The Daily Shot: 22-Nov-22

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

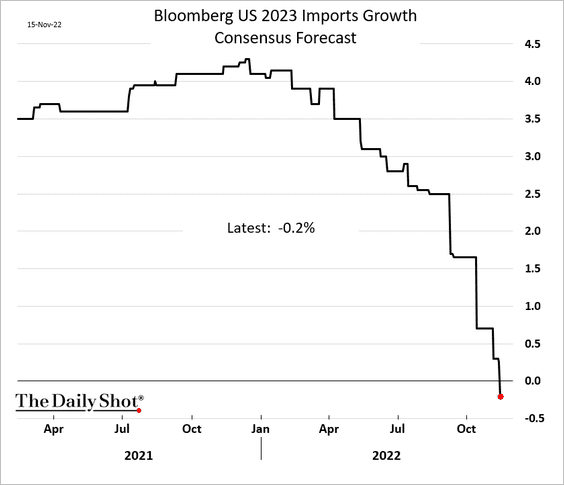

US imports are expected to decline next year

The United States

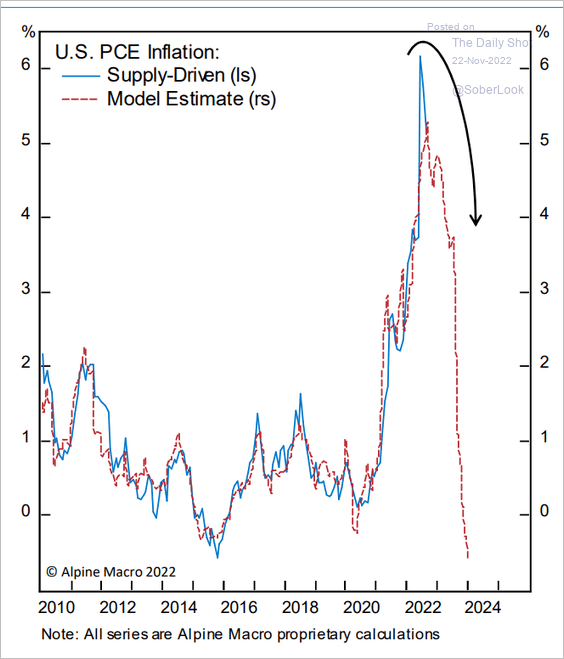

1. Let’s begin with some updates on inflation.

• Disinflation ahead?

Source: Alpine Macro

Source: Alpine Macro

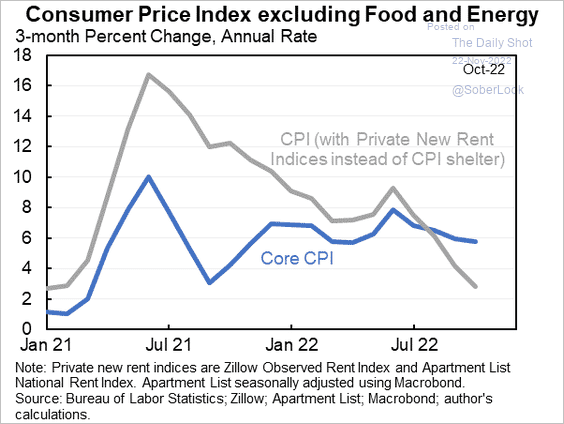

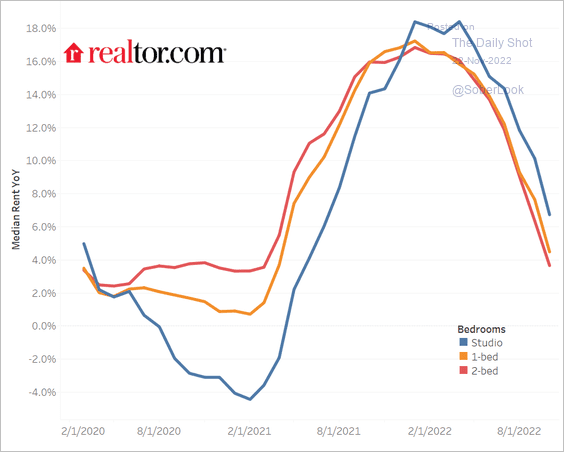

• Private measures of rent inflation have been falling faster than the official index (2 charts).

Source: @jasonfurman

Source: @jasonfurman

Source: realtor.com

Source: realtor.com

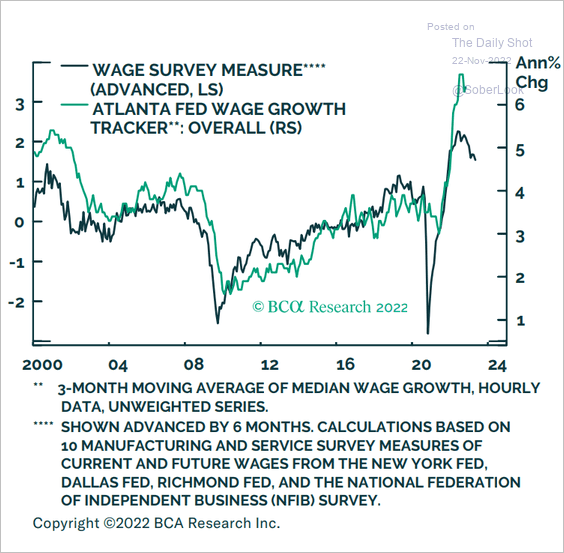

• Surveys point to some moderation in wage inflation.

Source: BCA Research

Source: BCA Research

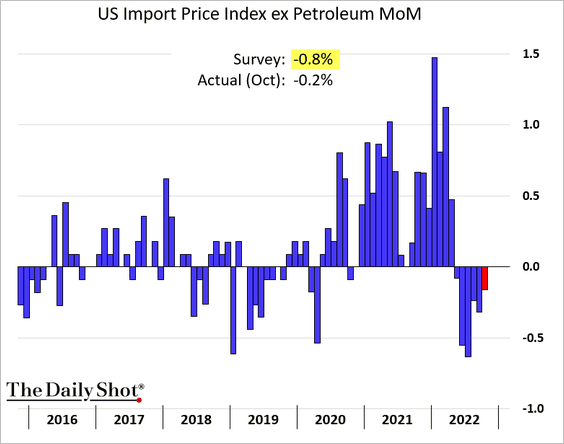

• Import prices declined less than expected in October.

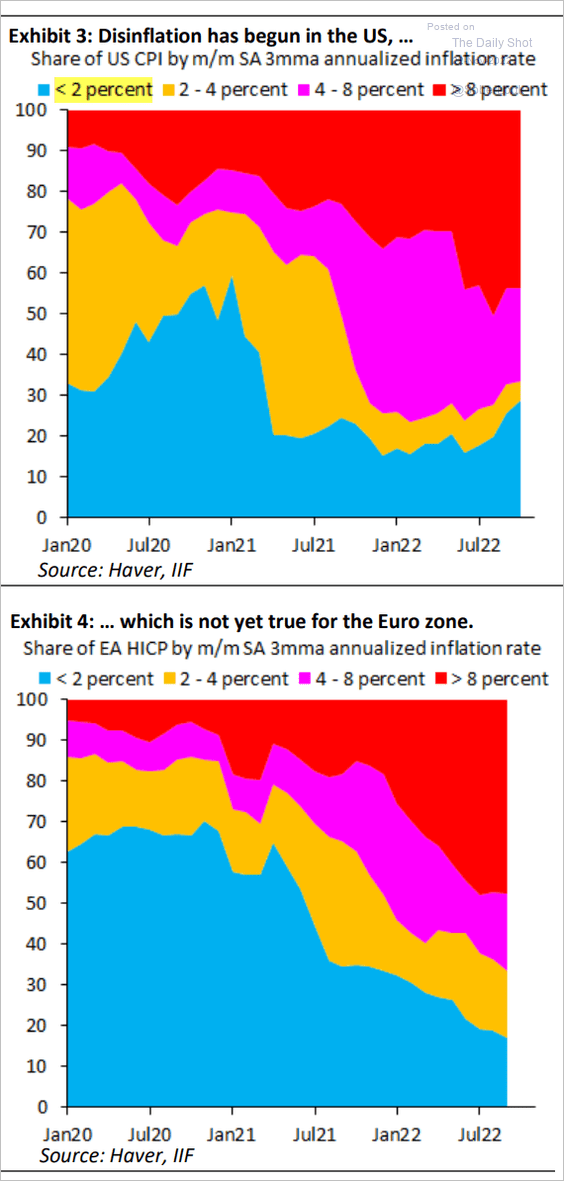

• These charts show CPI components by inflation rate for the US and the Eurozone.

Source: IIF

Source: IIF

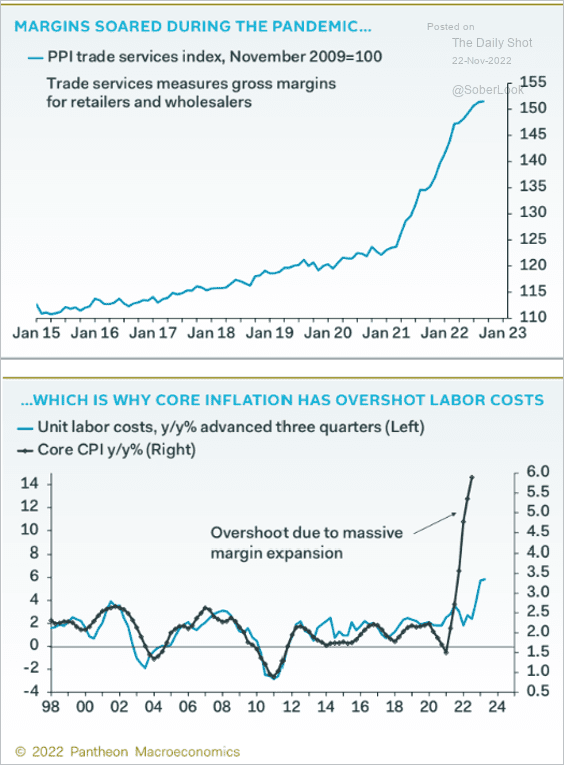

• What caused the COVID-era inflation spike? Hint: it wasn’t the Fed’s QE.

Source: @jessefelder, @BW, @foxjust Read full article

Source: @jessefelder, @BW, @foxjust Read full article

– Here is a more recent example of the above.

Source: KCRA3 Read full article

Source: KCRA3 Read full article

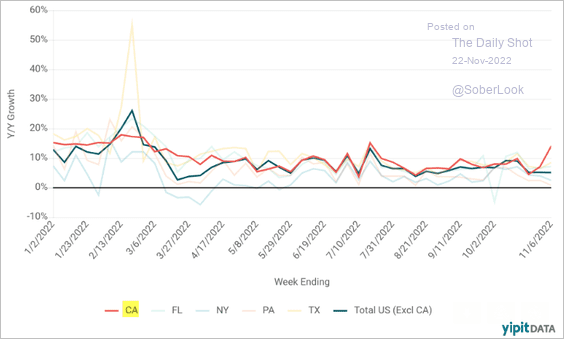

Consumer spending by state:

Source: YipitData

Source: YipitData

– The spike in margins, driven by surging demand (above) and strained supply chains, resulted in the CPI outpacing labor costs.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

