The Daily Shot: 23-Nov-22

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

Administrative Update

1. As a reminder, the next Daily Shot will be out on Monday, November 28th.

2. Please note that the Daily Shot search tool can locate individual images, not just posts. To view the chart results, click on the “Image” tab. For example, here are the search results for “Brazil.”

Back to Index

The United States

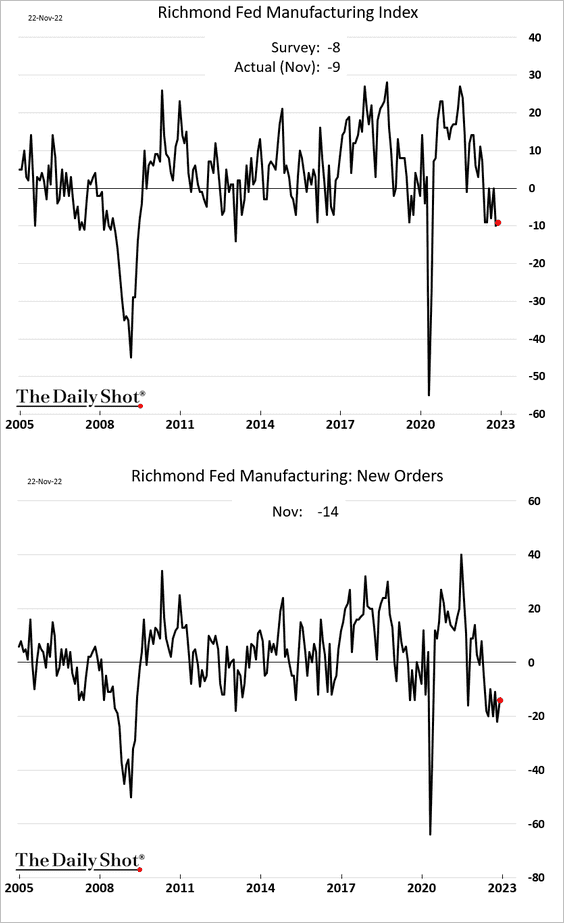

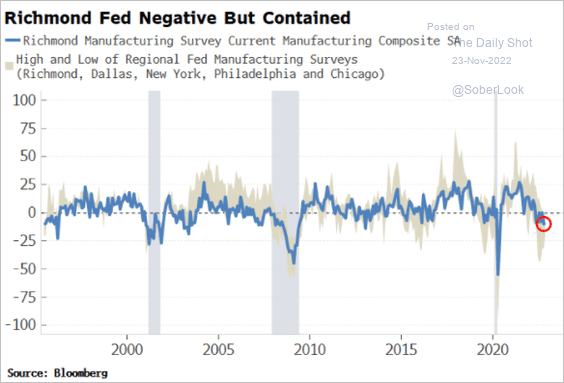

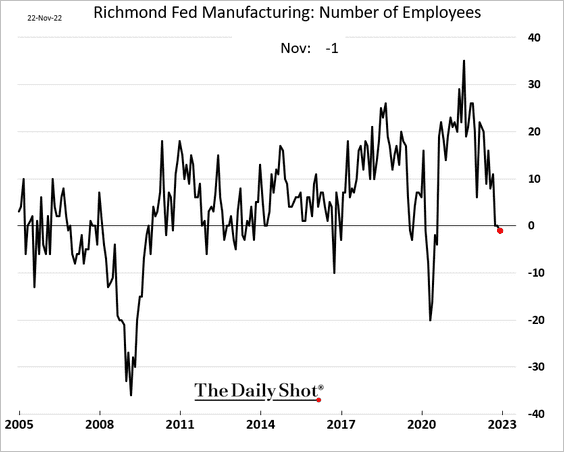

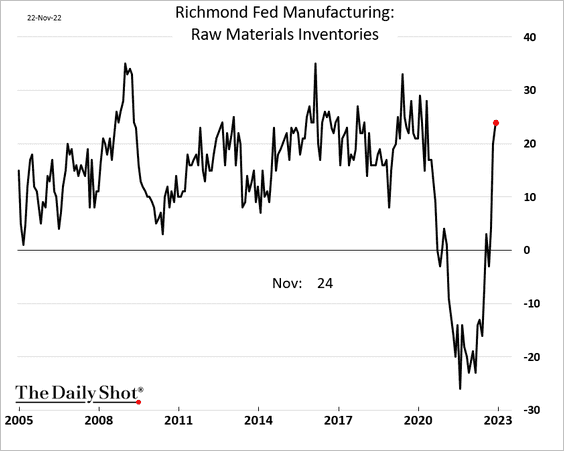

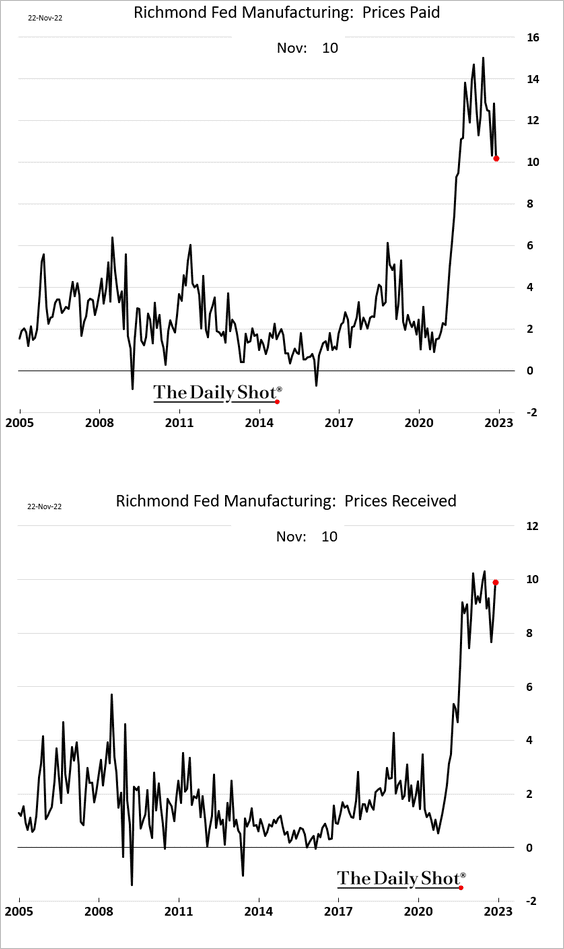

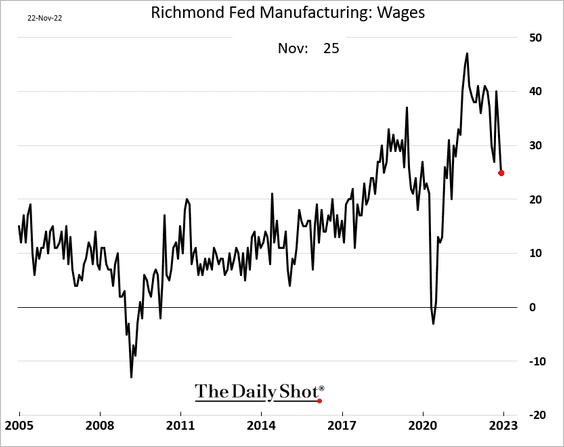

1. The Richmond Fed’s manufacturing index remains in contraction territory.

But it is holding in the upper range of US regional surveys.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

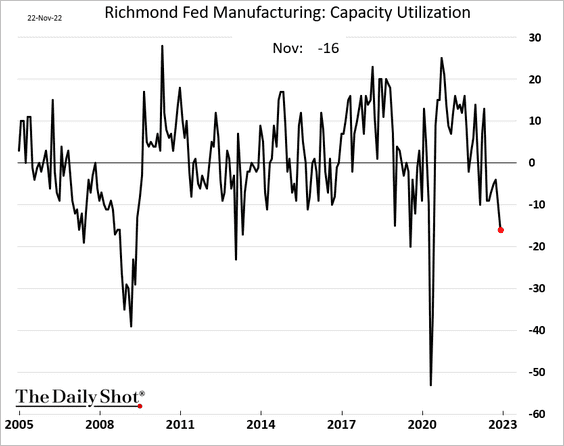

• Capacity utilization is deteriorating.

• Hiring has stopped.

• Raw materials inventory growth is back at pre-COVID levels.

But price pressures persist.

• Wage growth has been moderating.

——————–

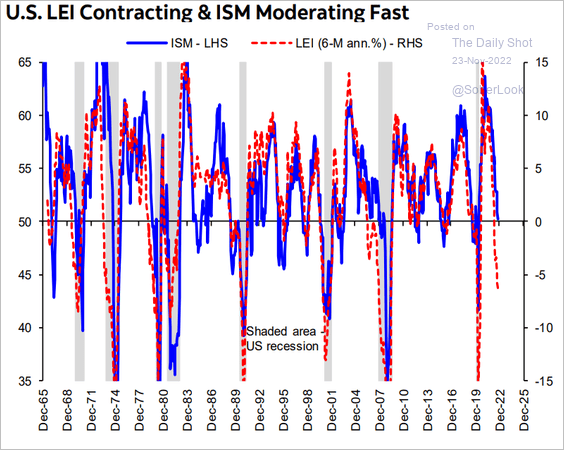

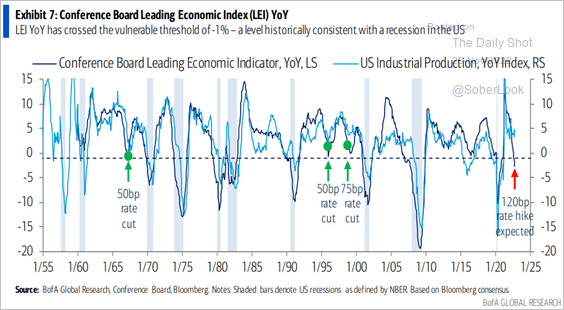

2. The Conference Board’s leading index points to manufacturing weakness ahead (2 charts).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: BofA Global Research

Source: BofA Global Research

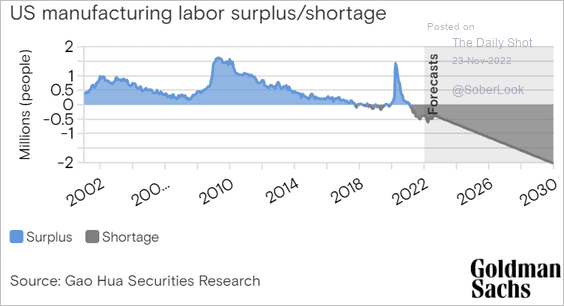

3. Over the long run, US manufacturers will increasingly face labor shortages.

Source: Goldman Sachs

Source: Goldman Sachs

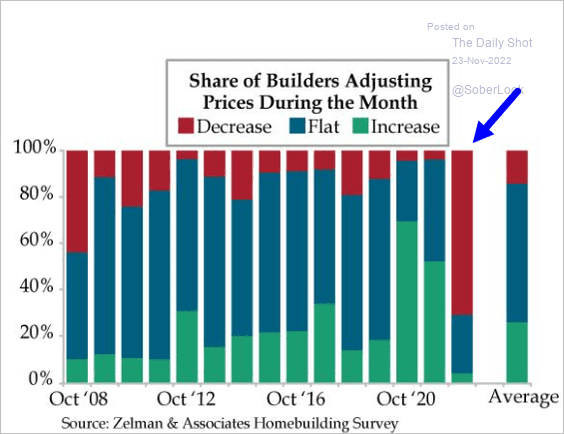

4. Homebuilders have been rapidly cutting prices.

Source: Quill Intelligence

Source: Quill Intelligence

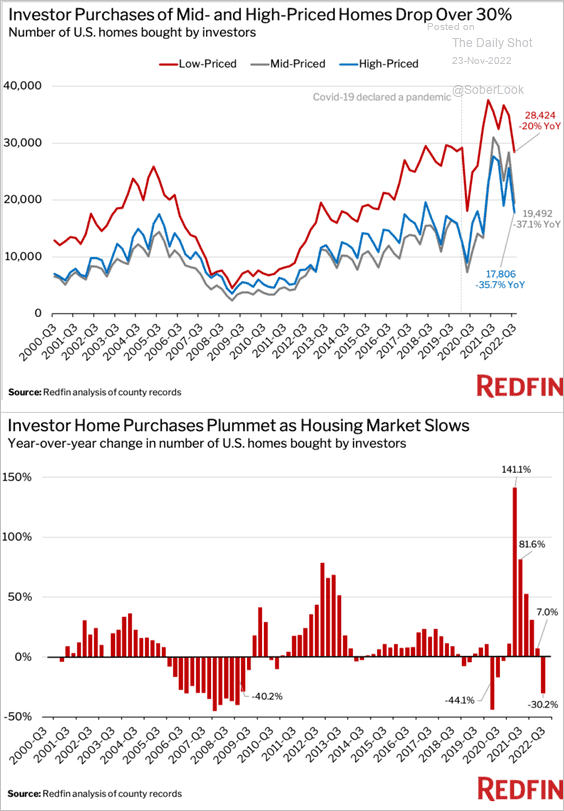

• Home purchases by investors declined sharply last quarter.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Redfin

