The Daily Shot: 30-Jun-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Commodities

• Energy

• Equities

• Alternatives

• Food for Thought

The United States

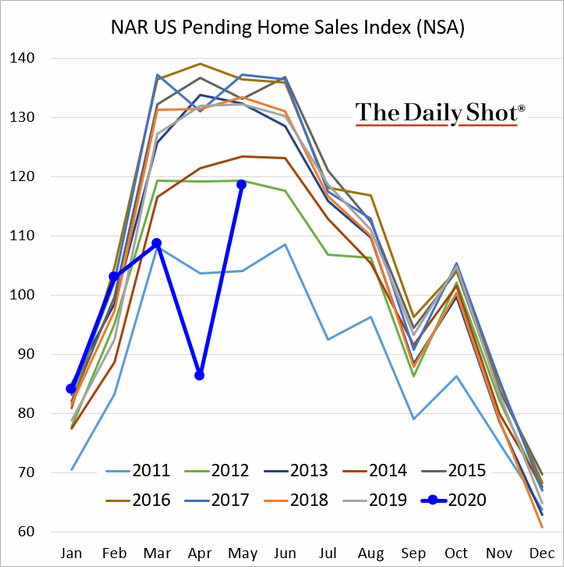

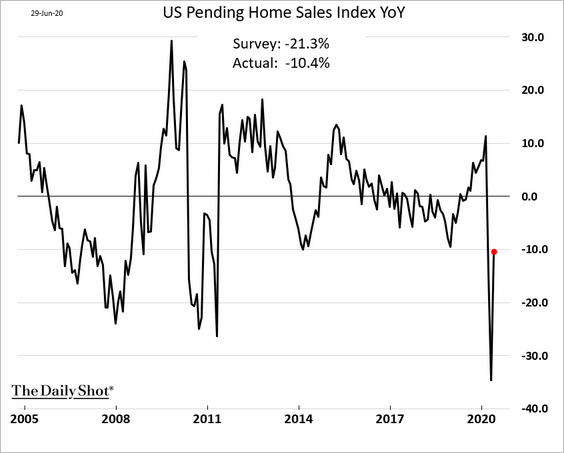

1. Pending home sales (contracts) rebounded sharply in May, topping economists’ forecasts.

• The pending sales index:

• Year-over-year changes:

——————–

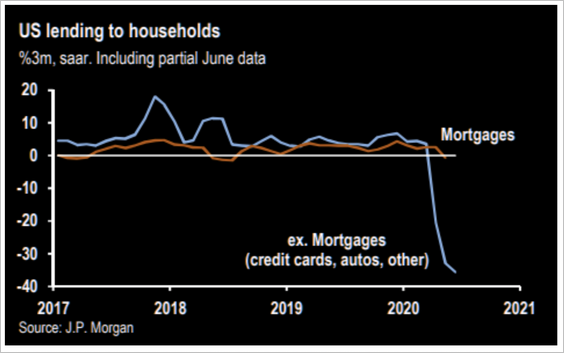

3. Next, we have a couple of updates on consumer credit.

• Mortgage lending has remained relatively stable even as credit cards and auto loans tumbled during the crisis.

Source: J.P. Morgan, @themarketear

Source: J.P. Morgan, @themarketear

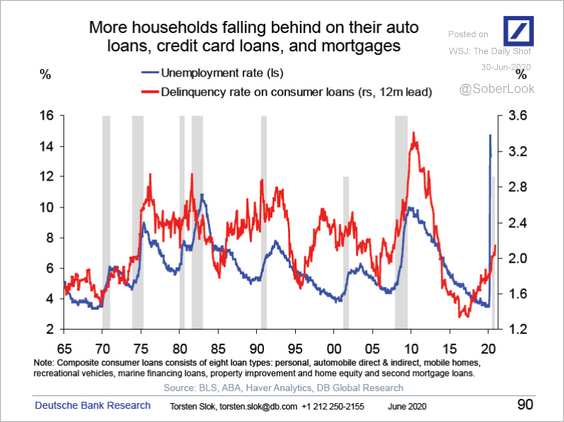

• Household delinquencies are expected to rise further, especially without additional government assistance.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

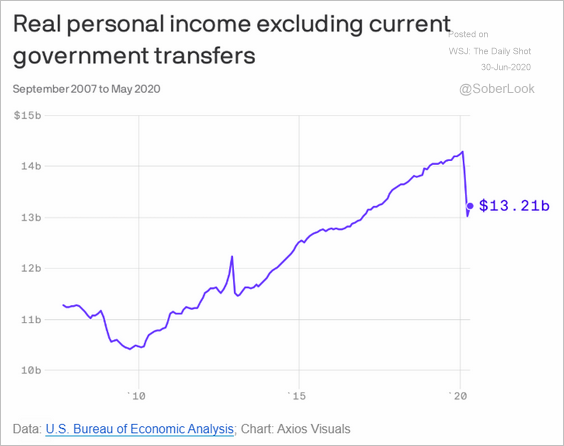

4. Personal income excluding government transfers declined sharply this year.

Source: @axios Read full article

Source: @axios Read full article

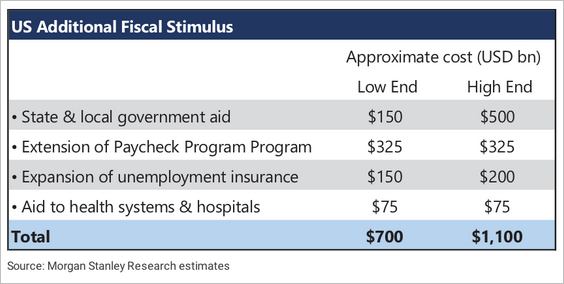

5. Morgan Stanley expects an additional $1 trillion in fiscal stimulus.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

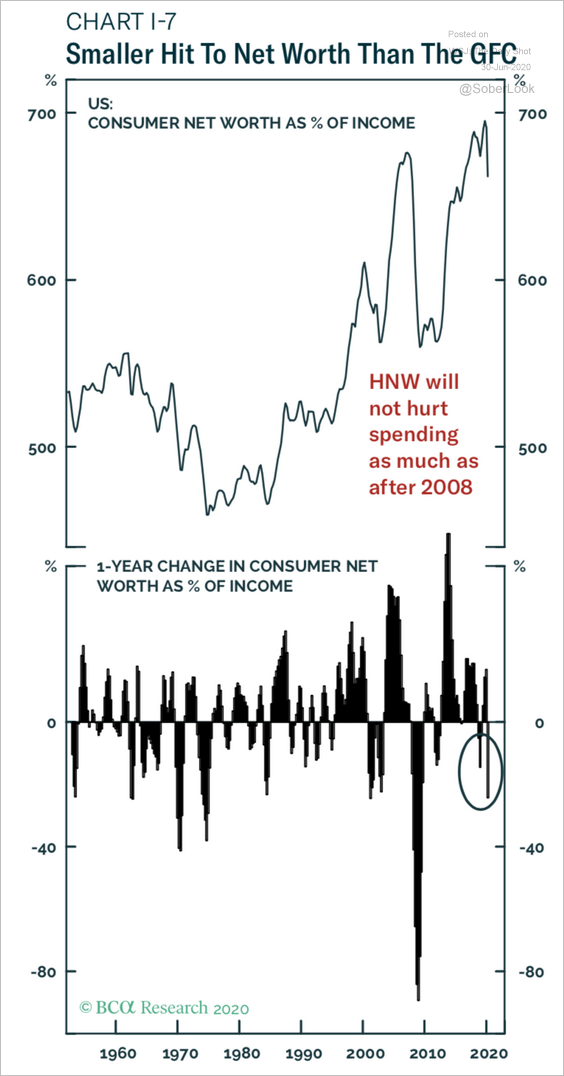

6. The impact on household net worth has been much less severe in this recession than after 2008. That’s mostly due to the stability of the housing market and the rebound in stock prices.

Source: BCA Research

Source: BCA Research

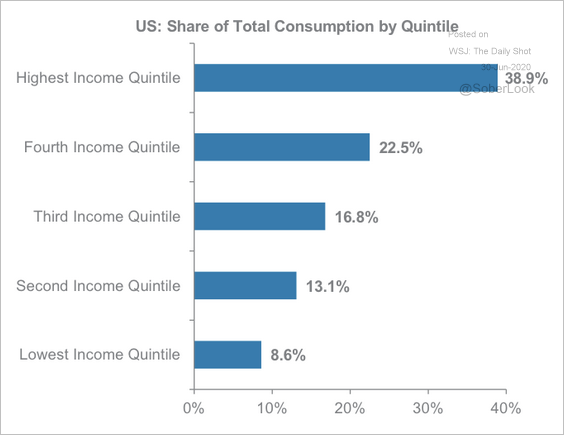

Equity price gains, in particular, should boost consumer spending. While it’s mostly the higher-income households that own stocks, they also represent a large share of total consumption.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

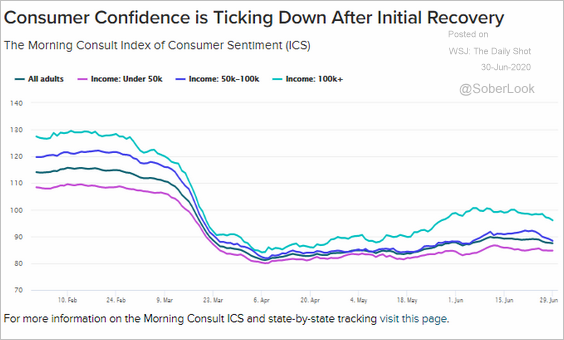

7. As we saw in the U. Michigan report, improvements in consumer confidence have slowed in recent weeks.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

