The Daily Shot: 13-Nov-23

• The United States

• Canada

• The United Kingdom

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

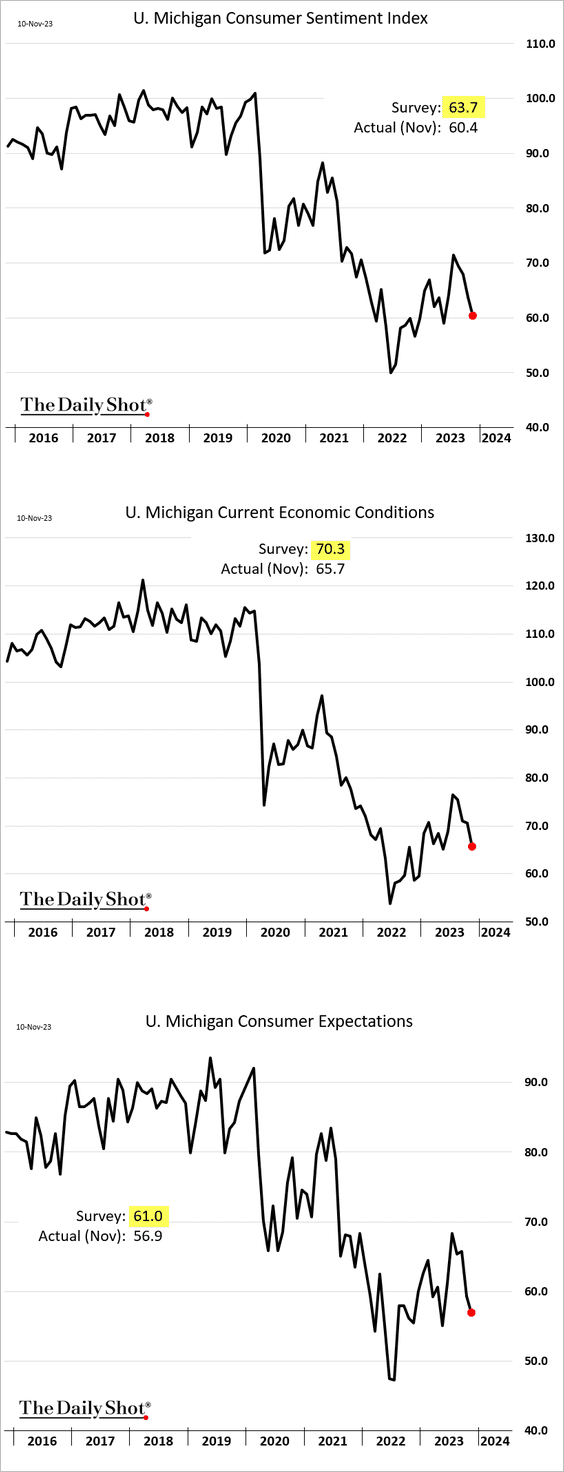

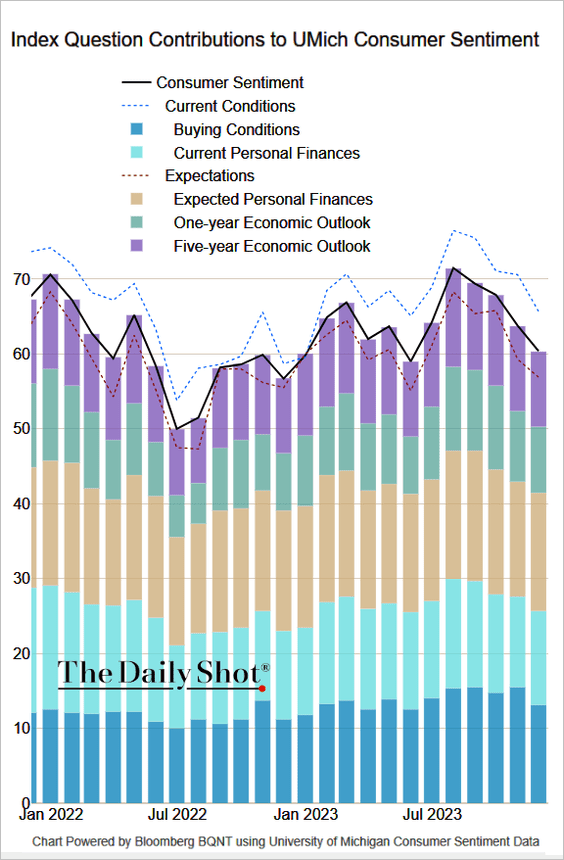

1. US consumer sentiment declined again this month.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

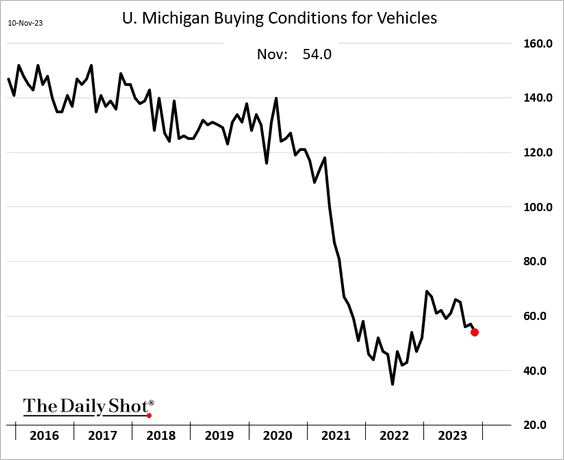

• Consumers’ outlook on vehicle buying conditions deteriorated further.

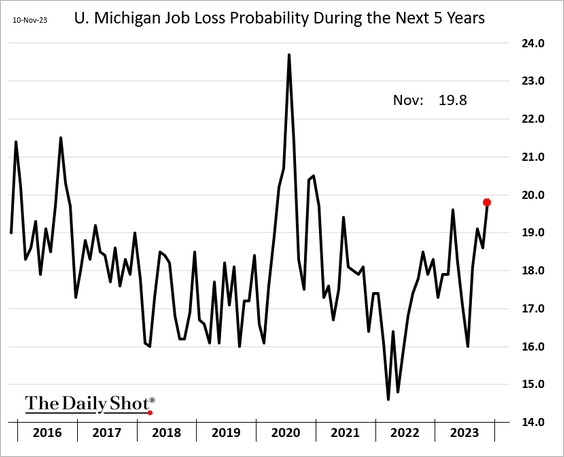

• There is more concern about job loss over the next few years.

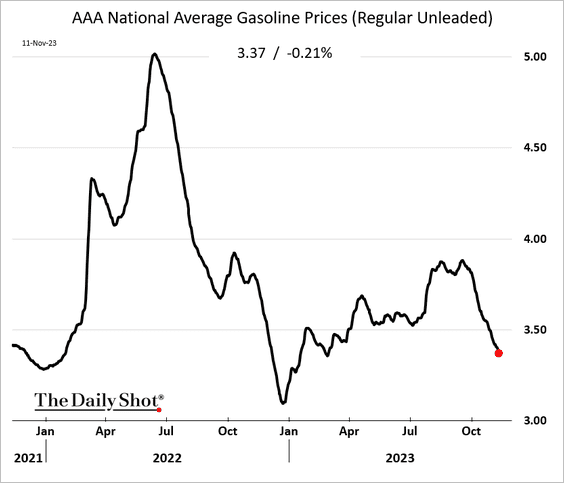

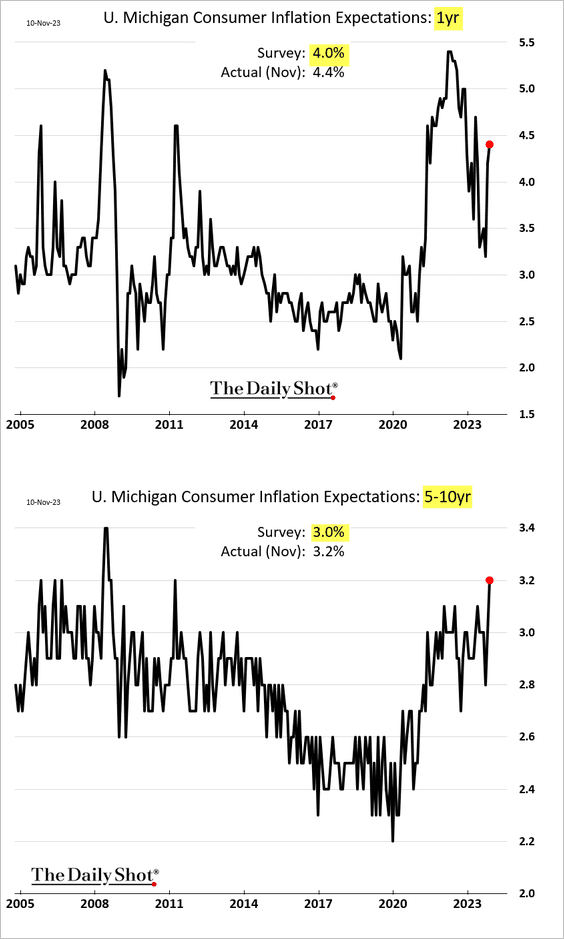

2. Next, we have a couple of updates on inflation.

• Despite falling gasoline prices, …

… consumers raised their outlook for inflation (topping expectations). This is not a trend the Fed wants to see.

Source: @markets Read full article

Source: @markets Read full article

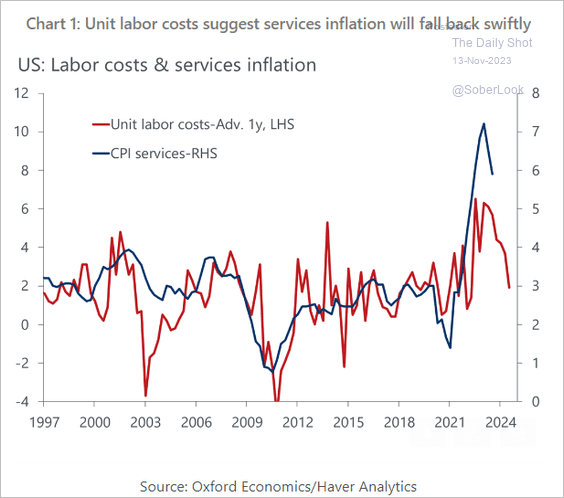

• Softer wage growth could help ease services CPI.

