The Daily Shot: 09-Nov-23

• The United States

• The United Kingdom

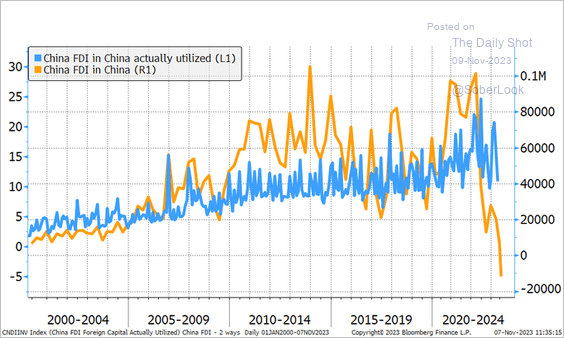

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities.

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

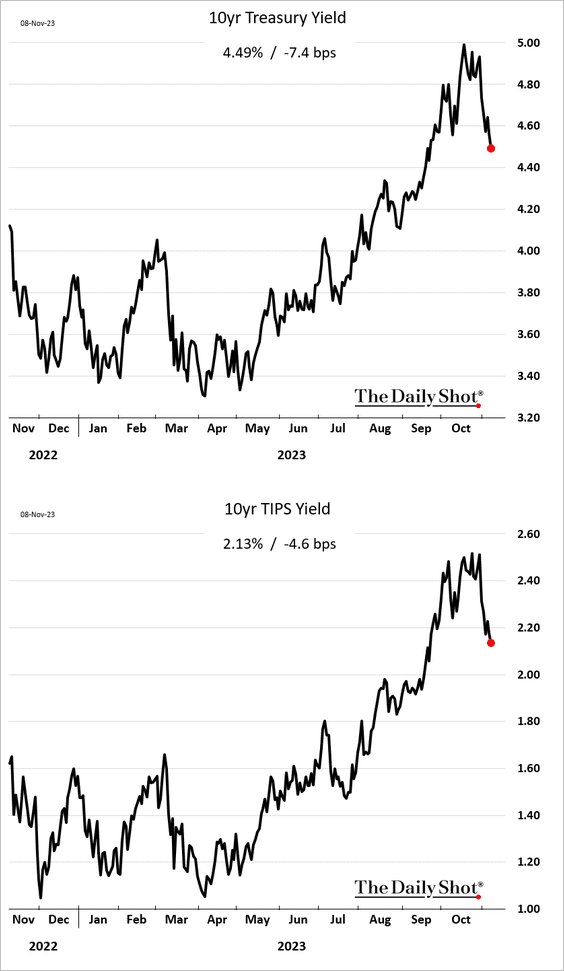

1. The retreat in Treasury yields, both nominal and real, continued on Wednesday.

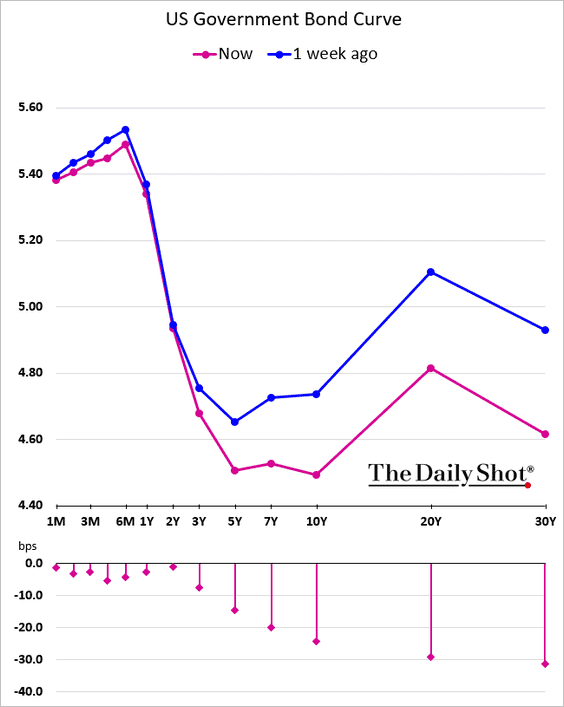

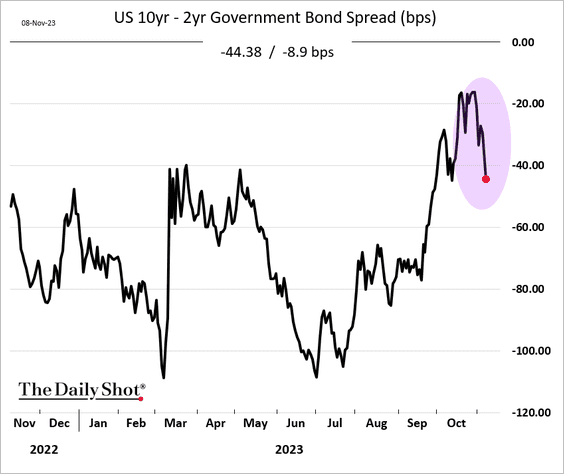

The yield curve inversion has intensified in the past few days.

——————–

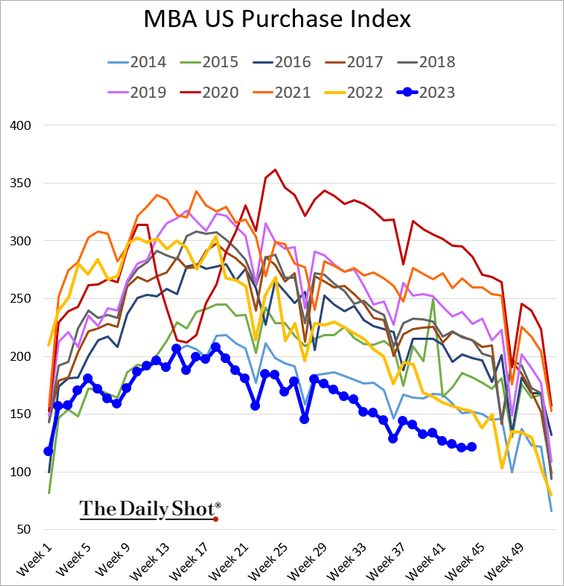

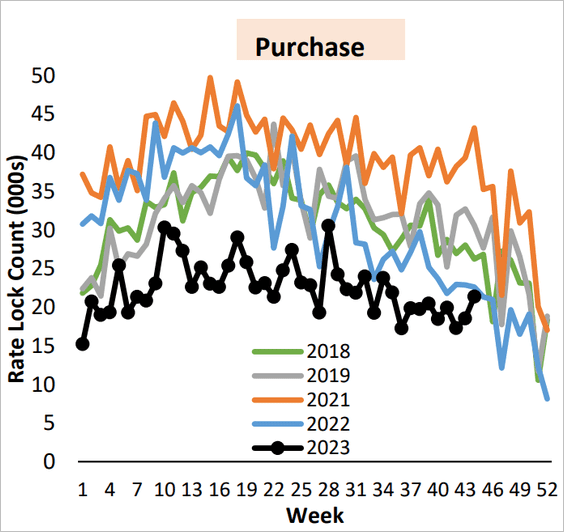

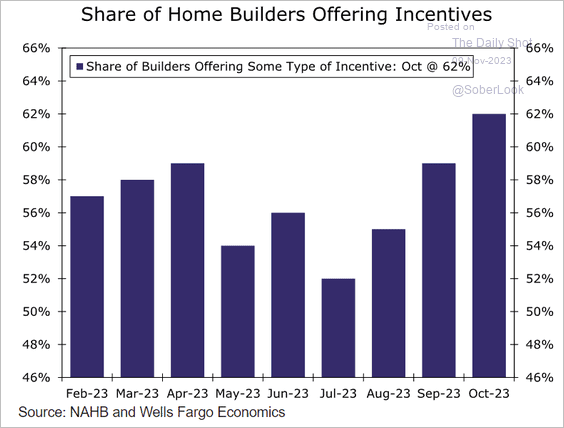

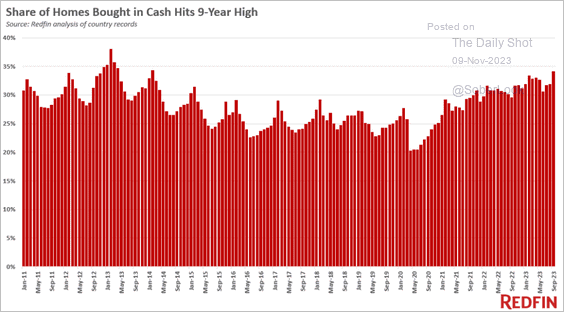

2. Next, we have some updates on the housing market.

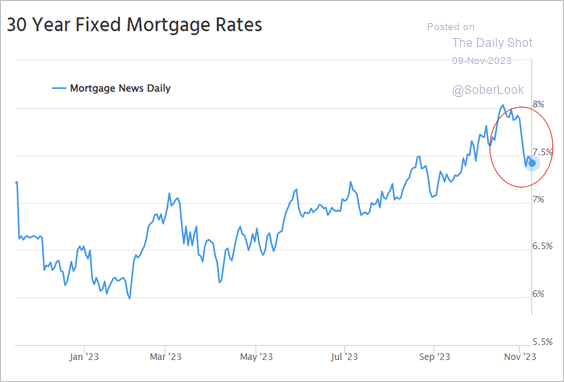

• The sharp pullback in mortgage rates …

Source: Mortgage News Daily

Source: Mortgage News Daily

… resulted in a modest gain in mortgage applications.

Source: NMP Read full article

Source: NMP Read full article

Here is the rate lock count.

• Homebuilders are increasingly offering incentives.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Cash purchases comprise an increasing share of housing transactions.

Source: Redfin

Source: Redfin

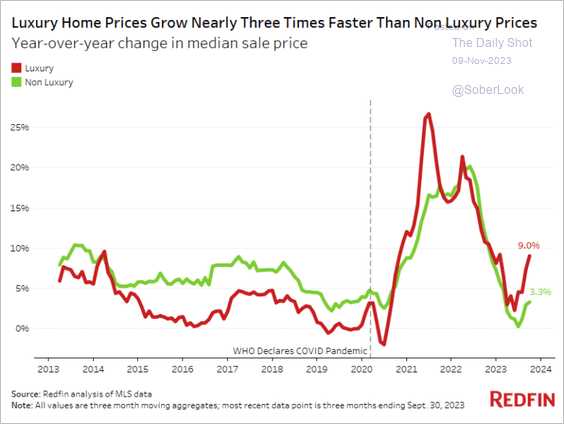

• Luxury homes are outperforming the broader housing market.

Source: Redfin

Source: Redfin

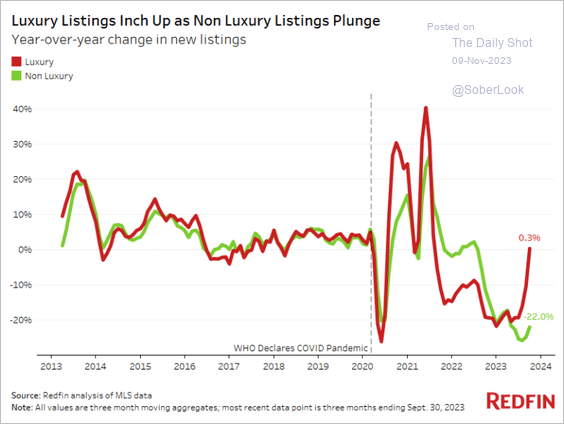

– Unlike the broader market, luxury home listings are up on a year-over-year basis.

