The Daily Shot: 09-Jun-20

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

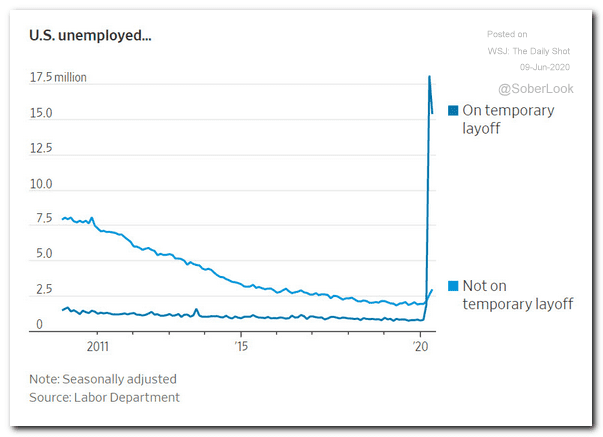

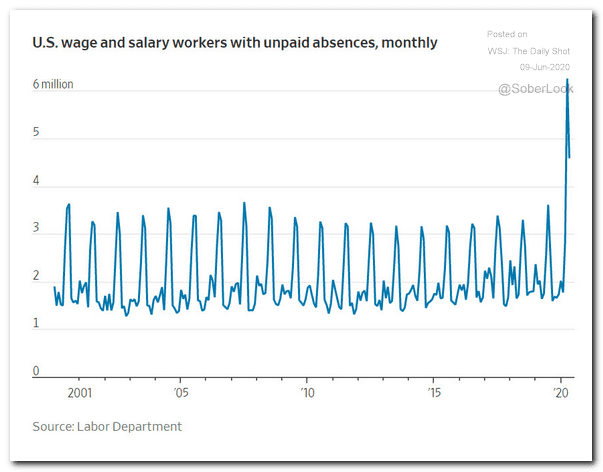

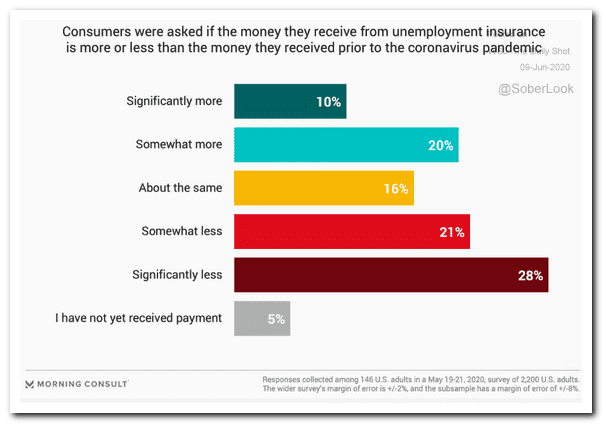

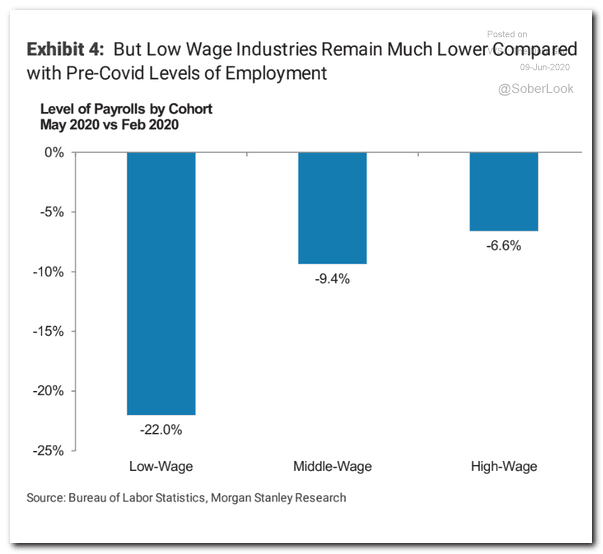

1. Let’s continue with the labor market data.

• Temporary vs. permanent layoffs (as reported by the worker):

Source: @WSJ Read full article

Source: @WSJ Read full article

• Unpaid absences:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Unemployment benefits vs. pre-crisis wages:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

• Job losses by wage category:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

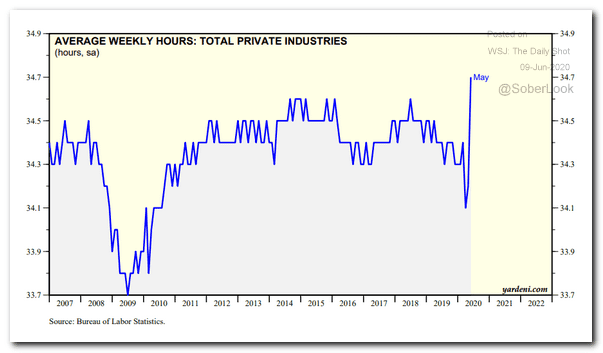

• Hours worked:

Source: Yardeni Research

Source: Yardeni Research

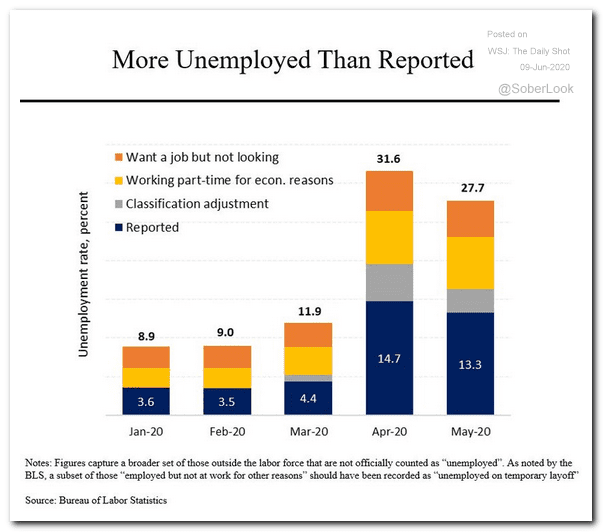

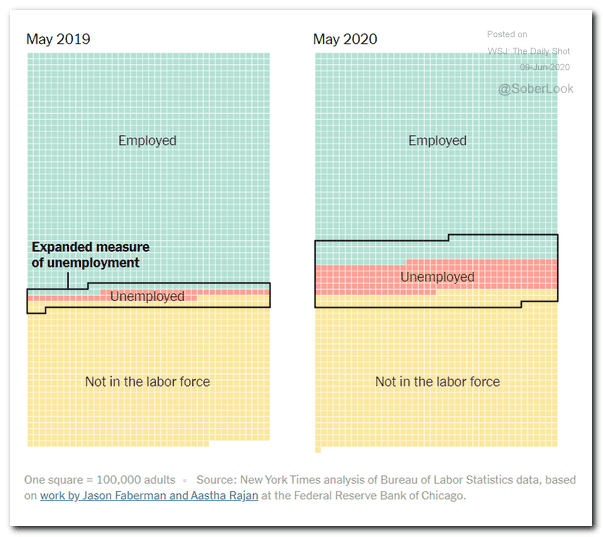

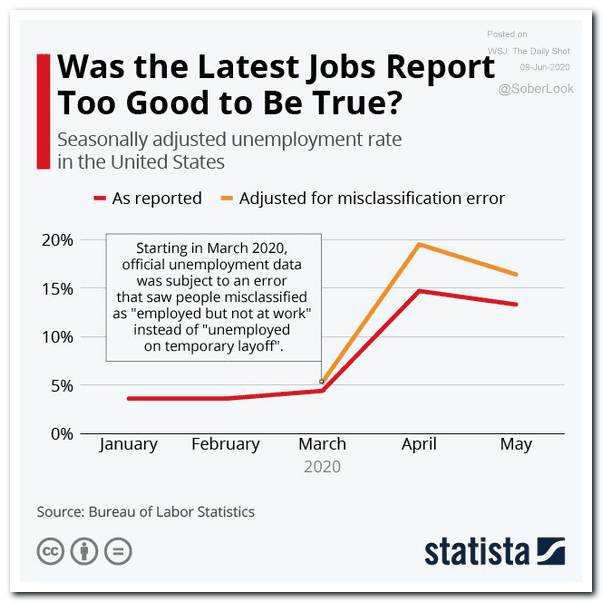

• Actual vs. reported unemployment (3 charts):

Source: @SteveRattner

Source: @SteveRattner

Source: The New York Times Read full article

Source: The New York Times Read full article

Source: Statista

Source: Statista

——————–

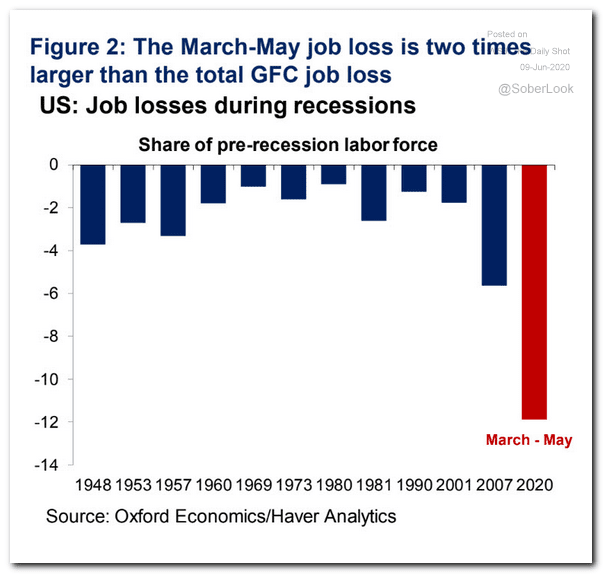

• Job losses during recessions:

Source: Oxford Economics

Source: Oxford Economics

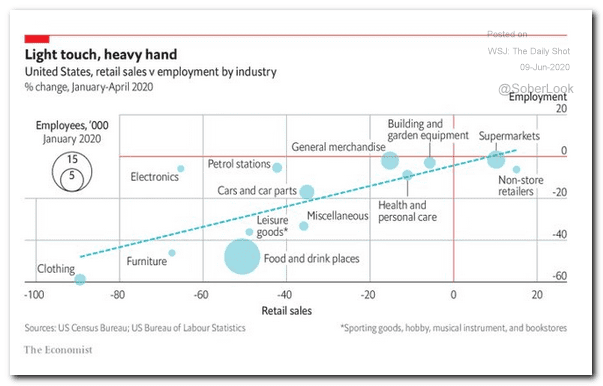

• Job losses vs. retail sales, by sector:

Source: @adam_tooze, The Economist Read full article

Source: @adam_tooze, The Economist Read full article

——————–

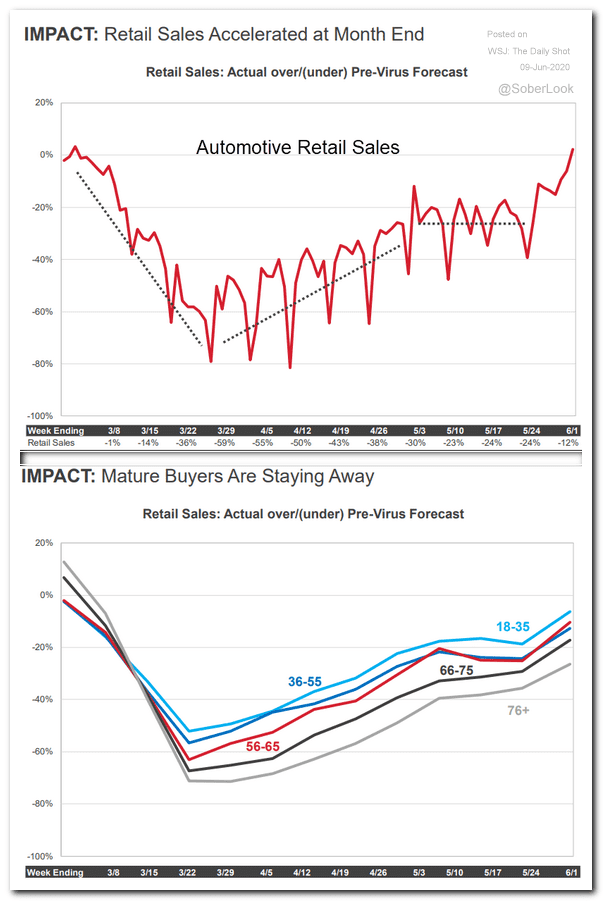

2. Automobile sales are recovering from the lockdown, with the greatest improvements among younger buyers (second chart).