Source: Oxford Economics

Source: Oxford Economics

——————–

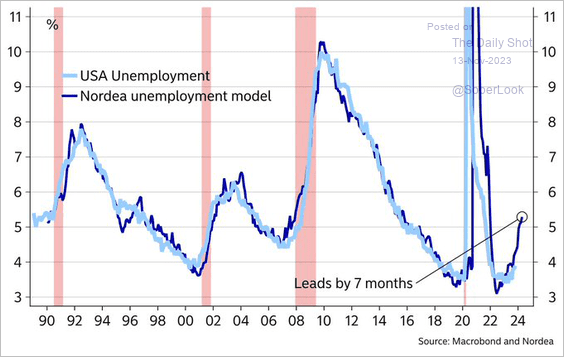

3. According to Nordea’s model, the unemployment rate is projected to exceed 5% next year.

Source: @MikaelSarwe

Source: @MikaelSarwe

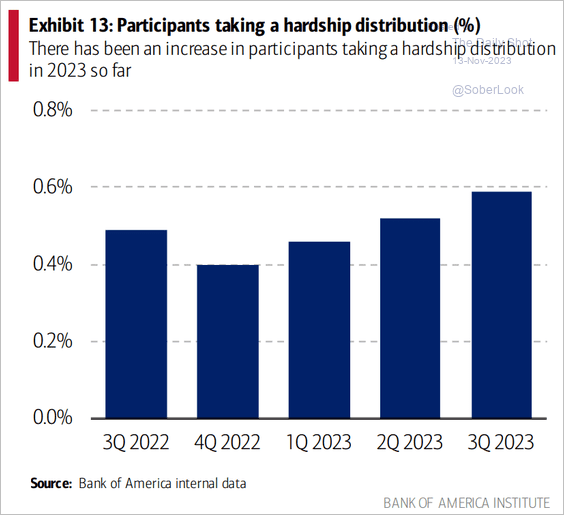

4. More Americans are taking a hardship distribution from their 401k/IRA account.

Source: Bank of America Institute

Source: Bank of America Institute

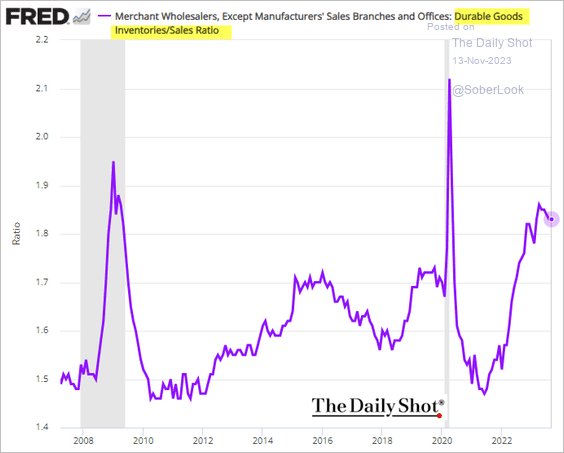

5. The ratio of wholesale durable goods inventories to sales remains high.

Source: AEI Housing Center

Source: AEI Housing Center

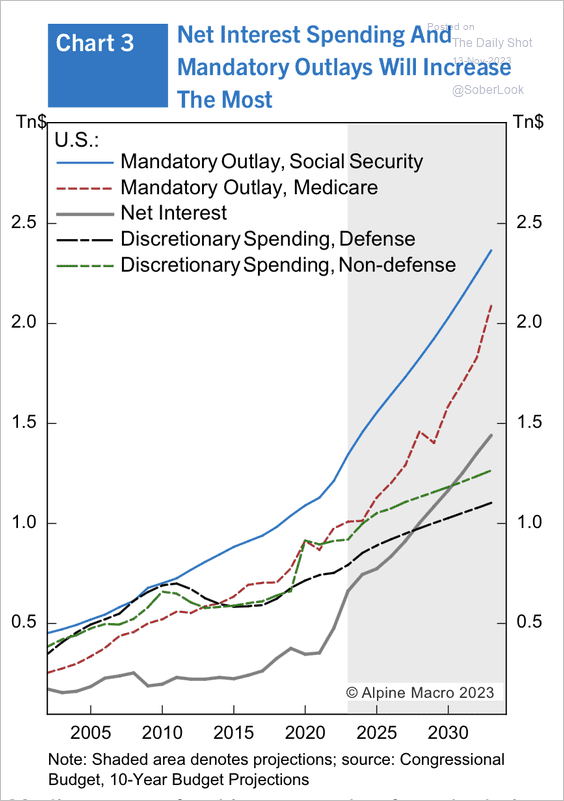

6. Interest on government debt could exceed defense spending by 2027 and non-defense discretionary spending by 2030.

Source: Alpine Macro

Source: Alpine Macro

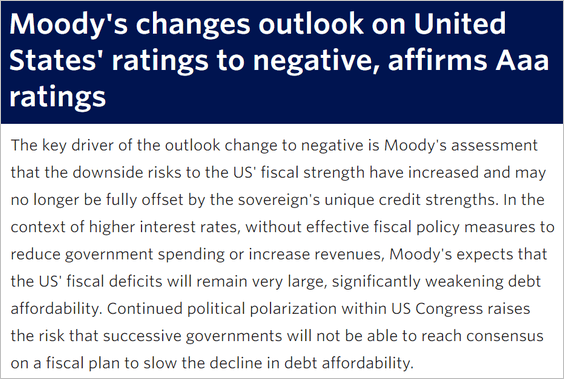

• Moody’s changed its credit outlook for the US to “negative.” Will we see a downgrade shortly?

Source: Moody’s Investors Service Read full article

Source: Moody’s Investors Service Read full article

Back to Index

Canada

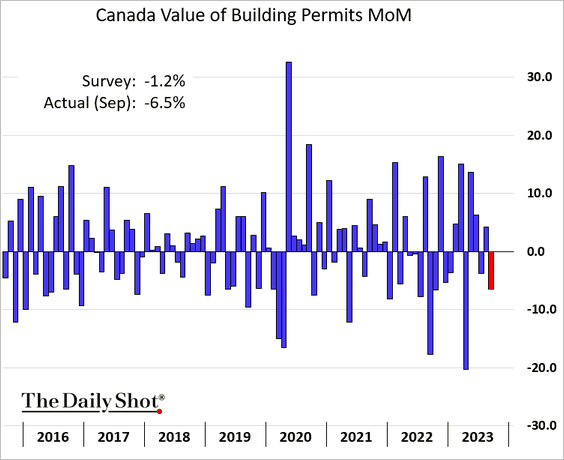

1. Building permits declined more than expected in September.

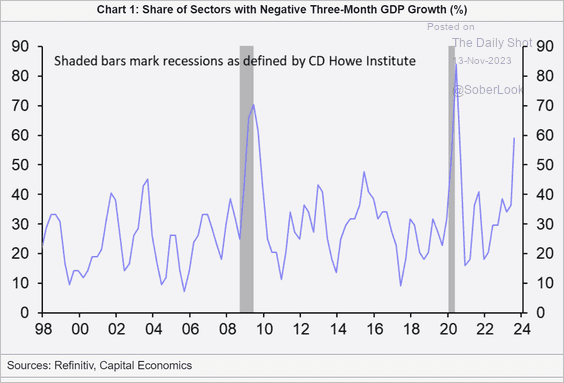

2. The breadth of GDP signals an impending recession.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

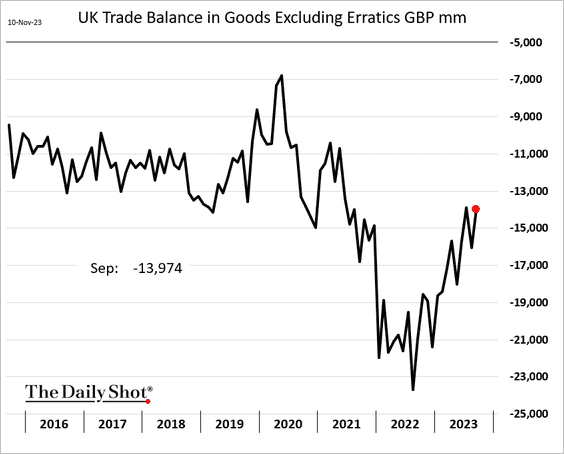

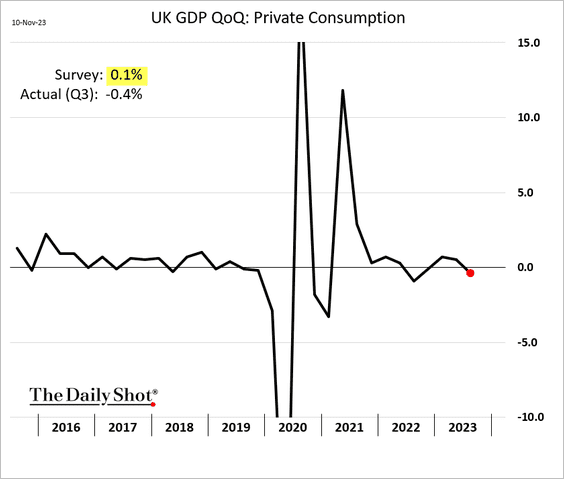

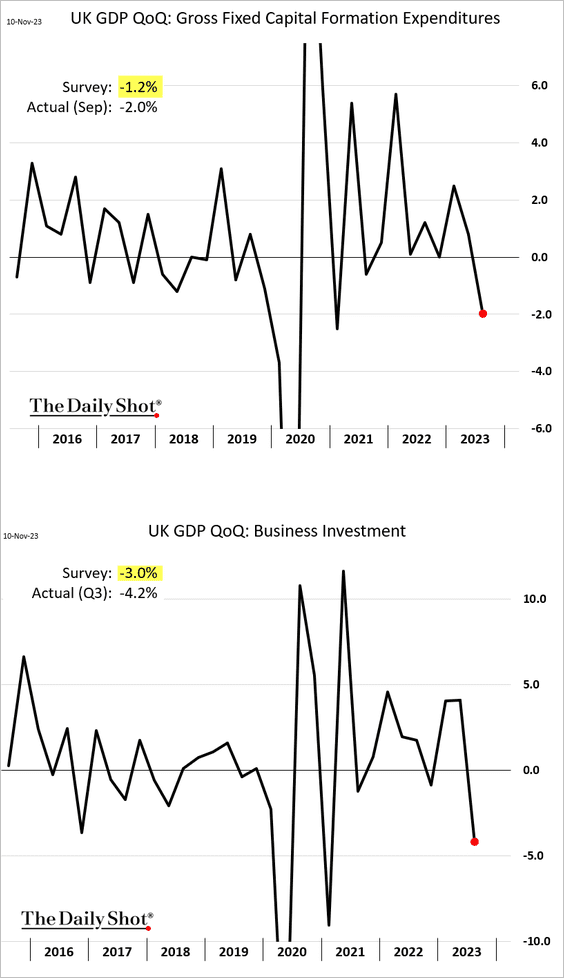

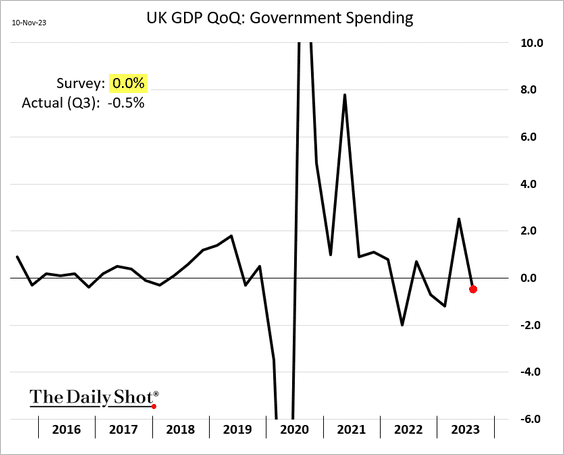

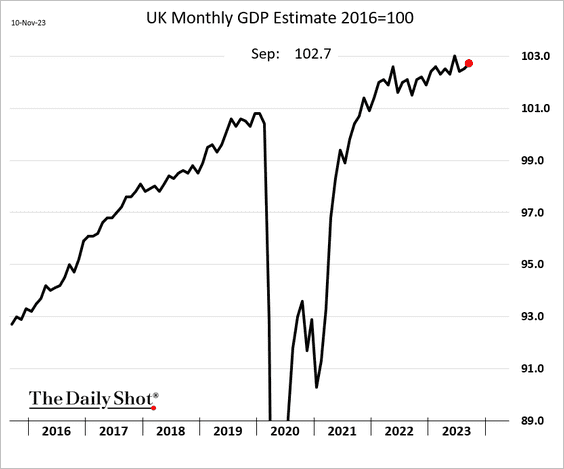

1. As we saw last week, the GDP report topped expectations. However, the economy avoided a contraction due, in part, to improving net exports.

Other key components declined (all weaker than expected).

– Consumer spending:

– Business spending:

– Government spending:

– Summary:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

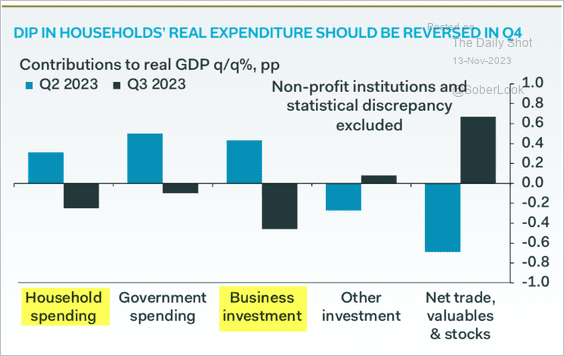

• Here is the monthly GDP index.

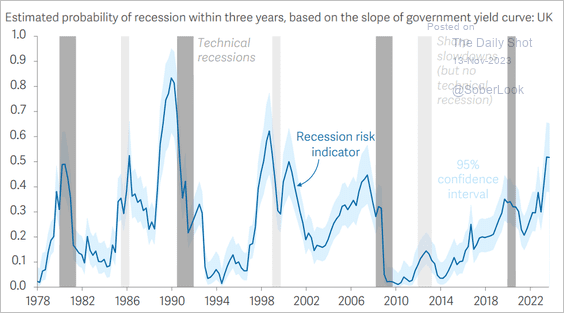

• Recession probability remains elevated.