Source: Redfin

——————–

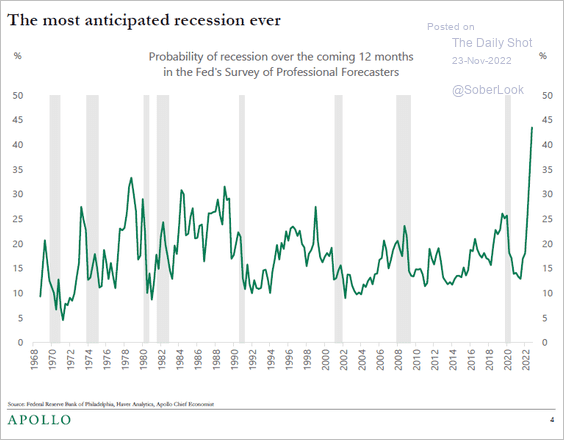

5. The looming recession has been highly anticipated.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

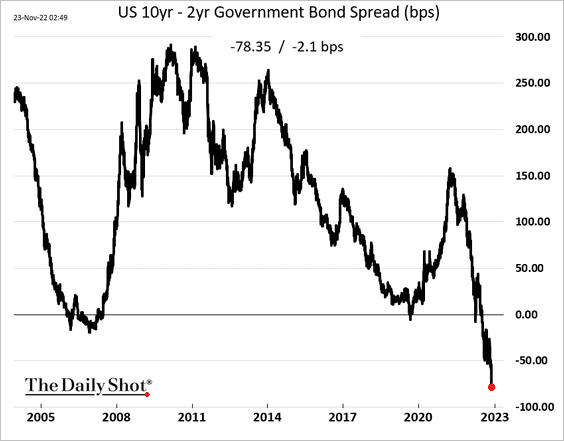

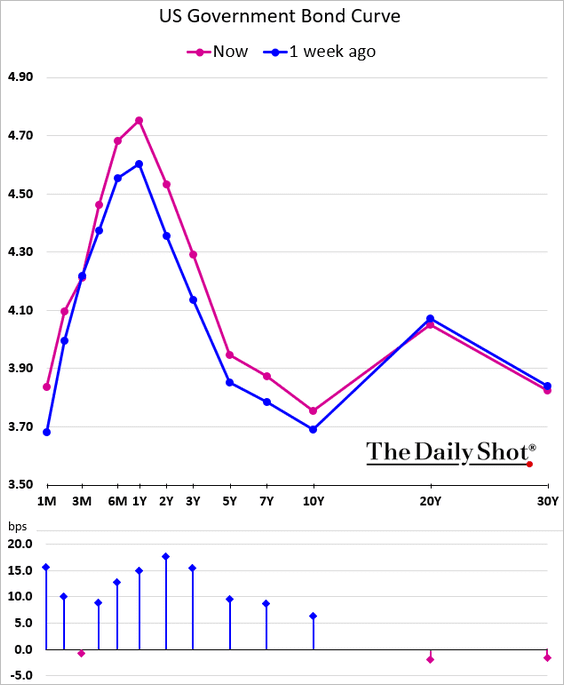

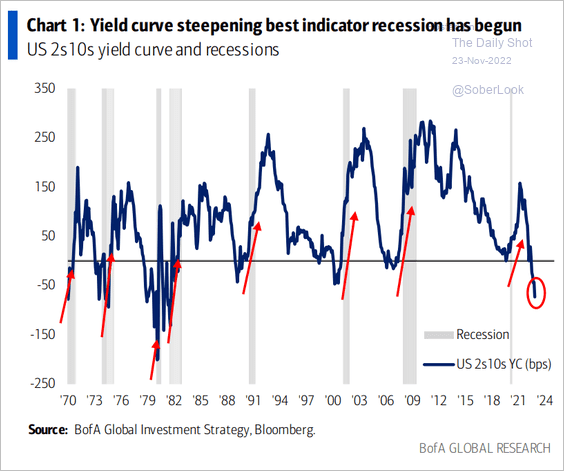

The yield curve inversion continues to hit multi-decade extremes.

The recession typically starts shortly after the yield curve begins to steepen again.

Source: BofA Global Research

Source: BofA Global Research

——————–

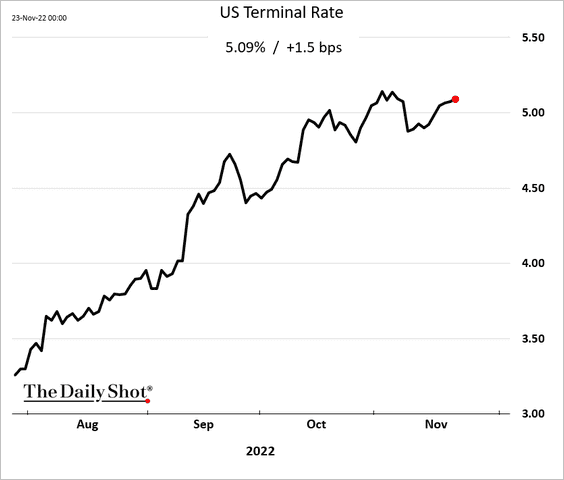

6. The terminal rate is back above 5%. Here is the market pricing for the maximum fed funds rate in the current cycle.

Back to Index

Canada

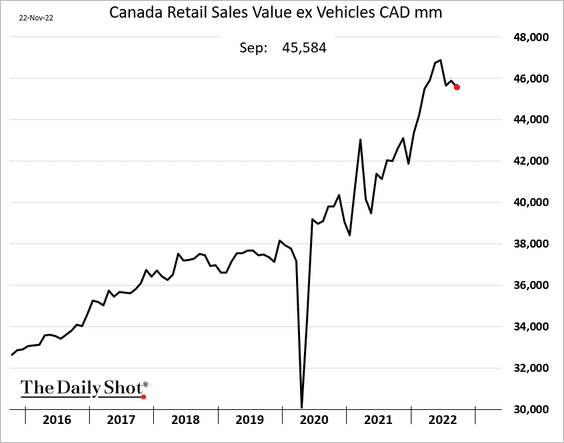

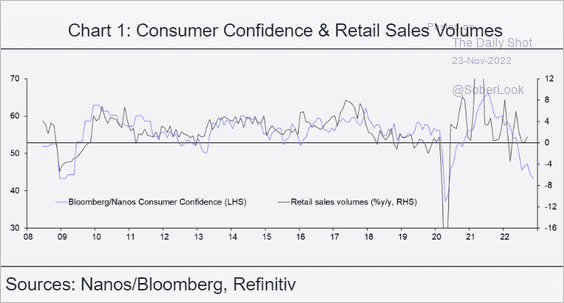

1. Retail sales declined in September, …

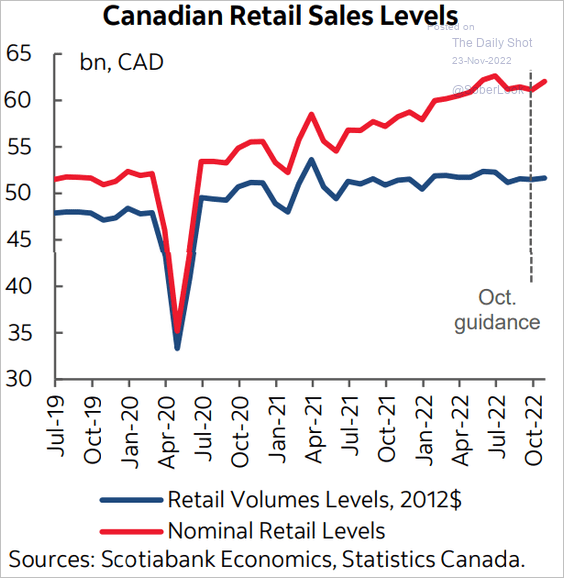

… but they probably rebounded last month. Real retail sales have been relatively flat.

Source: Scotiabank Economics

Source: Scotiabank Economics

Weak consumer confidence points to a deterioration in retail sales in the months ahead.

Source: Capital Economics

Source: Capital Economics

——————–

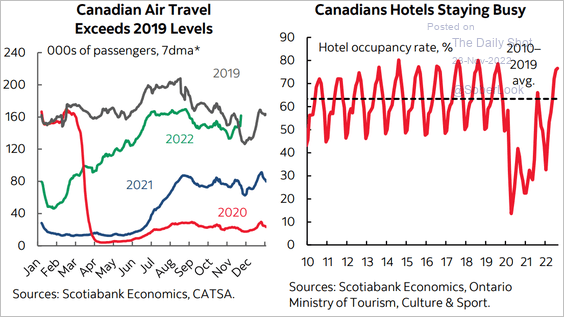

2. Mobility indicators have recovered.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

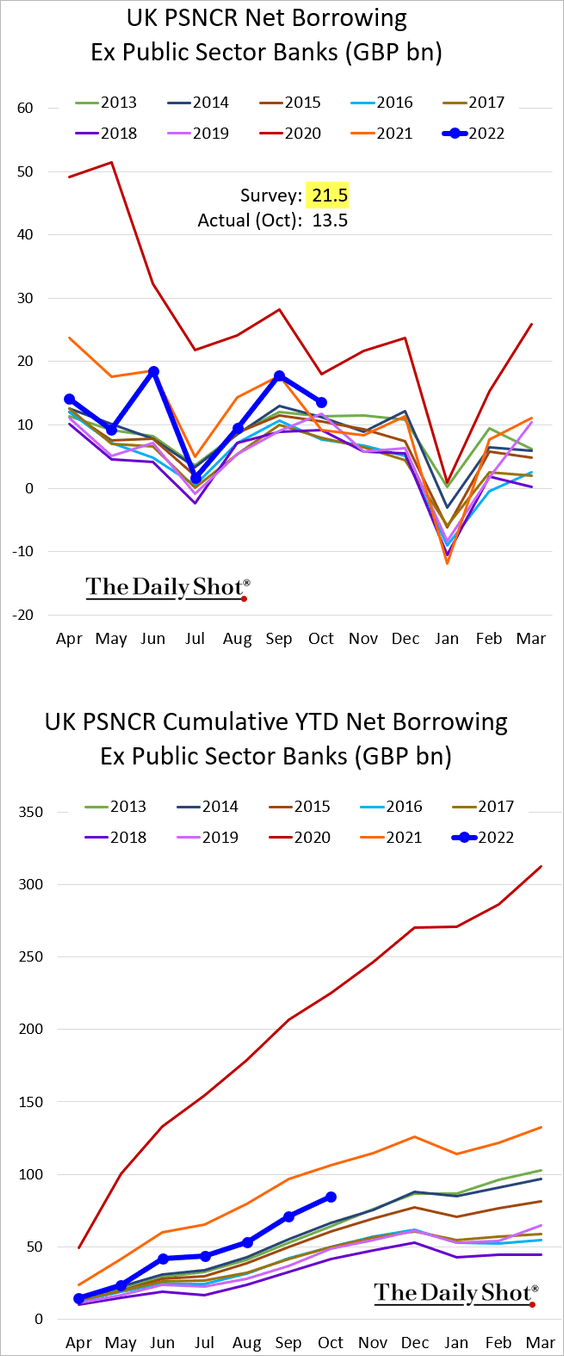

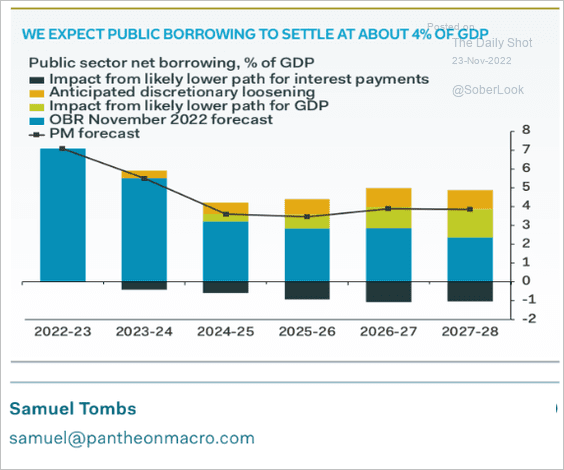

1. Government borrowing was lower than expected last month, but it will accelerate soon.

Source: Reuters Read full article

Source: Reuters Read full article

Here is a long-term forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

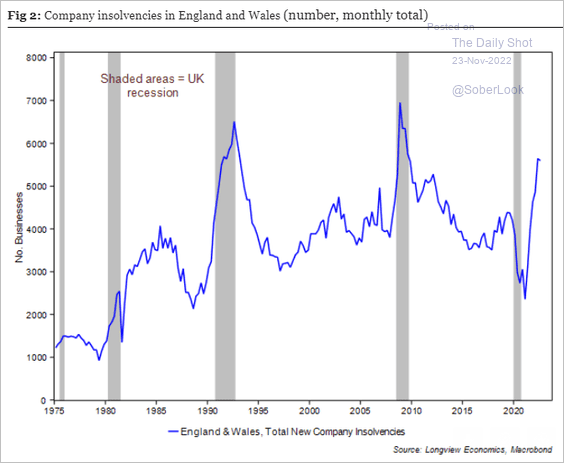

2. Corporate insolvencies have been rising.

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

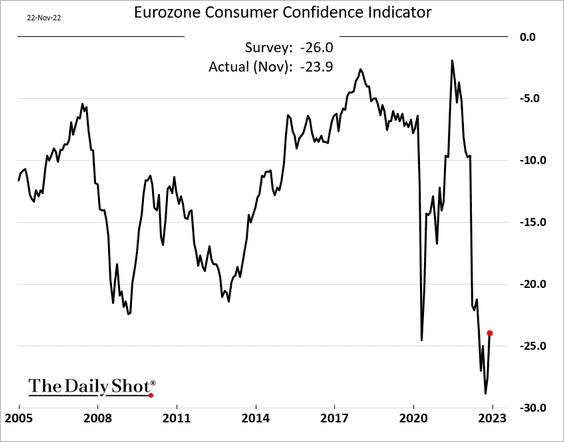

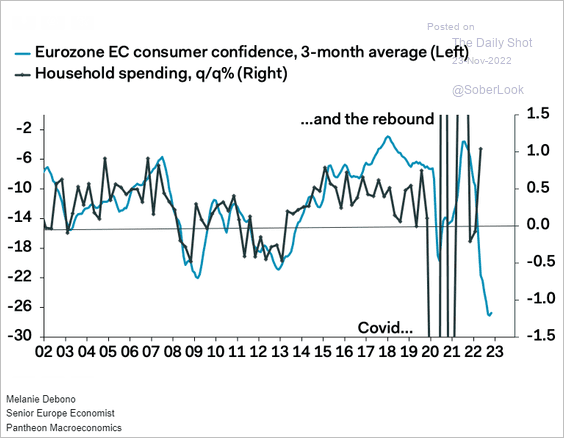

1. Euro-area consumer confidence bounced from the lows this month.

Nonetheless, household spending is headed lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