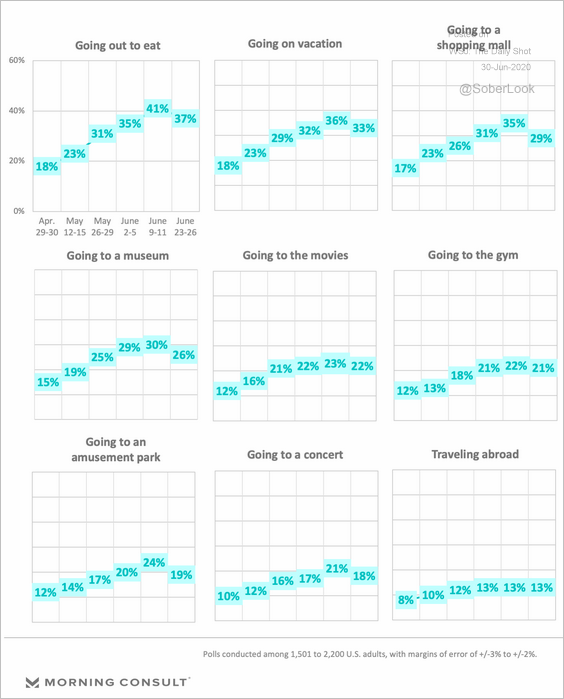

After months of gains, Americans’ comfort level with resuming various activities has peaked.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

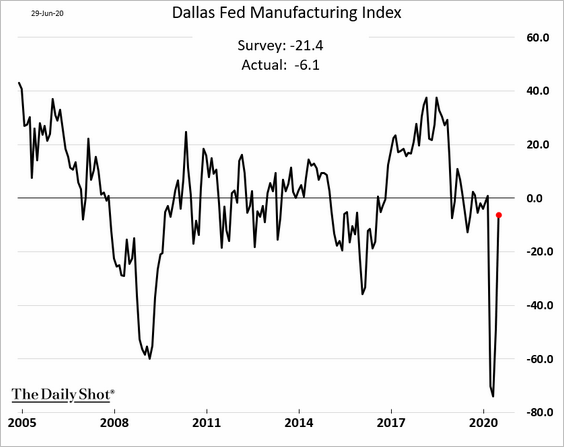

8. The Dallas Fed’s regional factory index rebounded sharply in June. Will we see some of these gains reversed next month as Texas battles a spike in coronavirus infections?

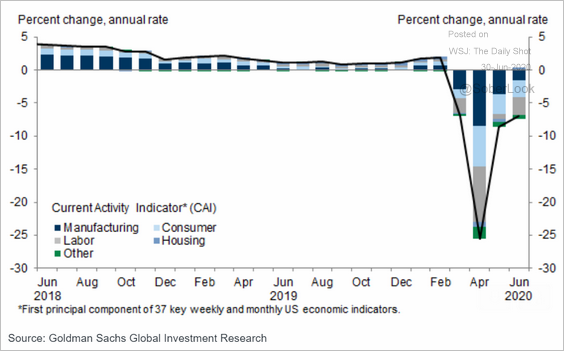

9. Goldman’s current activity indicator (CAI) rebounded from the April lows but continues to show persistent weakness.

Source: Goldman Sachs

Source: Goldman Sachs

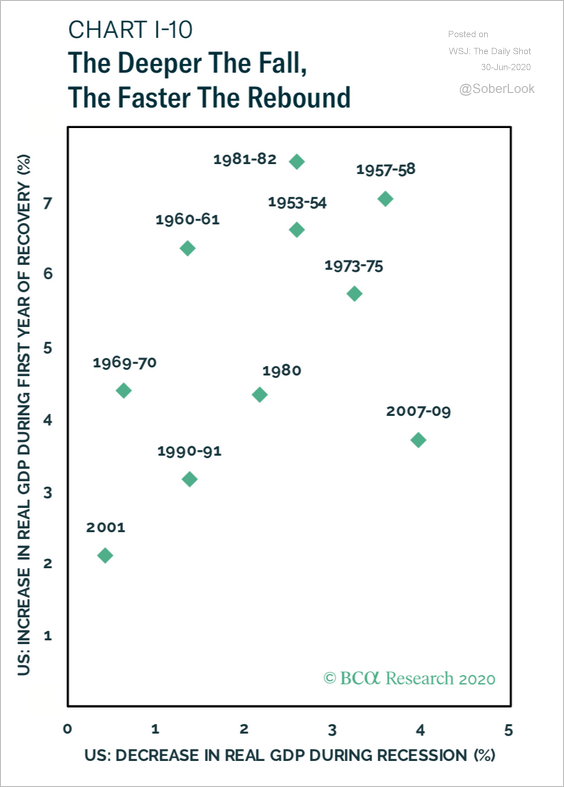

According to BCA Research, the historical pattern of deep recessions followed by sharp rebounds should repeat itself in this downturn.

Source: BCA Research

Source: BCA Research

——————–

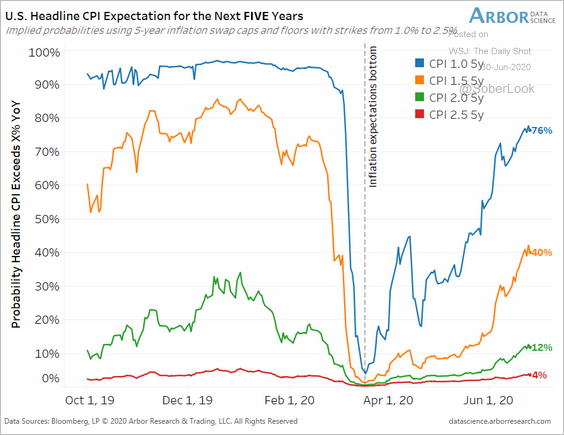

10. Inflation expectations have rebounded.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

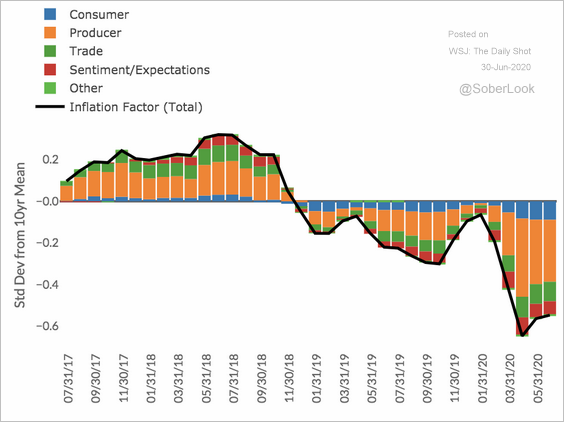

What were the drivers of below-trend inflation in recent quarters?

Source: DeepMacro

Source: DeepMacro

Canada

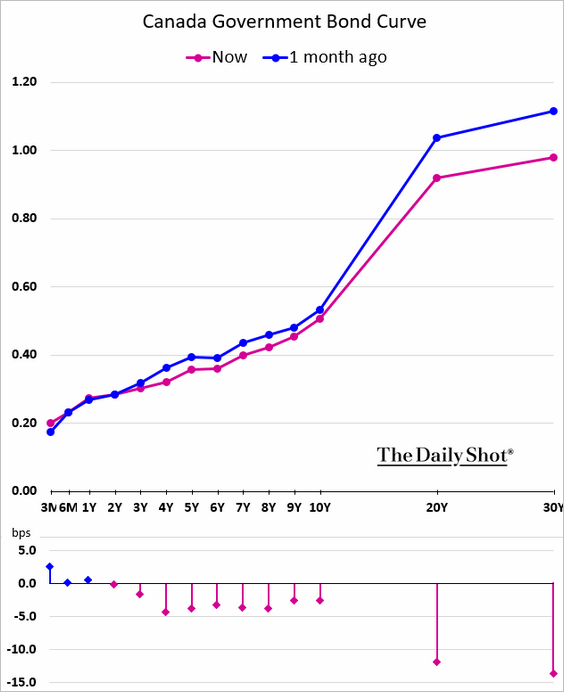

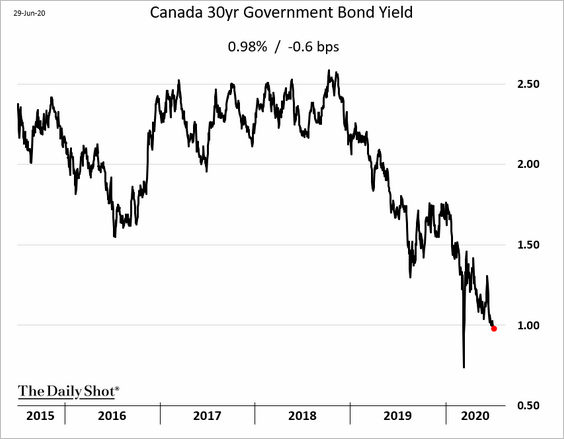

1. The yield curve has been flattening.

Here is the 30yr yield.

——————–

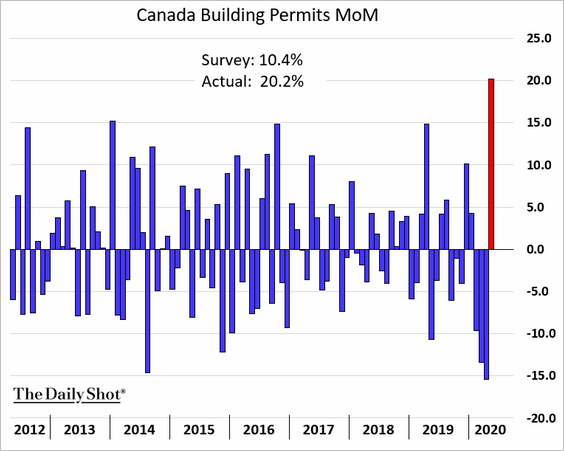

2. Last month’s building permits topped economists’ forecasts.

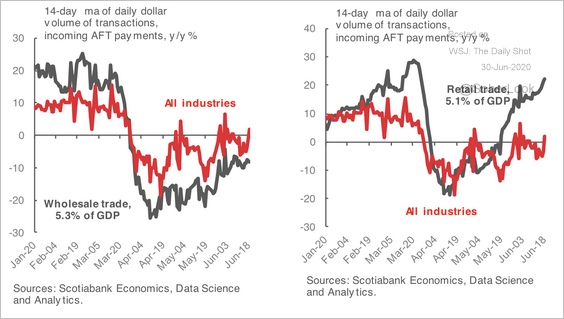

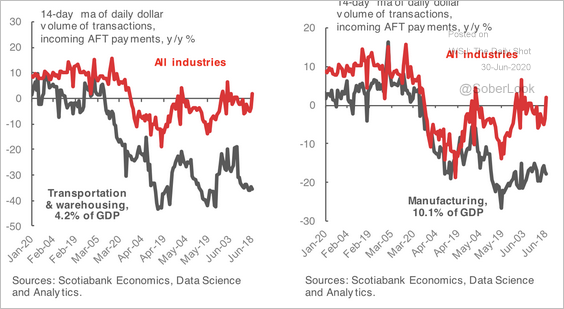

3. Increased retail and wholesale transactions in recent weeks have been offset by weakness in the transportation and manufacturing industries, according to Scotiabank.

