The Daily Shot: 14-Nov-23

• The United States

• The Eurozone

• Europe

• Asia-Pacific

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

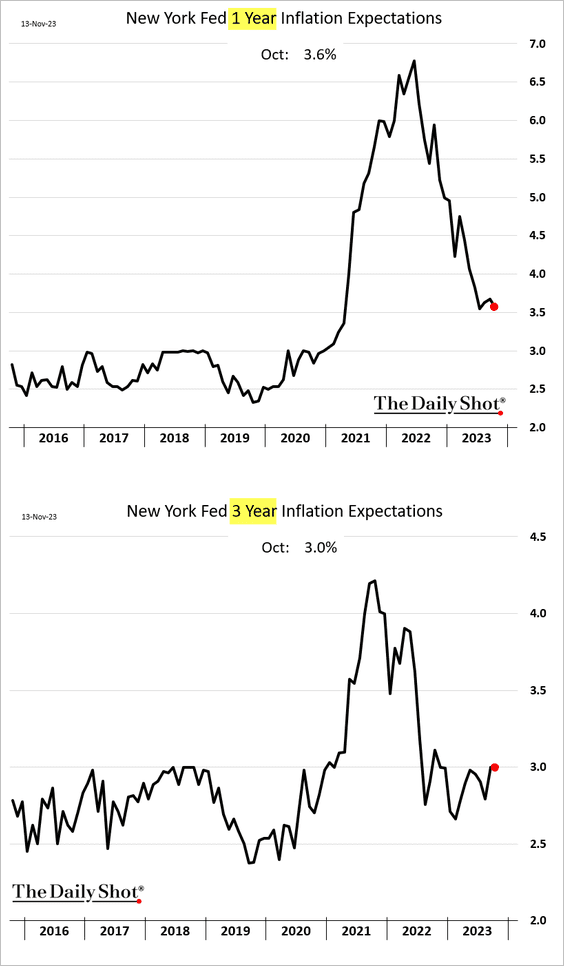

• Unlike the University of Michigan’s report, the NY Fed’s consumer survey showed relatively stable inflation expectations.

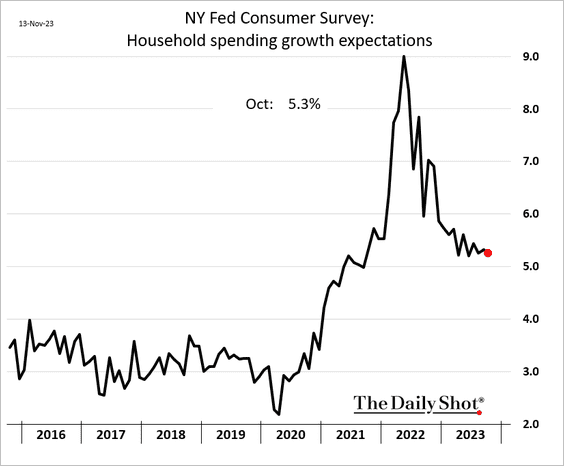

But households’ nominal spending growth expectations are holding above 5%.

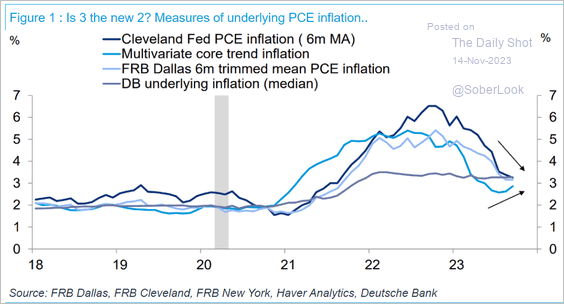

• It appears that core inflation is settling around 3%, which is a concern for the Fed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

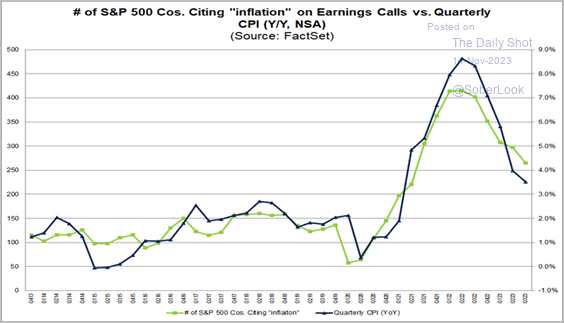

• Fewer firms are mentioning “inflation” on earnings calls.

Source: @FactSet Read full article

Source: @FactSet Read full article

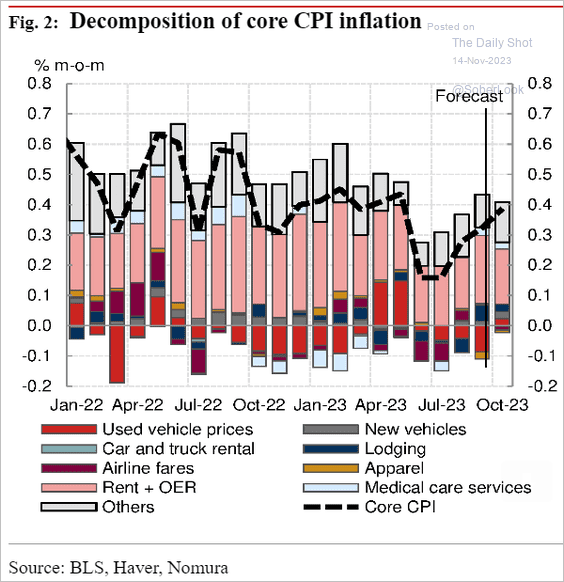

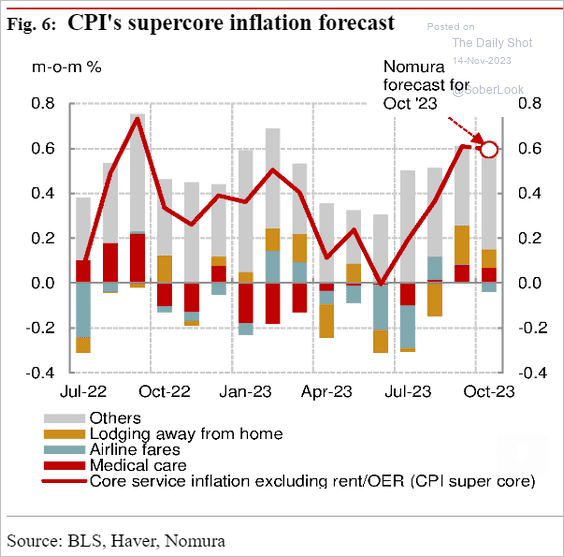

• Nomura estimates a rise in the core CPI for October compared to the previous month.

Source: Nomura Securities

Source: Nomura Securities

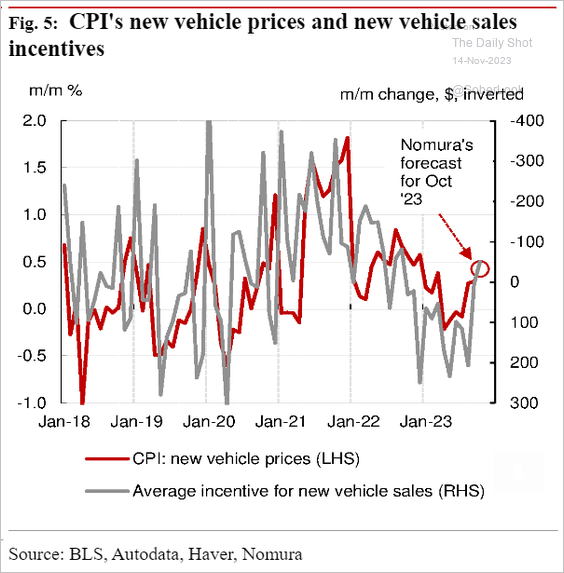

– The UAW strike led to an increase in vehicle prices, evident in reduced dealer incentives.

Source: Nomura Securities

Source: Nomura Securities

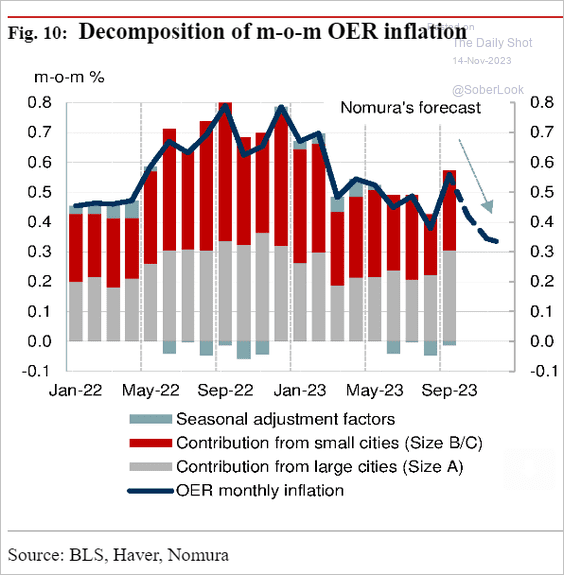

– Owners’ equivalent rent inflation should slow after the September surge.

Source: Nomura Securities

Source: Nomura Securities

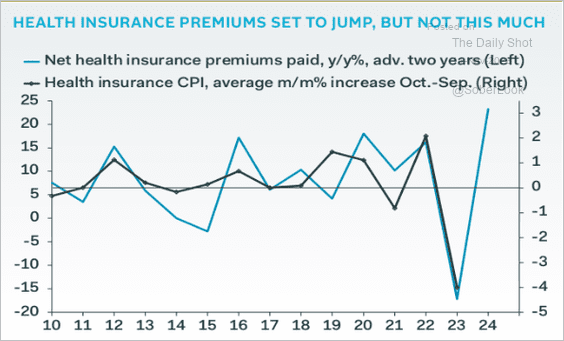

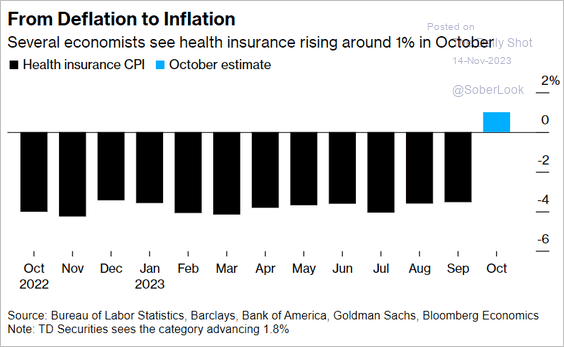

– After substantial declines, economists expect an increase in health insurance costs (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @economics Read full article

Source: @economics Read full article

The increase in health insurance costs is expected to be one of the factors that kept the supercore CPI elevated in October.

