The Daily Shot: 20-Mar-20

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

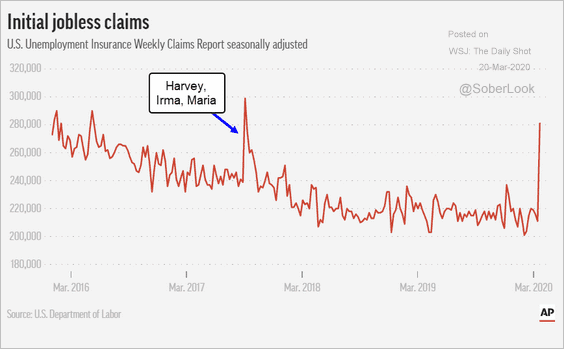

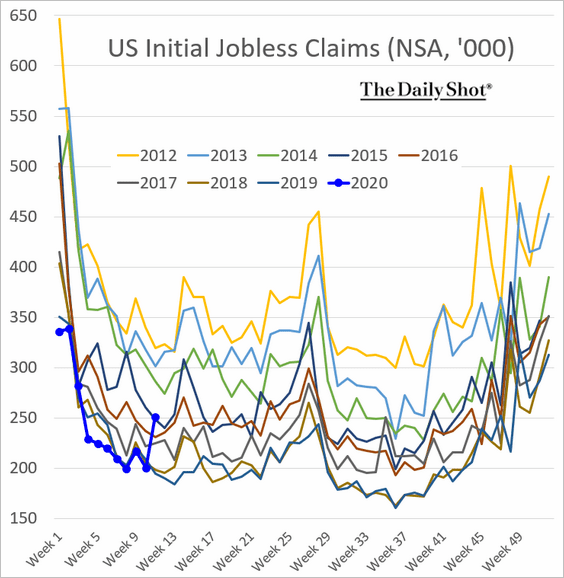

1. We are starting to see the first signs of deterioration in the labor markets, as unemployment applications jump.

Source: AP Read full article

Source: AP Read full article

• Below is the same index without seasonal adjustments (roughly at 2015 levels now).

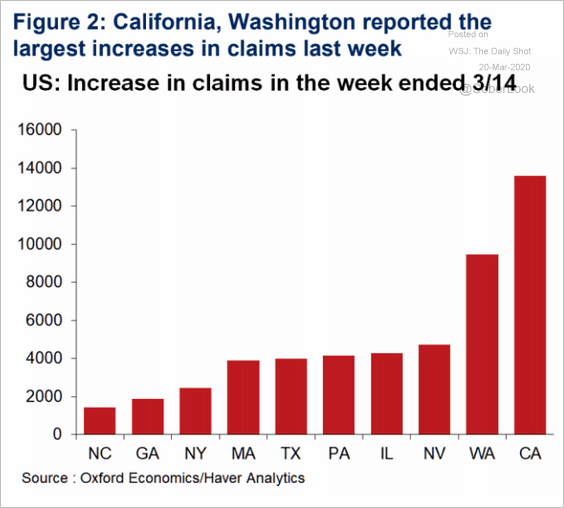

• Here are the increases by state.

Source: Oxford Economics

Source: Oxford Economics

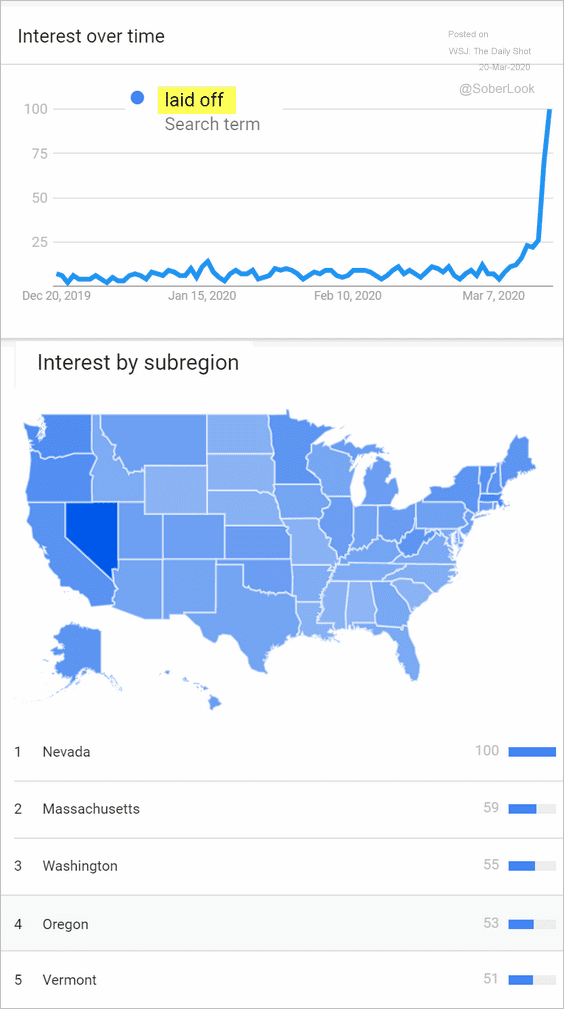

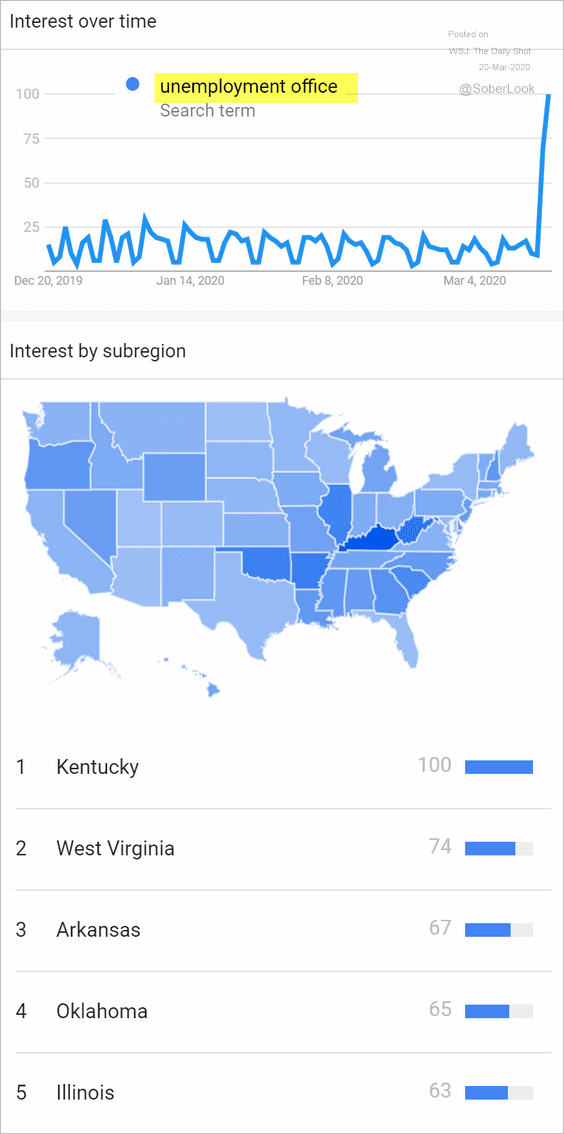

• Online search activity suggests that jobless claims will keep climbing.

Source: Google Trends, {ht} Goldman Sachs

Source: Google Trends, {ht} Goldman Sachs

Source: Google Trends, {ht} Goldman Sachs

Source: Google Trends, {ht} Goldman Sachs

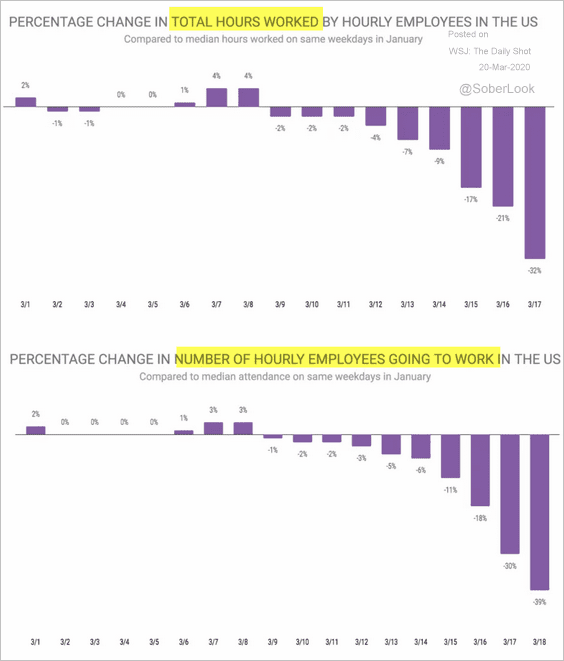

• The number of hourly employees that are not going to work is rising rapidly.

Source: homebase, @J_Waldmann Read full article

Source: homebase, @J_Waldmann Read full article

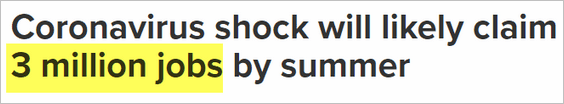

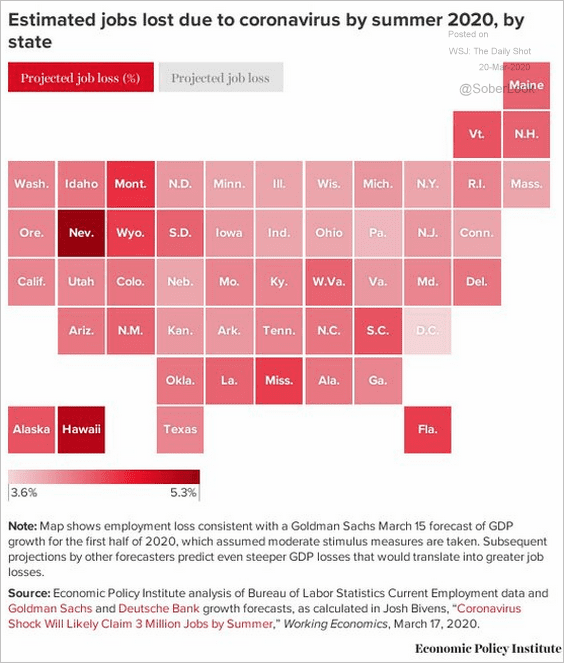

• By summer, job losses around the country will be severe.

