The Daily Shot: 08-Nov-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• China

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with consumer credit.

• Growth in consumer credit was slightly below forecasts in September.

– Credit card balances increased again, …

… but are holding below pre-COVID levels when measured as a share of disposable income.

Adjusted for inflation, credit card balances edged lower.

– By the way, credit card rates remain at record highs.

– Government-held student loan balances are now down on a year-over-year basis (in part due to student debt forgiveness).

• Consumer credit delinquencies have been moving higher.

Below are the trends by age group.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

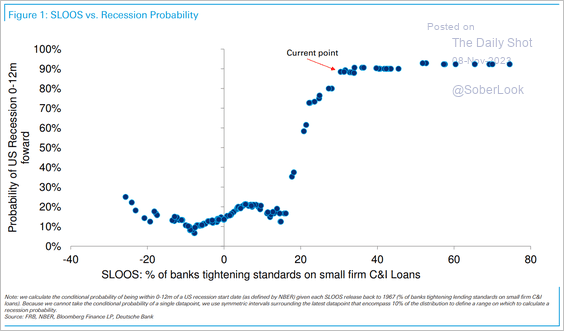

2. Tight bank lending standards indicate high recession odds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Goldman anticipates that the waning influence of monetary tightening on economic growth could weaken the case for Fed rate cuts next year.

Source: Goldman Sachs

Source: Goldman Sachs

4. Wholesale used automobile prices continue to ease.

5. The trade deficit increased in September.

Source: @economics Read full article

Source: @economics Read full article

• Both imports and exports grew.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The trade gap with China widened but remained at multi-year lows.

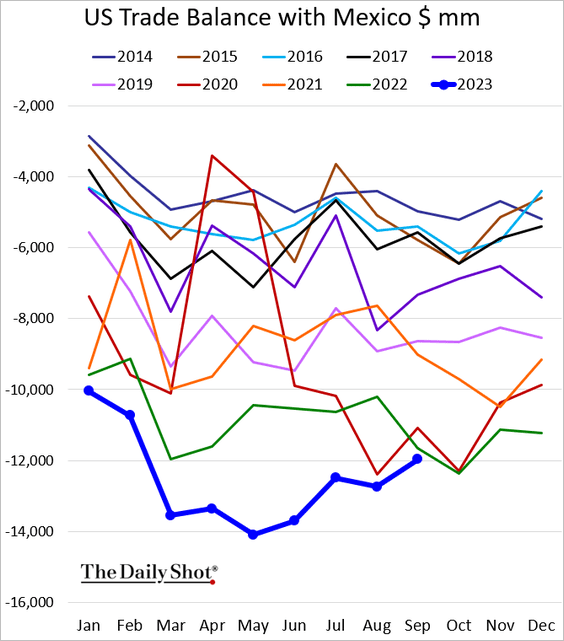

Here is the trade gap with Mexico.

——————–

6. More companies are mentioning reshoring during earnings calls.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Canada

1. The September trade surplus was higher than expected.

2. Roughly two-thirds of households with mortgages hold more deposits now than they did pre-pandemic.

Source: Scotiabank Economics

Source: Scotiabank Economics

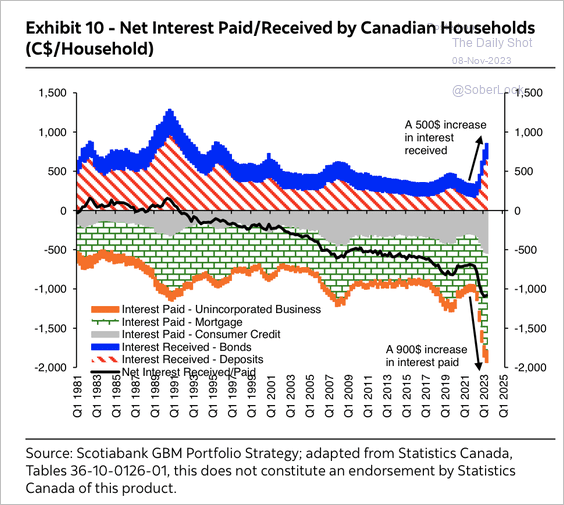

• Interest income received from both bonds and bank deposits increased in recent quarters. However, interest paid still outstrips interest income (black line), which is a net negative for Canadian consumers.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

1. Germany’s construction activity is crashing.

2. Below is the euro-area PPI (year-over-year).

3. The euro has appreciated above “weak link” currencies that are sensitive to higher interest rates like AUD, CAD, and GBP.

