The Daily Shot: 11-Aug-23

• The United States

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

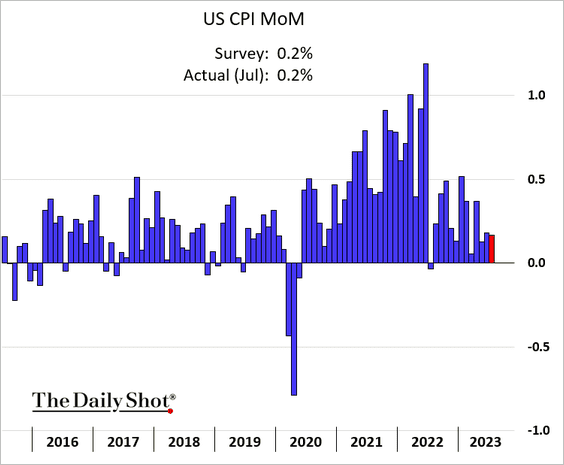

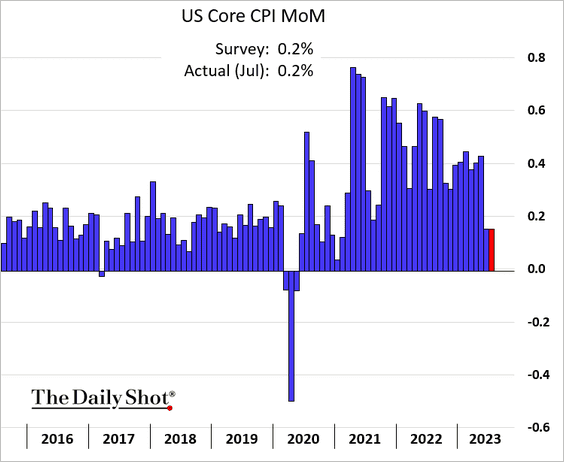

1. The July CPI report was in line with expectations, pointing to moderating inflationary pressures.

– Headline CPI (month-over-month):

– Core CPI:

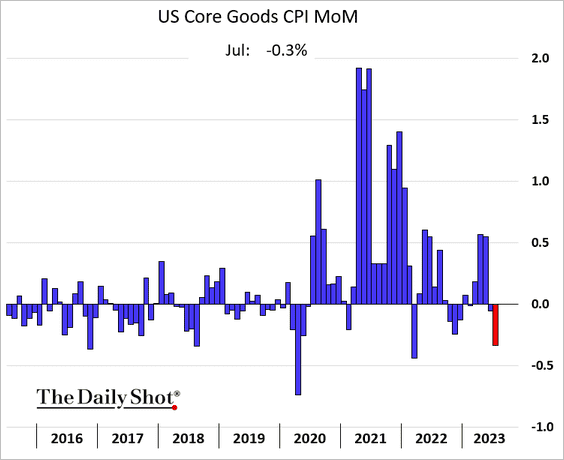

• The core goods CPI was negative again, …

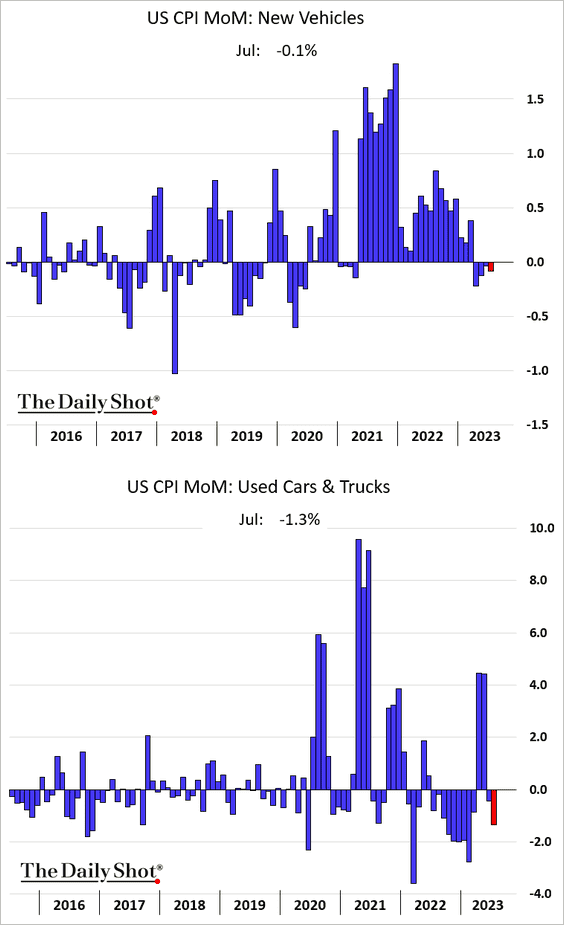

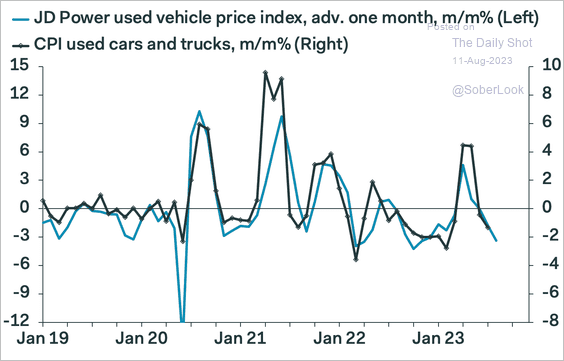

… as vehicle prices declined.

Used vehicle CPI could fall further.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

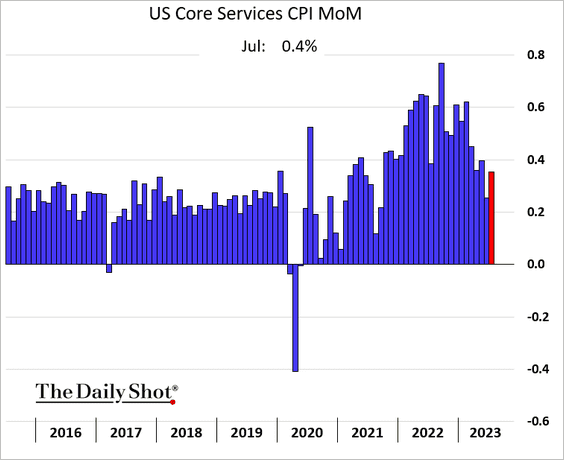

• The core services CPI increased.

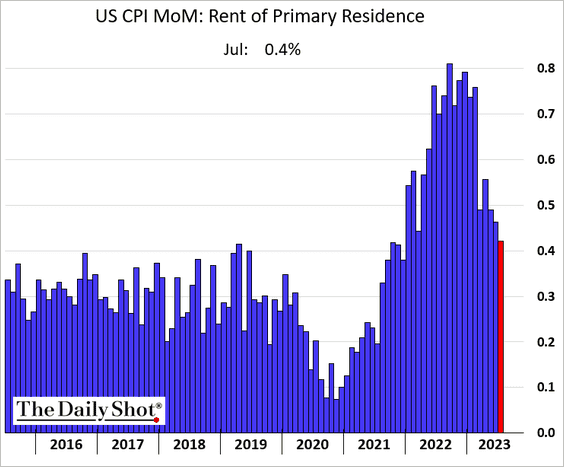

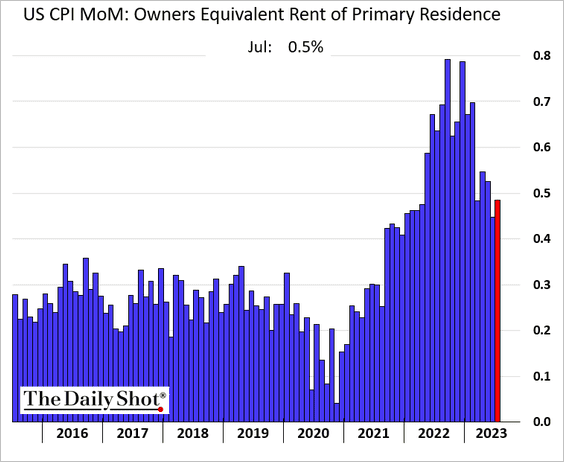

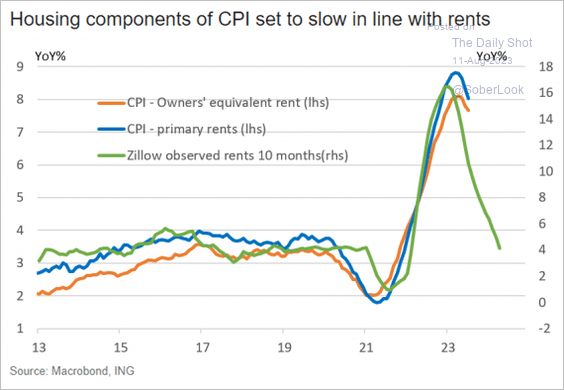

Here is a look at housing inflation, which remains elevated.

– Rent:

– Owners’ equivalent rent:

– Private indicators of rent costs point to further easing in housing inflation.

Source: ING

Source: ING

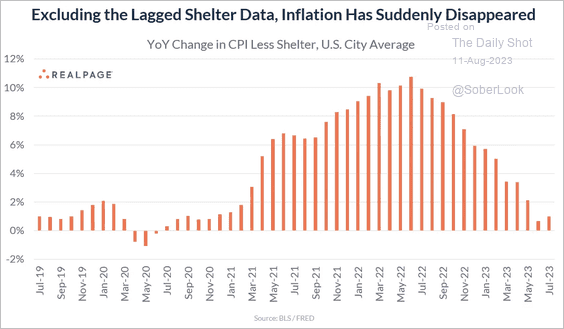

– By the way, excluding shelter, the overall CPI is well below 2%.

Source: @jayparsons

Source: @jayparsons

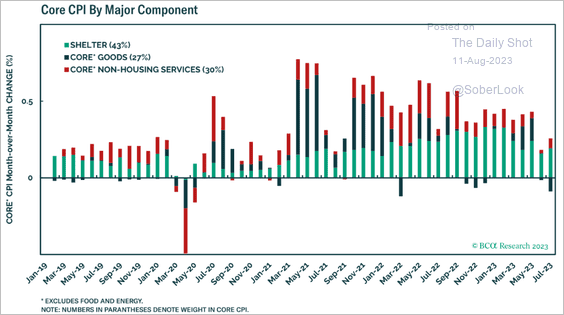

Here is how much shelter contributes to the monthly CPI changes.

