The Daily Shot: 20-Jul-23

• The United States

• The United Kingdom

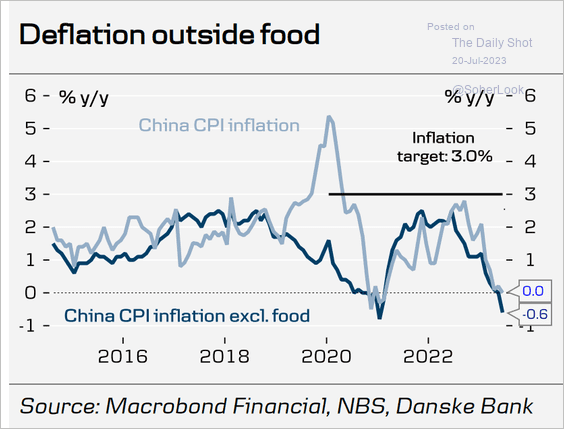

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

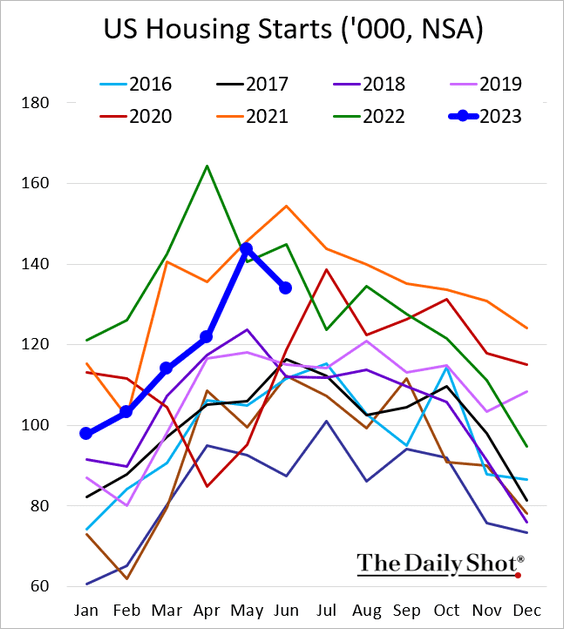

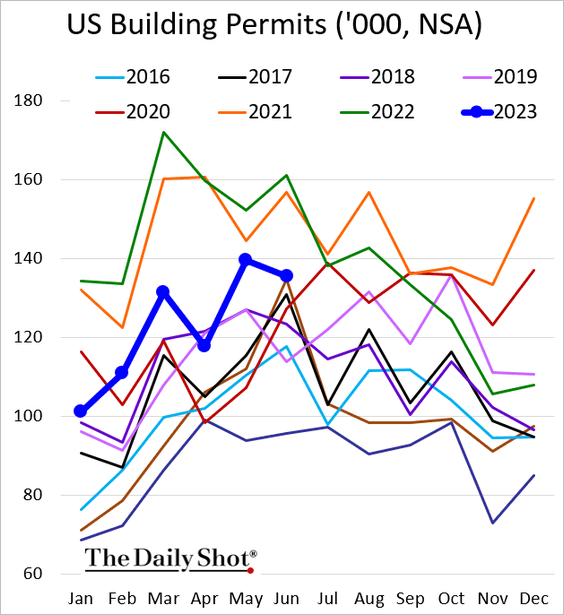

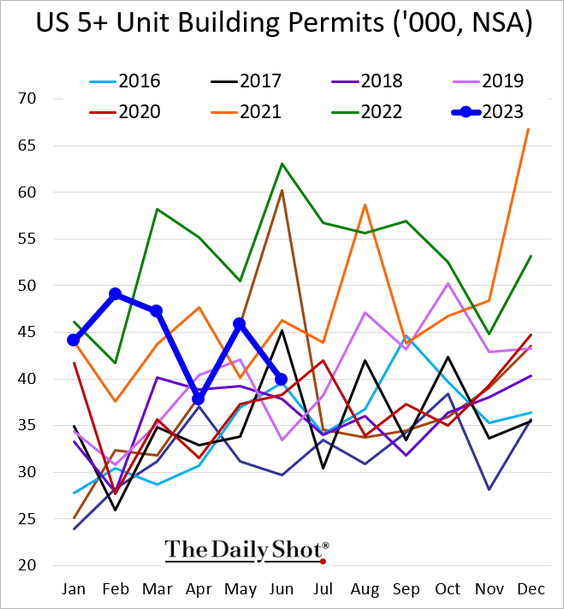

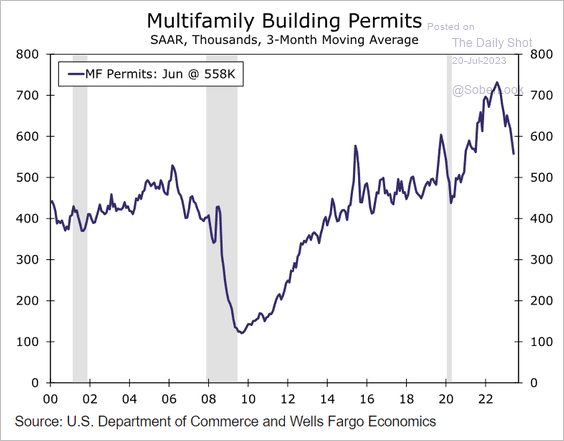

1. Let’s begin with the housing market.

• Residential construction activity eased last month.

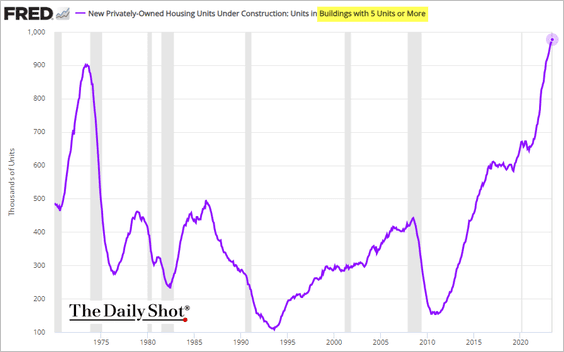

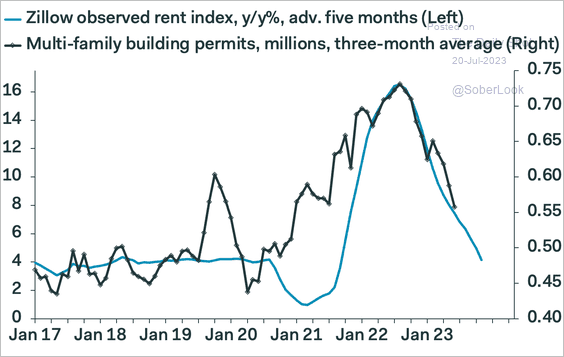

– The weaker permits print was due to multifamily housing (2 charts) …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

… as the pipeline of units under construction hits a new record, …

… and rents moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

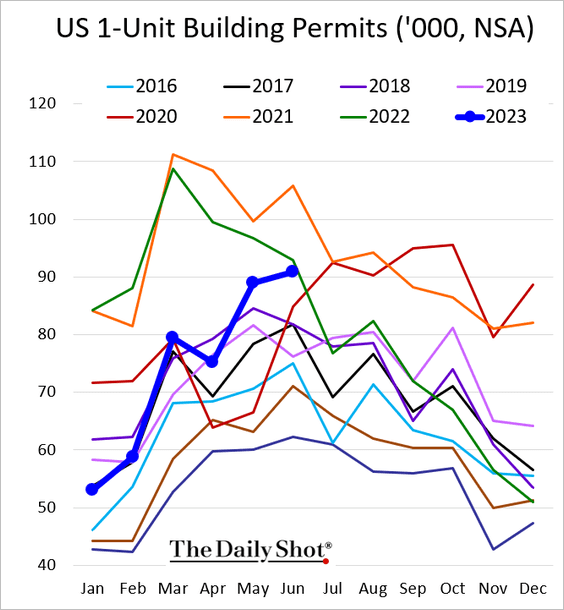

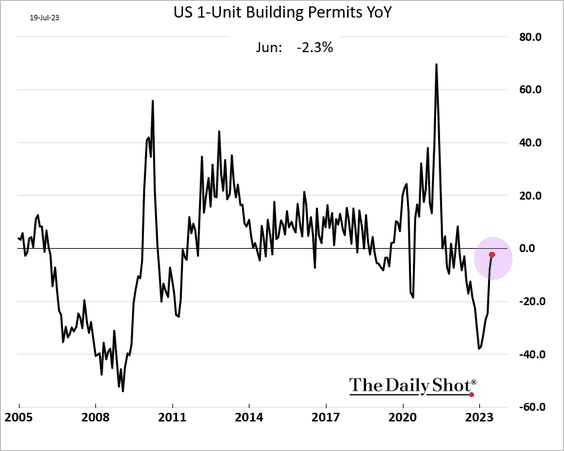

– Permits for single-family housing were strong last month, …

… nearing 2022 levels.

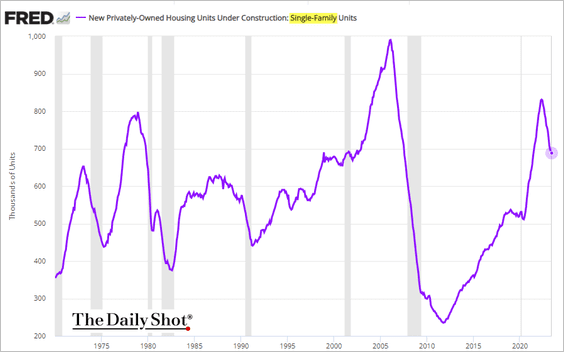

– The number of single-family housing units under construction continues to fall.

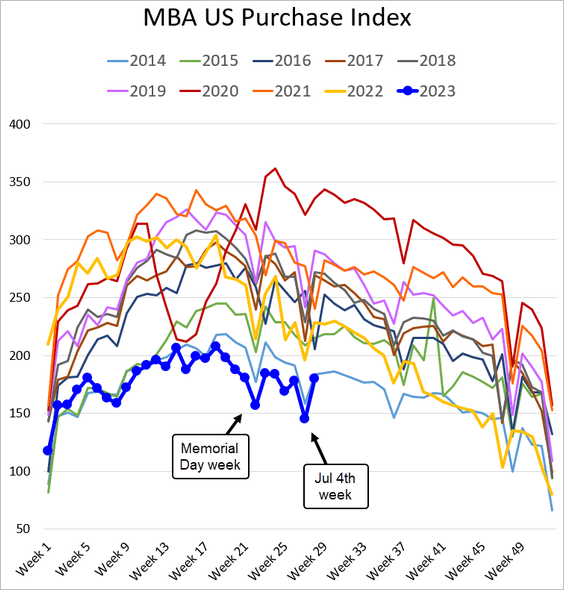

• Mortgage applications showed some improvement last week, …

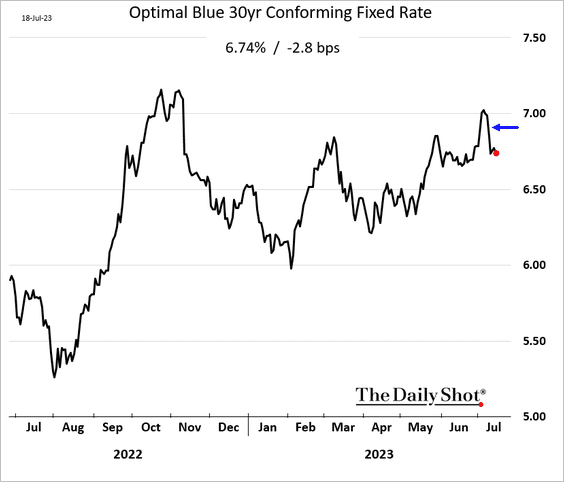

… as mortgage rates eased.

——————–

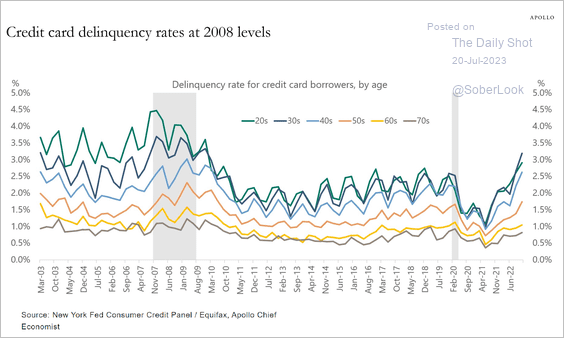

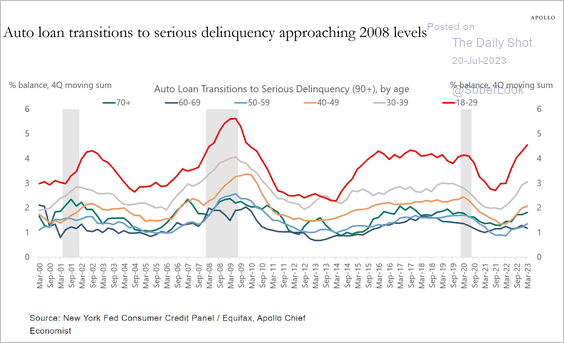

2. Credit card and auto loan delinquencies continue to rise.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

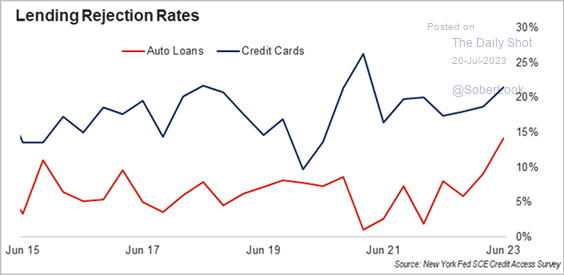

And so are the rejection rates.