Source: The Resolution Foundation Read full article

Source: The Resolution Foundation Read full article

——————–

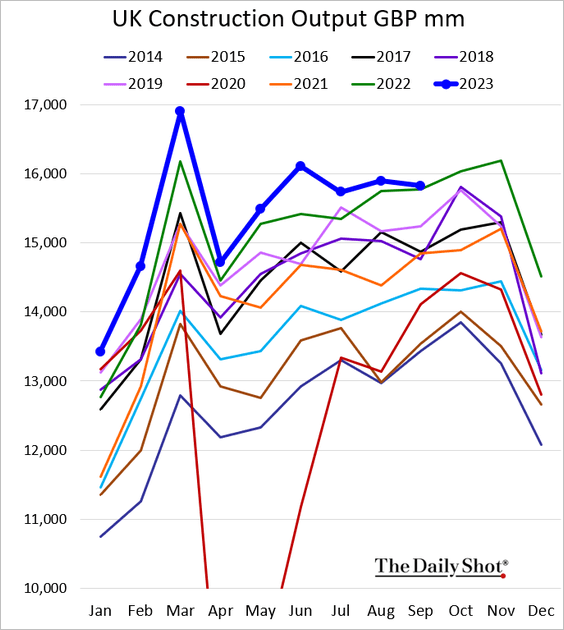

2. Construction activity slowed in September.

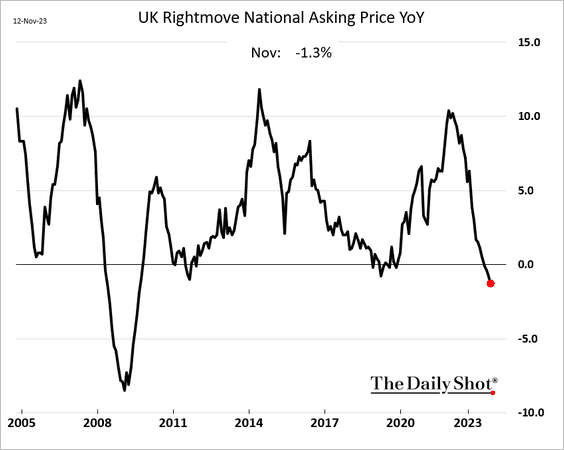

3. The Rightmove index showed home prices declining further this month.

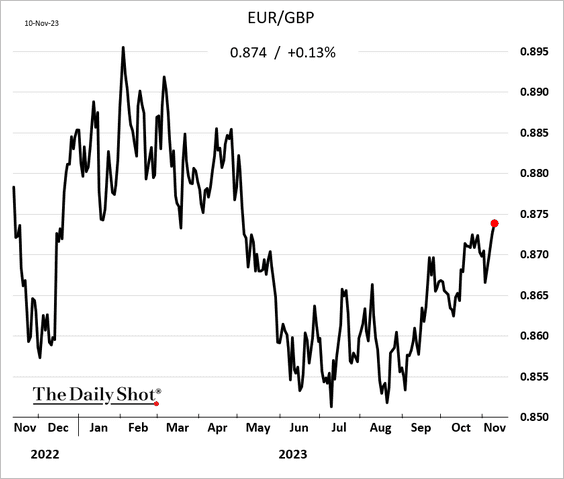

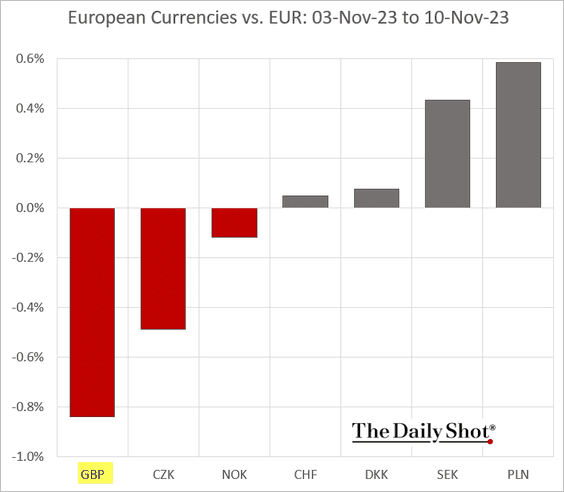

4. The pound has been weakening against the euro (2 charts).

——————–

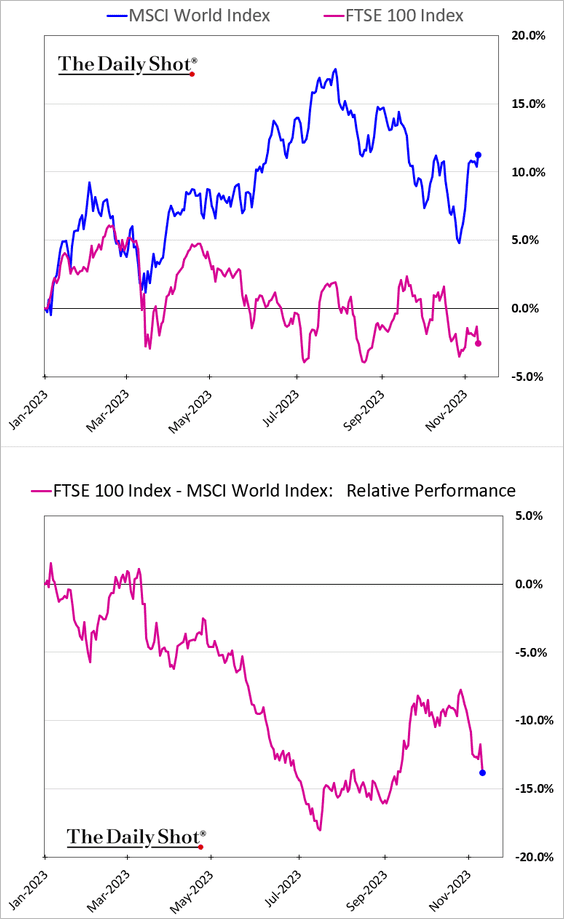

5. UK equities are underperforming again.

Back to Index

Europe

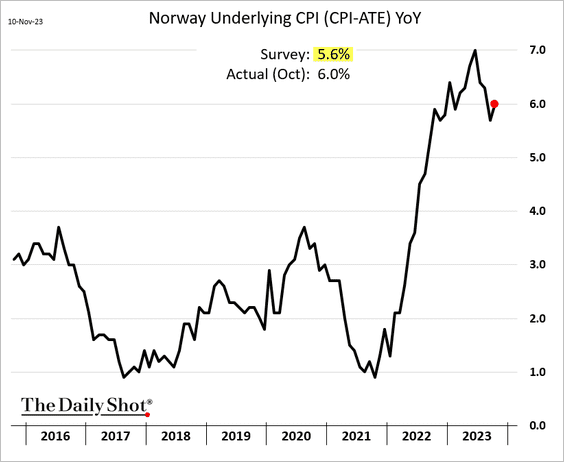

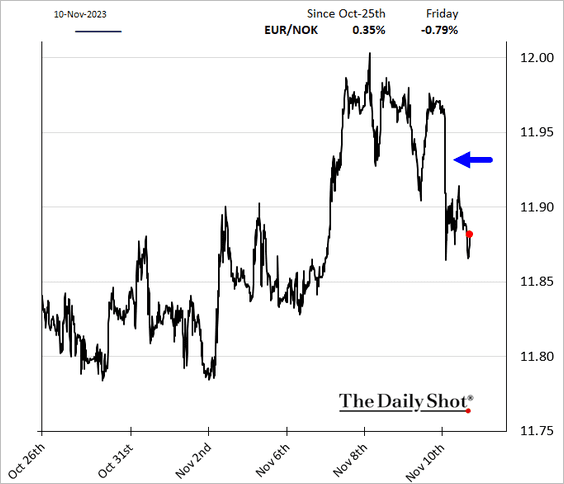

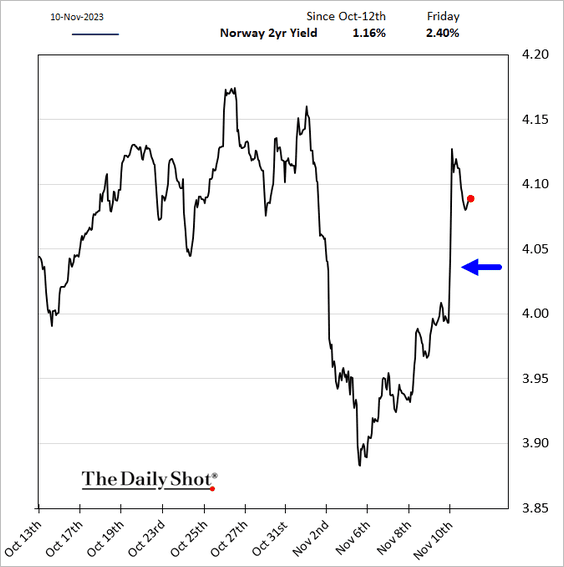

1. Norway’s inflation surprised to the upside.

Source: @economics Read full article

Source: @economics Read full article

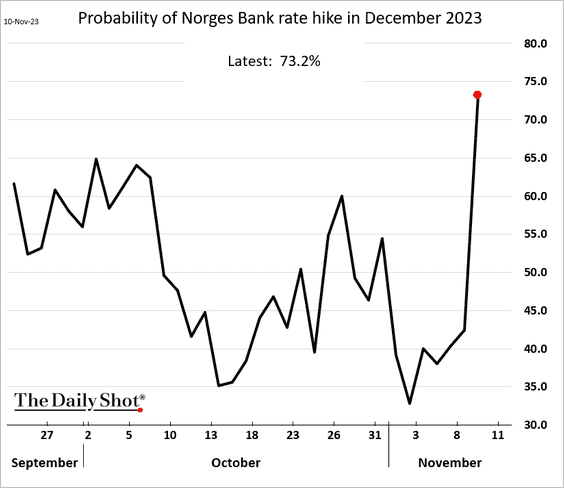

• The probability of a rate hike in December rose sharply.

Source: Bloomberg

Source: Bloomberg

• The Norwegian krone and bond yields jumped.

——————–

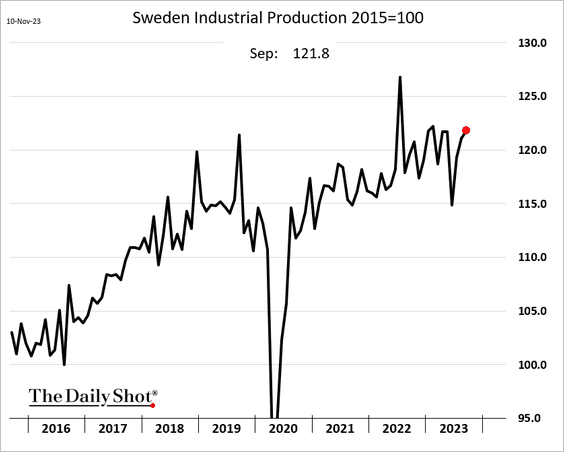

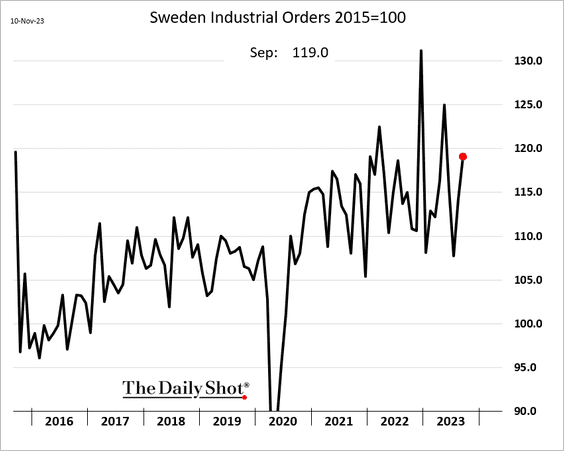

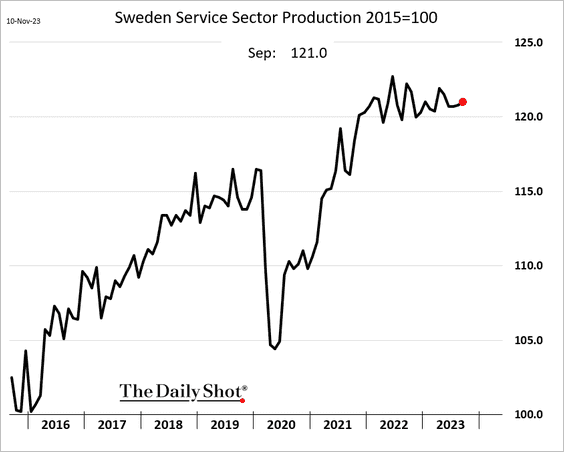

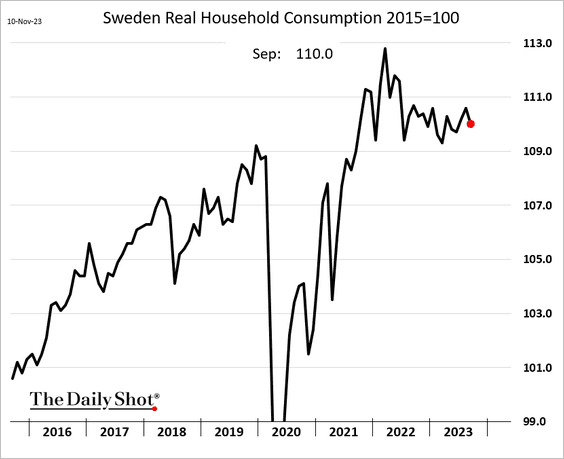

2. Next, we have some updates on Sweden.

• Industrial production:

• Industrial orders:

• Service sector output:

• Household consumption:

——————–

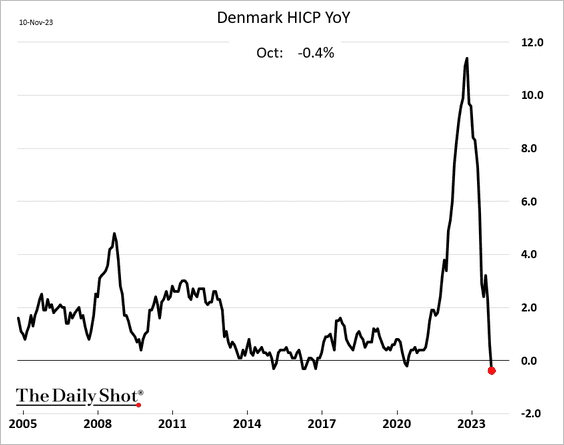

3. Denmark is in deflation.

Back to Index

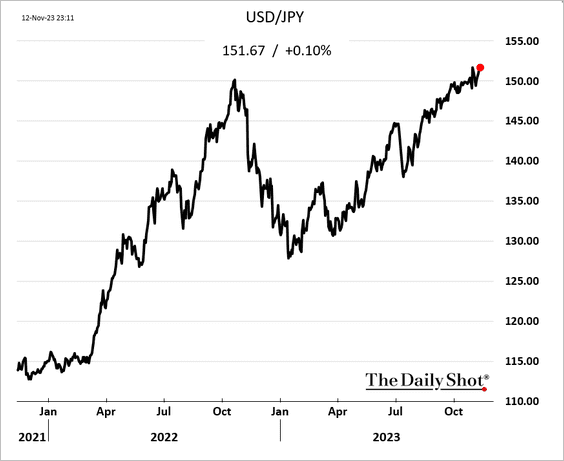

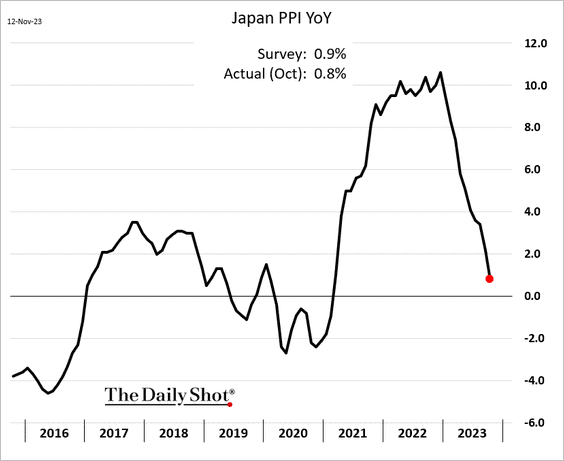

Japan

1. Dollar-yen is nearing 152.

2. Gains in producer prices slowed more than expected last month.

Back to Index

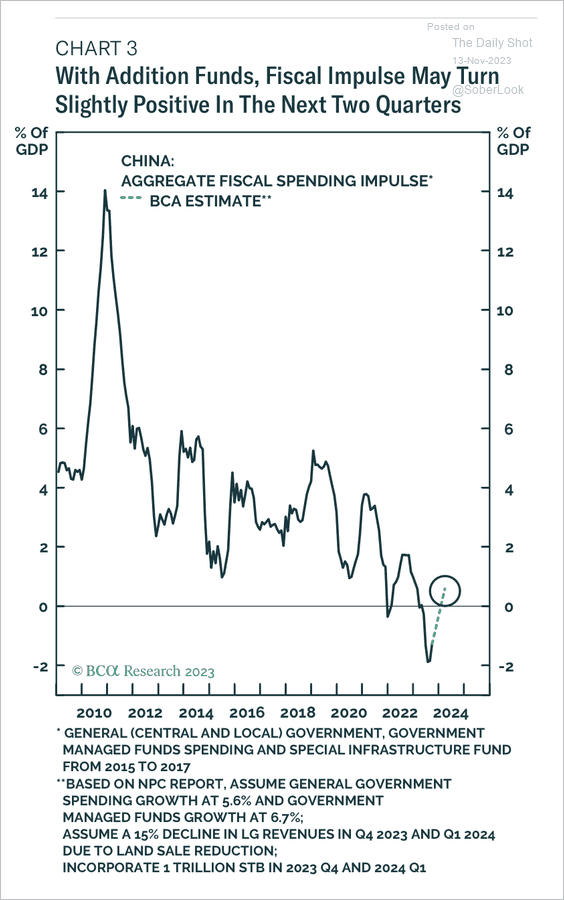

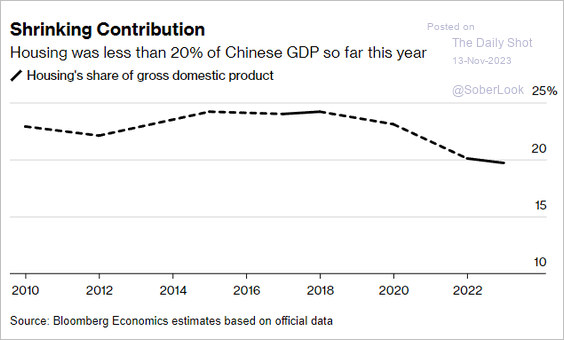

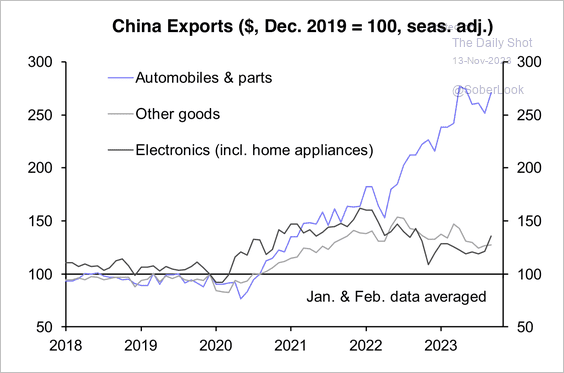

China

1. The fiscal impulse could turn positive over the next six months, albeit within a long-term downtrend.

Source: BCA Research

Source: BCA Research

2. Housing is becoming a smaller part of China’s economy.

Source: @economics Read full article

Source: @economics Read full article

3. Electric vehicle exports have shown remarkable strength in recent years.

Source: Capital Economics

Source: Capital Economics

Back to Index

Emerging Markets

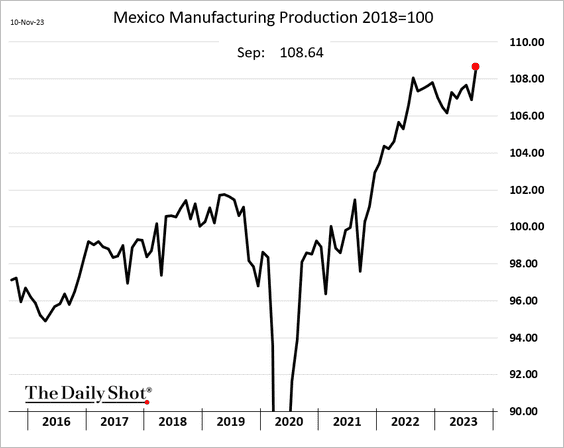

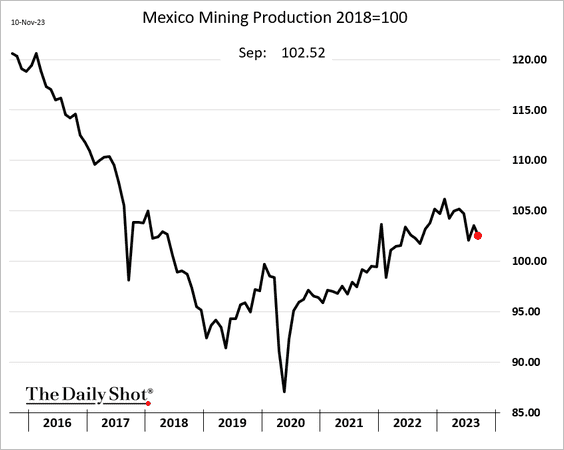

1. Mexico’s factory output surged in September.

Mining production eased.

