The Daily Shot: 19-May-20

• Equities

• Credit

• Rates

• Energy

• Emerging Markets

• China

• Australia

• The Eurozone

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Equities

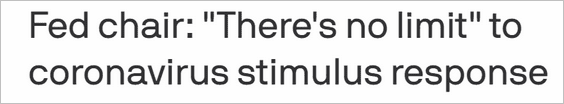

1. Some hopeful news on the vaccine development front and comments from Jerome Powell stent stocks sharply higher on Monday.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @axios Read full article

Source: @axios Read full article

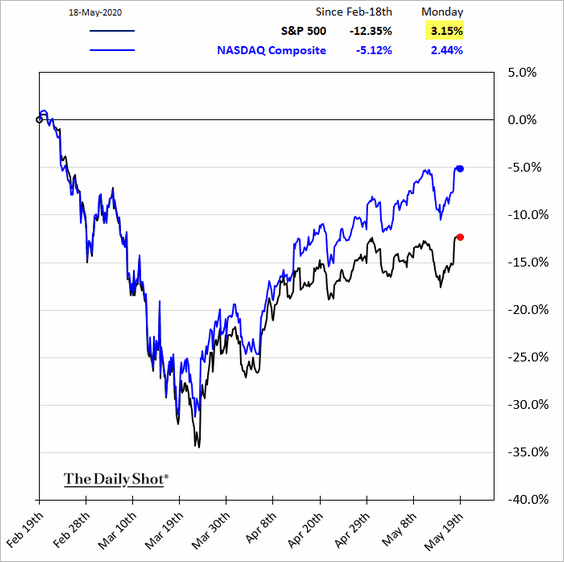

Here is Moderna’s share price.

Source: @business Read full article

Source: @business Read full article

——————–

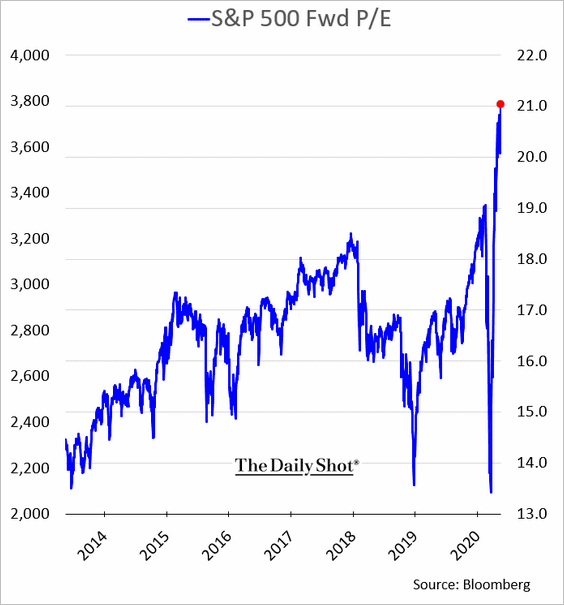

2. The S&P 500 12-month blended forward P/E ratio rose above 21x.

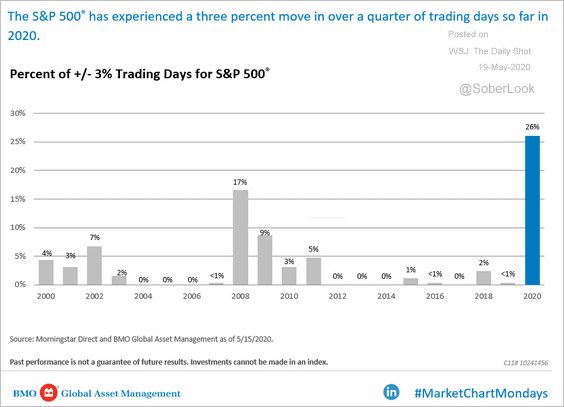

3. There have been quite a few +/- 3% days this year (including Monday).

Source: BMO Global Asset Management

Source: BMO Global Asset Management

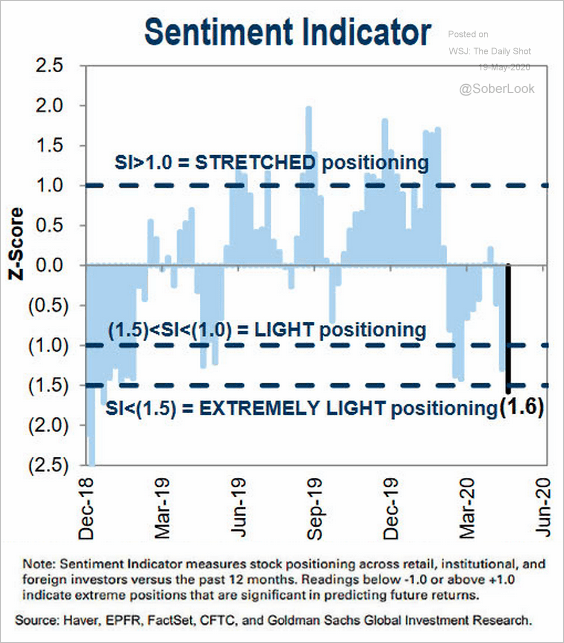

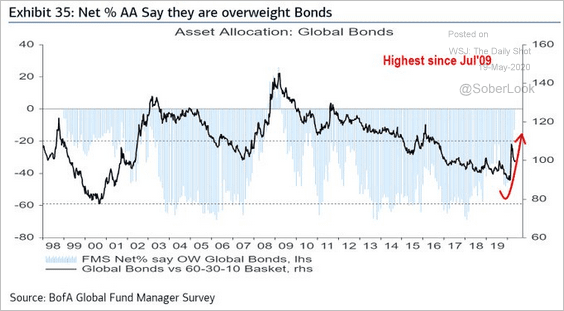

4. Investor positioning remains defensive, which has been fueling the rally.

Source: Goldman Sachs, @ISABELNET_SA

Source: Goldman Sachs, @ISABELNET_SA

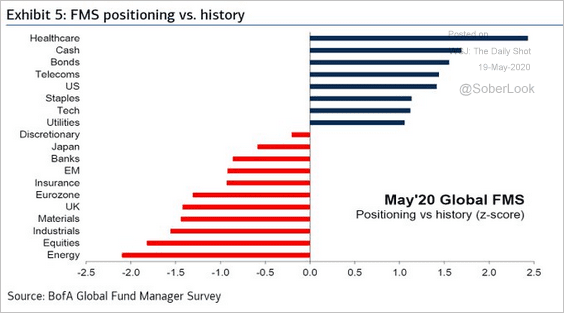

Fund managers are still overweight in healthcare and cash/bonds.

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

——————–

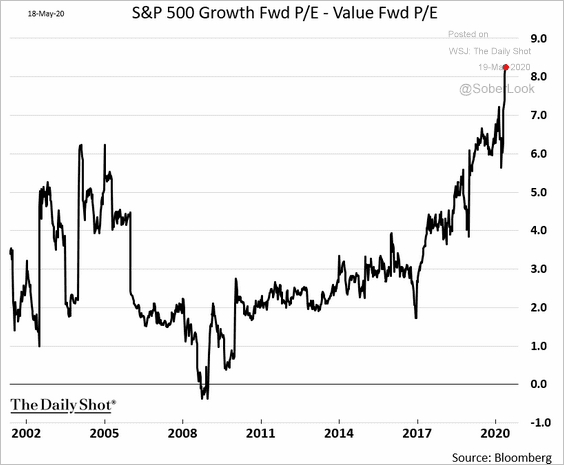

5. Valuations in growth shares have been stretched relative to value.

h/t @xieyebloomberg

h/t @xieyebloomberg

And fund managers have been giving up on value stocks.

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

Source: BofA Merrill Lynch Global Research, @Callum_Thomas

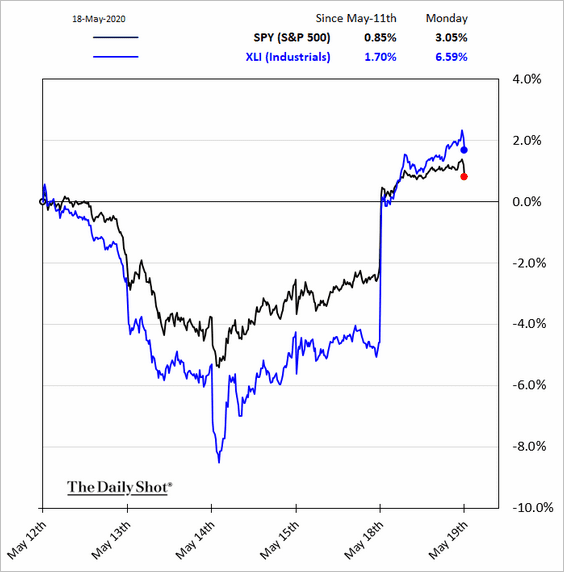

On Monday, value shares finally outperformed, which is reflected in sector trends below.