Source: J.D. Power

Source: J.D. Power

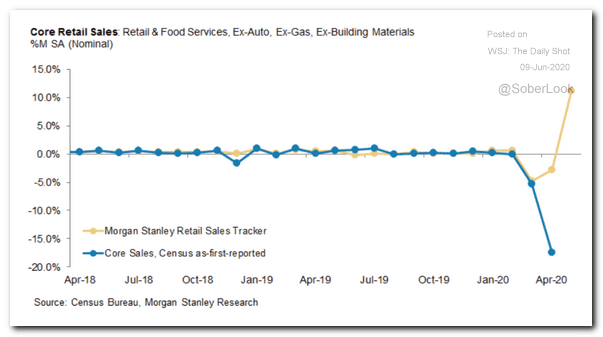

3. Morgan Stanley’s retail sales tracker shows a rebound.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

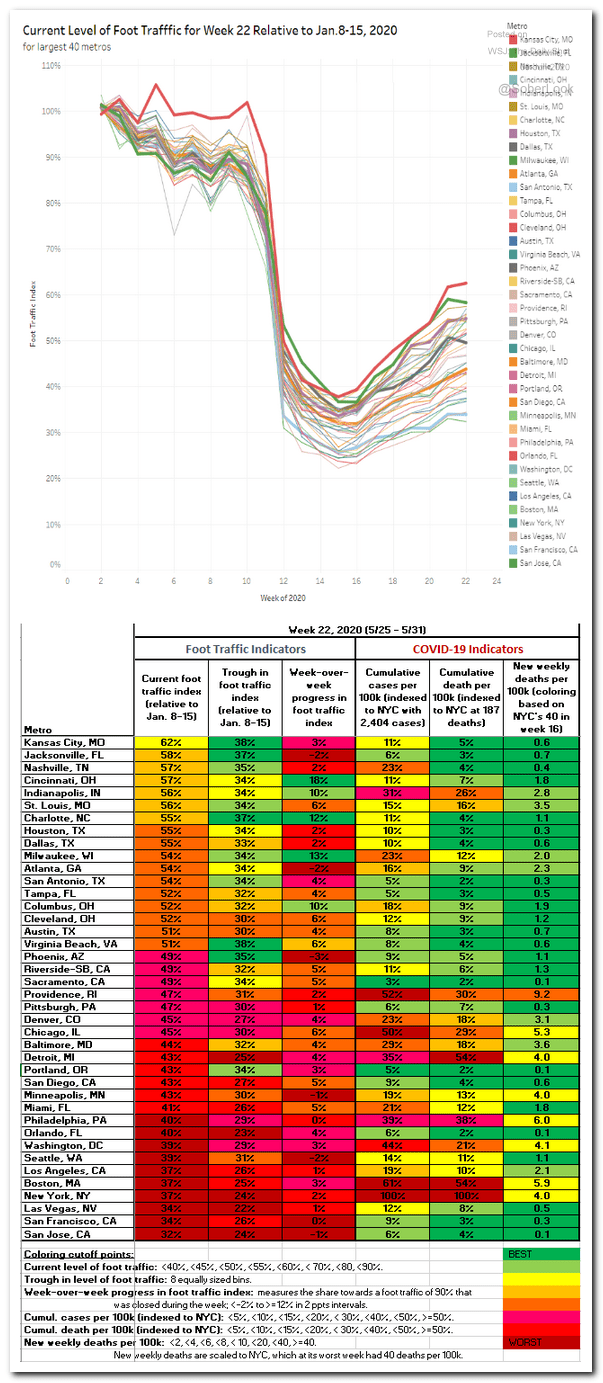

4. Foot traffic data point to improvements in the housing market, but gains vary substantially by city.

Source: AEI Housing Center

Source: AEI Housing Center

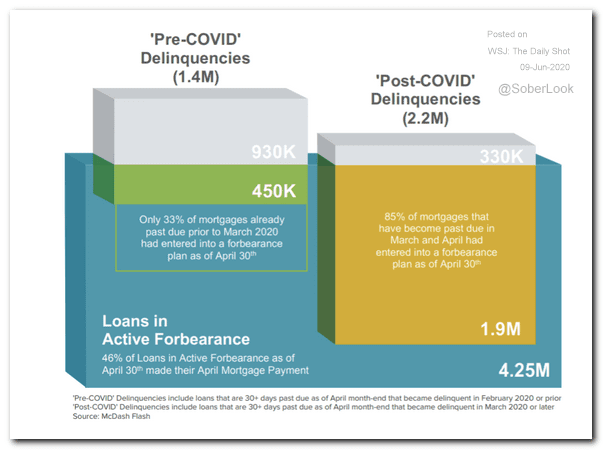

5. About 2.2 million homeowners became past due on their mortgage in March and April, according to Black Knight.

Source: Black Knight

Source: Black Knight

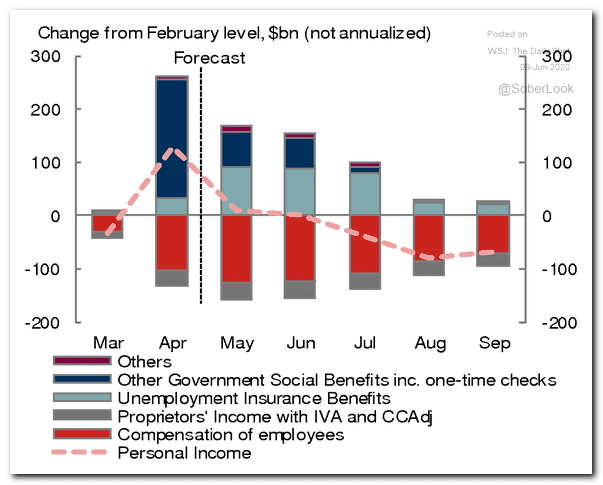

6. The household income cliff is coming unless the federal government puts together another stimulus package.

Source: Nomura Securities

Source: Nomura Securities

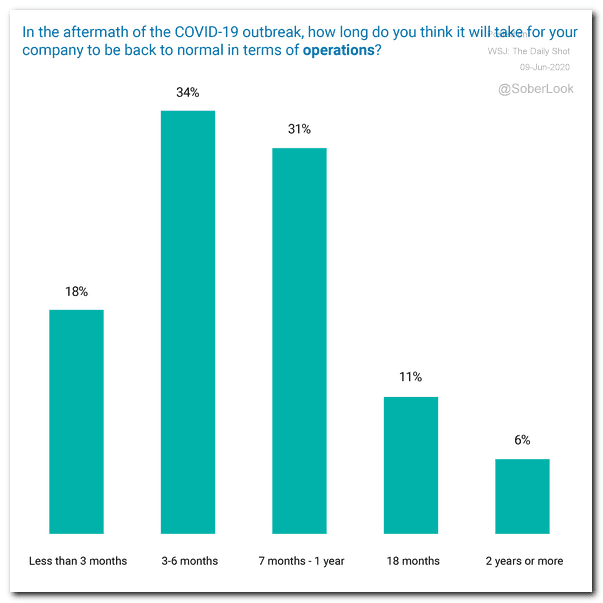

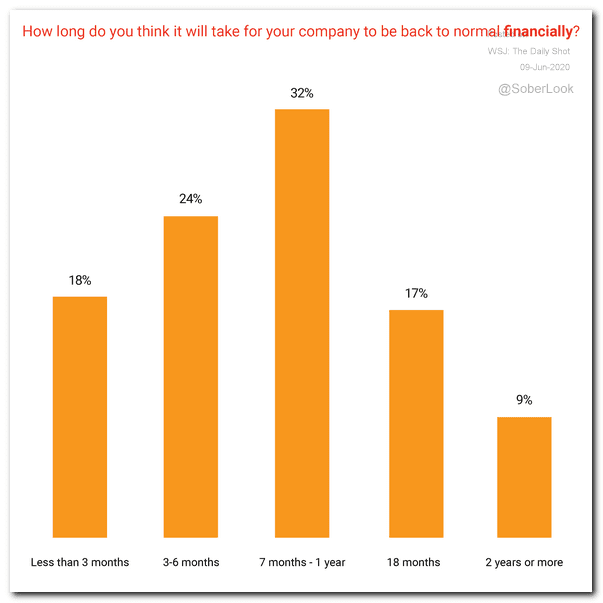

7. Next, we have some results from the TMF Group survey of corporate executives.

• Returning to normal operations:

Source: TMF Group

Source: TMF Group

Source: TMF Group

Source: TMF Group

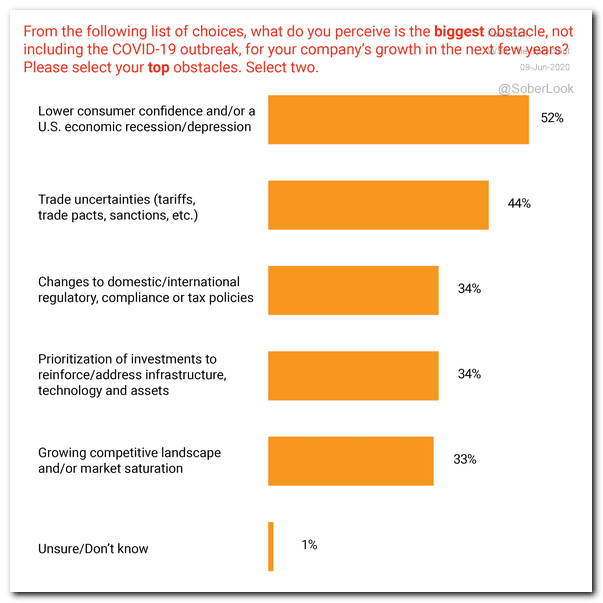

• The biggest obstacle:

Source: TMF Group

Source: TMF Group

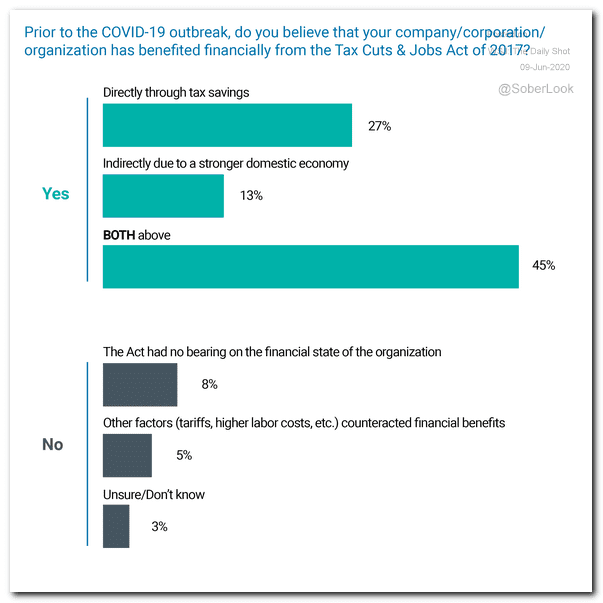

• Benefitting from the 2017 tax cut:

Source: TMF Group

Source: TMF Group

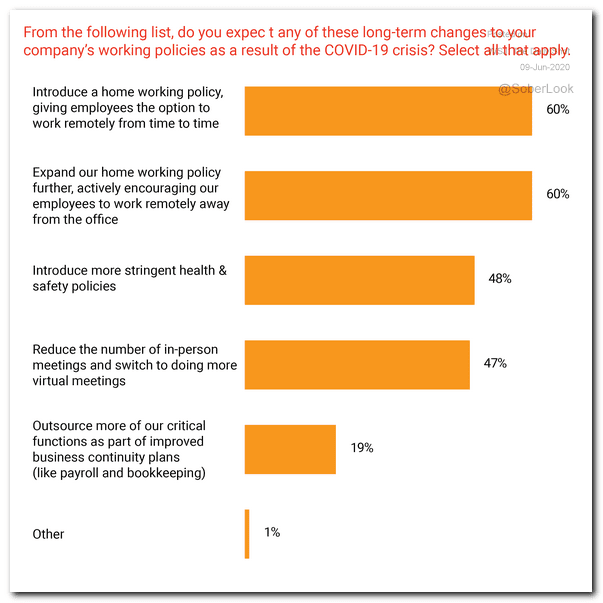

• Expected long-term changes as a result of the crisis:

Source: TMF Group

Source: TMF Group

——————–

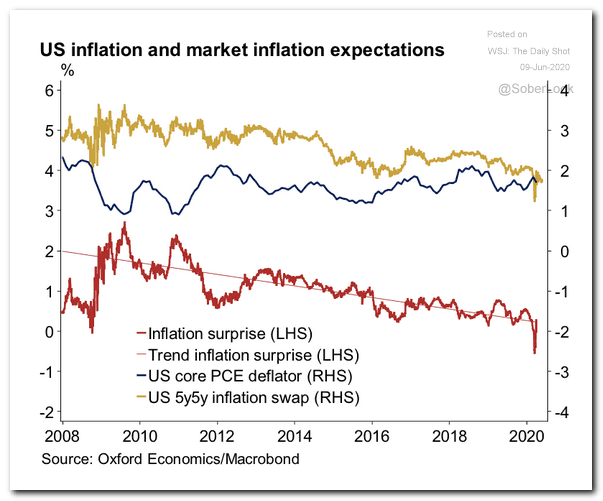

8. Here are a couple of updates on inflation.

• Markets have persistently overpredicted inflation over the last decade, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

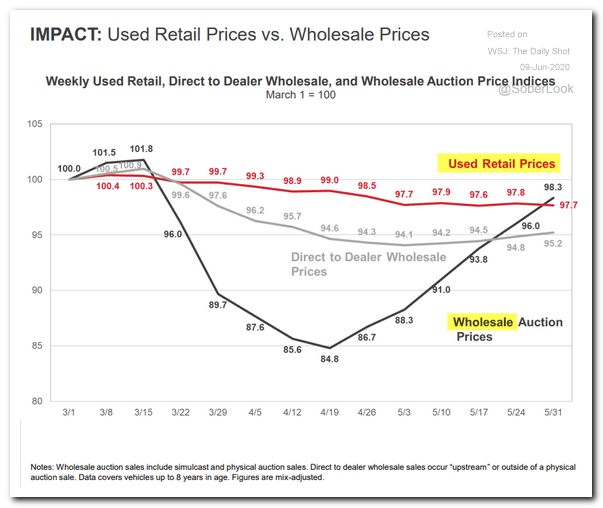

• Wholesale prices of used cars have rebounded from the crisis lows, but retail prices continue to drift lower.