Source: Economic Policy Institute Read full article

Source: Economic Policy Institute Read full article

Source: @EconomicPolicy Read full article

Source: @EconomicPolicy Read full article

——————–

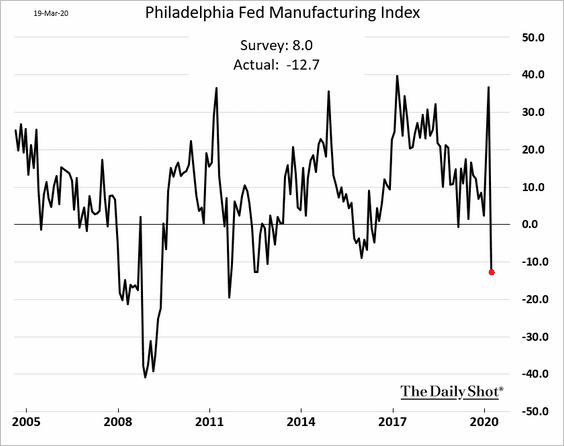

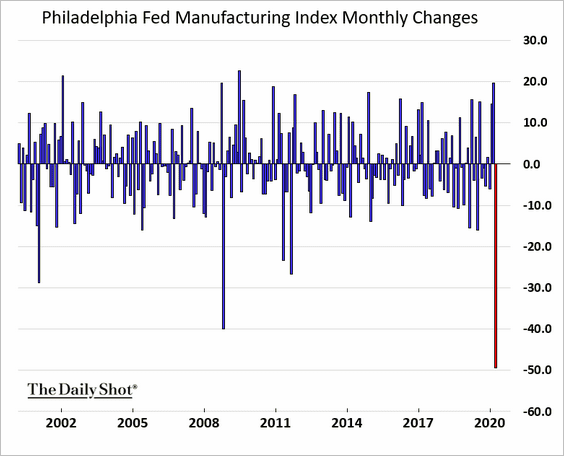

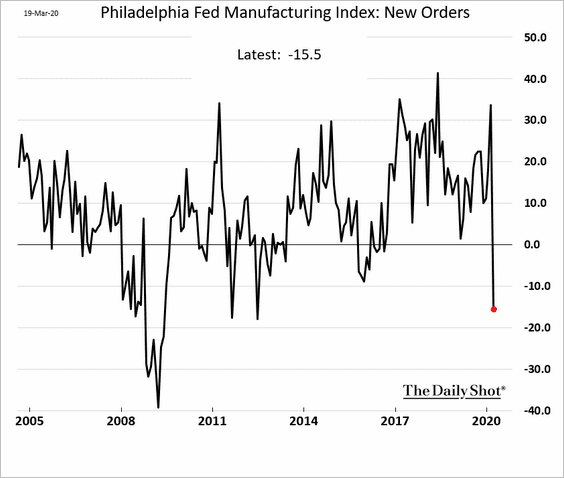

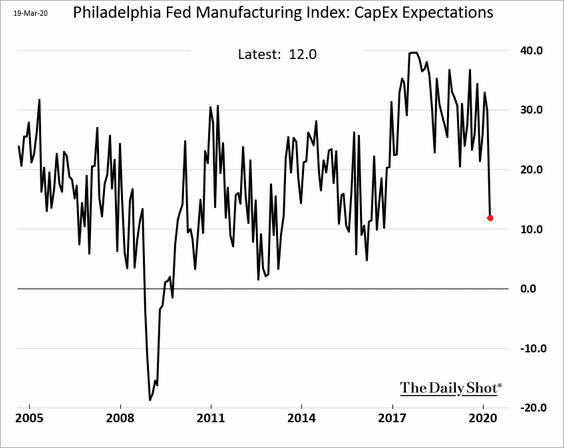

2. The Philly Fed’s manufacturing report showed that the region’s factory activity plummeted this month.

• The headline index:

• Monthly changes (the biggest decline on record):

• New orders:

• CapEx expectations:

——————–

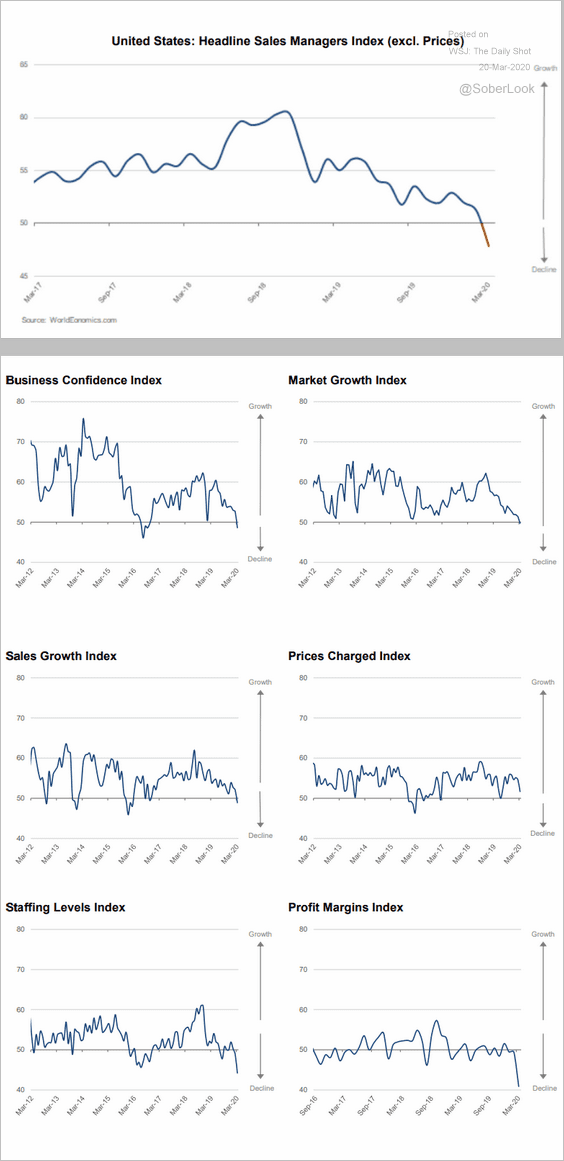

3. Business activity is deteriorating across the country. Here is the World Economics SMI.

Source: World Economics

Source: World Economics

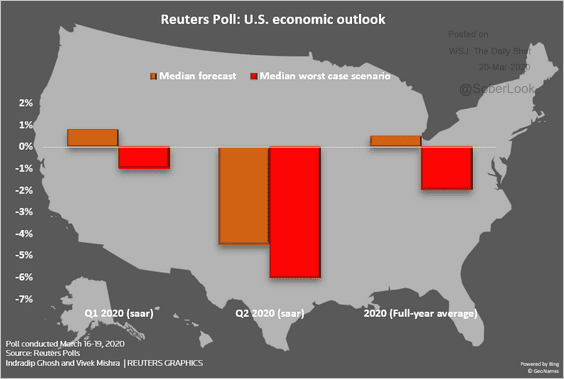

4. Will we see a GDP contraction for the full year?

Source: Reuters Read full article

Source: Reuters Read full article

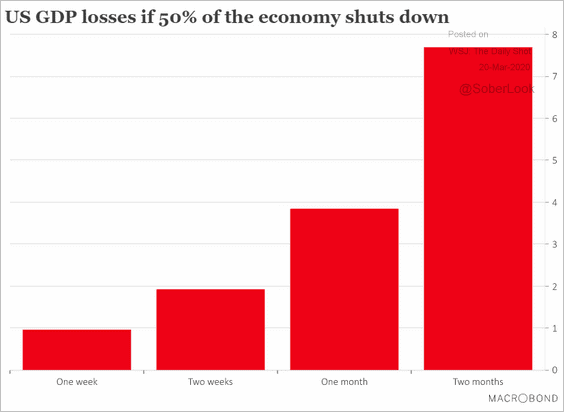

Much will depend on how long the country remains on “lockdown.”

Source: Macrobond Read full article

Source: Macrobond Read full article

——————–

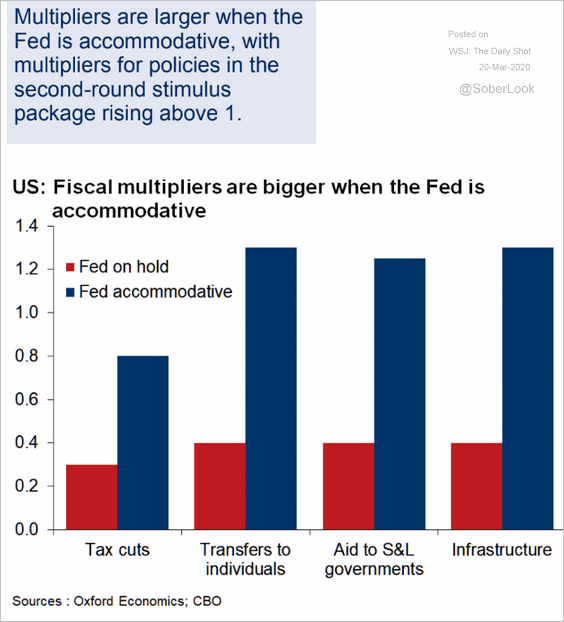

5. Government stimulus should cushion the blow to the economy, with federal programs generating a substantial multiplier effect.

Source: Oxford Economics

Source: Oxford Economics

The United Kingdom

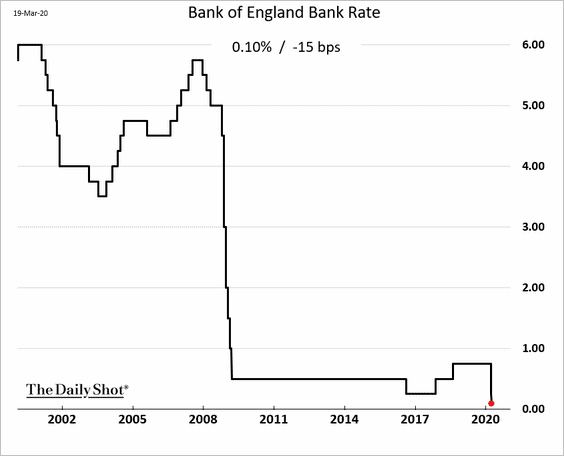

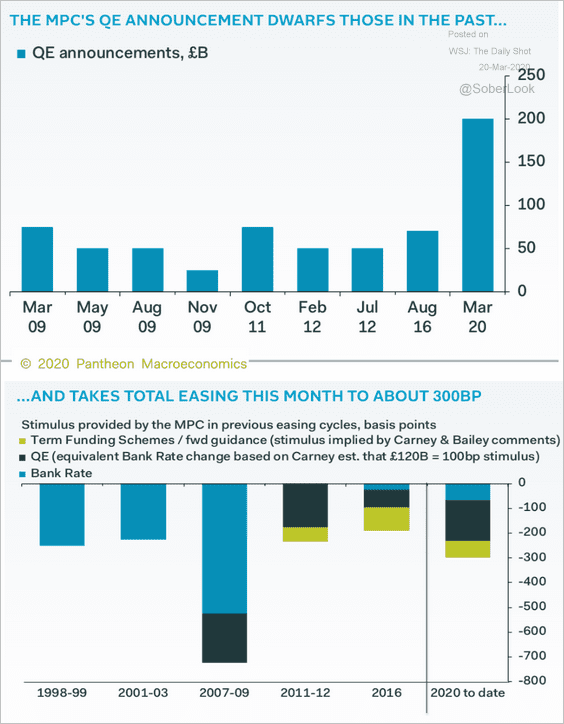

1. The Bank of England cut rates and launched a QE program.

Source: Reuters Read full article

Source: Reuters Read full article

The second chart below shows the total stimulus represented as a rate cut (equivalent to 300 basis points).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

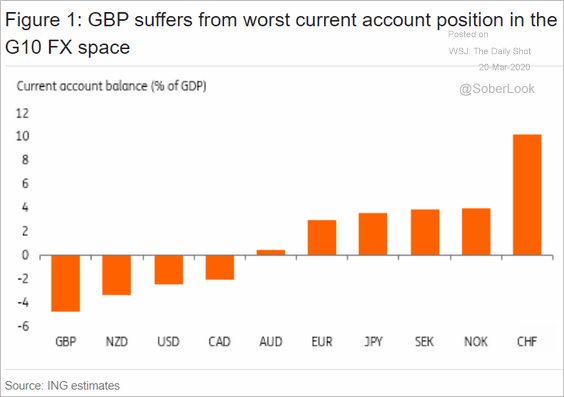

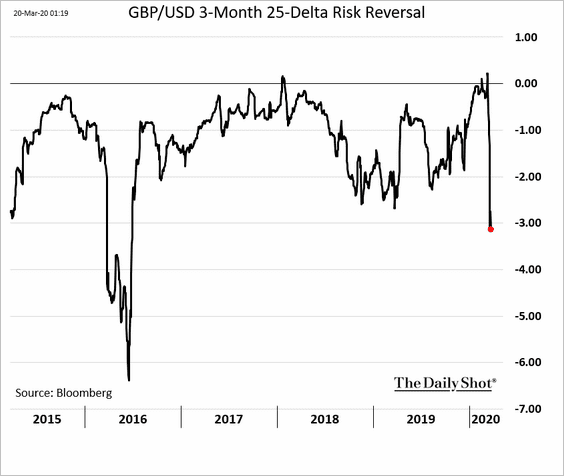

2. The extreme weakness in the British pound (chart) is problematic because of the UK’s large current account deficit.

Source: ING

Source: ING

Traders remain bearish on the pound. Here is the 3-month risk reversal.