——————–

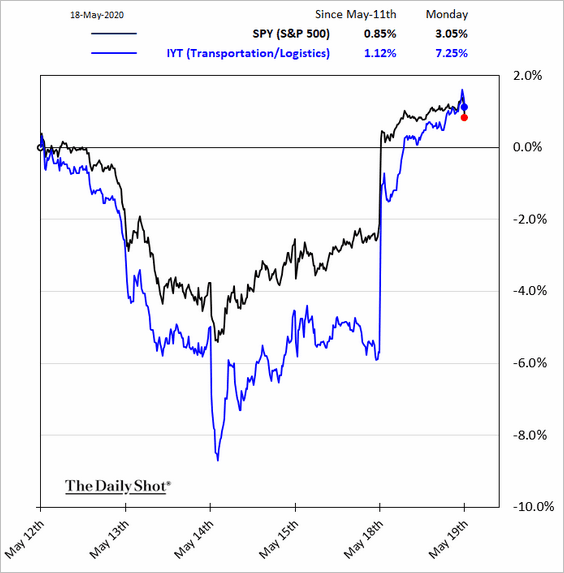

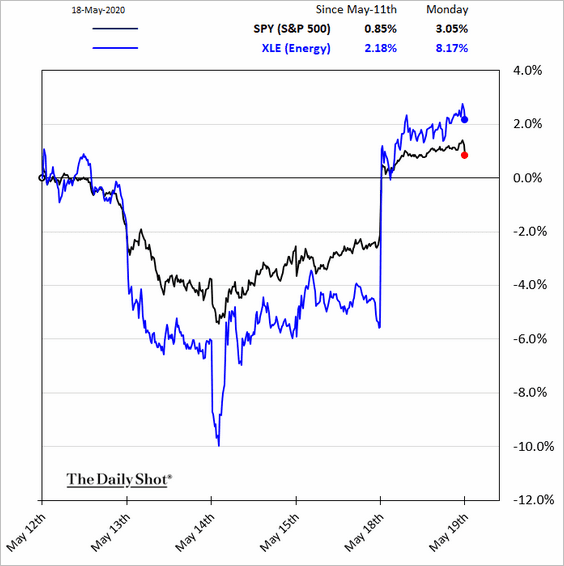

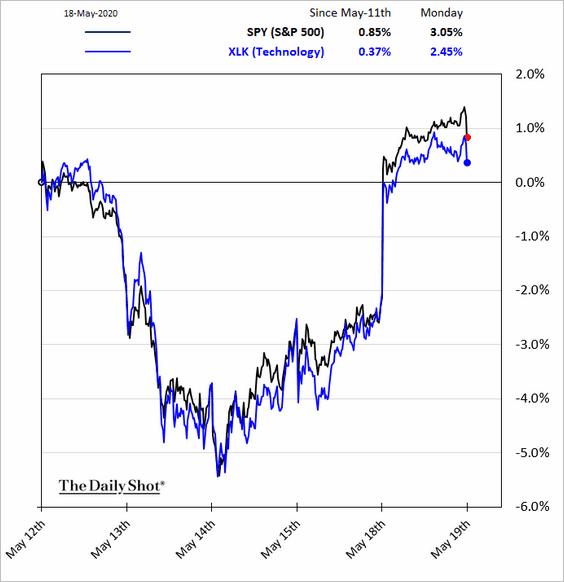

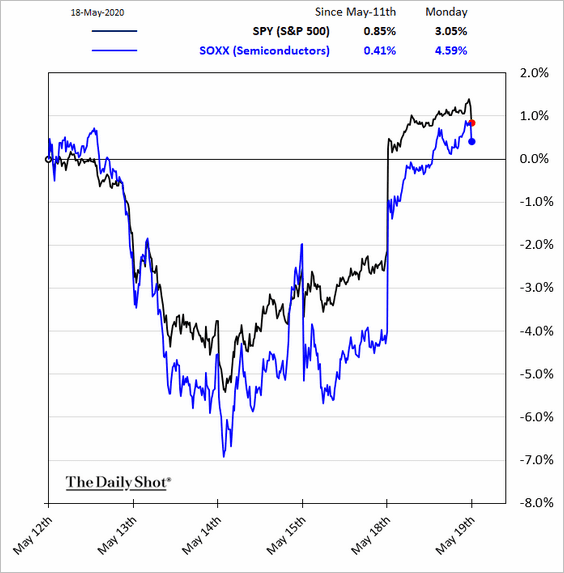

6. Here are some sector updates.

• Monday’s outperformers (beaten-down sectors):

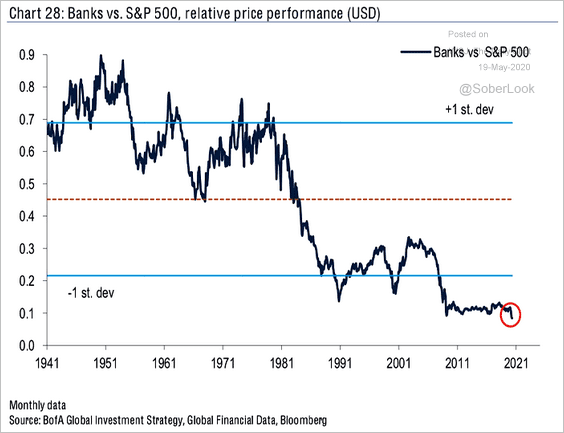

– Banks:

Here is the relative performance since the 1940s.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

– Industrials:

– Transportation:

– Energy:

• Underperformers:

– Tech:

– Semiconductors:

– Healthcare:

• Here are a couple of other sector trends.

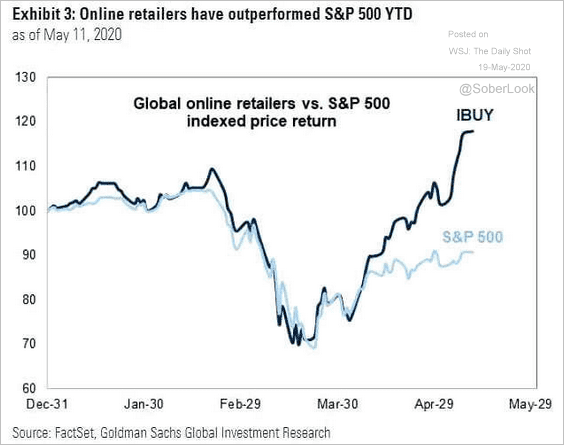

– Online retailers:

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

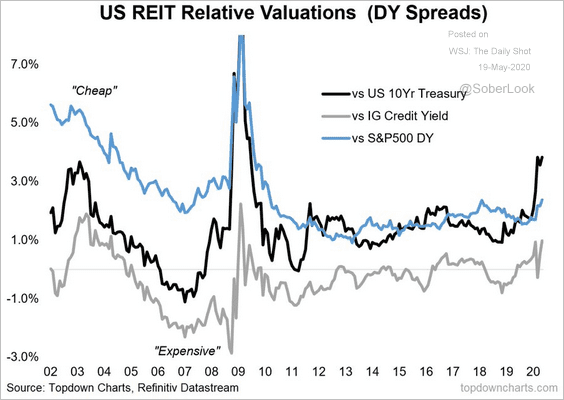

– REITs (relative valuations):

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

Credit

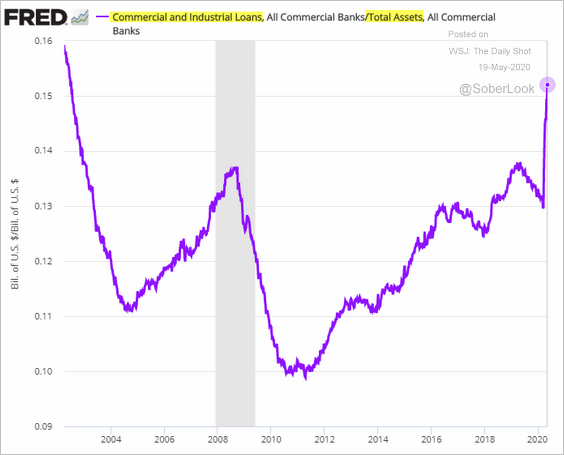

1. Let’s begin with some updates on banks.

• Business loans as a share of total bank assets:

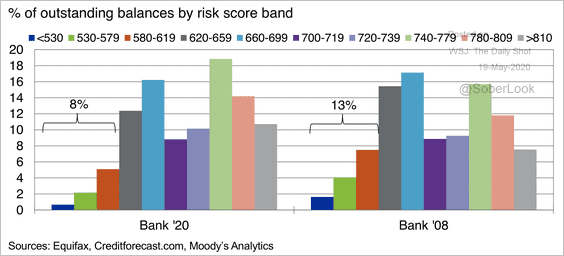

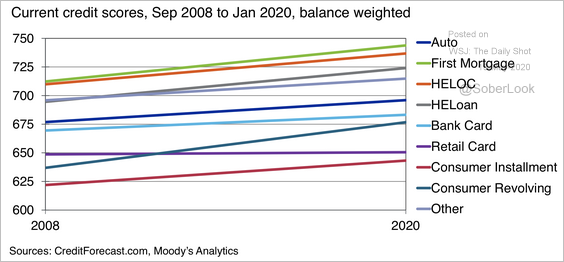

• Banks’ exposure to household debt by credit score (now and in 2008):

Source: Moody’s Analytics

Source: Moody’s Analytics

Source: Moody’s Analytics

Source: Moody’s Analytics

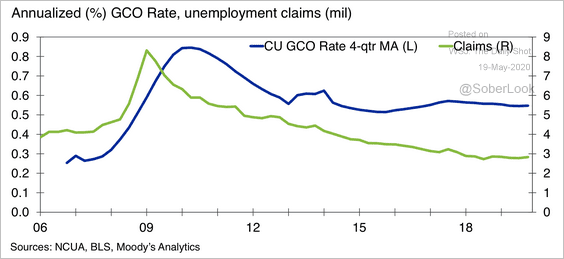

• Credit union default rates are expected to follow the uptick in unemployment claims, according to Moody’s.

Source: Moody’s Analytics

Source: Moody’s Analytics

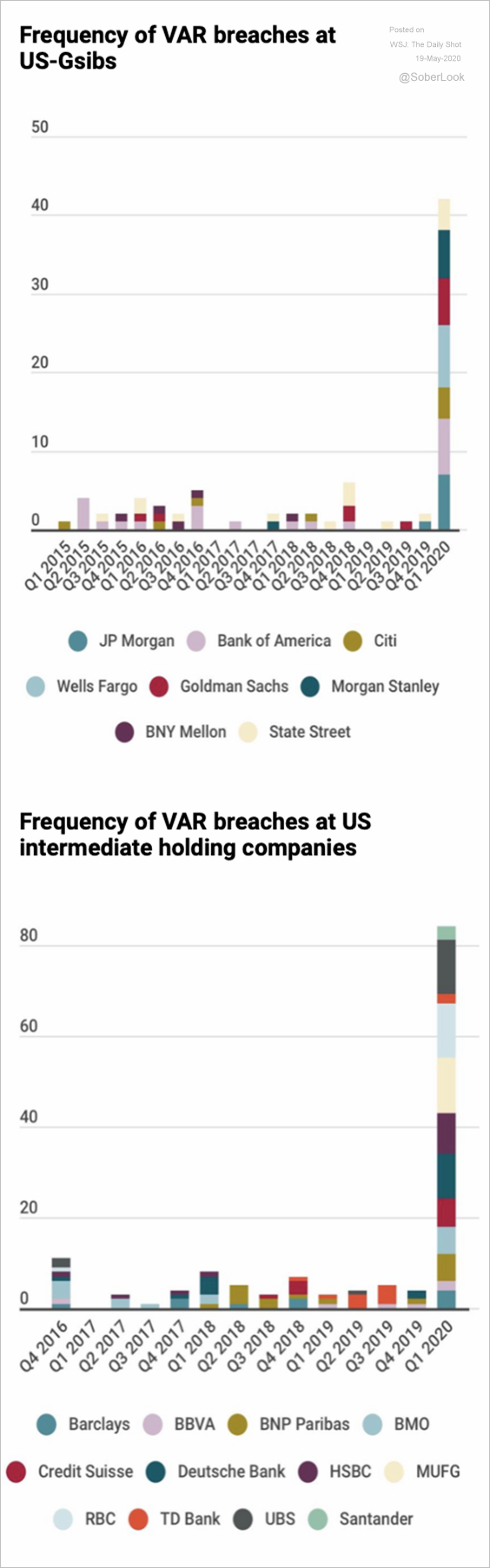

• Value-at-risk (VAR) breaches at banks:

Source: Risk.net

Source: Risk.net

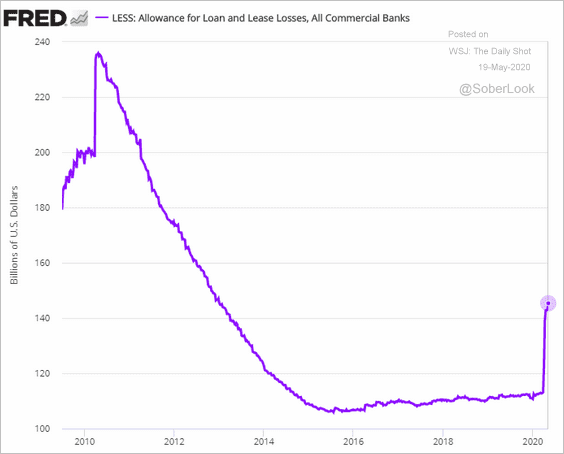

• Loan loss provisions:

——————–

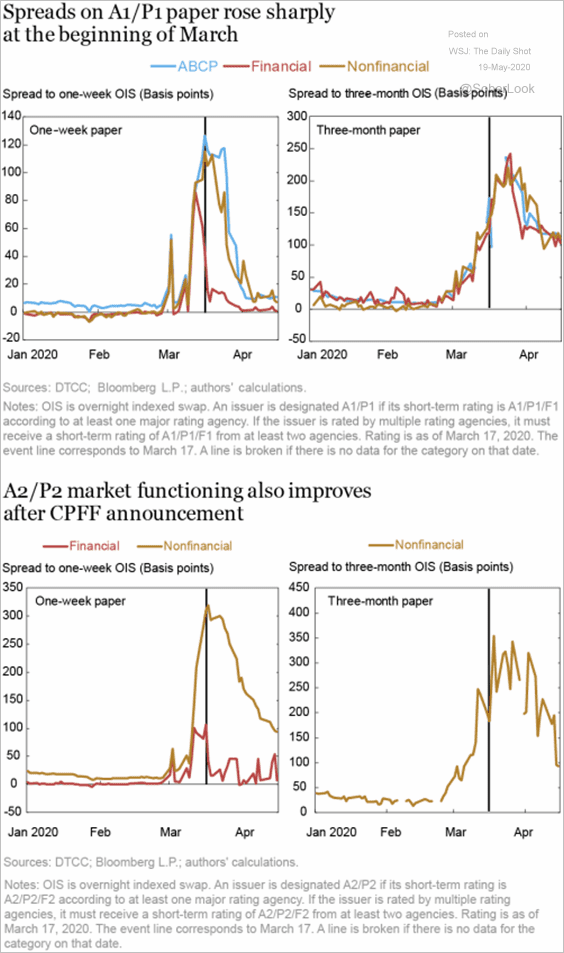

2. The Fed’s Commercial Paper Funding Facility helped tighten short-term funding spreads.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

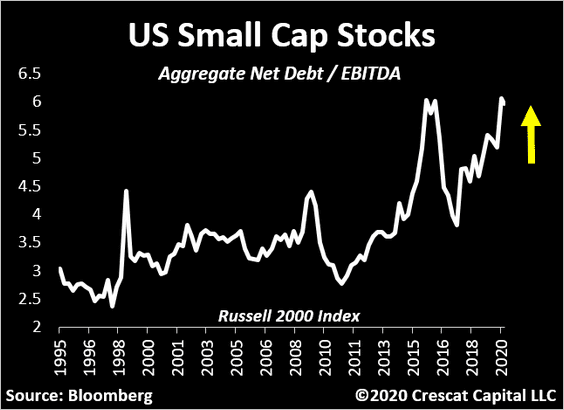

3. Small-cap leverage is elevated.

Source: @TaviCosta

Source: @TaviCosta

4. Sustainability debt issuance accelerated last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

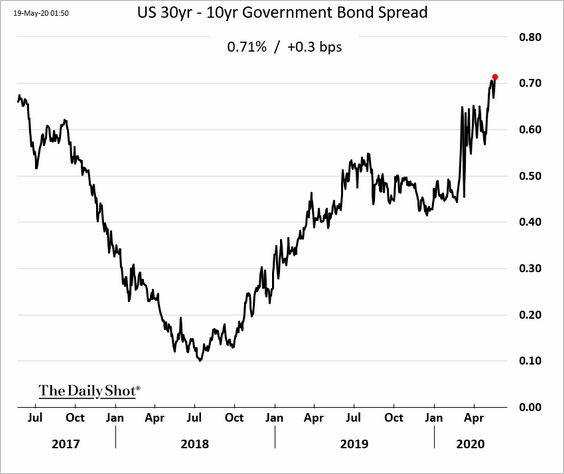

Rates

1. The upcoming 20-year Treasury issuance is putting pressure on the 30yr bond.

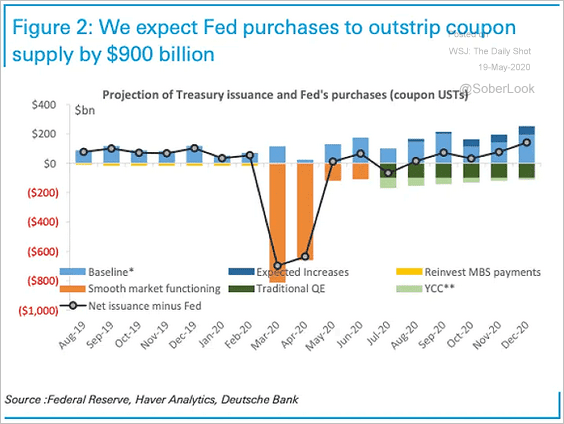

2. The Fed’s purchases of notes and bonds are expected to outstrip Treasury issuance.

Source: @ISABELNET_SA, @DeutscheBank

Source: @ISABELNET_SA, @DeutscheBank

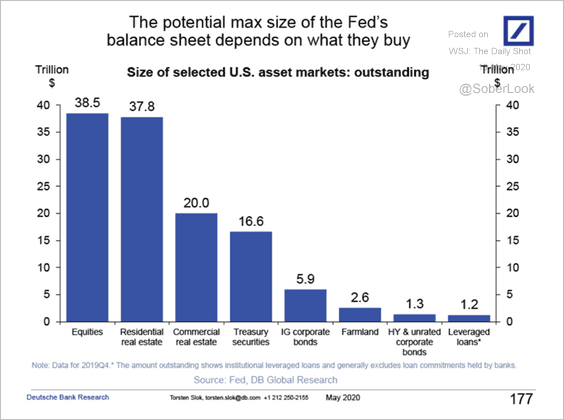

3. The Fed’s balance sheet is only limited by the size of the markets in which the central bank chooses to participate.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Energy

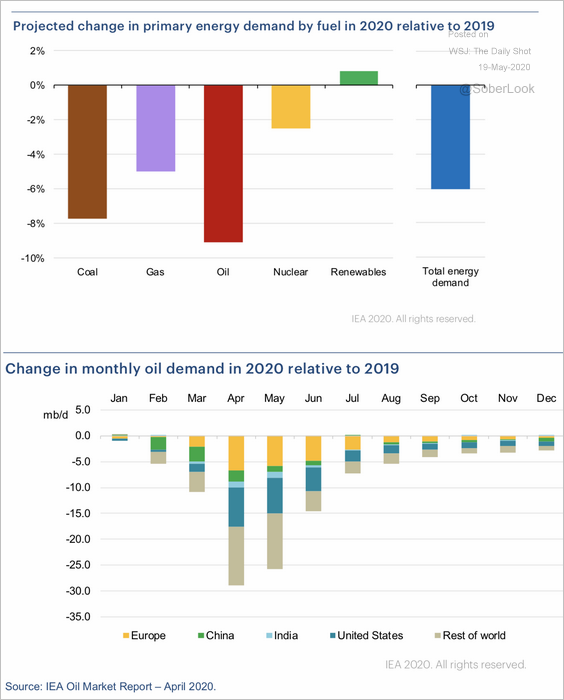

1. Energy demand tumbled this year.

Source: IEA Read full article

Source: IEA Read full article

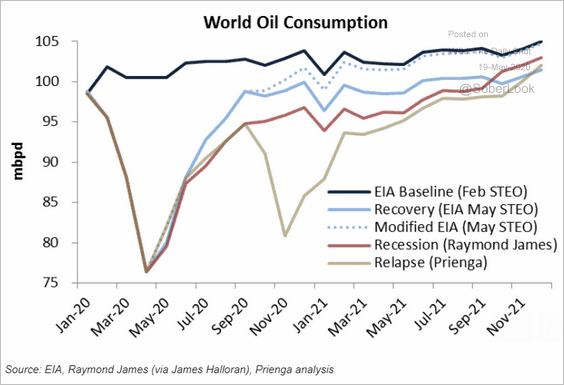

Here are some scenarios for global oil demand through the end of next year.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

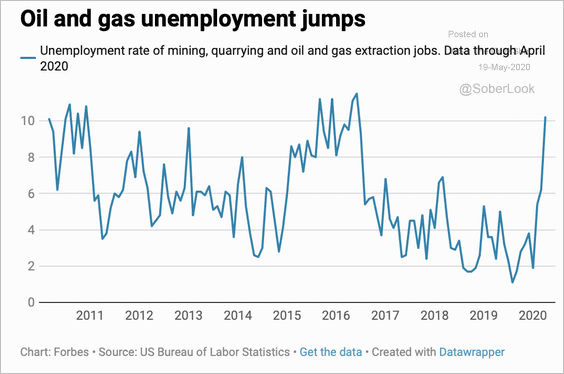

2. The US oil & gas sector unemployment rate rose sharply this year.

Source: Scott Carpenter Read full article

Source: Scott Carpenter Read full article

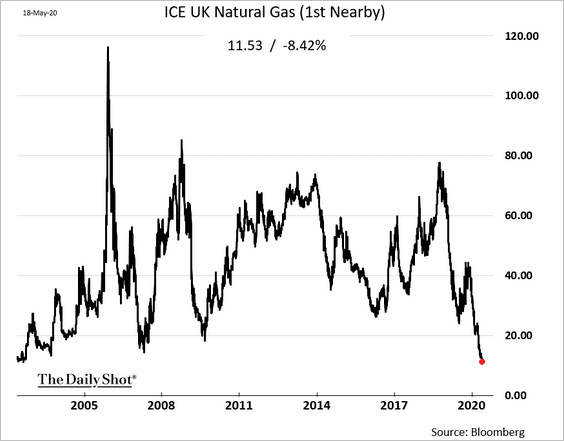

3. The global LNG market has been well supplied, …

Source: @markets Read full article

Source: @markets Read full article

… putting pressure on European natural gas prices. Lower electricity demand during the crisis exacerbated the selloff. Gas futures in the UK hit the lowest level since 2002.

