The Daily Shot: 09-Aug-23

• The United States

• Canada

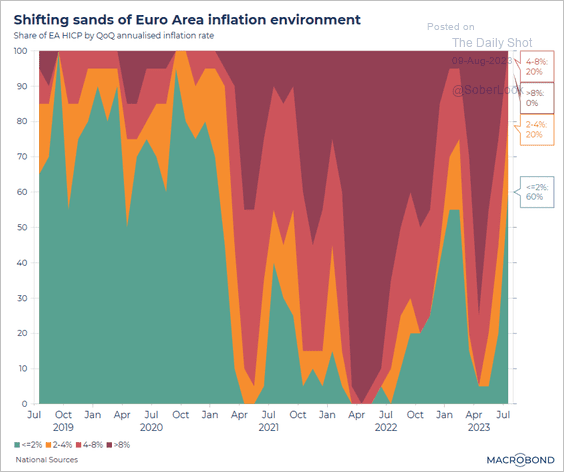

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

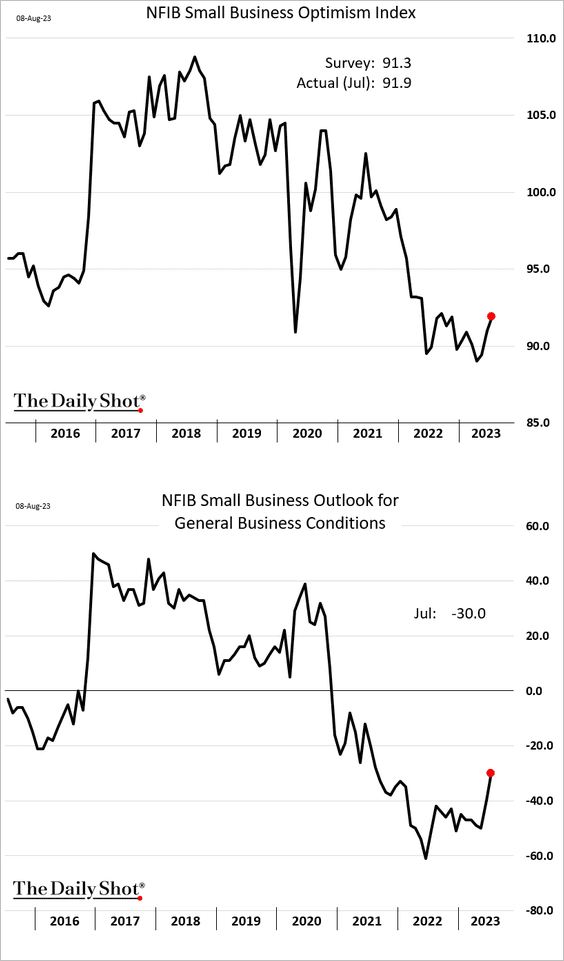

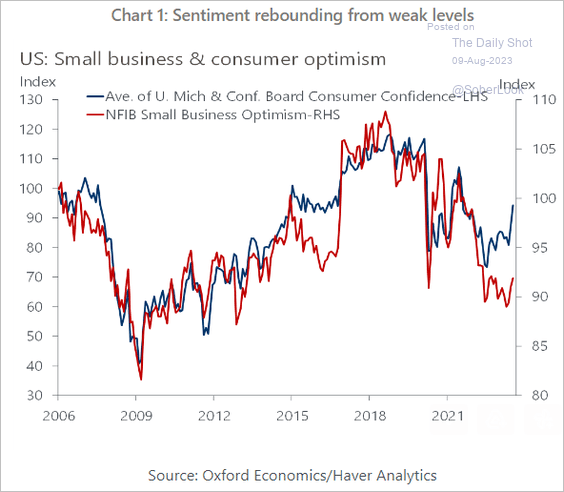

1. The NFIB small business sentiment index climbed again last month, boosted in part by the stock market strength.

Source: Reuters Read full article

Source: Reuters Read full article

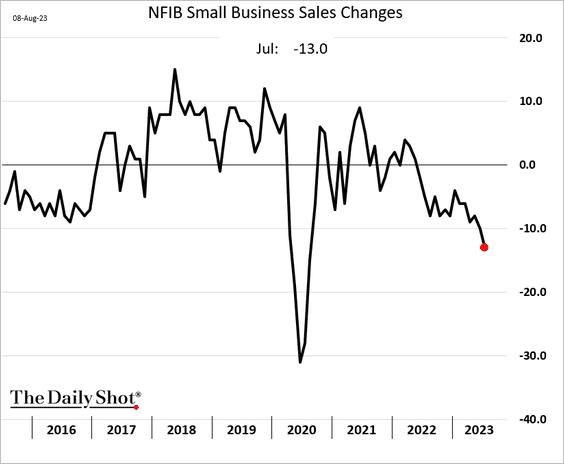

• More small businesses reported declining sales.

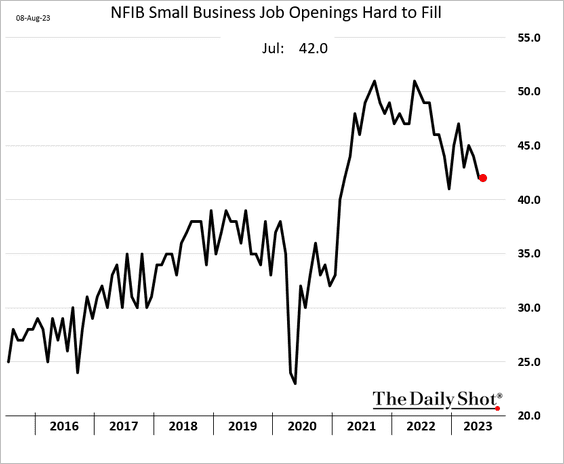

• Hiring remains challenging.

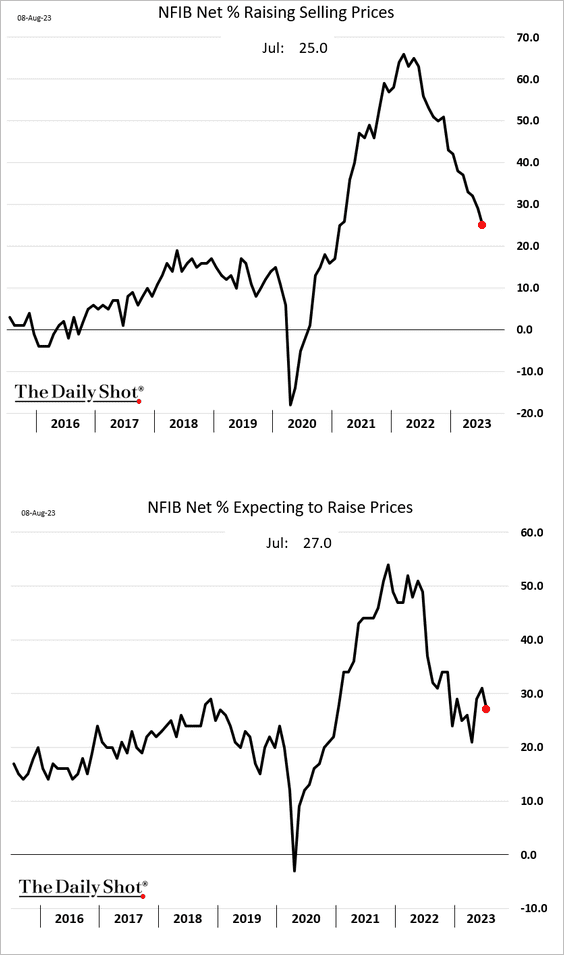

• Price gains are moderating …

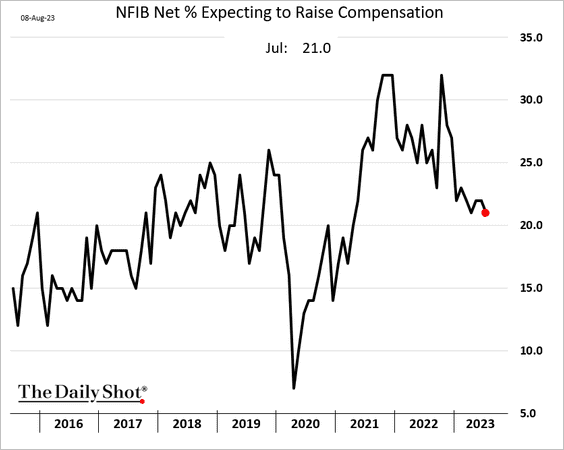

… and so are compensation plans.

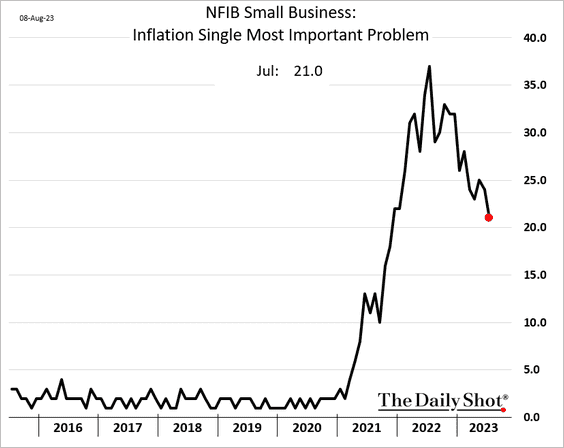

• Fewer firms see inflation as the most important problem.

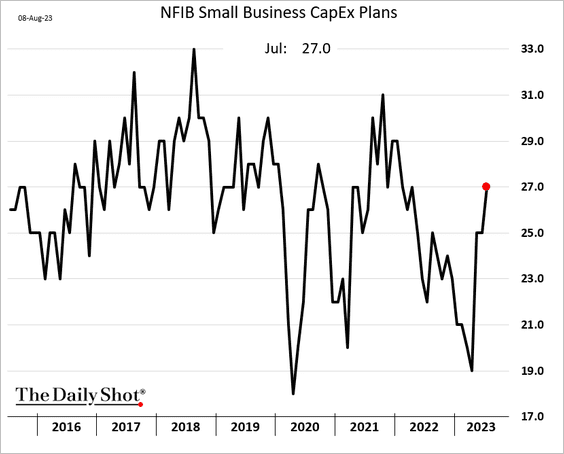

• CapEx expectations have been rebounding.

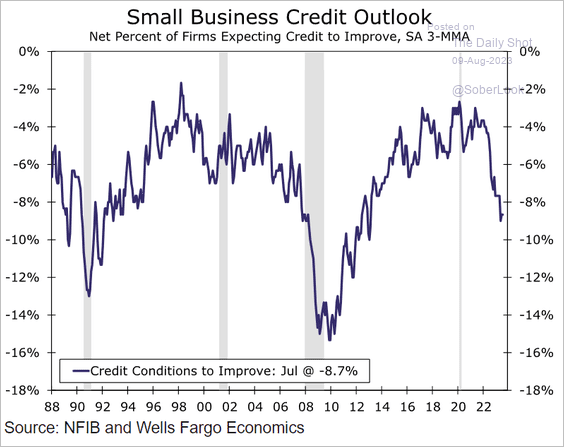

• Businesses remain concerned about credit conditions.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

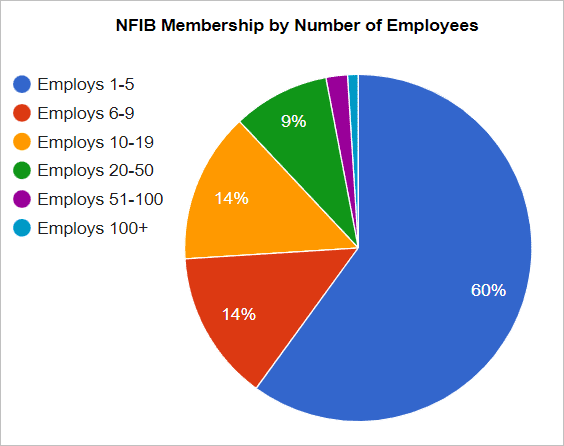

• Most NFIB members are very small companies, with survey responses provided by owners.

As a result, the NFIB headline index tends to be highly correlated with consumer surveys and impacted by indicators such as the stock market. One key difference is that consumer surveys are adjusted to reflect the representation of political parties in the population. The NFIB index is not.