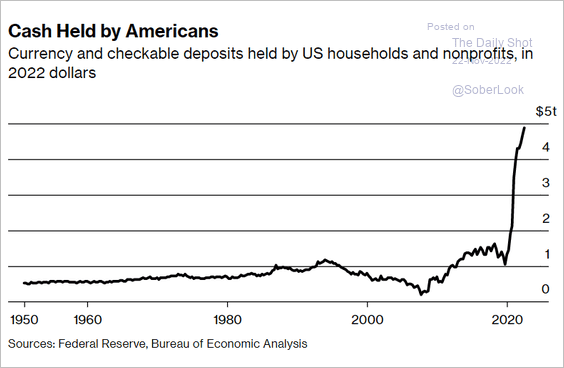

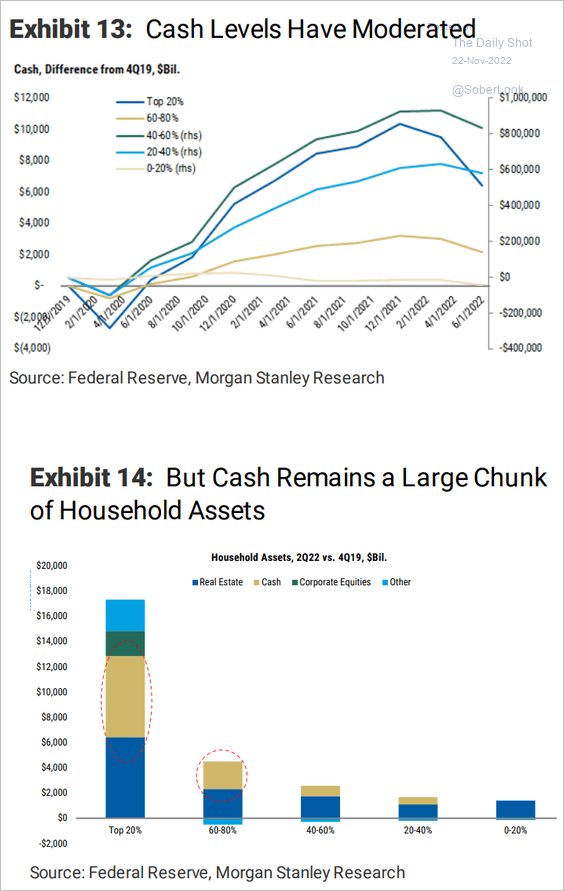

2. Excess cash levels have been moderating.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

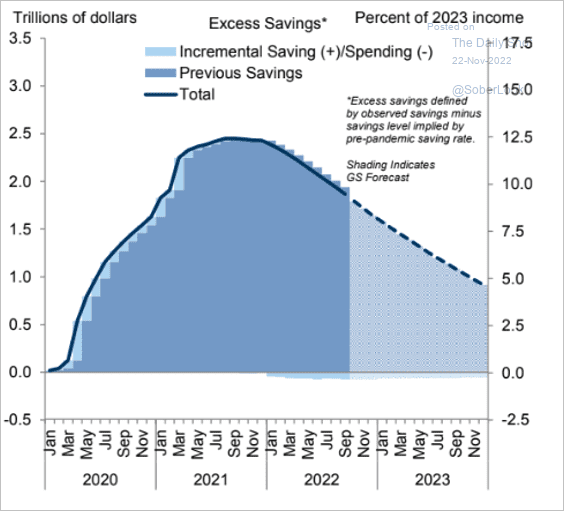

Households are expected to keep drawing on excess savings next year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

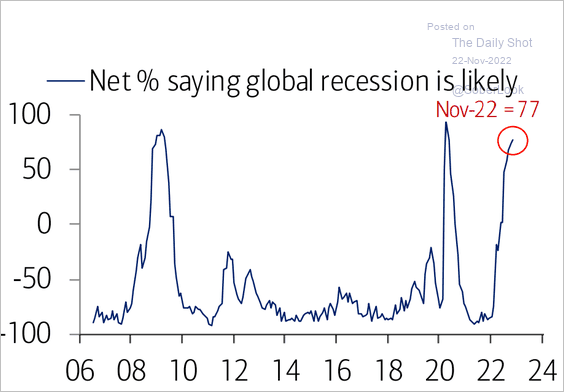

3. Fund managers increasingly expect a recession.

Source: BofA Global Research

Source: BofA Global Research

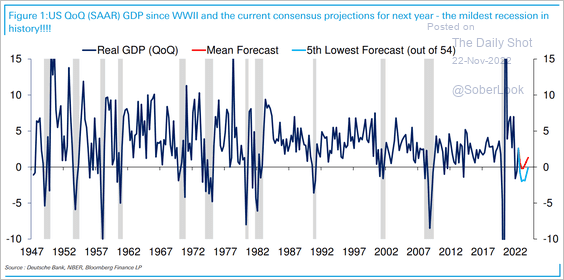

Forecasters are calling for a mild recession next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. Imports are expected to decline in 2023 as demand weakens.

