The Daily Shot: 12-Aug-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

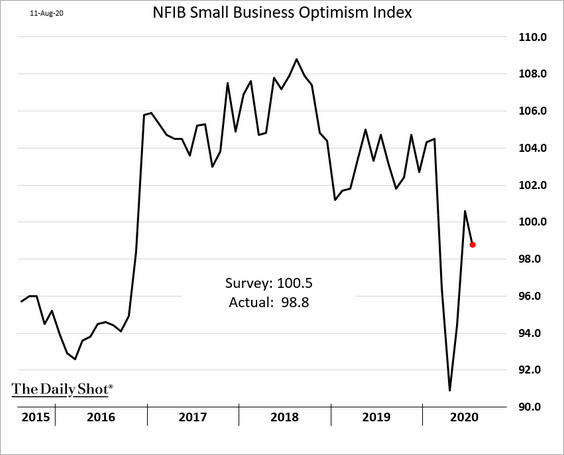

1. The NFIB small business sentiment index declined in July as the recovery slowed.

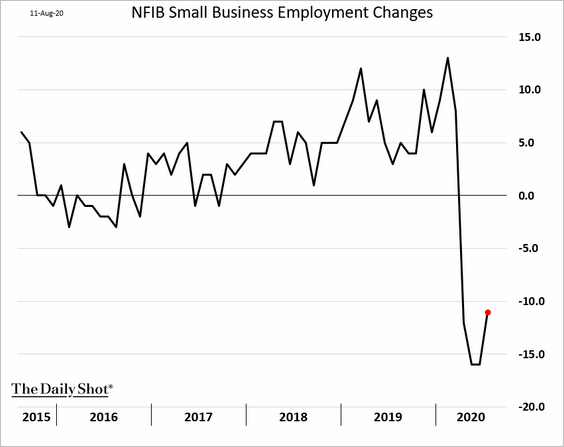

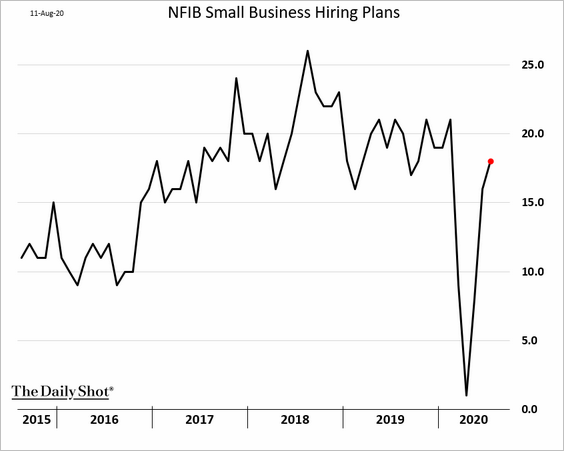

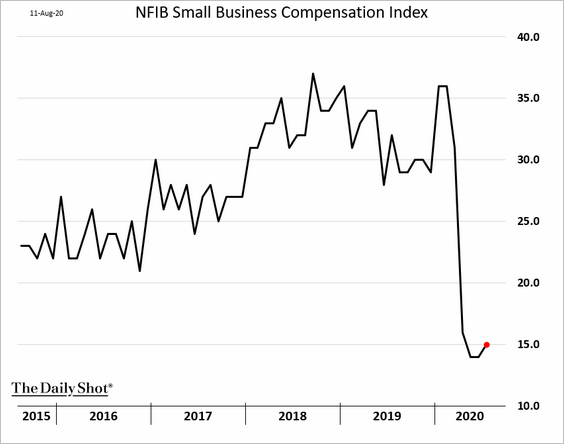

Below are some elements of the NFIB report.

• Employment recovery has been soft, …

… but hiring plans have rebounded.

• The compensation index remains depressed.

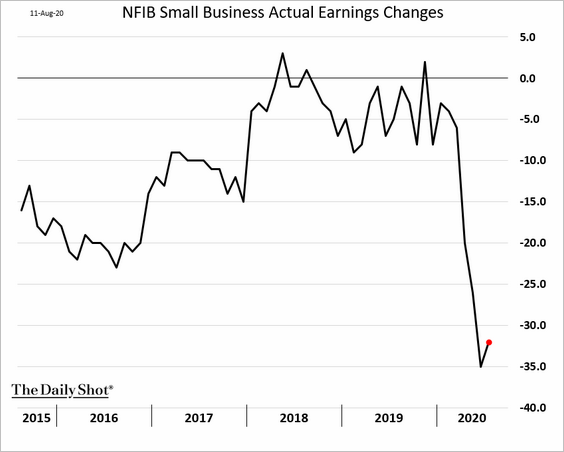

• Businesses continue to face weak earnings.

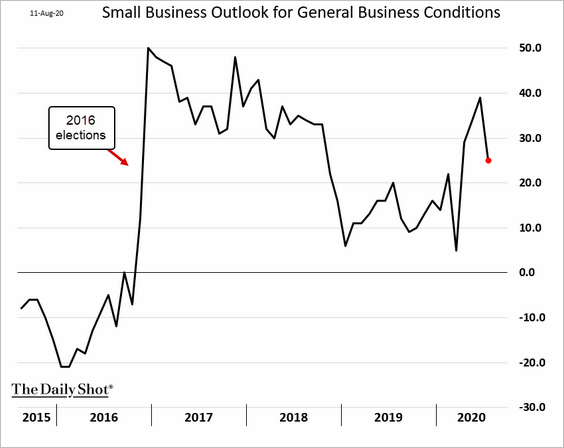

• Forward-looking indicators were lower.

– Outlook for business conditions:

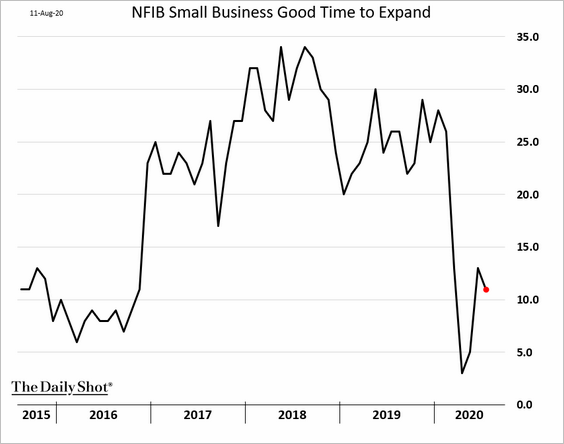

• Good time to expand:

——————–

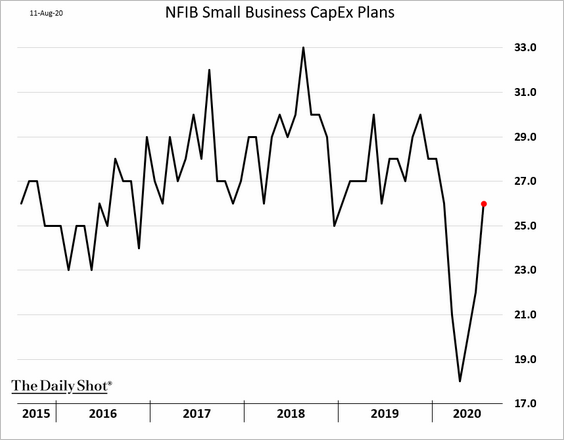

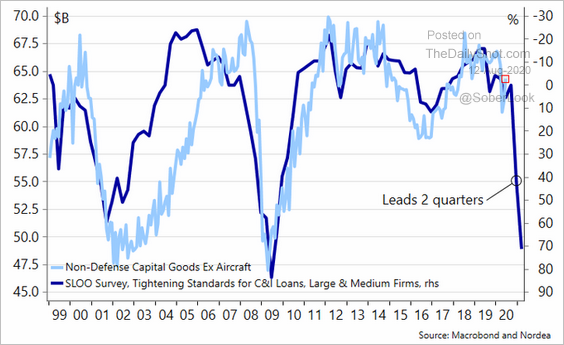

2. Small business CapEx expectations are improving.

But will tighter lending standards hold back business investment?

Source: @meremortenlund

Source: @meremortenlund

——————–

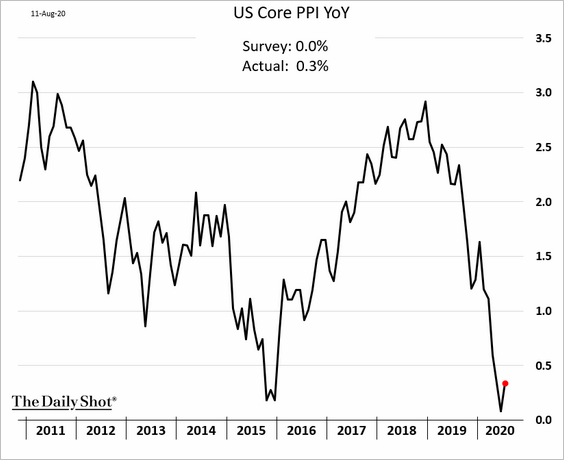

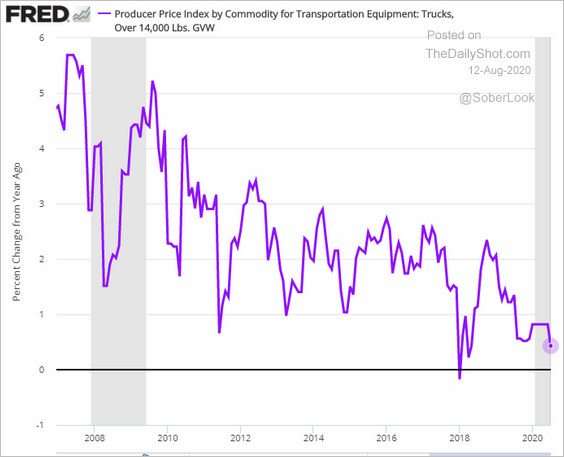

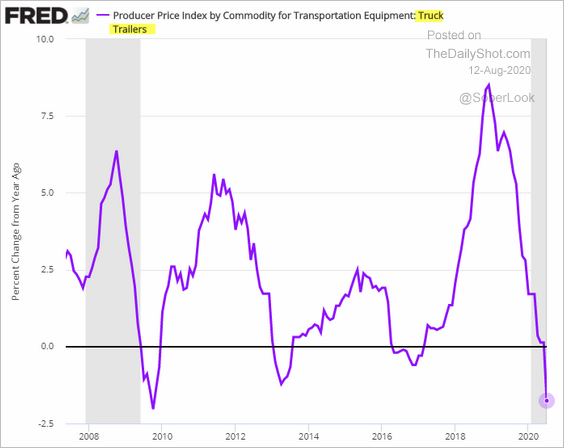

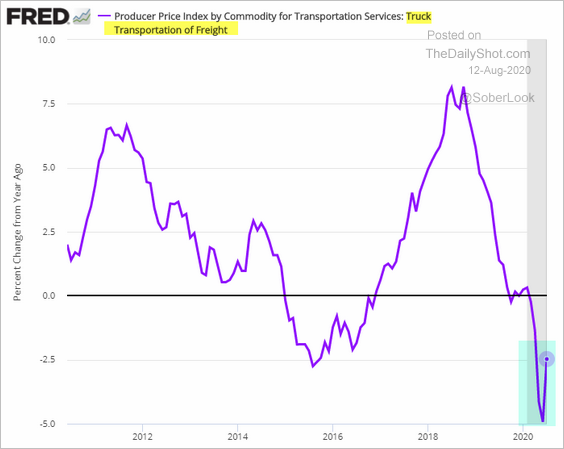

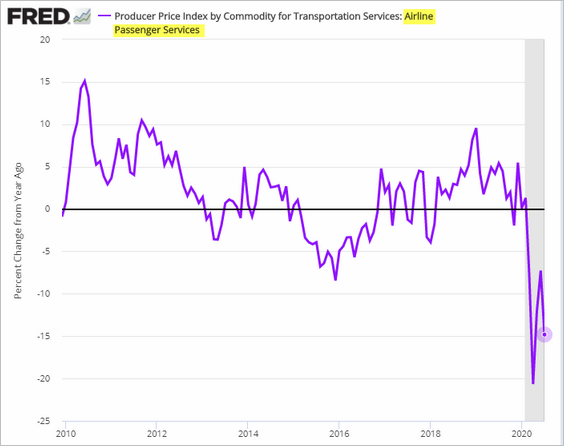

3. Producer price inflation ticked higher in July.

Below are some transportation-related PPI trends.