The Eurozone

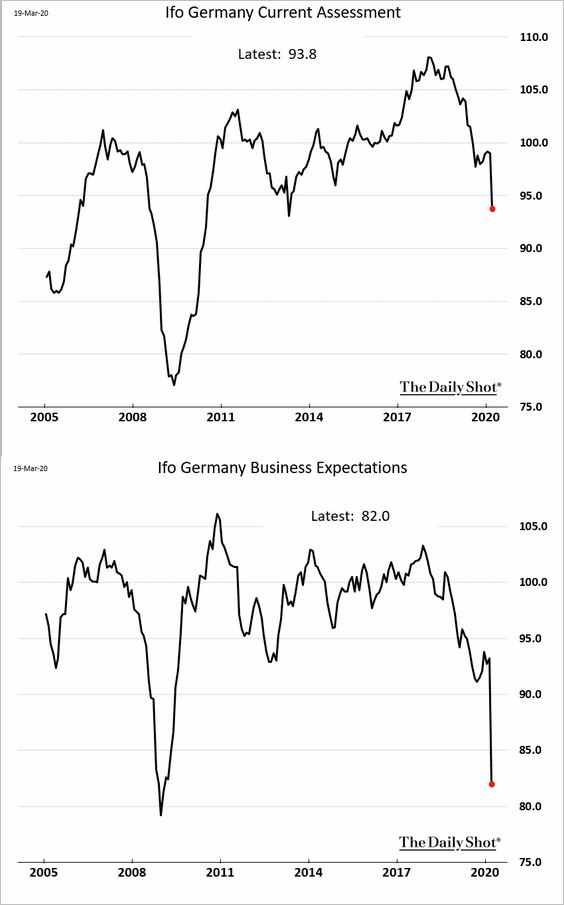

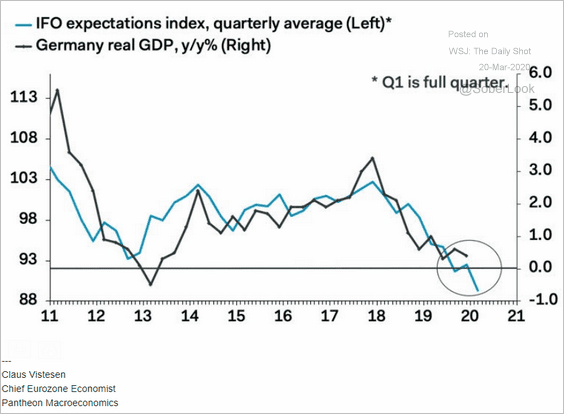

1. The Ifo report suggests that Germany’s economy is contracting rapidly as business expectations plummet.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

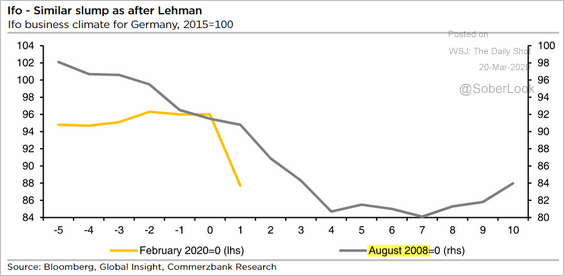

• The slump is similar to what we saw after the Leahman collapse.

Source: Commerzbank Research

Source: Commerzbank Research

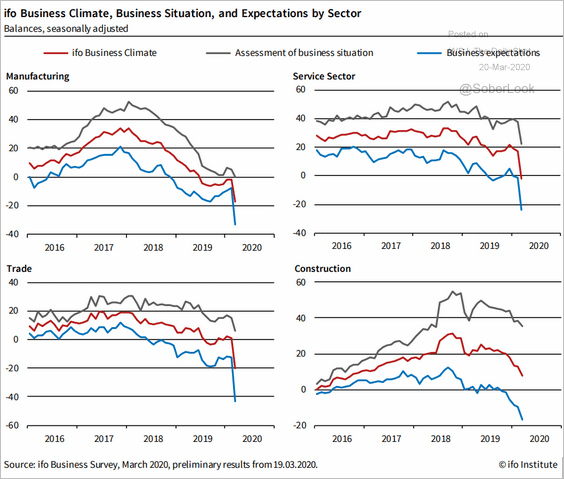

• Here is the breakdown by sector.

Source: ifo Institute

Source: ifo Institute

——————–

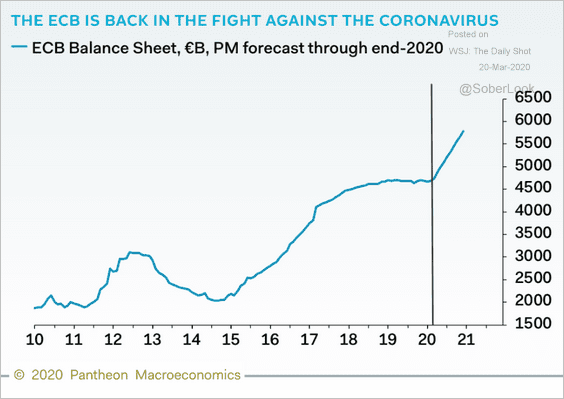

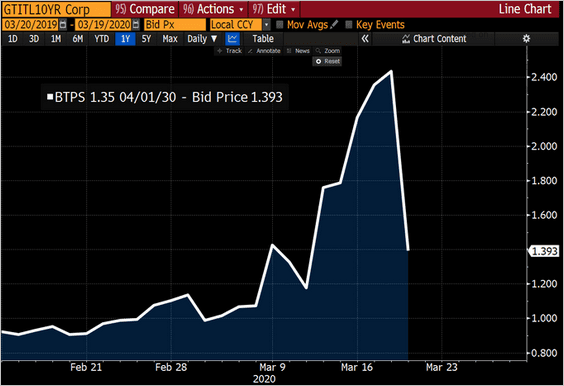

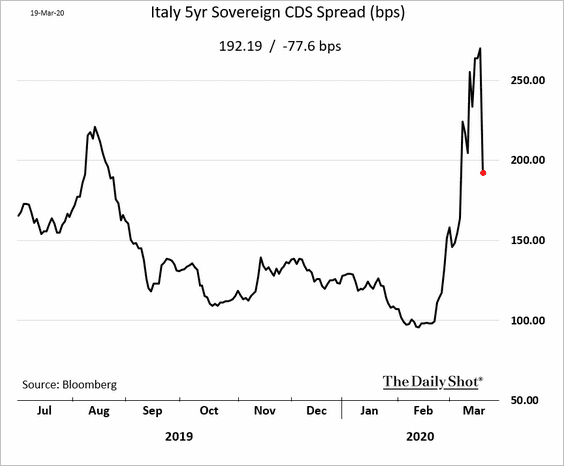

2. The ECB’s €750 bn QE program announcement boosted bond prices.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Italian bond yields (chart below) and credit default swap spreads (second chart) tumbled.

Source: @jsblokland, @TheTerminal

Source: @jsblokland, @TheTerminal

——————–

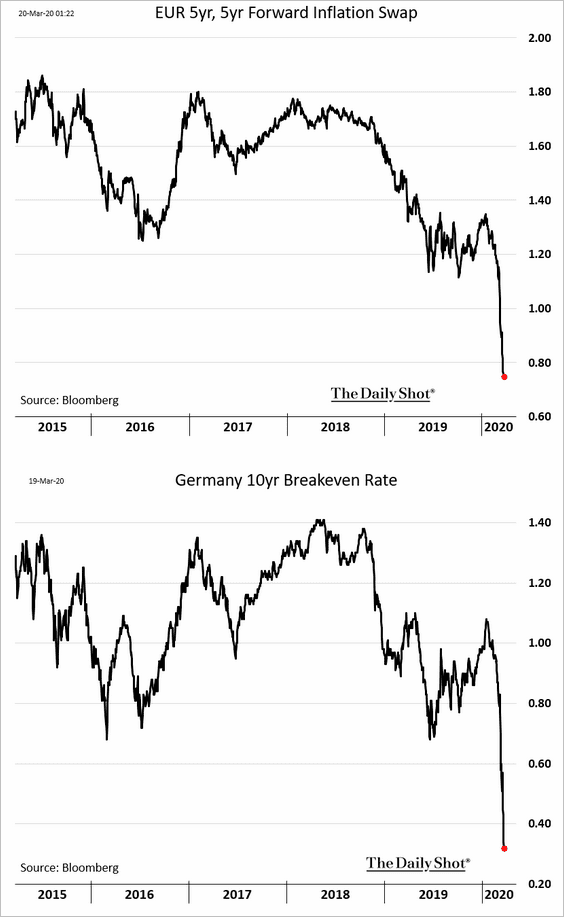

3. The markets see the Eurozone remaining in a disinflationary environment for years to come. Below are a couple of long-term inflation expectations indicators.

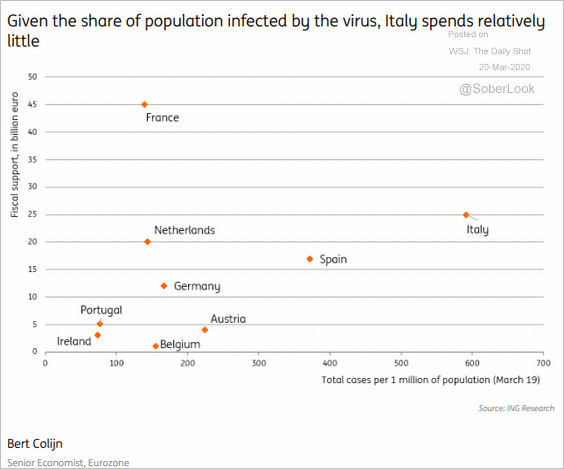

4. How much fiscal support are countries providing to cushion the impact of the epidemic?

Source: ING

Source: ING

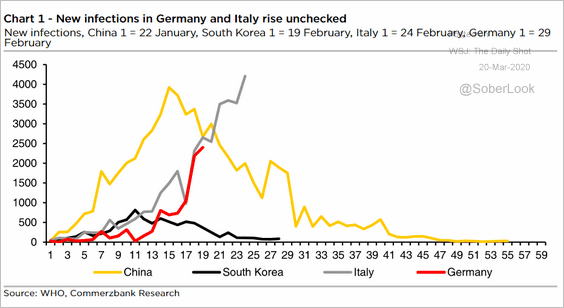

5. Next, we have some updates on the epidemic in Italy.

• The number of new infections keeps climbing.