Source: FHN Financial

Source: FHN Financial

——————–

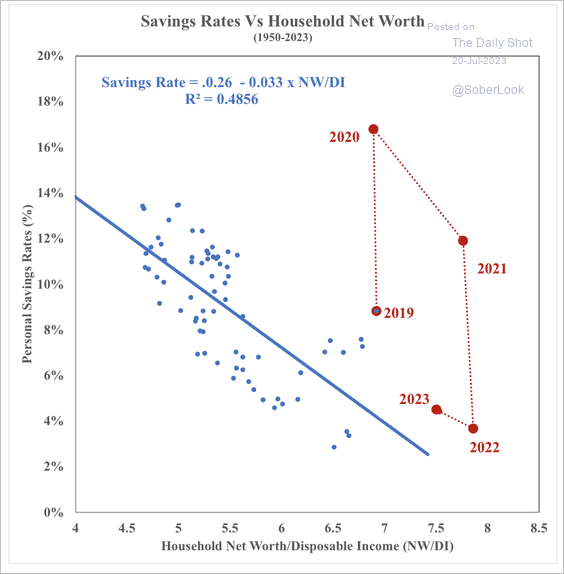

3. Is greater household wealth reducing the need to save?

Source: SOM Macro Strategies

Source: SOM Macro Strategies

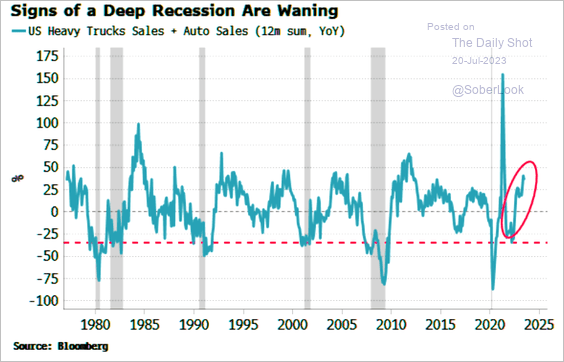

4. Heavy truck sales have been rising.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

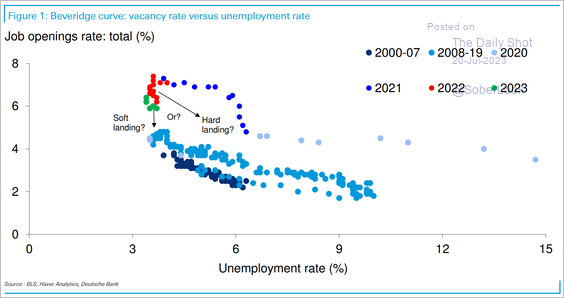

5. Here is a look at the Beveridge curve. Declining job openings and low/steady unemployment would imply a soft landing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

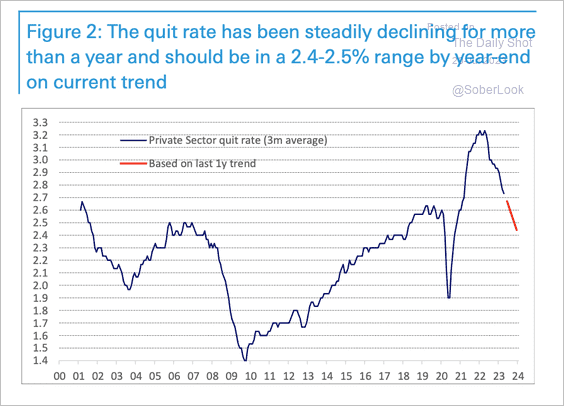

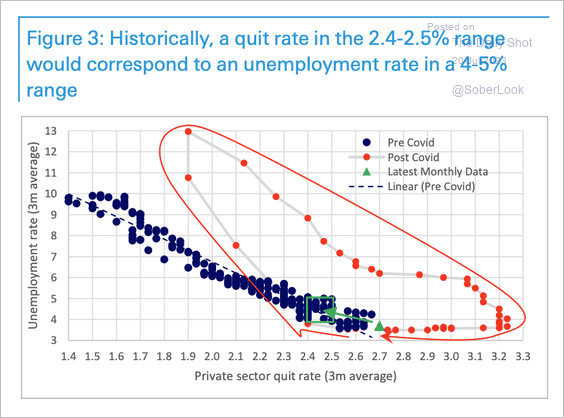

However, a lower trend in the quit rate points to a higher unemployment rate of around 4-5%. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

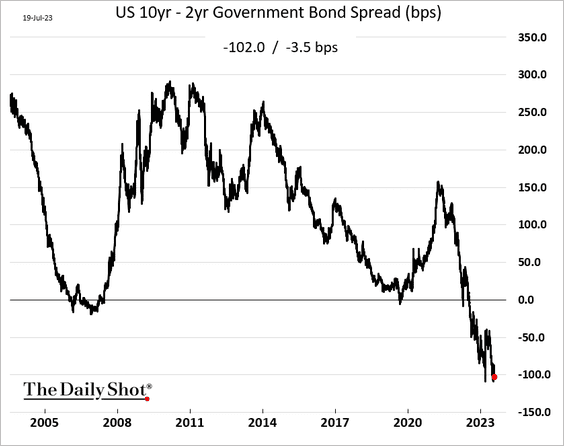

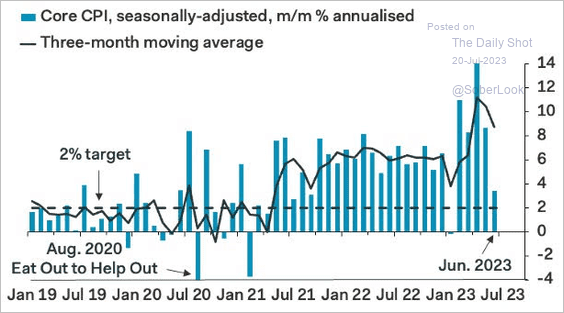

6. The heavily inverted yield curve continues to signal a recession ahead. But is this inversion different?

Source: @markets Read full article

Source: @markets Read full article

Back to Index

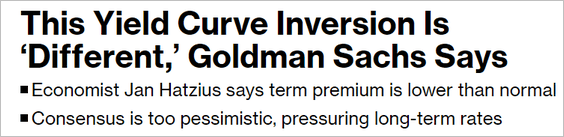

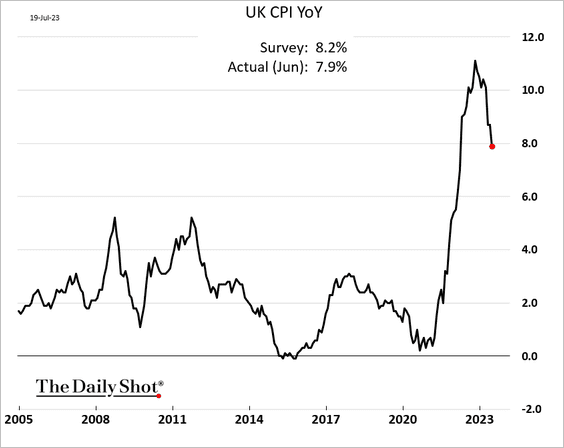

The United Kingdom

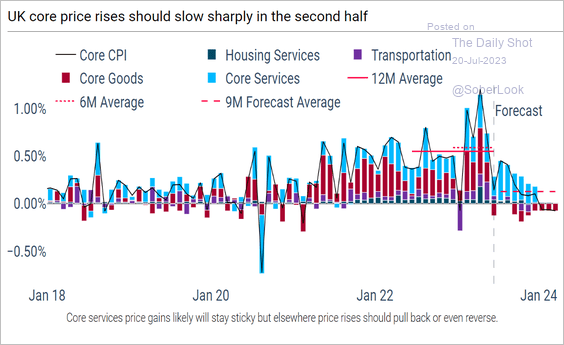

1. The CPI report finally surprised to the downside.

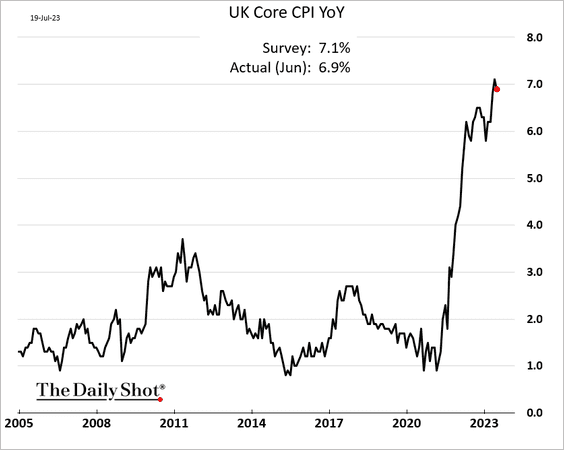

• Is core inflation finally peaking?

Here are the monthly changes.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Economists see core inflation slowing rapidly from here. Below is a forecast from TS Lombard (monthly changes).

Source: TS Lombard

Source: TS Lombard

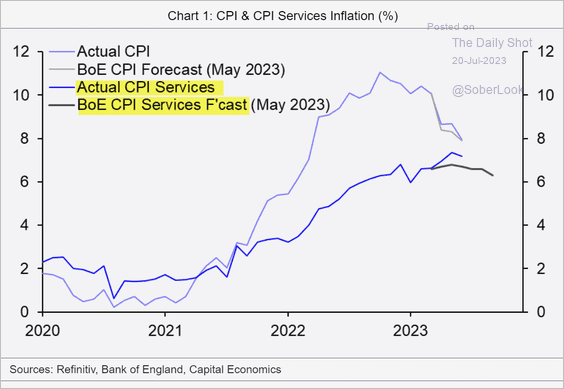

– Services inflation has been particularly strong, exceeding the BoE’s forecasts.

Source: Capital Economics

Source: Capital Economics

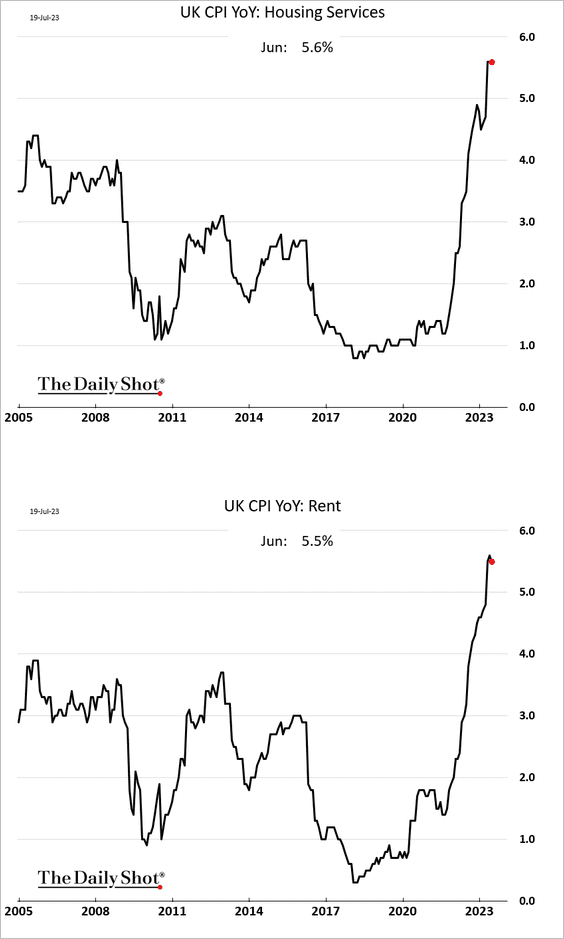

Here is the housing services CPI.

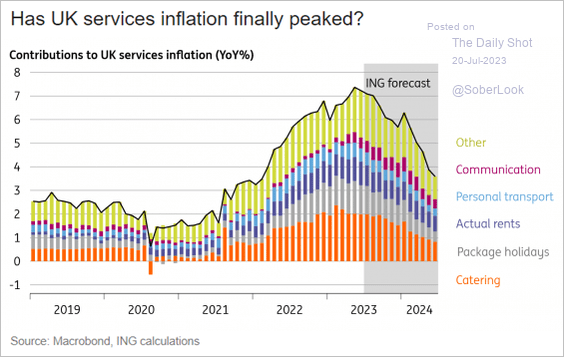

– But ING says that services inflation has peaked.