Source: Redfin

Source: Redfin

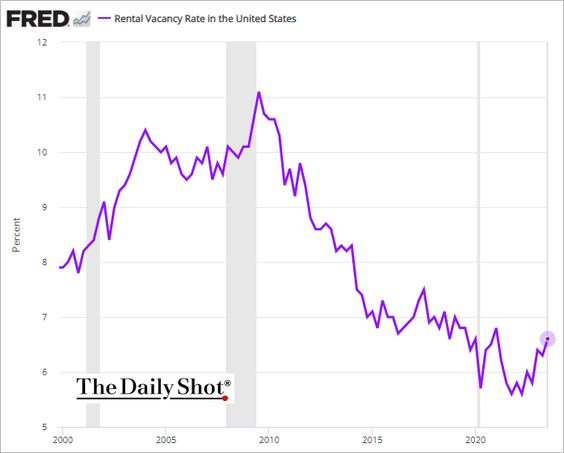

• Rental vacancies remain low but have shown an upward trend.

——————–

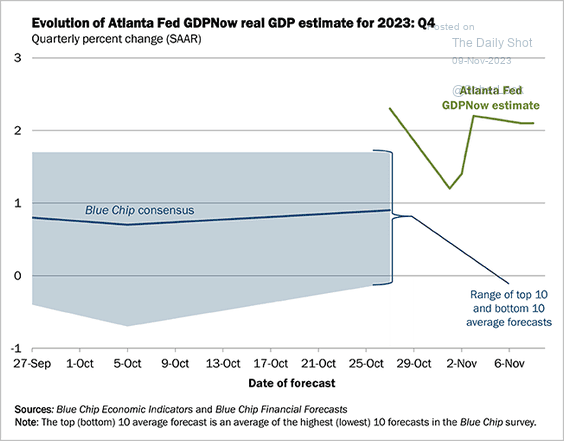

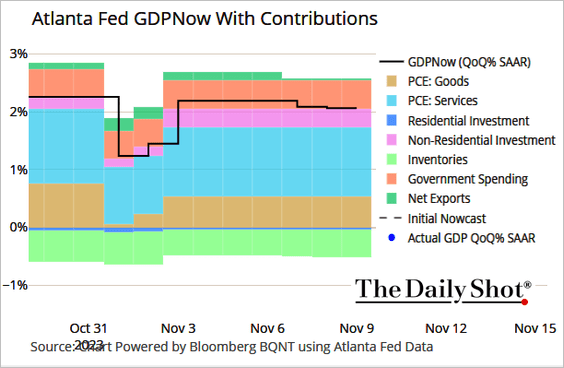

3. The Atlanta Fed’s GDPNow model is tracking the Q4 growth at above 2% (annualized), …

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

… boosted by expectations of robust consumer spending.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

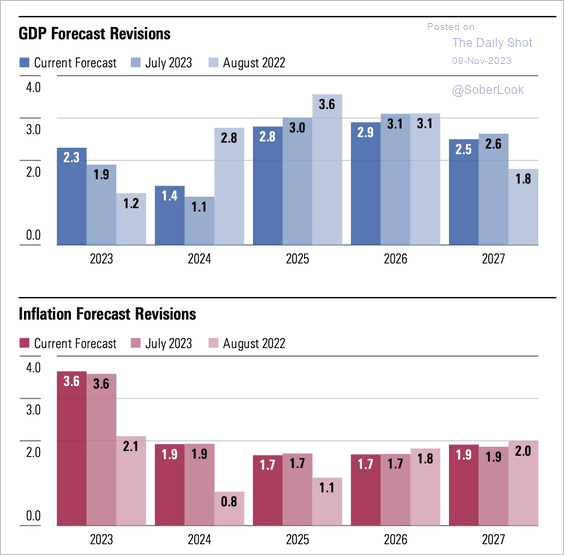

• Morningstar expects economic growth to trough next year but rebound by 2025 alongside lower inflation.

Source: Morningstar Read full article

Source: Morningstar Read full article

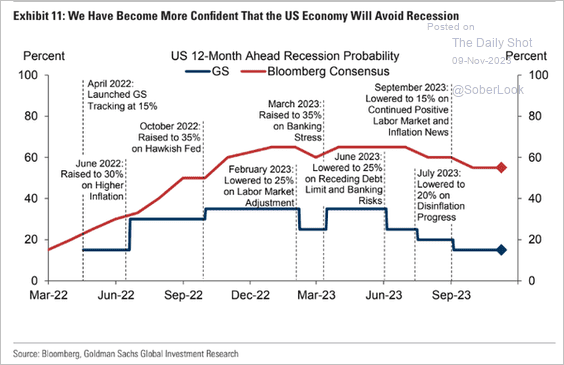

• Goldman increasingly expects the US to avoid a recession.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