Source: Oxford Economics

Source: Oxford Economics

——————–

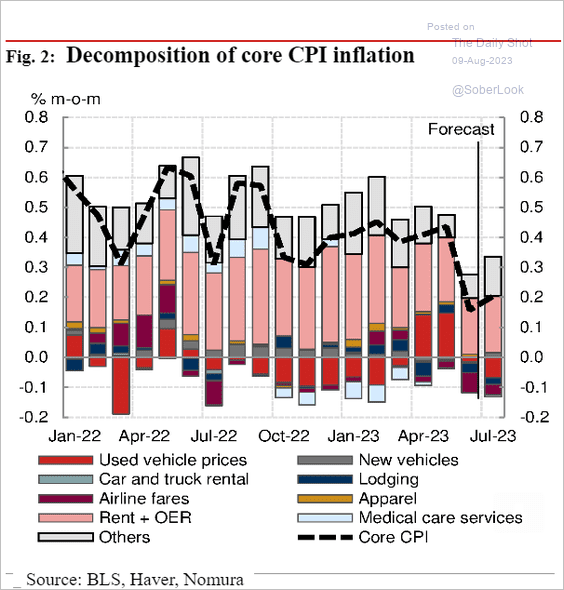

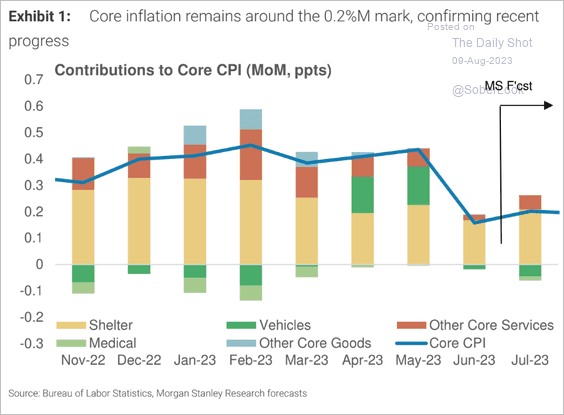

2. Next, we have some updates on inflation.

• Economists expect an uptick in the monthly core CPI change for July.

– Nomura:

Source: Nomura Securities

Source: Nomura Securities

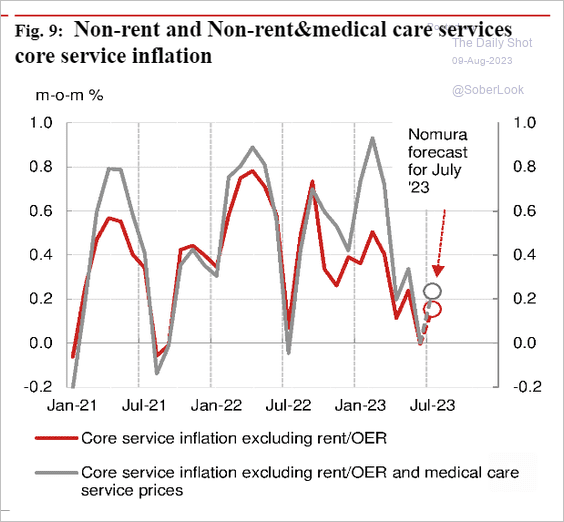

Here is the supercore inflation forecast.

Source: Nomura Securities

Source: Nomura Securities

– Morgan Stanley:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

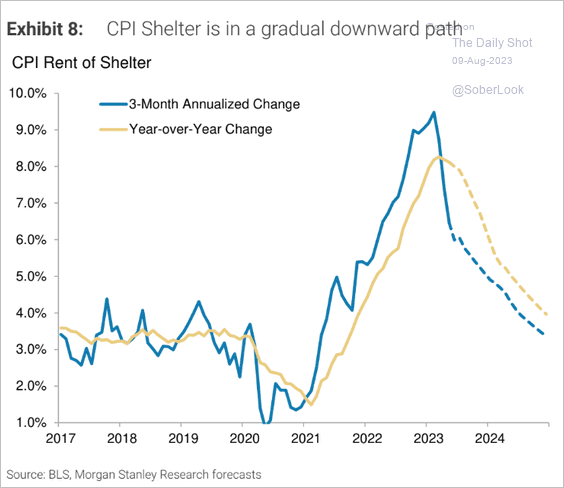

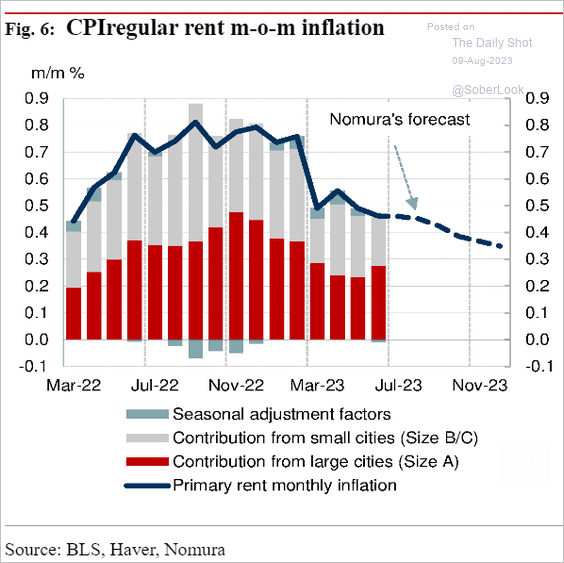

• The declines in rent inflation are expected to be gradual.

– Morgan Stanley (year-over-year and 3-month changes):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

– Nomura (monthly changes):

Source: Nomura Securities

Source: Nomura Securities

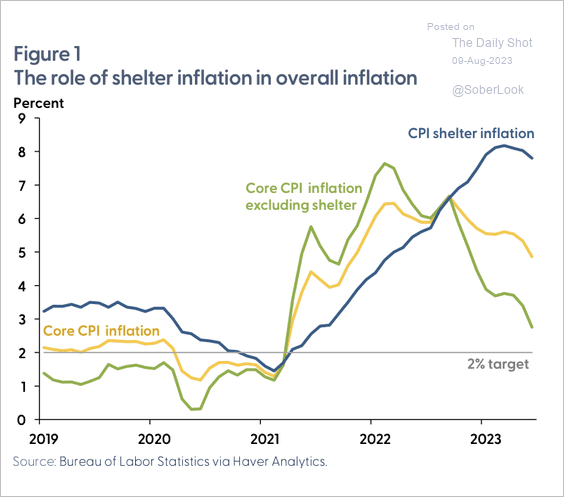

• How does shelter impact the core CPI?

Source: FRBSF Read full article

Source: FRBSF Read full article

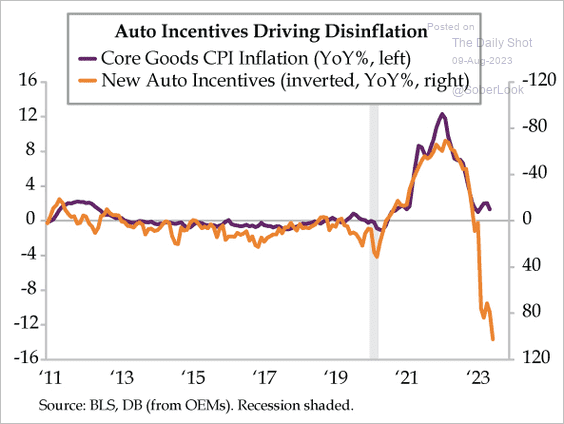

• Dealer incentives point to slower new vehicle CPI.

Source: Quill Intelligence

Source: Quill Intelligence

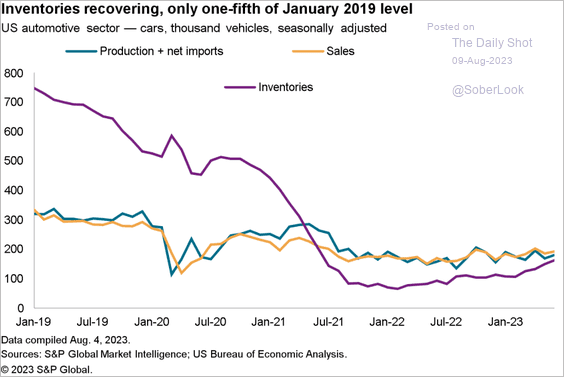

By the way, vehicle inventories are recovering very gradually.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

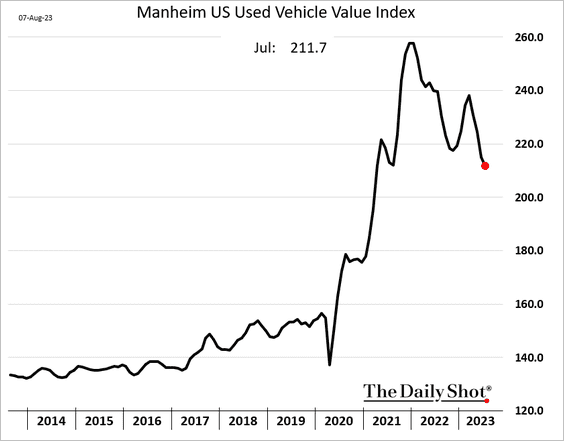

• Used vehicle prices eased further in July.

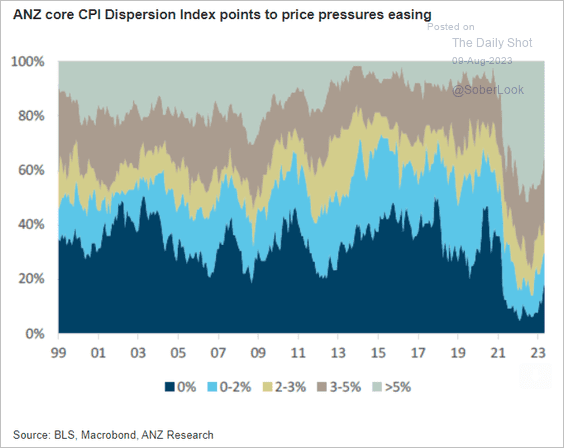

• Here is the CPI diffusion chart.

Source: @ANZ_Research

Source: @ANZ_Research

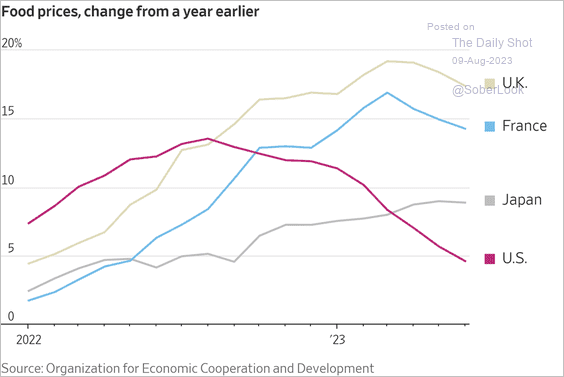

• US food inflation slowed faster than in other advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

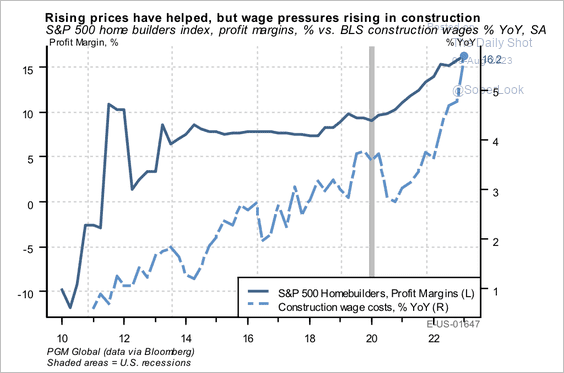

• Construction wage costs have accelerated, although rising house prices kept home builder margins afloat.

Source: PGM Global

Source: PGM Global

——————–

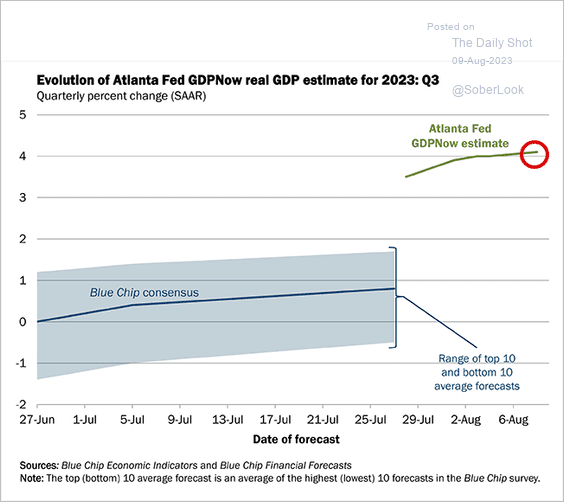

3. The GDPNow model has the Q3 growth running above 4% (annualized).

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

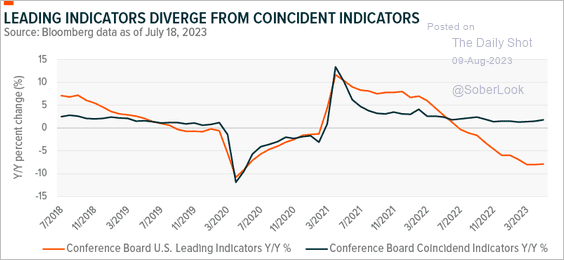

• According to Global X, if a recession is avoided, it is possible that leading indicators bottom out without a substantial decline in coincident indicators.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