Source: ING

Source: ING

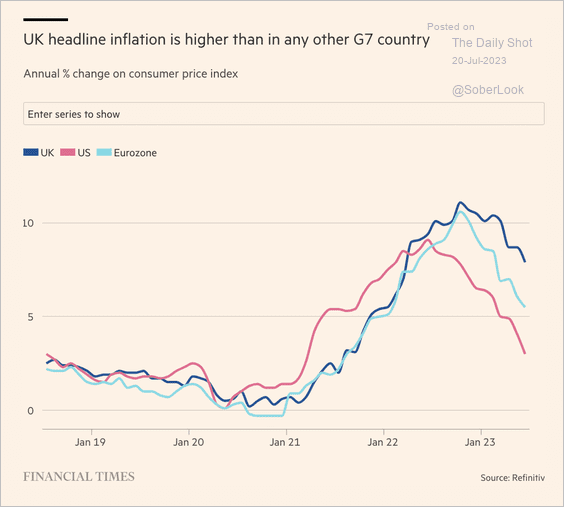

• UK inflation remains above that of the US and the Eurozone.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

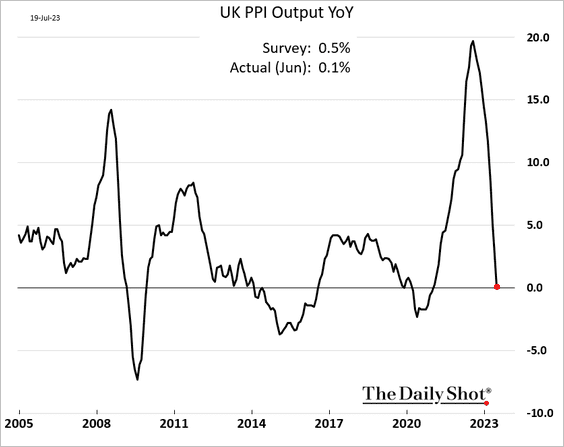

• The PPI is crashing.

——————–

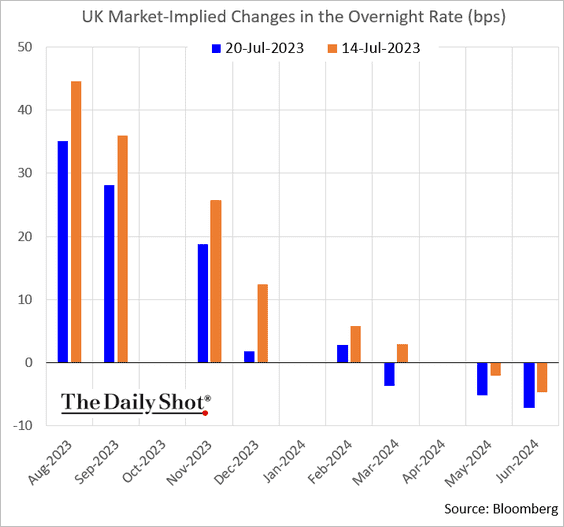

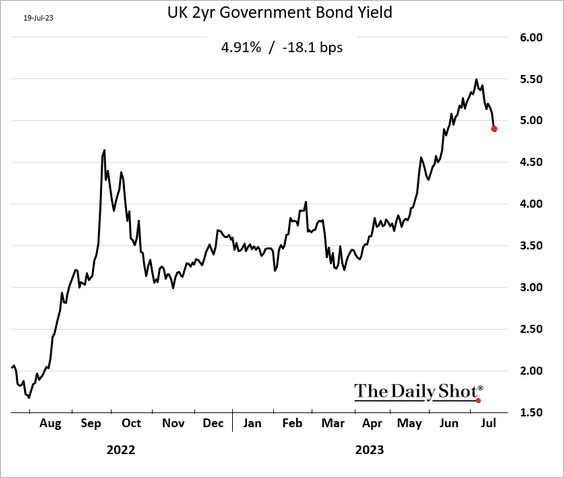

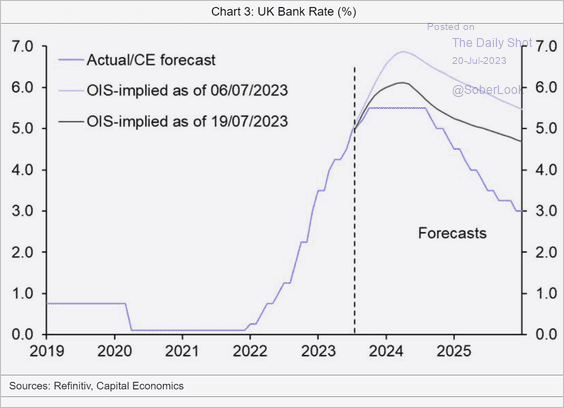

2. Rate hike expectations eased after the CPI report.

• Here is the 2-year yield.

• This chart shows the BoE rate projection from Capital Economics (compared to market expectations).

Source: Capital Economics

Source: Capital Economics

• The pound dropped.

Source: @5thrule, Bloomberg Markets Live

Source: @5thrule, Bloomberg Markets Live

——————–

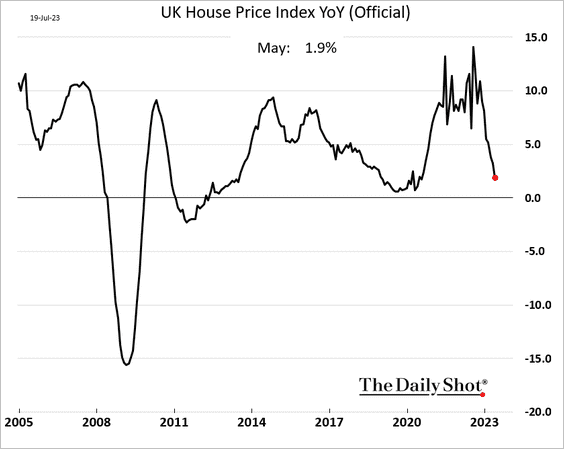

3. Home price appreciation continues to ease, according to the official report.

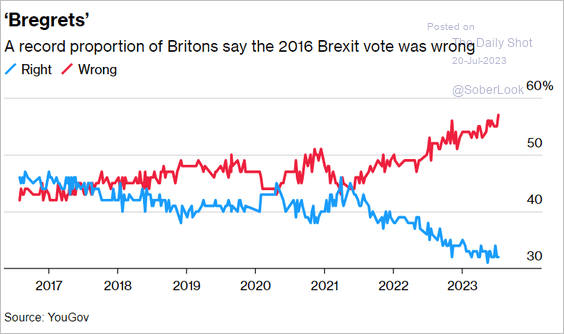

4. Bregrets?

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

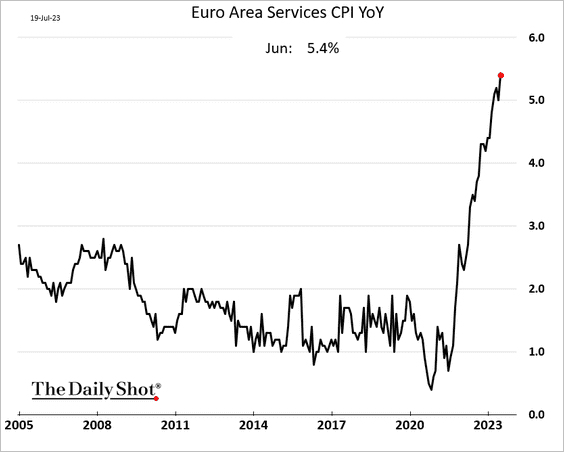

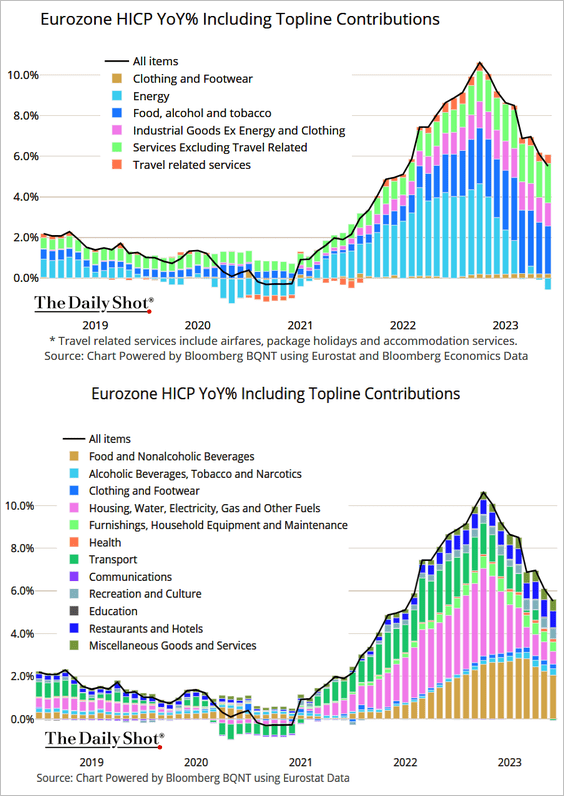

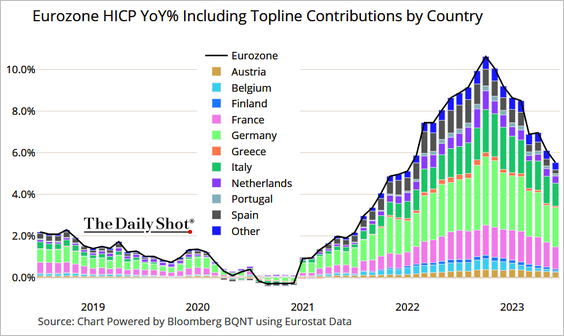

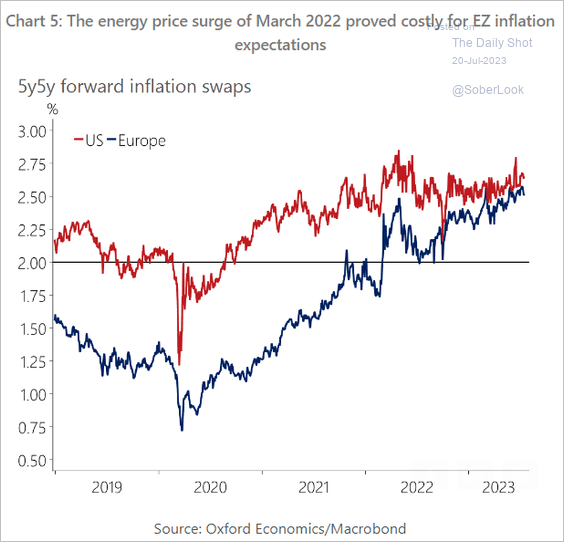

The Eurozone

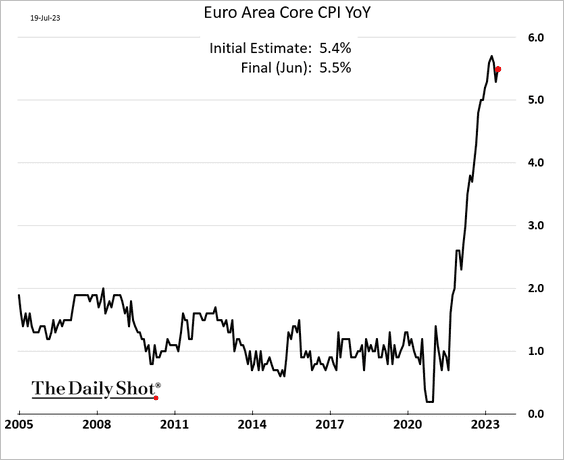

1. The June core inflation was revised higher.

• Services inflation continues to surge.

• Below are the CPI attributions.

– By sector:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– By country:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The US-Eurozone gap in longer-term inflation expectations has been closing.