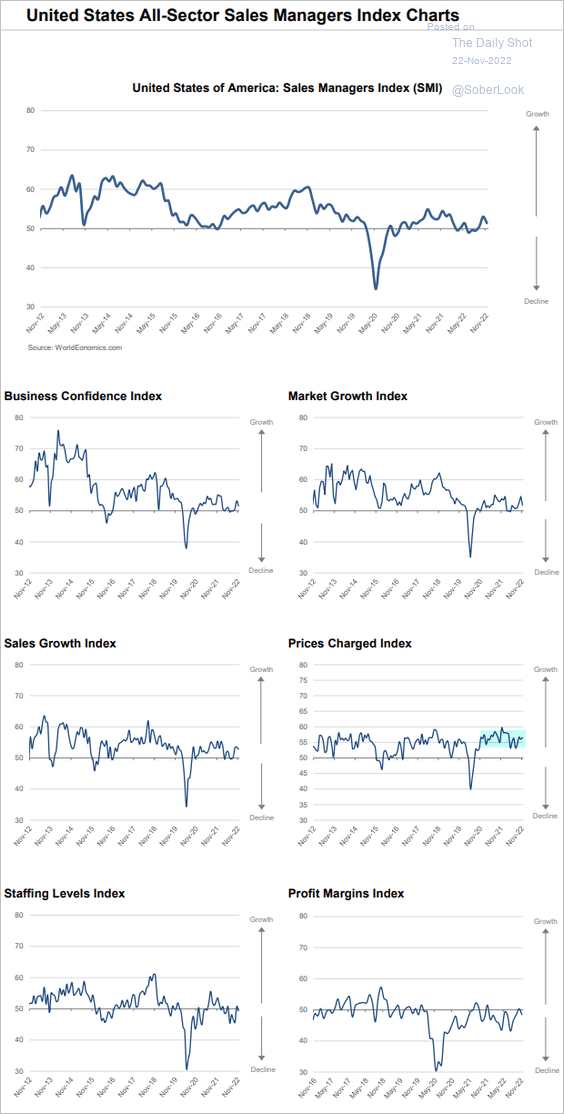

5. The World Economics SMI index shows slower growth in US business activity this month. Price pressures persist.

Source: World Economics

Source: World Economics

Back to Index

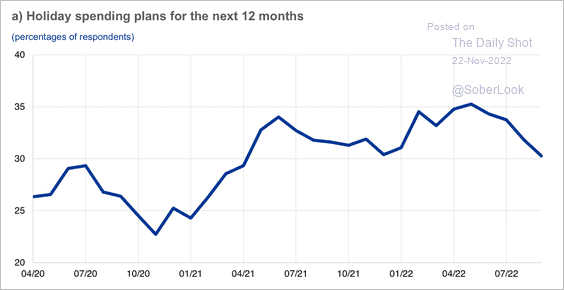

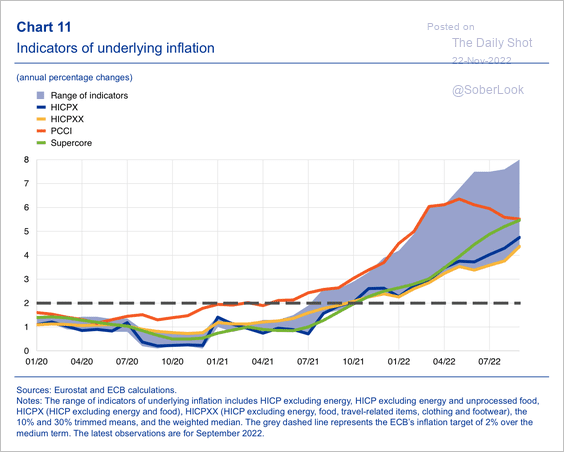

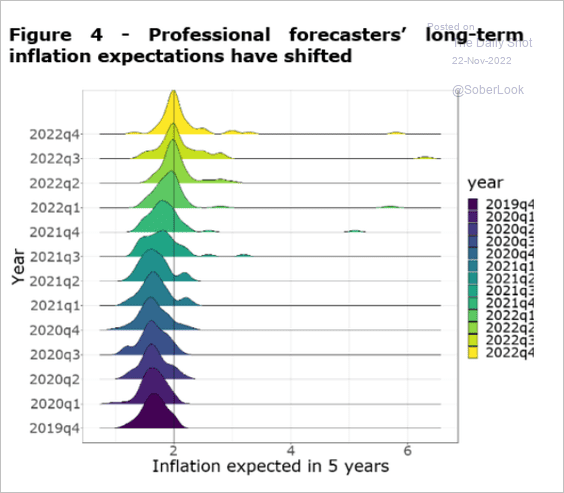

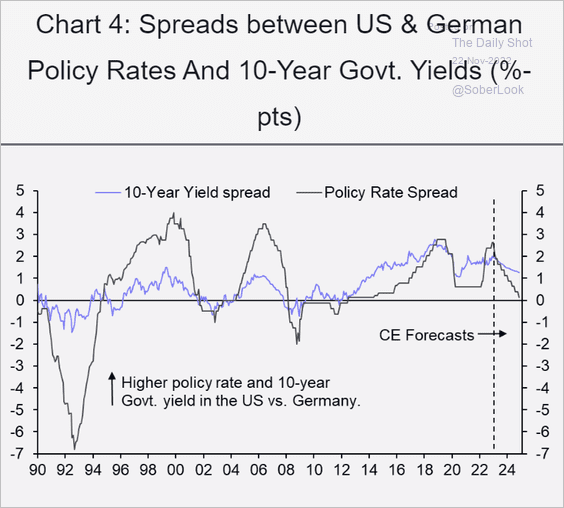

The Eurozone

1. Household holiday spending plans have declined.

Source: ECB

Source: ECB

2. Underlying inflation remains elevated, although PCCI (measures persistence) has been declining since May.

Source: ECB

Source: ECB

3. Long-term inflation expectations have been grinding higher.

Source: BIS Read full article

Source: BIS Read full article

4. Capital Economics expects the US-Germany rate spreads to tighten next year.

Source: Capital Economics

Source: Capital Economics

Back to Index

Europe

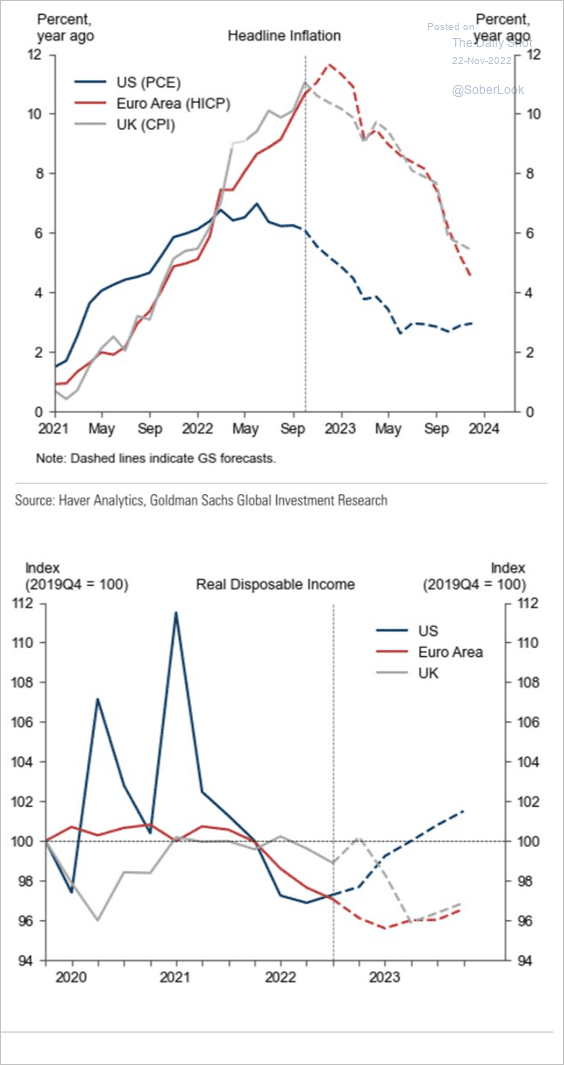

1. Energy dependence will keep European real disposable income in the red next year.

Source: Goldman Sachs

Source: Goldman Sachs

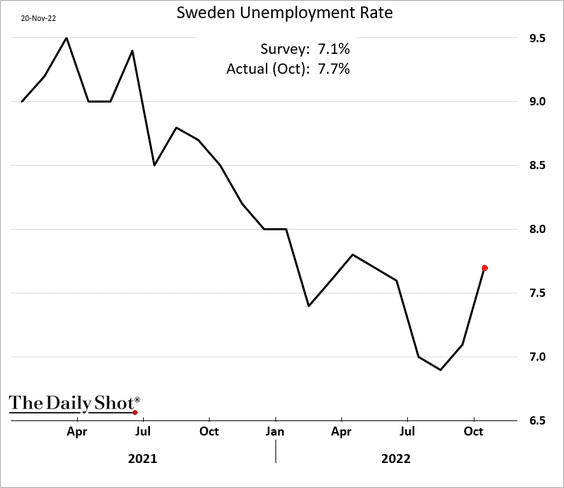

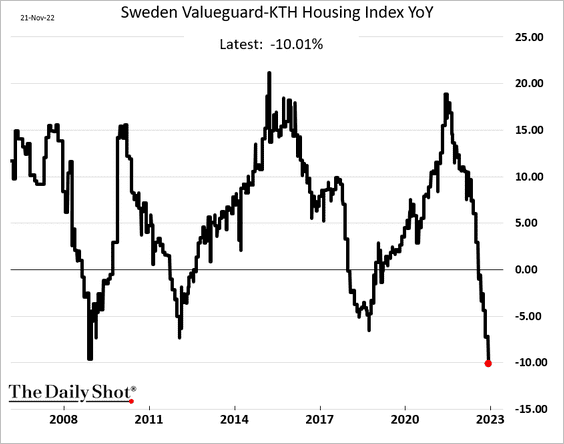

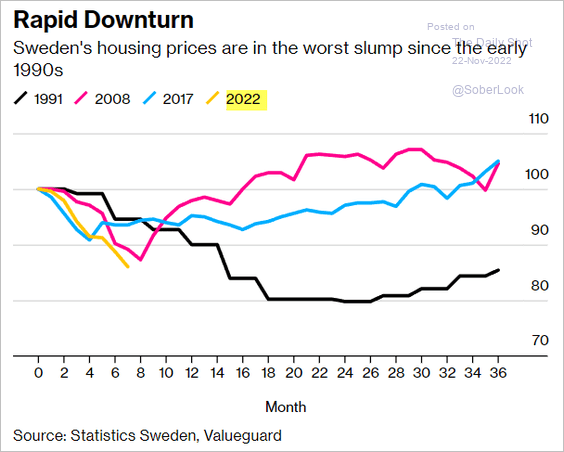

2. Next, we have some updates on Sweden.

• The unemployment rate topped expectations.

• Home prices are down 10% from a year ago, the largest decline in years.

Source: @wealth, @nicrolander Read full article

Source: @wealth, @nicrolander Read full article

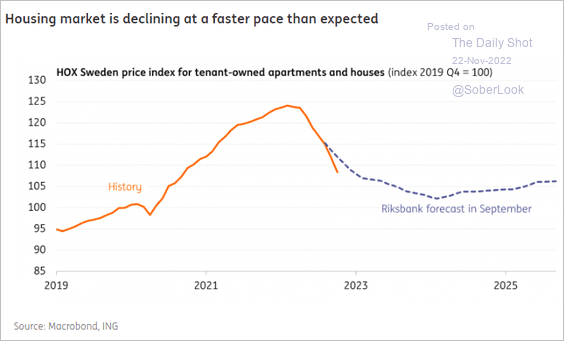

– The housing price decline has exceeded Riksbank’s forecasts.

Source: ING

Source: ING

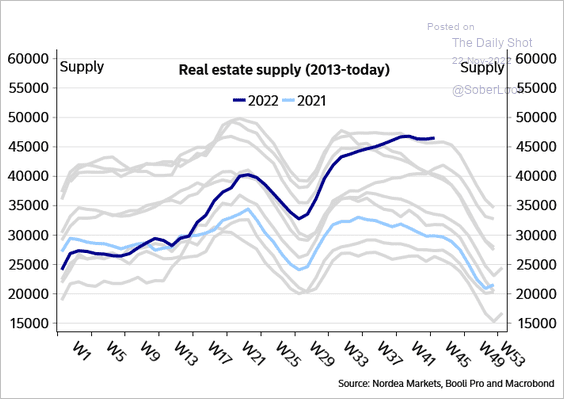

– Housing supplies are elevated.

Source: Nordea Markets

Source: Nordea Markets

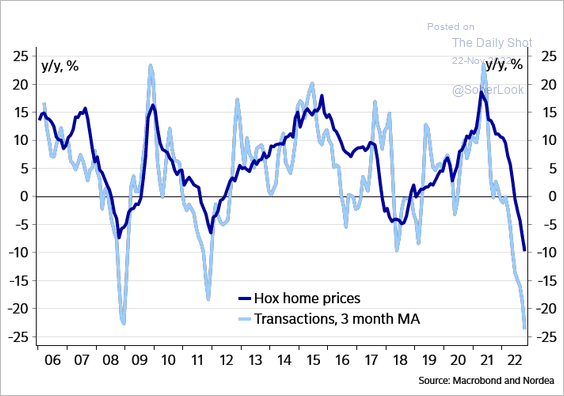

– More pain ahead in the housing sector?

Source: Nordea Markets

Source: Nordea Markets

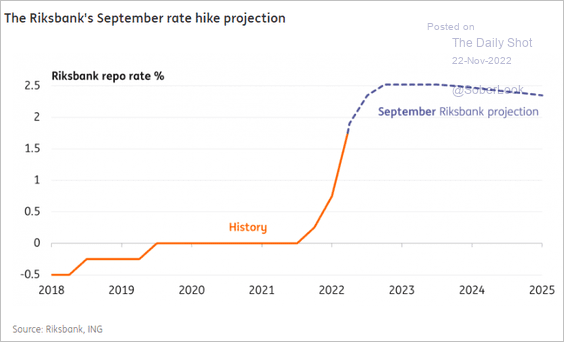

• Despite the housing market slump, more rate hikes are coming.

Source: ING

Source: ING

——————–

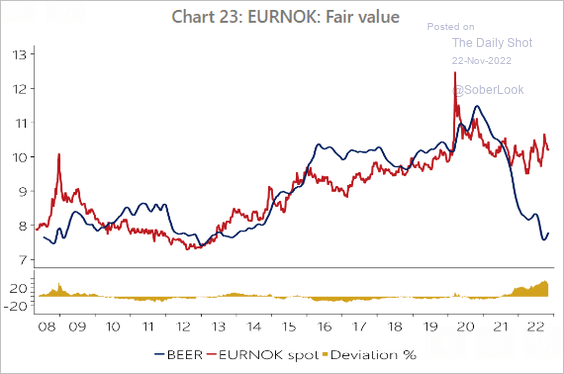

3. The Norwegian krone should be stronger versus the euro.

Source: Oxford Economics

Source: Oxford Economics

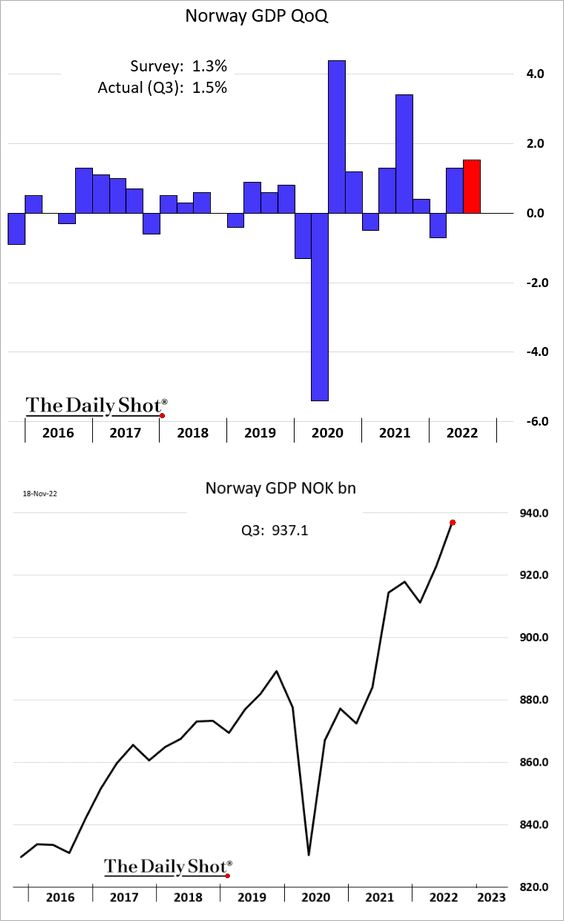

• Norway’s economy continues to grow.

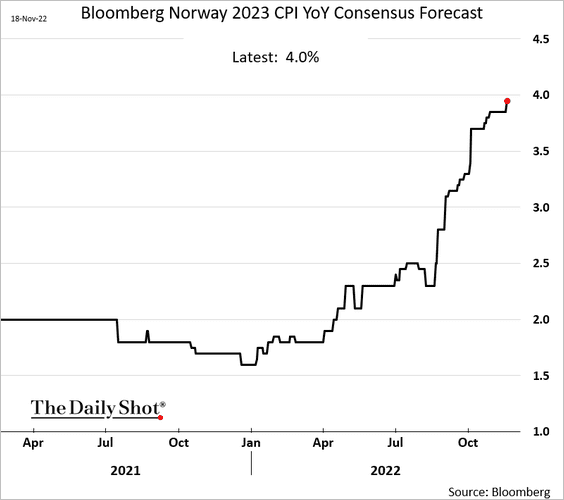

• Economists have been boosting their forecasts for Norway’s inflation next year.

