The Daily Shot: 27-May-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

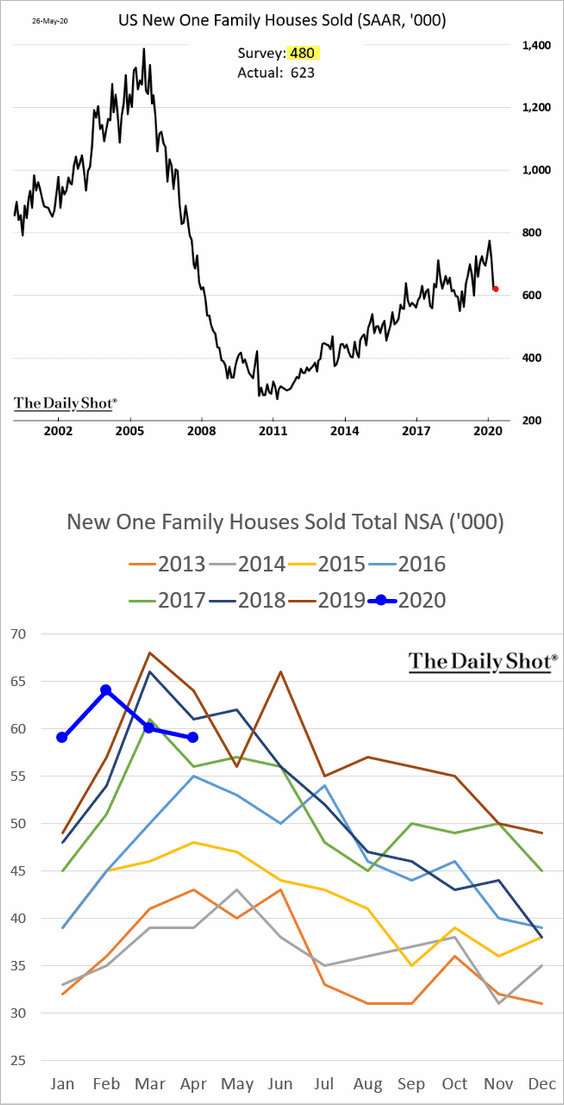

1. Let’s begin with the housing market.

• New home sales were surprisingly resilient last month, topping economists’ forecasts. The second chart shows sales by year without seasonal adjustments.

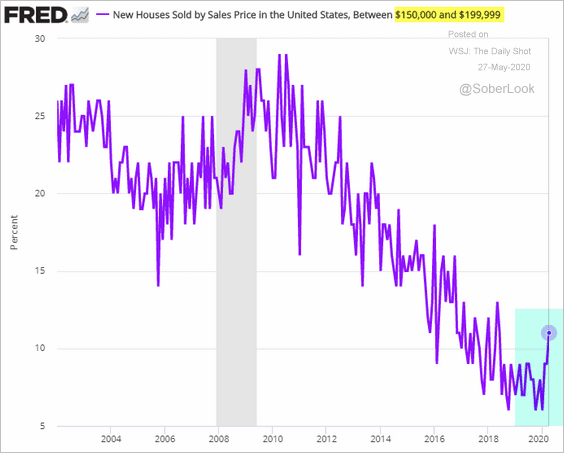

The share of starter homes increased.

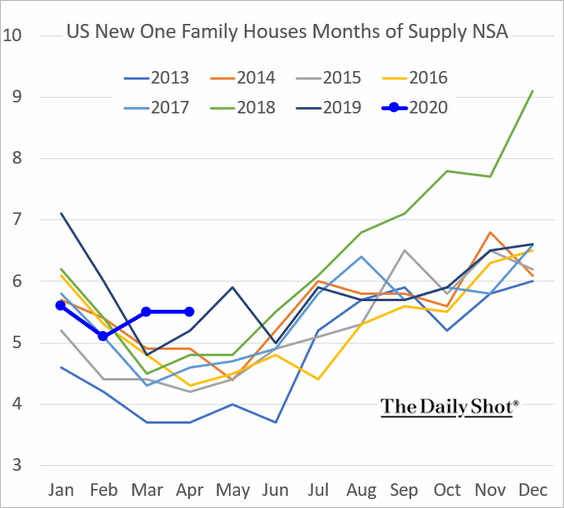

• The inventory of new homes, measured in months of supply, is slightly elevated relative to recent years.

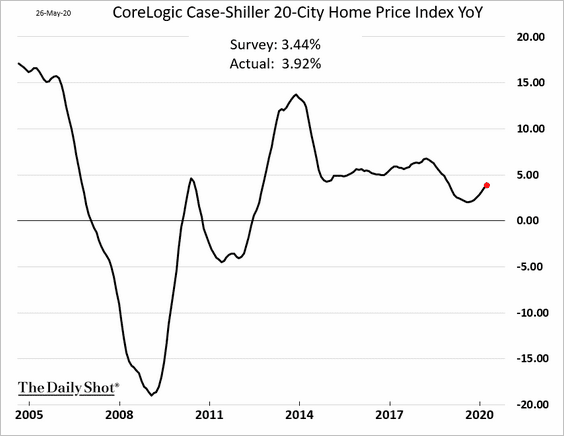

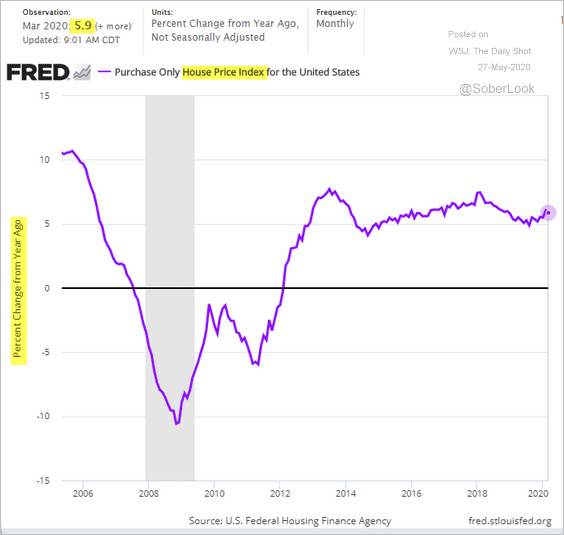

• Home price appreciation remained robust in March.

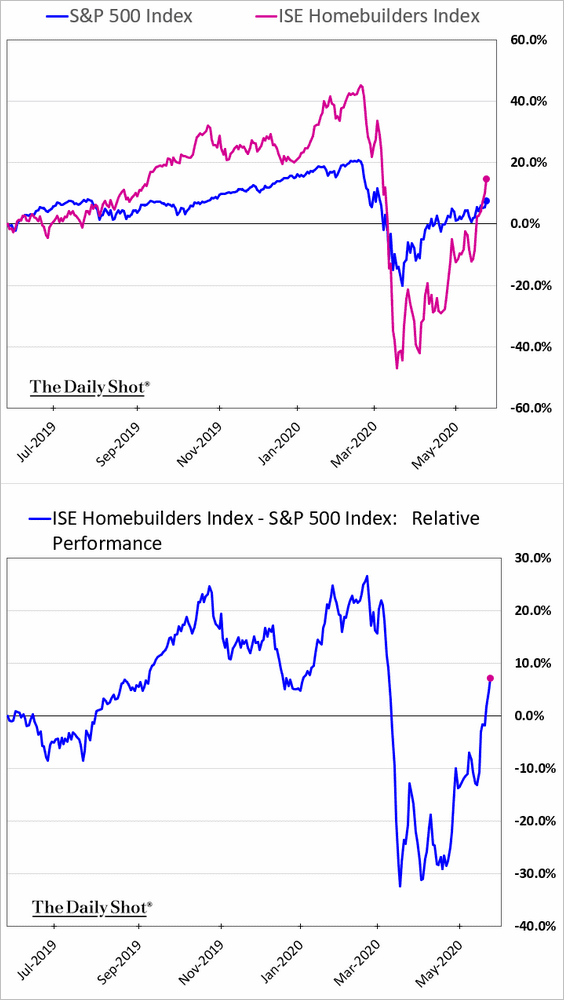

• Shares of homebuilders continue to outperform.

——————–

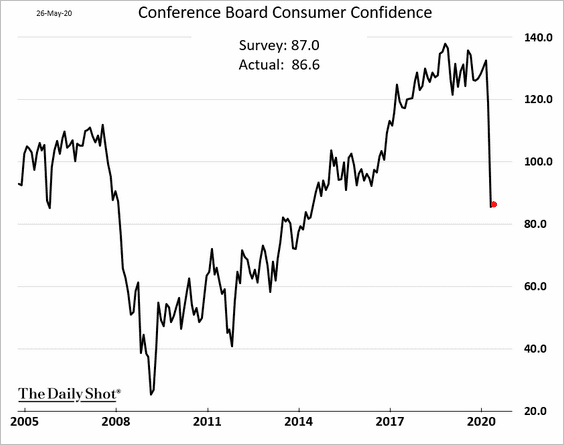

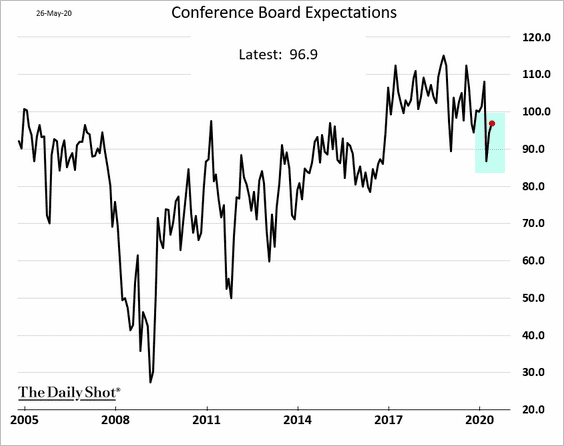

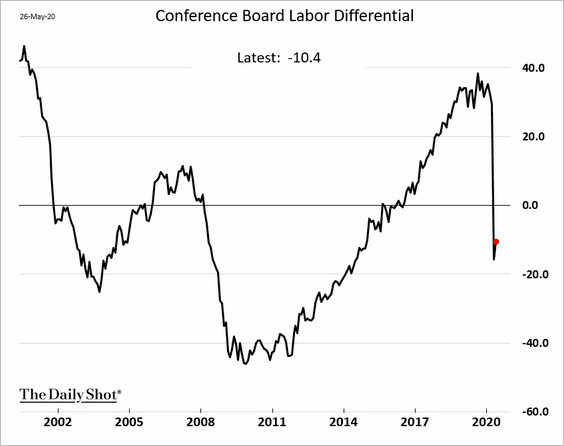

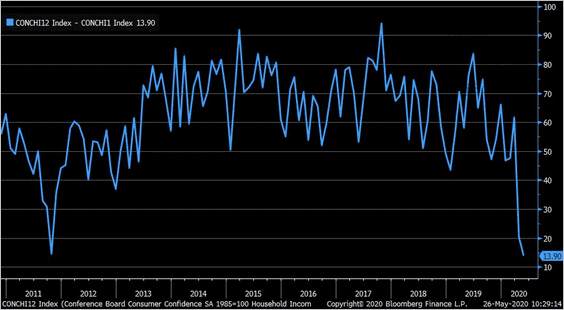

2. According to the Conference Board, consumer confidence has stabilized this month as expectations improve (second chart).

Here is the labor differential – the difference between the “jobs plentiful” and “jobs hard to get” indices.

And this chart shows the gap in confidence between households earning $125k and higher vs. those making less than $15k.

Source: @LizAnnSonders

Source: @LizAnnSonders

——————–

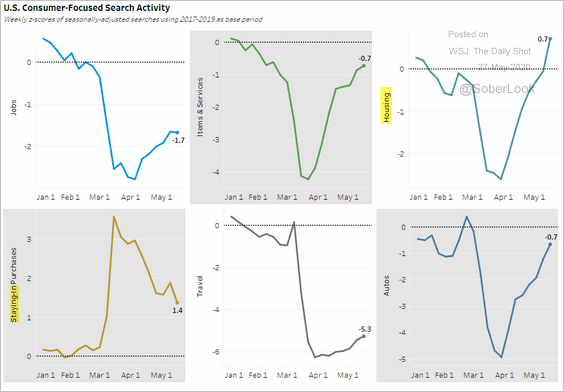

3. What do online search trends tell us about the US consumer?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

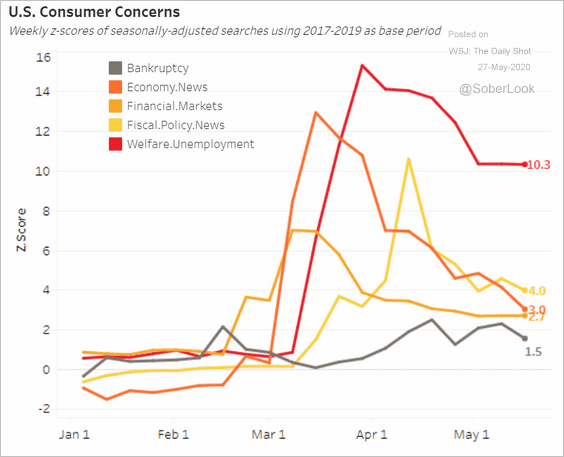

What are the key concerns for US households?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