Source: Commerzbank Research

Source: Commerzbank Research

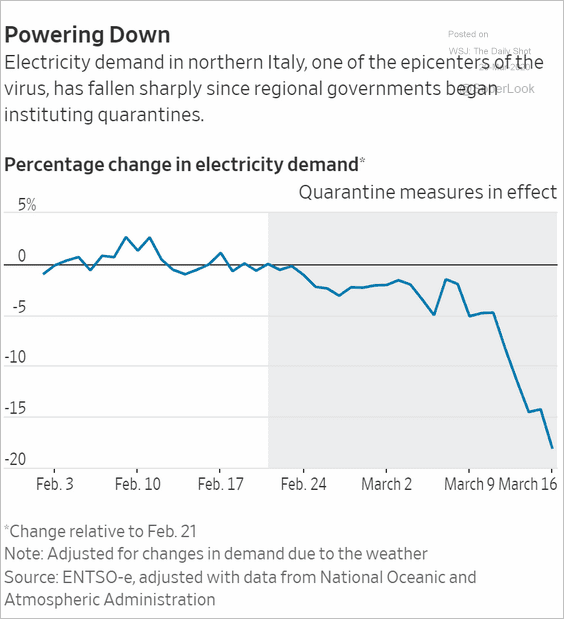

• Economic activity in northern Italy has ground to a halt.

Source: @WSJ Read full article

Source: @WSJ Read full article

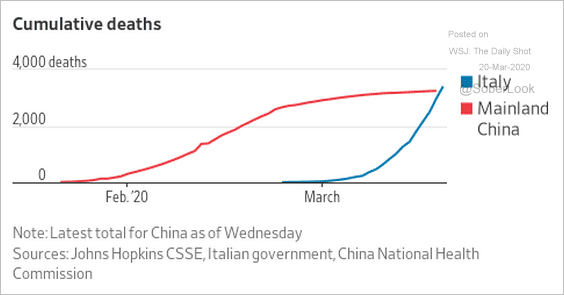

• The number of coronavirus-related deaths in Italy now exceeds those in China.

Source: @economistmeg, @FT, @ReutersBiz, @WSJGraphics Read full article

Source: @economistmeg, @FT, @ReutersBiz, @WSJGraphics Read full article

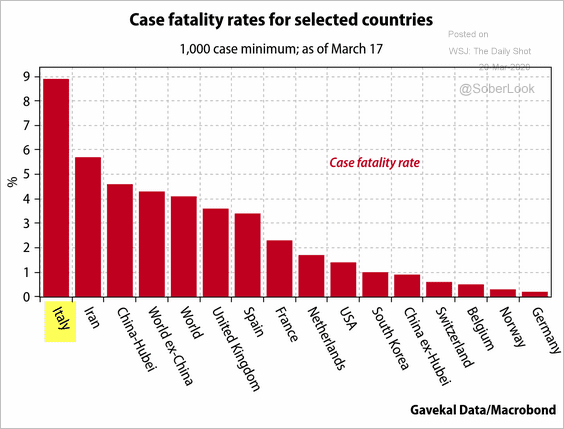

• Italy’s coronavirus fatality rate stands out.

Source: Gavekal

Source: Gavekal

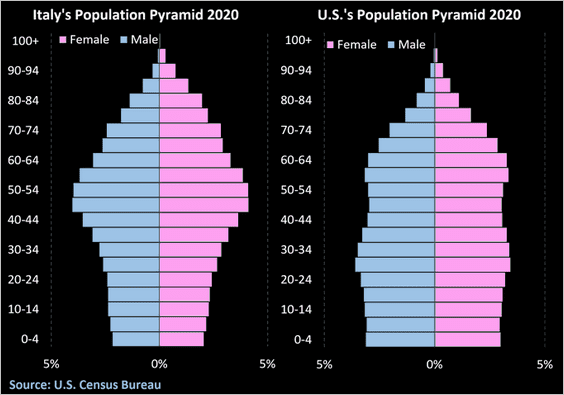

Part of the reason is Italy’s aging population.

Source: @M_McDonough

Source: @M_McDonough

Asia – Pacific

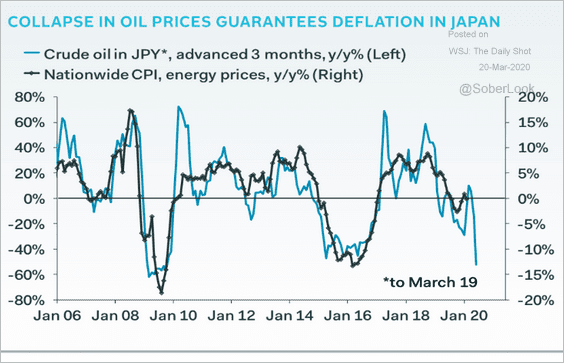

1. Japan is headed for deflation again.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

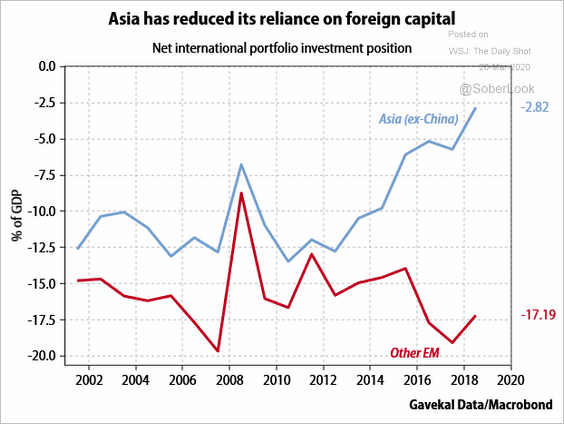

2. Asia’s economies have reduced their reliance on foreign capital.

Source: Gavekal

Source: Gavekal

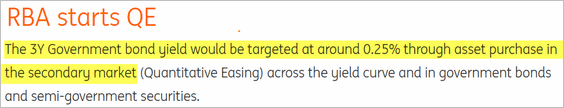

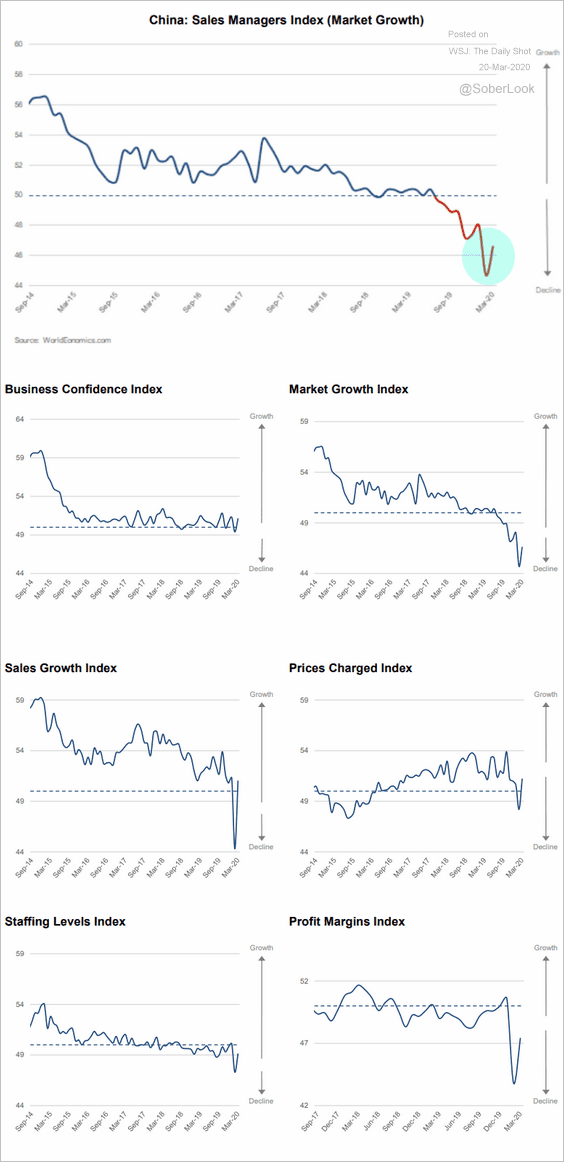

3. The RBA’s QE program announcement pushed Australia’s short-term bond yields to new lows.

Source: ING Read full article

Source: ING Read full article

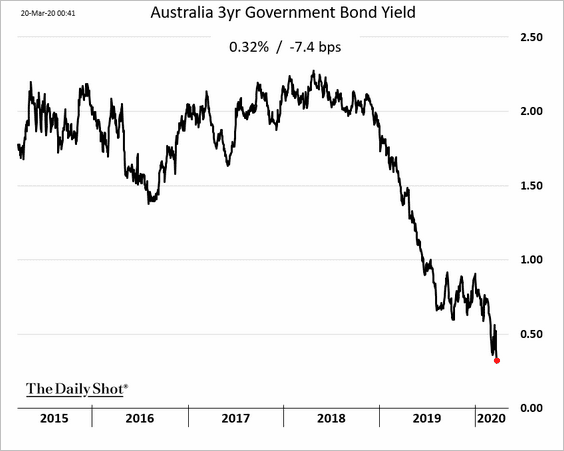

China

1. The stock market has sharply outperformed global peers.

Source: BCA Research

Source: BCA Research

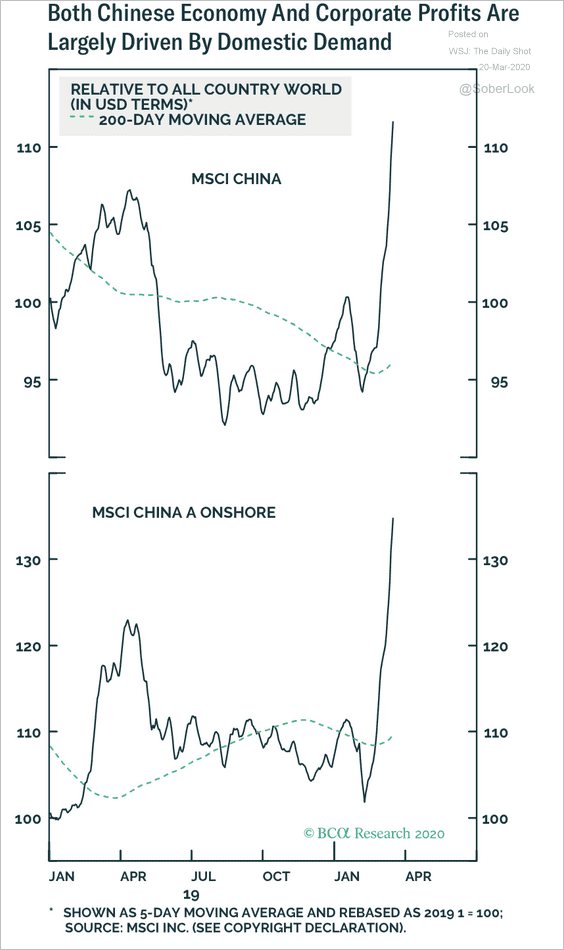

2. According to the World Economics SMI report, the contraction in business activity eased this month.

Source: World Economics

Source: World Economics

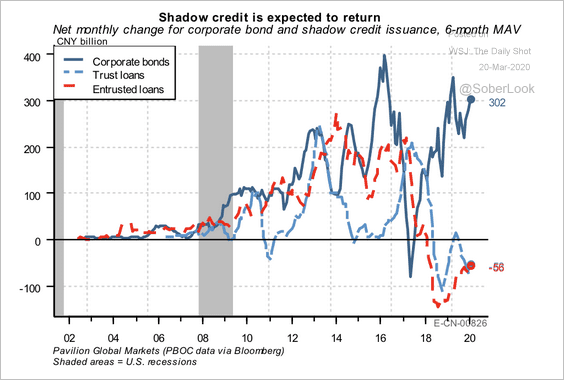

3. Large corporates are being directed to provide their smaller suppliers with shadow financing via entrusted loans, according to Pavilion Global Markets

