The Daily Shot: 31-Mar-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

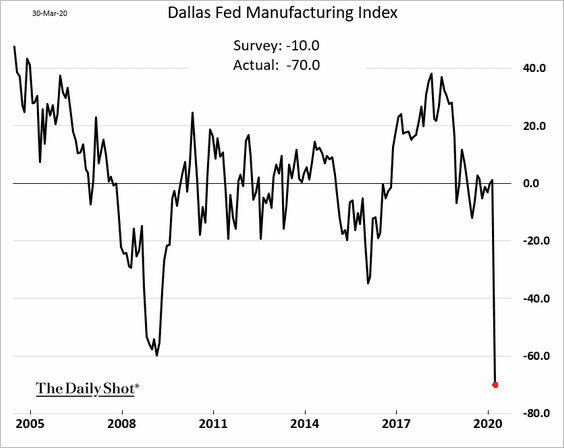

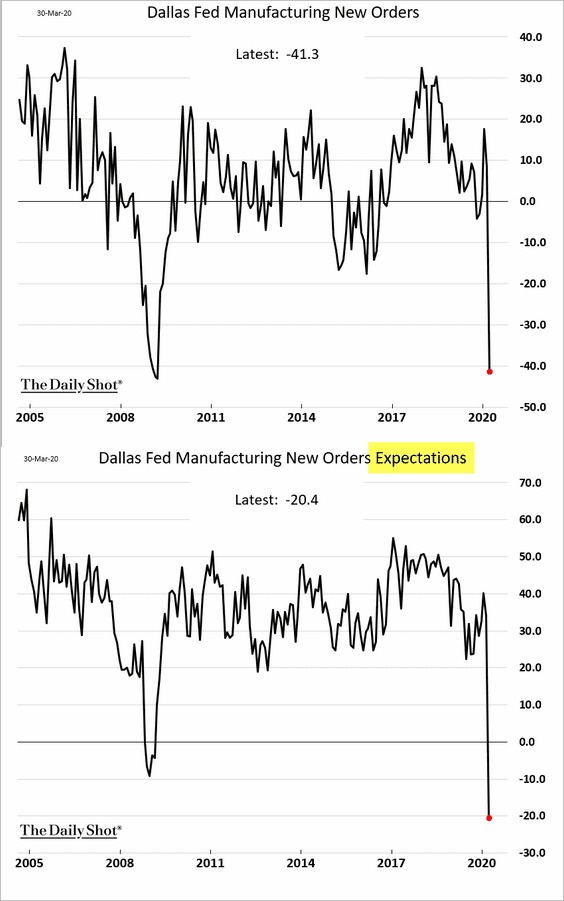

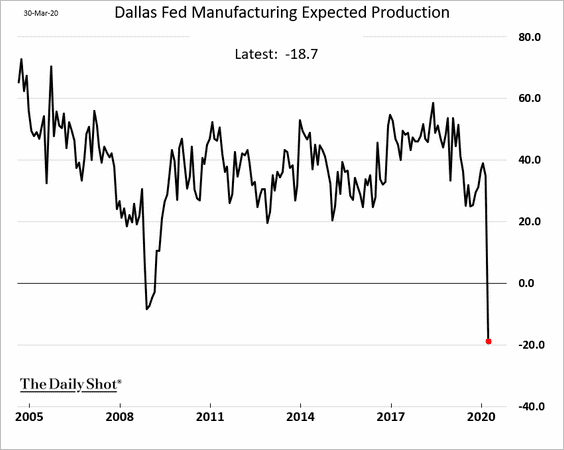

1. The Dallas Fed manufacturing report showed Texas-area factory activity collapsing in March.

• The headline index:

• New orders:

• Expected production in six months:

——————–

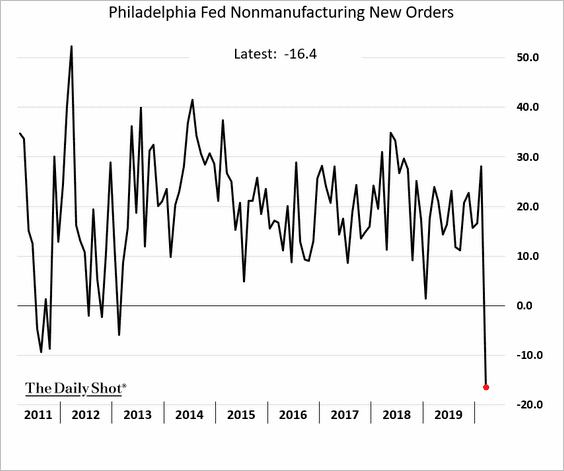

2. The Philly Fed’s nonmanufacturing report also showed severe deterioration.

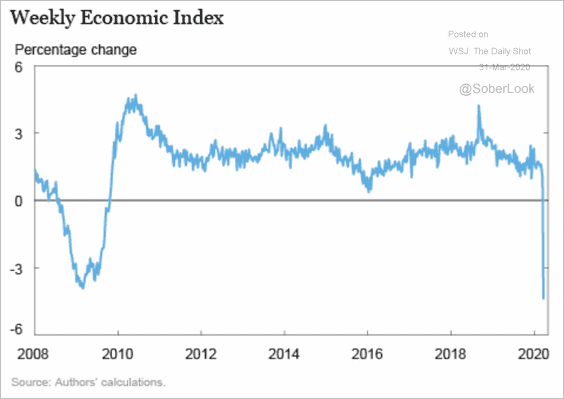

3. Here is the New York Fed’s high-frequency national economic activity indicator.

Source: @adam_tooze, @NYFedResearch Read full article

Source: @adam_tooze, @NYFedResearch Read full article

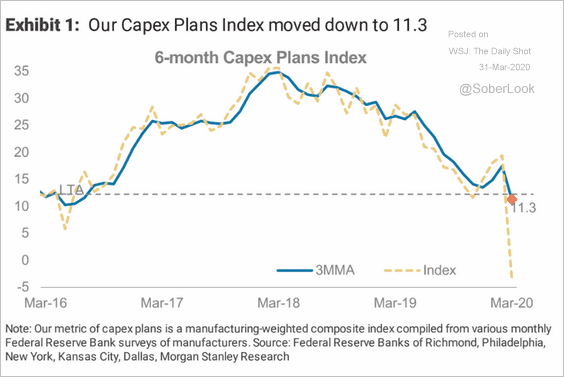

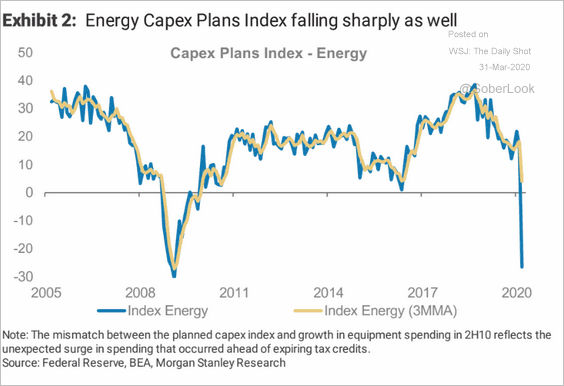

4. Morgan Stanley’s CapEx expectations index tumbled, as business investment plans get scrapped across the US.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

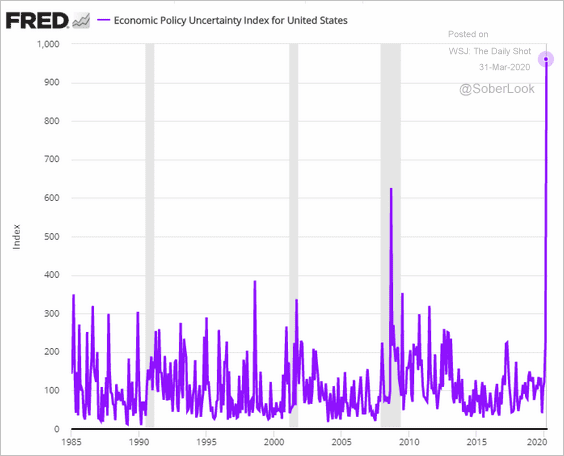

5. The Economic Policy Uncertainty Index hit another record high.

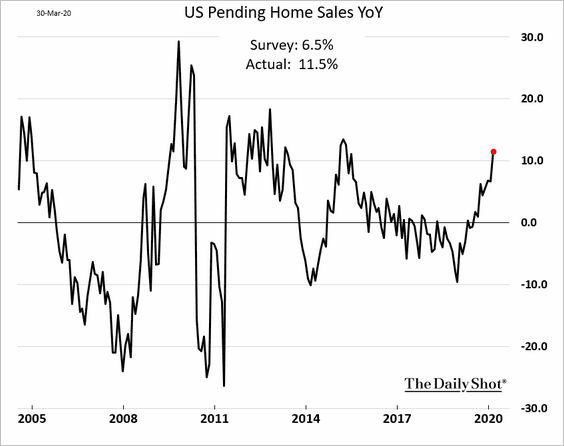

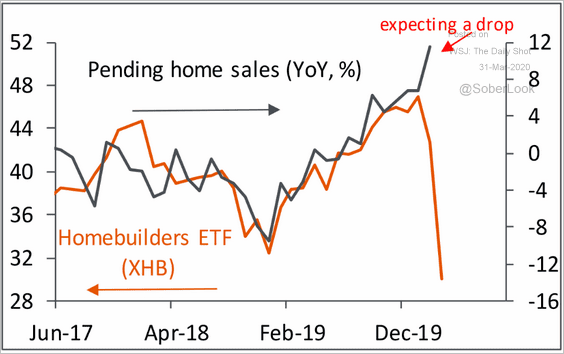

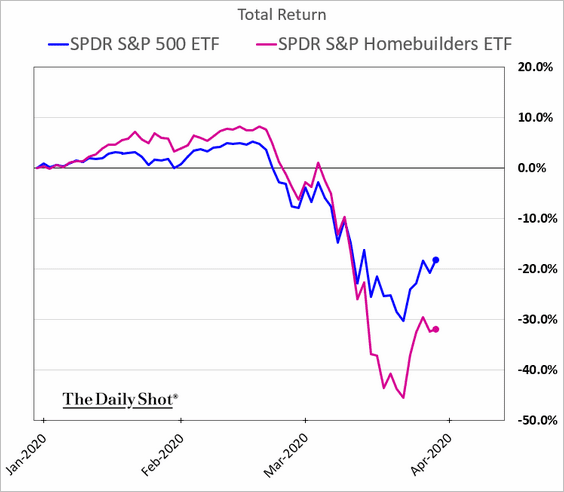

6. Growth in pending home sales accelerated in February.

But the trend probably reversed direction in March. This chart compares pending sales with the price of an exchange-traded fund that tracks homebuilders and other housing-related firms.

Source: Piper Sandler

Source: Piper Sandler

——————–

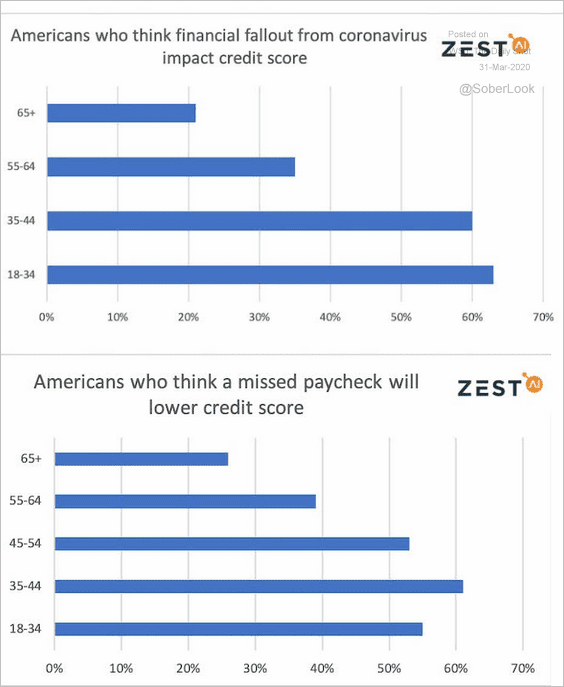

7. Americans are concerned that the crisis will damage their credit scores.

Source: Zest AI/The Harris Poll

Source: Zest AI/The Harris Poll

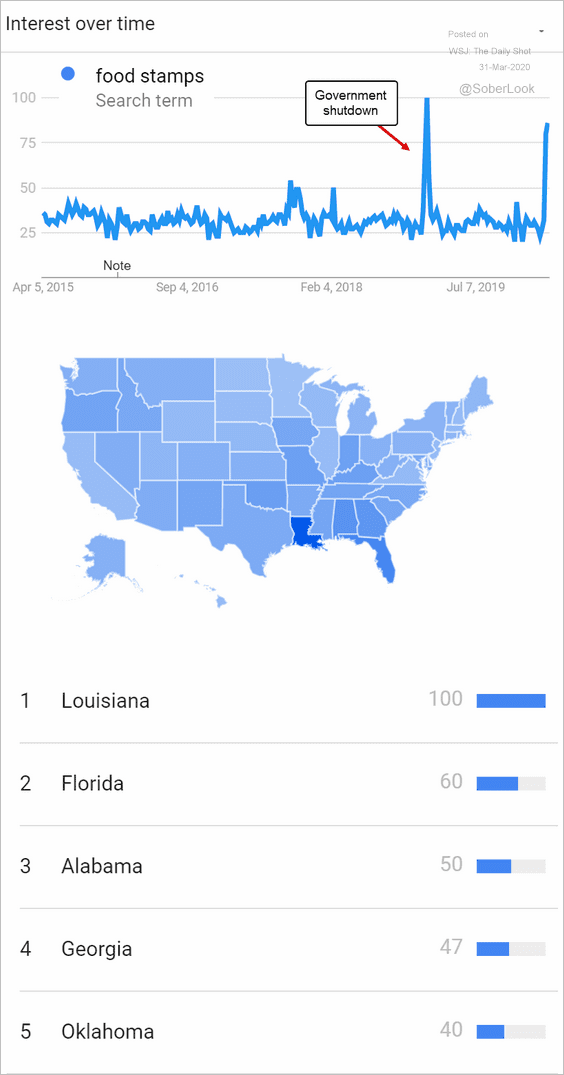

8. For some, the concern is more immediate. Here is the Google search frequency for “food stamps” (similar to what we saw during the government shutdown).