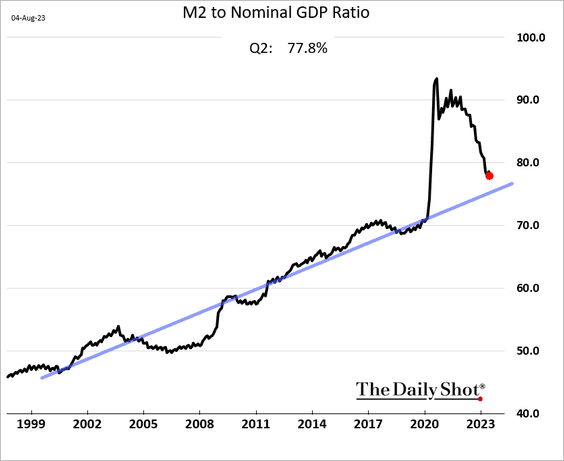

4. The broad money supply as a share of GDP has declined sharply from the peak but remains above the pre-COVID trend.

Back to Index

Canada

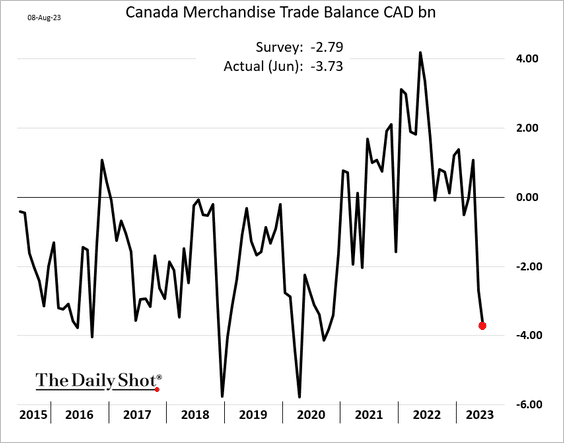

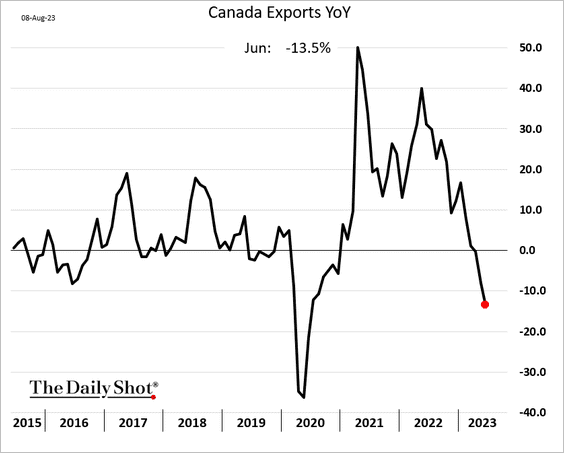

1. The trade deficit widened sharply in June, …

… as exports slowed.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

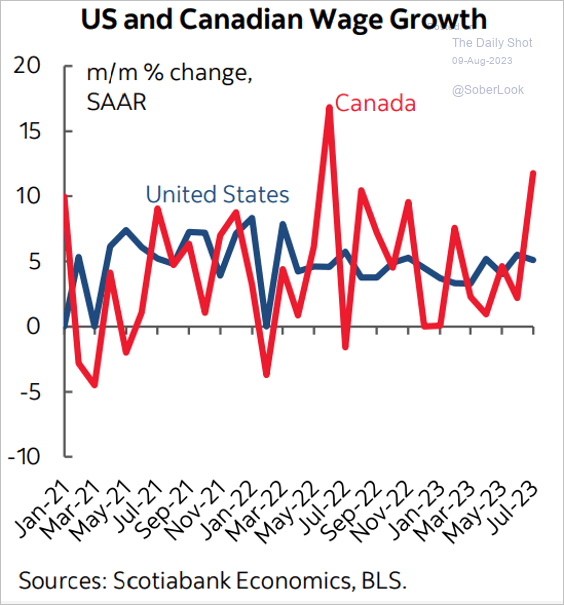

2. Canada’s wage growth has been outpacing the US.

Source: Scotiabank Economics

Source: Scotiabank Economics

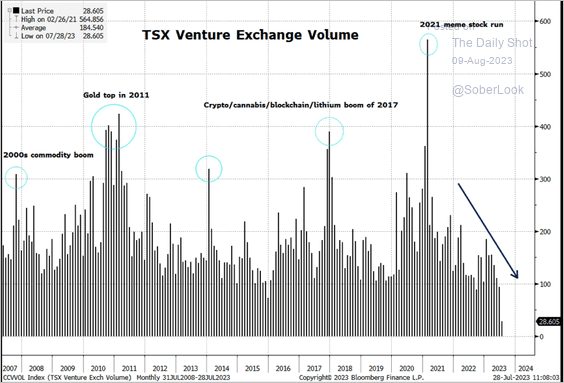

3. TSX Venture Exchange (microcaps) volumes collapsed in recent months, similar to late-2015, which marked the bottom of a downcycle.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

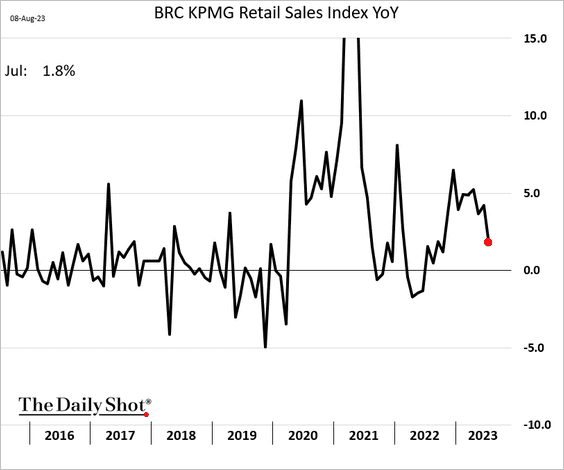

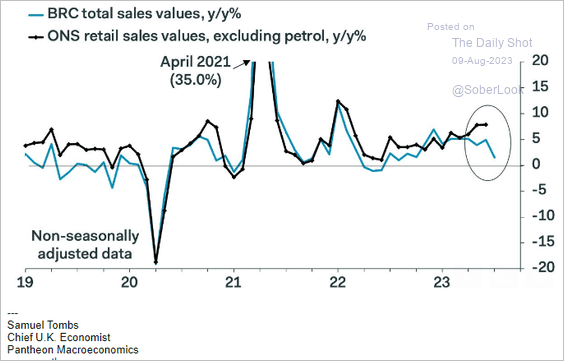

The United Kingdom

The BRC index points to slowing retail sales in July.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

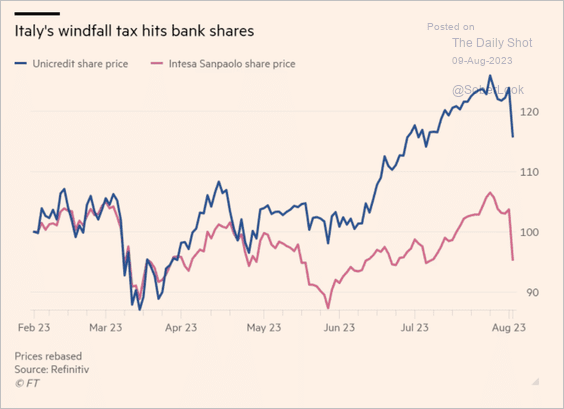

1. Italian bank shares took a beating after the windfall tax announcement.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: BBC Read full article

Source: BBC Read full article

——————–

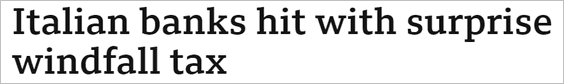

2. French current account is back in surplus.

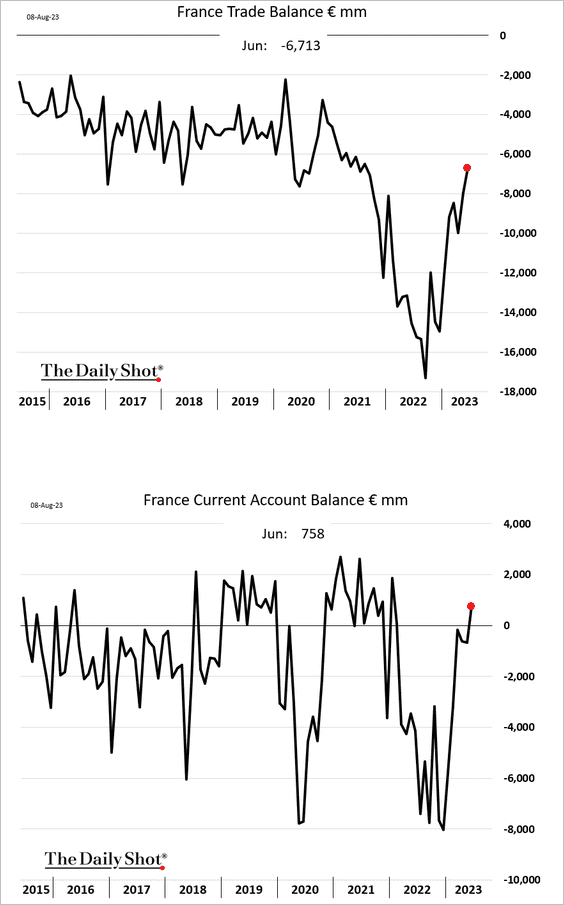

3. Here is the euro-area CPI diffusion chart.

Source: Macrobond

Source: Macrobond

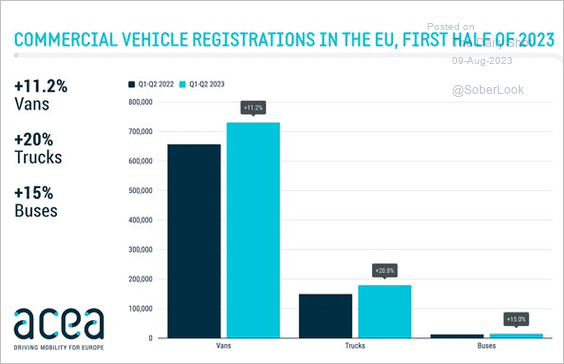

4. EU truck registrations picked up in the first half of the year.

Source: @ACEA_auto Read full article

Source: @ACEA_auto Read full article

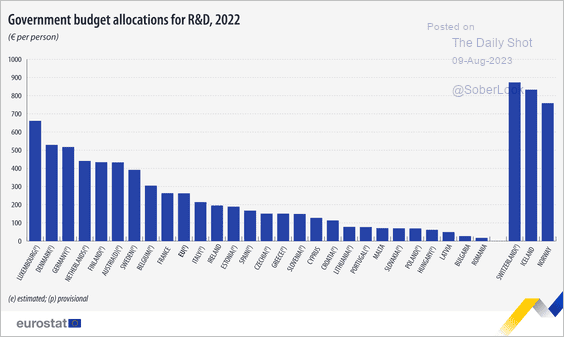

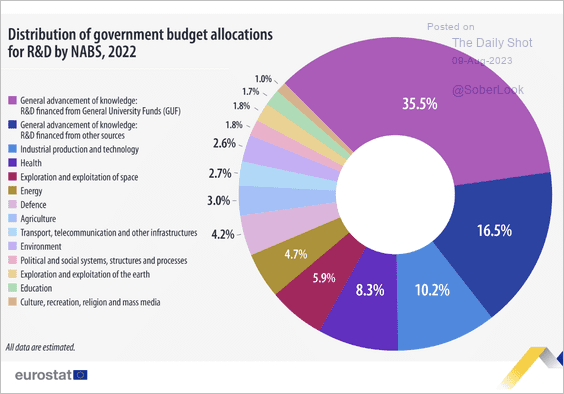

5. Next, we have some data on government budget allocation to R&D.

Source: Eurostat Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

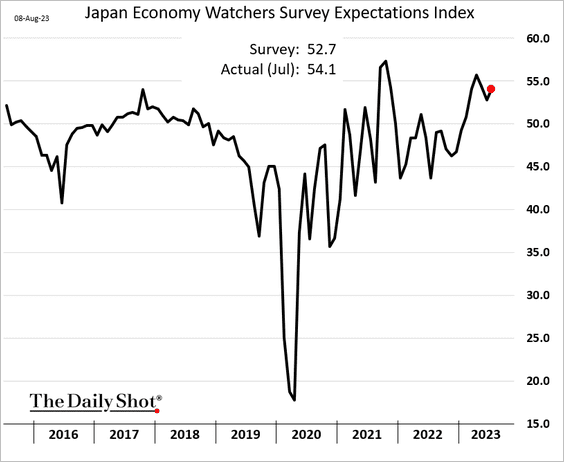

1. Japan’s Economy Watchers Survey Expectations index continues to trend higher.

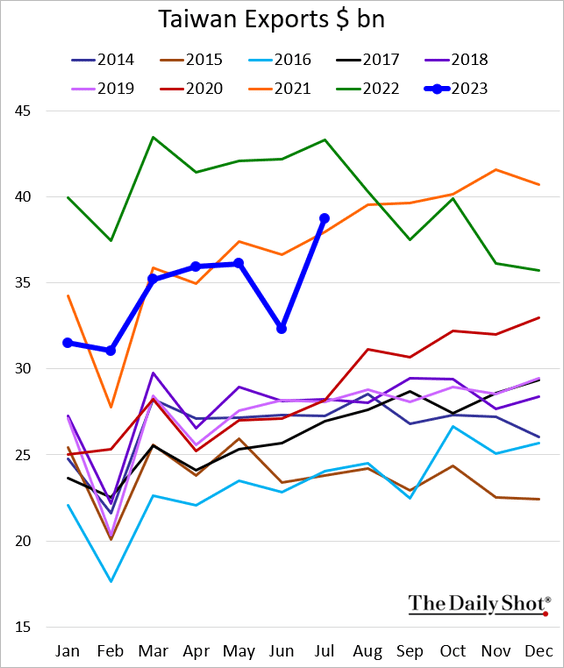

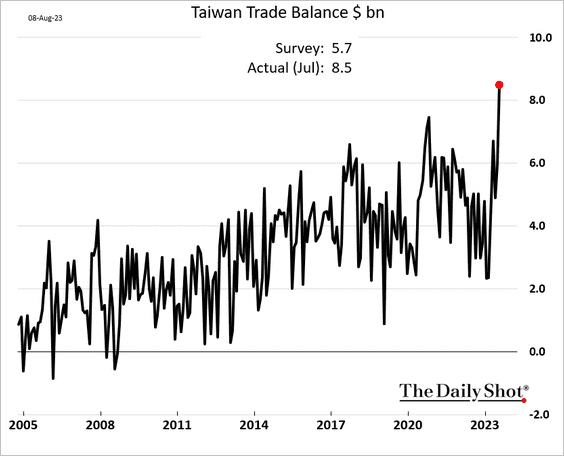

2. Taiwan’s exports rebounded last month but remain below last year’s levels.

The trade surplus hit a record high.