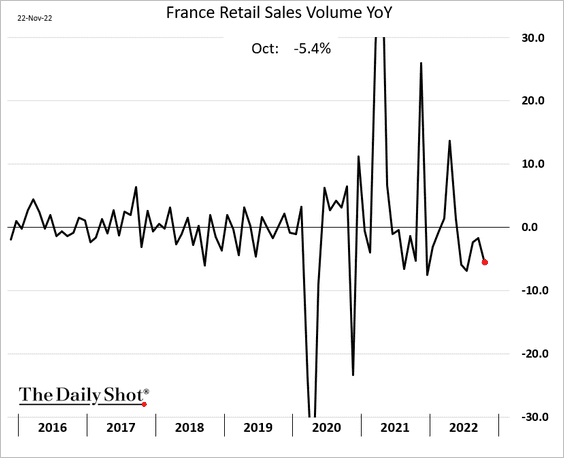

2. French retail sales have been softer (on a year-over-year basis).

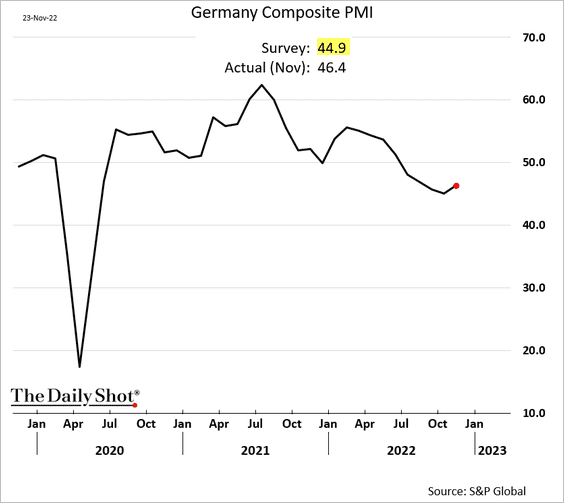

3. Germany’s November composite PMI surprised to the upside. We will have more on the euro-area PMI reports next week.

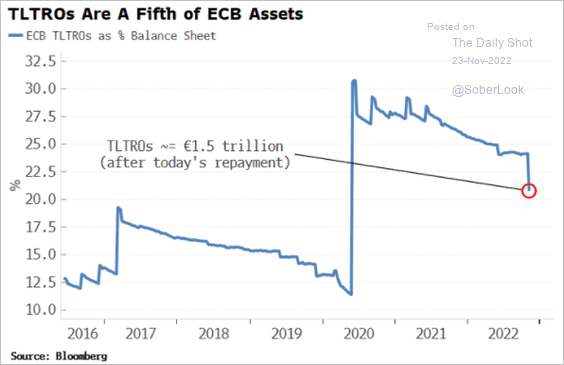

4. The TLTRO repayments are a form of quantitative tightening.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

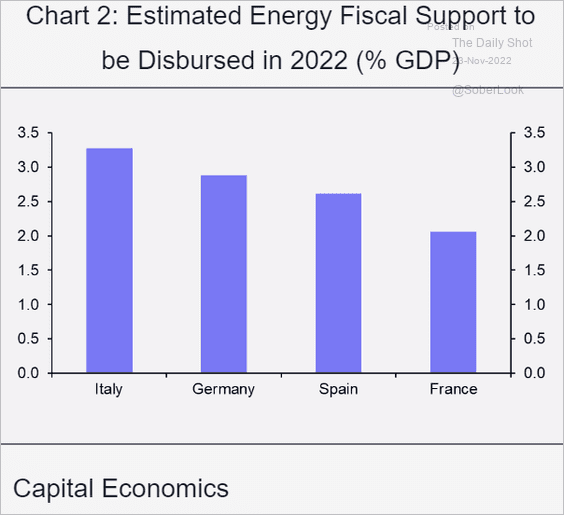

5. How much are governments spending on energy support?

Source: Capital Economics

Source: Capital Economics

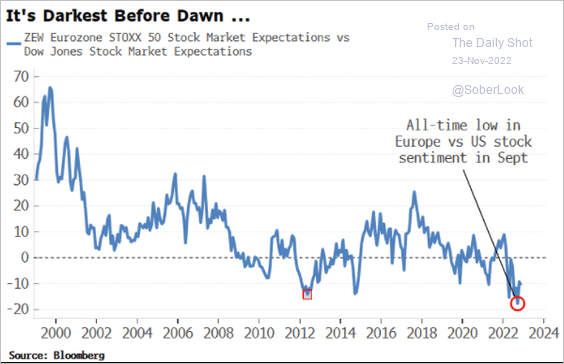

6. Are European stocks about to outperform?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Europe

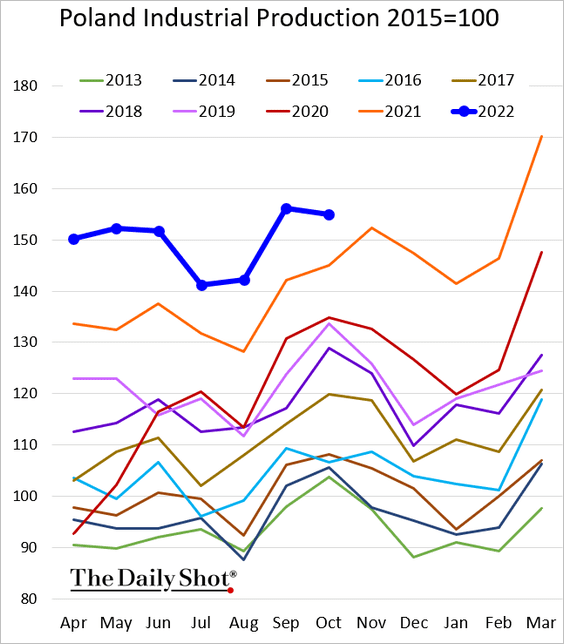

1. Is Poland’s industrial production turning lower?

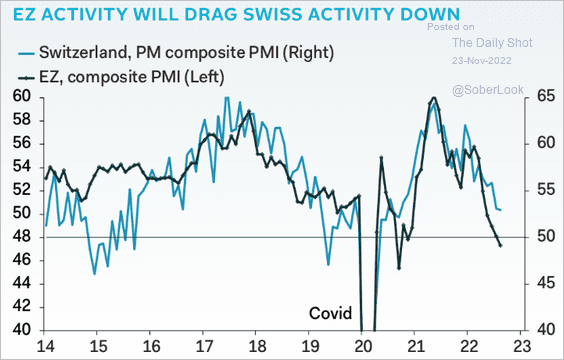

2. Euro-area weakness will be a drag on Swiss economic growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

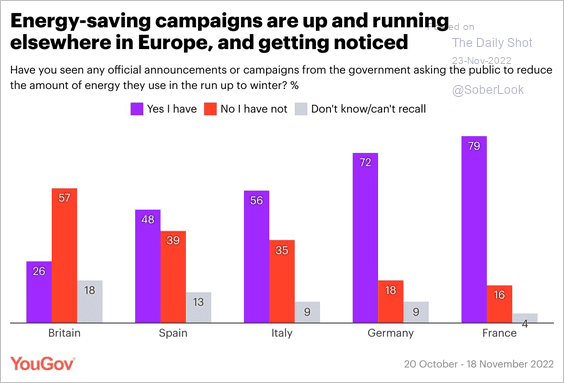

3. Europeans are paying attention to governments’ energy-saving campaigns (except in the UK).

Source: @YouGov Read full article

Source: @YouGov Read full article

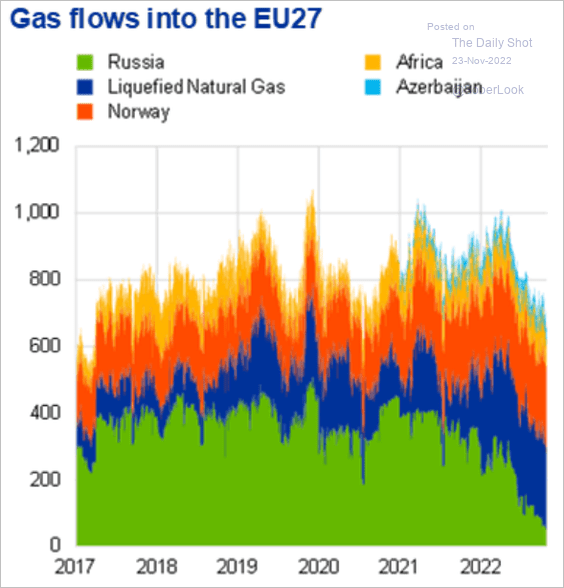

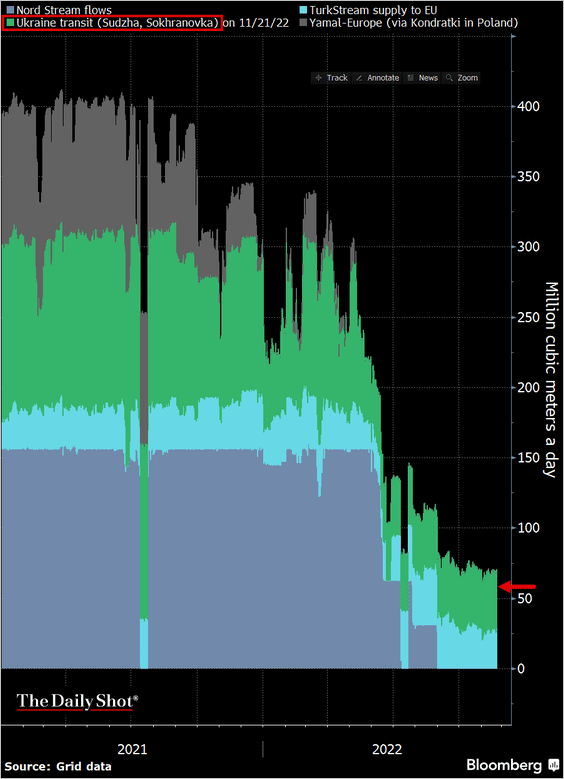

• This chart shows total gas flows to the EU.

Source: BIS Read full article

Source: BIS Read full article

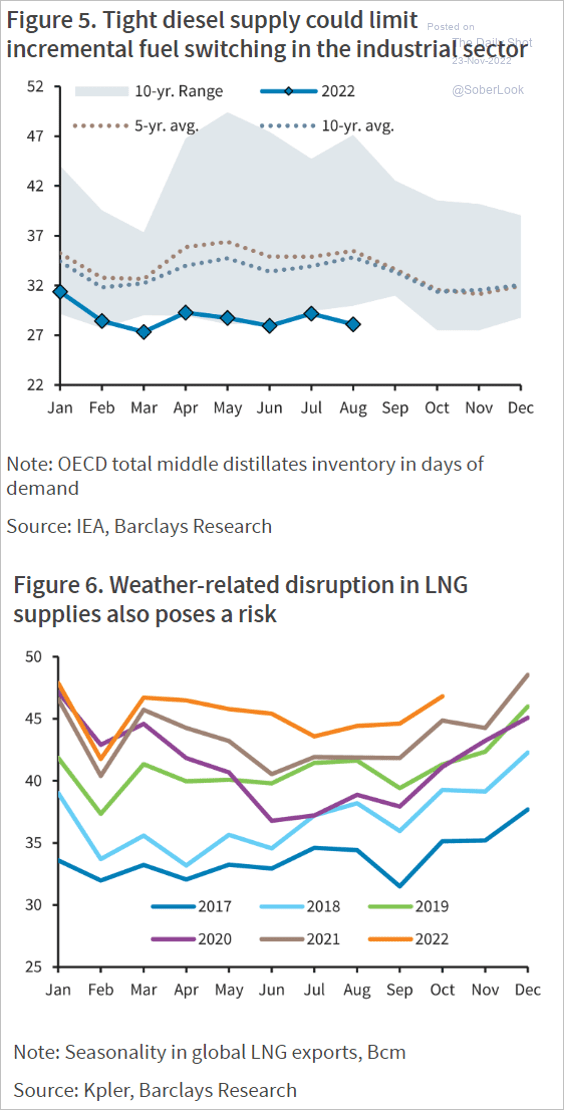

• Europe still faces energy risks this winter.

Source: Barclays Research

Source: Barclays Research

Back to Index

Asia – Pacific

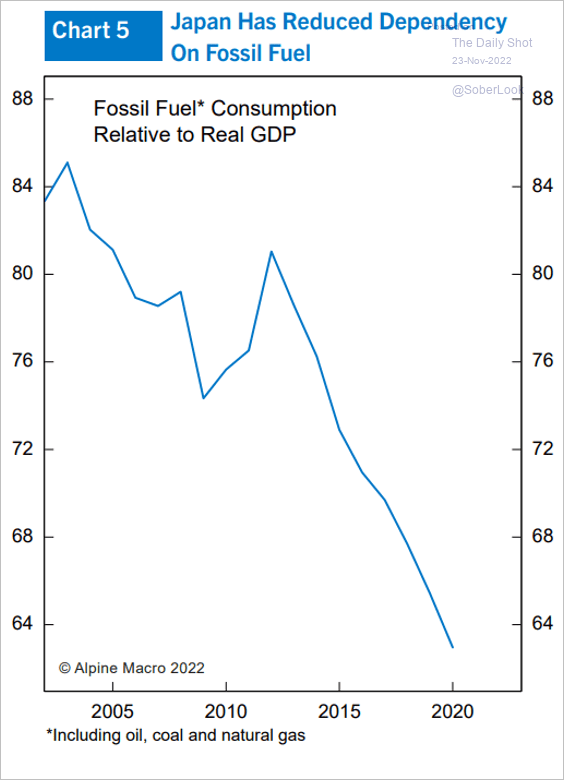

1. Japan has been reducing its dependency on fossil fuels.

Source: Alpine Macro

Source: Alpine Macro

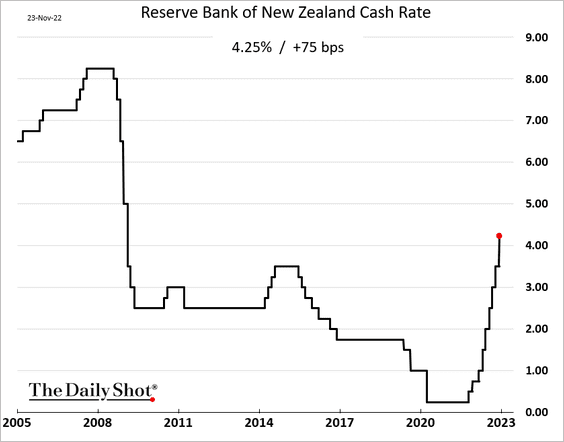

2. The RBNZ delivered a jumbo rate hike amid robust employment trends and elevated inflation.

Source: @WSJ Read full article

Source: @WSJ Read full article

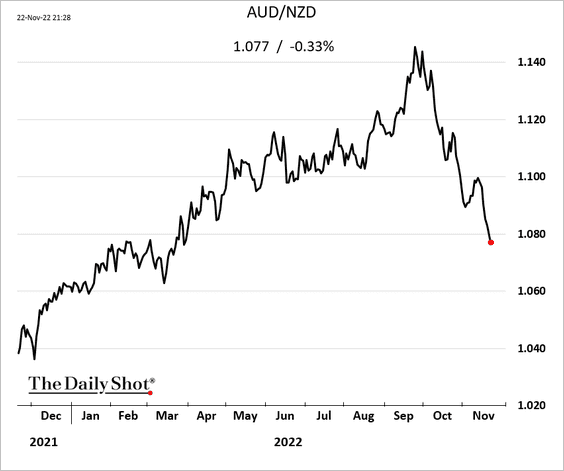

The New Zealand dollar has been strengthening against AUD.