Source: Oxford Economics

Source: Oxford Economics

——————–

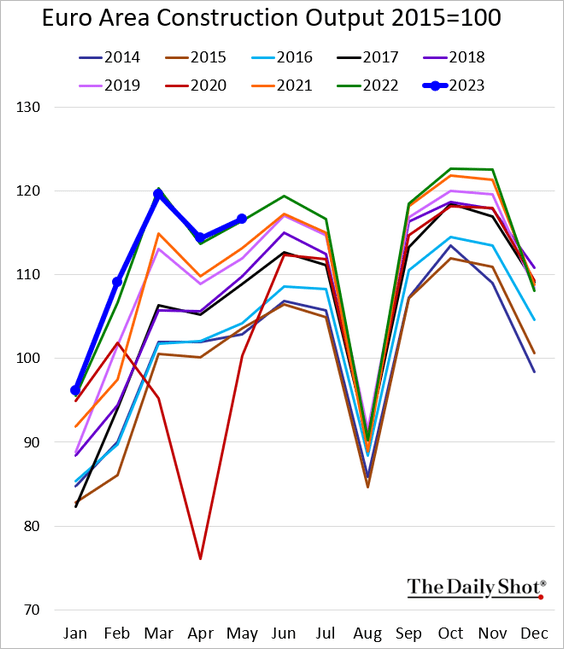

2. Construction output is running in line with last year’s levels (no growth).

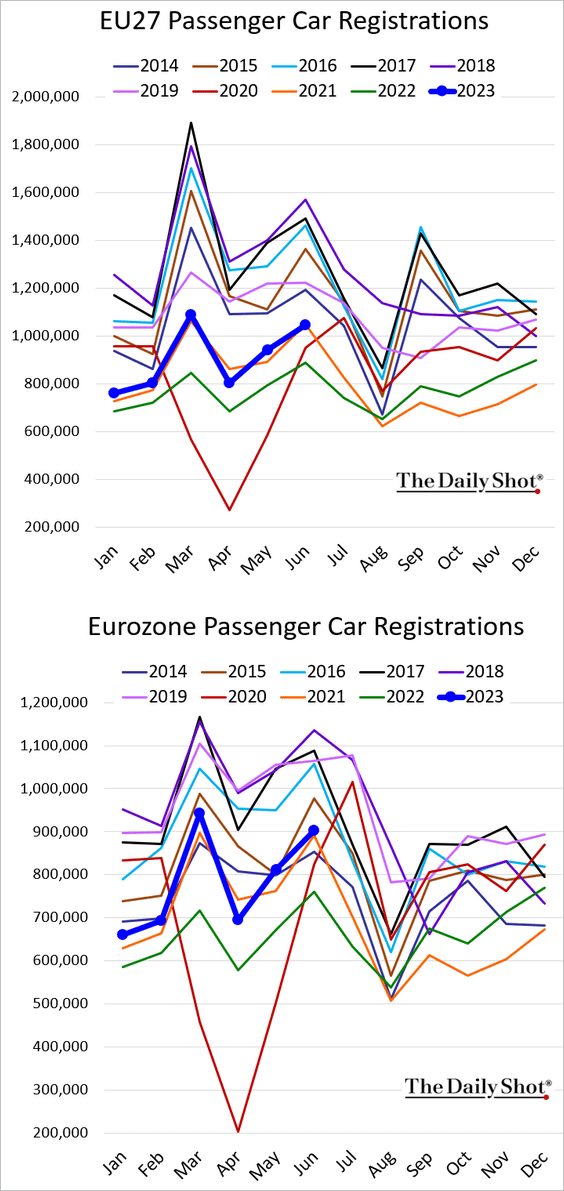

3. Car registrations are following the 2021 trajectory.

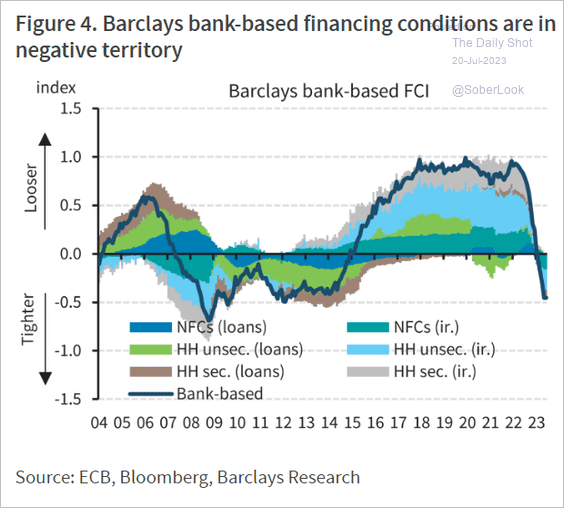

4. Credit conditions have tightened sharply.

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia-Pacific

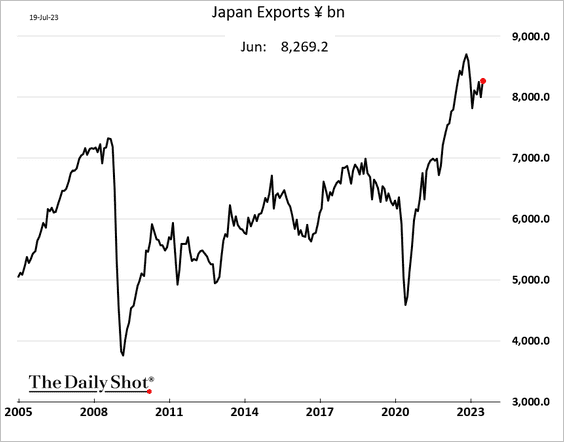

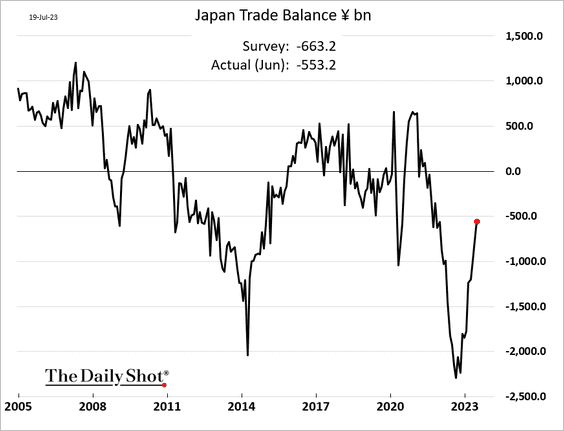

1. Japan’s exports climbed last month.

The trade deficit continues to narrow.

——————–

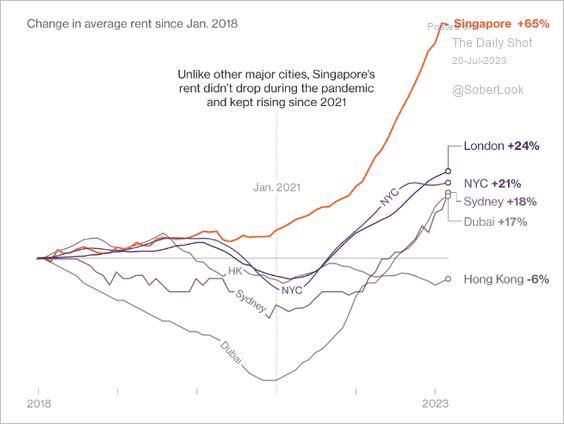

2. Singapore rents have been outpacing other large cities.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

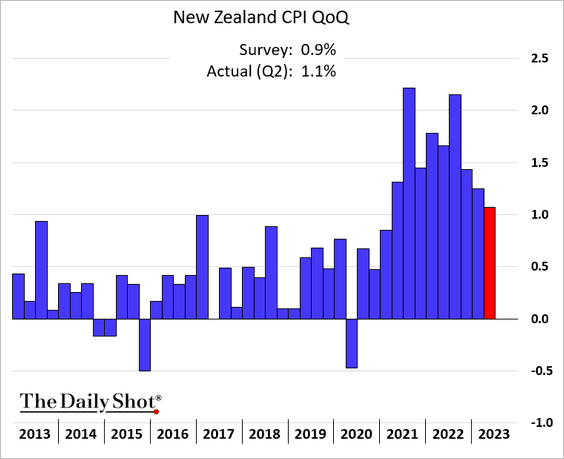

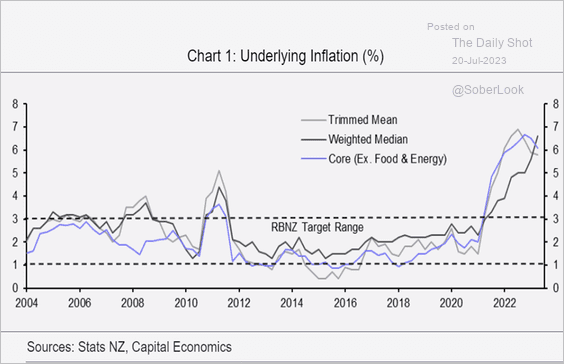

3. New Zealand’s inflation is moderating but remains high.

Source: Capital Economics

Source: Capital Economics

——————–

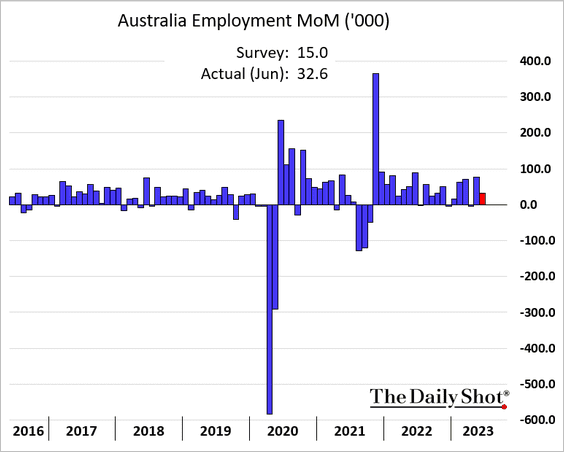

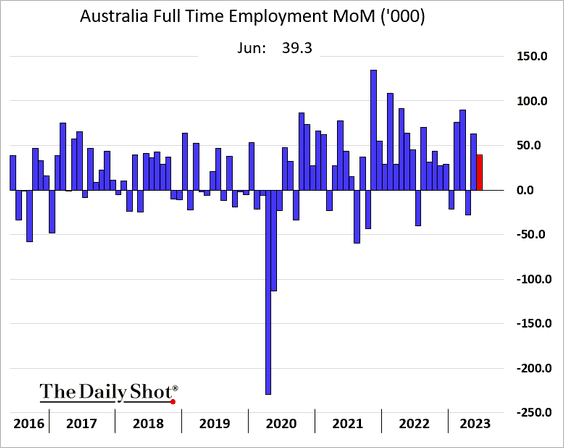

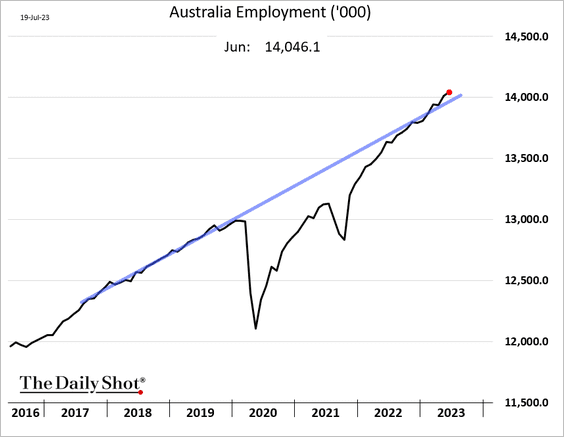

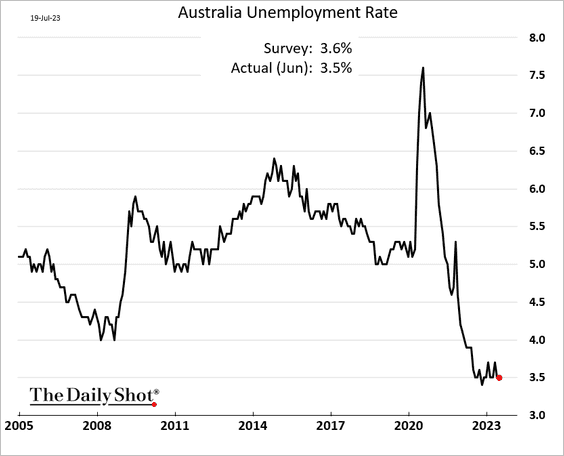

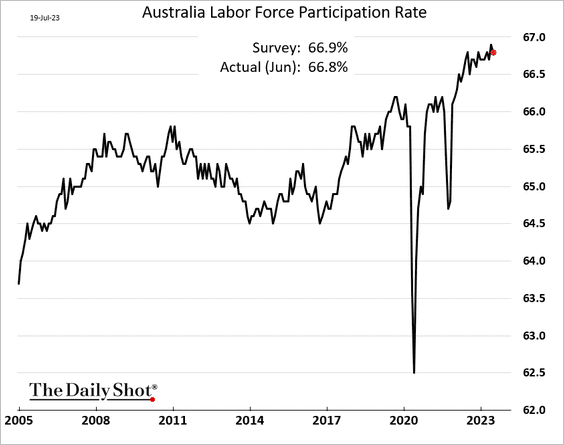

4. Australia’s jobs report topped expectations.

• Employment is above trend and is rising faster than before the pandemic.

• The unemployment rate is back at 3.5%.

• The participation rate edged lower but remains near the highs.

Back to Index

China

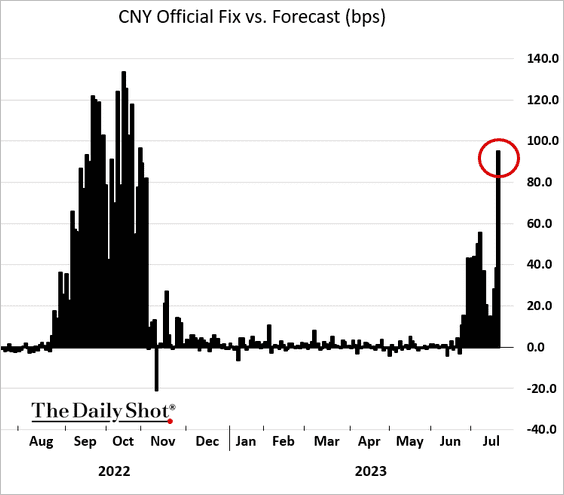

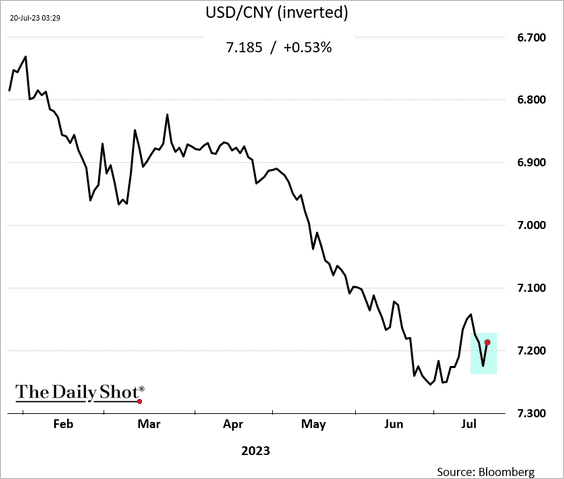

1. Beijing is getting aggressive in pushing China’s currency higher.

The renminbi jumped against the dollar.

