The Daily Shot: 13-Feb-24

• The United States

• The United Kingdom

• The Eruozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

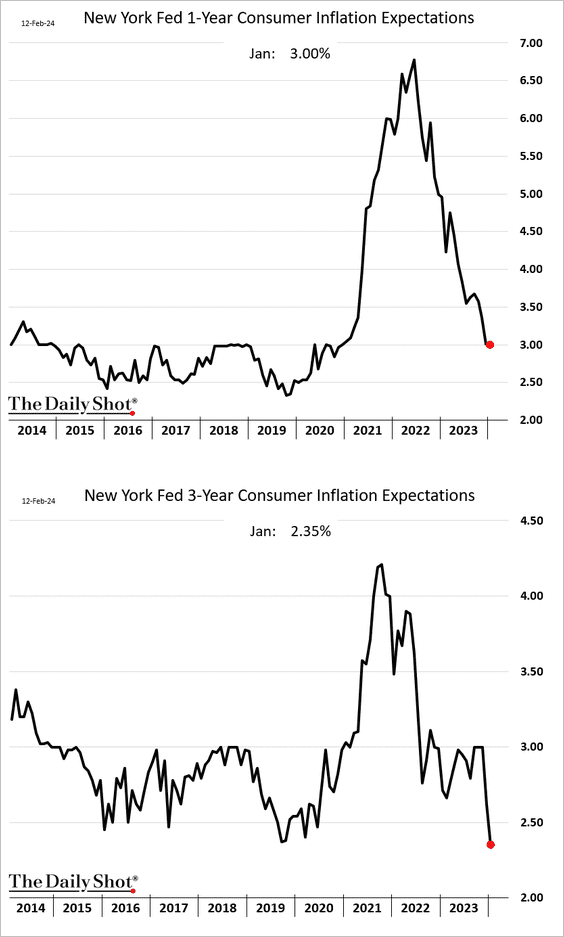

1. Let’s begin with some updates on inflation.

• The New York Fed’s consumer survey showed stable one-year inflation expectations, while the three-year outlook experienced a significant decline.

However, as gasoline futures indicate, inflation expectations may increase with rising gasoline prices.

• Investors see inflation as the biggest “tail risk” for the markets.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. Here are some additional trends from the New York Fed’s survey.

• Probability of losing a job:

• Probability of moving residence:

• Improving financial situation:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

3. In the first four months of fiscal 2024, the US budget deficit expanded by 16% compared to the previous year.

Source: @economics Read full article

Source: @economics Read full article

——————–

4. Tax refunds are coming.

Source: Oxford Economics

Source: Oxford Economics

5. CEO confidence has been improving.

Source: BofA Global Research

Source: BofA Global Research

But companies in consumer sectors increasingly mention “weak demand.”

Source: BofA Global Research

Source: BofA Global Research

——————–

6. Job switchers continue to see faster wage growth, but the gap with job stayers has narrowed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The United Kingdom

1. The revised/updated employment data indicate a stronger-than-anticipated labor market.

• Employment change:

• The unemployment rate:

– The market is not yet confident in the new employment figures.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Payroll estimates remained strong in January.

• The decline in job vacancies stalled last month.

• Wage growth slowed less than expected.

——————–

2. Five-year fixes make up the majority of mortgage debt, followed by two-year fixes.

Source: Barclays Research

Source: Barclays Research

The weighted average rate of fixed-rate debt to be refinanced will rise only gradually over the next year.

Source: Barclays Research

Source: Barclays Research

——————–

3. Global investors remain cautious on UK stocks.

Source: BofA Global Research

Source: BofA Global Research

4. Compared to their European and US counterparts, young adults in the UK express significantly lower confidence in achieving upward mobility.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eruozone

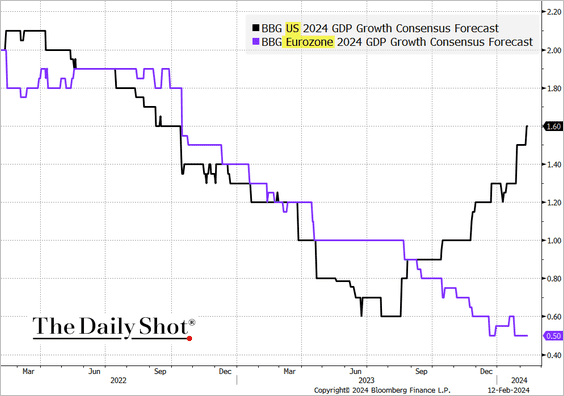

1. The euro-area GDP is expected to grow 0.5% this year, diverging sharply from the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Germany is increasingly a drag on the Eurozone economy.