Source: Pavilion Global Markets

Source: Pavilion Global Markets

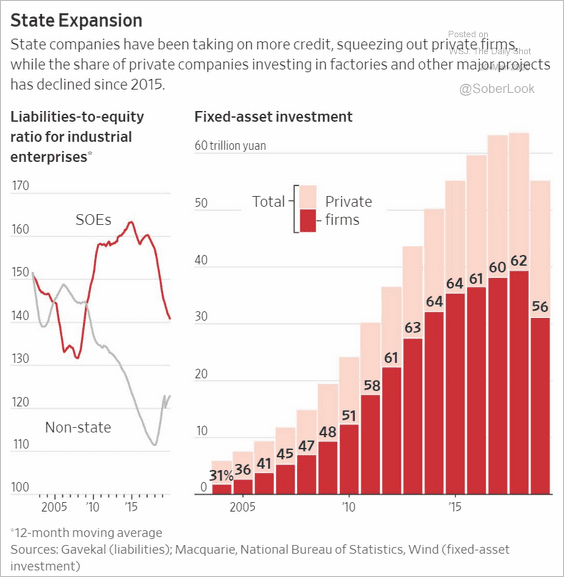

4. State firms’ debt issuance has crowded out the private sector.

Source: @WSJ Read full article

Source: @WSJ Read full article

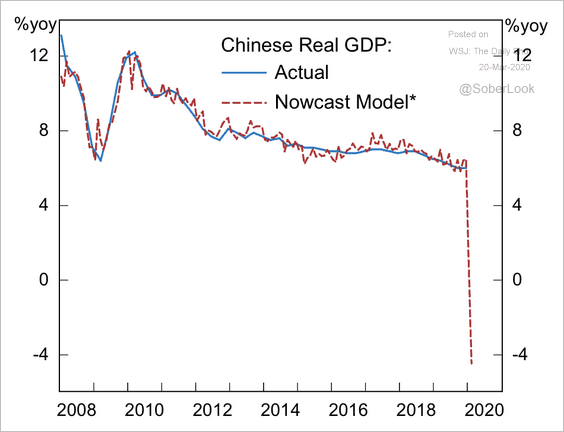

5. Alpine Macro expects GDP to contract by about 4% – the first negative-growth period in China’s post-reform history.

Source: Alpine Macro

Source: Alpine Macro

Emerging Markets

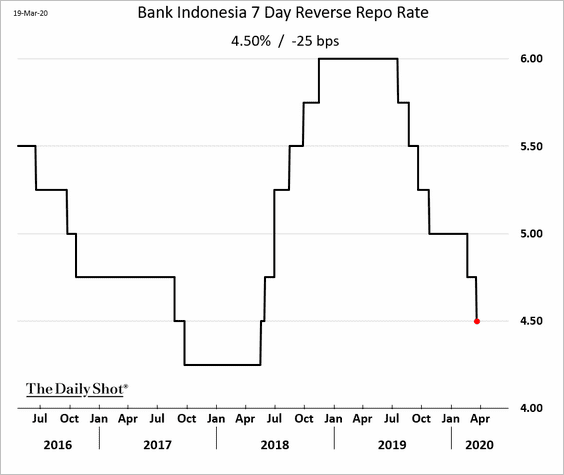

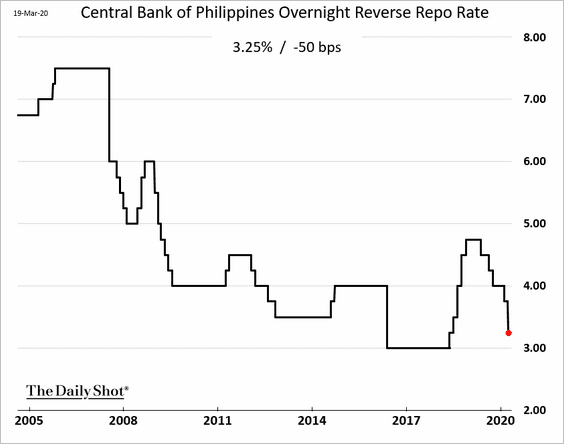

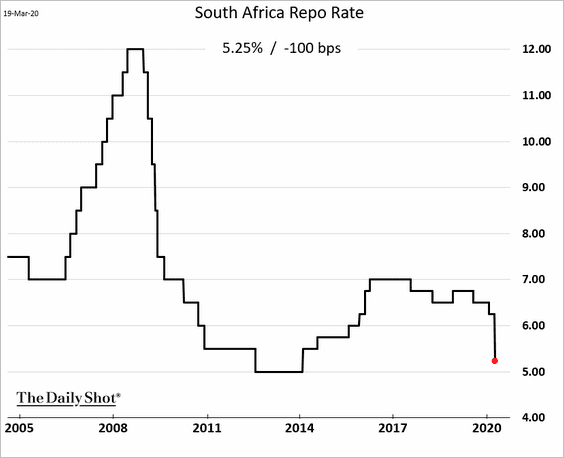

1. Central banks continue to ease.

• Indonesia:

• The Philippines:

• South Africa:

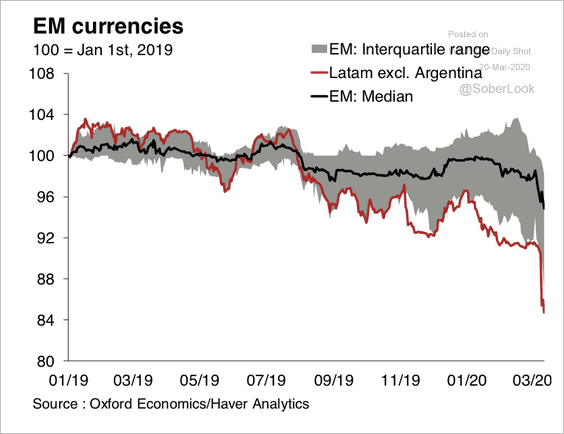

2. Latin American currencies have underperformed.

Source: Oxford Economics

Source: Oxford Economics

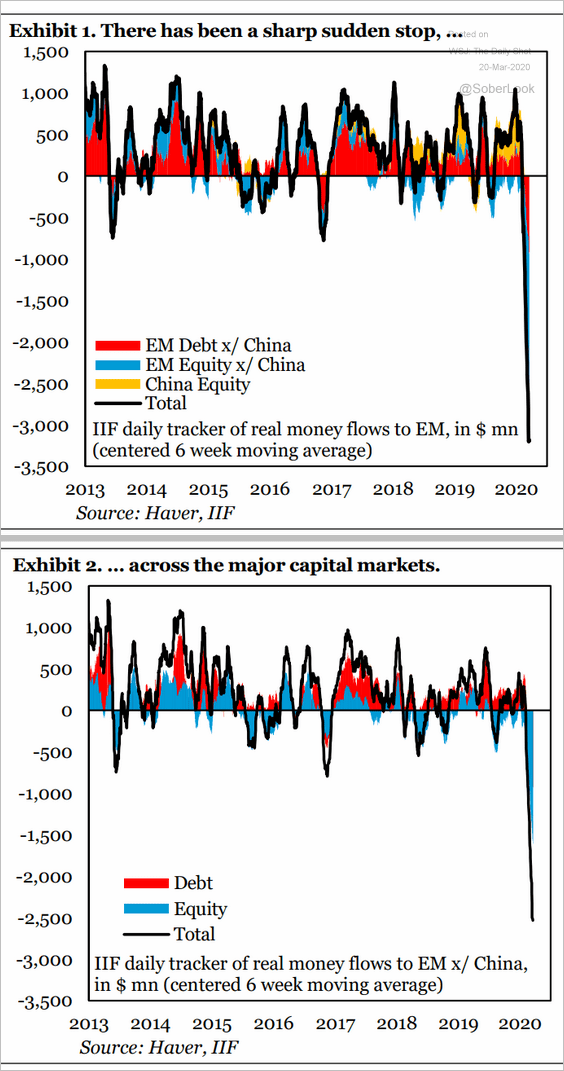

3. Portfolio outflows have been unprecedented.

Source: IIF

Source: IIF

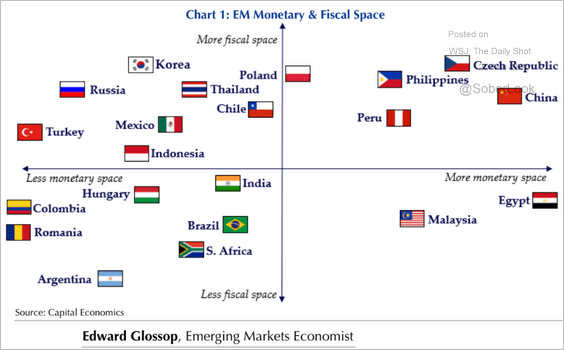

4. How much room do countries have for fiscal and monetary stimulus programs?

Source: Capital Economics

Source: Capital Economics

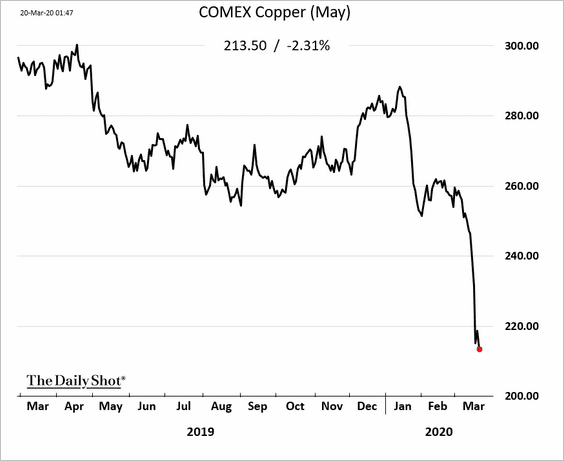

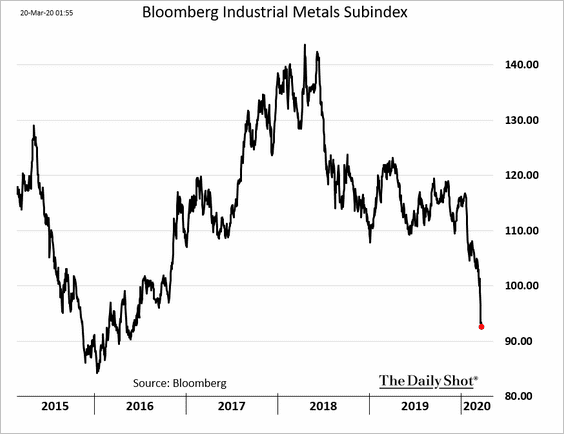

Commodities

The slump in copper continues.

——————–

Energy

1. Oil markets received some bullish news from the US on Thursday.

Source: The Hill Read full article

Source: The Hill Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Crude oil prices rose sharply.

