The Daily Shot: 21-Jul-23

• The United States

• The Eurozone

• Europe

• Emerging Markets

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

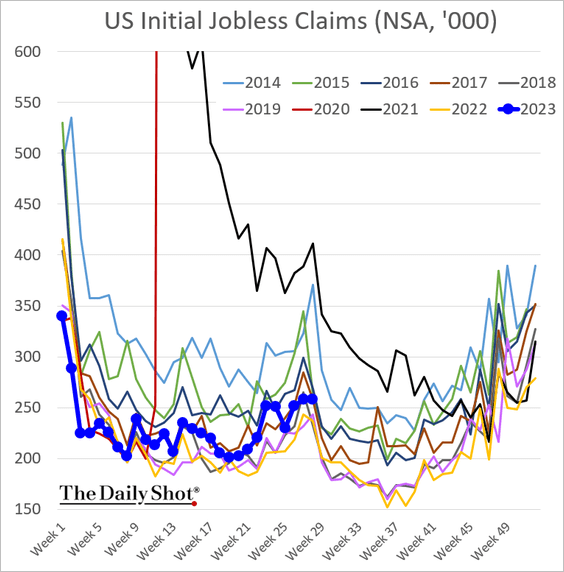

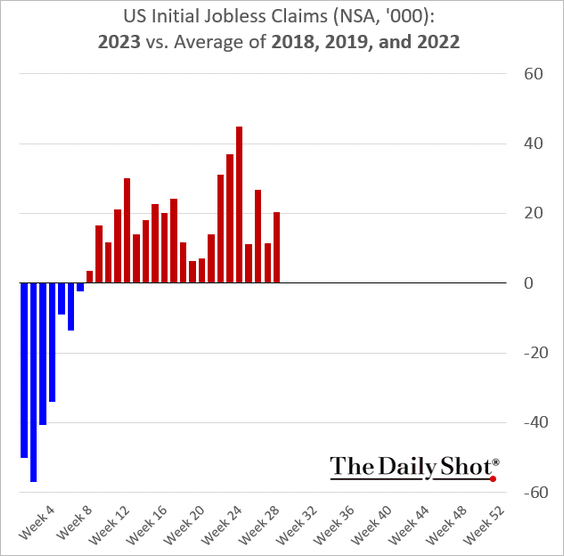

1. Last week’s initial jobless claims were below expectations.

However, there are some concerns about the veracity of the claims data.

Source: Cleveland.com Read full article

Source: Cleveland.com Read full article

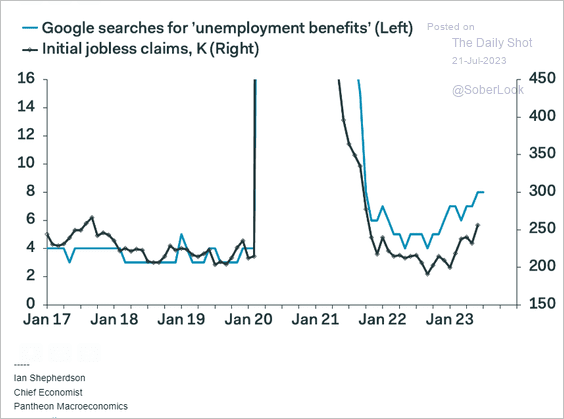

Google search activity for “unemployment benefits” suggests that the claims figure should be higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

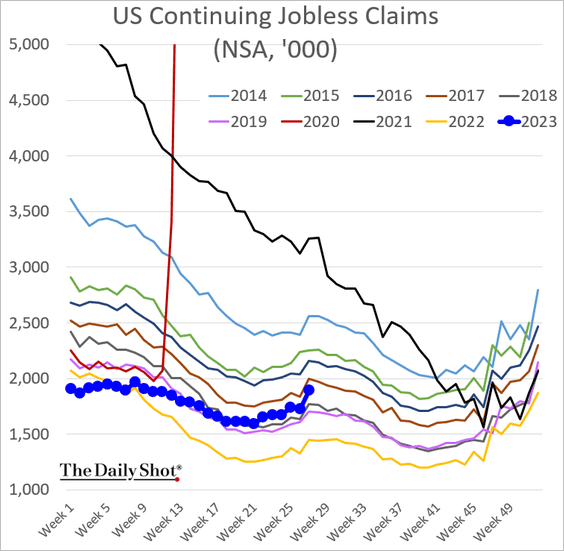

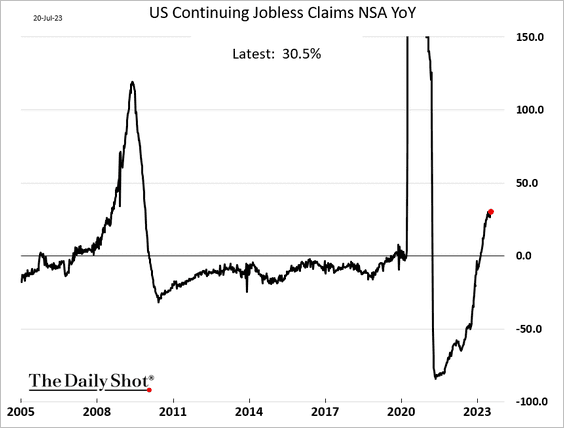

• Continuing claims, on the other hand, keep widening the gap with last year’s levels.

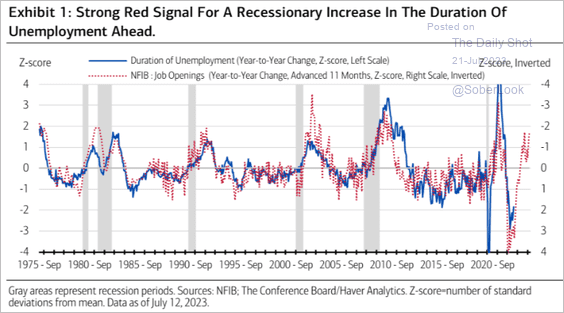

• Small-business surveys suggest that the duration of unemployment is about to rise.

Source: Merrill Lynch

Source: Merrill Lynch

——————–

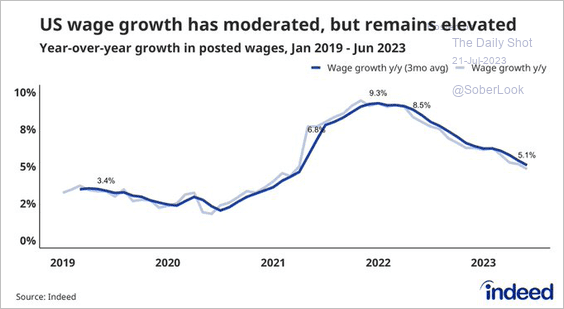

2. Growth in wages advertised on Indeed’s US job postings has been moderating.

Source: @nick_bunker, @Indeed

Source: @nick_bunker, @Indeed

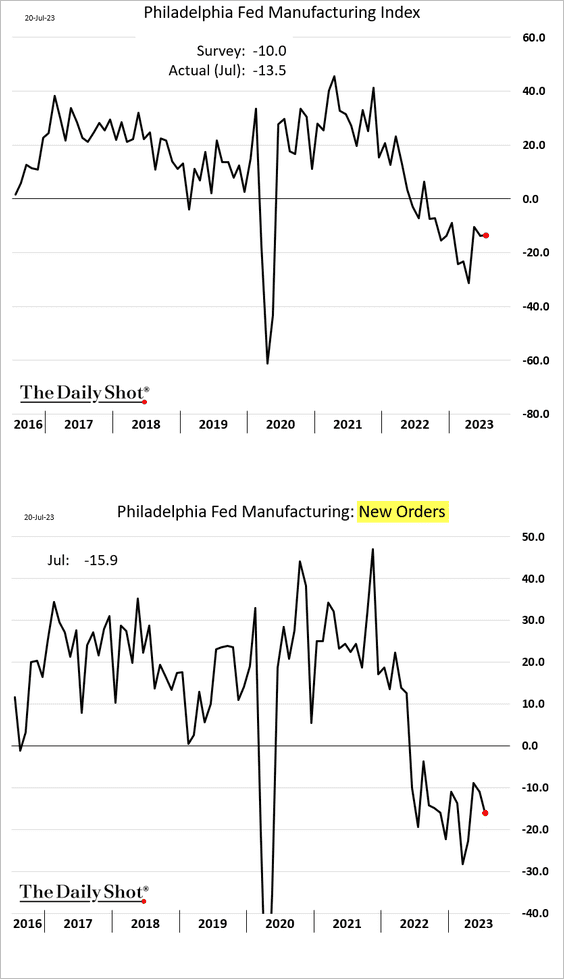

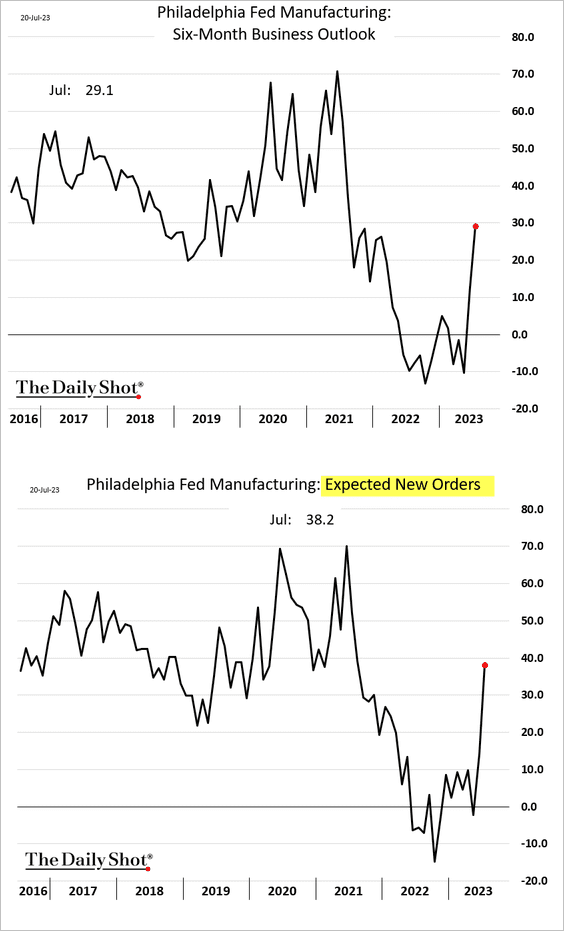

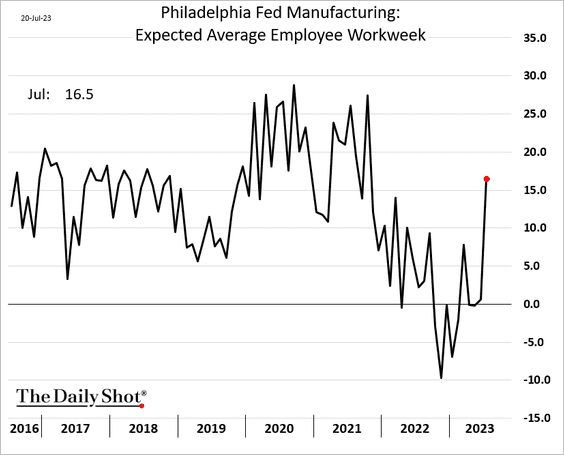

3. The Philly Fed’s manufacturing index continues to show weakness in the region’s factory activity.

• But the report showed a sharp improvement in manufacturers’ outlook.

Factories expect to boost workers’ hours in the months ahead.