——————–

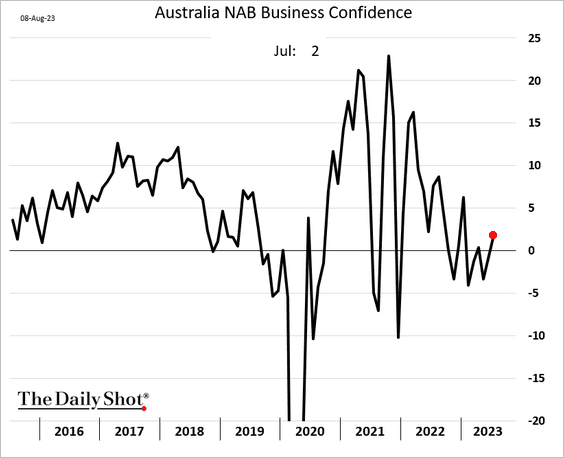

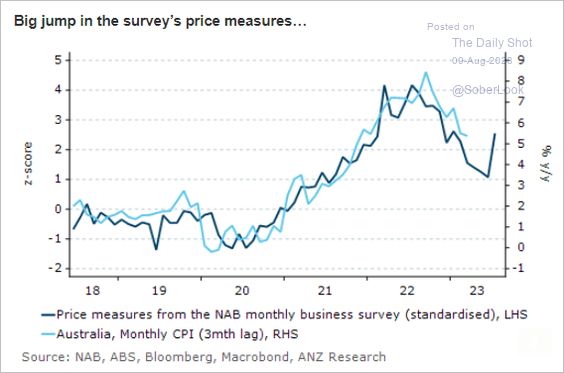

3. Australia’s business confidence showed some improvement in July.

But price pressures suddenly accelerated.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

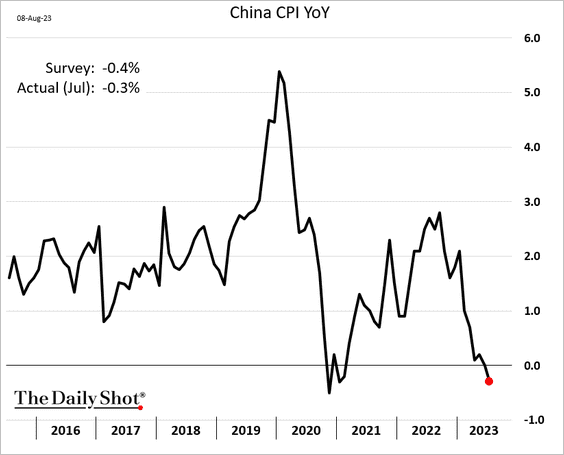

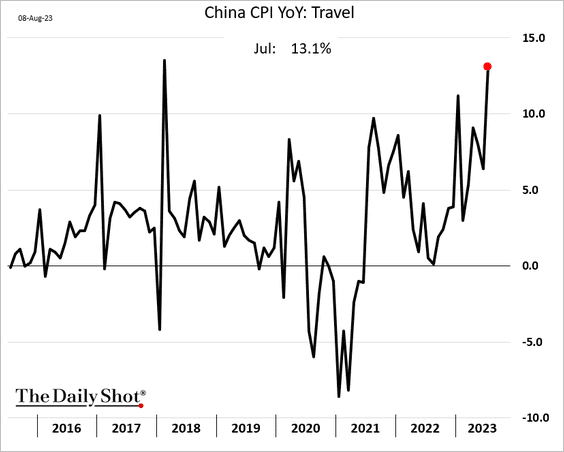

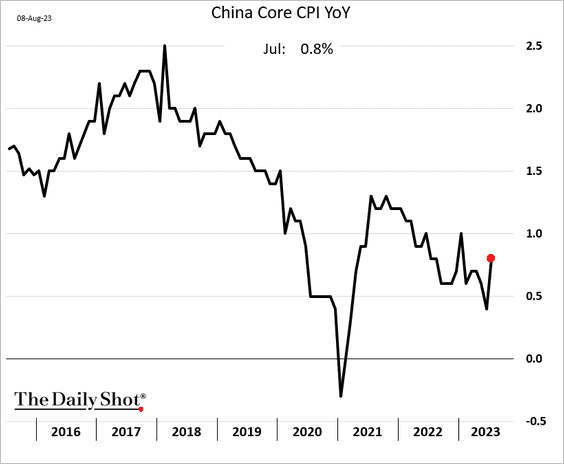

1. China is officially in deflation, …

Source: @economics Read full article

Source: @economics Read full article

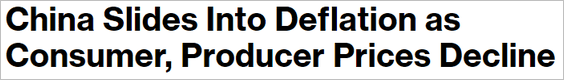

… with price declines driven by consumer goods.

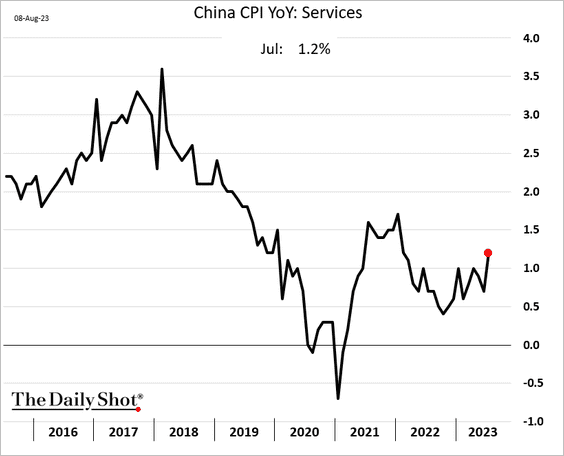

But services inflation jumped, …

… boosted by travel costs.

As a result, the core inflation increased.

——————–

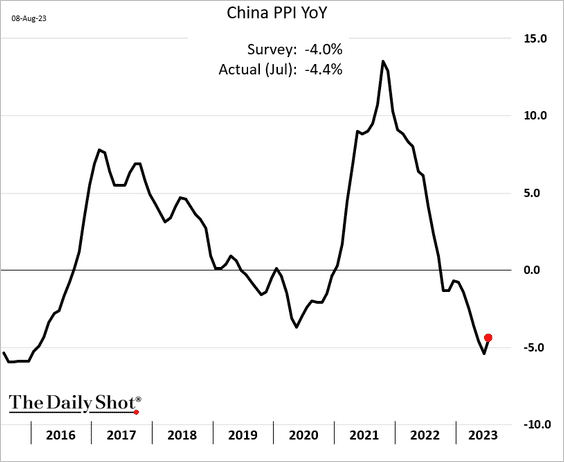

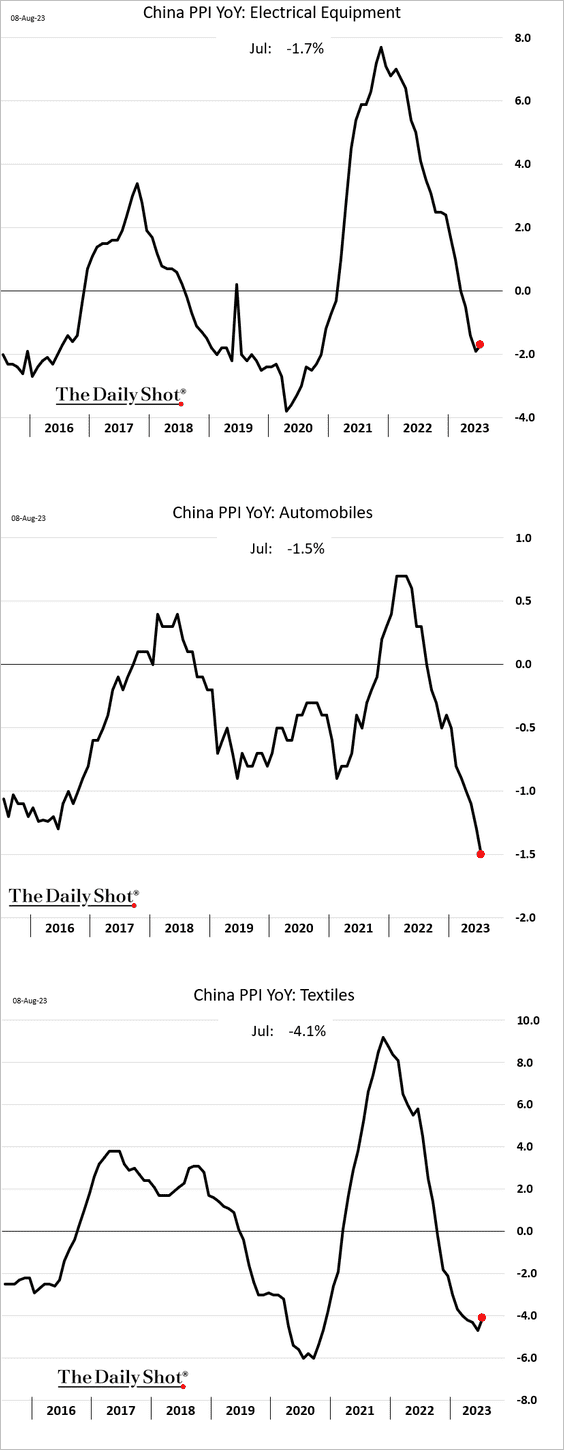

2. The PPI edged higher but remains negative on a year-over-year basis.

Here are some PPI components.

——————–

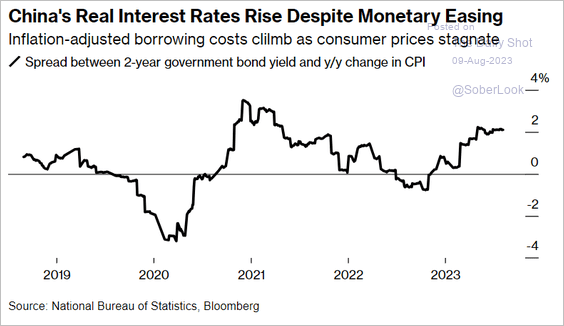

3. China’s real rates have been rising as inflation eases.

Source: @economics Read full article

Source: @economics Read full article

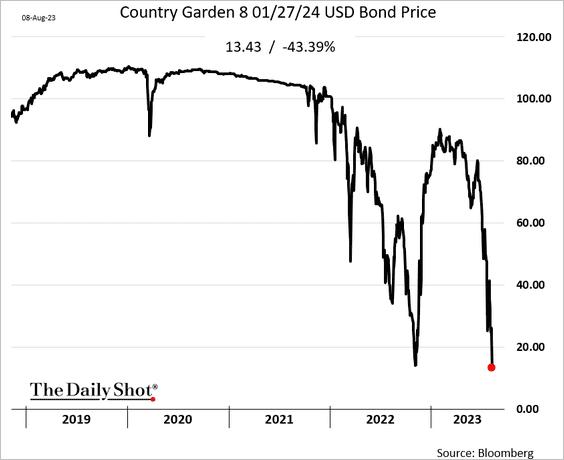

4. The developer credit crisis continues to fester.

Source: Reuters Read full article

Source: Reuters Read full article

Country Garden’s failure could be worse than the Evergrande fiasco.

