The Daily Shot: 07-Nov-23

• The United States

• Canada

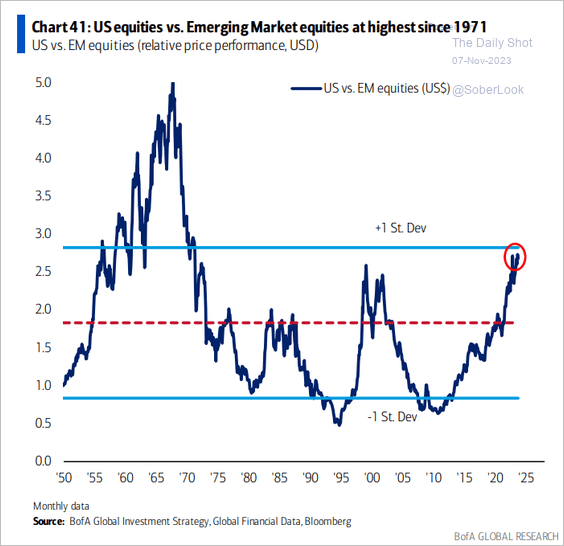

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

UPDATED

The United States

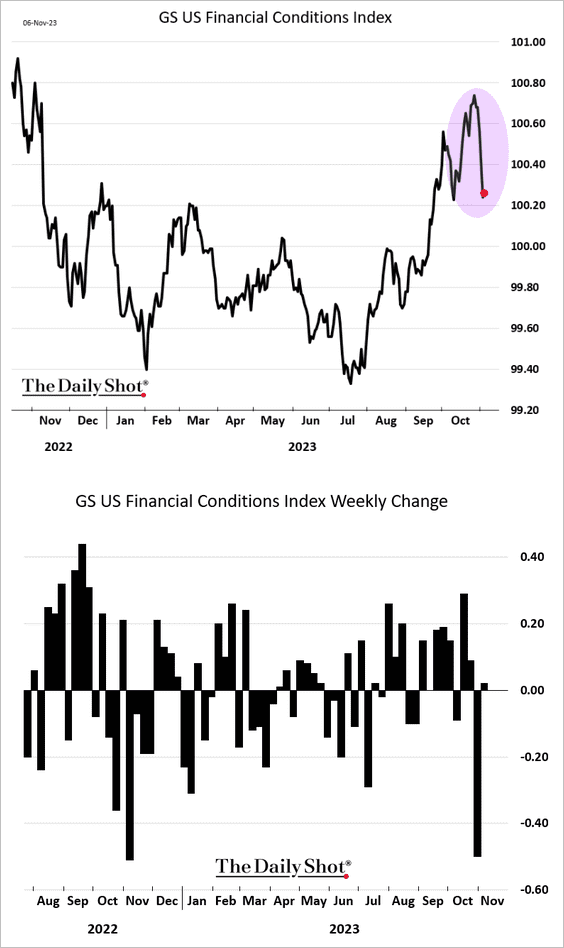

1. US financial conditions eased sharply over the past few days.

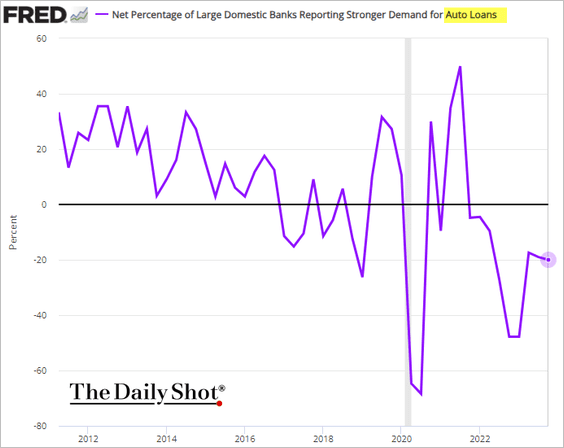

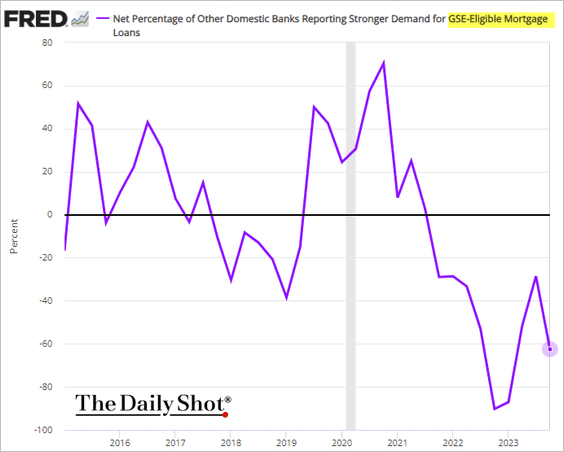

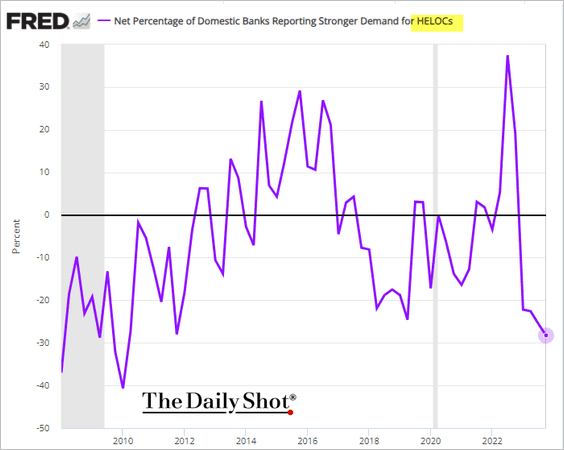

2. Next, we have some updates on consumer credit.

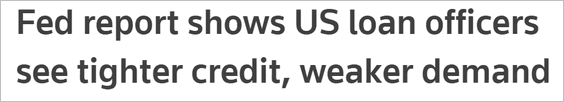

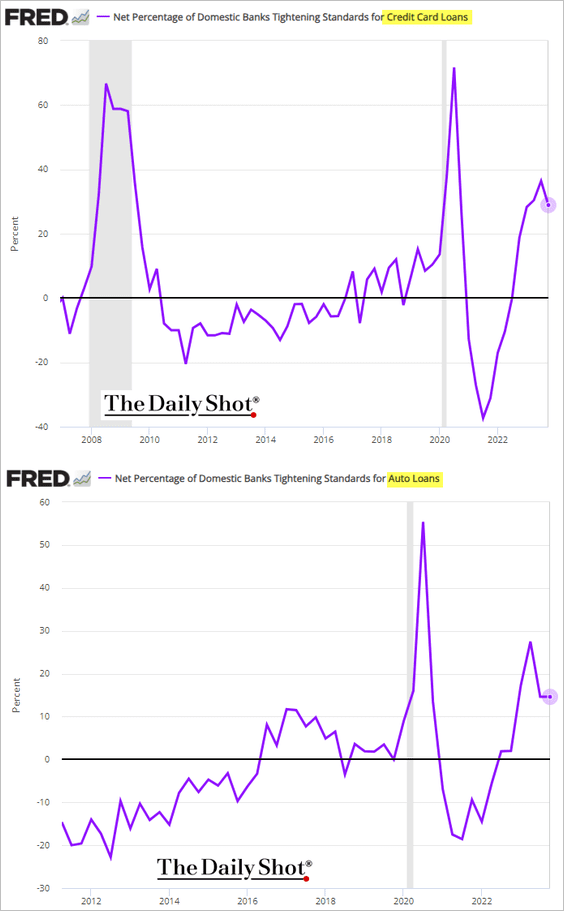

• Banks continue to report tightening credit standards and softer demand.

Source: Reuters Read full article

Source: Reuters Read full article

– Net percentage of banks tightening credit standards on credit card and auto loans:

– Net percentage of banks reporting stronger demand for credit card and auto loans:

– Net percentage of banks reporting stronger demand for mortgages and home equity loans:

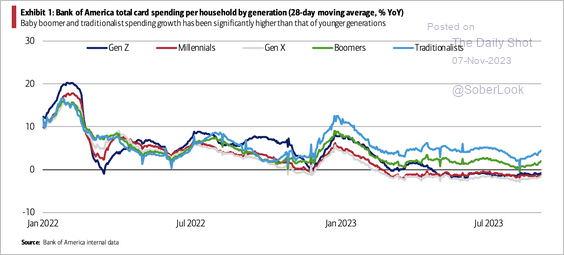

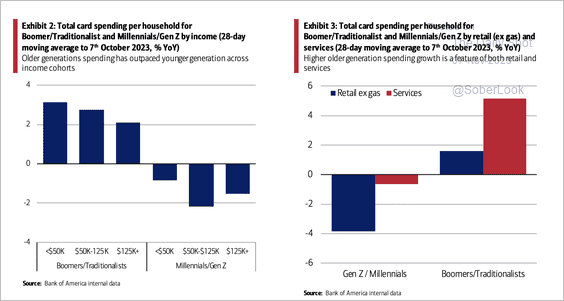

• Older generations have outpaced younger generations in credit and debit card spending this year, particularly in services, according to BofA. (2 charts)

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

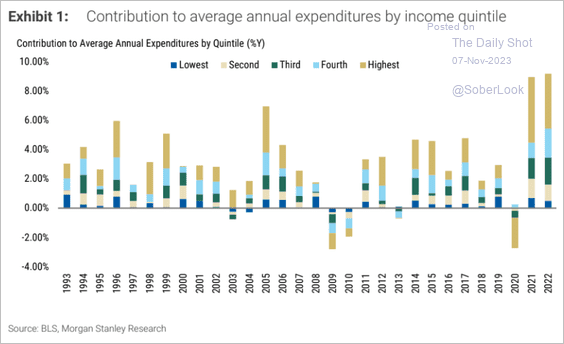

• Higher-income households have been driving US spending growth.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

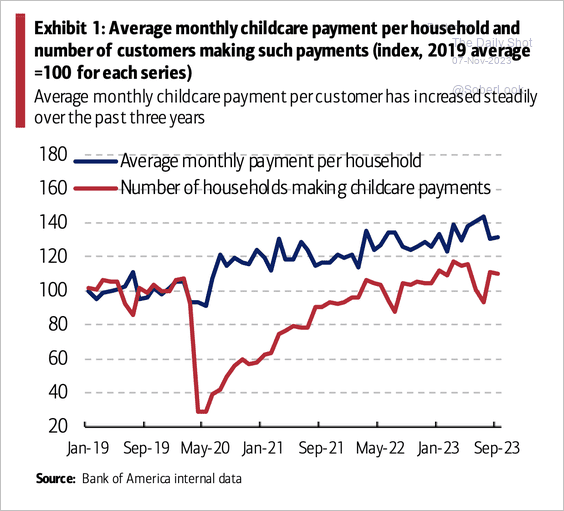

• Households continue to face high childcare costs, especially for those in the middle and upper-income brackets.