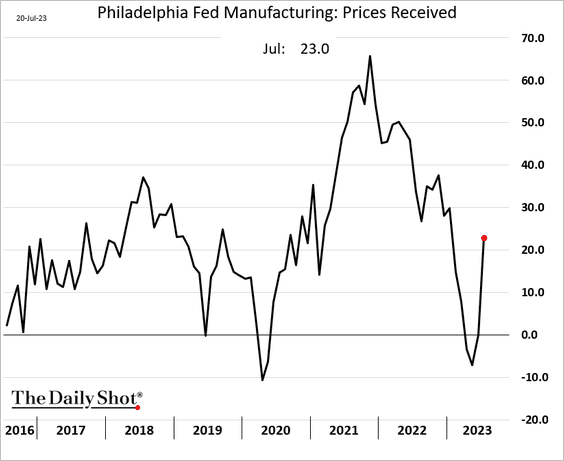

• The region’s manufacturers are boosting prices again.

——————–

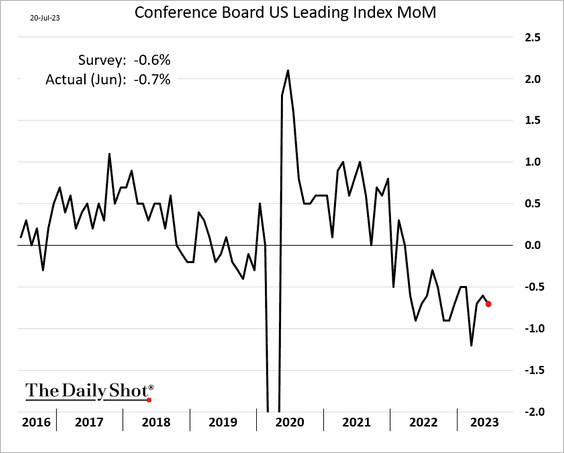

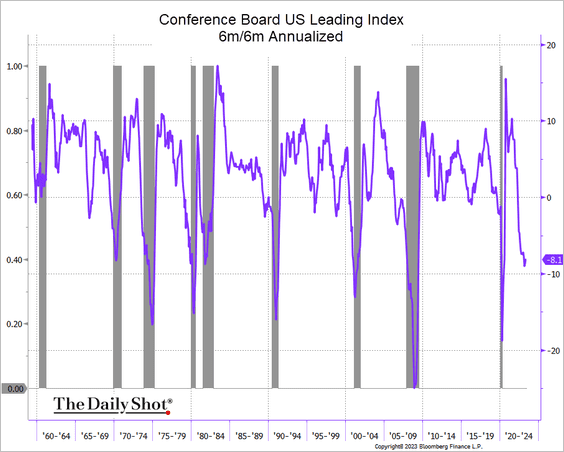

4. The Conference Board’s index of leading indicators is still signaling a recession ahead.

Source: Reuters Read full article

Source: Reuters Read full article

• This chart shows the 6-month rolling changes in the index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

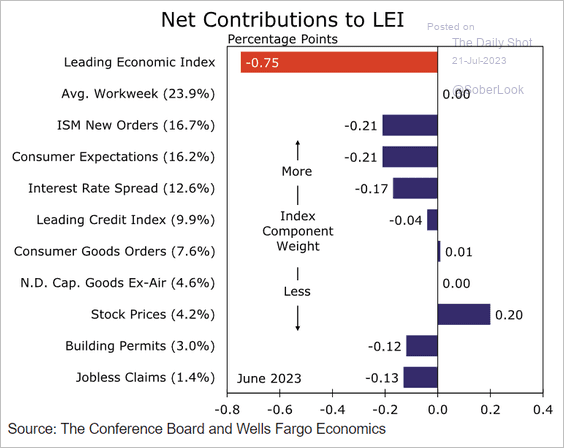

• Here are the contributions to last month’s changes.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

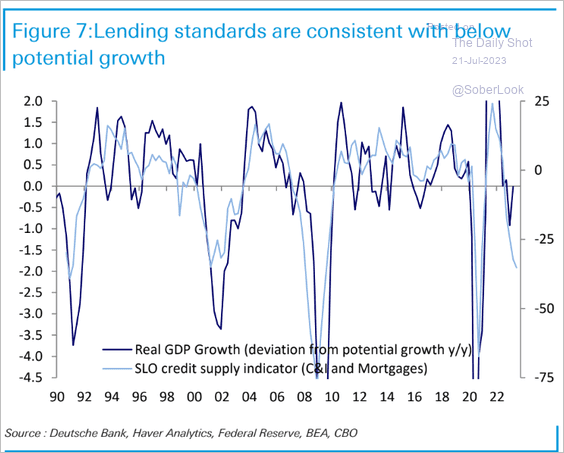

5. Tight credit conditions point to an economy that will likely expand well below its growth potential.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

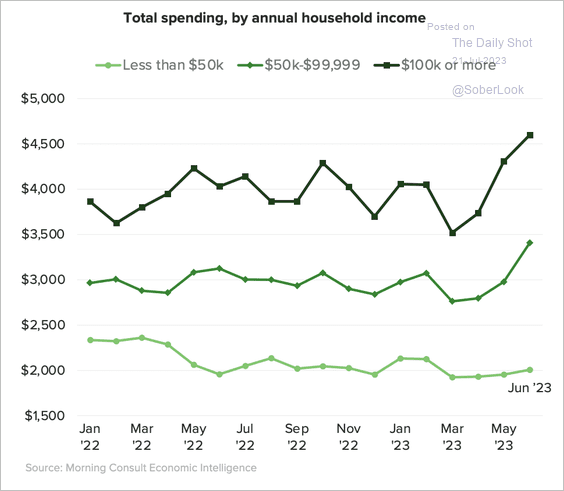

6. This chart from Morning Consult shows inflation-adjusted household spending by income.

Source: Morning Consult

Source: Morning Consult

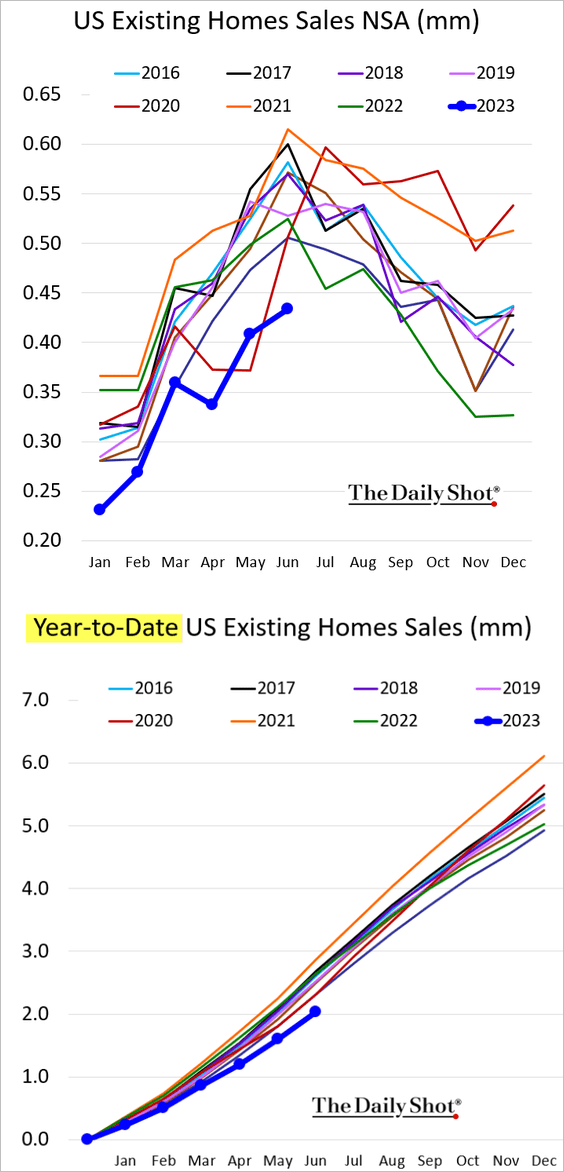

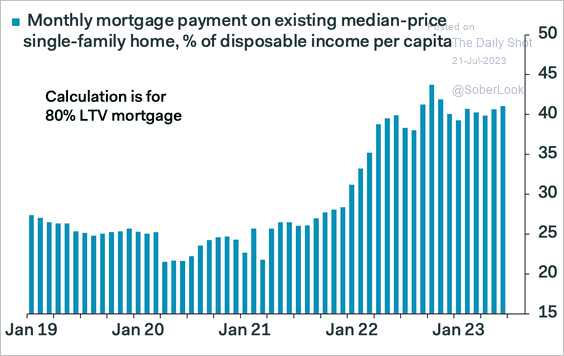

7. Existing home sales were soft last month, …

… as affordability remains a headwind for the housing market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

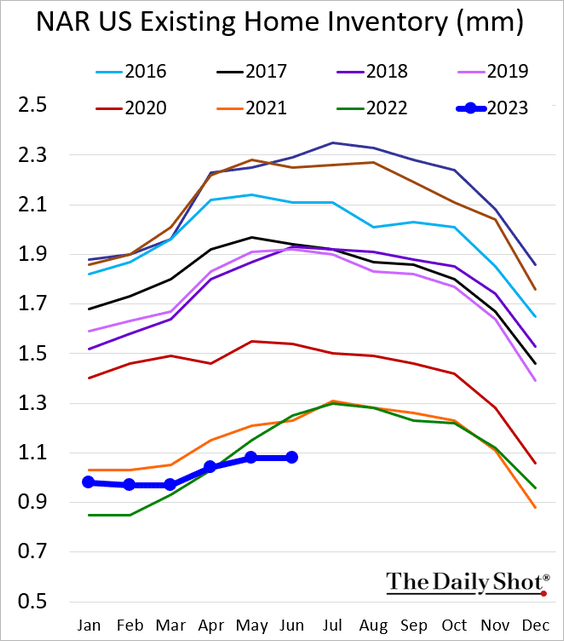

Housing inventories hit a new low for this time of the year.