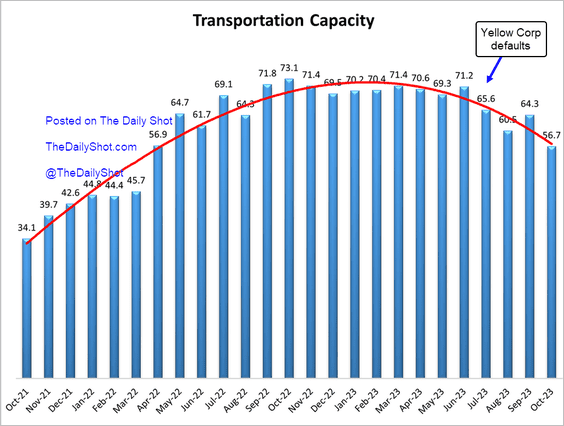

4. Freight markets have been tightening.

Source: Logistics Managers’ Index

Source: Logistics Managers’ Index

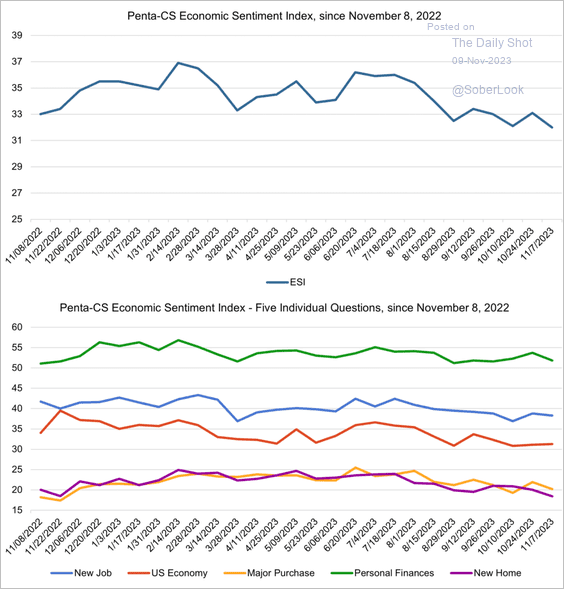

5. The Penta-CivicScience Economic Sentiment Index hit the lowest level in over a year.

Source: Penta-CivicScience Economic Sentiment Index

Source: Penta-CivicScience Economic Sentiment Index

Back to Index

The United Kingdom

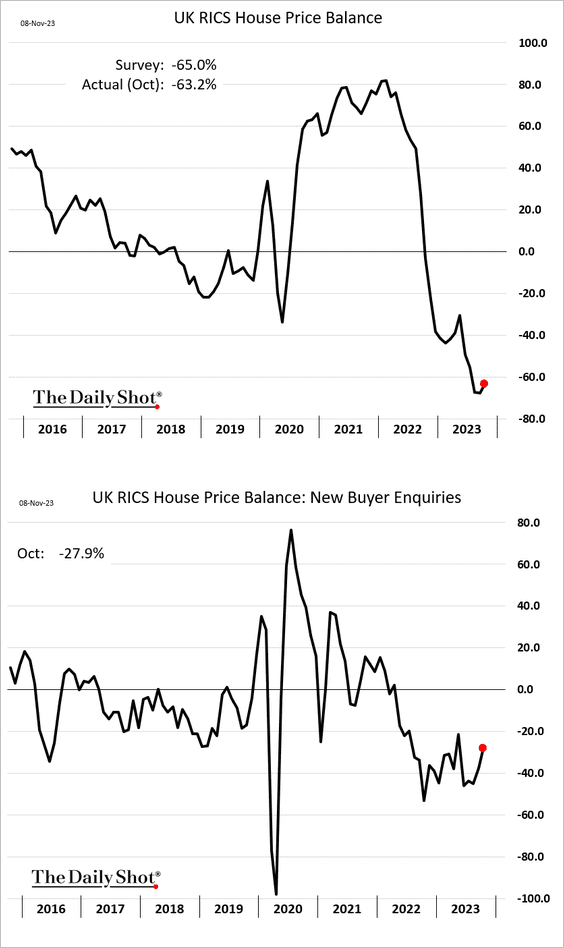

1. Housing price declines appear to be easing.

Source: The Independent Read full article

Source: The Independent Read full article

——————–

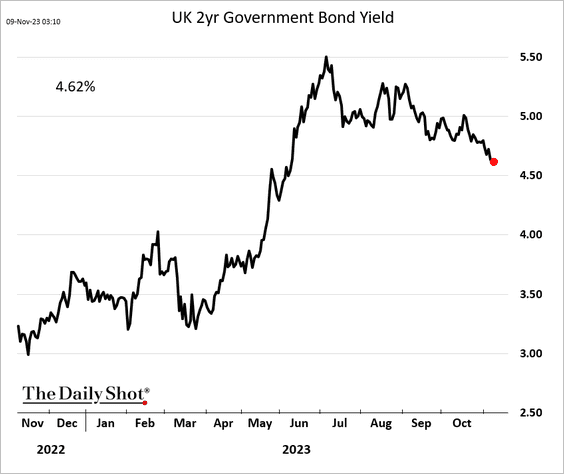

2. The 2-year gilt yield continues to drift lower.

Back to Index

The Eurozone

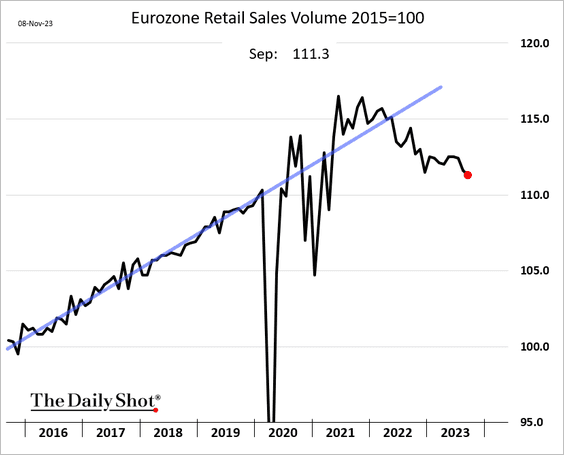

1. Euro-area retail sales edged lower in September, but the decline was smaller than expected.

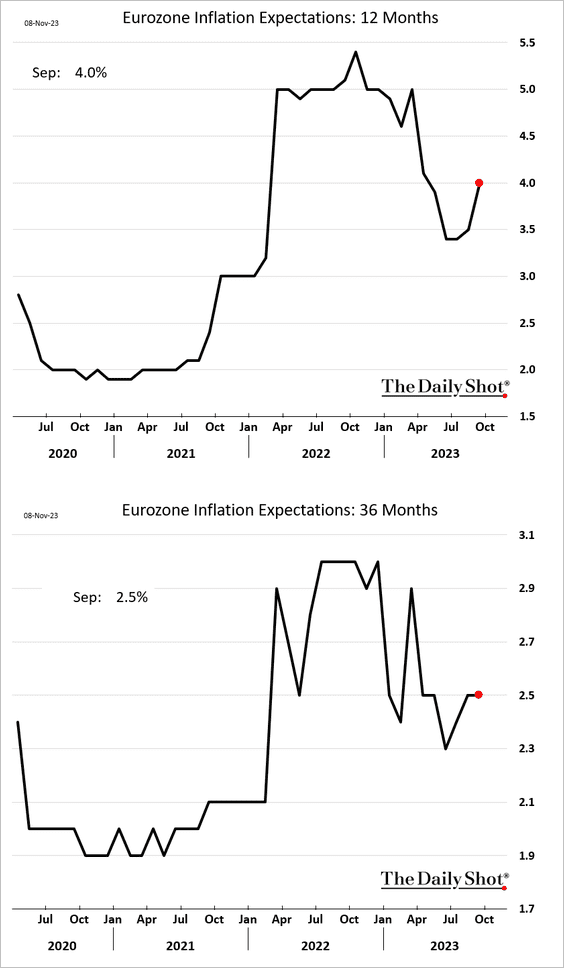

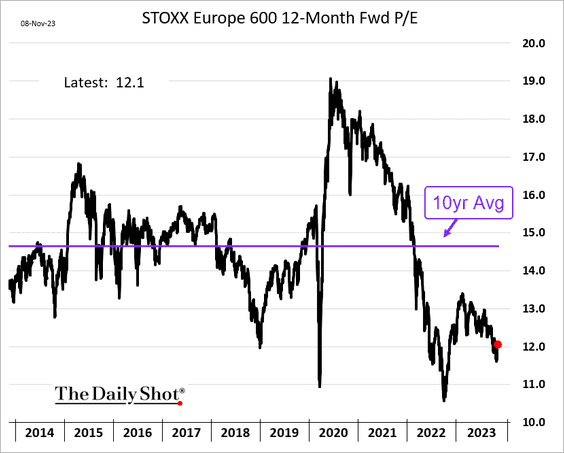

2. Short-term inflation expectations are rebounding.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

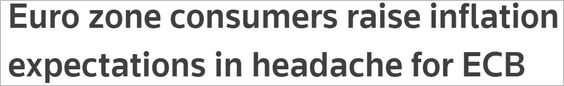

3. The market now expects a slower rebound in rates after the ECB finishes policy easing (at the end of 2025).

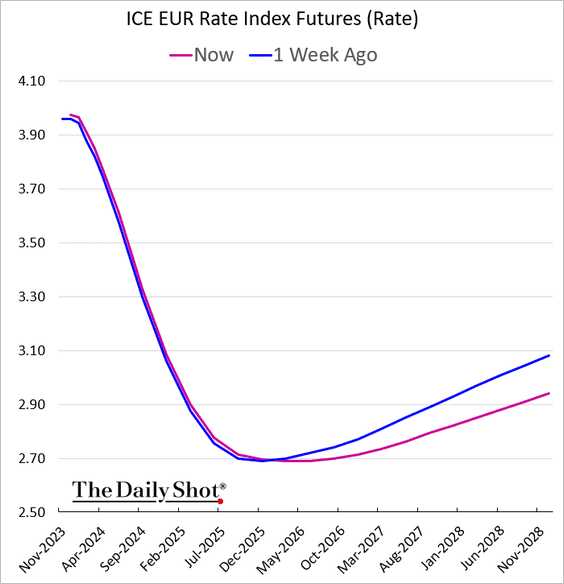

4. Valuations for European large-cap companies are currently well below their ten-year average.

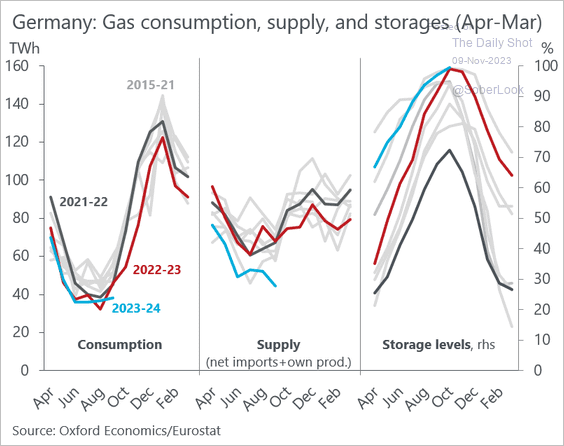

5. Germany’s natural gas supplies have reached multi-year lows. However, consumption is weakest in years, while gas storage is near its maximum capacity.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Japan

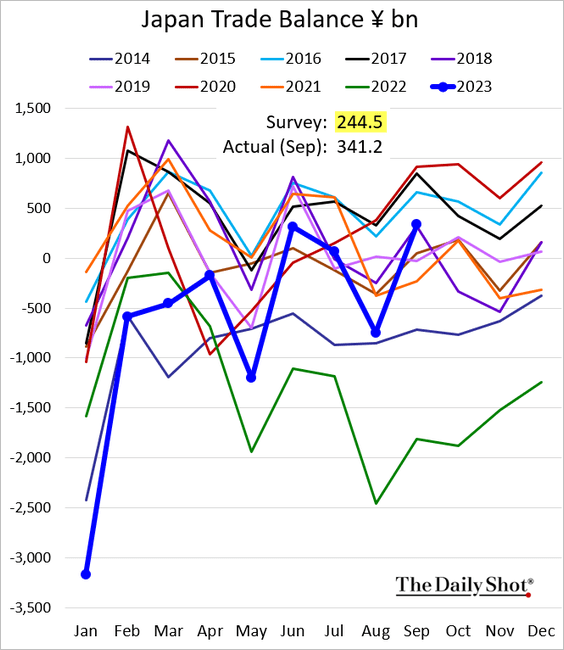

1. The trade surplus was higher than expected.

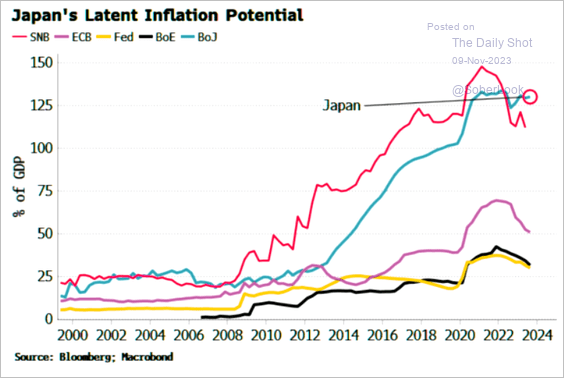

2. The BoJ’s balance sheet as a share of GDP is now above all major central banks.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

China

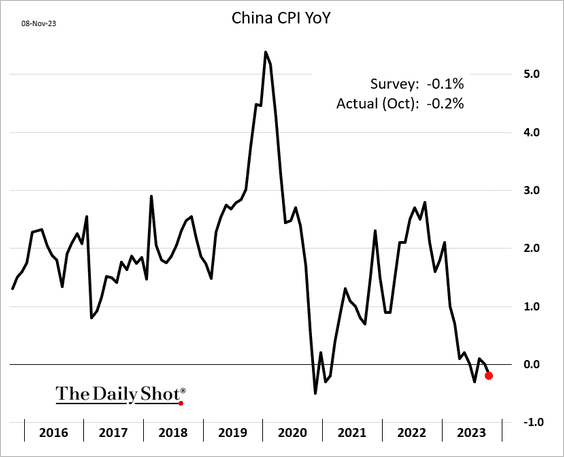

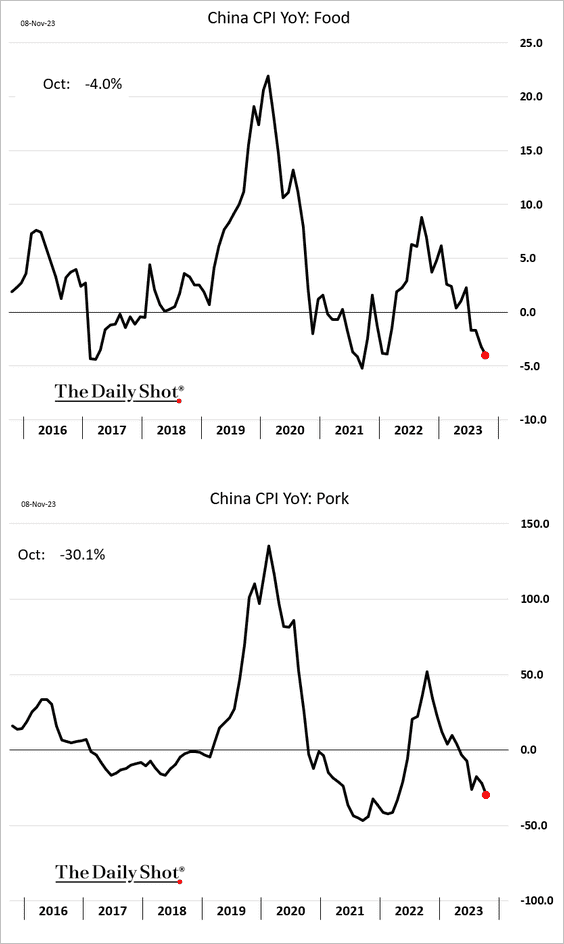

1. China is in deflation, …

Source: Reuters Read full article

Source: Reuters Read full article

… as food prices sink.

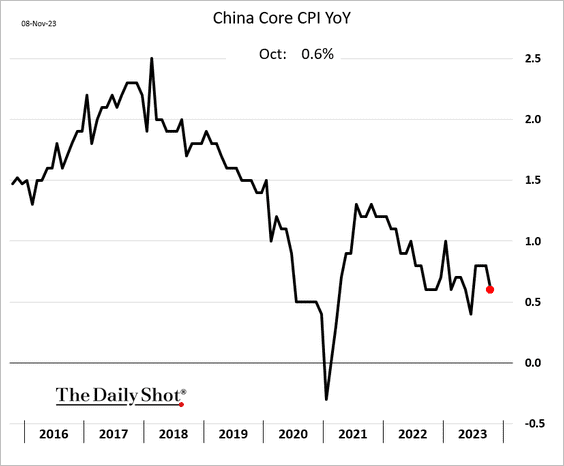

• Core inflation edged lower last month.

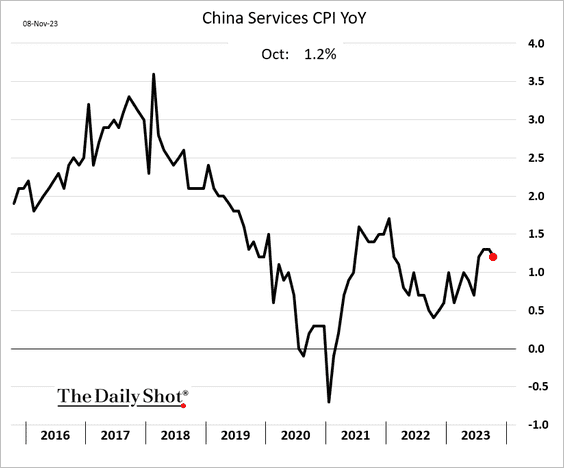

• Here is the services CPI.