Source: Google Trends

Source: Google Trends

9. Next, we have some updates on the labor markets.

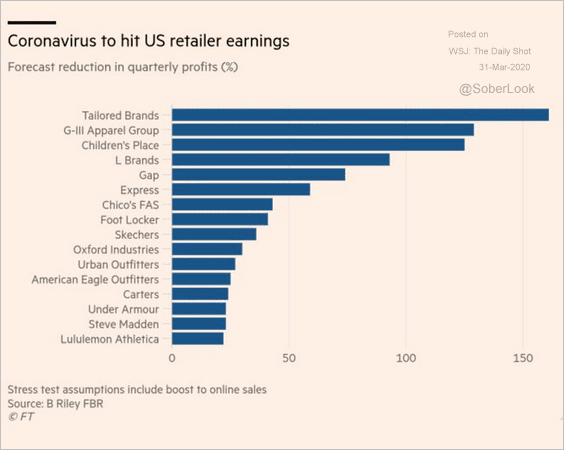

• The retail sector furloughs reached half a million as losses mount.

Source: @business Read full article

Source: @business Read full article

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

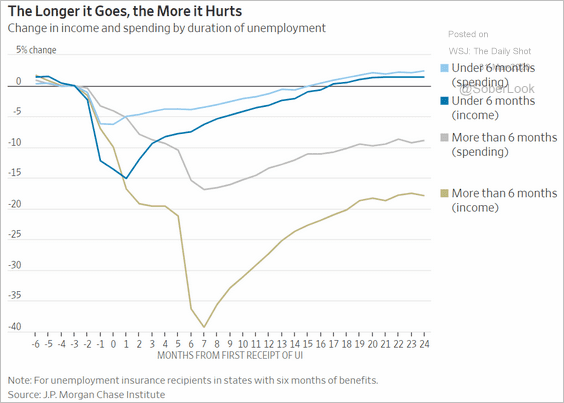

• The longer people are out of work, the harder the recovery when they re-enter the labor force.

Source: @WSJ Read full article

Source: @WSJ Read full article

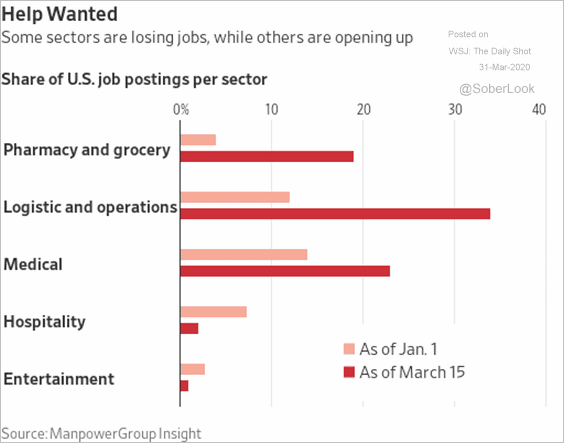

• This chart shows some of the labor reallocations that are taking place now.

Source: @WSJ Read full article

Source: @WSJ Read full article

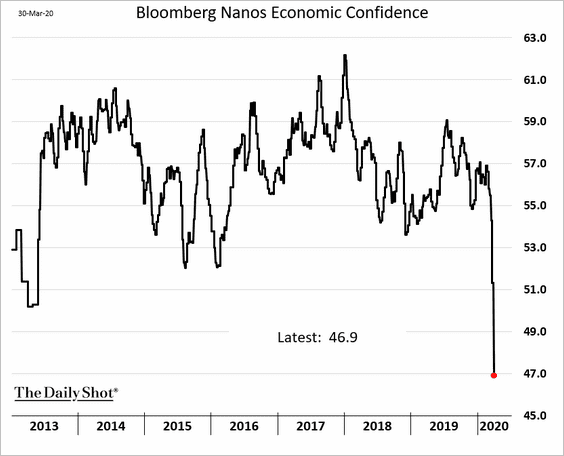

Canada

1. Consumer confidence is plummetting.

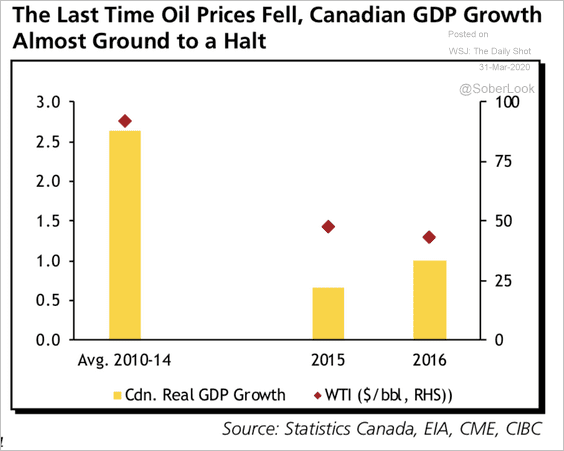

2. The massive drop in oil prices will be a drag on the GDP growth.

Source: CIBC Capital Markets

Source: CIBC Capital Markets

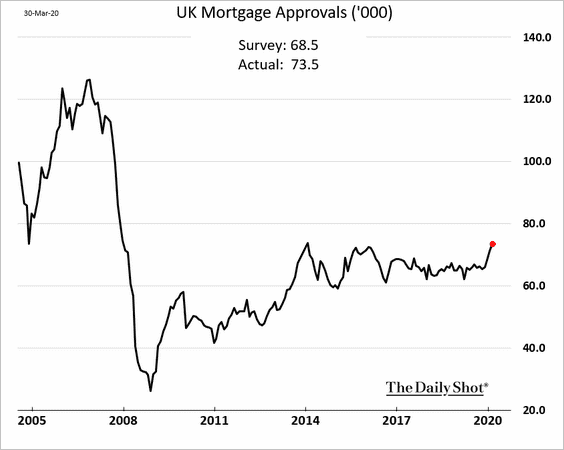

The United Kingdom

1. Mortgage approvals rose again in February.

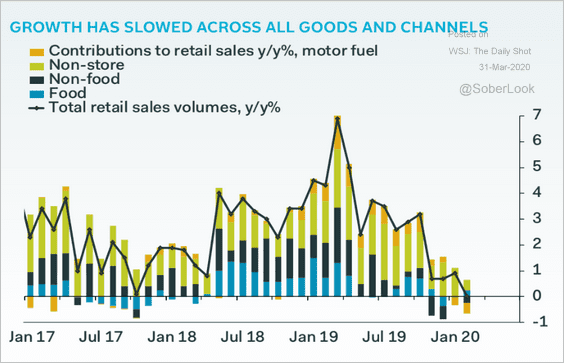

2. Retail sales growth has stalled.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

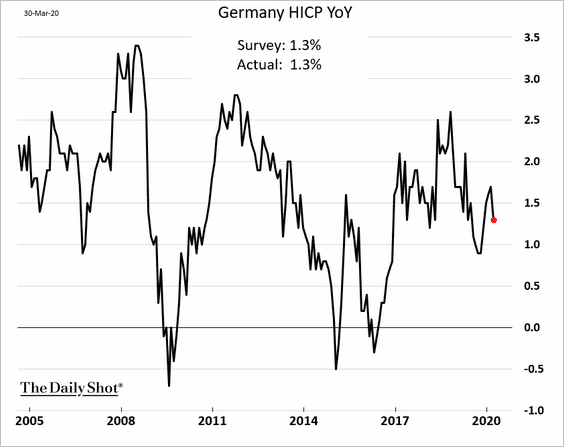

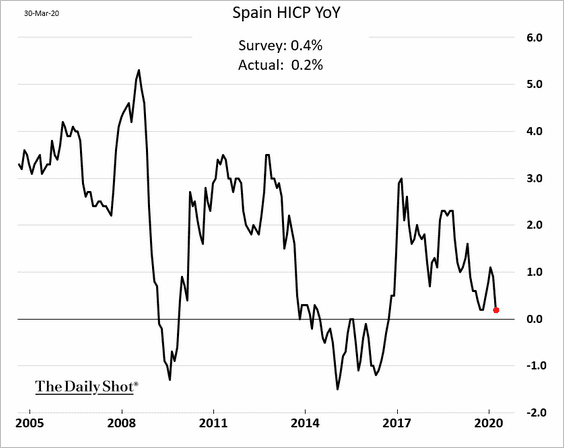

The Eurozone

1. Inflation ticked lower in Germany and Spain, and further declines are on the way.

——————–

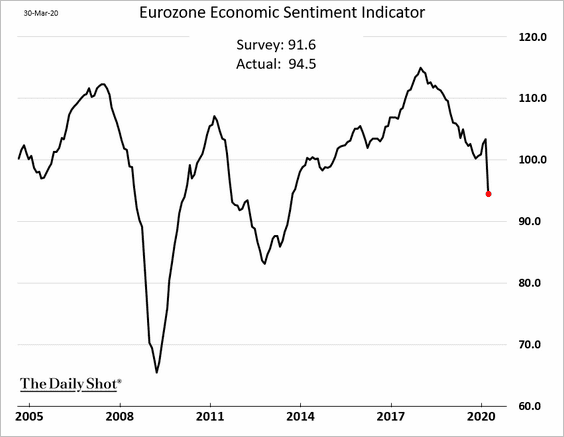

2. Economic sentiment has worsened but remains well above the Eurozone debt crisis lows.

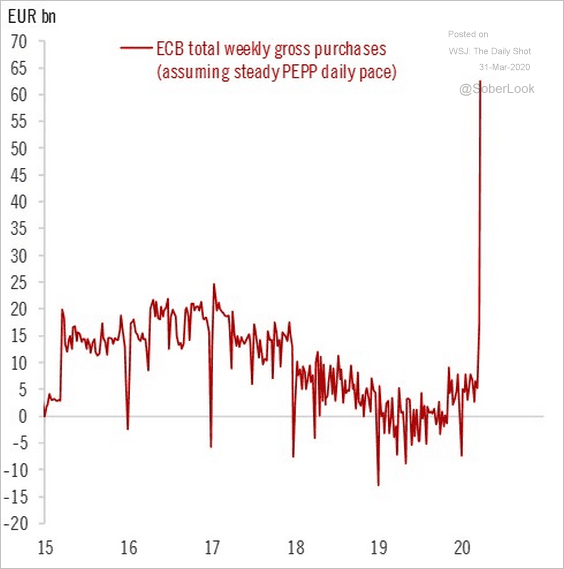

3. The ECB’s weekly securities purchases are expected to spike.

Source: @fwred

Source: @fwred

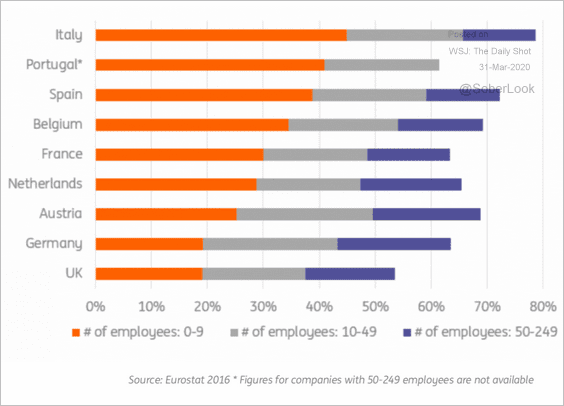

4. Small businesses are most vulnerable to the current crisis.

Source: ING

Source: ING

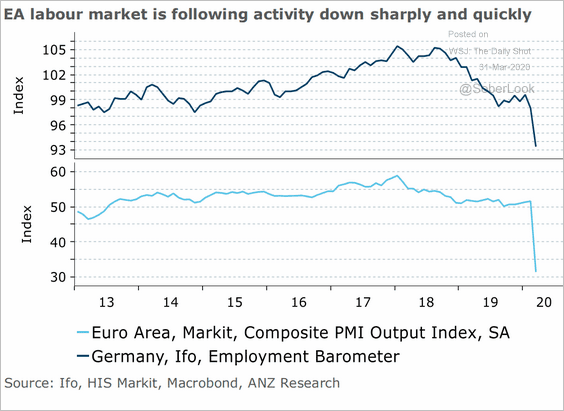

5. The euro-area labor markets have deteriorated sharply.

Source: ANZ Research

Source: ANZ Research

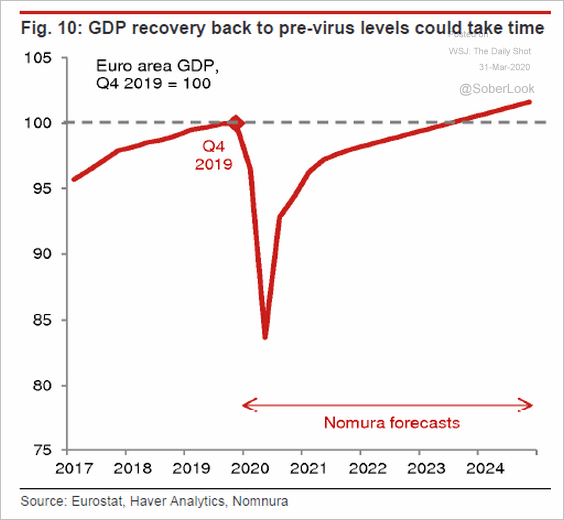

6. Nomura expects the Eurozone GDP to recover from the crisis by late 2023.

Source: Nomura Securities, @tracyalloway

Source: Nomura Securities, @tracyalloway

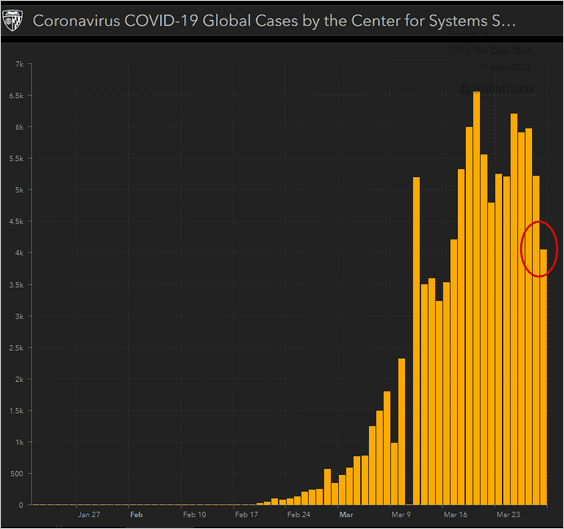

7. The number of new coronavirus cases in Italy continues to decline.

Source: JHU CSSE

Source: JHU CSSE

Europe

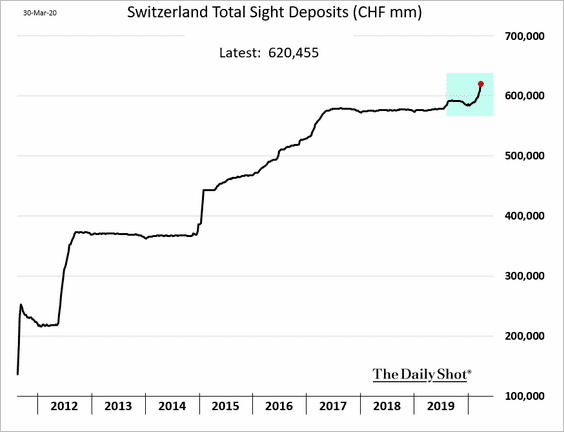

1. Demand for safe-haven assets has been putting upward pressure on the Swiss franc. The Swiss central bank has been buying foreign currencies (mostly euros) to keep the franc from appreciating further.