——————–

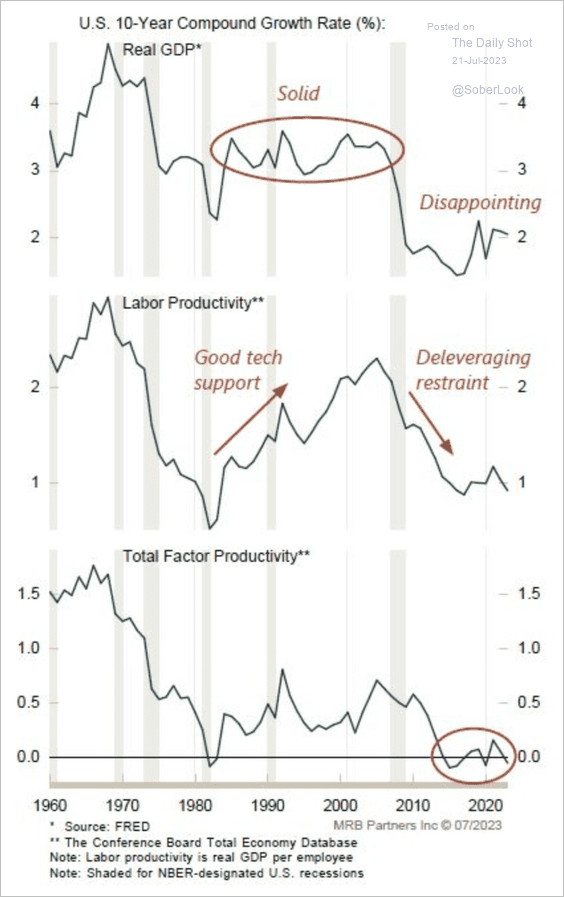

8. Labor productivity has been weak.

Source: MRB Partners

Source: MRB Partners

Back to Index

The Eurozone

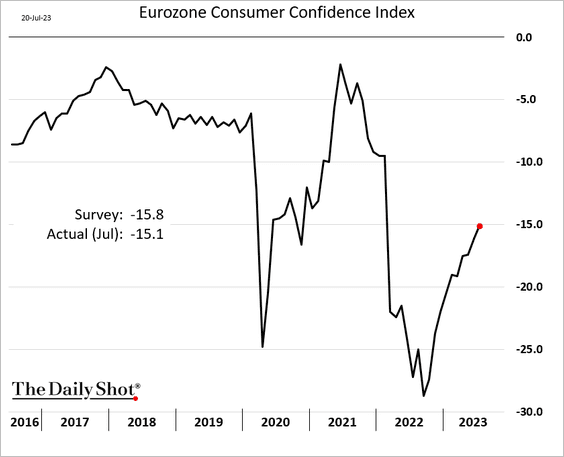

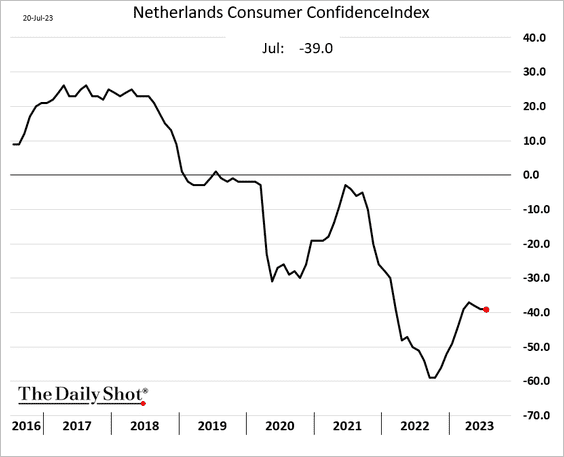

1. Consumer confidence continues to rebound.

But that’s not the case in all countries.

——————–

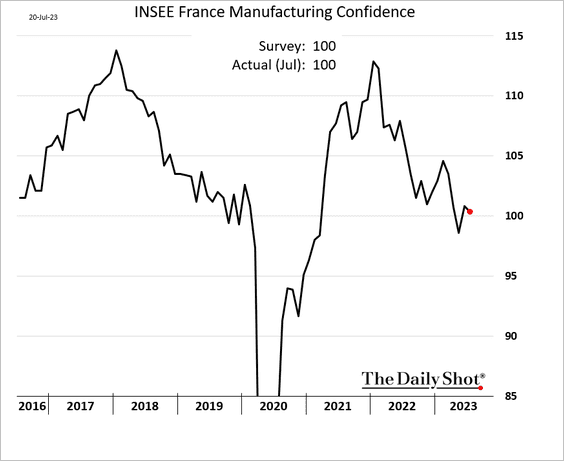

2. French manufacturing sentiment edged lower this month.

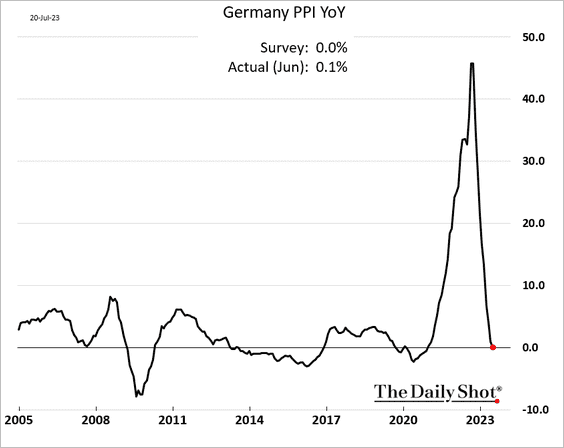

3. Germany’s PPI is crashing.

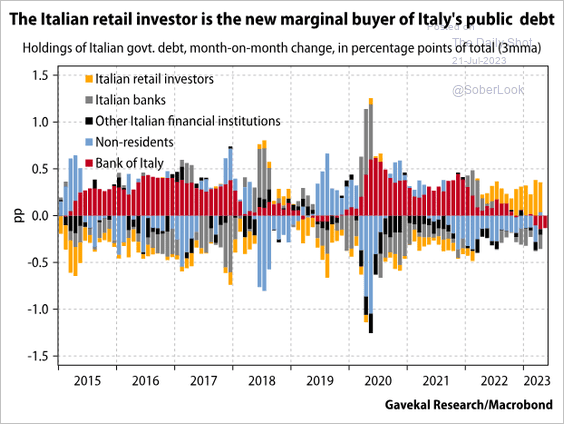

4. Who buys Italian government debt?

Source: Gavekal Research

Source: Gavekal Research

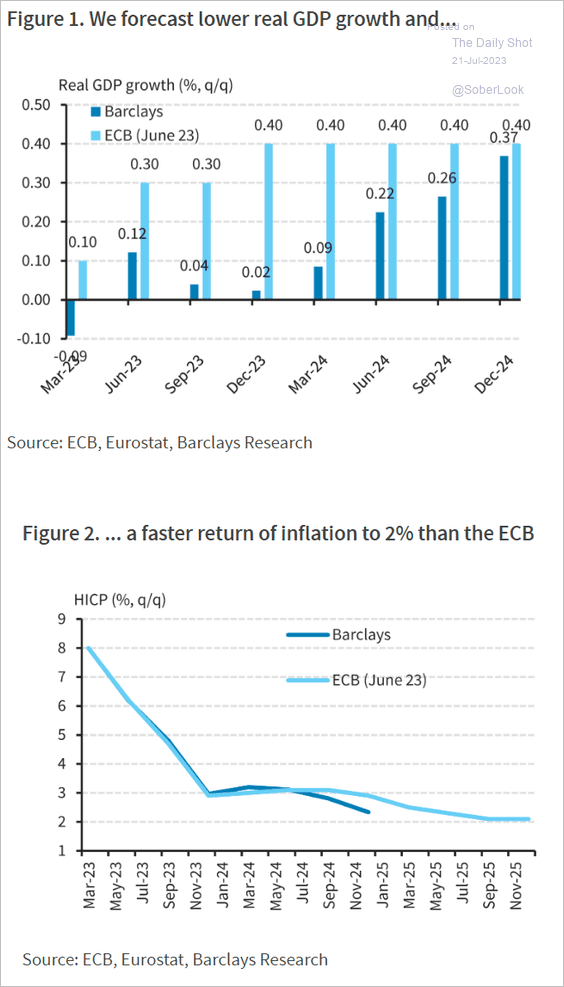

5. Barclays sees much weaker growth and lower inflation than the ECB’s forecasts.

Source: Barclays Research

Source: Barclays Research

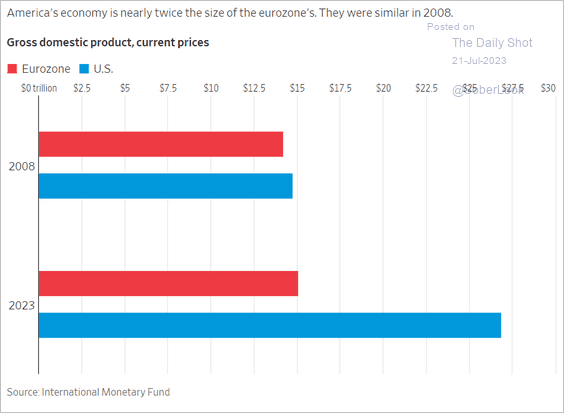

6. The Eurozone’s post-GFC economic growth has been weak.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Europe

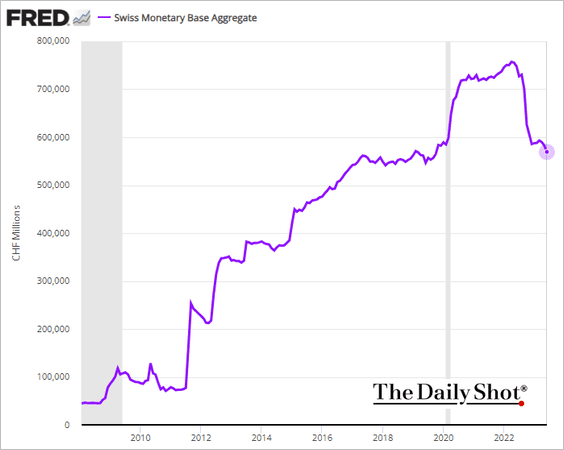

1. The Swiss central bank continues to tighten liquidity.

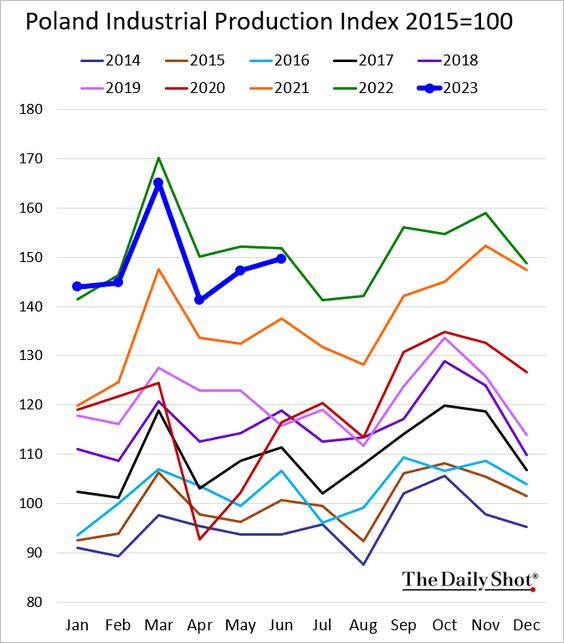

2. Poland’s industrial production is back near last year’s levels.

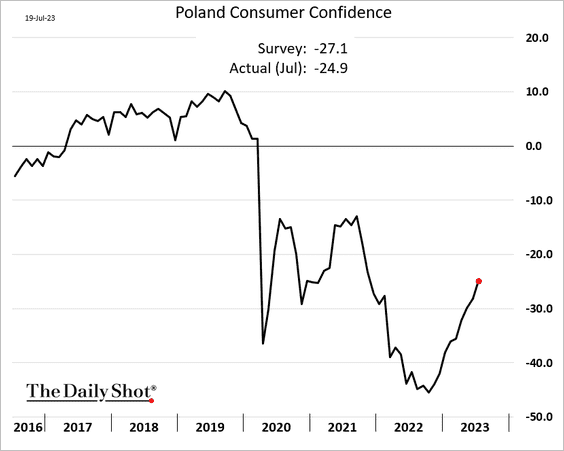

Consumer confidence is rebounding.