——————–

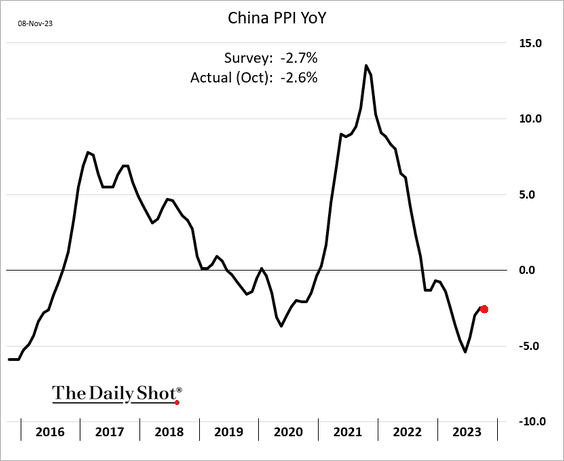

2. Producer prices remain below last year’s levels.

3. There has been some confusion about China’s foreign direct investment. Economists report two measures: FDI that is actually utilized (blue) and the one derived from the balance of payments data (orange). Please see this post for a summary explanation.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

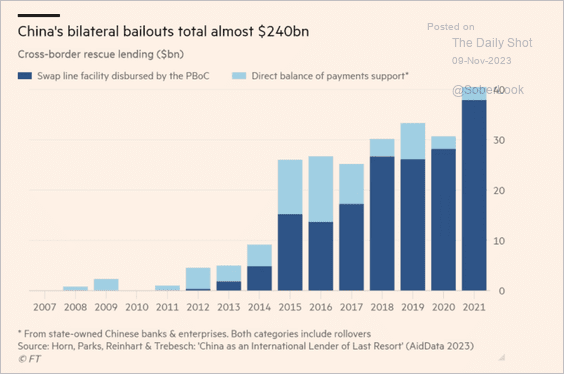

4. Belt & Road bailouts have been accelerating.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

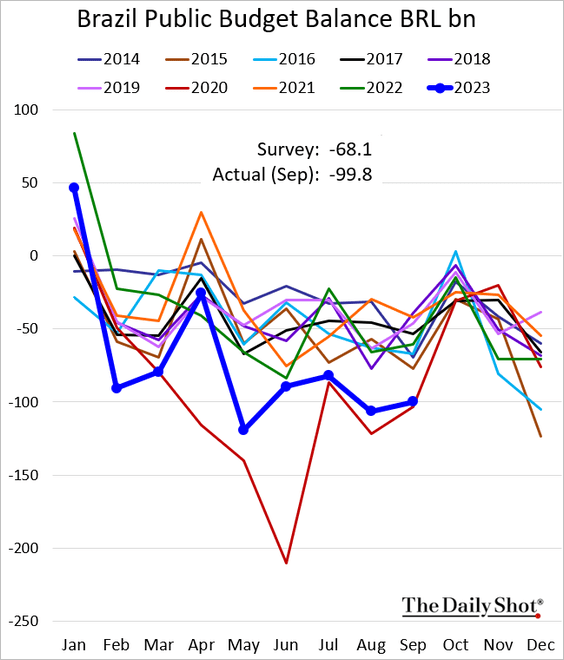

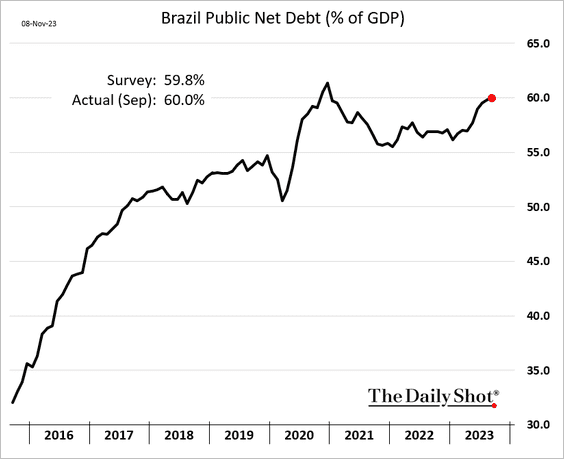

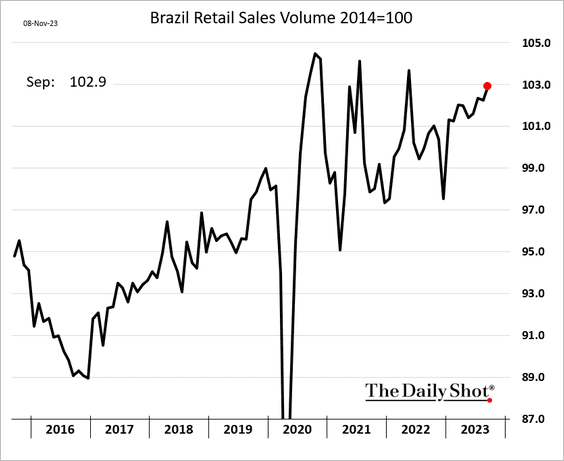

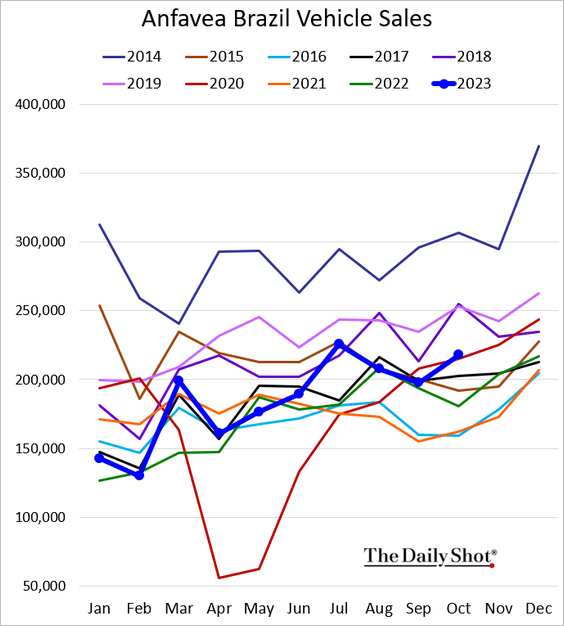

1. Let’s begin with Brazil.

• Budget deficit (wider than expected in September):

– Debt-to-GDP ratio:

• Retail sales (very strong):

• Domestic vehicle sales (above last year’s levels):

——————–

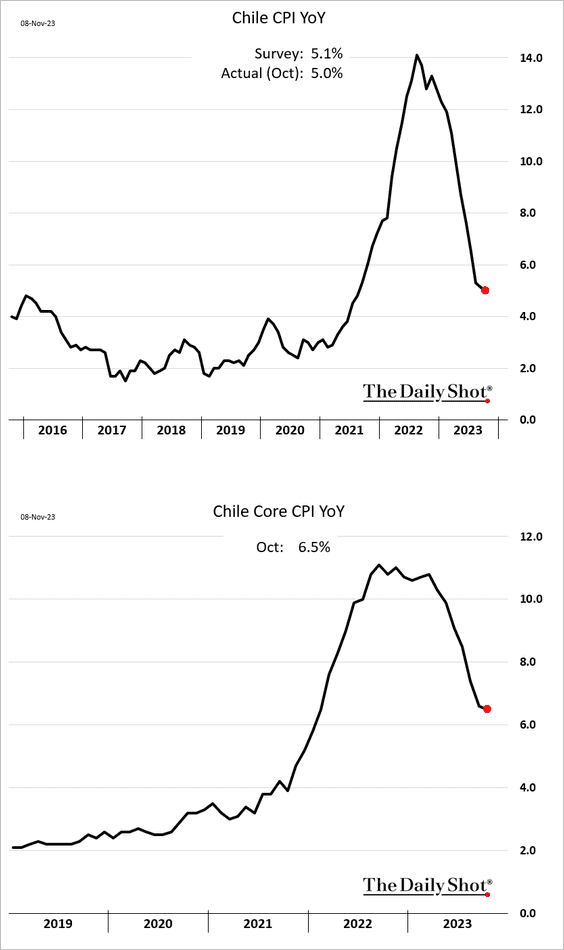

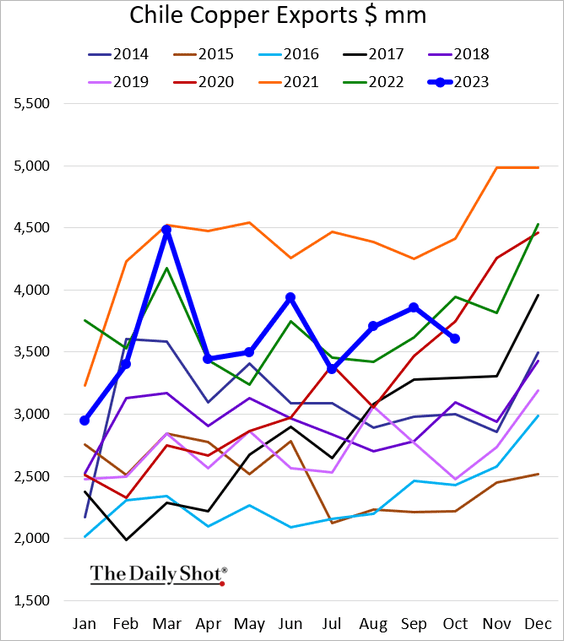

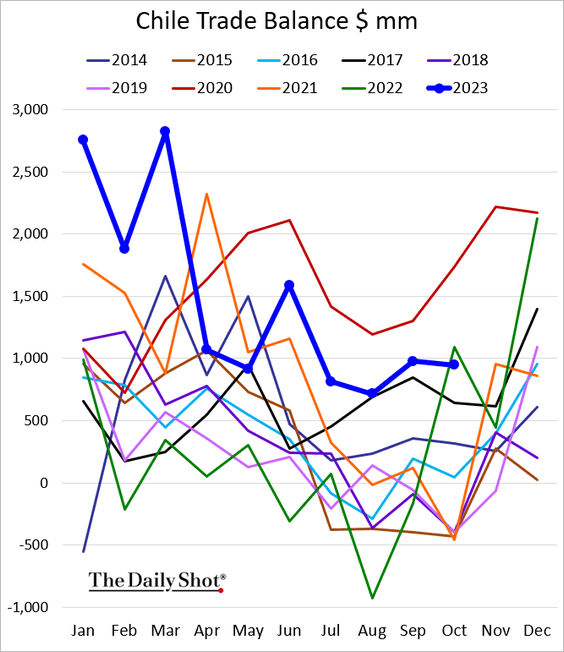

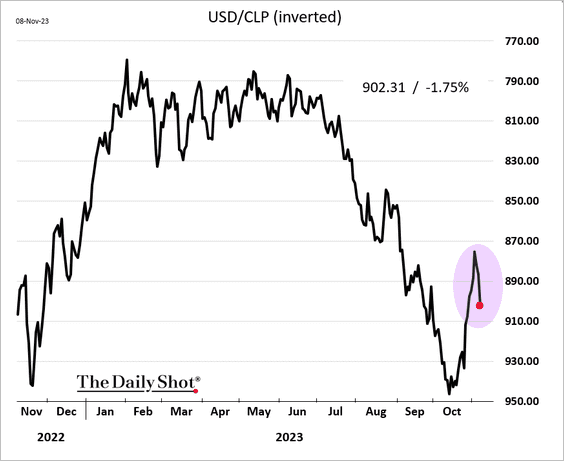

2. Next, we have some updates on Chile.

• Inflation (moderating):

• Copper exports (sputtered last month):

• The trade balance:

• The peso (the rebound is fading):