Source: BofA Global Research

Source: BofA Global Research

——————–

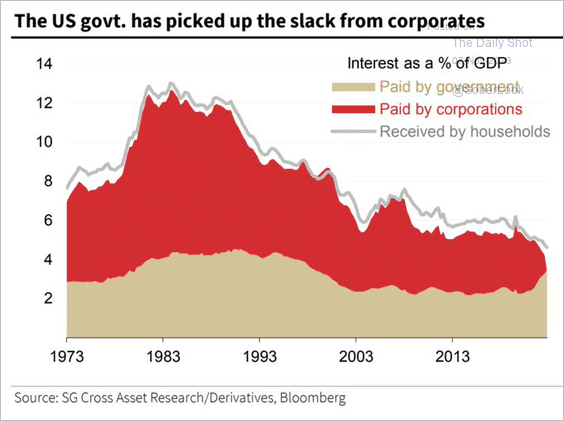

3. Households are now collecting much more interest from government bonds than from corporate debt.

Source: SocGen; @dailychartbook

Source: SocGen; @dailychartbook

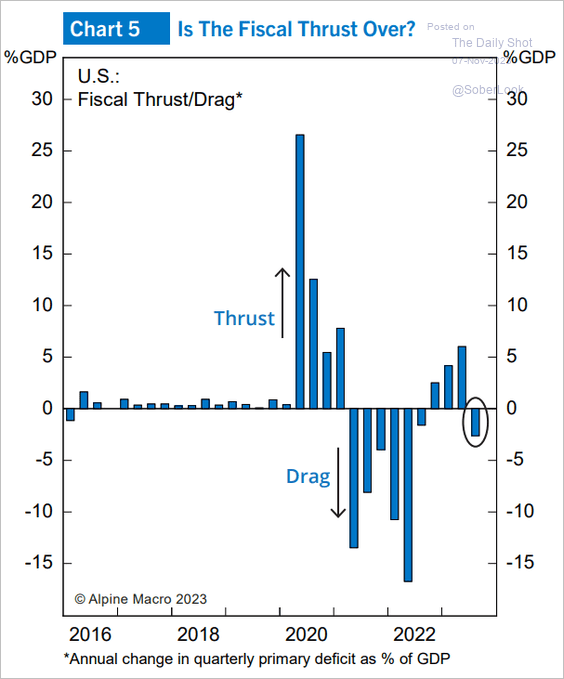

4. Fiscal policy is now a drag on growth.

Source: Alpine Macro

Source: Alpine Macro

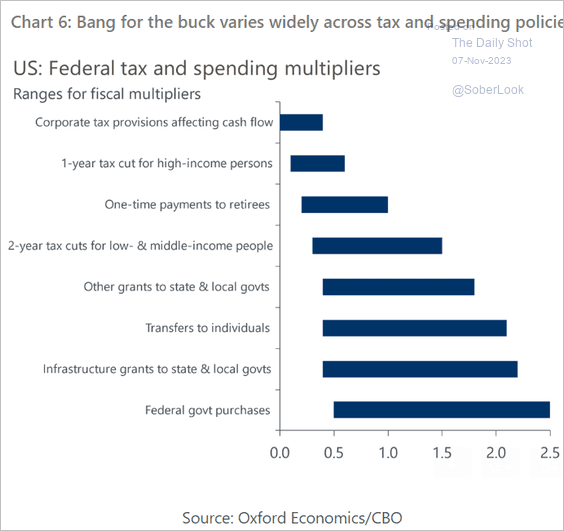

Here is a look at fiscal stimulus multipliers (ranges).

Source: Oxford Economics

Source: Oxford Economics

——————–

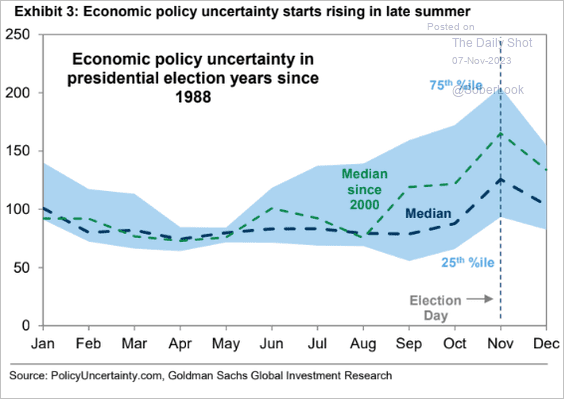

5. Economic uncertainty tends to rise going into US presidential elections.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

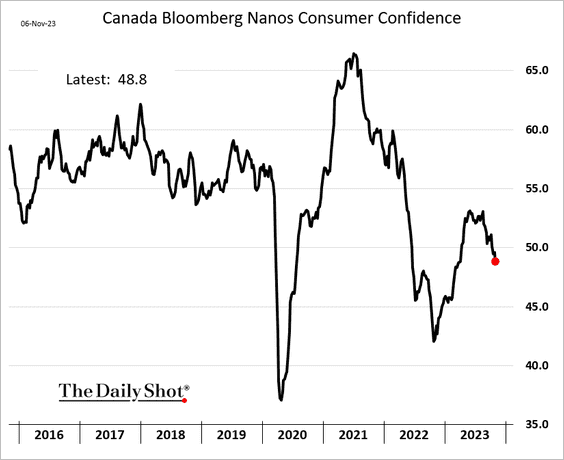

Canada

1. Consumer confidence continues to sink.

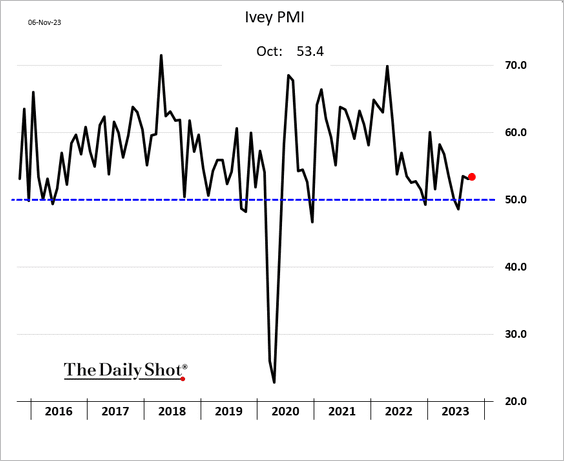

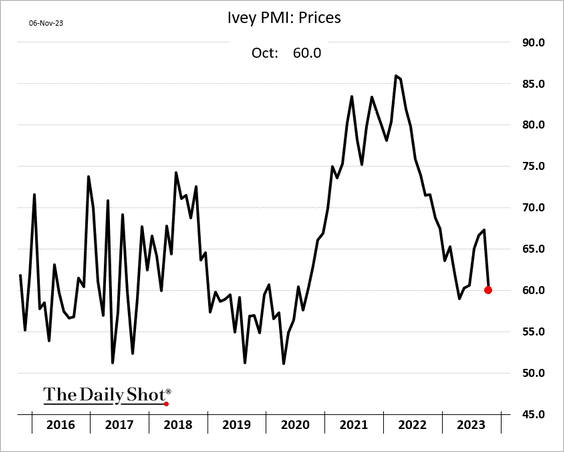

2. While private-sector business activity is in contraction territory, the whole-economy activity is holding up, according to the Ivey PMI.

Price pressures eased last month.