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

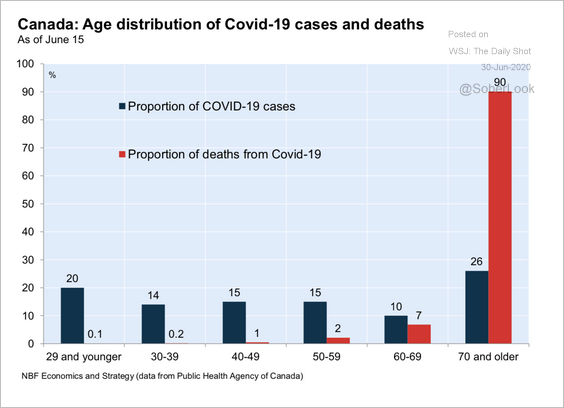

4. Here is the age distribution of COVID-19 cases and deaths.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

The United Kingdom

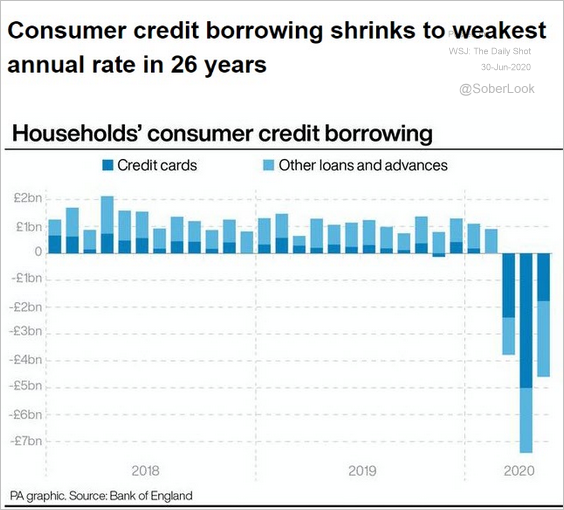

1. Consumer credit continues to contract.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

Mortgage approvals tumbled further in May (a rebound was expected).

Source: The Guardian Read full article

Source: The Guardian Read full article

——————–

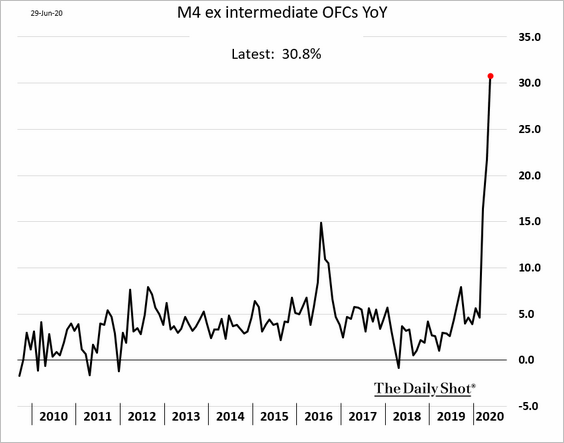

2. The broad money supply spiked as corporations tapped credit lines, and the BoE launched QE.

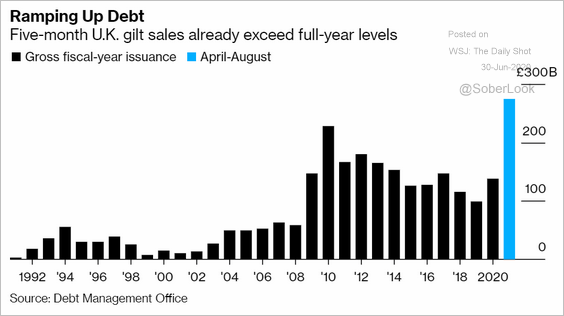

3. Gilt sales hit a record.

Source: @markets Read full article

Source: @markets Read full article

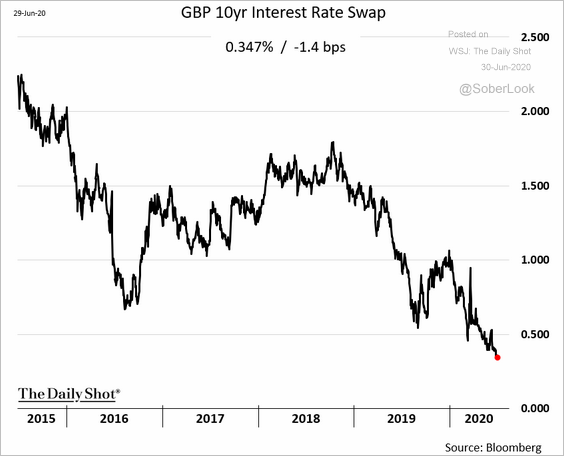

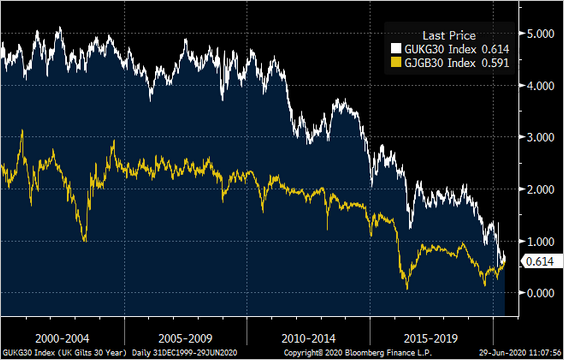

Nonetheless, rates continue to fall.

• The 10yr swap rate:

h/t Tradeweb

h/t Tradeweb

• The 30yr gilt yield (white line) vs. the 30yr JGB yield:

Source: @toby_n

Source: @toby_n

The Eurozone

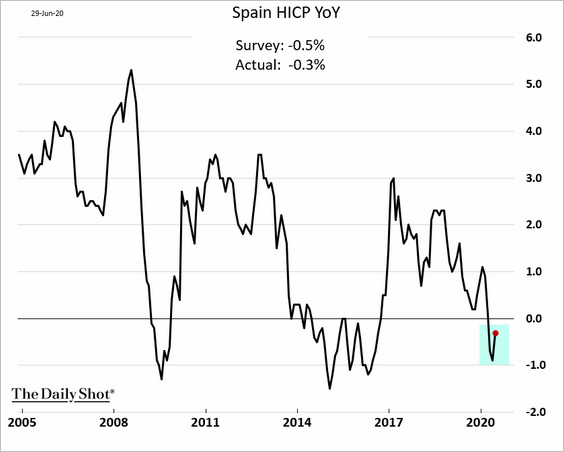

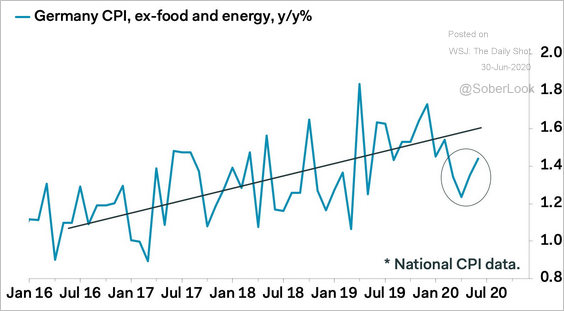

1. Consumer inflation ticked higher in Germany and Spain.

Here is Germany’s core CPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

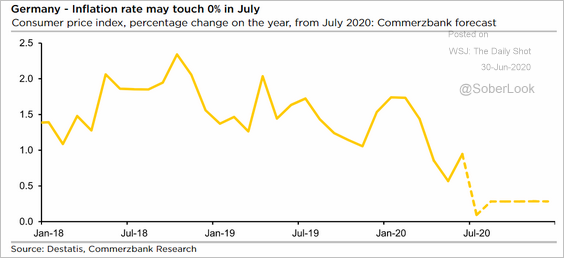

But according to Commerzbank, Germany’s inflation may touch zero in July.

Source: Commerzbank Research

Source: Commerzbank Research

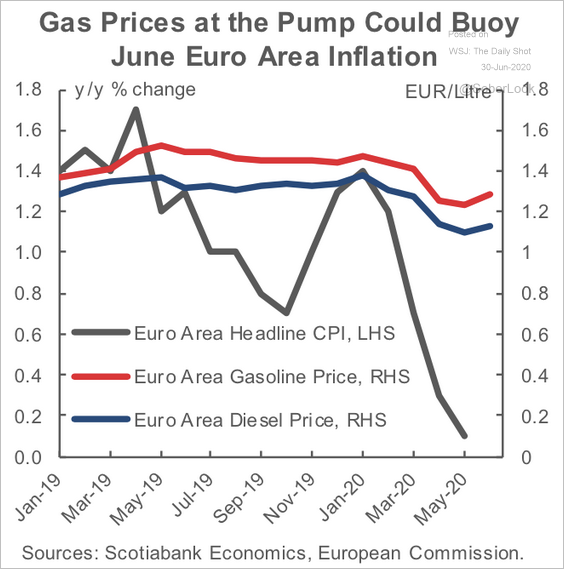

Euro-area inflation has diverged from gasoline and diesel prices in recent months, but that gap can’t persist for too long.