Source: MRB Partners

Source: MRB Partners

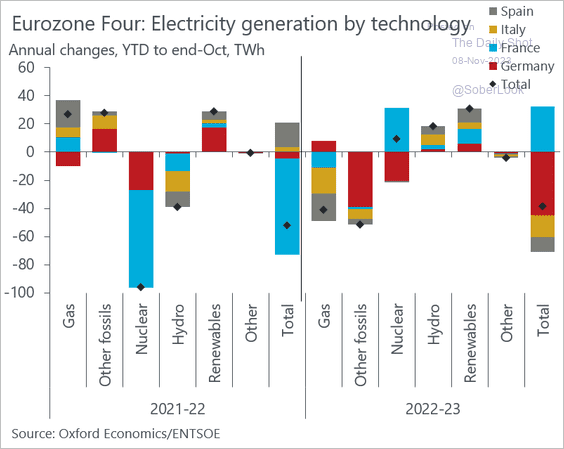

4. This chart shows the year-to-date changes in electricity generation.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Europe

1. Norway’s industrial production registered the largest decline on record due to natural gas outages.

Source: @economics Read full article

Source: @economics Read full article

The Norwegian krone continues to weaken, with EUR/NOK trading near 12.0 again.

——————–

2. Swden’s labor market has been softening.

Source: ING

Source: ING

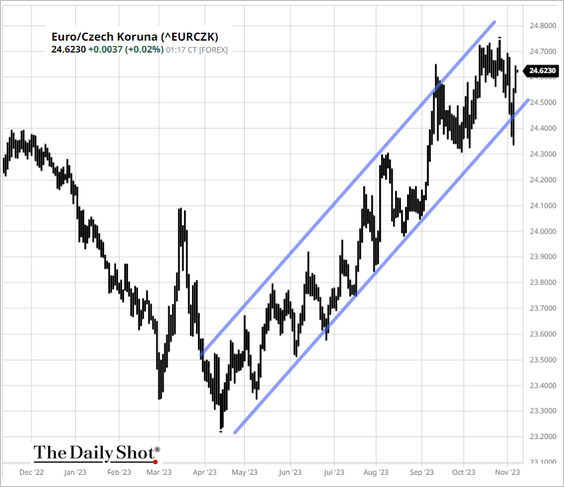

3. The Czech koruna has been sagging, with EUR/CZK maintaining the uptrend channel.

4. The EU’s foreign direct investment has been slowing.

Source: European Commission

Source: European Commission

Back to Index

Asia-Pacific

1. Dollar-yen is holding above 150.

2. South Korea’s trade balance has been rebounding.

3. Taiwan’s trade surplus came off the highs and was below forecasts last month.

Back to Index

China

1. Foreign exchange reserves declined again.

2. Beijing is orchestrating a bailout of Country Garden …

Source: Reuters Read full article

Source: Reuters Read full article

… which defaulted last month.

• China’s home sales remain sluggish.