——————–

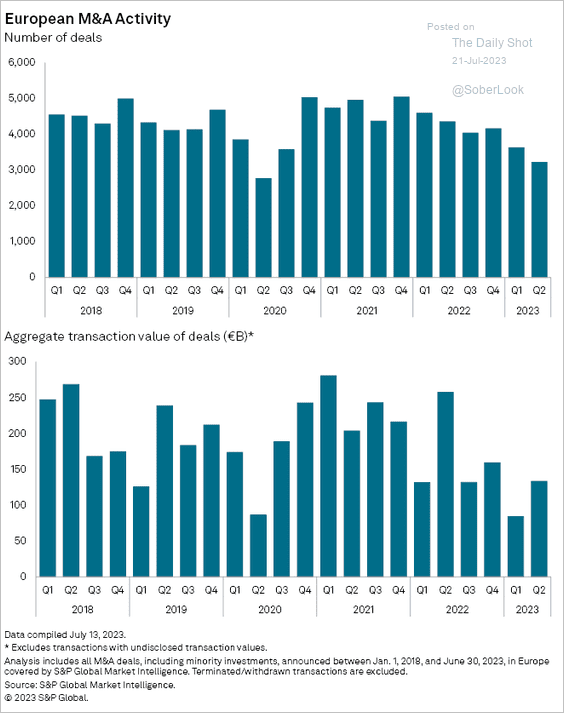

3. European M&A activity has been slowing.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

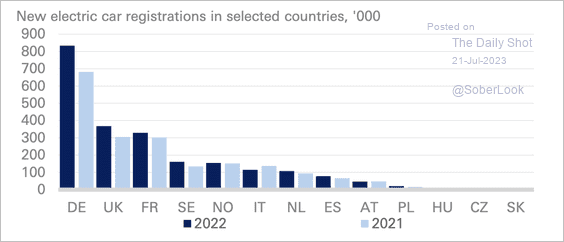

4. This chart shows new EV registrations by country.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Emerging Markets

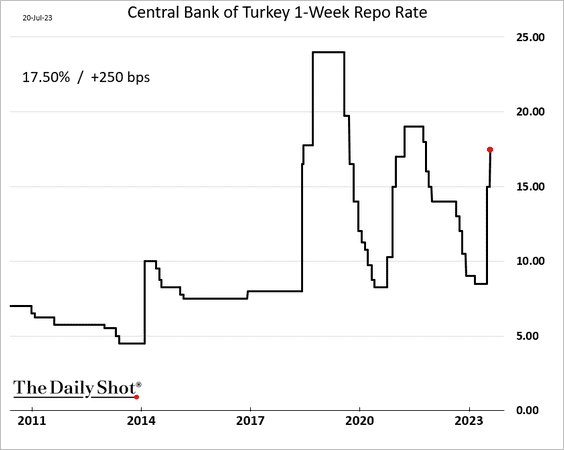

1. Turkey’s central bank (under “new management”) delivered another cautious rate hike (well below expectations).

Source: Reuters Read full article

Source: Reuters Read full article

——————–

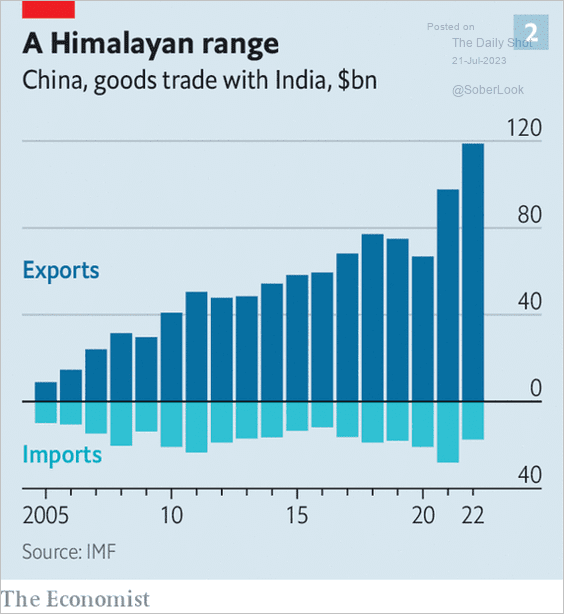

2. Here is India’s trade with China.

Source: The Economist Read full article

Source: The Economist Read full article

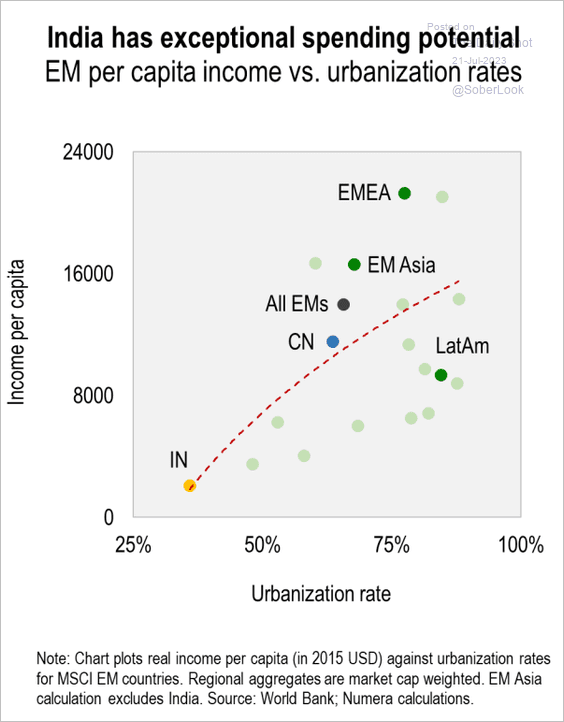

3. This scatterplot shows EM per-capita income vs. urbanization rates.

Source: @NumeraAnalytics

Source: @NumeraAnalytics

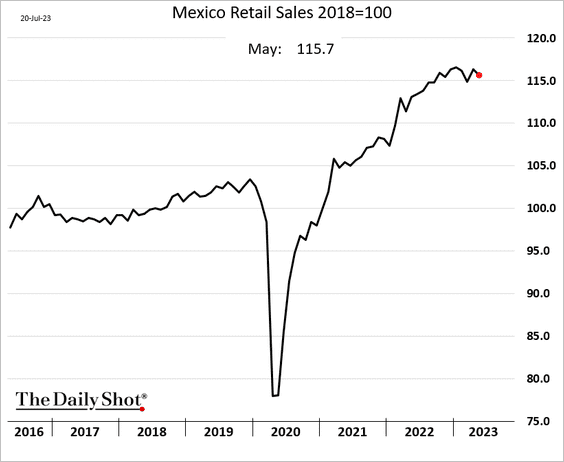

4. Mexico’s retail sales appear to have peaked for now.

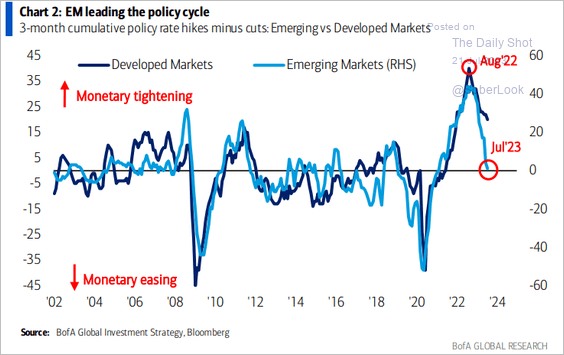

5. EM monetary policy easing has been outpacing DM.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

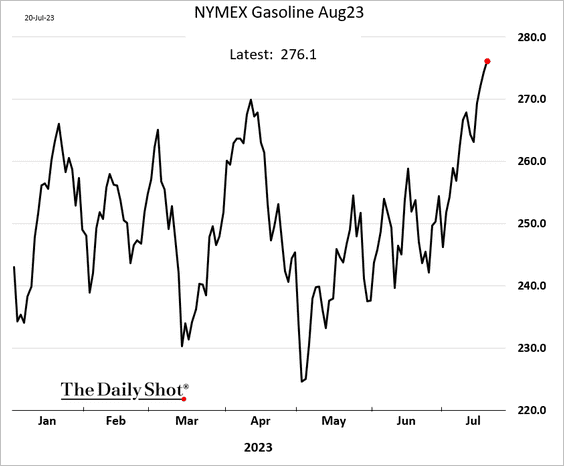

Energy

1. US gasoline futures have been rallying.

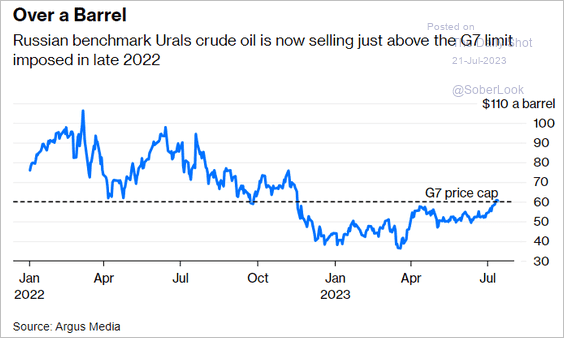

2. Russian crude oil is now trading slightly above the G7 limit.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

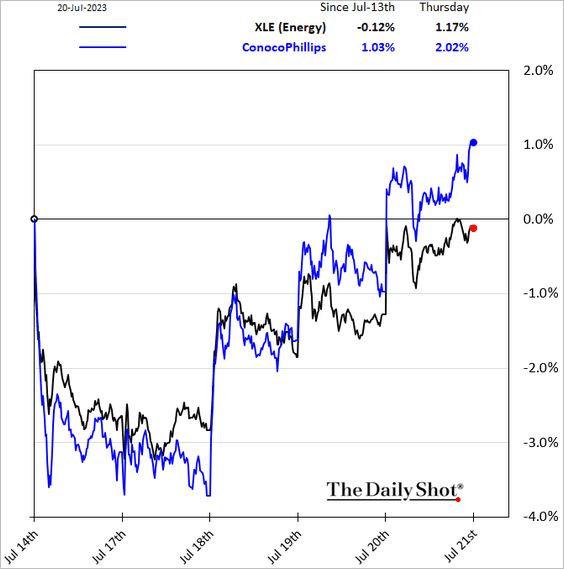

3. Energy shares have been rebounding.

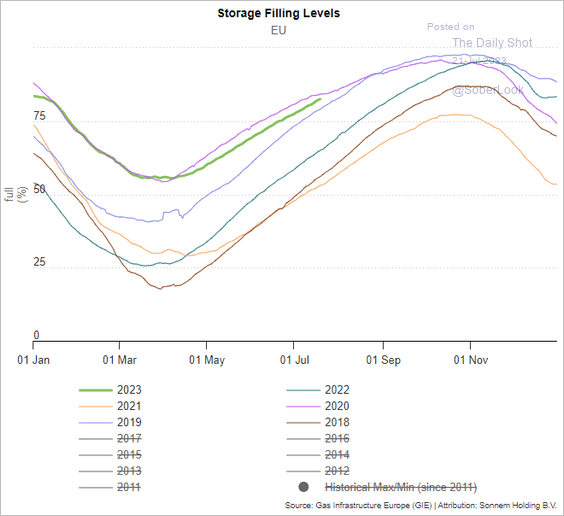

4. European natural gas in storage remained very high for this time of the year, …

Source: GIE

Source: GIE

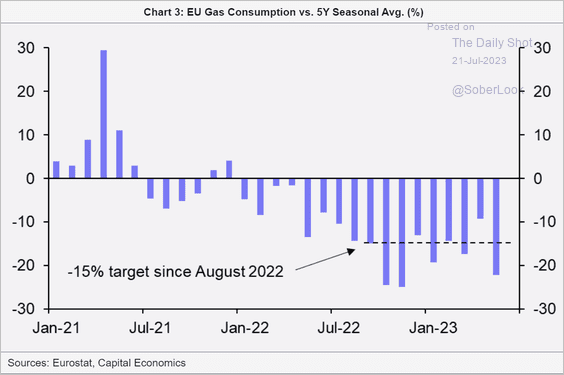

… driven by reduced consumption.