——————–

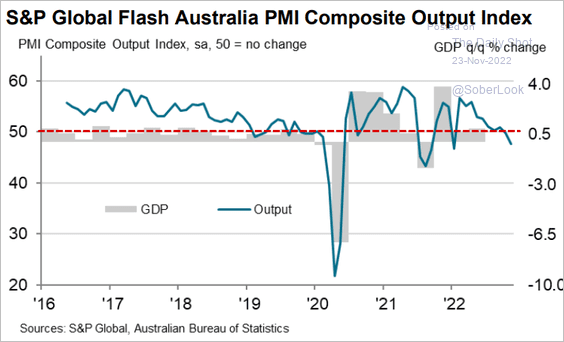

3. Australia’s PMI report showed a contraction in business output this month.

Source: S&P Global PMI

Source: S&P Global PMI

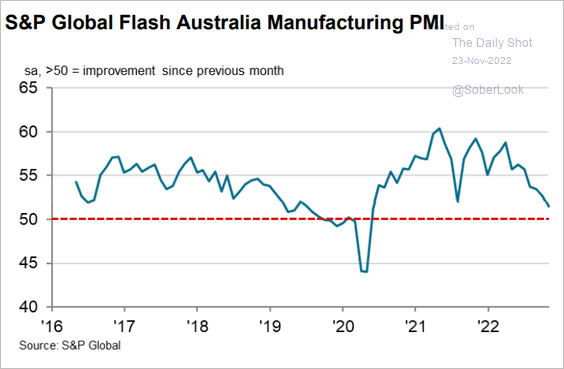

While manufacturing is still in growth territory, …

Source: S&P Global PMI

Source: S&P Global PMI

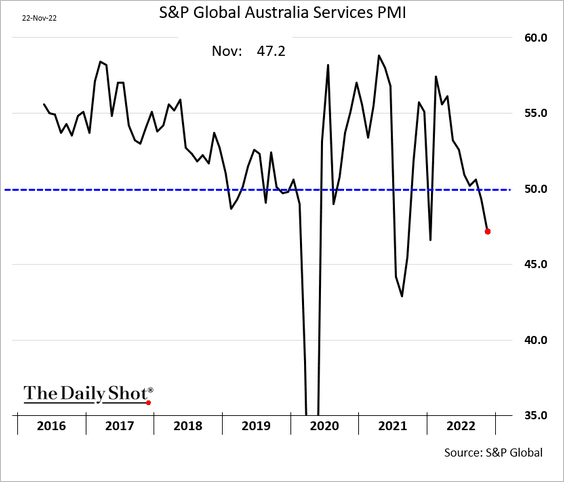

… service firms are struggling.

Back to Index

China

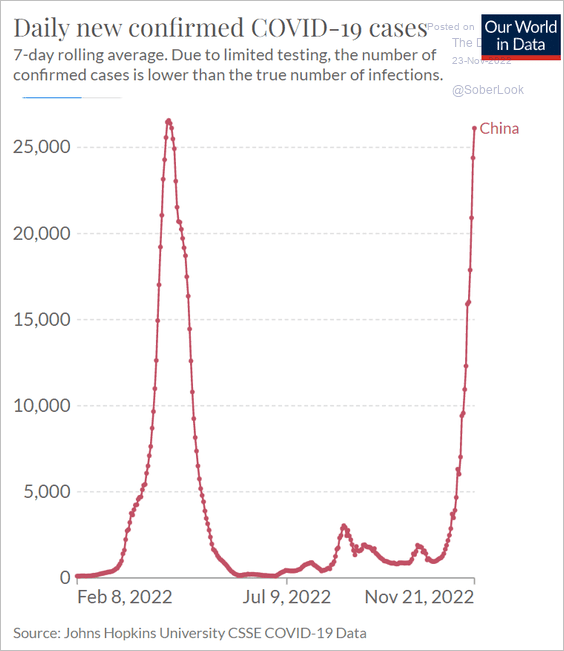

1. New COVID cases are nearing the Shanghai lockdown peak.

Source: Our World in Data

Source: Our World in Data

Source: Reuters Read full article

Source: Reuters Read full article

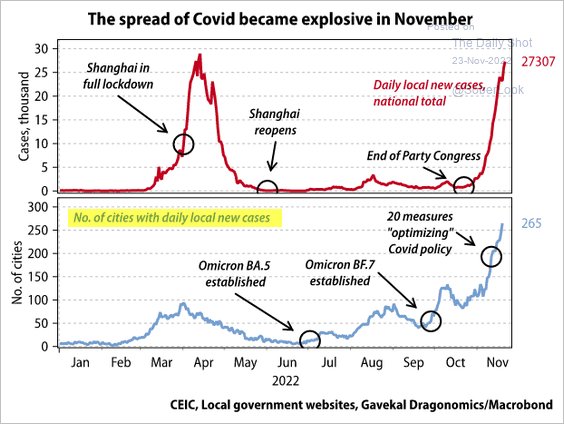

The number of cities in lockdown is surging.

Source: Gavekal Research

Source: Gavekal Research

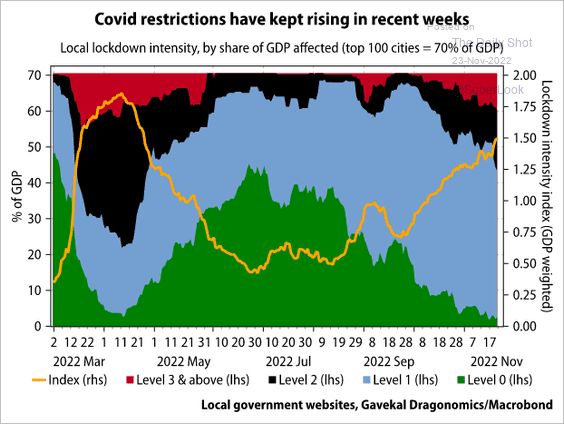

Here is Gavekal’s lockdown intensity index.

Source: Gavekal Research

Source: Gavekal Research

——————–

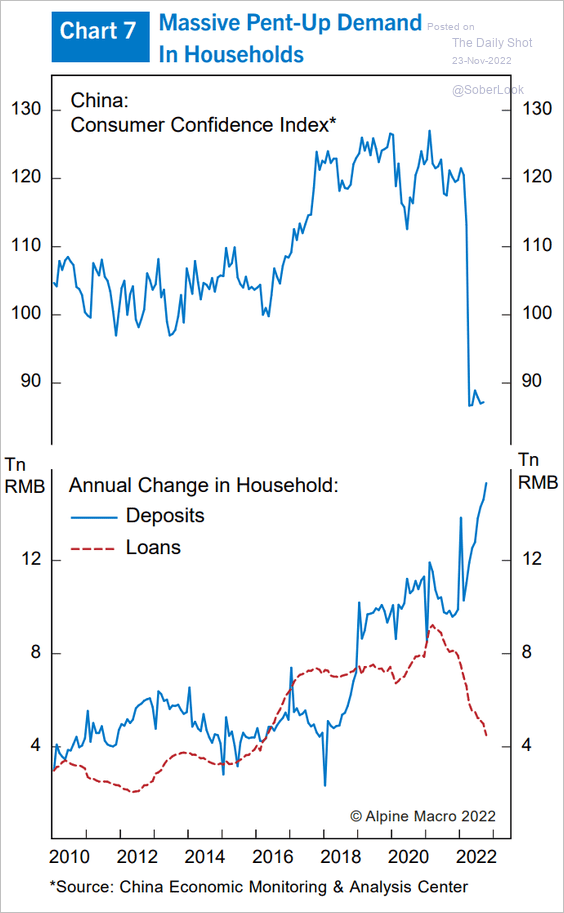

2. Households remain risk-averse.

Source: Alpine Macro

Source: Alpine Macro

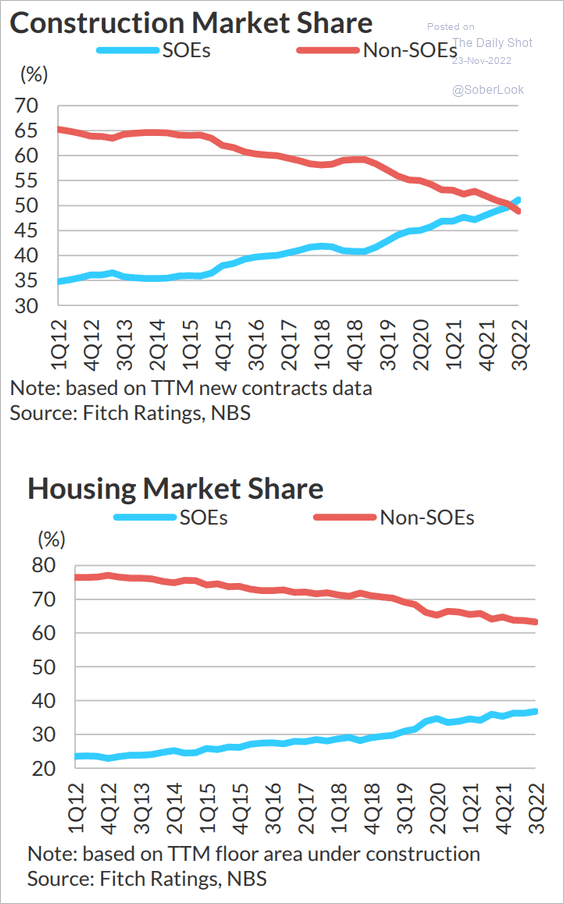

3. State-owned companies increasingly dominate the housing market.

Source: Fitch Ratings

Source: Fitch Ratings

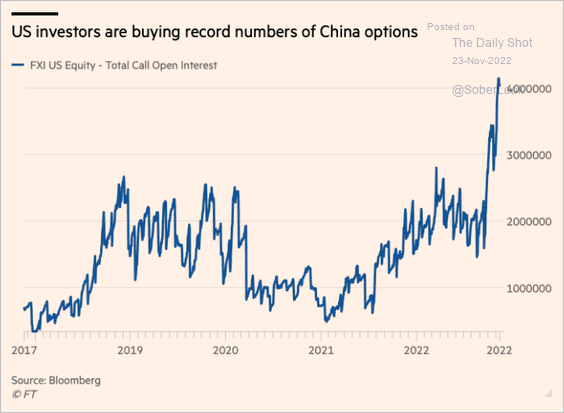

4. Demand for call options on the largest US-based equity ETF has been surging.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

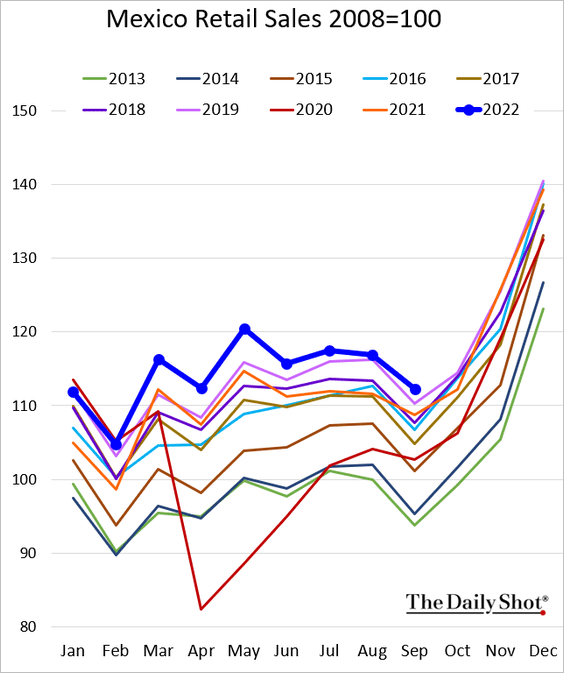

1. Mexico’s retail sales are holding up for now.

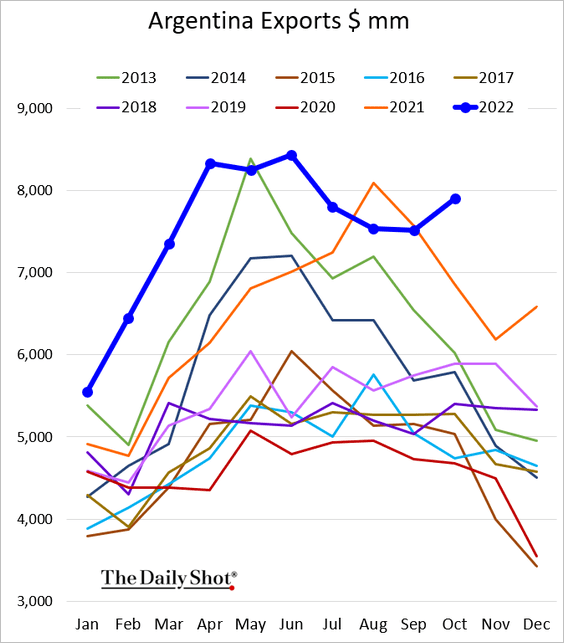

2. Argentina’s exports jumped in October.

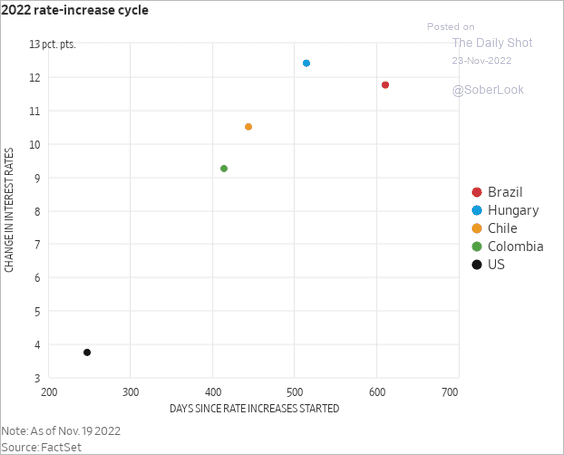

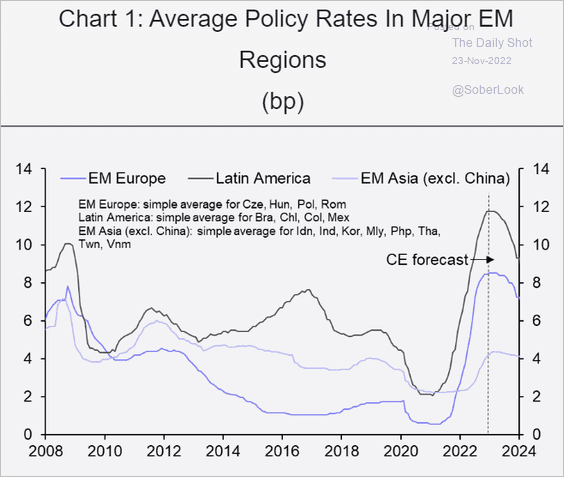

3. Many EM rate hike cycles are well ahead of the Fed.

Source: @WSJ Read full article

Source: @WSJ Read full article

Policy rates are peaking.