Emerging Markets

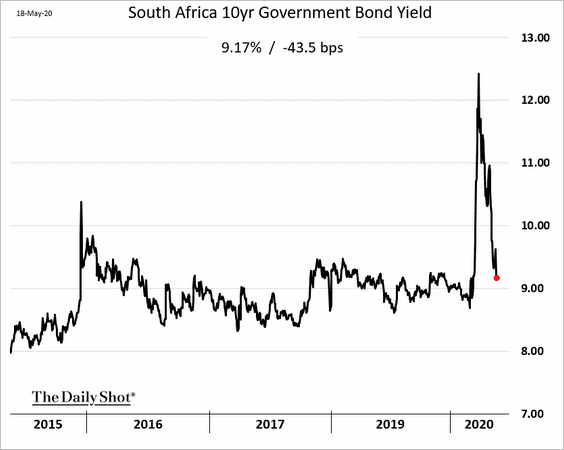

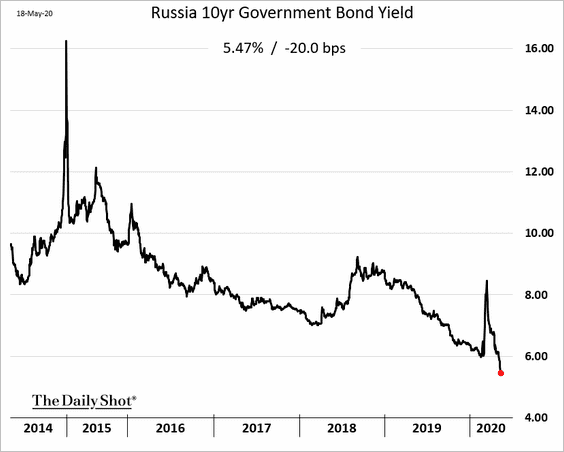

1. Capital is returning into local EM bonds.

• South Africa:

• Russia:

——————–

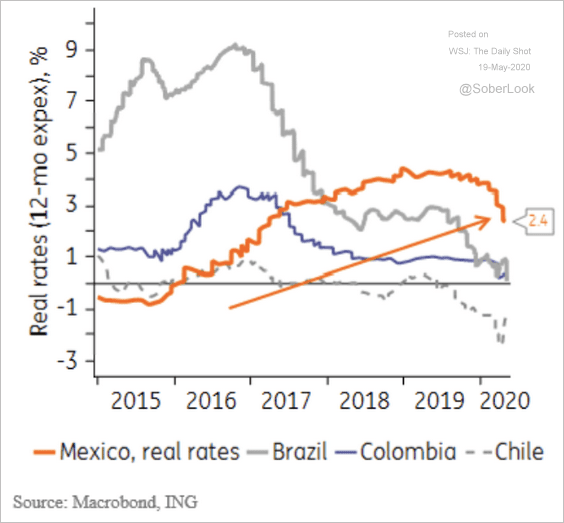

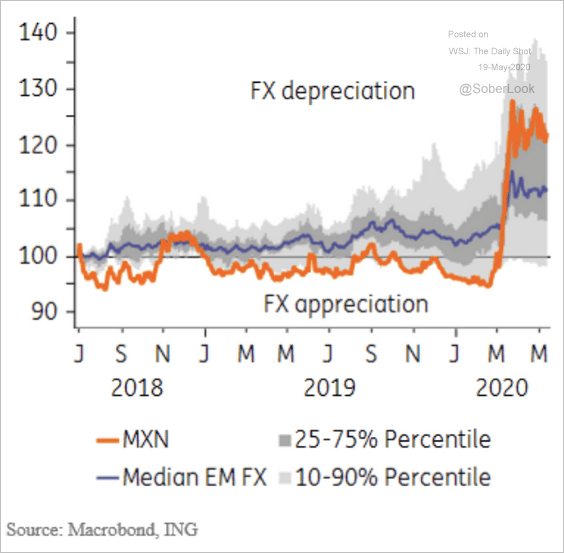

2. Mexico’s yield advantage should persist, according to ING, …

Source: ING

Source: ING

… which should benefit the nation’s currency in relation to LatAm peers.

Source: ING

Source: ING

——————–

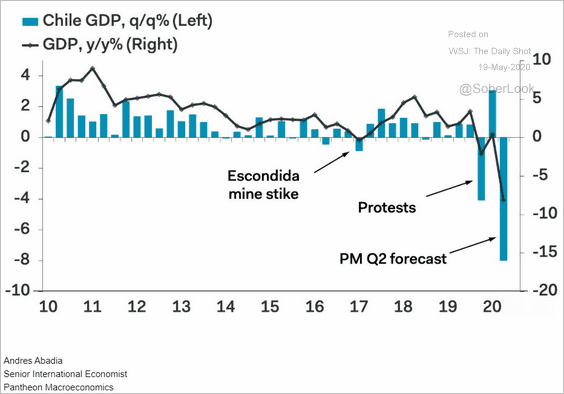

3. Here is the GDP forecast for Chile.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

4. EM shares have underperformed this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

China

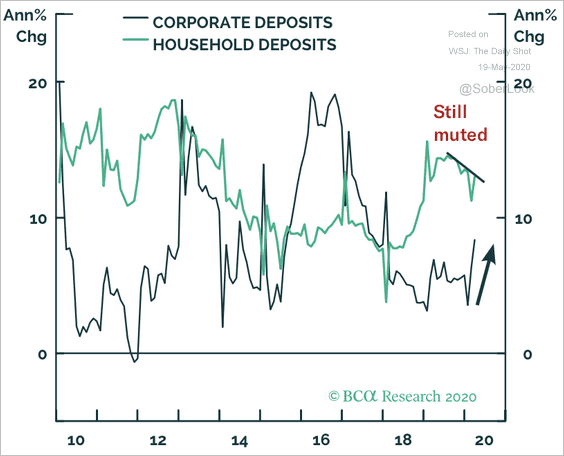

1. Corporate deposits are starting to recover, while household deposits remain muted.

Source: BCA Research

Source: BCA Research

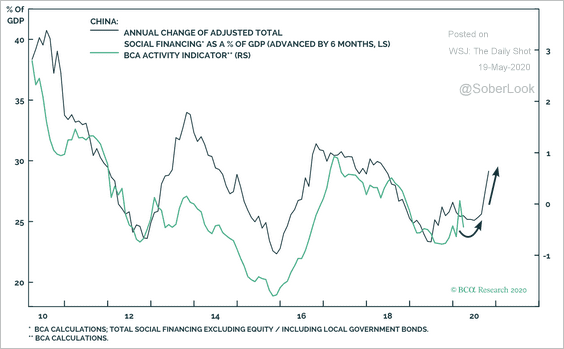

2. According to BCA Research, monetary and fiscal stimulus should begin working its way into the economy over the next 6-12 months.