• Heavy trucks:

• Semi-trailer trucks:

• Truck transportation of freight:

• Airline passenger services:

——————–

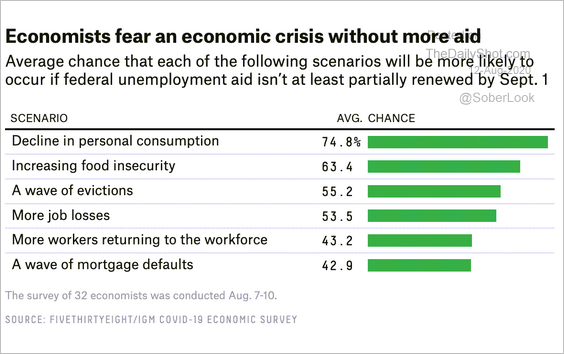

4. With pandemic aid on hold, economists are concerned about the looming income cliff.

Source: @FiveThirtyEight Read full article

Source: @FiveThirtyEight Read full article

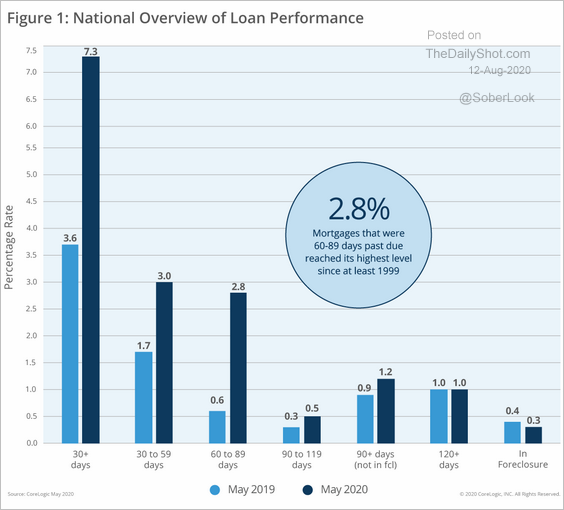

• Mortgage payment delays have skyrocketed.

Source: CoreLogic

Source: CoreLogic

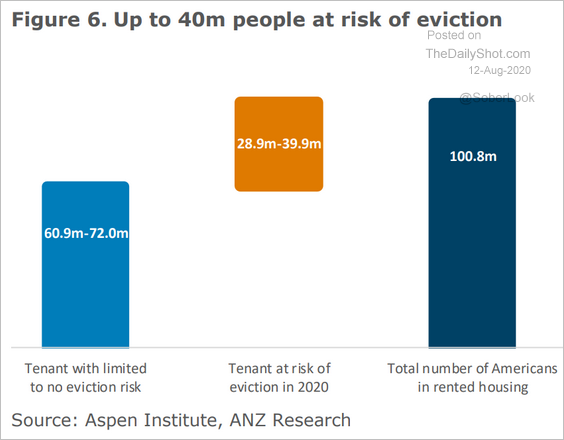

• Eviction numbers could be massive.

Source: ANZ Research

Source: ANZ Research

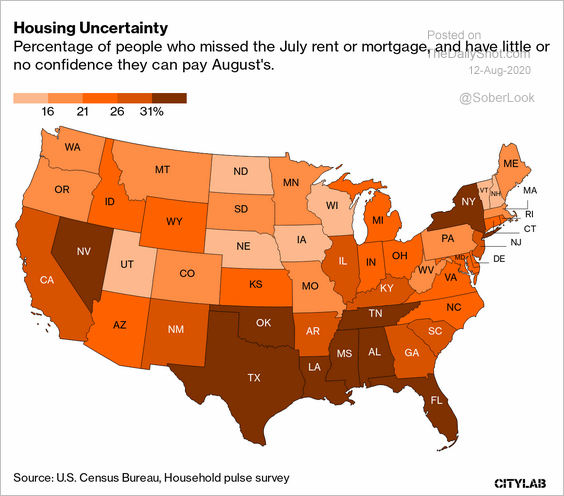

• Missed rent and mortgage payments continued into August.

Source: @citylab Read full article

Source: @citylab Read full article

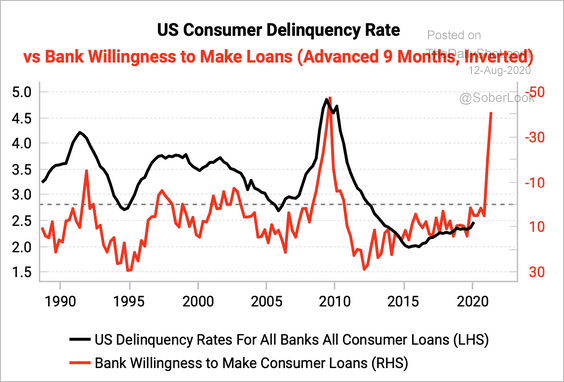

• Moreover, US consumer delinquency rates could rise sharply as banks become risk-averse.

Source: Variant Perception

Source: Variant Perception

——————–

5. US financial conditions are now easier than before the start of the crisis (low rates, tight spreads, a massive stock market rally, and a weaker dollar).

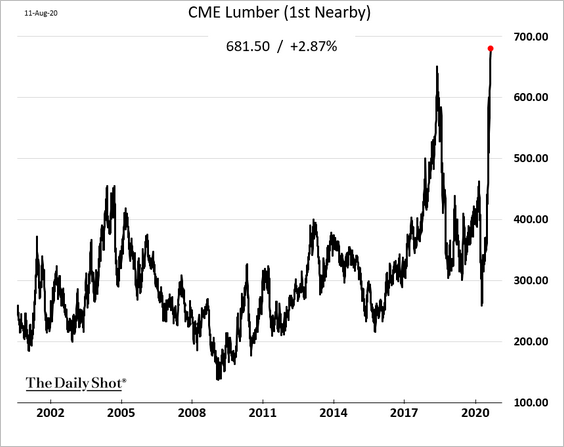

6. Lumber futures hit a record high amid COVID-driven demand for housing.

We could see an acceleration in new home prices.

Source: Builder Read full article

Source: Builder Read full article

——————–

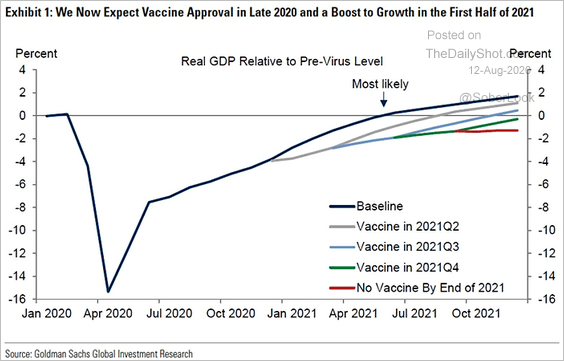

7. Goldman Sachs expects a vaccine approval late this year to boost GDP growth.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

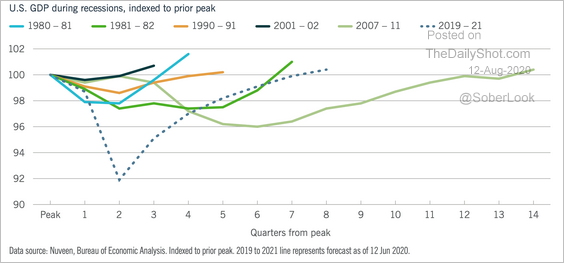

Here is the GDP trajectory forecast from Nuveen.

Source: Nuveen Read full article

Source: Nuveen Read full article

The United Kingdom

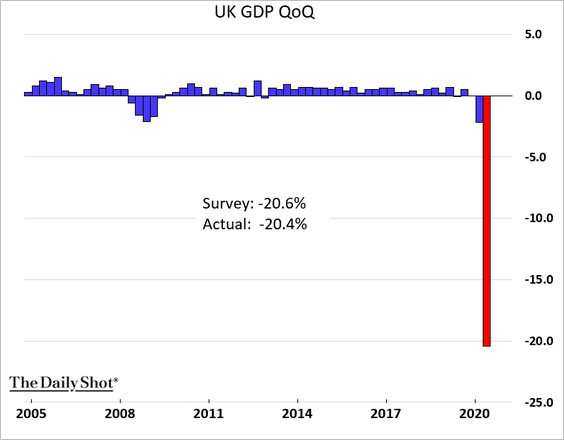

1. As expected, the GDP dipped by over 20% in Q2 (a record). More on the GDP report tomorrow.

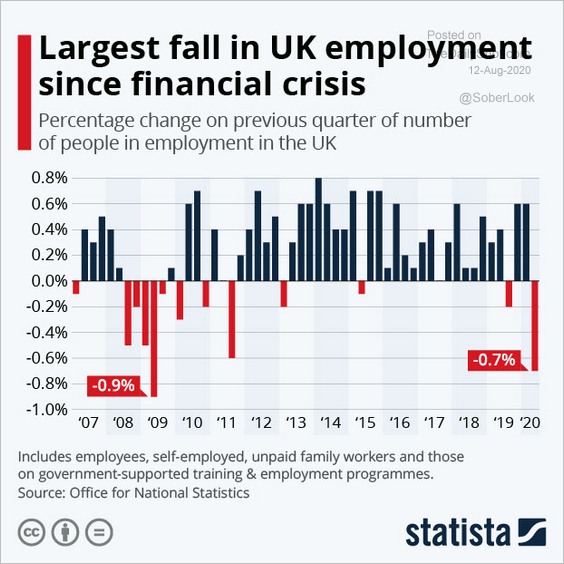

2. Now let’s take a look at the latest jobs report (through June). It’s not a great story.

• Employment decline (not as severe as feared):

Source: Statista

Source: Statista

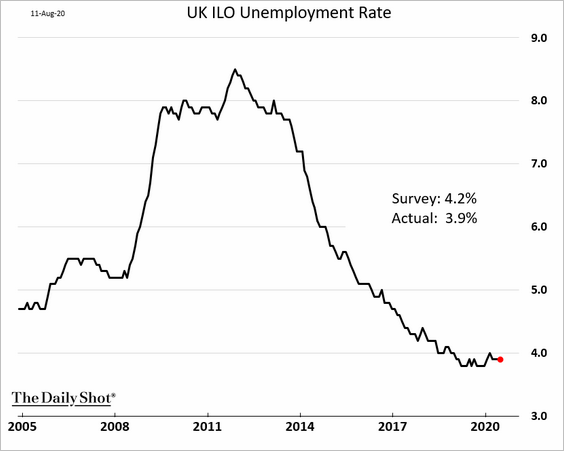

• The unemployment rate (remarkably stable):

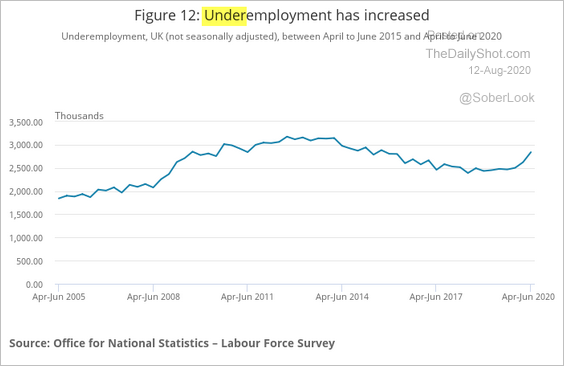

• Underemployment:

Source: ONS

Source: ONS

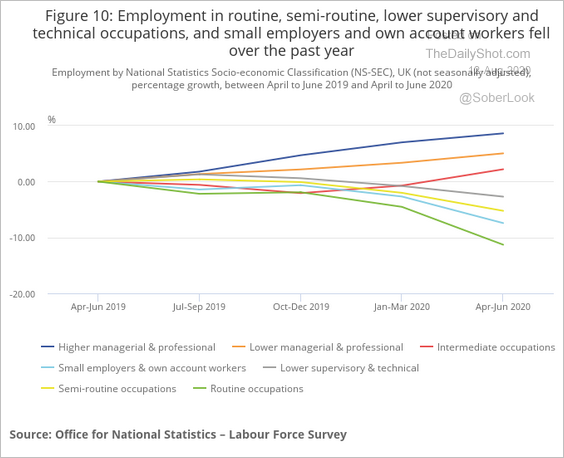

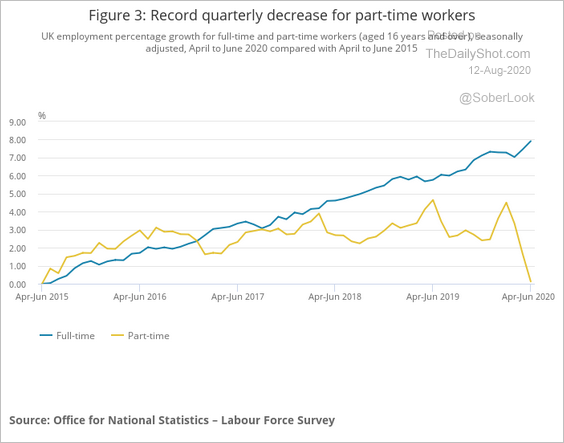

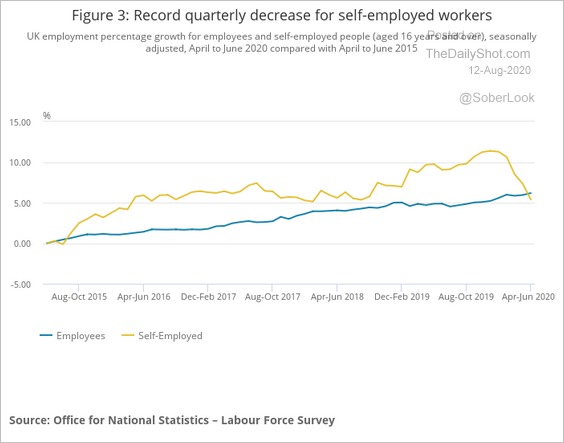

• Employment trajectories by category:

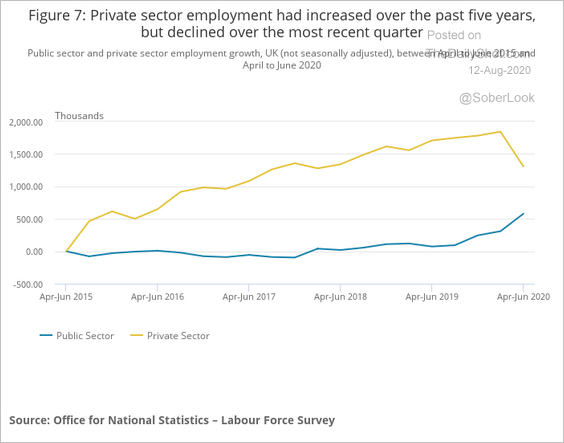

– Private vs. public sectors:

Source: ONS

Source: ONS

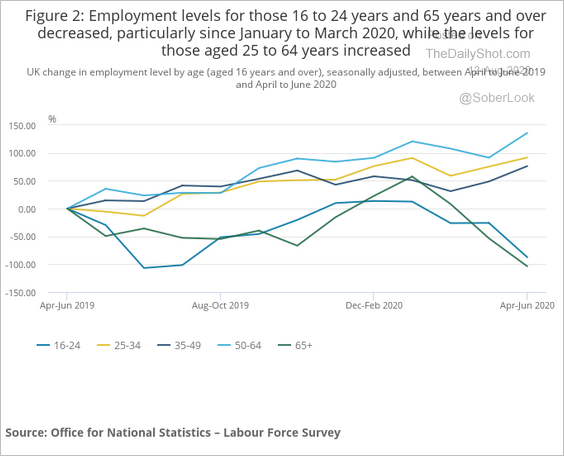

– By age:

Source: ONS

Source: ONS

– Type of employment:

Source: ONS

Source: ONS

– Full-time vs. part-time:

Source: ONS

Source: ONS

– Self-employed:

Source: ONS

Source: ONS

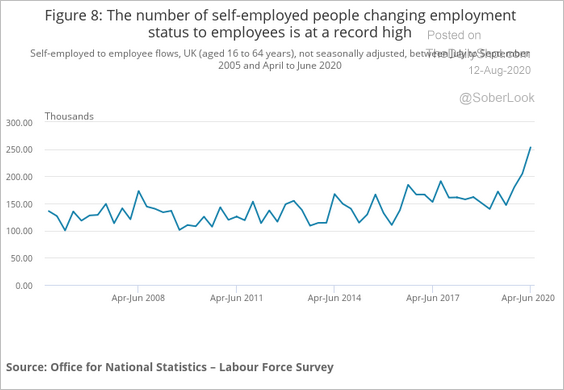

• Flows from self-employed to employed:

Source: ONS

Source: ONS

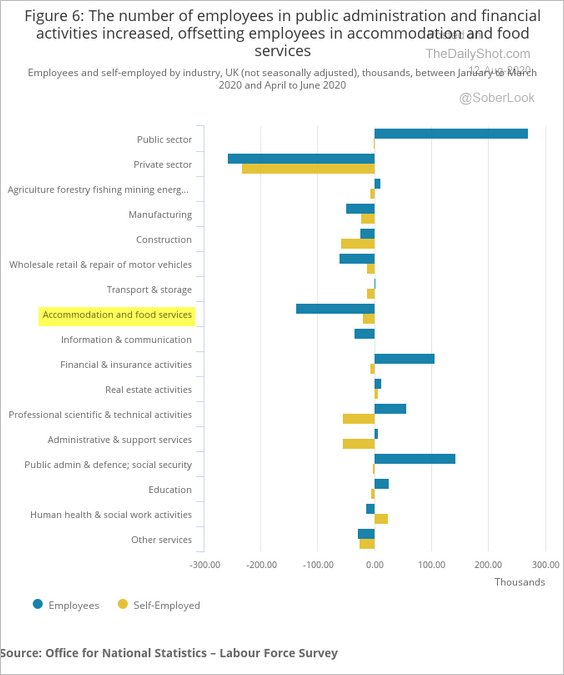

• Employment changes by sector:

Source: ONS

Source: ONS

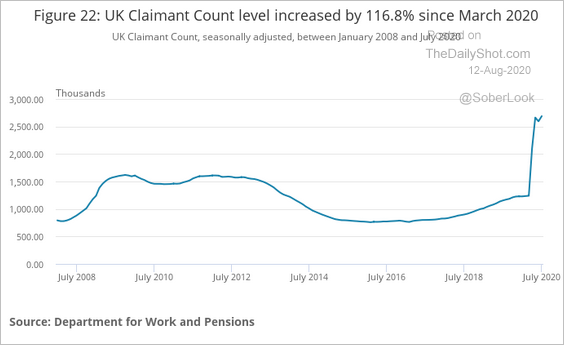

• Total unemployment claims:

Source: ONS

Source: ONS

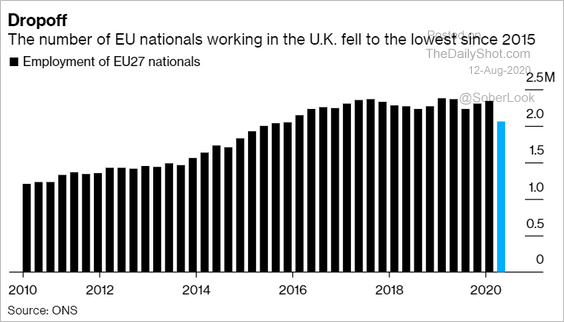

• EU nationals:

Source: @business Read full article

Source: @business Read full article

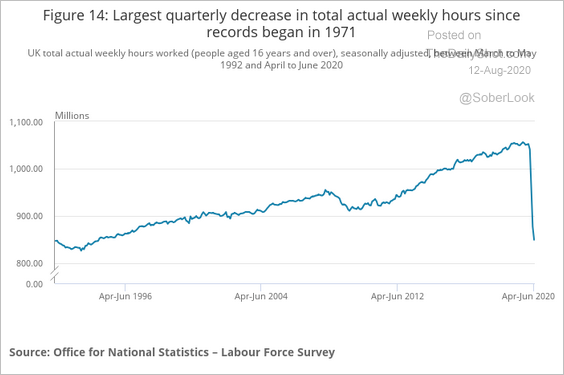

• Hours worked:

Source: ONS

Source: ONS

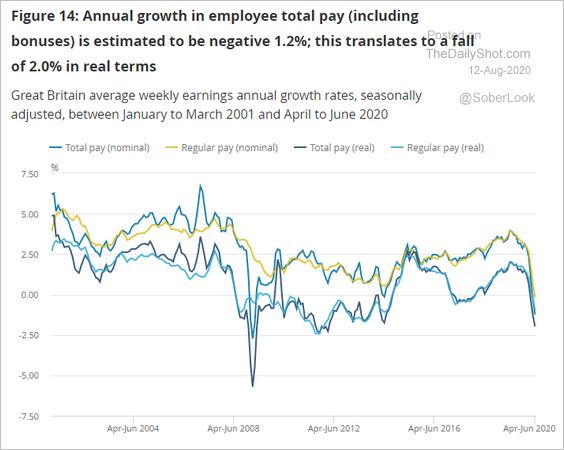

• Earnings growth:

Source: ONS

Source: ONS

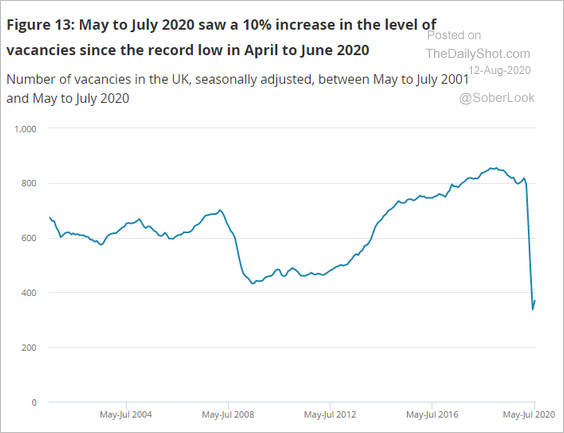

• Job openings:

Source: ONS

Source: ONS

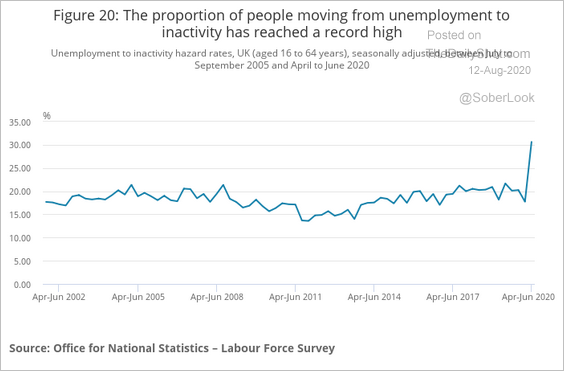

• Leaving the labor force:

Source: ONS

Source: ONS

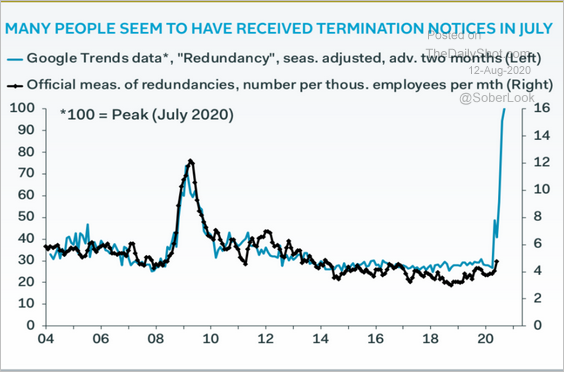

• Termination notices (through July):

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The Eurozone

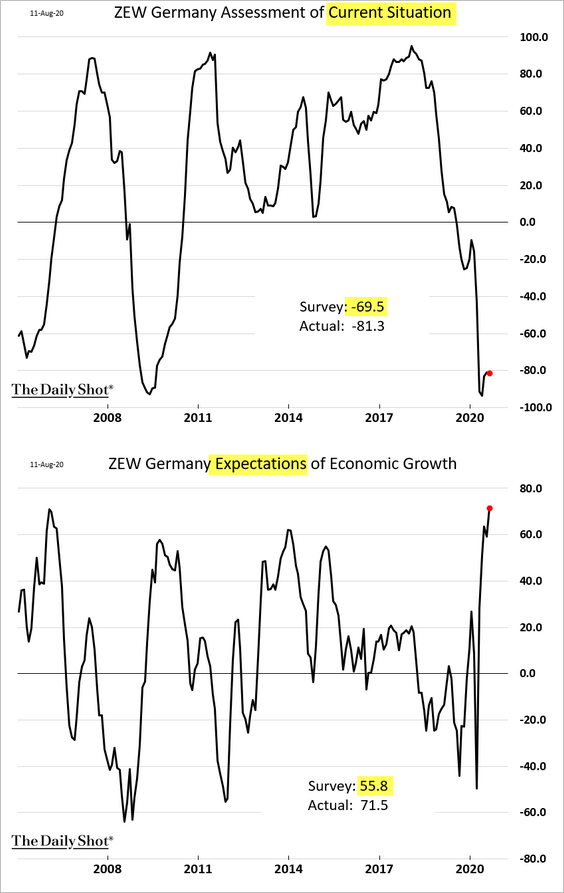

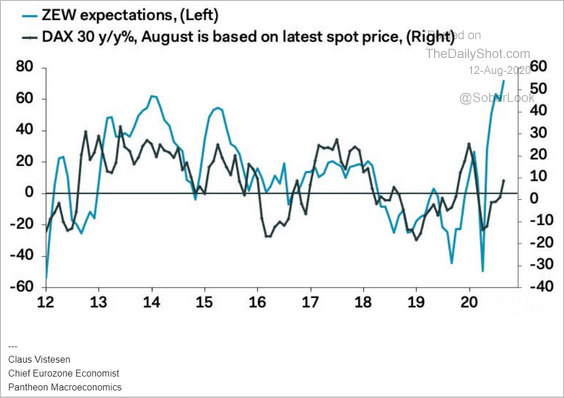

1. Germany’s ZEW economic expectations index was shockingly strong this month, diverging massively from the current conditions index.

