners sees potential for another up-wave of yields before reaching a cyclical peak.

Source: MRB Partners

Source: MRB Partners

Back to Index

Global Developments

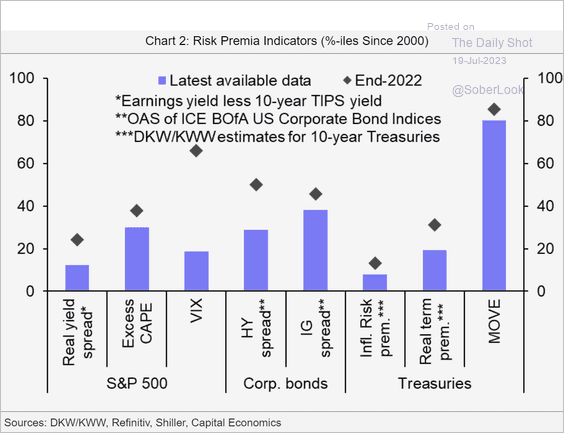

1. Risk premia indicators have declined significantly this year.

Source: Capital Economics

Source: Capital Economics

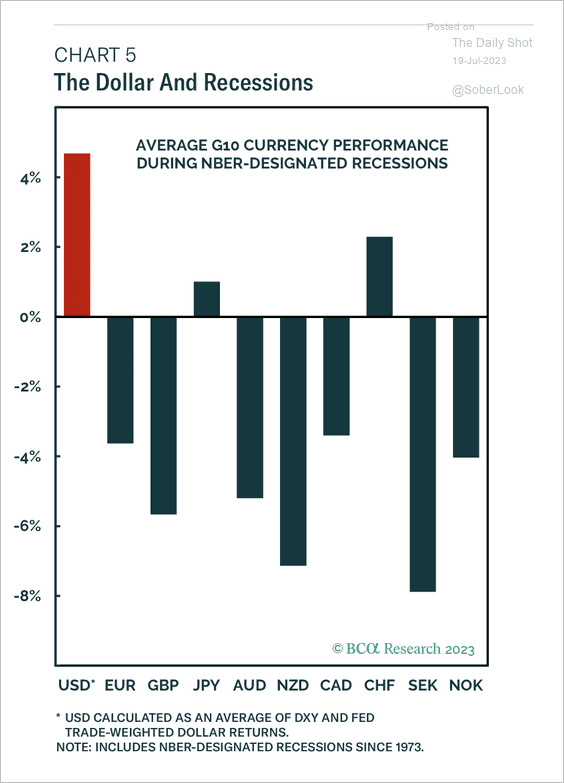

2. The dollar tends to rise during recessions …

Source: BCA Research

Source: BCA Research

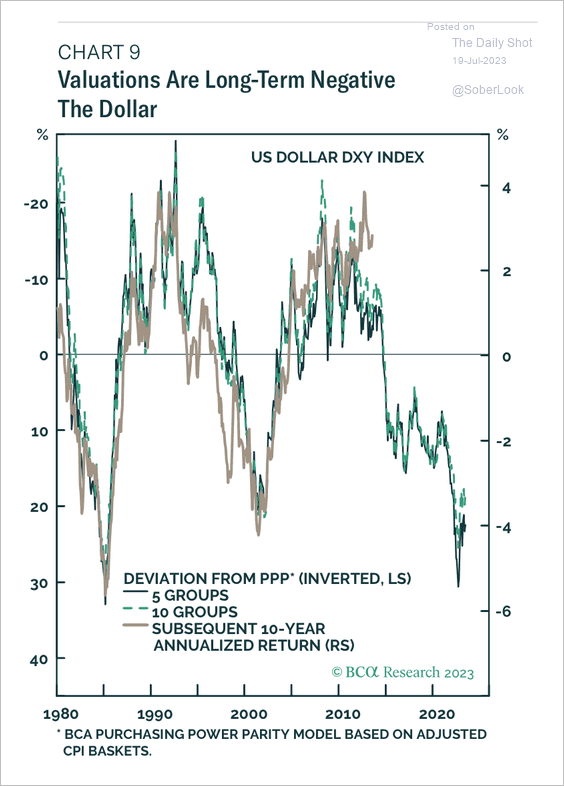

… but it appears overvalued, which could limit the upside.