Source: Nomura Securities

Source: Nomura Securities

——————–

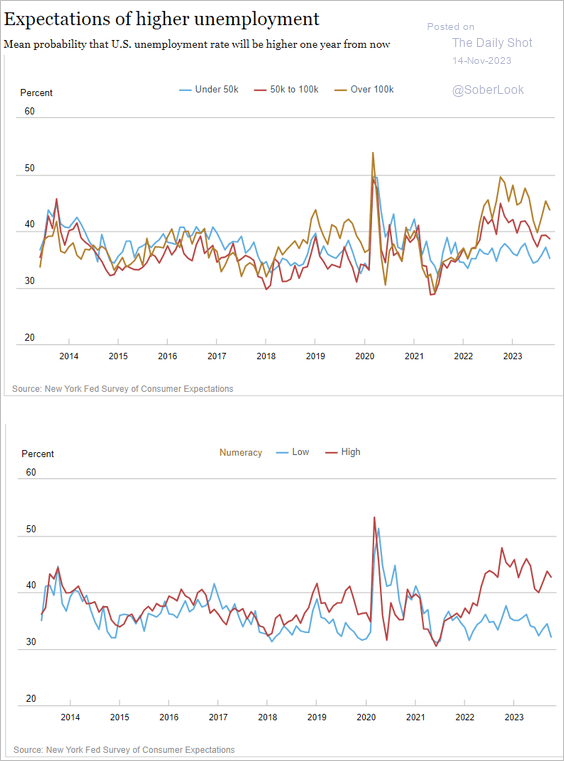

2. The NY Fed’s consumer survey shows a divergence in views on unemployment among participants based on their income and education levels.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

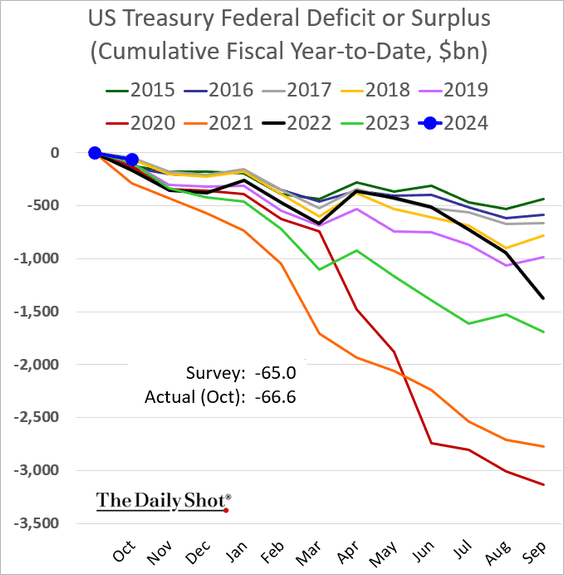

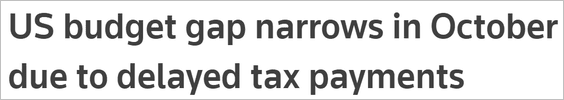

3. Last month’s budget deficit was below the levels we saw in October of 2022.

Source: Reuters Read full article

Source: Reuters Read full article

Reuters: … federal budget deficit in October shrank by nearly a quarter from a year earlier, as revenues climbed to a record for the month thanks to delayed tax payments from disaster-stricken areas that helped offset fast-rising interest costs.

——————–

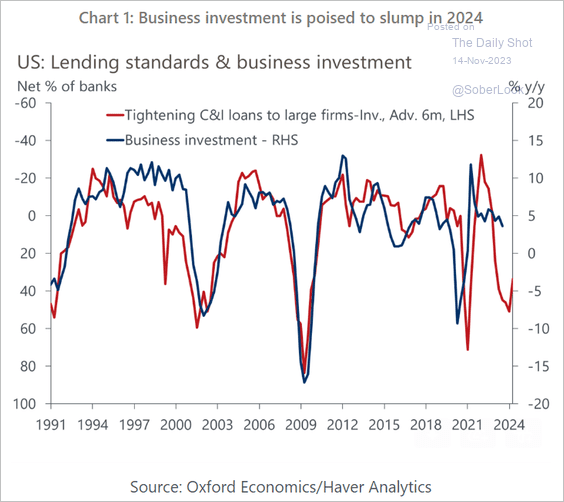

4. Tighter credit conditions continue to signal weakness in business investment.

Source: Oxford Economics Read full article

Source: Oxford Economics Read full article

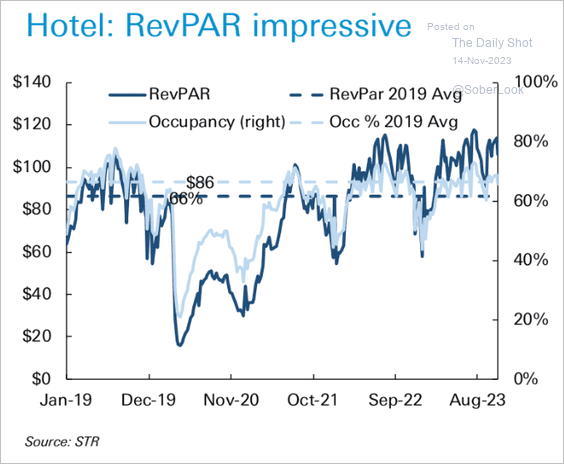

5. US hotel occupancy rates remain robust.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

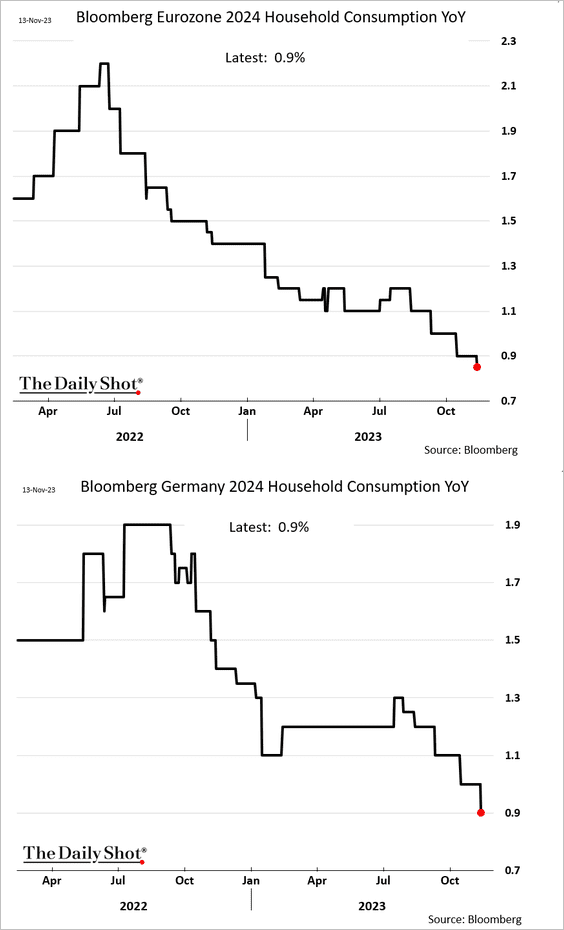

1. Economists continue to downgrade their forecasts for next year’s consumer spending.

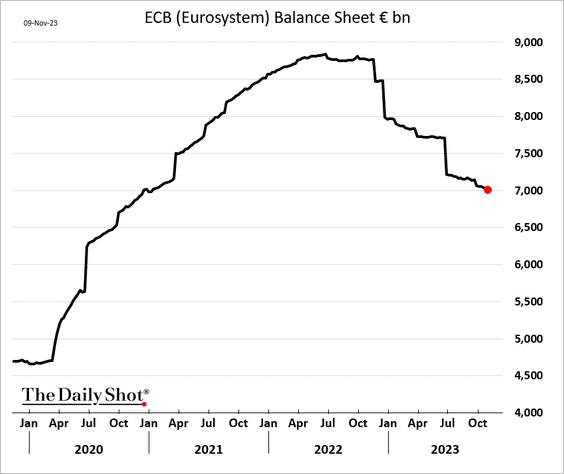

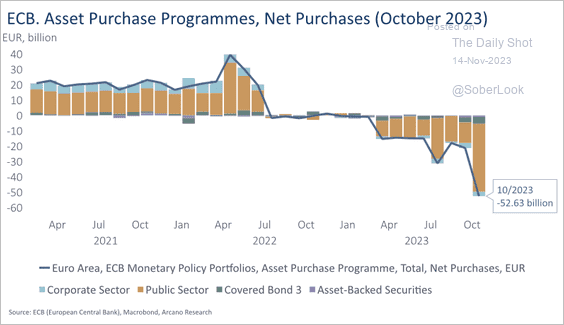

2. The ECB’s balance sheet continues to shrink.

In addition to the TLTRO repayments, the securities portfolio has also been shrinking.

Source: Arcano Economics

Source: Arcano Economics

——————–

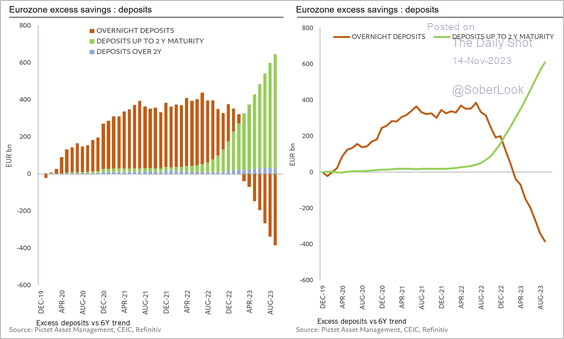

3. The rotation into longer-dated (higher-yielding) deposits has been reducing the money supply.

Source: @skhanniche

Source: @skhanniche

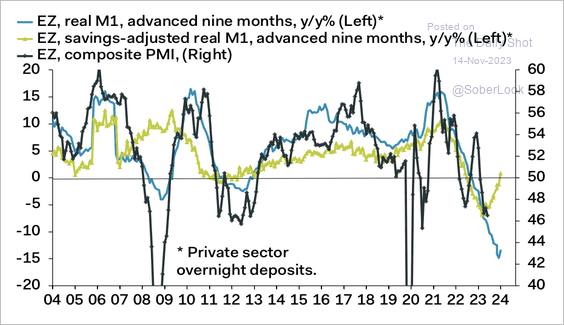

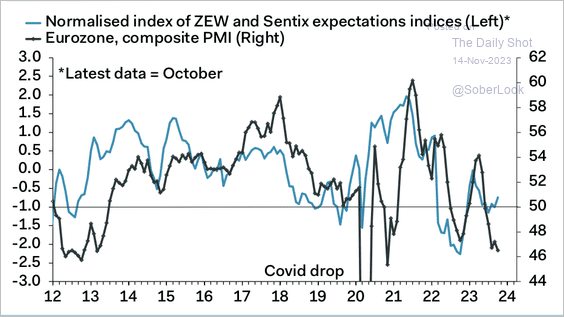

4. The uptick in the Eurozone savings-adjusted money supply could signal a trough in the composite PMI…

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

…as does the rise in investor sentiment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