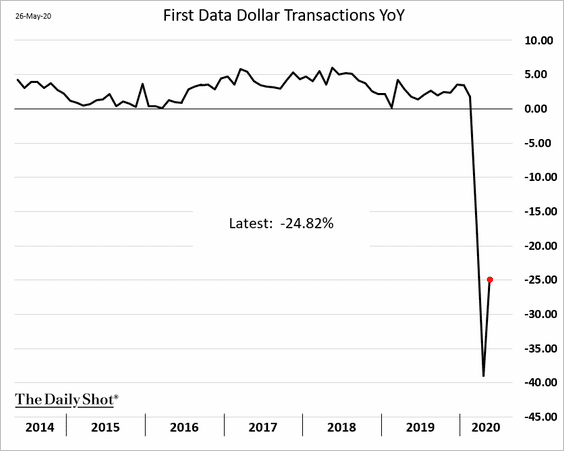

4. Credit card transaction volumes bounced from the lows.

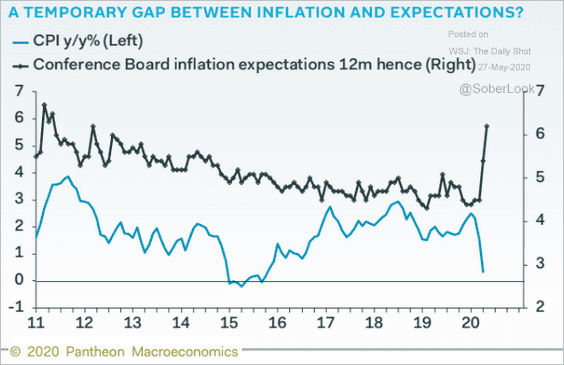

5. Consumer inflation expectations have diverged from the CPI as a result of higher grocery prices and disruptions in product availability.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

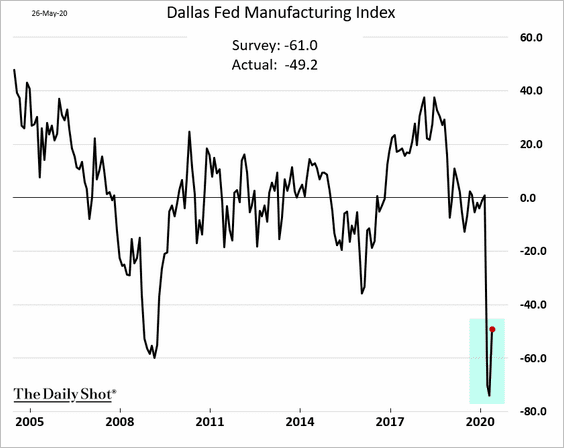

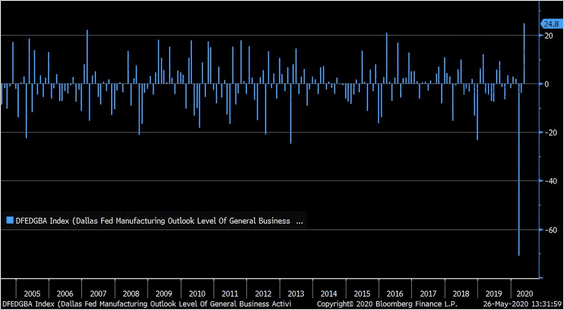

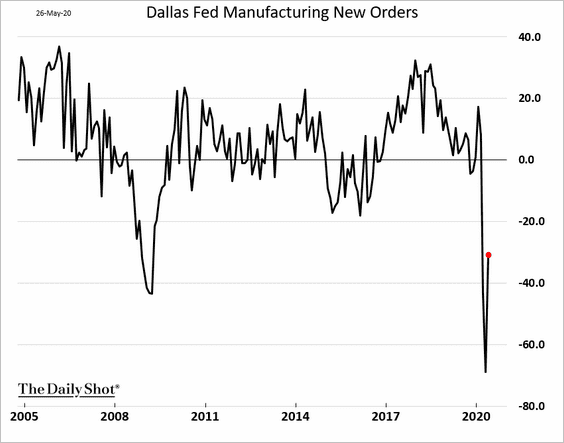

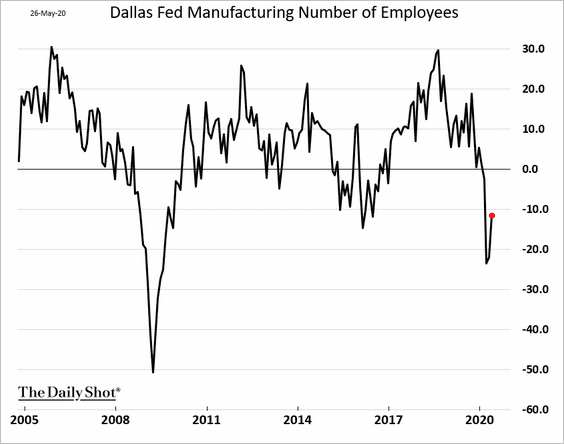

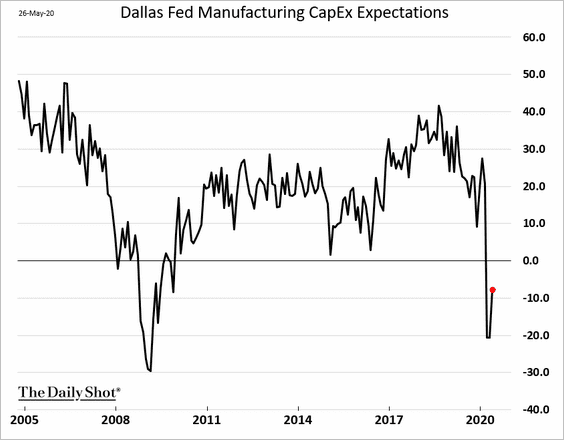

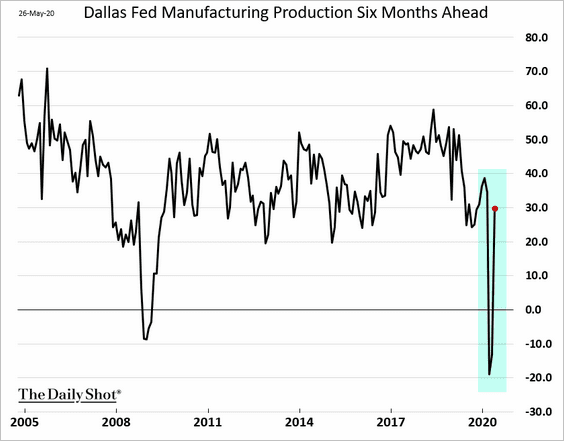

6. The Dallas Fed manufacturing index rebounded from record lows in May. It was the largest monthly increase on record (second chart).

Source: @LizAnnSonders, @DallasFed

Source: @LizAnnSonders, @DallasFed

Here are some of the components of the index.

• New orders:

• Employment:

• CapEx expectations:

• Production expectations:

——————–

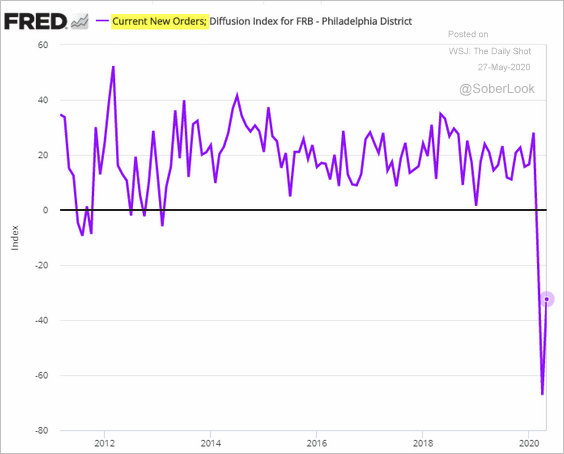

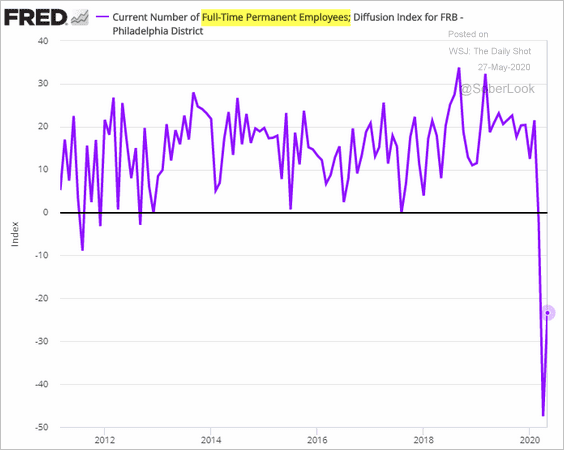

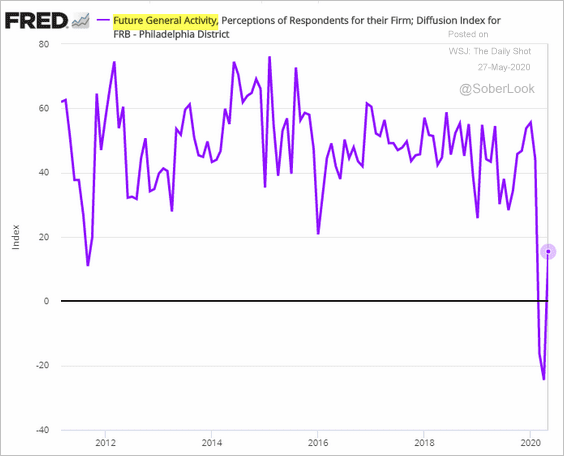

7. There was also a bounce in the Philly Fed’s service-sector index this month.

• New orders;

• Employment:

• Future activity:

——————–

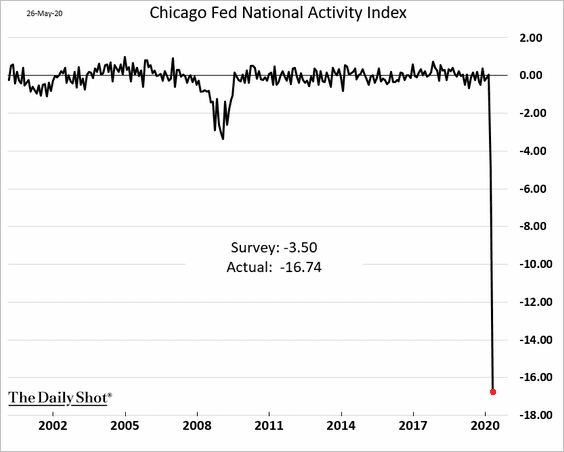

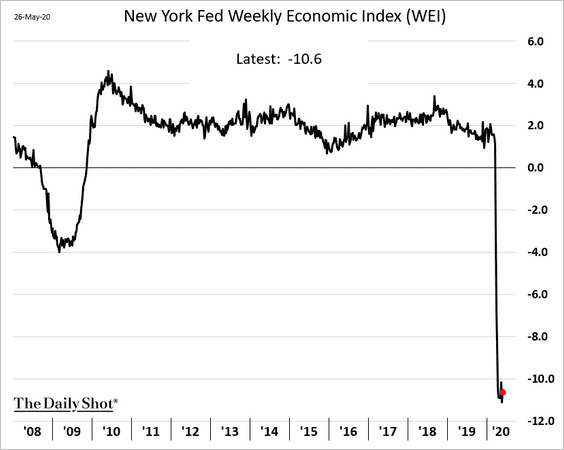

8. Broad measures of economic activity remain depressed.

• The Chicago Fed National Activity Index:

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• The NY Fed’s weekly activity index (WEI):

——————–

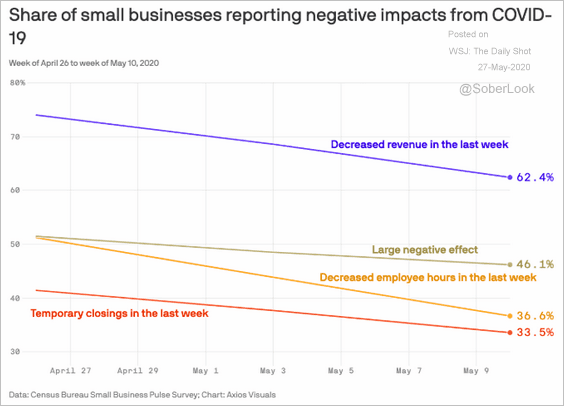

9. Small business surveys point to improvements.

Source: @axios Read full article

Source: @axios Read full article

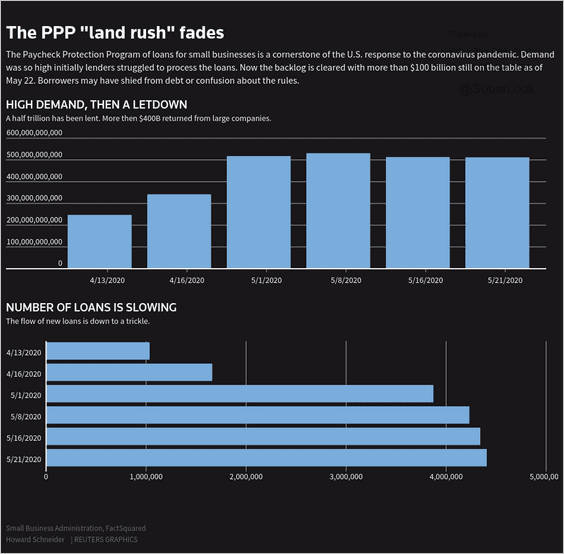

The PPP loan demand suddenly slowed.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

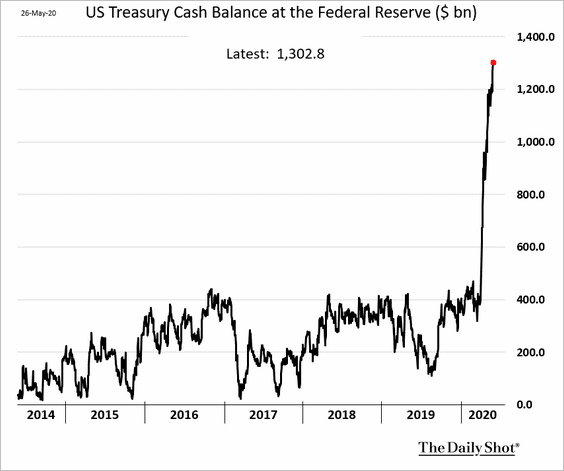

9. The US Treasury’s cash balances at the Fed exceeded $1.3 trillion as the federal government continues rapid-fire debt issuance.