——————–

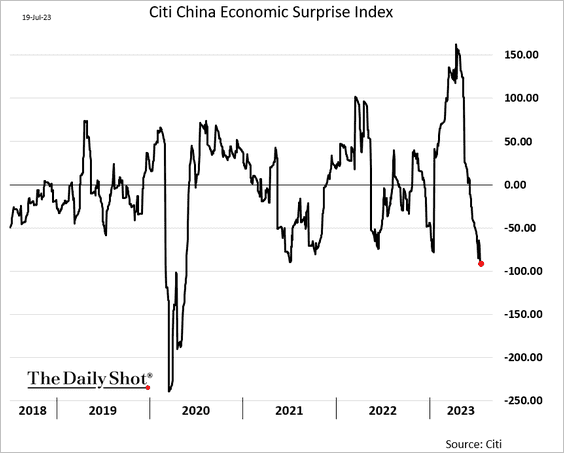

2. The Citi Economic Surprise Index continues to fall.

3. Outside of food, China’s CPI is in deflation territory.

Source: Danske Bank

Source: Danske Bank

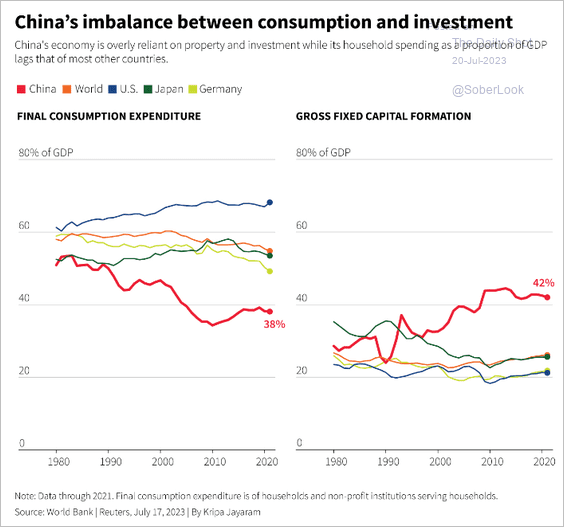

4. This chart illustrates China’s imbalance between consumption and investment.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Emerging Markets

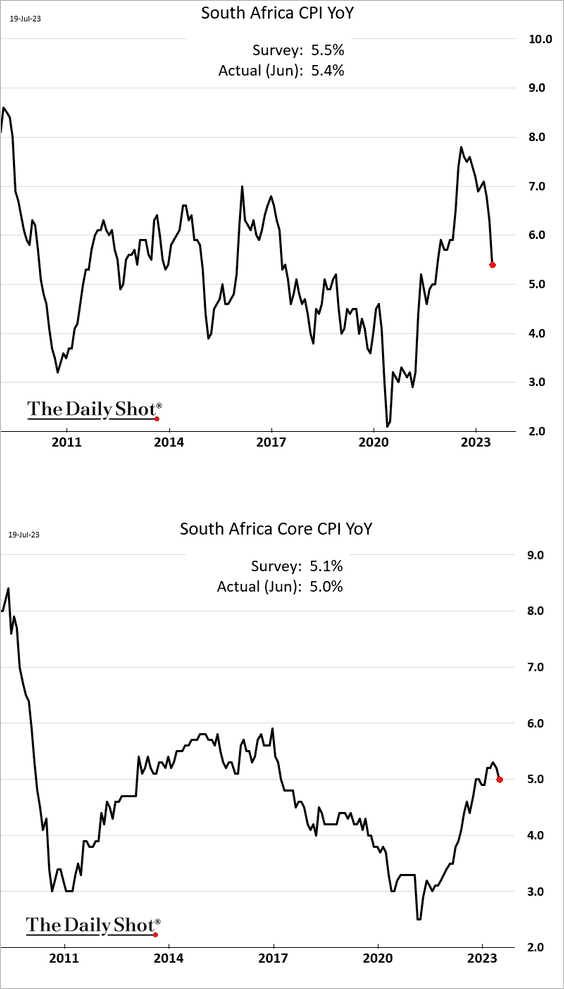

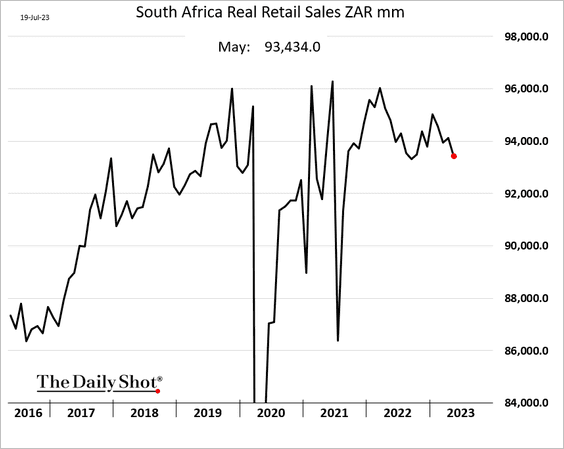

1. South Africa’s core inflation has finally peaked.

Retail sales are rolling over.

——————–

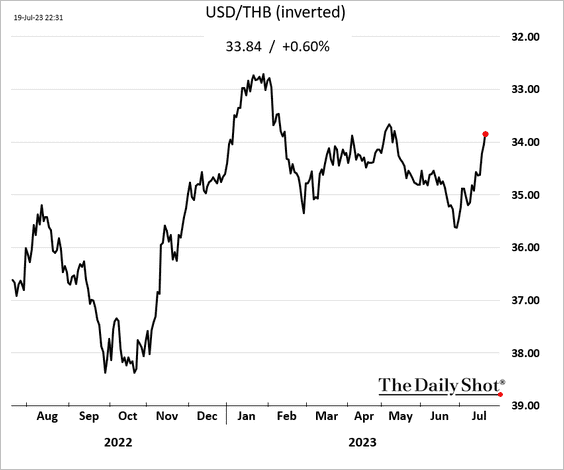

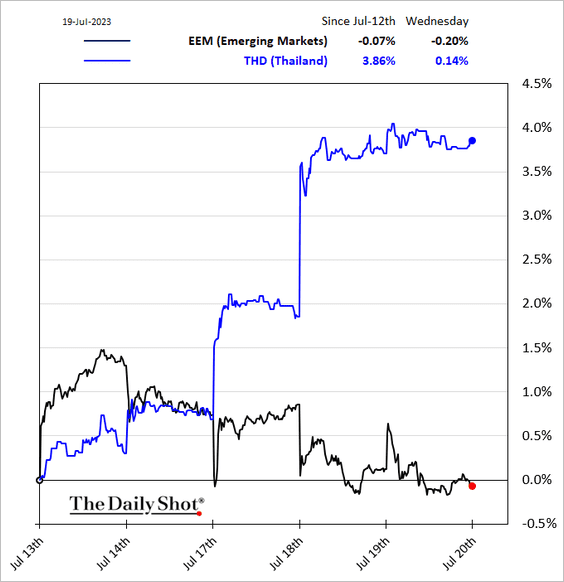

2. The Thai baht keeps rising.

Here is the iShares Thailand equity ETF.

The market wants to see the status quo.

Source: @bpolitics Read full article Further reading

Source: @bpolitics Read full article Further reading

——————–

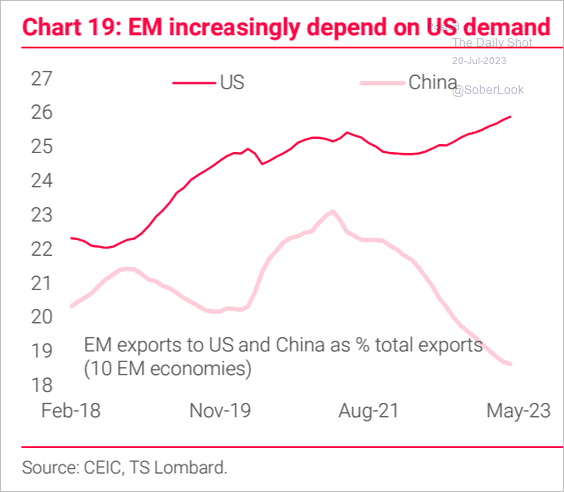

3. EM economies are increasingly dependent on US demand.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

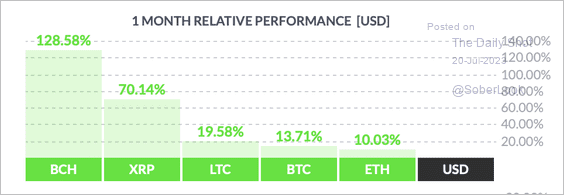

1. Here is a look at performance over the past month. Litecoin (LTC) also outperformed BTC.

Source: FinViz

Source: FinViz

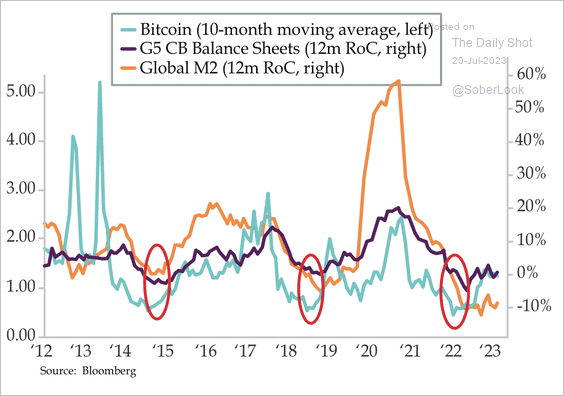

2. Bitcoin’s price has moved in line with global liquidity.

Source: Quill Intelligence

Source: Quill Intelligence

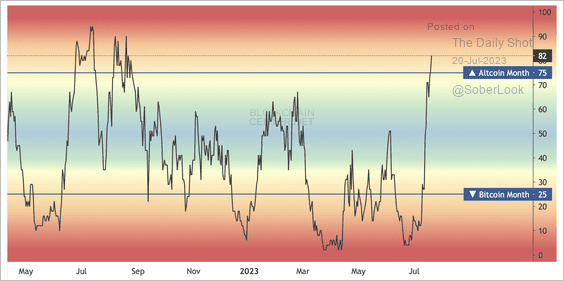

3. 82% of the top 50 altcoins outperformed bitcoin over the past month, led by BCH, XLM, and XRP.

Source: Blockchain Center

Source: Blockchain Center

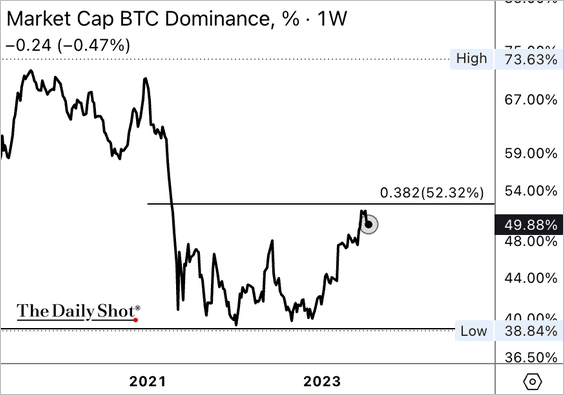

4. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) is testing resistance. It appears that favorable legal developments in the US toward altcoins boosted investor optimism outside of BTC.