Source: Capital Economics

Source: Capital Economics

——————–

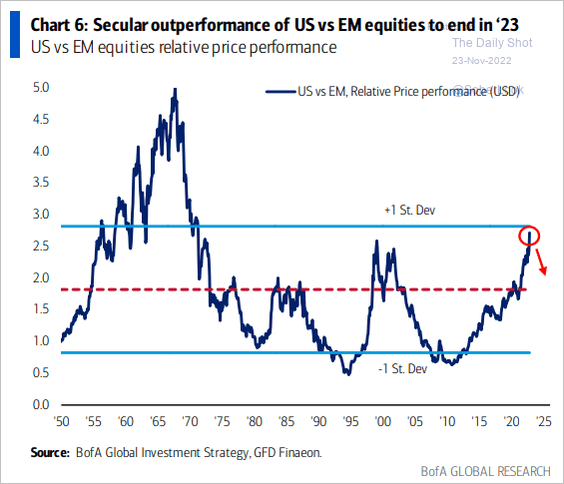

4. Is EM equity underperformance vs. the US about to end?

Source: BofA Global Research

Source: BofA Global Research

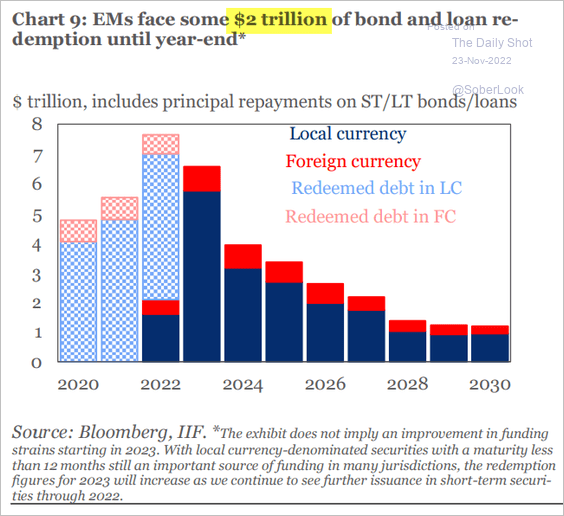

5. There is a lot of EM debt getting refinanced.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

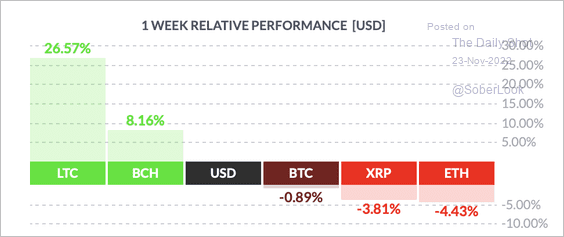

1. Litecoin (LTC) continues to outperform top crypto peers.

Source: FinViz

Source: FinViz

LTC broke above its 40-week moving average.

——————–

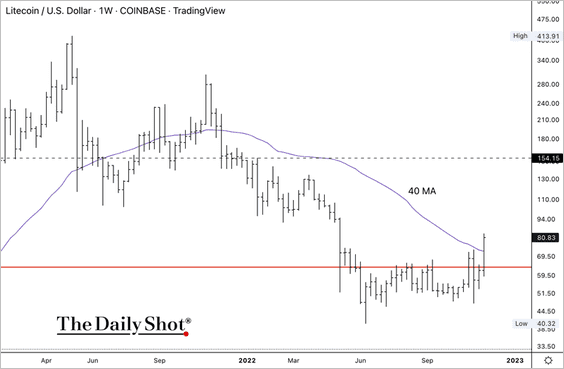

2. Bitcoin has been trading with a beta of 3 to the S&P 500.

Source: @WSJ Read full article

Source: @WSJ Read full article

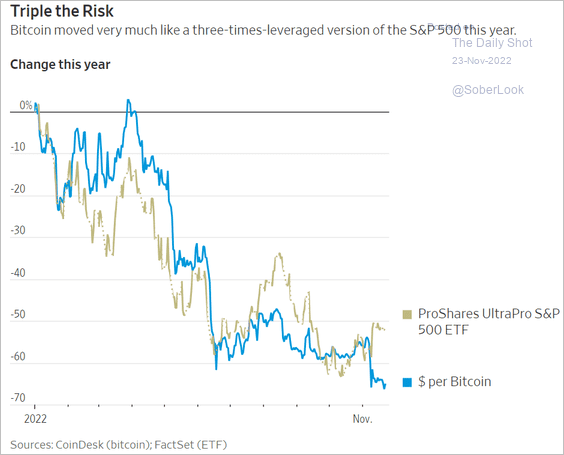

3. Decentralized exchange tokens (DEX) have outperformed centralized exchange tokens (CEX) this month.

Source: @Delphi_Digital

Source: @Delphi_Digital

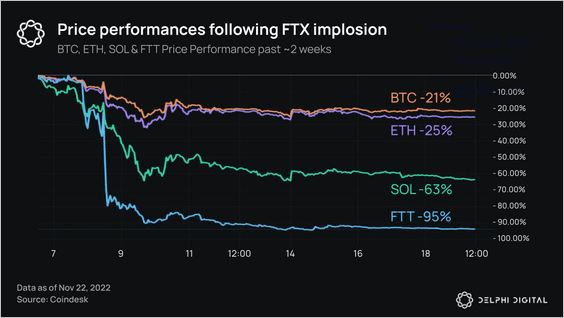

4. Here is a look at crypto performance following the FTX implosion.

Source: @Delphi_Digital

Source: @Delphi_Digital

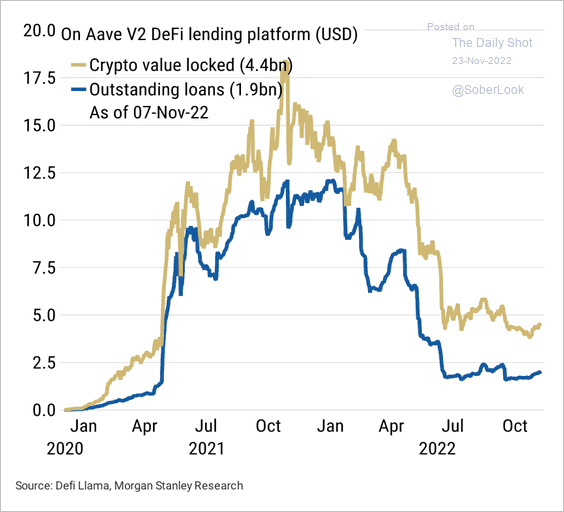

5. Outstanding crypto loans on decentralized finance (DeFi) platforms are down more than 70% from peak levels.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

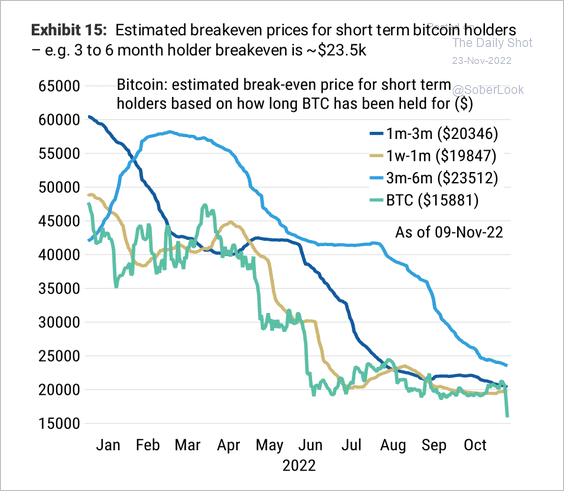

6. The estimated breakeven price for short-term BTC holders is around $23K.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Commodities

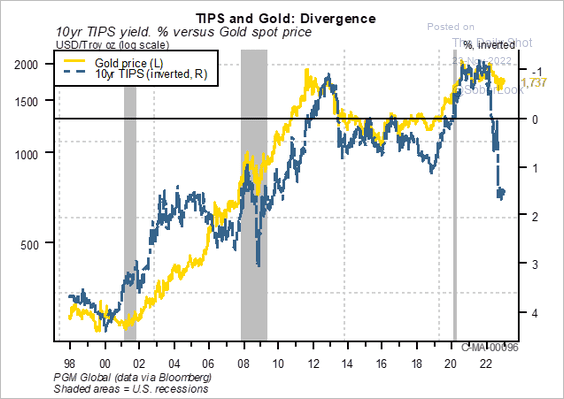

1. The gap between gold and real yields persists.

Source: PGM Global

Source: PGM Global

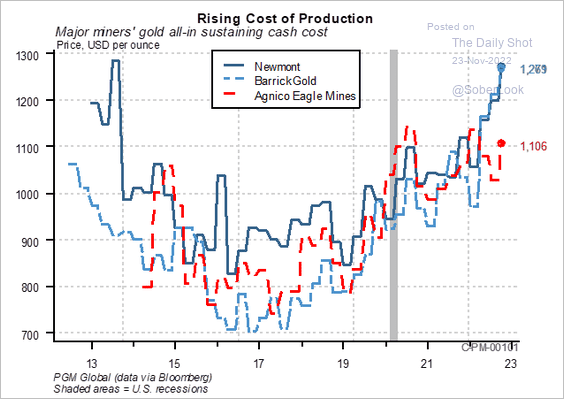

2. Gold production costs have been rising.

Source: PGM Global

Source: PGM Global

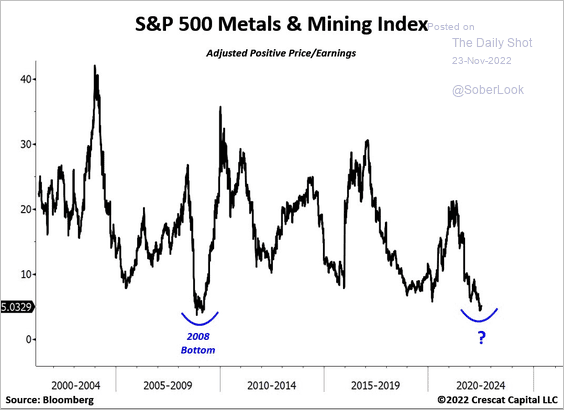

3. Metals & Mining companies look cheap.

Source: @TaviCosta, @CrescatMax

Source: @TaviCosta, @CrescatMax

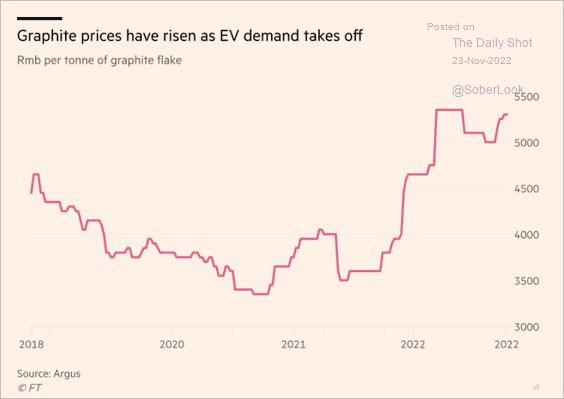

4. Graphite prices are climbing.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Energy

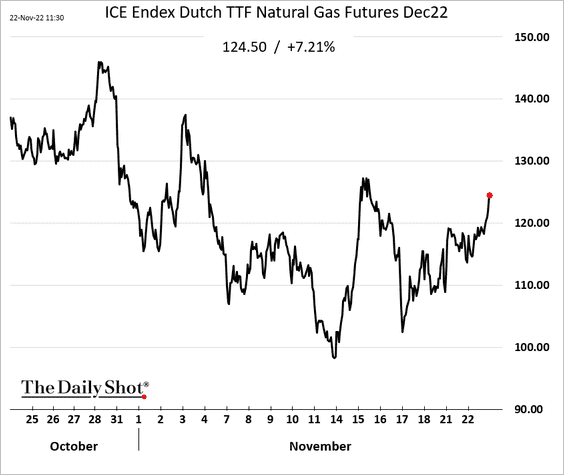

1. Gazprom is threatening to cut the remaining natural gas deliveries to Europe via Ukraine.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @markets, @a_shiryaevskaya, @MaznevaElena Read full article

Source: @markets, @a_shiryaevskaya, @MaznevaElena Read full article

European natural gas prices jumped.