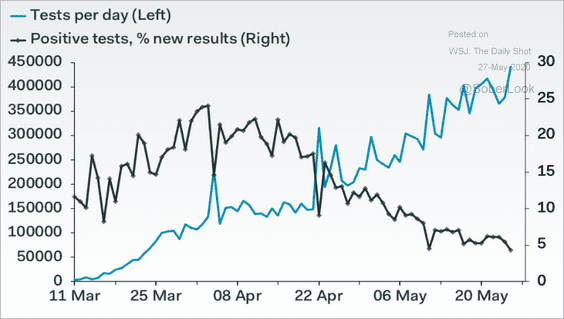

10. The pace of COVID-19 testing keeps improving.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The United Kingdom

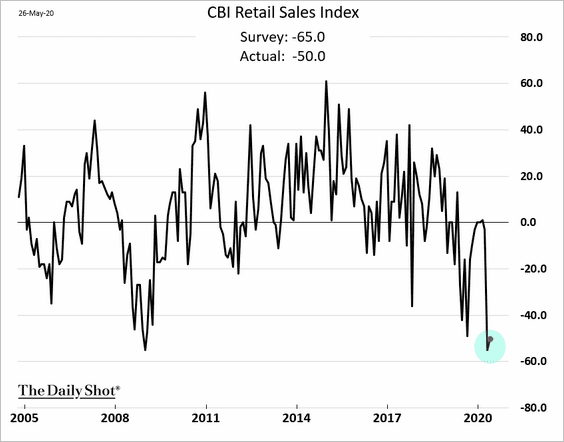

1. The CBI index of retail sales has stabilized but remains near record lows.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

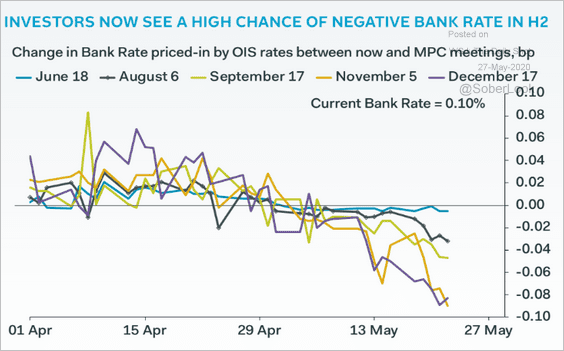

2. The markets are increasingly betting that the BoE will take rates into negative territory.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

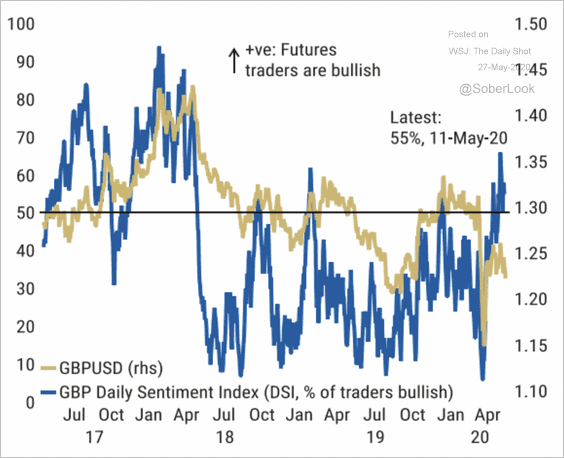

3. Futures speculators are turning more bullish on the British pound.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

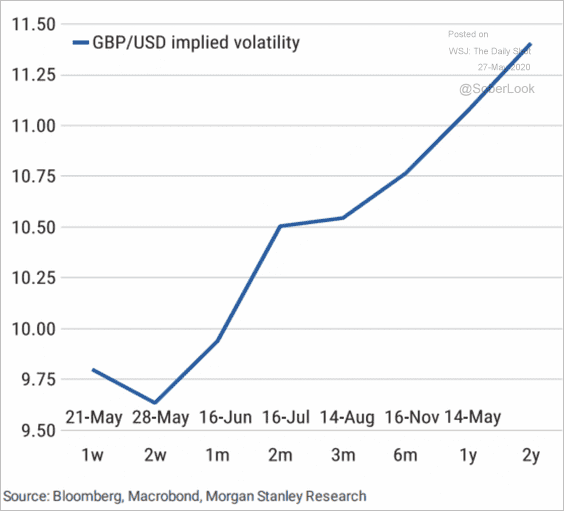

However, the GBP/USD implied volatility curve spikes after June. That’s the deadline to extend the Brexit transition period beyond the end of 2020.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

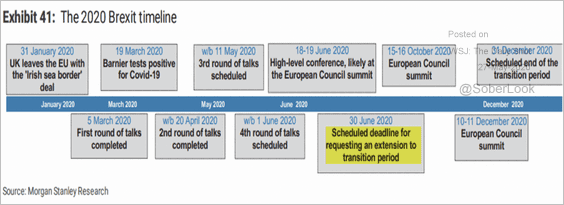

Here is the timeline.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

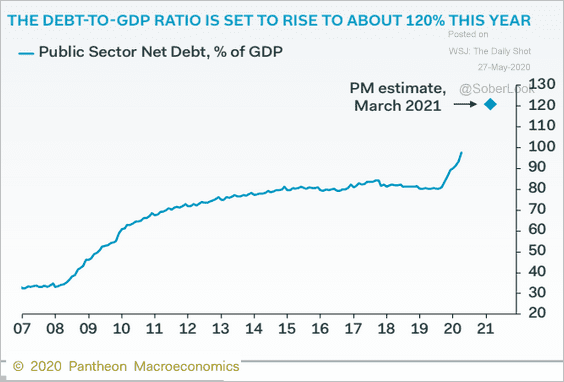

4. Below is a forecast for the UK’s public debt-to-GDP ratio from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

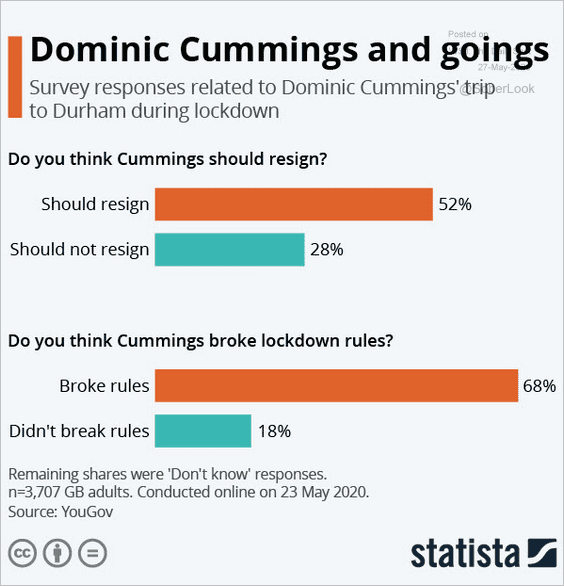

5. Should Dominic Cummings resign?

Source: Statista

Source: Statista

The Eurozone

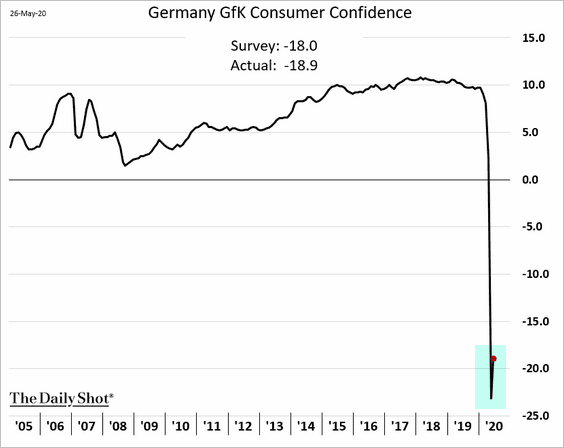

1. German consumer confidence ticked up but remains near extreme lows.

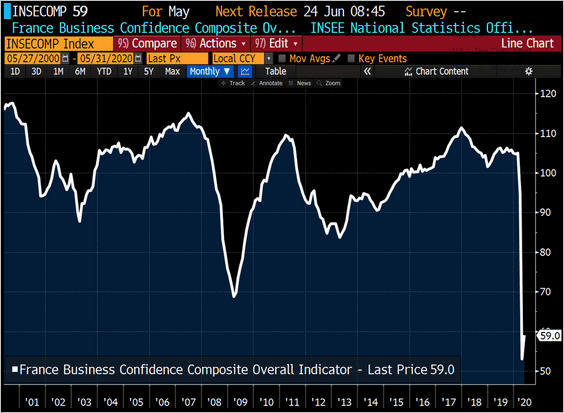

2. French business sentiment barely budged from the April lows.

Source: @TheTerminal, @jsblokland

Source: @TheTerminal, @jsblokland

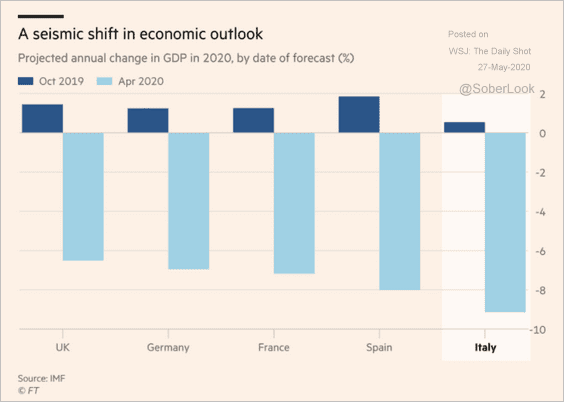

3. The economic contraction has been severe, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

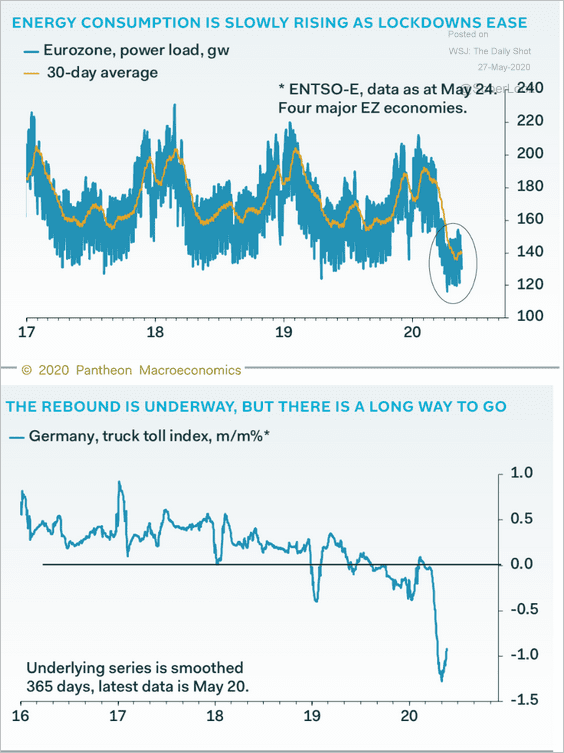

… and the recovery is expected to be painfully slow.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