Source: Capital Economics

Source: Capital Economics

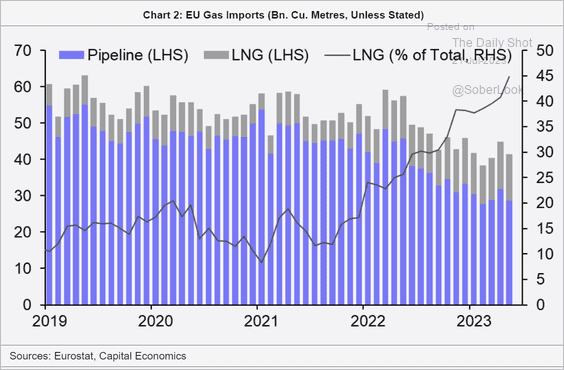

• EU LNG imports continue to rise as a share of total natural gas imports.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

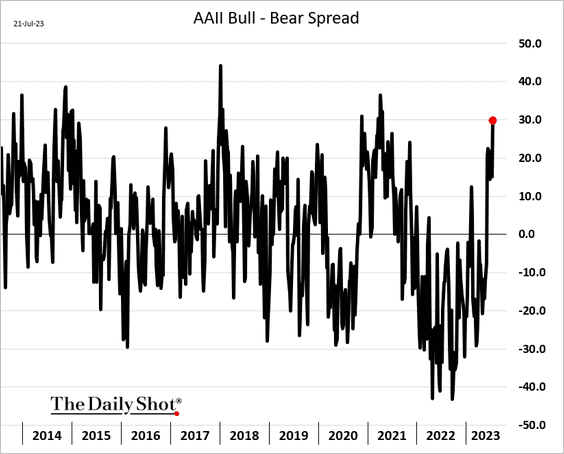

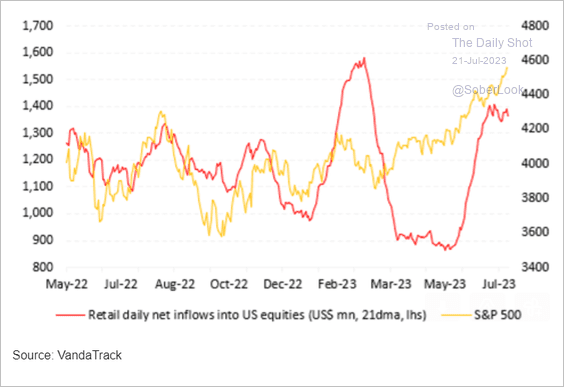

1. Retail investors are increasingly bullish, …

… continuing strong participation in the market.

Source: Vanda Research

Source: Vanda Research

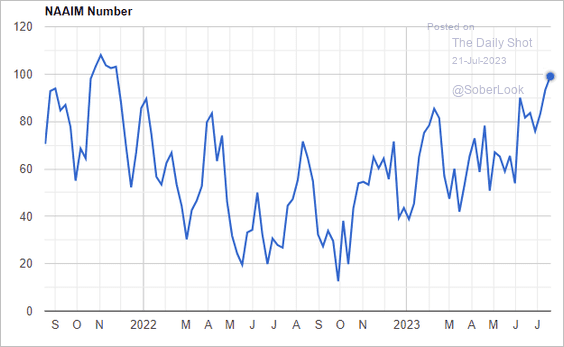

• Investment managers keep boosting their equity exposure.

Source: NAAIM

Source: NAAIM

——————–

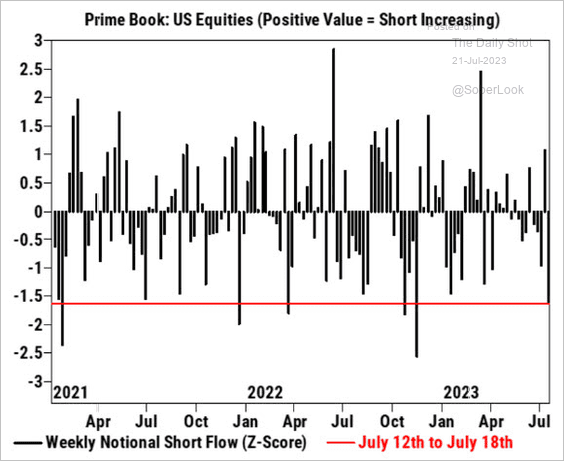

2. Hedge funds have been short-covering.

Source: Goldman Sachs, h/t @dailychartbook

Source: Goldman Sachs, h/t @dailychartbook

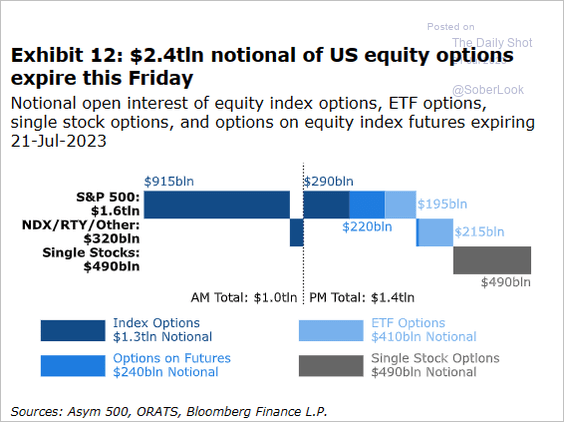

3. $2.4 trillion worth of equity options is expiring today.