Back to Index

The United Kingdom

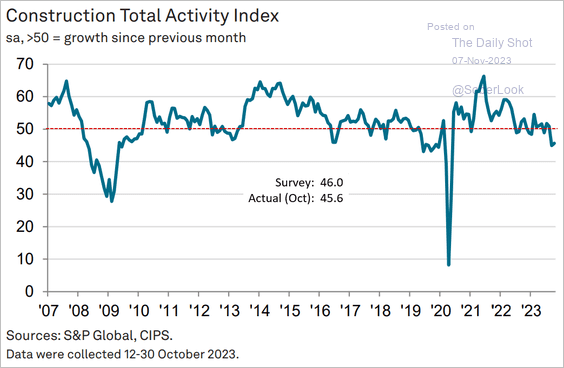

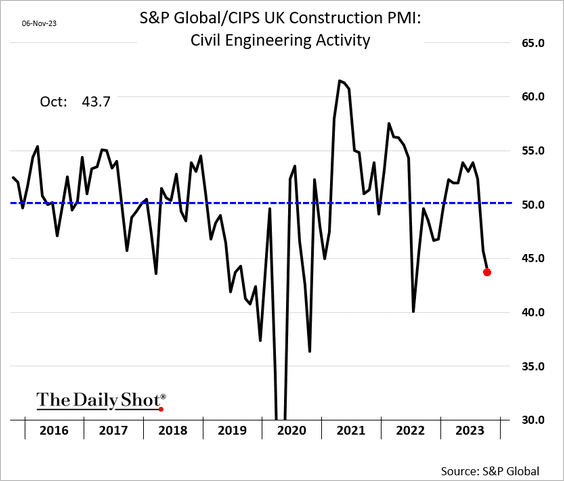

1. Construction activity continues to shrink (2 charts).

Source: S&P Global PMI

Source: S&P Global PMI

——————–

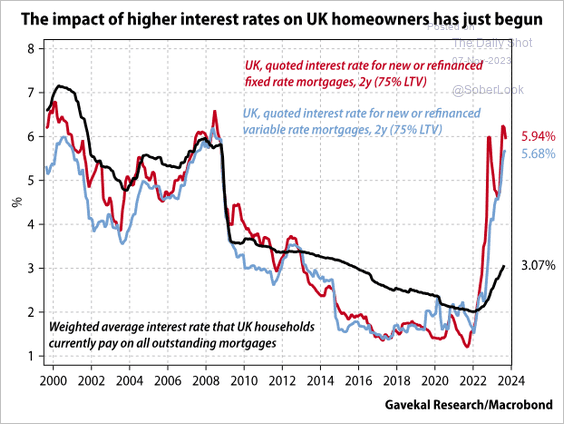

2. Homeowners are facing a refinancing shock.

Source: Gavekal Research

Source: Gavekal Research

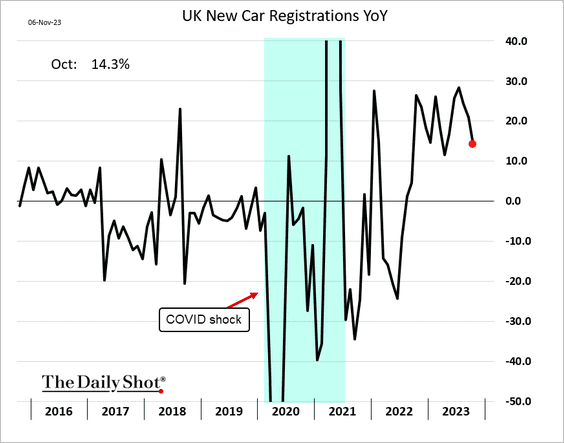

3. New car registrations are running well ahead of last year’s levels.

Back to Index

The Eurozone

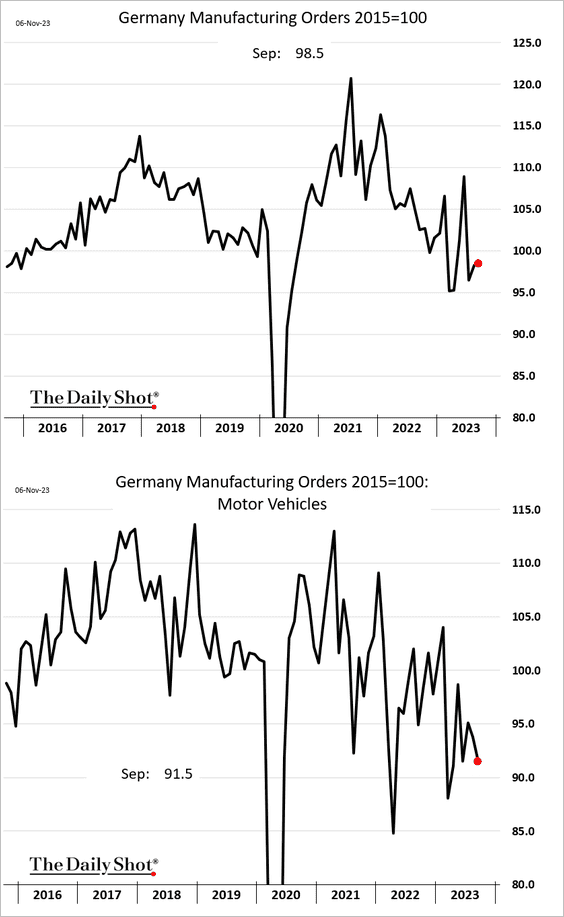

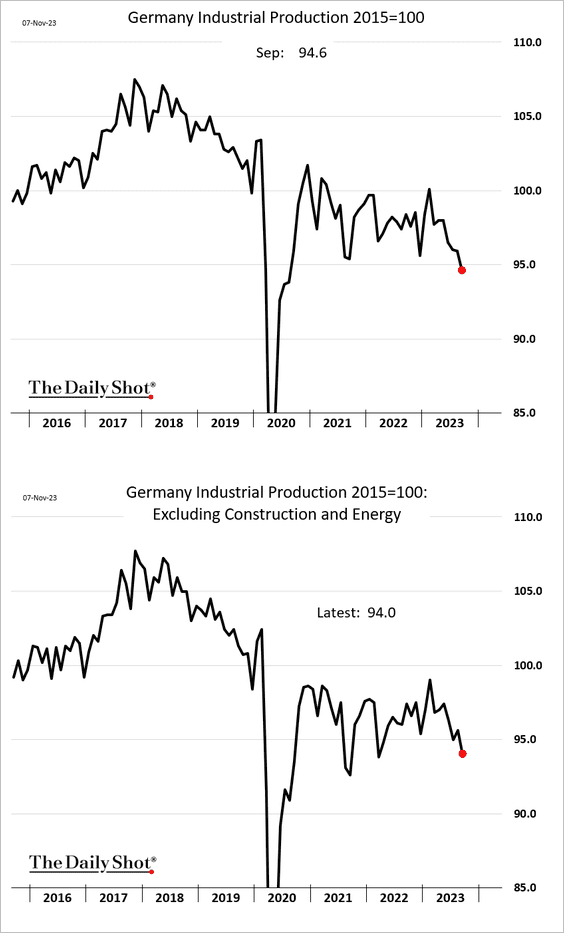

1. Germany’s manufacturing orders edged higher in September, …

But industrial production is tumbling.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

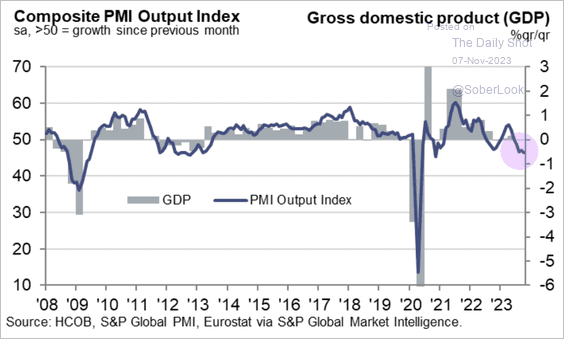

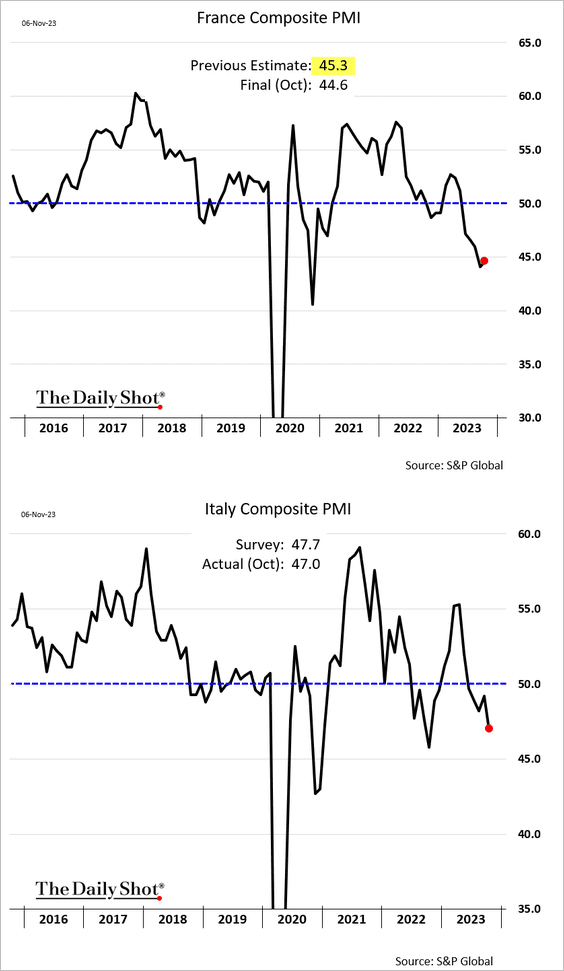

2. Euro-area October PMI reports have been awful.

Source: S&P Global PMI

Source: S&P Global PMI

Source: Reuters Read full article

Source: Reuters Read full article

——————–

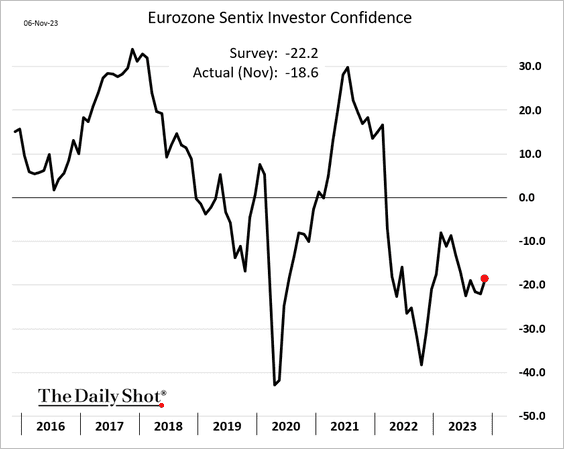

3. The Sentix index showed some improvement this month.

Back to Index

Europe

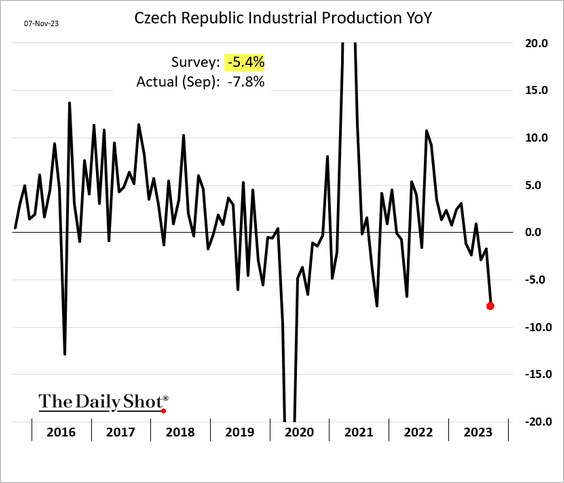

1. Czech industrial production is down sharply on a year-over-year basis.

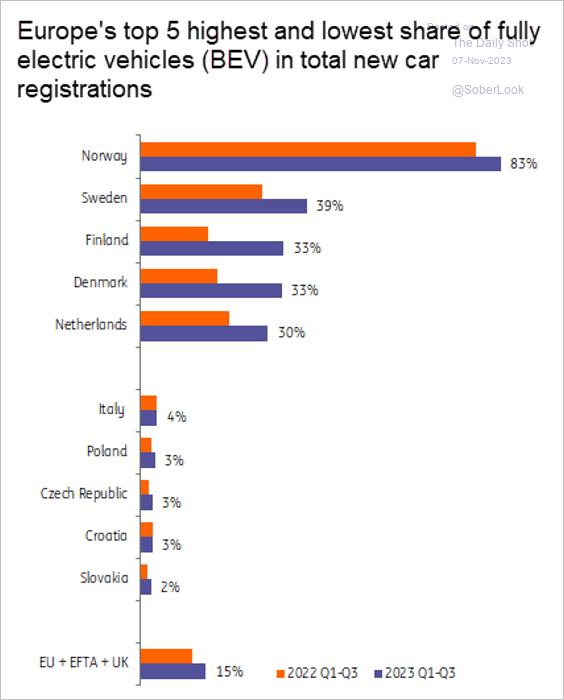

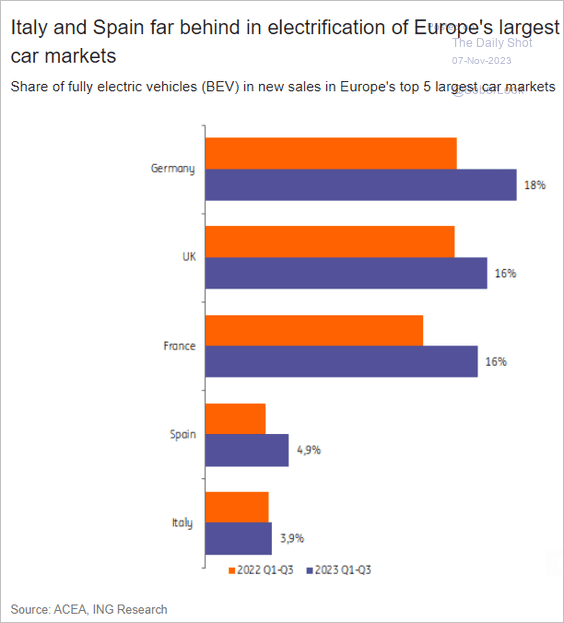

2. Here is a look at the shift to EVs (2 charts).

Source: ING

Source: ING

Source: ING

Source: ING

Back to Index

Asia-Pacific

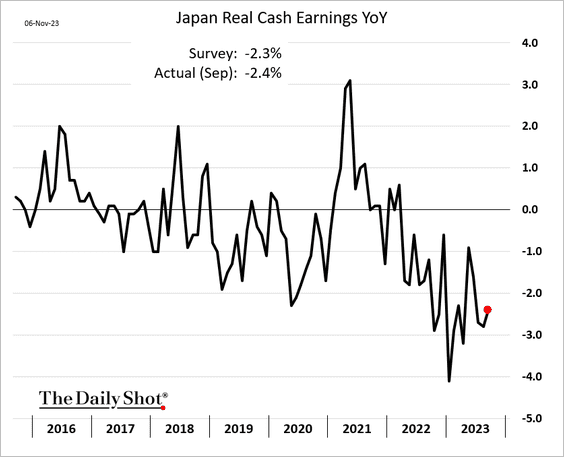

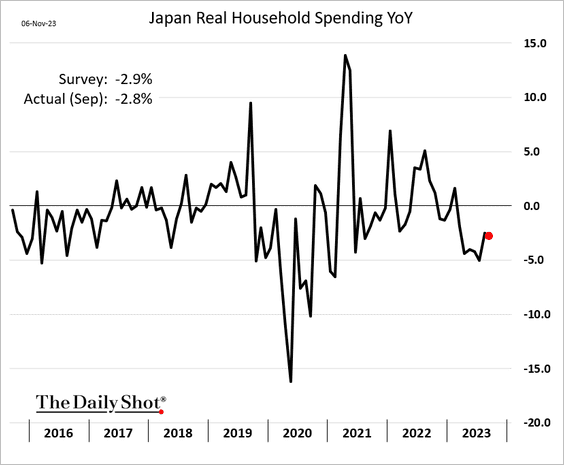

1. Japan’s real wages remain well below last year’s levels …

… which has been a drag on consumer spending.