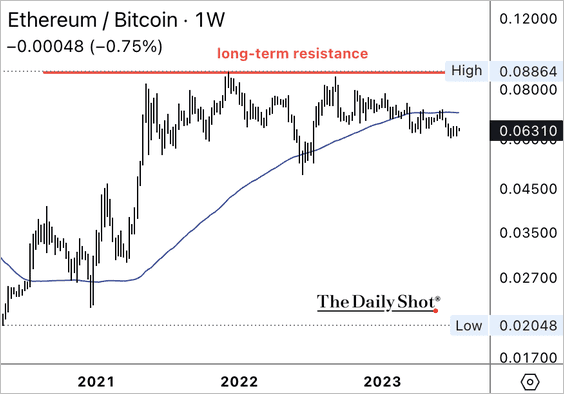

5. The ETH/BTC price ratio remains capped below resistance despite positive moves in altcoins.

Back to Index

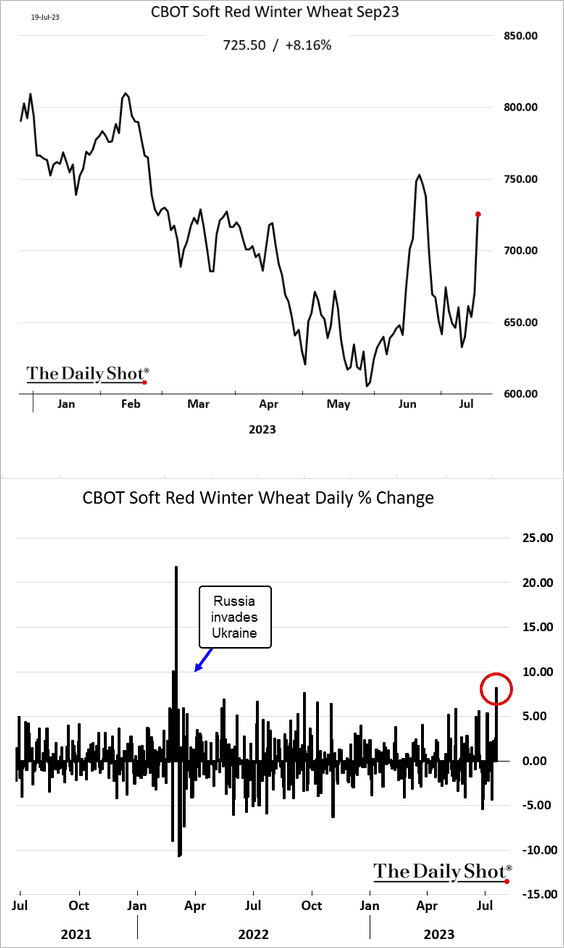

Commodities

1. The wheat market is finally responding to the Ukraine situation.

Source: Politico Read full article

Source: Politico Read full article

Source: Barron’s Read full article

Source: Barron’s Read full article

——————–

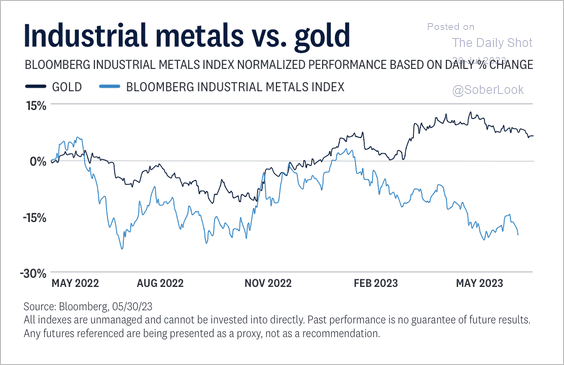

2. Gold has outperformed industrial metals during the recent global economic slowdown.

Source: LPL Research

Source: LPL Research

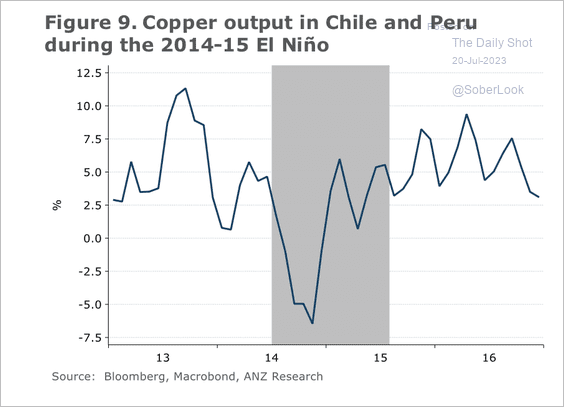

3. Copper production in Chile and Peru fell sharply during the 2014-2015 El Niño.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Energy

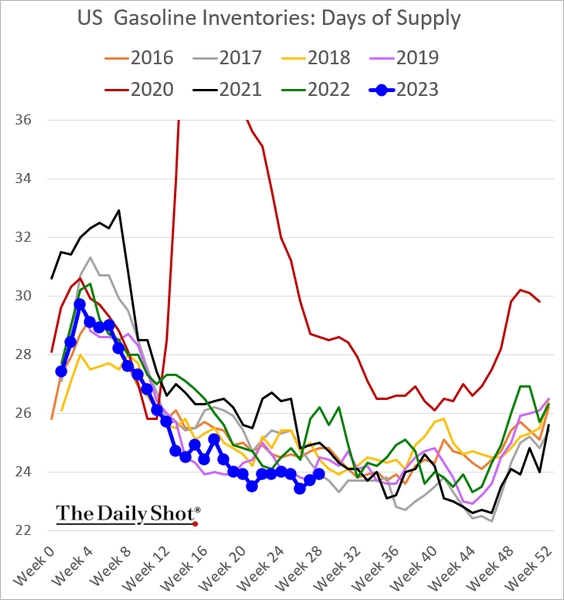

1. US gasoline inventories remain tight.

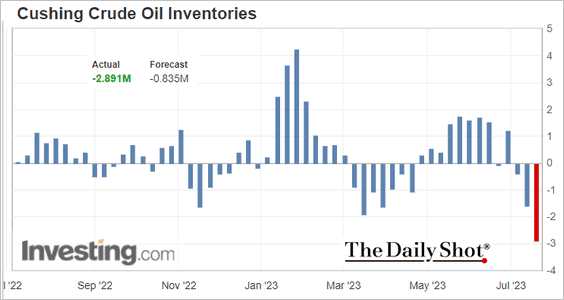

2. The amount of crude oil stored at Cushing, OK (WTI settlement hub) declined sharply last week.

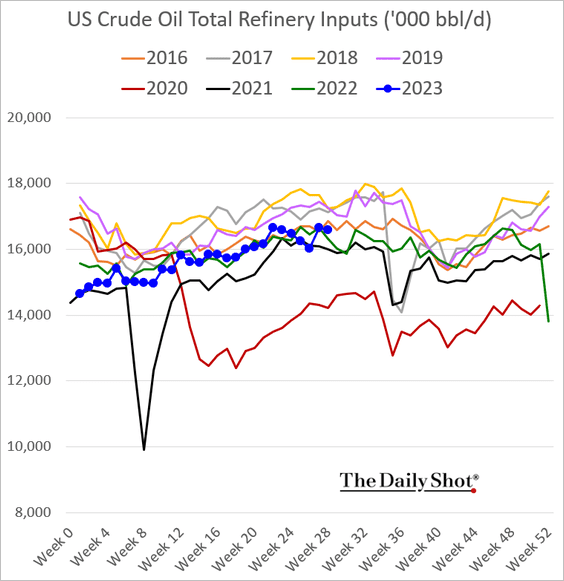

3. US refinery runs are holding above last year’s levels.

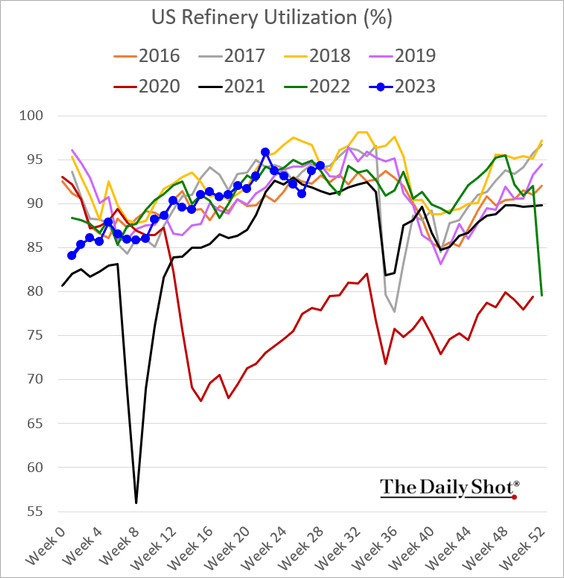

Refinery utilization is nearing multi-year highs.

——————–

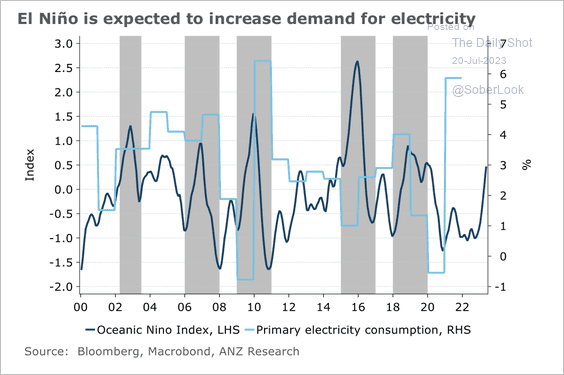

4. El Niño could trigger a rise in global electricity consumption.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

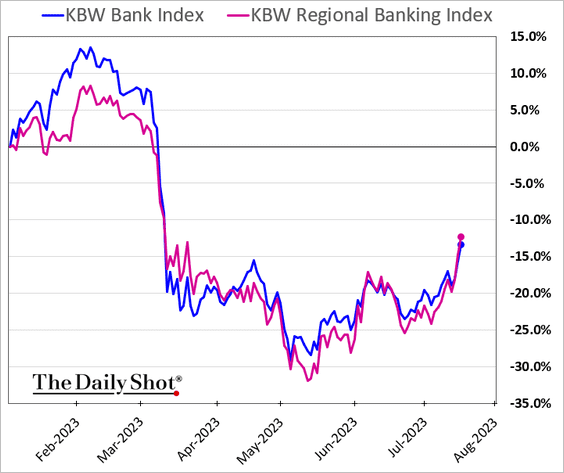

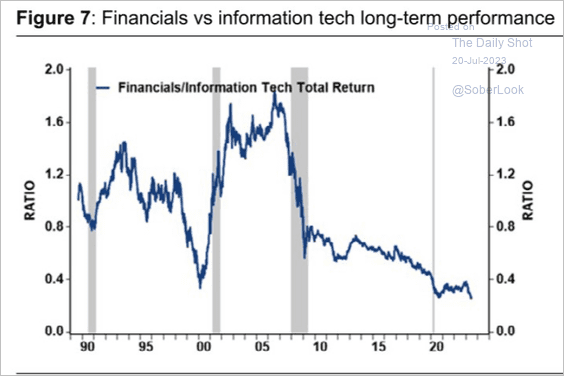

1. Bank shares are rebounding.

Here is a long-term chart of financials vs. tech.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