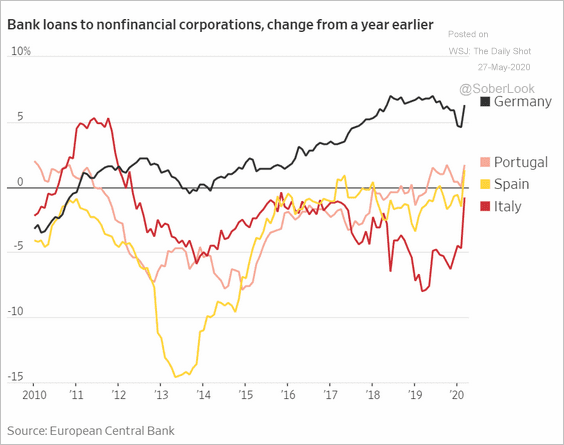

4. This chart shows the growth in euro-area business loans. Companies have been raising cash this year amid lockdowns.

Source: @WSJ Read full article

Source: @WSJ Read full article

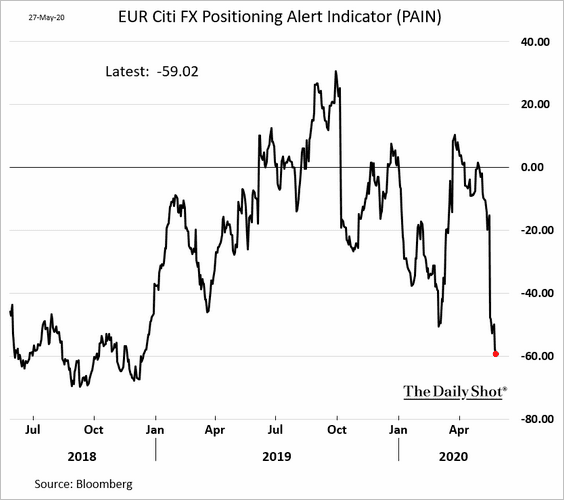

5. Active currency traders are betting against the euro.

Europe

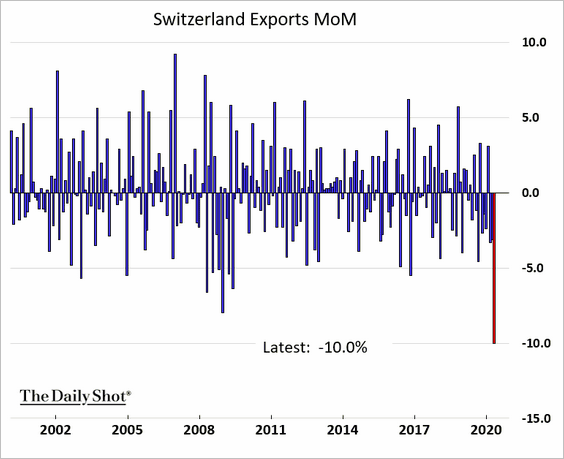

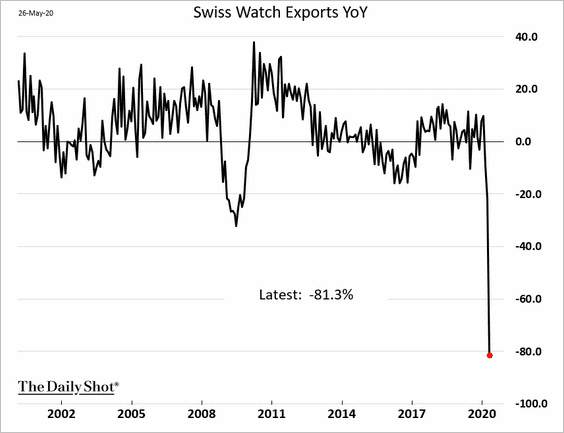

1. Swiss exports declined sharply last month.

——————–

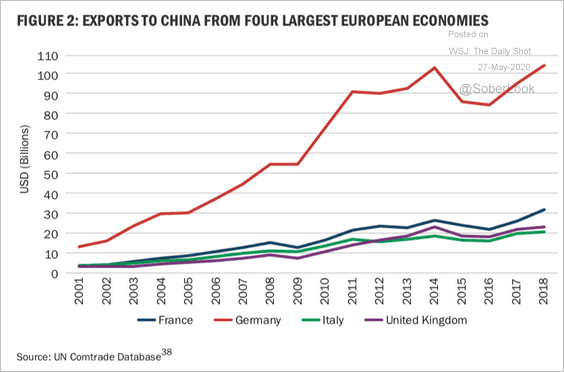

2. This chart shows European exports to China.

Source: Brookings Read full article

Source: Brookings Read full article

Asia – Pacific

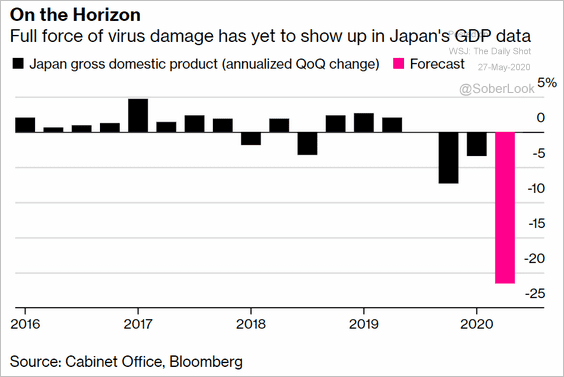

1. Economists expect a massive GDP decline in Japan this quarter.

Source: @markets Read full article

Source: @markets Read full article

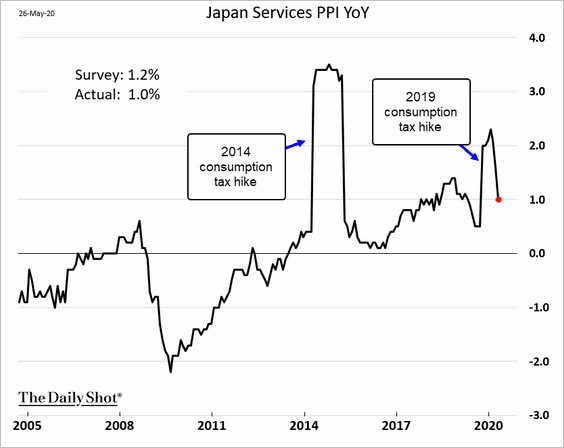

Separately, Japan’s services PPI is moderating.

——————–

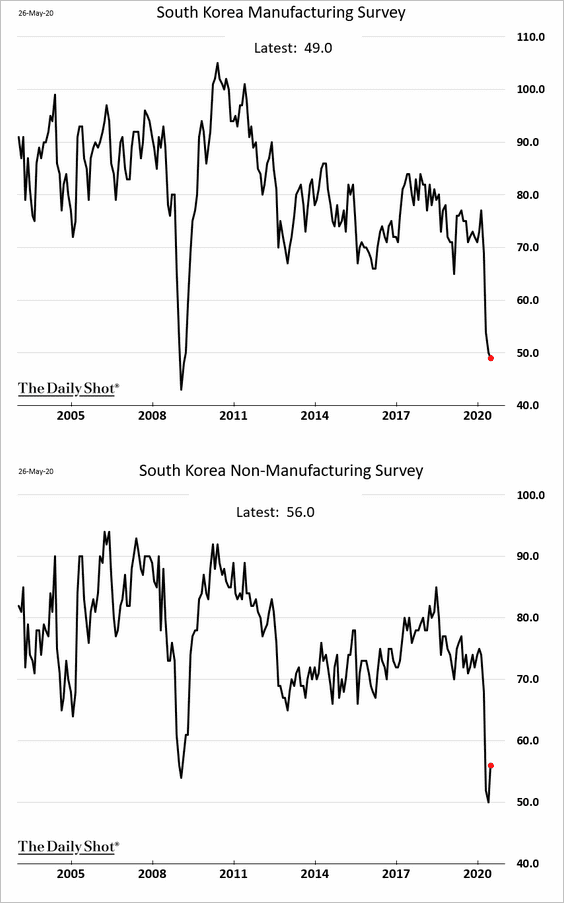

2. South Korea’s manufacturing activity kept deteriorating this month. The index of services showed a modest improvement.

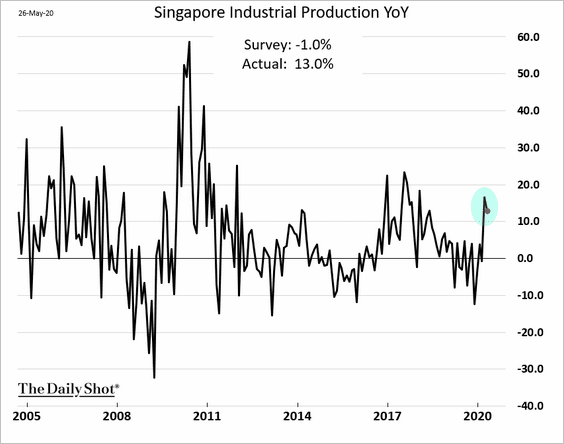

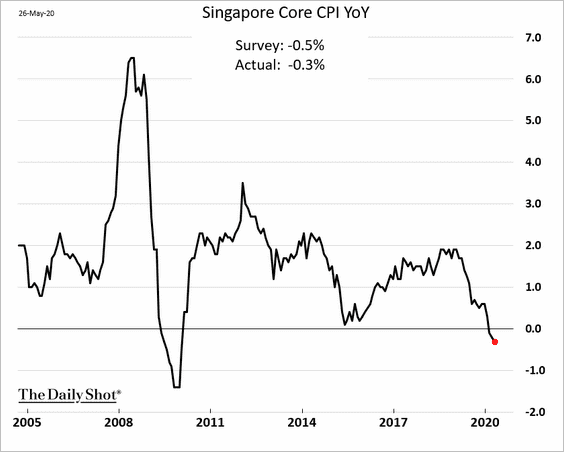

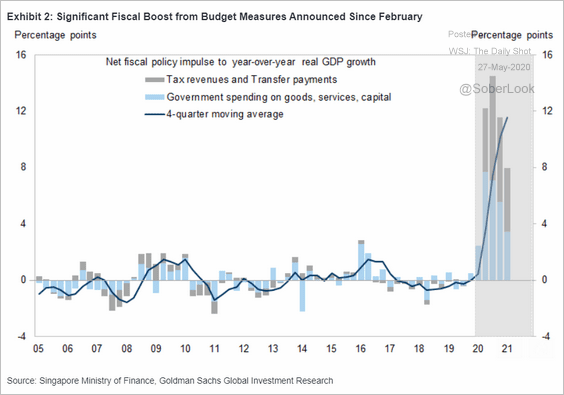

3. Next, we have some updates on Singapore.

• Industrial production has been resilient.

• Singapore is in deflation.

• The latest fiscal stimulus measures should cushion the impact of the crisis.

Source: Goldman Sachs

Source: Goldman Sachs

China

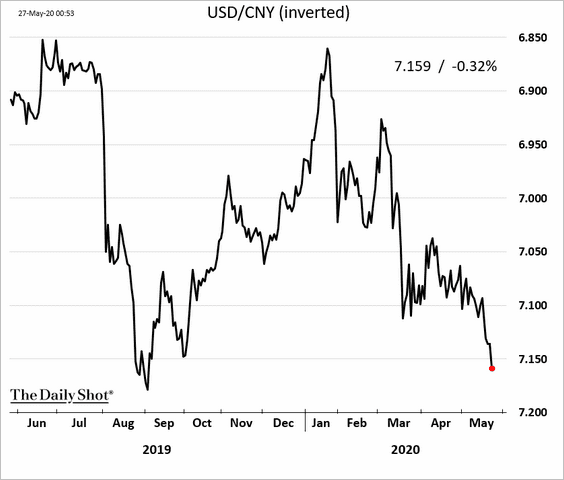

1. The renminbi is weakening on concerns that Beijing will allow substantial depreciation in China’s currency. Some see this trend as a salvo in the US-China trade war.

Source: @markets Read full article

Source: @markets Read full article

——————–

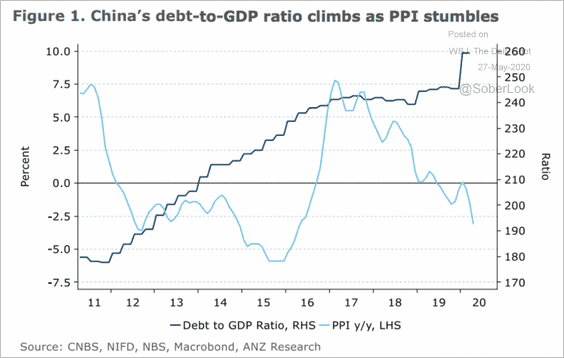

2. China’s total debt-to-GDP reached 260% in Q1.

Source: ANZ Research

Source: ANZ Research

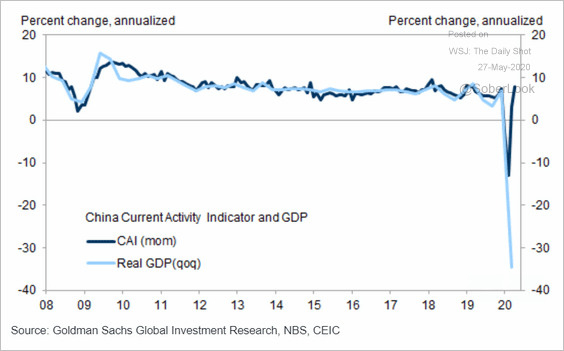

3. Goldman’s current activity indicator (CAI) points to a rebound in the GDP.

Source: Goldman Sachs

Source: Goldman Sachs

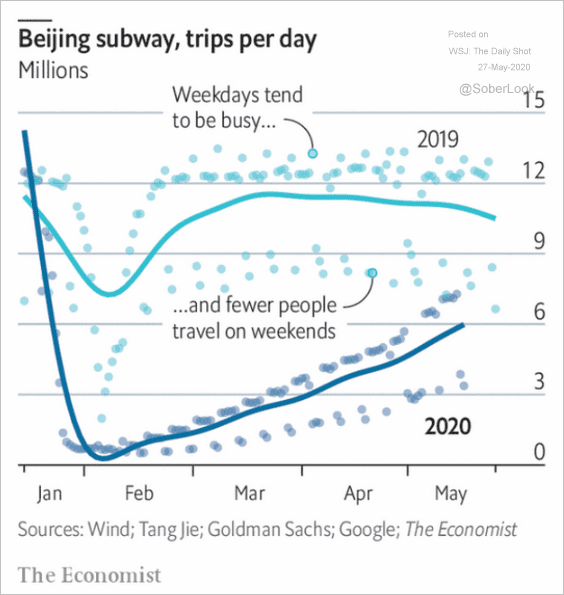

4. Beijing subway ridership is improving.

Source: The Economist Read full article

Source: The Economist Read full article

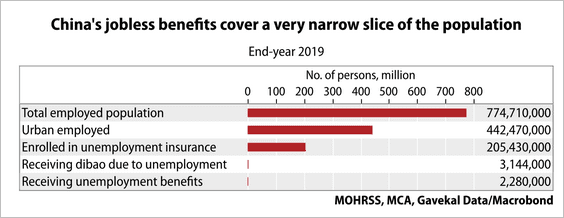

5. Jobless benefits have been inadequate, although the government has promised that more income support should flow to the unemployed in the coming months, according to Gavekal.

Source: Gavekal

Source: Gavekal

Emerging Markets

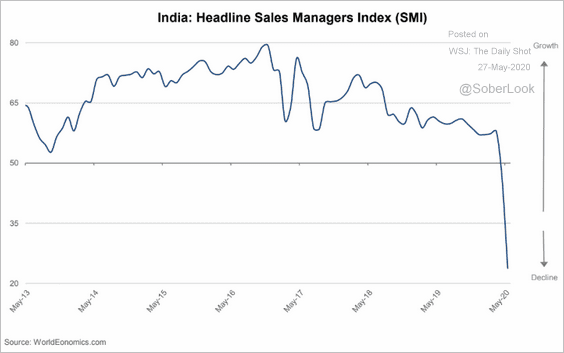

1. Let’s begin with India.

• The World Economics SMI shows severe deterioration in business activity this month.

Source: World Economics

Source: World Economics

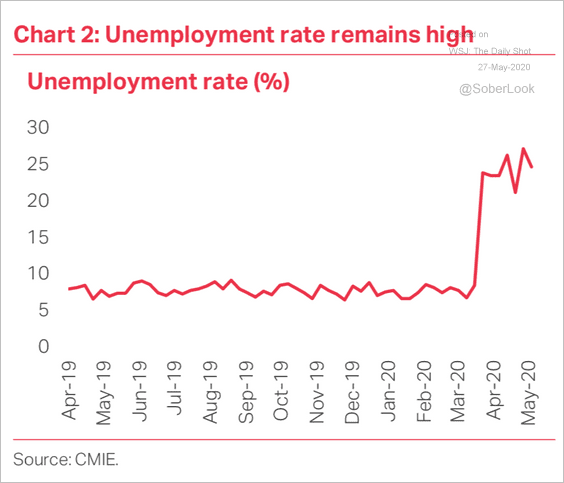

• The unemployment rate remains elevated.