——————–

2. Next, we have some updates on Australia.

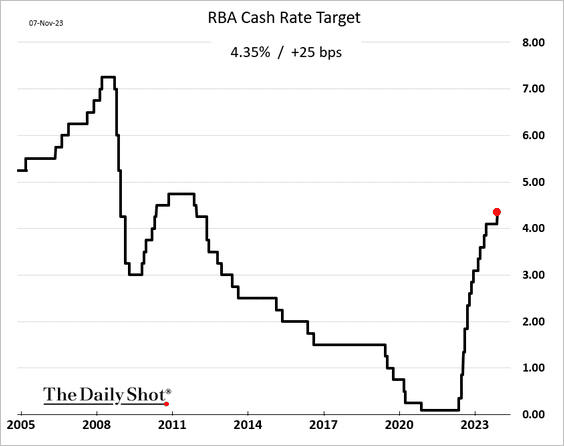

• It’s not over until it’s over. Earlier this year, there was speculation that the RBA had finished raising rates, yet the central bank has implemented another rate hike. This development could hold a lesson for the Fed watchers who say the US central bank is done.

Source: @WSJ Read full article

Source: @WSJ Read full article

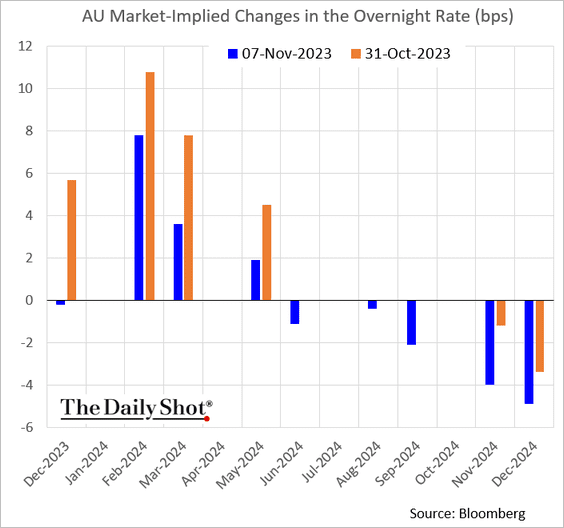

– The market is currently pricing in a probability of more than 50% for another rate increase.

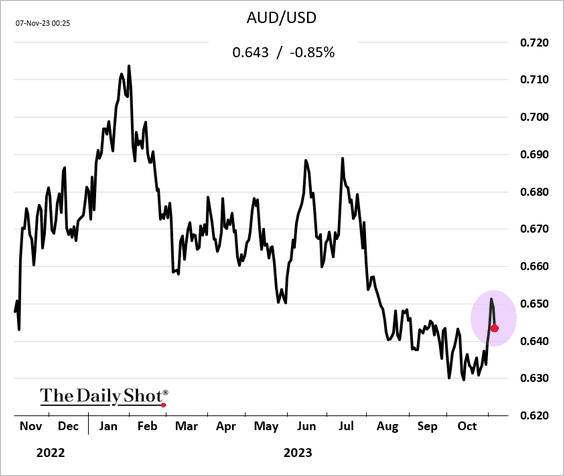

– The Aussie dollar is off the recent high.

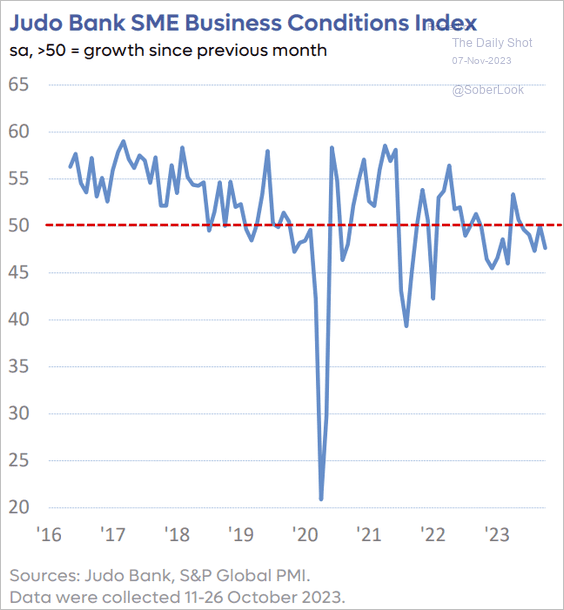

• Separately, Australia’s small businesses continue to face challenges.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

China

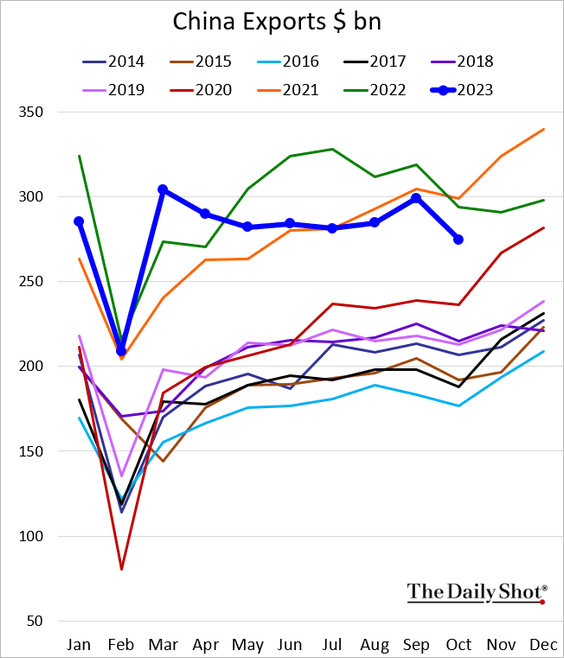

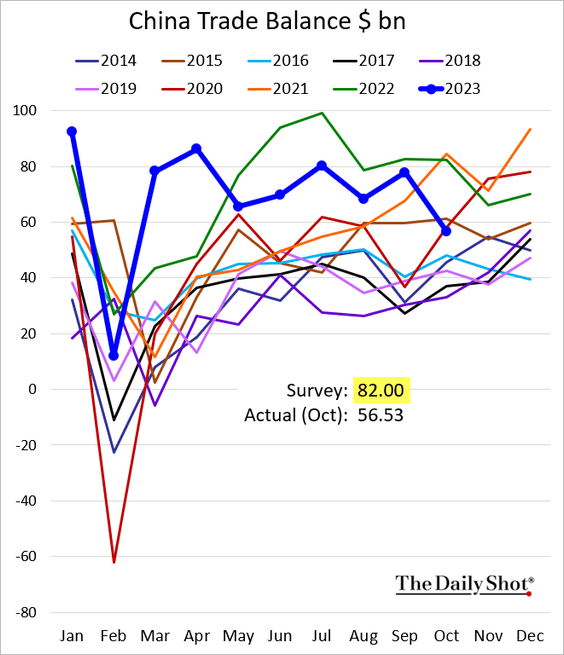

1. Exports held below last year’s levels in October.

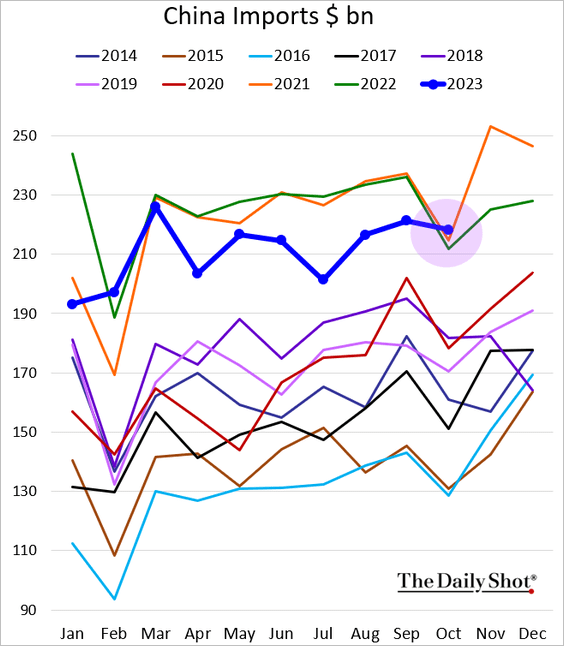

But imports hit a record high for this time of the year.

As a result, the trade balance was well below expectations.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

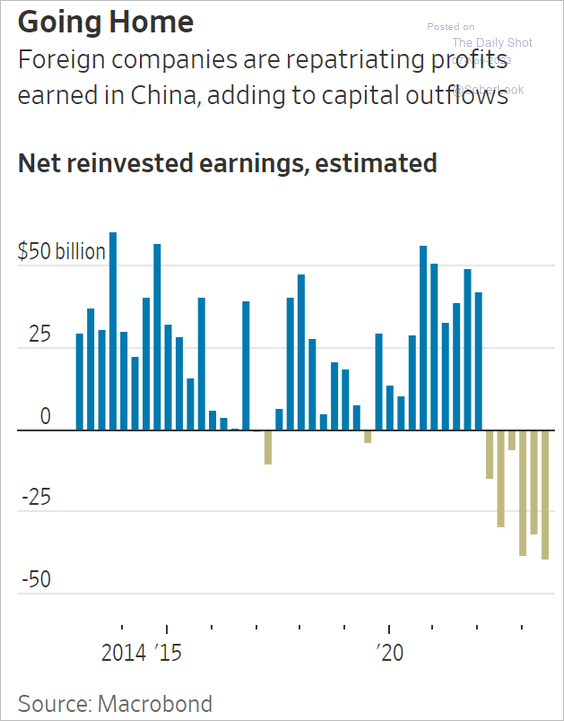

2. Foreign companies have been increasingly repatriating profits out of China.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

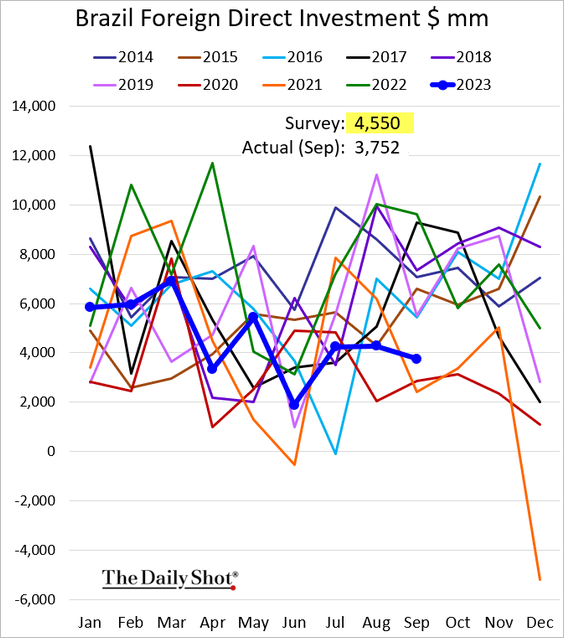

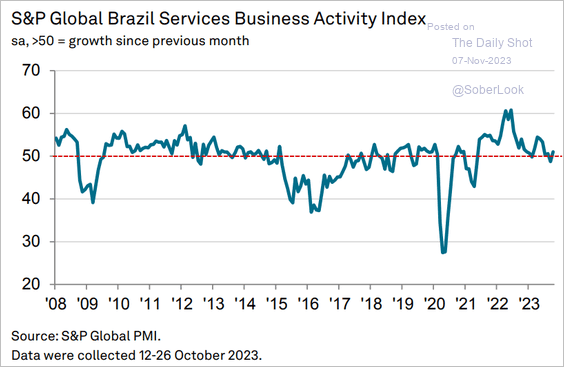

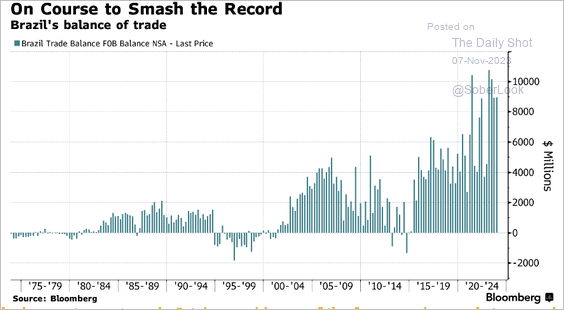

1. Let’s begin with Brazil.

• Foreign direct investment (softer than expected):