Source: @jsblokland, @TheTerminal

Source: @jsblokland, @TheTerminal

——————–

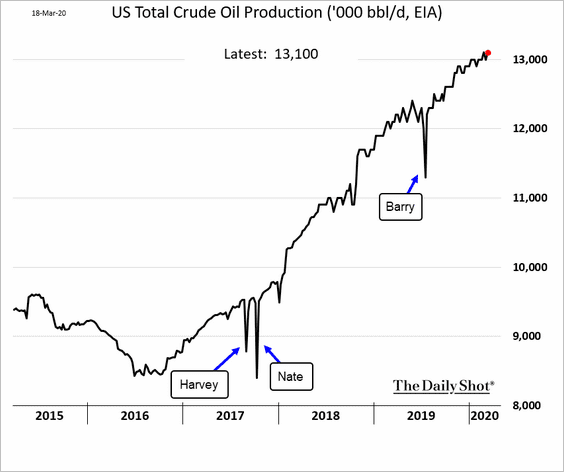

2. US crude oil output remains near record levels.

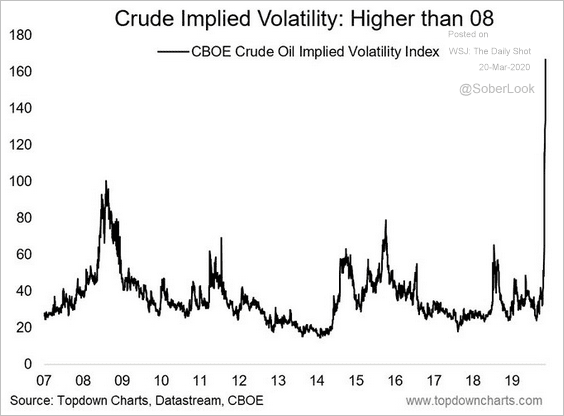

3. Crude oil implied volatility has been soaring.

Source: @Callum_Thomas

Source: @Callum_Thomas

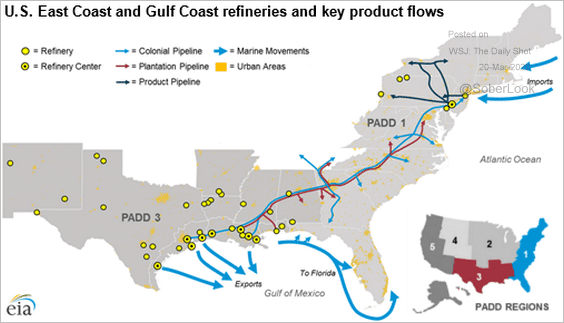

4. Colonial Pipeline, which operates the largest refined products pipeline system in the US, said it was cutting volumes by 20% as demand craters.

Source: @JavierBlas

Source: @JavierBlas

Equities

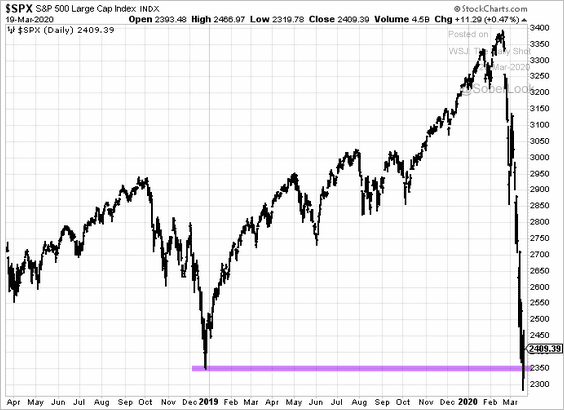

1. The market appears to have stabilized near the 2018 “Christmass selloff” lows.

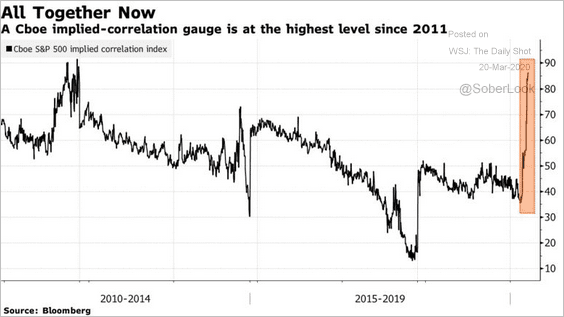

2. Correlations have spiked.

Source: @markets Read full article

Source: @markets Read full article

——————–

Credit

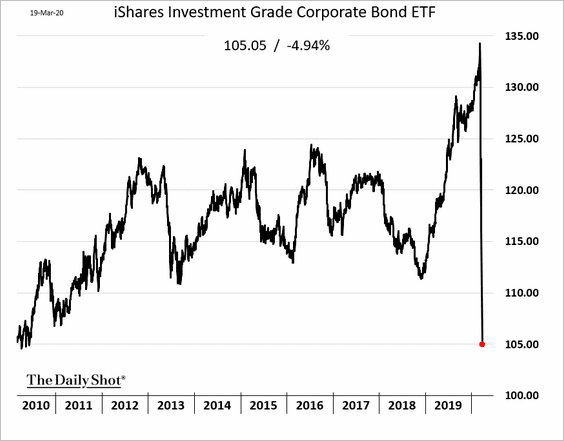

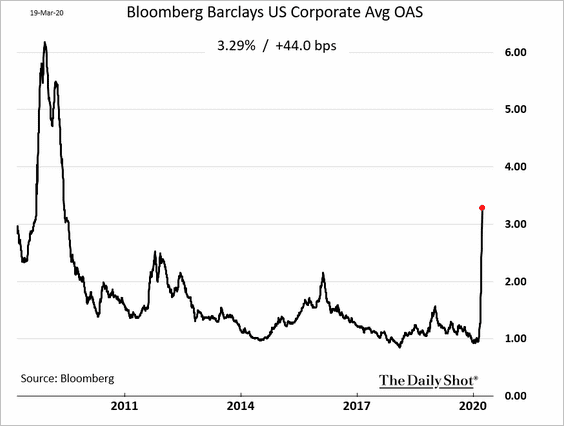

1. The selloff continued on Thursday, with investment-grade (IG) debt getting hit especially hard.

• The largest US investment-grade bond ETF (LQD) has given up a decade worth of gains in a matter of days.

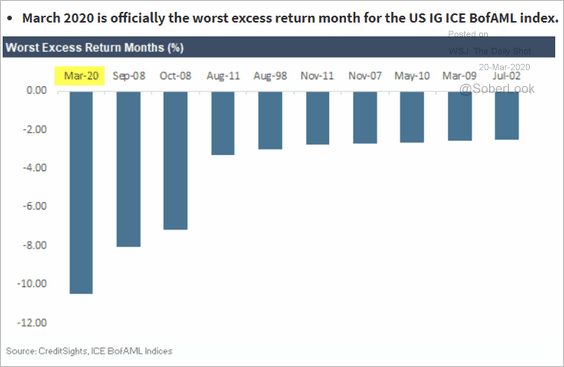

• It’s been the worst month for IG debt on record.

Source: CreditSights

Source: CreditSights

• Bond spreads continue to widen.

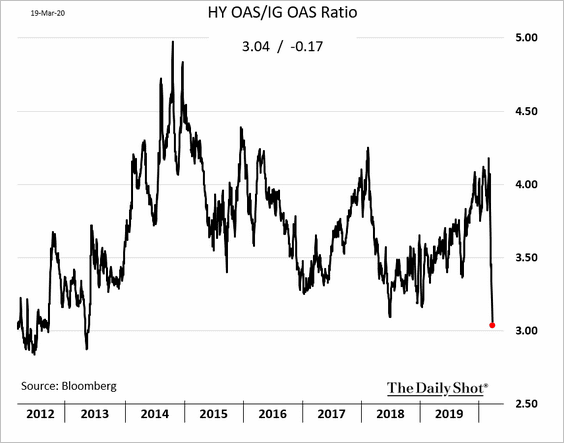

• Here is the ratio of high-yield to investment-grade spreads (IG underperforming HY).

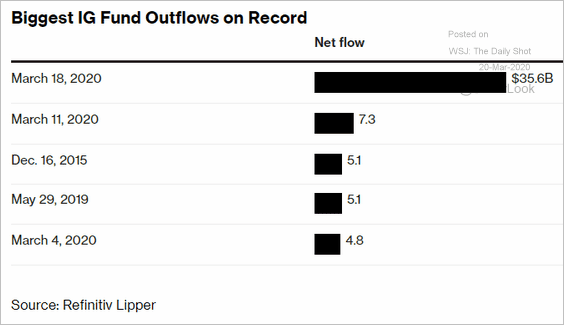

• Fund outflows hit a record.