Source: BCA Research

Source: BCA Research

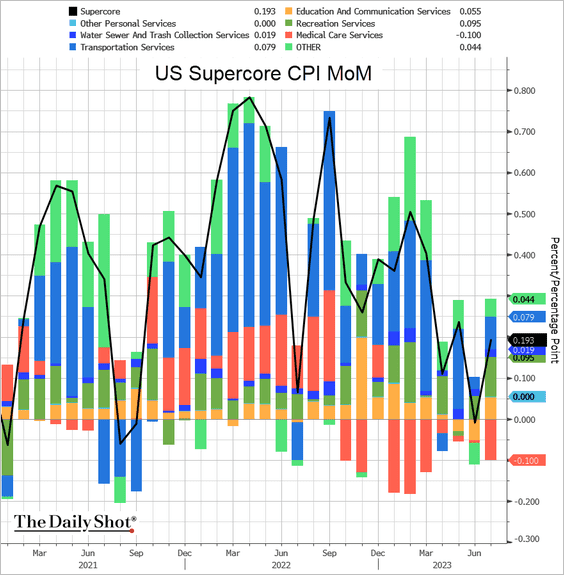

• Supercore inflation (core services excluding housing) remains subdued.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

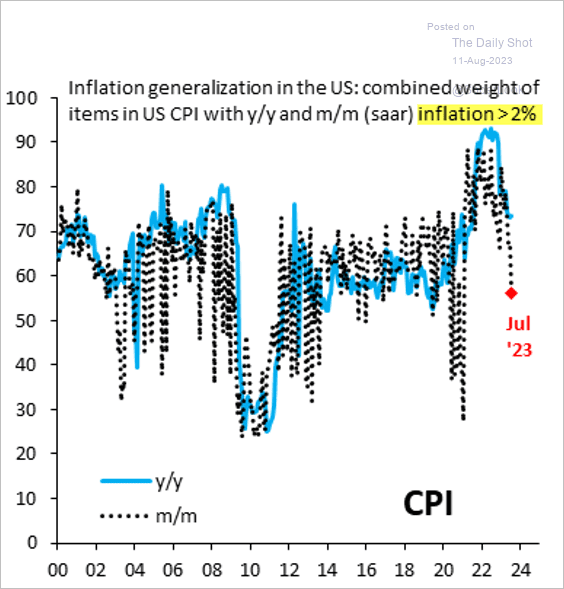

• The percentage of CPI components that are greater than 2% declined sharply in July.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

• Despite hopeful signs on the inflation front, Fed officials remain cautious.

Source: @economics Read full article

Source: @economics Read full article

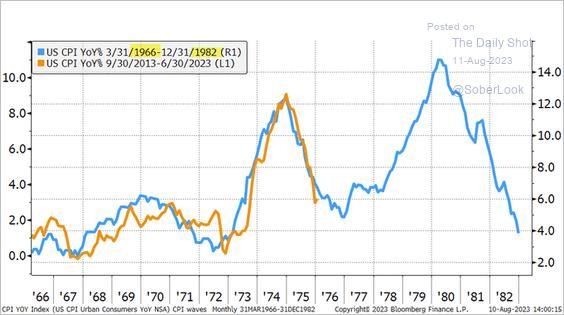

Concerns persist about inflation remaining stubbornly high or re-accelerating, as we saw in the 1970s.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Source: FXS Read full article

Source: FXS Read full article

We will have more data on inflation next week.

——————–

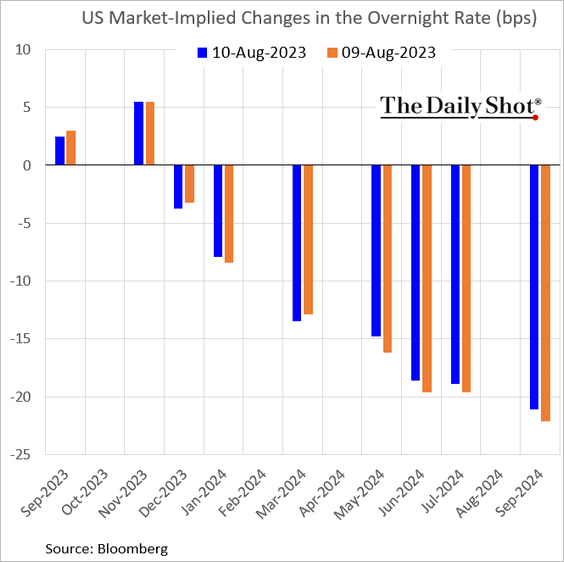

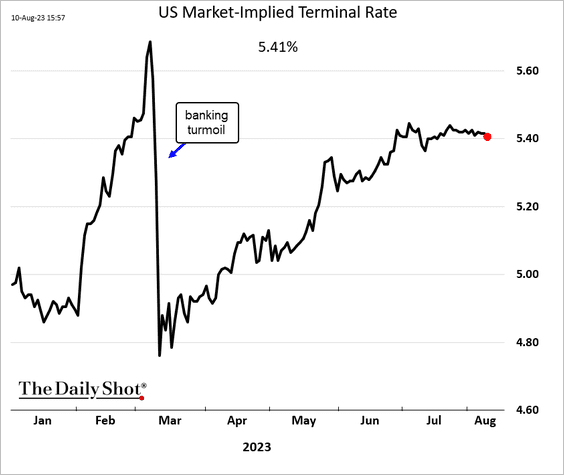

2. The market is increasingly convinced that the Fed will be on hold in September.

The implied terminal rate has been drifting lower in recent weeks.

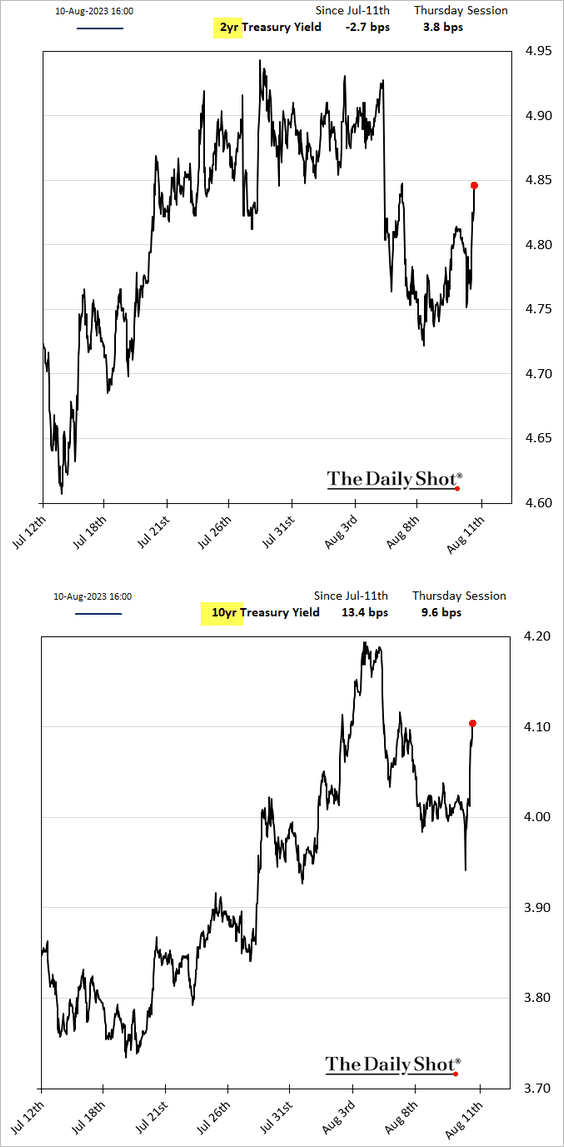

• Treasury yields jumped after the CPI report.

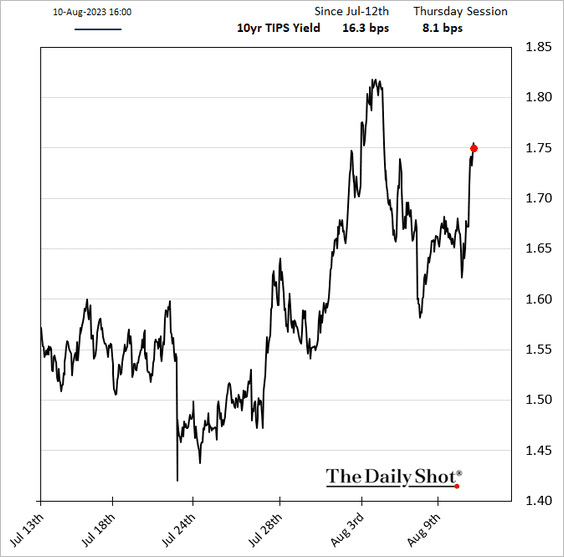

Real yields also climbed.

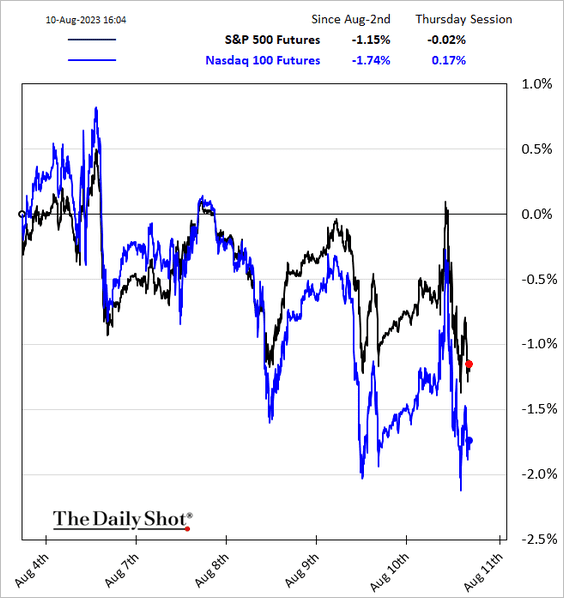

• Equities rallied initially but ended up closing flat on the day.

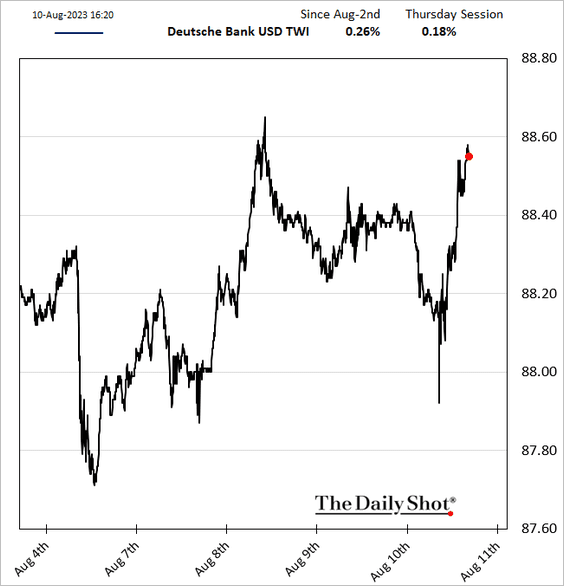

• The dollar was higher.