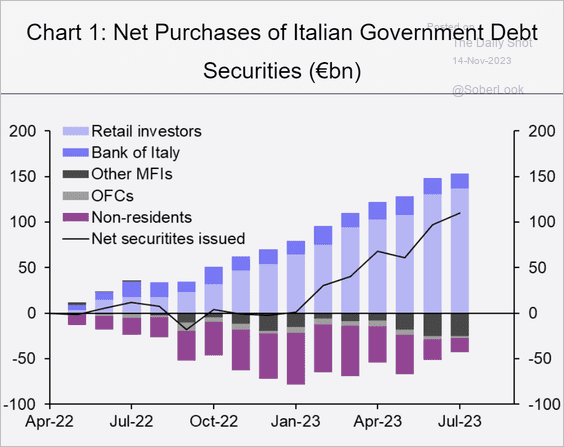

5. Italian households have been the primary buyers of the nation’s government debt.

Source: Capital Economics

Source: Capital Economics

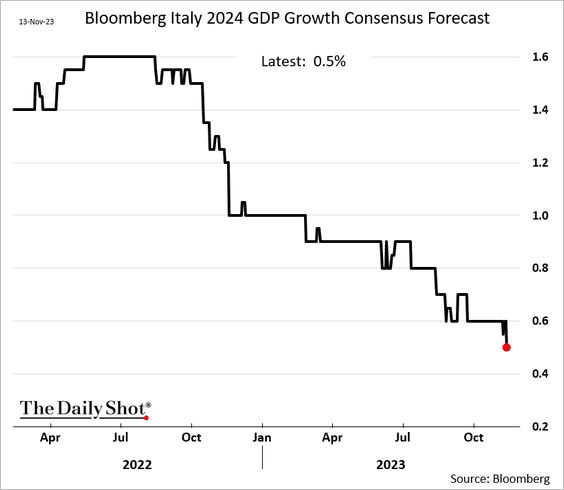

Separately, economists continue to downgrade their forecasts for Italy’s GDP growth next year.

——————–

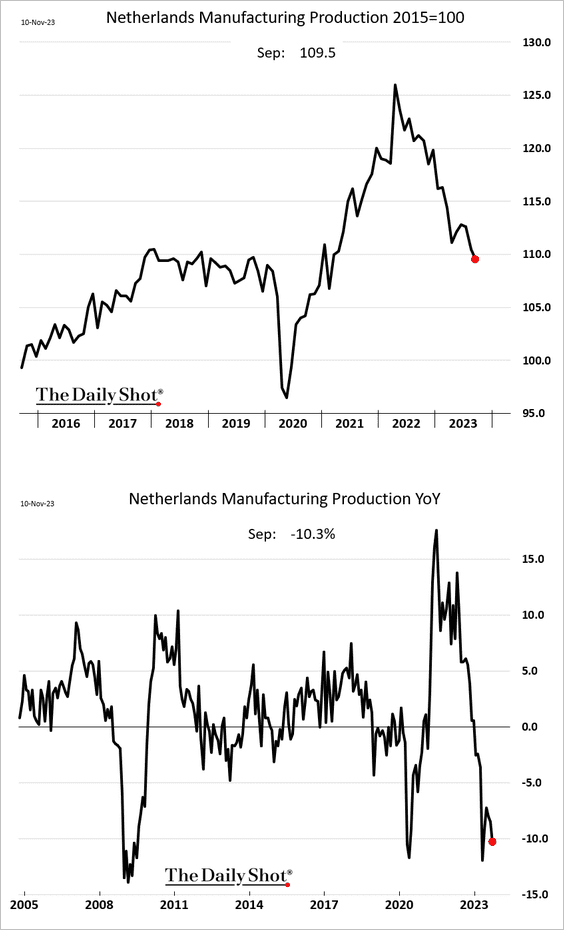

6. Dutch manufacturing output is now 10% below last year’s levels.

Back to Index

Europe

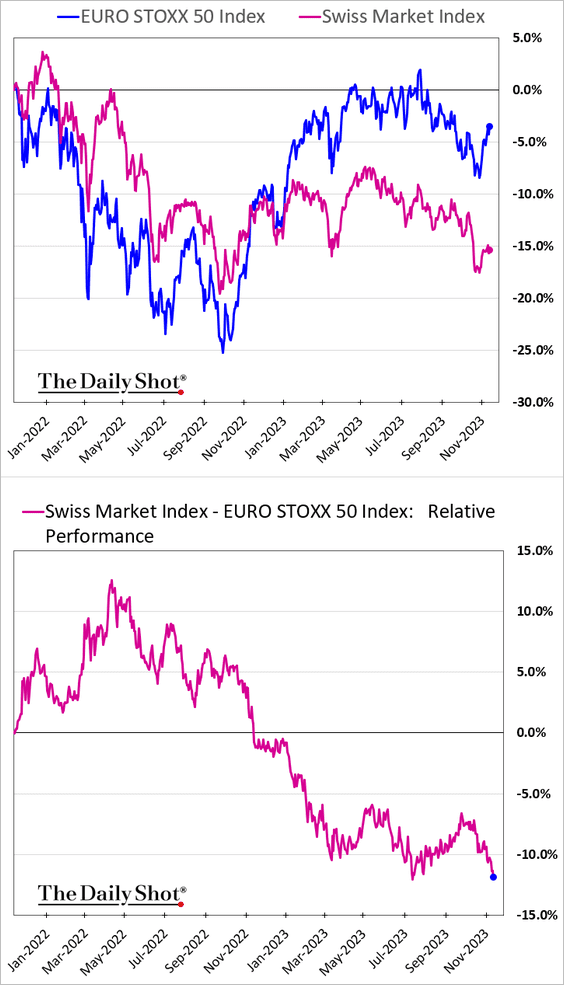

1. Swiss stocks have underperformed this year.

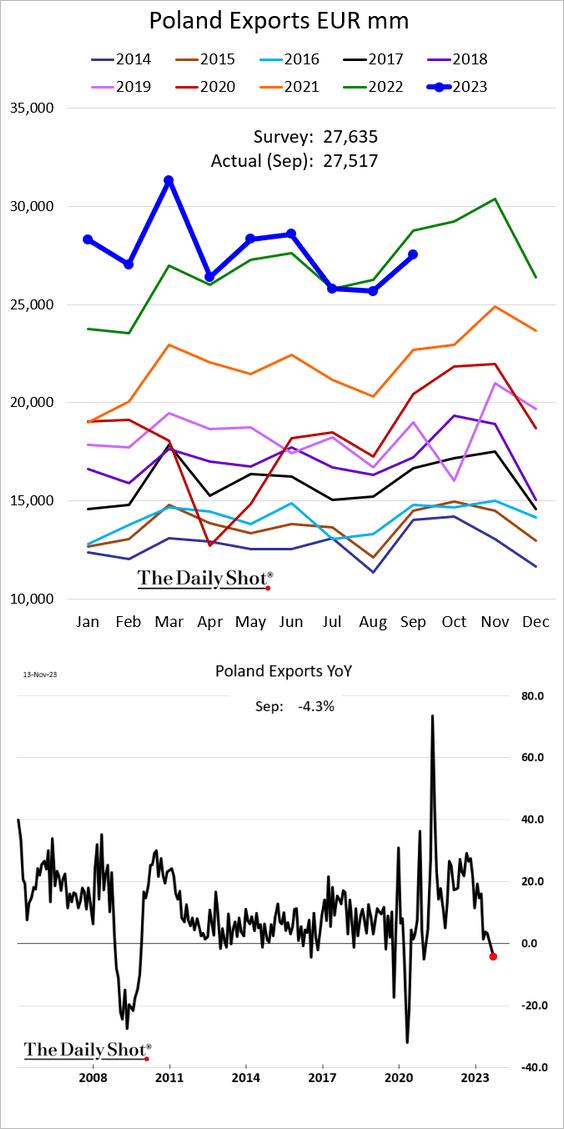

2. Poland’s exports dipped below last year’s levels.

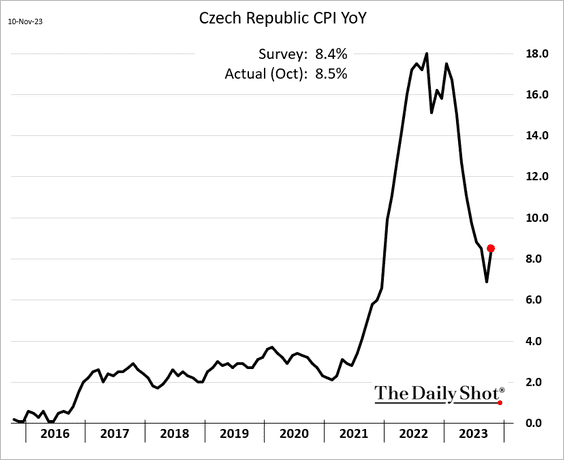

3. Czech inflation is back above 8%.

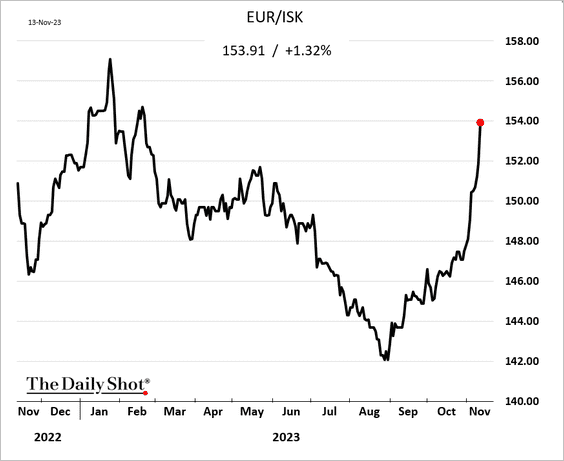

4. Iceland’s looming volcanic eruption …

Source: CBS News Read full article

Source: CBS News Read full article

… has been pressuring the Krona and the nation’s stock market.