Source: J.D. Power

Source: J.D. Power

——————–

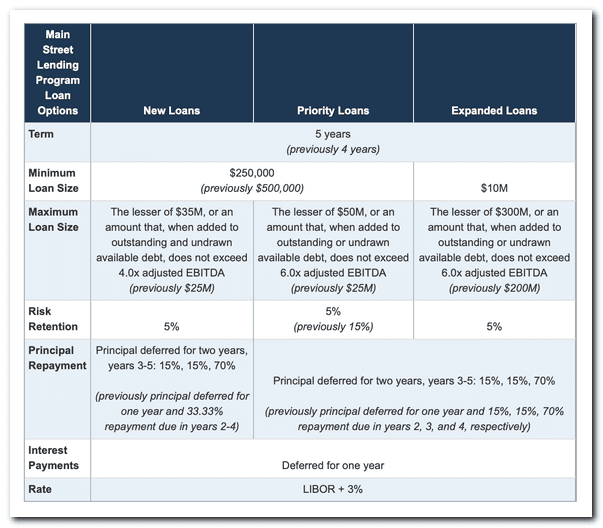

9. The Fed expanded its Main Street Lending program to support small-to-medium-sized businesses. Here’s a summary.

Source: The Federal Reserve Read full article

Source: The Federal Reserve Read full article

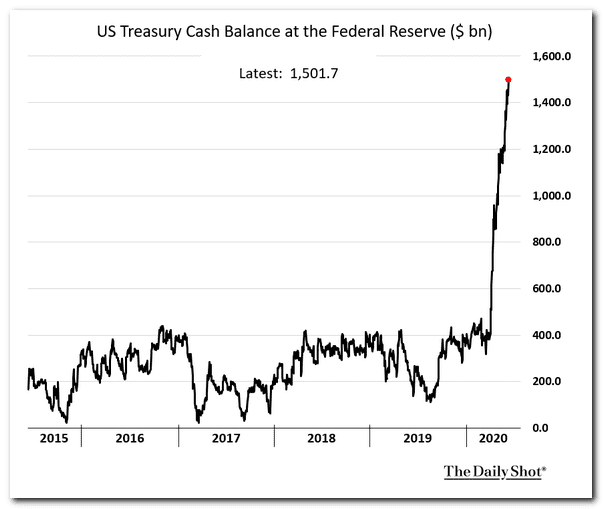

10. The Treasury is now holding $1.5 trillion in its cash account at the Fed.

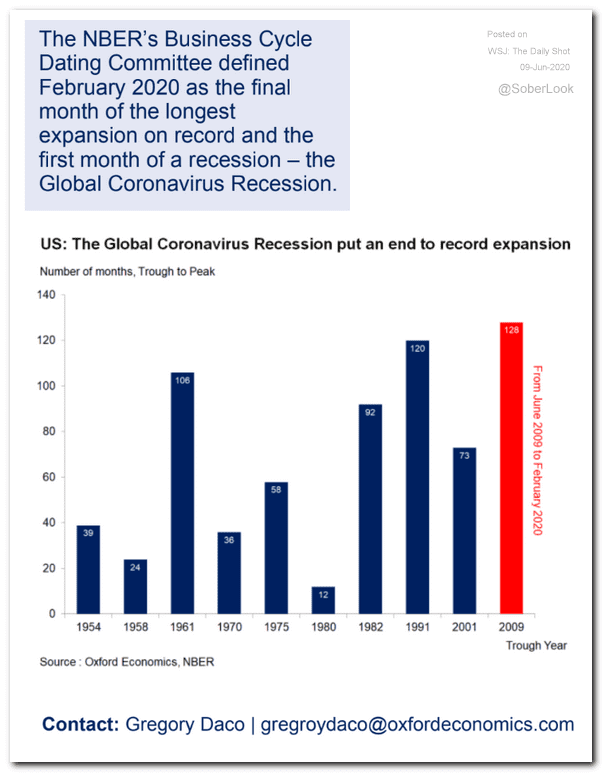

11. The US is officially in recession.

Source: Oxford Economics

Source: Oxford Economics

Canada

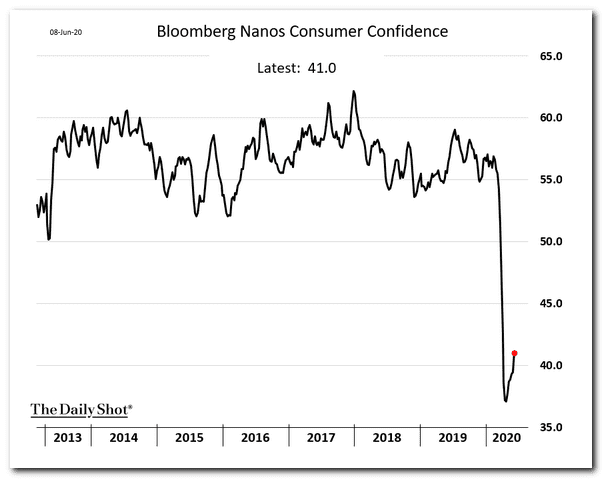

1. Consumer confidence has bounced from the lows but remains extremely weak.

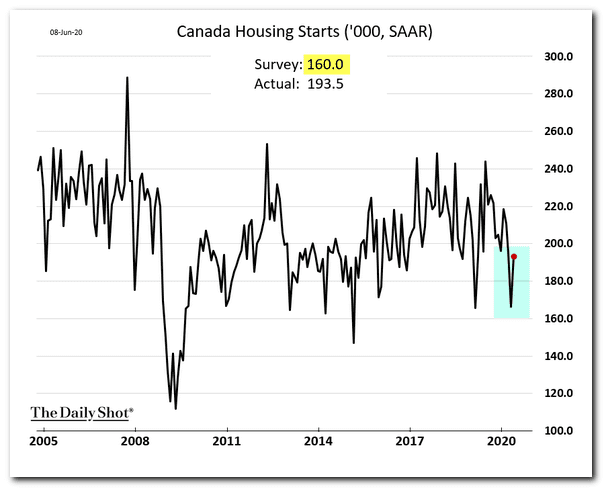

2. Housing starts topped economists’ forecasts.

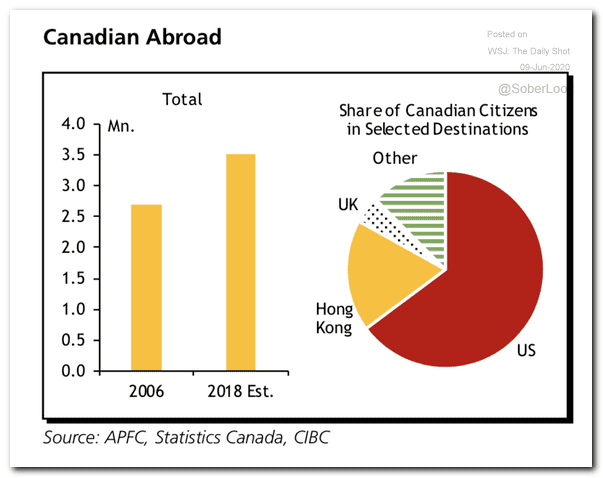

3. Where are all the Canadians who live outside the country?

Source: CIBC Capital Markets

Source: CIBC Capital Markets

The Eurozone

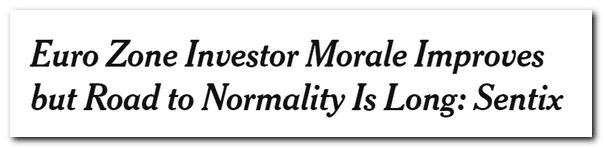

1. The Sentix index showed some improvement in June.

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

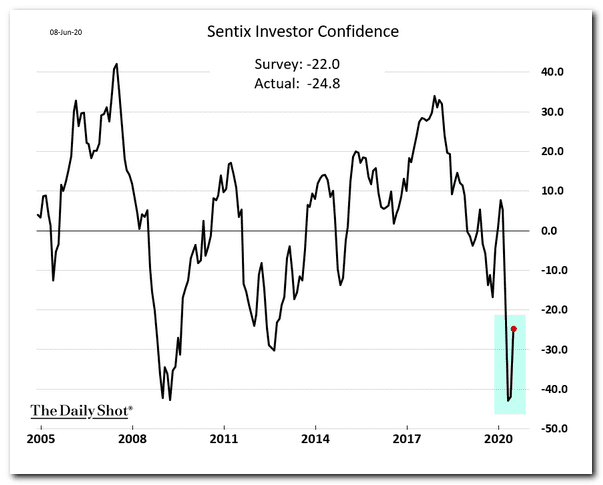

2. The road to recovery will be long, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

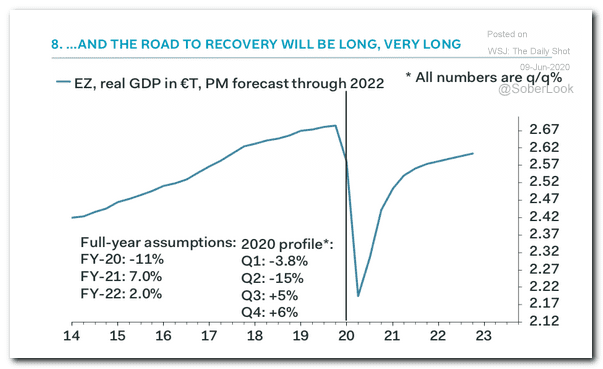

3. Here is a quote from the Wall Street Journal’s Jon Sindreu on productivity.

Some sectors, such as manufacturing and technology, generate disproportionately more productivity gains than others, like agriculture and tourism, which is why countries have only ever become rich specializing in the former. Because these are industries with large economies of scale and accumulated know-how, incumbents can be hard to out-compete in the free market.

Source: @WSJ Read full article

Source: @WSJ Read full article

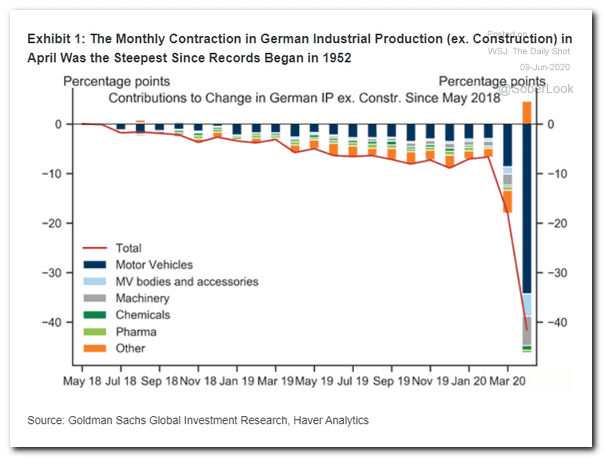

4. This chart shows the composition of Germany’s industrial production changes.

Source: Goldman Sachs

Source: Goldman Sachs

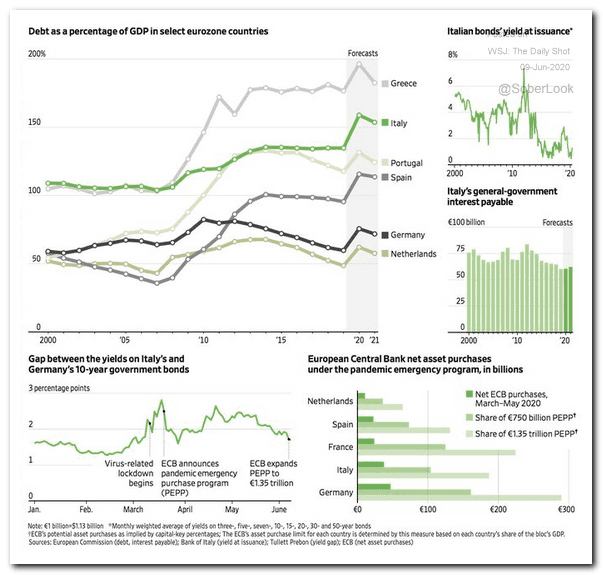

5. The ECB’s easing measures have boosted Italian bond prices, despite soaring government debt.

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

Europe

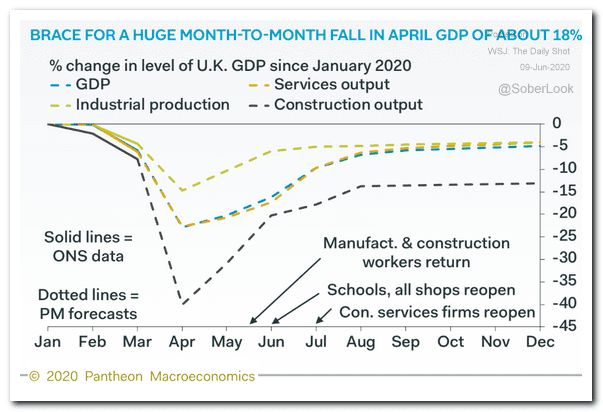

1. Pantheon Macroeconomics expects a massive contraction in the UK’s GDP in April.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