——————–

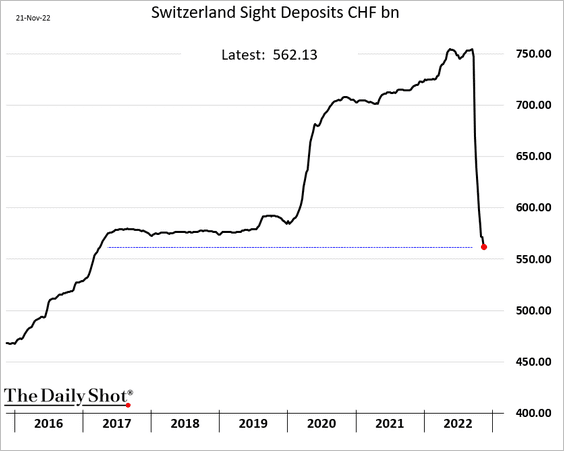

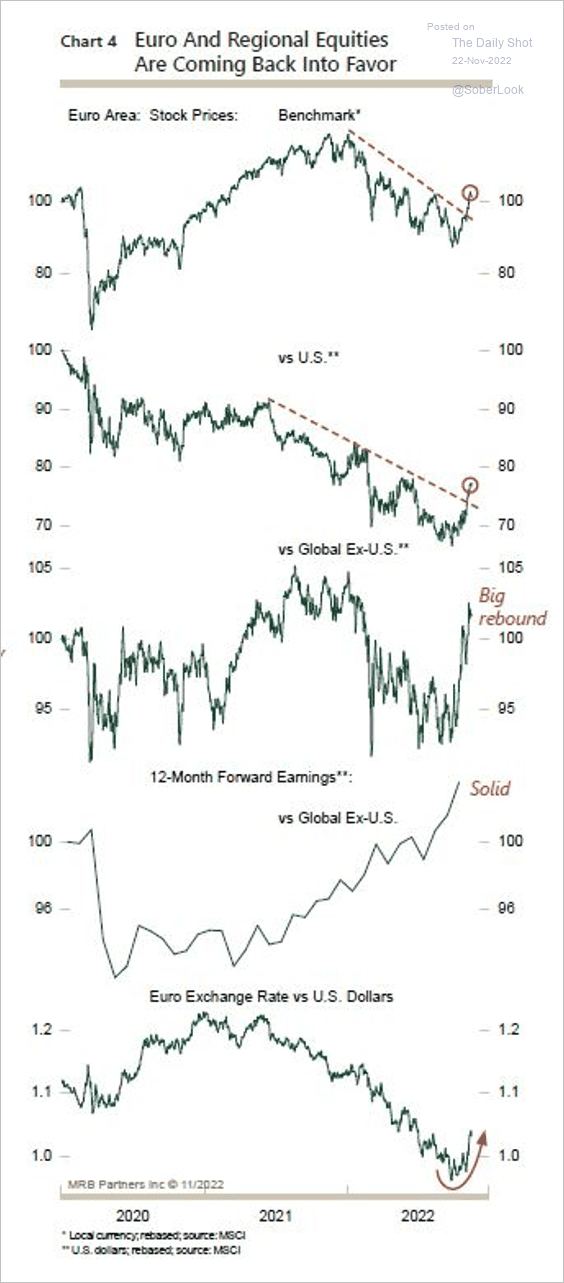

4. The Swiss central bank continues to reduce liquidity.

5. European assets bounced relative to the US, partly because of the weaker dollar.

Source: MRB Partners

Source: MRB Partners

Back to Index

Asia – Pacific

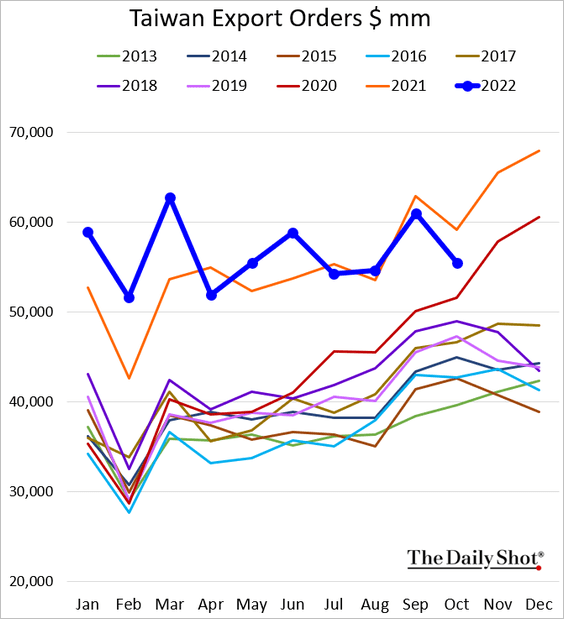

1. Taiwan’s export orders fell well below last year’s levels.

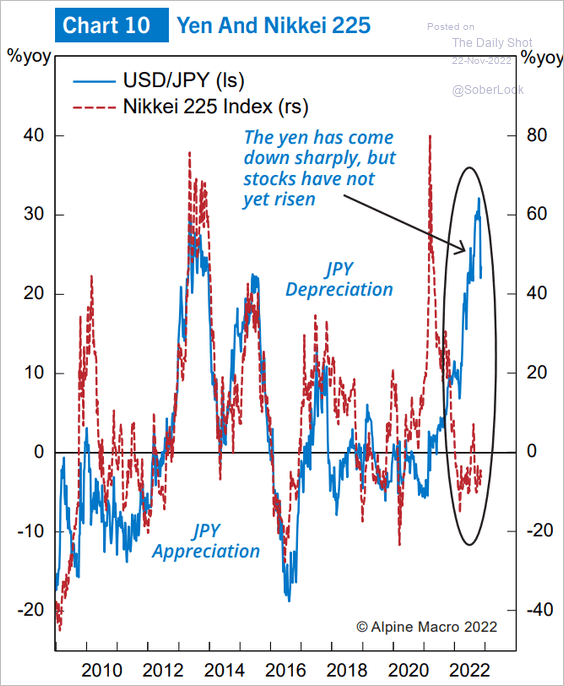

2. A weak yen should be a tailwind for Japan’s stocks.

Source: Alpine Macro

Source: Alpine Macro

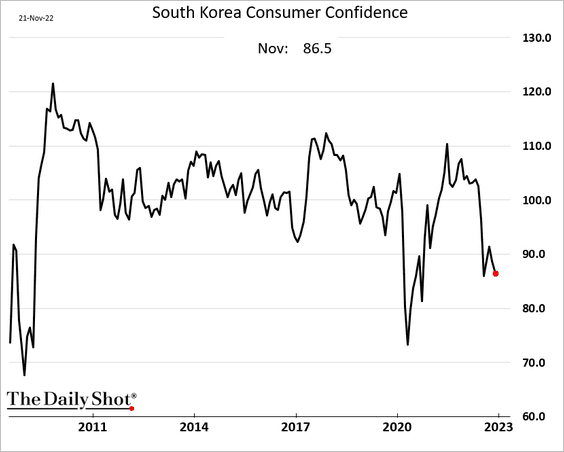

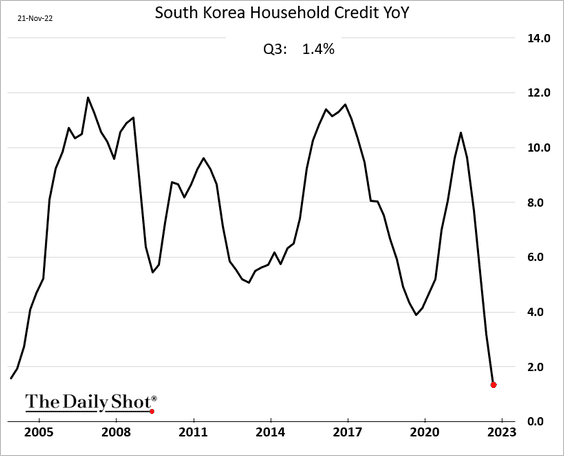

3. South Korea’s consumer confidence declined this month.

Growth in household credit has slowed sharply.

——————–

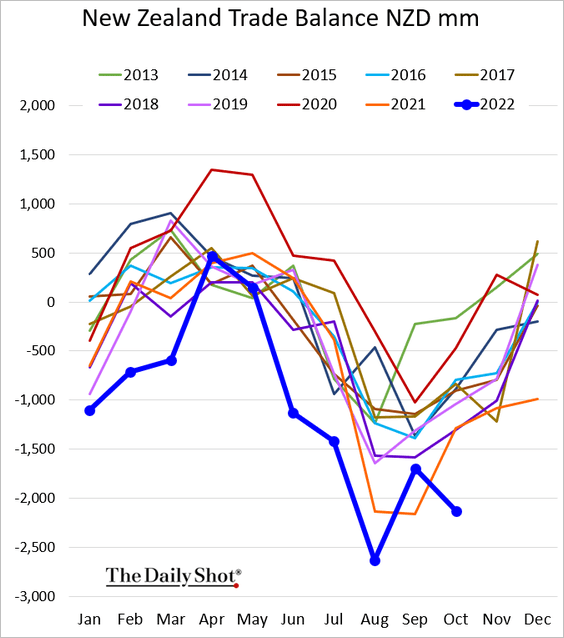

4. New Zealand’s trade deficit has blown out, …

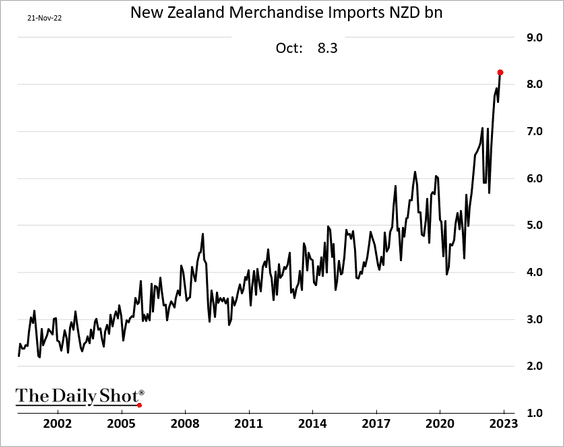

… as imports hit a record high.

Back to Index

China

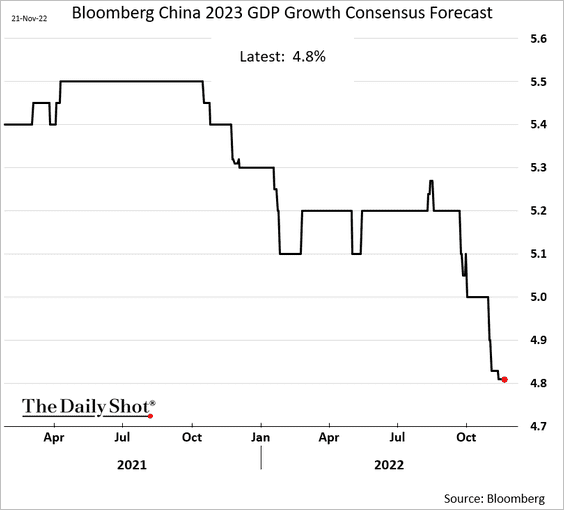

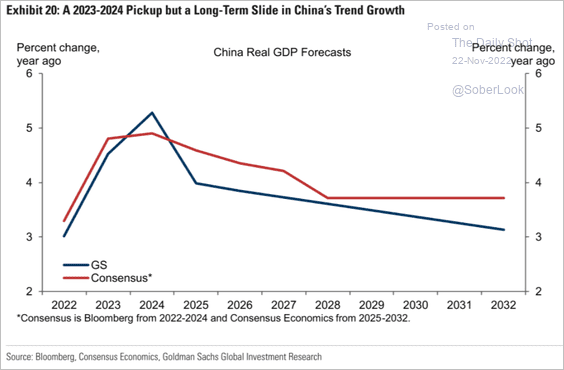

1. Economists have been downgrading projections for China’s 2023 GDP growth.

Here is Goldman’s forecast over the next decade.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