Back to Index

Asia-Pacific

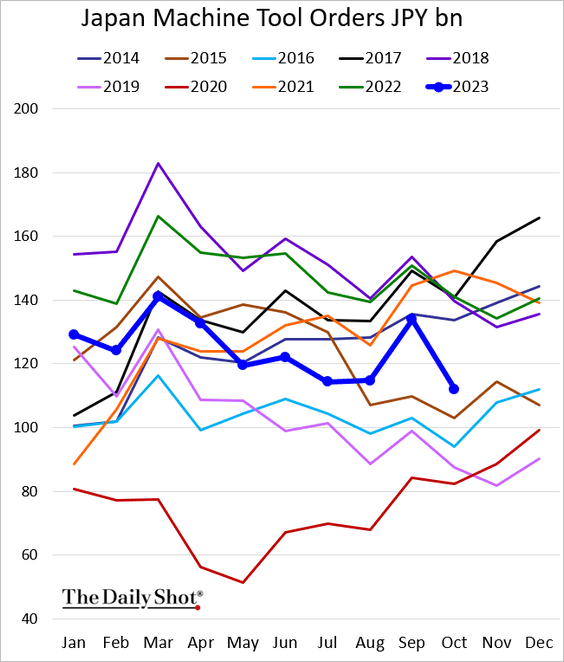

1. Japan’s machine tool orders sagged last month.

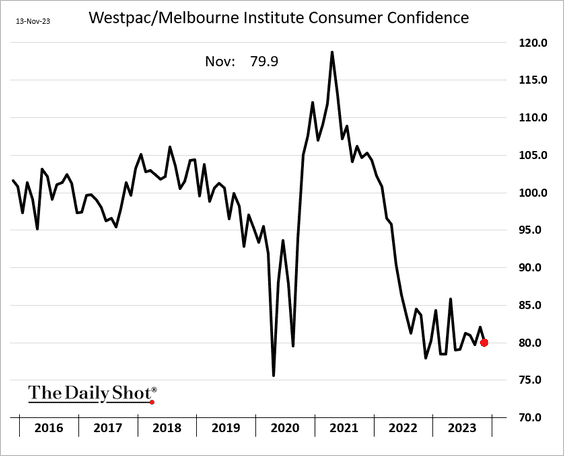

2. Australia’s consumer sentiment remains depressed.

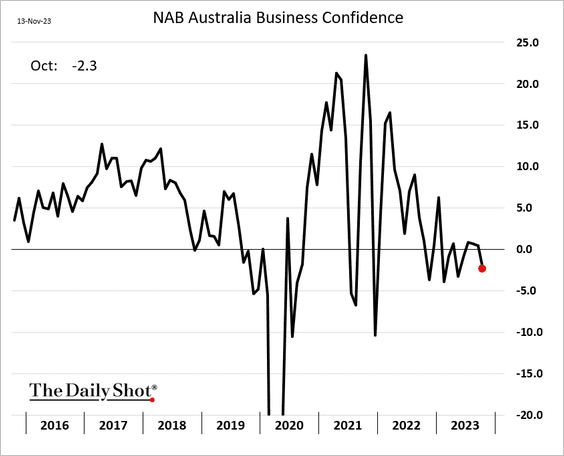

Business confidence softened last month.

Back to Index

China

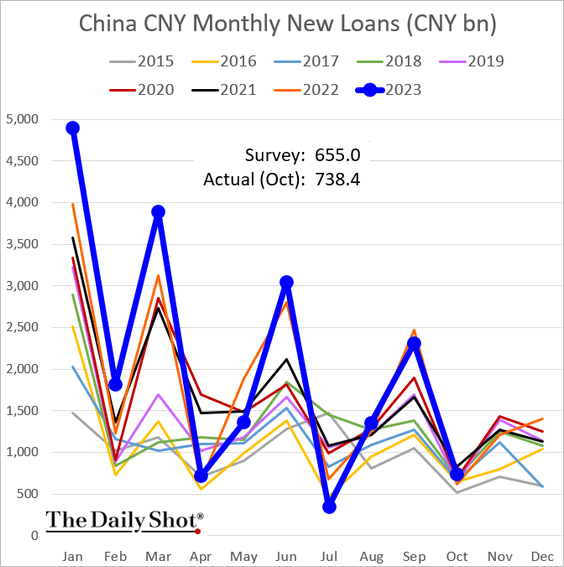

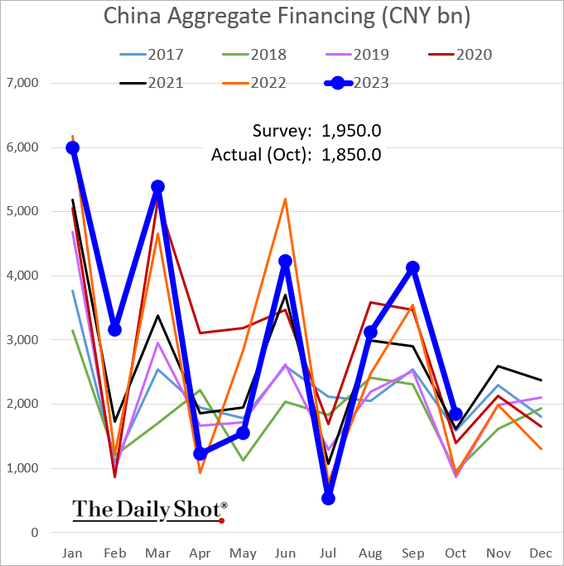

1. Bank lending remains lackluster, although last month’s figure topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

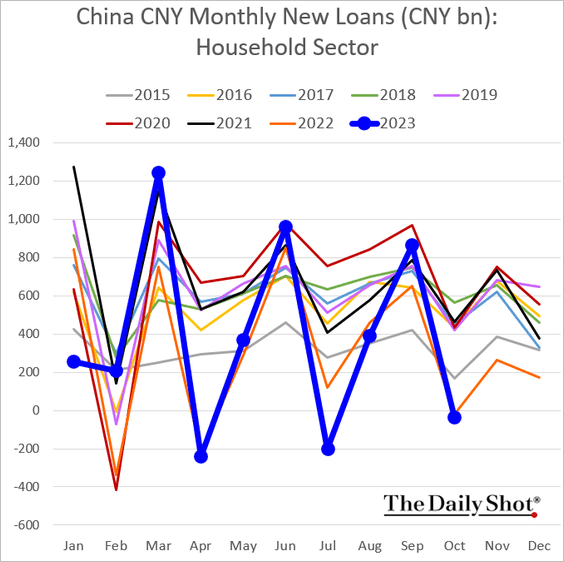

• Here is net lending in the household sector.

• Aggregate financing held at multi-year highs amid government bond issuance.

The elevated debt issuance is visible in government deposits (proceeds).

Source: @markets Read full article

Source: @markets Read full article

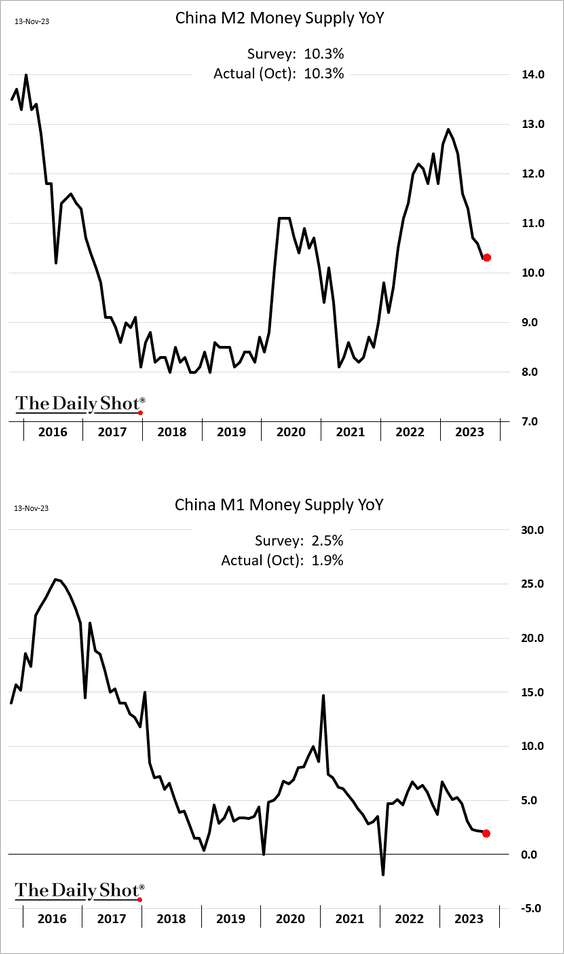

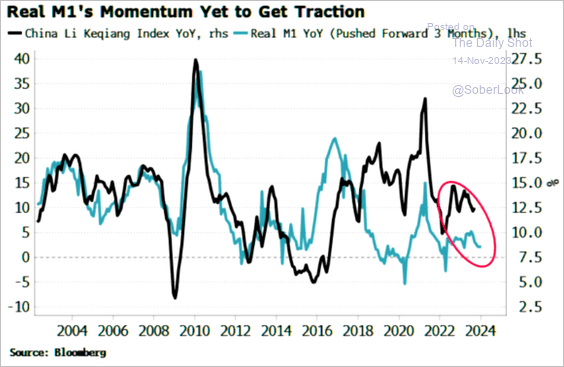

2. The narrow money supply growth unexpectedly dipped below 2% (2nd panel).

The M1 money supply expansion remains well below the rate of growth in economic activity.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