Source: @markets Read full article

Source: @markets Read full article

——————–

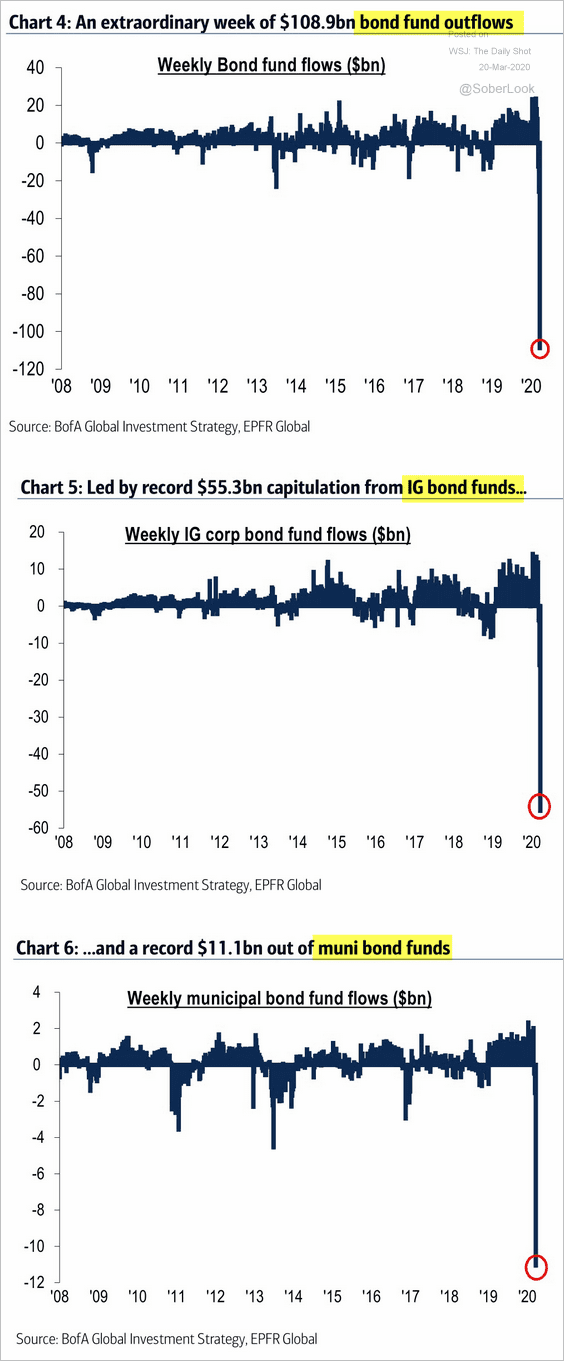

2. Outflows from credit funds have been remarkable.

Source: BofAML, @TayTayLLP

Source: BofAML, @TayTayLLP

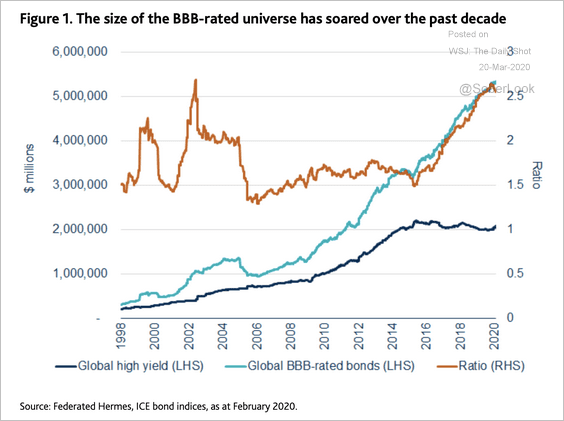

3. BBB-rated corporate credit has grown from less than $2 trillion in 2010 to over $5 trillion in 2020.

Source: Federated Hermes Read full article

Source: Federated Hermes Read full article

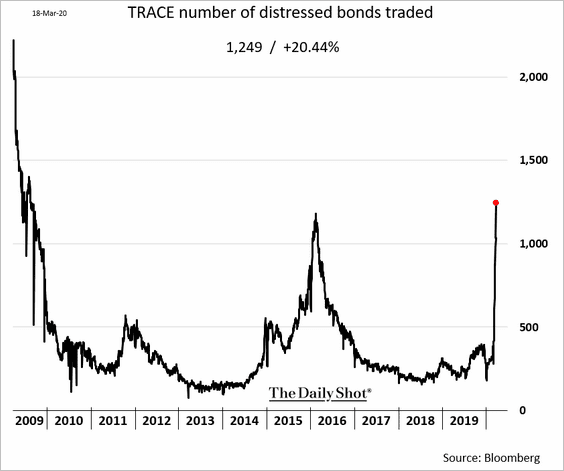

4. The number of bonds trading at distressed levels is the highest since 2009.

h/t @LivRaiReports

h/t @LivRaiReports

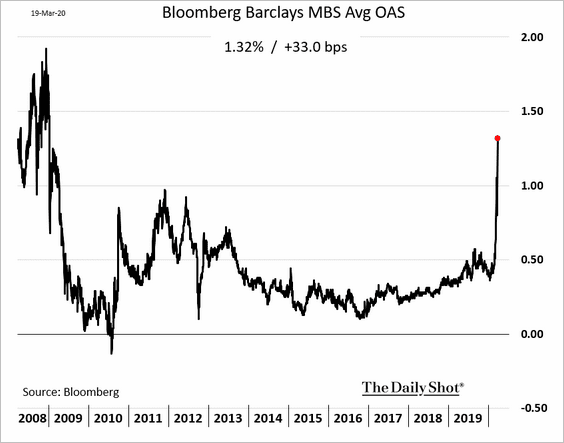

5. Mortgage-backed securities (MBS) spreads have blown out to the highest level since 2008.

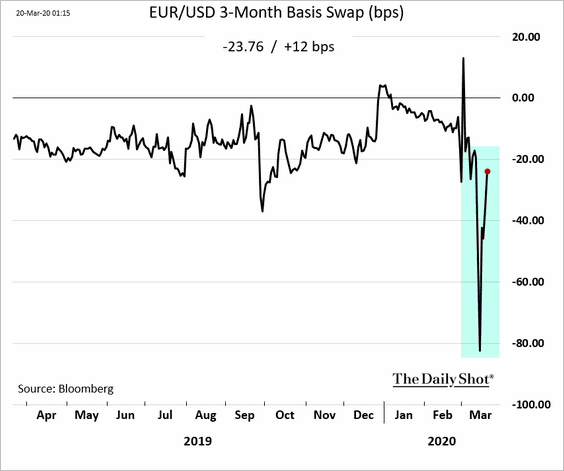

6. The Fed’s quick action on dollar swap lines eased the stress on US dollar financing for foreign banks.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

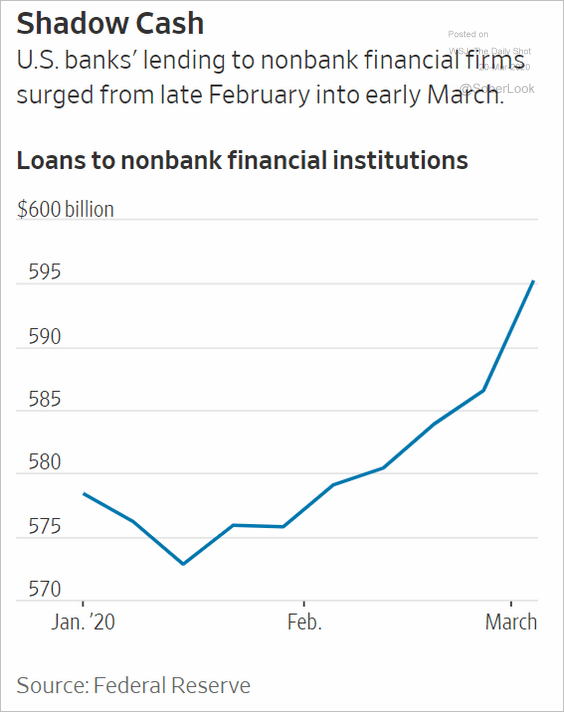

7. US banks have been providing more financing to non-bank mortgage lenders lately as demand picked up (due to record low rates). As long as Fannie Mae and Freddie Mac keep buying mortgages, this increase shouldn’t be an issue (these short-term loans are repaid when mortgage pools are sold).

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

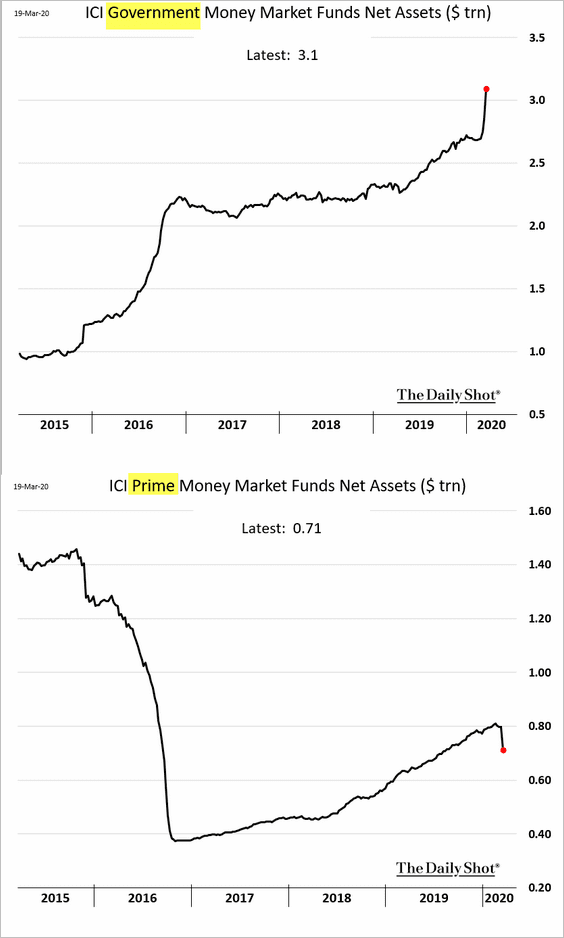

1. Investors have been shifting cash from prime money market funds to treasury funds, sending T-Bill yields into negative territory.

h/t Alexandra Harris , @TheTerminal

h/t Alexandra Harris , @TheTerminal

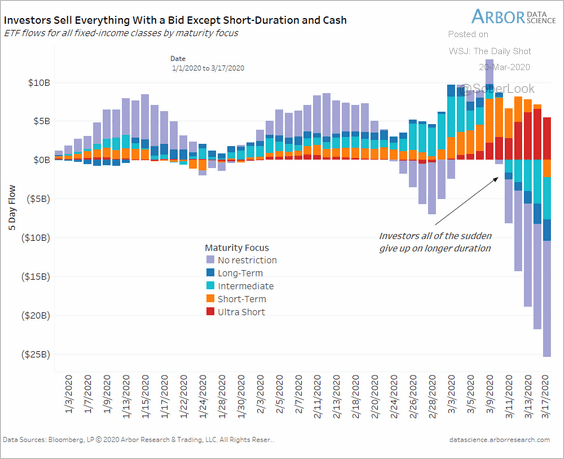

2. It’s been all about getting rid of duration risk.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

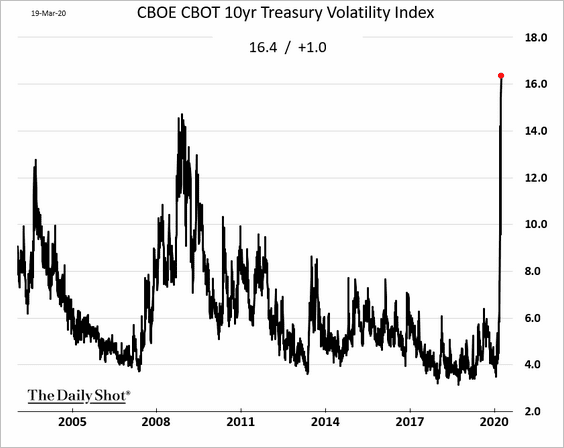

3. The 10yr Treasury implied volatility hit a new high.

Global Developments

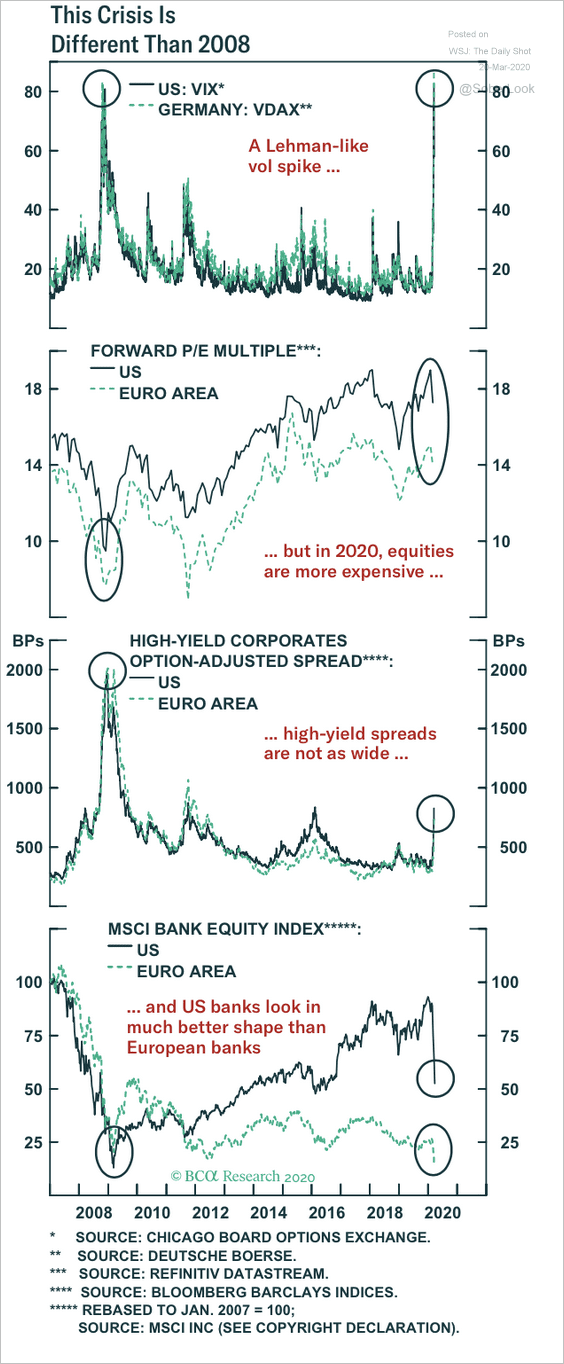

1. Similarities with 2008 are mostly seen in volatility, whereas credit spreads, valuations, and banking sector performance are different today.