Source: @markets Read full article

Source: @markets Read full article

——————–

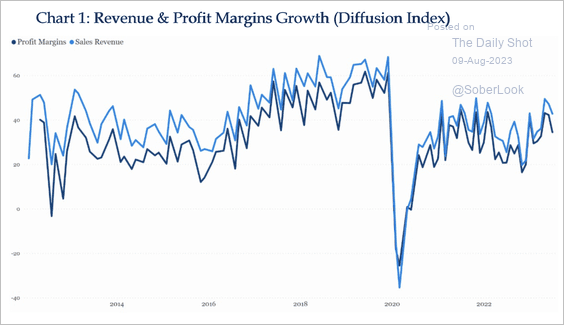

5. Revenue and profit margin growth slowed in July and remain below pre-pandemic highs.

Source: China Beige Book

Source: China Beige Book

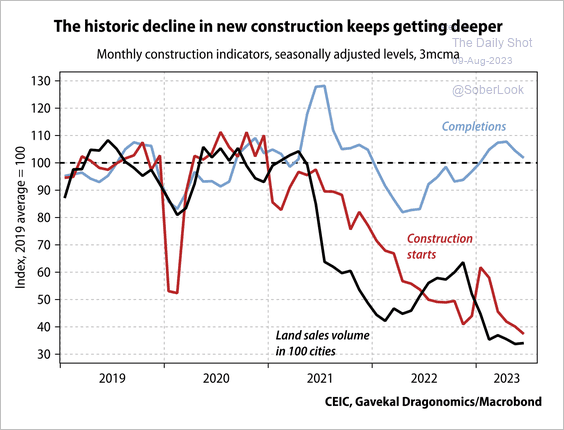

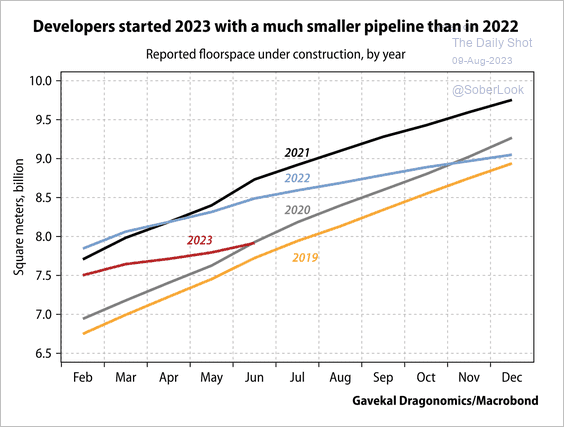

6. Property construction is stuck in a deep decline. Completions have held up because of policy support to finish stalled projects. But developers scaled back new investment as demand weakened and financing became tight. (2 charts)

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

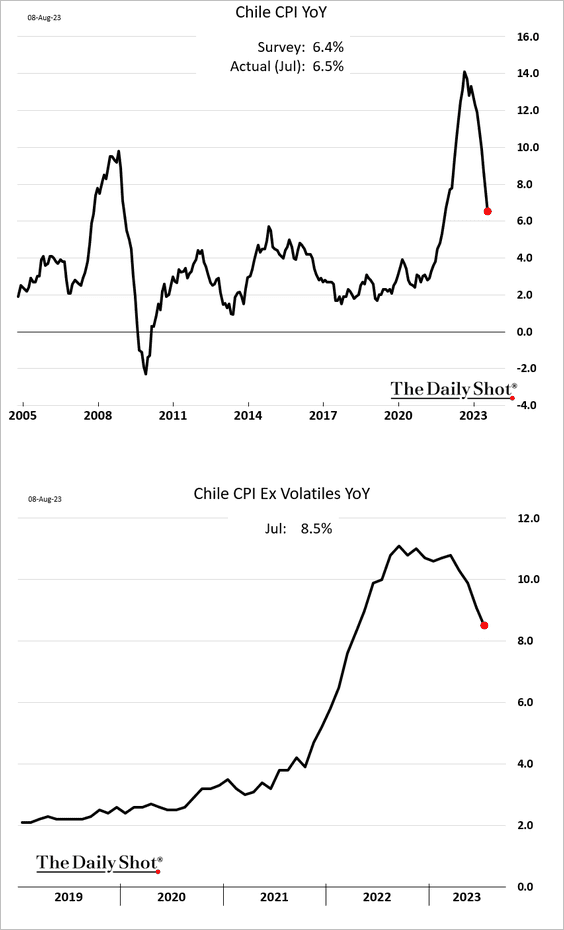

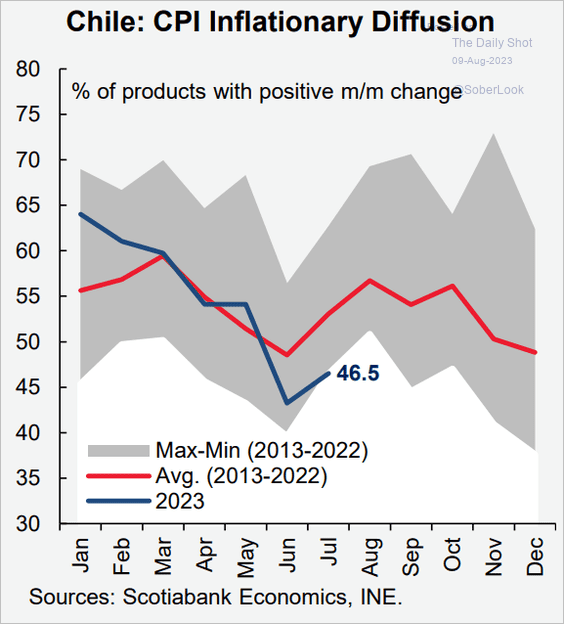

1. Chile’s inflation is moderating.

Here is the diffusion index.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

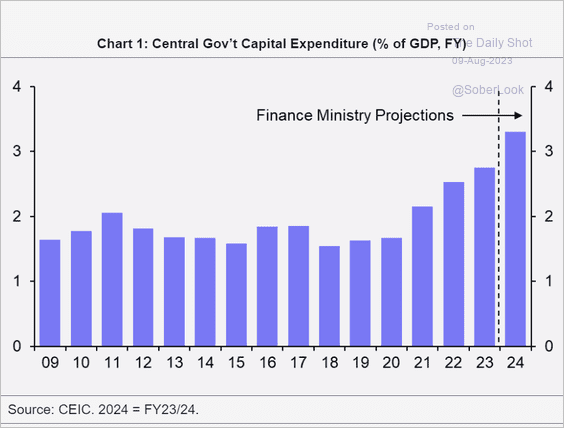

2. Indian government’s investment has been surging.

Source: Capital Economics

Source: Capital Economics

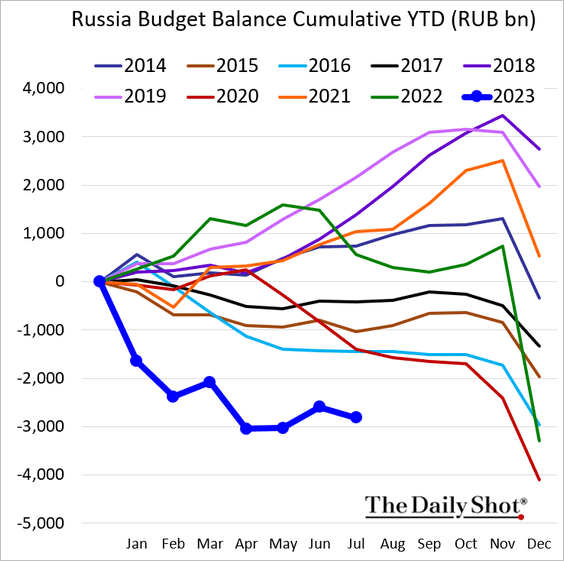

3. According to the Russian Ministry of Finance, the nation’s government budget deficit remains wide (to finance the war).

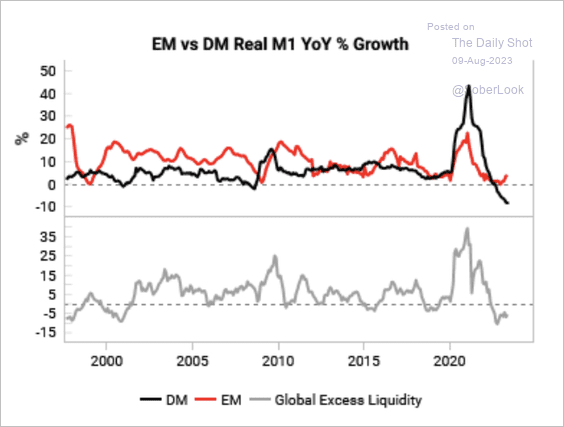

4. Real money supply growth has weakened in developed markets while emerging markets have held up. According to Variant Perception, an upturn in global excess liquidity is typically positive for EM equities.

Source: Variant Perception

Source: Variant Perception

Back to Index

Cryptocurrency

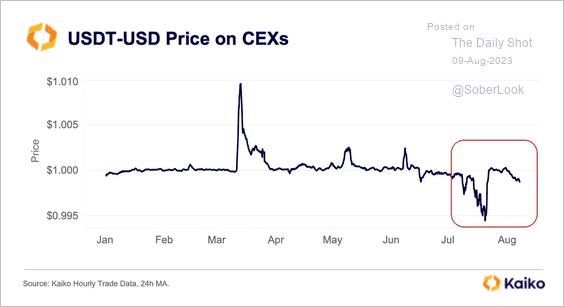

1. Tether’s USDT stablecoin lost its dollar peg again.

Source: @KaikoData

Source: @KaikoData

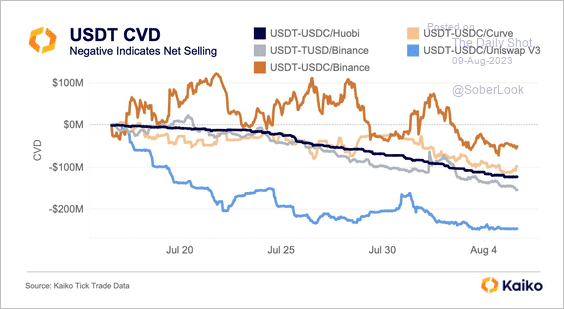

• USDT experienced selling pressure in recent weeks, especially on the Huobi exchange.

Source: @KaikoData

Source: @KaikoData

• On Monday, PayPal announced it will issue a dollar-peg stablecoin.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

2. The Federal Reserve reiterated the requirement for banks to receive pre-approval before engaging in stablecoin activities. Controls will need to be established to mitigate customer runs, money laundering, hacks, and other vulnerabilities.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

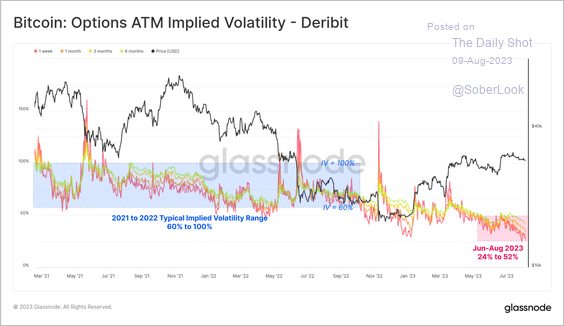

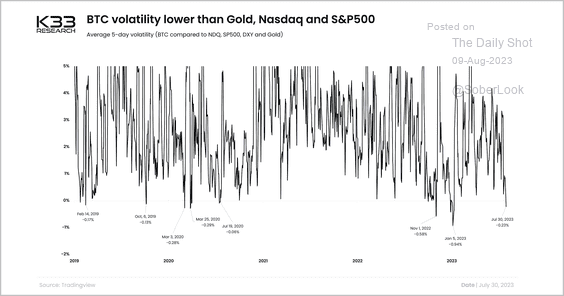

3. Bitcoin remains in a historically low volatility regime. (2 charts)

Source: @glassnode

Source: @glassnode

Source: @K33Research

Source: @K33Research

Back to Index

Commodities

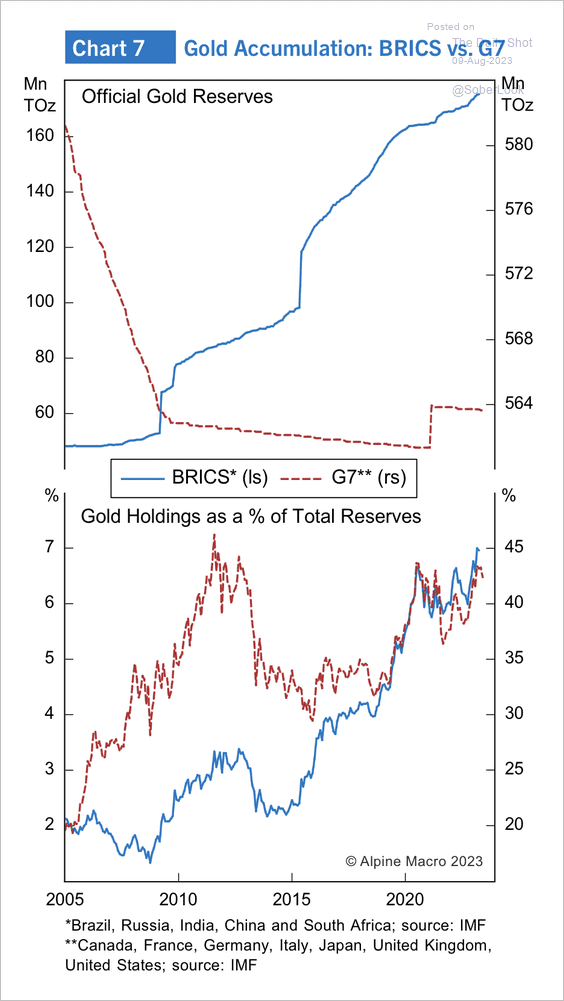

1. The BRICS central banks continue to amass gold.

Source: Alpine Macro

Source: Alpine Macro

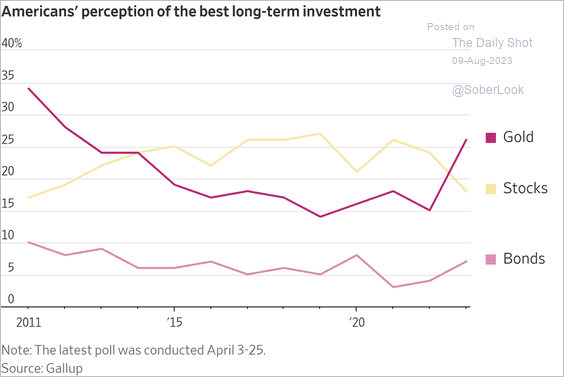

• Retail investors are interested in gold again.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