——————–

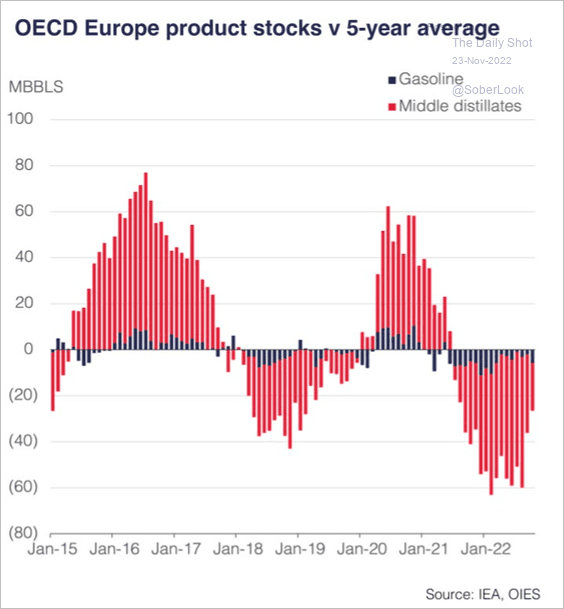

2. Europe’s diesel inventories remain depressed.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

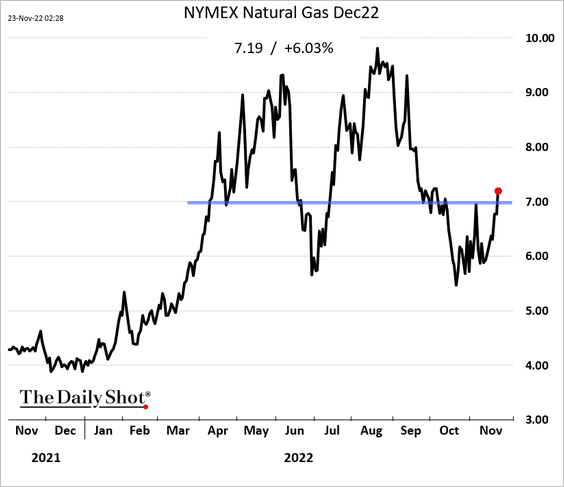

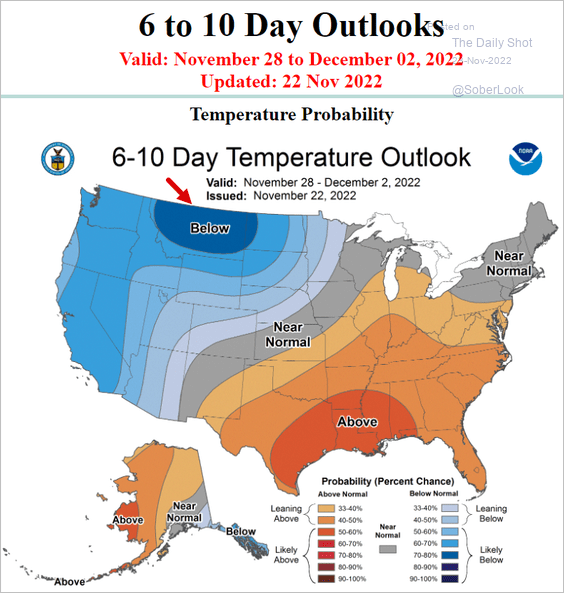

3. US natural gas prices climbed in recent days as the Northwest is about to get some cold weather.

Source: NOAA

Source: NOAA

——————–

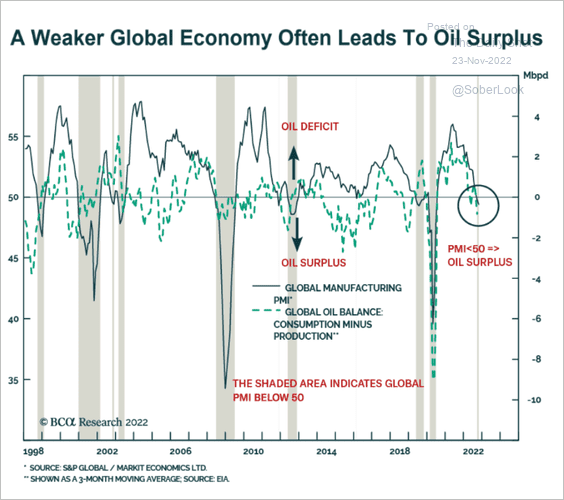

4. Oil markets are vulnerable to a global economic slump.

Source: BCA Research

Source: BCA Research

Back to Index

Equities

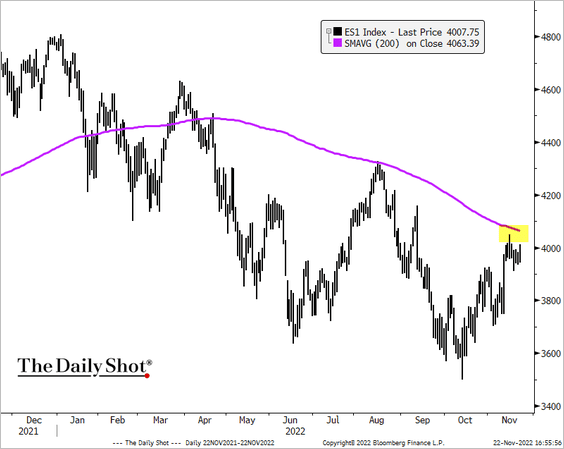

1. Is the S&P 500 about to test resistance at the 200-day moving average?

S&P 500 futures:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

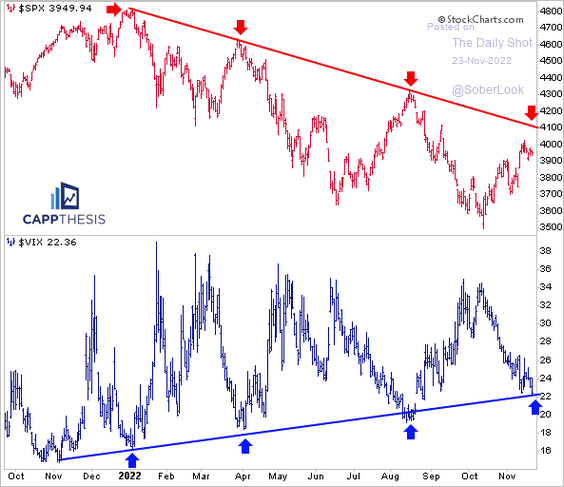

The S&P 500 also faces a downtrend resistance, while VIX is at support.

Source: @FrankCappelleri

Source: @FrankCappelleri

——————–

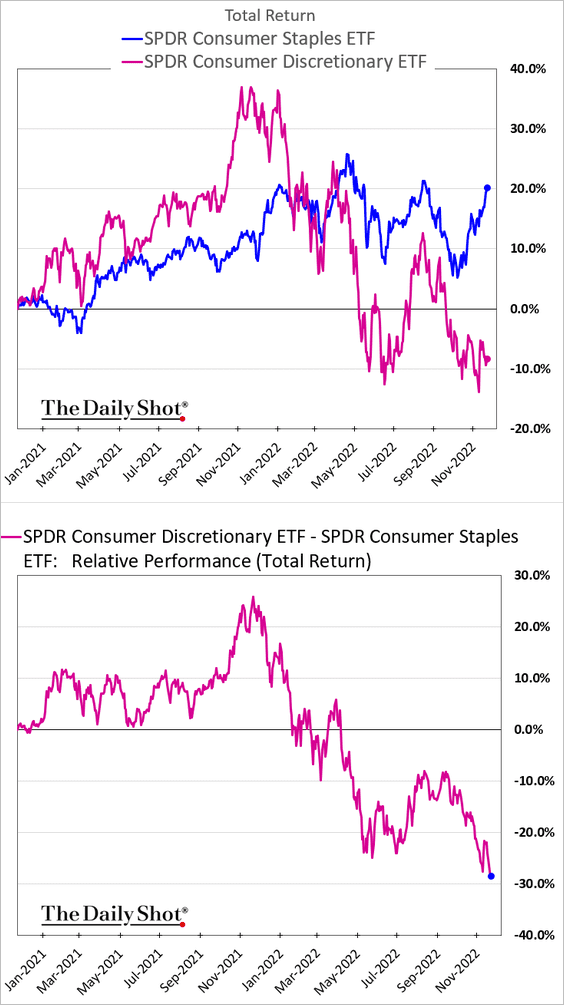

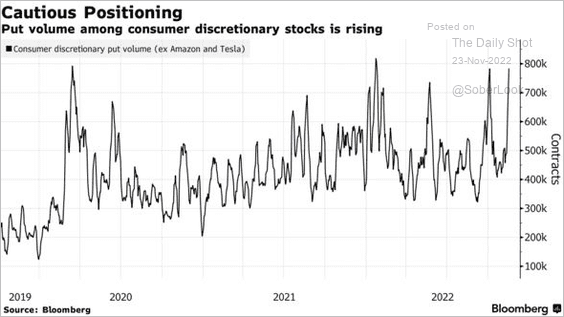

2. Consumer discretionary stocks are widening their underperformance vs. consumer staples. The market is increasingly concerned about US households cutting back on discretionary spending. And Tesla’s losses exacerbated the index declines.

The put option volume on consumer discretionary stocks has been rising.

Source: @markets, @katrinamlewis, @JPBarnert Read full article

Source: @markets, @katrinamlewis, @JPBarnert Read full article

——————–

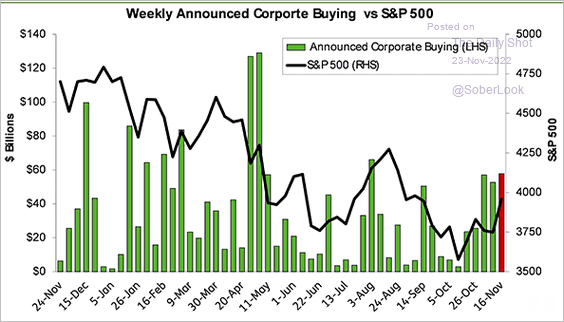

3. Share buybacks have been robust.

Source: EPFR Navigator

Source: EPFR Navigator

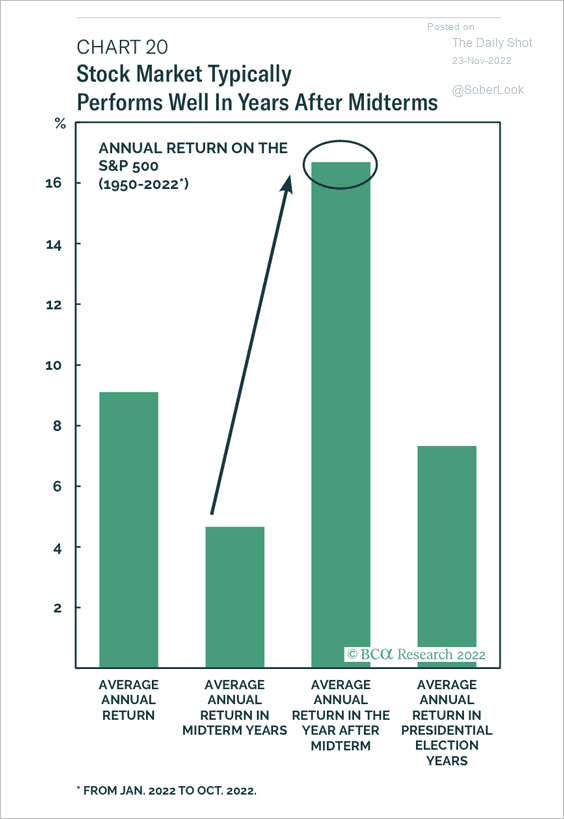

4. Stocks typically perform well after midterm election years.

Source: BCA Research

Source: BCA Research

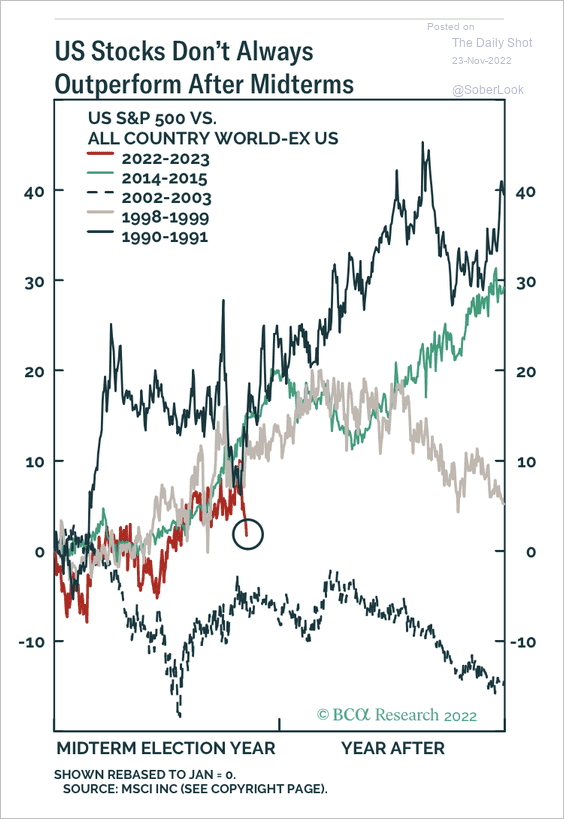

However, at times, US stocks have lagged international peers after midterm elections.