• Services PMI (back in growth mode):

Source: S&P Global PMI

Source: S&P Global PMI

• The trade surplus (very strong):

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

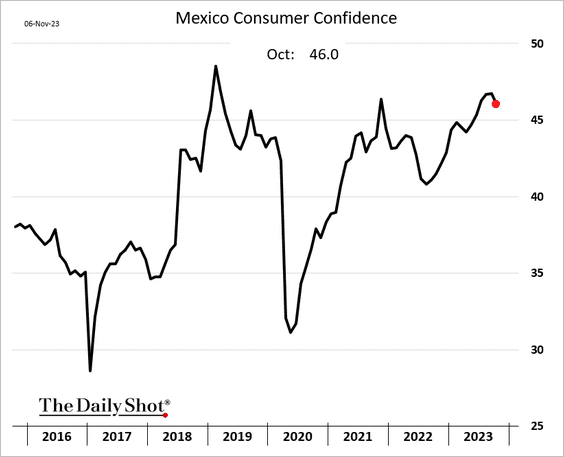

2. Mexico’s consumer confidence remains elevated.

3. Is US outperformance versus EM equities about to end?

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

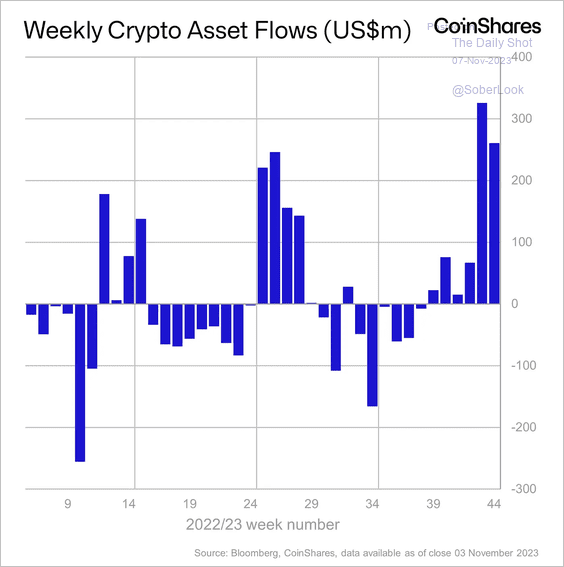

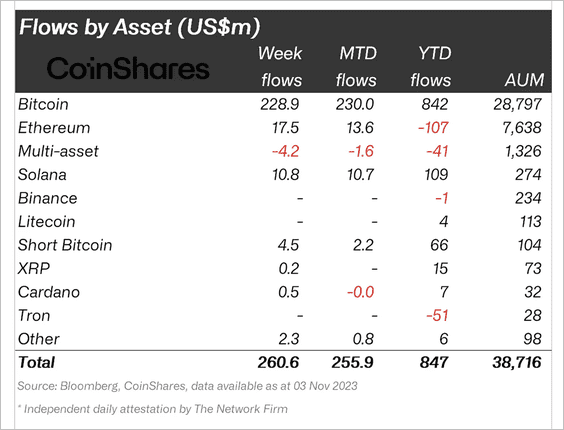

1. Crypto funds saw the sixth consecutive week of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

• Long-bitcoin products accounted for most inflows last week, while investors continued to exit multi-asset funds.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

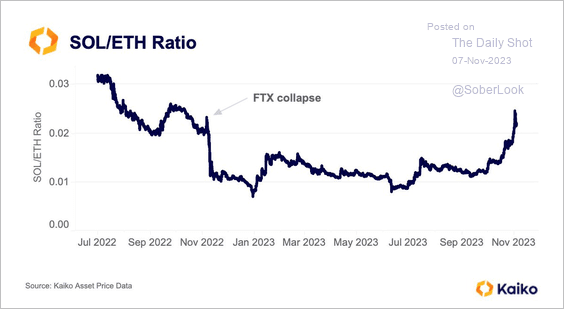

2. The SOL/ETH price ratio is reversing its previous downtrend.

Source: @KaikoData

Source: @KaikoData

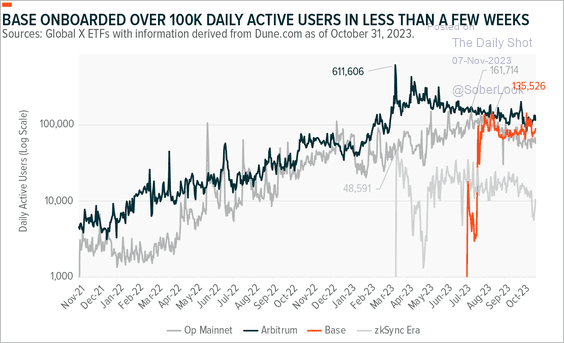

3. Base, Coinbase’s Ethereum L2 network, saw a surge in onboarding activity during its first few weeks. The “testnet” allows developers to build blockchain apps, such as financial services and social platforms, which could generate fee revenue for Coinbase.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

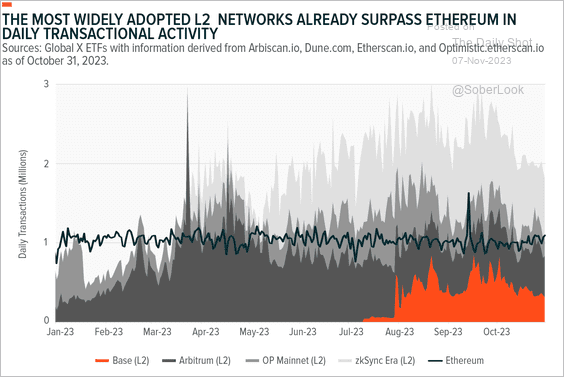

• More blockchain transactions have migrated from Ethereum to lower-cost Layer 2 (L2) networks.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Commodities

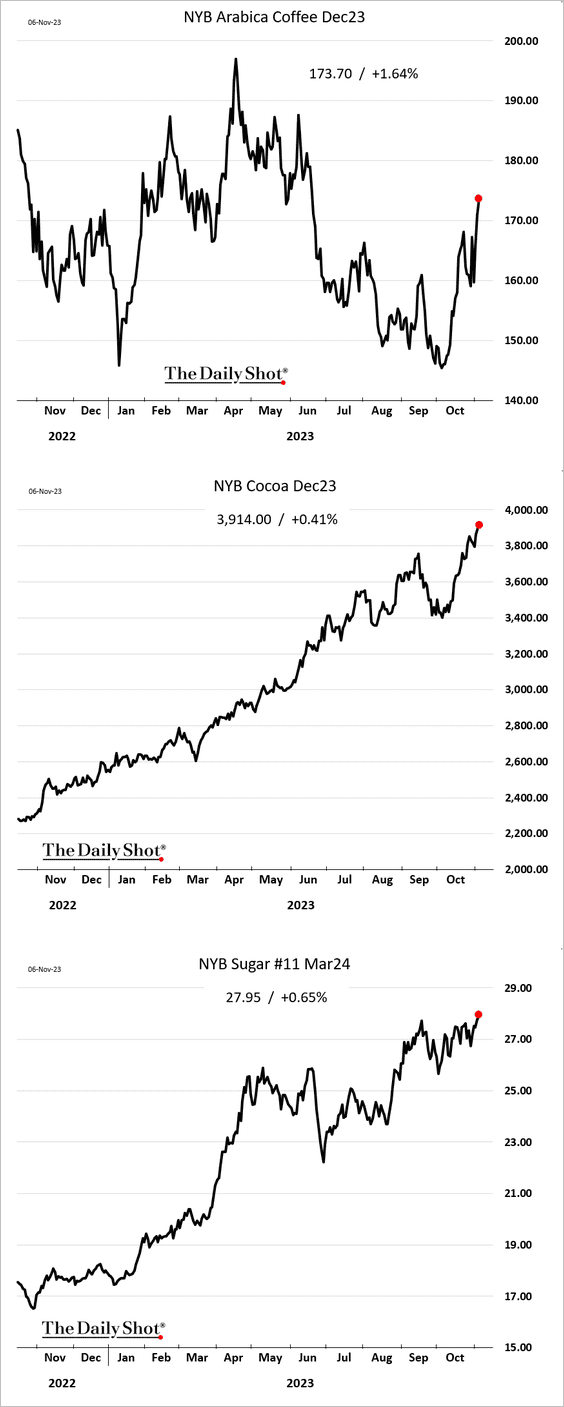

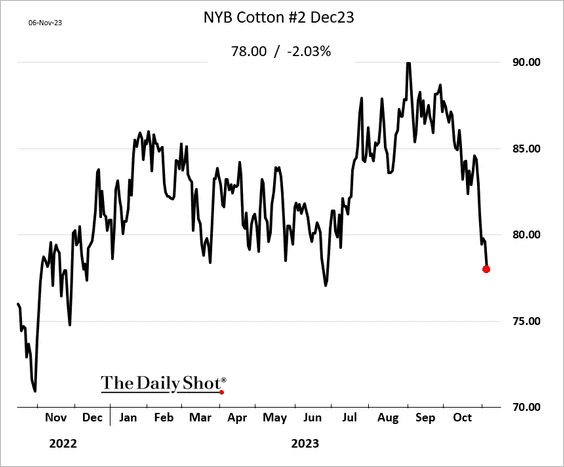

1. Coffee, cocoa, and sugar continue to surge.

But cotton has been a drag on softs.

——————–

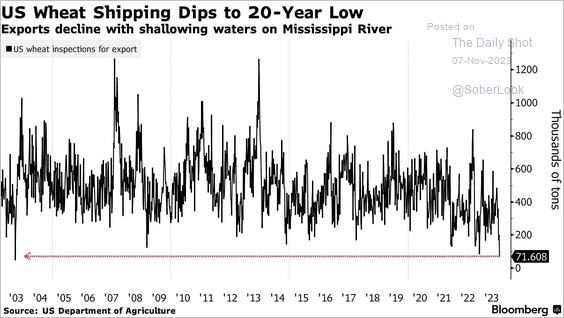

2. US wheat exports stall as the drought-stricken Mississippi River becomes difficult to navigate.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

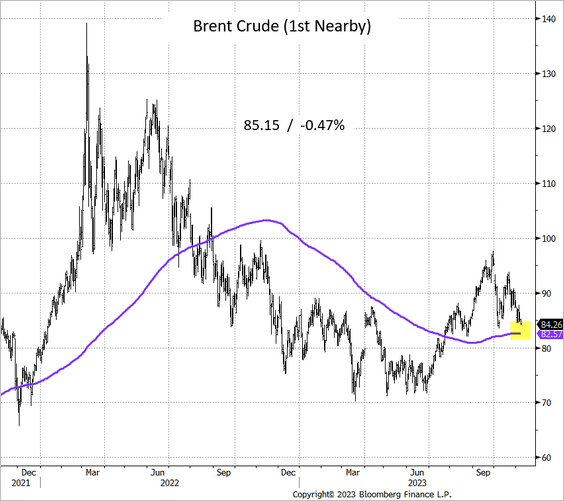

1. Brent crude is nearing the 200-day moving average.

Will the SPR buying support prices?