Will this optimism convert into higher stock prices?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

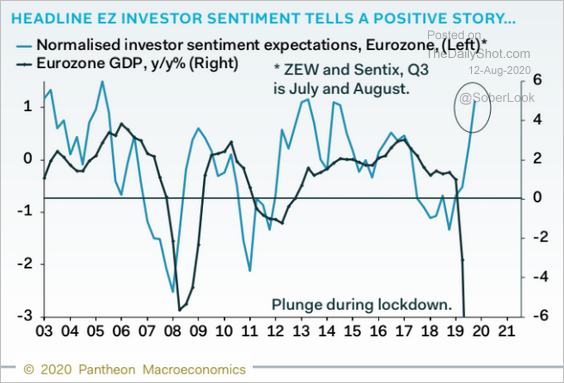

It certainly points to a sharp rebound in growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

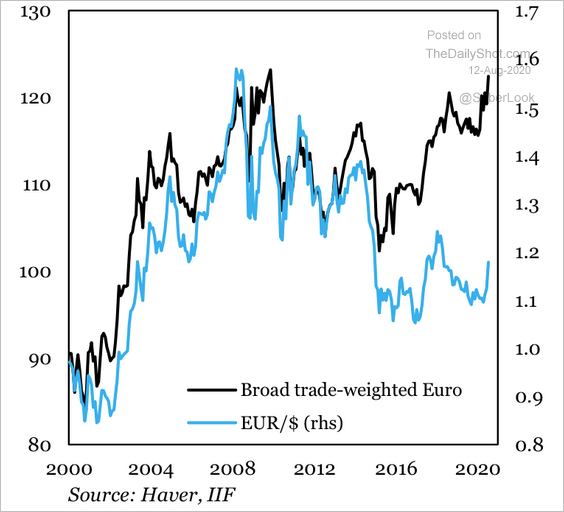

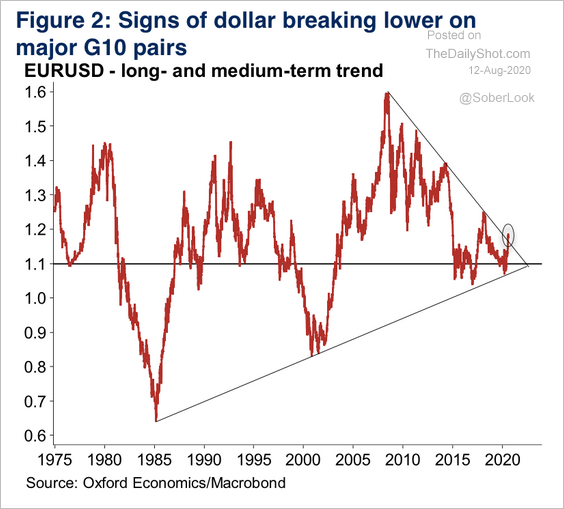

2. The broad trade-weighted euro had diverged from EUR/USD in 2016.

Source: IIF

Source: IIF

EUR/USD is attempting a break above its decade-long downtrend.

Source: Oxford Economics

Source: Oxford Economics

For now, the euro is back below $1.18.

——————–

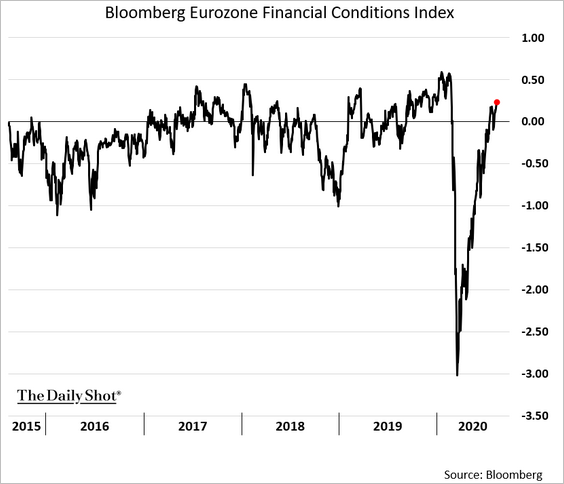

3. Financial conditions continue to ease.

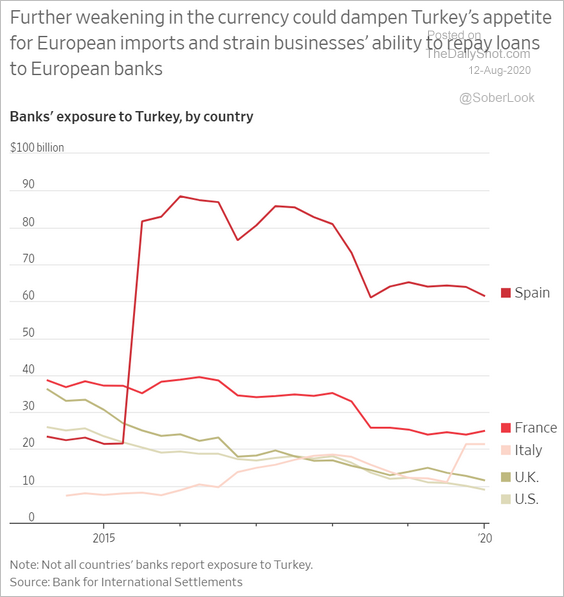

4. Some Eurozone banks have substantial exposure to Turkey.

Source: @WSJ Read full article

Source: @WSJ Read full article

Europe

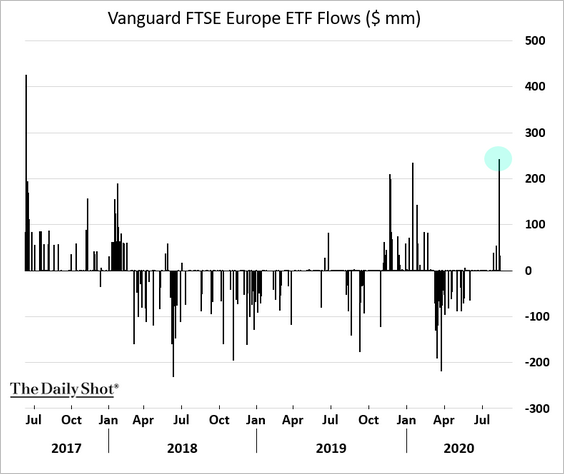

1. Vanguard’s dollar-denominated Europe ETF got some inflows recently.

Source: @ksengal

Source: @ksengal

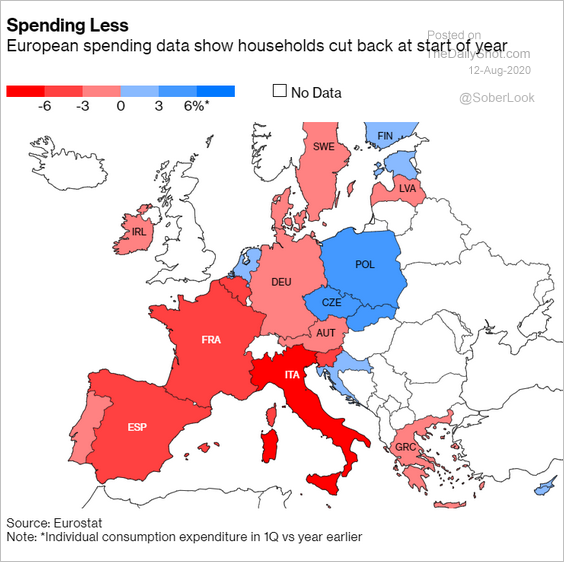

2. This map shows consumer spending changes in Q1.

Source: @markets Read full article

Source: @markets Read full article

Asia – Pacific

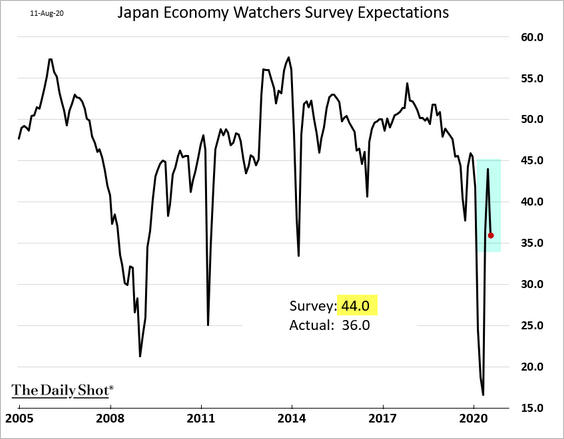

1. Japan’s Economy Watchers Expectations index unexpectedly tumbled again in July.

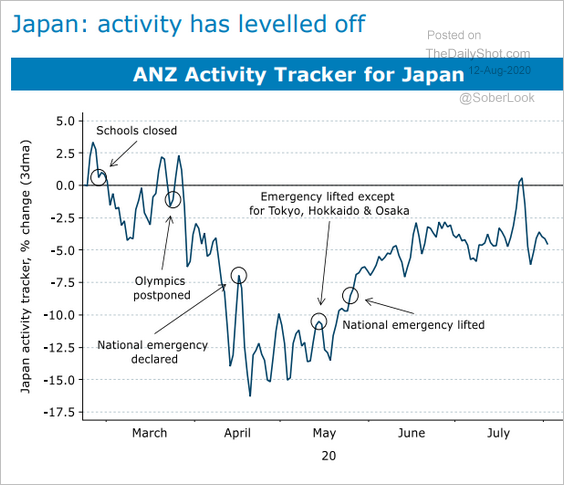

Here is ANZ’s activity tracker.

Source: ANZ Research

Source: ANZ Research

——————–

2. Asian currencies have been trending higher.

Source: @markets Read full article

Source: @markets Read full article

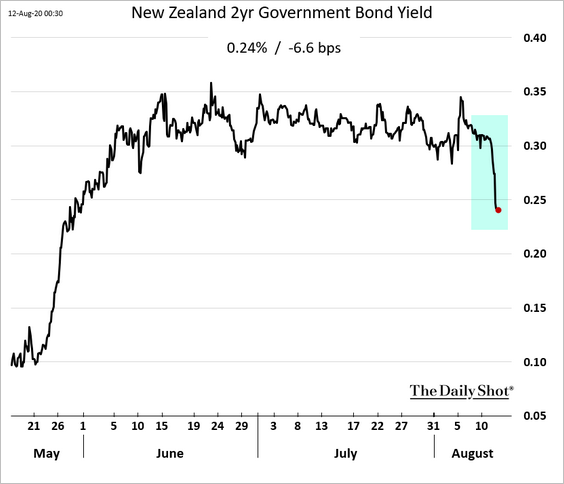

3. New Zealand’s central bank is expanding bond purchases, sending yields lower.

Source: @markets Read full article

Source: @markets Read full article

——————–

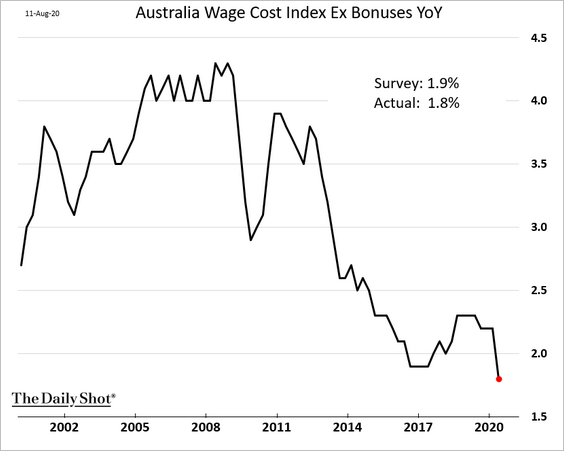

4. Australia’s wage growth fell sharply this year.

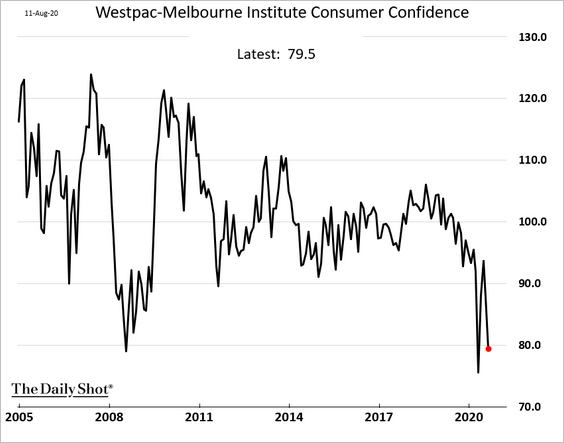

Australia’s economic confidence is back near extreme lows.

China

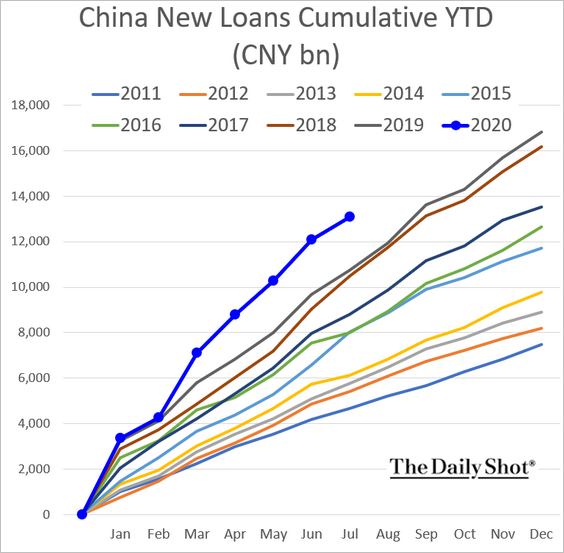

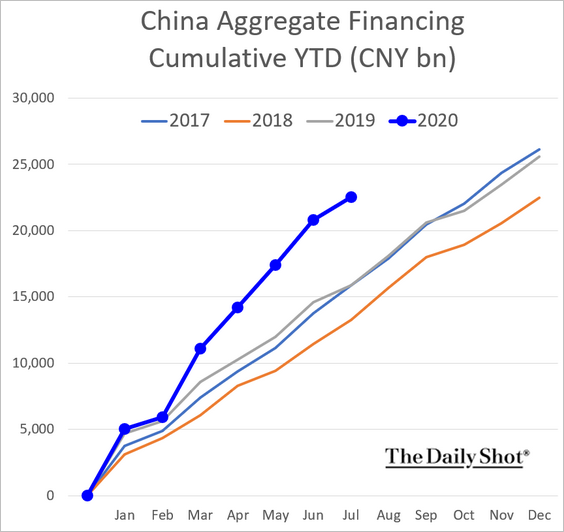

1. Loan growth slowed somewhat last month, but the cumulative year-to-date credit expansion remains well above last year’s.