Source: Scotiabank Economics

Source: Scotiabank Economics

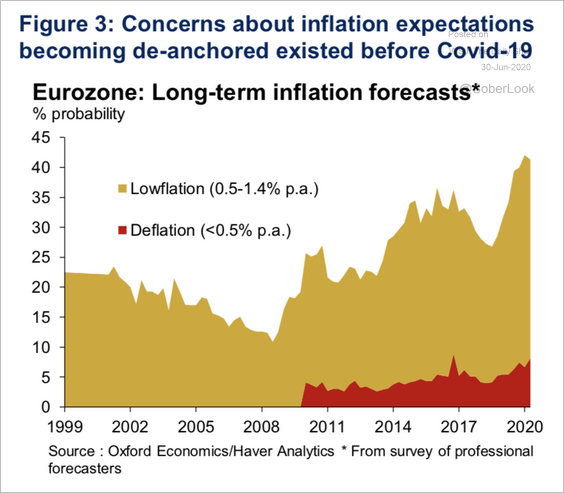

Many forecasters expect lowflation to persist despite the ECB’s massive QE program.

Source: Oxford Economics

Source: Oxford Economics

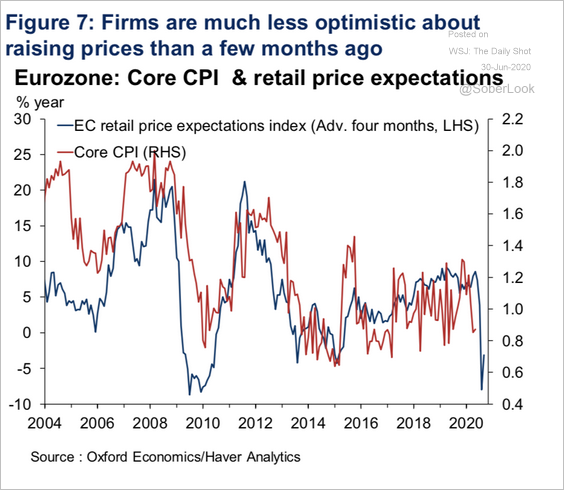

Companies are also less optimistic about rising prices.

Source: Oxford Economics

Source: Oxford Economics

——————–

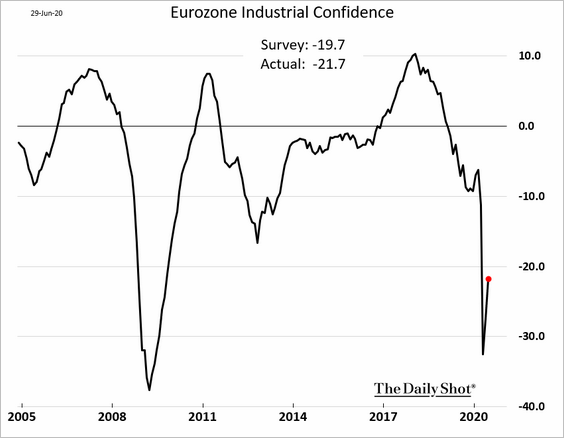

2. Business confidence improved in June but remains fragile.

• Industrial confidence:

• Services:

The improvement in consumer sentiment has been more pronounced.

3. Speculative accounts have been increasing their bets on the euro.

Source: Capital Economics

Source: Capital Economics

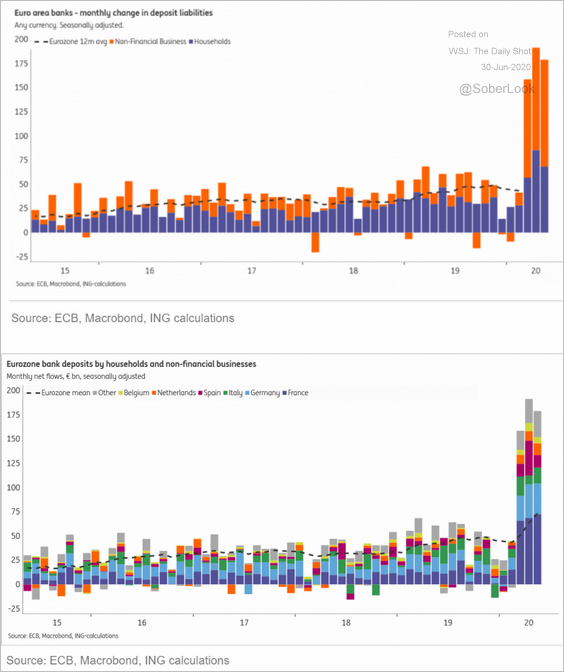

4. Deposits in the Eurozone spiked this year, driven by corporations and, to a lesser extent, households. The largest gains were in France.

Source: ING

Source: ING

Japan

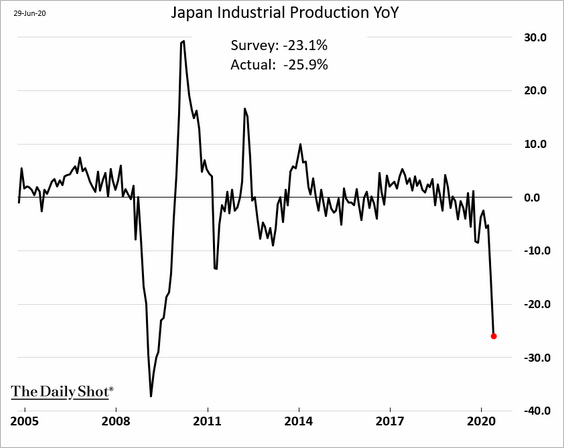

1. Industrial production deteriorated further in May, now down nearly 26% from a year ago.

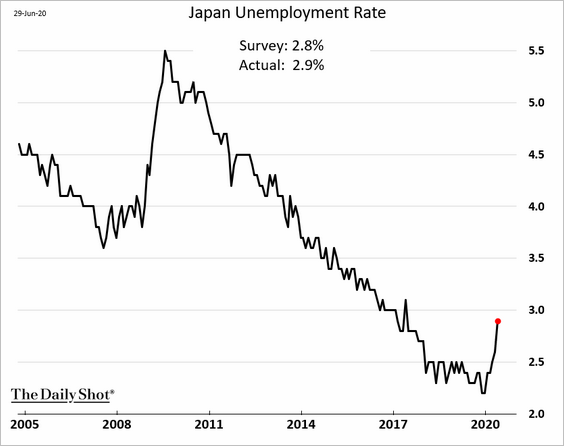

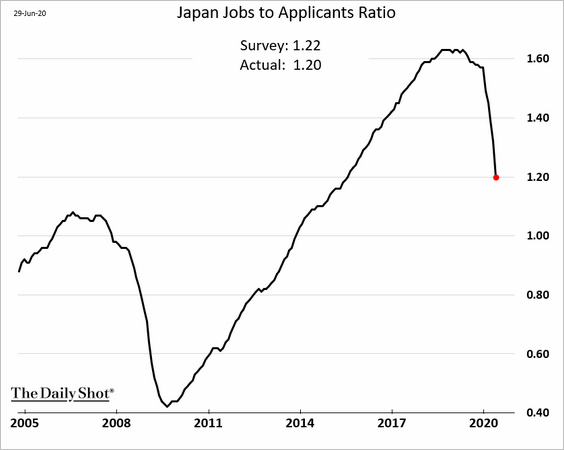

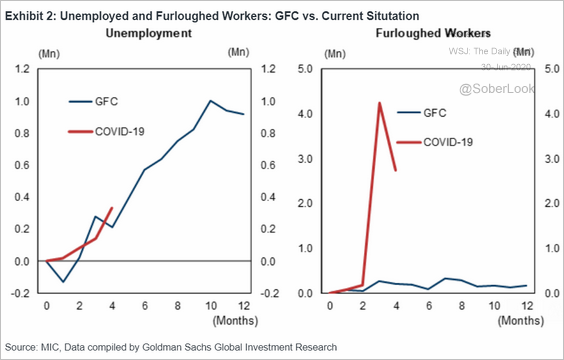

2. Japan’s employment situation worsened last month.

• The unemployment rate:

• The jobs-to-applicants ratio:

• Comparison to the Global Financial Crisis (GFC):

Source: Goldman Sachs

Source: Goldman Sachs

Asia – Pacific

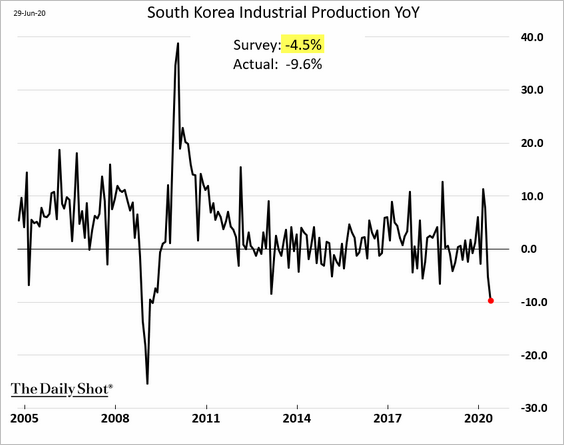

1. South Korea’s service-sector outlook showed some improvement this month.

But manufacturing confidence remains depressed.

Industrial production fell further in May, now down almost 10% from a year ago.