——————–

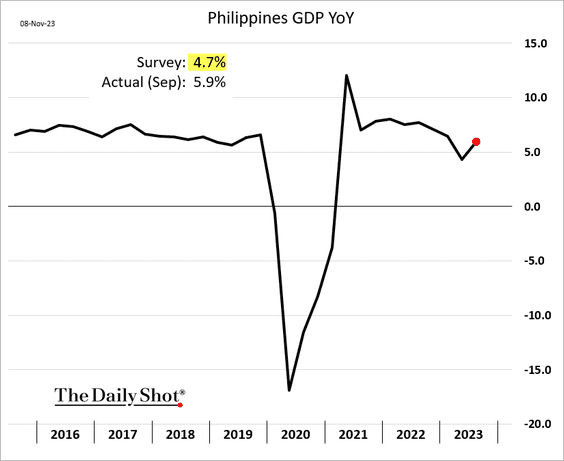

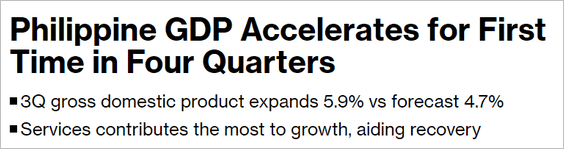

3. The Philippine GDP topped expectations last quarter.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Cryptocurrency

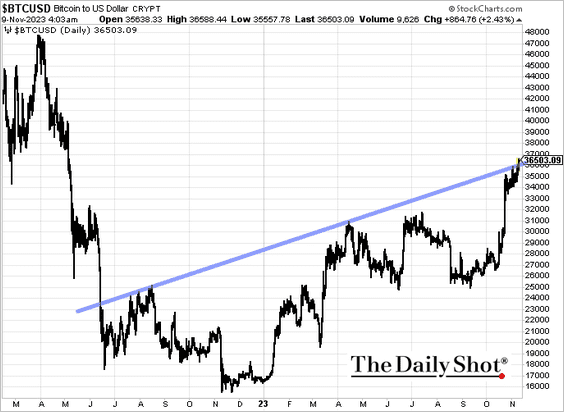

1. Bitcoin is nearing $37k.

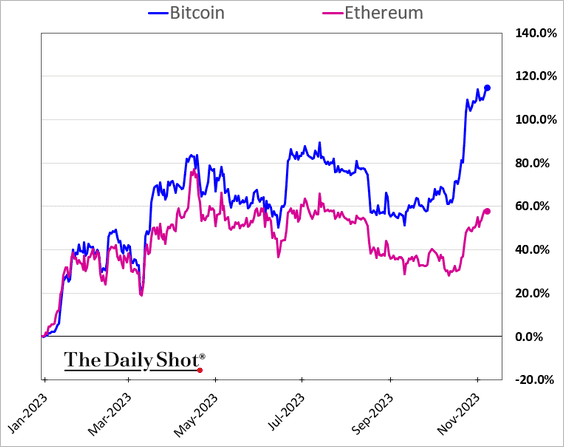

2. Ether has been underperforming this year.

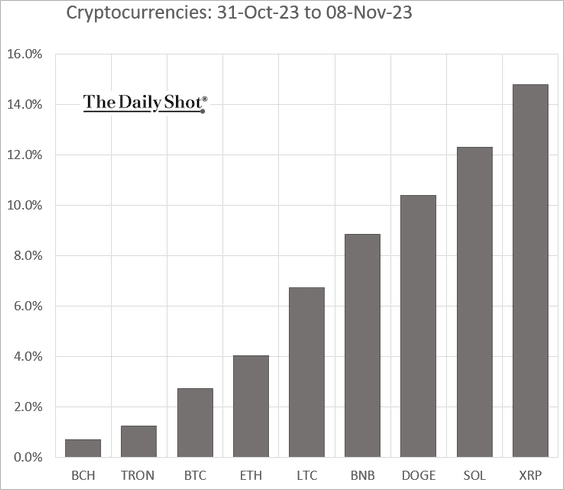

3. Here is the month-to-date performance across some of the most liquid cryptos.

Back to Index

Commodities.

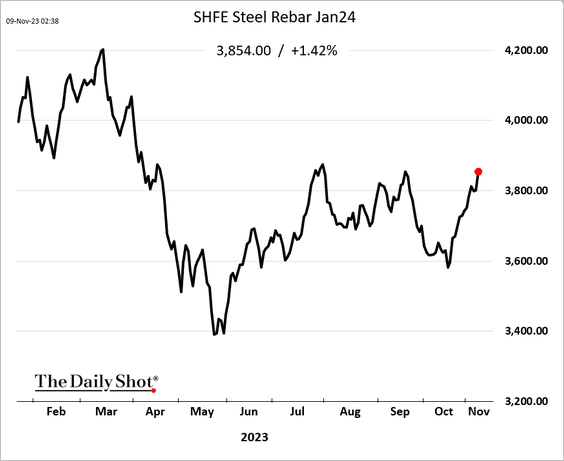

1. Shanghai steel futures are rebounding.

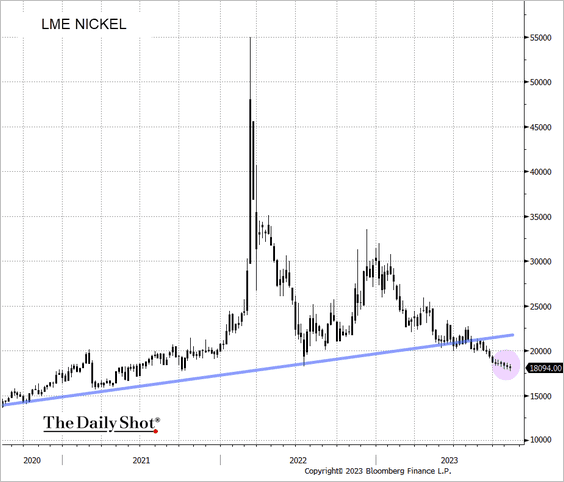

2. Nickel remains under pressure.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

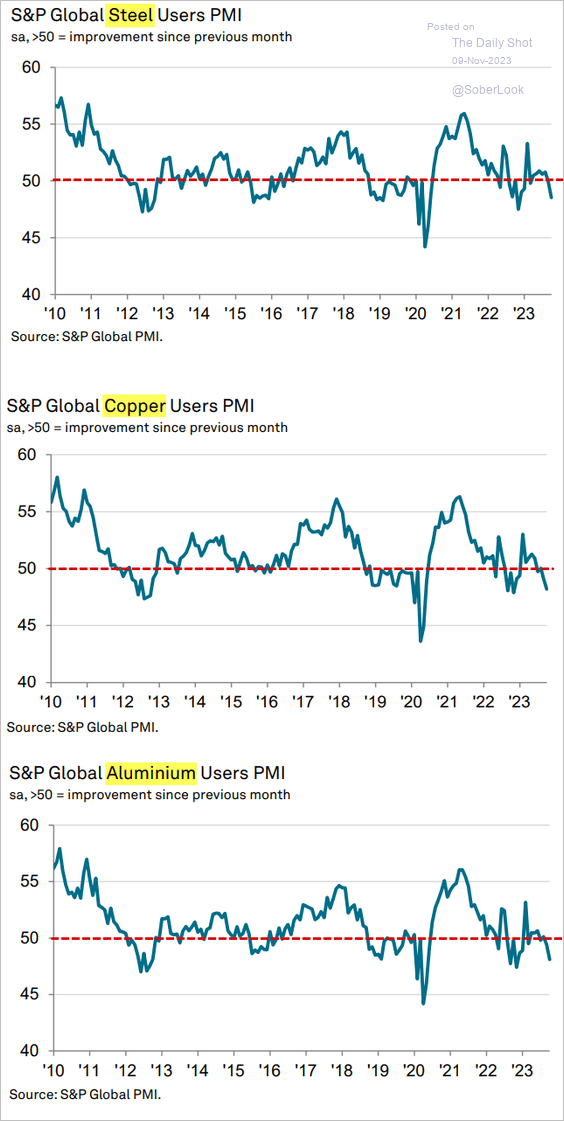

3. Industrial commodity users reported a faster contraction in business activity last month.

Source: S&P Global PMI

Source: S&P Global PMI

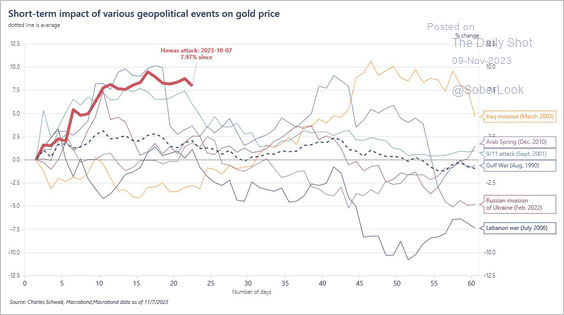

4. This chart shows how gold responds to geopolitical events.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Back to Index

Energy

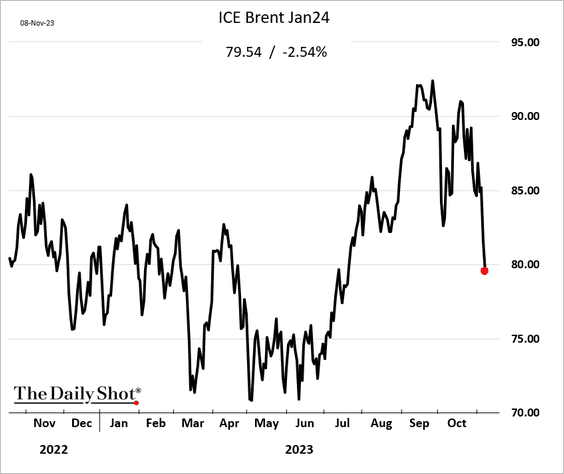

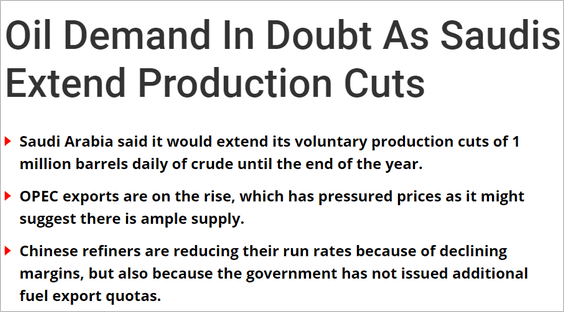

1. Brent crude is below $80/bbl.

Source: OilPrice.com Read full article

Source: OilPrice.com Read full article

Here are the NYMEX gasoline futures.