Source: BCA Research

Source: BCA Research

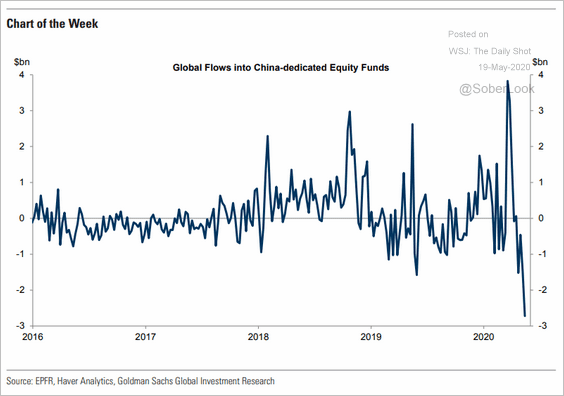

3. Investors have been getting out of China-dedicated equity funds.

Source: Goldman Sachs

Source: Goldman Sachs

Australia

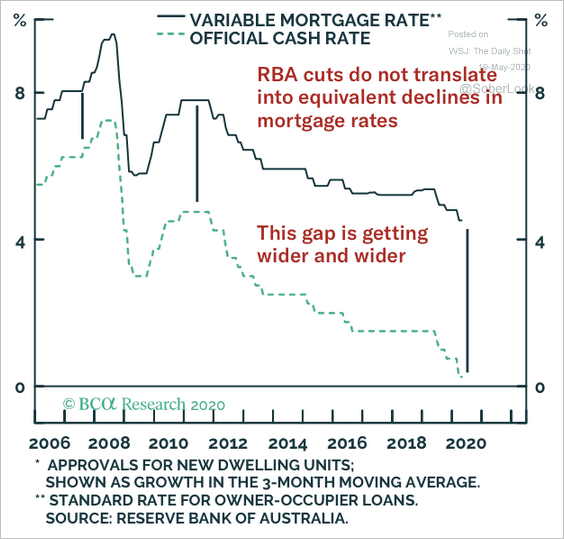

1. Cuts to the RBA cash rate have not yet translated into equivalent declines in mortgage rates.

Source: BCA Research

Source: BCA Research

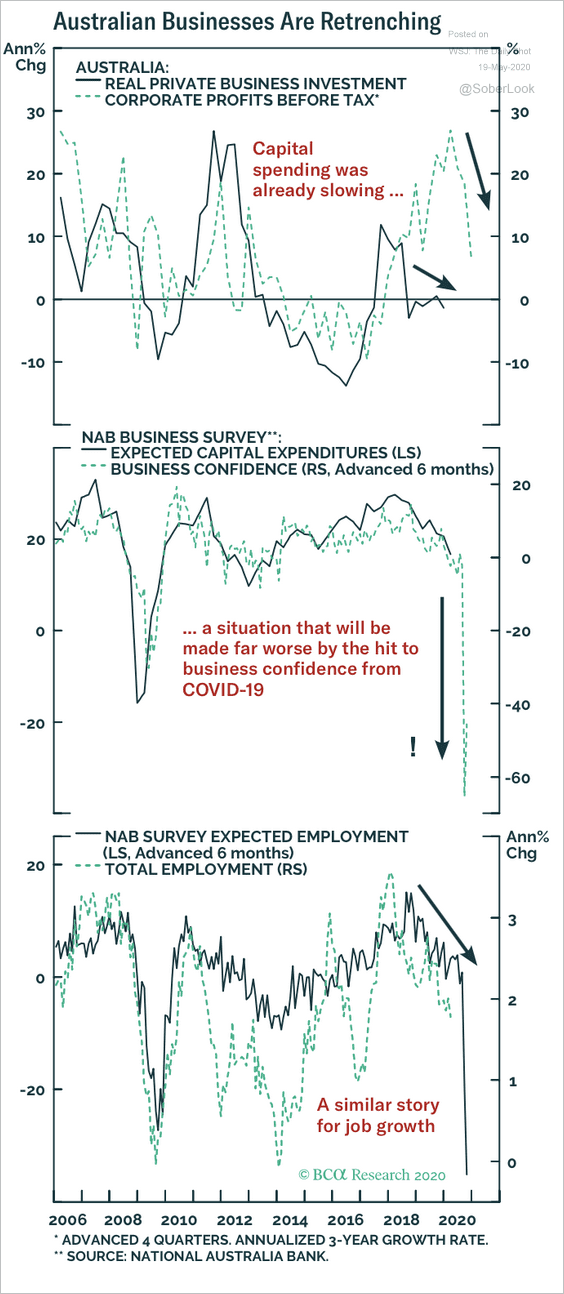

2. Companies are expecting to cut back on capital spending and labor.

Source: BCA Research

Source: BCA Research

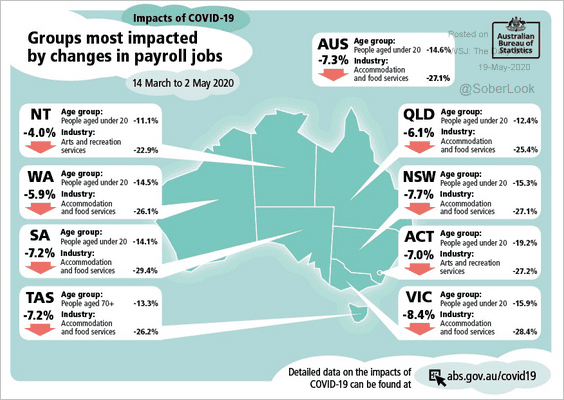

3. Here is a regional breakdown of age groups and industries most impacted by job cuts.

Source: @Scutty

Source: @Scutty

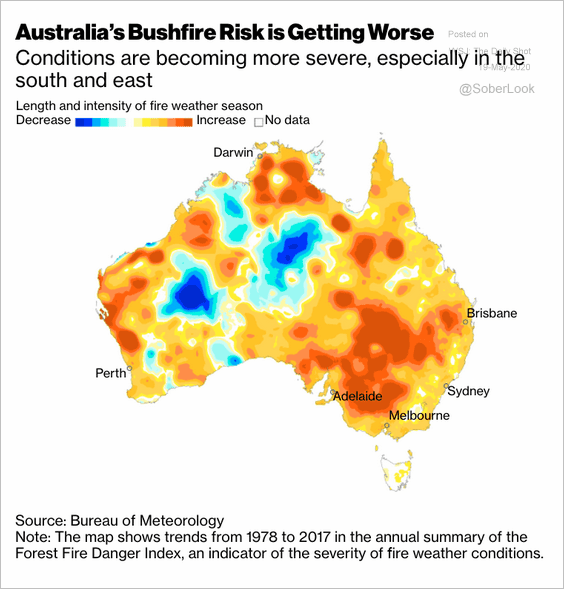

4. The risk of severe bushfires remains elevated.

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

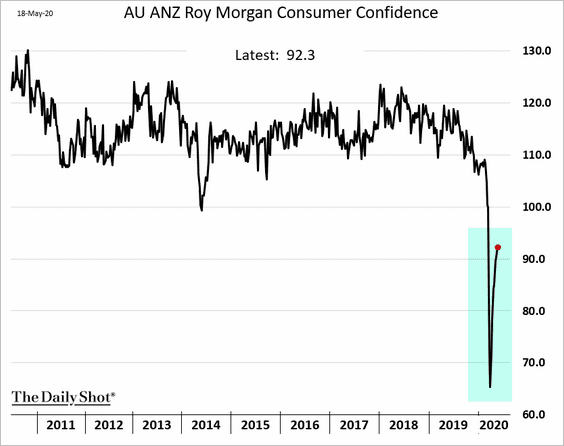

5. Consumer confidence continues to rebound.

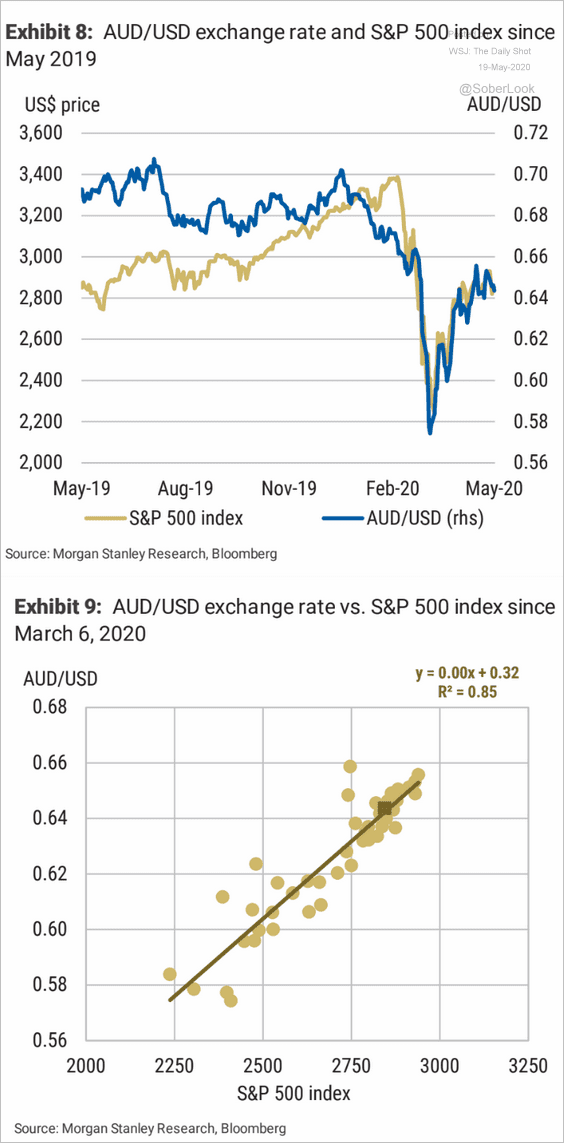

6. The Aussie dollar has been highly correlated to the S&P 500 since the start of the crisis.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

The Eurozone

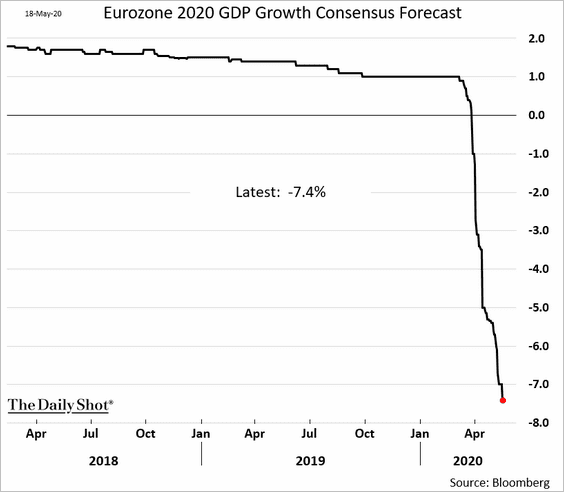

1. Economists continue to lower their estimates for the Eurozone’s GDP this year.

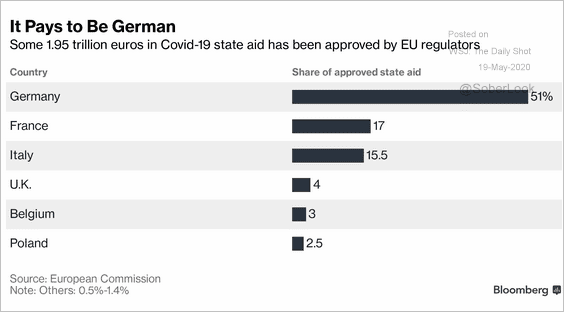

2. Germany dominates the Eurozone’s fiscal response to the crisis.

Source: @business Read full article

Source: @business Read full article

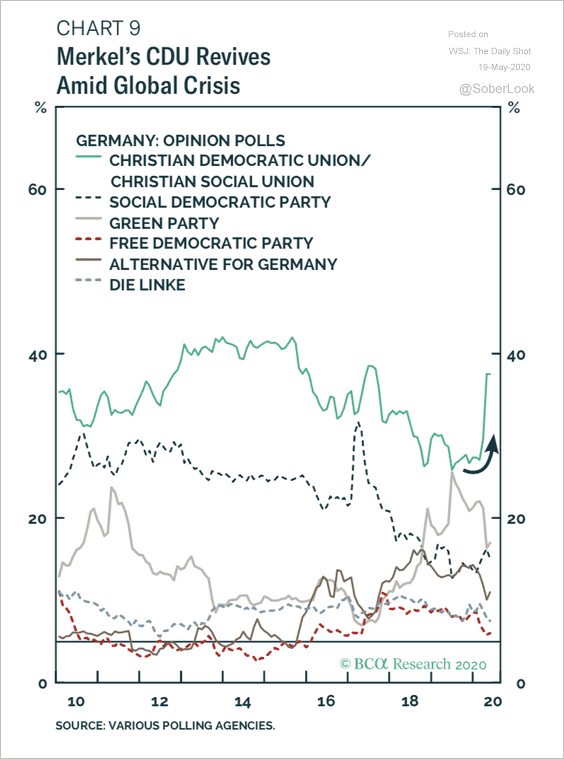

3. Support for Germany’s CDU party has improved as a result of the crisis.

Source: BCA Research

Source: BCA Research

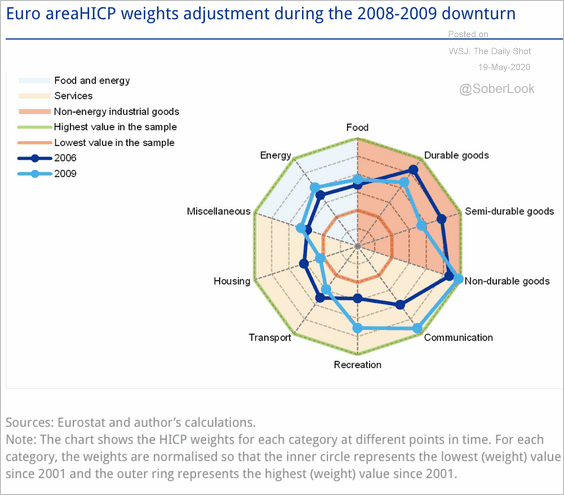

4. Given the changes in consumption during this crisis, the inflation weights will be adjusted, as was the case in 2009.

Source: ECB Read full article

Source: ECB Read full article

The United Kingdom

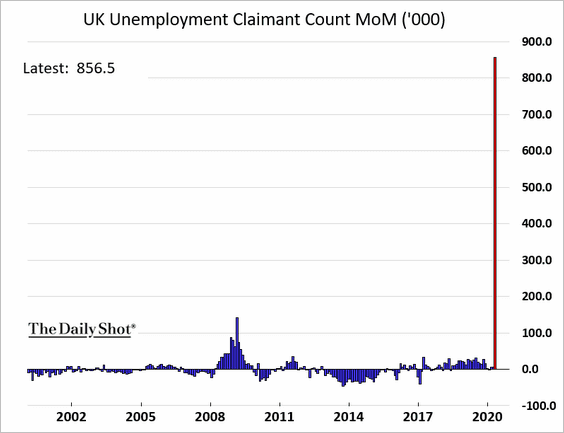

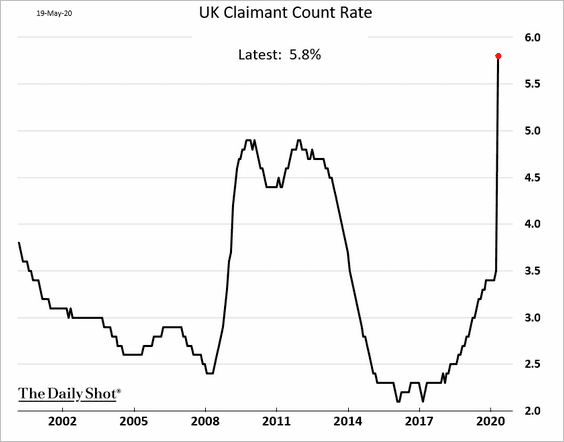

1. The April increase in unemployment claims was unprecedented.

Here is the claimant rate.