• Economists are more upbeat on Spain.

——————–

2. On a monthly basis, inflation has picked up in recent months.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

3. German office prices took a hit last year.

Source: @business Read full article

Source: @business Read full article

4. Here is a look at borrowing costs in the Eurozone.

Source: ECB

Source: ECB

Back to Index

Japan

1. The Nikkei 225 is surging, nearing the 1990 peak.

2. The PPI appears to have bottomed.

Back to Index

Asia-Pacific

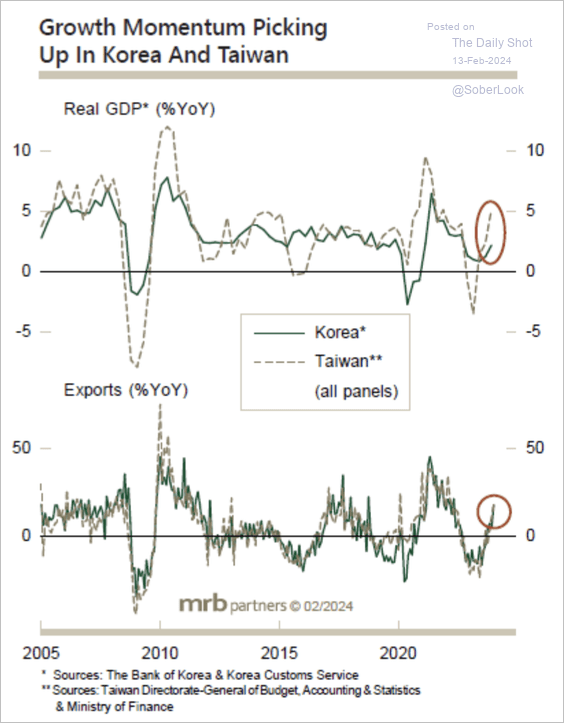

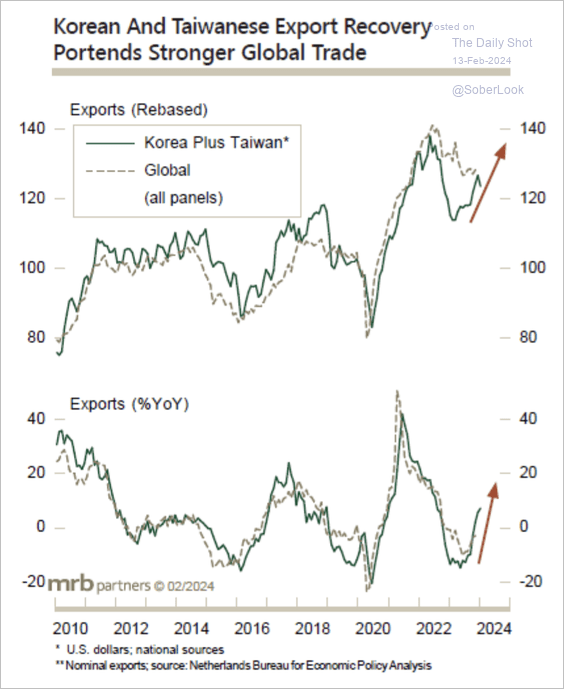

1. Economic growth is improving in South Korea and Taiwan, which could signal stronger global trade. (2 charts)

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

——————–

2. Australia’s consumer sentiment improved this year (2 charts).

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

1. Global investors remain cautious on China.

Source: BofA Global Research

Source: BofA Global Research

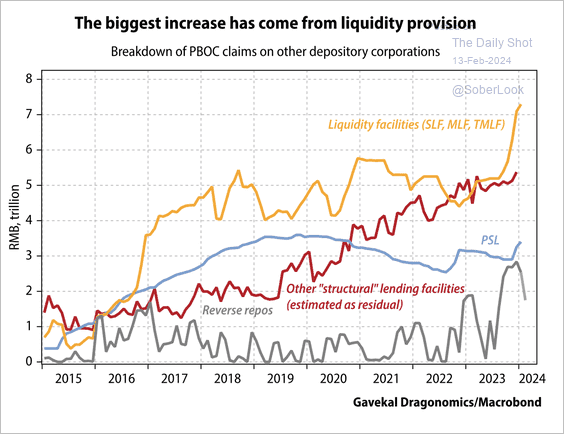

2. Liquidity provisions have been a main driver of the PBoC’s balance sheet expansion. This is mainly to help the banking system buy a surge of government bonds, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

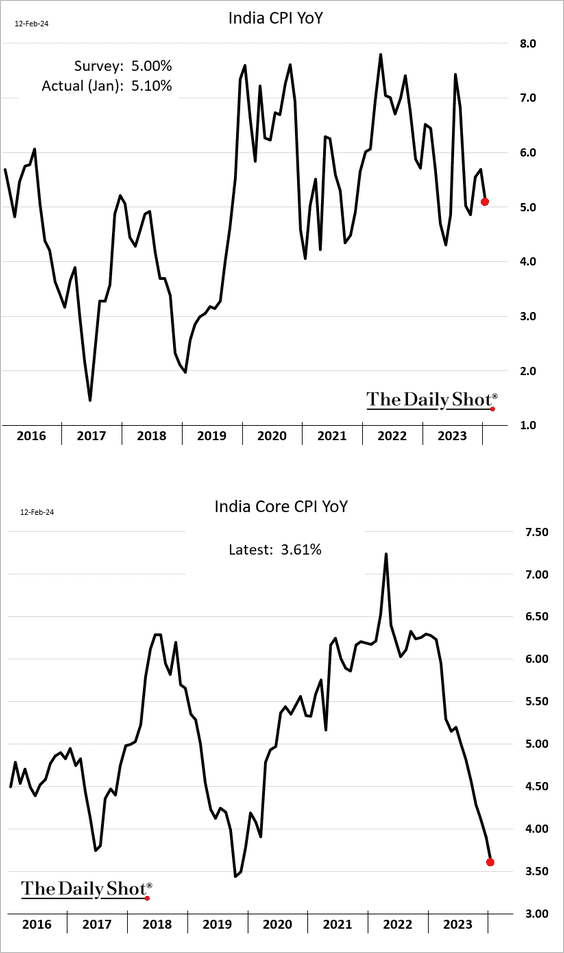

1. India’s inflation eased last month.

Source: @economics Read full article

Source: @economics Read full article

• Industrial production held up well in December.

——————–

2. EM stocks’ discount to DM peers continues to widen.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Cryptocurrency