Money supply growth has been sluggish relative to other periods of Beijing’s stimulus injections.

——————–

2. The stock market rally has stalled.

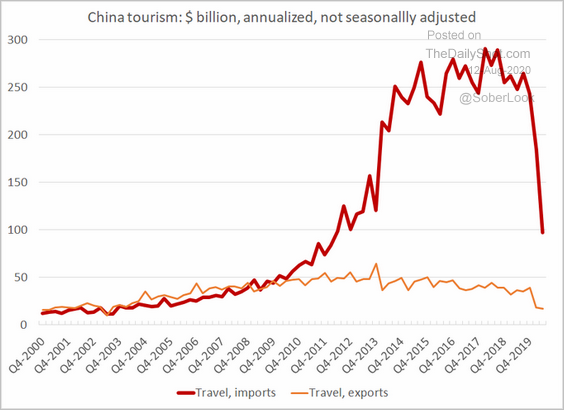

3. This chart shows China’s inbound and outbound tourism.

Source: @Brad_Setser

Source: @Brad_Setser

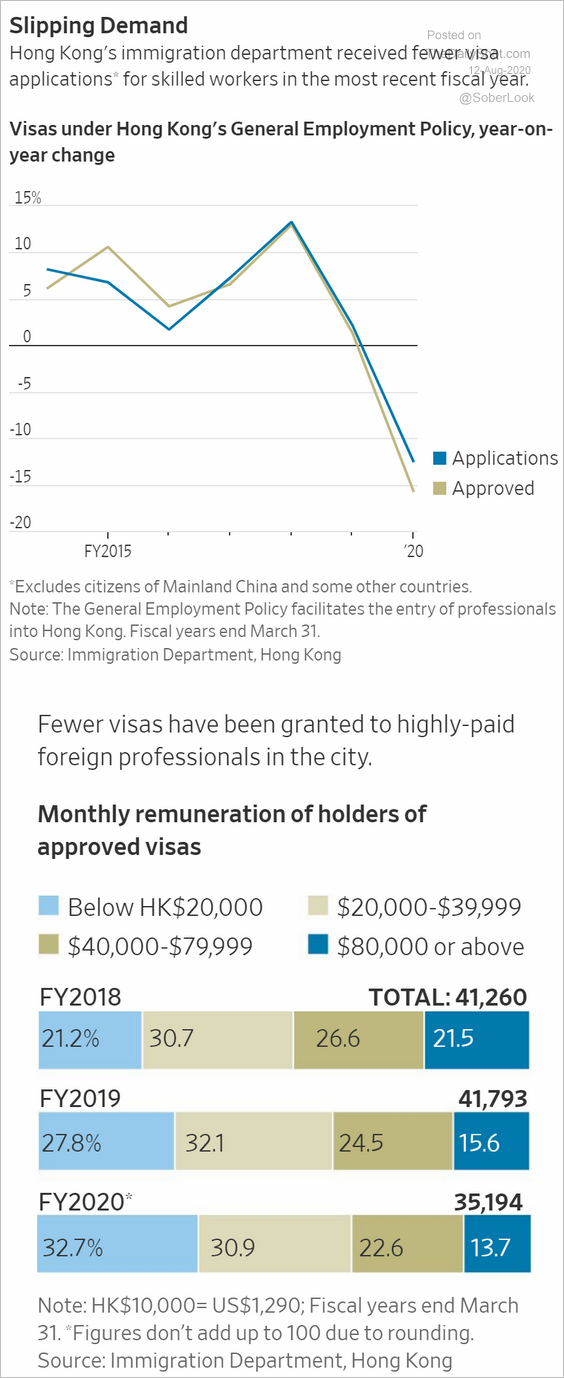

4. Skilled foreign workers are shying away from Hong Kong.

Source: @WSJ Read full article

Source: @WSJ Read full article

Emerging Markets

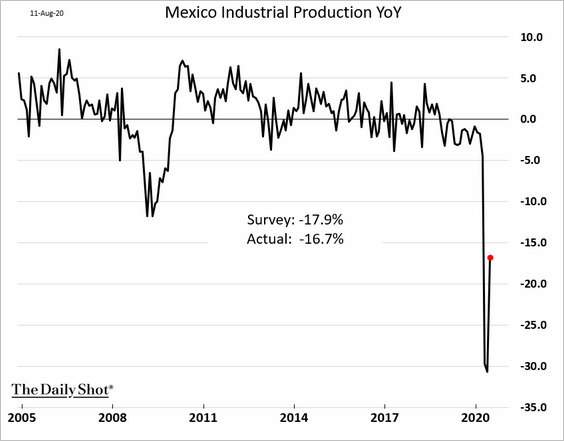

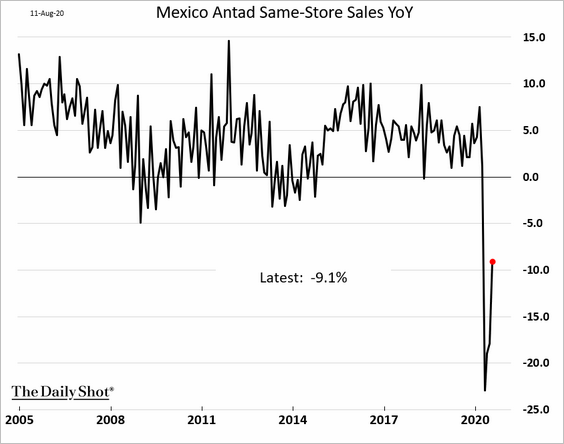

1. Mexico’s industrial production firmed up in June, boosted by US demand for vehicles.

Same-store sales improved last month but remained well below normal levels.

——————–

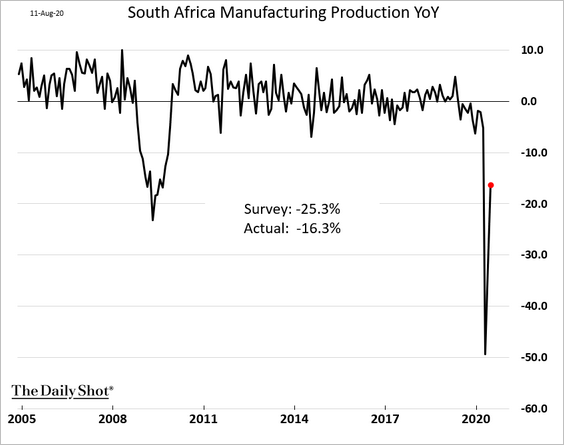

2. South Africa’s factory output is rebounding rapidly (as of June).

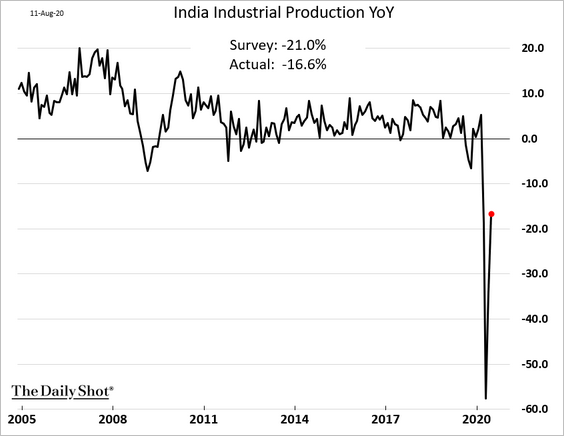

3. India’s industrial production surprised to the upside.

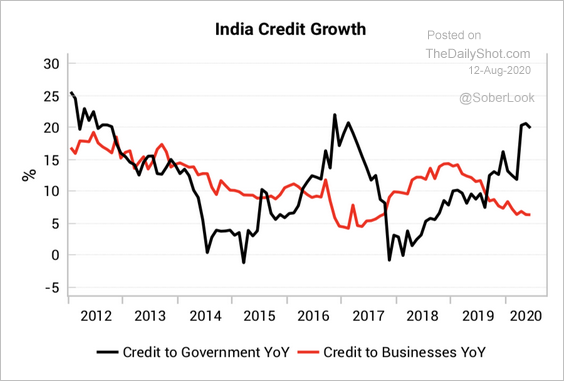

Separately, this chart shows government vs. business credit growth.

Source: Variant Perception

Source: Variant Perception

Commodities

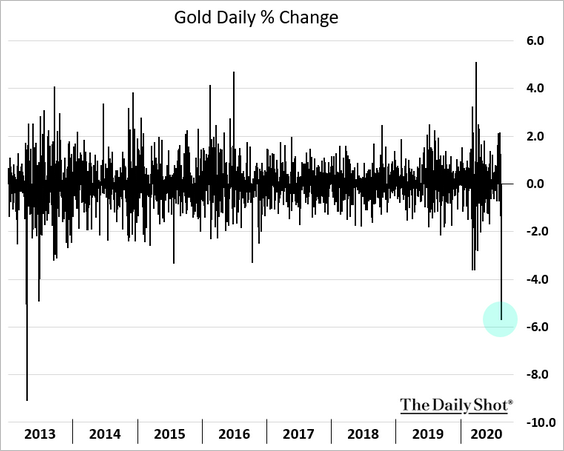

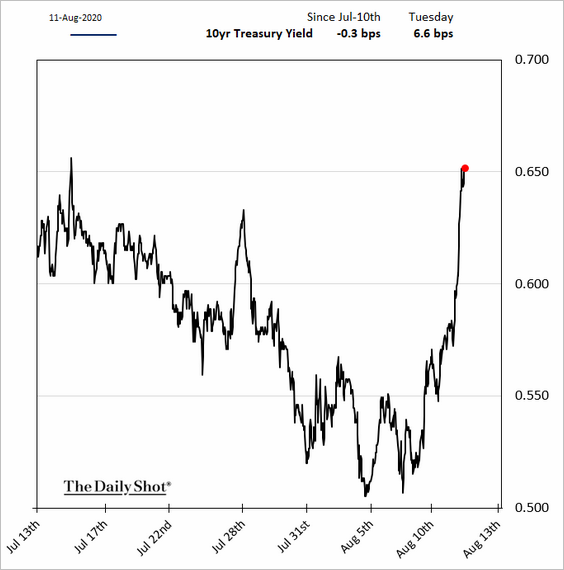

1. Precious metals took a hit on Tuesday as Treasury yields jumped (see the rates section).

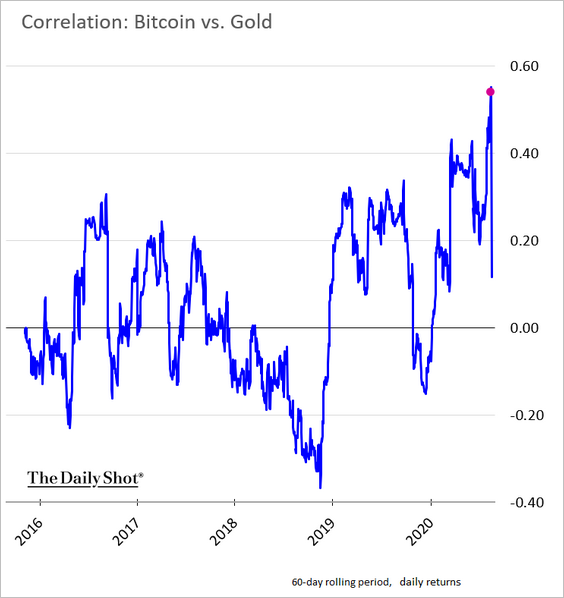

Separately, the correlation between Bitcoin and gold rose to a multi-year high.

——————–

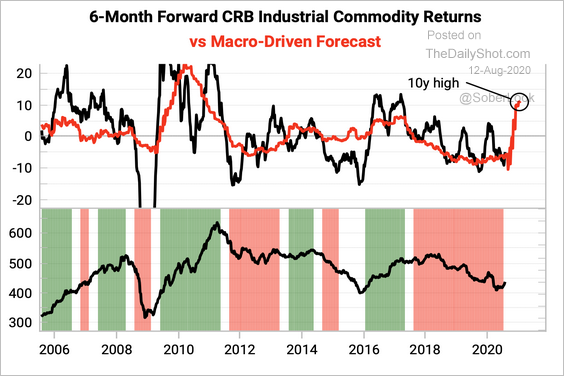

2. Variant Perception forecasts higher industrial commodity prices, mostly driven by the expansion of liquidity in China.