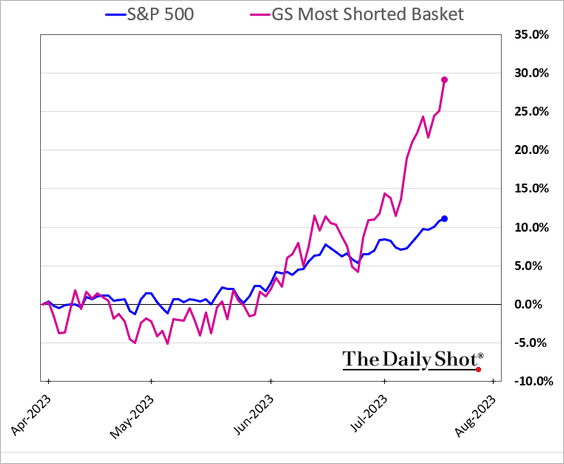

2. There has been a lot of short-covering this month.

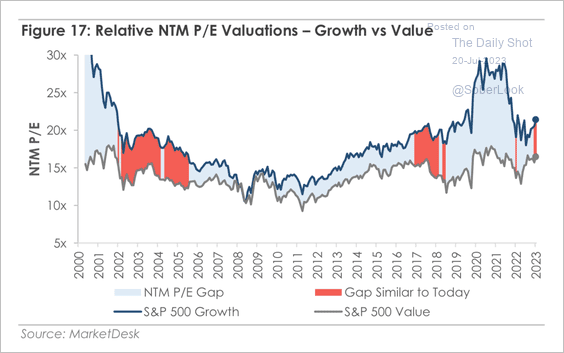

3. S&P 500 growth stocks are trading at a wide premium to value stocks.

Source: MarketDesk Research

Source: MarketDesk Research

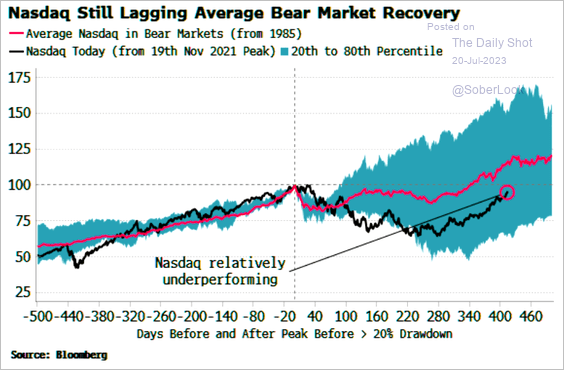

4. The Nasdaq is lagging the average bear-market recovery.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

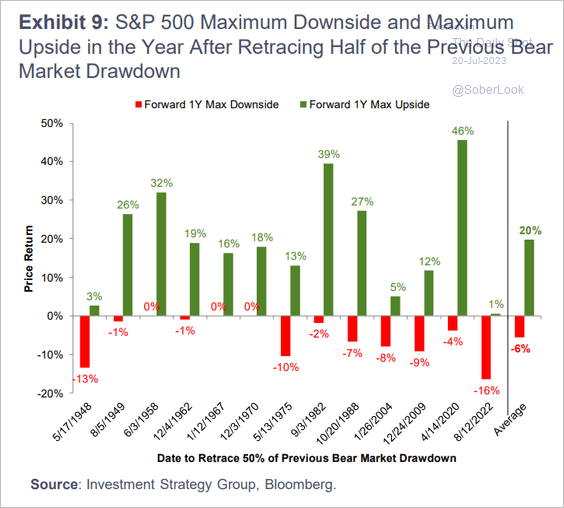

5. This chart shows the market risk profile after retracing half of the previous bear-market drawdown.

Source: Goldman Sachs

Source: Goldman Sachs

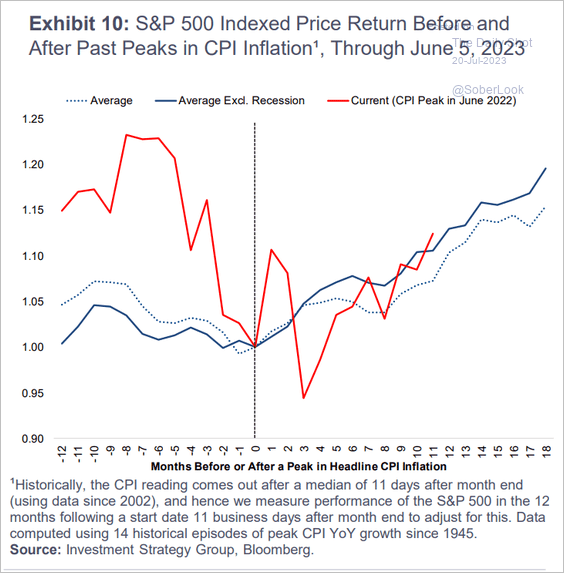

6. How did stocks perform after inflation peaks?

Source: Goldman Sachs

Source: Goldman Sachs

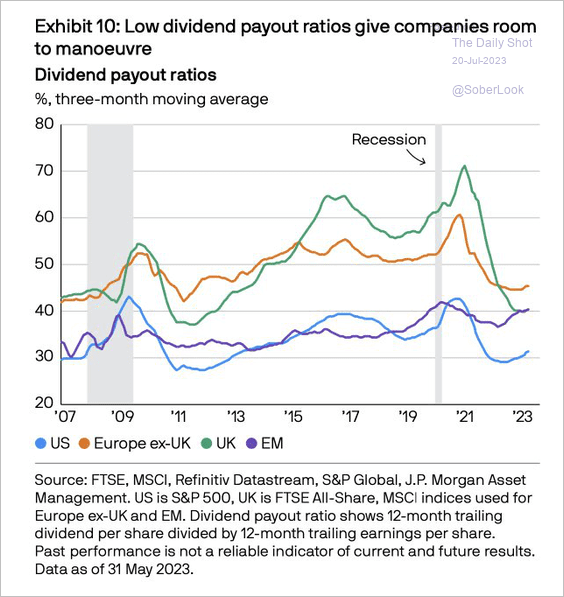

7. Next, we have the dividend payout ratios in the US, Europe, and EM.

Source: @acemaxx, @JPMorganAM

Source: @acemaxx, @JPMorganAM

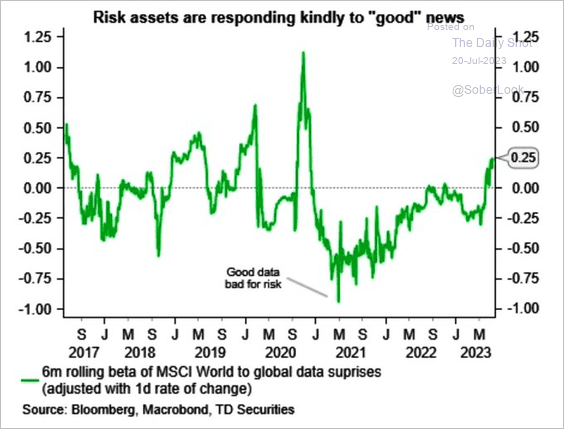

8. RIsk assets have been responding positively to good news.

Source: TD Securities; @WallStJesus

Source: TD Securities; @WallStJesus

Back to Index

Credit

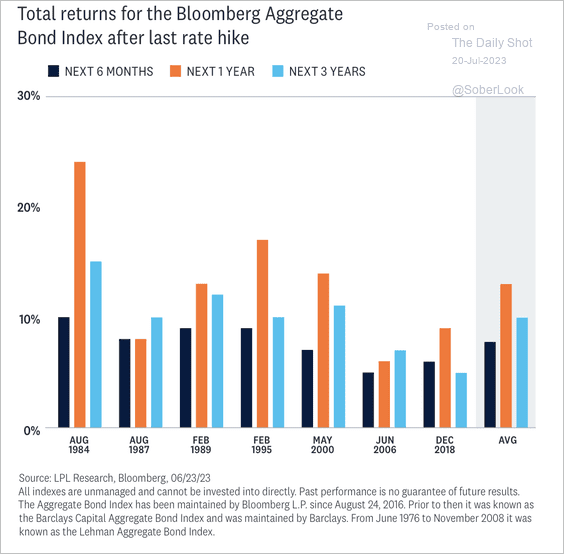

1. Core bonds tend to do well after the last Fed rate hike.

Source: LPL Research

Source: LPL Research

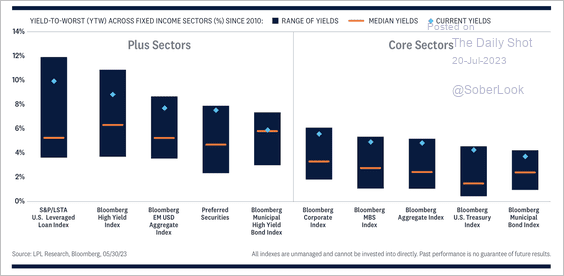

2. Yields across fixed-income sectors are above long-term averages.

Source: LPL Research

Source: LPL Research

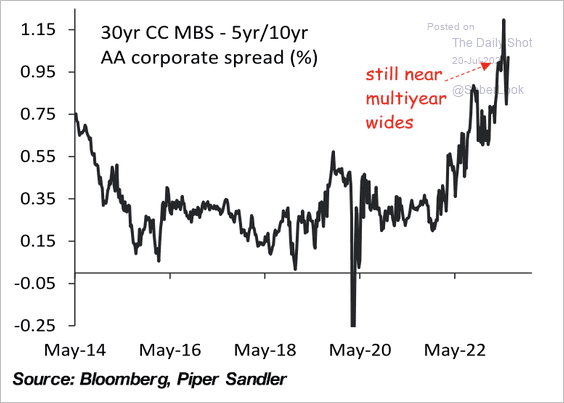

3. Mortgage-backed securities are trading at a notable discount to corporates.

Source: Piper Sandler

Source: Piper Sandler

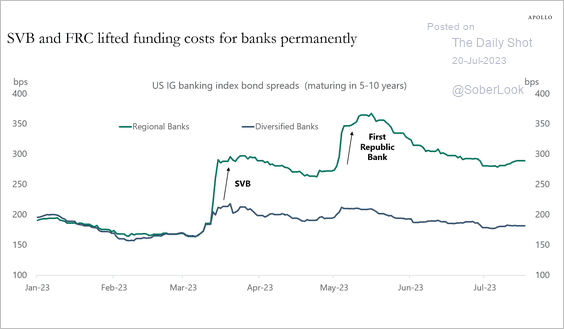

4. Small banks’ funding costs remain elevated.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

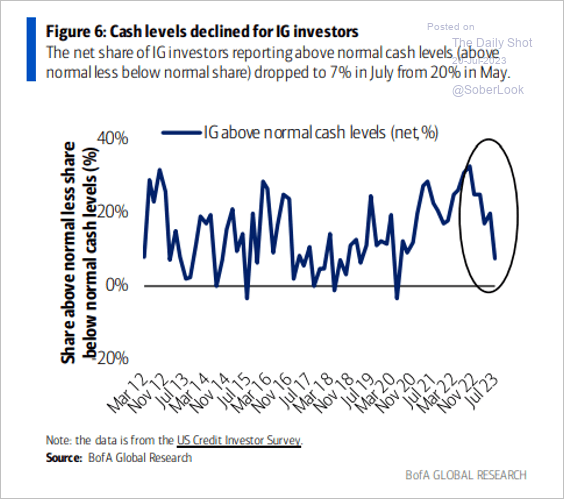

5. Investment-grade portfolio managers have reduced their cash positions.

Source: BofA Global Research

Source: BofA Global Research

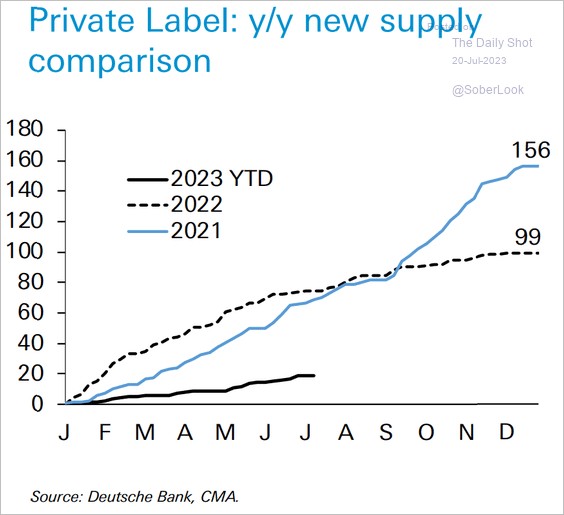