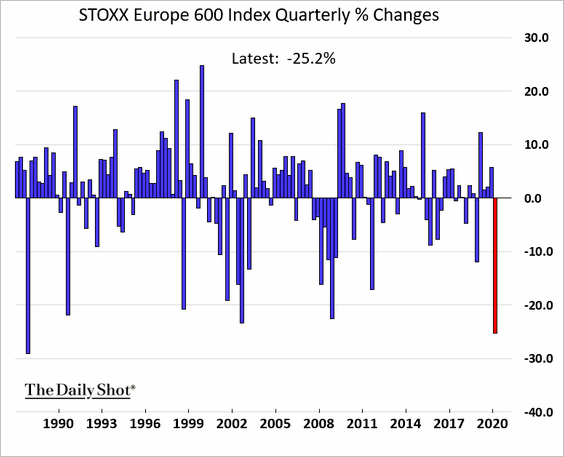

2. It’s been a rough quarter for European shares.

h/t Namitha Jagadeesh, @TheTerminal

h/t Namitha Jagadeesh, @TheTerminal

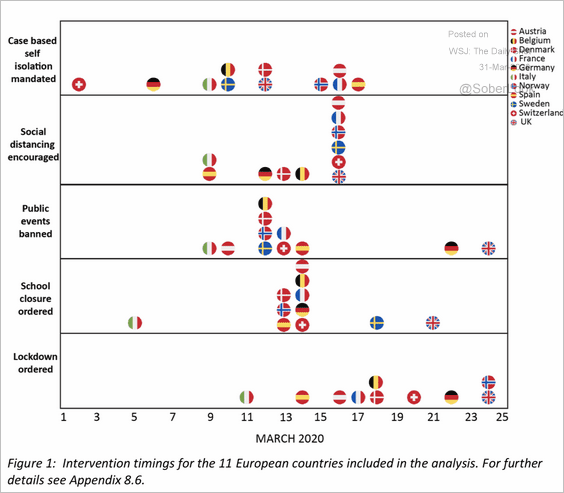

3. Here is a timeline of government actions to fight the epidemic.

Source: Imperial College COVID-19 Response Team Read full article

Source: Imperial College COVID-19 Response Team Read full article

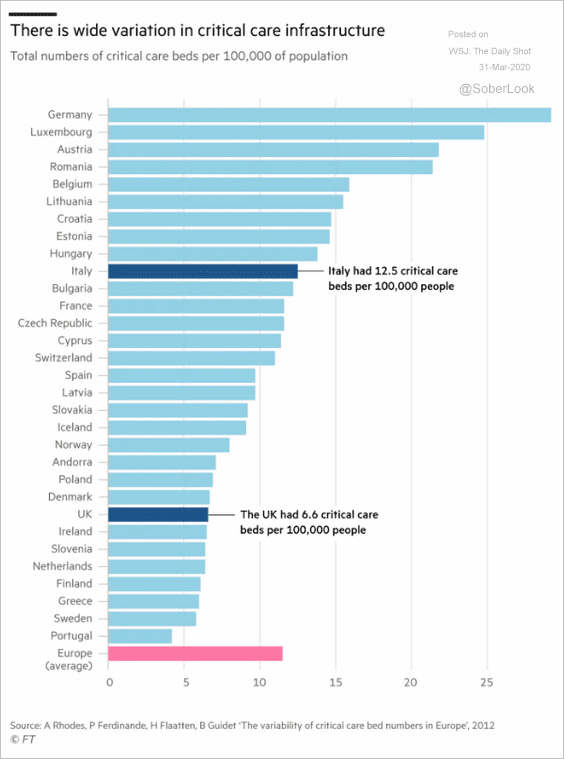

4. How many critical care beds does each country have per 100,000 people?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Japan

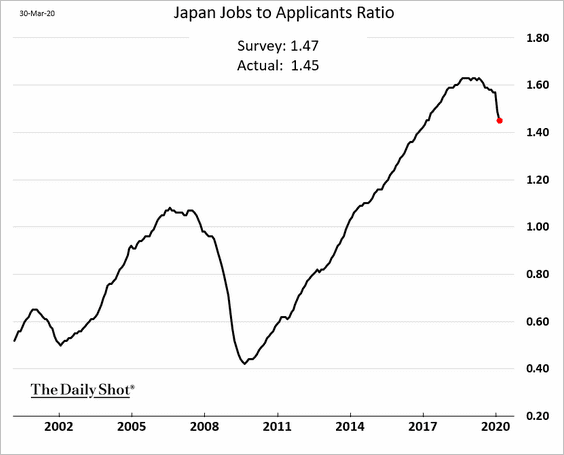

1. Japan’s jobs-to-applicants ratio has been rolling over.

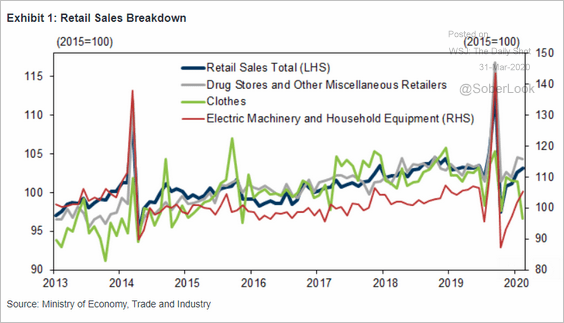

2. Retail sales rebounded from the post-tax-hike decline, but there is evidence of crisis-related hoarding.

Source: Goldman Sachs

Source: Goldman Sachs

Asia – Pacific

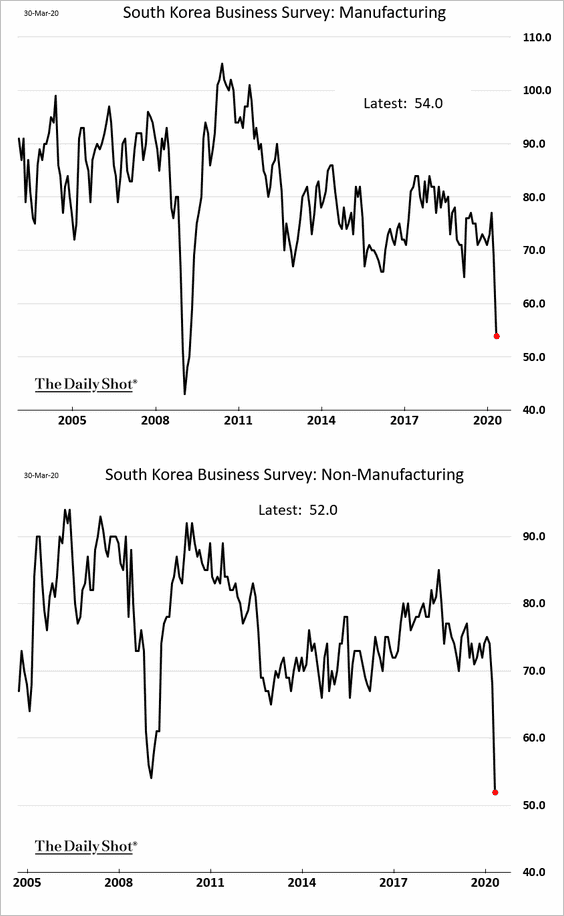

1. Let’s begin with South Korea.

• Business activity plummeted this month.

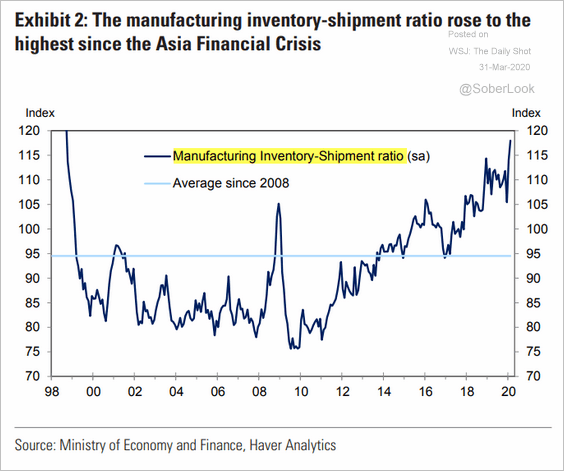

• The manufacturing inventory-to-shipments ratio hit the highest level in over two decades.

Source: Goldman Sachs

Source: Goldman Sachs

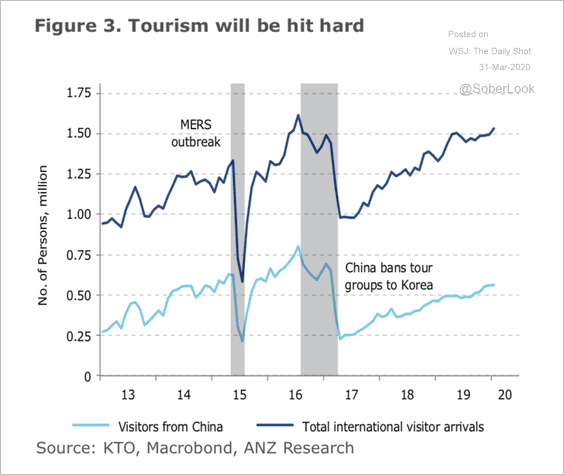

• The epidemic will put severe pressure on South Korea’s tourism industry.

Source: ANZ Research

Source: ANZ Research

——————–

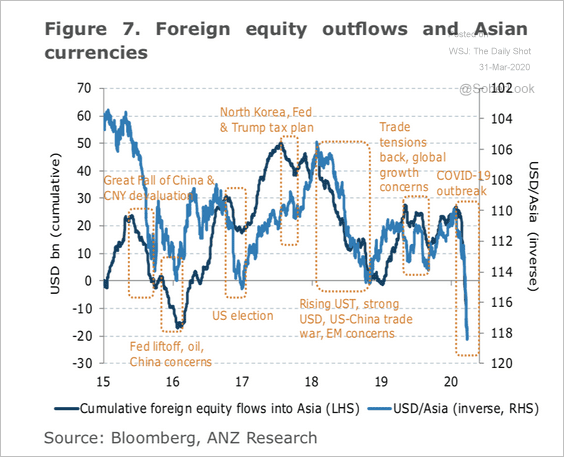

2. According to ANZ, March month-to-date Asian “equity outflows totaled almost USD28bn, the largest monthly outflow on record.”

Source: ANZ Research

Source: ANZ Research

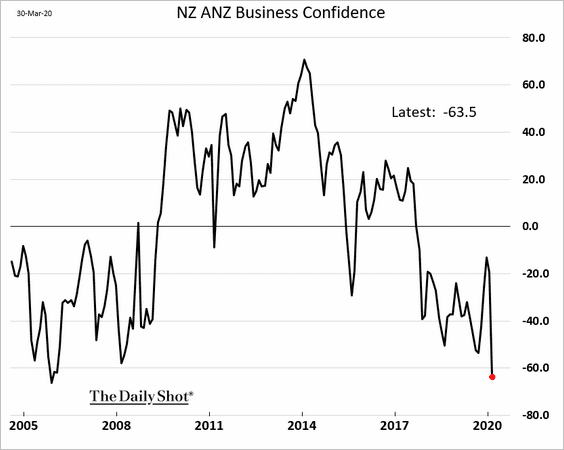

3. New Zealand’s business confidence hit the lowest level since 2006.

4. Next, we have some updates on Australia.

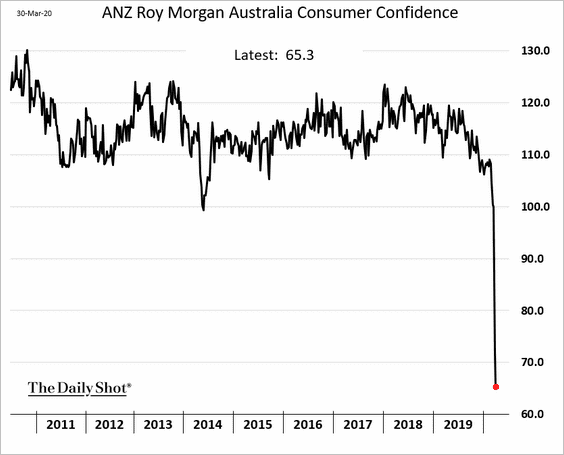

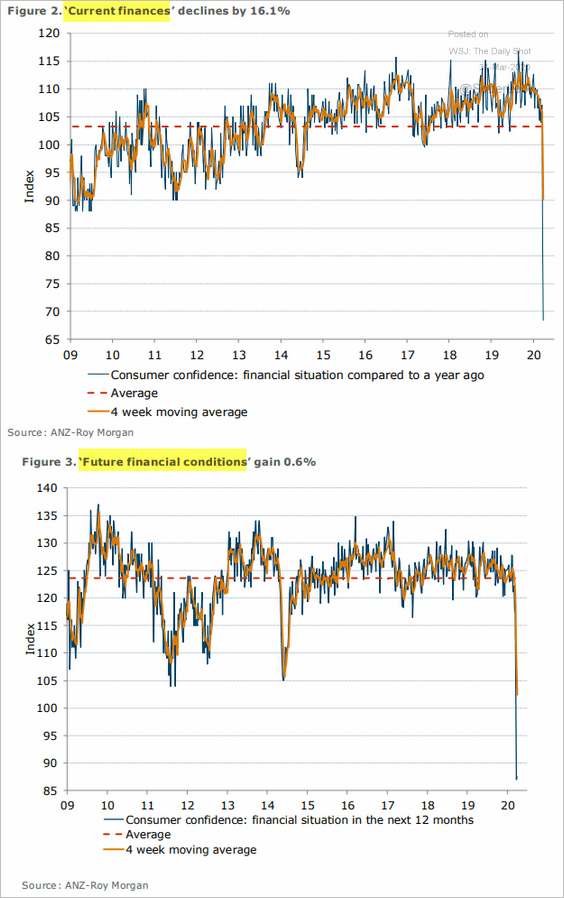

• ANZ’s consumer confidence index hit a record low.