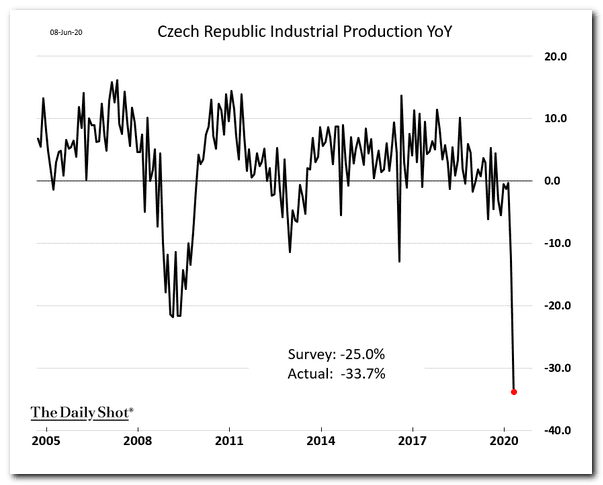

2. Czech industrial production contracted by more than a third in April.

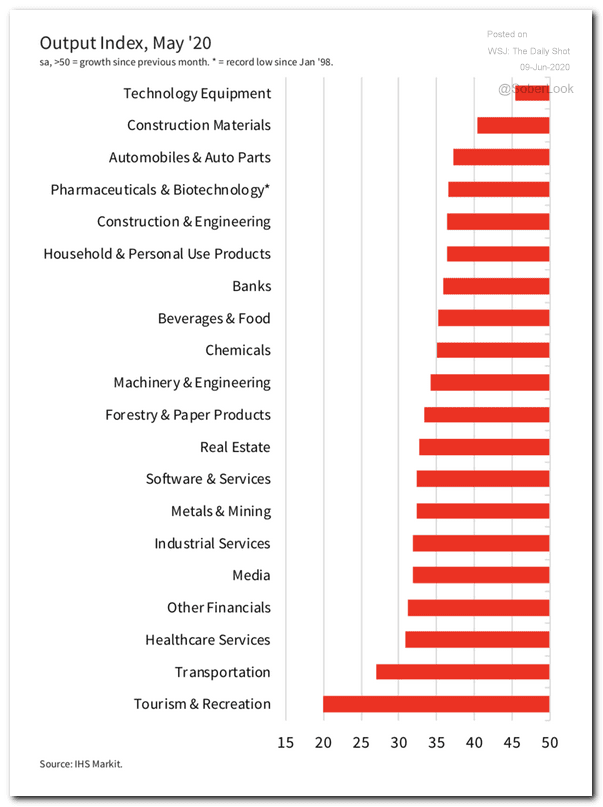

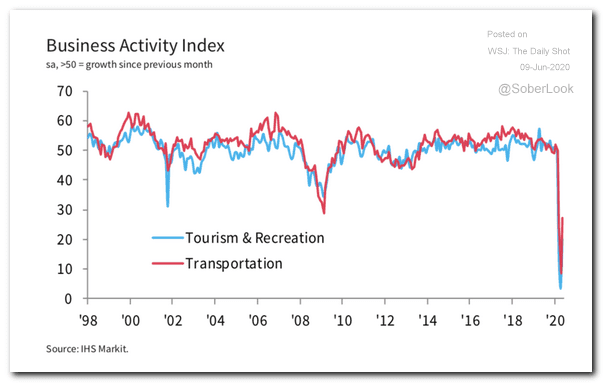

3. Here are the May PMI measures by sector.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

Source: IHS Markit Read full article

Source: IHS Markit Read full article

——————–

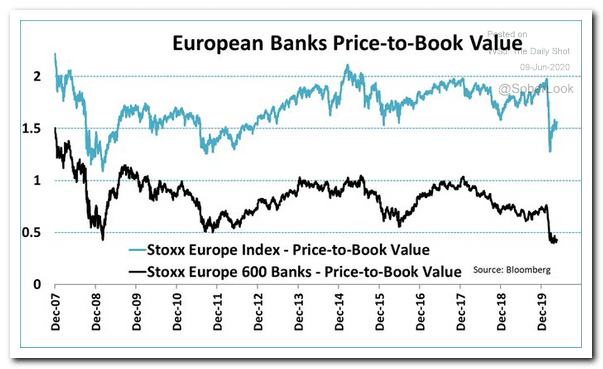

4. European bank valuations remain depressed.

Source: @jsblokland

Source: @jsblokland

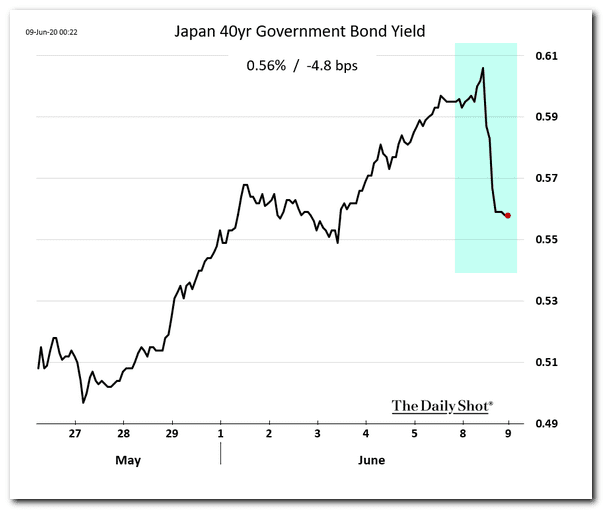

Japan

1. The selloff in long-dated JGBs suddenly stopped on Tuesday.

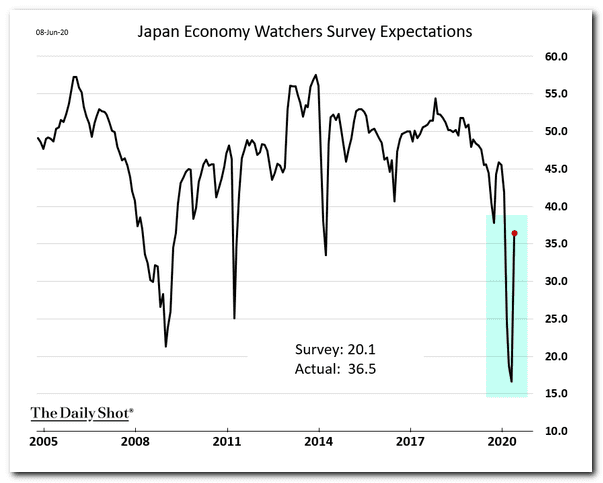

2. The Economy Watchers Expectations index rebounded sharply.

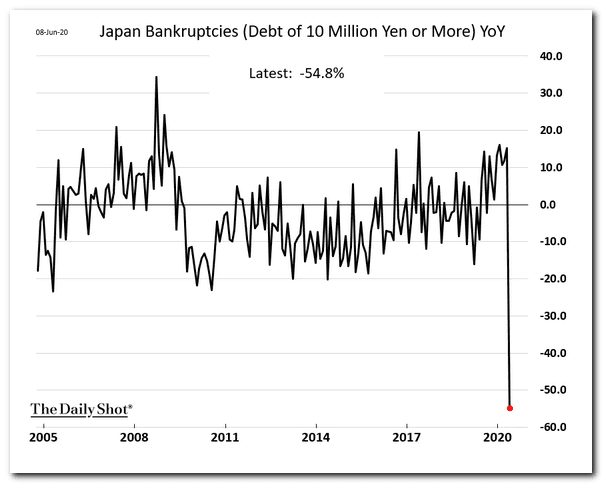

3. Japan’s bankruptcies collapsed in May as law offices and courts remained closed.

Asia – Pacific

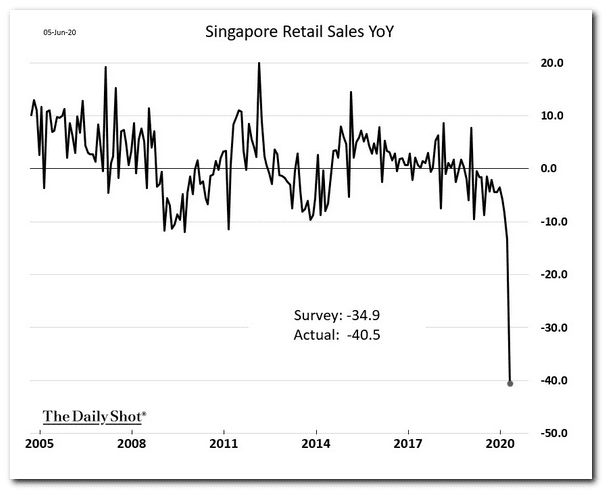

1. Singapore’s retail sales were down over 40% in April (year-over-year).

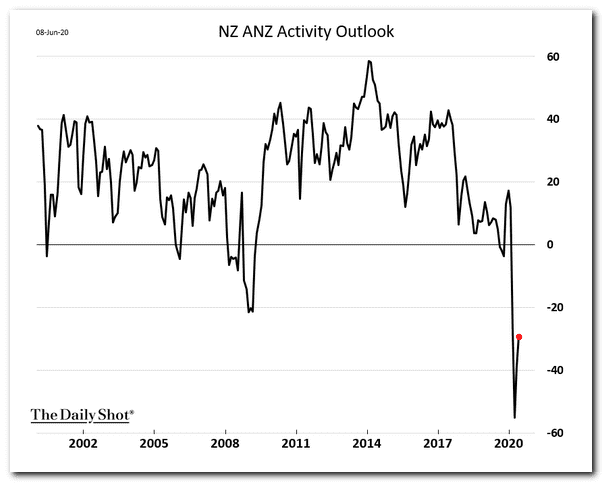

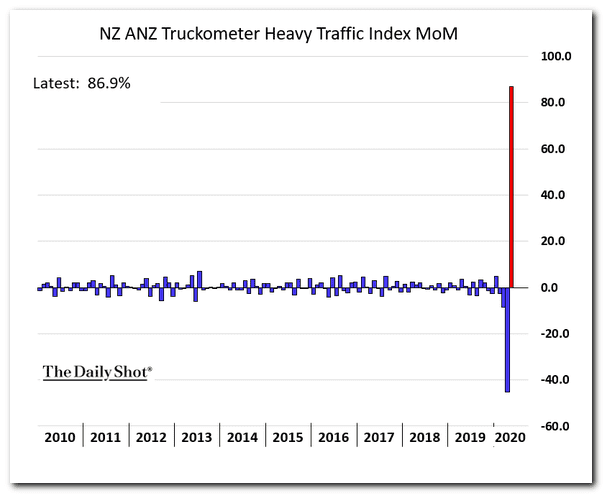

2. New Zealand’s business outlook is recovering.

New Zealand’s traffic volumes are almost back to normal.

——————–

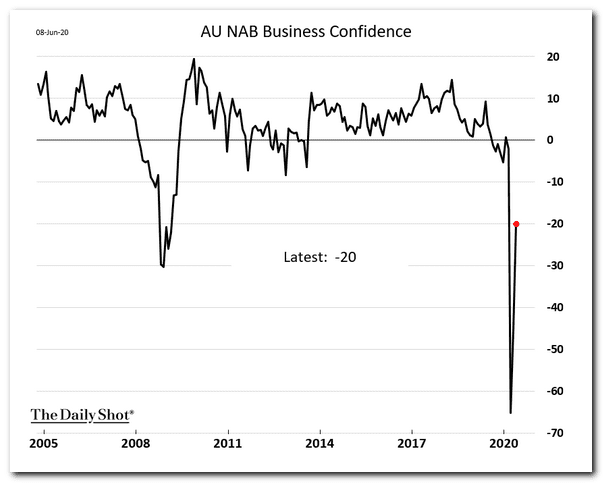

3. Next, we have a couple of updates on Australia.

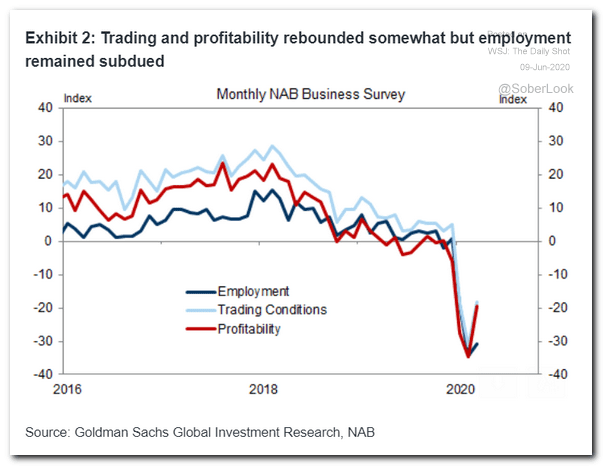

• Business confidence rebounded sharply.

However, the employment indicator remains extremely weak.

Source: Goldman Sachs

Source: Goldman Sachs

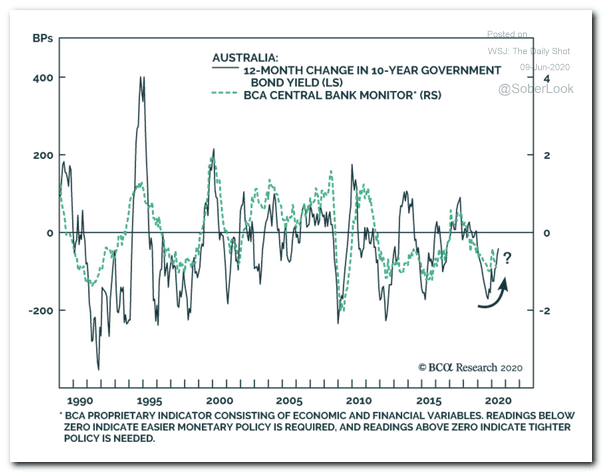

• Bond yields have probably fully priced in the RBA’s dovish stance, according to BCA Research.