Source: BCA Research

Source: BCA Research

——————–

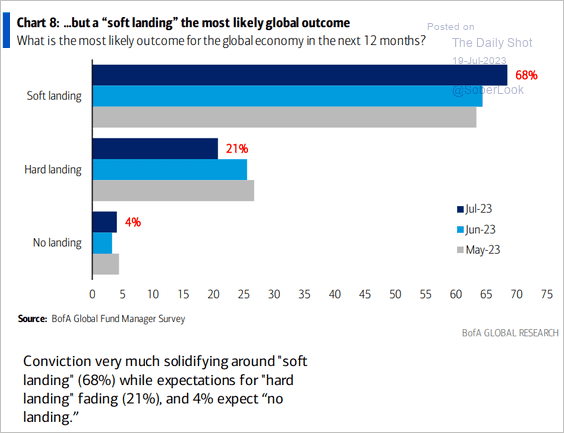

3. Investors increasingly expect a soft landing for the global economy.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

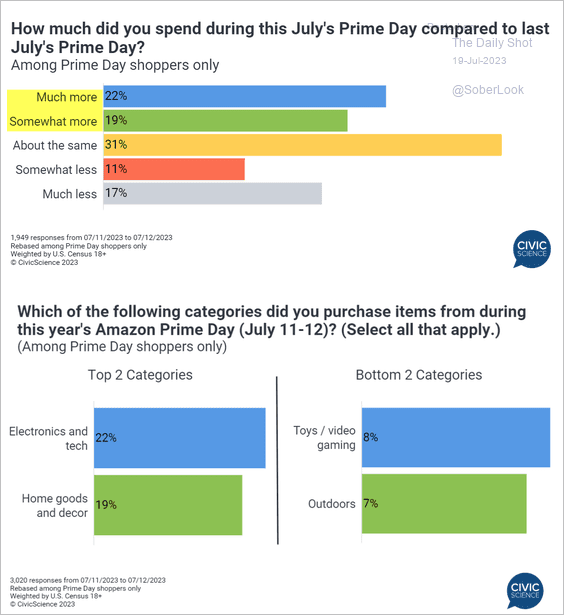

1. Amazon Prime Day spending:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

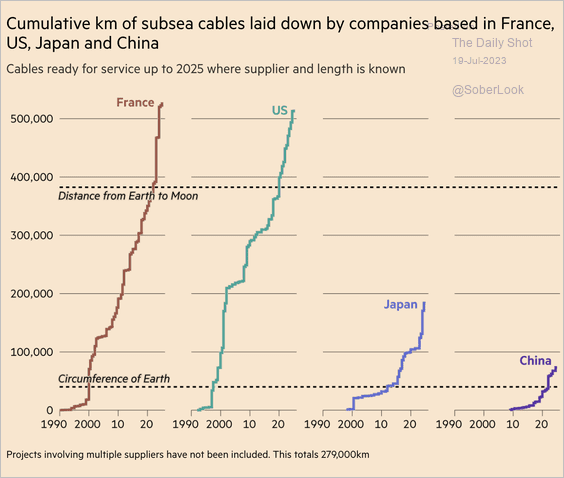

2. Subsea cables:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