——————–

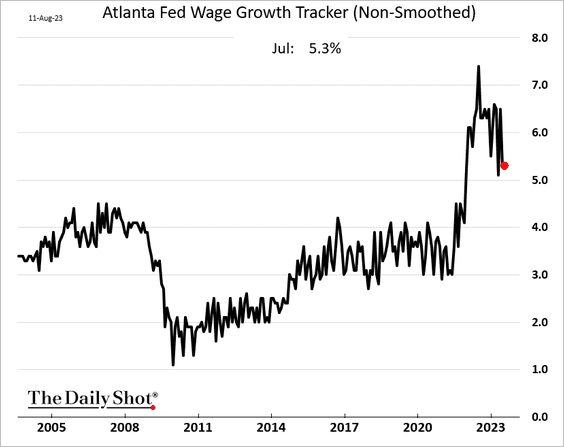

3. The Atlanta Fed’s wage growth tracker is holding above 5%, which adds to inflation re-acceleration concerns.

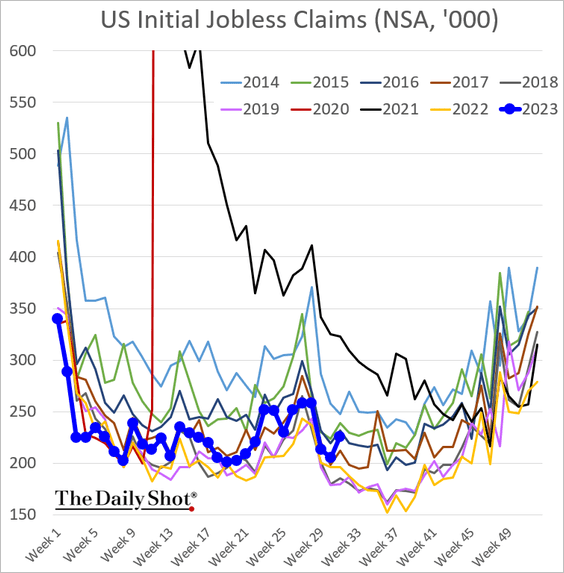

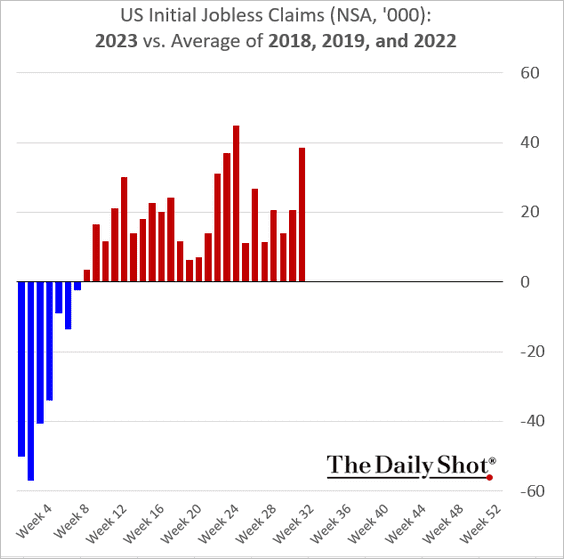

4. Initial jobless claims popped last week.

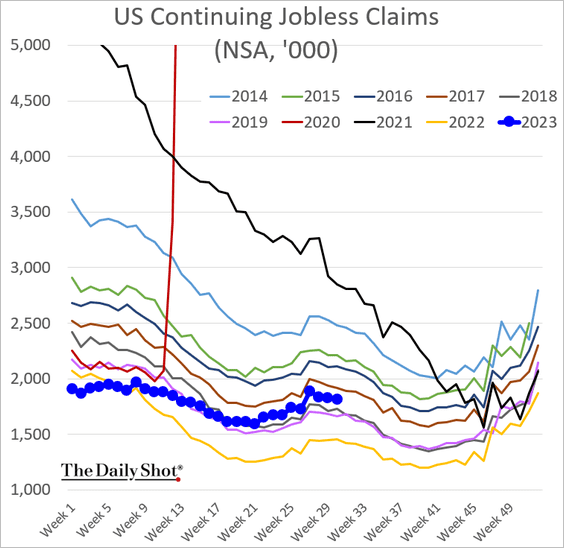

Continuing claims are holding steady.

——————–

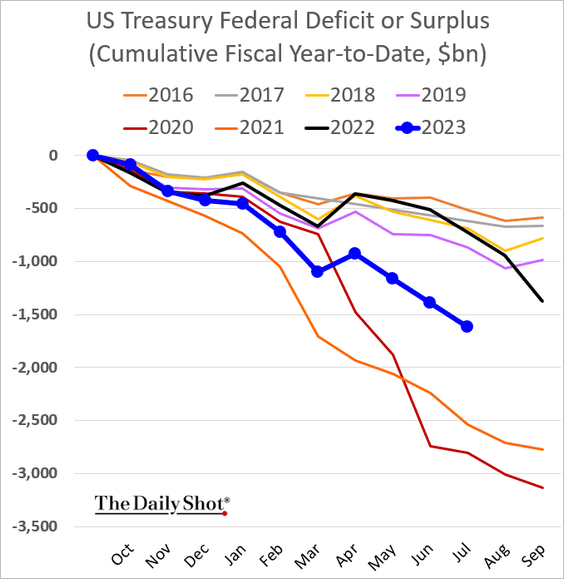

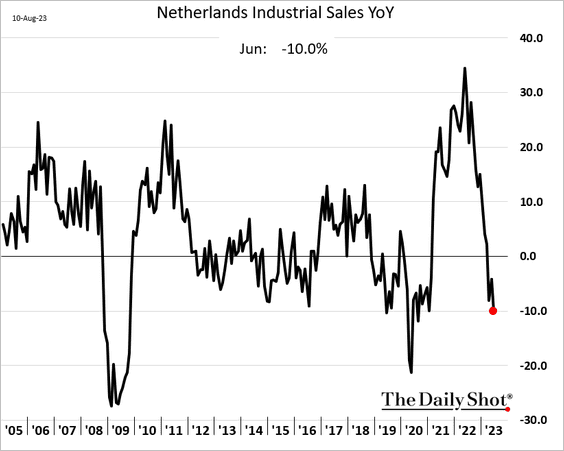

5. The federal budget deficit widened more than expected in July and is now more than double last year’s gap.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

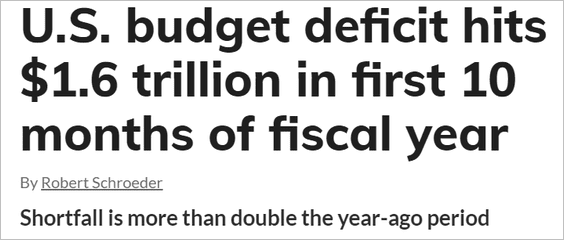

Interest payments continue to surge.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Europe

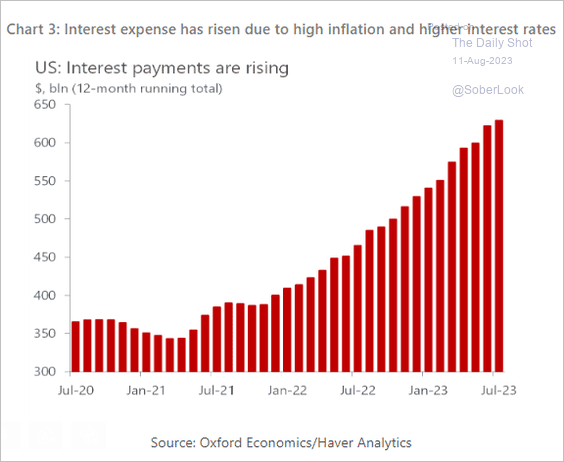

1. Dutch industrial sales are down 10% from a year ago.

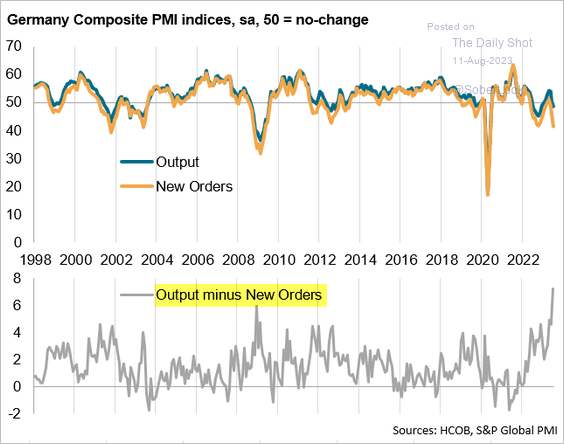

2. The spread between output and new orders in Germany’s PMI points to trouble ahead. Production is too high, given weaker demand.

Source: @SPGlobalPMI, @HCOB_Economics

Source: @SPGlobalPMI, @HCOB_Economics

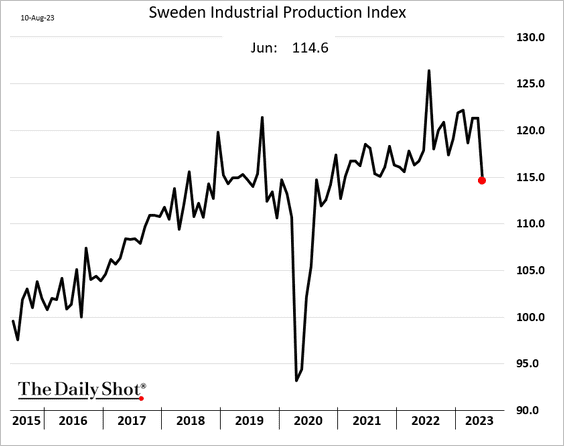

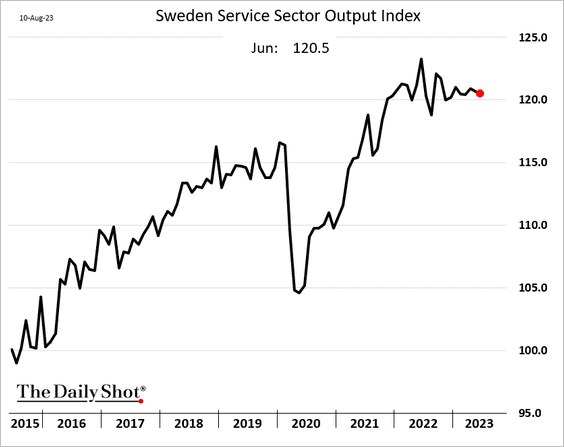

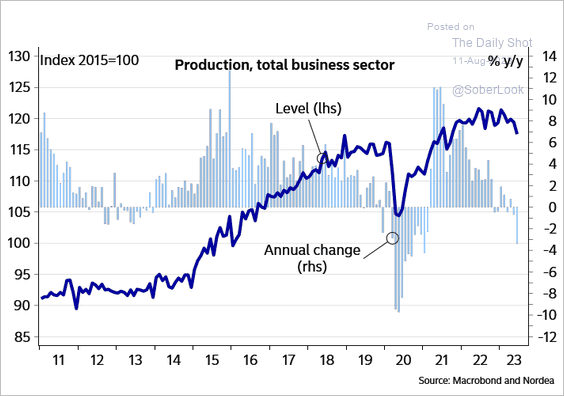

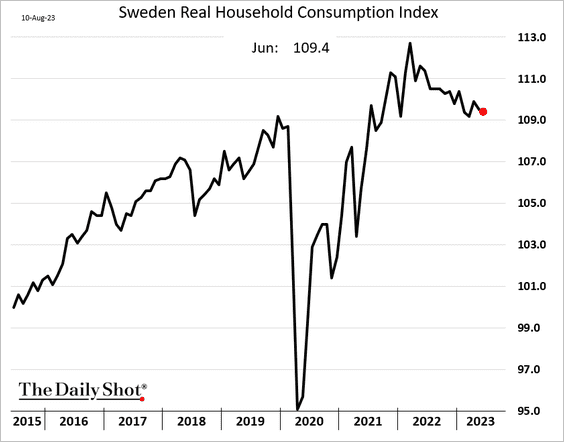

3. Next, we have some updates on Sweden.

• Industrial production tumbled in June.

• Services output edged lower.

• Here is the composite business sector production.

Source: Nordea Markets

Source: Nordea Markets

• Household consumption has been trending lower.