Source: @markets Read full article

Source: @markets Read full article

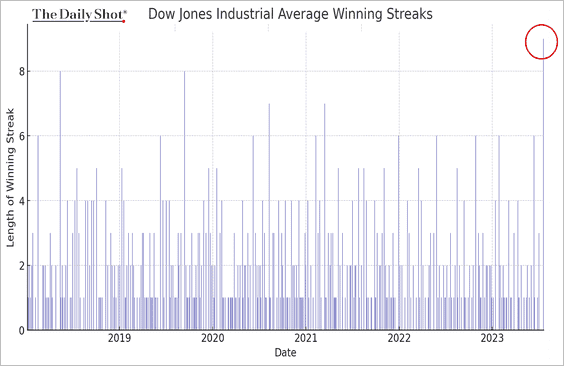

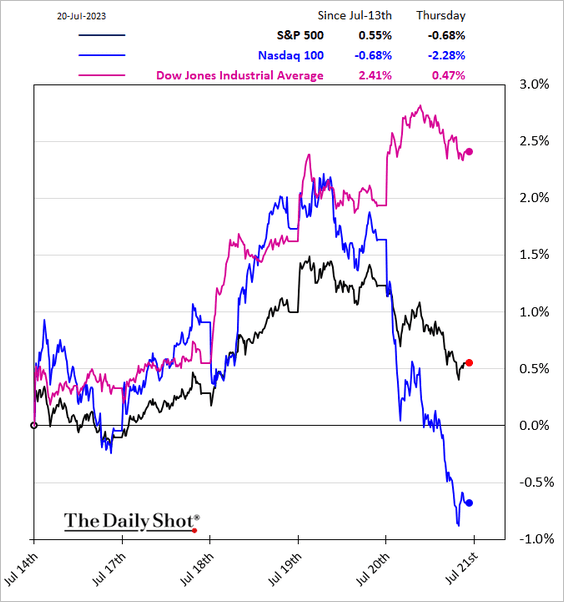

4. The Dow has been up for nine sessions in a row.

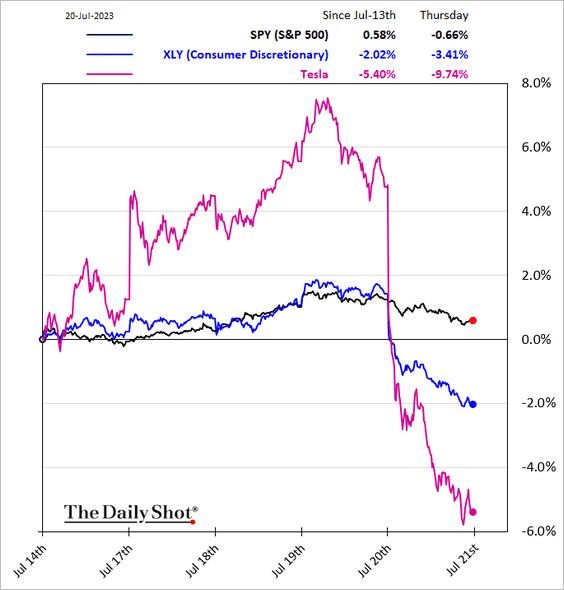

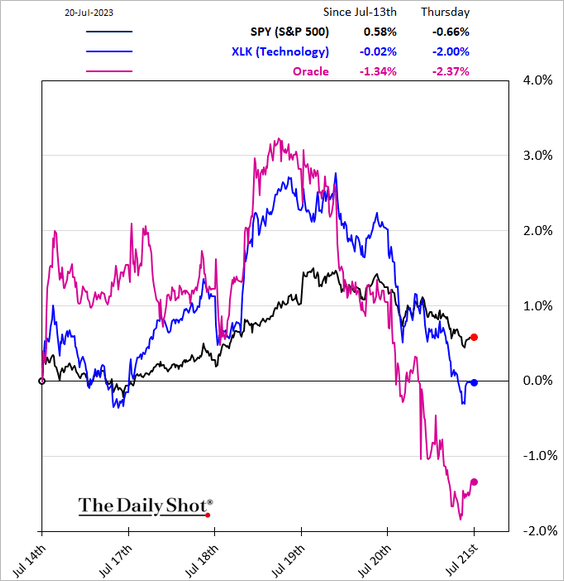

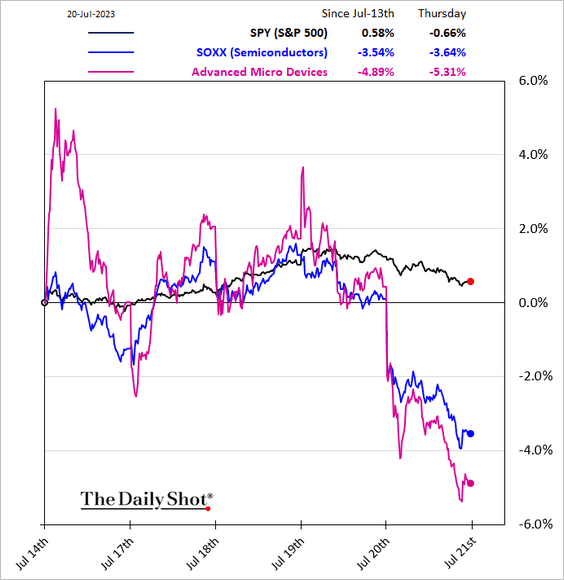

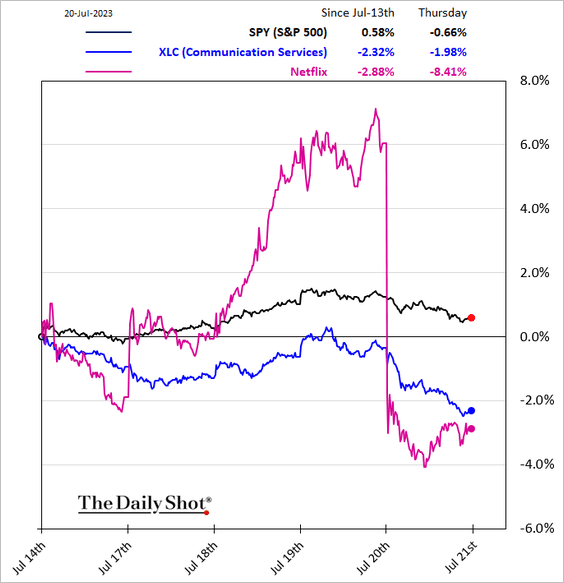

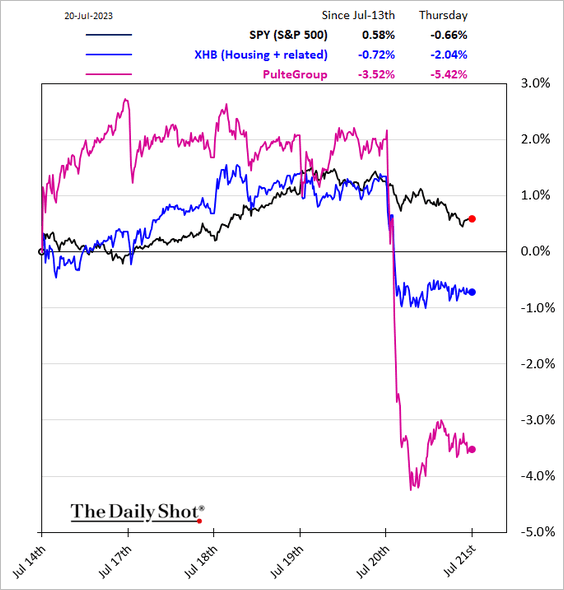

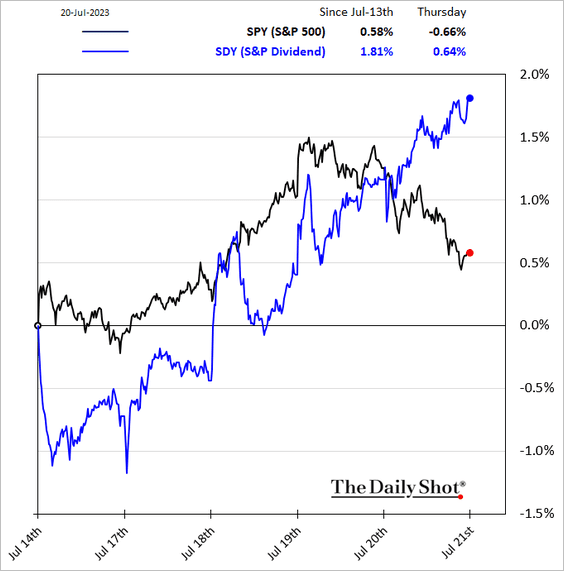

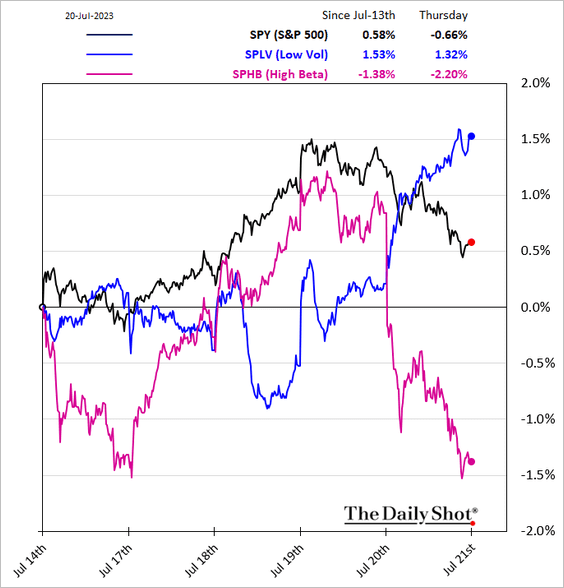

But US indices diverged on Thursday, …

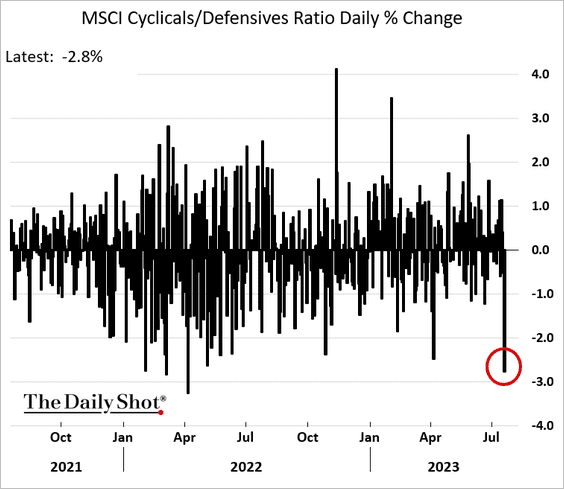

… as cyclicals tumbled relative to defensives.

——————–

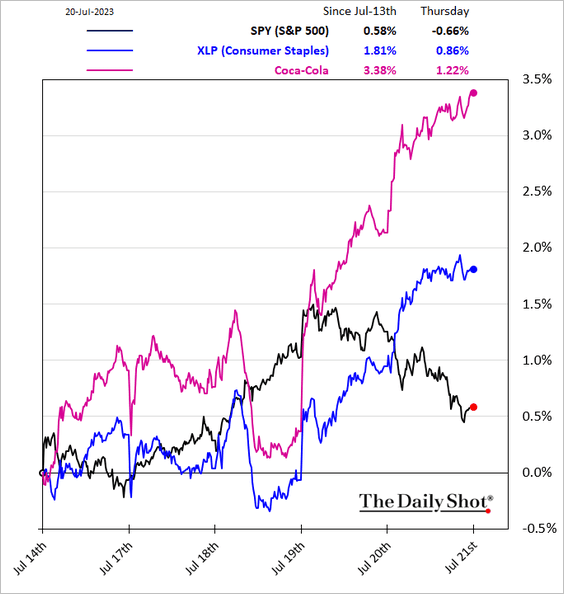

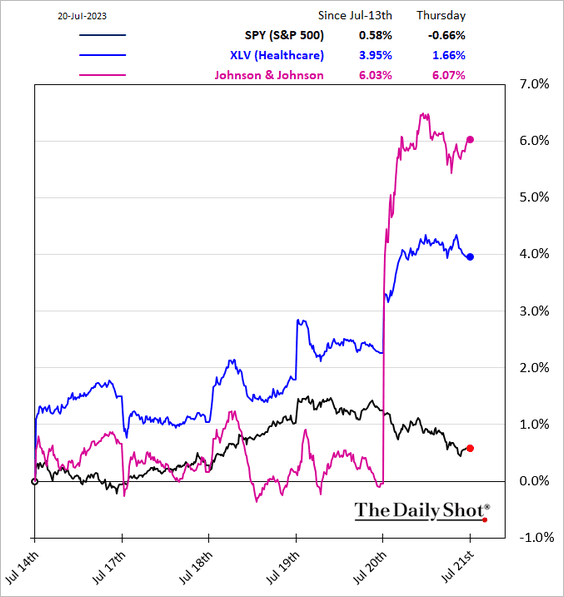

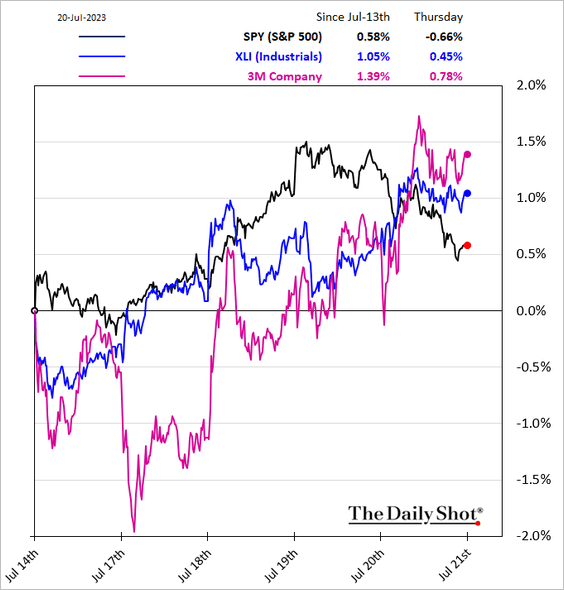

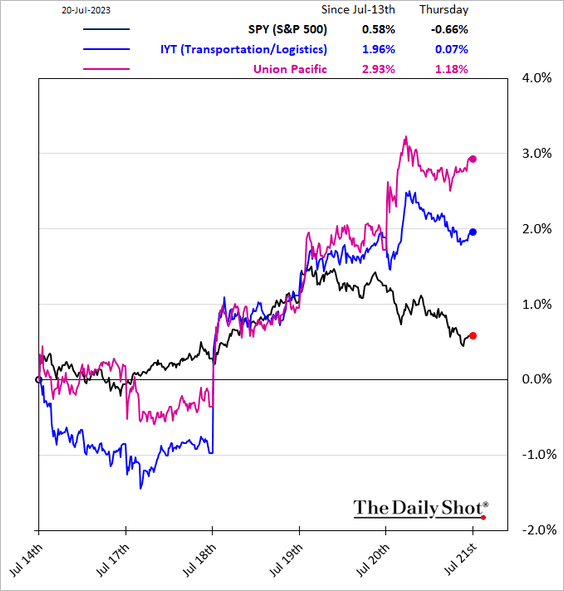

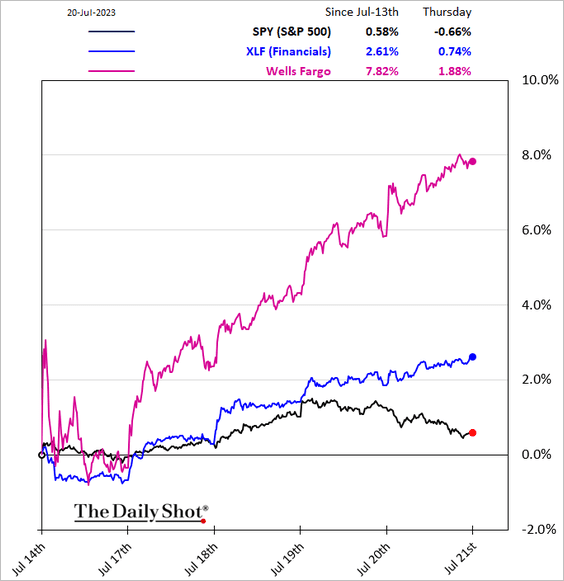

5. Let’s take a look at some sector movements contributing to the above divergence.

• Outperformers:

– Consumer Staples:

– Healthcare:

– Induatrials:

– Transportation:

– Financials:

• Underperformers:

– Consumer Discretionary:

– Tech, Semiconductors, Communication Services:

– Housing:

——————–

6. Here are a couple of equity factors.

• High-dividend:

• High-beta and low-vol:

——————–

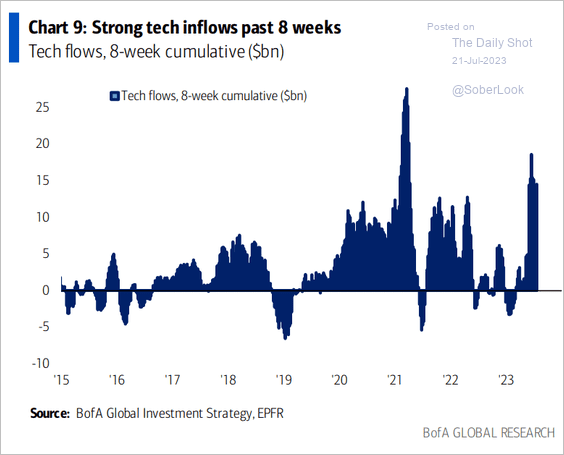

7. Tech fund inflows have been strong.

Source: BofA Global Research

Source: BofA Global Research

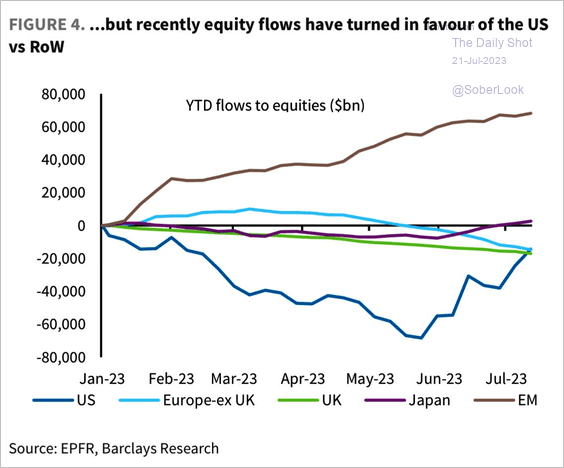

This chart shows global year-to-date equity fund flows.