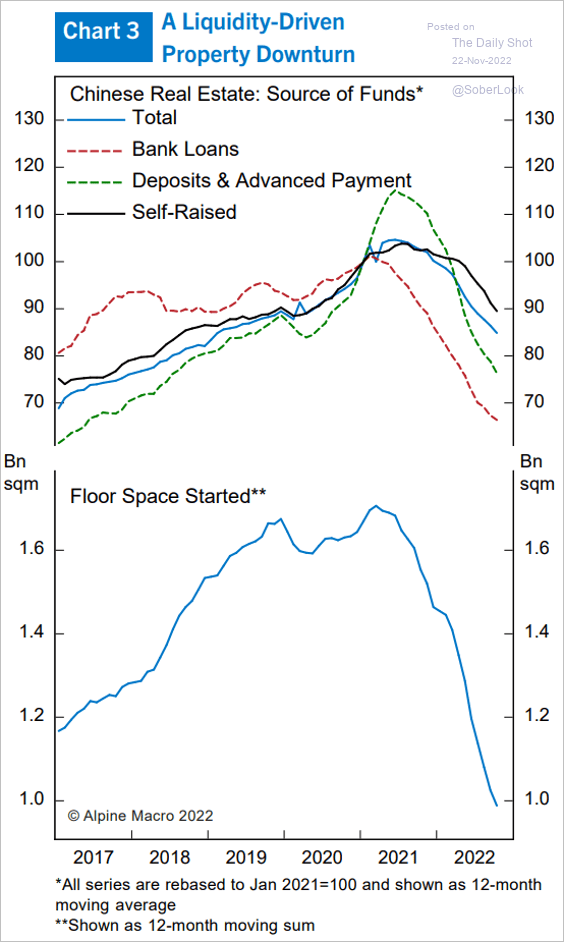

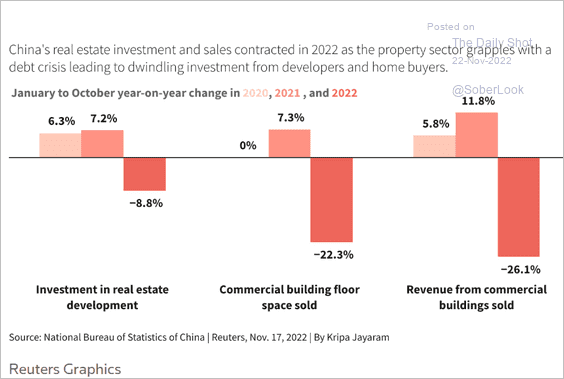

2. Beijing wants banks to boost lending to property firms.

Source: Alpine Macro

Source: Alpine Macro

Source: Reuters Read full article

Source: Reuters Read full article

——————–

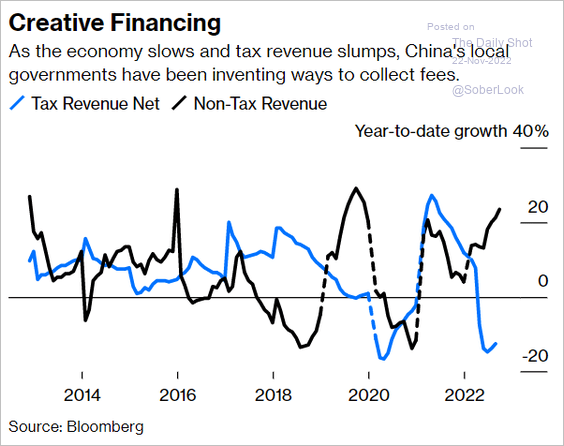

3. Local governments increasingly rely on non-tax revenue.

Source: @opinion, @shuli_ren Read full article

Source: @opinion, @shuli_ren Read full article

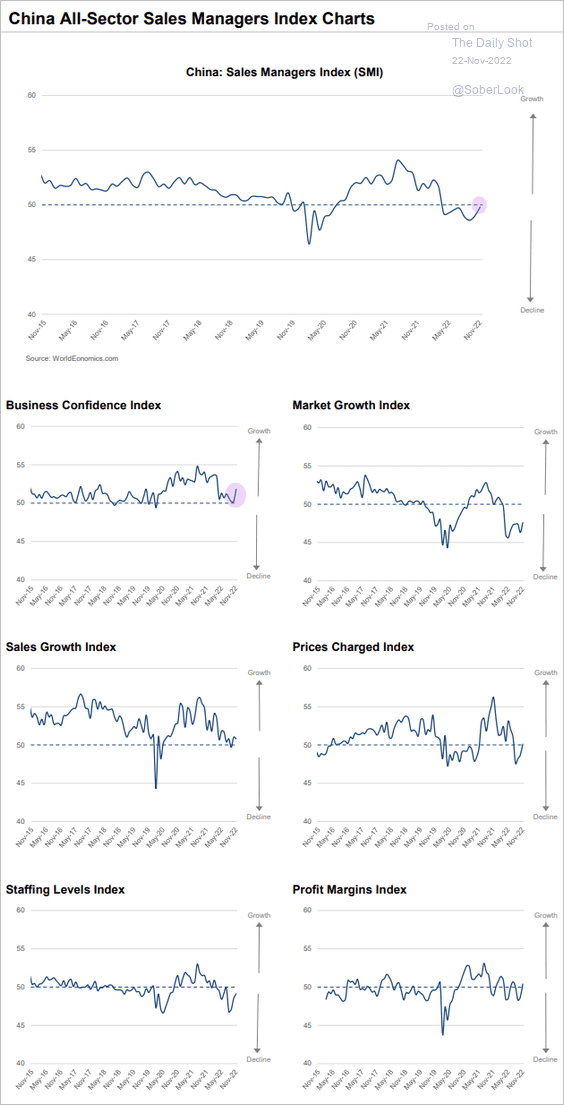

4. The World Economics SMI report shows business activity stabilizing this month as business confidence improves.

Source: World Economics

Source: World Economics

Back to Index

Emerging Markets

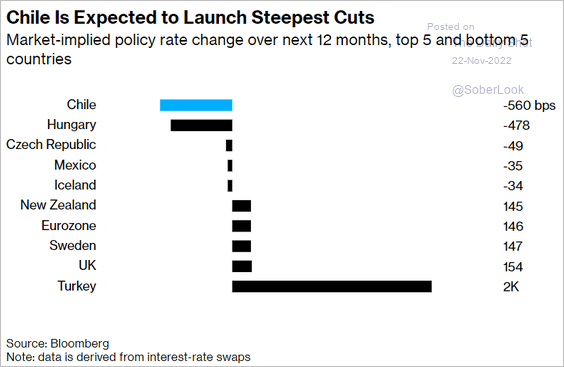

1. The market is pricing sharp rate cuts ahead for Chile as recession looms.

Source: @business, @Sebaboyd, @ValentinaKaryme Read full article

Source: @business, @Sebaboyd, @ValentinaKaryme Read full article

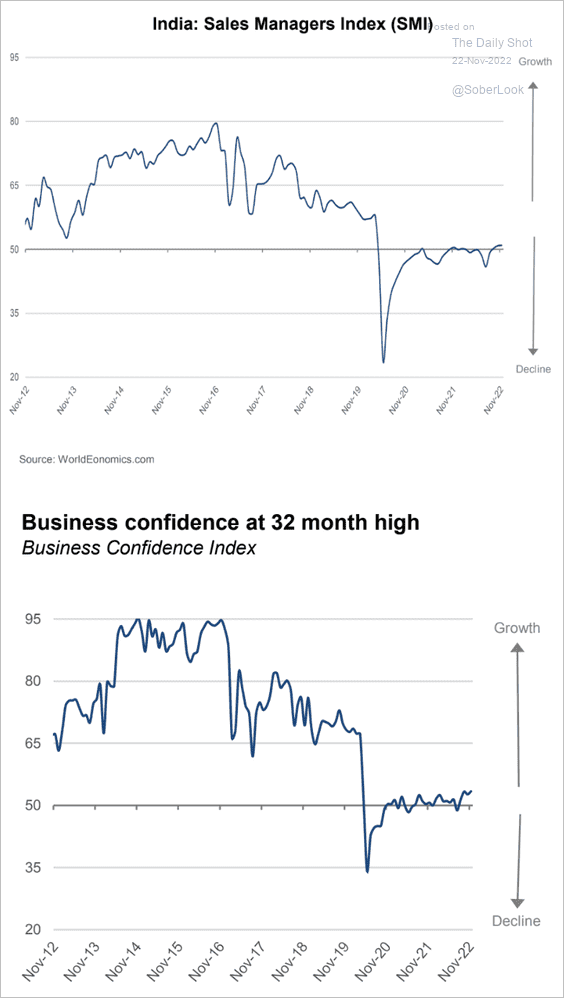

2 India’s SMI indicator is in growth territory as business confidence jumps.

Source: World Economics

Source: World Economics

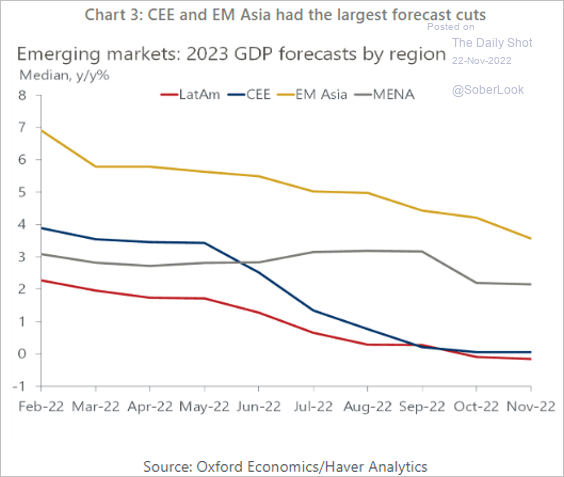

3. This chart shows the evolution of 2023 GDP growth forecasts from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

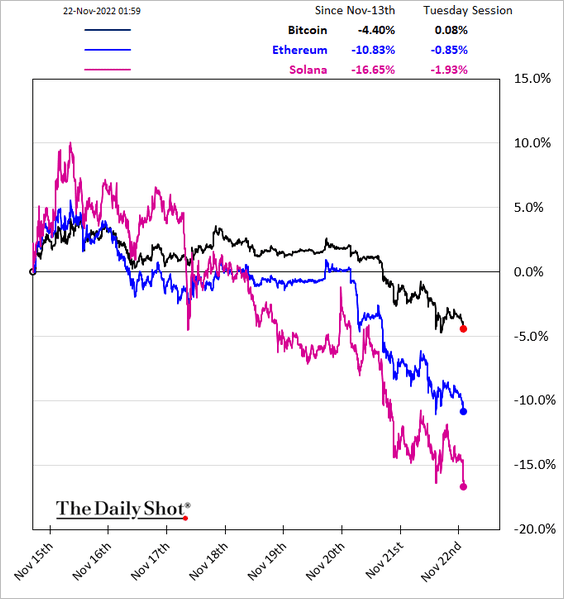

Cryptocurrency

1. Crypto market pain persists, …

… with bitcoin holding below $16k.

——————–

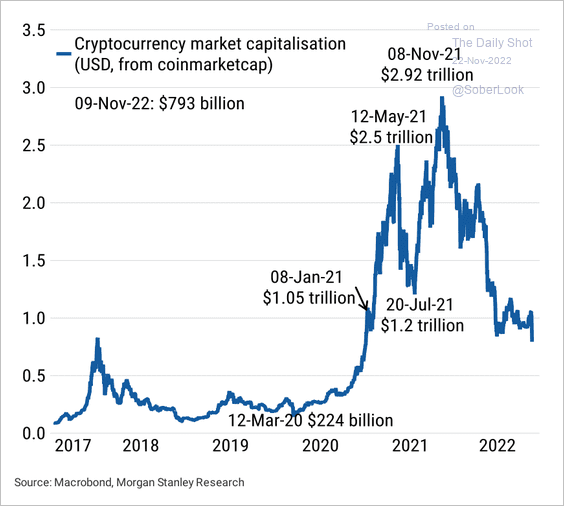

2. The total crypto market cap has fallen to around $800 billion from its peak of $2.9 trillion last year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

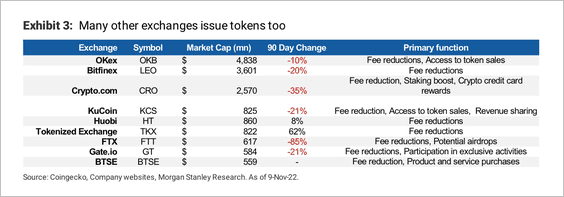

3. Here is a list of crypto exchange tokens, which are treated as a representation of the company’s value.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

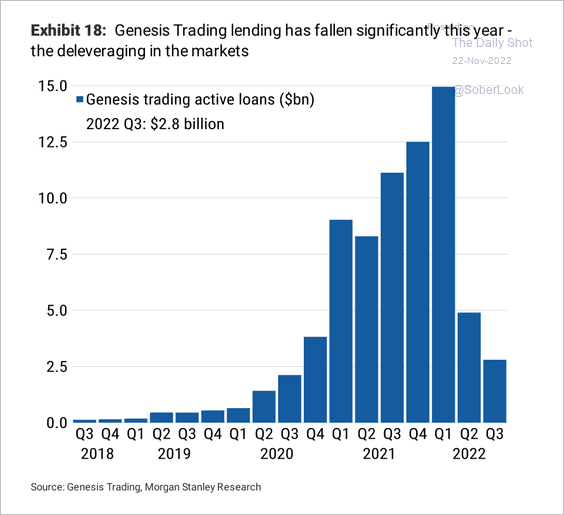

4. Genesis Trading, a major crypto broker-dealer, warned that it may file for bankruptcy.

Source: Decrypt Read full article

Source: Decrypt Read full article

The company’s lending has fallen significantly this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