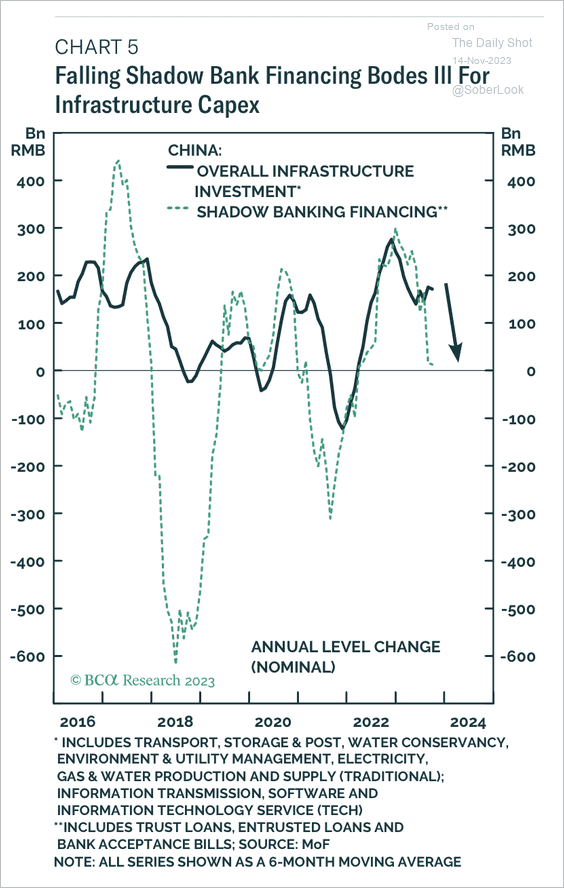

3. The decline in shadow bank financing could weigh on infrastructure investment despite recent stabilization.

Source: BCA Research

Source: BCA Research

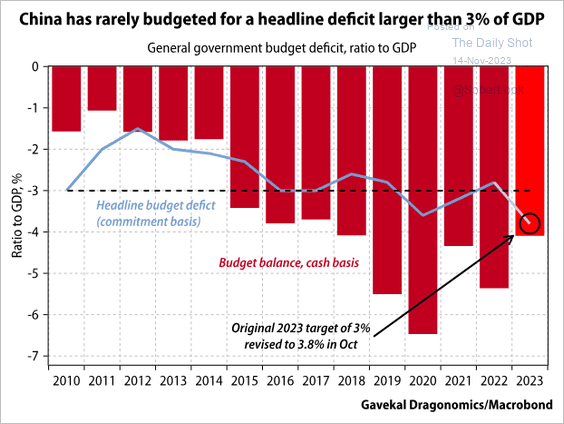

4. Are budget deficits of over 3% of the GDP becoming the norm?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Cryptocurrency

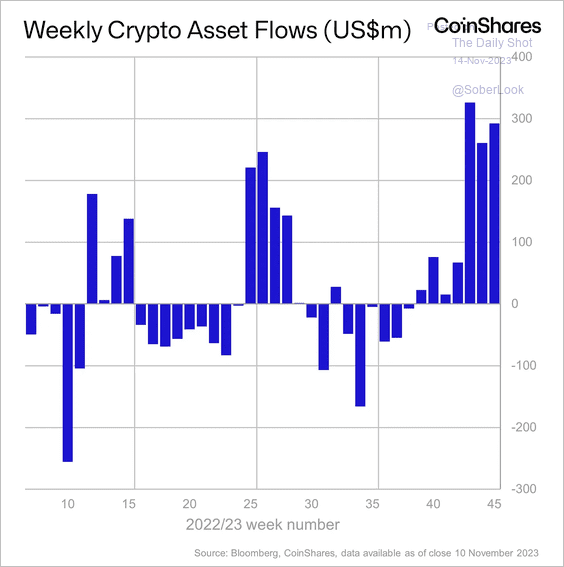

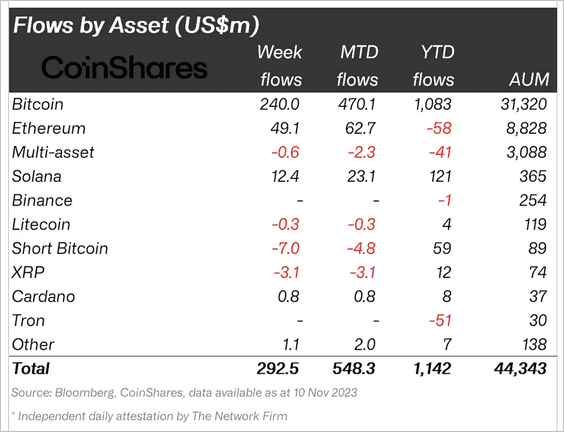

1. Crypto funds continued to see inflows last week, led by long-bitcoin products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

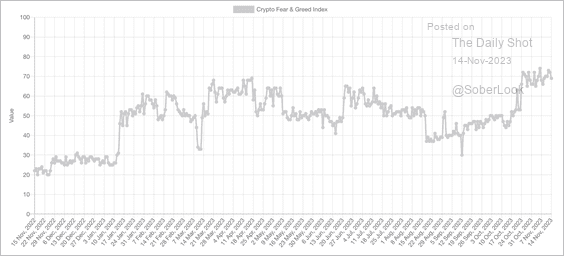

2. The Crypto Fear & Greed Index remains in “greed” territory after spending most of the past two months in the “fear” zone.

Source: Alternative.me

Source: Alternative.me

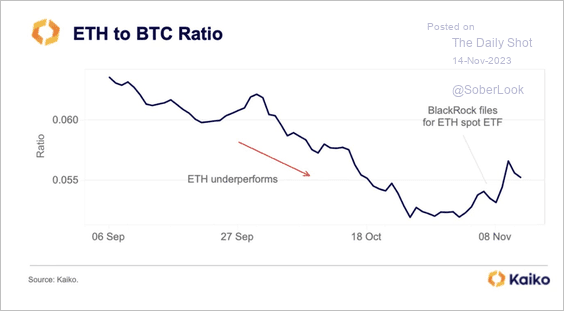

3. The ETH/BTC price ratio rose after BlackRock filed for a spot ETF.

Source: @KaikoData

Source: @KaikoData

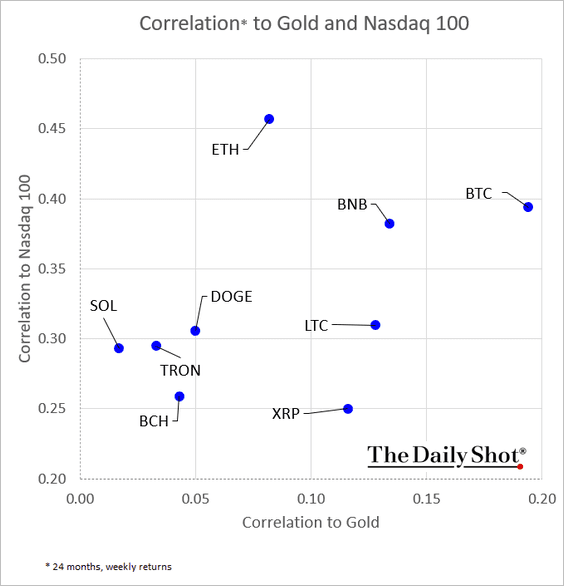

4. How are various cryptos correlated to gold and US equities?

Back to Index

Commodities

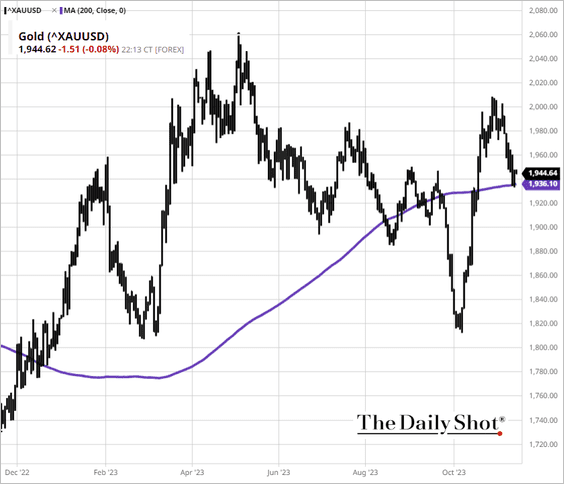

1. Gold is holding support at the 200-day moving average.

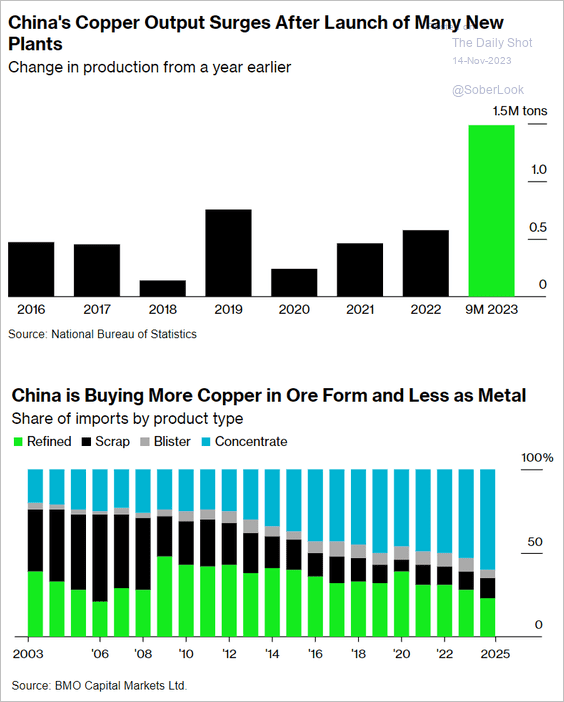

2. China’s domestic copper production has been rising.

Source: @climate Read full article

Source: @climate Read full article

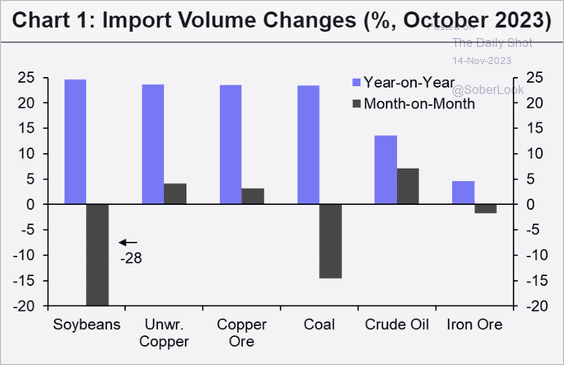

• China’s commodity import growth has been strong this year.