Source: TS Lombard

Source: TS Lombard

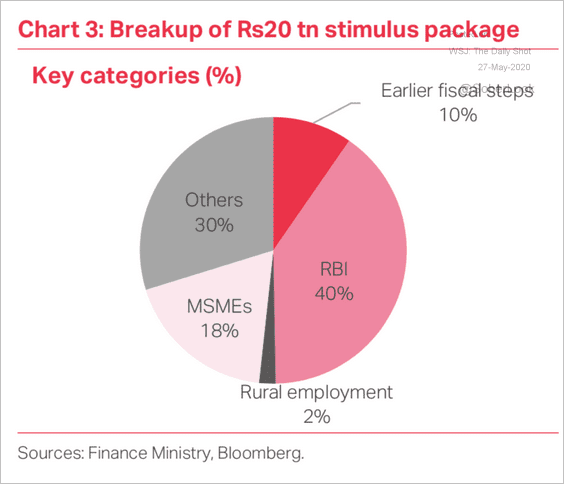

• Here are the components of the latest fiscal stimulus measure.

Source: TS Lombard

Source: TS Lombard

——————–

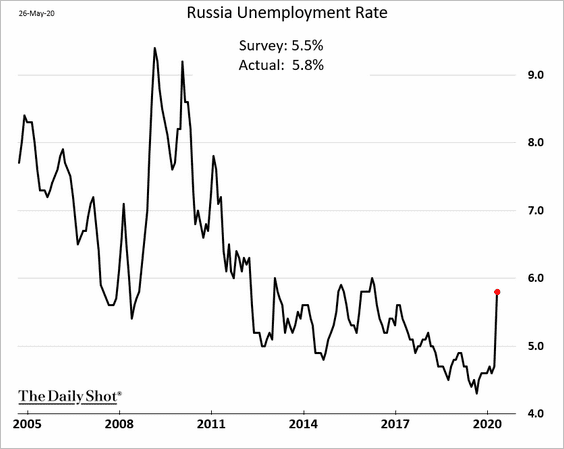

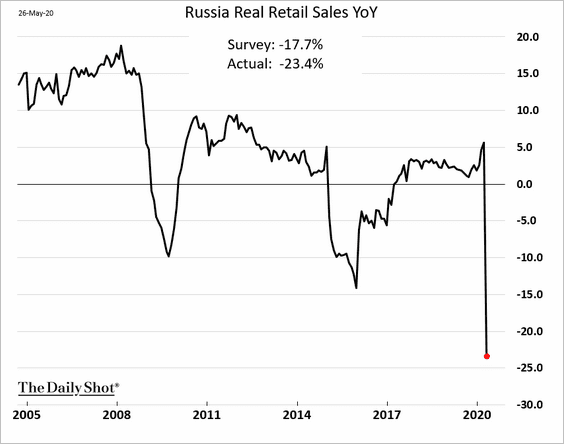

2. Russia’s unemployment rate jumped in April.

And retail sales plummetted.

——————–

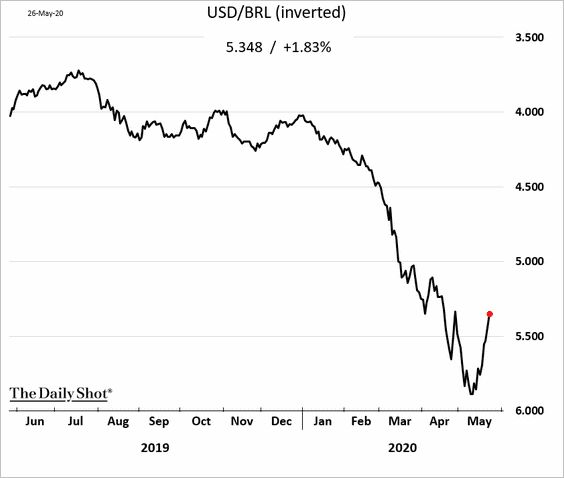

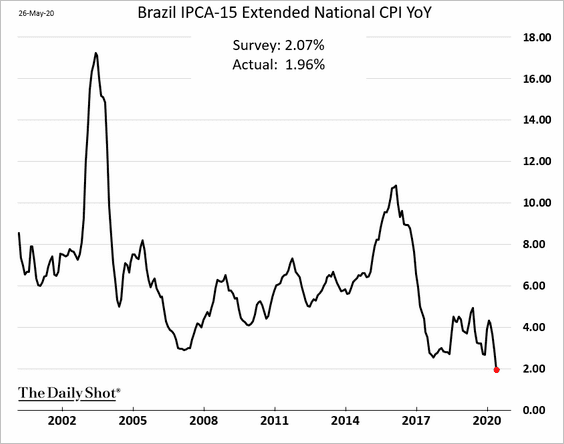

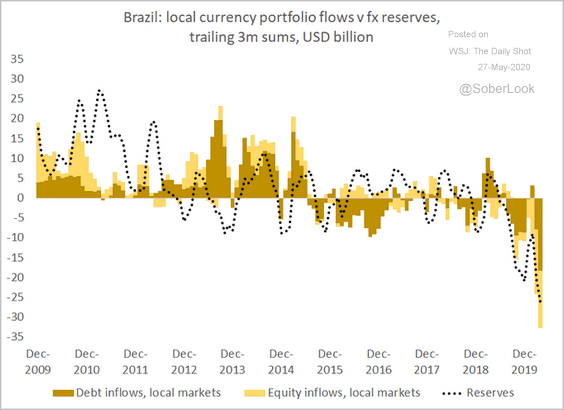

3. Next, we have some updates on Brazil.

• The real appears to have bottomed.

• Despite the currency weakness, the CPI dipped below 2% for the first time.

• Investors have been exiting local debt and equity markets.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

——————–

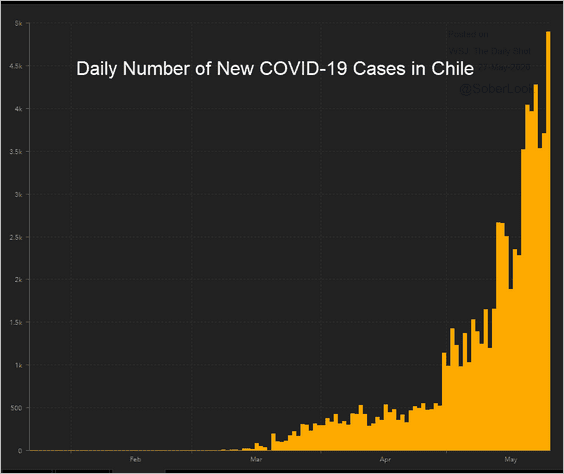

4. The number of new coronavirus cases in Chile spikes.

Source: JHU CSSE

Source: JHU CSSE

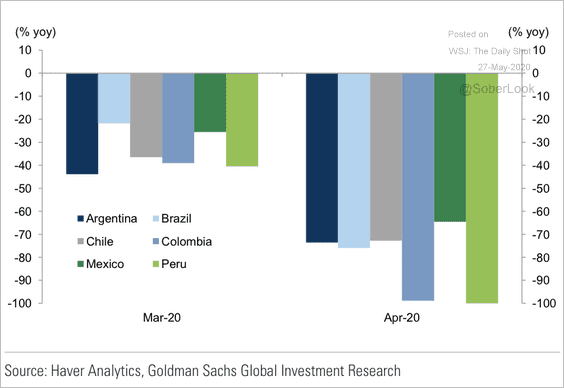

5. Auto sales in Latin America experienced a sudden stop last month.

Source: Goldman Sachs

Source: Goldman Sachs

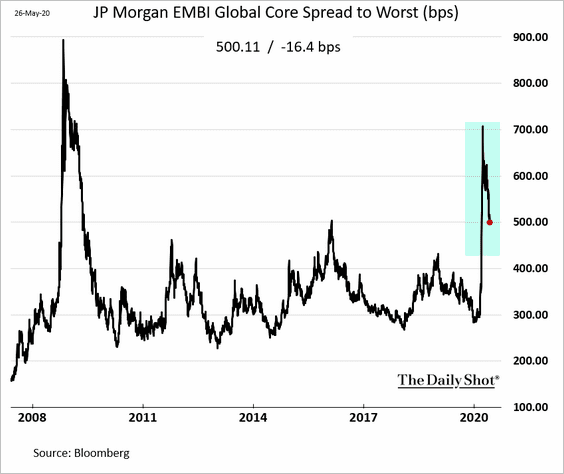

6. EM dollar-denominated bonds are gradually recovering.

Cryptocurrency

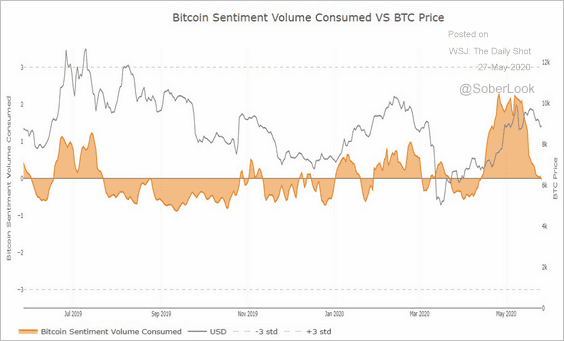

1. Twitter sentiment volume on Bitcoin has turned negative.

Source: @santimentfeed

Source: @santimentfeed

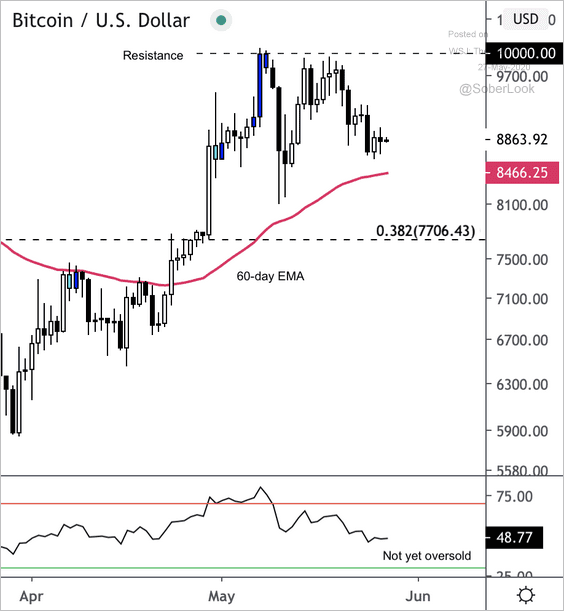

2. Technicals show that Bitcoin is not oversold.

Source: @DantesOutlook

Source: @DantesOutlook

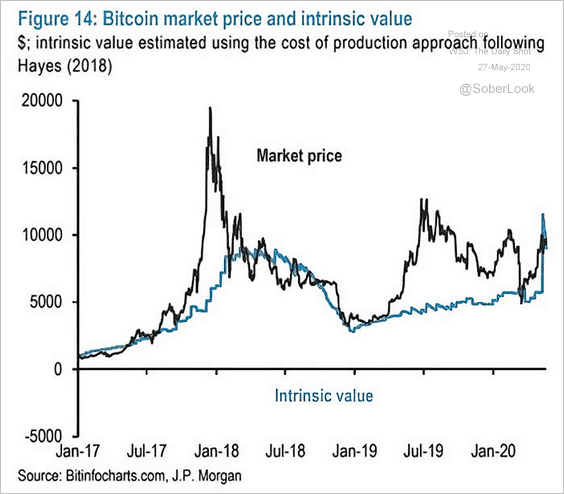

3. According to JP Morgan, Bitcoin is now roughly at fair value.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

Energy

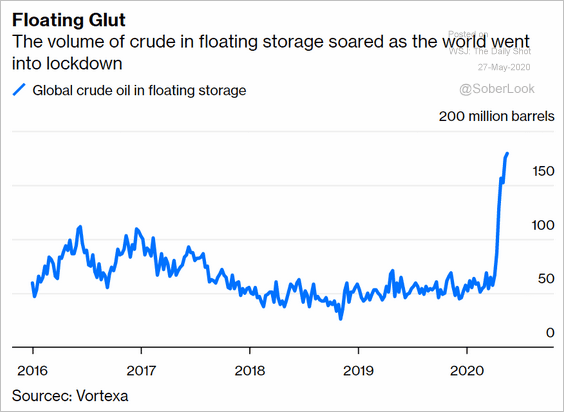

1. Crude oil floating storage remains elevated.

Source: @bopinion Read full article

Source: @bopinion Read full article

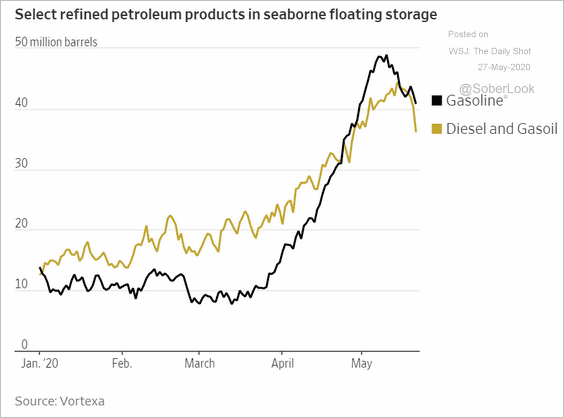

But the amount of refined products at sea is starting to moderate.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

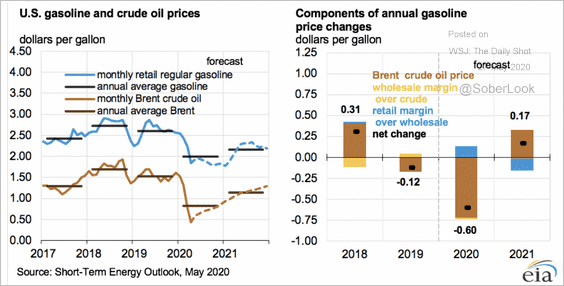

2. US gasoline prices have taken a severe hit this year, but are expected to recover in 2021 with Brent swinging upwards.