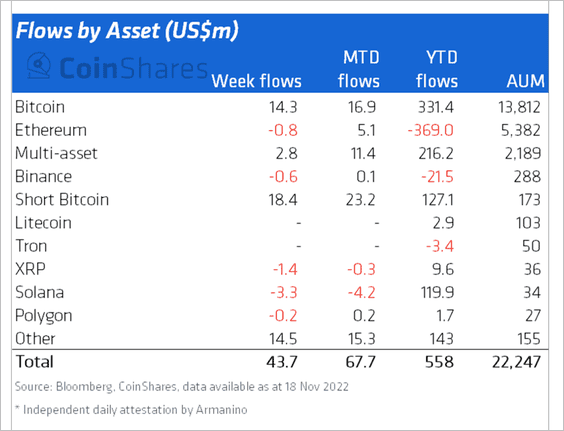

5. Investors piled into short-Bitcoin investment products last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

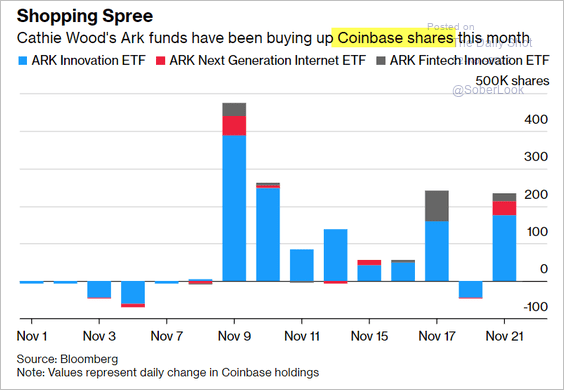

6. Ark funds have been buying up Coinbase as well as other crypto-focused companies.

Source: @business, @Matt_Turnerr Read full article

Source: @business, @Matt_Turnerr Read full article

Back to Index

Energy

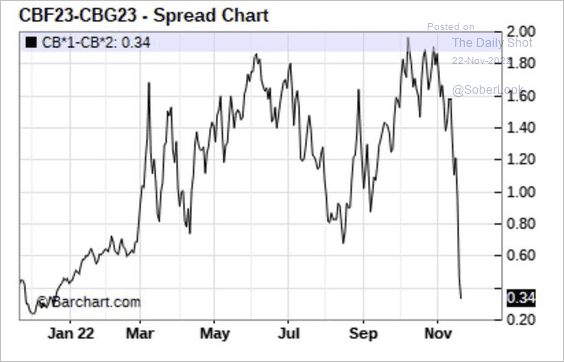

1. The decline in Brent backwardation (curve flattening) has been rapid.

Source: @HFI_Research

Source: @HFI_Research

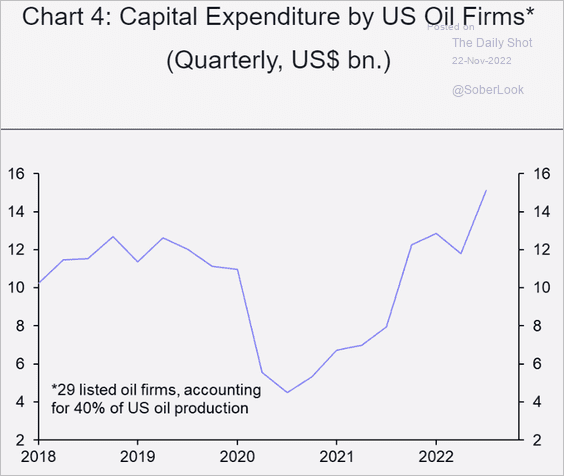

2. US energy companies have been boosting CapEx.

Source: Capital Economics

Source: Capital Economics

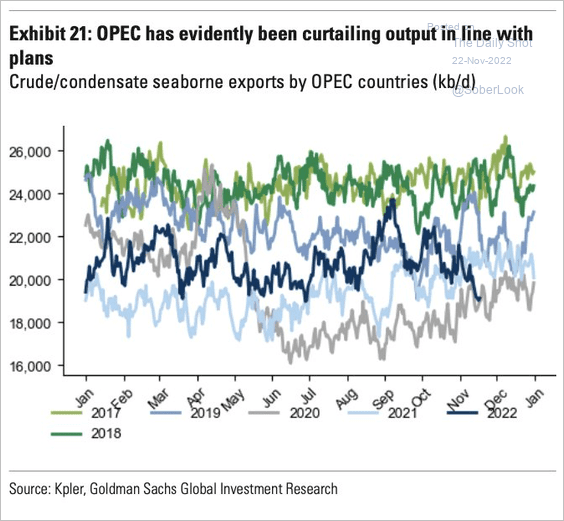

3. OPEC has been taking production down, as promised.

Source: Goldman Sachs

Source: Goldman Sachs

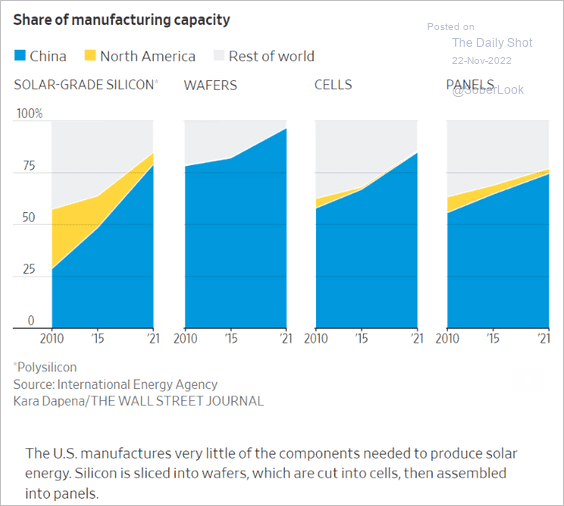

4. This chart illustrates China’s rising control over global solar capacity manufacturing.

Source: @WSJ Read full article

Source: @WSJ Read full article

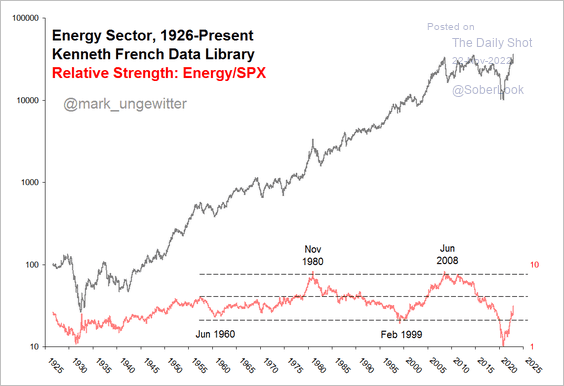

5. Energy stocks are not yet overbought relative to the S&P 500.

Source: @mark_ungewitter

Source: @mark_ungewitter

Back to Index

Equities

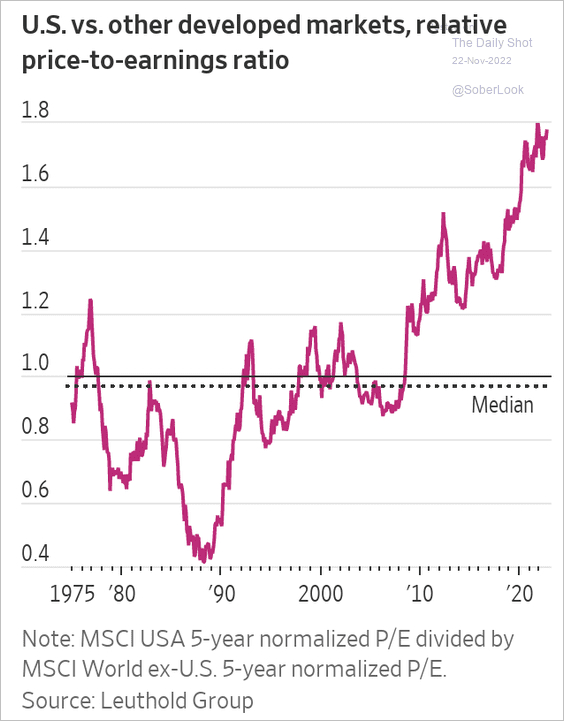

1. US stocks continue to trade at a premium to other advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

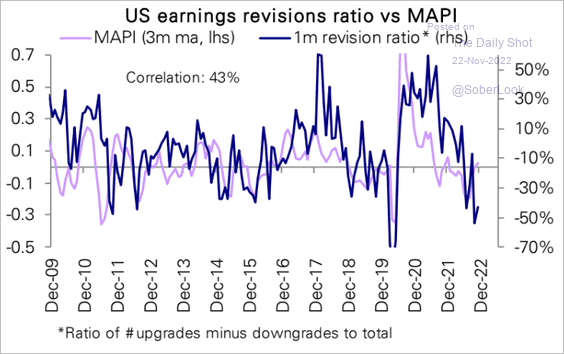

2. Will the pace of earnings downgrades ease as economic surprises turn positive?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