Source: Capital Economics

Source: Capital Economics

——————–

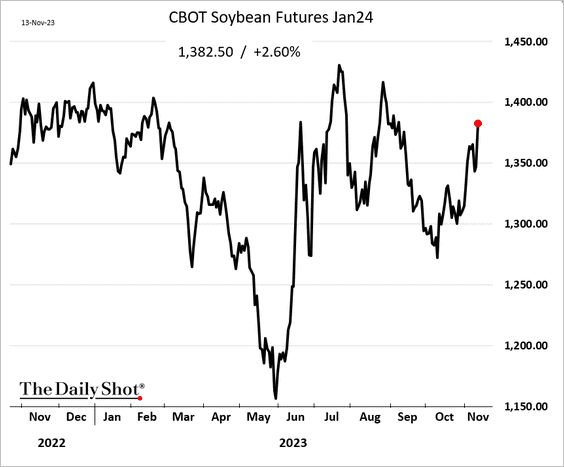

3. Excessive rain in Southern Brazil prompted concerns about the soybean harvest.

Back to Index

Energy

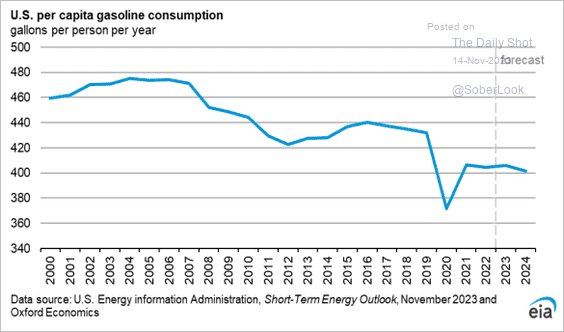

1. US gasoline consumption is expected to decline next year.

Source: @EIAgov

Source: @EIAgov

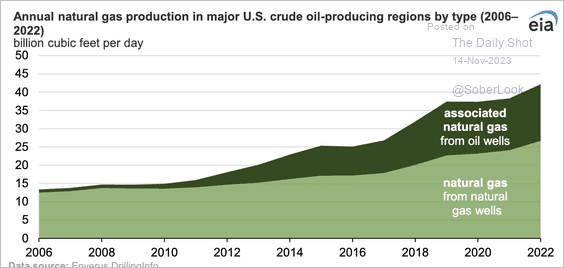

2. Increased US crude oil production boosted natural gas output.

Source: @EIAgov

Source: @EIAgov

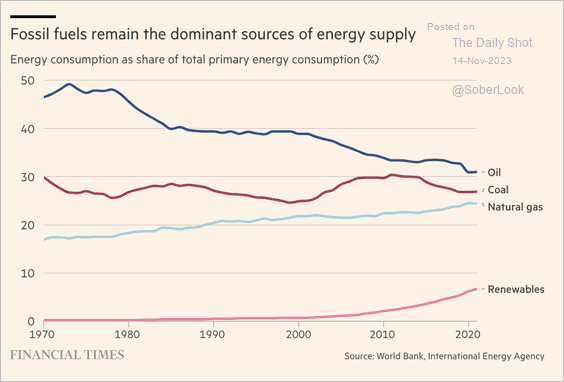

3. Fossil fuels continue to dominate the global energy supply.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

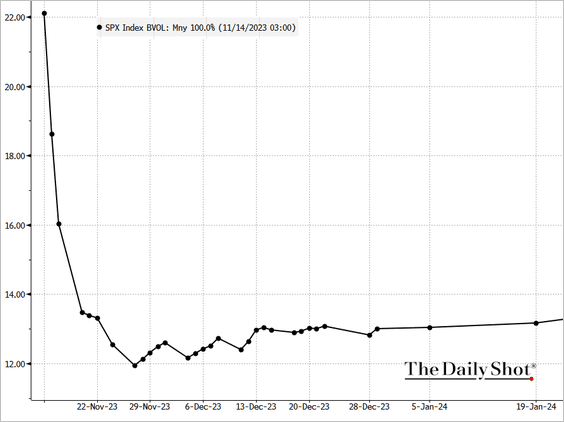

1. The S&P 500 volatility curve is highly inverted ahead of the CPI report.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

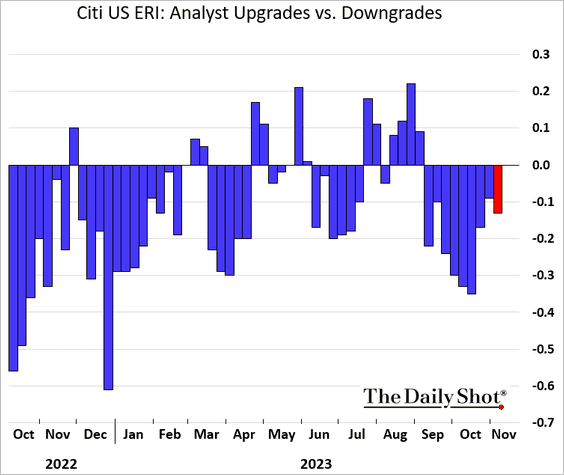

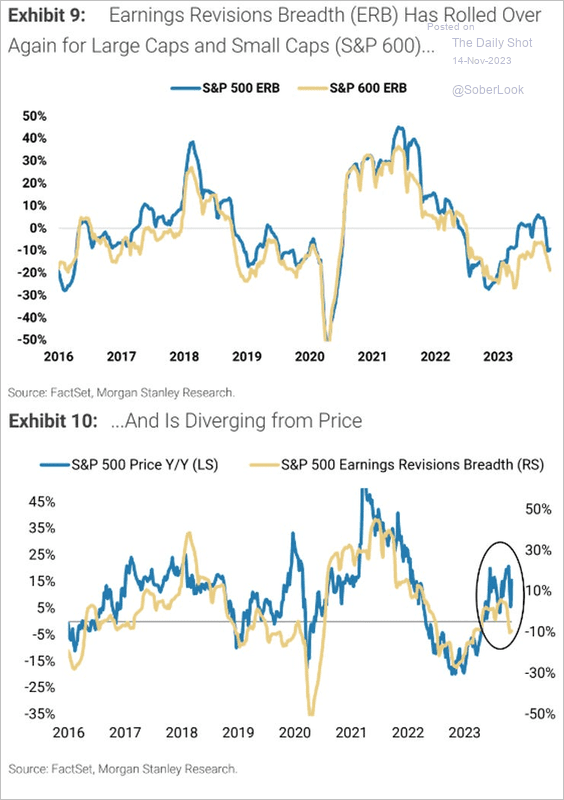

2. Earnings downgrades have outnumbered upgrades for nine weeks in a row.

The earnings revision breadth has worsened for both large and small caps.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

——————–

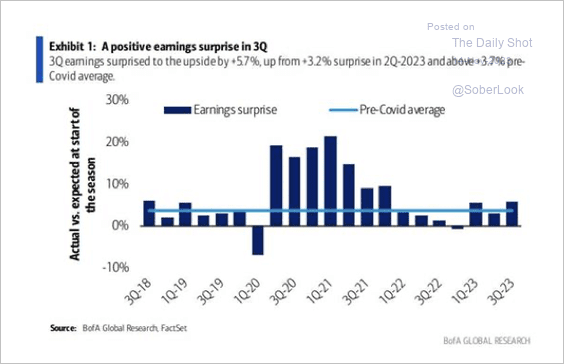

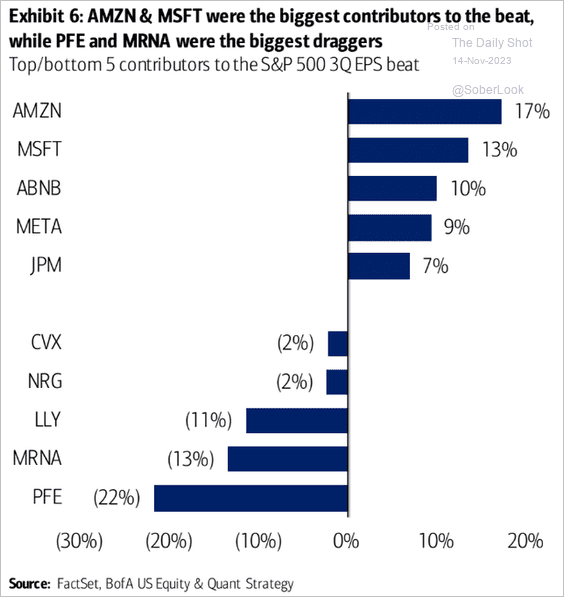

3. US Q3 earnings have come in ahead of expectations and above the pre-COVID average surprise.

Source: BofA Global Research

Source: BofA Global Research

Here are the drivers of the Q3 earnings beats.

Source: BofA Global Research; @AyeshaTariq

Source: BofA Global Research; @AyeshaTariq

——————–

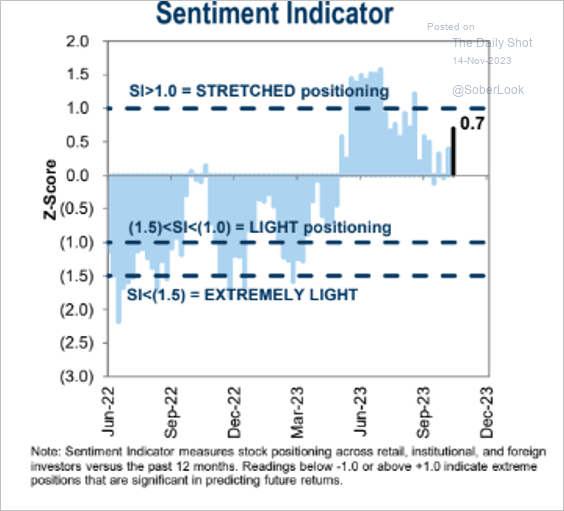

4. Goldman’s latest positioning indicator shows improved investor sentiment.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

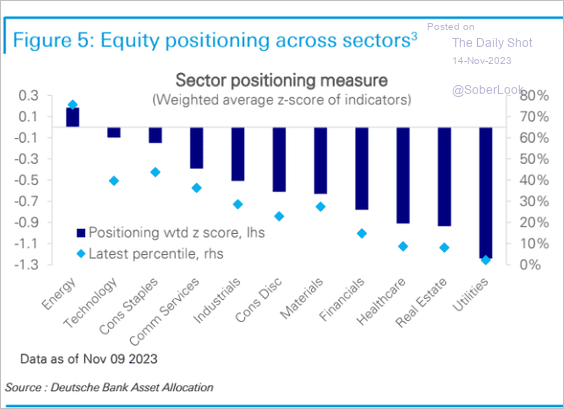

This chart shows Deutsche Bank’s positioning measure by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