——————–

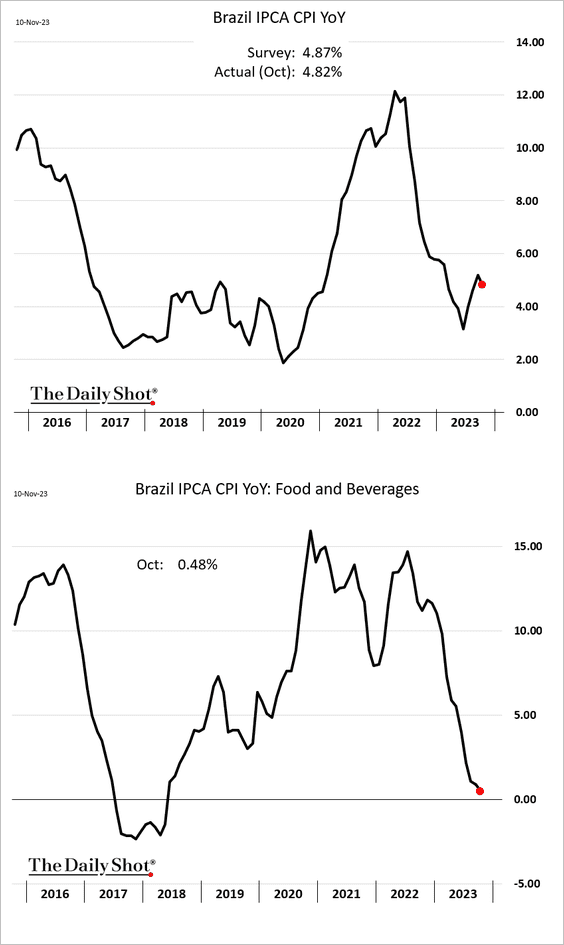

2. Brazil’s inflation slowed last month.

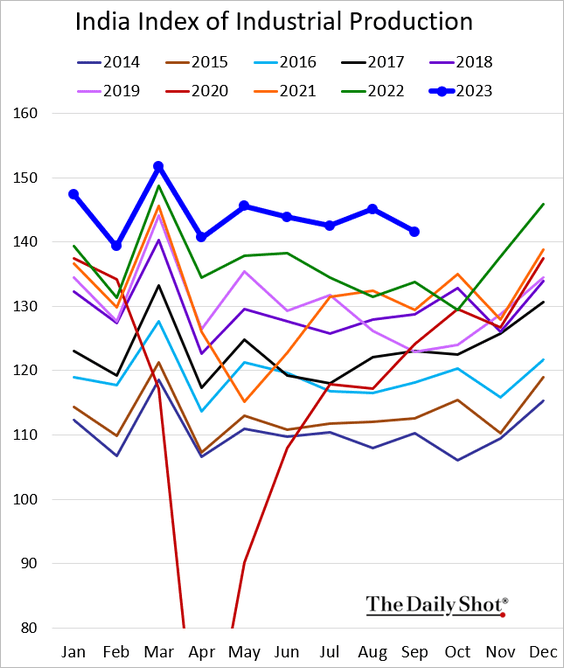

3. India’s industrial production eased in September but remained well above 2022 levels.

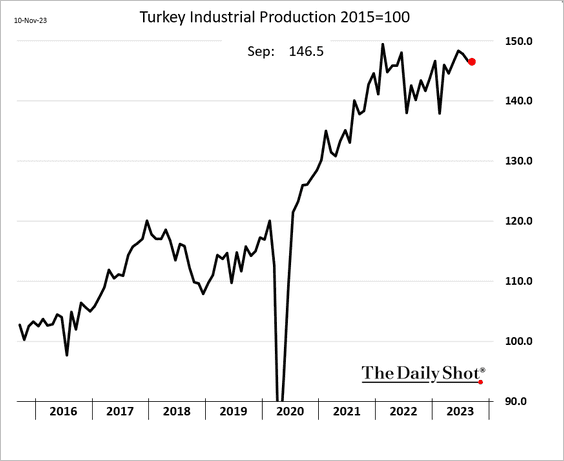

4. Turkey’s industrial production was roughly unchanged.

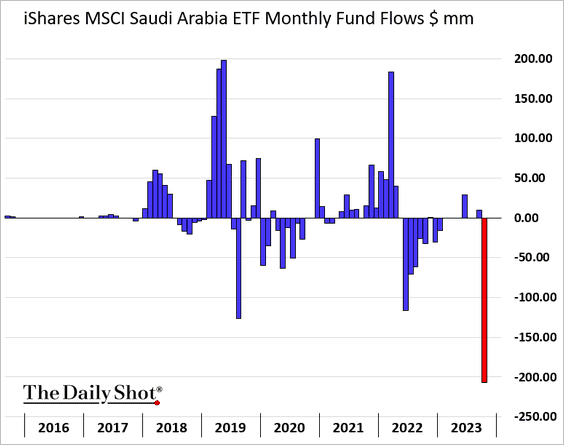

5. Middle East equity funds saw severe outflows last month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

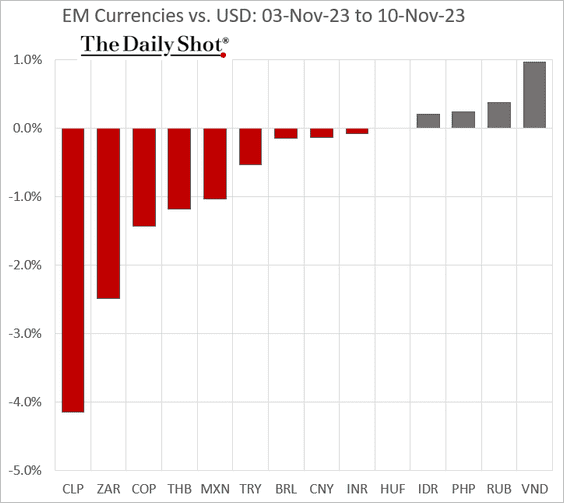

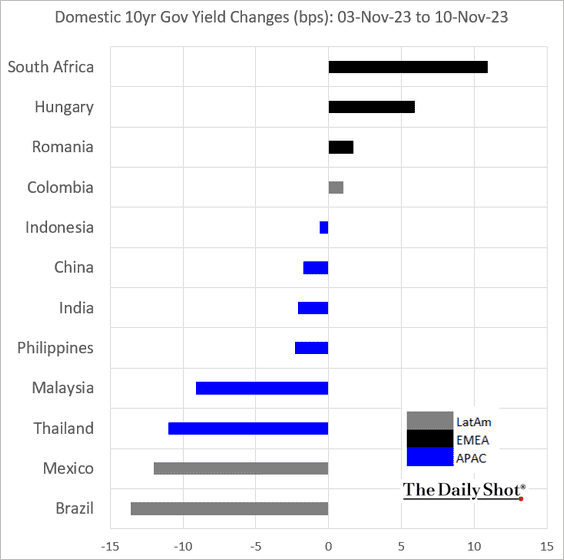

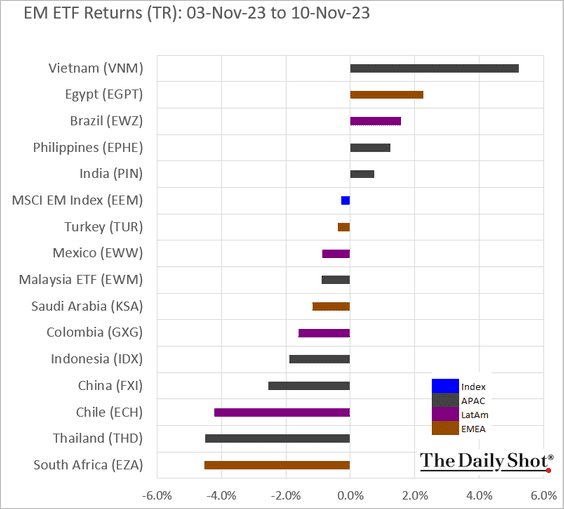

6. Finally, we have last week’s performance data.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

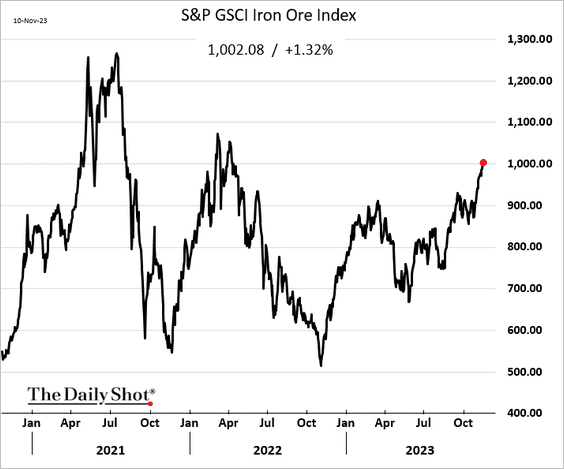

1. While iron ore continues to rally, …

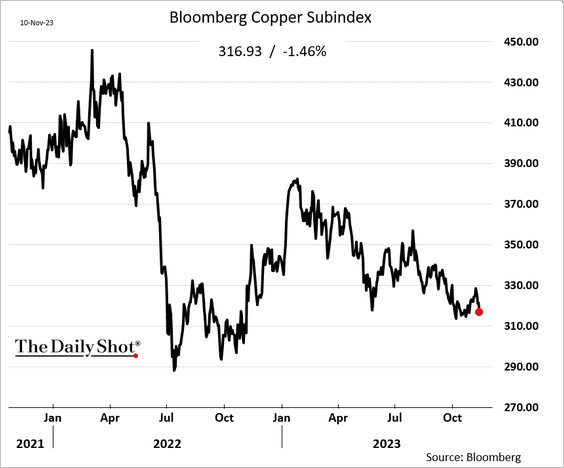

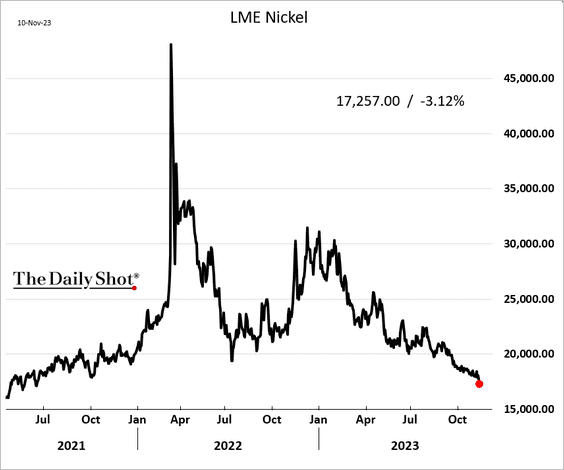

… other industrial commodities are struggling.

• Copper:

• Nickel:

——————–

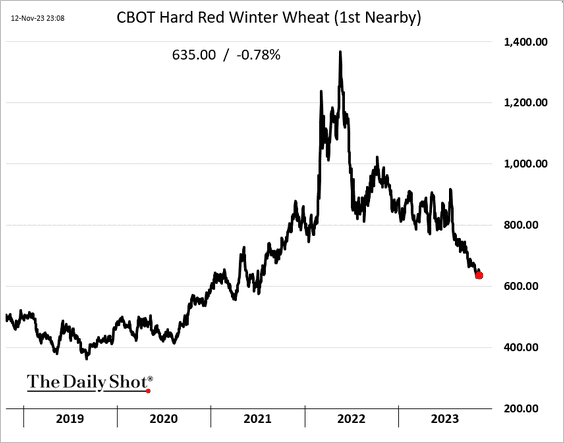

2. US wheat prices are under pressure, …

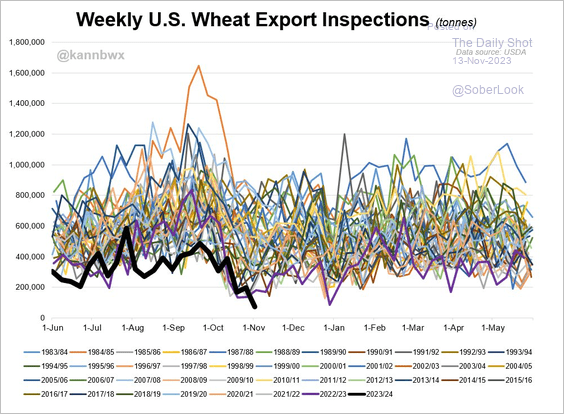

… as exports sag.