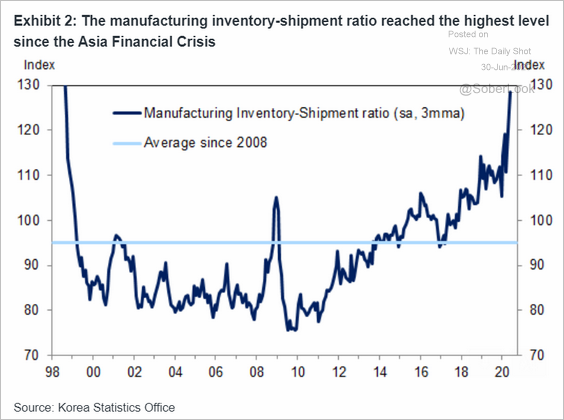

Here is South Korea’s manufacturing inventory-to-shipments ratio.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

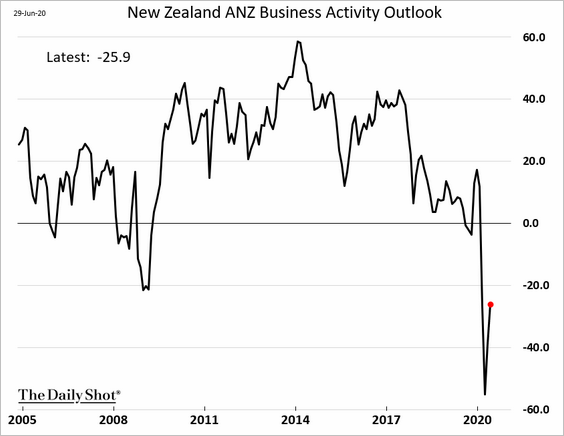

2. New Zealand’s business outlook bounced from the lows.

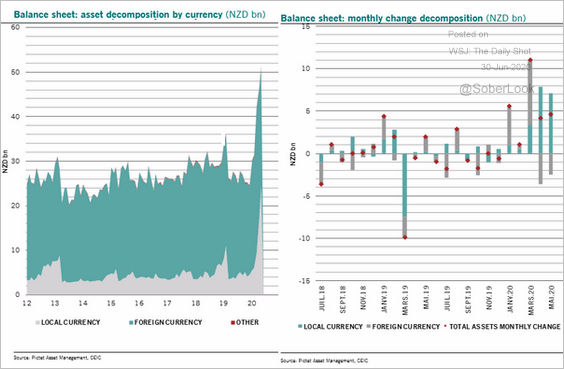

Separately, here is the evolution of the RBNZ’s balance sheet.

Source: @AnjezaKadilli

Source: @AnjezaKadilli

——————–

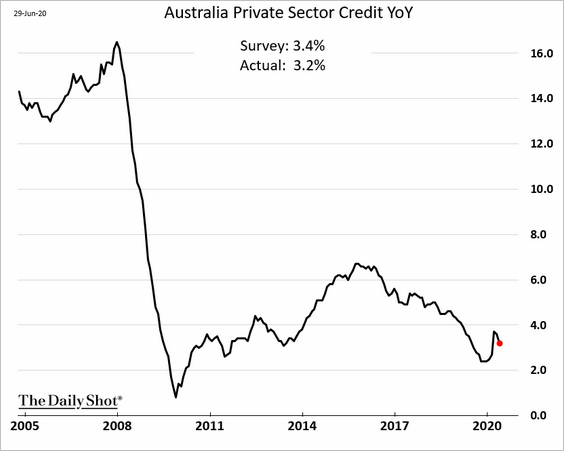

3. Australia’s credit growth slowed again last month.

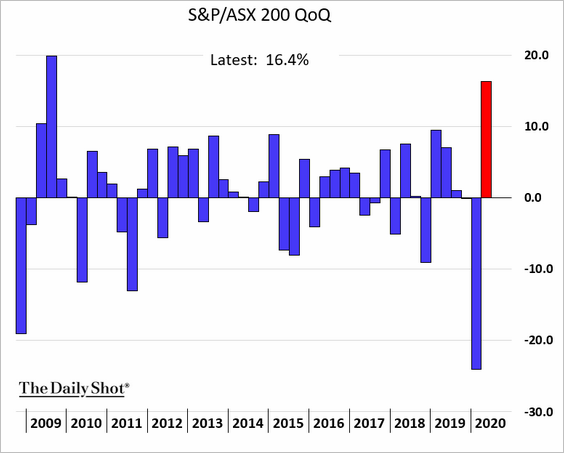

It’s been an excellent quarter for Australia’s stock market.

h/t Jackie Edwards

h/t Jackie Edwards

China

1. The stock market has recovered most of the crisis-related losses.

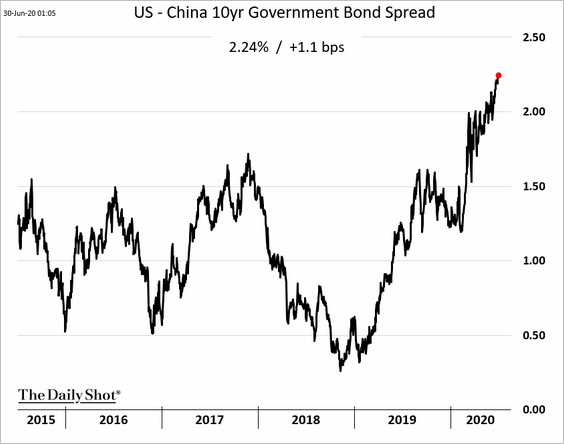

2. The China-US 10yr bond spread continues to widen.

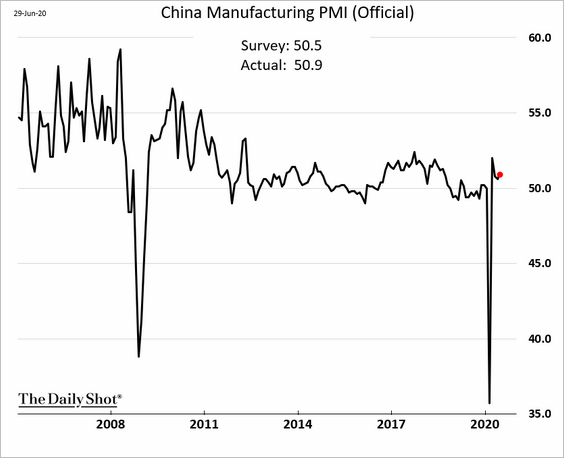

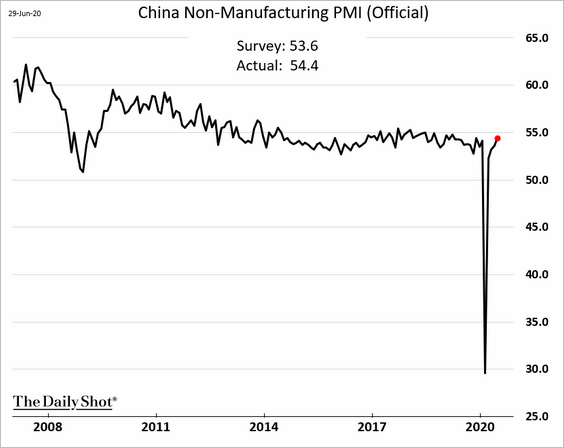

3. Business activity remained stable in June, with the PMI figures topping expectations.

• Manufacturing PMI:

• Non-manufacturing PMI:

——————–

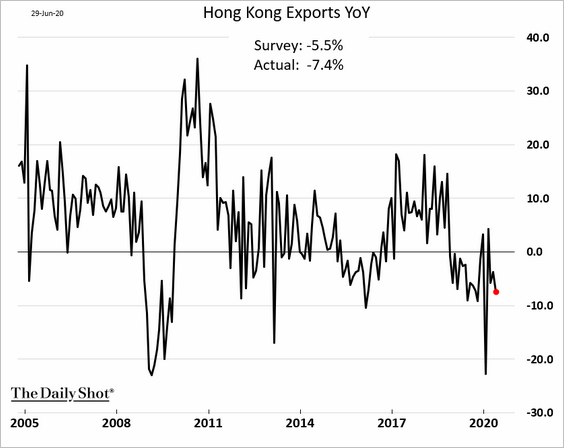

4. Hong Kong’s exports weakened in May.

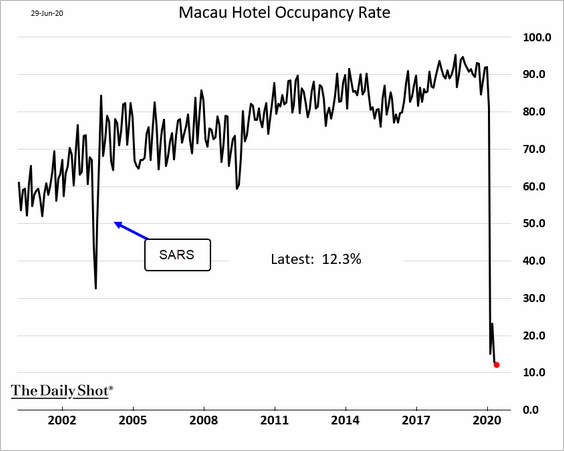

5. Macau’s hotel occupancy rate hit another low.

Commodities

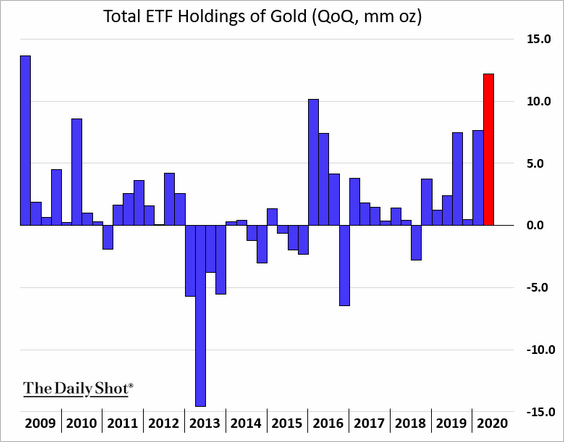

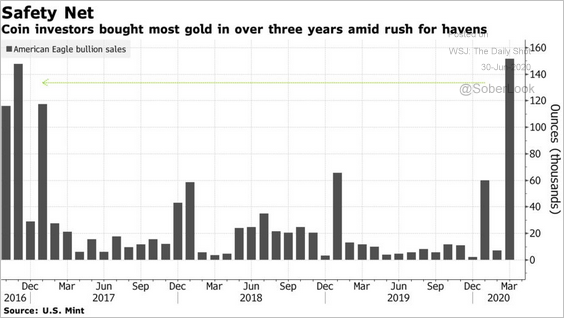

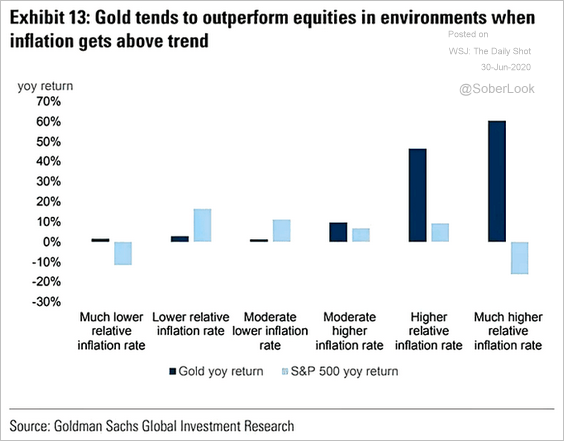

1. Here are some updates on gold.

• ETF holdings of gold (quarterly changes):

h/t Joe Richter

h/t Joe Richter

• Coin investors buying gold:

Source: @markets Read full article

Source: @markets Read full article

• Gold vs. stocks in different inflation scenarios:

Source: Goldman Sachs, @ISABELNET_SA

Source: Goldman Sachs, @ISABELNET_SA

——————–

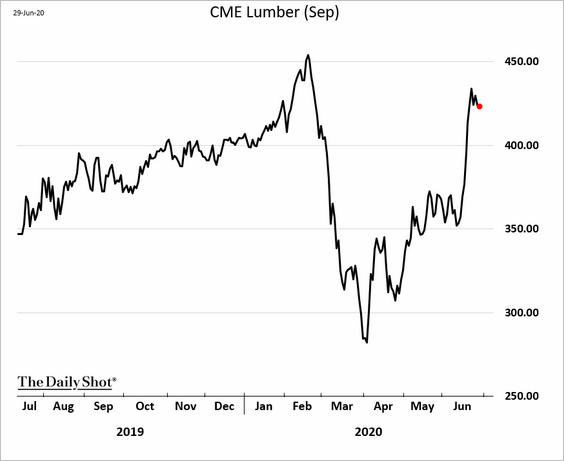

2. US lumber prices have recovered from the crisis selloff.

Energy

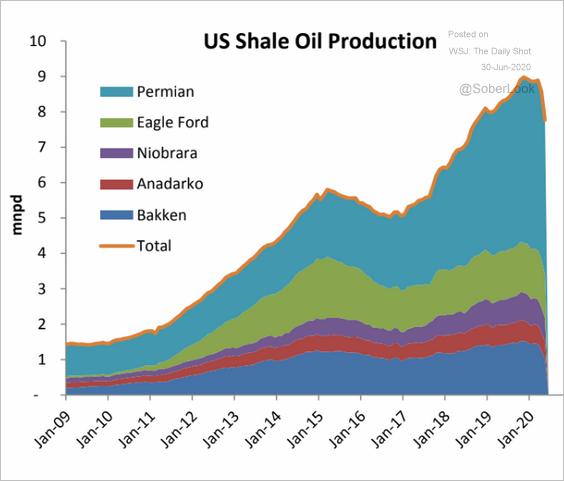

1. Let’s start with the US shale oil production.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

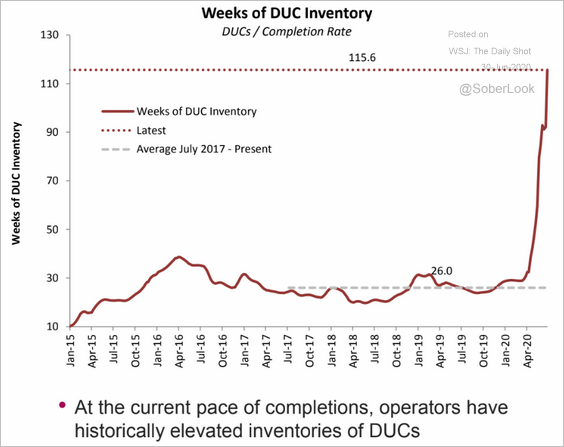

2. There is a substantial amount of oil output capacity that can be brought online should oil prices rebound (DUC = drilled but uncompleted wells).

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

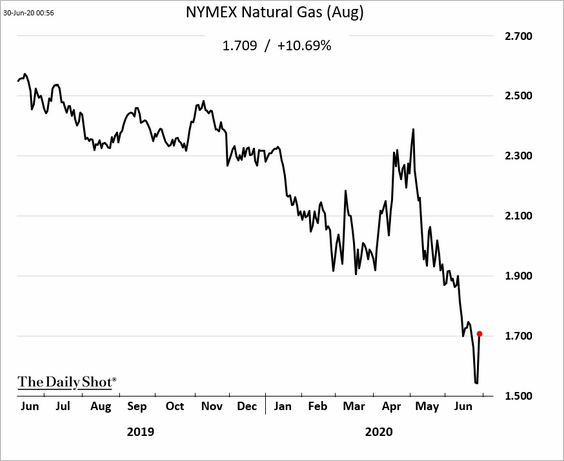

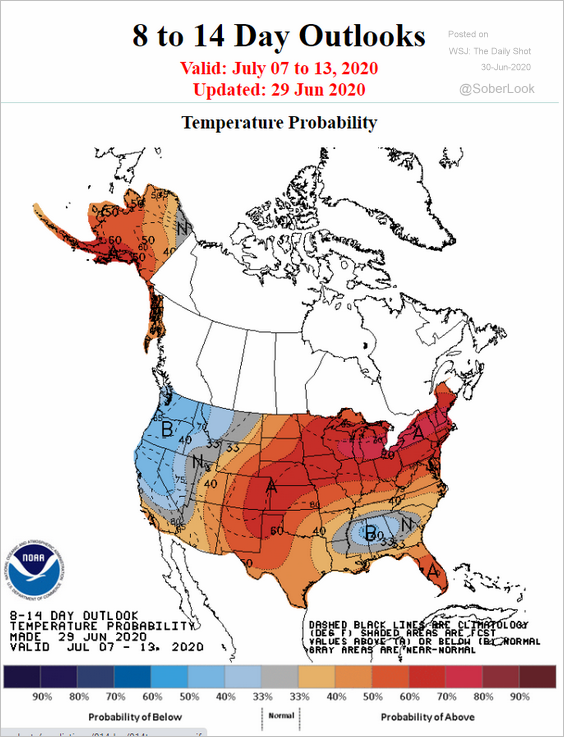

3. US natural gas futures jumped by more than 10% (from extreme lows) on Monday on warmer weather expectations. It was a bit of a short-squeeze.

Source: Reuters Read full article

Source: Reuters Read full article

Source: NOAA

Source: NOAA

Equities

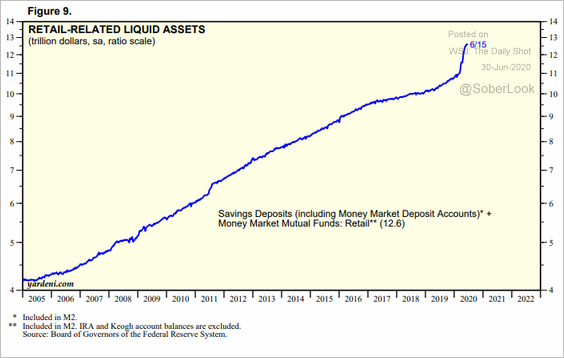

1. Flush with cash and stuck at home, some US retail investors have been more active in the stock market.

Source: Yardeni Research

Source: Yardeni Research

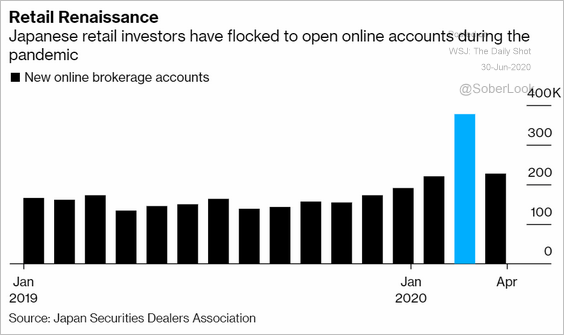

As retail trading activity in the US rises, here is a look at some trends in Asia.

• The increase is not unique to the US.

Source: @markets Read full article

Source: @markets Read full article

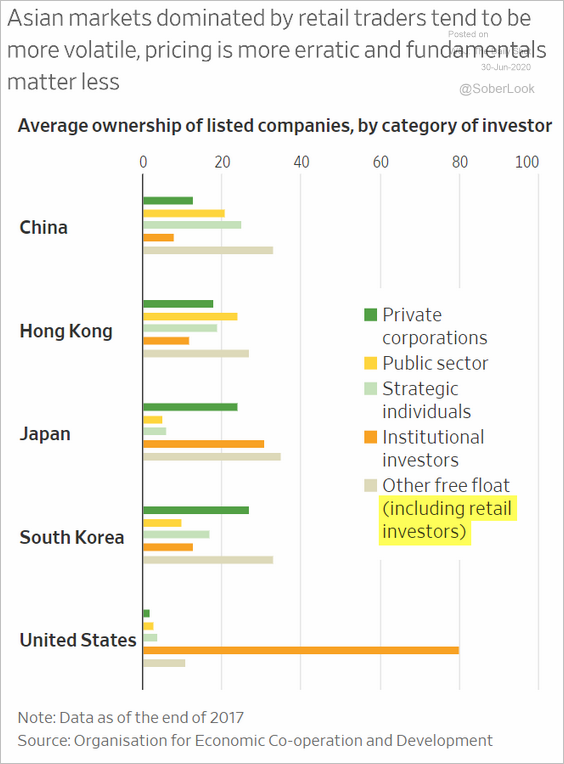

• When retail investors become a significant part of the market, “… pricing is more erratic and fundamentals matter less.”

Source: @WSJ Read full article

Source: @WSJ Read full article

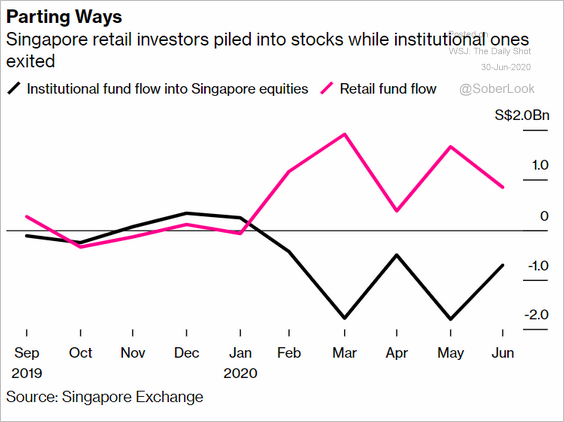

• In Singapore, retail investors offset institutional trading.