Source: @EIAgov

Source: @EIAgov

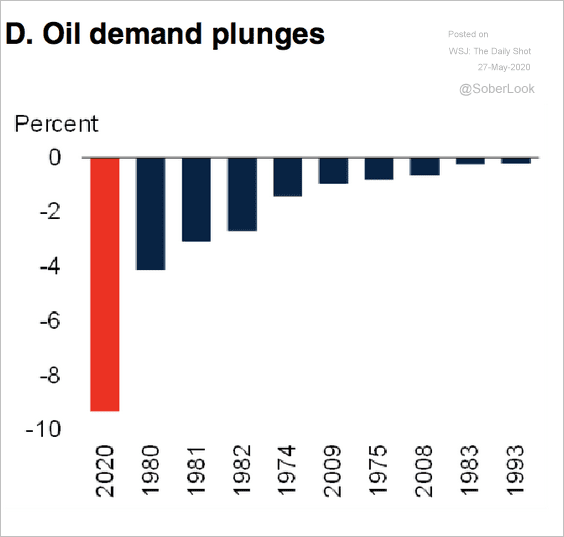

3. This chart shows the biggest declines in oil demand in recent decades.

Source: World Bank Read full article

Source: World Bank Read full article

Equities

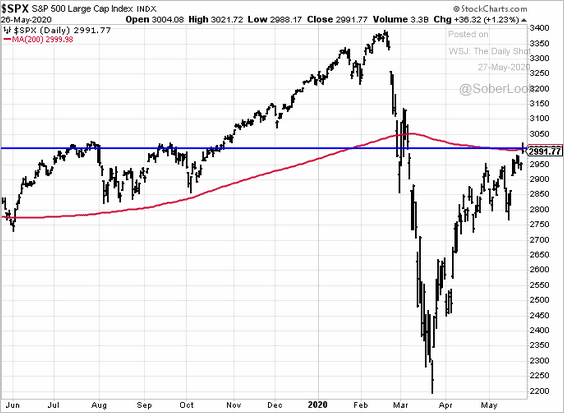

1. The S&P 500 is testing resistance at 3,000.

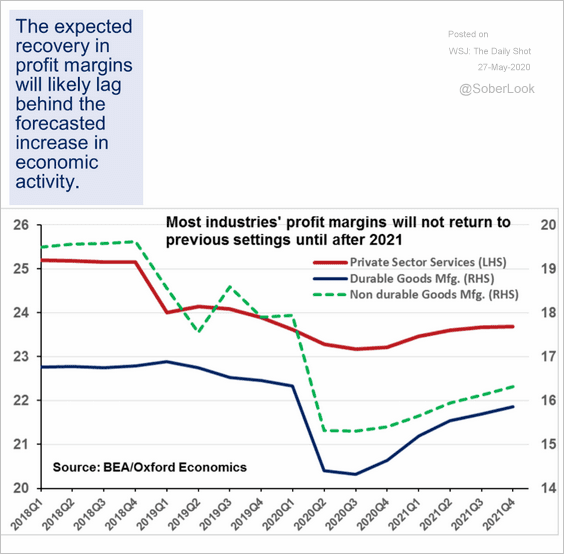

2. Oxford Economics expects profit margins to lag economic recovery.

Source: Oxford Economics

Source: Oxford Economics

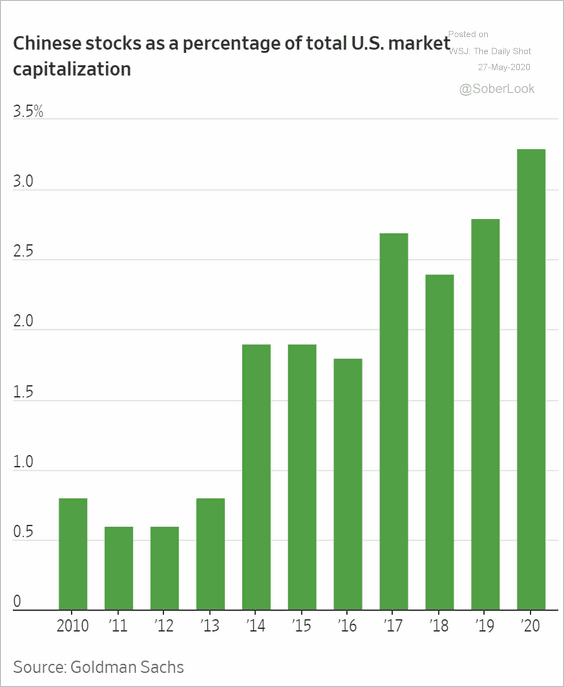

3. This chart shows China-domiciled stocks as a percentage of the US market cap.

Source: @WSJ Read full article

Source: @WSJ Read full article

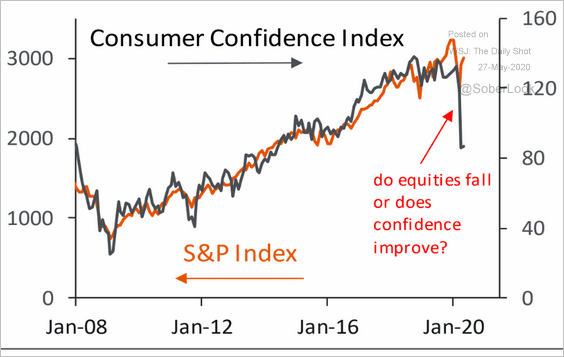

4. The stock market has decoupled from consumer confidence.

Source: Piper Sandler

Source: Piper Sandler

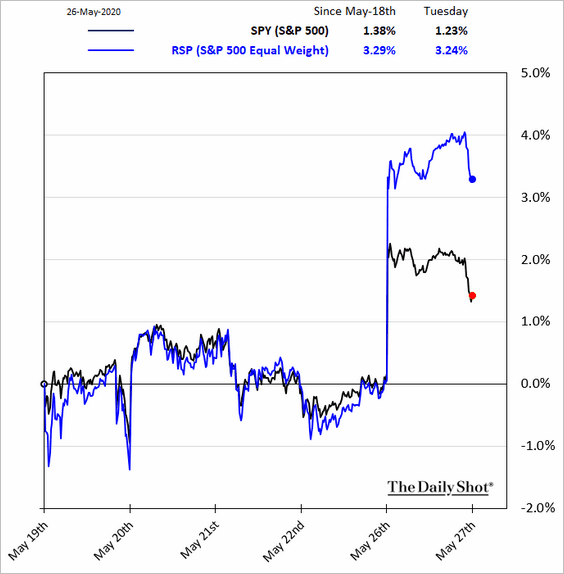

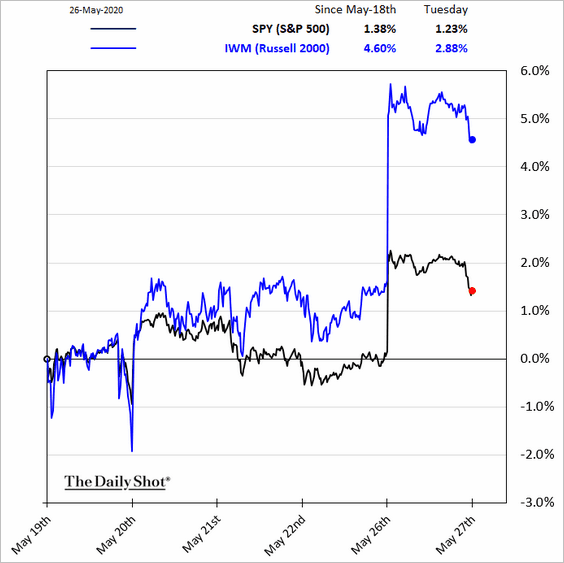

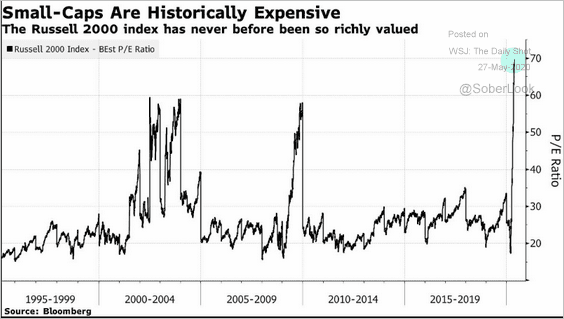

5. Tuesday was a good day for beaten-down stocks as mega-caps underperformed.

– Equal-weight S&P 500:

– Small caps:

By the way, this chart shows the Russell 2000 P/E ratio.

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

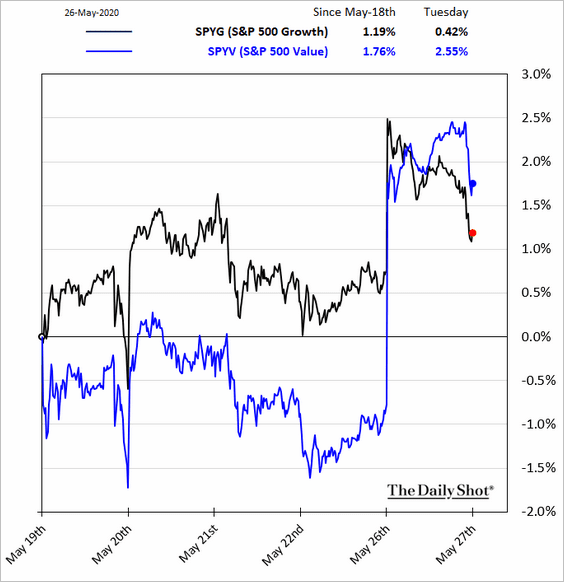

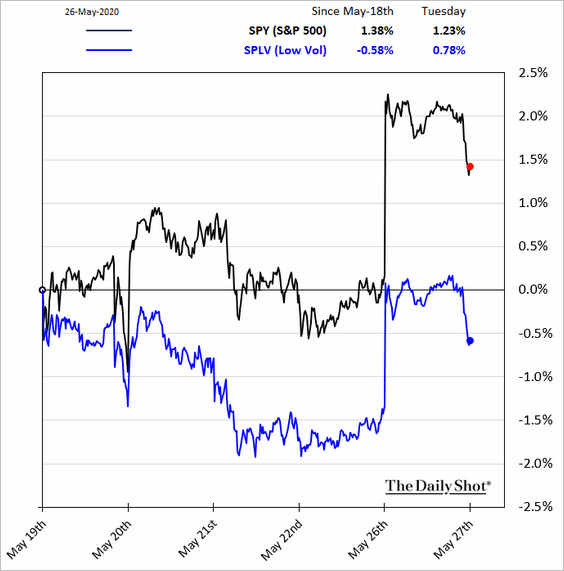

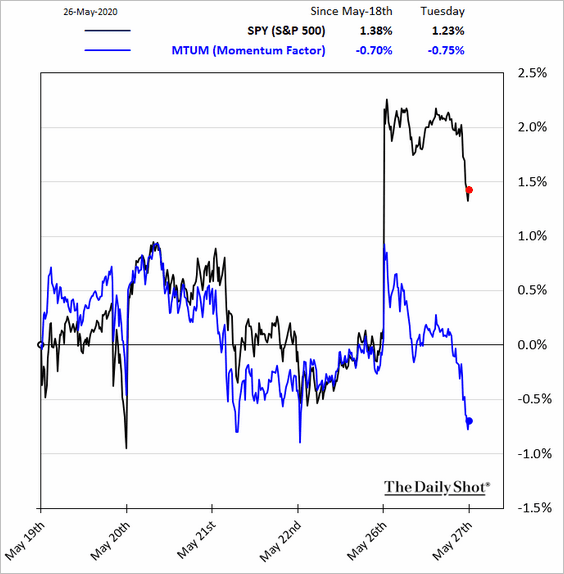

• Here are some equity factor performance charts.