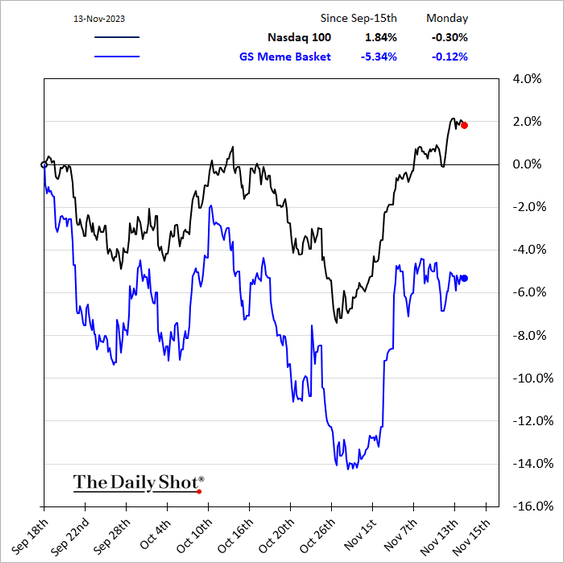

5. Meme stocks have underperformed over the past couple of months.

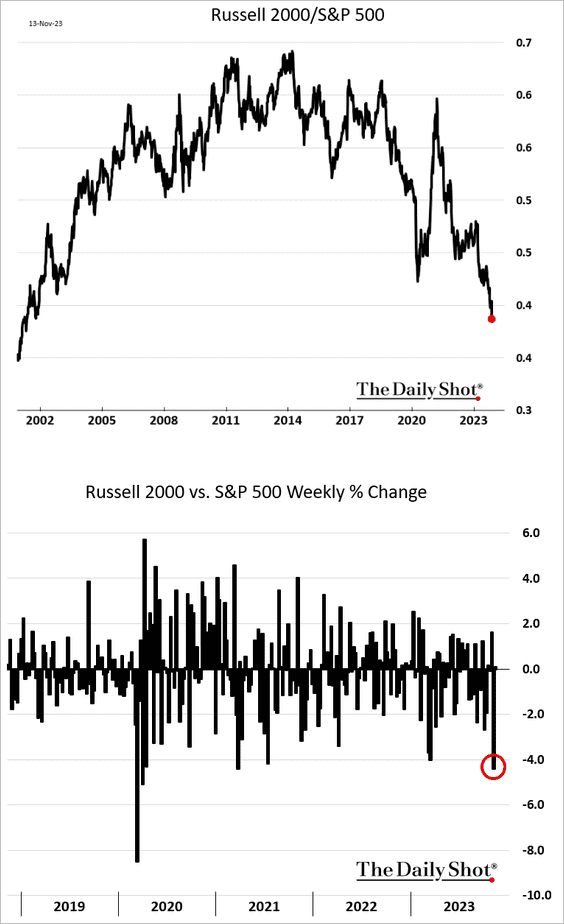

6. Small caps continue to widen their underperformance.

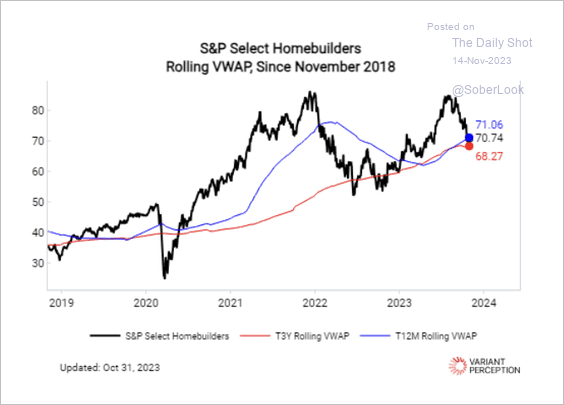

7. S&P 500 homebuilding stocks are testing support.

Source: Variant Perception

Source: Variant Perception

Back to Index

Credit

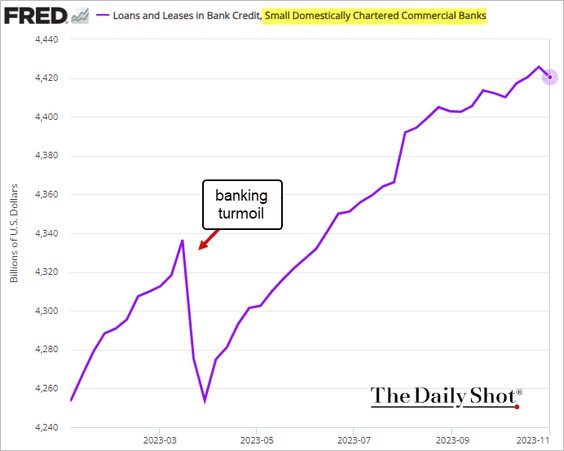

1. Despite all the talk of US small banks downsizing their balance sheets, they are still actively lending.

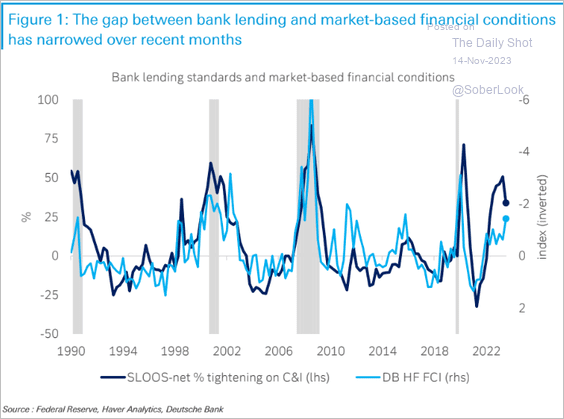

2. This chart compares bank lending conditions with Deutsche Bank’s financial conditions index.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

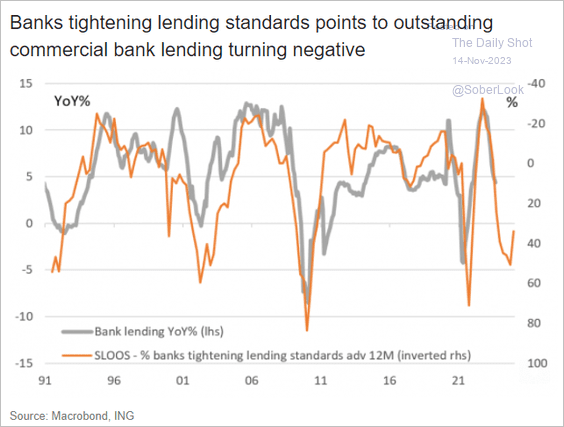

• More softening ahead for loan growth?

Source: ING

Source: ING

——————–

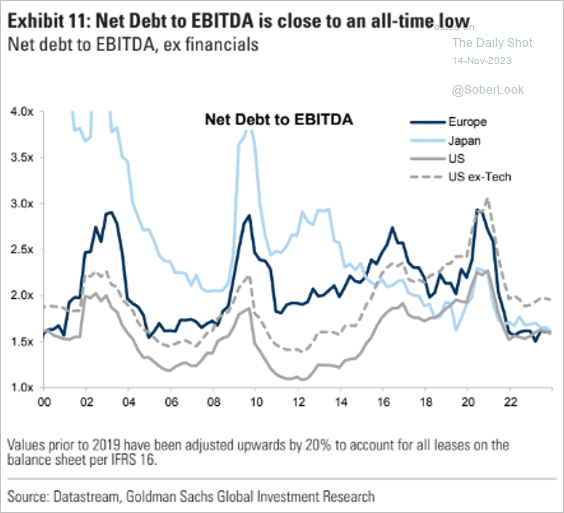

3. Broadly, corporate leverage remains relatively modest.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

Back to Index

Rates

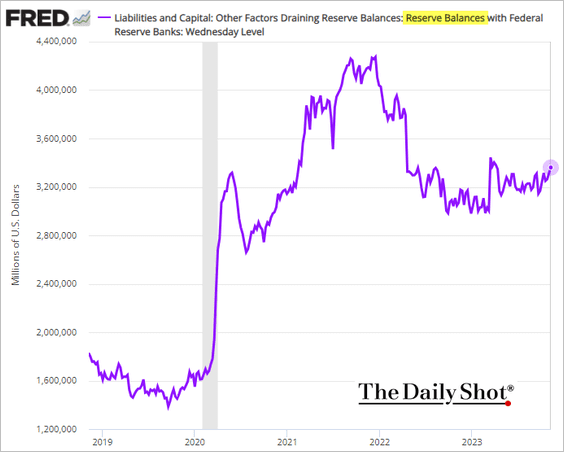

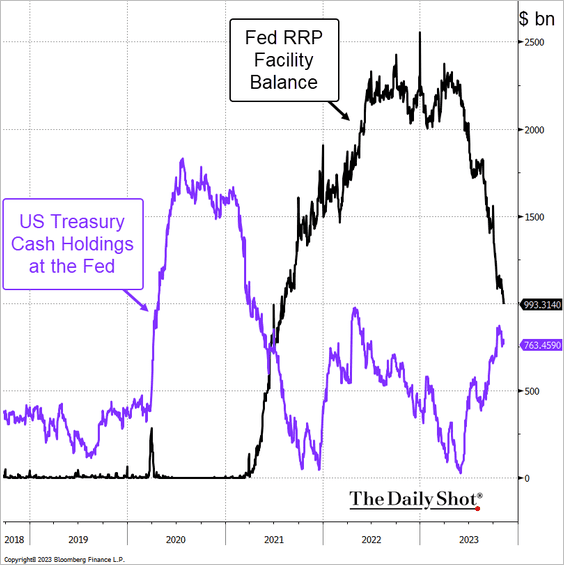

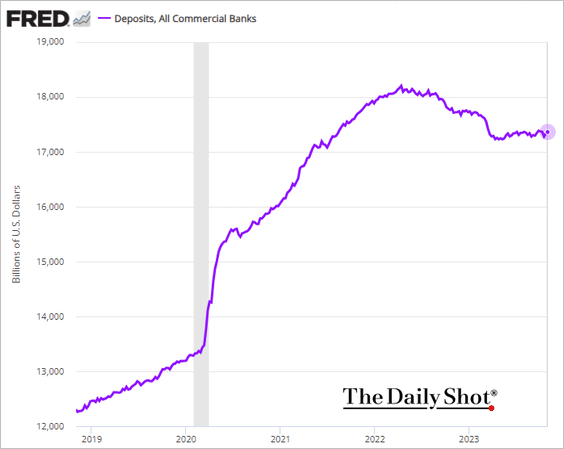

1. US reserve balances have been rising, …

… as the Fed’s RRP facility balances dip below $1 trillion.

Source: @markets Read full article

Source: @markets Read full article

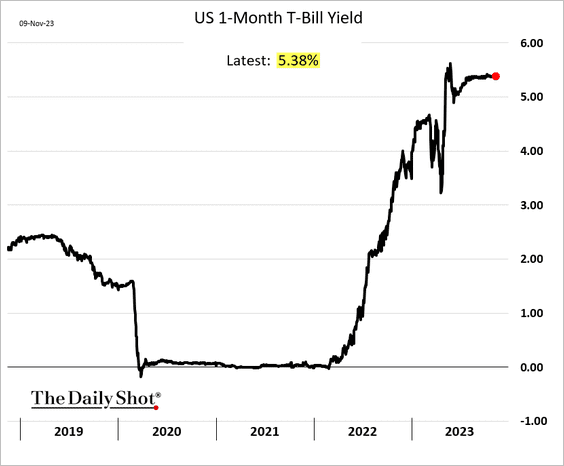

• The Fed’s RRP offering is competing with T-bills yielding 5.4%.