Source: @economics Read full article

Source: @economics Read full article

——————–

3. Foreigners have stepped in to buy mainland shares amid promises of more stimulus.

Source: @markets Read full article

Source: @markets Read full article

4. The PMI data points to a rebound in producer prices.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Commodities

1. Iron ore continues to rally.

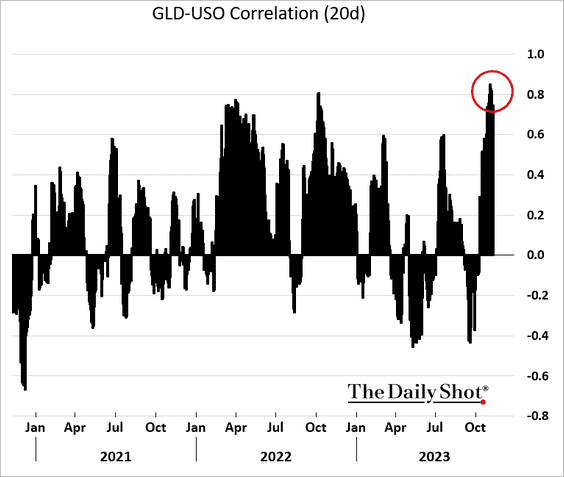

2. Gold and oil have been highly correlated in recent days.

h/t Robert Fullem, Bloomberg

h/t Robert Fullem, Bloomberg

3. Forecasts suggest that the US corn crop may hit a new record, pressuring prices.

4. Chicago cattle futures fell further this week.

Source: barchart.com Read full article

Source: barchart.com Read full article

Back to Index

Energy

1. Brent futures dipped below the 200-day moving average.

Crude oil backwardation has been narrowing amid demand concerns.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. CTAs remain bullish on crude oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

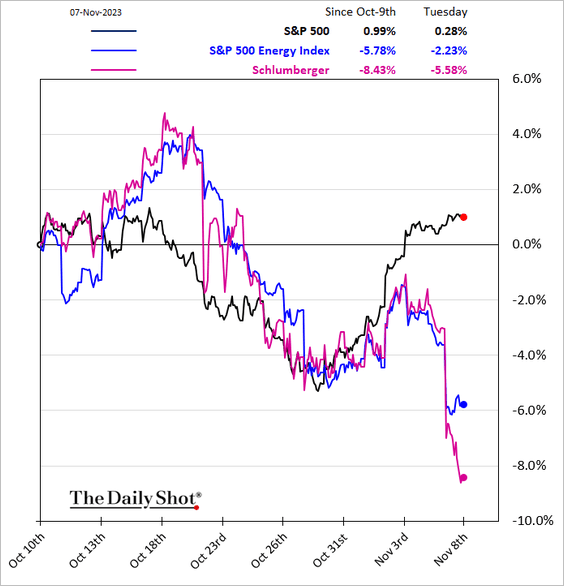

3. Energy shares have been under pressure in recent days.

Back to Index

Equities

1. Historically, a peak in US large-cap market concentration has preceded sustained small-cap outperformance.

Source: Goldman Sachs Asset Management

Source: Goldman Sachs Asset Management

• The Russell 2000 index held resistance at the 50-day moving average.

——————–

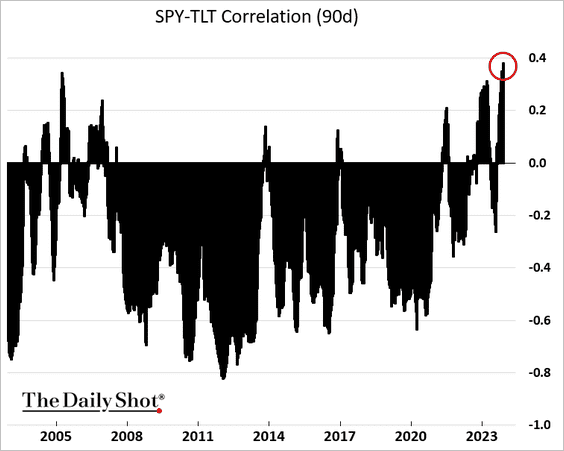

2. The correlation between stocks and bonds remains elevated.

3. Fewer firms have been beating sales forecasts.

Source: @markets Read full article

Source: @markets Read full article

Companies remain very concerned about flagging demand.

Source: @markets Read full article

Source: @markets Read full article

——————–

4. Companies with high international exposure have been underperforming on earnings and revenue.

Source: @FactSet Read full article

Source: @FactSet Read full article

5. Outside of the US, valuations appear to be reasonable relative to the 20-year history.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

6. On an equal-weight basis, cyclical growth stocks started to underperform over the past few months and could face additional pressure if inflation remains sticky, according to Stifel.

Source: Stifel

Source: Stifel

Meanwhile, equal-weight cyclical value stocks appear to be near a trough relative to the S&P 500.