Source: @kannbwx

Source: @kannbwx

——————–

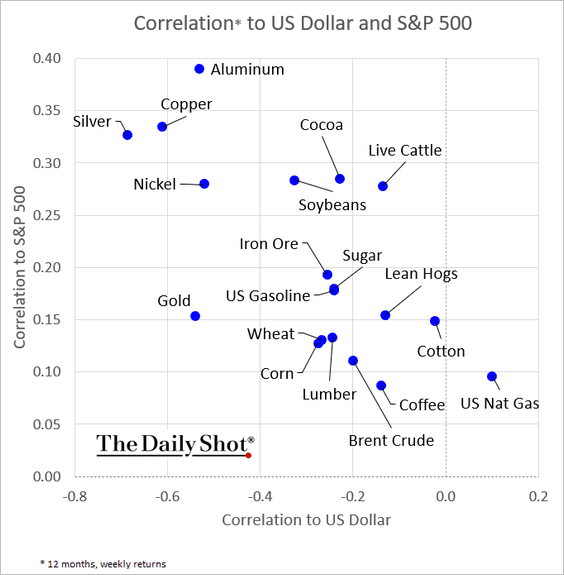

3. How correlated are different commodity markets to the S&P 500 and the US dollar (updated chart)?

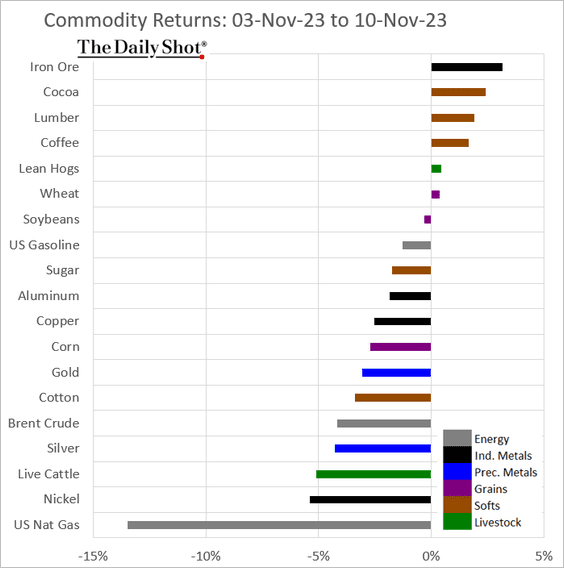

4. Below is last week’s performance data.

Back to Index

Energy

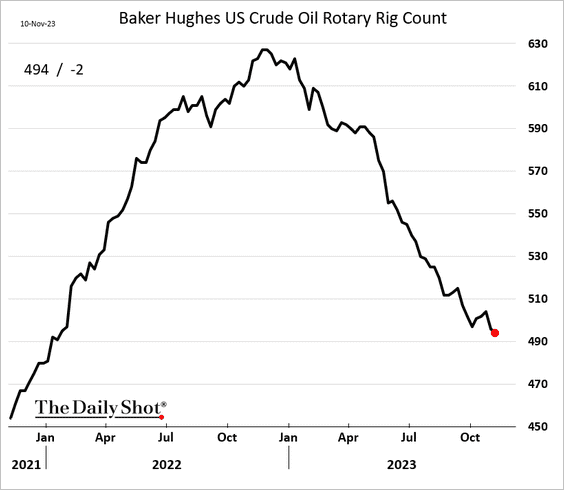

1. The US rig count is trending lower.

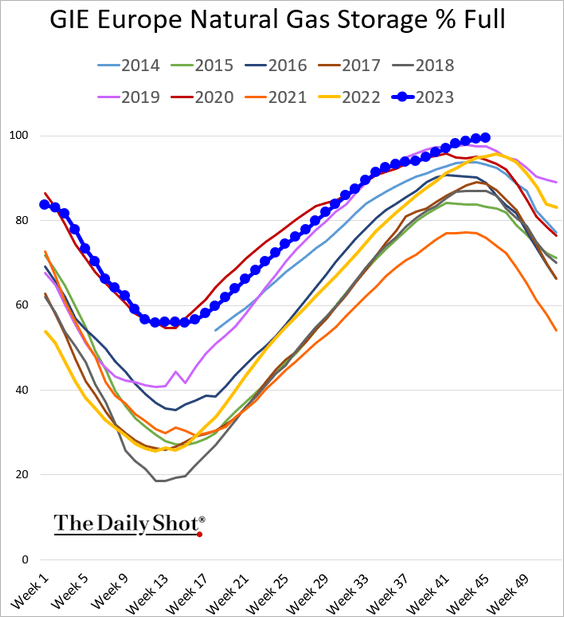

2. European natural gas storage is full.

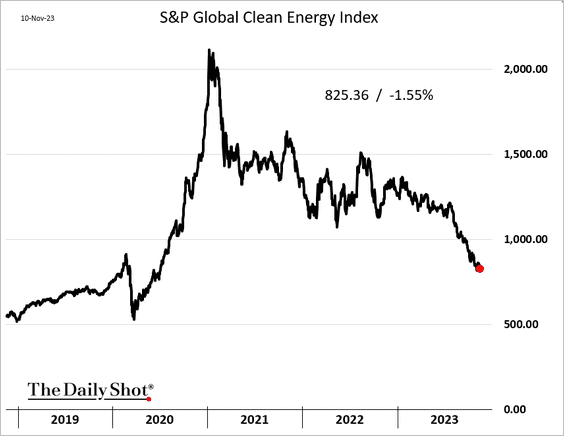

3. Clean energy shares remain under pressure.

Back to Index

Equities

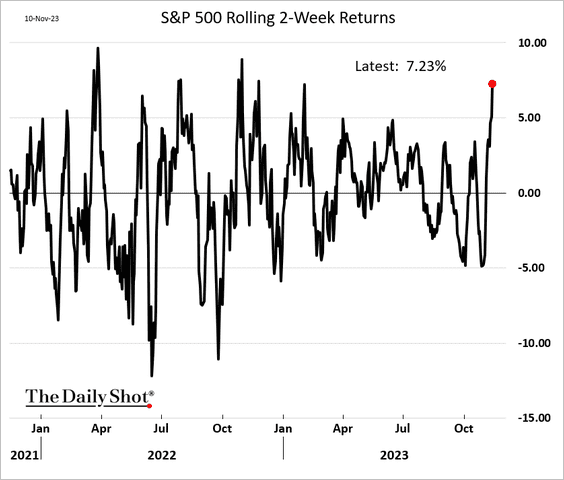

1. It’s been a good couple of weeks for US stocks.

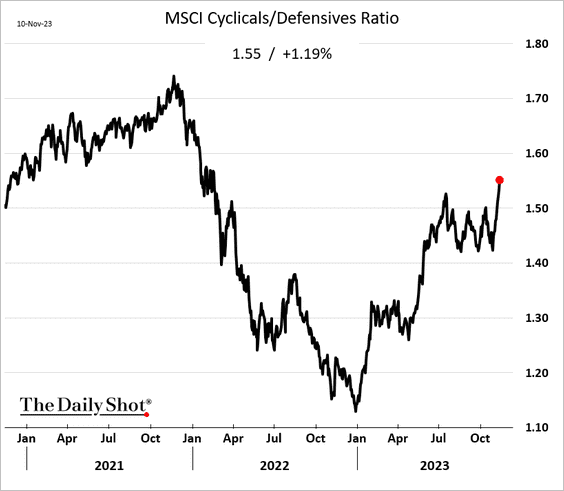

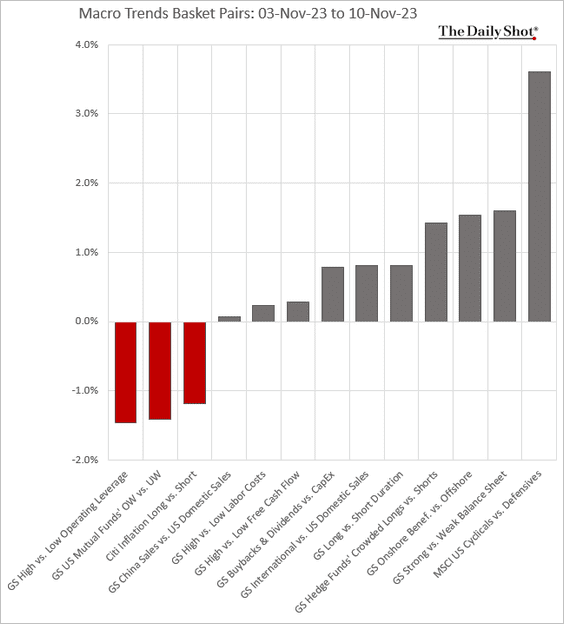

2. Cyclicals continue to outperform defensives.

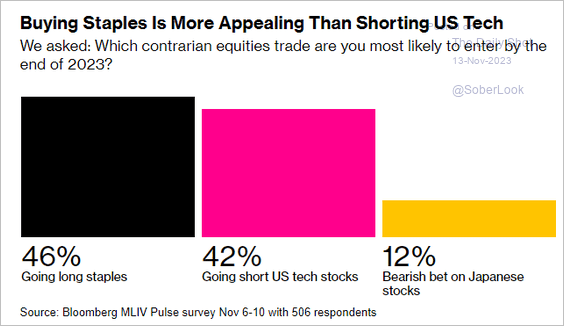

• Is going long consumer staples a good contrarian trade?

Source: @markets Read full article

Source: @markets Read full article

——————–

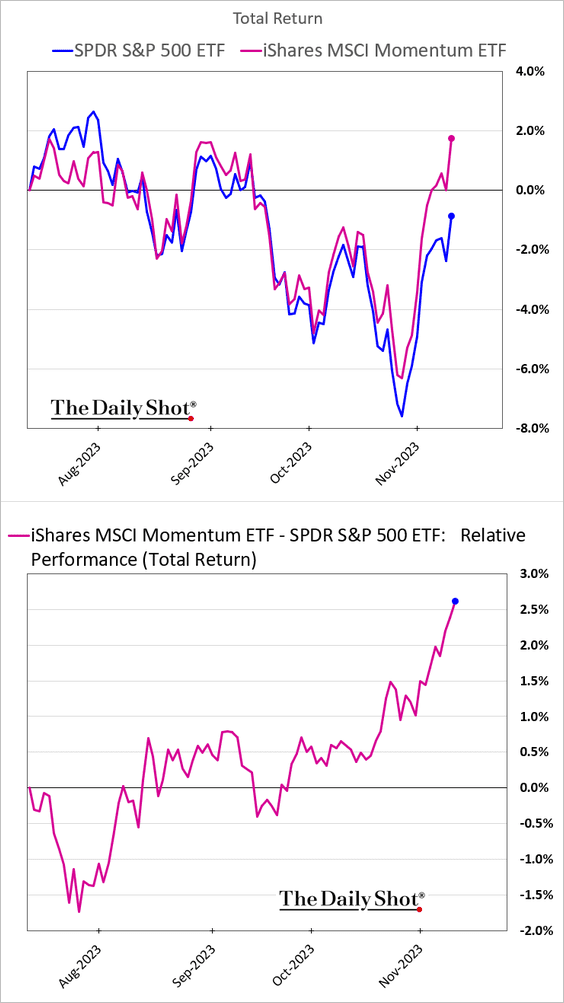

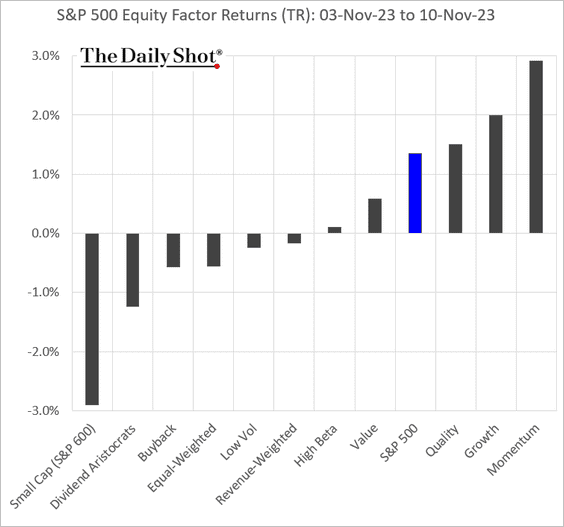

3. Momentum stocks have been outperforming.

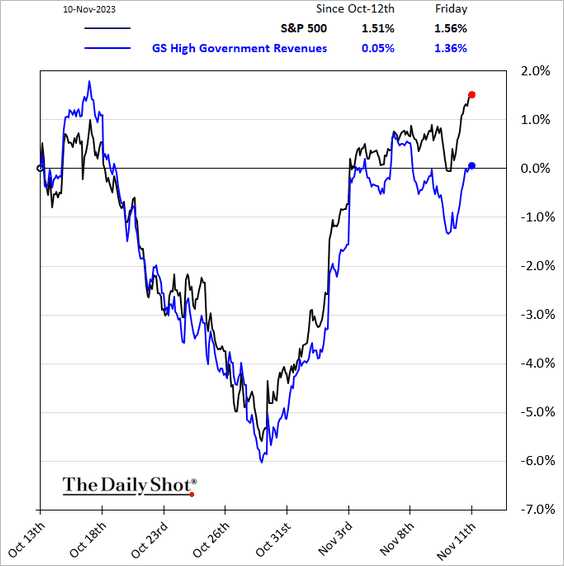

4. The market was becoming concerned about the government shutdown last week.

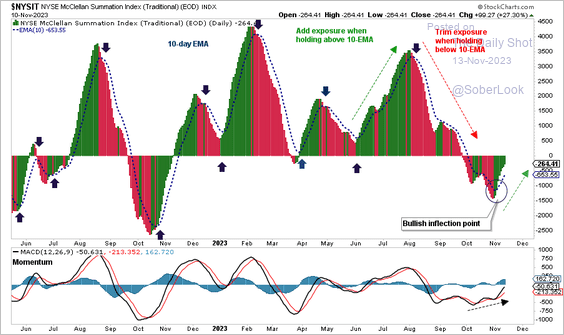

5. Short-term market breadth is starting to improve among NYSE stocks.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

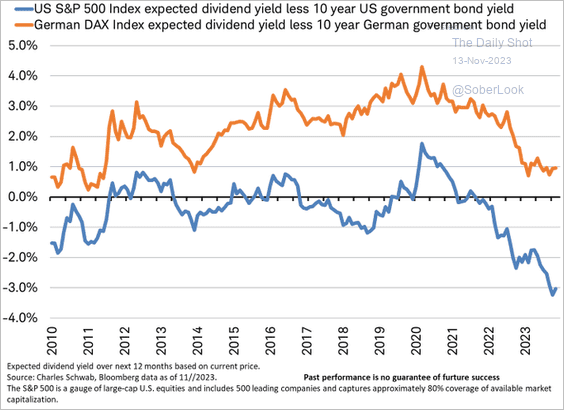

6. Here is a look at dividend yields relative to government bonds in the US and Germany.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

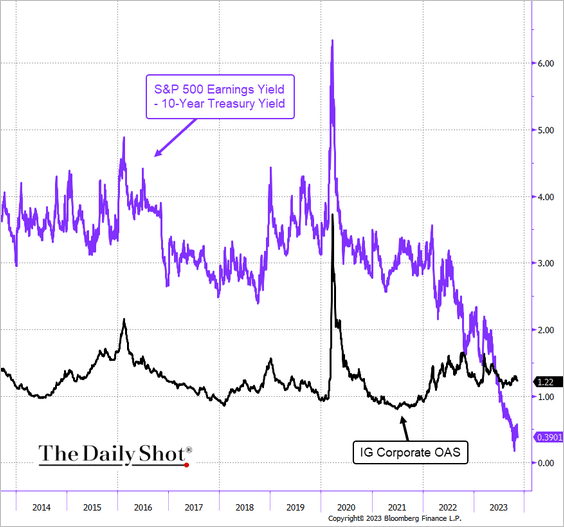

• US investment grade bonds offer much better spreads than the S&P 500 earnings yield spread to Treasuries.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