– Value vs. growth:

– Low vol:

– Momentum:

——————–

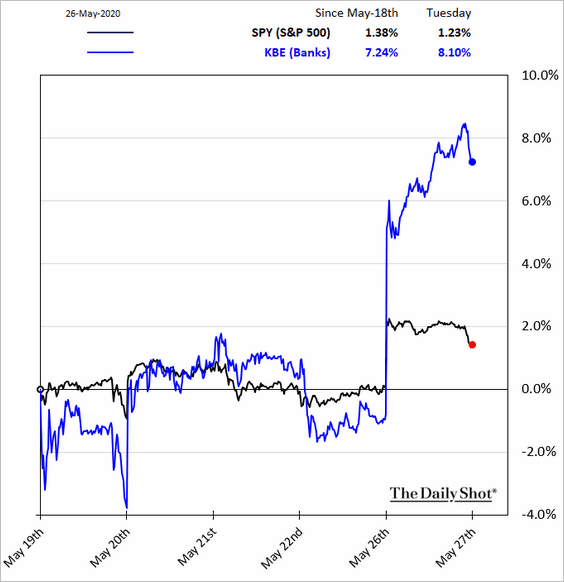

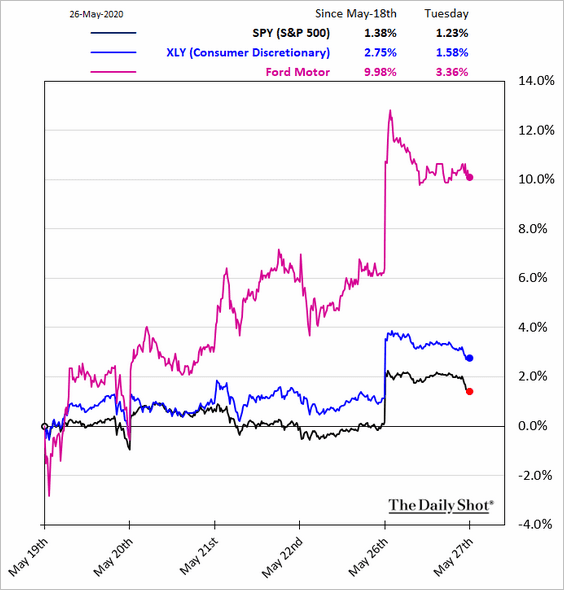

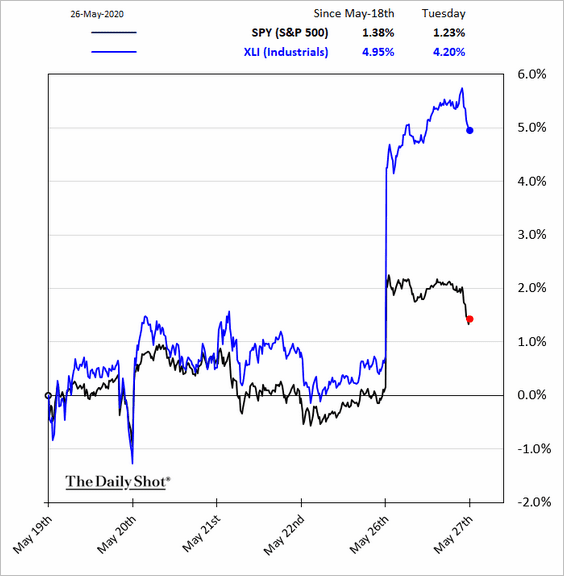

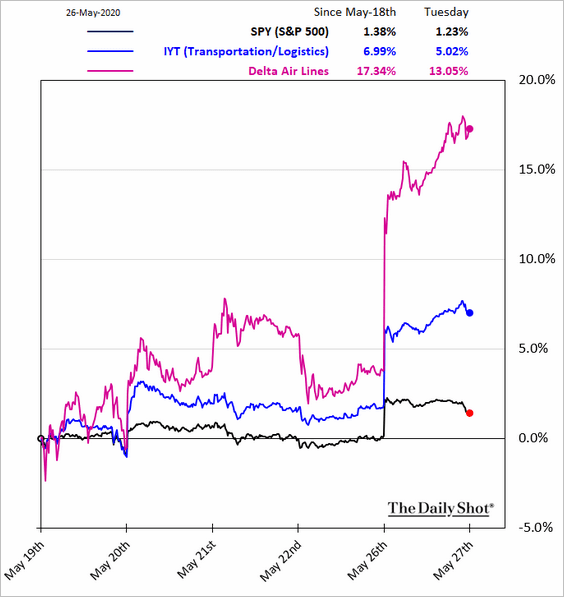

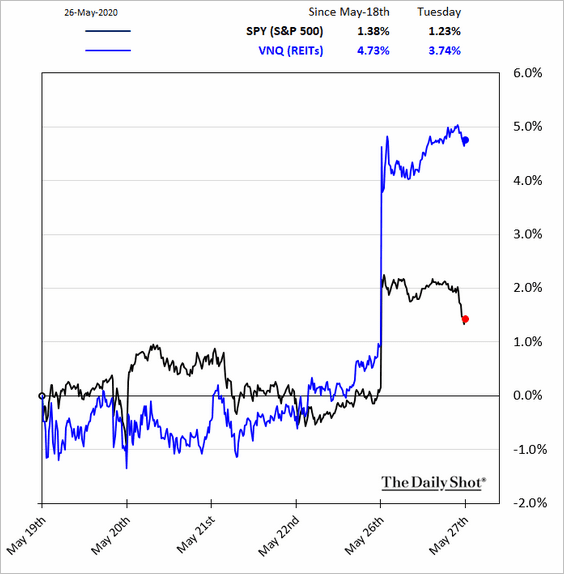

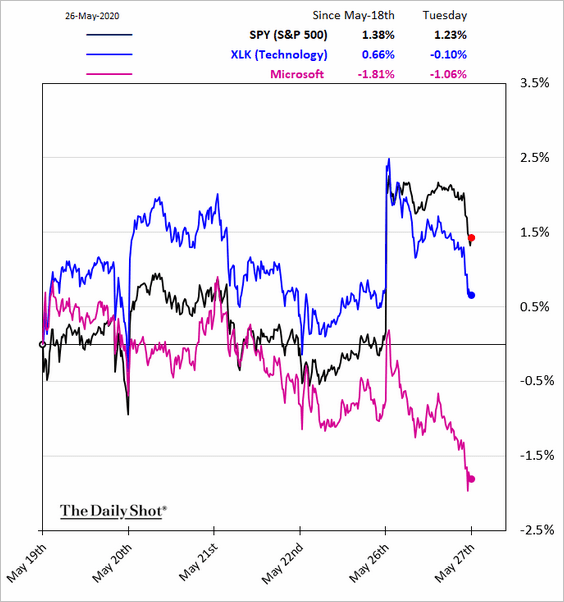

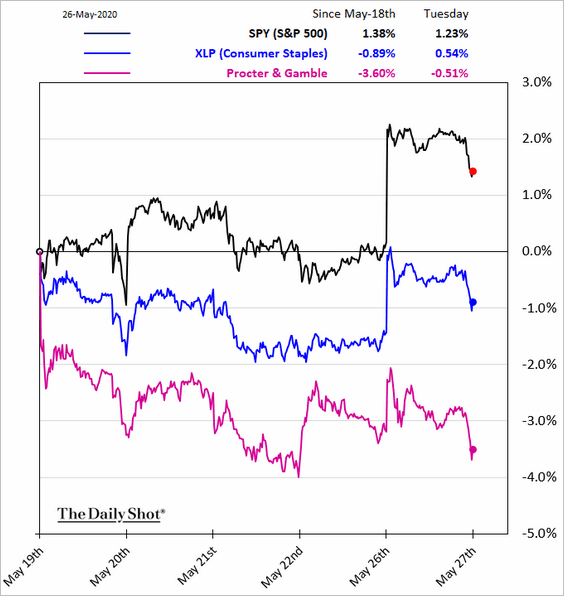

6. Sectors that underperformed this year enjoyed a rebound on Tuesday.

• Banks:

• Consumer Discretionery:

• Industrials:

• Transportation:

• REITs:

On the other hand, tech and consumer staples underperformed.

Credit

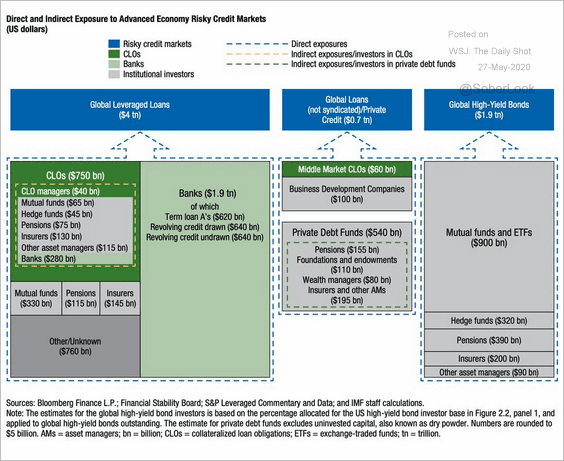

1. Who owns sub-invenstment-grade corporate credit?

Source: @adam_tooze, @rohitgoel_rg Read full article

Source: @adam_tooze, @rohitgoel_rg Read full article

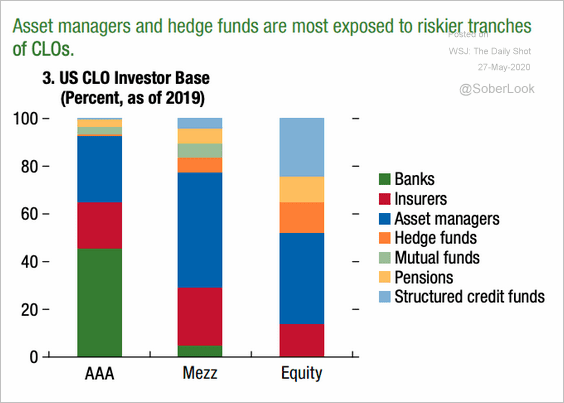

2. Who are the holders of different CLO tranches?

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

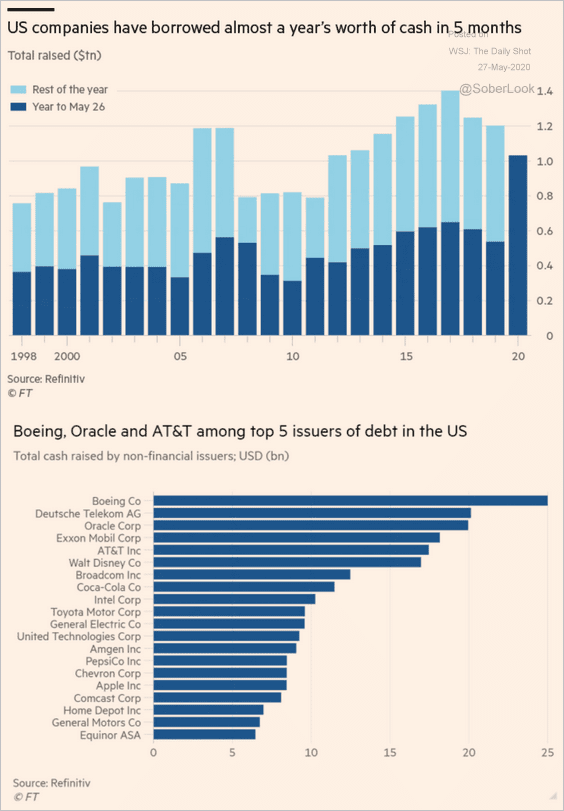

3. These charts put the 2020 US corporate borrowing spree in perspective.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

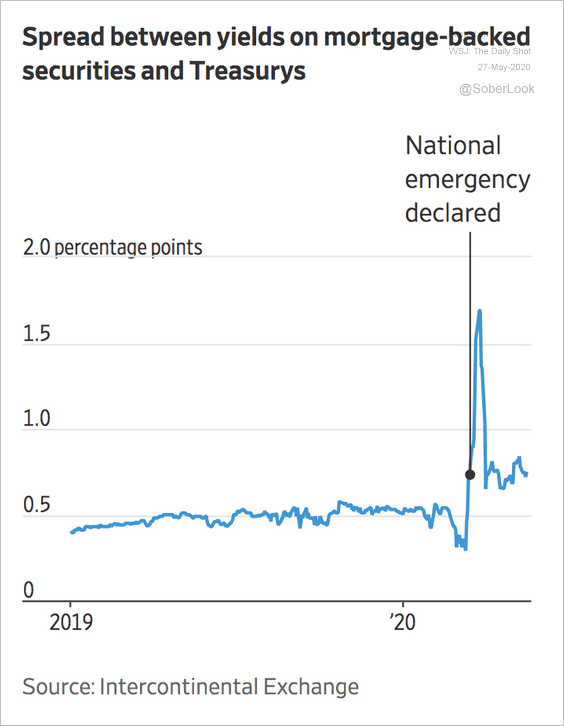

4. MBS spreads have tightened since March but remain elevated relative to pre-crisis levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