Source: BCA Research

Source: BCA Research

China

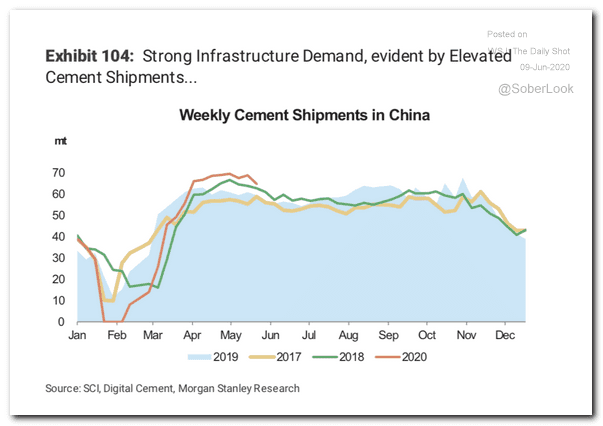

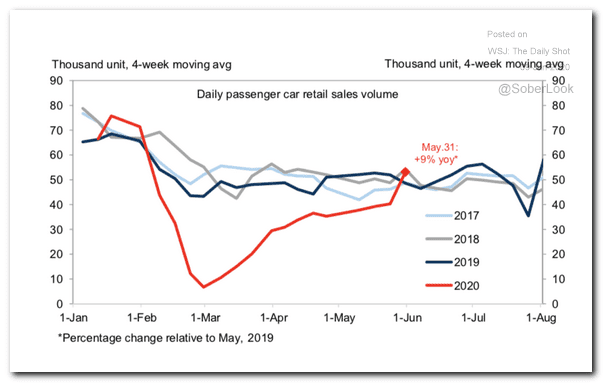

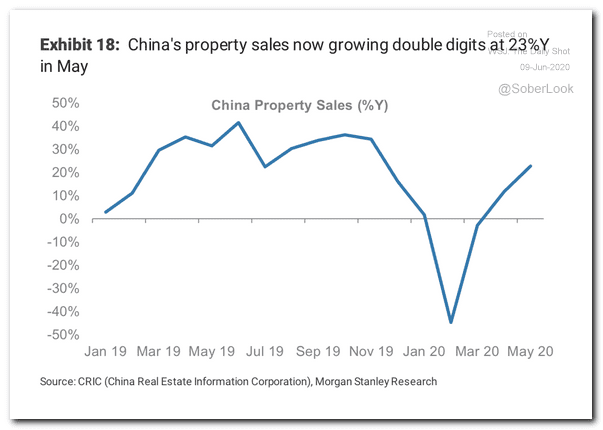

1. Here are some closely-watched economic trends.

• Cement shipments:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Car sales:

Source: Goldman Sachs

Source: Goldman Sachs

• Property sales:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

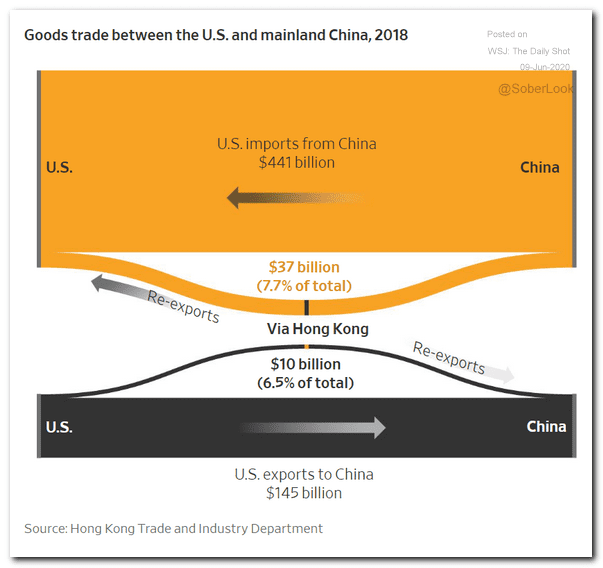

2. Below is an illustration of the US-China trade flows that include Hong Kong.

Source: @WSJ Read full article

Source: @WSJ Read full article

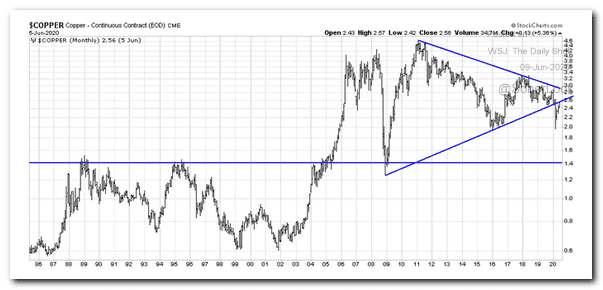

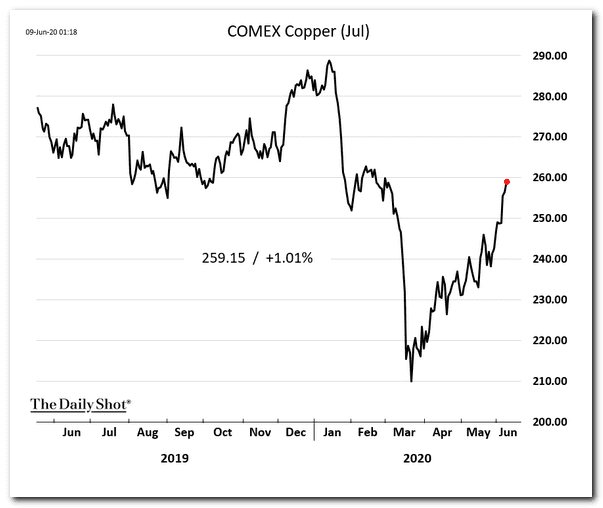

Commodities

Copper is testing resistance.

Source: @jessefelder

Source: @jessefelder

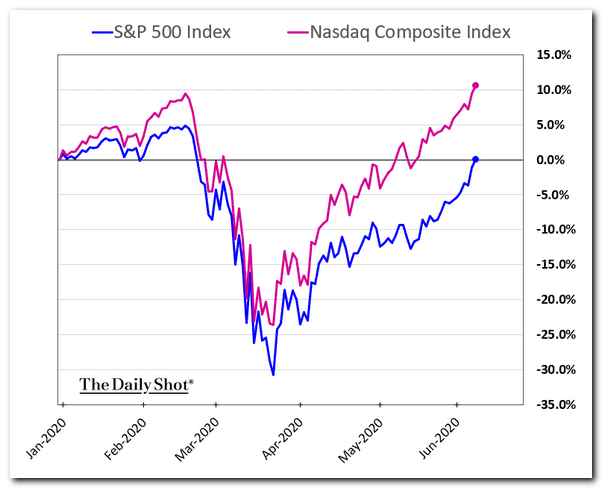

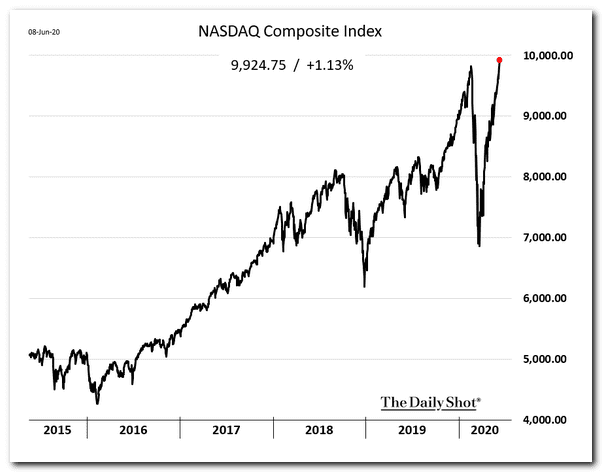

Equities

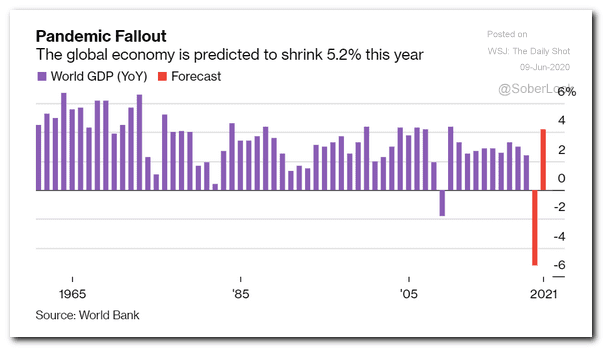

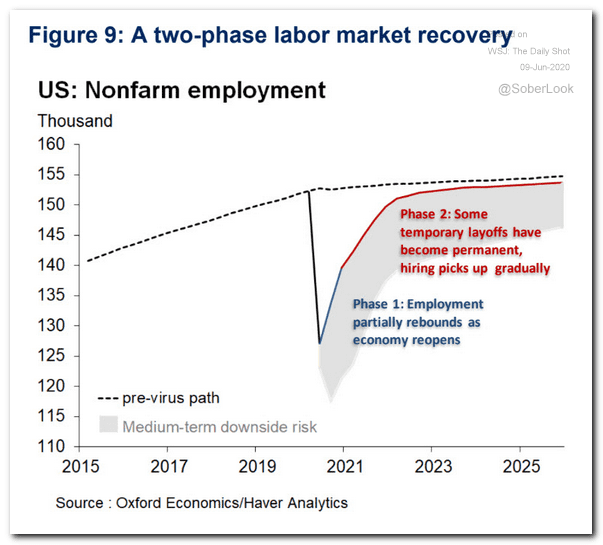

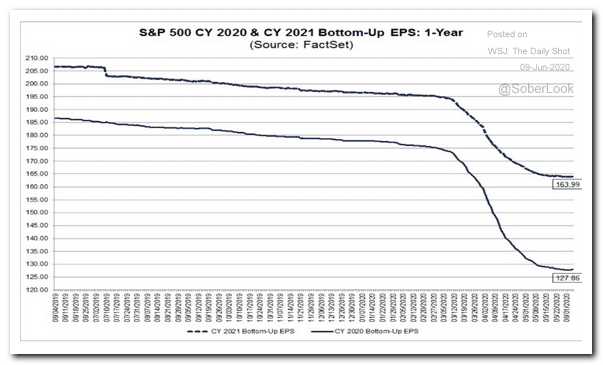

1. The S&P 500 is now flat for the year.

And the Nasdaq Composite hit a record high.

Of course, nothing material happened between the beginning of the year and now.

• Maybe a bit of a global economic slowdown:

Source: @business Read full article

Source: @business Read full article

• A slight shift in US employment:

Source: Oxford Economics

Source: Oxford Economics

• And a minor adjustment to earnings expectations:

Source: @FactSet

Source: @FactSet

——————–

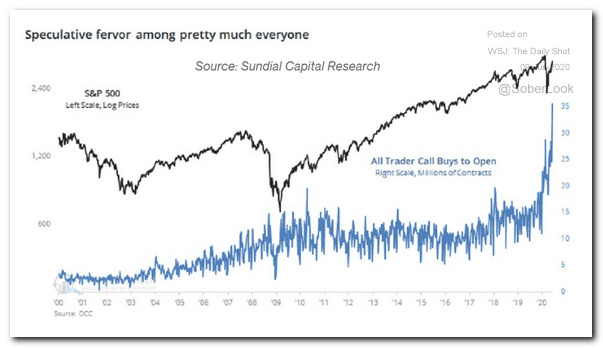

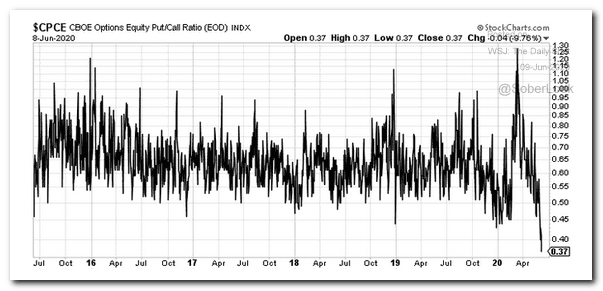

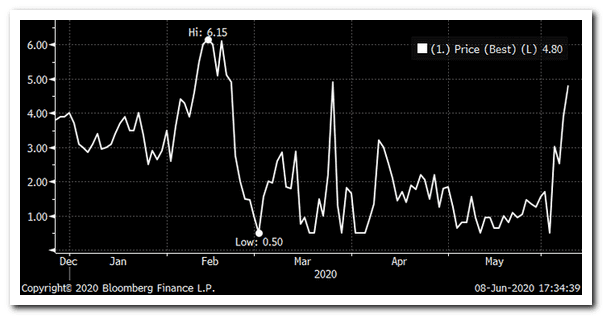

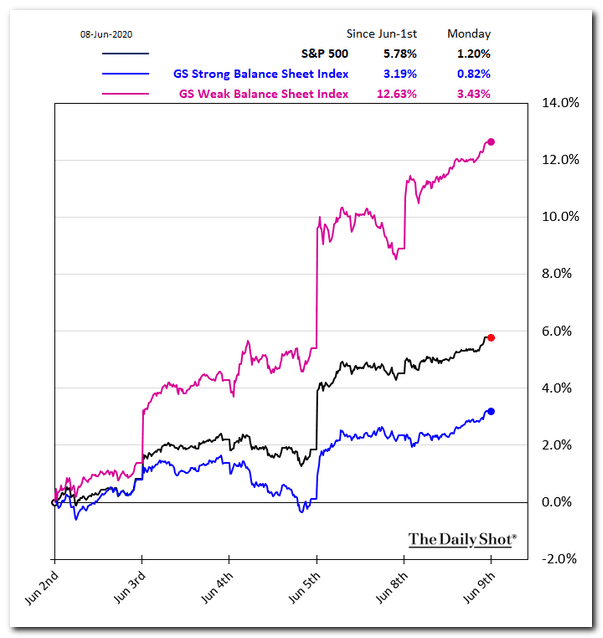

2. Speculative fervor has gripped the market as demand for upside bets spikes.

Source: @markets Read full article

Source: @markets Read full article

• Here is the put/call ratio.