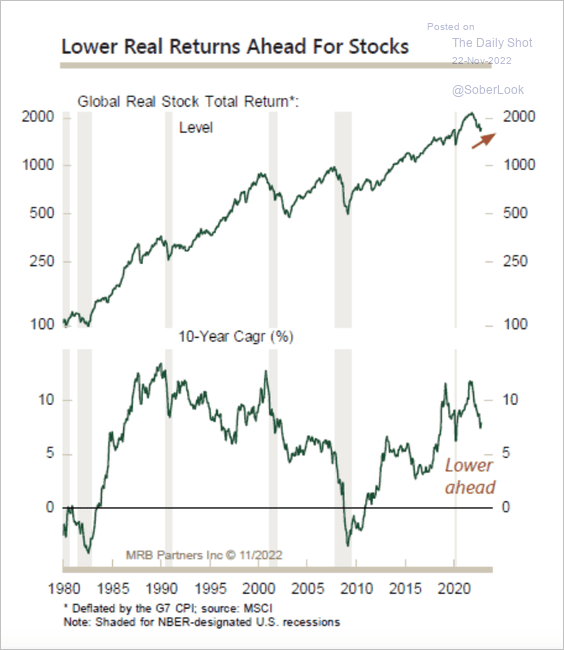

3. MRB Partners expects lower real returns for stocks.

Source: MRB Partners

Source: MRB Partners

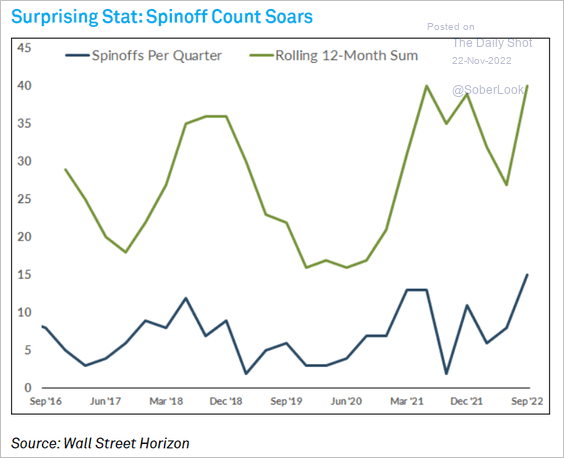

4. The number of corporate spinoffs jumped this year.

Source: @FactSet Read full article

Source: @FactSet Read full article

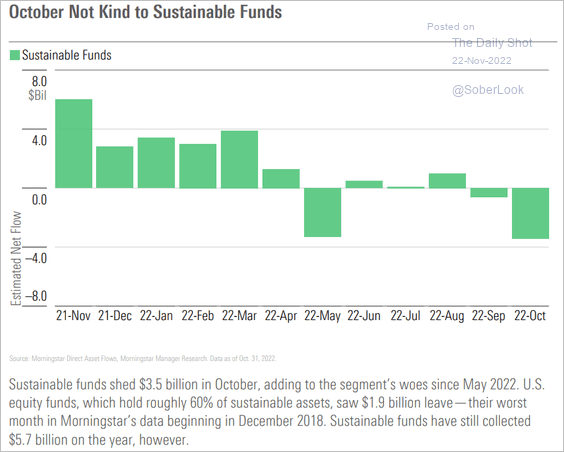

5. Sustainable funds saw outflows in October.

Source: Morningstar

Source: Morningstar

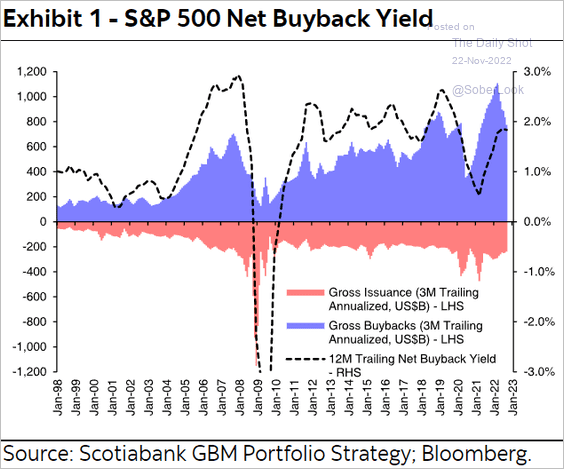

6. The S&P 500 buyback yield is back near 2%.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

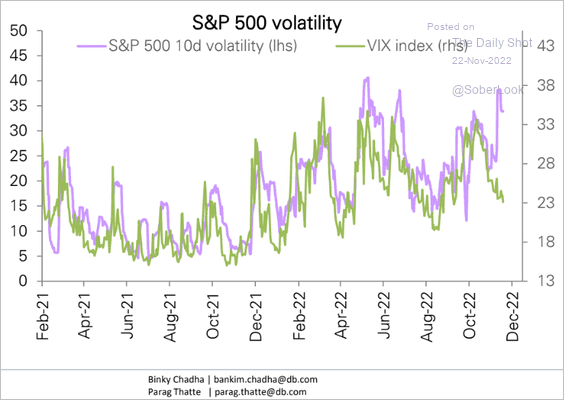

7. Implied and realized volatility indicators have diverged.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

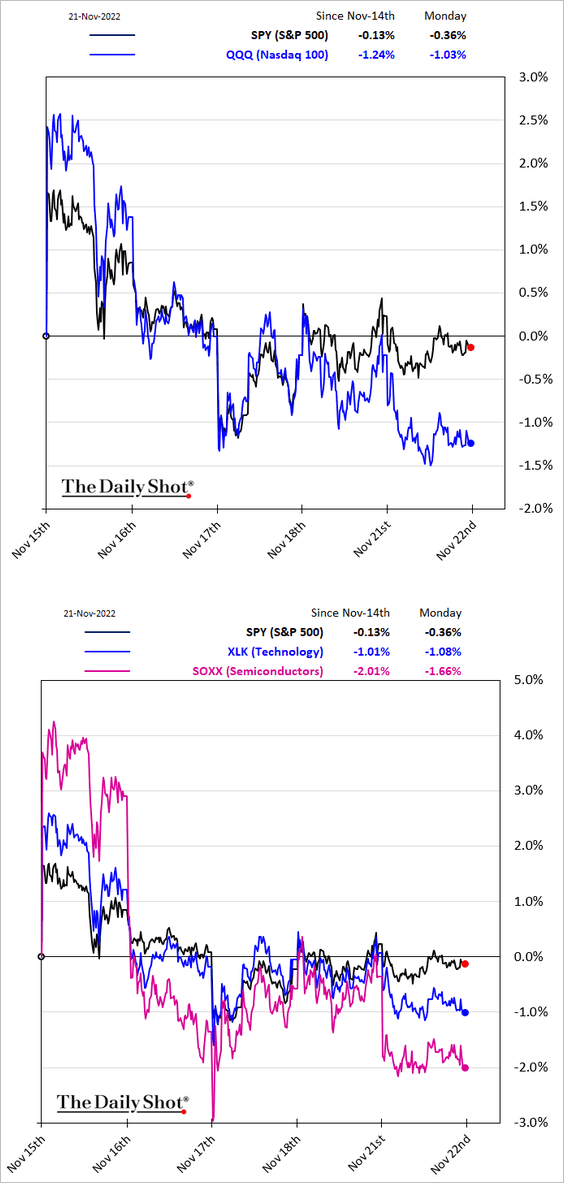

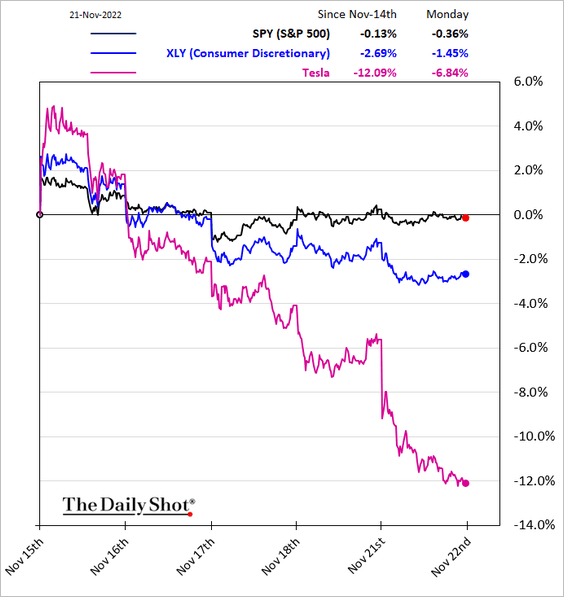

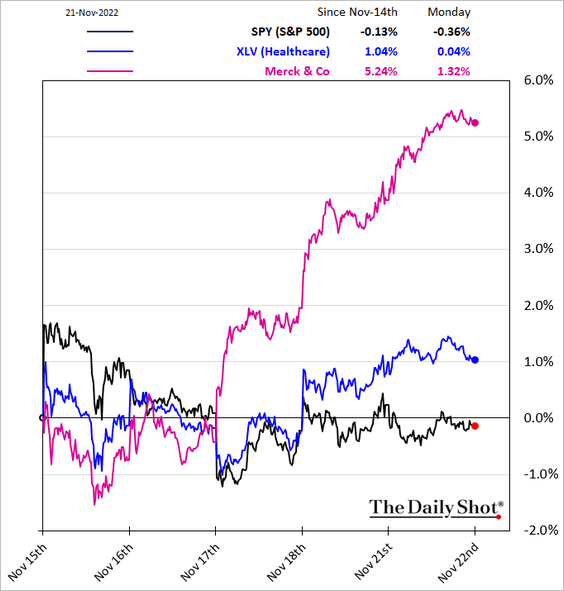

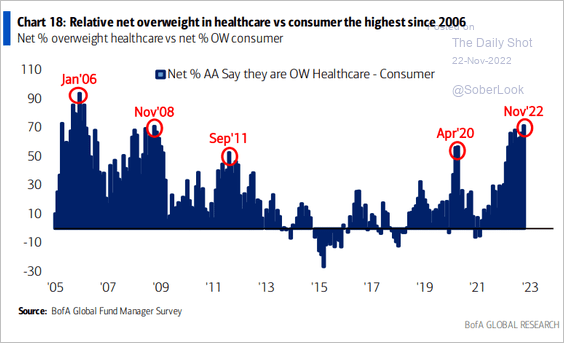

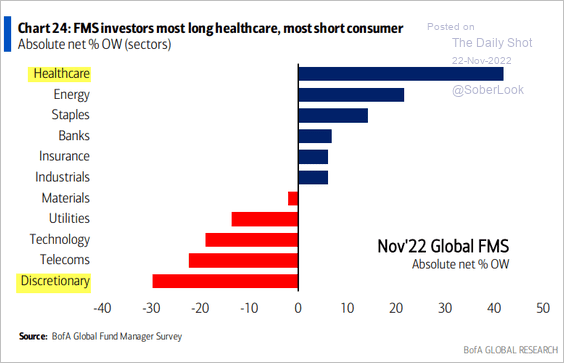

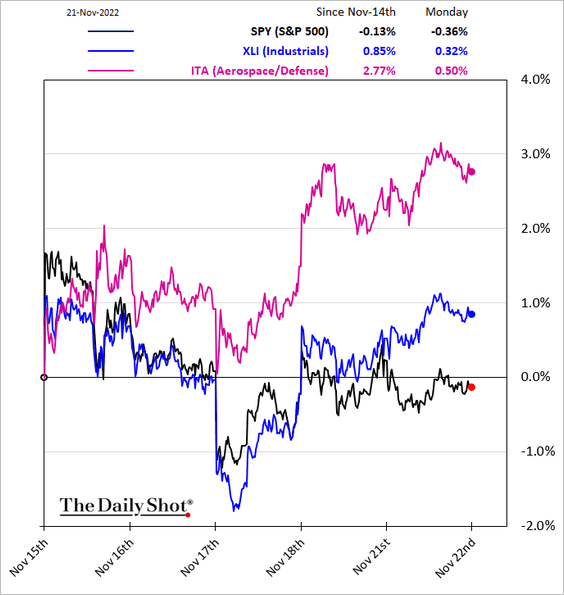

8. Next, we have some sector updates.

• Tech and consume discretionary shares underperformed on Monday.

• Healthcare outperformed.

Here is fund managers’ positioning in healthcare vs. the consumer sector (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

——————–

• Industrials have been outperforming.

Back to Index

Rates

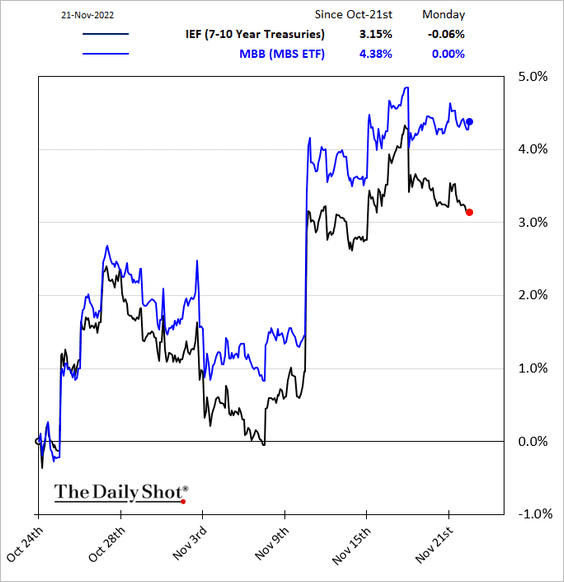

1. Mortgage bonds have been outperforming Treasuries in recent days, …

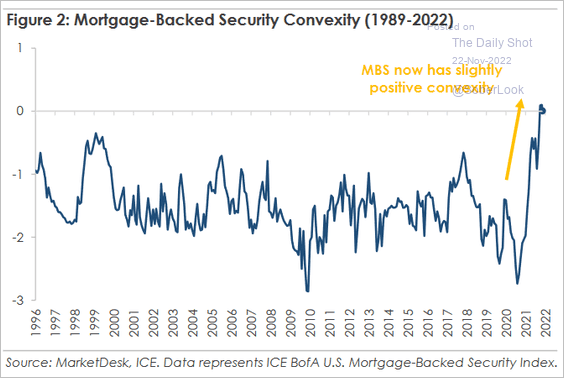

… as convexity turns positive.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

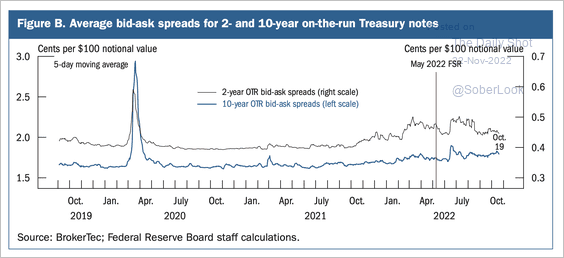

2. The average bid-ask spreads for Treasury notes remain moderately wide, although well below the pandemic peak in 2020.

Source: Federal Reserve Read full article

Source: Federal Reserve Read full article

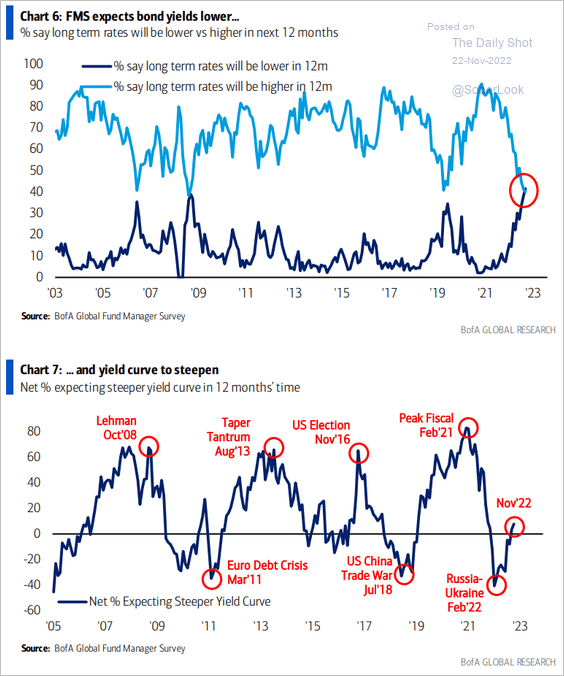

3. Fund managers see lower yields and a steeper curve ahead.

Source: BofA Global Research

Source: BofA Global Research

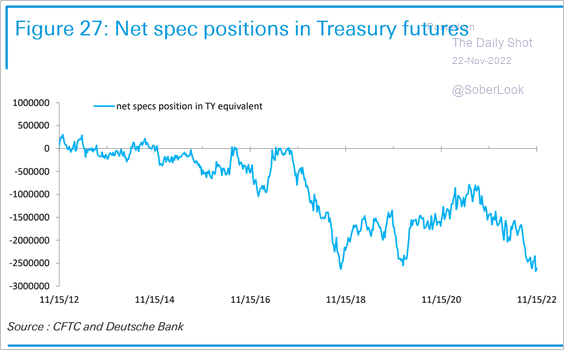

4. Speculative accounts remain very short rate futures.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

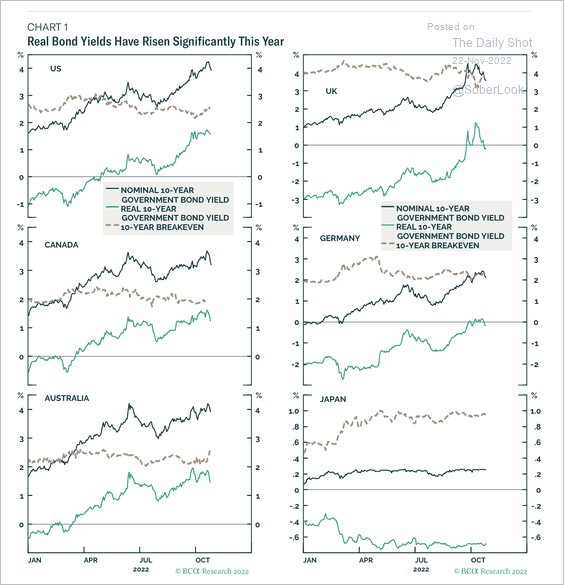

1. The increase in bond yields has been concentrated in the real component as inflation expectations have remained broadly stable.