Source: Reuters Read full article

Source: Reuters Read full article

——————–

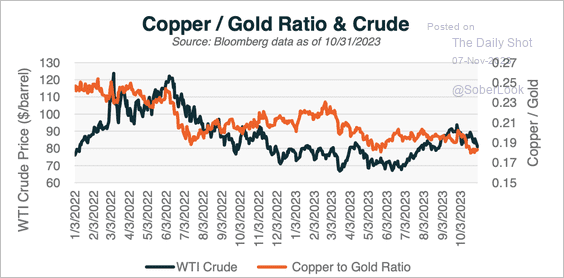

2. The pullback in WTI crude oil occurred alongside a decline in the copper/gold ratio.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

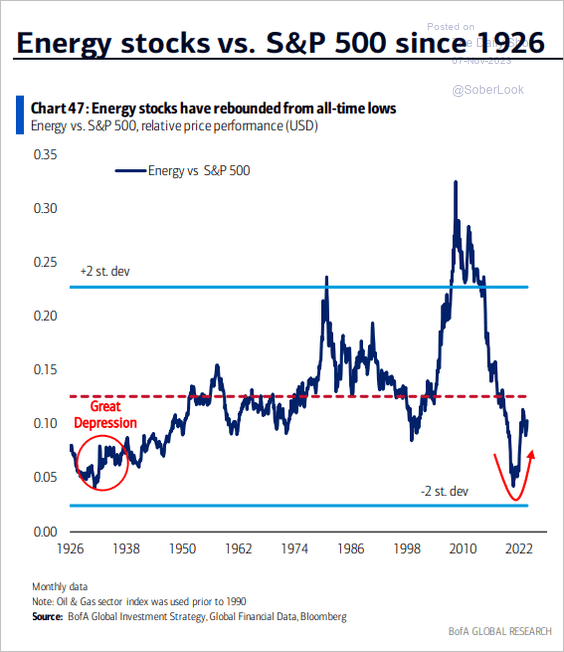

3. The energy sector rebounded from all-time lows relative to the S&P 500.

Source: BofA Global Research

Source: BofA Global Research

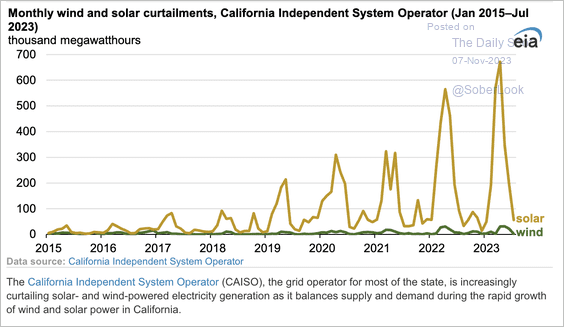

4. California needs to boost its utility-scale battery storage capacity.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

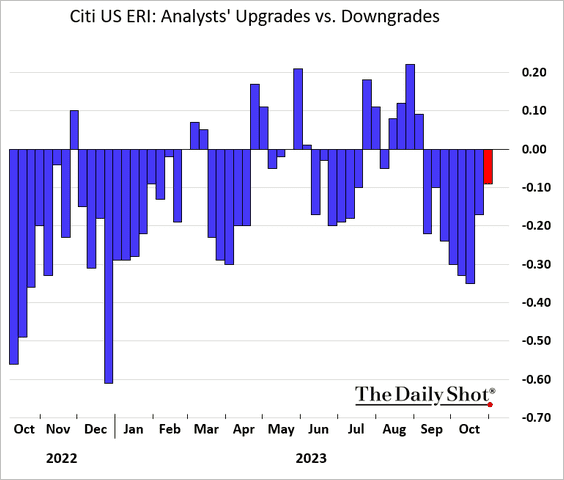

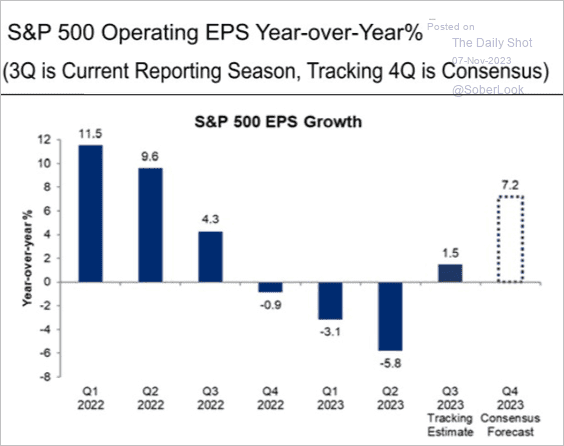

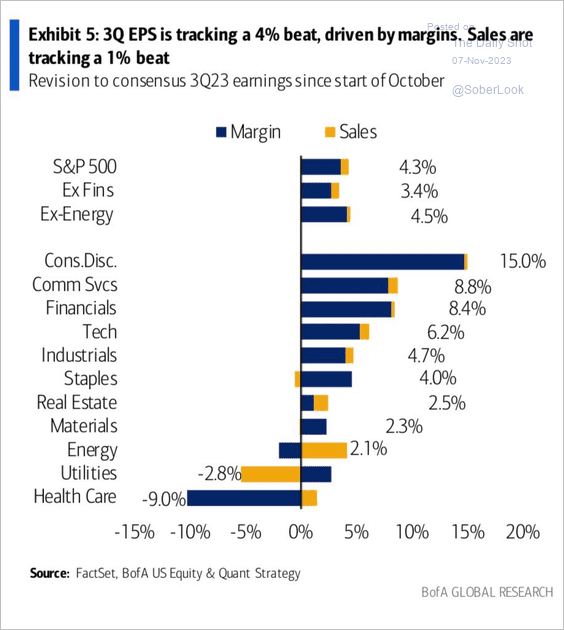

1. Earnings downgrades have exceeded upgrades for eight weeks in a row.

• Analysts still expect a substantial year-over-year earnings boost this quarter for the S&P 500.

Source: Citi Private Bank

Source: Citi Private Bank

• Companies are reporting robust margin expansion.

Source: BofA Global Research

Source: BofA Global Research

——————–

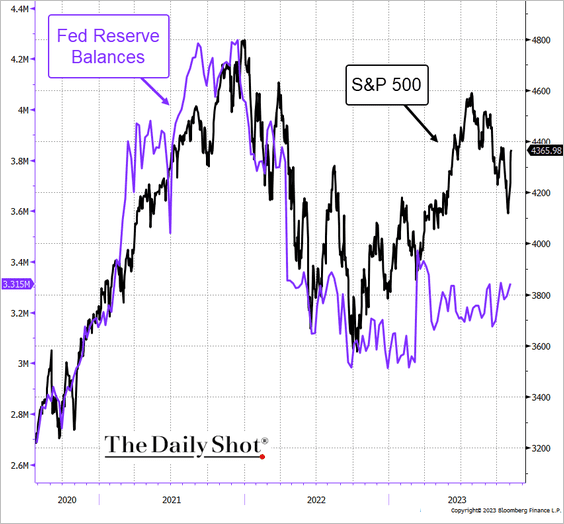

2. Weaker liquidity conditions could become a drag on stocks.

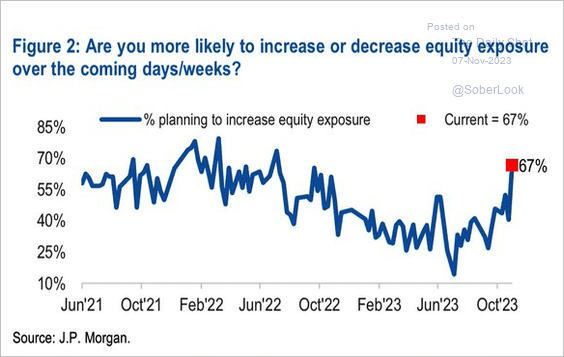

3. Next, let’s take a look at some sentiment indicators.

• JP Morgan’s clients (increasingly bullish):

Source: JP Morgan Research

Source: JP Morgan Research

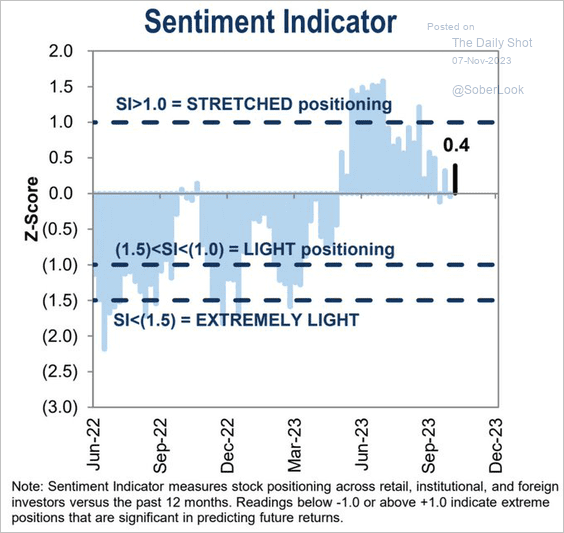

• The GS positioning indicator (in positive territory):

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

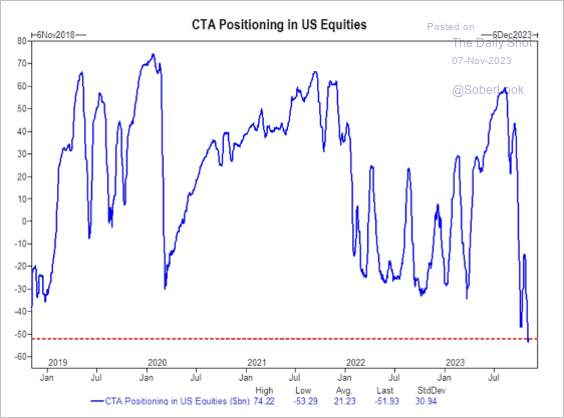

• CTAs (very bearish):

Source: Goldman Sachs

Source: Goldman Sachs

——————–

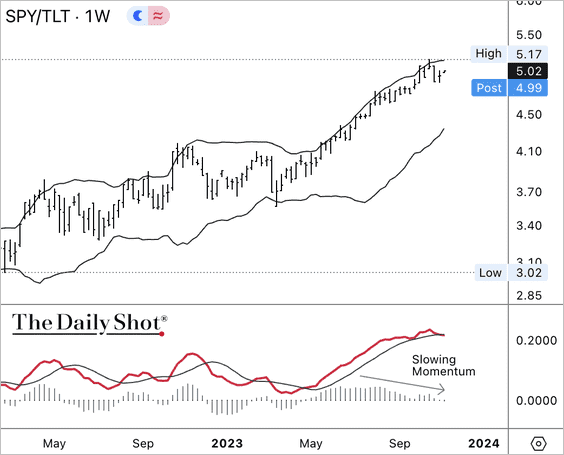

4. The stock/bond ratio (SPY/TLT) appears stretched with slowing upside momentum.

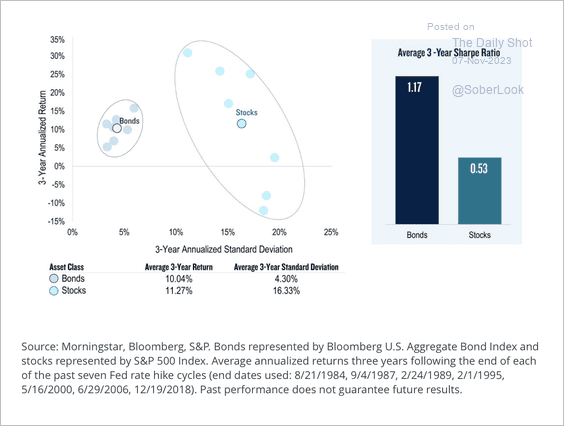

5. Historically, equities have generated weaker risk-adjusted returns compared to bonds in the three years following Fed tightening cycles.