Source: @hmeisler

Source: @hmeisler

• This chart shows the Dec 31st S&P 500 call option struck at 4,000.

Source: @danny_kirsch

Source: @danny_kirsch

• Companies with weak balance sheets are in favor again.

——————–

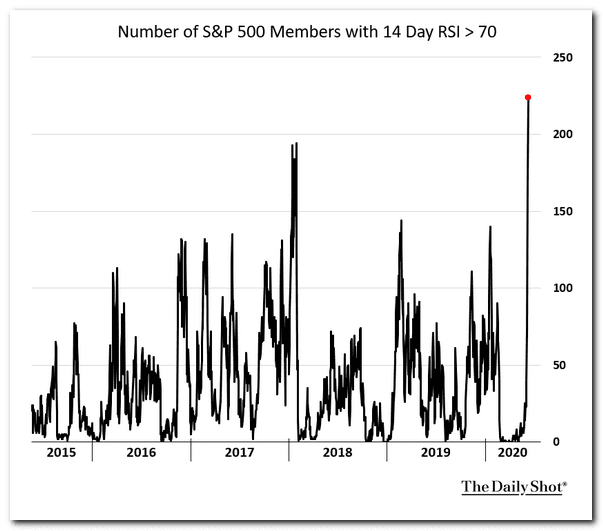

3. Technicals tell us that the S&P 500 is just a bit overbought.

——————–

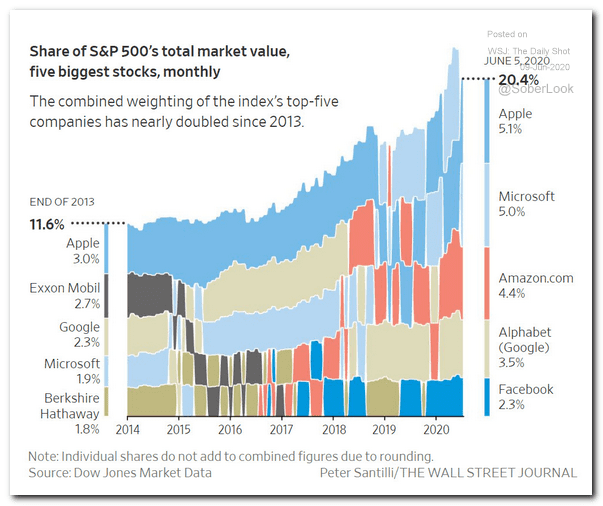

4. The weight of the top five stocks in the S&P 500 has nearly doubled since 2013.

Source: @WSJ Read full article

Source: @WSJ Read full article

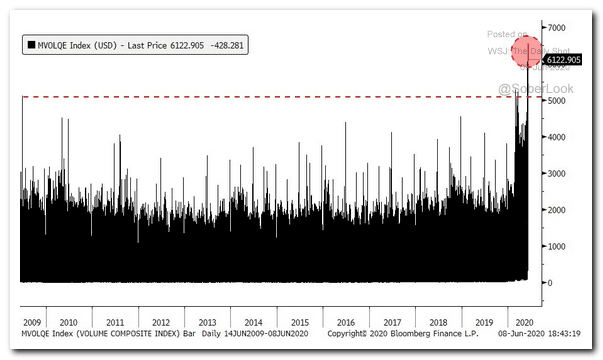

5. The Nasdaq trading volume has spiked.

Source: @carlquintanilla

Source: @carlquintanilla

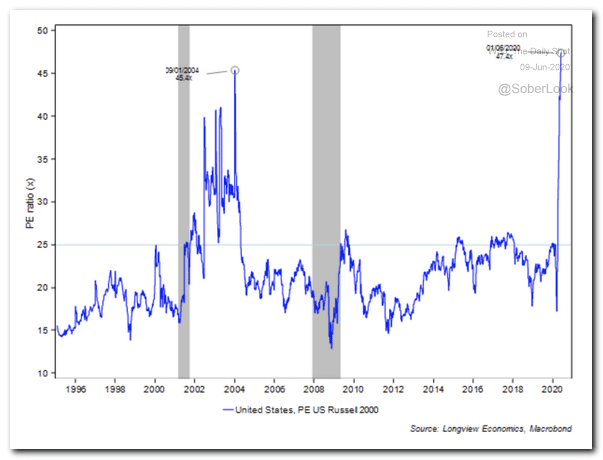

6. The Russell 2,000 consensus 12-month forward price-to-earnings ratio is at an extreme.

Source: Longview Economics

Source: Longview Economics

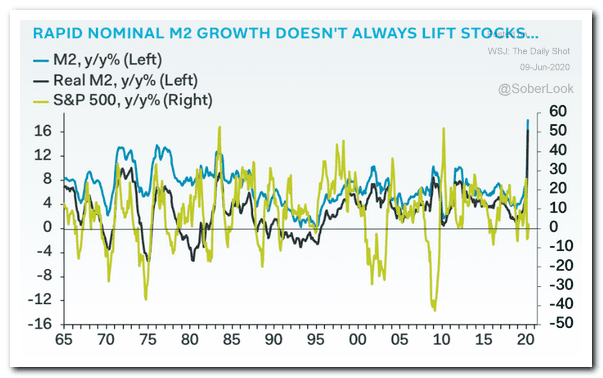

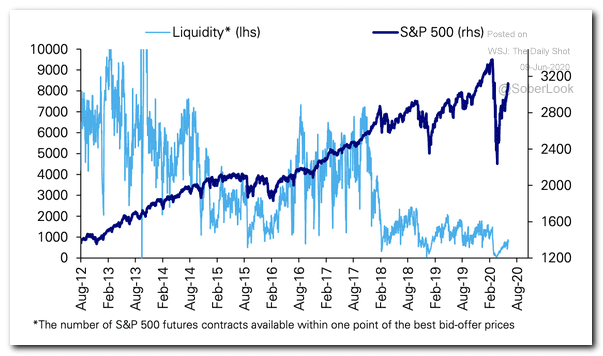

7. Is the spike in liquidity (see chart) responsible for the market rally? The link has been tenuous in the past.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

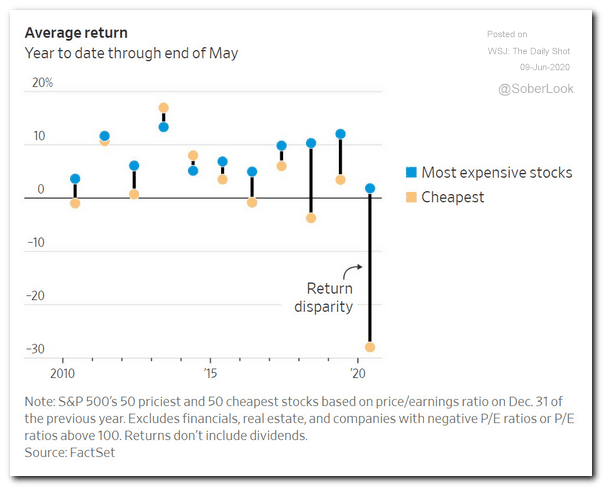

8. There has been a massive divergence in performance between the most expensive and cheapest stocks.

Source: @WSJ Read full article

Source: @WSJ Read full article

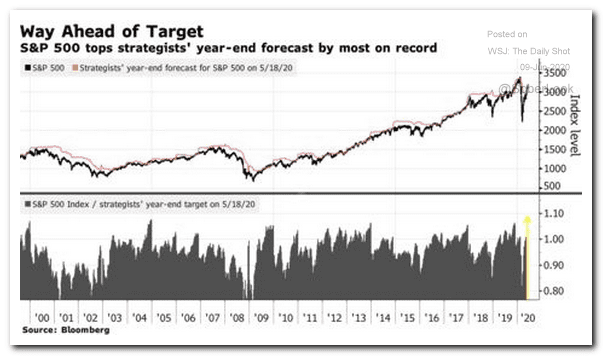

9. The S&P 500 is rapidly busting through all the price targets.

Source: @markets Read full article

Source: @markets Read full article

10. Liquidity remains low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

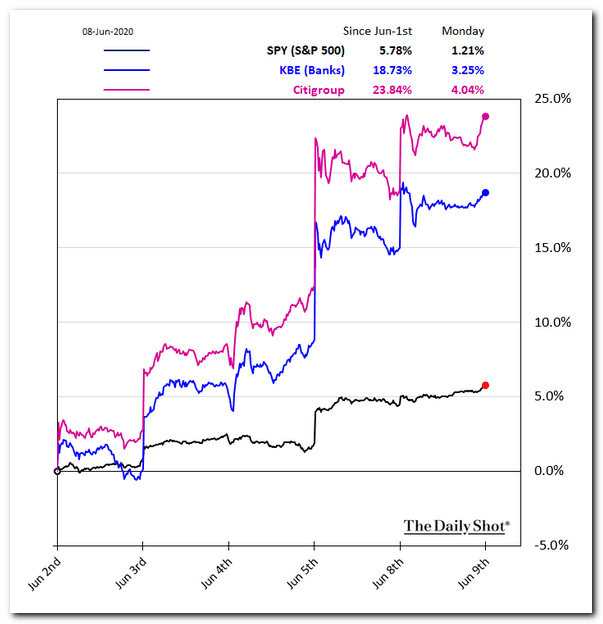

11. Finally, we have some sector updates.

• Banks:

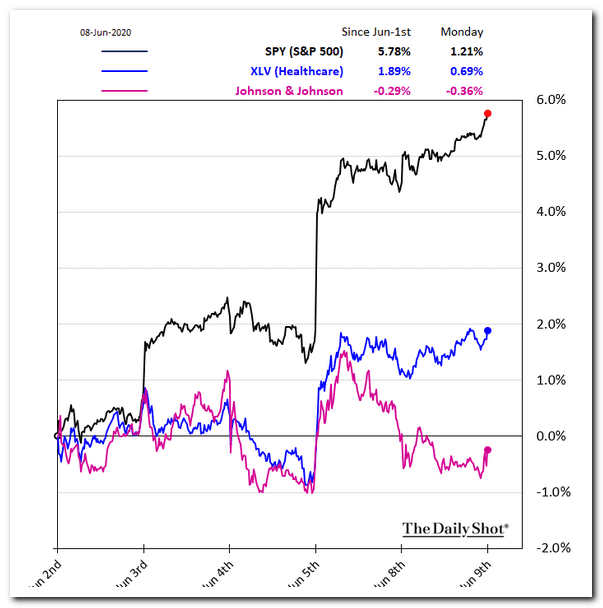

• Healthcare:

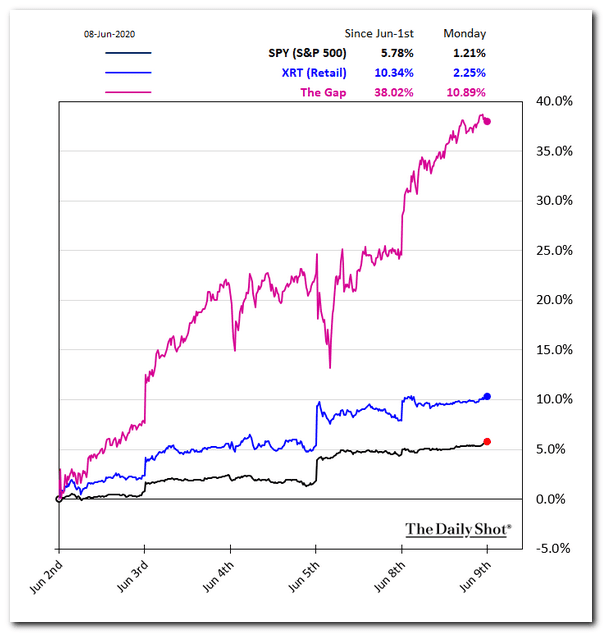

• Retail:

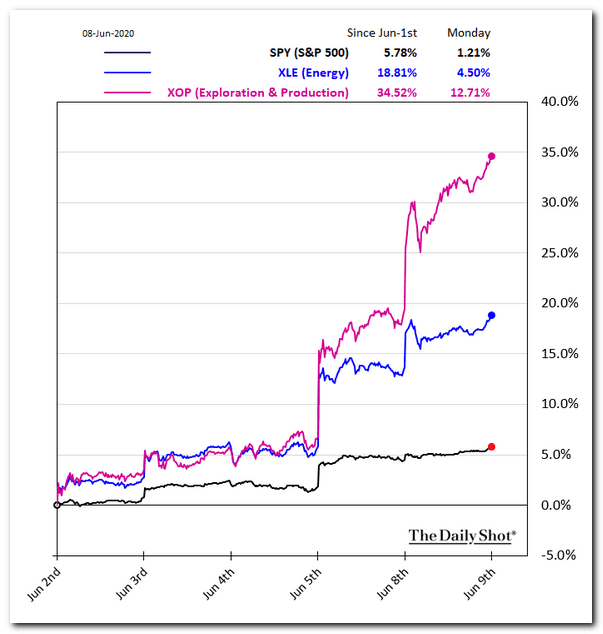

• Energy:

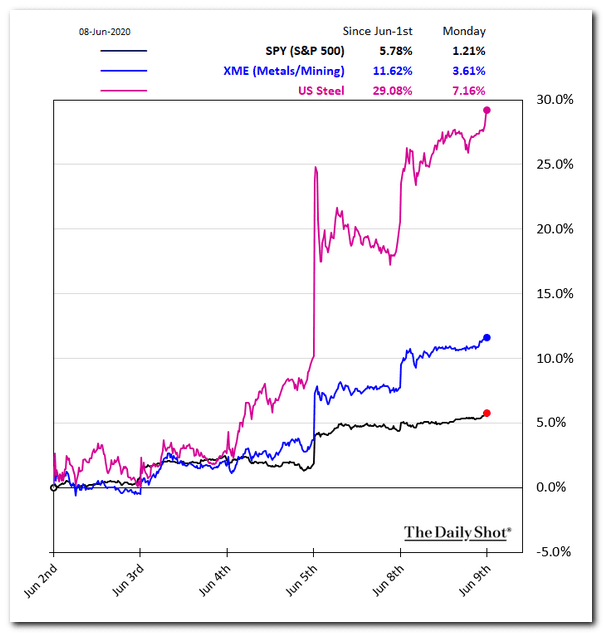

• Metals & Mining:

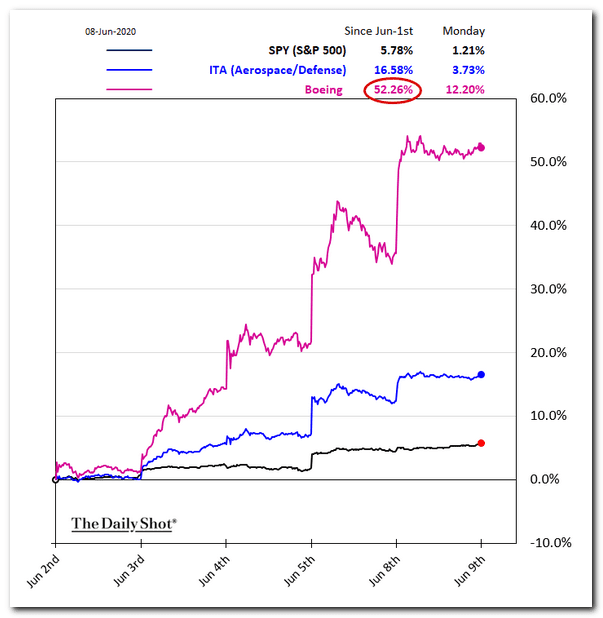

• Aerospace/defence:

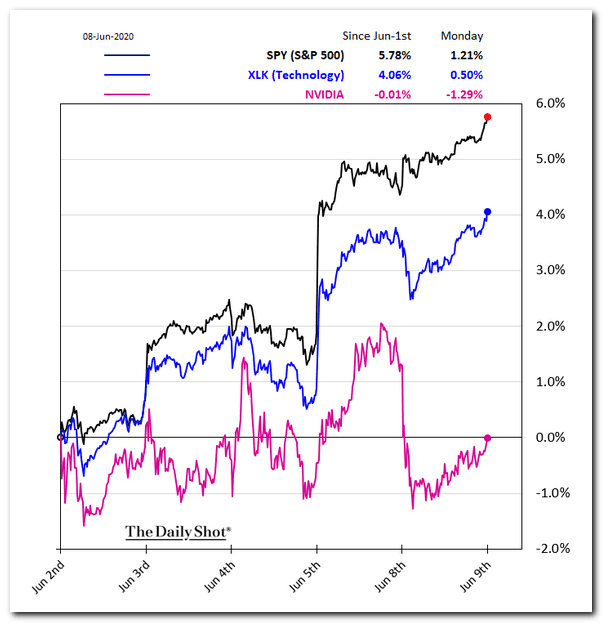

• Tech:

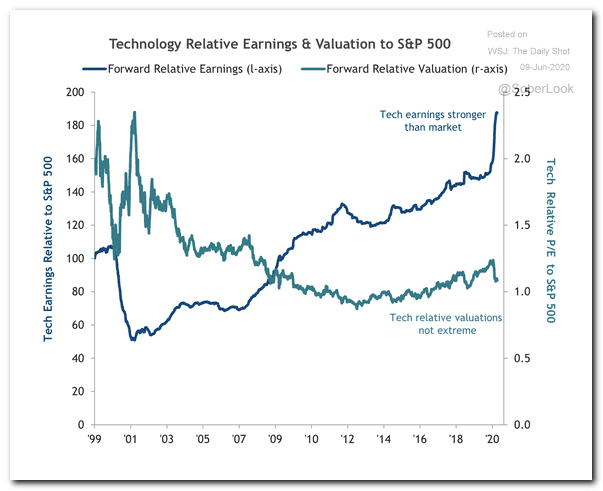

While the tech sector has concentration risk, its earnings remain much stronger than those for the overall market, and relative valuations are not extreme, according to SunTrust.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Credit

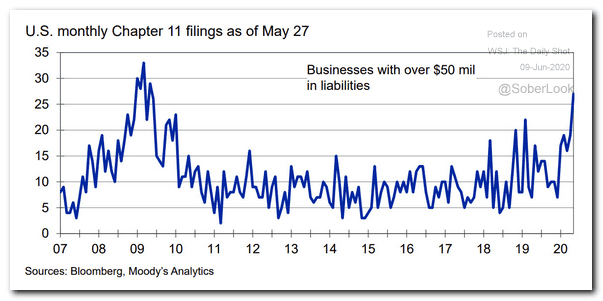

1. Bankruptcies have been rising.

Source: Moody’s Analytics

Source: Moody’s Analytics

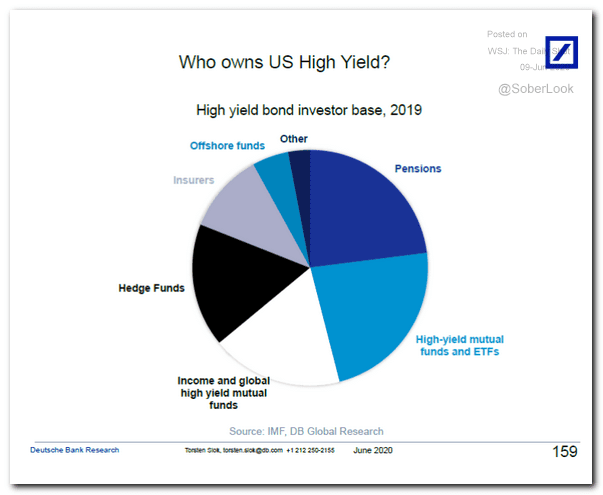

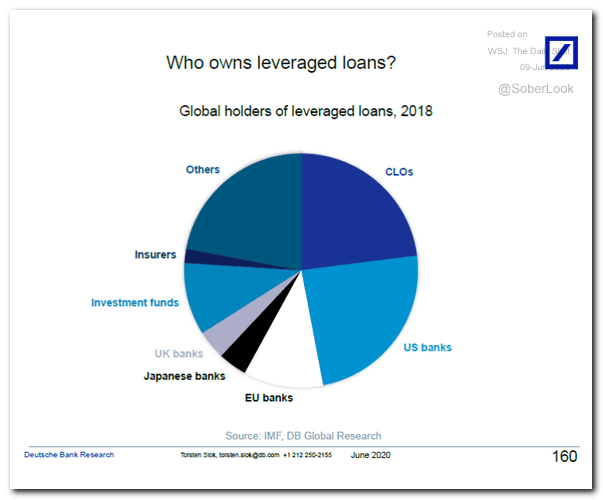

2. Who owns all the leveraged-finance debt?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

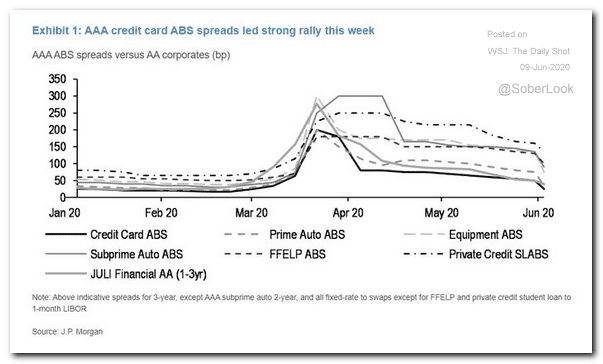

4. ABS spreads have been tightening.

Source: @tracyalloway

Source: @tracyalloway

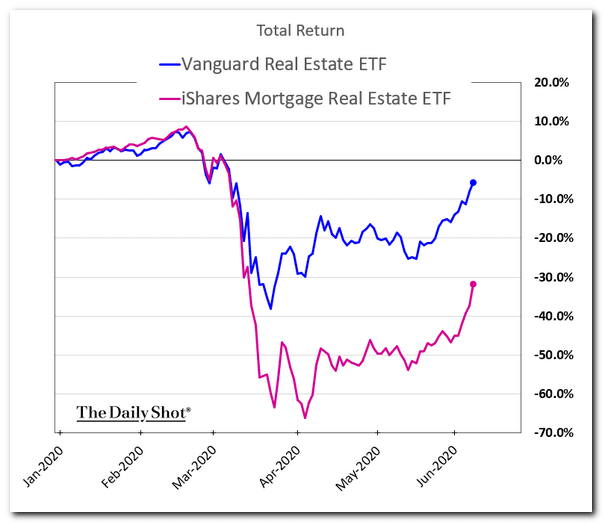

5. Mortgage REITs are recovering.

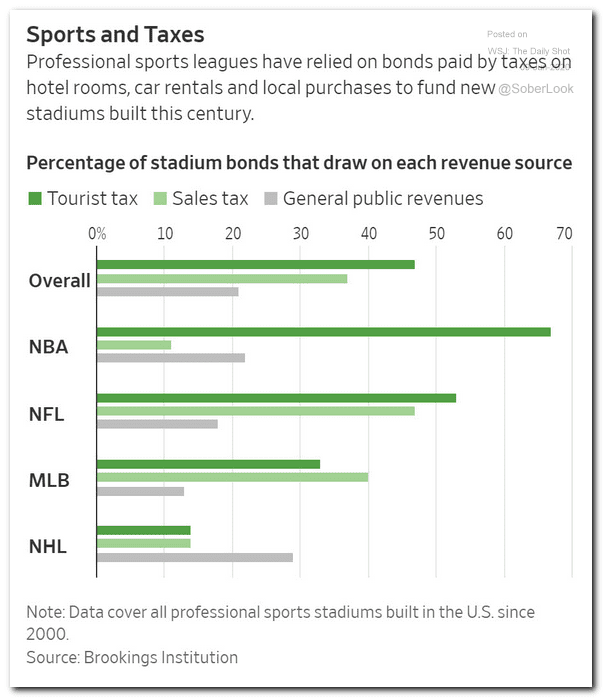

6. Sources of revenue for stadium bonds have dried up recently.

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

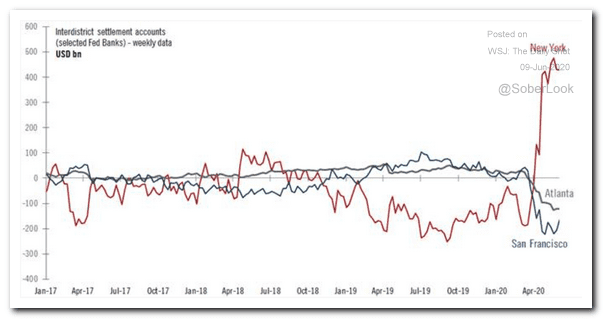

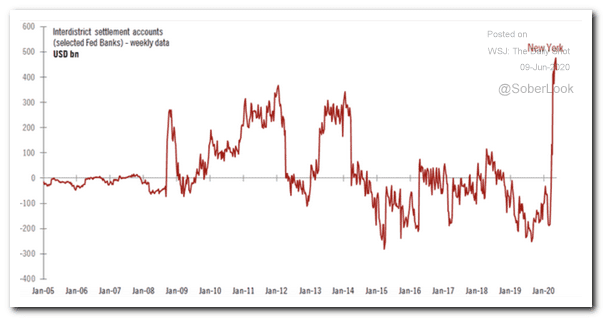

1. There has been a massive liquidity divergence between the NY Fed and other regional Fed banks, according to Pictet Wealth Management. (It’s the US version of TARGET2 imbalances).