——————–

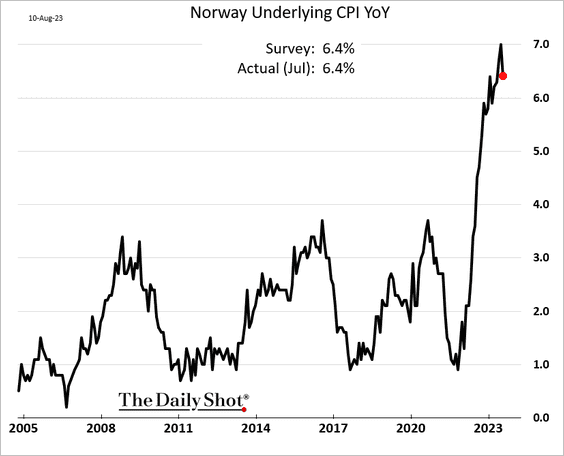

4. Norway’s core CPI is off the highs but remains elevated. Another rate hike is on the way (25 bps).

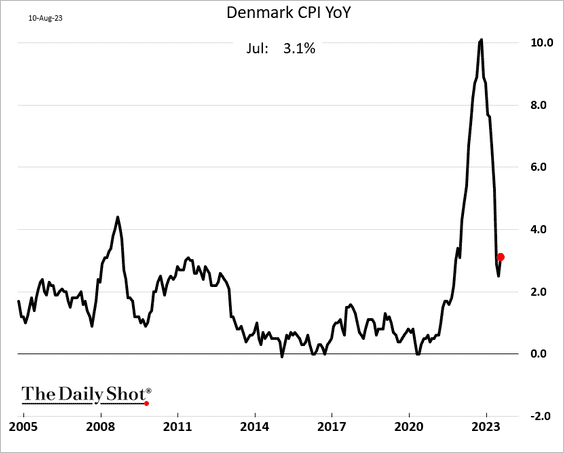

5. Denmark’s inflation jumped last month.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Japan

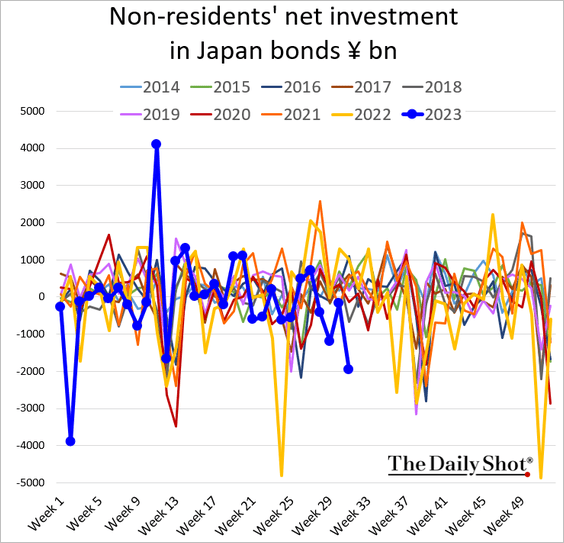

1. Foreigners have been dumping JGBs.

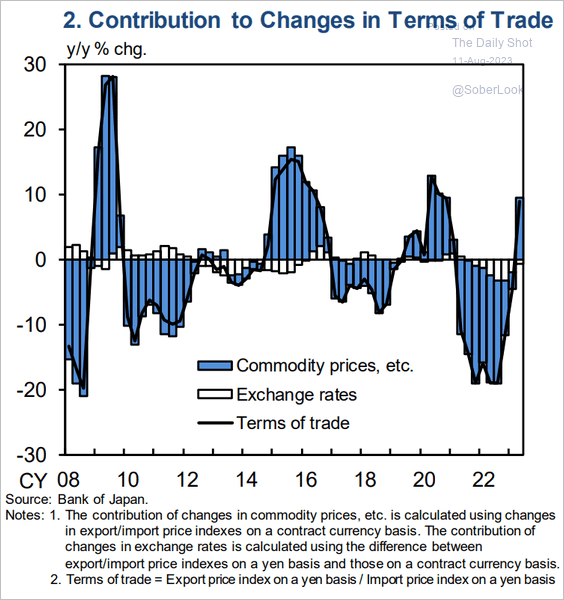

2. Terms of trade have improved sharply as commodity prices fell.

Source: BoJ Read full article

Source: BoJ Read full article

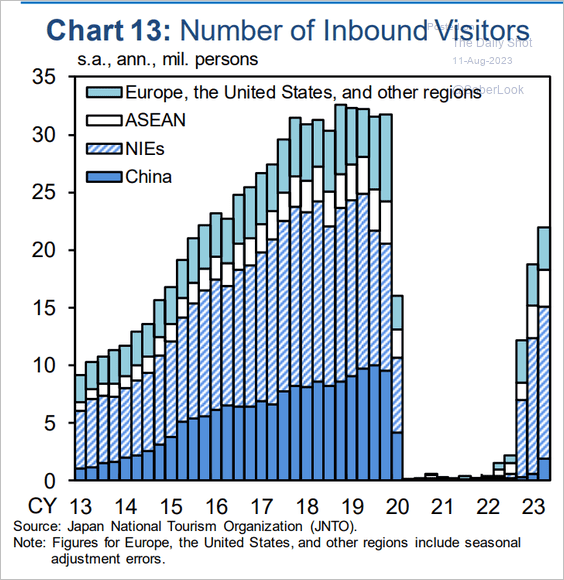

3. This chart shows the number of visitors to Japan.

Source: BoJ Read full article

Source: BoJ Read full article

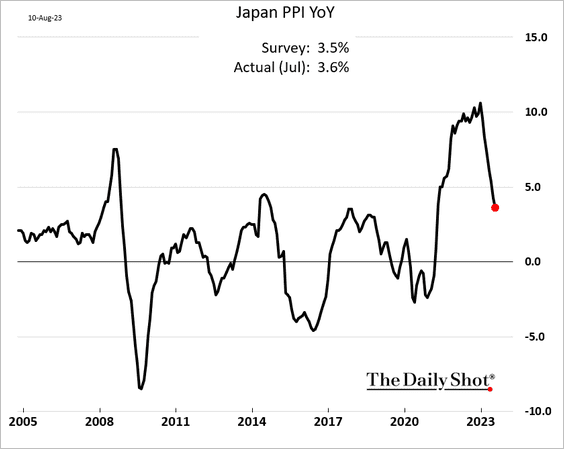

4. The PPI is moderating.

Back to Index

Asia-Pacific

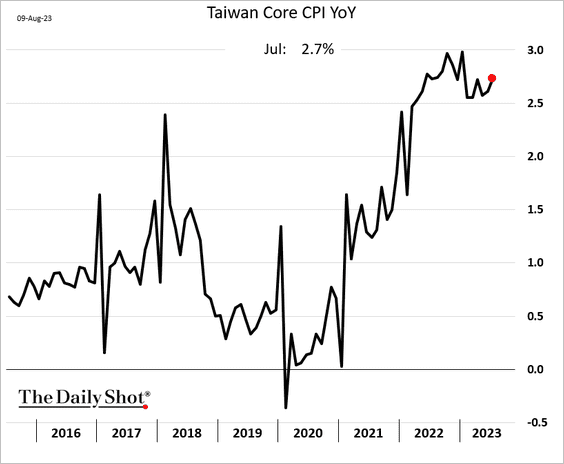

1. Taiwan’s inflation is not slowing.

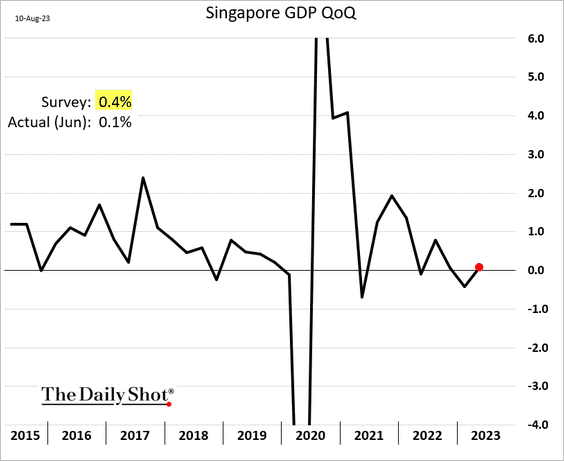

2. Singapore’s Q2 GDP growth surprised to the downside.

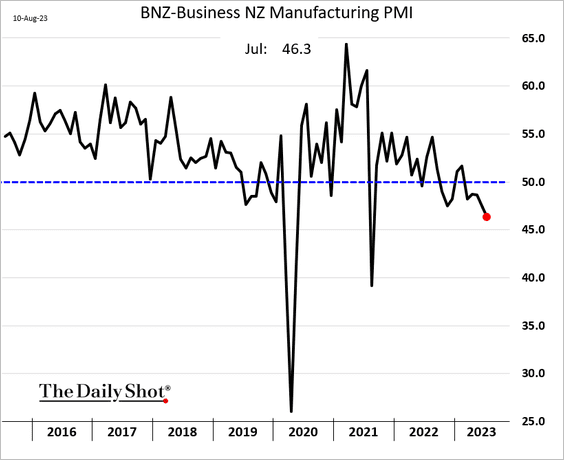

3. New Zealand’s manufacturing contraction accelerated last month.

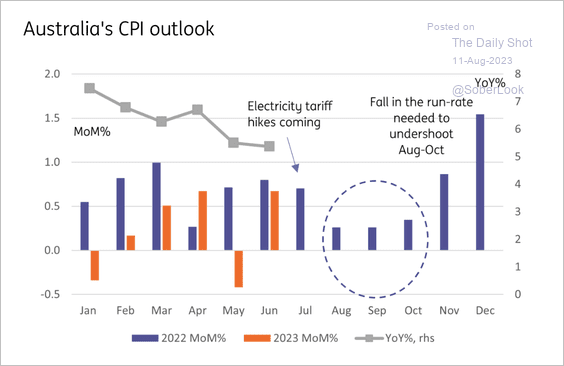

4. Next, we have some updates on Australia.

• Elevated inflation could increase the chance of additional rate hikes.

Source: ING

Source: ING

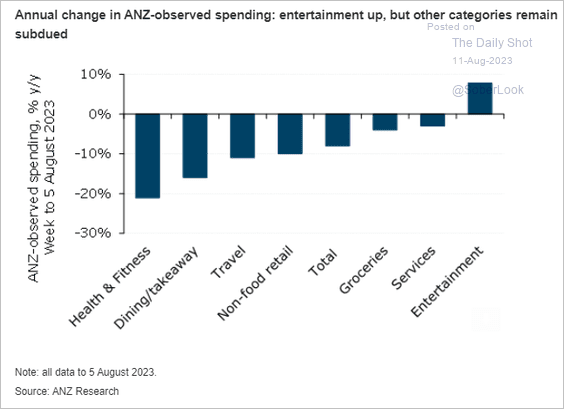

• Household spending has been subdued.

Source: @ANZ_Research

Source: @ANZ_Research

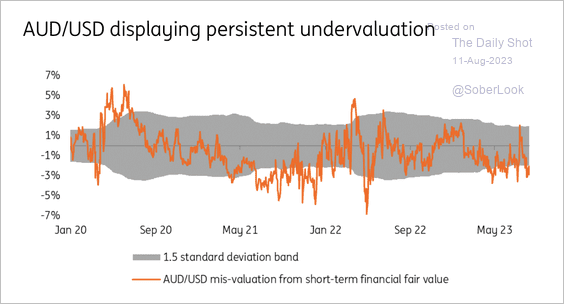

• AUD/USD appears undervalued.