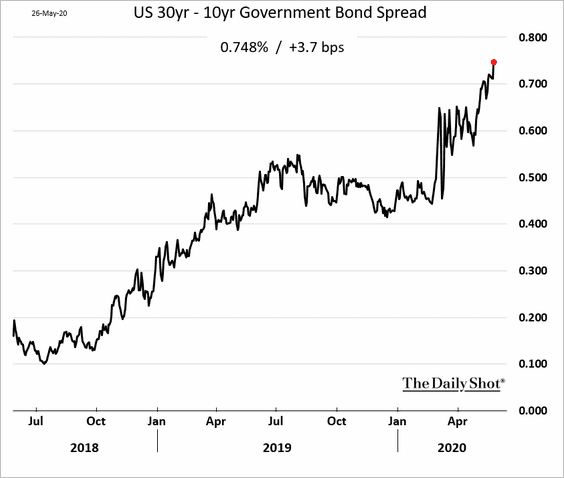

1. The long bond continues to underperform, partially as a result of the 20yr Treasury issuance.

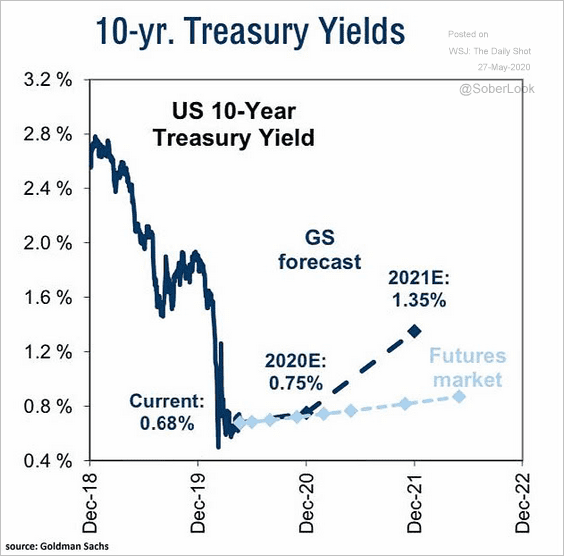

2. Goldman expects the 10yr Treasury yield to rise next year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

3. Will the Fed follow the BoJ with yield-curve targeting?

Source: @markets Read full article

Source: @markets Read full article

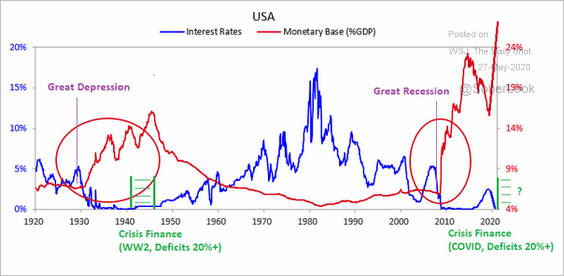

4. Here is a long-term chart of the US monetary base.

Source: @LynAldenContact

Source: @LynAldenContact

Global Developments

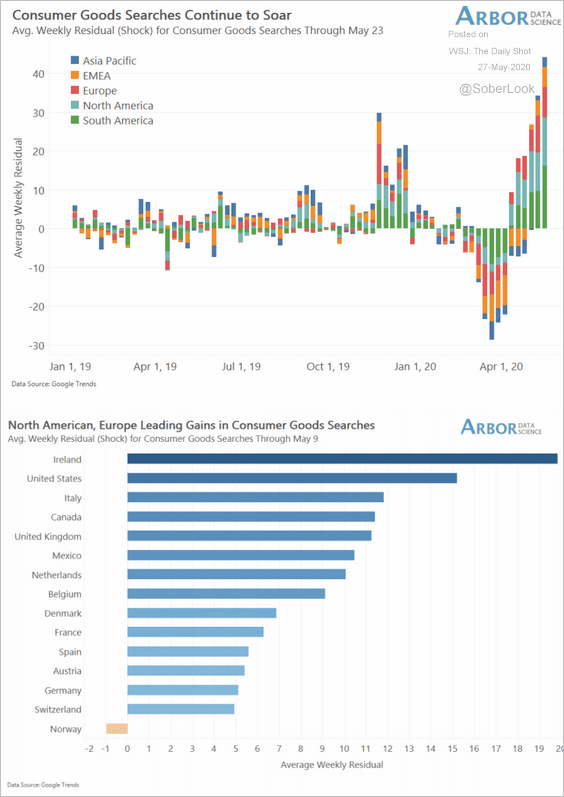

1. Online search activity for consumer goods is accelerating.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

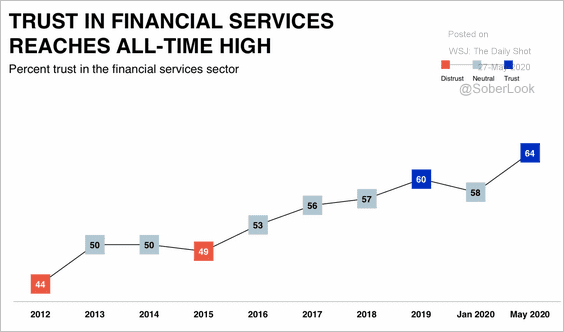

2. The public’s trust in financial services firms has been rising.

Source: Edelman Trust Barometer Read full article

Source: Edelman Trust Barometer Read full article

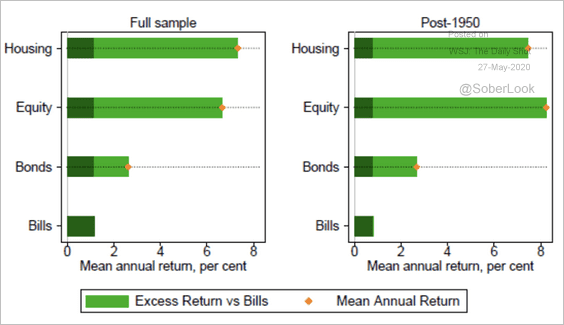

3. This chart shows that global housing markets have comparable returns to equities.

Source: @ReformedTrader Read full article

Source: @ReformedTrader Read full article

——————–

Food for Thought

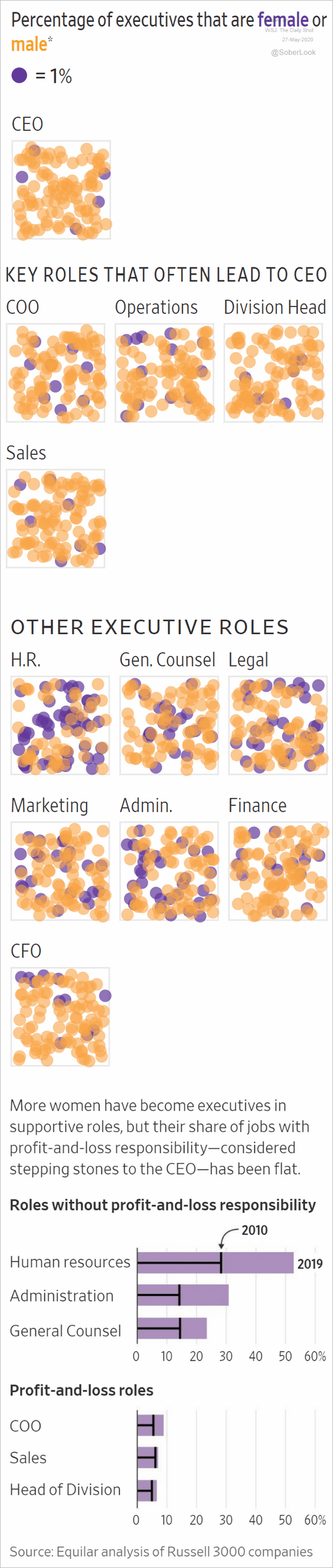

1. Female executives:

Source: @WSJ Read full article

Source: @WSJ Read full article

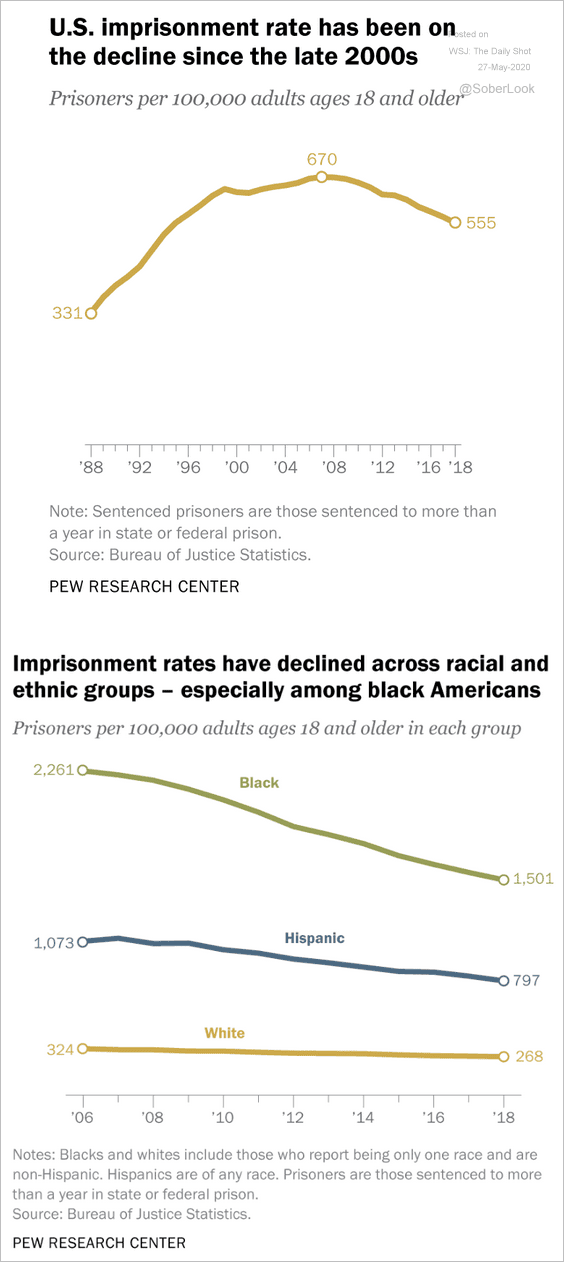

2. US incarceration rate:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

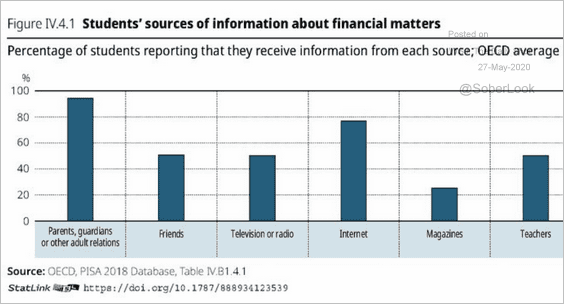

3. Where students learn about financial matters:

Source: OECD Read full article

Source: OECD Read full article

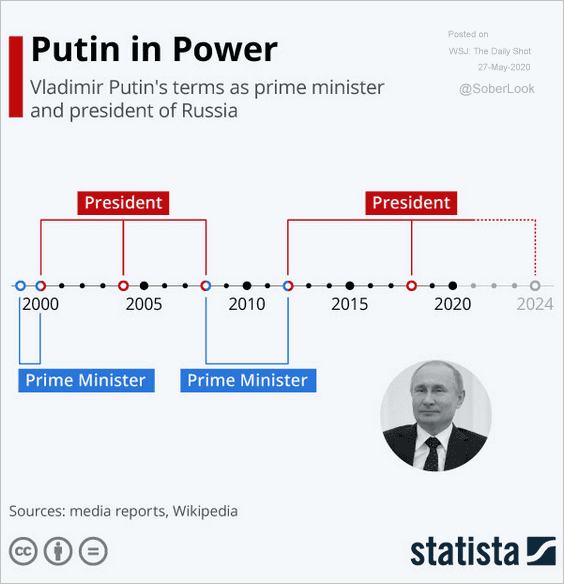

4. The timeline of Putin in power:

Source: Statista

Source: Statista

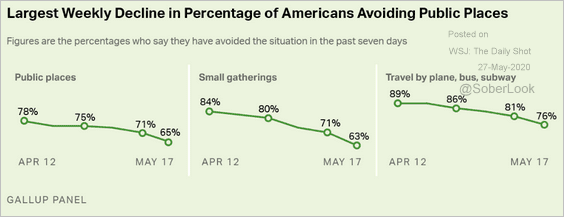

5. The percentage of Americans avoiding public places:

Source: Gallup Read full article

Source: Gallup Read full article

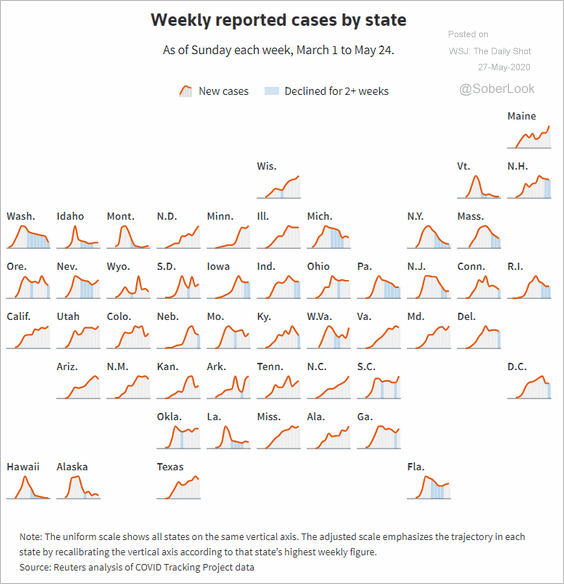

6. New coronavirus cases by state (trends):

Source: Reuters Read full article

Source: Reuters Read full article

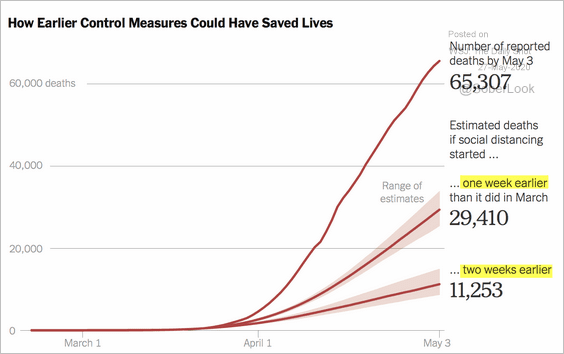

7. Estimated impact of earlier pandemic control measures:

Source: The New York Times Read full article

Source: The New York Times Read full article

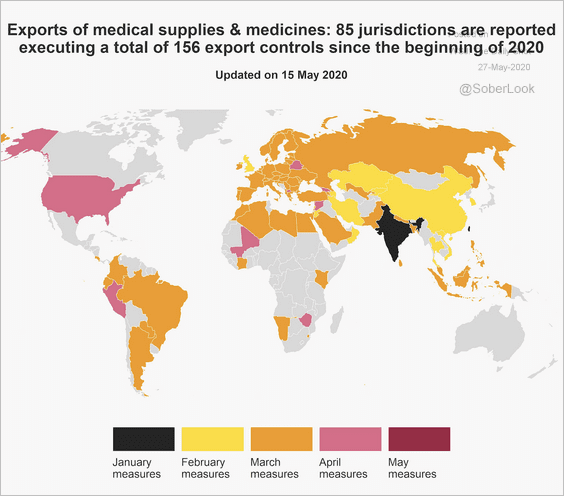

8. Medical supplies export restrictions:

Source: @gtalert

Source: @gtalert

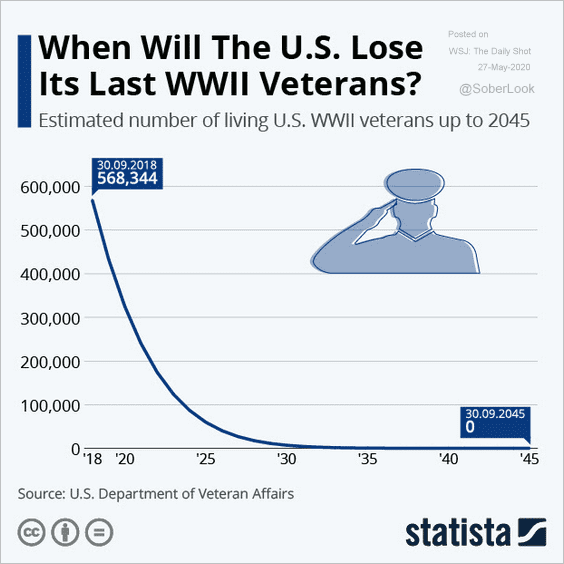

9. Living US WW-II veterans:

Source: Statista

Source: Statista

——————–