Source: @markets Read full article

Source: @markets Read full article

——————–

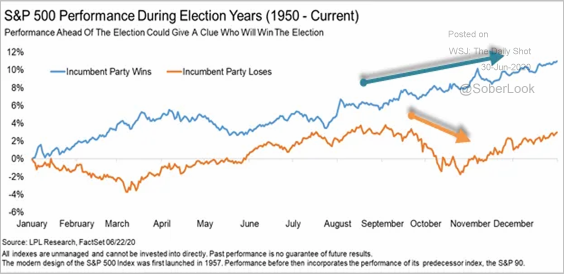

2. How does the market typically behave in election years?

• Predicting the outcome:

Source: LPL Research

Source: LPL Research

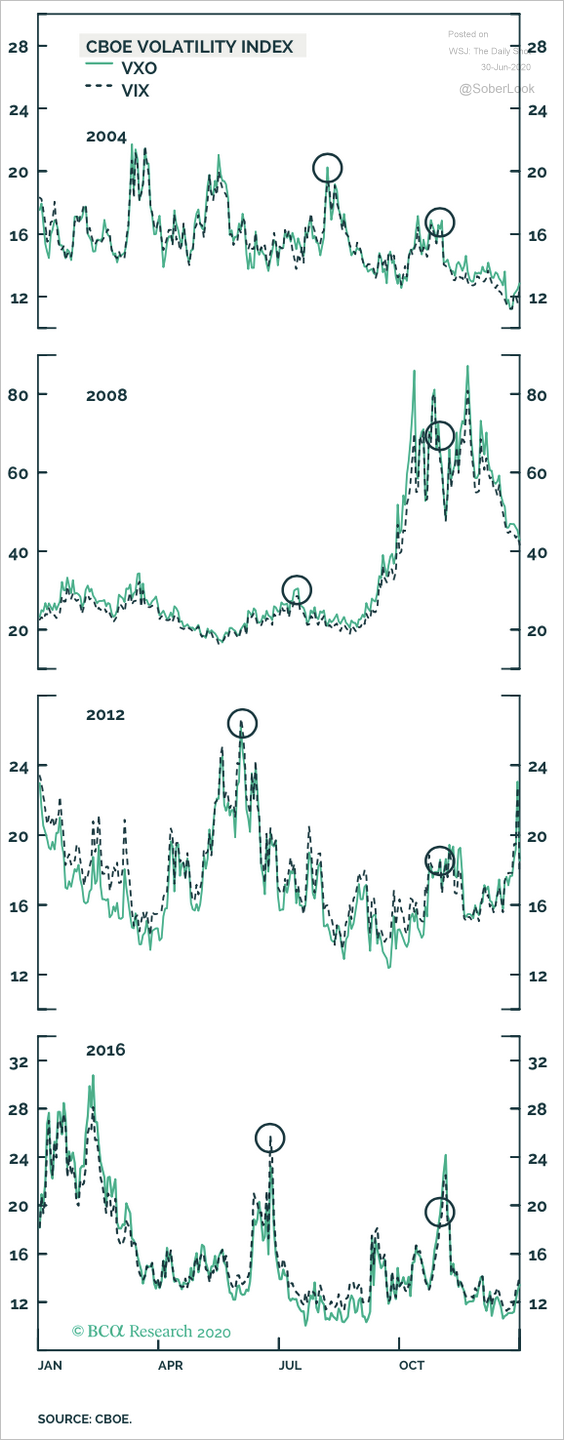

• Pre-election volatility:

Source: BCA Research

Source: BCA Research

——————–

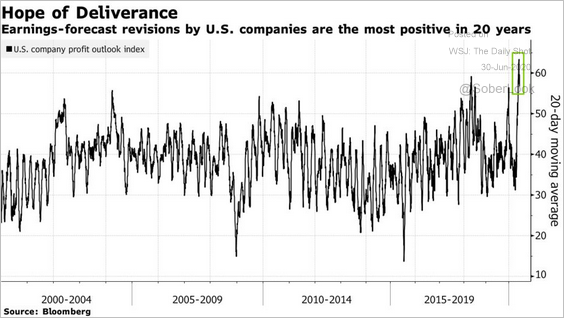

3. Companies have been revising their earnings forecasts higher.

Source: @markets Read full article

Source: @markets Read full article

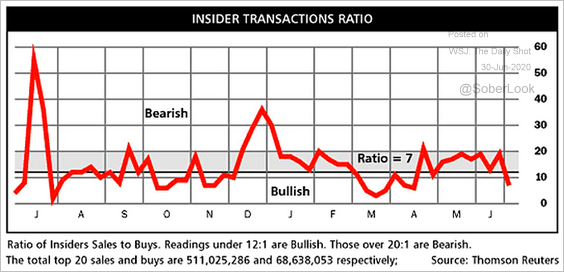

4. The insider transactions ratio has improved.

Source: Thomson Reuters, @ISABELNET_SA

Source: Thomson Reuters, @ISABELNET_SA

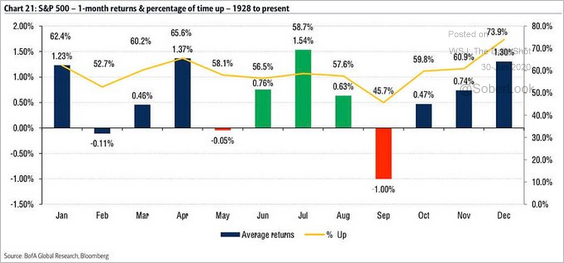

5. Here is the S&P 500 seasonality.

Source: @ISABELNET_SA, @BofAML Read full article

Source: @ISABELNET_SA, @BofAML Read full article

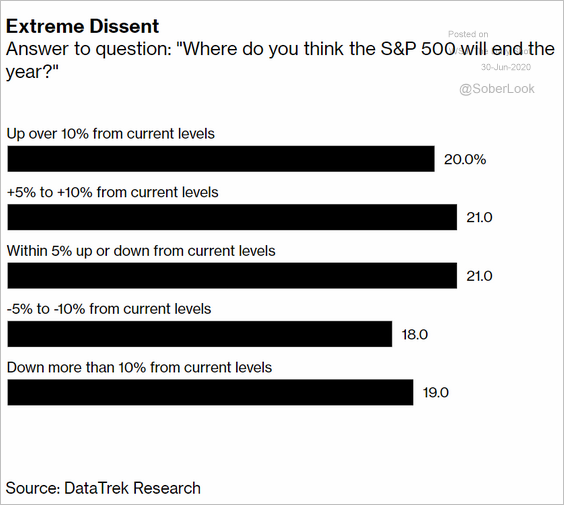

6. Views on the market are evenly distributed across potential scenarios.

Source: @lisaabramowicz1 Read full article

Source: @lisaabramowicz1 Read full article

Alternatives

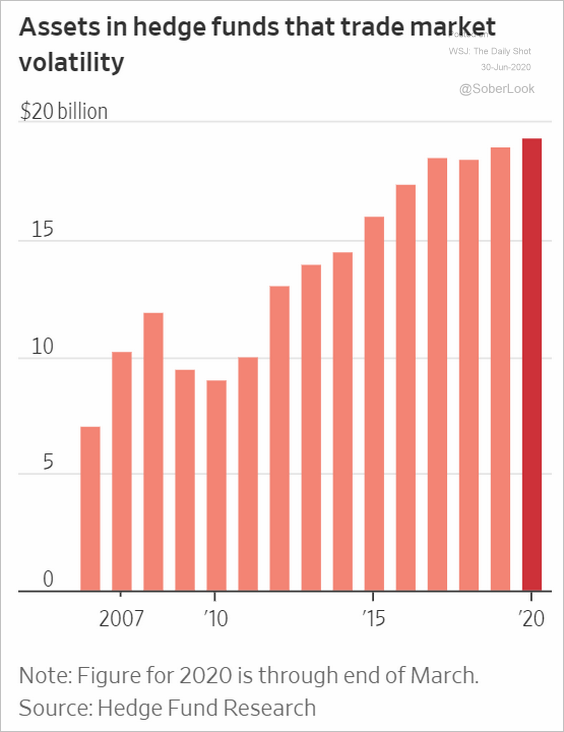

1. The AUM of hedge funds focused on volatility keeps climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

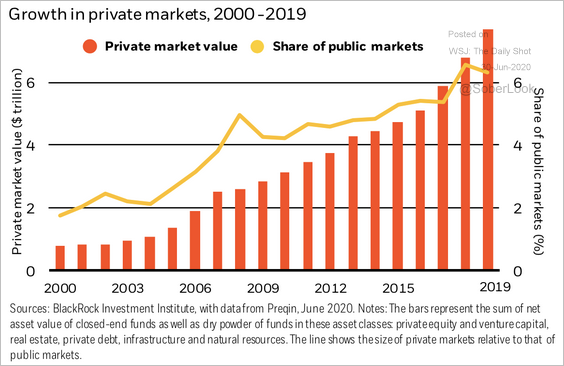

2. Growth in private markets (private equity, VC, etc.) has been impressive.

Source: BlackRock

Source: BlackRock

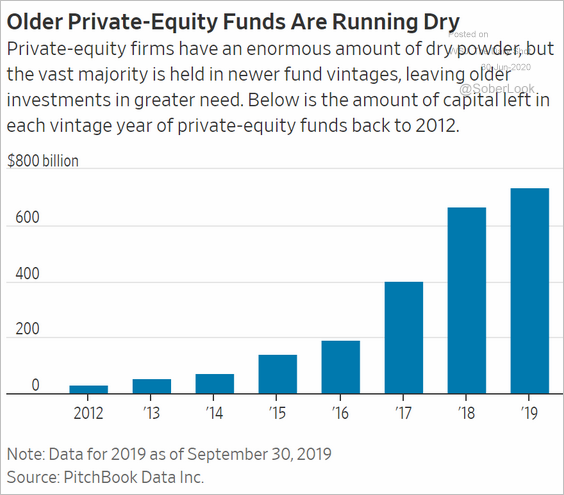

3. This chart shows the current private equity dry powder by fund vintage year.

Source: @WSJ Read full article

Source: @WSJ Read full article

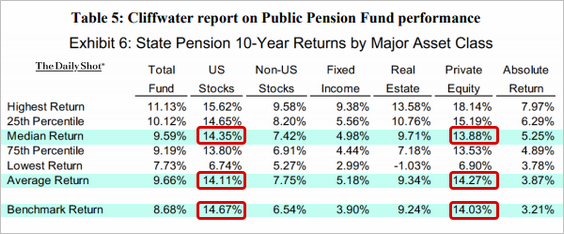

4. State pension funds’ results show that private equity performance is not significantly different from public markets.

Source: Phalippou, SSRN Read full article

Source: Phalippou, SSRN Read full article

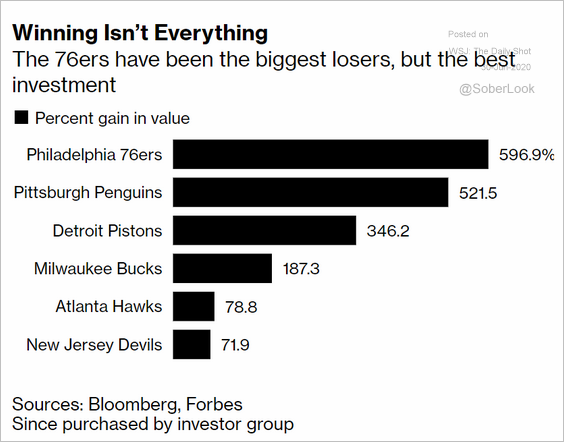

5. Which sports club investment has been the most profitable?

Source: @business Read full article

Source: @business Read full article

——————–

Food for Thought

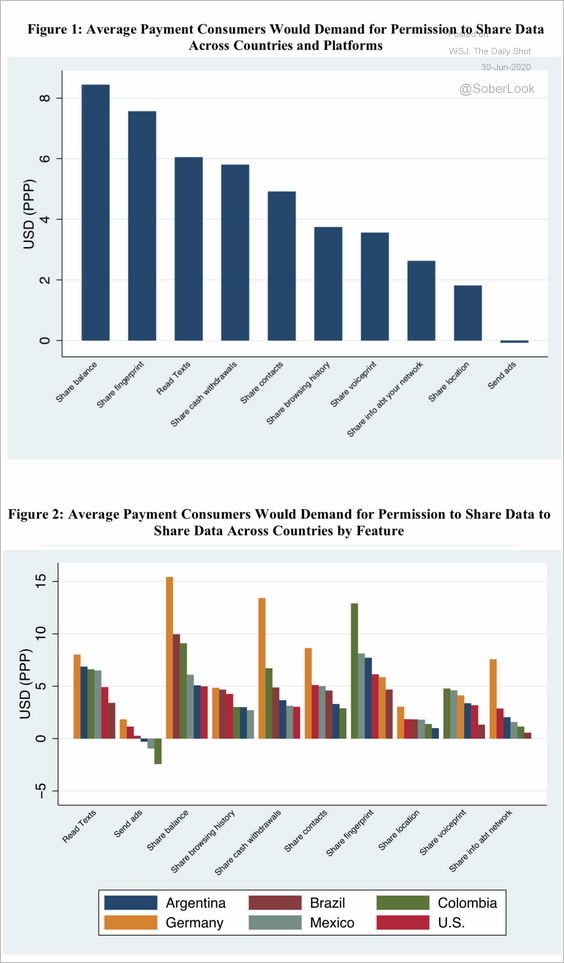

1. How much is privacy worth to consumers?

Source: Prince, Wallsten (SSRN) Read full article

Source: Prince, Wallsten (SSRN) Read full article

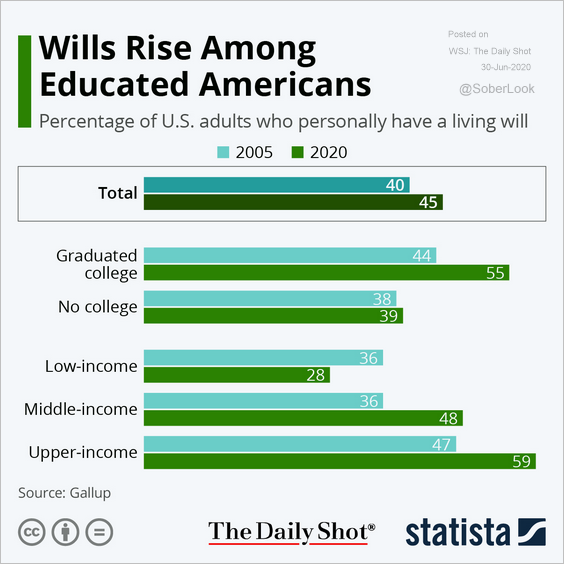

2. The increase in living wills:

Source: Statista

Source: Statista

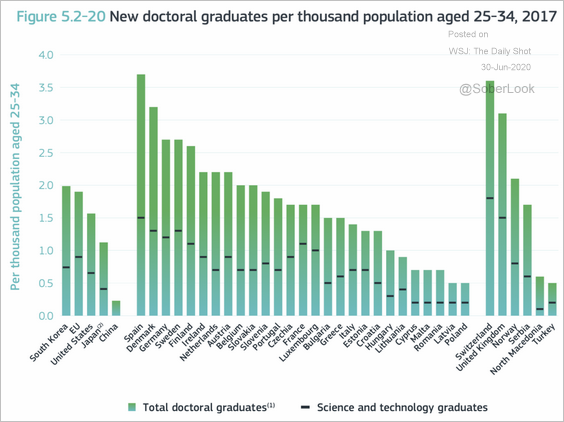

3. Doctoral students by country:

Source: European Commission Read full article

Source: European Commission Read full article

4. A Russian radiation leak:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

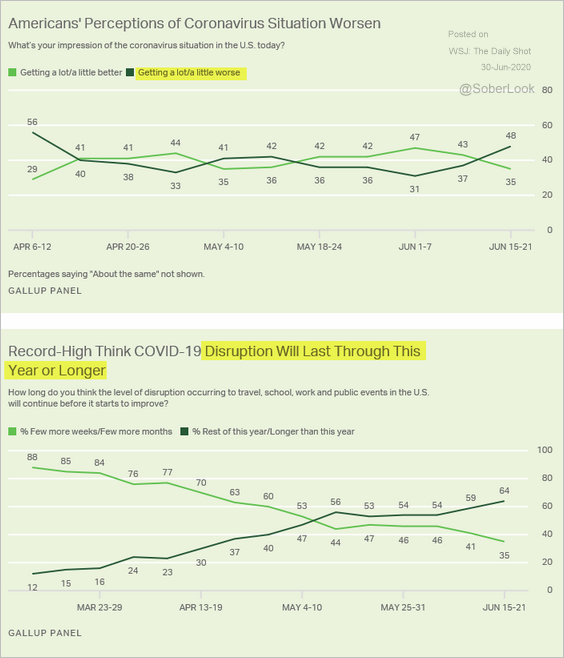

5. Americans’ views on the COVID-19 disruption:

Source: Gallup Read full article

Source: Gallup Read full article

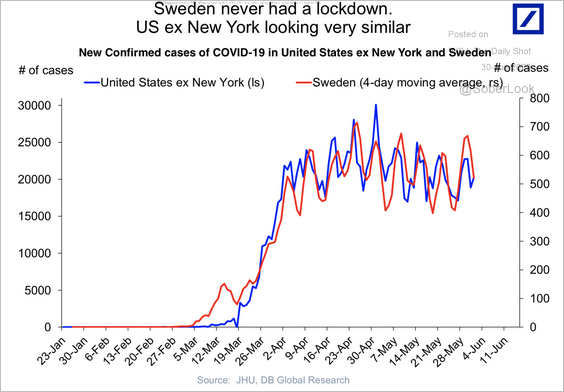

6. Coronavirus cases in Sweden vs. the US (ex NY):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

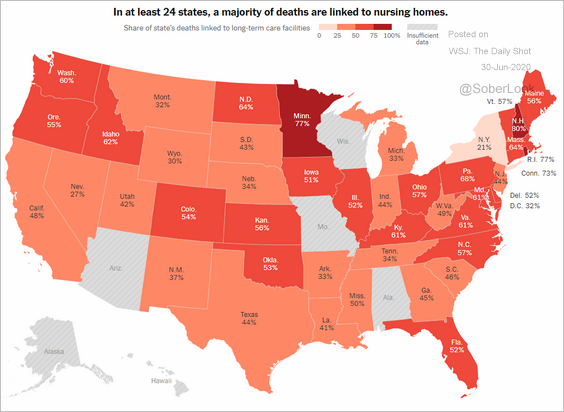

7. Deaths in nursing homes:

Source: The New York Times Read full article

Source: The New York Times Read full article

8. Chemicals in cigarettes:

Source: Airtopia Read full article

Source: Airtopia Read full article

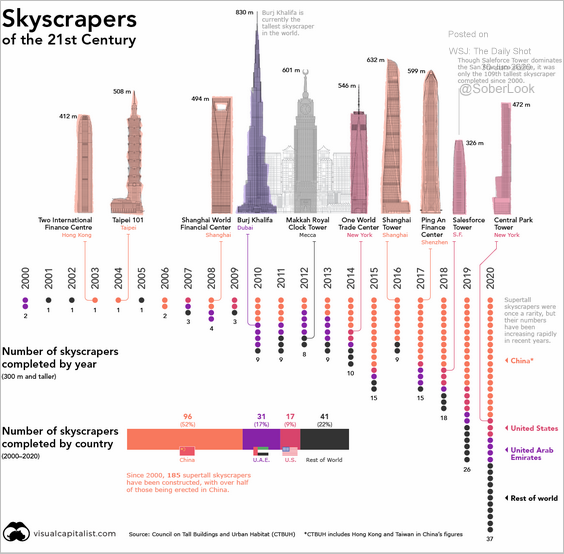

9. Skyscrapers:

Source: @VisualCap Read full article

Source: @VisualCap Read full article

——————–