Source: Thomas Costerg, Pictet Wealth Management

Source: Thomas Costerg, Pictet Wealth Management

Source: Thomas Costerg, Pictet Wealth Management

Source: Thomas Costerg, Pictet Wealth Management

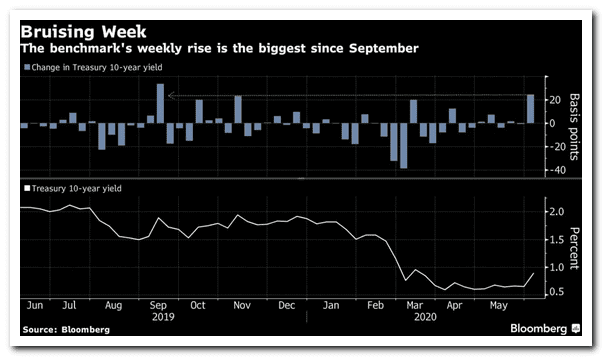

2. It’s been a rough week for the 10yr Treasury.

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

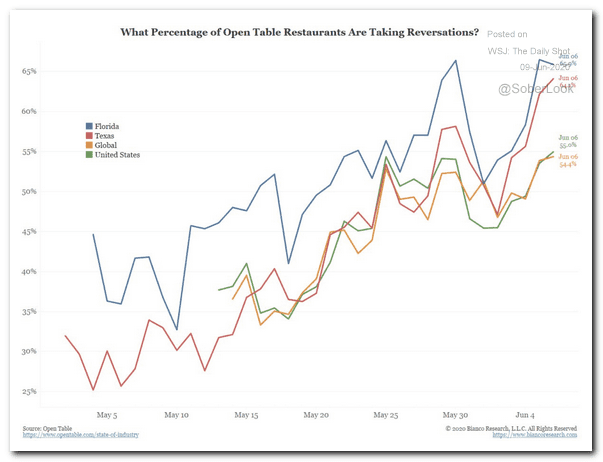

1. The percentage of US restaurants taking reservations:

Source: @biancoresearch

Source: @biancoresearch

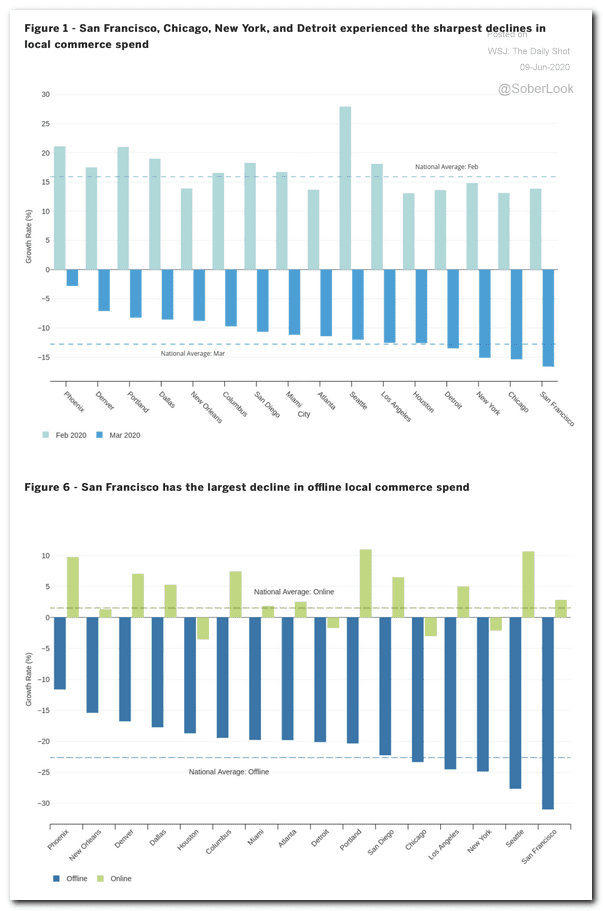

2. The hit to local commerce, by city:

Source: JPMorgan Chase Institute Read full article

Source: JPMorgan Chase Institute Read full article

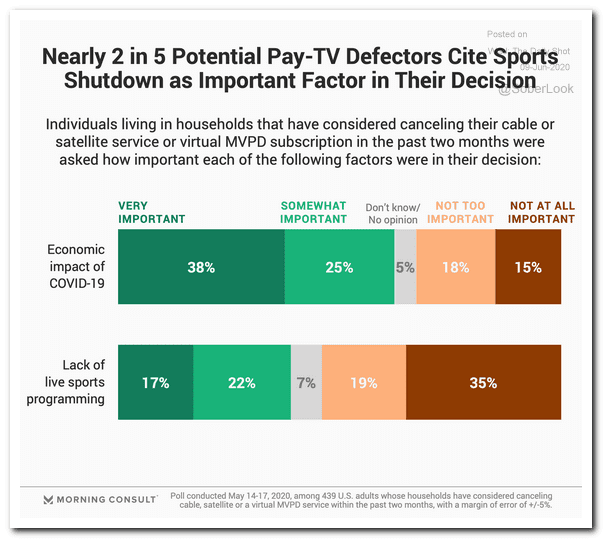

3. Pay-TV defectors:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

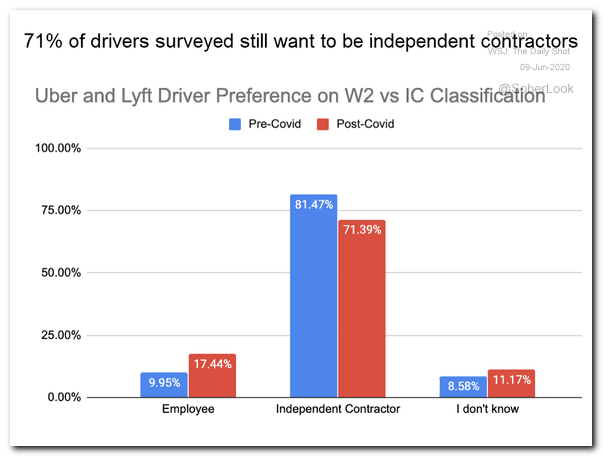

4. Uber drivers want to be contractors:

Source: The Rideshare Guy Read full article

Source: The Rideshare Guy Read full article

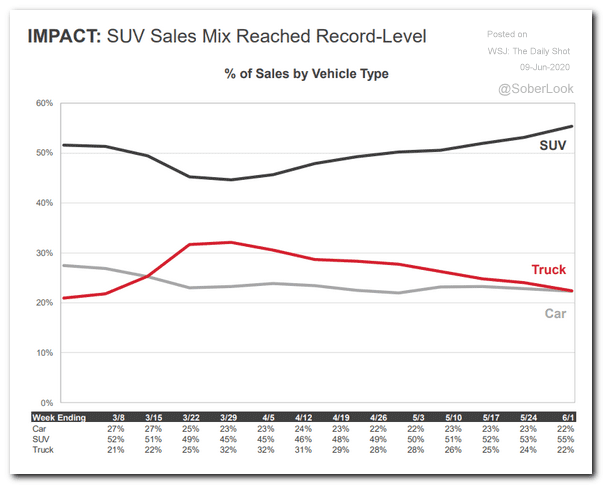

5. SUV sales vs. cars and trucks:

Source: J.D. Power

Source: J.D. Power

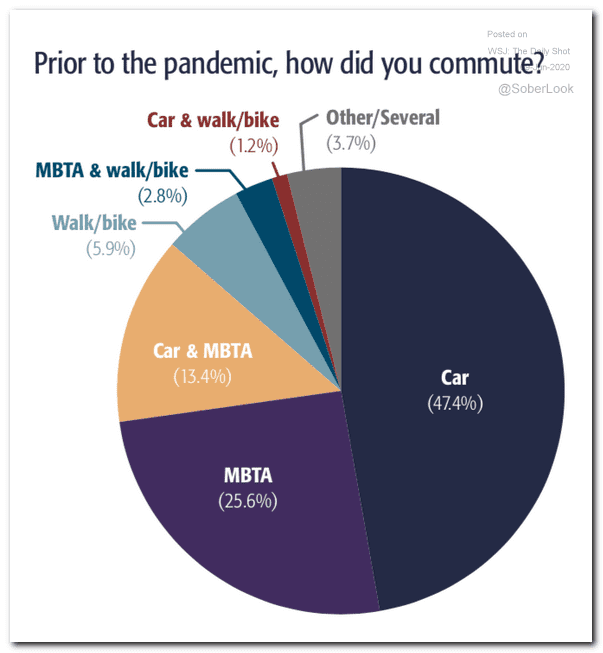

6. Commuting to work before the pandemic:

Source: Pioneer Public

Source: Pioneer Public

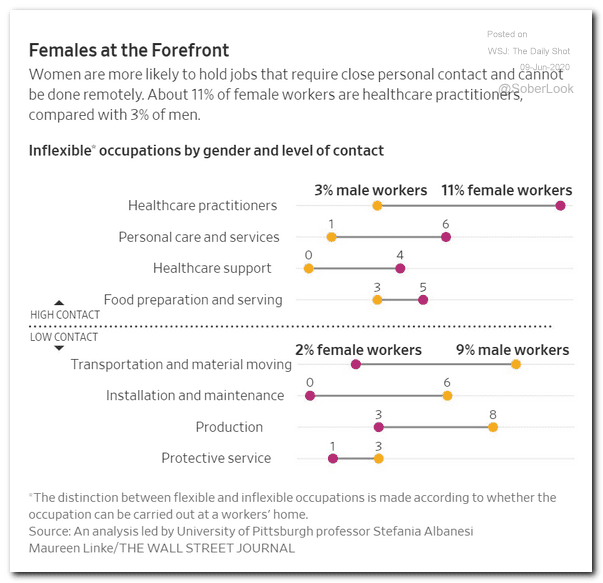

7. High-contact professions:

Source: @WSJ Read full article

Source: @WSJ Read full article

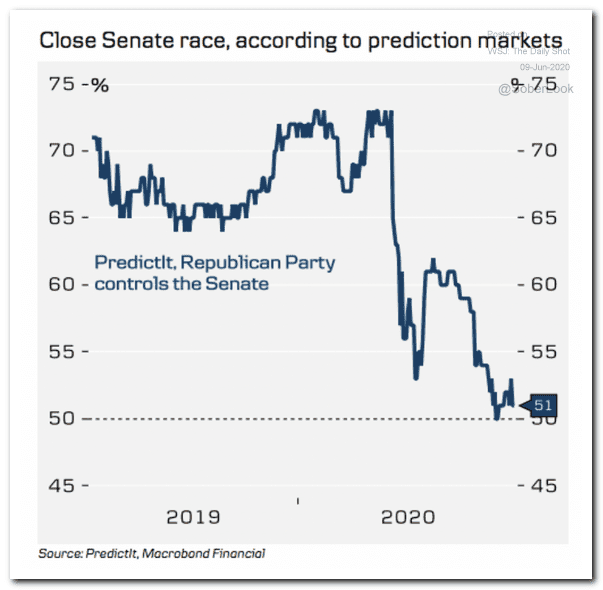

8. Betting markets’ odds on the US Senate race:

Source: Danske Bank

Source: Danske Bank

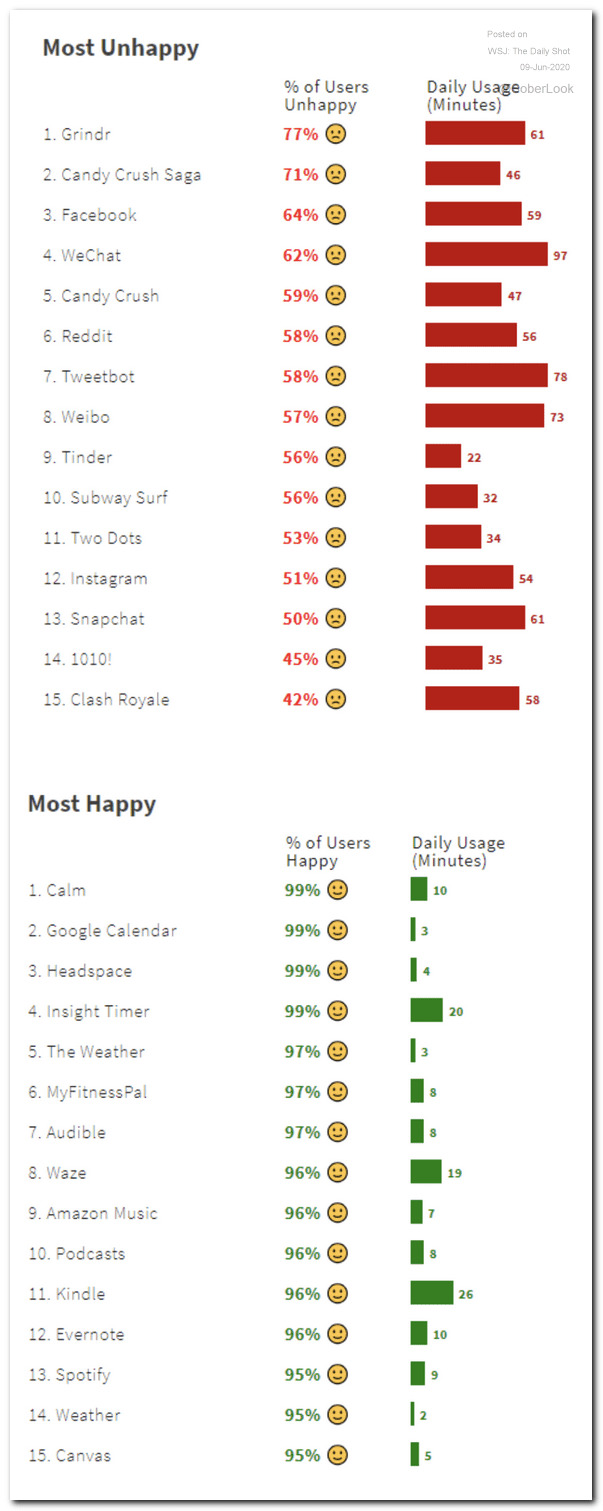

9. App reviews:

Source: Center for Humane Technology

Source: Center for Humane Technology

——————–