Source: ING

Source: ING

Back to Index

China

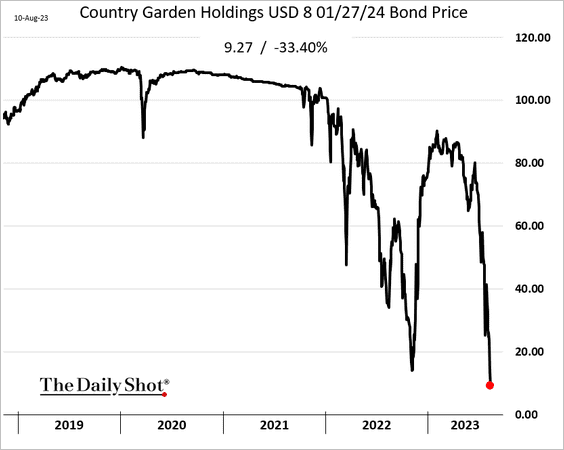

1. Moody’s downgraded Country Garden’s debt to a near-default level.

Source: Moody’s Investors Service Read full article

Source: Moody’s Investors Service Read full article

Bonds hit a new low.

——————–

2. The stock market retreated on concerns about property developers.

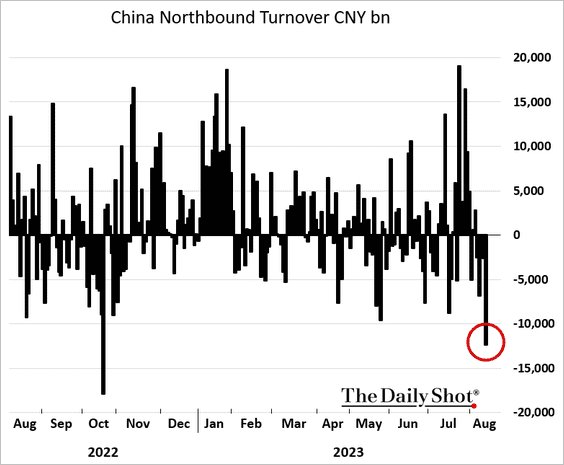

Hong Kong and international investors withdrew a significant amount of capital from mainland Chinese stocks.

——————–

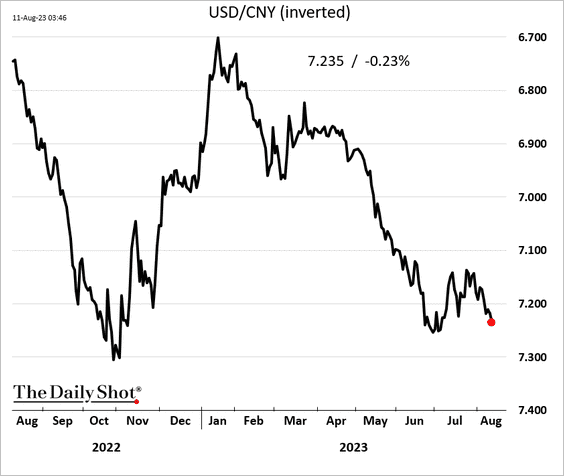

3. The renminbi has reversed its recent bounce, …

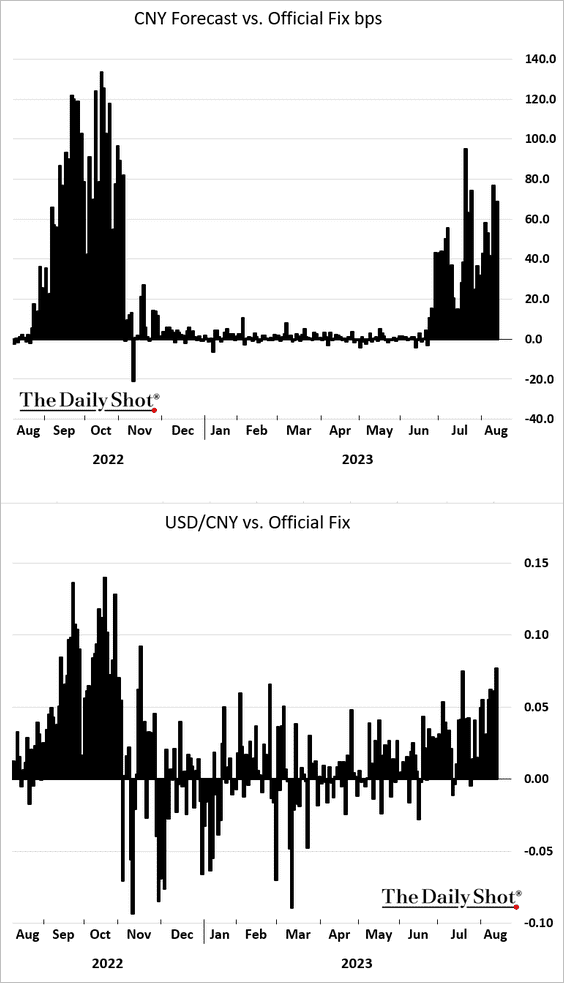

… even as Beijing continues its attempts to prop up the currency.

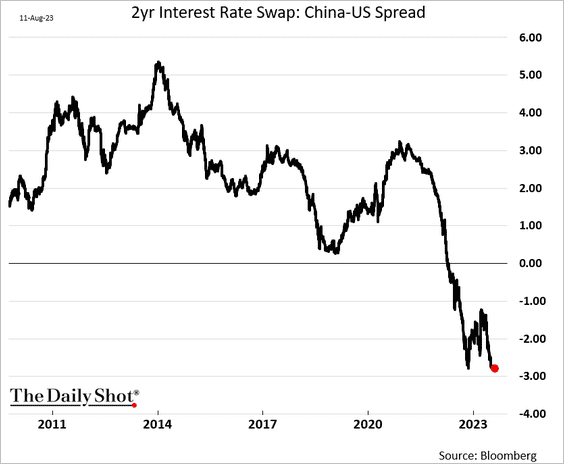

The rate differential with the US has made supporting China’s currency more challenging.

Back to Index

Emerging Markets

1. India’s central bank held rates unchanged but remained hawkish, …

Source: Capital Economics Read full article

Source: Capital Economics Read full article

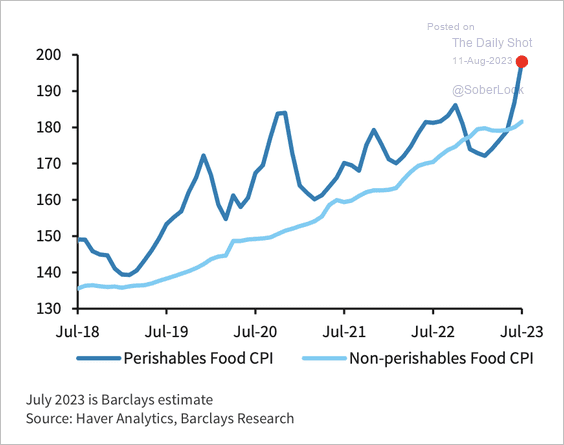

… amid elevated food prices.