Source: ANZ Research

Source: ANZ Research

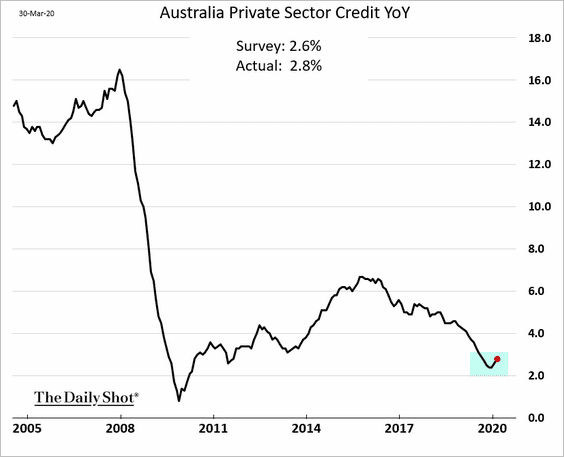

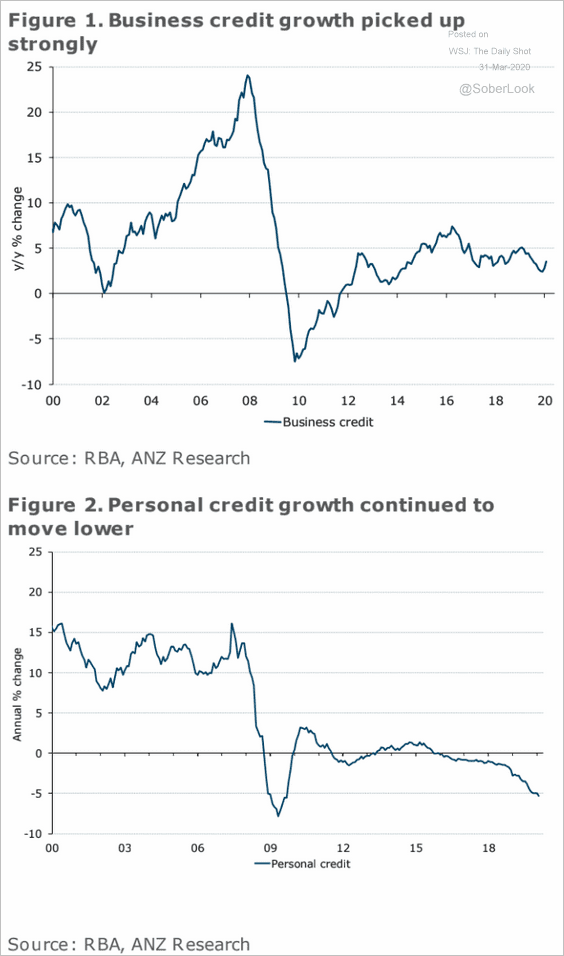

• Private sector credit growth showed signs of improvement in February, driven by business credit.

Source: ANZ Research

Source: ANZ Research

China

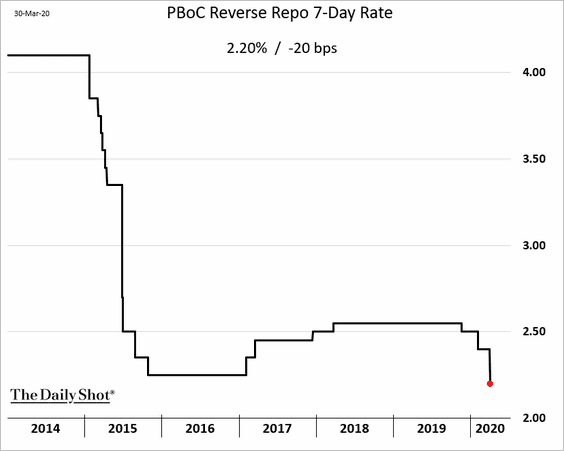

1. China’s central bank cut short term rates.

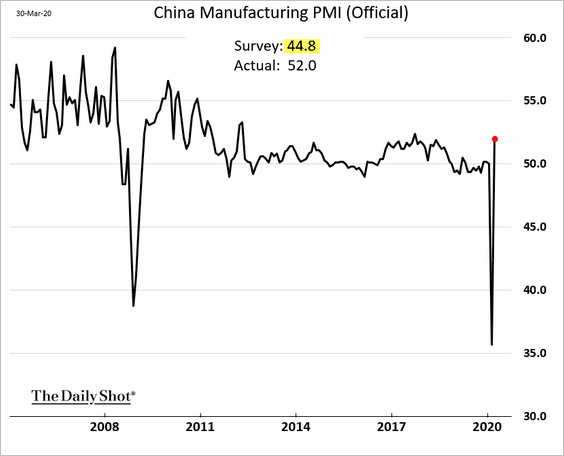

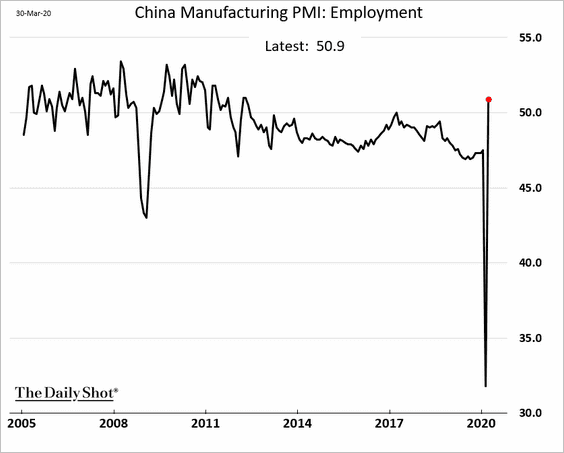

2. According to the official PMI data, business activity staged a remarkable rebound in March. Some economists are skeptical.

• Manufacturing PMI:

• Export orders:

• Factory employment:

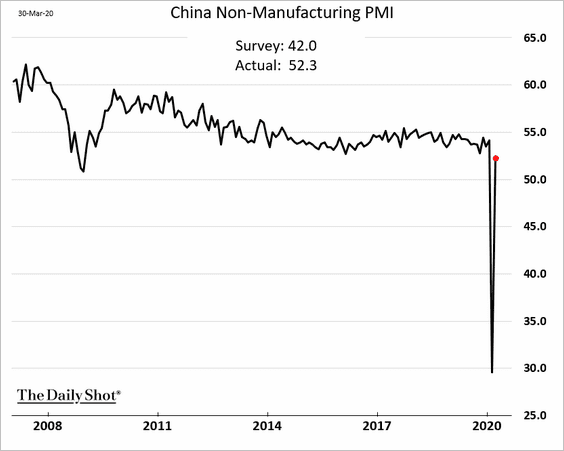

• Non-manufacturing PMI:

——————–

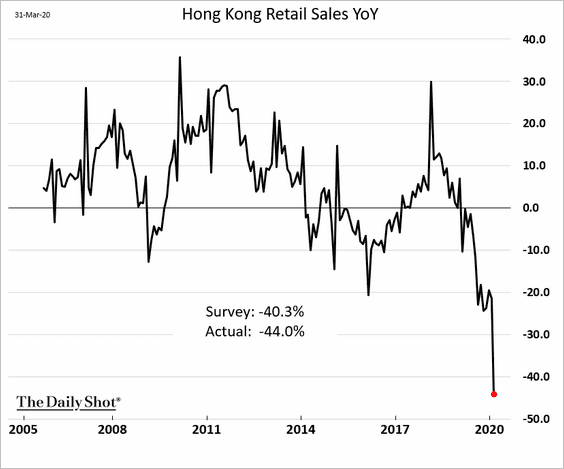

3. Hong Kong’s retail sales registered the largest year-over-year decline on record.

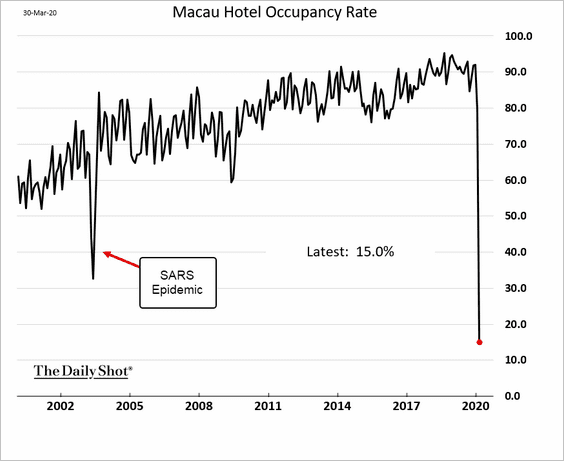

4. Macau hotel occupancy rate has collapsed.

Emerging Markets

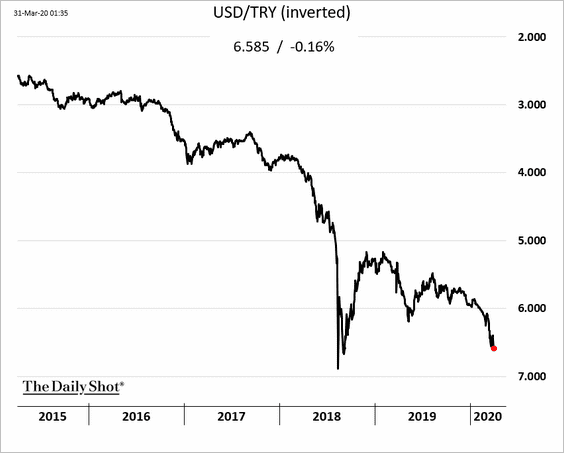

1. The Turkish lira continues to weaken.

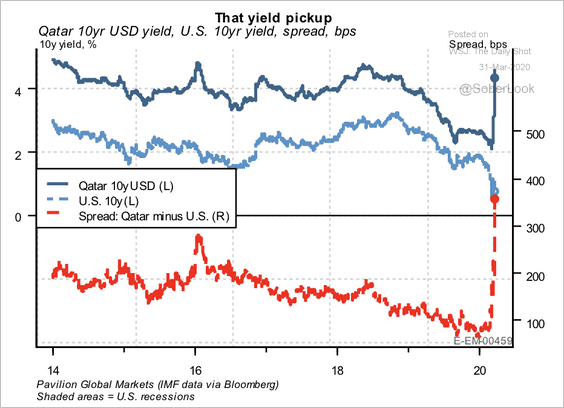

2. The recent fall in oil prices sent Qatar’s 10-year government bond yield soaring.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