Source: PGIM Investments Read full article

Source: PGIM Investments Read full article

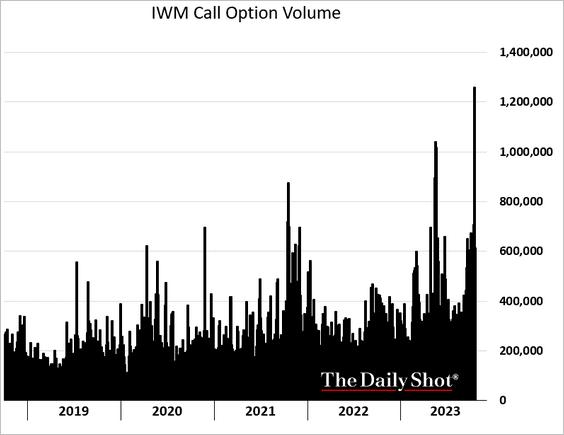

6. The IWM (Russell 2000 ETF) call options volume surged last week.

7. Next, we have some sector trends.

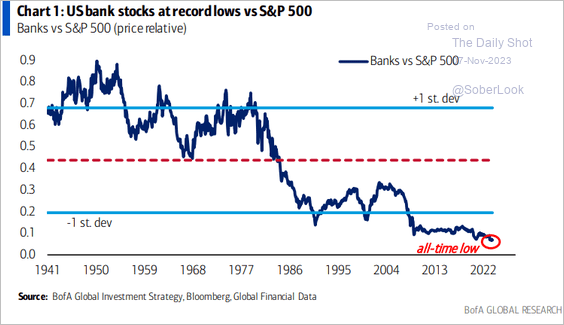

• Banks’ underperformance has been remarkable.

Source: BofA Global Research

Source: BofA Global Research

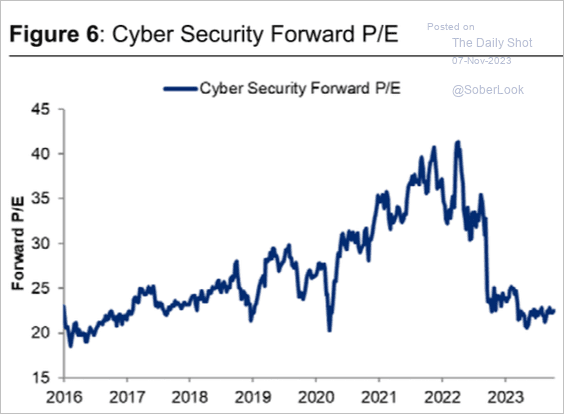

• The cyber bubble has deflated.

Source: Citi Private Bank

Source: Citi Private Bank

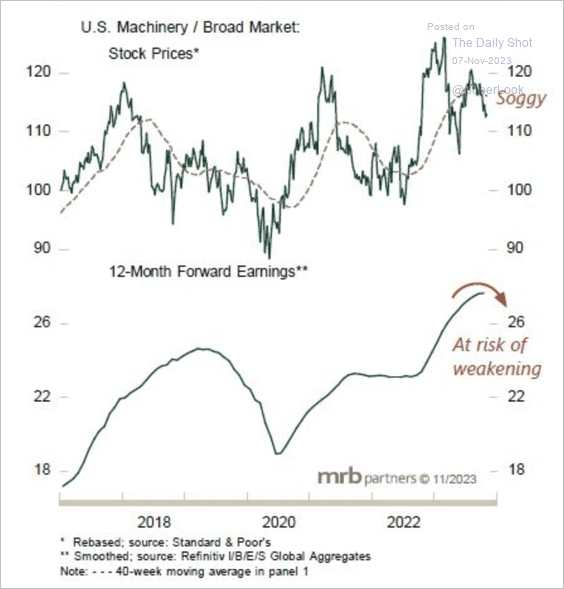

• The underperformance of US machinery stocks could signal a peak in relative earnings.

Source: MRB Partners

Source: MRB Partners

Back to Index

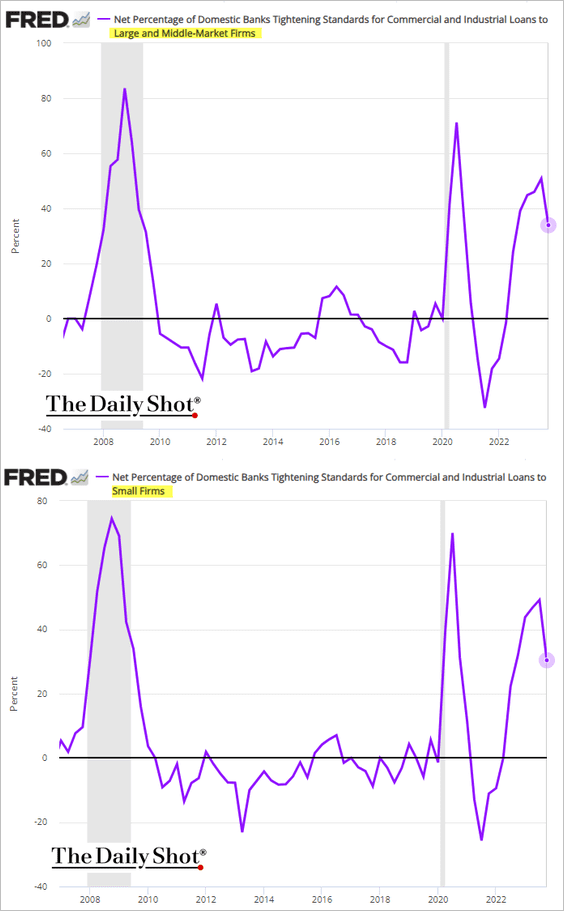

Credit

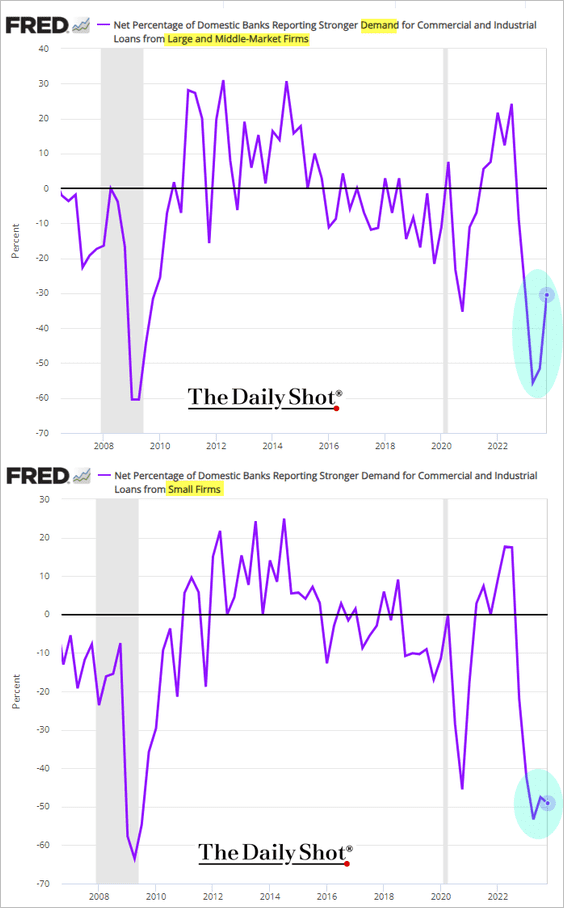

1. The net percentage of banks tightening credit standards on business loans remains elevated.

• Demand for loans has been very soft, although there is some divergence between large and small companies.

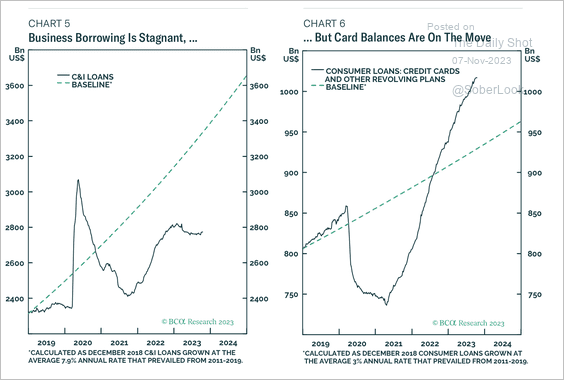

• US business borrowing remains sluggish while consumers have been tapping their credit cards.

Source: BCA Research

Source: BCA Research

——————–

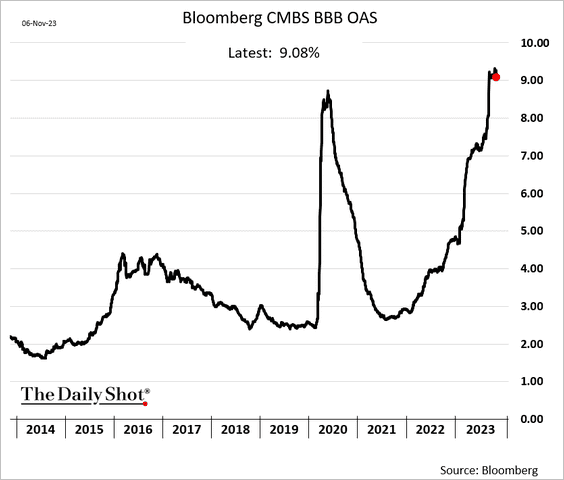

2. CMBS spreads are holding near multi-year highs, signaling concerns about commercial property credit.

Back to Index

Rates

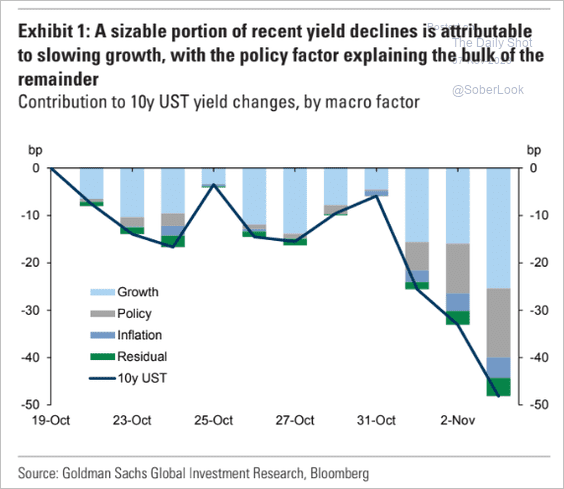

1. Let’s start with the attribution of recent declines in Treasury yields.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