Source: BCA Research

Source: BCA Research

——————–

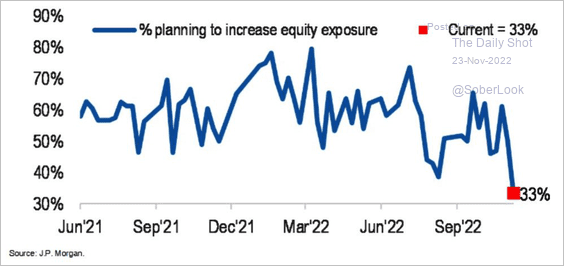

5. JP Morgan’s clients are not in a hurry to increase their equity exposure.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

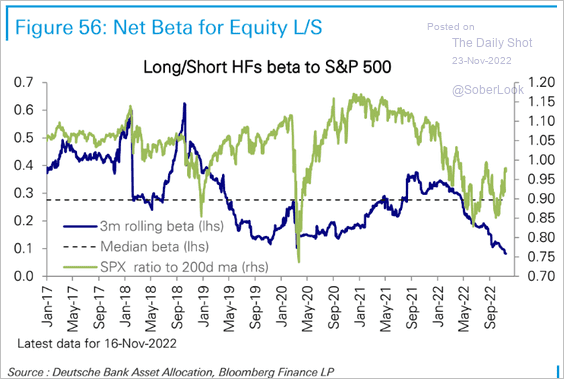

6. Long/short hedge funds’ equity exposure remains at multi-year lows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

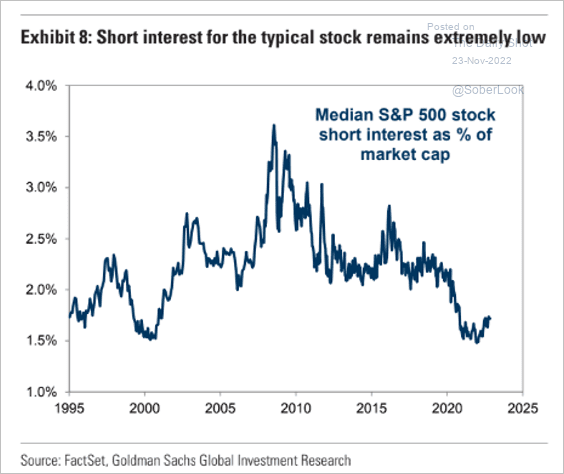

7. Short interest in S&P 500 stocks is still very low.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

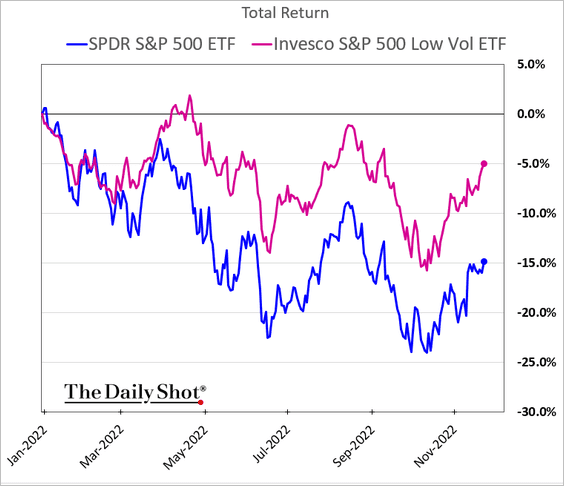

8. The low-vol equity factor has outperformed this year.

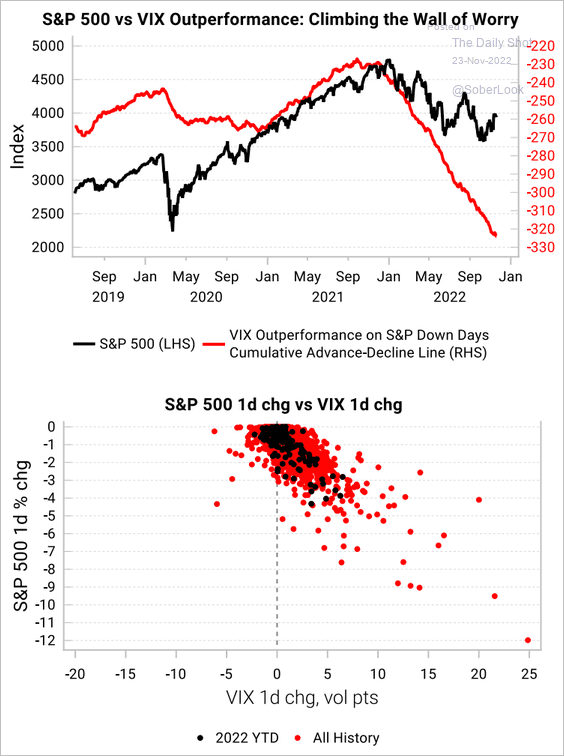

9. VIX has not been an effective hedge for stocks in 2022.

Source: Variant Perception

Source: Variant Perception

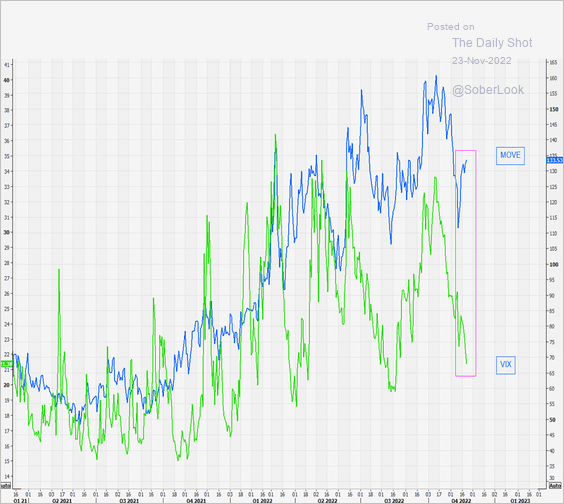

• VIX has diverged from its Treasury market equivalent (MOVE).

Source: @themarketear

Source: @themarketear

Back to Index

Credit

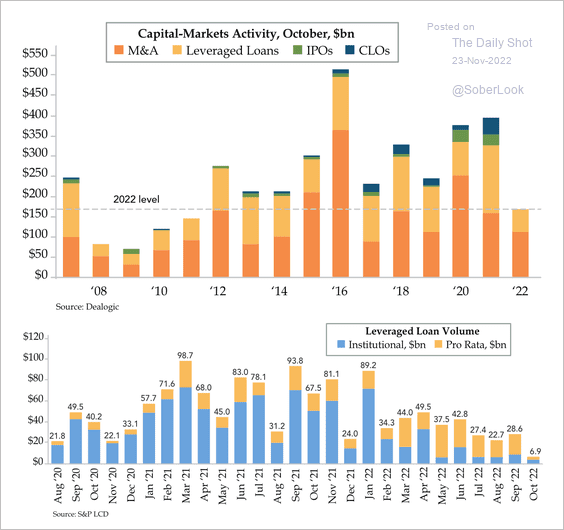

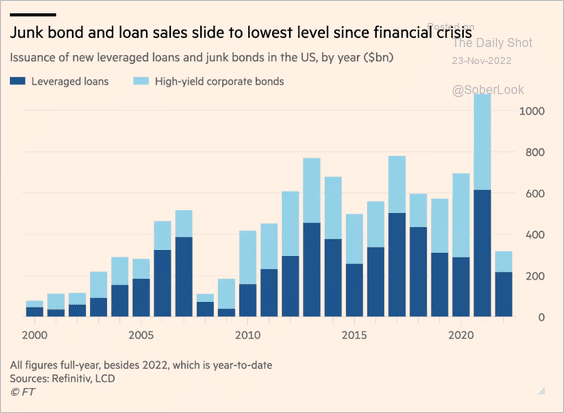

1. Capital markets activity has slowed, particularly in leveraged loans (2 charts).

Source: Quill Intelligence

Source: Quill Intelligence

Source: The Economist Read full article

Source: The Economist Read full article

——————–

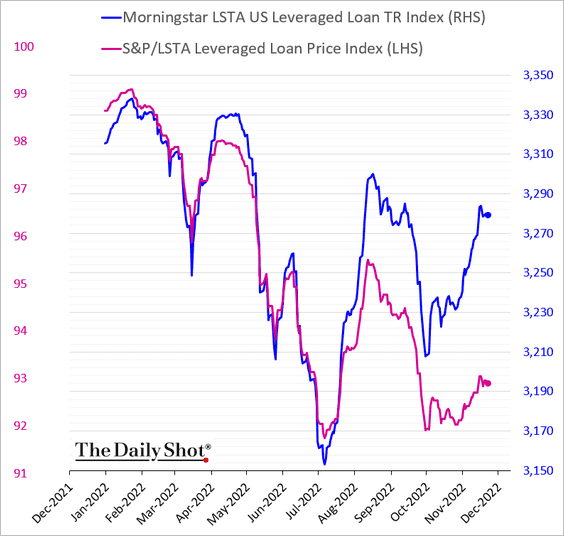

2. Despite price declines, leveraged loans’ total returns have held up because the coupon increased sharply due to the Fed’s rate hikes.

h/t @tatianadariee

h/t @tatianadariee

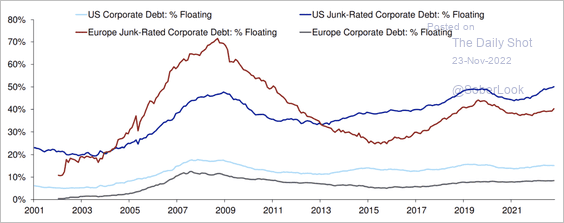

3. US and European junk-rated firms have meaningful exposure to central bank rate hikes. One reason is leveraged loans (floating-rate coupon).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

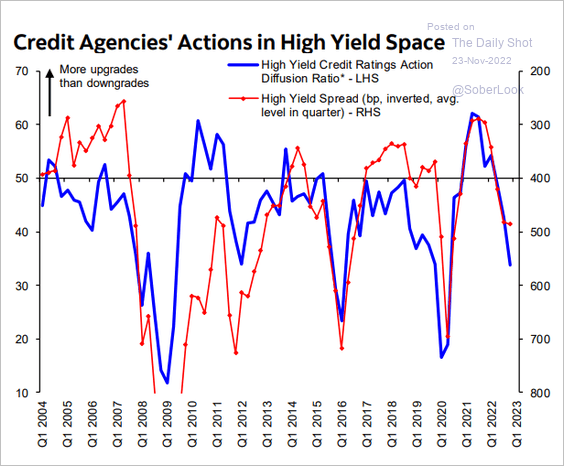

4. Credit downgrades point to wider HY spreads.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

Global Developments

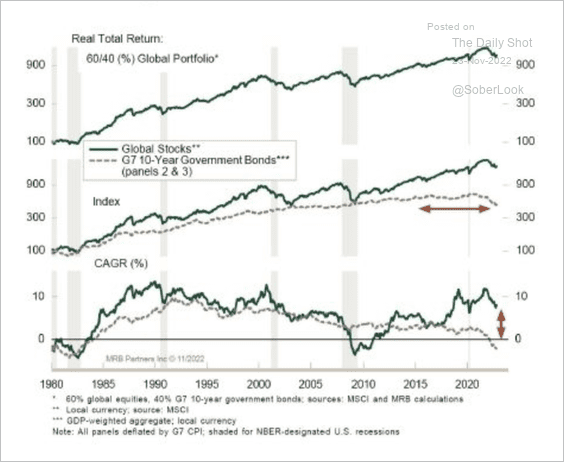

1. G7 10-year sovereign bonds have wiped out a decade of returns.

Source: MRB Partners

Source: MRB Partners

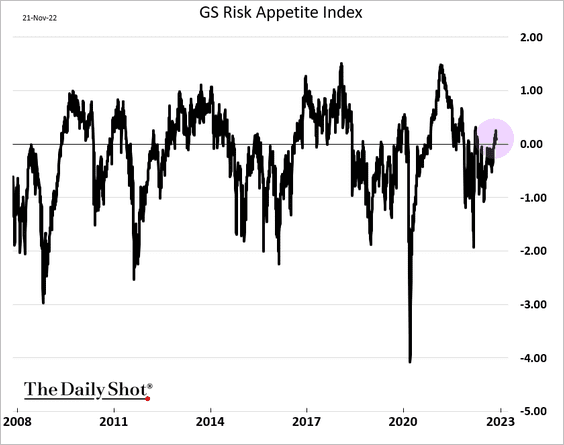

2. Goldman’s risk appetite index is back in positive territory.

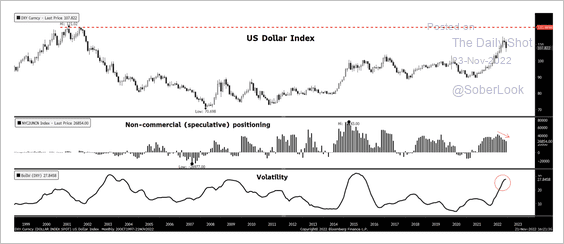

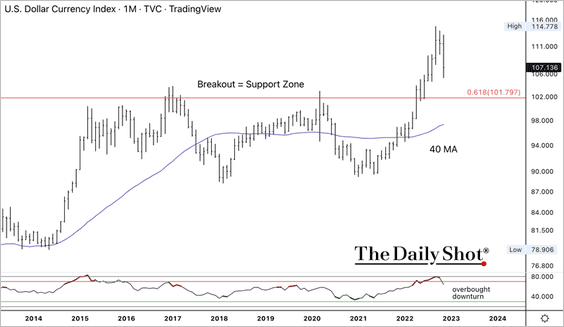

3. The dollar’s uptrend is starting to weaken as speculators cut their net long positions. A break below the 100-105 support zone could signal a major trend reversal. (2 charts)

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

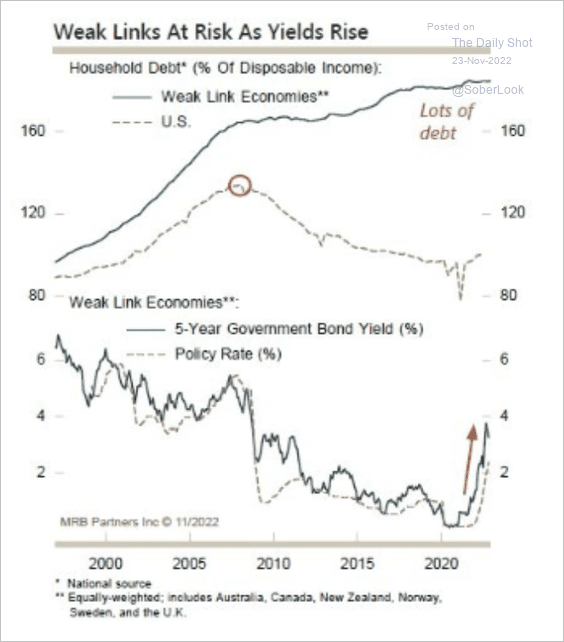

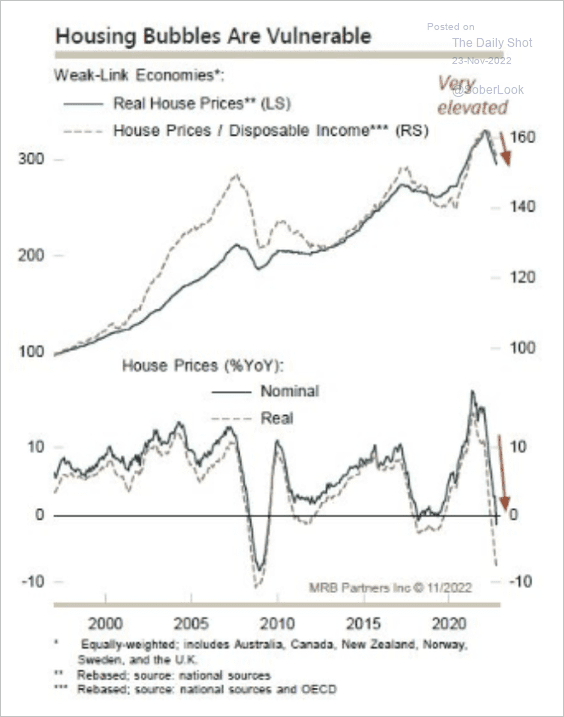

4. Countries with high household debt, such as Australia and Canada, remain vulnerable amid rising interest rates. (2 charts)