——————–

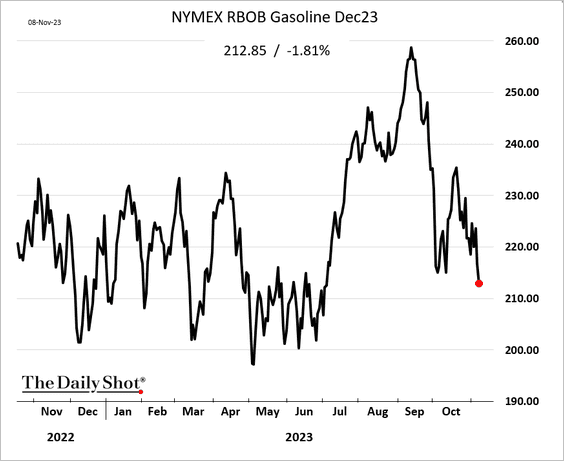

2. OPEC production capacity is expected to rise next year.

Source: @EIAgov

Source: @EIAgov

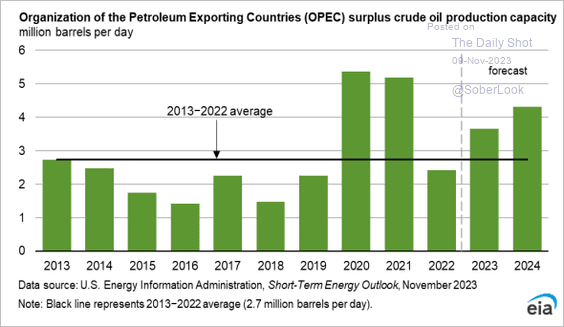

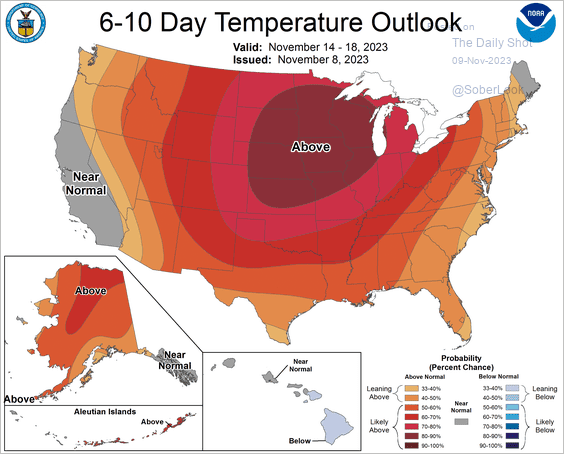

3. US natural gas prices are nearing $3.0/MMBtu on warm weather across the US.

Source: NOAA

Source: NOAA

Back to Index

Equities

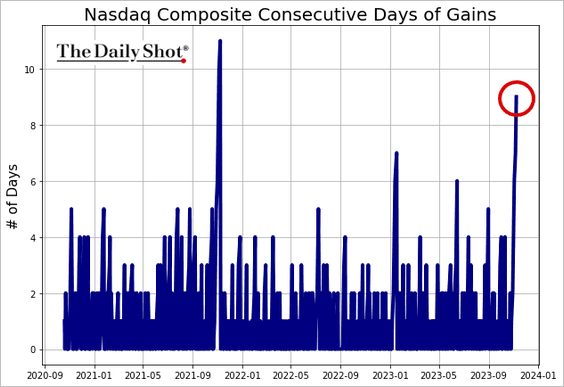

1. The Nasdaq Composite has been up for nine consecutive trading sessions.

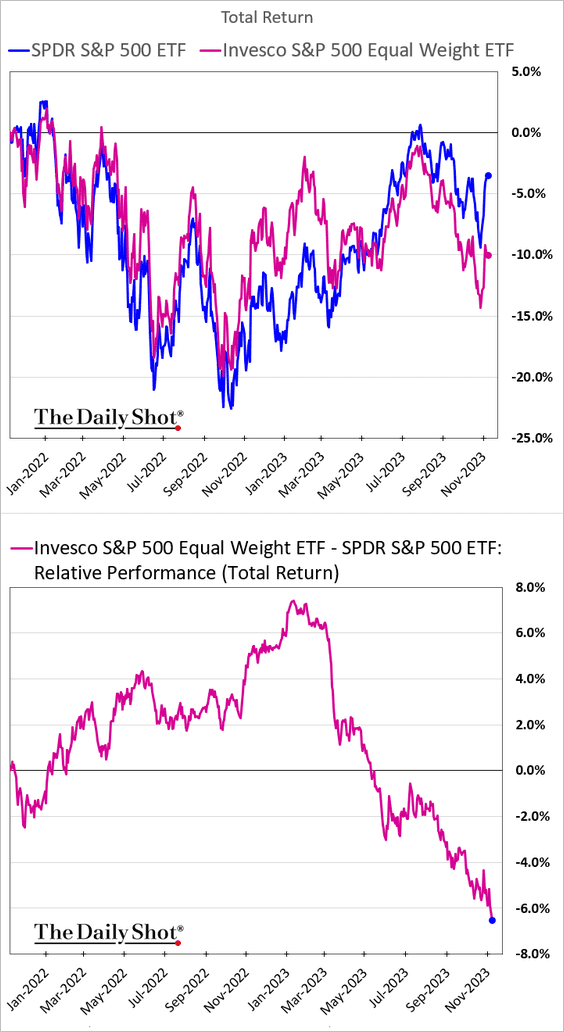

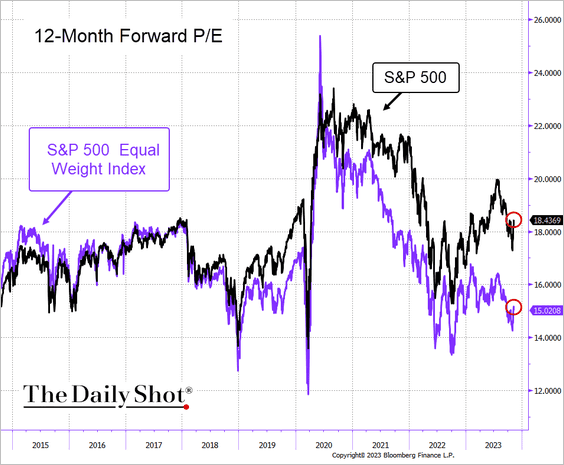

2. The S&P 500 equal-weight index underperformance continues to widen.

The average S&P stock’s discount to the S&P 500 keeps growing.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

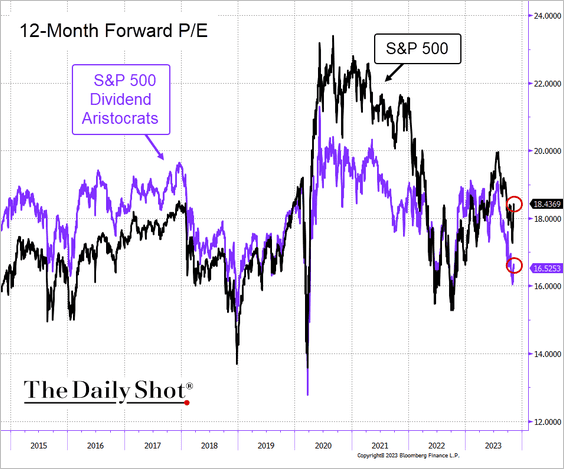

3. Dividend growers are also trading at a discount.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

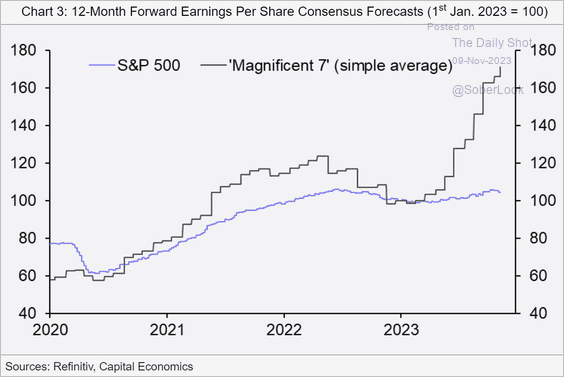

4. Analysts have been rapidly boosting earnings forecasts for the tech mega-caps.

Source: Capital Economics

Source: Capital Economics

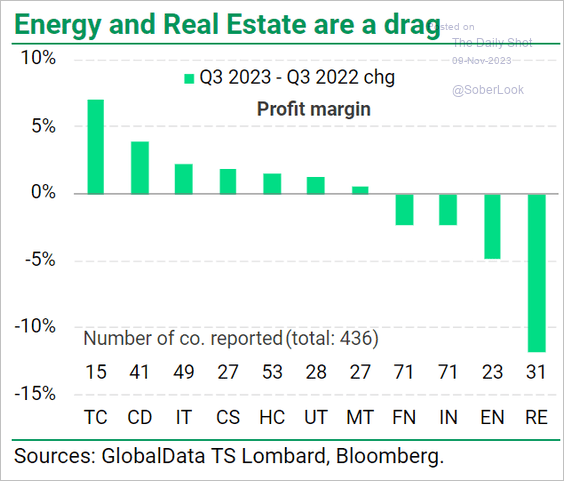

5. Here is a look at margin growth by sector.

Source: TS Lombard

Source: TS Lombard

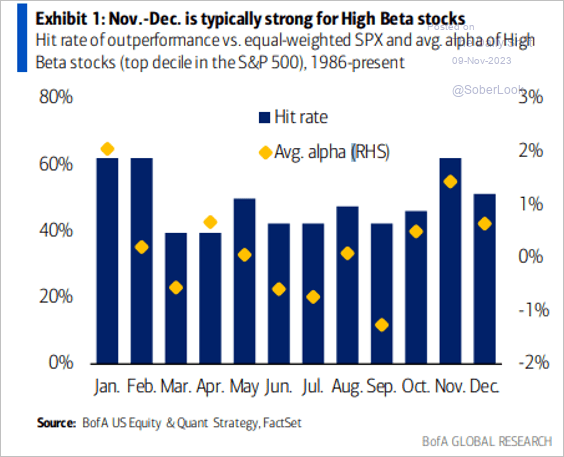

6. High-beta socks tend to perform well in November and December relative to the broader market.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

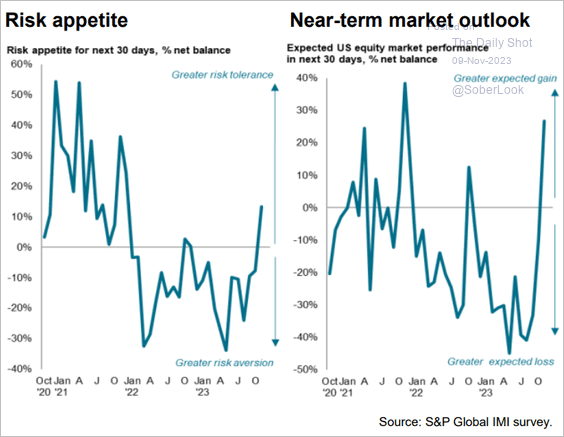

7. Investment managers are more upbeat on US stocks.

S&P Global: – Overall US equity market sentiment is at its highest for two years, buoyed by expectations that the US will outperform the broader global economy amid easing headwinds from both monetary and fiscal policy, helping calm concerns over equity fundamentals and valuations. Increasingly bullish sentiment is consequently seen for energy and tech, and bearish views have softened markedly for interest-rate sensitive sectors such as financials, real estate, and consumer discretionary.