Source: Barclays Research

Source: Barclays Research

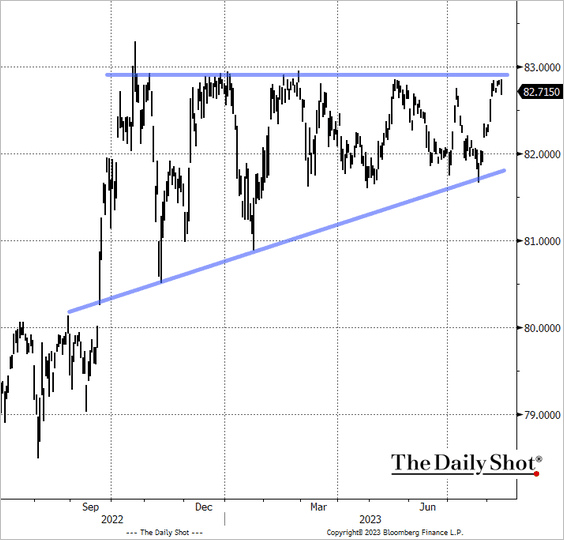

USD/INR is at resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

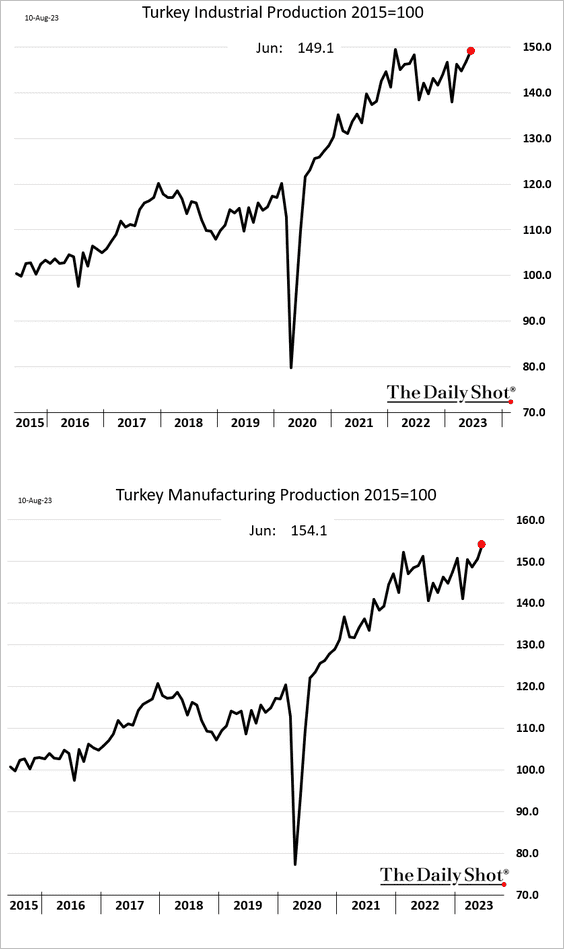

2. Turkey’s manufacturing output has been surging this year.

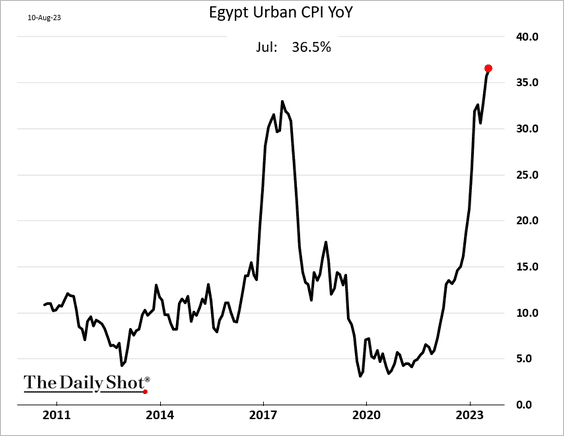

3. Egypt’s inflation continues to climb.

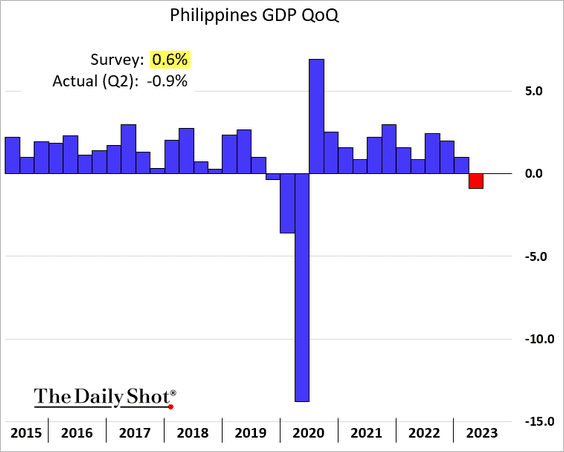

4. The Philippine GDP unexpectedly contracted last quarter.

Source: @economics Read full article

Source: @economics Read full article

——————–

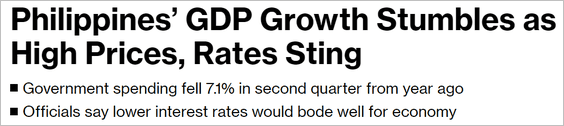

5. The Mexican peso appears overbought versus the dollar.

Back to Index

Commodities

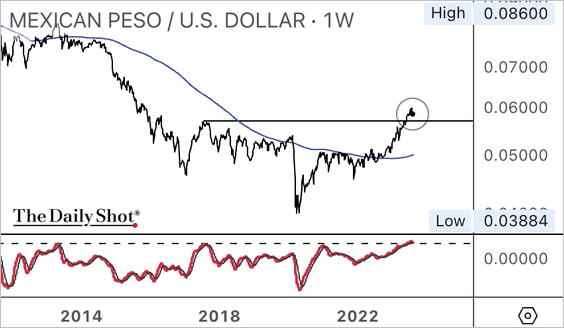

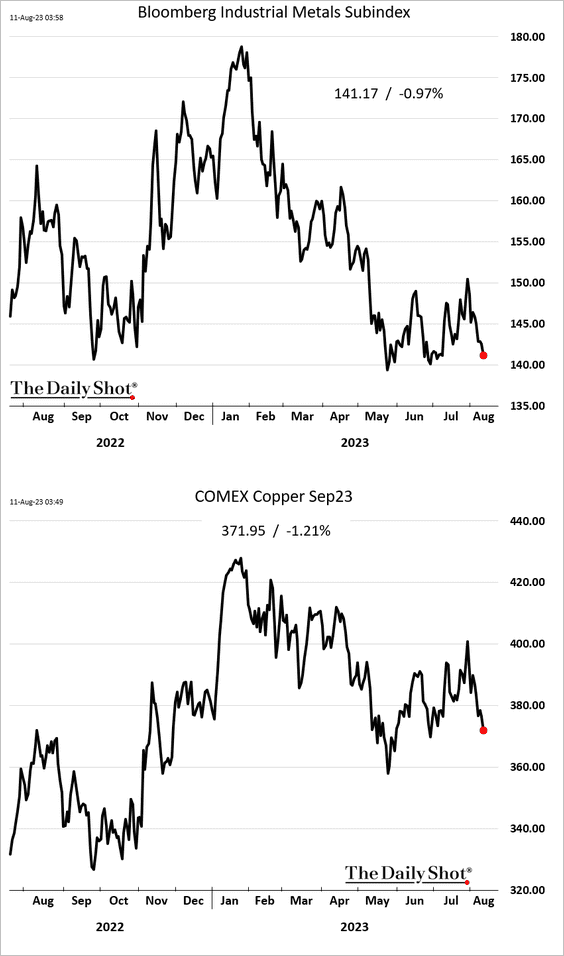

1. Industrial metals have been selling off.

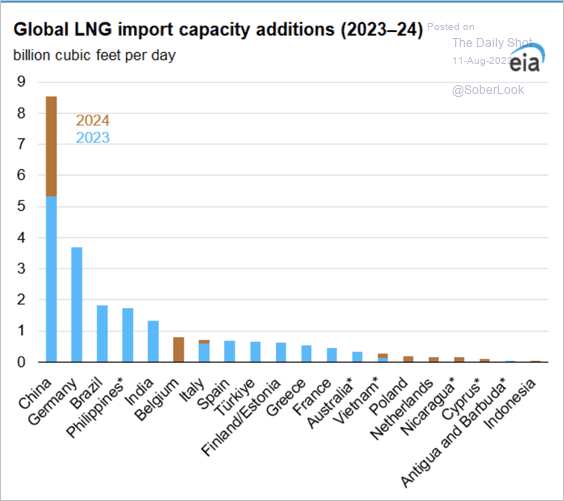

2. This chart shows LNG import capacity additions globally.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

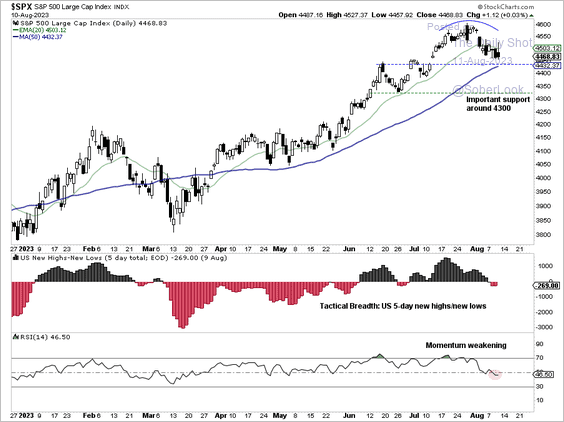

1. The S&P 500’s uptrend has been losing momentum as breadth weakens. Important support is around 4,300.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

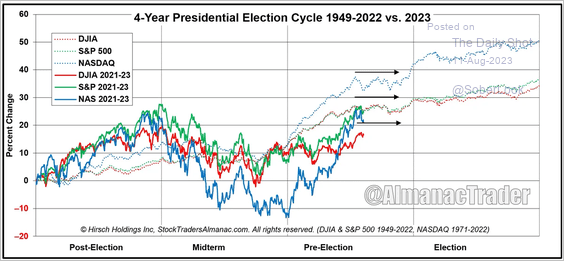

• Historically, the rally in US stocks stalls toward the end of pre-election years.

Source: @AlmanacTrader

Source: @AlmanacTrader

——————–

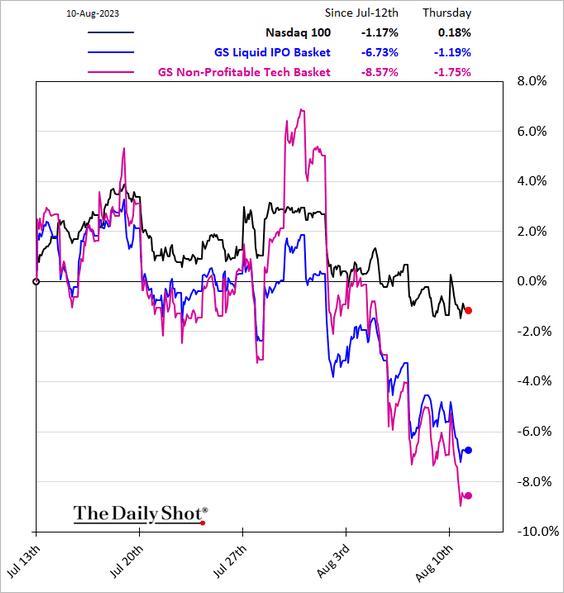

2. Speculative stocks are under pressure.

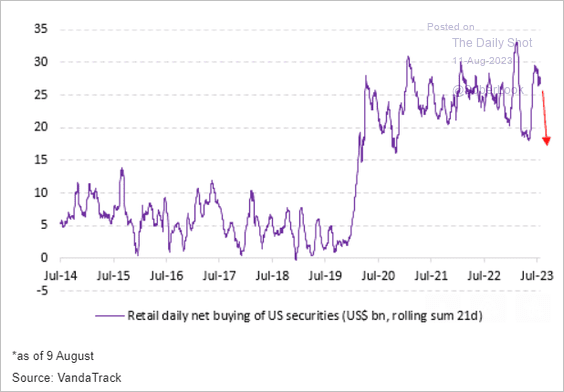

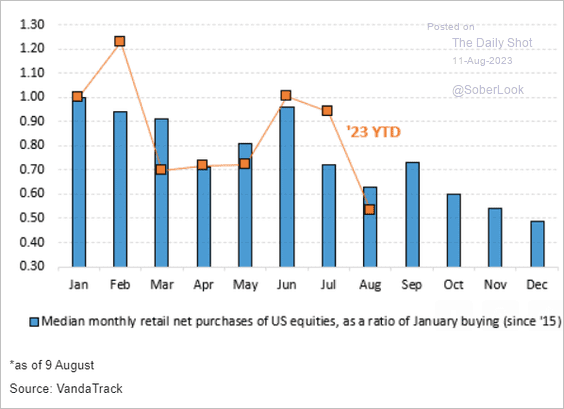

3. Retail buying has been strong, but a seasonal slowdown is coming (2 charts).

Source: Vanda Research

Source: Vanda Research

Source: Vanda Research

Source: Vanda Research

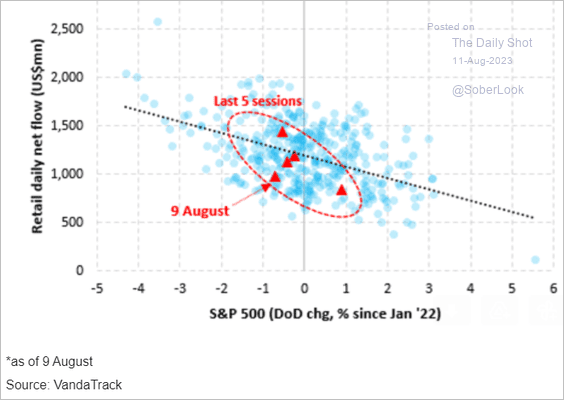

Retail investor dip buying is alive and well.

Source: Vanda Research

Source: Vanda Research

——————–

4. Next, we have some sector updates.

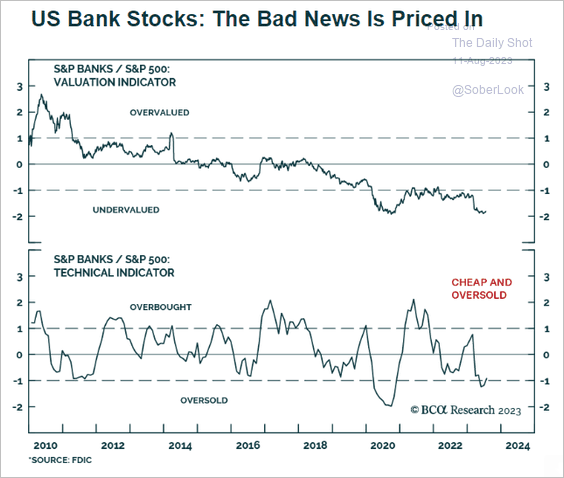

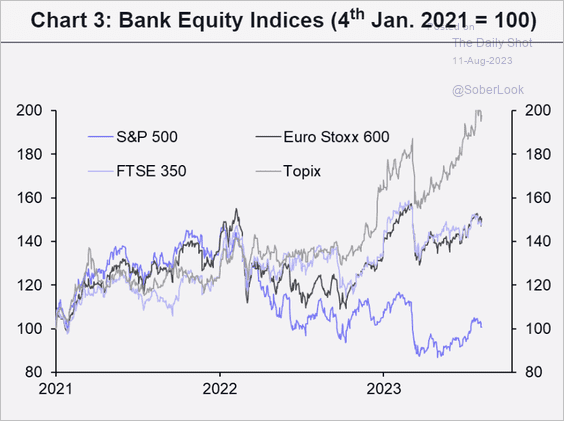

• Are US bank shares oversold?

Source: BCA Research

Source: BCA Research

US bank shares have massively underperformed global peers.