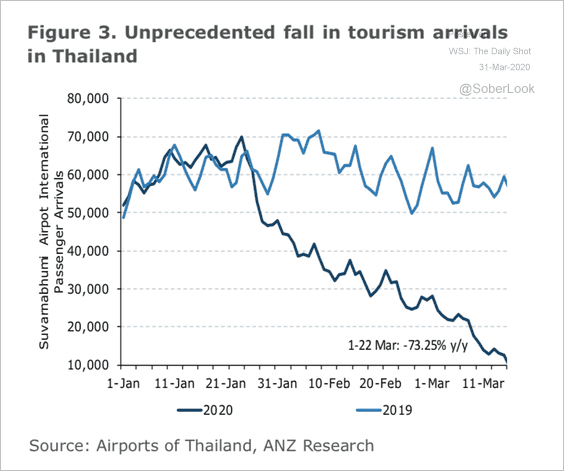

3. The decline in Thai tourism has been unprecedented.

Source: ANZ Research

Source: ANZ Research

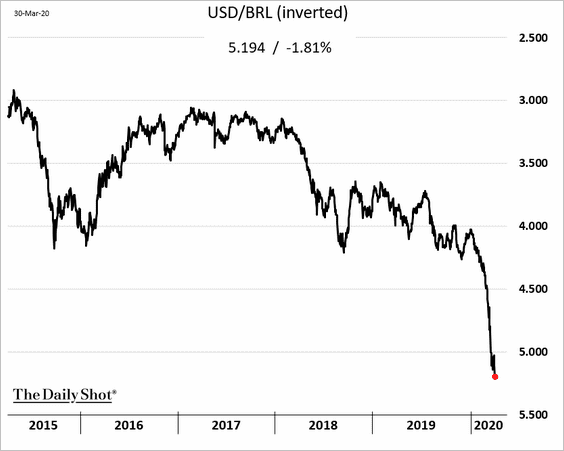

4. The Brazilian real hit another record low.

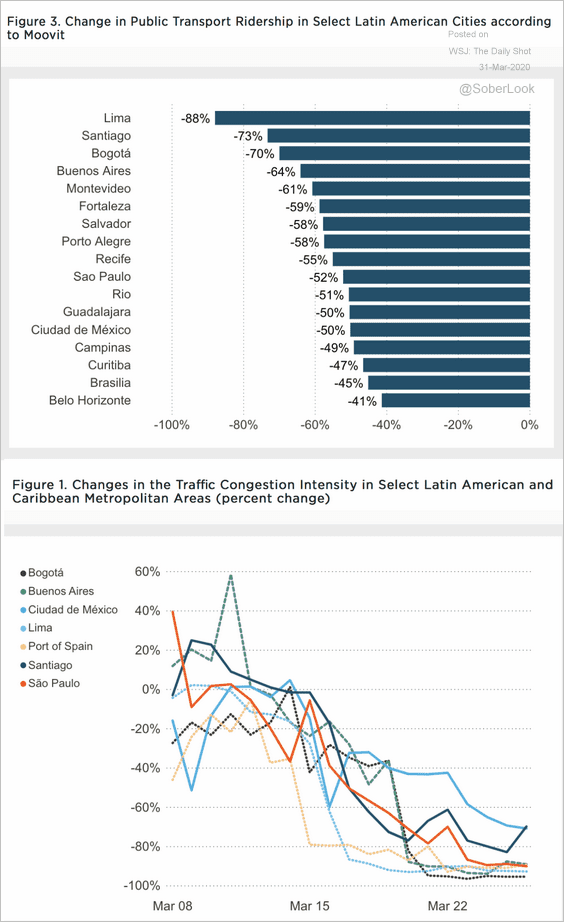

5. Next, we have some data on traffic and public transit ridership in select Latin American cities.

Source: Inter-American Development Bank Read full article

Source: Inter-American Development Bank Read full article

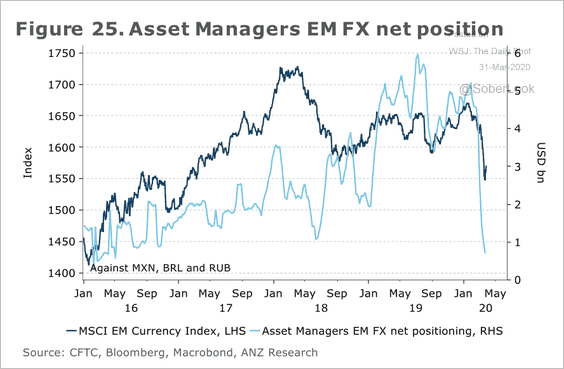

6. Asset managers have been cutting back on EM currency exposure.

Source: ANZ Research

Source: ANZ Research

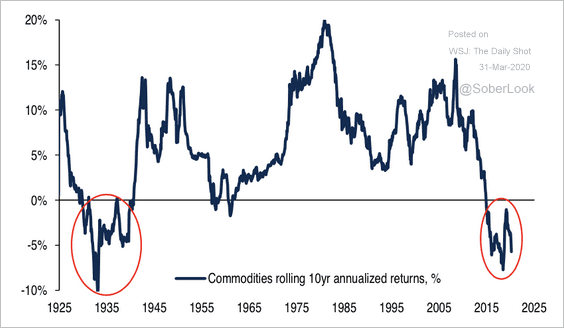

Commodities

1. 10-year rolling returns for commodities are the worst since the 1930s. Have we reached a bottom?

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

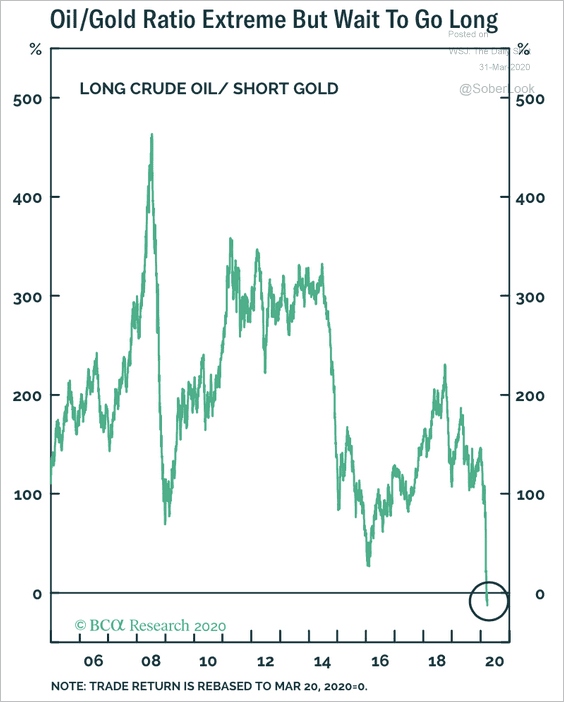

2. The oil-to-gold ratio is at a 14-year low.

Source: BCA Research

Source: BCA Research

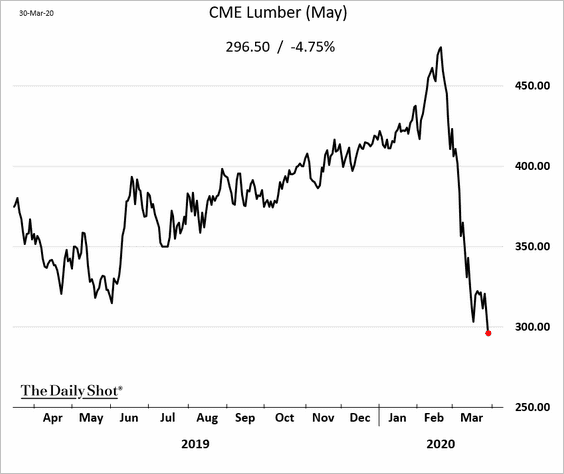

3. US lumber futures dipped below $300.

Energy

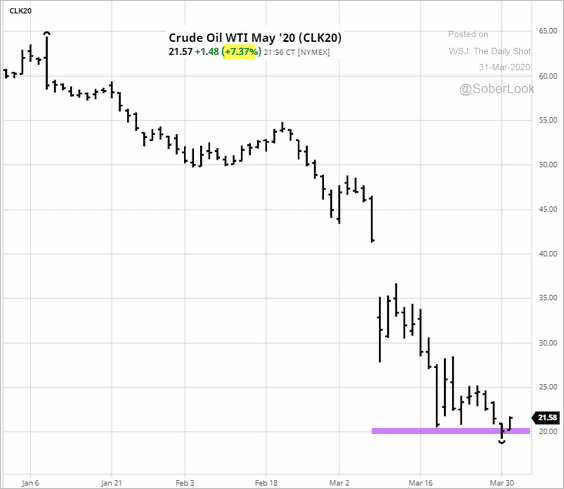

1. The $20/bbl support for WTI crude oil futures is holding.

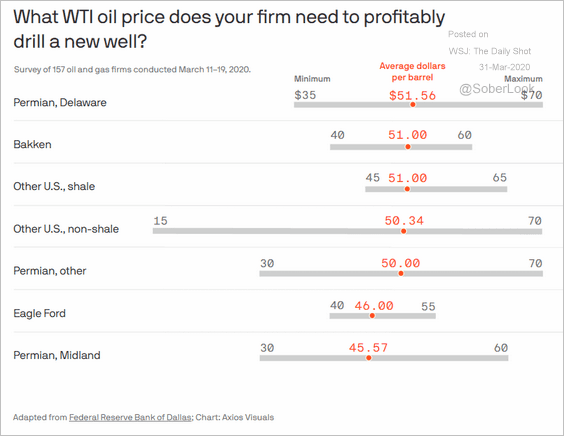

2. What oil price do US producers need to profitably drill a new well?

Source: @axios Read full article

Source: @axios Read full article

As a result of the above, energy CapEx plans have collapsed.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

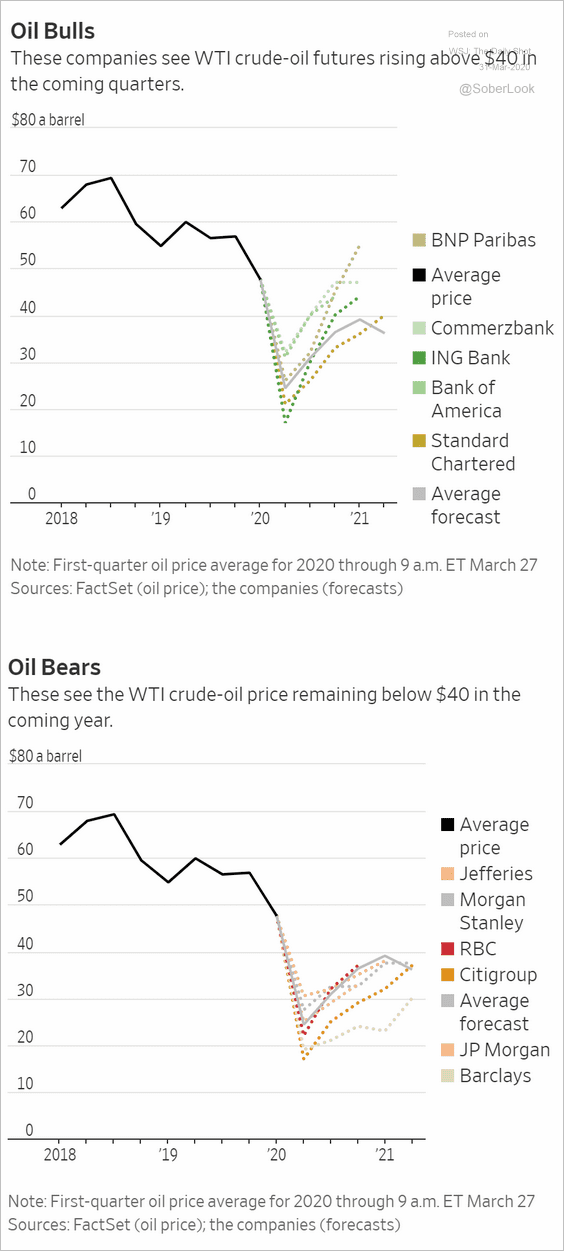

3. Next, we have some forecasts for crude oil prices over the next few quarters.

Source: @WSJ Read full article

Source: @WSJ Read full article

Equities

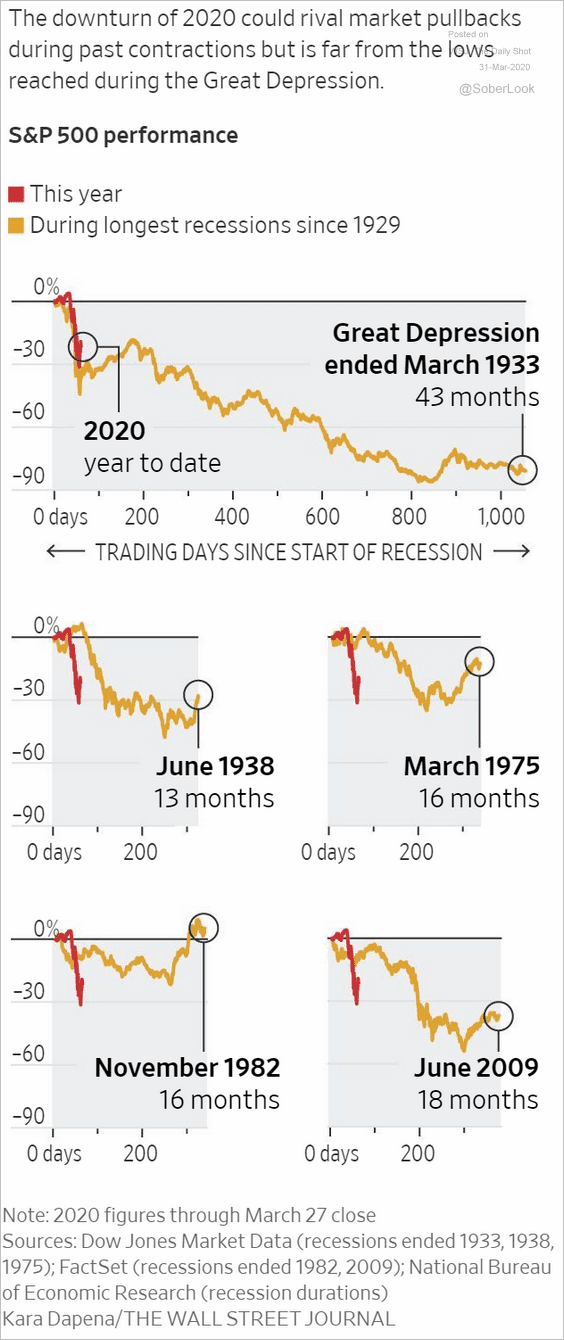

1. Let’s start with some previous market contractions.

Source: @WSJ Read full article

Source: @WSJ Read full article

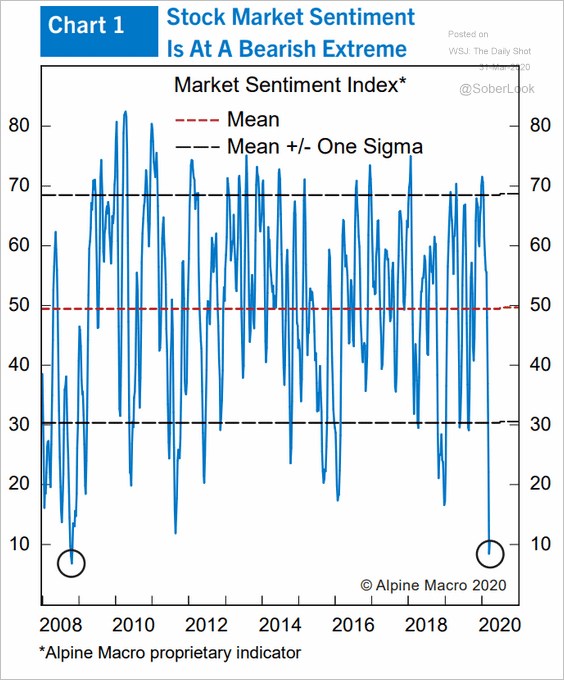

2. Alpine Macro’s sentiment index shows extreme bearishness.

Source: Alpine Macro

Source: Alpine Macro

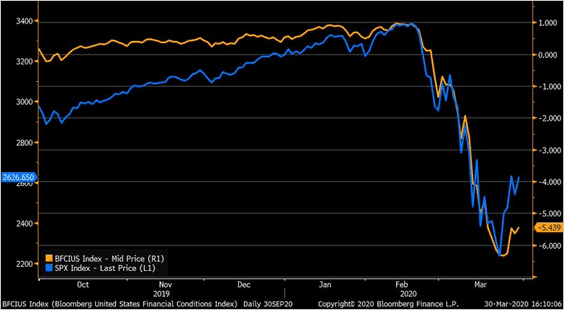

3. The market rebound has outpaced improvements in financial conditions.

Source: @LizAnnSonders, @bloomberg

Source: @LizAnnSonders, @bloomberg

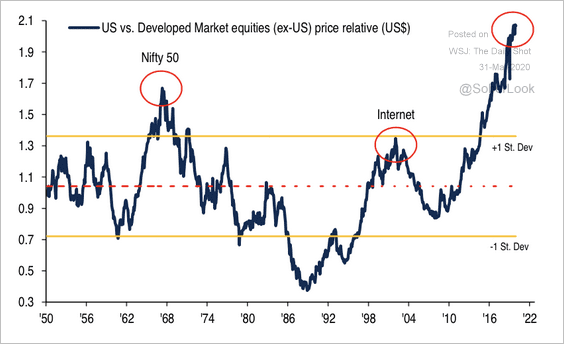

4. US equities are at 70-year highs relative to developed market (ex-US) equities.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