Source: S&P Global PMI

Source: S&P Global PMI

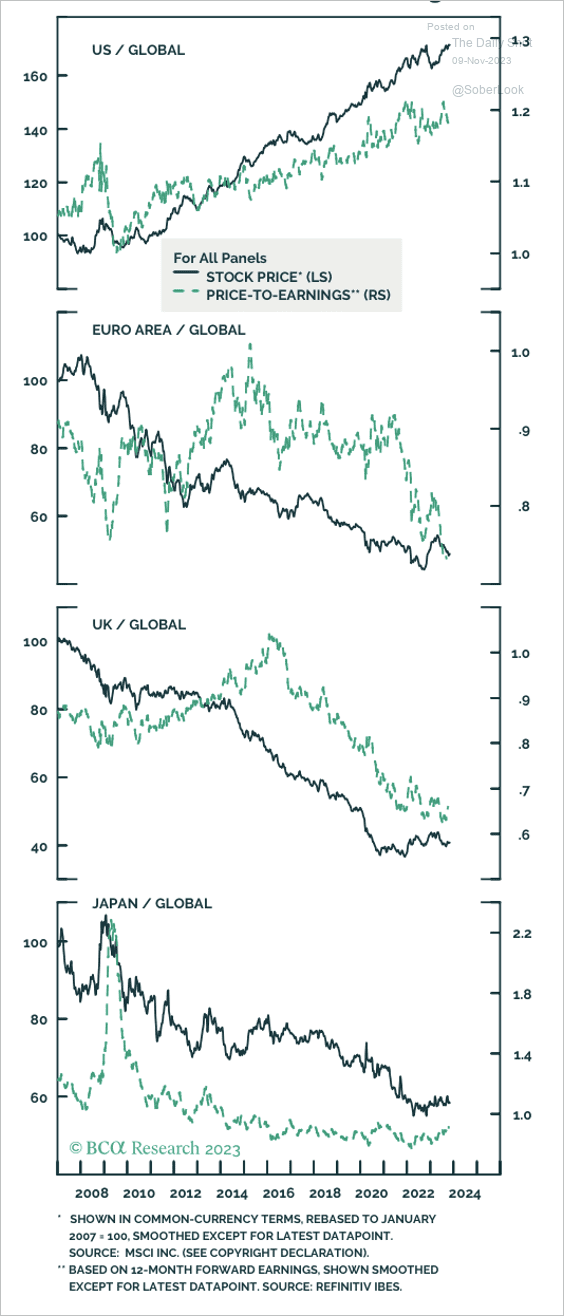

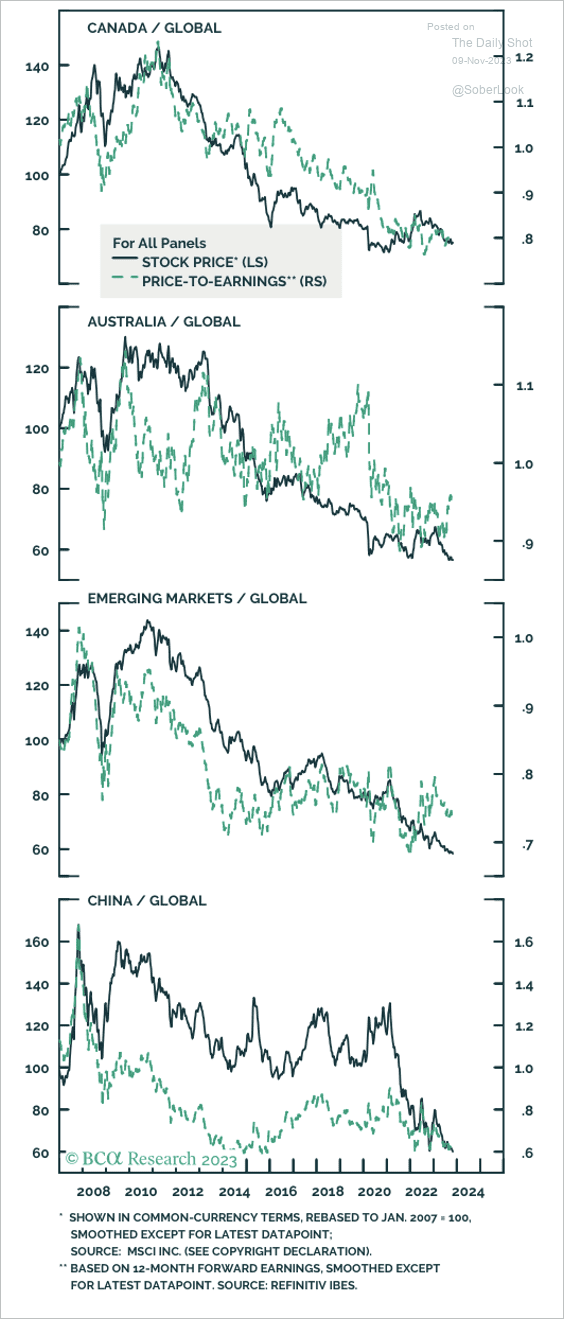

8. Here is a look at relative equity prices and valuations across select global markets. Could we see a rotation out of the US?

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

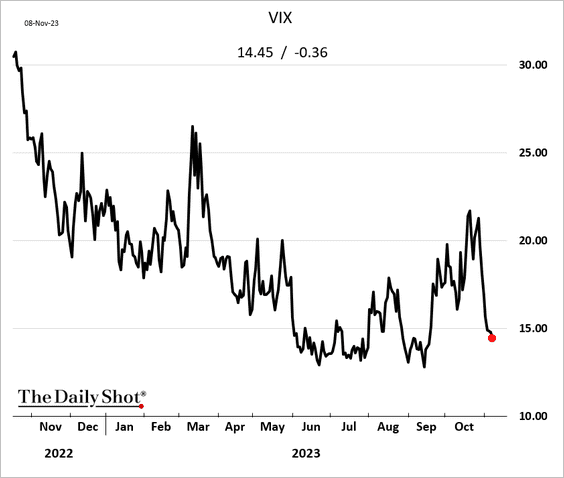

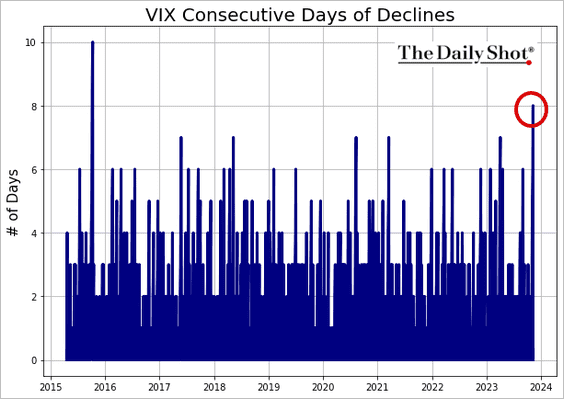

9. It’s been a while since VIX was down for eight days in a row.

Back to Index

Credit

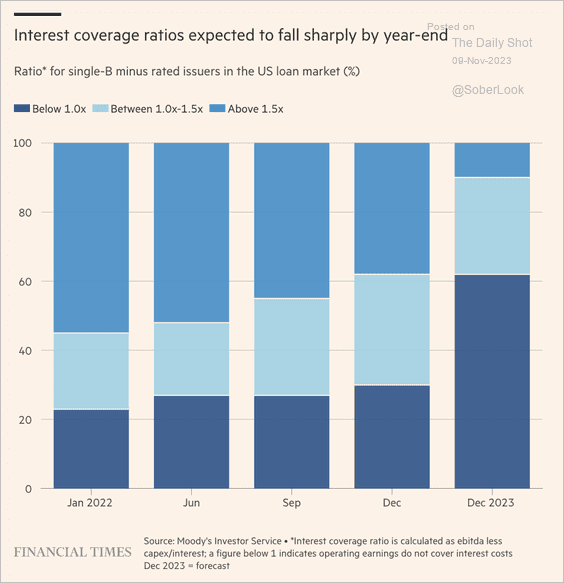

1. Leveraged companies’ interest coverage ratios are expected to drop sharply by the end of this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

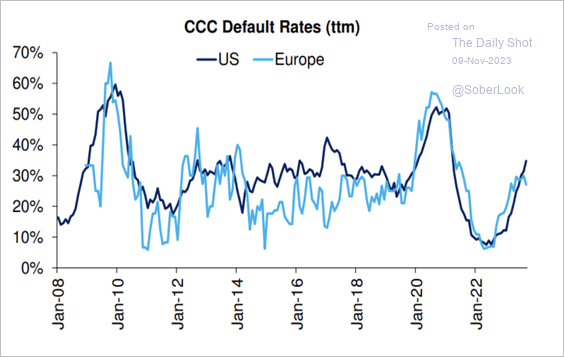

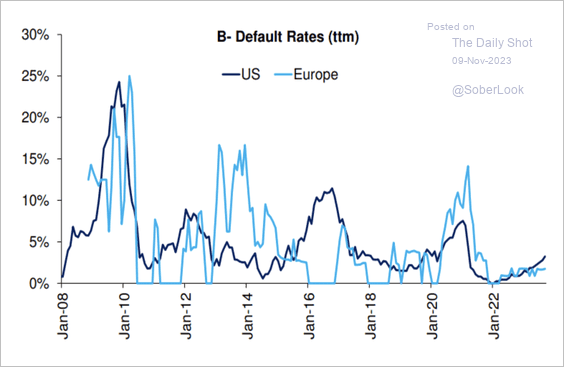

2. US CCC and B3-rated defaults are rising faster than in Europe. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

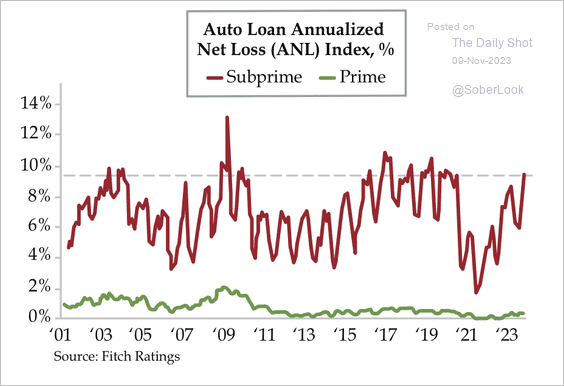

3. Losses on US auto loans are typically confined to the subprime category.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Rates

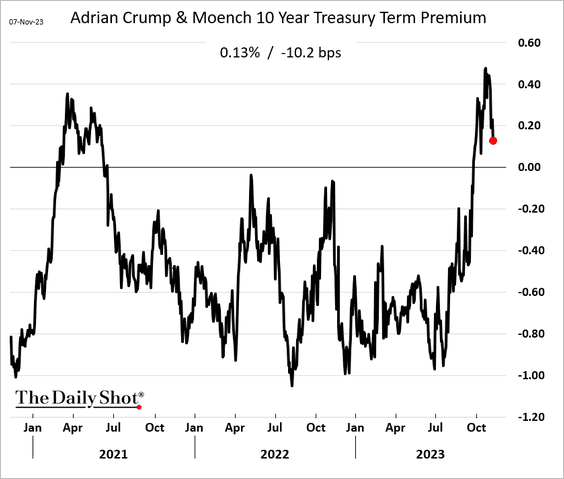

1. Treasury term premium is retreating again.

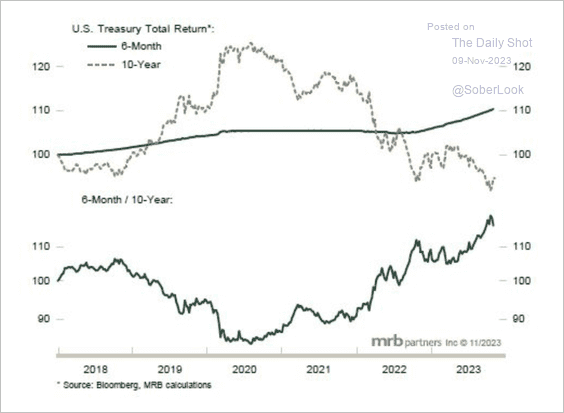

2. Cash has outperformed Treasuries in recent years, but the divergence could narrow at the end of the Fed’s rate hike cycle.