Source: Stifel

Source: Stifel

——————–

7. How are long-only funds positioned in tech mega-caps?

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Credit

1. Growth in new credit applications for business loans has slowed.

2. PIK deals have been popular as sponsors try to preserve cash, but this type of financing will be very costly over the long run.

Source: @markets Read full article

Source: @markets Read full article

3. US corporate net interest expense as a percentage of GDI declined sharply in recent years, more so than in other major economies. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. MBS spreads remain well above IG corporate credit spreads.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

5. Next, we have some updates on commercial real estate.

• Credit growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Tightening bank underwriting standards (2 charts):

• Office-to-apartment conversion:

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

1. Three consecutive years of negative treasury returns is highly unusual.

Source: BofA Global Research

Source: BofA Global Research

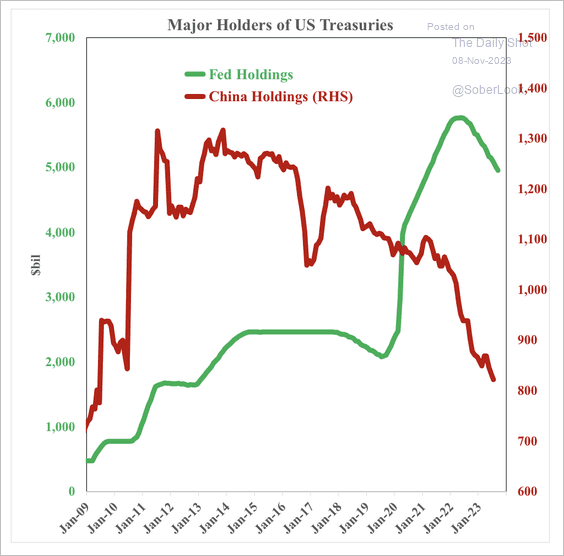

2. China’s holdings of Treasuries continue to decline alongside the Fed’s QT.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

3. Demand for zero-coupon Treasuries surged last month.

Source: @markets Read full article

Source: @markets Read full article

4. The implied return asymmetry in intermediate-duration Treasuries has significantly improved relative to the low-rate environment in 2020.

Source: Goldman Sachs Asset Management

Source: Goldman Sachs Asset Management

5. Survey indicators point to further declines in Treasury yields.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

6. Millennials embrace bonds.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

Back to Index

Global Developments

1. Central banks’ policy rate cuts have picked up momentum.

Source: BofA Global Research

Source: BofA Global Research

2. Here is a look at reserve assets by country.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

3. There are big differences across countries in dominant sources of tax revenue.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

Food for Thought

1. US household formation projections:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Nonparticipation rates in the US labor force by generation and age:

Source: Federal Reserve Bank of San Francisco

Source: Federal Reserve Bank of San Francisco

• Reasons for nonparticipation:

Source: Federal Reserve Bank of San Francisco

Source: Federal Reserve Bank of San Francisco

——————–

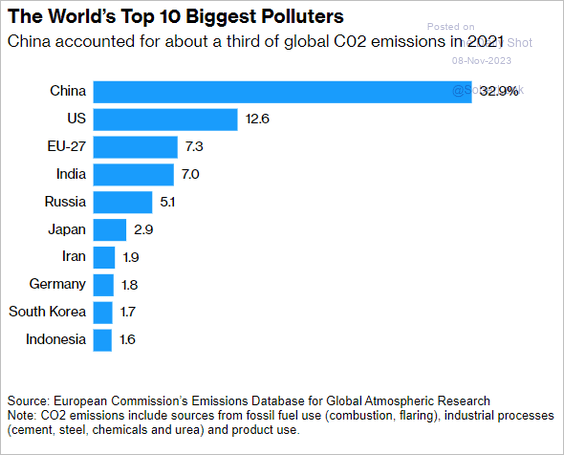

3. Contributions to CO2 emissions:

Source: @climate Read full article

Source: @climate Read full article

4. Global sea surface temperature:

Source: Climate Reanalyzer

Source: Climate Reanalyzer

5. Views on US government agencies:

Source: Gallup Read full article

Source: Gallup Read full article

6. Anti-Latino hate crimes:

Source: @TheDailyShot

Source: @TheDailyShot

7. How Americans organize their book collections:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index