1. Bitcoin climbed above $50k.

• BTC/USD maintained positive momentum over the past week.

2. The total cryptocurrency market cap continues to rise.

3. Crypto funds saw another week of inflows while investors exited short-bitcoin products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

1. HRW wheat dipped below $6 per bushel.

2. The massive rally in rice futures appears to be fading.

3. US textile mills’ cotton demand has dropped to its lowest since 1885.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

1. Capex among the top five energy companies is on an upward trend, yet remains significantly below the peaks of 2014.

Source: Longview Economics

Source: Longview Economics

• Free cash flow is starting to trend lower while the sharp reduction in debt levels has stalled. (2 charts)

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

——————–

2. Global investors are underweight energy stocks.

Source: BofA Global Research

Source: BofA Global Research

3. The US natural gas contango has intensified amid near-record production and elevated inventories in storage.

• This chart shows US LNG Exports.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

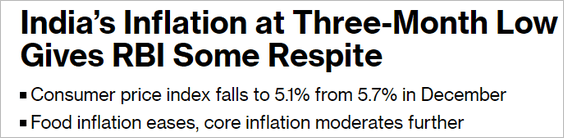

1. Global investors are increasingly bullish, …

Source: BofA Global Research

Source: BofA Global Research

… drawing down their cash positions.

Source: BofA Global Research

Source: BofA Global Research

• Allocations to US stocks (particularly tech) have climbed sharply.