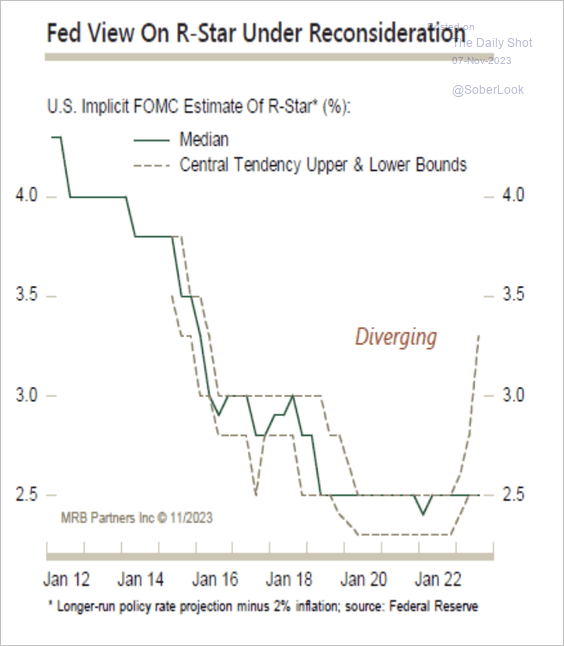

2. Some FOMC members have raised their estimates of the long-run equilibrium rate (R*).

Source: MRB Partners

Source: MRB Partners

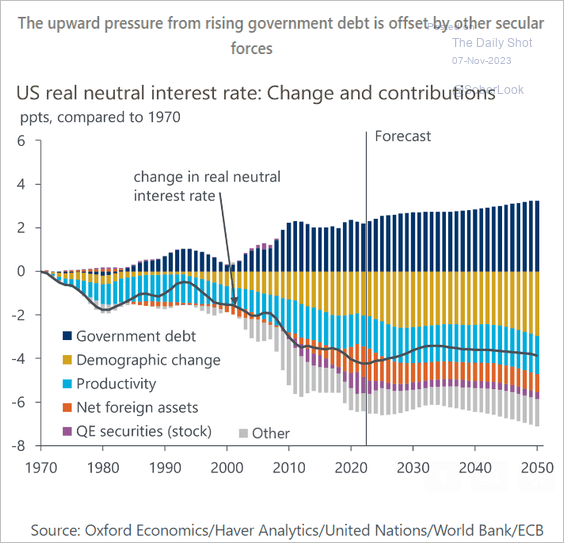

• What are the drivers of changes in the neutral rate? Here is an estimate from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

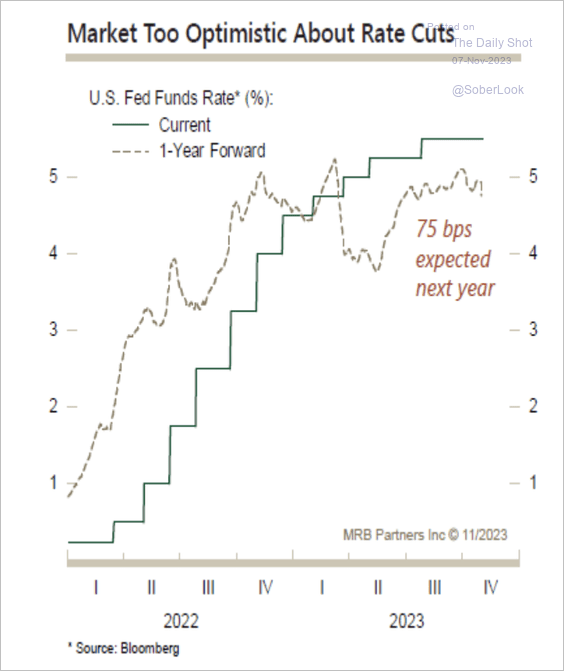

3. Although markets expect about 75 basis points of rate cuts next year. MRB Partners sees this as too optimistic as the 10-year Treasury yield typically peaks at a level slightly above the Fed’s terminal rate.

Source: MRB Partners

Source: MRB Partners

Back to Index

Food for Thought

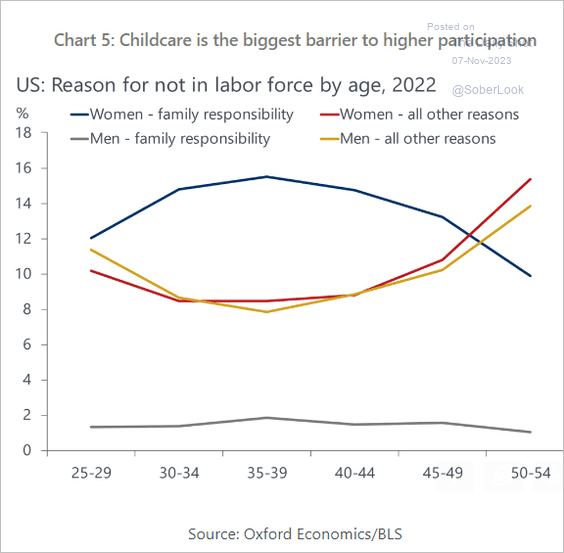

1. Reasons for not participating in the labor force:

Source: Oxford Economics

Source: Oxford Economics

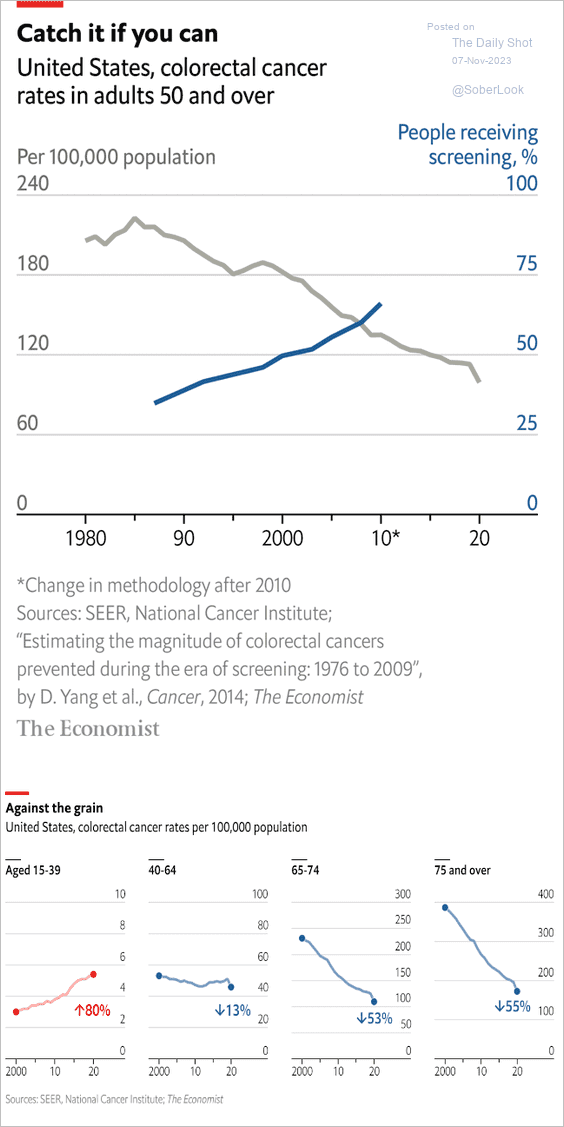

2. Colorectal cancer rates:

Source: The Economist Read full article

Source: The Economist Read full article

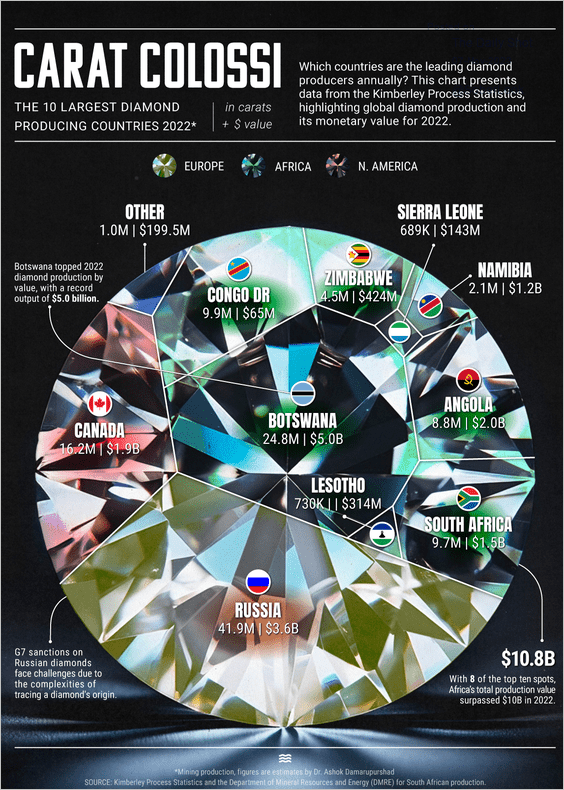

3. Largest diamond producers:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

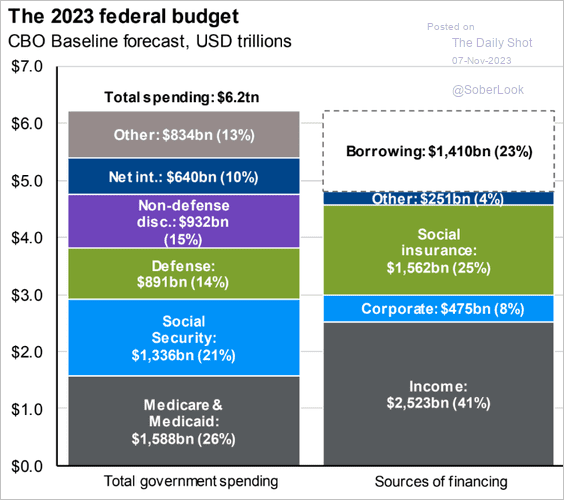

4. The US federal budget:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

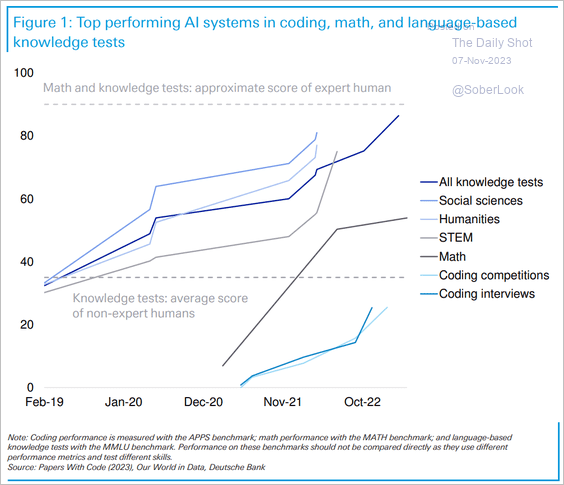

5. Strength of AI systems over the past few years:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

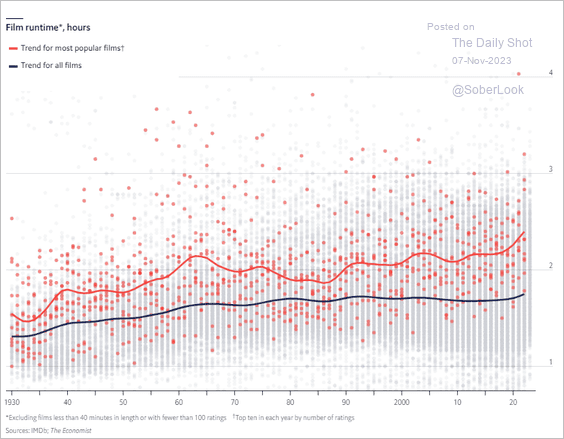

6. Movies are becoming longer:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index