Source: Variant Perception

Source: Variant Perception

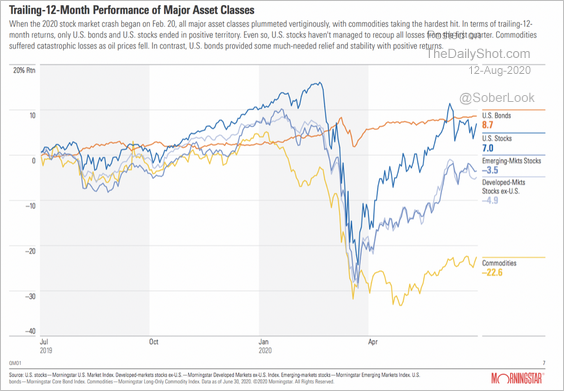

Commodities have been hit especially hard this year, and have lagged the risk-on rally since March.

Source: Morningstar

Source: Morningstar

——————–

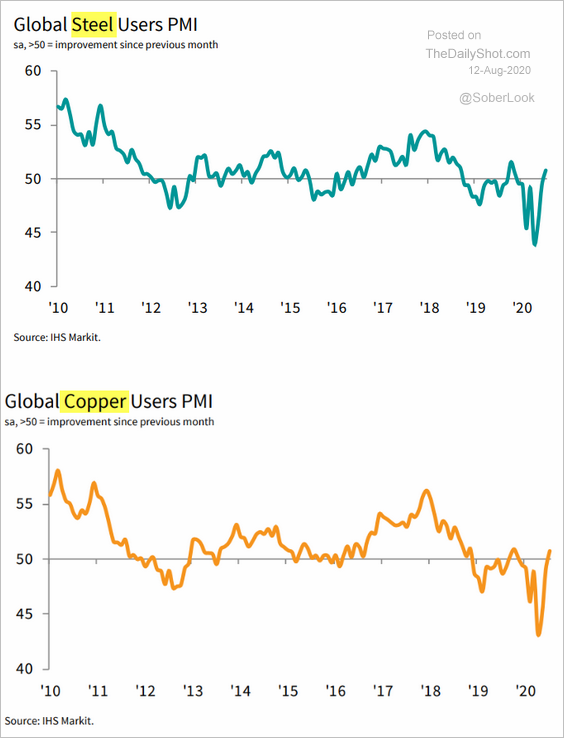

3. Purchasing activity in steel and copper is back in growth mode.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

Energy

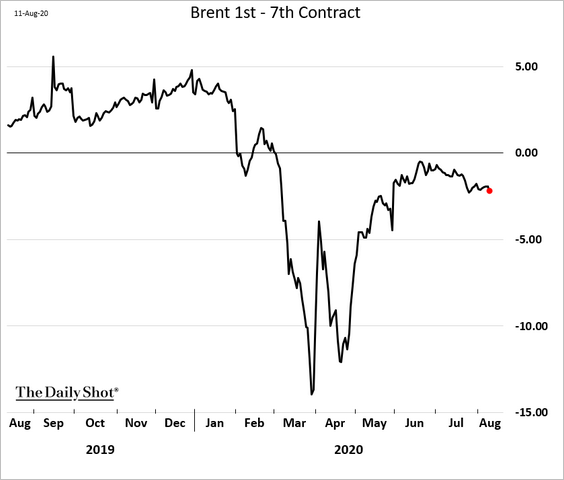

1. Brent crude is moving further into contango.

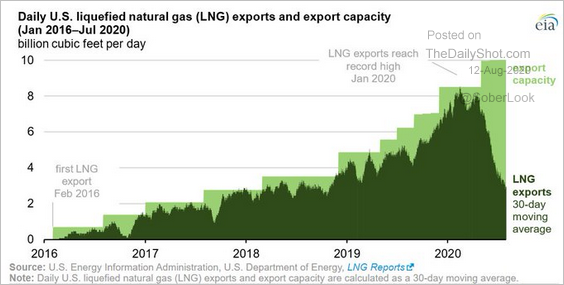

2. The decline in US LNG exports has been extraordinary.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

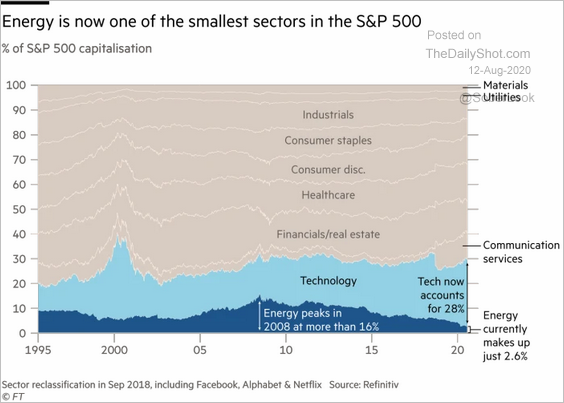

3. Energy is now one of the smallest sectors in the S&P 500.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. The decline in US weekly railcar loadings this year reflects less demand for coal internationally and less generation at domestic coal-fired plants, according to the EIA.

Source: EIA Read full article

Source: EIA Read full article

Equities

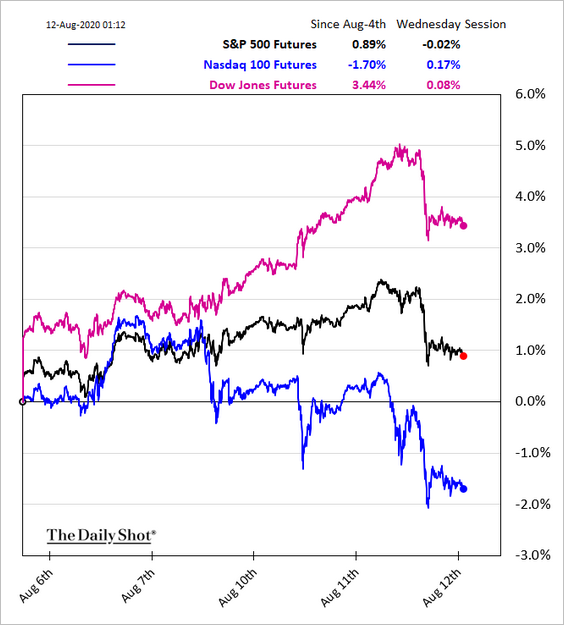

1. Stock investors were spooked by rising Treasury yields (see the rates section) and the pandemic aid impasse. Tech shares continue to underperform.

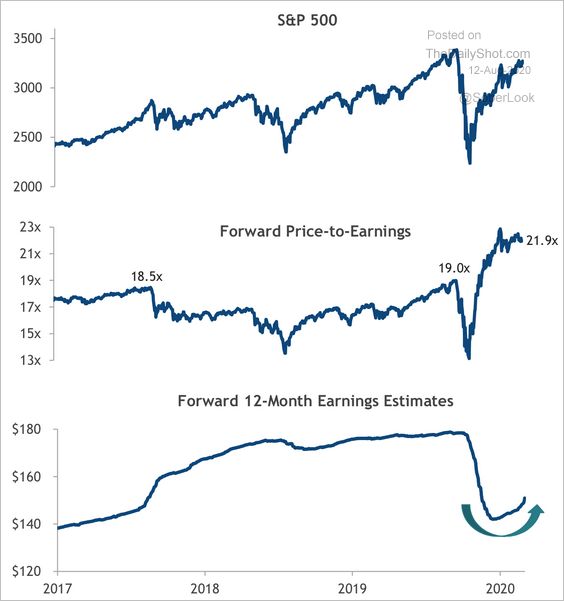

2. S&P 500 valuations are stretched, although earnings estimates are now rising.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

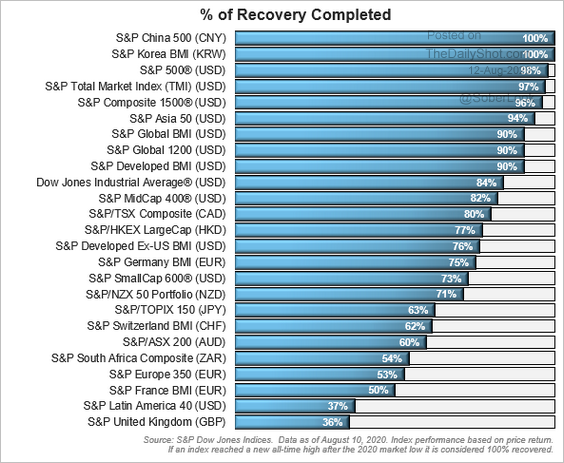

3. How much of the pandemic losses have the various markets/indices now recovered?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

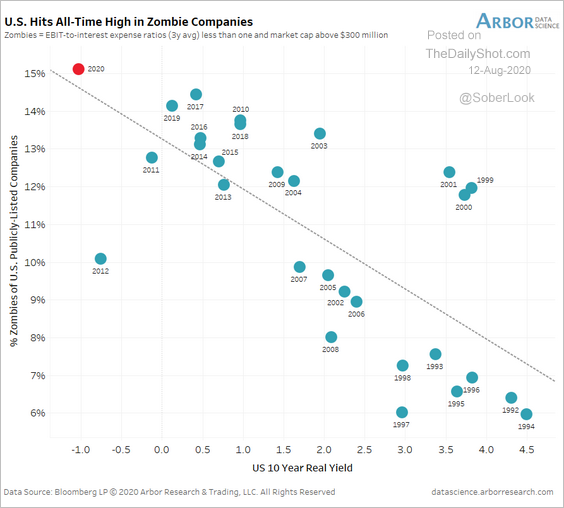

4. There are quite a few “zombie” companies in the US now.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

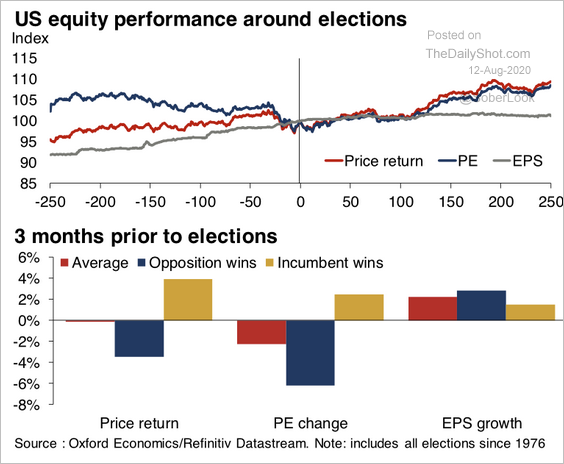

5. US equities tend to struggle three months prior to a presidential election.

Source: Oxford Economics

Source: Oxford Economics

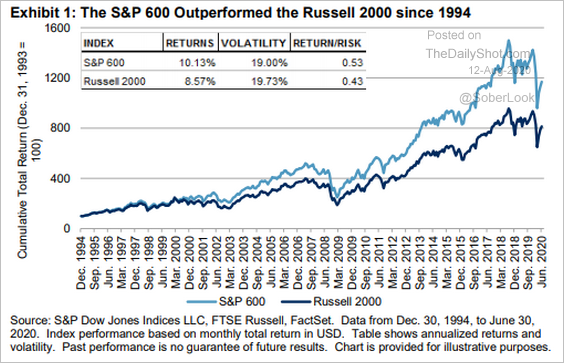

6. This chart shows the long-term relative performance of the S&P 500 and Russell 2000.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

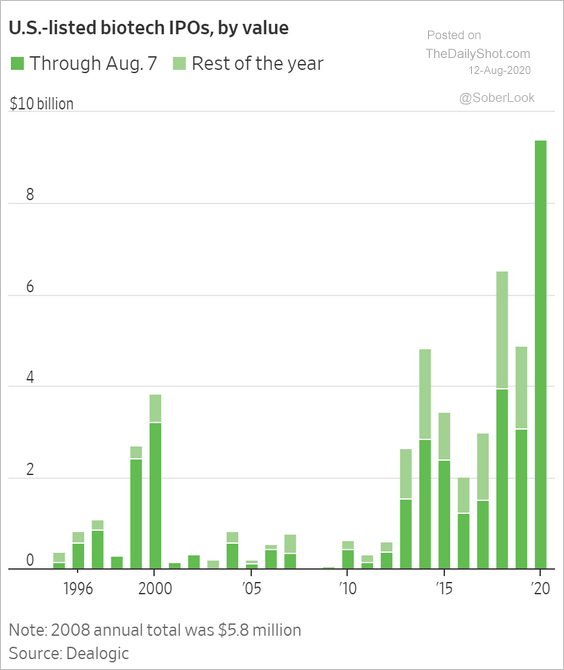

7. Finally, we have a couple of sector updates.

• Biotech IPOs:

Source: @WSJ Read full article

Source: @WSJ Read full article

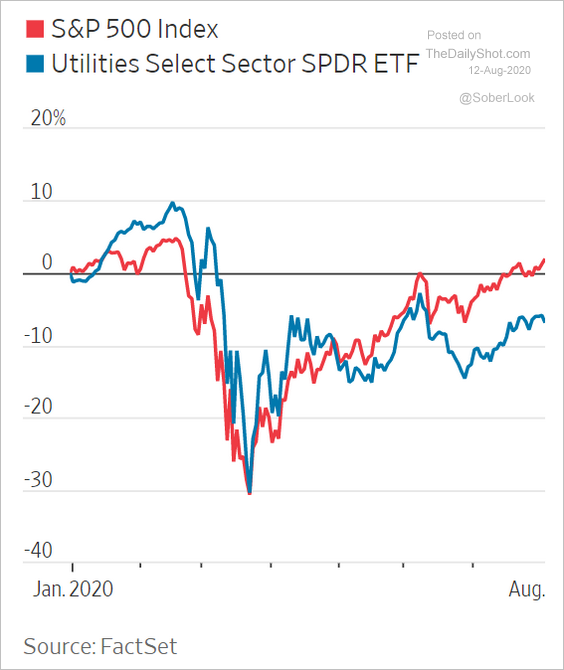

• Utilities underperforming:

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

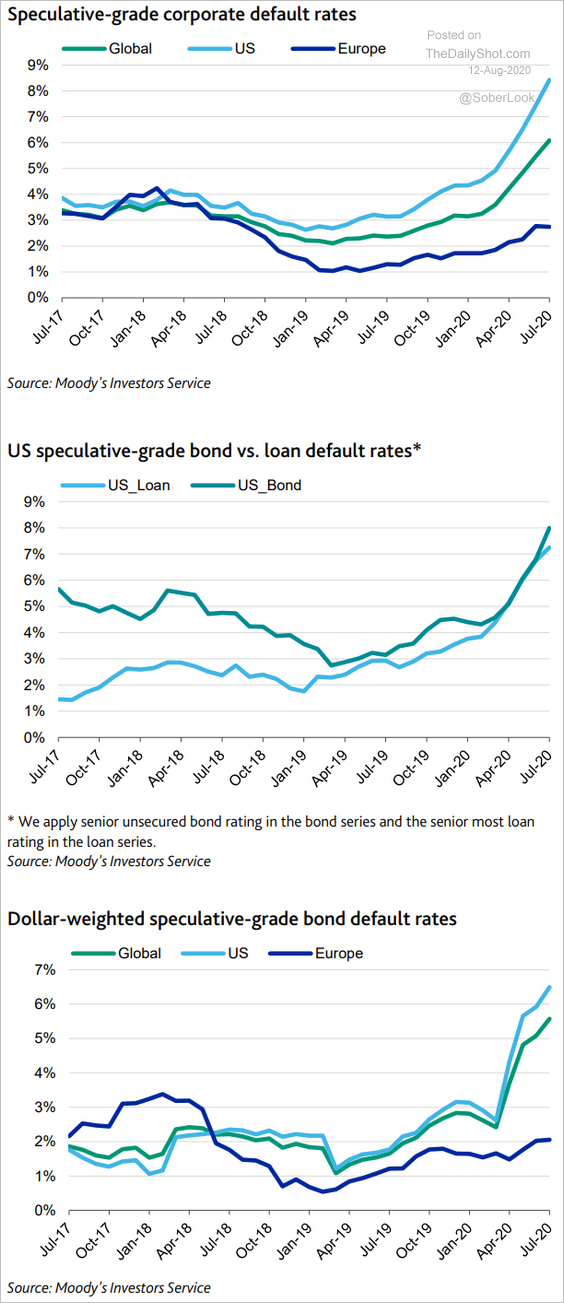

1. Speculative-grade default rates are grinfing higher.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

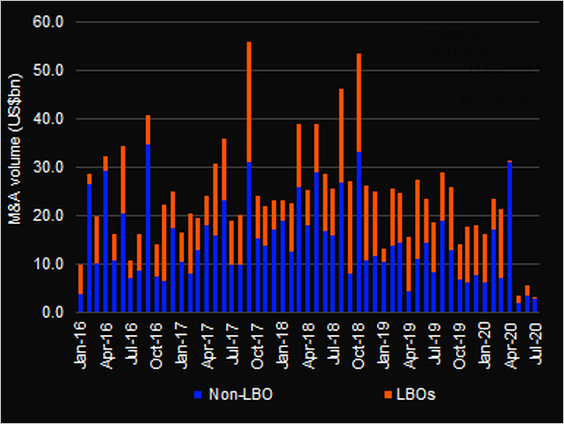

2. LBO activity has slowed.

Source: @LPCLoans, @refinitiv

Source: @LPCLoans, @refinitiv

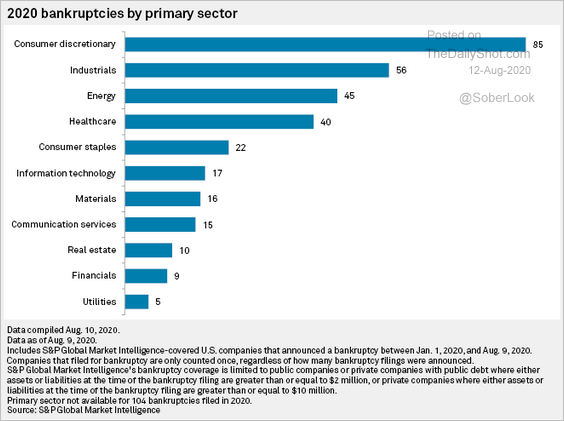

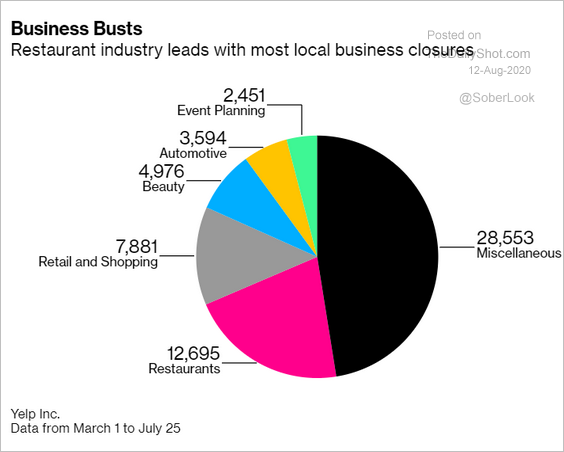

3. Here are two charts on business defaults/closures by sector.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: @business Read full article

Source: @business Read full article

Rates

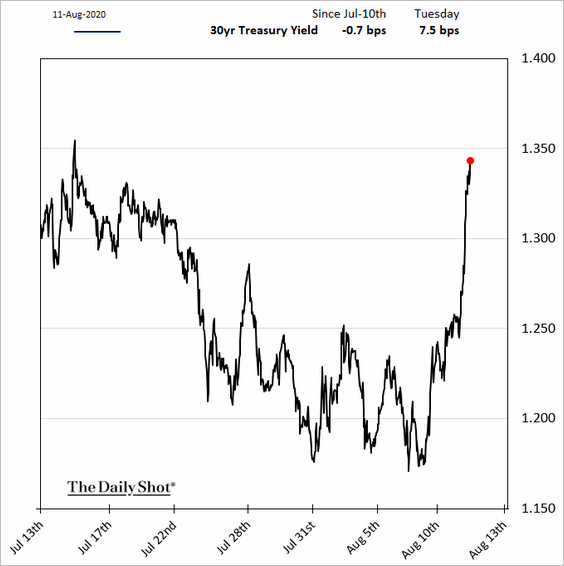

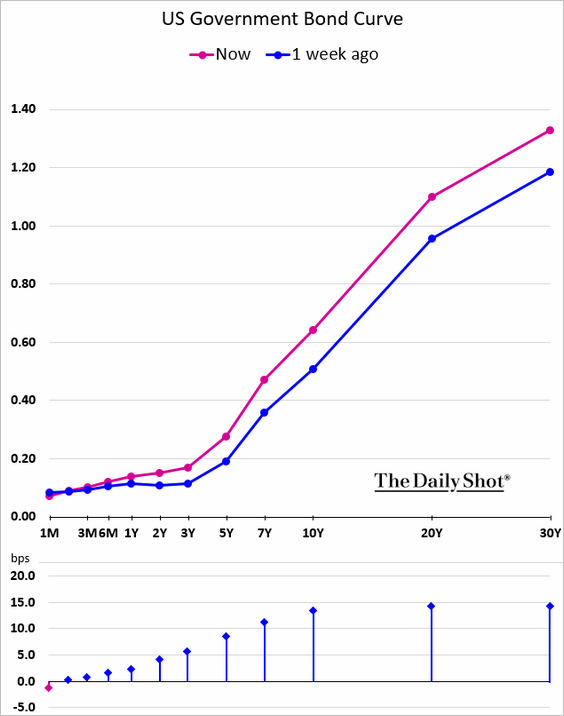

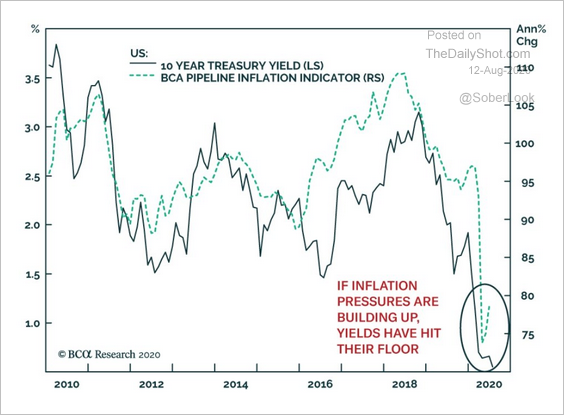

1. Treasury yields rose sharply on Tuesday, sending shockwaves through equity and precious metals markets.

The curve steepened.

• Bond investors are nervous about inflation.

Source: @Scutty, @bcaresearch

Source: @Scutty, @bcaresearch

• However, given the sideways movements in crude oil, have inflation expectations overshot?

Source: Piper Sandler

Source: Piper Sandler

——————–

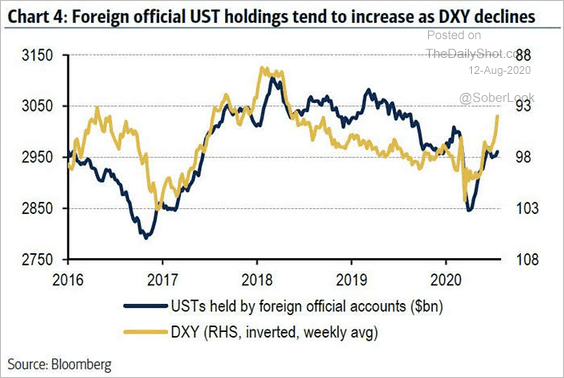

2. Foreigners tend to boost their Treasury holdings when the dollar weakens.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