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

——————–

2. Deutsche Bank’s positioning indicator is grinding higher.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Positioning in financials has shifted to overweight.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

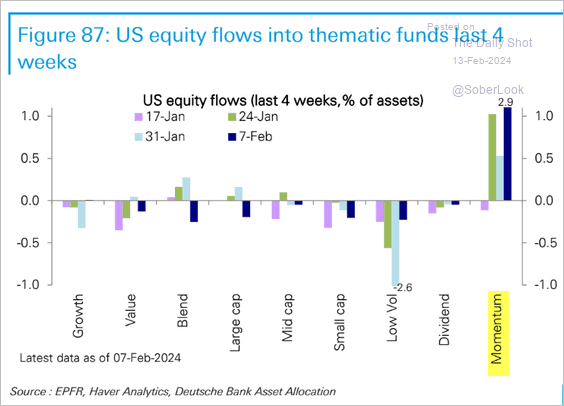

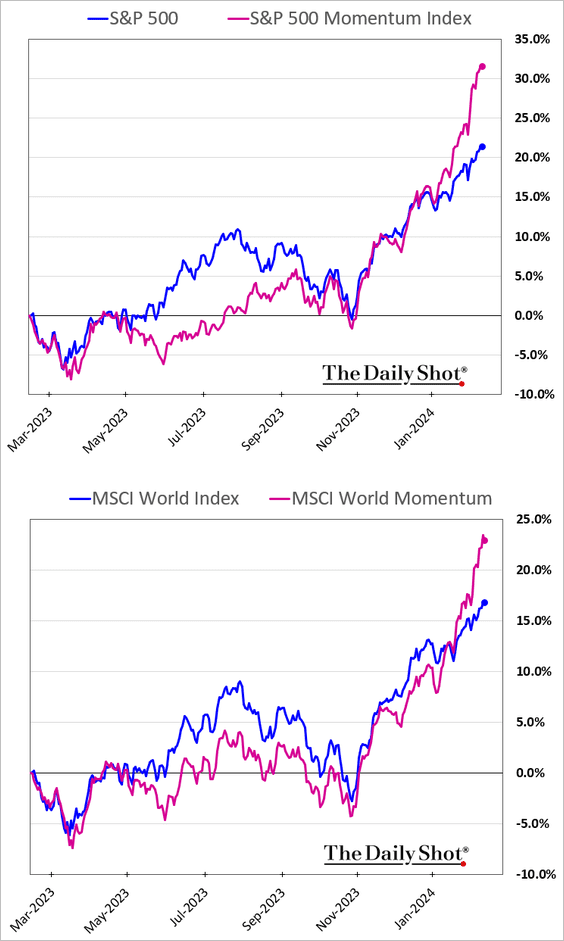

3. The momentum factor has been seeing robust inflows in recent weeks, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… boosting outperformance in the US and globally.

——————–

4. 2024 EPS estimates are holding up well.

Source: BofA Global Research

Source: BofA Global Research

5. The share of negative earnings surprises among small firms has been climbing.

Source: @markets Read full article

Source: @markets Read full article

6. The average S&P 500 stock is trading at a substantial discount to the index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

7. The S&P 500 skew shows increasing complacency in the market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Similarly, here is Goldman’s Panic Index.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

——————–

8. Correlations among S&P 500 stocks have been moving lower.

There is a similar trend among Nasdaq 100 stocks.

——————–

9. Stock funds saw some outflows this month.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Credit

1. The BBB – single-A bond spread has been tightening amid increased risk appetite.

2. CCC-rated bonds have been outperforming.

3. Investment-grade financials have been outperforming the broader corporate bond market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

4. Here is a list of the top 20 US distressed cities based on late consumer debt payments.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Rates

1. Traders are pressing the basis trade (futures vs. cash bonds). The unwind could be ugly.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. DM bond liquidity could worsen amid elevated CPI volatility.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

3. Investors increasingly see the yield curve steepening.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

1. Political openness and economic freedom:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Top US import trading partners:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

3. Adults experiencing long COVID:

Source: USAFacts

Source: USAFacts

4. Cognitive test score by age:

Source: The Economist Read full article

Source: The Economist Read full article

5. Cookie controls:

Source: Statista

Source: Statista

6. Films adapted from a musical:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

Back to Index