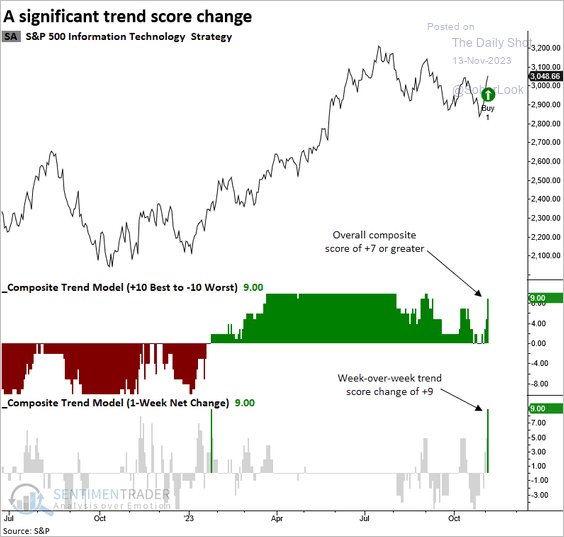

7. S&P 500 tech stocks maintained a positive trend score despite the recent market correction.

Source: SentimenTrader

Source: SentimenTrader

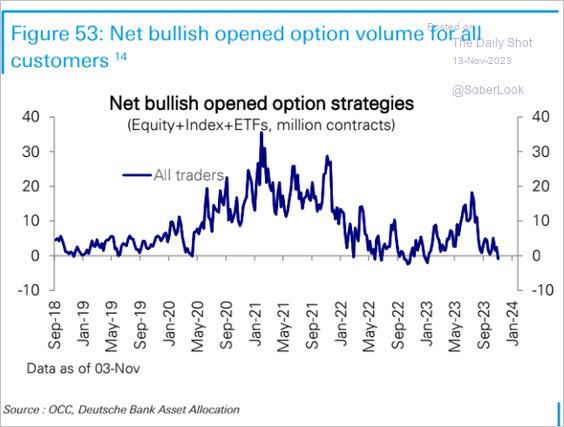

8. Activity in bullish options strategies has dried up.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

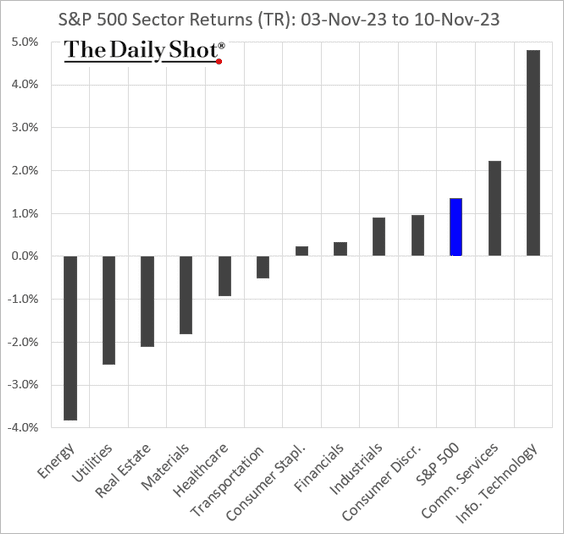

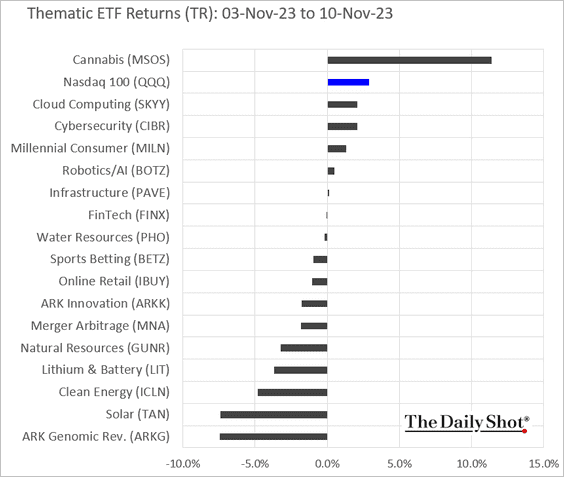

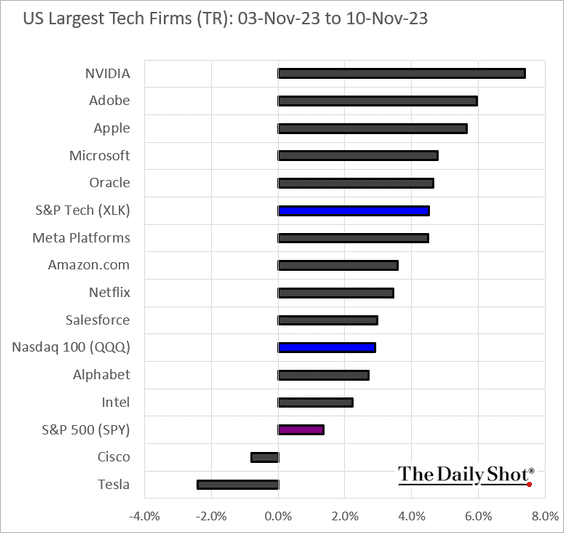

9. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

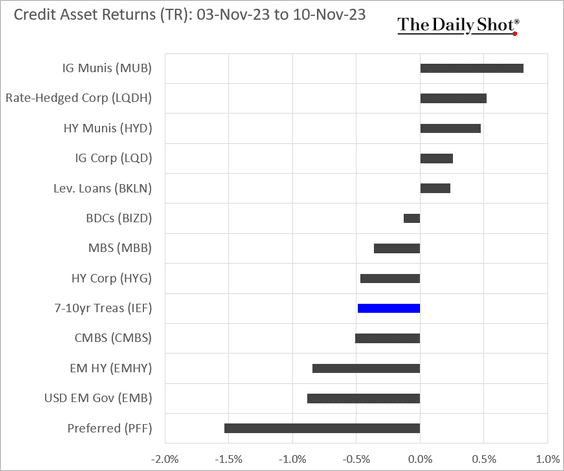

Credit

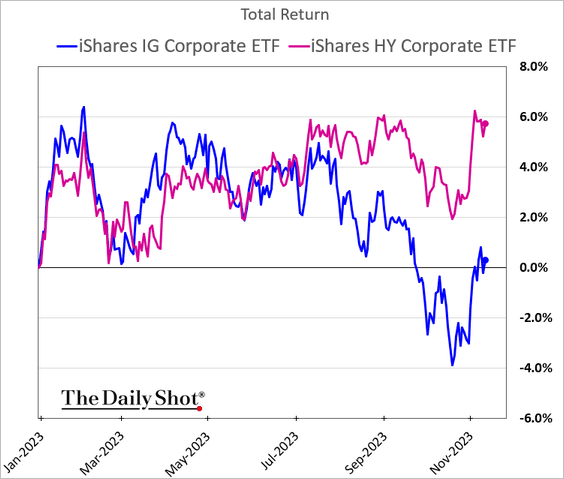

1. High-yield bonds have been outperforming investment-grade debt.

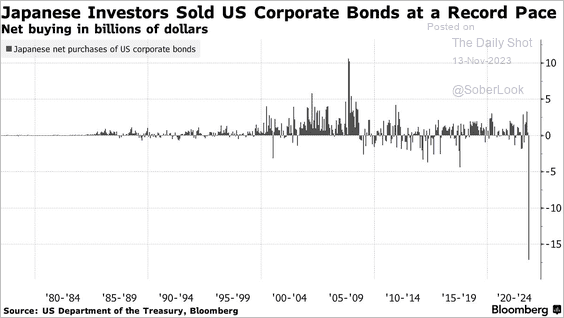

2. Japanese investors dumped US corporate bonds in August.

Source: @markets Read full article

Source: @markets Read full article

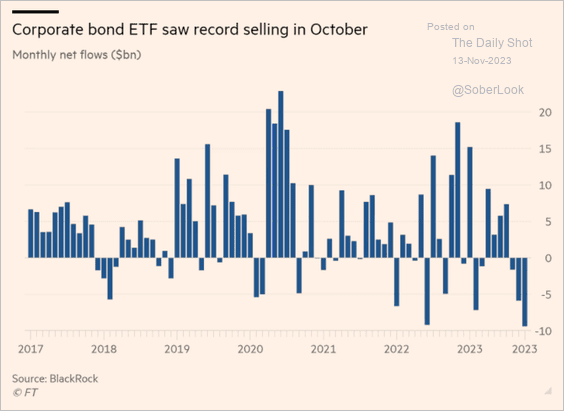

• Corporate bond ETFs saw substantial outflows in October.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

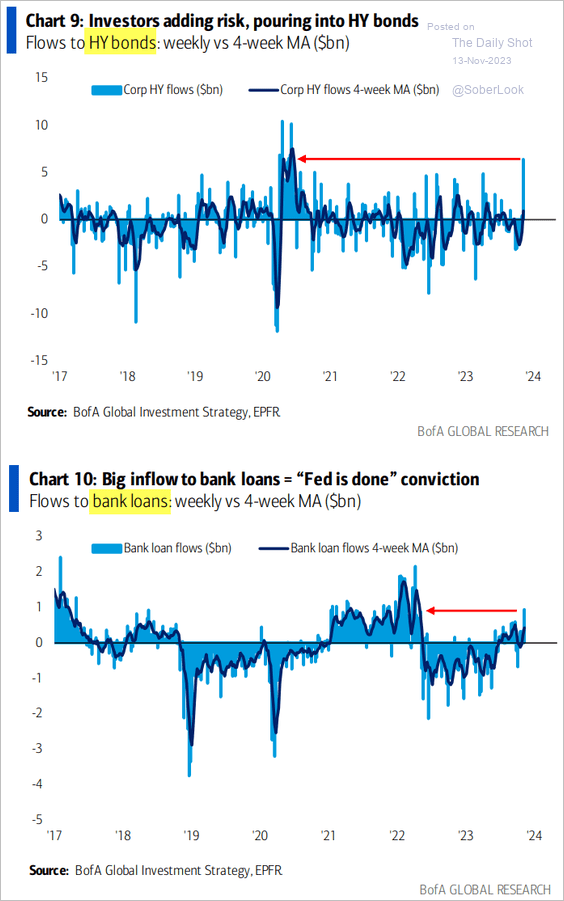

• But capital is returning to HY bonds and leveraged loans.

Source: BofA Global Research

Source: BofA Global Research

——————–

3. Next, we have last week’s performance data.

Back to Index

Rates

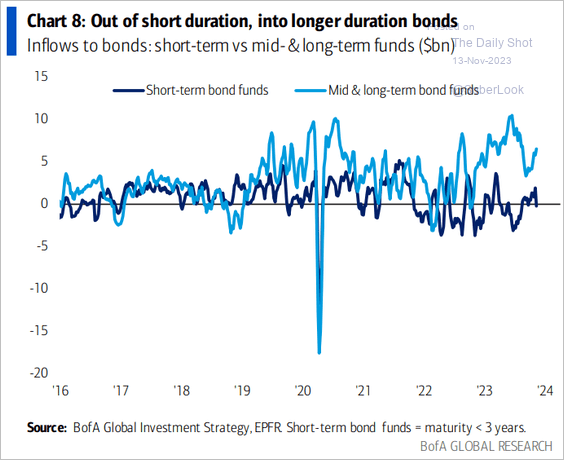

1. Rotation into longer-dated bonds continues.

Source: BofA Global Research

Source: BofA Global Research

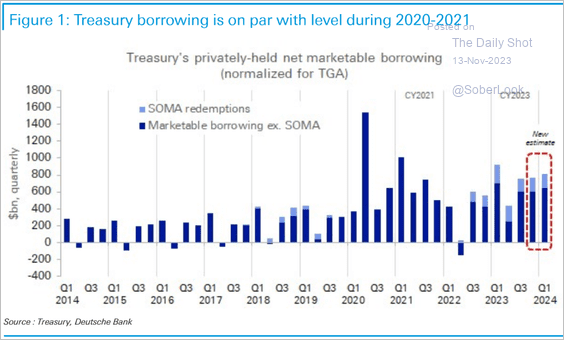

2. Treasury net issuance will remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

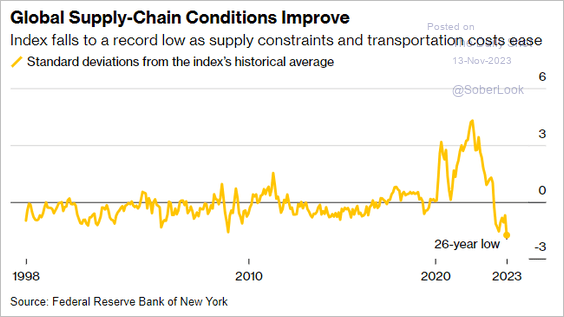

1. Supply chain pressures have dissipated.

Source: @economics Read full article

Source: @economics Read full article

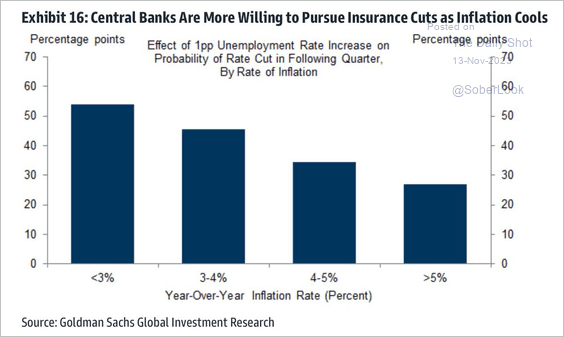

2. As inflation cools, central banks are more likely to ease in response to softer labor markets.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