——————–

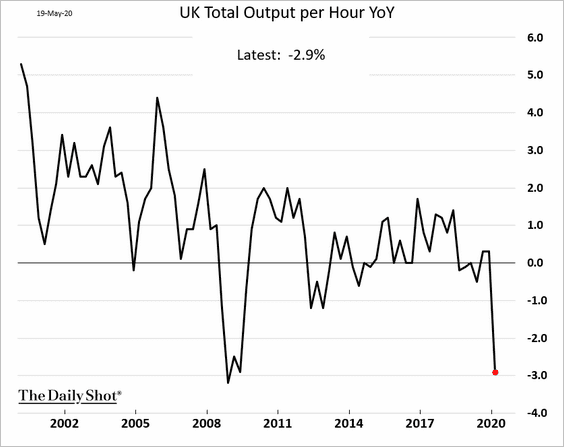

2. Productivity deteriorated in the first quarter.

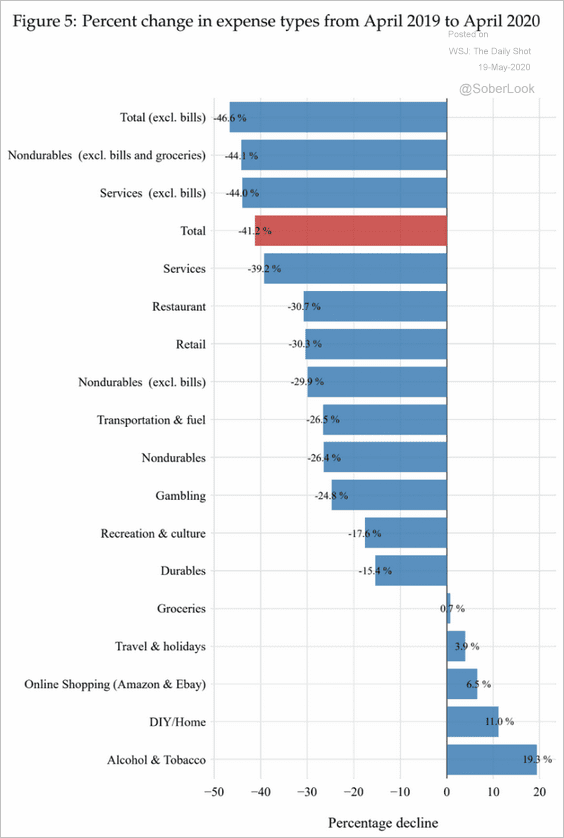

3. Consumer spending plummetted in April.

Source: Paolo Surico, Diego Känzig and Sinem Hacioglu (CEPR) Read full article

Source: Paolo Surico, Diego Känzig and Sinem Hacioglu (CEPR) Read full article

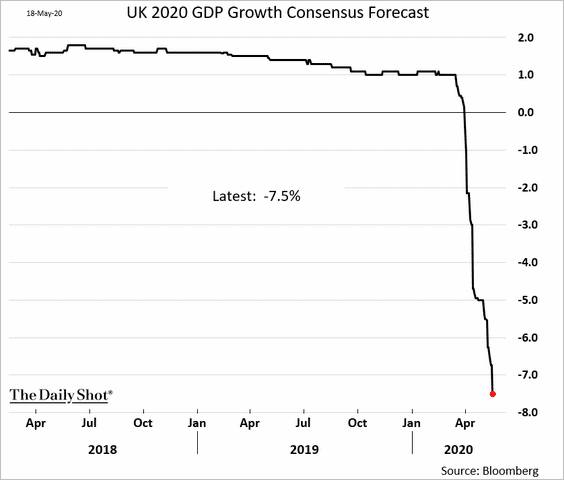

4. Forecasters keep lowering their 2020 GDP estimates.

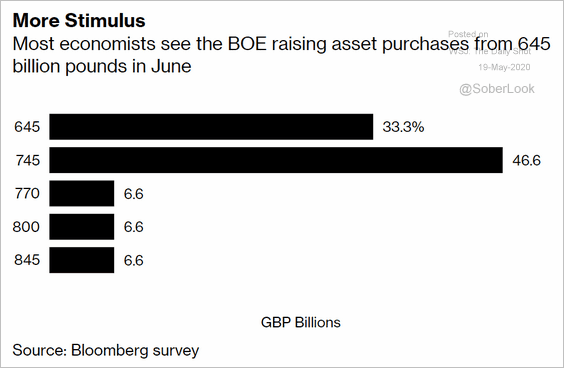

5. Economists expect the BoE to boost the pace of its QE program.

Source: @markets Read full article

Source: @markets Read full article

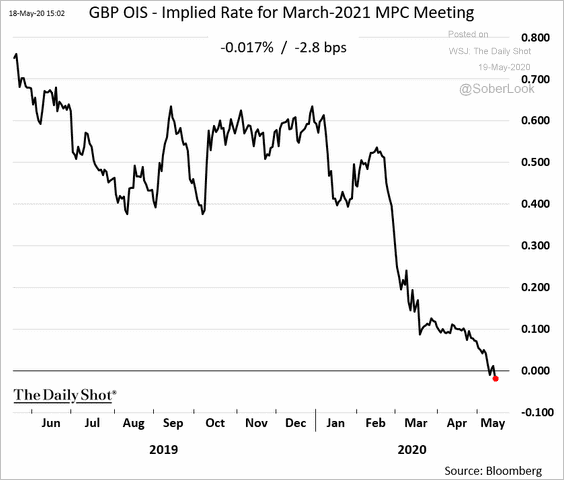

6. The markets are pricing in the possibility of negative rates in the UK.

h/t @highisland

h/t @highisland

The United States

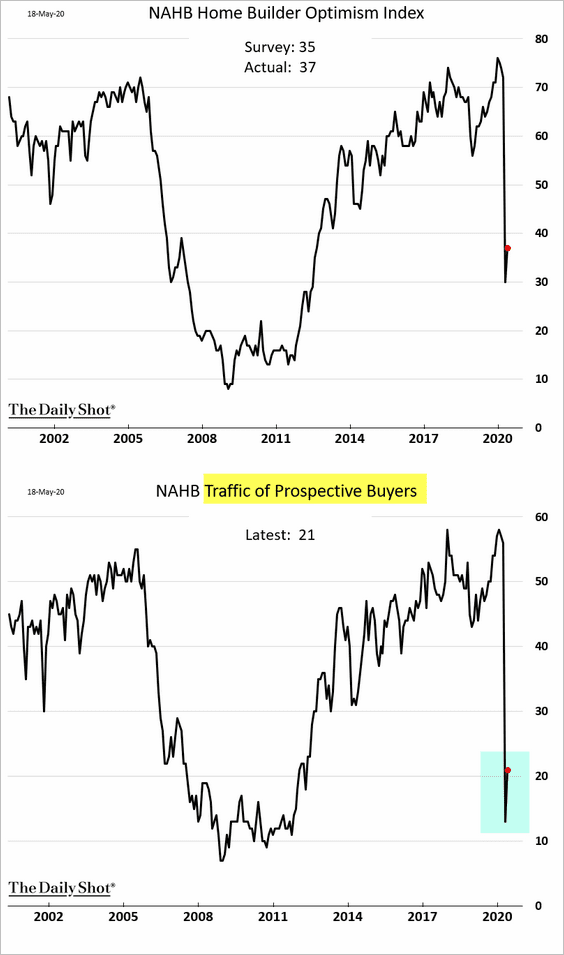

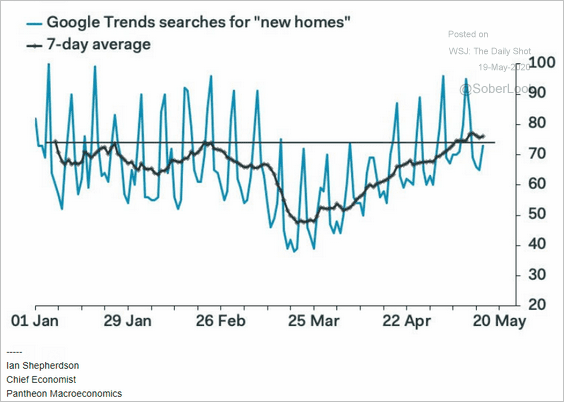

1. Homebuilder sentiment improved slightly this month.

Here is the online search frequency for “new homes.”

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

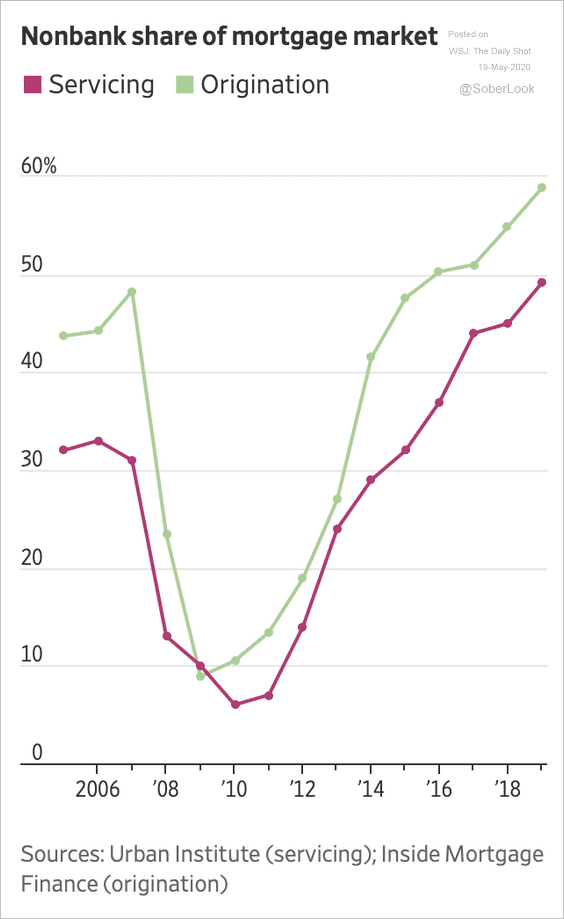

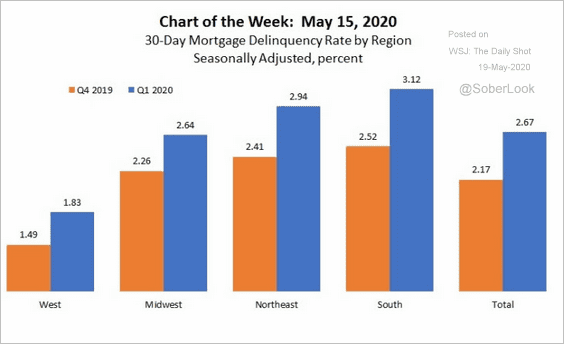

2. Next, we have a couple of updates on the mortgage market.

• Non-bank mortgage originations:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Mortgage delinquencies in the first quarter, by region:

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

——————–

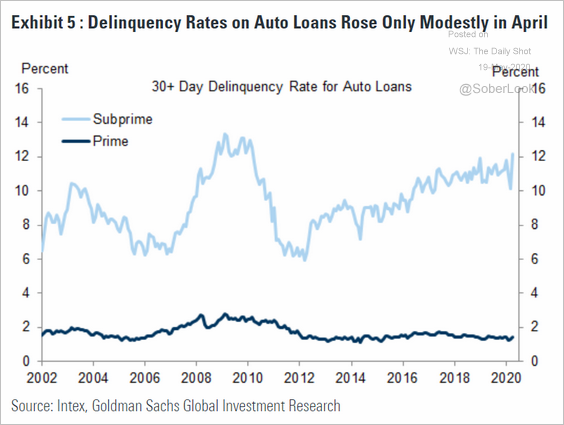

3. Auto loan delinquencies increased only slightly in April.

Source: Goldman Sachs

Source: Goldman Sachs

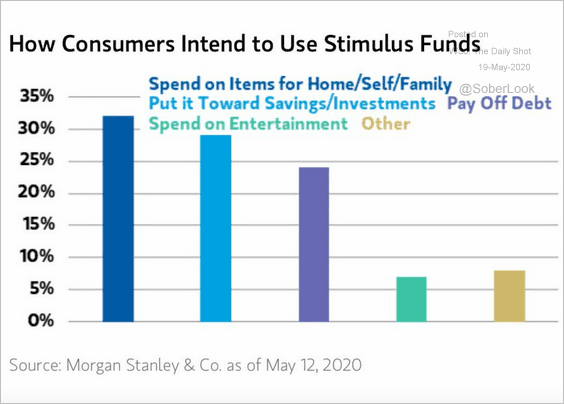

4. Here is how consumers expect to spend stimulus funds.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

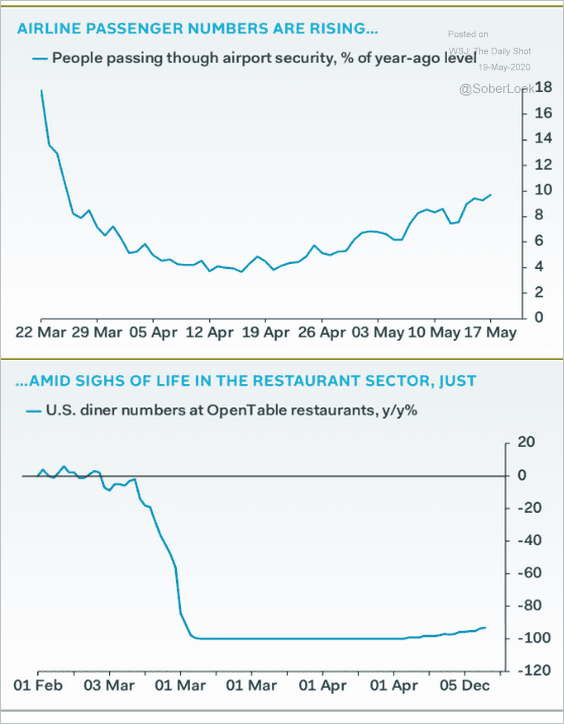

5. Airline passenger activity is gradually recovering.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

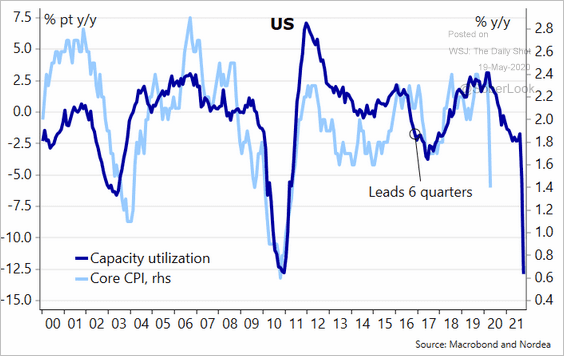

6. Capacity utilization points to disinflationary pressures.

Source: @meremortenlund Read full article

Source: @meremortenlund Read full article

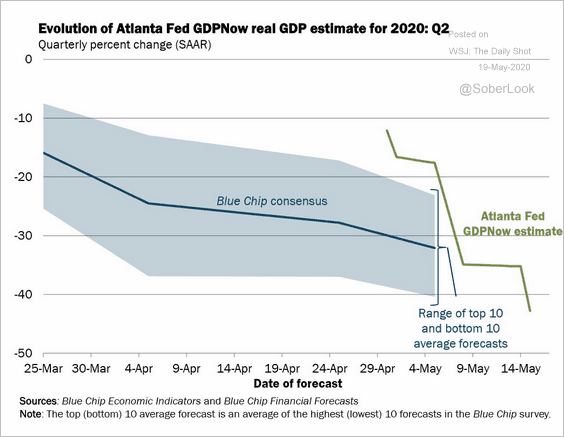

7. The Atlanta Fed’s GDPNow model has the economy contracting by over 40% this quarter (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

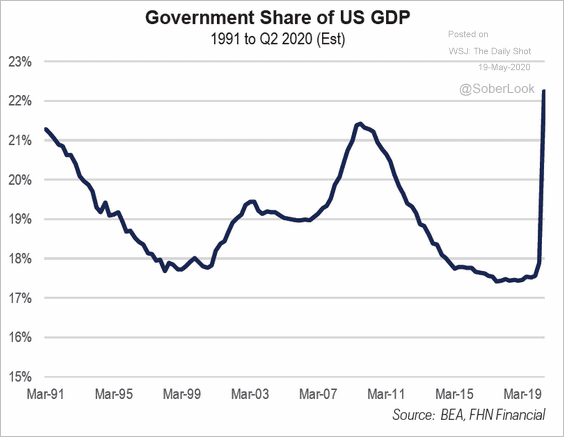

8. The government’s share of the GDP hit a multi-decade high.

Source: FHN Financial

Source: FHN Financial

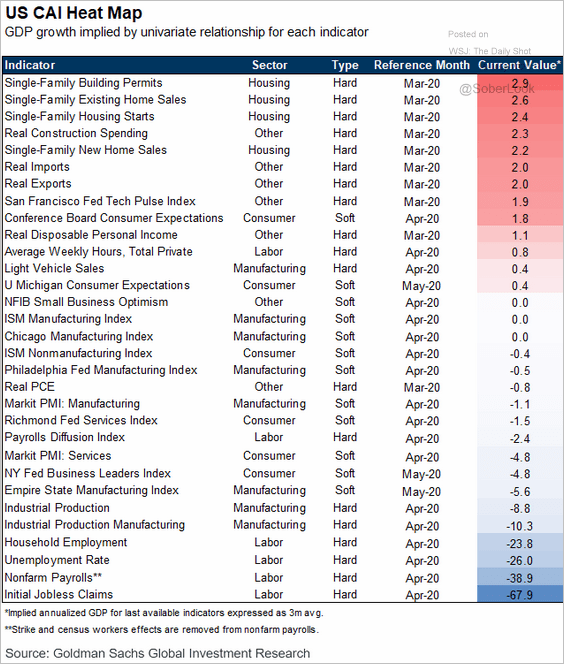

9. Finally, here is Goldman’s current activity heat map.

Source: Goldman Sachs

Source: Goldman Sachs

Global Developments

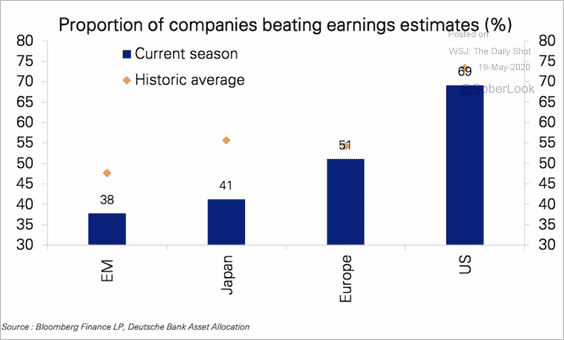

1. This earnings season has been especially weak in Japan and emerging markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

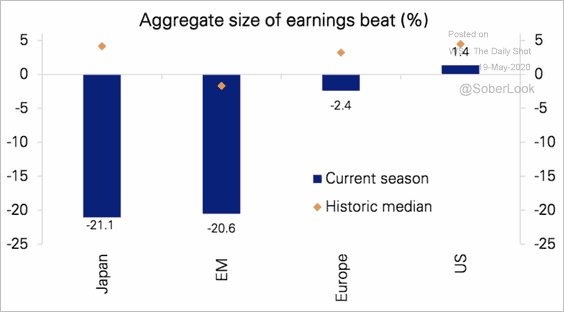

This chart shows the aggregate size of earnings beats.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

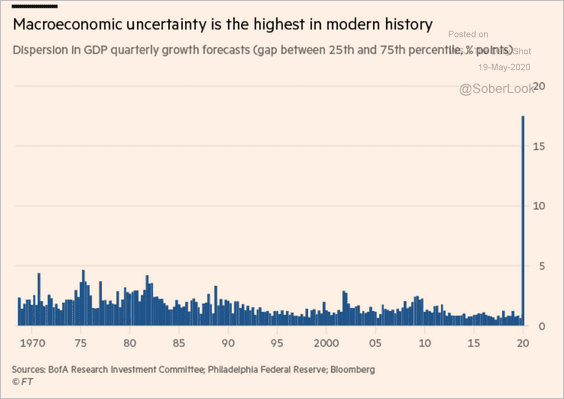

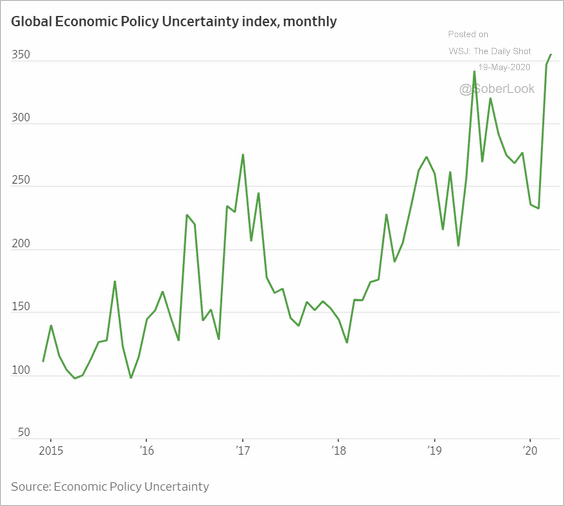

2. The current macroeconomic uncertainty is unprecedented in modern history.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Here is the global Economic Policy Uncertainty index.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