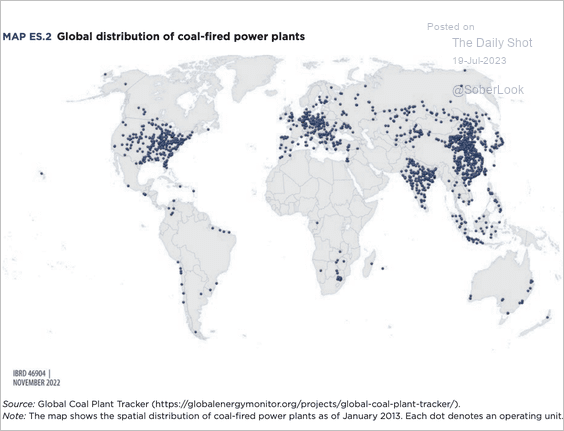

3. Coal-fired power plants:

Source: World Bank Read full article

Source: World Bank Read full article

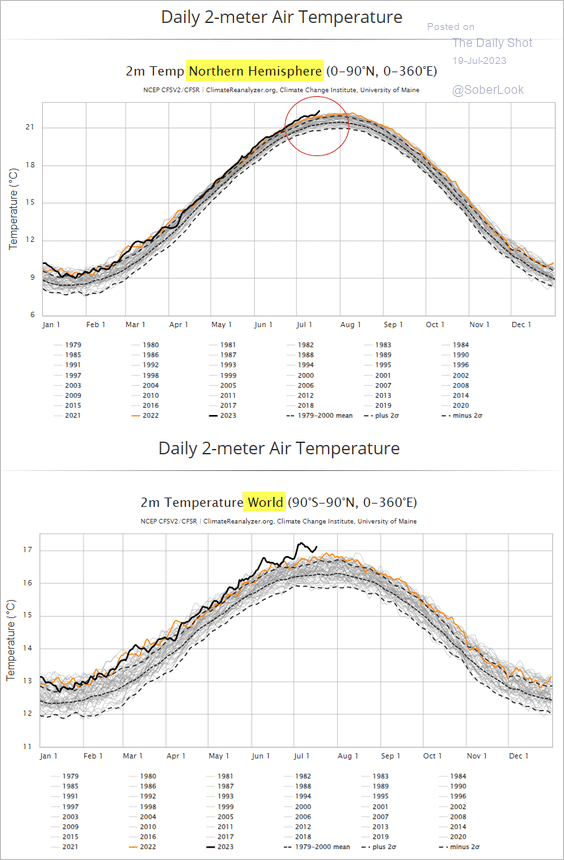

4. A toasty July:

Source: Climate Reanalyzer

Source: Climate Reanalyzer

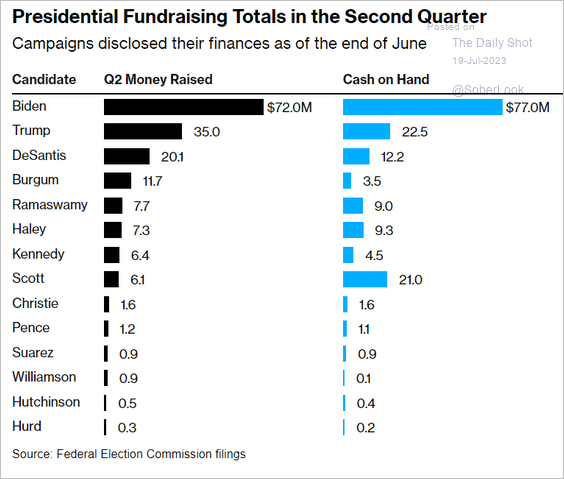

5. US presidential race fundraising;

Source: @bpolitics Read full article

Source: @bpolitics Read full article