• Lower RRP balances mean higher bank deposits.

Back to Index

Global Developments

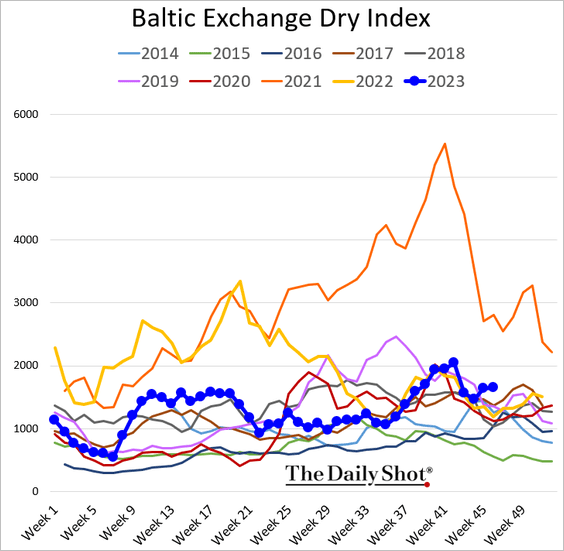

1. Dry bulk shipping costs are elevated for this time of the year.

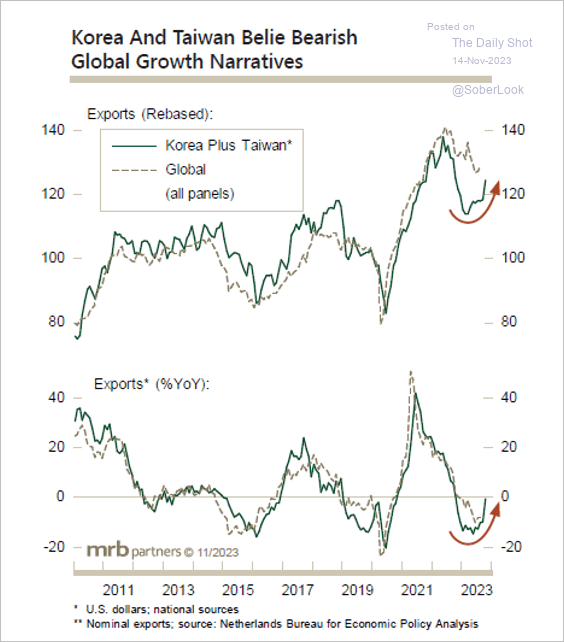

2. The rise in Korea’s and Taiwan’s exports bodes well for global trade growth.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

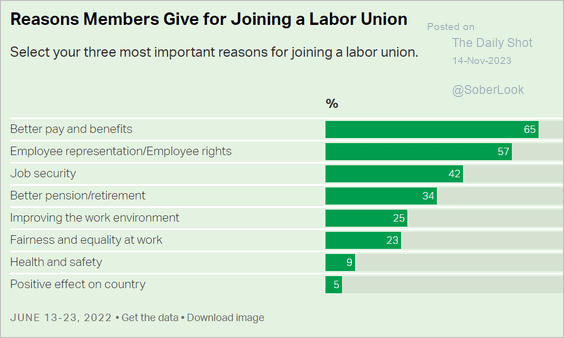

1. Reasons for joining a labor union:

Source: Gallup Read full article

Source: Gallup Read full article

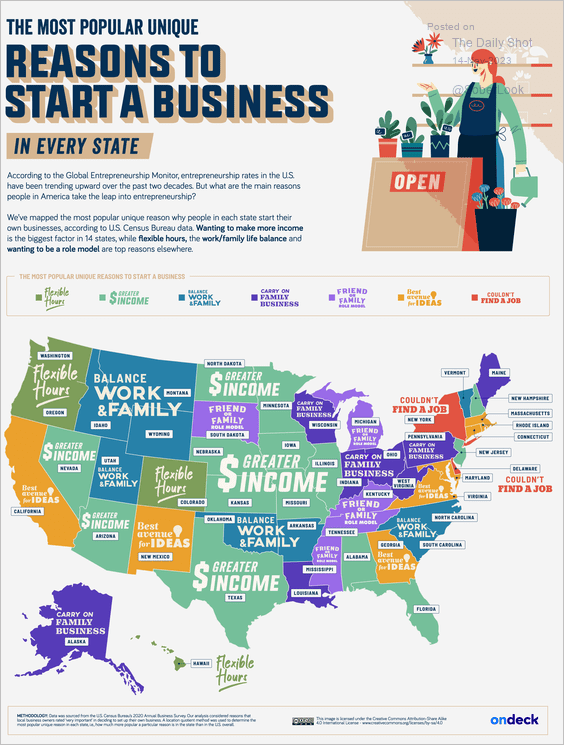

2. Popular reasons to start a business:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

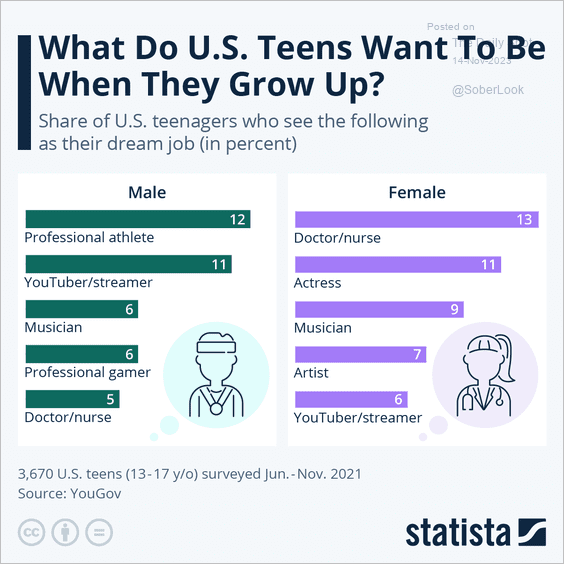

3. Teenagers’ dream jobs:

Source: Statista

Source: Statista

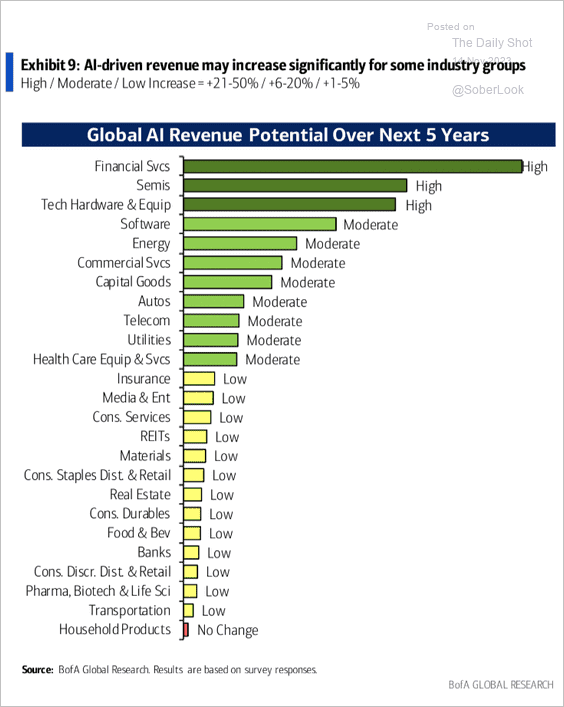

4. AI-driven revenue potential:

Source: BofA Global Research

Source: BofA Global Research

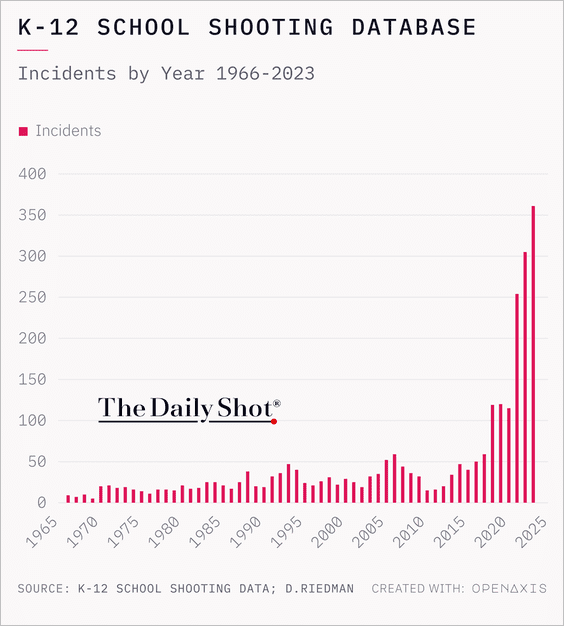

5. K-12 school shootings:

Source: @TheDailyShot

Source: @TheDailyShot

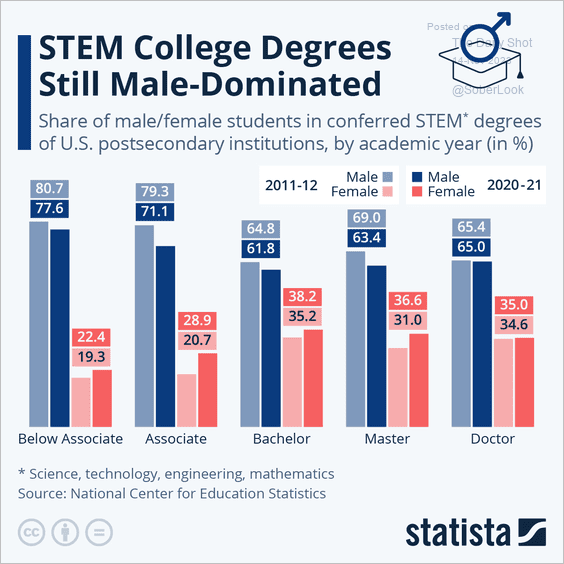

6. STEM degrees:

Source: Statista

Source: Statista

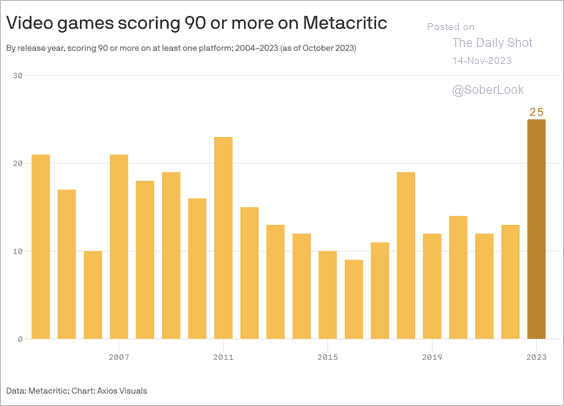

7. Top-rated video games:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index