Source: Capital Economics

Source: Capital Economics

——————–

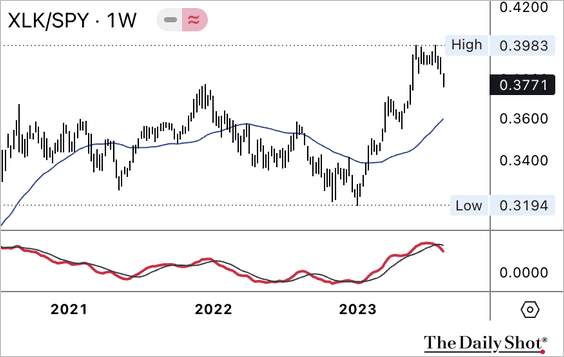

• The rally in tech stocks relative to the S&P 500 is starting to fade.

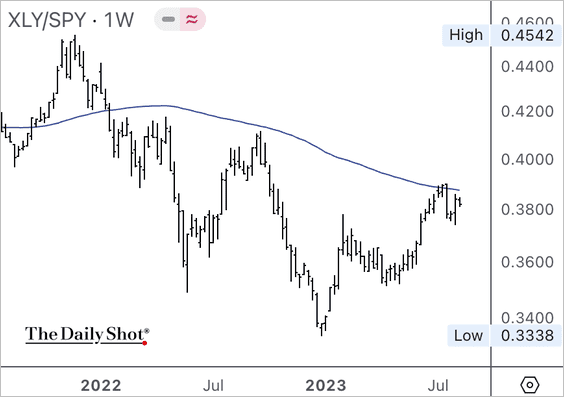

• The consumer discretionary sector is testing resistance relative to the S&P 500.

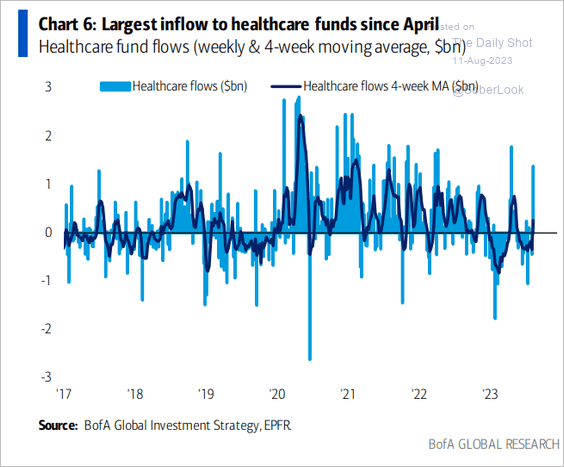

• Healthcare funds registered some inflows.

Source: BofA Global Research

Source: BofA Global Research

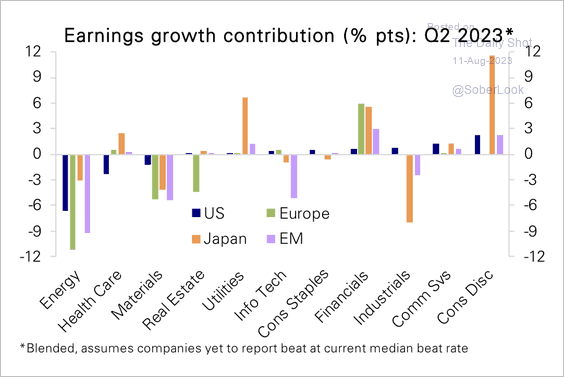

• Globally, energy and materials were a drag on earnings growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

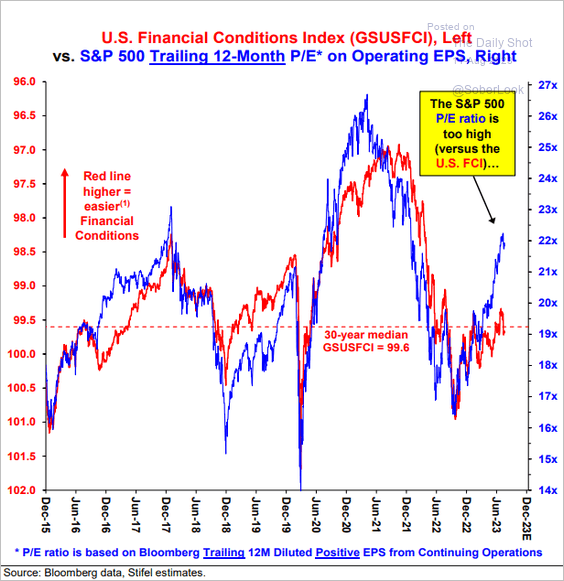

5. US stock valuations are too high, given the relatively tight financial conditions.

Source: Stifel

Source: Stifel

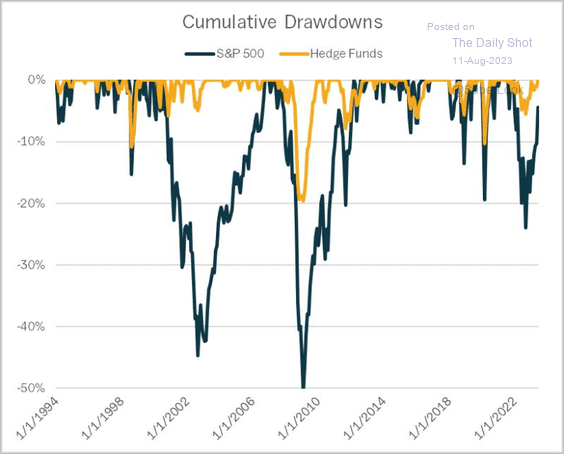

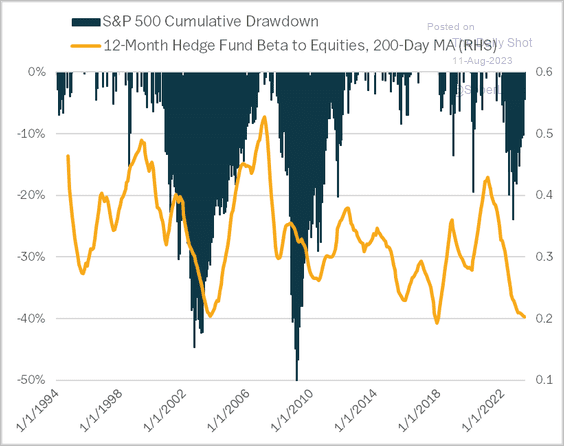

6. Over the past 30 years, hedge funds have experienced lower drawdowns versus the S&P 500, possibly because of their lower aggregate exposure to equity risk. (2 charts)

Source: Unlimited ETFs Read full article

Source: Unlimited ETFs Read full article

Source: Unlimited ETFs Read full article

Source: Unlimited ETFs Read full article

Back to Index

Credit

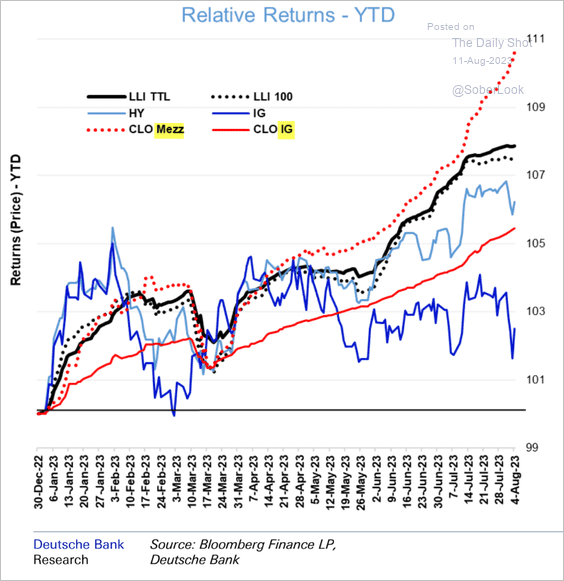

1. CLO returns have been strong this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

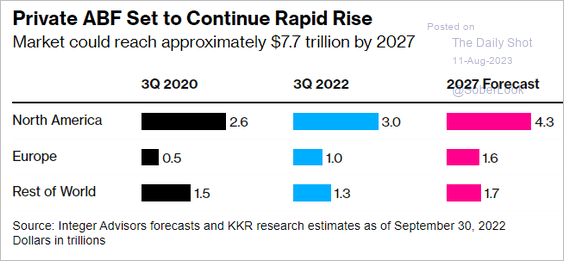

2. Private credit funds are boosting their investments in consumer debt (ABF = asset-backed finance).

Source: @business Read full article

Source: @business Read full article

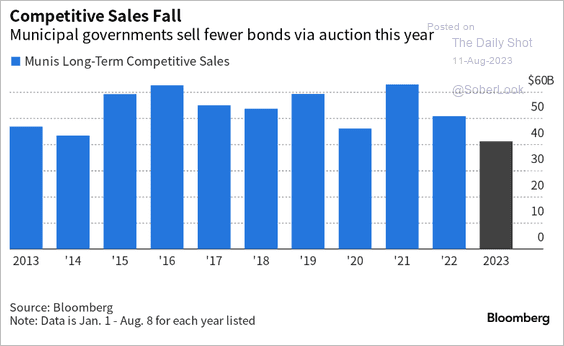

3. Muni auctions have slowed.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

Back to Index

Rates

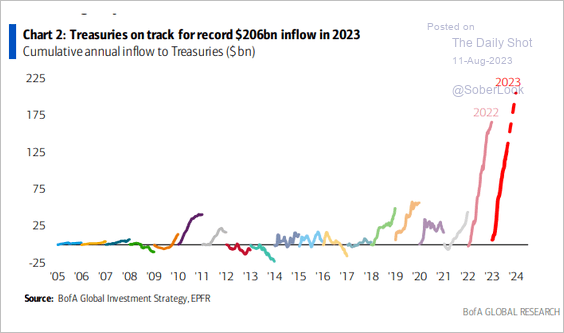

1. Treasury fund inflows will hit a record this year.

Source: BofA Global Research

Source: BofA Global Research

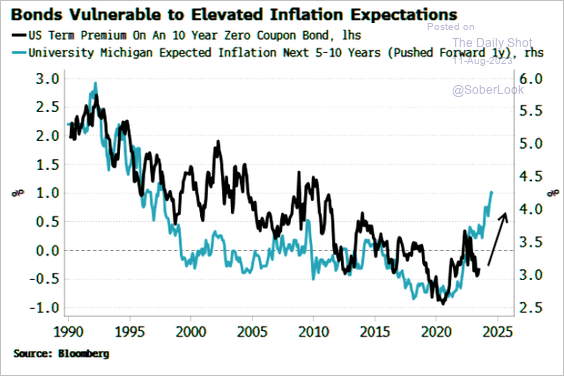

2. Elevated inflation expectations suggest that Treasury term premium will rise.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