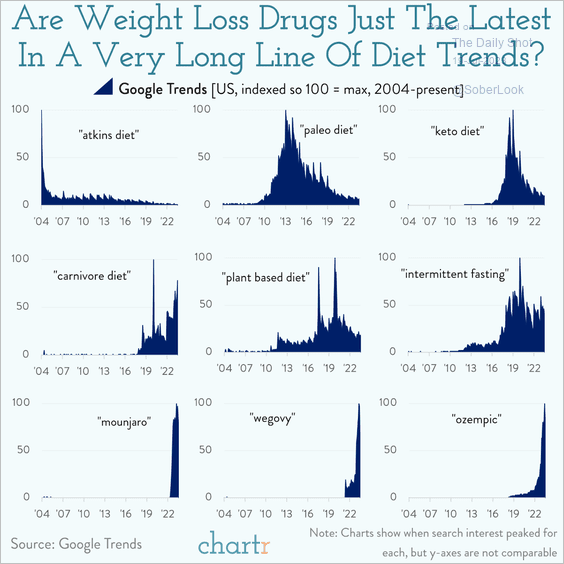

6. Google search activity for weight-loss diets and medications:

Source: @chartrdaily

Source: @chartrdaily

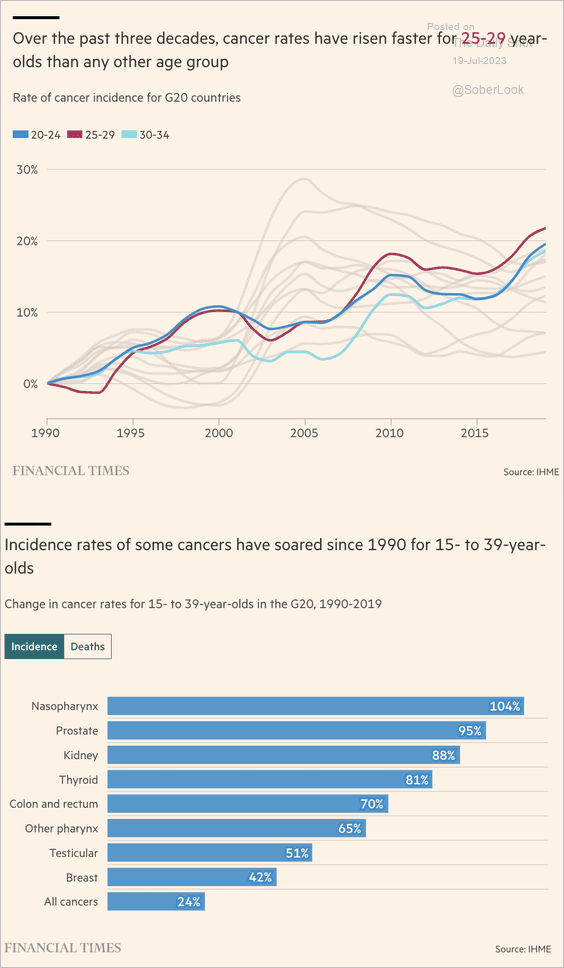

7. Cancer rates among young adults:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

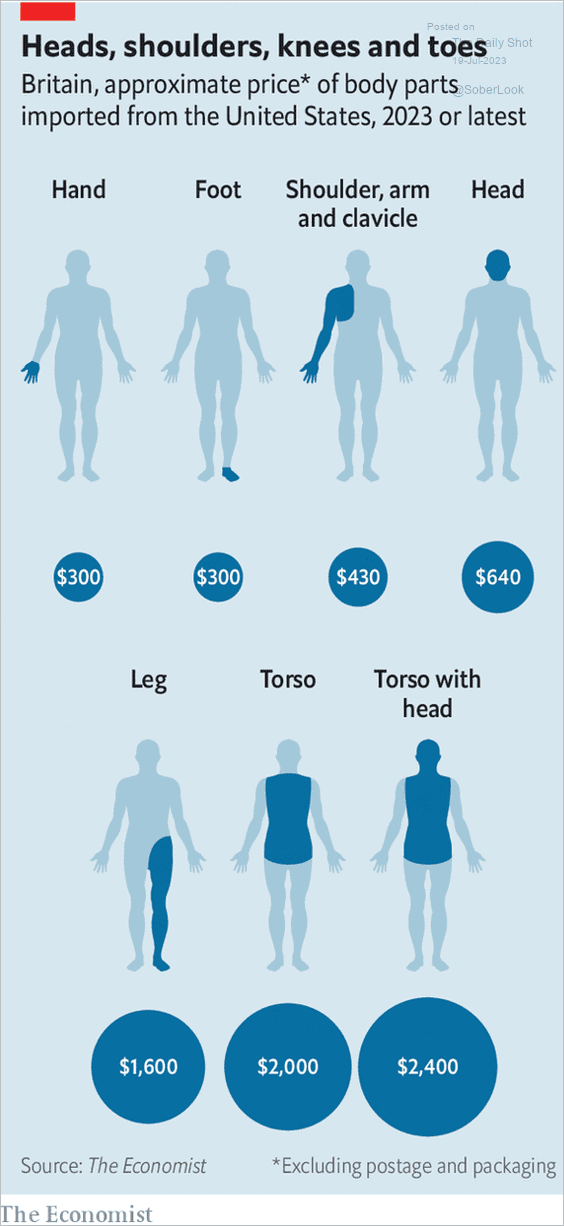

8. The cost of human body parts for medical research/training:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index