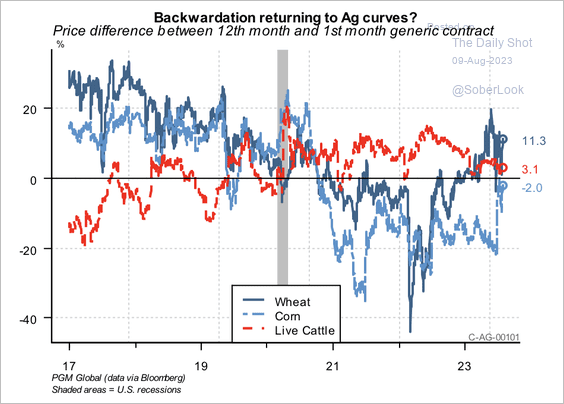

2. Backwardations have been most notable in the wheat futures curve, while corn futures appear to be exiting a long stretch of contango.

Source: PGM Global

Source: PGM Global

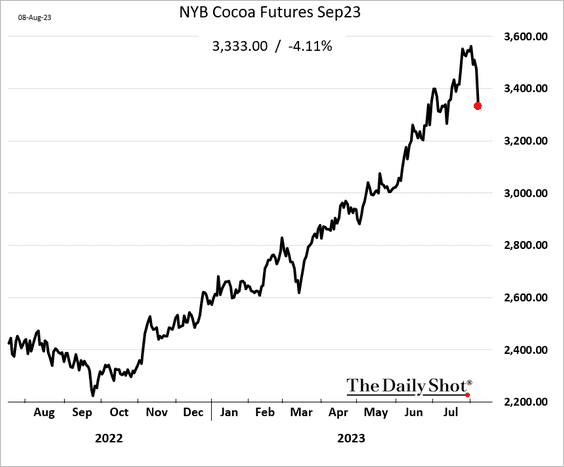

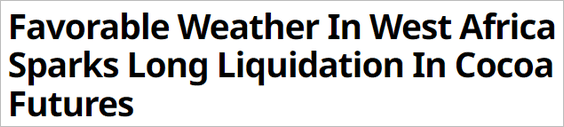

3. The cocoa rally has stalled.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

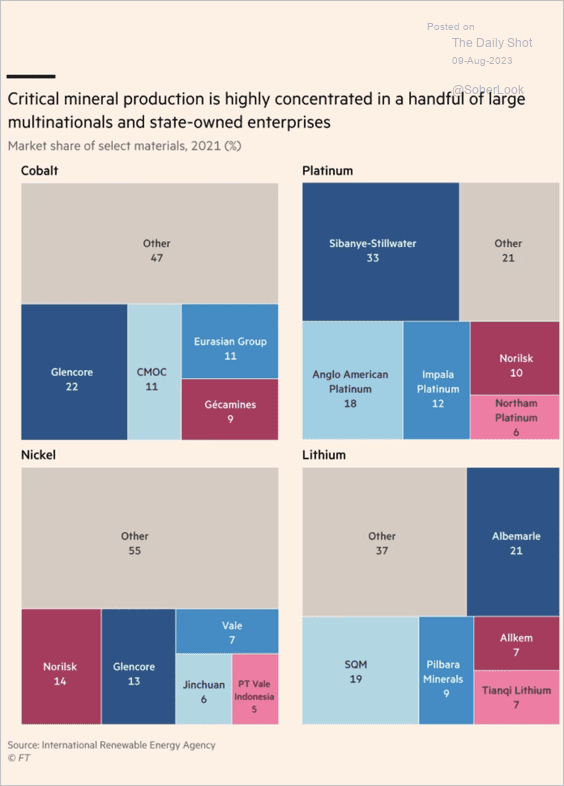

4. This chart shows the concentrations in global mineral production.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Energy

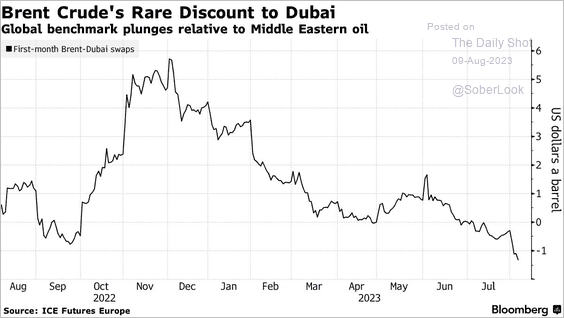

1. Brent is trading at a discount to Dubai crude. Two primary factors contribute to this trend. Firstly, coordinated production cuts by Saudi Arabia and Russia have constricted the medium-sour crude market. Secondly, S&P Global’s inclusion of US crude in its pricing basket has led to an influx of US WTI crude into the benchmark. This has exerted downward pressure on Dated Brent’s value compared to other global grades.

Source: @markets Read full article

Source: @markets Read full article

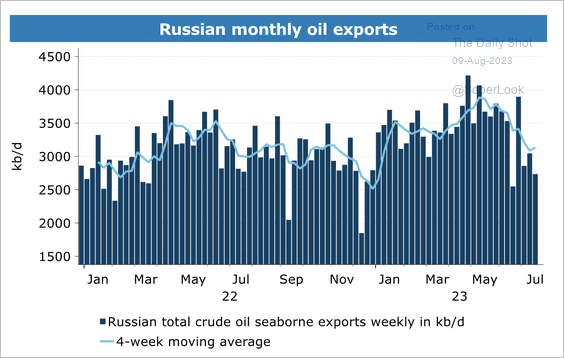

2. Russian oil exports are retreating.

Source: @ANZ_Research

Source: @ANZ_Research

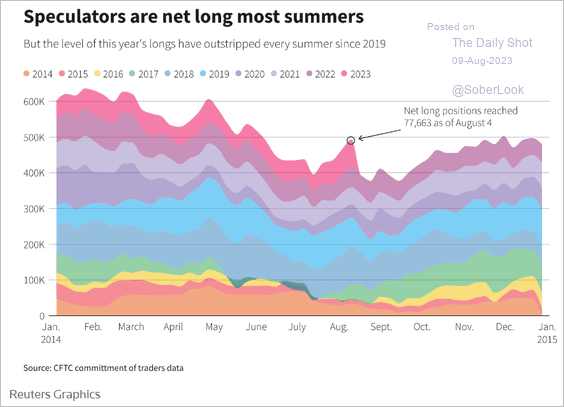

3. Speculative accounts are boosting bets on US gasoline as the hurricane season ramps up.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

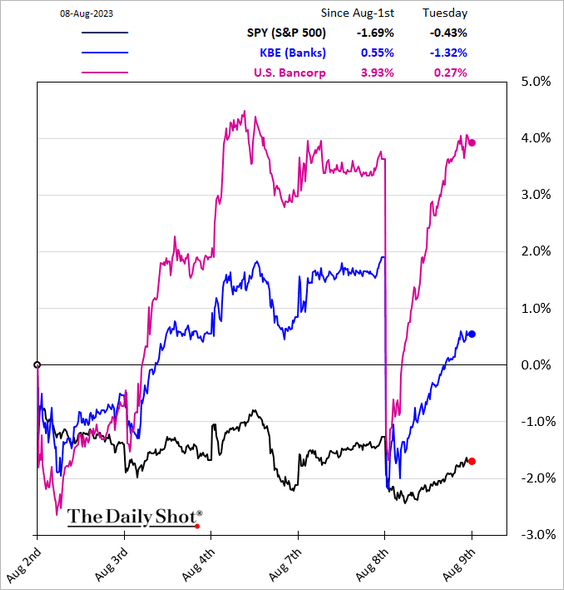

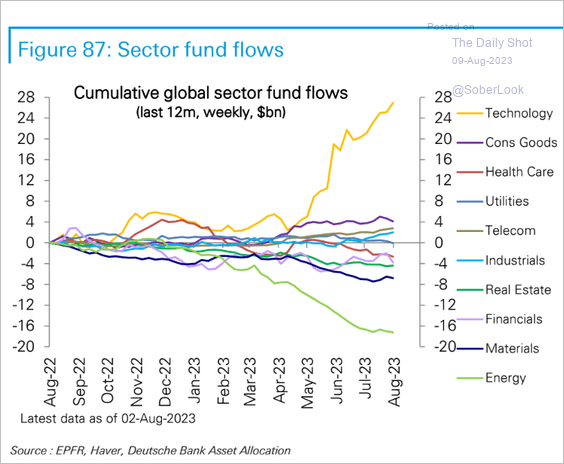

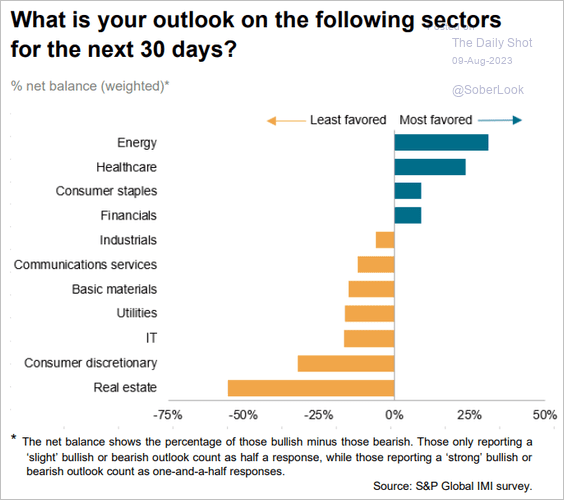

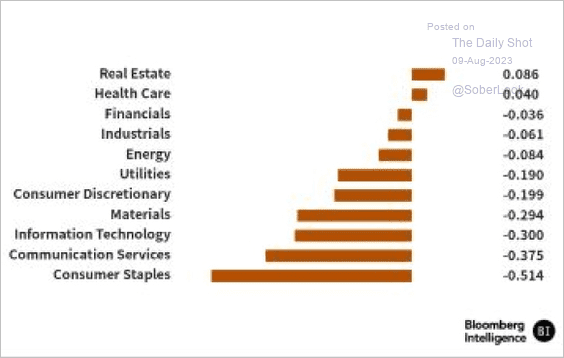

1. Let’s begin with some sector updates.

• Banks:

Source: CNBC Read full article

Source: CNBC Read full article

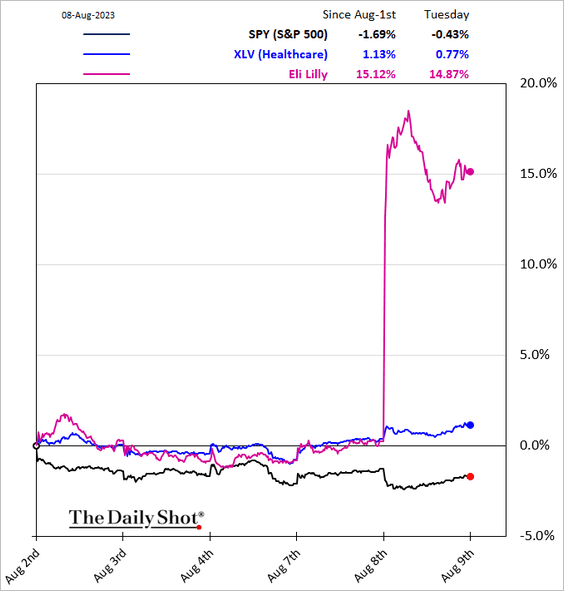

• Healthcare:

Source: Reuters Read full article

Source: Reuters Read full article

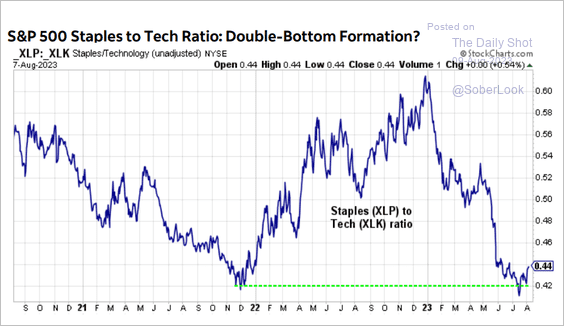

• Consumer Staples vs. Tech (a rebound coming?):

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• Fund flows by sector:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Global investment managers’ sector preferences:

Source: S&P Global PMI

Source: S&P Global PMI

• Sector correlations to the US dollar:

Source: BNN Read full article

Source: BNN Read full article

——————–

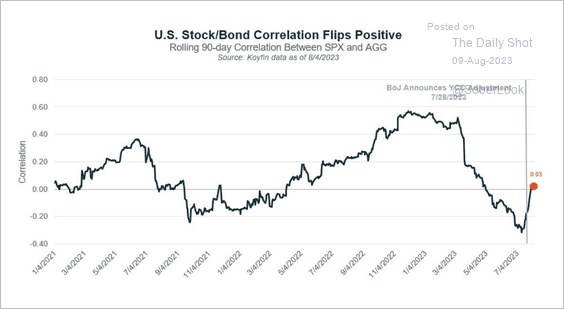

2. The US stock/bond correlation flipped positive following the BoJ’s surprise yield curve control adjustment.

Source: Global X ETFs

Source: Global X ETFs

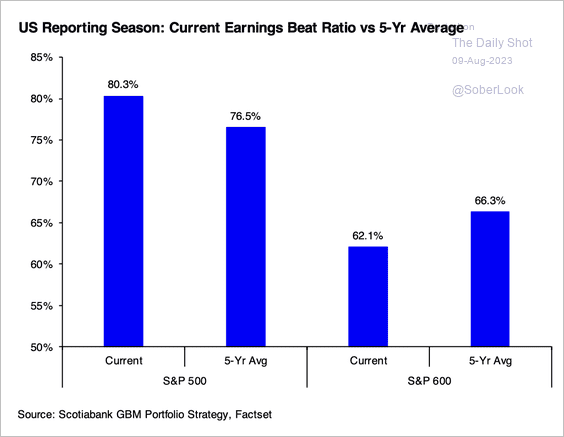

3. So far, US large-cap stocks have a higher earnings-beat ratio than small caps.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

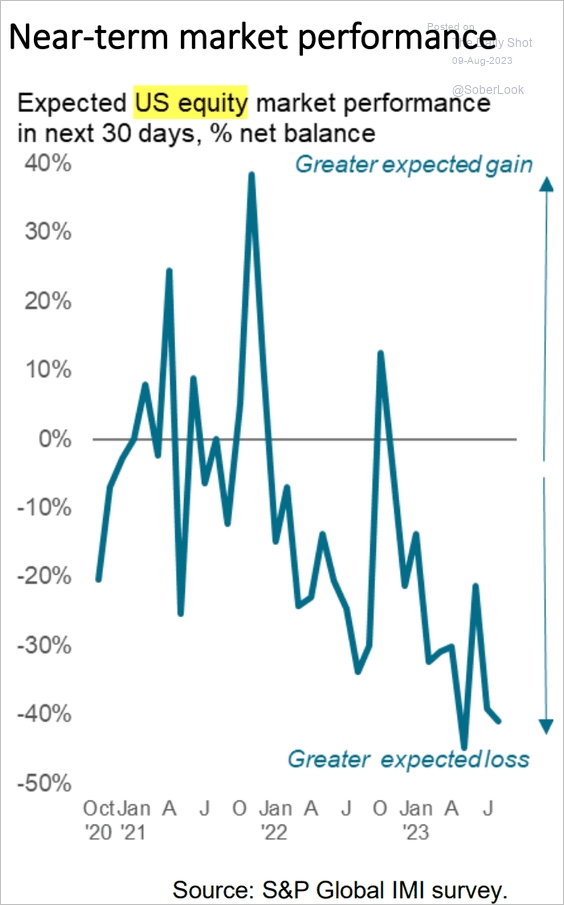

4. Global investment managers missed the rally and remain bearish on US stocks.

Source: S&P Global PMI

Source: S&P Global PMI

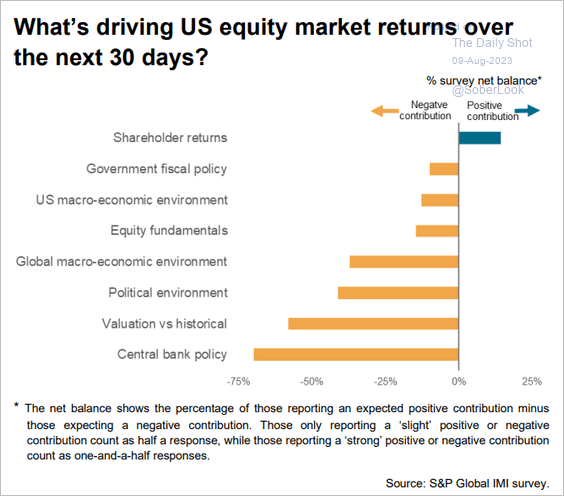

Here is why they are bearish.

Source: S&P Global PMI

Source: S&P Global PMI

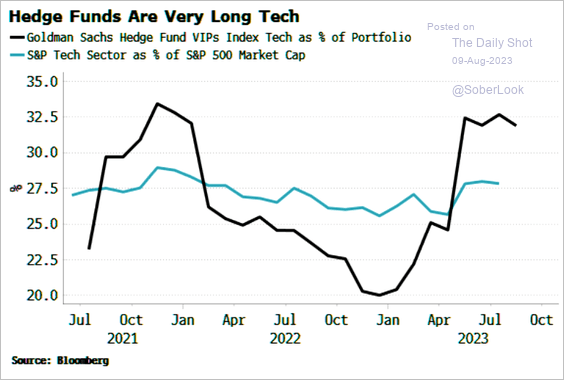

5. Hedge funds fell in love with tech this year.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

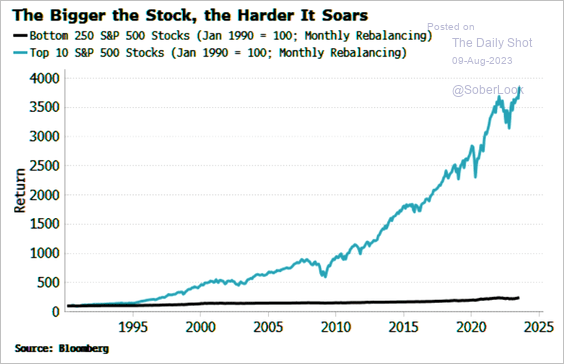

6. What would happen if one only holds the top ten S&P 500 stocks, rebalancing monthly?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

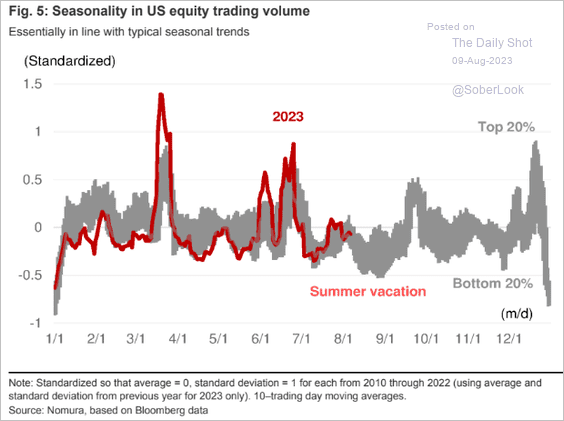

7. We are entering a period of low trading volume.

Source: Nomura Securities; @AyeshaTariq

Source: Nomura Securities; @AyeshaTariq

Back to Index

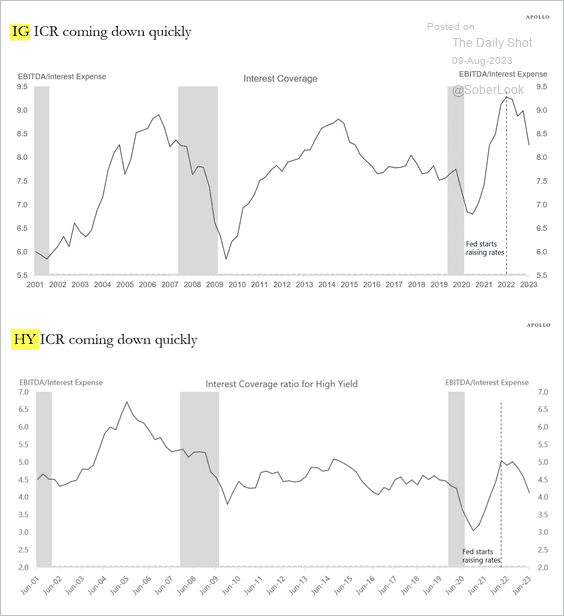

Credit

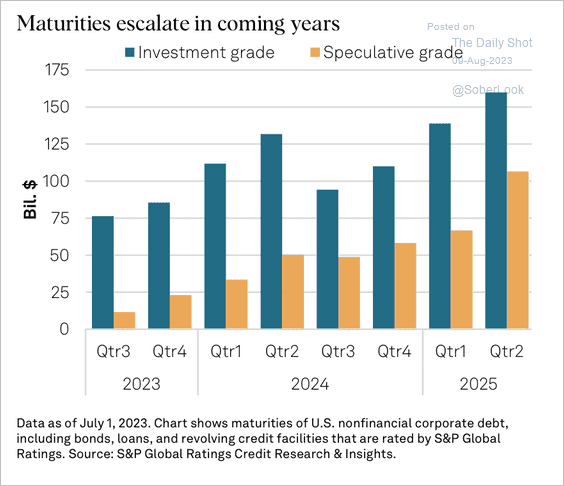

1. US firms made progress in reducing or extending near-term maturities.

Source: S&P Global Ratings

Source: S&P Global Ratings

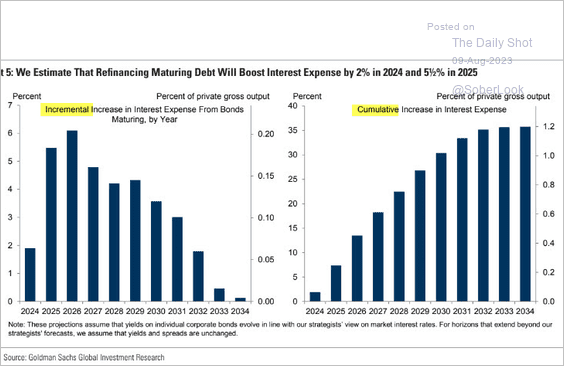

But as they roll their debt at higher rates, interest expense is expected to surge.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

Interest coverage ratios are heading lower.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