Source: MRB Partners

Source: MRB Partners

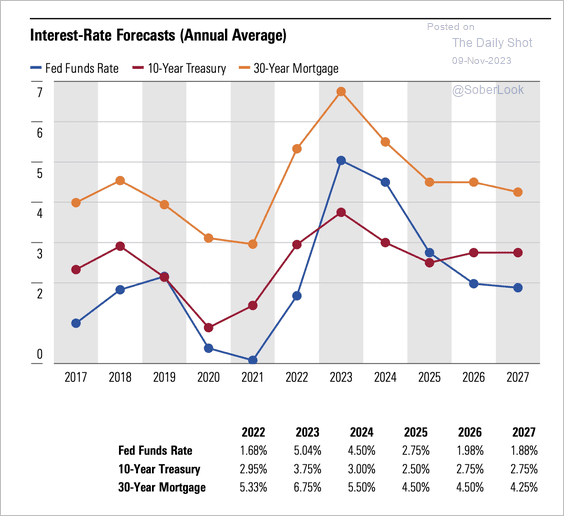

3. Morningstar expects falling inflation to give the Fed the green light to pivot back to easing early next year.

Source: Morningstar Read full article

Source: Morningstar Read full article

Back to Index

Global Developments

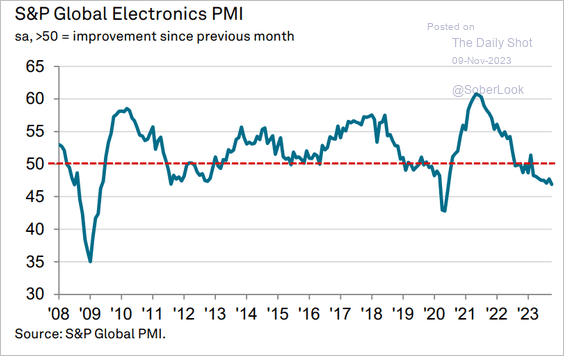

1. Contraction in the global electronics sector accelerated in October.

Source: S&P Global PMI

Source: S&P Global PMI

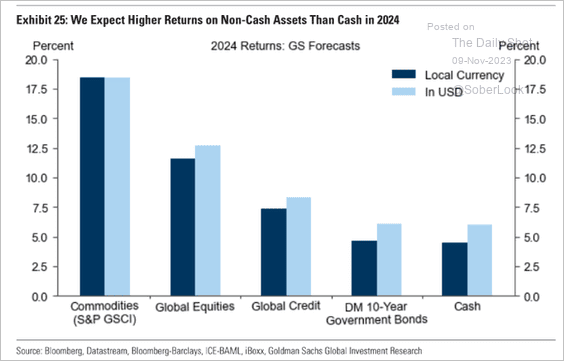

2. Goldman is constructive on risk assets in 2024.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

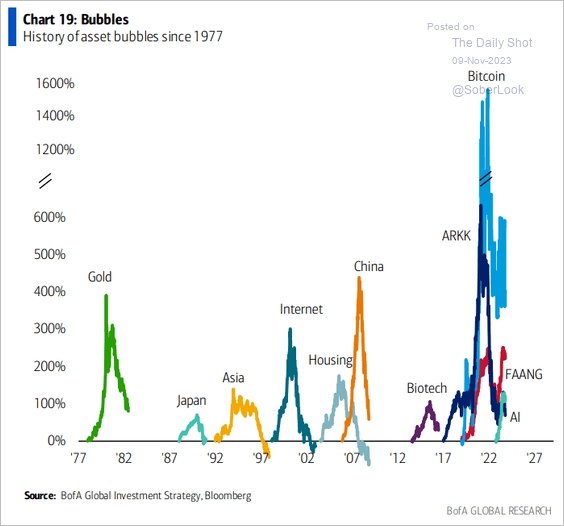

3. Here is a look at some market bubbles.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

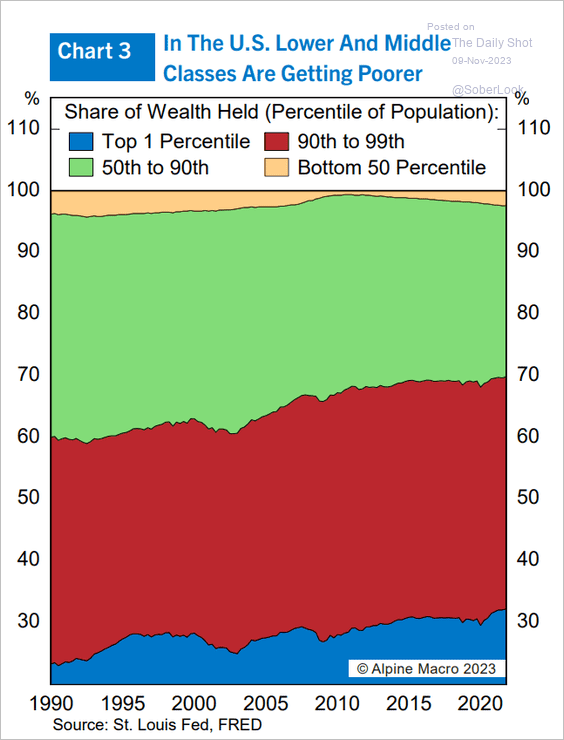

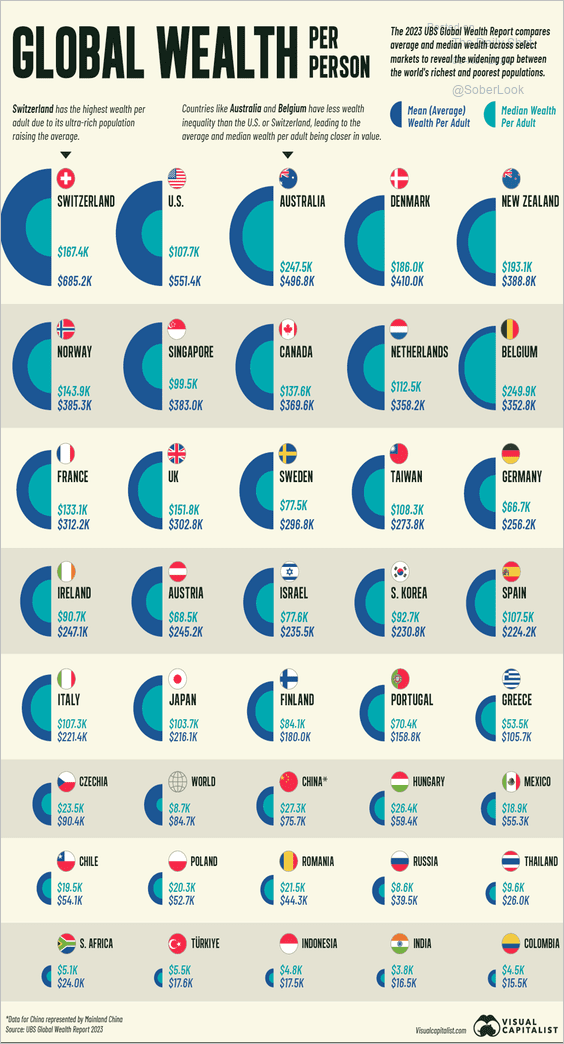

1. Share of wealth held:

Source: Alpine Macro

Source: Alpine Macro

• Wealth per capita globally:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

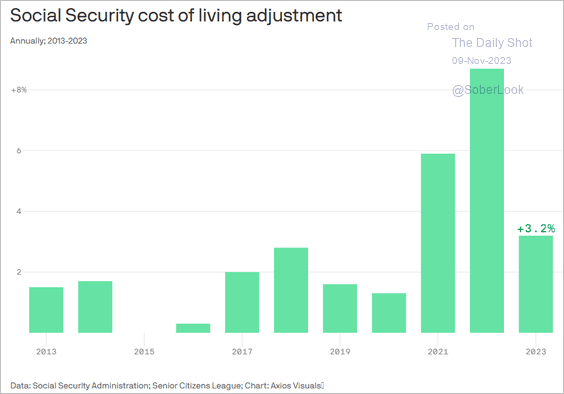

2. Social Security cost-of-living adjustments:

Source: @axios Read full article

Source: @axios Read full article

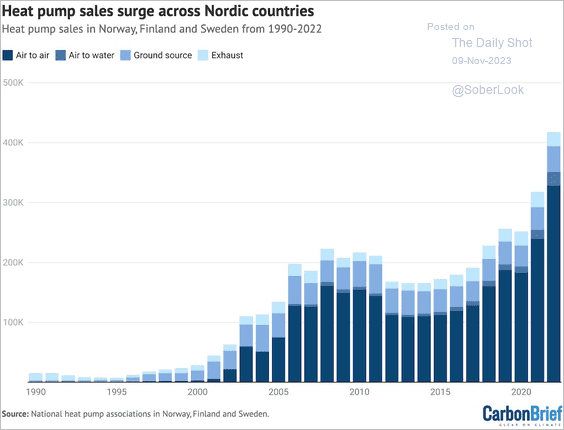

3. Heat pump sales in Nordic countries:

Source: Carbon Brief Read full article

Source: Carbon Brief Read full article

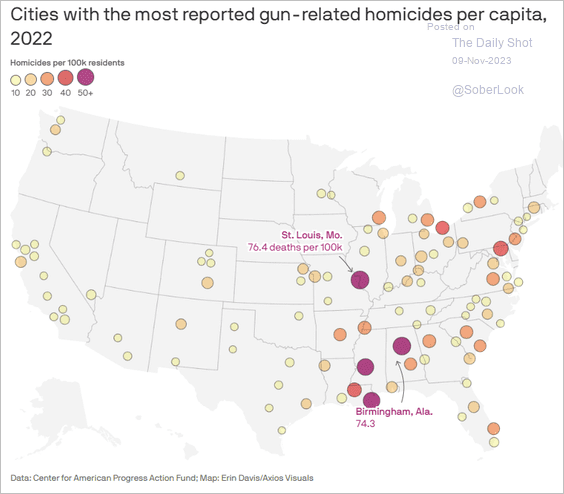

4. Gun-related homicides per capita:

Source: @axios Read full article

Source: @axios Read full article

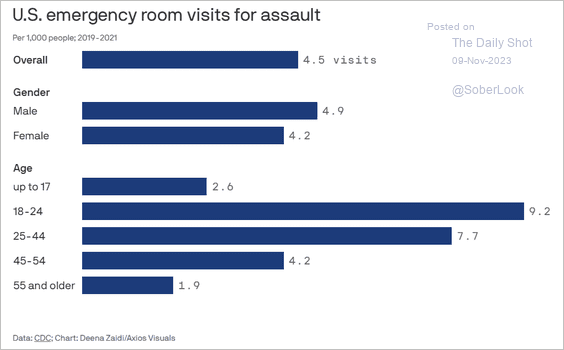

5. The demographics of assault injuries:

Source: @axios Read full article

Source: @axios Read full article

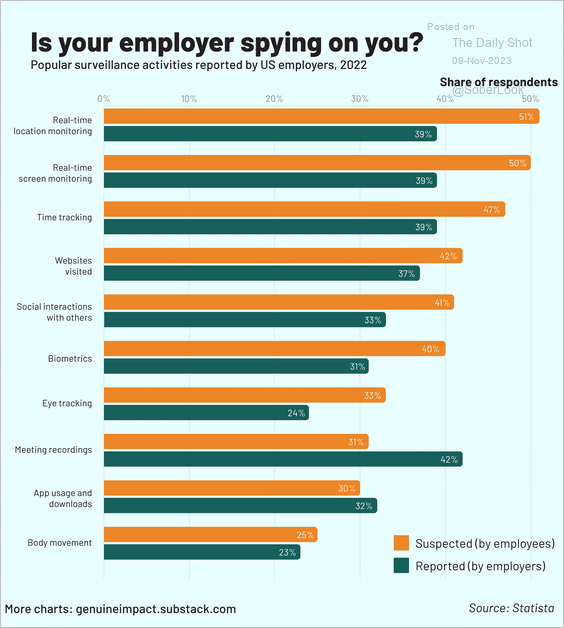

6. Is your employer spying on you?

Source: @genuine_impact

Source: @genuine_impact

——————–

Back to Index