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

——————–

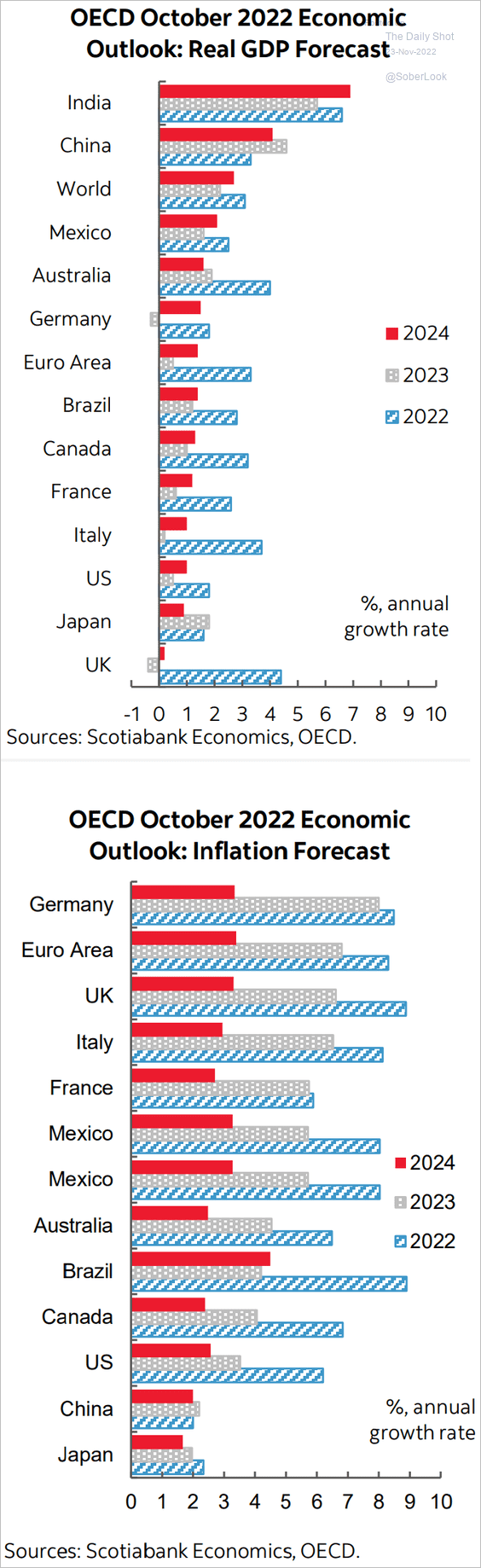

5. Finally, we have the OECD forecasts for growth and inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

Food for Thought

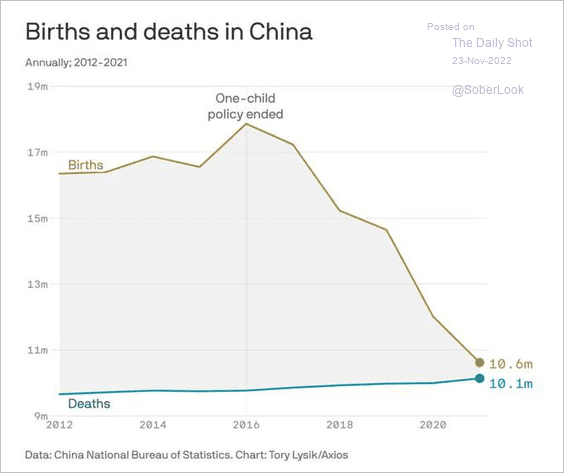

1. Births and deaths in China:

Source: @simongerman600

Source: @simongerman600

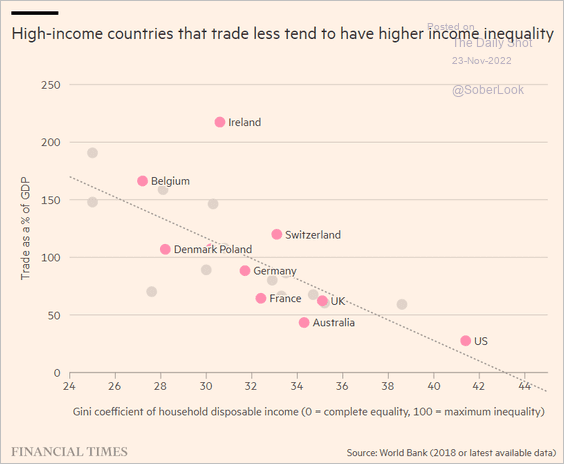

2. Trade as a share of GDP vs. income inequality:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

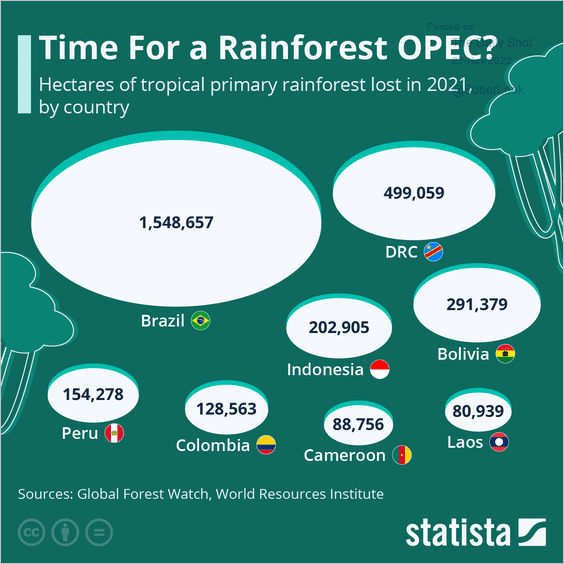

3. Tropical rainforest loss in 2021:

Source: Statista

Source: Statista

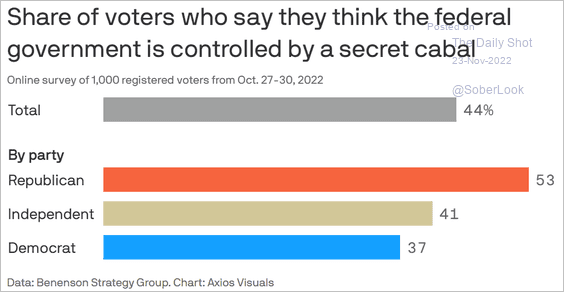

4. The secret cabal:

Source: @axios Read full article

Source: @axios Read full article

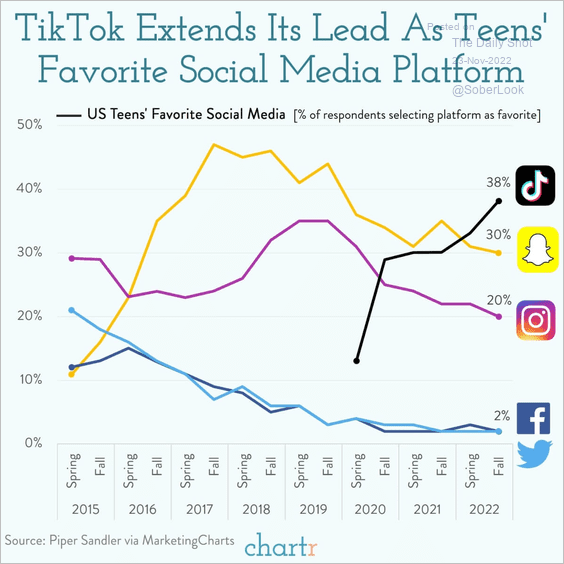

5. Teens’ favorite social media platforms:

Source: @chartrdaily

Source: @chartrdaily

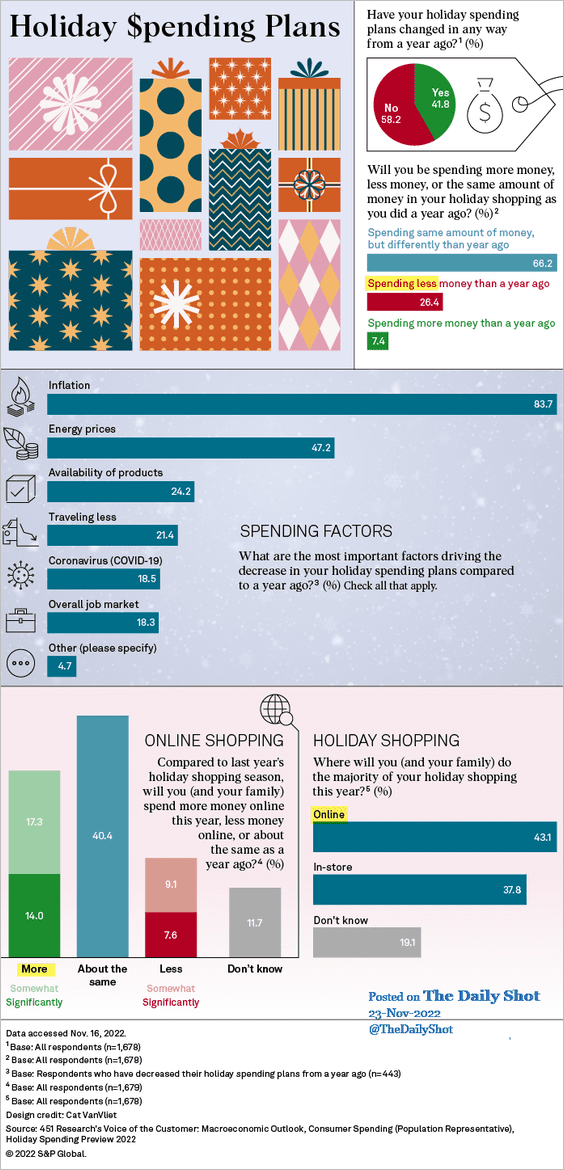

6. Holiday spending plans (survey):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

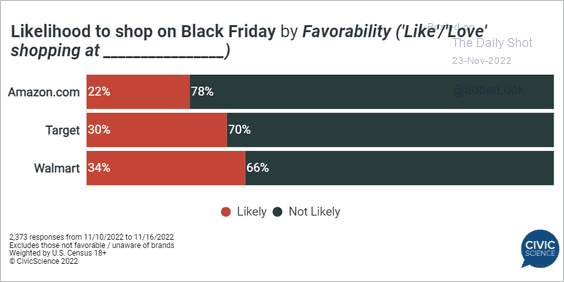

• Black Friday shopping preferences this year:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

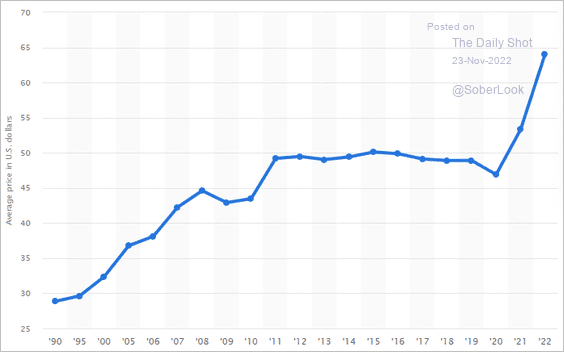

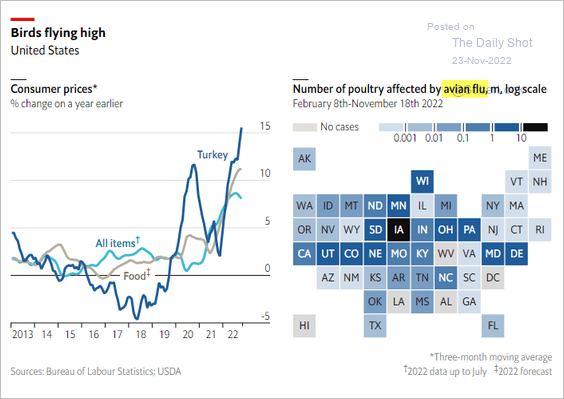

7. Average cost of a Thanksgiving dinner (2 charts):

Source: Statista

Source: Statista

Source: The Economist Read full article

Source: The Economist Read full article

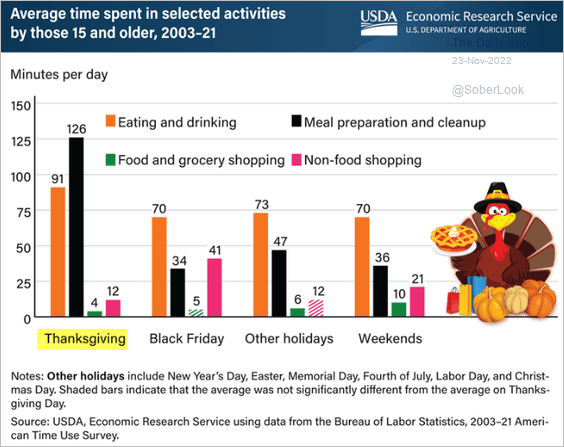

8. Average time spent on various activities:

Source: USDA Read full article

Source: USDA Read full article

——————–

Happy Thanksgiving to our readers in the United States.

The next Daily Shot will be out on Monday, November 28th.

Back to Index