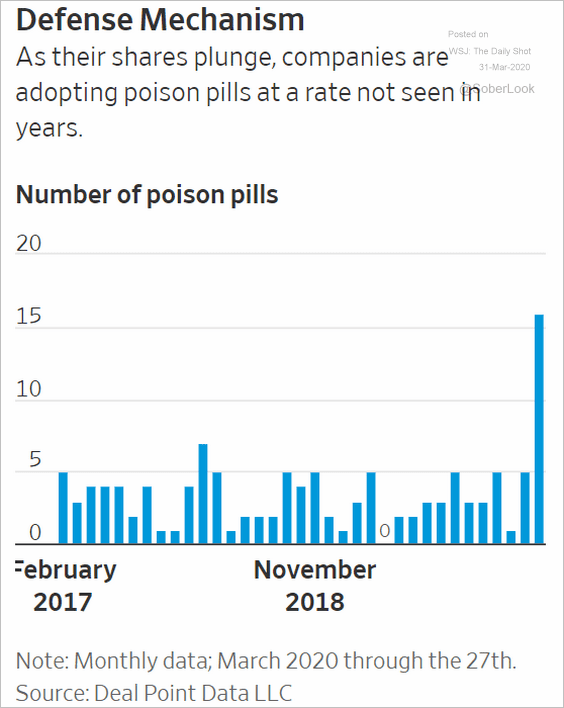

5. With share prices down sharply, companies are defending themselves against potential hostile takeover attempts (see **definition of poison pill**https://www.investopedia.com/terms/p/poisonpill.asp

**).

Source: @WSJ Read full article

Source: @WSJ Read full article

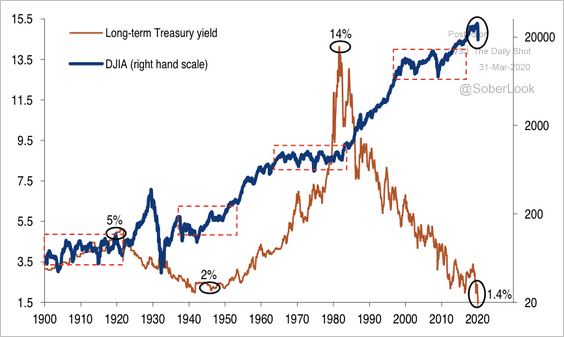

6. Here is a chart of the Dow Jones Industrial Average and long-term Treasury yields going back to 1900.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

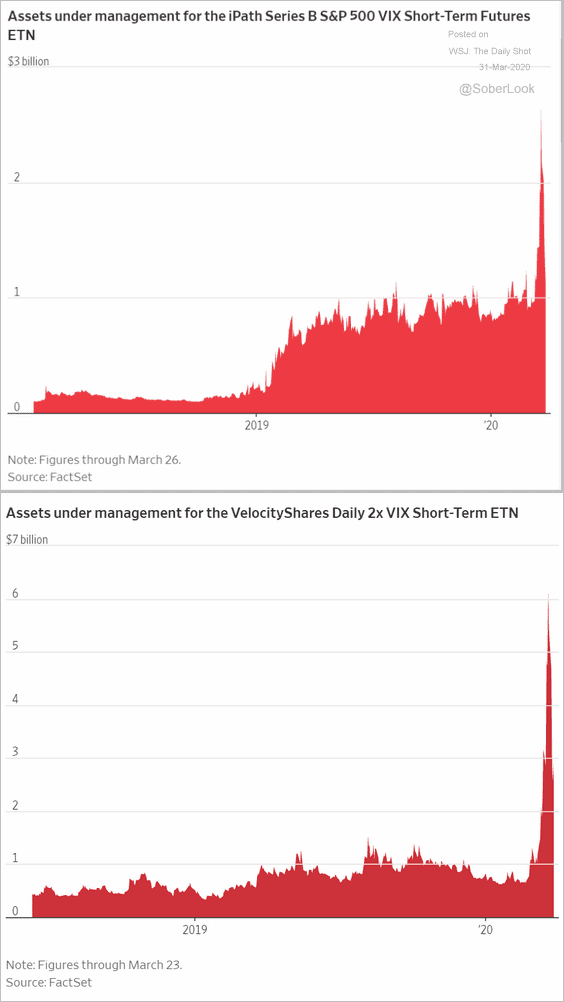

7. Assets of ETFs that bet on volatility spiked in recent weeks. A contrarian indicator?

Source: @WSJ Read full article

Source: @WSJ Read full article

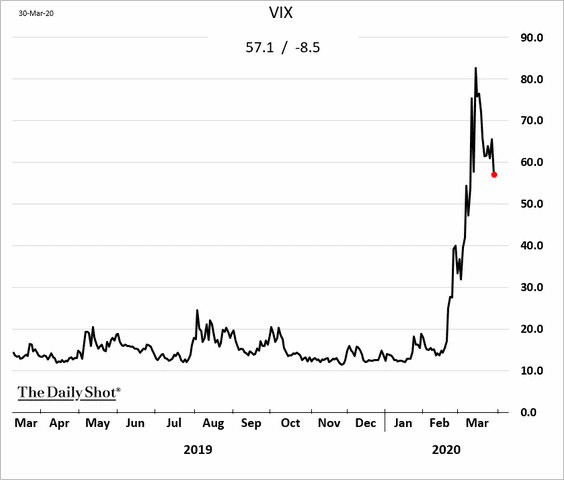

VIX dipped below 60 for the first time in a couple of weeks.

——————–

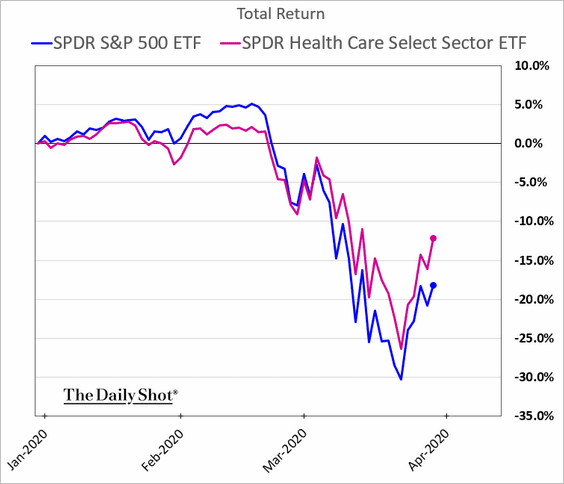

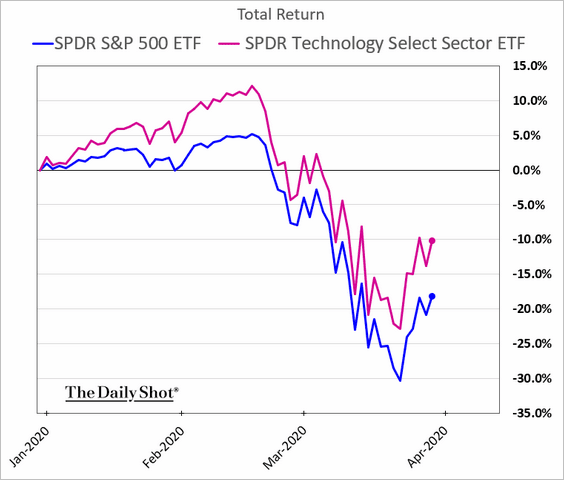

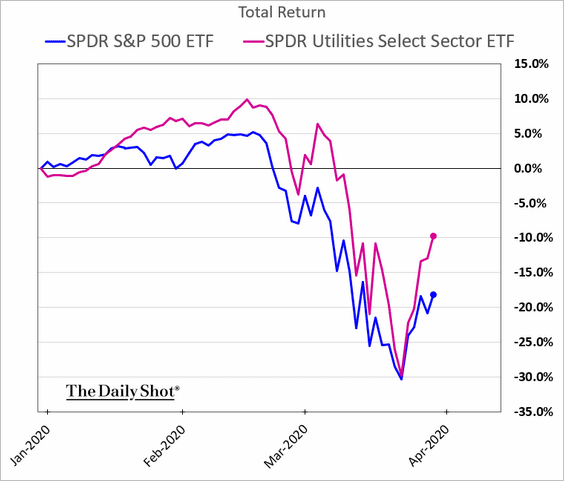

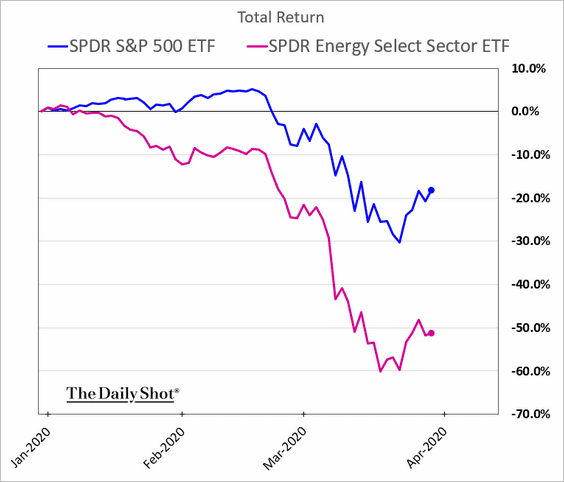

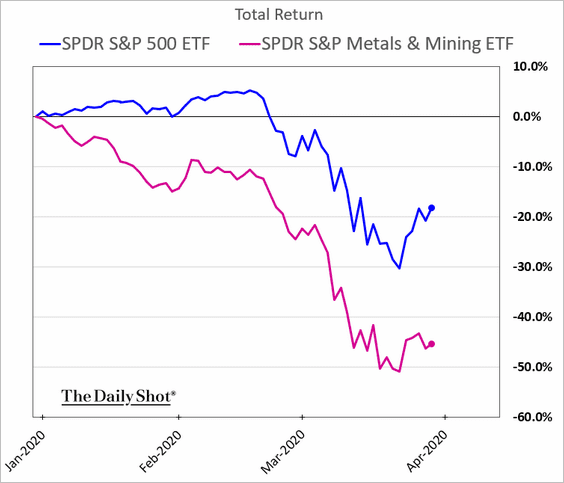

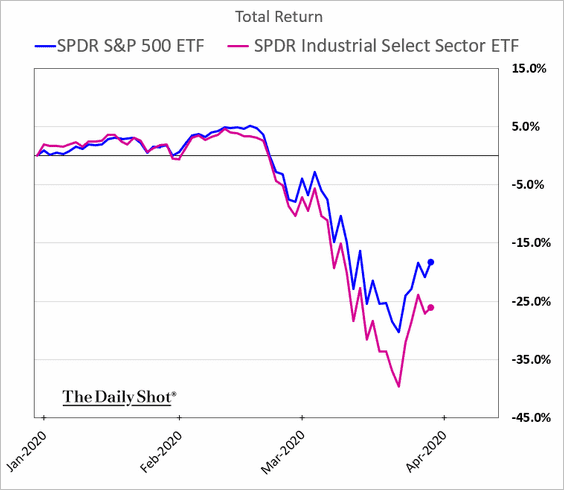

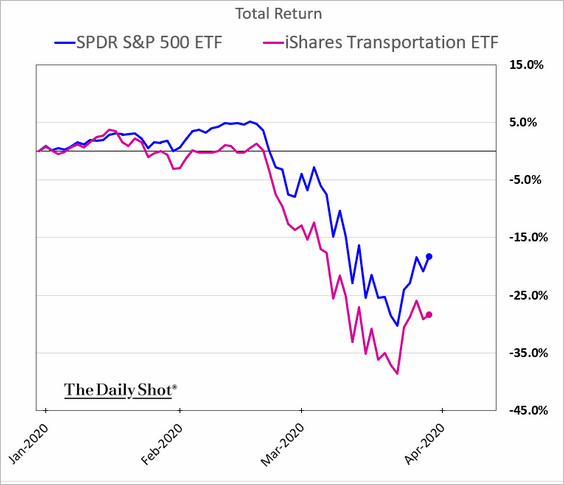

8. Next, we have some sector performance updates (year-to-date).

• Healthcare:

• Tech:

• Utilities:

• Energy:

• Metals & Mining:

• Industrials:

• Transportation:

• Homebuilders:

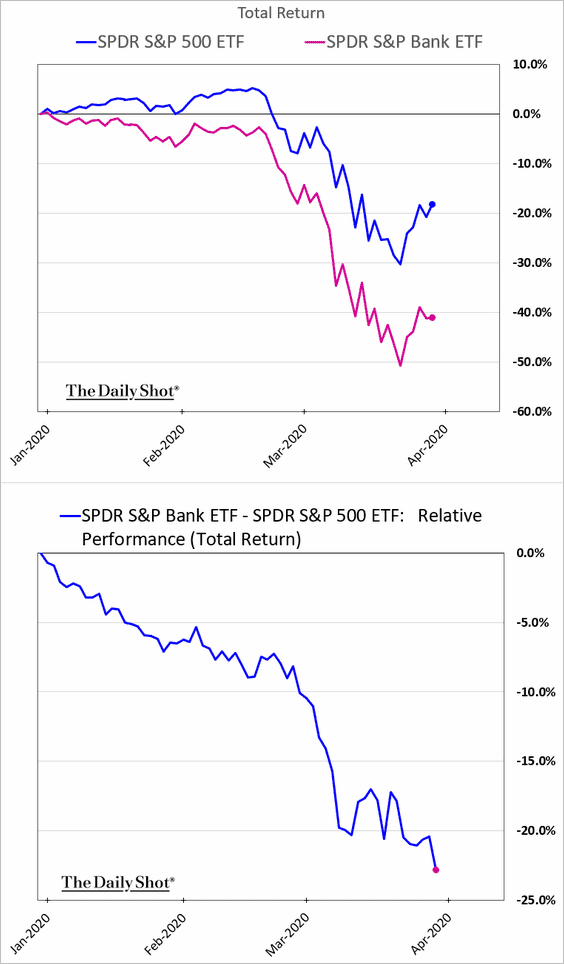

• Banks:

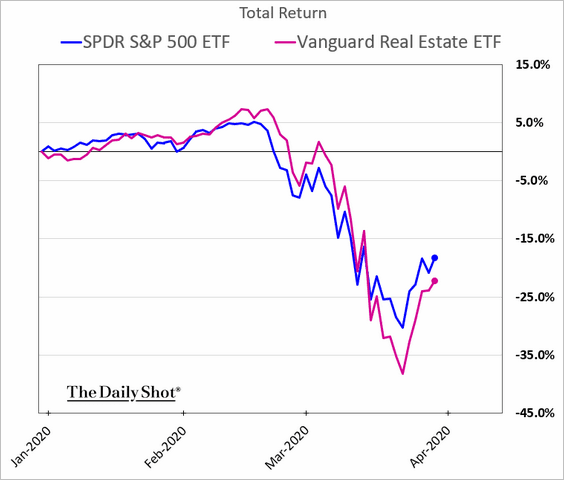

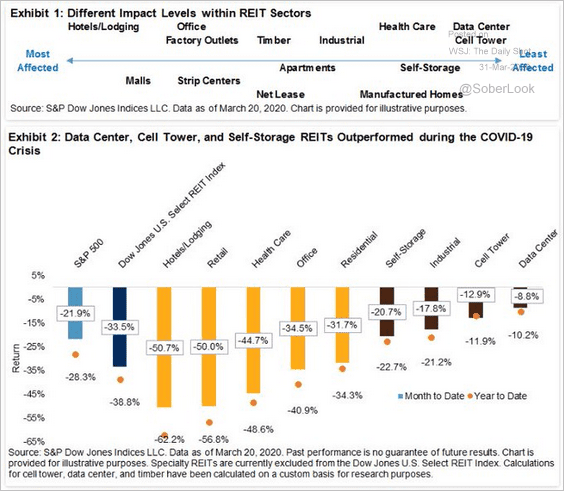

• REITs (surprisingly resilient giving the looming spike in account receivables):

Here is the performance across different types of REITs.

Source: @LizAnnSonders, @SPDJIndices

Source: @LizAnnSonders, @SPDJIndices

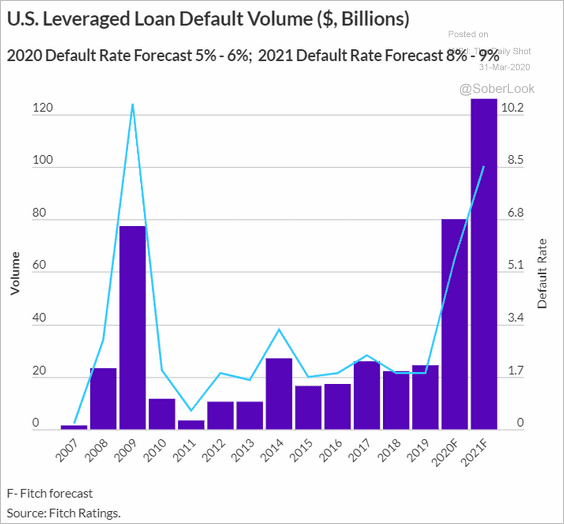

Credit

1. According to Fitch Ratings, leveraged loan defaults are going to spike this year.

Source: Fitch Ratings

Source: Fitch Ratings

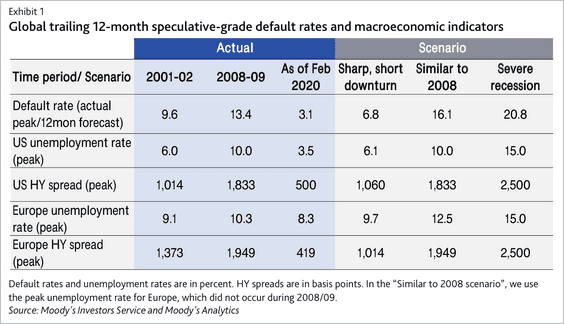

2. The global speculative-grade default rate could climb to 6.8% in one year in a sharp but short downturn. Alternatively, it could be 16.1% under conditions similar to the global financial crisis, according to Moody’s.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

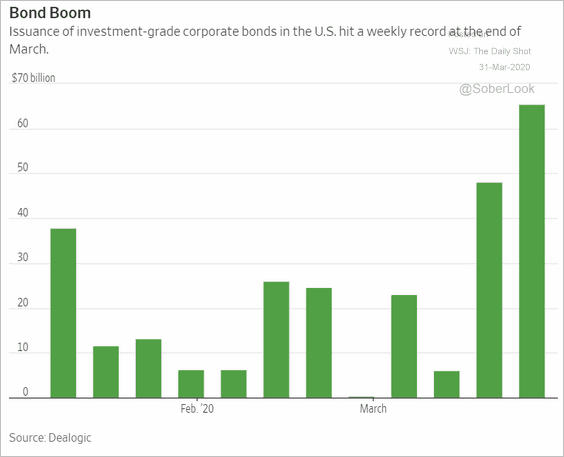

3. Investment-grade bond issuance hit a weekly record.

Source: @wsj Read full article

Source: @wsj Read full article

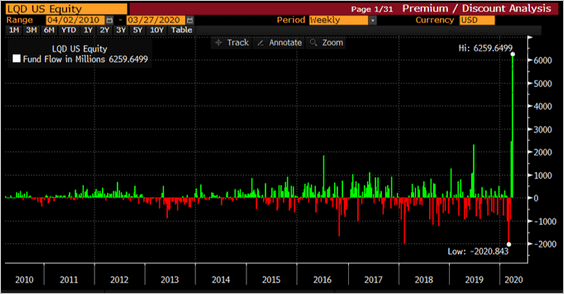

4. The Fed’s decision to support investment-grade debt resulted in record inflows into LQD (iShares Investment Grade Corporate Bond ETF).

Source: @lisaabramowicz1

Source: @lisaabramowicz1

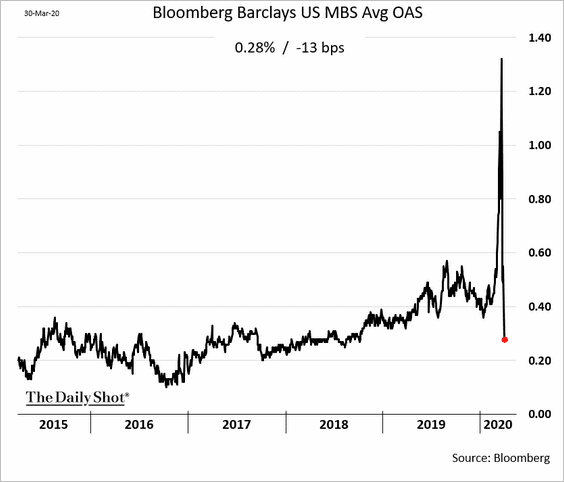

5. Here is what the Fed’s QE did to MBS spreads.

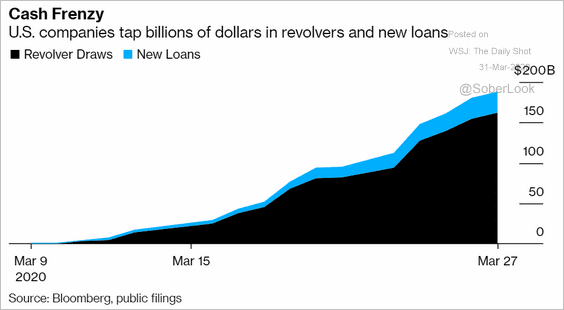

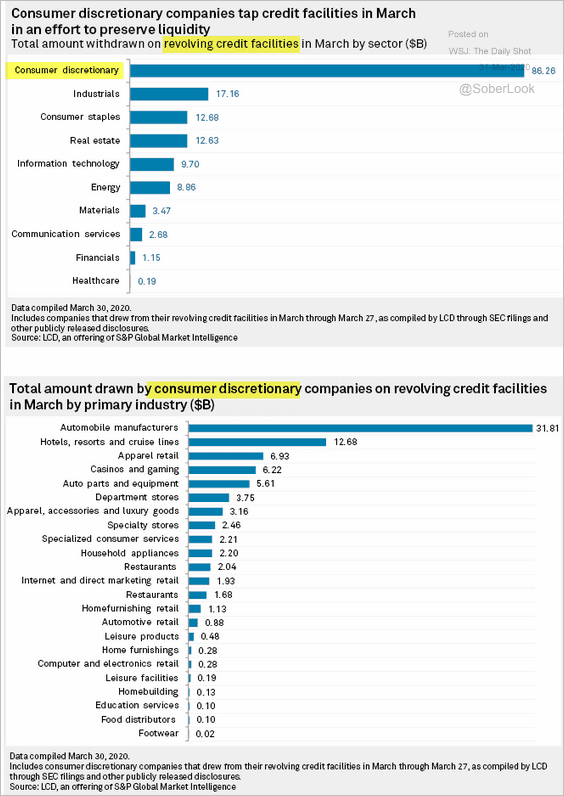

6. Companies continue to draw on revolving facilities.

Source: @markets Read full article

Source: @markets Read full article

Consumer discretionary firms have been most active in tapping liquidity.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

7. Next, we have some updates on municipal finance.

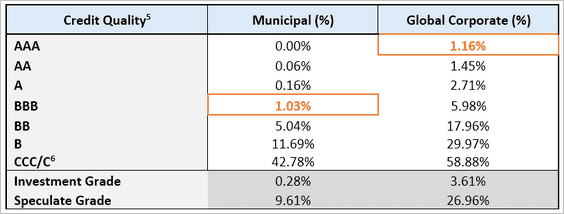

• Historically, BBB-rated munis (i.e., the lowest rating in investment-grade) had essentially the same ultra-low default rate as AAA-rated corporate bonds. That’s unlikely to persist in the current environment.

Source: Russell Investments Read full article

Source: Russell Investments Read full article

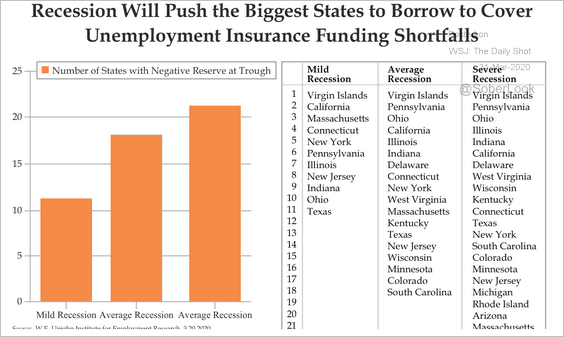

• These states are most at risk of depleting their reserve cushions in mild, moderate, or severe recession scenarios.

Source: Quill Intelligence

Source: Quill Intelligence

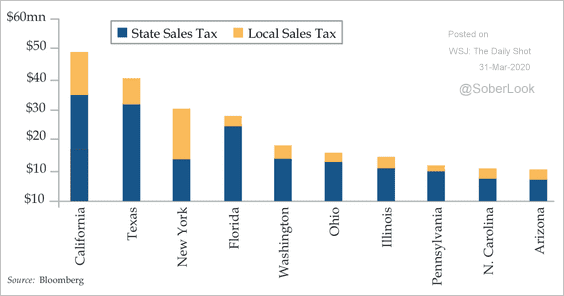

• Which states are most reliant on sales taxes?