Source: Barclays Research

Source: Barclays Research

——————–

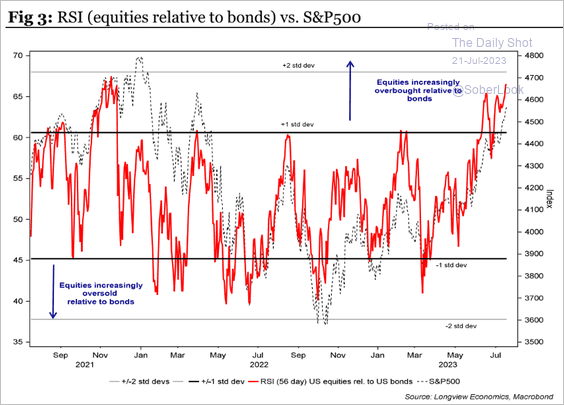

8. Technicals show that stocks are very overbought relative to bonds.

Source: Longview Economics

Source: Longview Economics

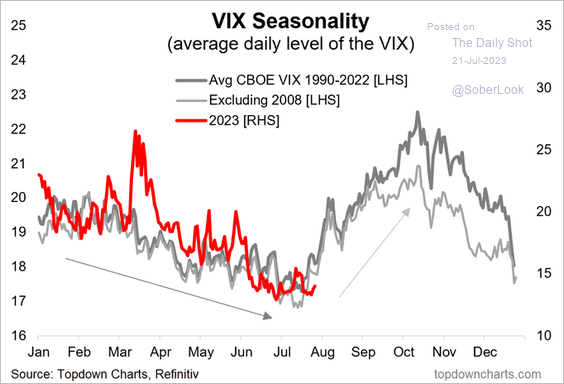

9. Is volatility about to surge?

Source: @Callum_Thomas

Source: @Callum_Thomas

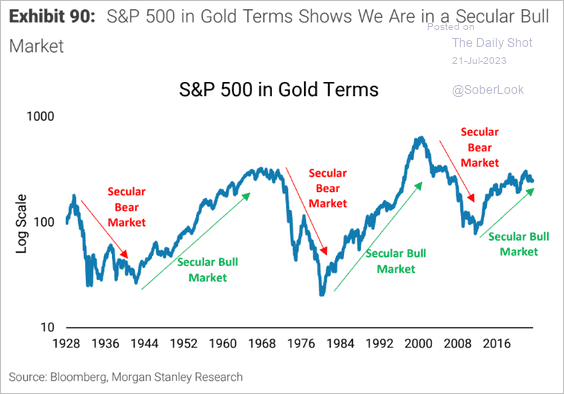

10. This chart shows the S&P 500 priced in gold terms.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

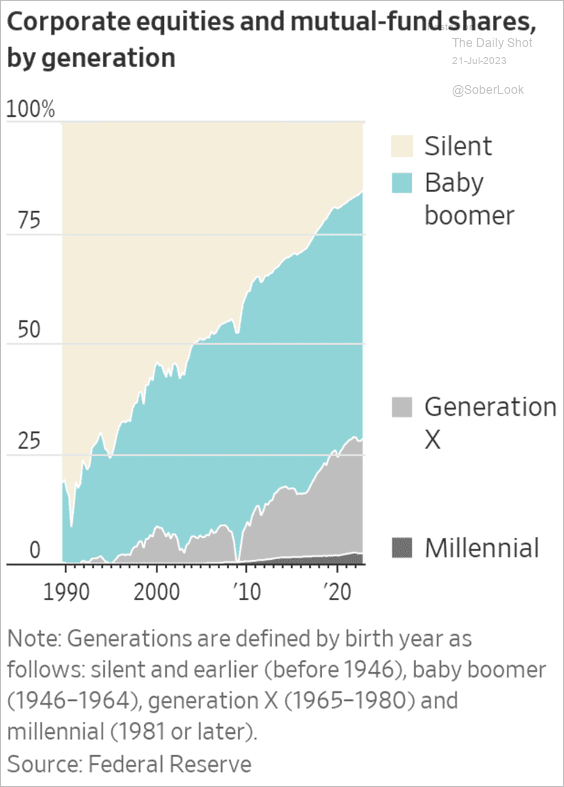

11. Finally, we have US equity holdings by generation.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

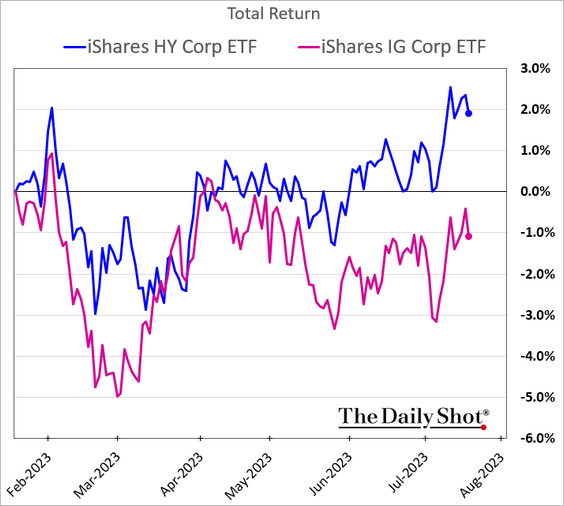

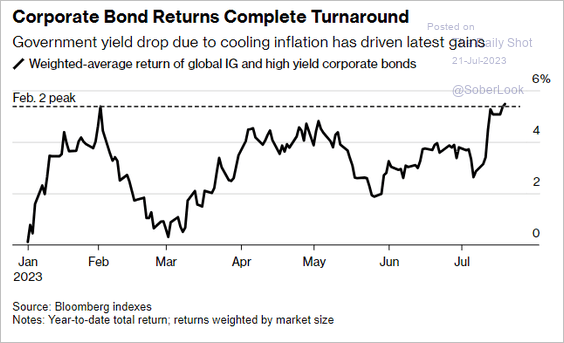

1. High-yield bonds are outperforming investment-grade debt.

The overall corporate bond rally has been impressive.

Source: @markets Read full article

Source: @markets Read full article

——————–

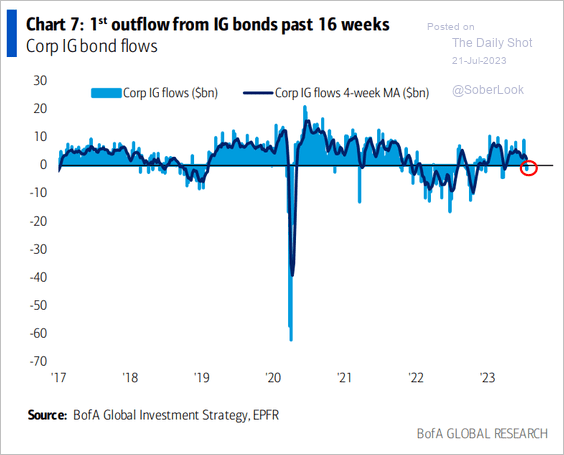

2. Investment-grade bond funds saw some outflows recently.

Source: BofA Global Research

Source: BofA Global Research

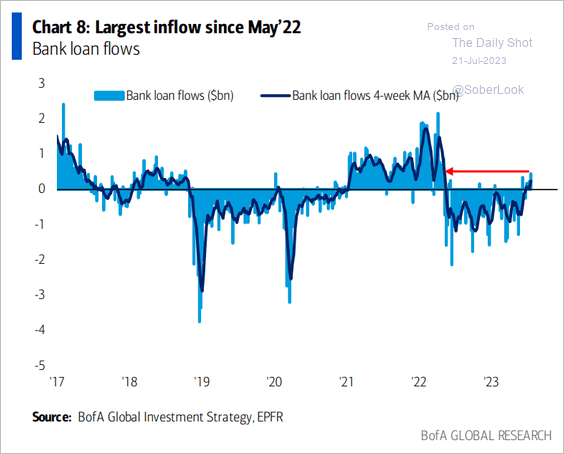

But leveraged loans are getting fresh capital.

Source: BofA Global Research

Source: BofA Global Research

——————–

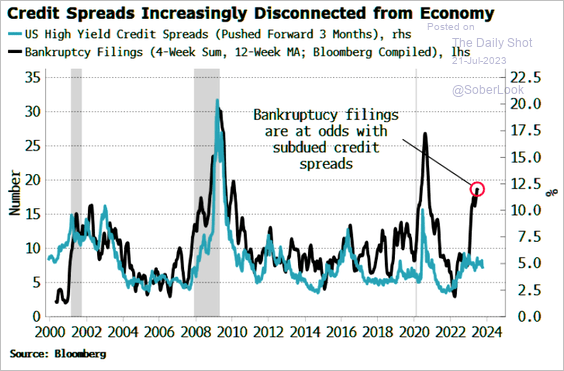

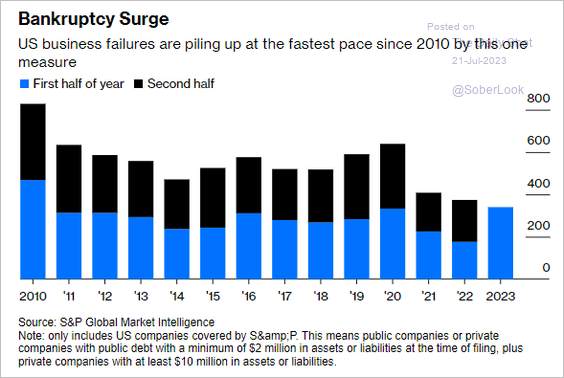

3. Increased bankruptcy levels point to wider HY spreads.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Source: @chrismbryant, @opinion Read full article