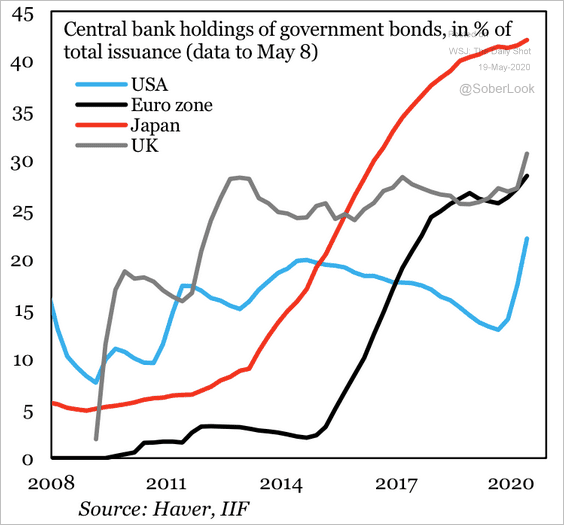

3. Central banks are increasing their share of government bonds relative to total issuance.

Source: IIF

Source: IIF

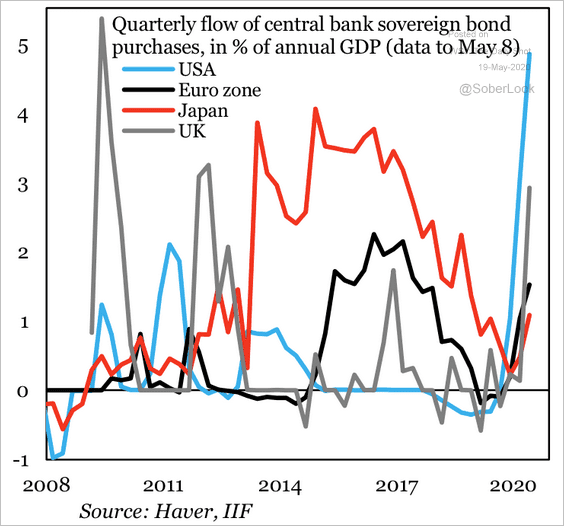

The next chart shows bond purchases as a percentage of the GDP.

Source: IIF

Source: IIF

——————–

Food for Thought

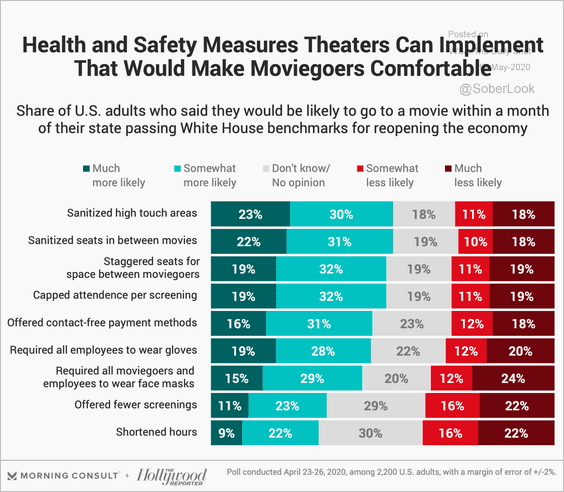

1. Making movie theaters safer:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

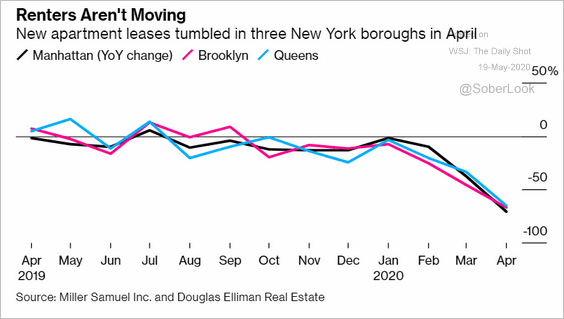

2. New York City apartment leases:

Source: @markets Read full article

Source: @markets Read full article

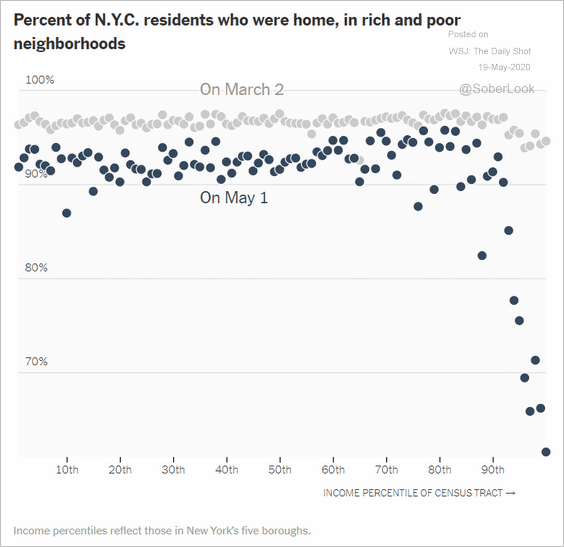

3. Wealthiest residents leaving New York City during the pandemic:

Source: The New York Times Read full article

Source: The New York Times Read full article

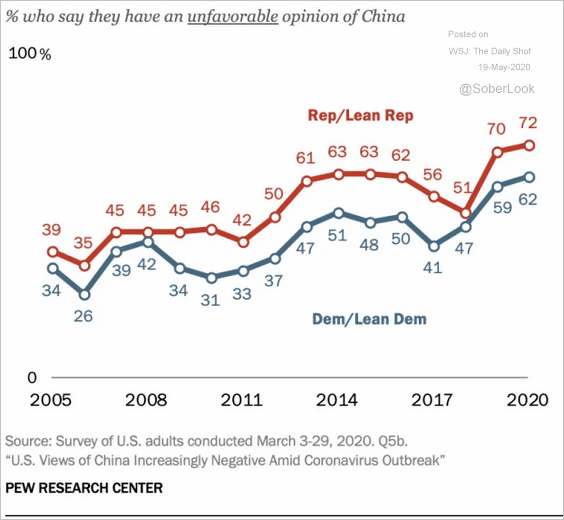

4. Americans’ views on China:

Source: @pewresearch Read full article

Source: @pewresearch Read full article

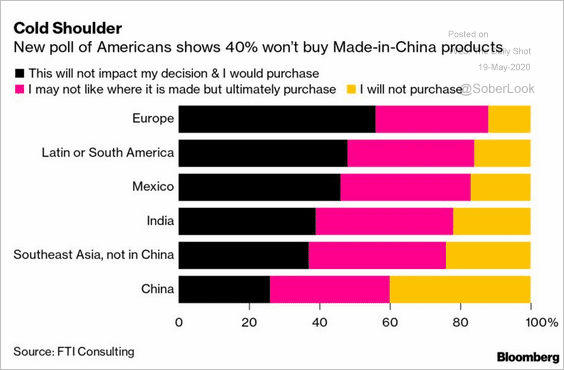

5. US consumer purchasing decisions based on product origin:

Source: @business Read full article

Source: @business Read full article

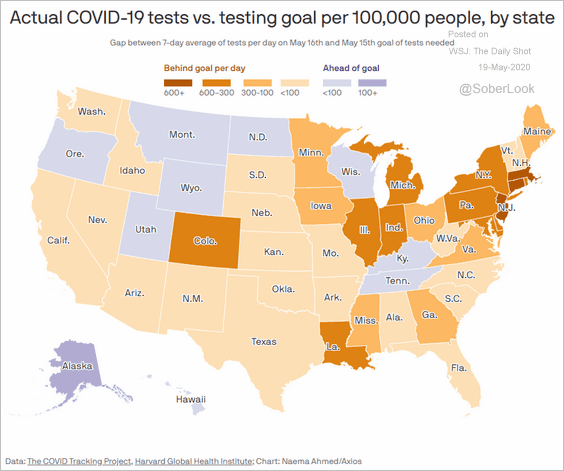

6. COVID-19 tests vs. goals:

Source: @axios Read full article

Source: @axios Read full article

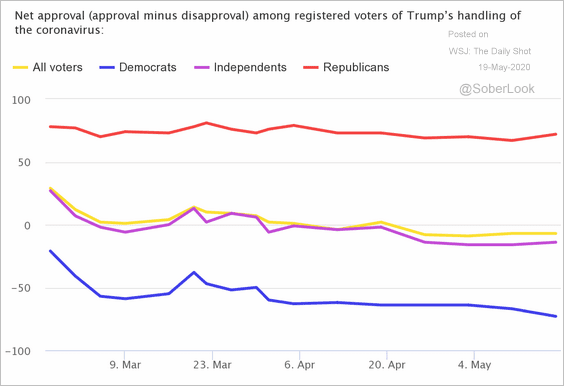

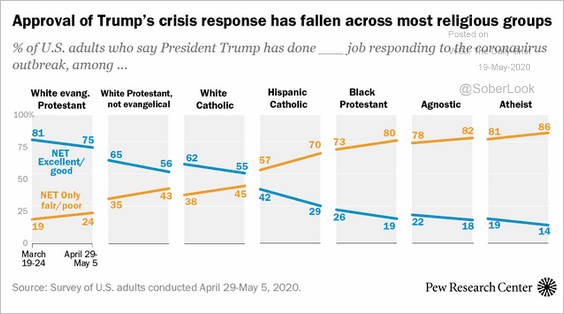

7. Approval ratings for the White House COVID-19 response (by religious and party affiliation):

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Source: @FactTank Read full article

Source: @FactTank Read full article

——————–

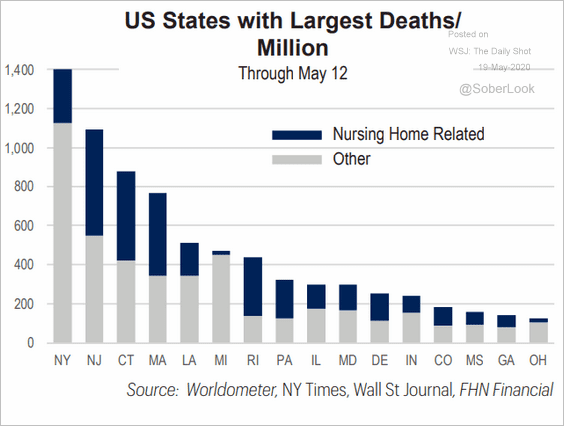

8. Deaths per million:

Source: FHN Financial

Source: FHN Financial

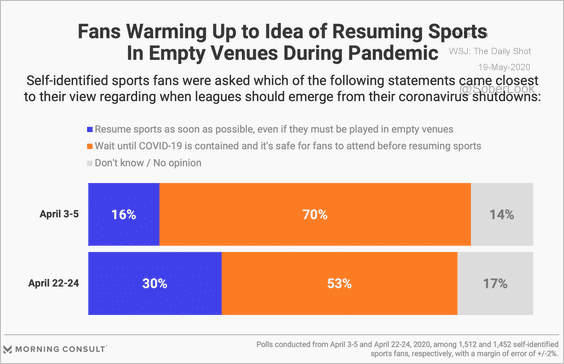

9. Resuming sports:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–