Source: Quill Intelligence

Source: Quill Intelligence

Global Developments

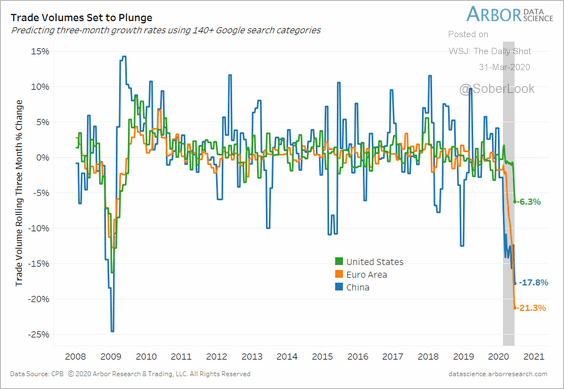

1. Google search activity signals sharp declines in global trade.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

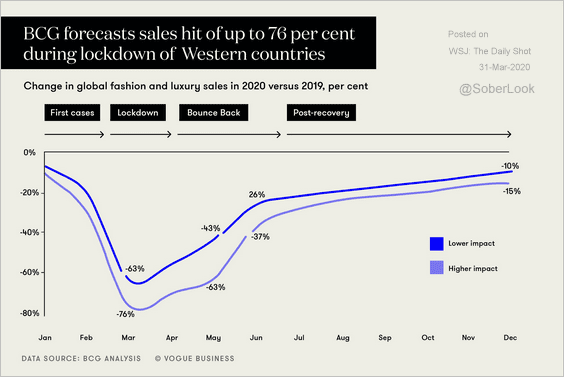

2. BCG expects luxury sales to decrease by up to 76% this year.

Source: Vogue Business Read full article

Source: Vogue Business Read full article

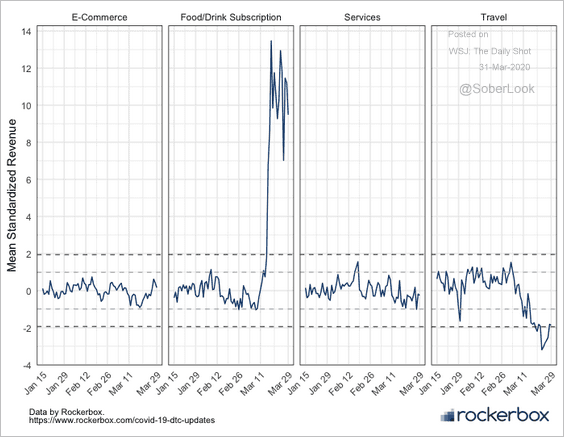

3. The charts below show the daily change in revenue by sector. Travel had a significant uptick over the weekend, while food/drink subscriptions remain elevated.

Source: Rockerbox Read full article

Source: Rockerbox Read full article

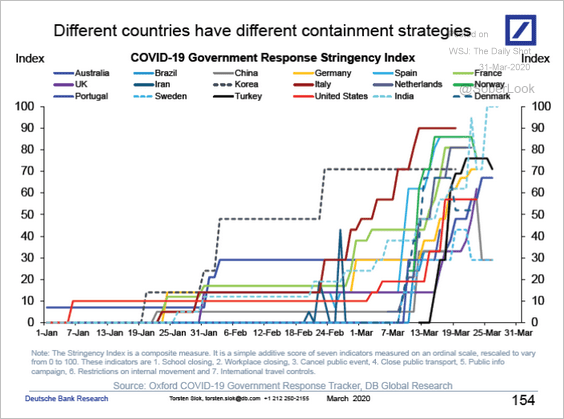

4. Here is the COVID-19 Government Response Stringency Index from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

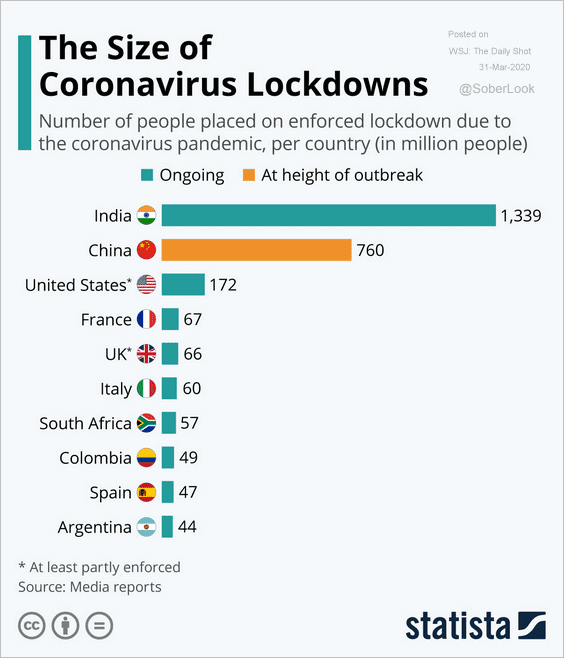

And this chart shows the size of lockdowns in different countries.

Source: Statista

Source: Statista

——————–

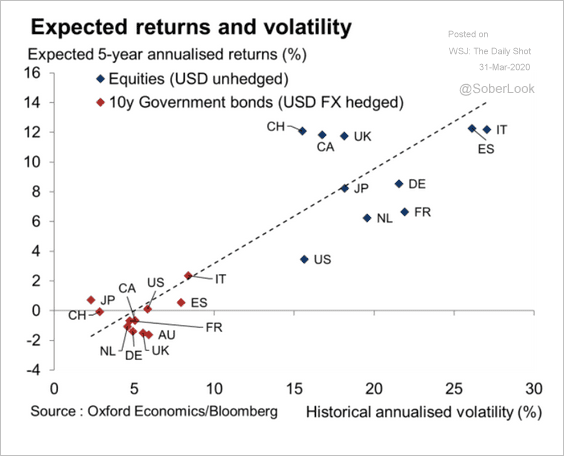

5. Finally, we have the expected 5-year annualized returns and volatility for global equities and government bonds from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

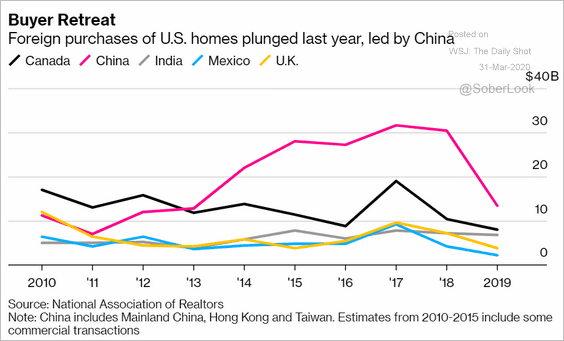

1. Foreign purchases of US homes:

Source: @WSJ Read full article

Source: @WSJ Read full article

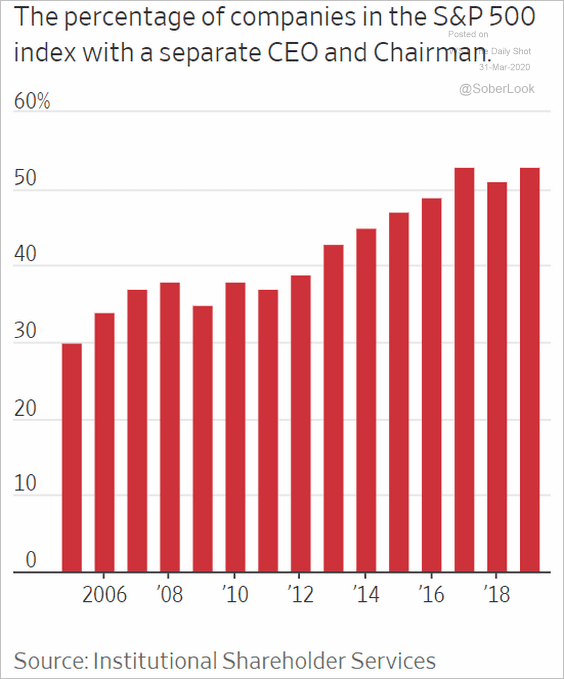

2. Firms with a separate CEO and Chairman:

Source: @WSJ Read full article

Source: @WSJ Read full article

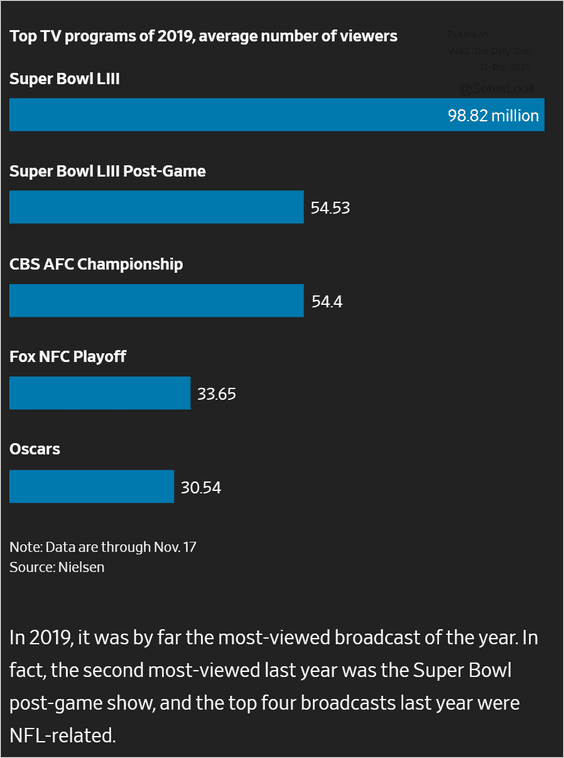

3. Top TV programs in 2019:

Source: @WSJ Read full article

Source: @WSJ Read full article

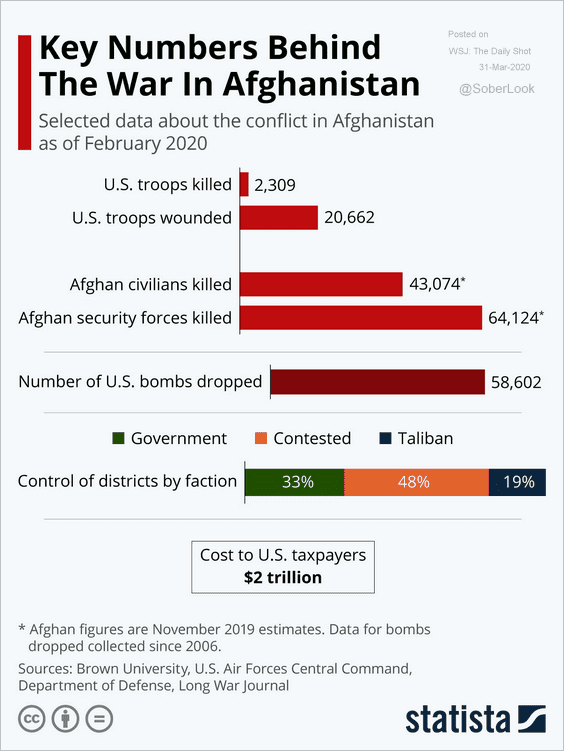

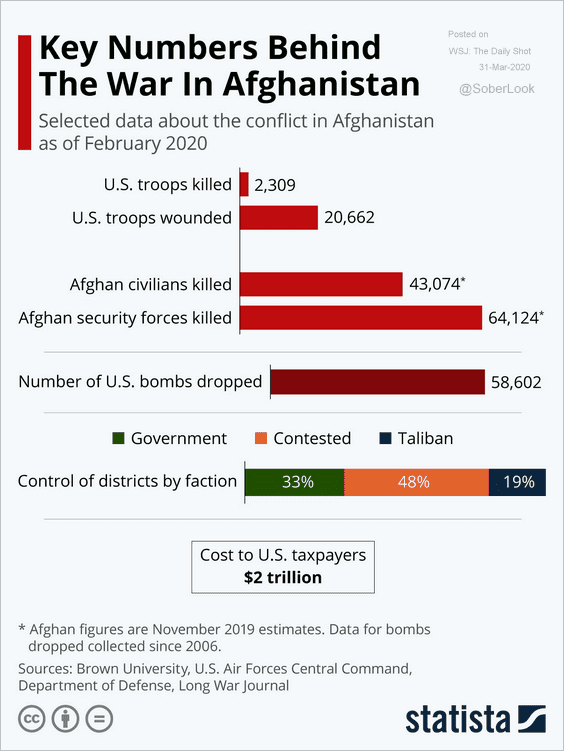

4. Stats on the Afghan war:

Source: Statista

Source: Statista

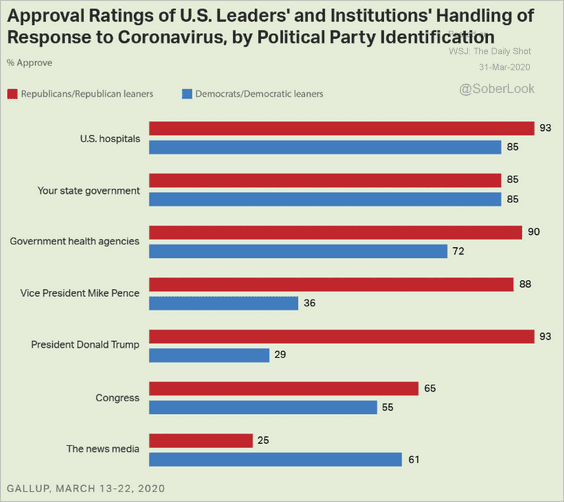

5. Approval ratings of US leaders and institutions:

Source: Gallup Read full article

Source: Gallup Read full article

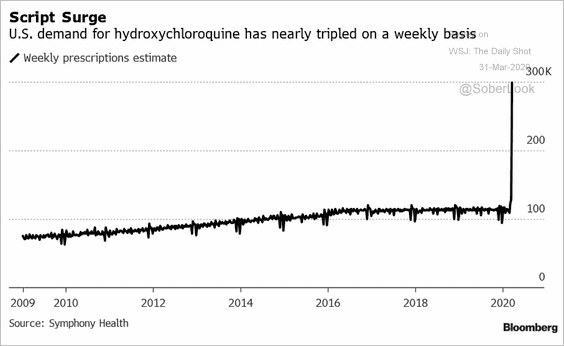

6. A promising small-scale clinical trial to treat the COVID-19:

Source: Statista

Source: Statista

• Doctors prescribing hydroxychloroquine before the FDA approval:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

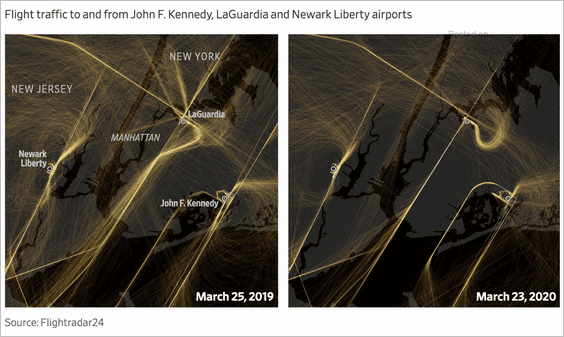

7. New York City area airport traffic:

Source: @WSJ Read full article

Source: @WSJ Read full article

8. Preferred interpersonal distances:

Source: @bopinion Read full article

Source: @bopinion Read full article

——————–