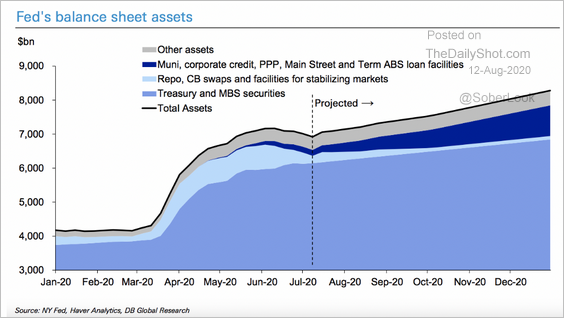

3. Here is Deutschebank’s forecast for the Fed’s balance sheet.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

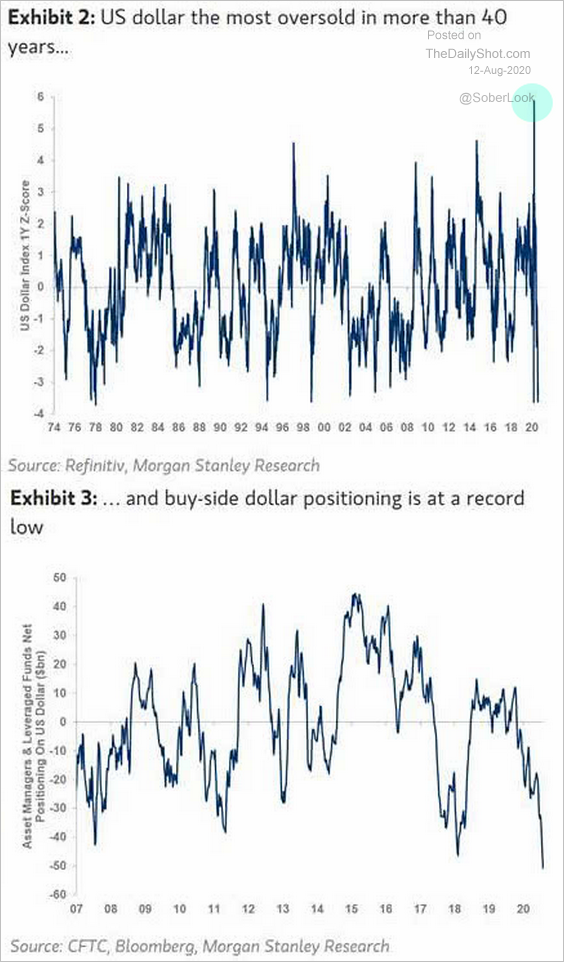

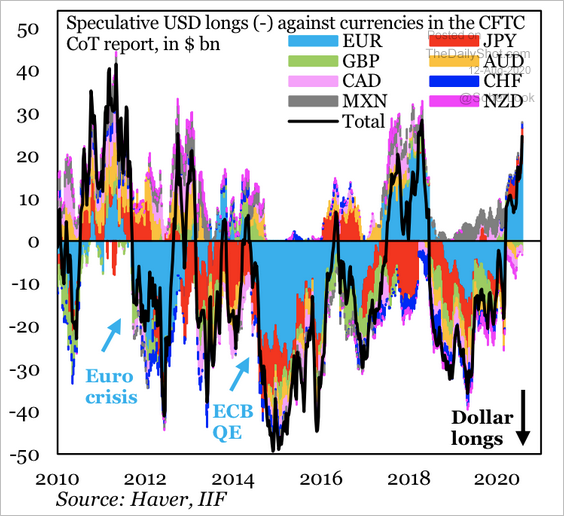

1. Betting against the US dollar has become a crowded trade.

Source: Morgan Stanley Research, @BofAML

Source: Morgan Stanley Research, @BofAML

Source: IIF

Source: IIF

——————–

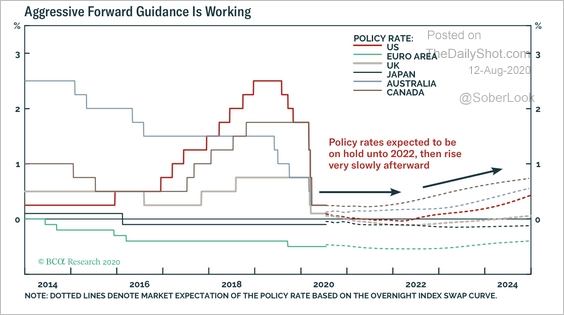

2. BCA Research expects policy rates to rise very slowly after 2022.

Source: BCA Research

Source: BCA Research

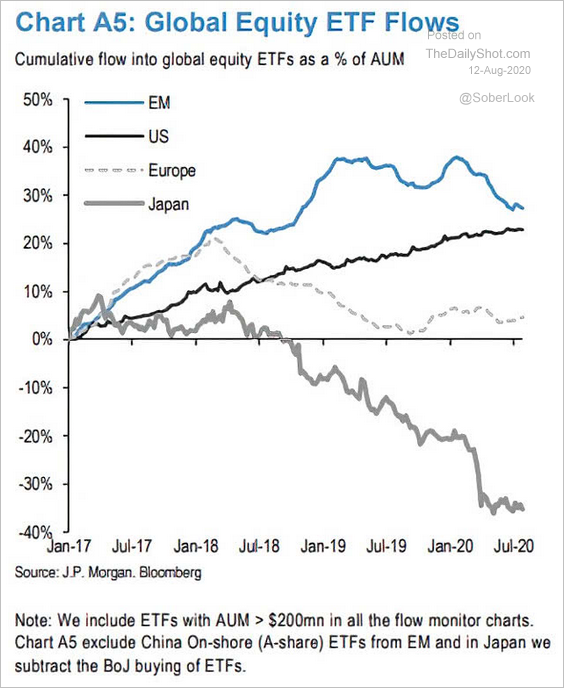

3. Finally, this chart shows global equity ETF flows.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

——————–

Food for Thought

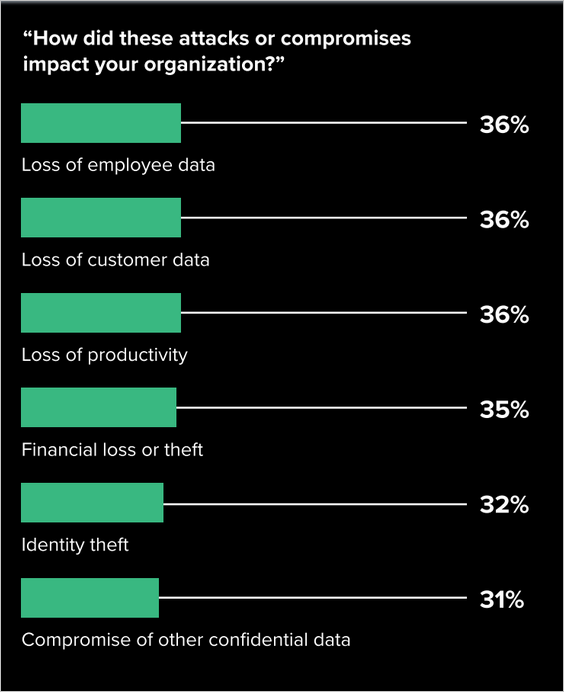

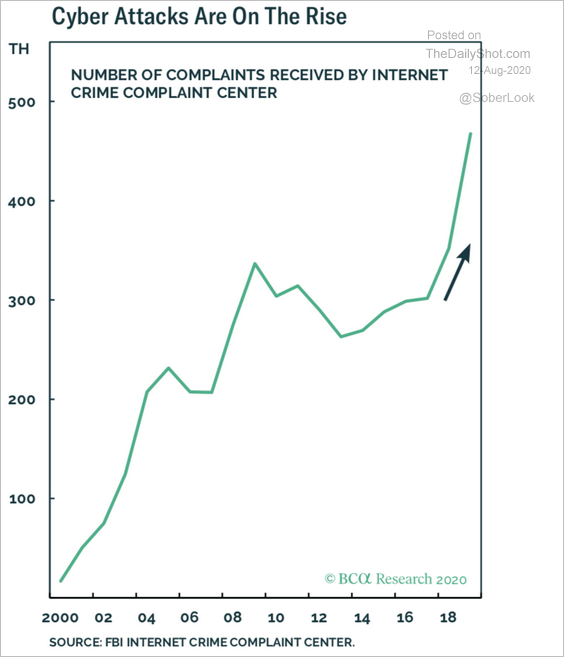

1. Cyberattacks during the pandemic (2 charts):

Source: Forrester Consulting Read full article

Source: Forrester Consulting Read full article

Source: Forrester Consulting Read full article

Source: Forrester Consulting Read full article

A longer-term trend:

Source: BCA Research

Source: BCA Research

——————–

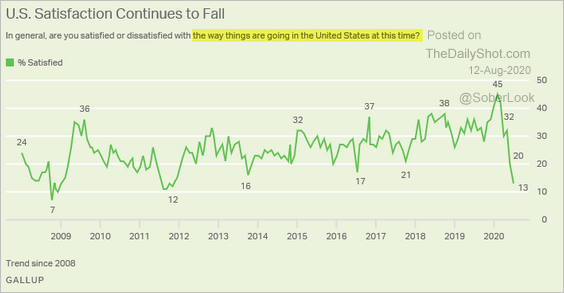

2. Satisfaction with the way things are going in the US:

Source: Gallup

Source: Gallup

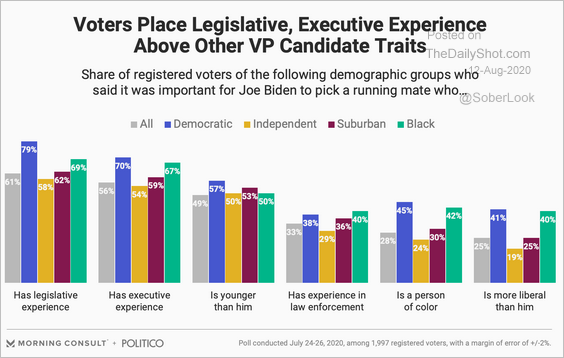

3. Voters’ views on VP candidate traits:

Source: Morning Consult

Source: Morning Consult

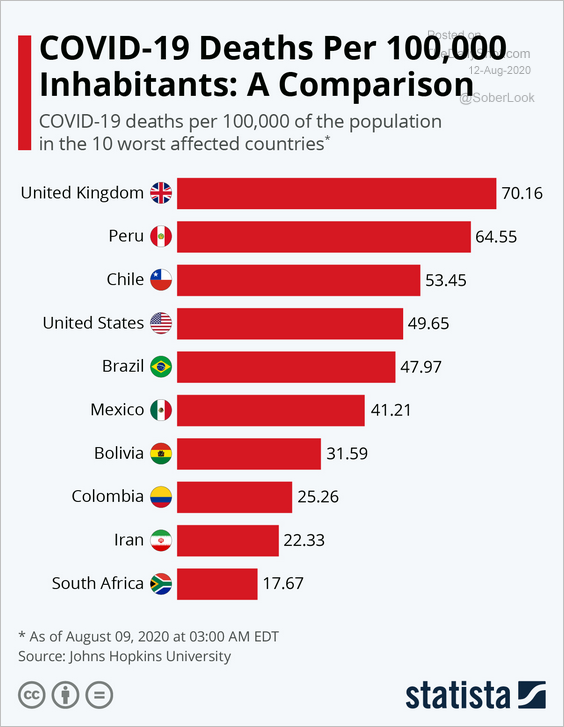

4. COVID deaths:

Source: Statista

Source: Statista

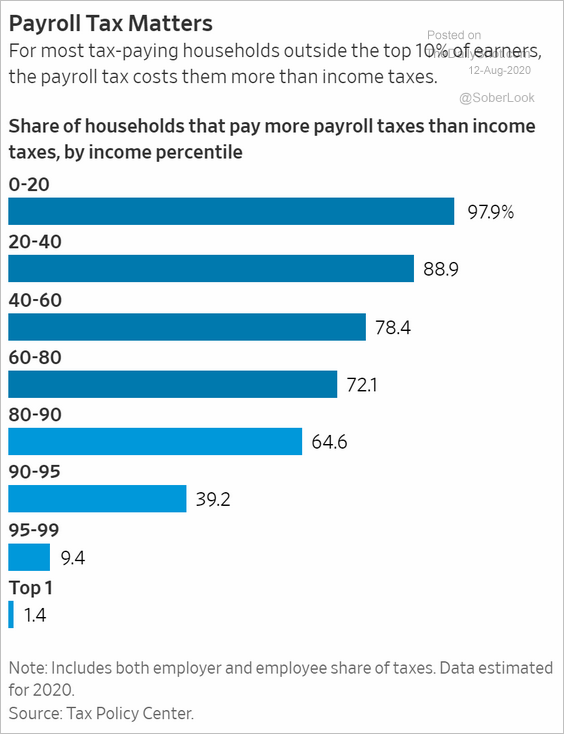

5. Payroll taxes vs. income taxes:

Source: @WSJ Read full article

Source: @WSJ Read full article

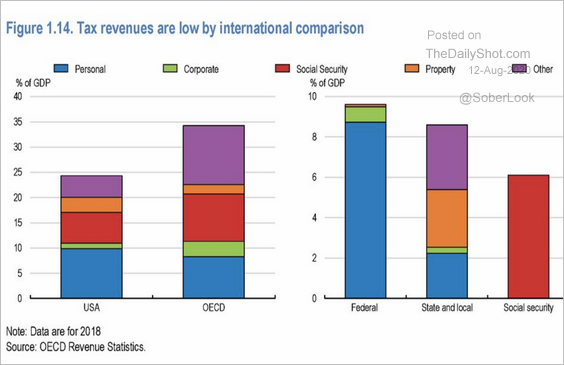

6. Tax revenues:

Source: OECD Read full article

Source: OECD Read full article

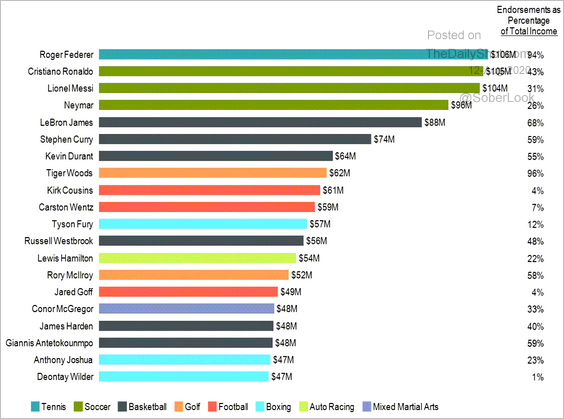

7. Highest-paid athletes:

Source: Mekko Graphics

Source: Mekko Graphics

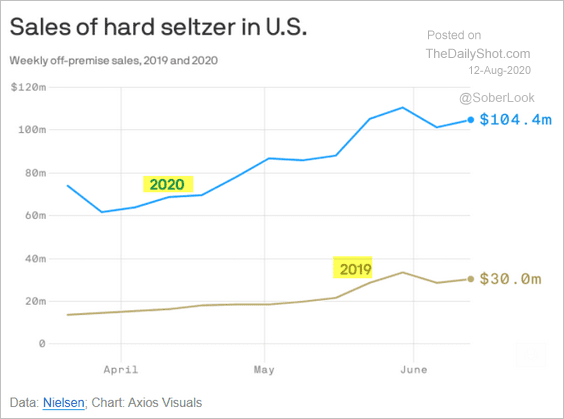

8. Sales of hard seltzer:

Source: @axios Read full article

Source: @axios Read full article

——————–