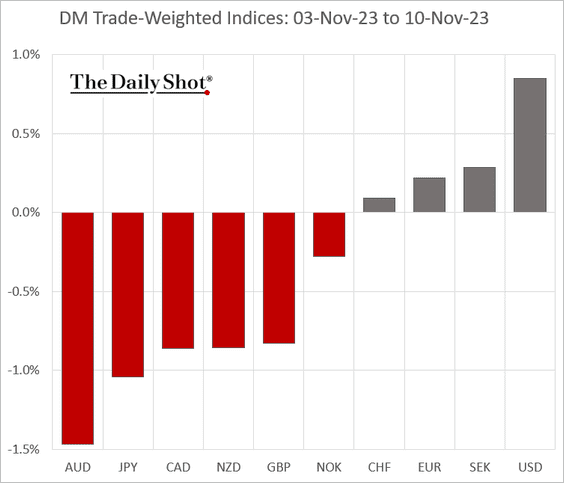

3. Finally, we have last week’s performance data.

• Currencies:

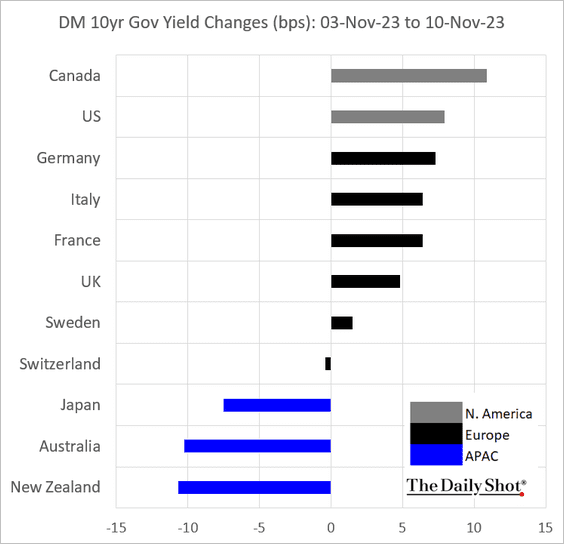

• Bond yields:

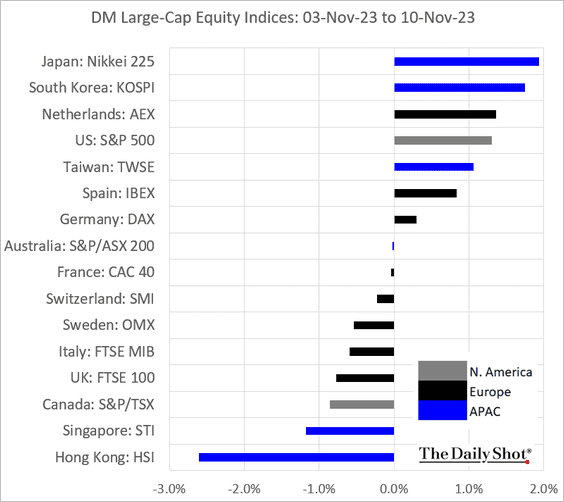

• Equities:

Back to Index

Food for Thought

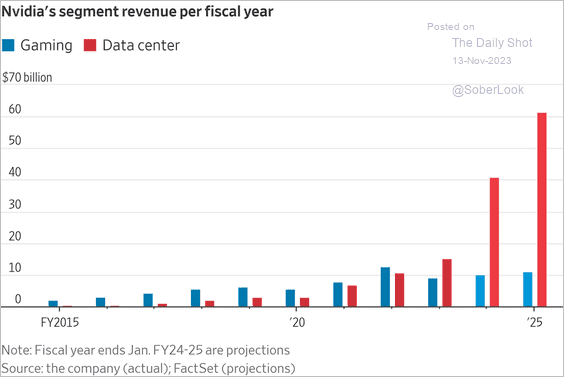

1. Nvidia’s shift from gaming to AI:

Source: @WSJ Read full article

Source: @WSJ Read full article

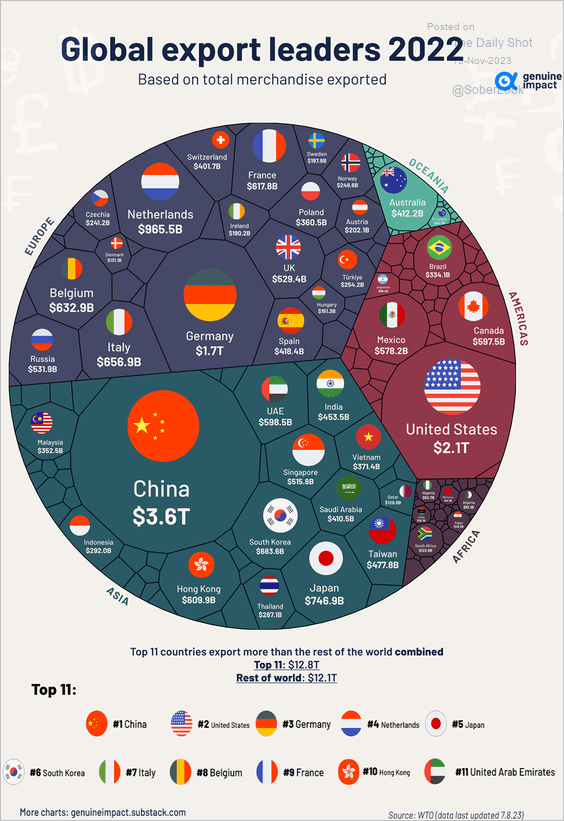

2. The largest exporters:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

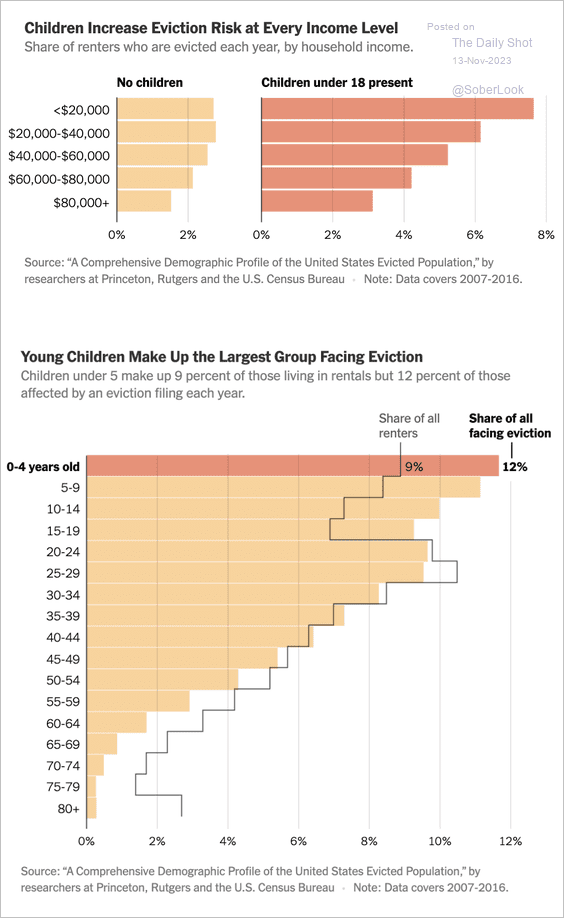

3. Children facing eviction:

Source: The New York Times Read full article

Source: The New York Times Read full article

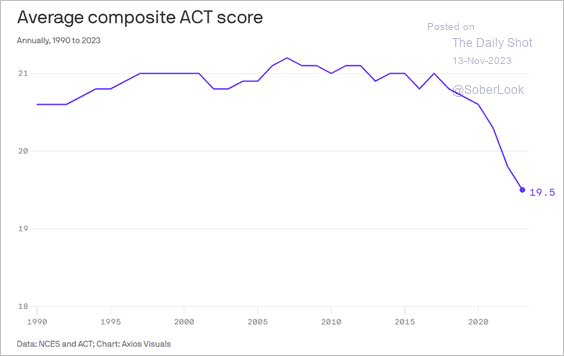

4. US college admissions test scores:

Source: @axios Read full article

Source: @axios Read full article

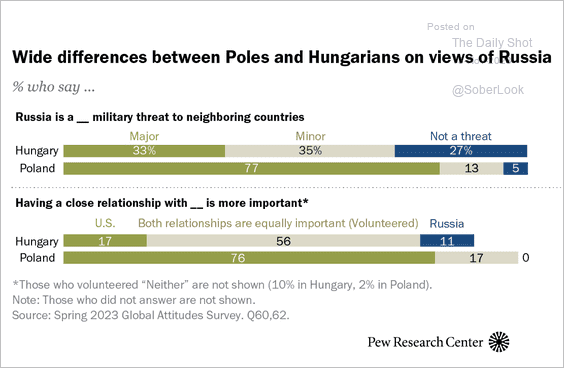

5. How Poland and Hungary view Russia and the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

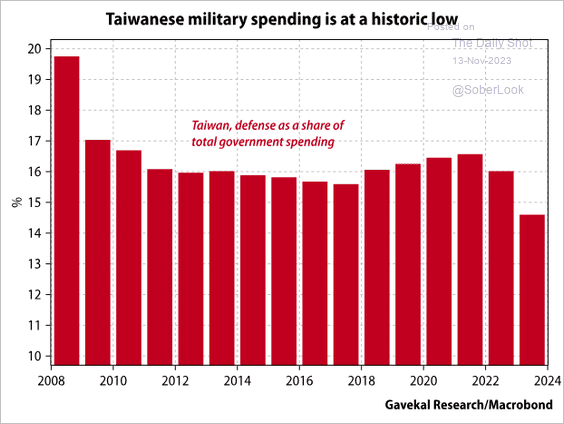

6. Taiwan’s military spending:

Source: Gavekal Research

Source: Gavekal Research

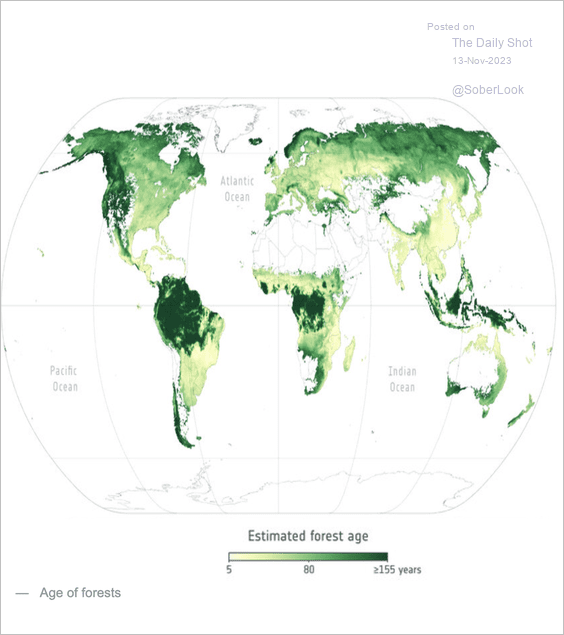

7. How old are the forests around the world?

Source: European Space Agency Read full article

Source: European Space Agency Read full article

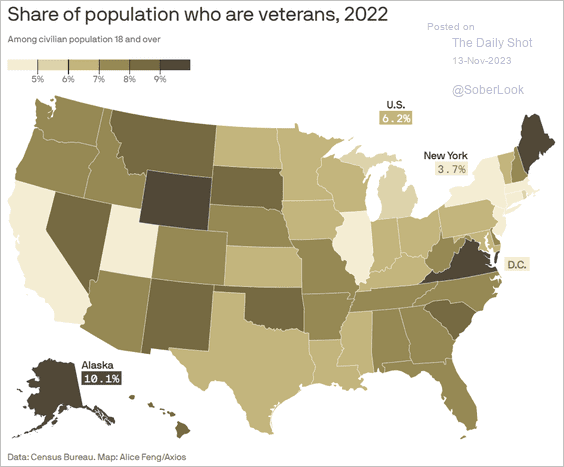

8. Share of US adults who are veterans:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index