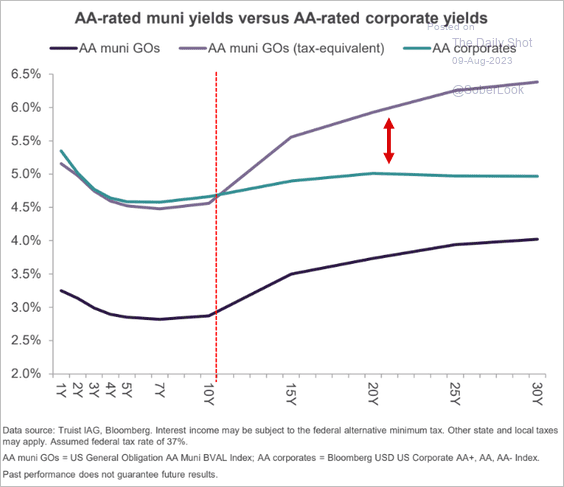

2. Longer-dated munis are attractive relative to corporate bonds.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

Food for Thought

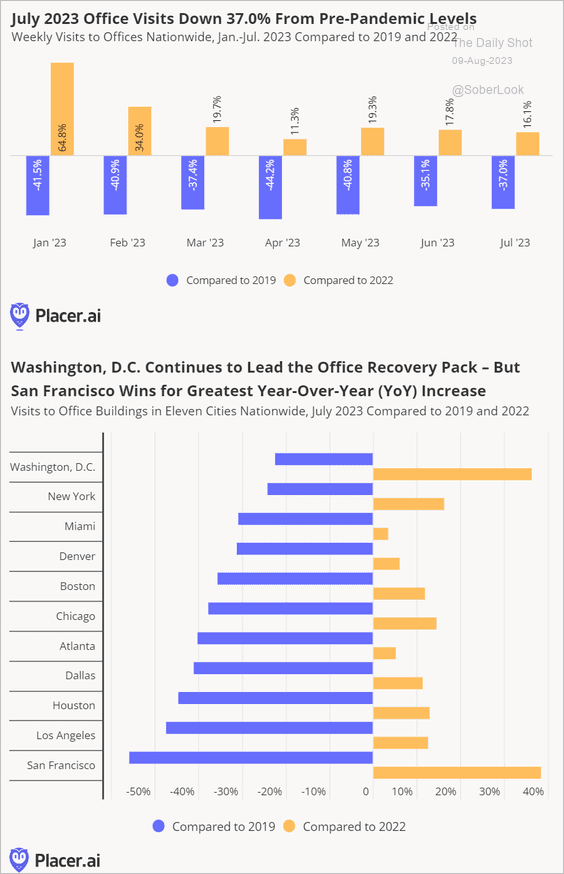

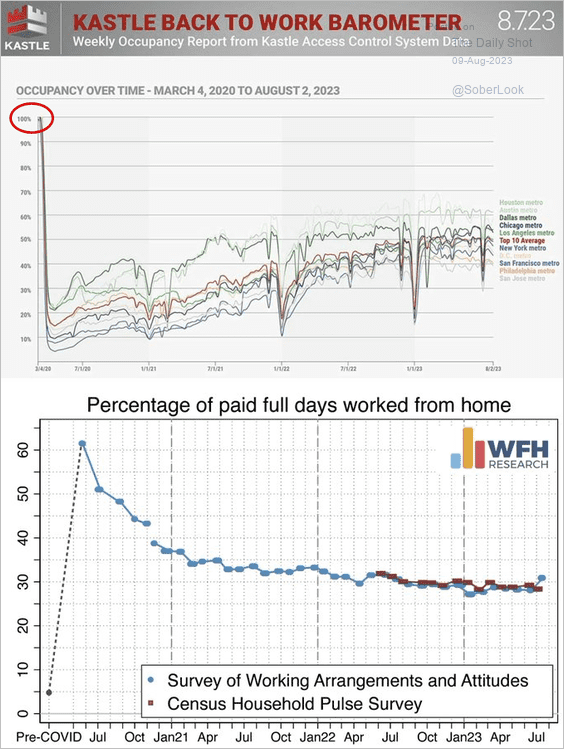

1. Office visits vs. 2019 and 2022:

Source: Placer.ai

Source: Placer.ai

• WFH levels holding steady:

Source: @I_Am_NickBloom

Source: @I_Am_NickBloom

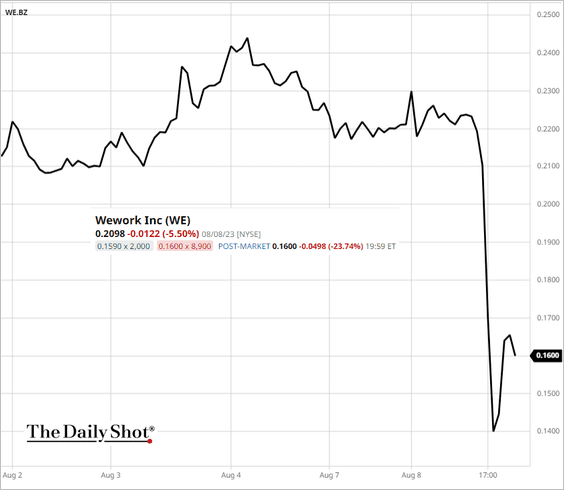

• Wework share price:

——————–

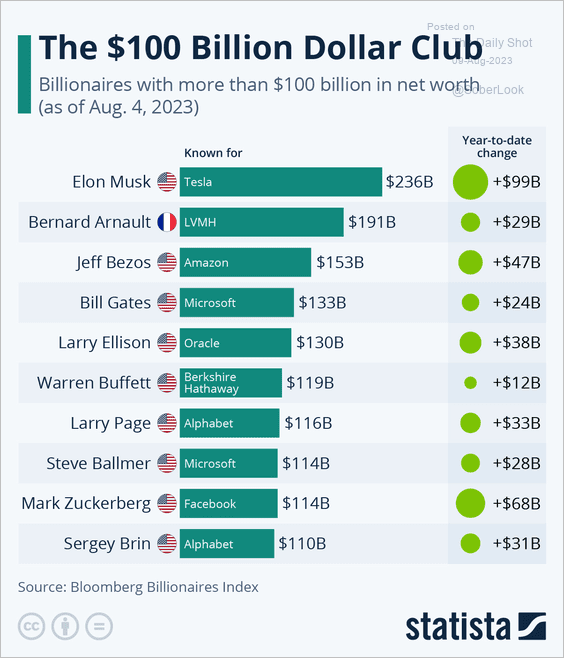

2. Billionaires with more than $100 billion of net worth:

Source: Statista

Source: Statista

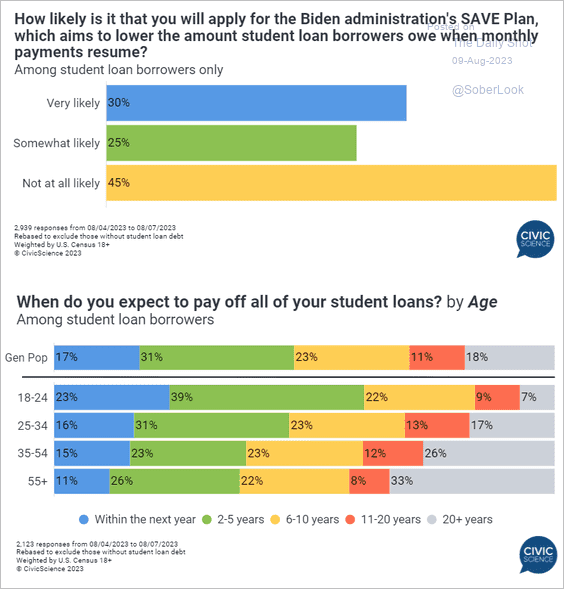

3. Paying off student debt:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

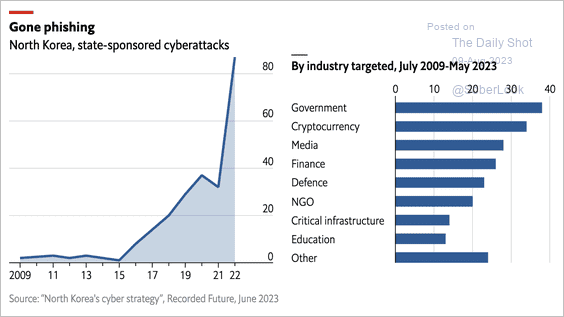

4. North Korea’s cyberattacks:

Source: The Economist Read full article

Source: The Economist Read full article

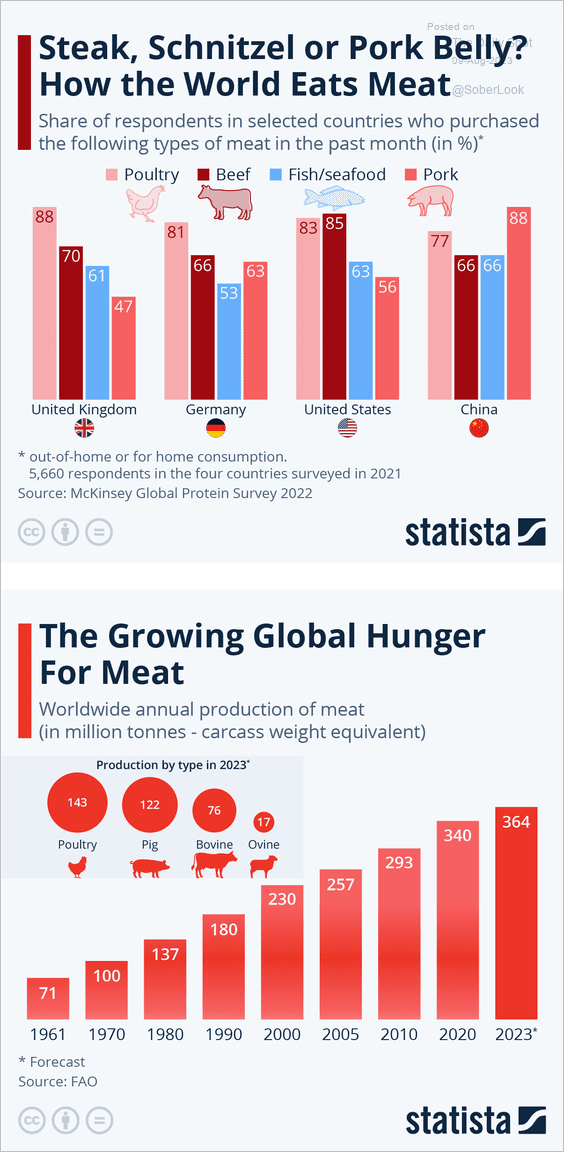

5. Meat consumption:

Source: Statista

Source: Statista

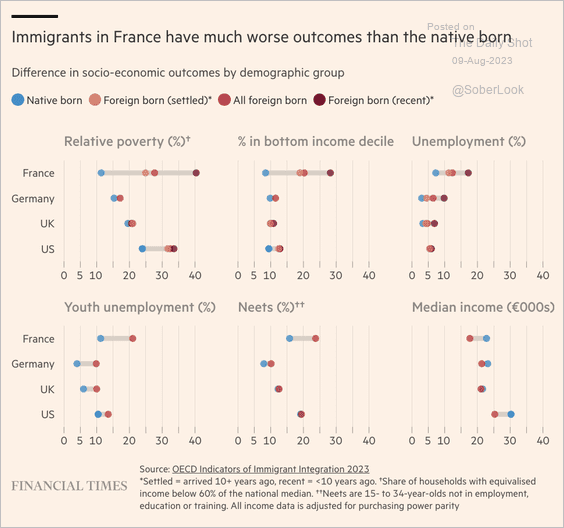

6. Immigrants’ relative socio-economic outcomes:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

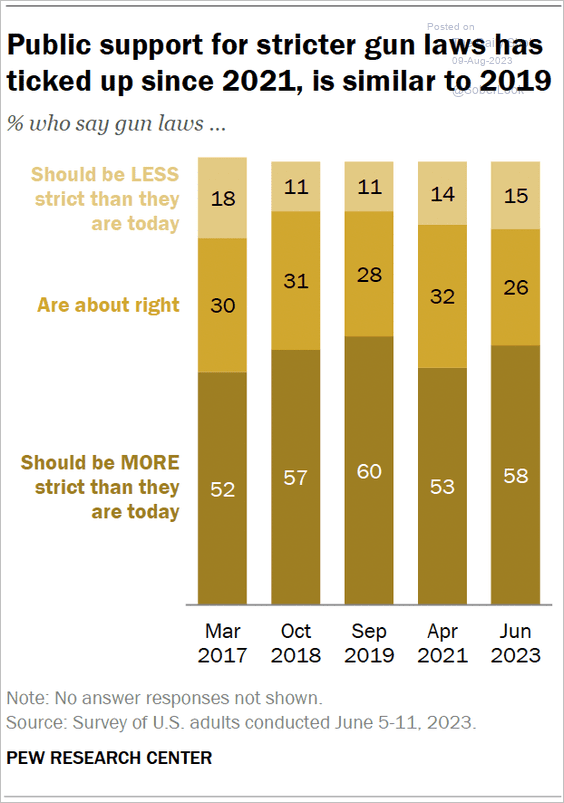

7. Support for stricter gun laws:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

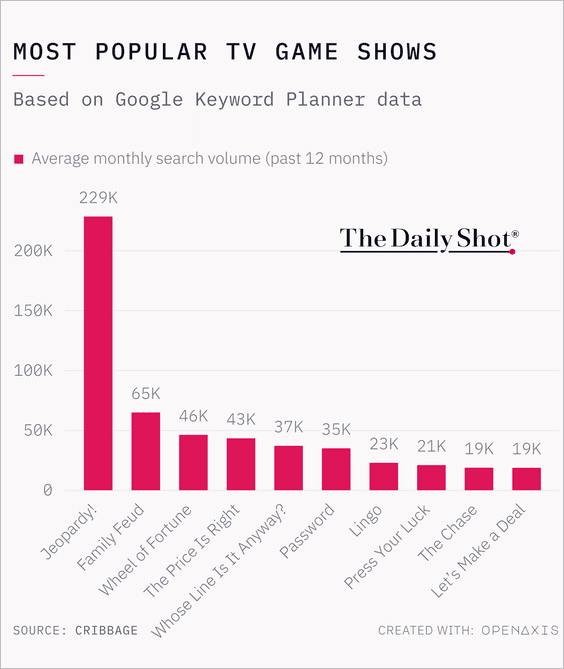

8. Most popular TV game shows:

Source: @TheDailyShot

Source: @TheDailyShot

——————–

Back to Index