6. CMBS new issuance remains depressed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

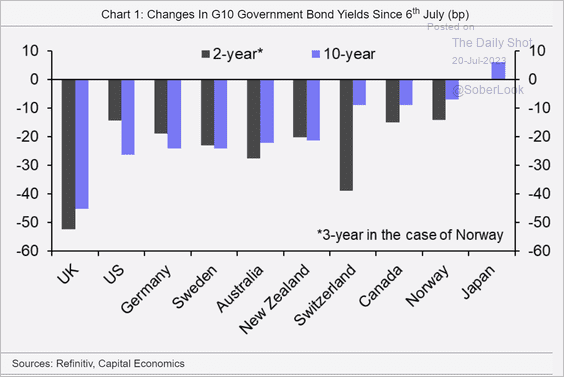

1. Bond yields are falling across advanced economies.

Source: Capital Economics

Source: Capital Economics

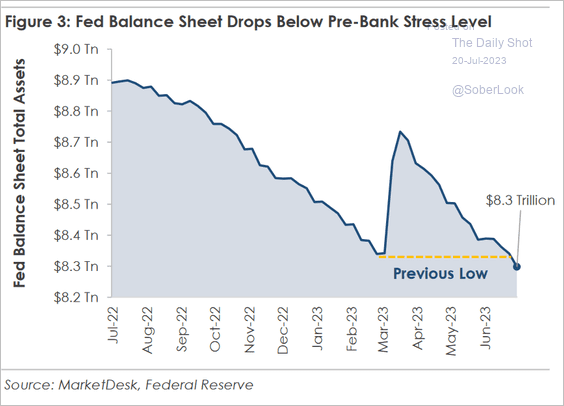

2. The Fed’s balance sheet is now below pre-bank-turmoil levels.

Source: MarketDesk Research

Source: MarketDesk Research

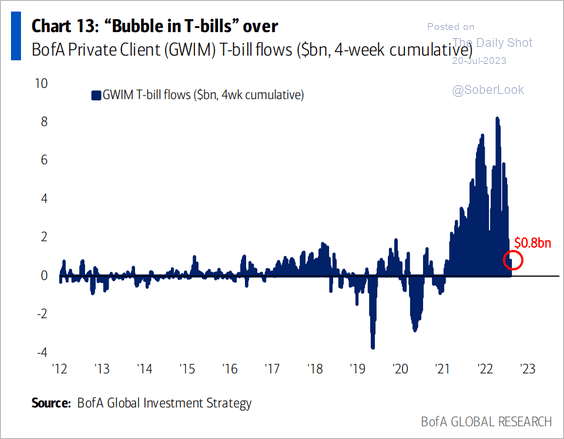

3. T-Bill inflows appear to be slowing.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

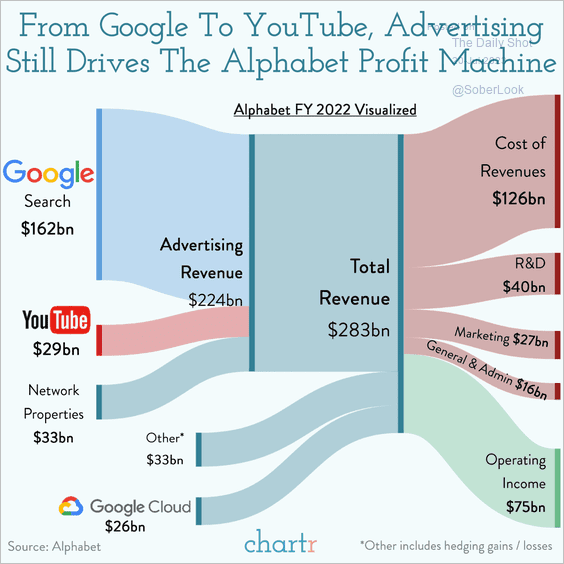

1. Alphabet’s 2022 financials visualized:

Source: @chartrdaily

Source: @chartrdaily

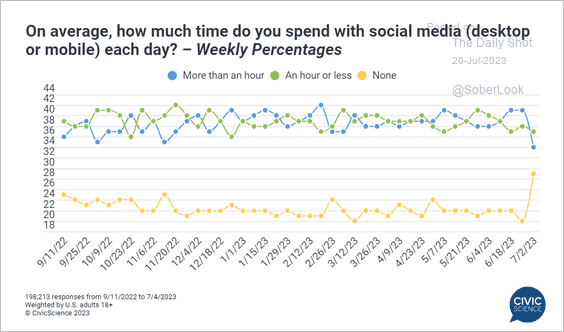

2. Taking a break from social media:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

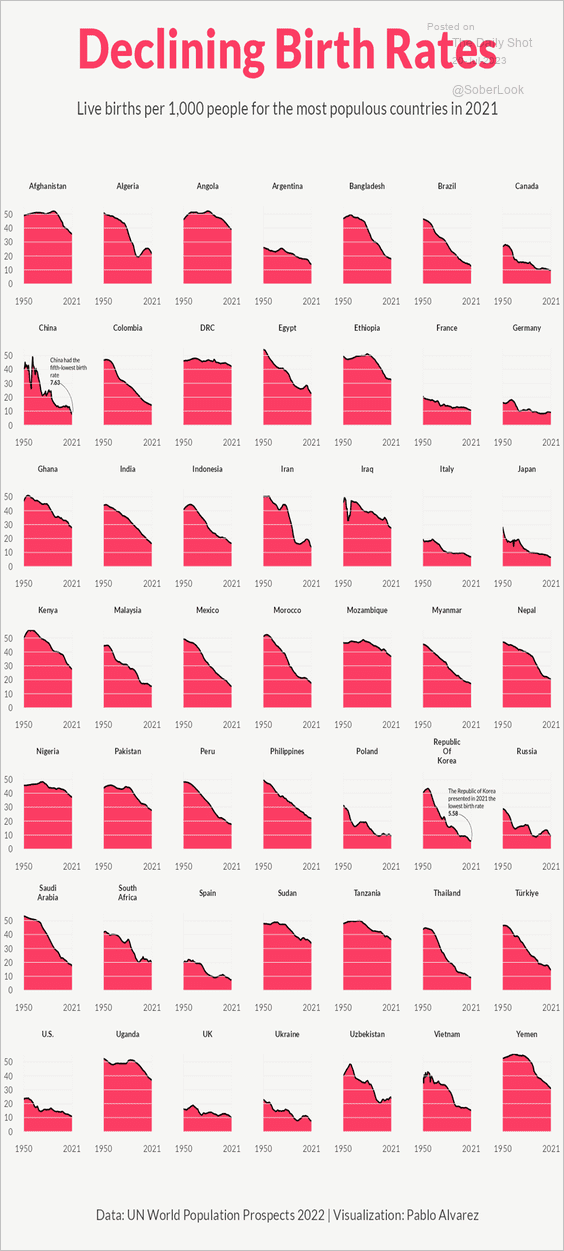

3. Declining birth rates:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

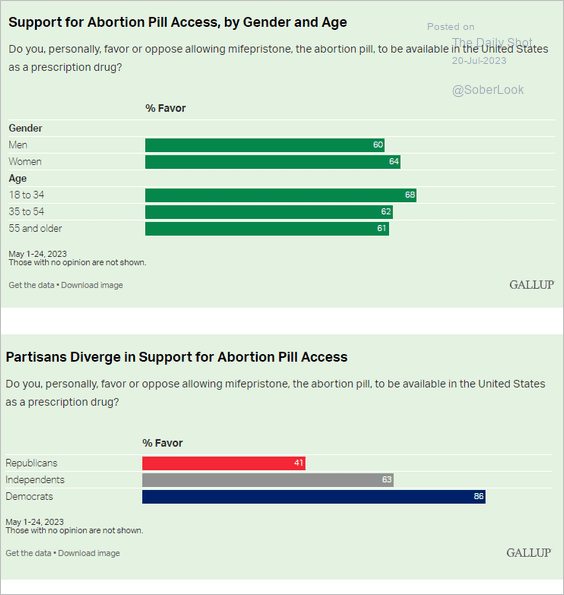

4. US support for access to the abortion pill:

Source: Gallup Read full article

Source: Gallup Read full article

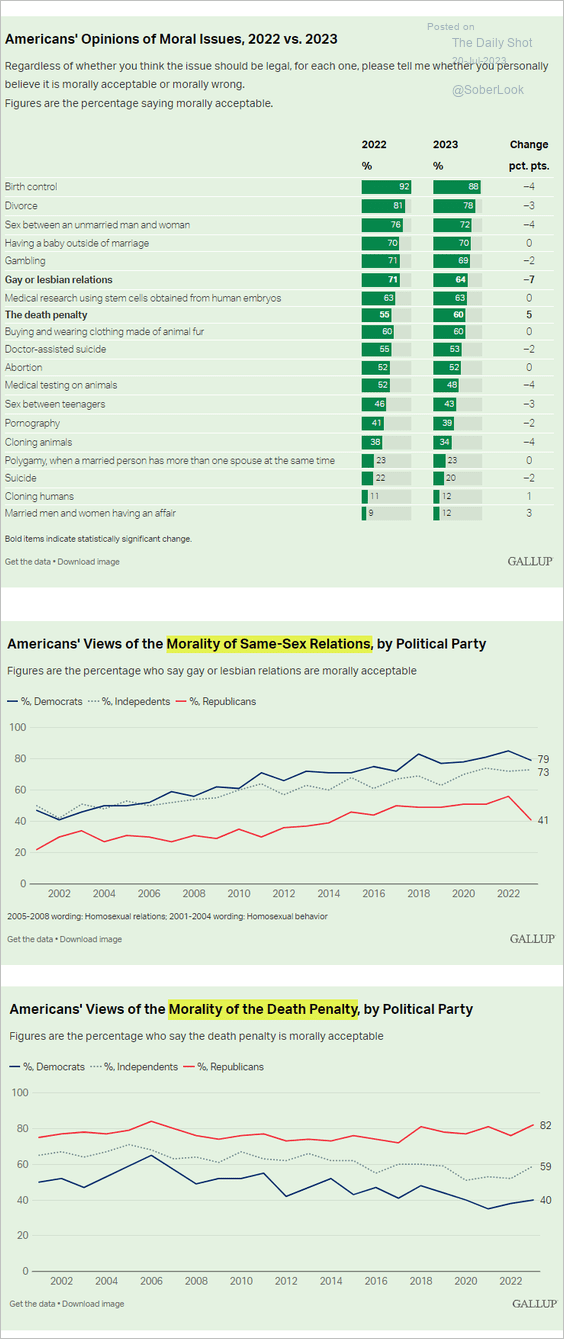

5. Views on the morality of various behaviors and practices:

Source: Gallup Read full article

Source: Gallup Read full article

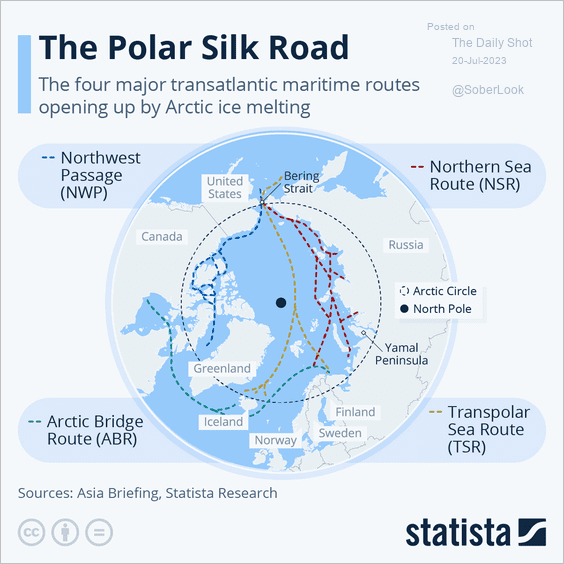

6. New shipping routes opening as Arctic ice melts:

Source: Statista

Source: Statista

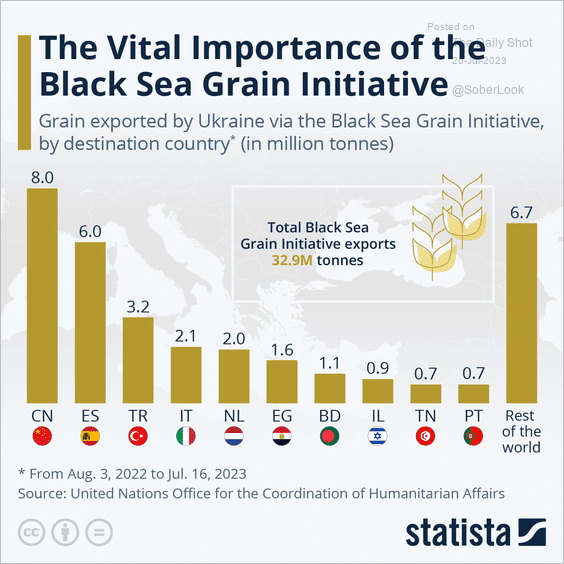

7. The Black Sea Grain Initiative (which Russia blocked):

Source: Statista

Source: Statista

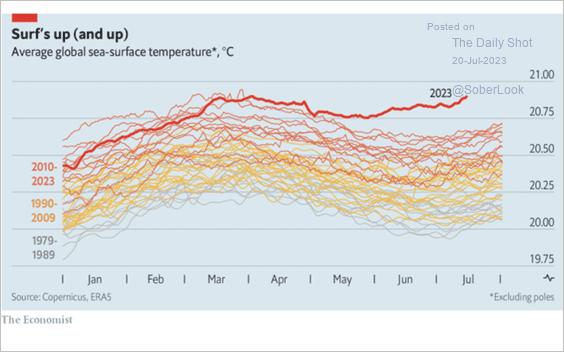

8. Warmer oceans:

Source: The Economist Read full article

Source: The Economist Read full article

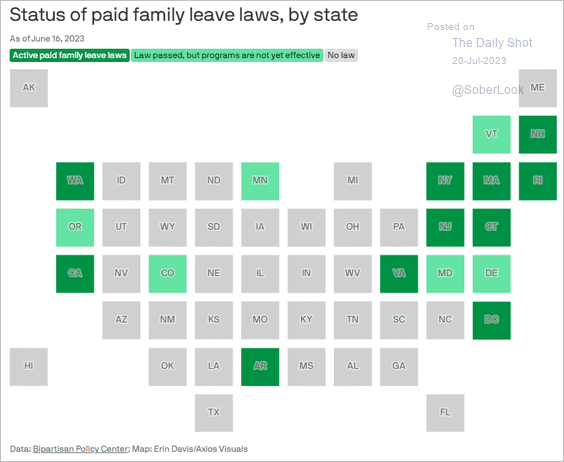

9. Paid family leave laws:

Source: @axios Read full article

Source: @axios Read full article

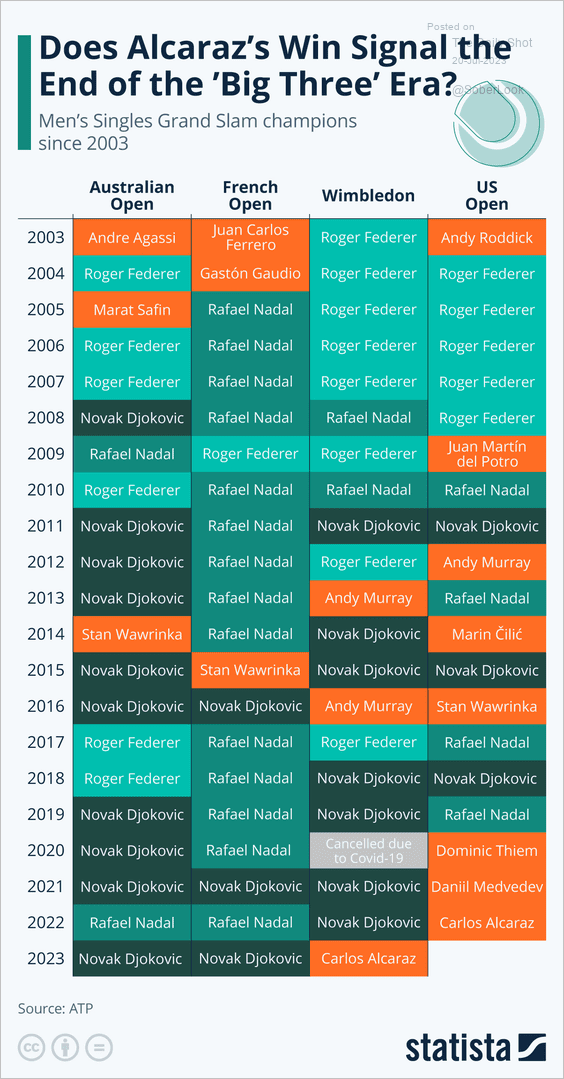

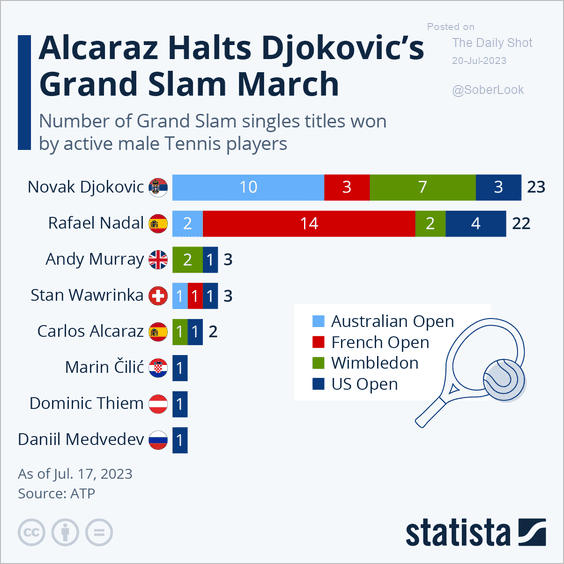

10. Men’s singles Grand Slam champions:

Source: Statista

Source: Statista

• Grand Slam titles won:

Source: Statista

Source: Statista

——————–

Back to Index