Source: BCA Research

Source: BCA Research

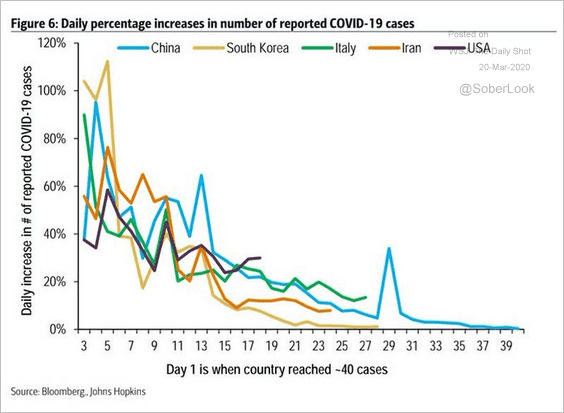

2. Growth rates in the number of new coronavirus cases appear to follow a similar path.

Source: BofAML, @ISABELNET_SA

Source: BofAML, @ISABELNET_SA

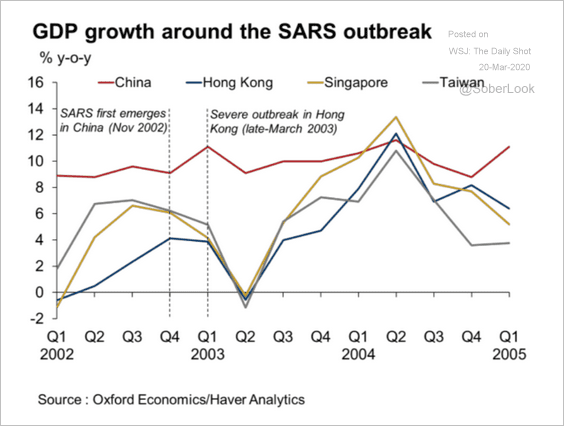

3. Here is a look at the economic impact of the SARS outbreak.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

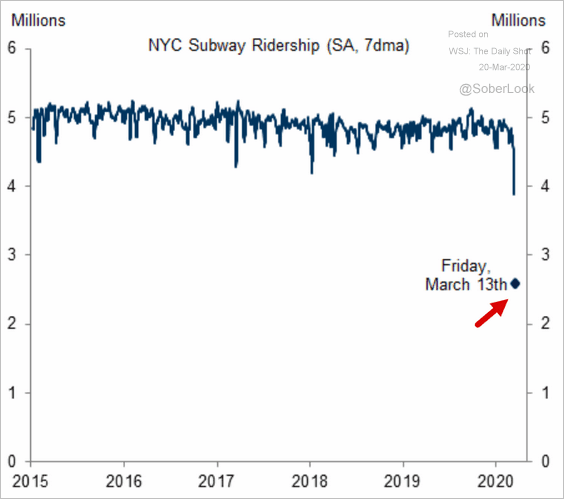

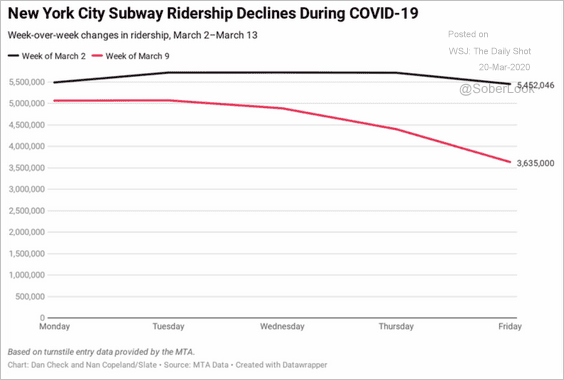

1. New York City subway ridership:

Source: Goldman Sachs

Source: Goldman Sachs

Source: Slate Read full article

Source: Slate Read full article

——————–

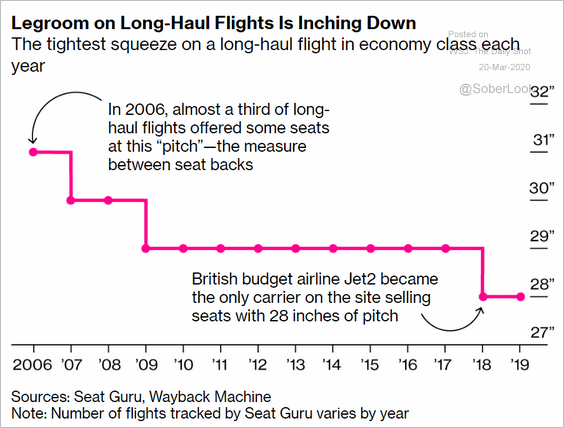

2. Airline leg room:

Source: @bopinion Read full article

Source: @bopinion Read full article

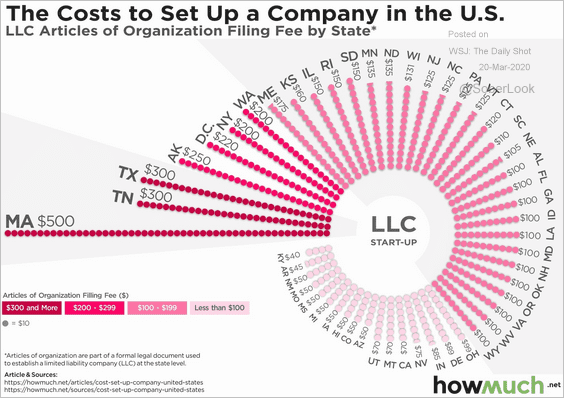

3. The cost to set up a company in the US:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

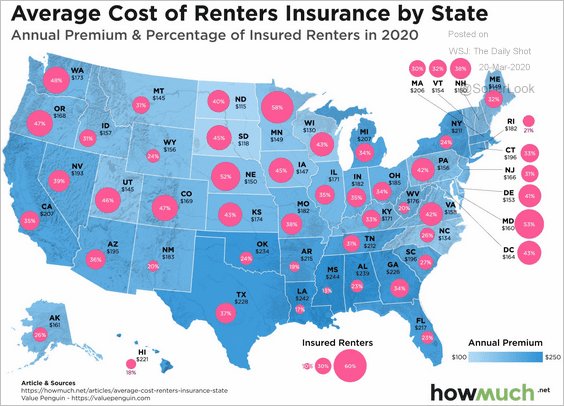

4. The cost of renters insurance:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

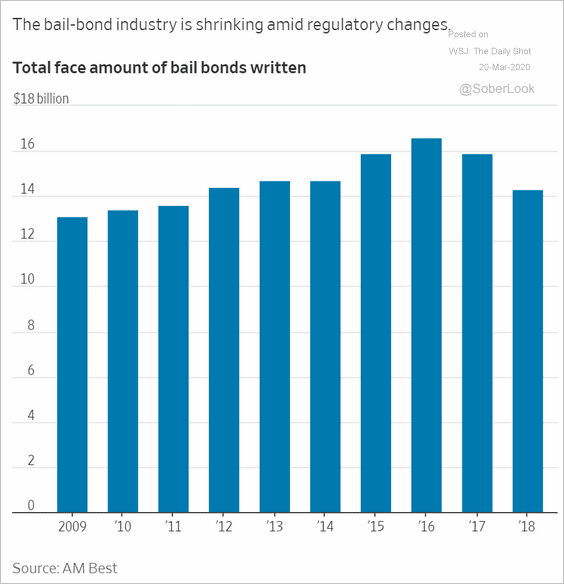

5. The bail-bond industry:

Source: @WSJ Read full article

Source: @WSJ Read full article

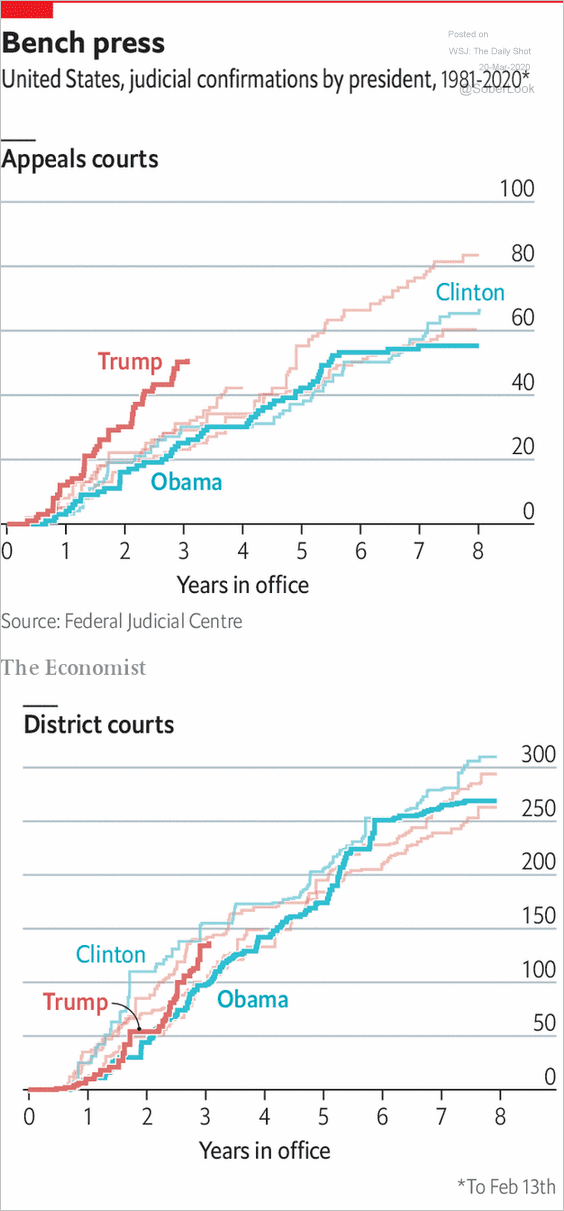

6. Judicial confirmations:

Source: The Economist Read full article

Source: The Economist Read full article

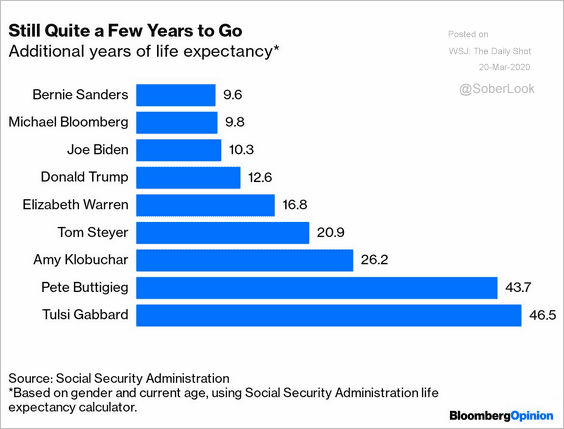

7. Presidential candidates’ (former and current) life expectancy:

Source: @bopinion Read full article

Source: @bopinion Read full article

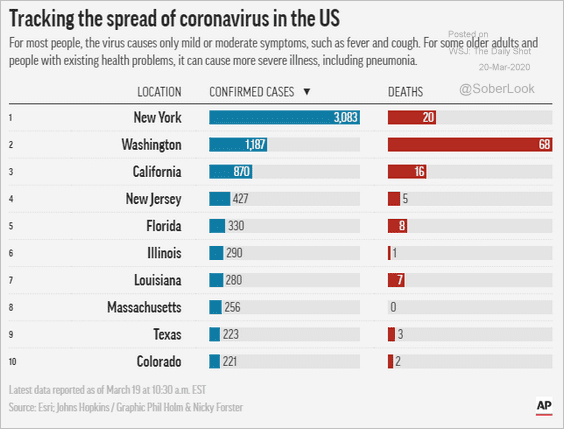

8. Coronavirus cases across the US:

Source: AP Read full article

Source: AP Read full article

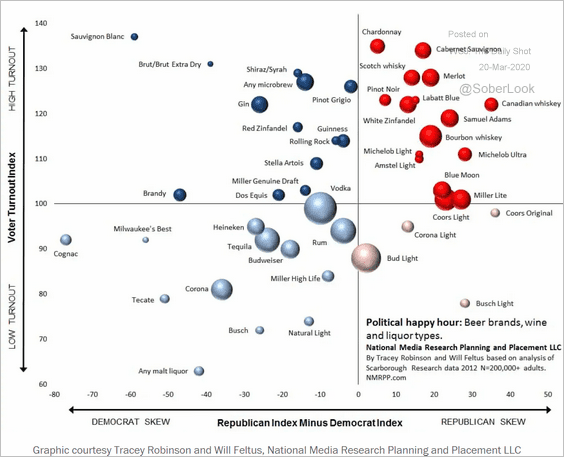

9. Voter turnout and party affiliation vs. alcoholic beverage preferences:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

Have a great weekend!