Source: @chrismbryant, @opinion Read full article

——————–

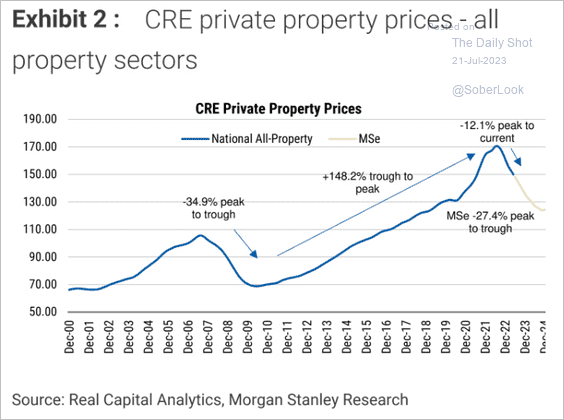

4. Commercial property prices are headed lower.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

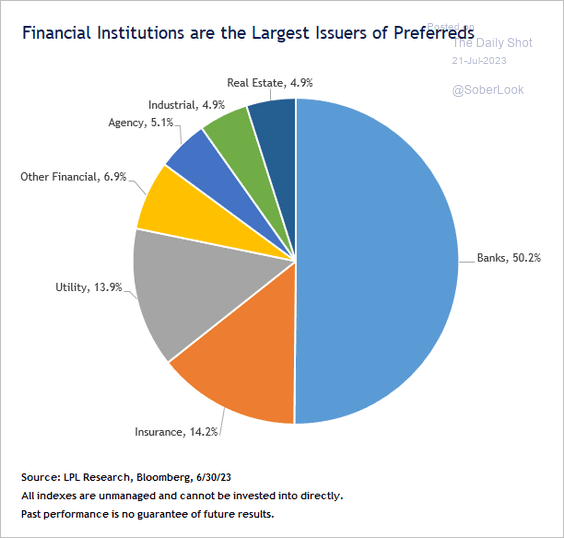

5. Who issues preferred securities?

Source: LPL Research

Source: LPL Research

Back to Index

Global Developments

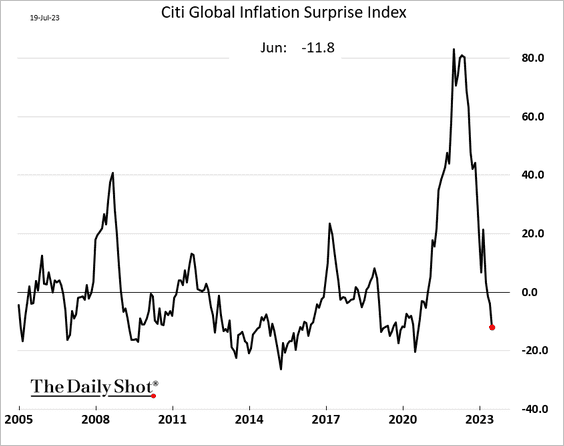

1. Inflation indicators continue to surprise to the downside.

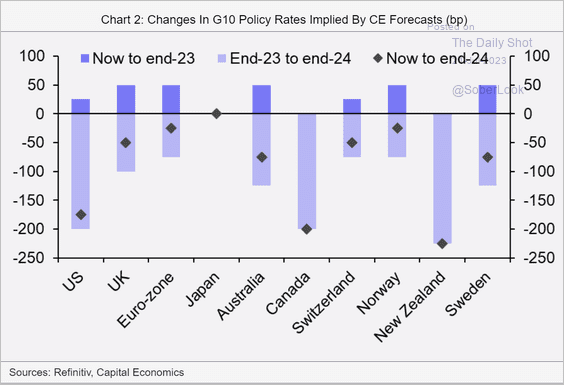

2. Advanced economies will see substantial rate cuts next year, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

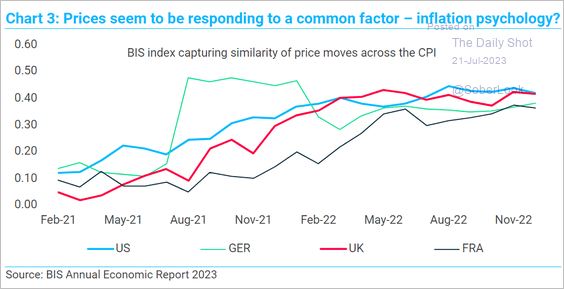

3. Advanced economies’ price changes across categories are converging.

TS Lombard: – This makes the general price level more relevant for individual decisions, which could be a sign that a sort of “inflation psychology “ is becoming entrenched.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

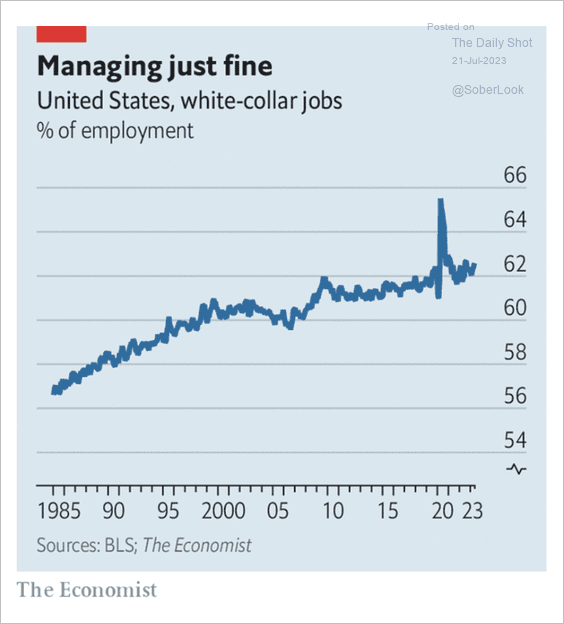

1. US white-collar jobs:

Source: The Economist Read full article

Source: The Economist Read full article

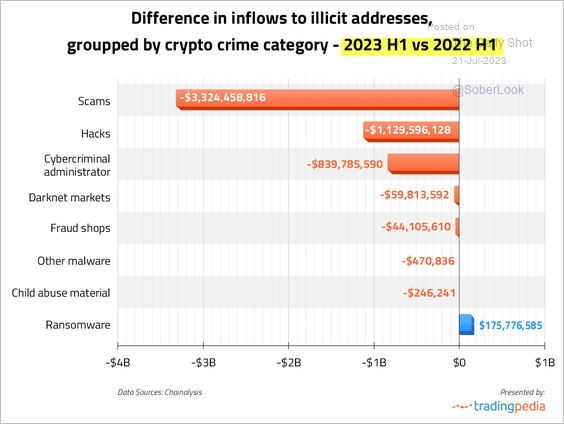

2. A large drop in crypto crime in 2023:

Source: TradingPedia

Source: TradingPedia

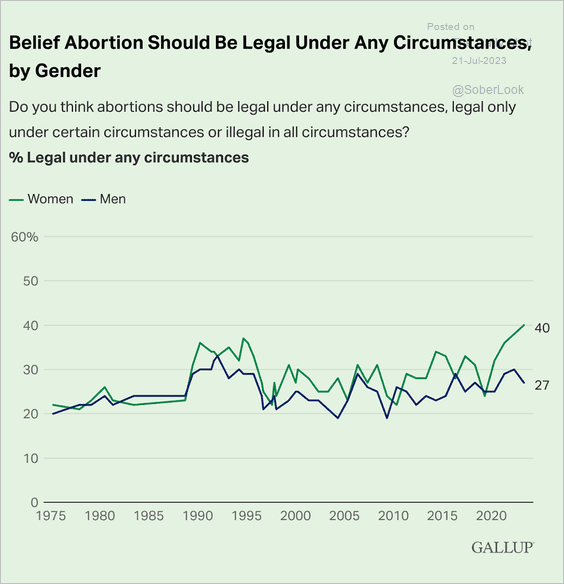

3. Views on abortion:

Source: Gallup Read full article

Source: Gallup Read full article

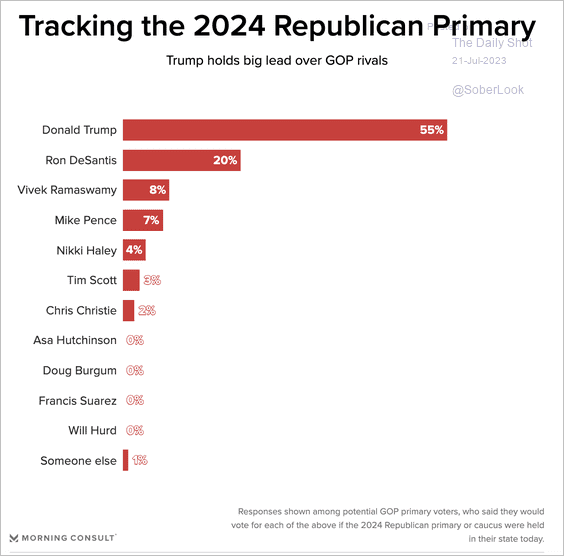

4. GOP presidential nomination poll:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

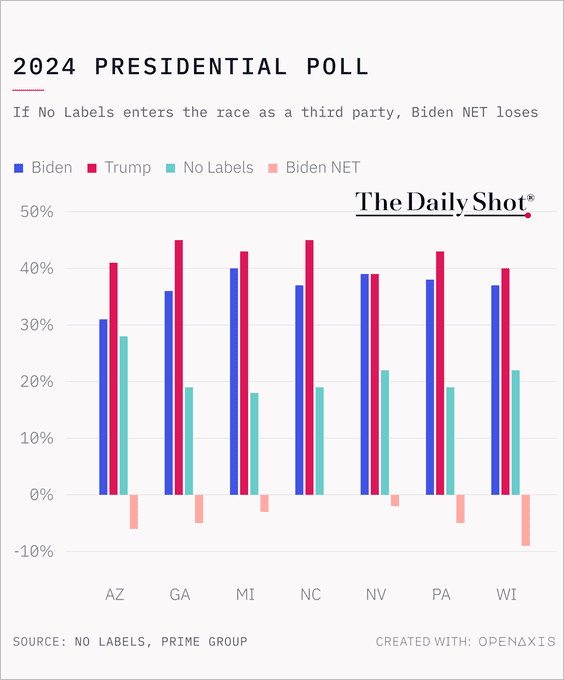

5. How will a third-party candidate impact Biden’s chances in key states?

Source: @TheDailyShot

Source: @TheDailyShot

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

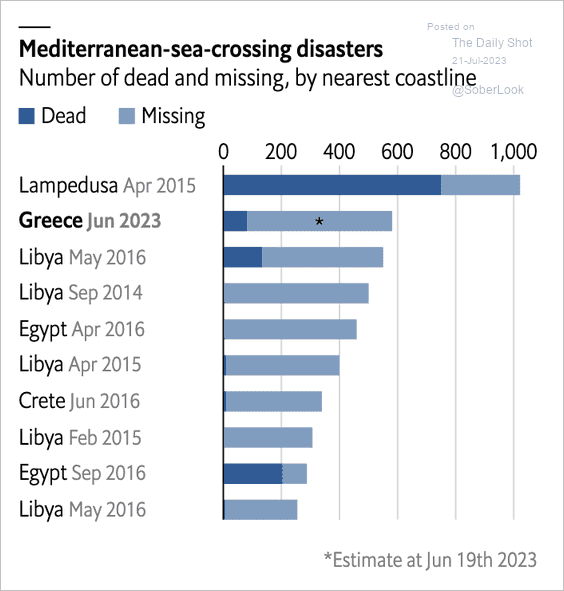

6. Mediterranean-sea-crossing disasters:

Source: The Economist Read full article

Source: The Economist Read full article

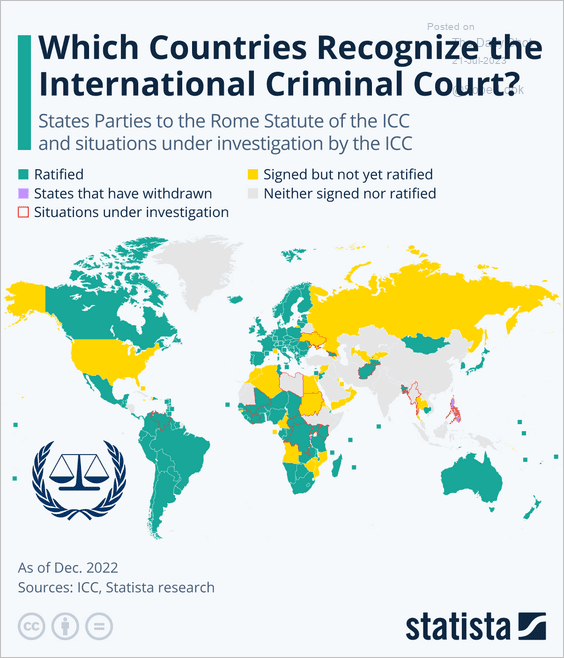

7. Which countries recognize the International Criminal Court?

Source: Statista

Source: Statista

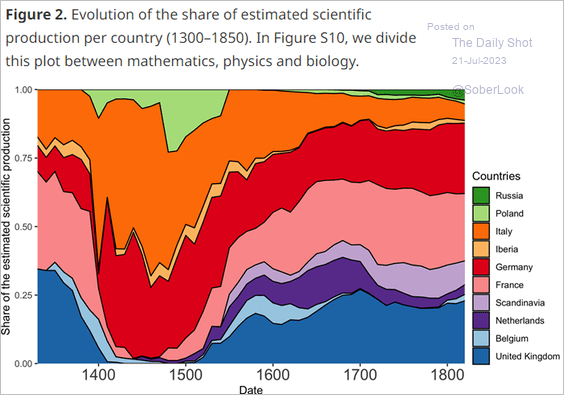

8. Evolution of the share of estimated scientific production per country 1300-1850:

Source: Cambridge University Read full article

Source: Cambridge University Read full article

——————–

Have a great weekend!

Back to Index