Source: BCA Research

Source: BCA Research

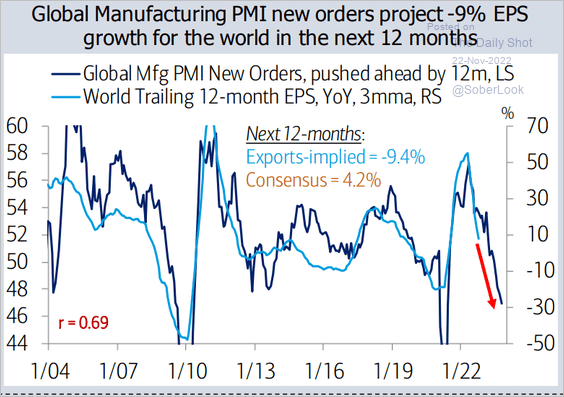

2. The manufacturing PMI signals a global earnings recession.

Source: BofA Global Research

Source: BofA Global Research

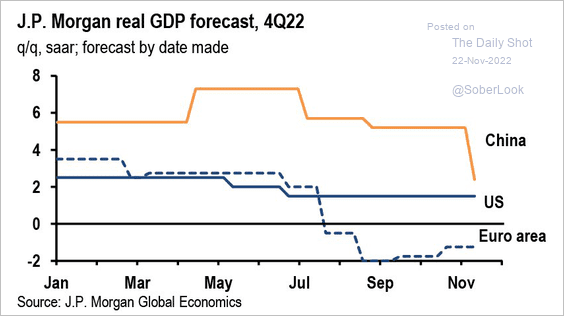

4. Here is JP Morgan’s Q4 growth forecast for the three largest economies.

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

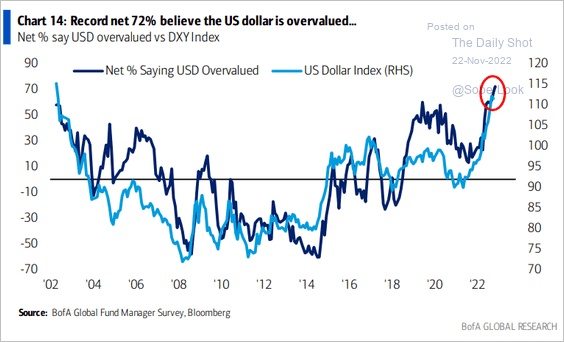

5. Fund managers increasingly view the US dollar as overvalued, …

Source: BofA Global Research

Source: BofA Global Research

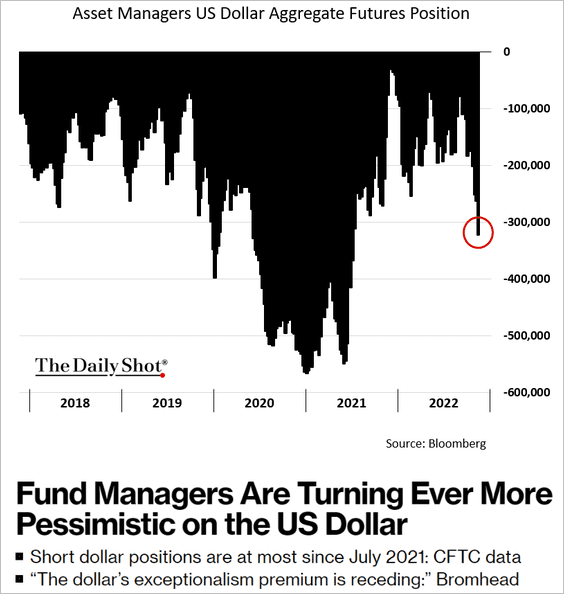

… boosting their bets against the greenback.

Source: @markets, @Ruth_Liew10 Read full article

Source: @markets, @Ruth_Liew10 Read full article

——————–

Food for Thought

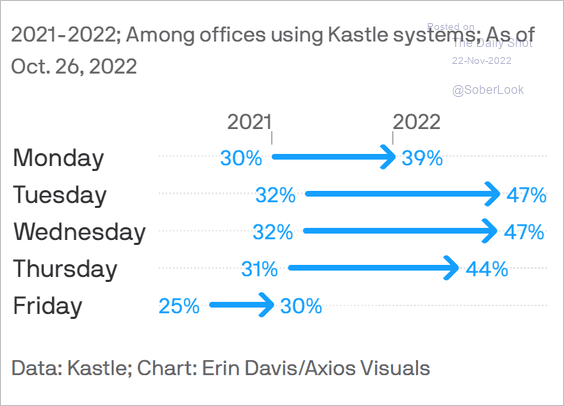

1. Office occupancy rates by day of the week:

Source: @axios Read full article

Source: @axios Read full article

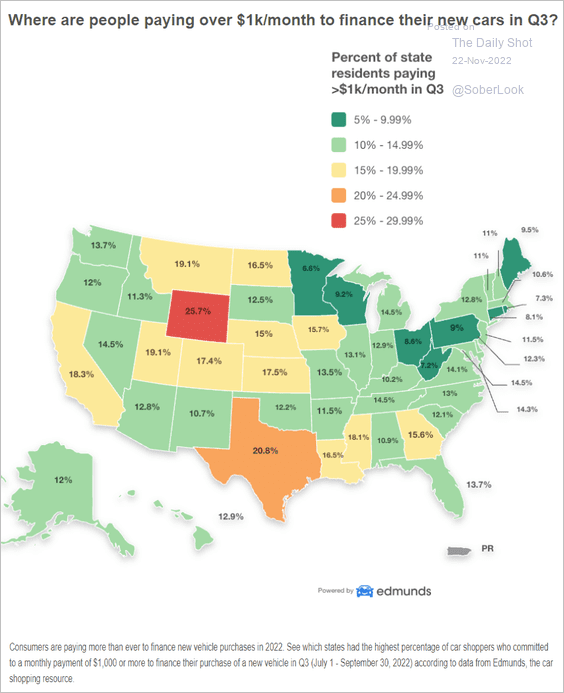

2. Paying over $1k per month for a new car:

Source: Edmunds

Source: Edmunds

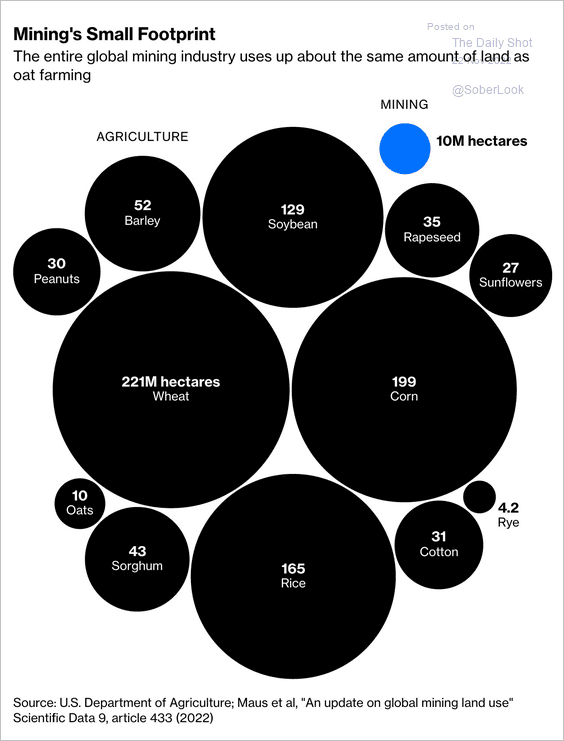

3. Land used for mining:

Source: @BBGVisualData, @opinion, @davidfickling Read full article

Source: @BBGVisualData, @opinion, @davidfickling Read full article

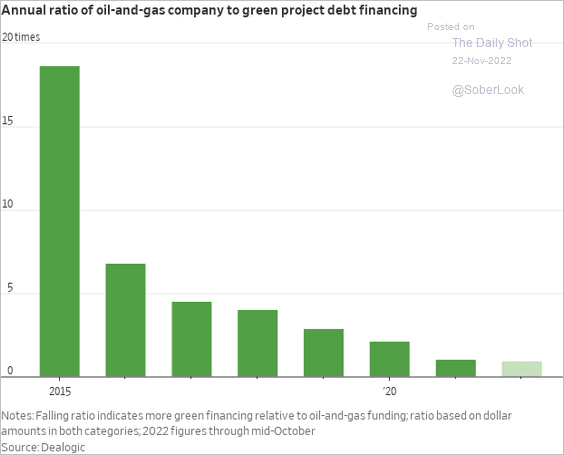

4. Green project debt financing:

Source: @WSJ Read full article

Source: @WSJ Read full article

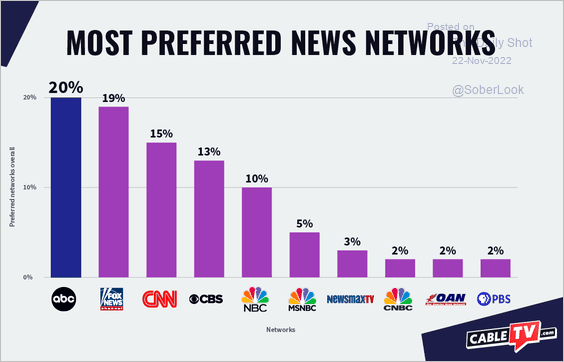

5. Preferred news networks:

Source: CableTV Read full article

Source: CableTV Read full article

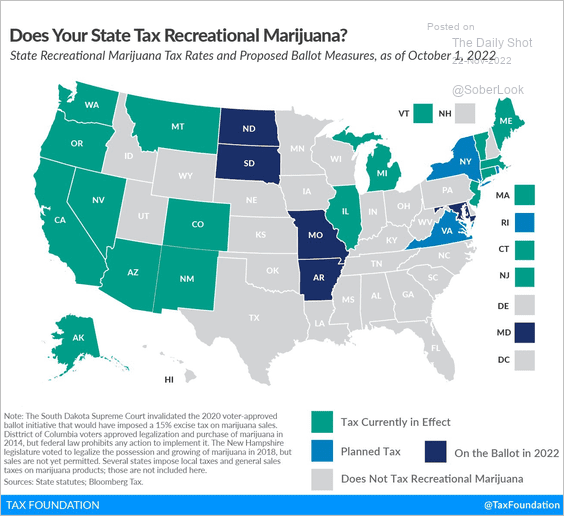

6. State tax on recreational marijuana:

Source: @TaxFoundation

Source: @TaxFoundation

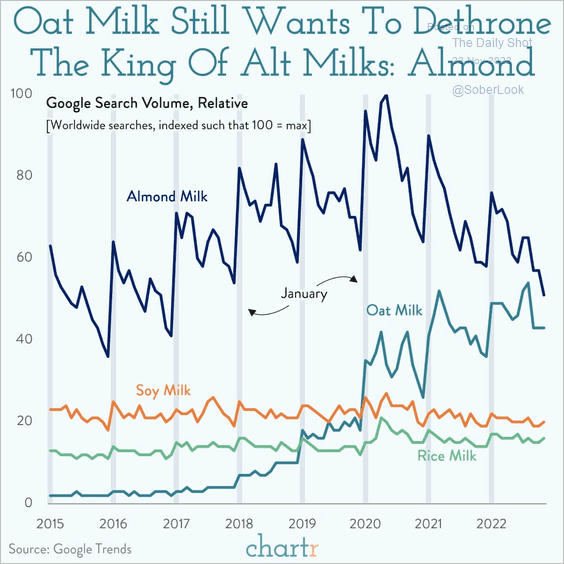

7. Search volume for plant-based milk alternatives:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index