Food for Thought

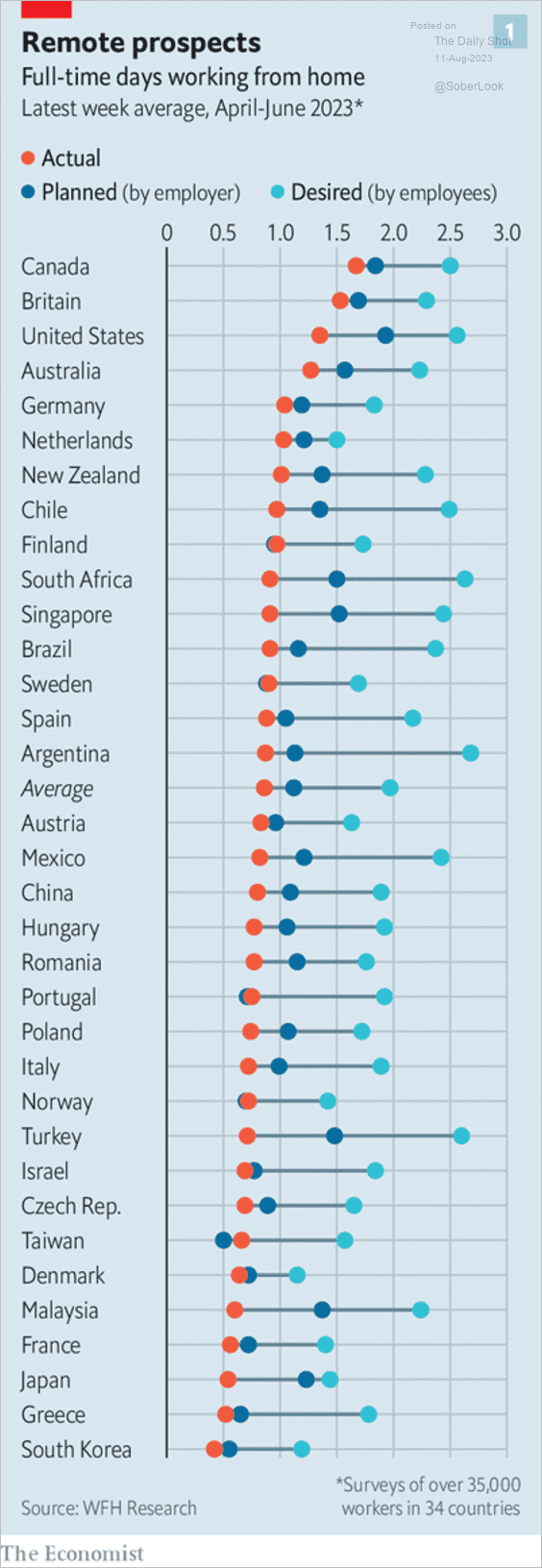

1. Full-time days working from home:

Source: The Economist Read full article

Source: The Economist Read full article

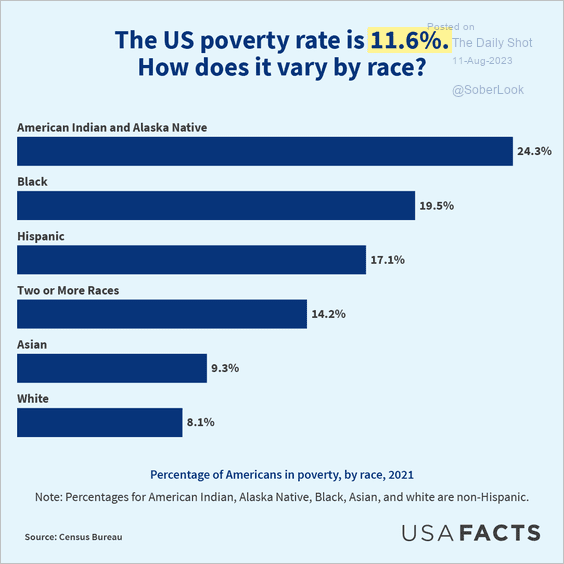

2. US poverty rates:

Source: USAFacts

Source: USAFacts

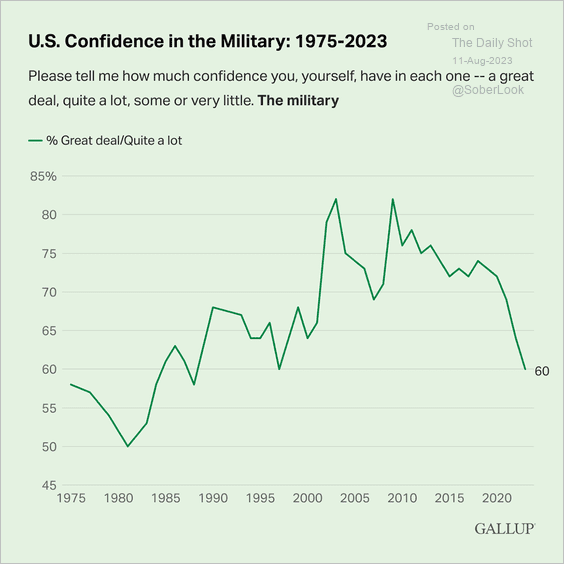

3. Confidence in the US military:

Source: Gallup Read full article

Source: Gallup Read full article

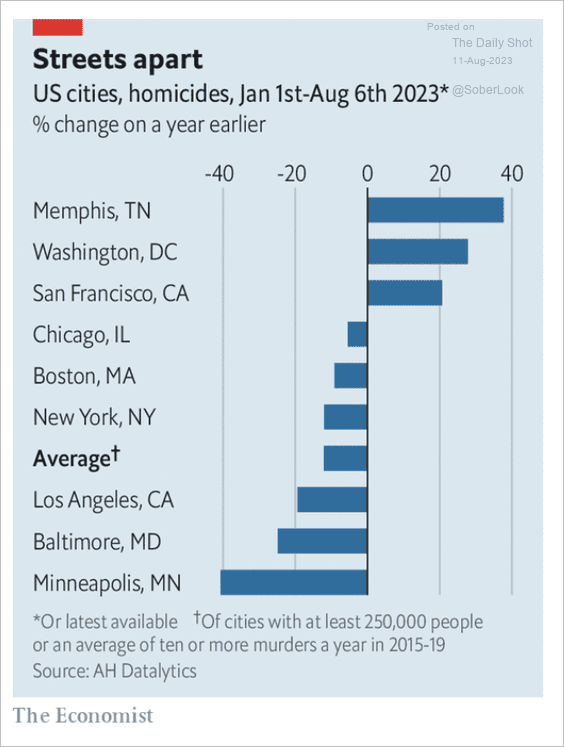

4. Change in homicides from last year:

Source: The Economist Read full article

Source: The Economist Read full article

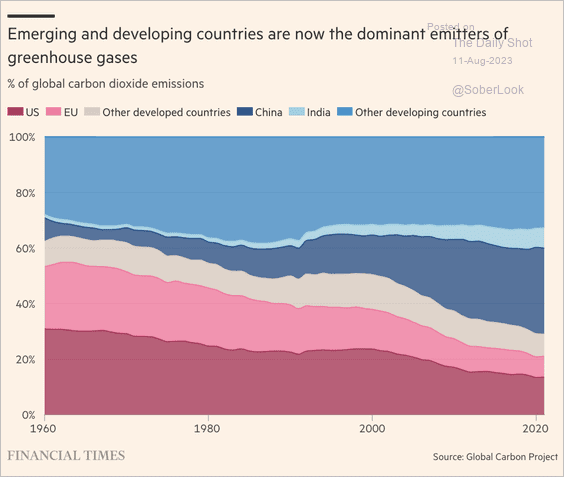

5. Greenhouse gas emitters:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

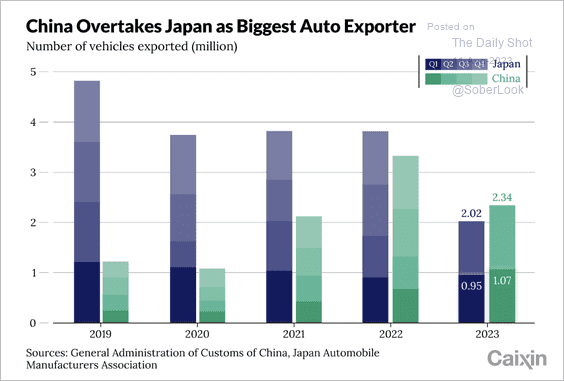

6. China vs. Japan vehicle exports:

Source: Caixin Read full article

Source: Caixin Read full article

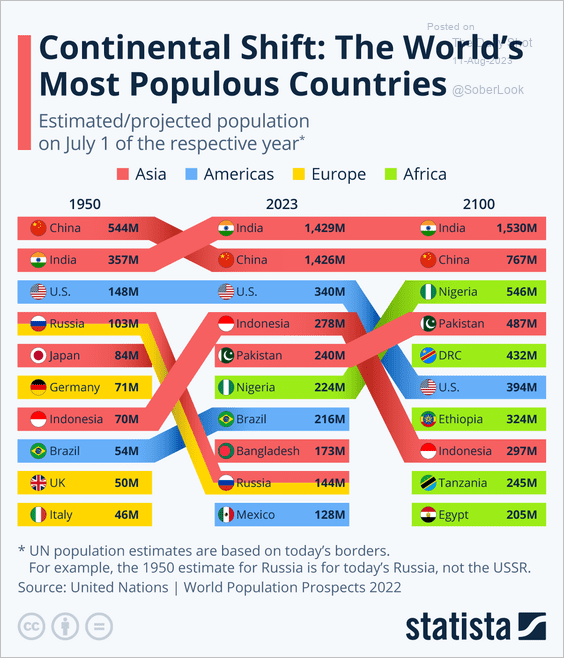

7. The most populous countries:

Source: Statista

Source: Statista

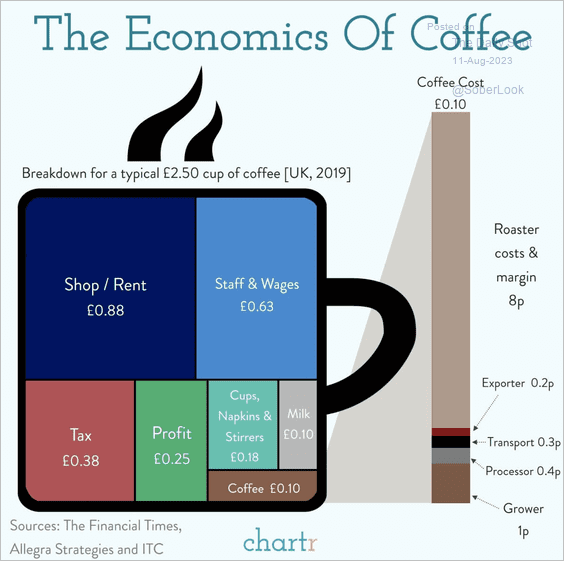

8. The economics of coffee:

Source: @chartrdaily

Source: @chartrdaily

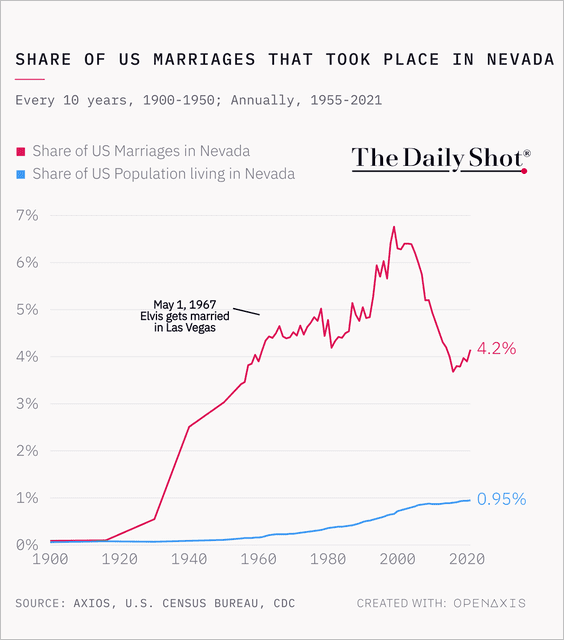

9. Share of US marriages that took place in Nevada:

Source: @TheDailyShot Further reading

Source: @TheDailyShot Further reading

——————–

Have a great weekend!

Back to Index